Tech Talk - Pipelines from the Arctic

Posted by Heading Out on September 18, 2011 - 5:25am

Art Berman commented, in regard to my last post on the oil and gas reserves in offshore Alaska, that at one time companies looked for an estimated 1 billion barrels in reserves before they would consider starting down the long road to bringing them to market. With the rising price of oil, that number may have declined a little but for natural gas, a similar need for a long-term assured market is currently potentially raising barriers to progress. As I mentioned in that post, there is a considerable sum involved, not just in acquiring the leases for the sites but in all the preparatory work needed before the first drill even hits the surface. Even after the wells have come in, the hydrocarbons must still be moved down to the customer and as the Trans-Alaska Pipeline System (TAPS) showed, it takes time, money, and a considerable commitment before that connection can be made.

One of the recent changes that I noted a couple of posts ago is that more of the reserve in the North Slope is now known to be natural gas rather than oil. With the current relative natural gas glut in the contiguous United States, that reduces the immediate market and the potential current price that the gas could bring in. This, in turn, slows lease development. But times change and with an increase in natural gas demand there will be a growing demand with time. One can also see an increased future need for natural gas in Alberta, where it helps in the production of the heavy oils from the shallow sands around Fort McMurray. And that brings us to the current controversy over the building of another pipeline, this time for natural gas, down from the Arctic.

More particularly, I thought I would tie in the problems that the MacKenzie Valley Pipeline has had in Canada with the debate about the Alaskan pipeline. This is not so much to argue either side, but rather to show some of the delays that have arisen and to underscore one of the points that these last few posts have been hopefully suggesting - that when somebody says that all we have to do is go out there and drill to solve our energy problems, they really don’t understand the complexities of the real world. The MacKenzie River flows into the Beaufort Sea just to the east of Alaska, in the Canadian Northwest Territories.

The recent application for approval of the MacKenzie River pipeline was originally filed in August 2004, but by then the project was already old. Back in 1977, Mr. Justice Berger, a Canadian judge who had examined the project over a three-year period, recommended that it be put in abeyance for 10 years, following his Inquiry. A major concern of the time was the expressed opposition of many of the native tribes (First Nations) through whose land the pipeline would run.

Move forward some 34 years, and some of those tribal leaders are now in favor of the project. While in that time frame, the Canadian Government had pledged billions to the First Nations of Canada, with recent emphasis being on schools, water, and community services, a more likely reason is because of the work of settling land claims, (all the land belongs to the First Nations) and, for example, that the Inuvialuit now own the company that runs the barges up and down the river. At the same time, through the Aboriginal Pipeline Group, the First Nations will now also own a third of the pipeline itself.

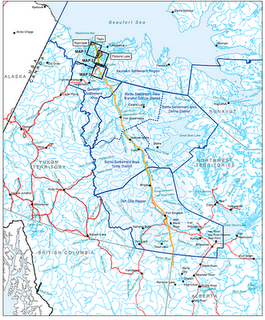

At the time that the National Energy Board approved the project, it included the development of three natural gas fields (Niglintgak, Taglu, and Parsons Lake), about 120 miles of gathering pipelines and an almost 300-mile natural gas liquids pipeline as well as the 743-mile pipeline itself, which will carry 1.2 Bcf/day of gas down to Alberta.

With construction now scheduled to begin in 2014 (and to occur mainly during the winter months), it is expected that the pipeline will be in operation by the end of 2018 at a cost of $16 billion. It will take some $800 million to develop the Niglintgak field with 6 - 12 wells started from 3 pads. It will take some $2.5 billion to develop the Taglu field, with 15 producing wells extended from a single pad, but requiring a compressor and more wells as the field ages. And the cost of the Parsons Lake field is anticipated to be around $2.5 billion with two drilling pads that will hold from 3 to 19 wells.

Now move West a tad, and Alaska also has those significant gas resources that I have mentioned in previous posts. They are, however, not quite as far along in the process of getting a pipeline in place to move it to where it becomes a real reserve. I will forego exploring the idea (mentioned in comments on earlier posts) of converting the natural gas to methanol and sending it down TAPS to Valdez, where it would be separated from the oil, and converted into gasoline. (Because methanol is corrosive to pipes, the plan is moving toward doing the conversion to gasoline near Deadhorse, and mixing the gasoline with the crude.) The initial target for the project would produce 63 kbd of gasoline, with an original estimate of the cost being around $7.7 billion.

