Sunday Times Predicts US As Top Oil Producer in 2017

Posted by aeberman on September 15, 2011 - 4:15am

Editor's Note: After posting this article, we received the cited report thanks to a Goldman Sachs partner. The report does not claim that the present or future liquids production is "oil" although the production levels reported by The Times are corroborated in the report. We have accordingly changed the title and made other minor modifications to the post but remain firm that the message is relevant and important.

On Sunday, September 11, 2011, The Sunday Times quoted a Goldman Sachs (GS) report also summarized by Rigzone that predicted the United States will become the world's largest oil-producing country. This astonishing production increase is accomplished by changing the definition of oil and by using optimistic projections of liquids-rich shale production.

The claim was that U.S. daily production will increase from 8.3 to 10.9 million barrels of oil per day (Mbopd) by 2017. This would surpass Russia and Saudi Arabia according to press reports. While these reports did not mention that Saudi Arabia claims it can produce as much as 12 Mbopd, they did state that Russia would not increase its current production of 10.7 Mbopd by more than 100,000 bopd by 2017. It is curious that the announcement was apparently not carried by any of the major business- or energy-oriented journals (Bloomberg, Wall Street Journal, Oil & Gas Journal, etc.) nor was it featured on the GS website.

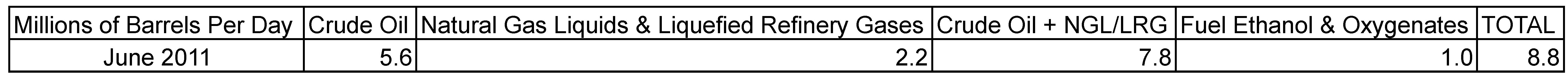

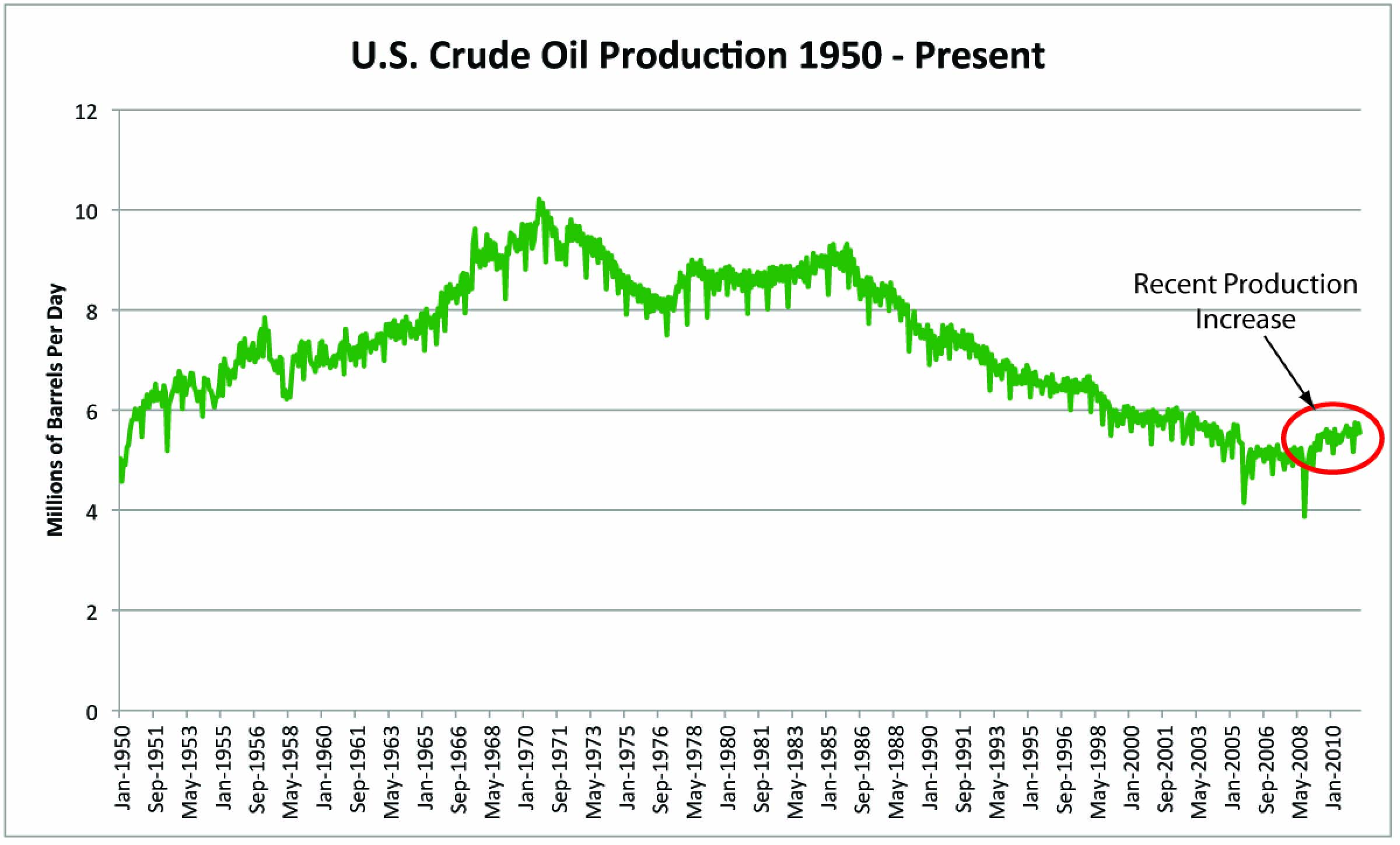

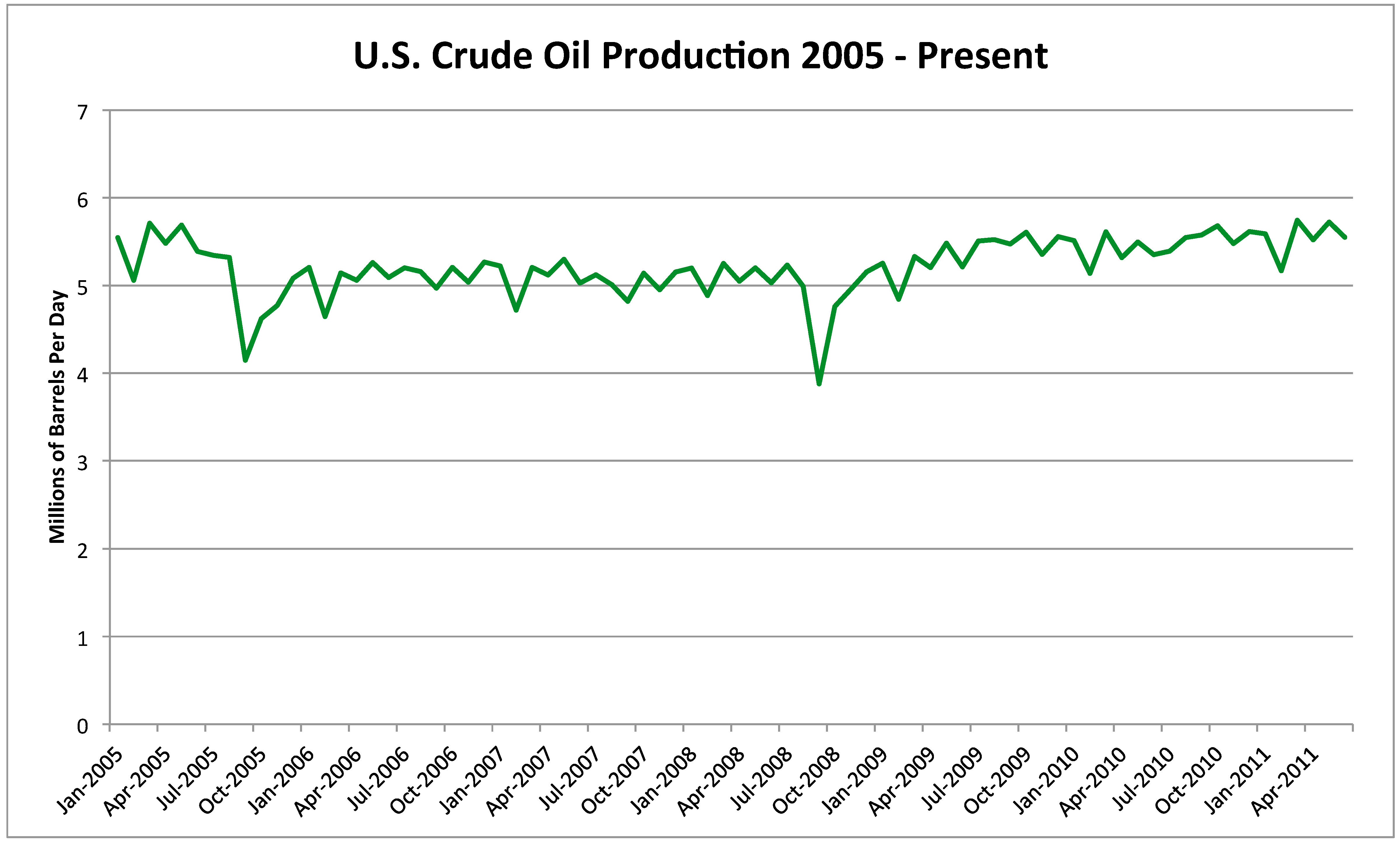

It is unclear how GS arrived at 8.3 Mbopd*. According to the Energy Information Agency (EIA), daily U.S. production in June 2011 was 5.6 Mbopd (Exhibit 1). I assume that GS included natural gas liquids (NGL) and liquefied refinery gases (LRG) as liquids, but that only gets us to 7.8 Mbopd. It is possible that GS also included some fraction of biofuels as oil to arrive at 8.3 Mbopd.