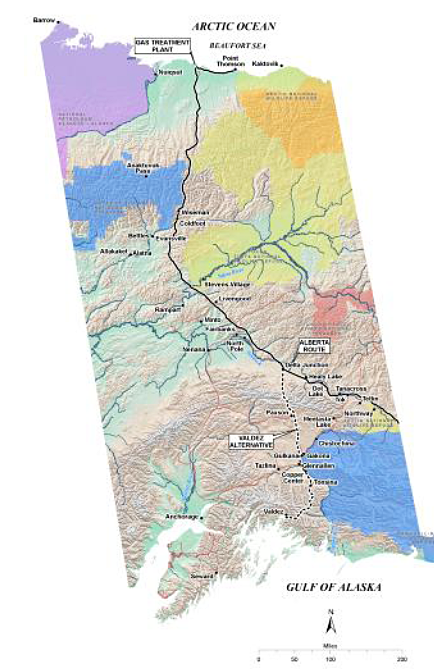

Moving the natural gas itself through a new pipeline, however, requires customers, and while a number of different proposals have been put forward, the lack of such customers at this time recently caused Denali to discontinue their efforts to build a 48-inch diameter pipe that would carry up to 4.5 Bcf/day from the North Slope to Alberta.

TransCanada, who remains in the hunt, is also finding it hard to find any firm customers. Given that they estimate that the cost of a similar-sized pipeline would run between $20 and $41 billion, depending on whether the line feeds an LNG plant in Valdez or runs over into Alberta, they are hesitant to move forward even though they will receive $500 million for planning the project and getting the regulatory approvals. (The top map shows both alternatives).

Nevertheless, TransCanada and Exxon, who are now partnering in the Alaska Pipeline Project have held meetings with the project communities likely to be affected by the project, offering refreshments and door prizes for the present and potential feeder lines in the future. Their presentation can be found here, and notes that under the current schedule first gas will flow in 2021.

By that time it is quite likely that there will be more of a demand for natural gas supplies in the anticipated market, but convincing investors and potential customers of that is likely to be an uphill task in the more immediate term and the project will likely not be able to make headway until those folk show up. And so, while it may not take the almost 40 years of the MacKenzie River pipeline (which isn’t started yet), the current Alaskan effort is likely to take longer than currently hoped.

If the total capital cost for the three fields plus pipeline is $2.5B + $2.5B + $0.8B + $16B = $22B and the project produces 1.2Bcf per day @ $4 per MMBtu (1,000,000 MMBtu = 1 Bcf) that would have revenue of ~$2B per year. If you add interest, the payback about 15-20 years.

Considering the risk of the project, seems like building wind farms would be a better investment.

Perhaps they are hoping for $8 gas again. Hmm, that would make wind even more attractive...

Apples to oranges.

All parties involved stand to gain more than a simple return on investment. Even the investment bankers.

sure, we can melt the arctic icecaps. No harm in that.

sure, each degree rise in global temperature increases droughts and reduces crop yields. Damn the torpedos, full steam ahead!

Your windfarms need gas.

Not if combined with solar PV or solar thermal or nuclear or hydro or pumped hydro or ...

Existing gas infrastructure makes sense but I don't think rational investors will start snaking pipelines through the arctic tundra in hopes of a return in 2030. Even if they don't pay interest the time value of money is real. Why tie up all that cash for so long hoping that renewables don't catch up?

The window is closing fast for $4-$5 gas projects.

"Not if combined with solar PV or solar thermal or nuclear or hydro or pumped hydro or "

Wind needs gas much more than gas needs wind. At least for today's grid.

Manufacturing needs gas more than it needs wind.

Transportation needs gas more than it needs wind.

Climate damage is largely not included in the costs.

It seems to me there is more than one way for a rational investor to look at it.

edit - not to mention home heating, bitumin production, or export to eg Japan.

Windfarms don't always need gas as backup power. Wind power needs a usable form of energy storage and energy distribution/use management. Gas will help but will require much higher prices to be developed. Users will conserve or substitute other energy sources before we get to $8 to $10 per mmBTU, the price where the pipeline from NWT and Alaska is profitable, IMHO.

Great post Dave, thanks.

I note that you don't mention the alternative Alaskan pipeline route of an undersea pipeline in the Beaufort sea from Prudhoe Bay to Inuvik, to then connect with the Mackenzie Valley pipeline - the so called "over the top" route.

I have always though this to be the best of all options - but is it no longer on the table?

"With construction now scheduled to begin in 2014, (and to occur mainly during the winter months) it is expected that the pipeline will be in operation by the end of 2018"

At this point in time, I am wondering about the viability of ANY project anticipated to take several years to complete. If this project is to be completed in 2018, that would seem to require that the overall economy keep at least stumbling along.

Yet if I were an investor I would look around and see that the US appears to be headed for a double-dip in the Great Recession, European politicians running around like chickens with their heads cut off trying to finagle their way out of increasing debt problems. At the same time economic growth seems to have stopped in Germany, while the rate of contraction is rising in Greece and others of the PIIGS. And some of the PIIGS and some of the banks involved fall in the "Too big to fail, but too big to bail out" category.

In short, if I were an investor I would be concerned that if this goes forward, we could end up with a situation where the pipeline gets half finished, then something happens and the economy crashes, a worldwide depression.

In Las Vegas back in '08, they were constructing a new mega-casino/hotel, four or five 56 story towers. When the crash came, loans were recalled or couldn't be rolled over, and the project stopped, frozen in mid-construction, the skeletons of partially completed structures fenced off and essentially abandoned.

So I'm wondering, how much do the developers and proponents of this think about the possibility of the end result being a pipeline half finished and then abandoned to rust away in the ice.

Antoinetta III

I'm sure that is a possibility, but I also think that most of the likely investors in such a venture are not doomers, and see BAU continuing for quite some time.

I think the biggest factor behind this is the increasing NG consumption - not price - we will see more and more gas turbine power plants, and this is a way for the oil/gas industry to start to displace the coal industry. If there is any sort of move into using CNG for vehicles, then this would support that too.

Having these pipelines built will encourage more investment in NG fuelled stuff, and if the oil co's and the power co's get together - to guarantee a use for the gas and the supply of it, then I think this is a stable a business proposition as any other.

Also, the increasing production of oil from the oilsands uses huge amounts of NG - they are predicted to be at 4mbd by 2020, at which time they will use all the NG produced in Alberta. So right there is a huge market for the arctic gas, which is right next to where the pipelines connect to the existing system.

The only real uncertainty, for the Cdn pipeline at least, has been the prospect of First Nations blocking the project - which is effectively what happened in the '70's. That is still a possibility today, though a lesser one.

The Mackenzie Valley natural gas pipeline to bring gas south from the Arctic has finally been approved, and the First Nations people are onside with respect to the project. The only question is: will the economics ever work out. With the shale gas glut in the US Lower 48 and Eastern BC, there is no real telling.

However, if Alberta needs the gas to fuel its oil sands plants, Alberta will get the gas.

There is one missing critical element in these plans and that is electrical generation and transmission. Combined with the load growth in northern BC (east and west), the electrical energy supply deficit will continue to increase.

NG pipelines don't require much electricity if they can use their own gas to drive turbines at the compressor stations, but the gas has to be cleaned.

A sea change may be coming in the oil sands with the commercial operation of an all electric in-situ bitumen extraction technology. Pilot and demonstration sites have been operating for some time now with documented results showing 25 kWh per barrel for extraction. The master plan is have the users of this technology get up to 1 million barrels per day using renewable energy sources from NE BC.

The size of the NE BC (primarily wind) RE plant will be in the neighbourhood of 8,500 MW. Mine development, LNG terminals, and an electric railway for the export of oil sands product to the west coast will require another 1,600-1,700 MW. NG extraction in the NE - Montney and Horn River Basin shale gas plays - will require 500-800 MW.

We're up to another WAC Bennett dam here.

Getting back to how it is all connected in this part of the world, the transmission lines to handle this capacity are not only insufficient, they don't exist. Many may have a fair idea of how long it takes to get a transmission line built due to permits, public outcry, and bureaucracy - 10 years.

The short answer would be to build GT's (Gas Turbines).

BTW, the aforementioned electric in-situ technology will increase the oil sands reserve number to ~500 billion barrels. That ought to peak the interest of a couple Tooder's...

of course the short answer is gas turbines--just how amenable are north western Canadians to major hydro projects? We of course know no one likes transmission lines in their 'backyard.'

BTW, the aforementioned electric in-situ technology will increase the oil sands reserve number to ~500 billion barrels. That ought to peak the interest of a couple Tooder's... nice big number but what we really want to known is the timeline for future bpd coming down the pipe.

We see the housing equivalent of that all over the California central valley and Delta region. Road for suburban housing complete with driveways and utility hokups, sometimes even foundation slabs were poured. Then the sites were summarily abandoned.