NGL and LRG are not crude oil. These result from processing impurities and various non-methane hydrocarbons and fluids to produce what is known as 'pipeline quality' dry natural gas. These liquids and liquefied gases include ethane, propane, butane, pentane, and certain condensates that do not naturally separate from crude oil. They contain approximately 60-70% of the heating content of oil so a barrel of NGL/LRG is not comparable to a barrel of oil. In fact, ethane, the largest component of NGL, is not even a fuel and is used primarily to make plastic.

U.S. crude oil production growth will come principally from the Bakken Shale in North Dakota and Montana, and from the resource plays of the Permian basin in West Texas and New Mexico. Bakken-Three Forks production has reached about 400,000 bopd and some believe it could eventually exceed 1 Mbopd. Most of the renewed activity in the Permian basin is from shale and low permeability limestone reservoirs. Permian production has increased from a low of 841,000 bopd in 2004 by 100,000 bopd in 2010.

Early Eagle Ford production estimates in South Texas are as high as 750,000 bopd of liquids that include both condensate and NGL (Bernstein Research, August 24, 2011). Condensate, like NGL, is not crude oil although it can be used as a fuel. While there is great enthusiasm and hope for the Eagle Ford Shale, it is a very new play and there is insufficient production history in the liquid portion of the play to confidently estimate reserves. It seems highly speculative to extrapolate from current rates of about 14,000 to 750,000 bopd by 2015.

I assume that most of the remainder of the increased future production in the Times announcement comes from NGL in the Marcellus Shale in Pennsylvania, New York and West Virginia. This is another play that is in an early stage of development and has similar uncertainties as were described for the Eagle Ford Shale. Underscoring this uncertainty, in late August, the U.S. Geological Survey (USGS) downgraded the Marcellus Shale technically recoverable resources by 80% from EIA estimates earlier this year.