The same sort of thing happened about ten or twelve miles west of Chicago after the 1929 crash--my father said he learned to drive on the paved streets (all curbed for driveways) of never built subdivisions. Of course the post WWII suburban push built those suburbs and the kept expanding another 20-30-40 miles out when the boomers born in those burbs bought farther out...jury is still out on the future of all that though...

I have always though this to be the best of all options - but is it no longer on the table?

I can see how as a Canadian you may find the "over the top" route the best option--but there is the little problem that most proven Alaska natural gas 'reserves' are under state land. Article 8 of the Alaska constitution states

§ 2. General Authority

The legislature shall provide for the utilization, development, and conservation of all natural resources belonging to the State, including land and waters, for the maximum benefit of its people. (my emphasis)

It will be hard to get any North Slope gas line built that does not give Alaska's two biggest cities access to the gas. Of course given the current economics of natural gas and iffy nature of potential future Cook Inlet gas supplies...predicting when any North Slope gas line might be built requires access to a very high resolution crystal ball ?- )

Economic nationalism (or in this case statism) has a powerful political pull. Thats been one of the difficulties with the gas line, US economic nationalism is at odds with the optimum economic solution. Given that the economics are marginal at best, a political neccessity for a suboptimal solution could be a game stopper.

'Suboptimal solution' is a fully loaded term--gray areas up the yin yang. Natural gas liquids are one of the jewels the fields will produce--lots of revenue generated (including tax revenue) where they get separated and sold. No chance of Alaska getting any of that benefit with the 'over the top route.'

Of course in this case we are also talking about 'owner's' interests. The philosophical discussion about the impossibility of resource ownership would be a pointless exercise-its accepted world wide practice that some entity has resource ownership. It is the people of Alaska that own the gas--we are not quite so third world up here that we will allow a colonial like power like BP or Exxon to ship all of our gas elsewhere without us getting to use any of it. As owners we would like to reap the liquids value added as well--do you blame us?

It is certainly in our best interests to burn gas and sell oil but right now the lions share of heating and power generation for interior Alaska comes from burning fuel oil. Except for that there is no real reason to get in a rush to produce the gas, it is doing an excellent job keeping the North Slope oil fields pressurized at the moment.

Oh yeah, there is the Cook Inlet gas field depletion thing--HO touched on that a few tech talks back. So the state does need some of the gas--we should see a full fledged debate on the economics or non economics of the various sized instate gas lines this legislative session. They were just getting warmed up last season.

I do have to agree that as long as the economics of a North Slope gas line remain marginal at best it is very likely to remain stranded.

But one good thing may come of that. If the Cook Inlet region has to start importing a sizeable volume of LNG (it was exporting it until lately) there is a very good chance the 'local' hydro project will actually go through this time. With that in place we should be able to avoid burning some gas as well as oil.

H.O.

As usual your posts give the important perspective on energy "supply", not just energy "production". Most people, especially the politicians, forget that if you cannot economically get the energy to the user for a marketable price, then the energy is not a reserve. "Drill baby drill" doesn't do a damn thing if the oil or gas can't reach the user.

Looking long term or at least ten years out, the energy flow will be toward Asia and China in particular. As more electrical power is needed there, to displace imported coal and fuel new industry, the shift toward gas will begin.

I think LNG conversion at Pacific ports in Alaska makes more sense long term than trying to build pipelines through Canada for tar sands production or to US for heat/industrial uses. Since US has shale gas reserves to last far longer than 20 years, my money would be on any facilities that can get the gas to China. Climate change will encourage moving to gas from coal, as will China's more extensive use of NG powered cars and electric powered transport (cars, rail freight, high speed rail and transit).

My advice: don't put any money into companies that are promoting these trans Canada pipelines.

I find the conversation about the desire (or reticence) to invest in log-term energy production (and energy conservation {enhanced freight rail, light rail, etc) projects to be most interesting, especially in light of other things we are plenty willing to 'invest' huge sums in over the timescale of the next 70 years or so.

http://www.aviationweek.com/aw/generic/story_generic.jsp?channel=aerospa...

http://en.wikipedia.org/wiki/SSBN-X_future_follow-on_submarine

[Many more references on-line if you care to look}

For example,contemplate the U.S. DoD program to replace its current fleet of Ohio-class Strategic Submarine Ballistic Missile (SSBN) boats.

According to open-source literature, this program will cost ~$72-100B, between now and the expected first ship in class (2028-9) through the end of the class build (a number of years later). Then consider that this ship class will likely have an expected in-service life of 40-50 years...that puts it in operation through ~ 2080. Consider that the O&M (operations and maintenance) cost to run these huge, complex ships, with all the attended shore facilities and command and control systems, will be many many more billions of dollars over its service life.

Did I mention that the Navy will likely spend ~several tens of billions of dollars to equip its new subs with a new missile sometime after the new subs are in service?

Let us also consider that the Air Force wants a 'New Bomber' sometime next decade...and a replacement for the current Intercontinental Ballistic Missile fleet, and separately, perhaps a brand new basing system for that.

The payloads for all these delivery systems require lots of care and feeding as well over the course of decades...

Some ball-park (based on open-source Internet research) Research, Development, Test and Evaluation (RDT&E) and manufacturing cost estimates for all that:

- New SSBN: ~ $70-100B

- New SLBM: ~25-40B$

- New ICBM: ~25-40B$

- New ICBM Basing Infrastructure: ~25-40B$

- New Bomber: ~$50-70B

- Operations and Maintenance for all of that: easily ~$5-10B per year, for 30-50 years of service

- Supporting infrastructure, including intelligence and command and control, etc (RDT&E and O&M): Easily several hundred Billion dollars.

So...RDT&E and manufacturing from now for the next 40 years: Upwards to $500B

O&M from ~ 2025-2080: $500B-1,000B

And I neglected to give cost estimates for the weapons delivery system payload RDT&E and O&M.

And remember that the programs I enumerated above are but a fraction of U.S. DoD/Military/'Defense' spending...figure that total as upwards past $1T per year.

So, let us consider how much energy all of this expenditure nets the U.S. : Zero. If fact, lots of FF will be consumed for RDT&E and manufacturing and O&M.

How much 'security' will this 'investment' net us? Please don't make me laugh that hard...it hurts! I will tell you this...there is a group of folks who are living well on all this corporate welfare...and ironically, many of these same folks would prefer to deny poor folks health care etc.

So...how many NG pipelines and new freight and passenger rail would this buy us? Perhaps replacing every light in the U.S. with an LED light? Perhaps replacing every car with a Prius/Leaf/Volt? How many wind farms, PV installations, replacing 65% efficient home NG furnaces with high-efficiency heat pumps, upgrading insulation for houses, etc. etc? Could we afford to replace/upgrade those old, heavily-polluting coal plants with updated plants which spew much less pollutants? Could we afford to properly provide long-term nuclear waste storage, upgrade our nuke plants to be more flood/earthquake/terrorism-resistant? Upgrade our electrical grid to provide greater capacity and redundancy?

And how much energy would that provide us over the course of decades? And how many jobs would be provided for manufacturing, installation, and maintenance?

Oh, I forgot...'we can't afford' to invest in energy production and energy conservation/efficiency in this country. The green eye shades folks can't justify it based on NPV etc. But those calculations are not even a factor in DoD/MIC spending...and 95% of U.S. Americans give them a complete pass...an utter Carte Blanche.

I do not expect any talk of these opportunity costs to get any airtime in the upcoming Presidential and Congressional election talk. Except for from Ron Paul, and he doesn't get very much airtime/media play at all.

+10

Good post!

You forgot to mention that even on a moderate GHG emission path much of the US will be uninhabitable before any of these long-term projects come to fruition.

http://www2.ucar.edu/news/2904/climate-change-drought-may-threaten-much-...

Heisenberg, excellent comment.

I am sure the USSR had all sorts of 50-100 year plans for similar hardware. A bankrupt empire can make these plans, but I can't imagine such fantasies will come to fruition.

One might be able to support NG pipelines and development if it was part of a reality-based energy policy that didn't involve tar sands and wars.

MaxPlanck (good name there) and sgsstat,

Indeed, I often quip to my fellows at work when they fret about the status of certain of our military capabilities in ~2040 "Maybe we'll be throwing rocks at each other by then."

It is always interesting to see what reaction I get from that line...

It all comes down to: Most folks haven't a clue about long-term sustainability issues, and furthermore don't want a clue.

IBGYBG.

In the meantime, people make a good living planning to spend big bucks on stuff that won't make us secure, and indeed, drains away capital we could spend to do some truly useful things to help us and our progeny out somewhat.

As far as AGW/climate change...I honestly see a slight tad more probability that people will grok PO/energy before they come to grips with that...and the probability that most folks will grok PO/energy is rather small as well...a lot of folks will continue to blame speculators (liberals), enviro-Nazis (conservatives), socialism (conservatives), oil companies (liberals), the Illuminati (crazy folks), etc well after most of the gasoline and diesel-powered cars and trucks become immobile.