Some will undoubtedly interpret the Sunday Times article citing Goldman Sachs to mean that energy concerns for the U.S. are over and that, as the biggest oil producer in the world, we will no longer depend on foreign oil. The most optimistic increase in oil production will mean that the U.S. still will have to import more than half of our oil based on present consumption levels.

It is likely that the public will not understand that the production increase will come only by drilling tens of thousands of wells that will produce at very low rates after the first year. That means that the oil will likely be expensive and will not provide consumers with relief from high oil prices. The good news is that the U.S. will be sending fewer dollars out of the country and the drilling and producing activity will be good for jobs.

*The Oil Drum contacted GS and requested the report or a summary. We received the report after this story was posted. The information in the report corroborates the production increases mentioned in the Sunday Times and Rigzone articles

Maybe somebody screwed up and a report intended for internal use only was made public.

It seems unlikely at first glance that GS would release such an error riddled report as this one, given that the errors are so glaring and so obvious.

Now if the "bent facts" were of the kind less subject to simple verification........

On the other hand, no one ever went broke overestimating the gullibility of the American public.

My guess after a moment's thought is that this is a deliberate attempt to influence public opinion in favor of the banksters and the conservative wing prior to the next election cycle.

This report will become a sort of Area 51 flying saucer and will be accepted as gospel by those who WANT TO believe it.It is perfectly safe to assume that none of them will bother to check the accuracy of the report.

The less Gold in Sacks has to say about it, from this perspective, the better it will work; mystery, conspiracy, and coverup are essential elements of such ploys.