Edit: I don't know what the Russians are planning...and I sincerely hope that Europe and China and the ROW is doing a better job planning and implementing changes to adapt to the future than we are...

Can any gas on the North Slope be classified other than 'technically recoverable resources' ? Is there a market for North Slope gas deposits ?

What is the planning horizon for the people of the U.S.?

Perhaps another question could be: How long will the domestics shale-gas plays last, and when (not will there be) the market for far-northern NG from Canada and Alaska?

Follow-up question: And given that predicted date (the date by which Lower-48 NG plays will be start their serious declines), when must we have one or more NG pipelines and attendant infrastructure in place to draw upon NG deposits present in the high latitudes of Canada and the U.S.?

Or should it be preferable to wait until the Lower-48 NG peak is assuredly in our rear-view mirror, and then start the 10 to 30-year process of planning and building these Arctic NG pipelines and the wells, compressor stations, etc. etc.?

We can continue to spend great sums to have military adventures in the Middle East (then Africa and Venezuela etc) to secure access to U.S. markets for their (our!) oil and NG in the name of 'National Security'...or we could take some of those future military adventure expenditures and make investments to have the infrastructure in place at the proper time to access high-latitude NG and oil from our country and from our trusted good friend and neighbor Canada, a truly mutually-beneficial arrangement.

Sorry, just the strategic planner in me coming out.

For those who believe that the U.S. military groks PO and Peak NG and energy issues in general, please let me know when they publish treatises that say (in much greater detail) what I just said above.

Be careful of people with very long time horizons. Once you grant him his fantasy of a perfect society/world, A. Hitler was a very longterm thinker. His thousand year reich was to glorious, and the fact that it required horrific sacrifices from the first generation or two to achieve it, only made it seem more glorious. If your time horizon is too long (even if your vision isn't delusional), you will be prepared to impose any degree of sacrifice on the near term inhabitants of our planet.

The current ideology that has been drummed into Americans, doeasn't believe in government interference in the economy "the government shouldn't pick winners). And developing resources we may need twenty years down the road, is a case of the government picking a winner. I think we've propagandized ourselves out of the capability to implement long term strategic plans. Except in the military arena, which according to the modern American cannon is sacred.

eos,

Your two posts, back-to-back as they are, are fascinating to me.

In your first post, you caution against long-term planning by raising the specter of Hitler and the 1,000-year Reich...then in your second post, you lament the propaganda drummed into Americans that the government is evil, not to be trusted, and (unstated by you) the obvious corollary that the fictitious unfettered absolutely free market will deal with any circumstance in the best possible manner!

Interesting bookends to frame the argument presented!

As for the first...I hopefully did not come across seeming to advocate invading Canada and conscripting non-white Americans and strong-backed Canadians to work as slaves to build our modern version of the pyramids (the NG pipelines and the accompanying infrastructure etc)! I wasn't even proposing this infrastructure be purely government-financed...perhaps robust loan guarantees, tax credits, guaranteed NG rates when the gas flows, etc. There is ample opportunity to leverage some government investment and incentive $$ to make a partnership with private industry. Certainly such projects would provide many well-paying jobs for willing employees and decent profuts for makers of steel pipe, heavy equipment, etc?

Functionally, I see nothing in such plans any more heinous than the white-collar corporate welfare provided by the military industrial complex over the past many decades...indeed, I think that diverting some monies from DoD/other MIC agencies to these types of energy projects would provide a much higher ROI /tangible benefits for the taxpayers over time.

I sing the praises of the private enterprise system when deserved ( and that is often), but I fully realize that the U.S. is, and always has been, a 'mixed economy' (as all other countries that are not complete state-run dictatorships)...however, I realize that 'the market (unfettered)' is not likely able to forecast certain future circumstances and trends and may not be able to justify to the accountants and stockholders the pre-situation investments required to 'head the issues off at the pass'.

One last, I award you a penalty for unsportsmanlike conduct (15-yard penalty)for your implementation of Godwin's Law!

http://en.wikipedia.org/wiki/Godwin%27s_law

one could convert it to DME on the north slope which is handled like like propane. It can be burned in diesel trucks by changing the injectors pump and tank.

Yes, and when there is an economical means to process the gas, and transport the product to market, these gas 'resources' can be called gas 'reserves'.

A few comments of interest to the readers.

First, thanks to HO for yet another timely and interesting article.

Some additional information and background.

I started in the oil business in an indirect manner, working in Terrain Sciences of Geological Survey of Canada on the Mackenzie Valley Pipeline Project and Arctic Islands Pipeline Project in 1973-1976. I compiled 20 quarter million map sheets in the southern Mackenzie Valley (NWT) up to Norman Wells and ~8 map sheets north of beautiful downtown Baker Lake, NWT, now Nunavut.

We were very disappointed when Mr Justice Thomas Berger handed down his report. However, in hindsight, his conclusions were perfectly justified – the pipeline had to wait on the land claims, and none of the land claims were settled. Additionally, there would have been very little economic benefit to the First Nations at the time. Today, the First Nations would have a 33.3% working interest and be major contractors in the construction.

The Inuvialuit settled their land claims in 1984, the Sahtu and the Gwich’in later. These claims cover the Delta and the northern and central part of the valley.

One land claim remains unsettled, that of the Deh Cho in the southern portion of the valley between Wrigley, Fort Simpson, Trout Lake and the Alberta border. However, the Deh Cho now seem to be in favour of the project, partially because they have become more development minded, and partially IMHO because the other First Nations have already carved out their own interests in the Aboriginal Pipeline Group (“APG”). Additionally, the principal political objector was voted out of office - Canadians will know who I'm referring to.

However, it must be stressed that all the First Nations are still very concerned about the environmental impact on their traditional way of life.

The Canadian oil and gas industry should be profoundly grateful to Mr Berger. If the Mackenzie Pipeline had started construction in 1978/9, then it would have been completed in 1983/4, when gas prices were rock bottom. This would have wrecked TCPL, Dome Canada, probably Shell Canada, maybe IOE and Gulf Canada ….

But of course, Dome was already dead and gone, blown up by inability to fund corporate acquisitions (delete the name of the principal culprit, NOT Smiling Jack), and Gulf Canada had been spun off by Gulf to Hiram Walker the distillers, etc.

With regards to investment in the pipeline itself, it crosses the NWT - Alberta border at MP 1208, southeast of Trout Lake, where it will tie into TCPL’s system. This is critical to investment.

In Canada, gathering and processing fees are set according to the present version (2004) of the Jumpingpound Formula, “JP-04”, (named after the Shell Jumpingpound gas processing plant, where the formula was first developed).

The original partners in the Mackenzie Gas Pipeline Project will be able to charge Third Party Transmission Fees to non-partners wishing to export gas from the Mackenzie Delta and Beaufort Sea, i.e. the pipeline will a common user / utility.

Under the JP-04 Formula (it’s probably been improved since, but I’m now international), the transmission fees allow for the recovery of:

ã Calculated Return on the Capital Investment.

ã Cost of Capital is based on WACC of equity and debt financing.

ã Operating costs.

ã Abandonment costs.

ã Plus a return on investment (“RROC”) above the cost of capital.

Most importantly, because the pipeline will cross a provincial border, it is under NEB (National Energy Board) jurisdiction. The NEB has the power to ensure a third party gains access to infrastructure/reasonable tariff rates where development of resources is being hindered due to denial of access to infrastructure or the imposition of unreasonably high tariff rates.

NEB also sets the RROC, which is based on long-term Canadian bond rates, and can be assumed to be ~10%. Investment in the project thus has a guaranteed Rate of Return on Capital, conceptually equivalent to but more than a Canadian Government bond.

ã Rate of Return on Capital:

ã RROC = (LTGBR + Equity Premium)/(1 – EITR)

ã LTGBR = Long Term Government Bond Rate

ã EITR = Effective Combined Income Tax Rate

Regarding investment in the project: this is for the Big Boys who think 25 years out, not the junior and intermediate equity markets or NASDAQ type speculators. It will be funded by the majors, maybe some international players, by TCPL and APG. And APG is in for 33.3%. If you don’t want to work with them, close the door behind you quietly as you leave. This is Canada.

Interest in the project was revived in the late 1990’s, and TCPL and APG are now in partnership. The APG management team IMHO, is strong. I’m ex-TCPL, before the NOVA merger.

A second round of review hearings was started in 2004, expected to take ~2 years, but actually finished in 2009. One of the principal reasons was that the Joint Review Panel wished to be as thorough as Mr Justice Berger. Unfortunately, "I have been reliably informed that" the Panel was taken advantage of, in that certain parties that claimed an interest testified both as interest groups and then again as concerned individuals.

Shell Canada pulled out of the project in 2010; this IMHO was a strikingly dumb strategic move.

Purely by geological coincidence, the pipeline will cross into Alberta about 250 km east of the Middle-Upper Devonian Horn River Shale Gas Basin and about 100 km east of the Cordova Embayment Shale Gas Basin (mostly the same formations), both in BC.

The Horn River gas play has badly damaged the Mackenzie Valley Pipeline. I suspect that the Horn River play will postpone the pipeline until the full cost economics and the production profiles of the shale gas are understood.

However, I must point out that Horn River is a BC play, not an Alberta play. BC gas goes to California. Alberta gas goes to Alberta and points south and east. And Alberta gas reserves and production are declining at an alarming rate; we’ve hit peak gas and peak conventional oil, although this appears to have been beyond the comprehension of our last Premier, referred to popularly as “Special Ed”.

IMHO, panic will set in around 2015-2017, and construction of the Pipeline will start around 2018-2020.

Regarding “Over The Top”

I do not know what the latest status of the proposal “Over the top” from Prudhoe to the Mackenzie Delta. The surficial geology has been well mapped, but to the best of my knowledge, no full engineering proposal has been worked out. I do not even know who are the supporters of this particular project.

Thanks Harry for your insight!

I am curious, with Alberta's gas reserves "declining at an alarming rate" is there not a great deal of concern in the tar sands? Getting bitumen out of the tar sands is entirely dependent on the supply of NG. It wasn't that long ago that a nuclear facility, if I recall correctly, was being proposed for the tar sands when the price of NG was high and before 'fracking' technology changed things.

As well, with Alberta NG in decline won't a lot of folks in Canadian cities east of Alberta be surprised in a few years at how much it costs to heat their homes with NG?

Cheers,

Andrew

Regarding the Over The Top route. Sorry to come late to this discussion, but I've been off the grid, enjoying our Alaskan fall season. There are two possibilities for taking Alaska gas 'over the top' to join with Canadian gas in a McKenzie River pipeline. One could either go overland, across the ANWR coastal plain, or offshore along the Beaufort Sea coastline.

Given the intense political opposition to oil exploration in ANWR, I think the overland route is a non starter for the foreseable future. The same folks who have so far stopped any oil exploration in the ANWR coastal plain can be expected to fight a pipeline crossing there with the same fervor. The offshore route would be technically very challenging, for the same reasons that oil production from the Beaufort Sea will be very difficult.

There are some good economic, environmental, and engineering reasons why building a gas pipeline along the existing TAPS coridor and then south following (more or less) the Alaska Highway route makes sense.

"There are some good economic, environmental, and engineering reasons why building a gas pipeline along the existing TAPS coridor and then south following (more or less) the Alaska Highway route makes sense".

I'm not 100% sure all the land claims in southern YT have been settled, in fact I don't think they have been settled along the YT/ NWT / BC border.

The Alaska Hwy roue makes most sense.

However, I must caution against political interference in Alaska. At the Petroleum Show about 10 years ago, I was sitting with a group of other project and financial analysts from "six or seven certain Canadian and America major oil and gas and pipeline companies with interests north of 60" at a seminar on the Alaska Hwy Route. The Senator from Alaska was a gentleman whom I will not name but for convenience will call Frank; he would have made a suitable Premier in Newfoundland, PEI or New Brunswick. He informed us that he had absolute control over the project, that the oil and gas companies were plundering Alaska's heritage, and that the pipeline absolutely would not be approved unless, as I remember, "all towns and villages in Alaska were hooked up to gas from the North Slope".

It wasn't me who started laughing out loud first, honest. If looks could kill, we'd all have been dead thrice over.

You are probabaly aware that that senator was later elected governor and immediately appointed his daughter to fill his empty US senate seat. That trick and high level of corruption in the state legislature during his term had a great deal to do with old 'red jackets' quick rise on the political scene--I think the tea party still loves her. The waves of that state legislature's corruption eventually even brought down the longest serving Republican in the US Senate, Uncle Ted, who brought home the bacon like no other during his day.

Interestingly, about the best thing Gov. Frank did was to appoint Lisa to fill his vacated seat. Thoughtful moderate Republicans have become a real endangered species in the US Senate, and she is about as close to being such as any other in that body.

The sort of puffery you mentioned is not quite as prevalent here these days (I think red jacket moved to Arizona)--but we do want our cut of the gas if any of our north slope gas ever does get produced.

Am in no way an expert on these issues, but a thought comes to my mind; Floating NGL facilities? Could be profitably as well. What's the calculation on that?