I think that your comments are insightful. We must question both motive behind this "report" and authenticity.

Art

Could this be a "below the radar" ploy - issue a report that purposely doesn't get MSM play, but will be picked up by *needy* people in the blogosphere showing that we have enough oil domestically, drill here, drill now...

This is really inferring a lot. But either way it seems mis-representative and overly optimistic (nothing new in the world of PR plants that we live in).

Goldman Sachs is the most powerful financial company in the world, and second place isn't close. What a couple of bloggers think has little bearing on their considerable wealth and political power.

Sounds like a rationalisation from the "drill baby drill" crowd.

I can confirm that the research note is real. A friend of mine received it about two days ago via email.

That would be the "Roswell Crash" not Area 51, although why wouldn't "someone" feel its worth a trip here to document the collapse of a global civilization? Albeit not exactly a stellar example of "Civilization". Seems most who absolutely discount the possibility that we "aren't the only kids on the block" will readily embrace the idea that they have "invisible friends" that they kowtow to on Sundays.

The chances that the GS report holds water, is IMHO less than any given theology being true...

Are you saying that the GS research note doesn't exist, that I'm lying about a friend having said note, or that the research is flawed? Not trolling, just trying to understand your comment.

What are you talking about? You are the only one who has mentioned any research note. The Rigzone article said nothing about any research of any kind, only what Goldman Sachs said.

If you know anything about any research that Goldman Sachs did before making this declaration we would love to hear it. However just saying that some note exists doesn't carry much weight. We have no way of evaluating the claim that "a research note exists." What on earth does that mean?

Anyway, Nessus was not replying to your post, he was replying to Oldfarmermac. Simply because the post falls directly below your post does not mean that it was a response to your post. Your hostile response was uncalled for. Click on "parent" to see which post he was replying to.

Ron P.

The debris from the "Roswell Crash" reportedly was moved to Area 51 in 1951, hence the name "Area 51".

Area 51 is in the Nevada Test and Training Range. The Nevada nuclear test site was divided into a couple of dozen numbered areas. To blend in, Groom Lake became "Area 51.".

Either Sachs bought Bachmann or Bachmann bought Sachs?

Bachmann is just one more pathetic little fly, buzzing about over same old sh!t

http://www.occasionalplanet.org/2011/08/18/election-2012-koch-brothers-v...

Either way, we're all f**ked!

Folks - Maybe because I live and breathe the oil biz every day my take on the GS statement is somewhat different: So what? Before the GS press release: the US is one of the 3 largest oil producers on the planet...all clustered fairly close together. And after the GS press release: the US is one of the 3 largest oil producers on the planet...all clustered fairly close together.

It's not the NBA championship game where a difference of one point separates the winner from the loser. Maybe in a few years the US will be #1. Then a few years later the KSA will be #1...or maybe Russia. A few years later maybe the US again. And in 20 years maybe Brazil will be #1. But even if the US slips slightly ahead of the pack, we'll still be importing the majority of our oil...subject to economic conditions, of course.

I also wonder if some folks take the GS statement to imply cheaper oil. It might mean a slightly lower trade imbalance but cheaper is not at all certain. As most here know, like rust, depletion and ELM never sleep. Just MHO but the GS press release is one of the biggest non-news worthy events I've seen in a while. What's their next big shocker: US debt to increase over the next two years? LOL

I think what has most of the people here in a tizzy is that Goldman has the direction precisely wrong and, in order to do so, they had to either:

1. be incompetent

2. lie to benefit themselves

3. a combination of 1 and 2

IMO, U.S. oil production will be closer to 5.5mbpd circa 2020. I think a lot of the people on TOD would agree with that.

But for below- or above-ground reasons, the other major producers may drop even faster.

Even if their reasoning is wrong, their conclusion could end up to be right.

But who cares? If we can't supply our demand with domestic production, it doesn't matter much whether we are the top producer, the second, or the nth.

"Even if their reasoning is wrong, their conclusion could end up to be right."

True. The effects of politicizing reserves still haven't been felt IMO.

Greenie - I avoid making predictions...especially about the future. So I'll rely on you: US oil production has been increasing as of late. When do you predict this increase trend to stop? While we're at it: what do you predict oi production will be in 2017?

Also, since GS says current US production is over 8 million bb/day they must be counting something other than crude oil since our crude oil rate is around 5.6 million bbl/day according to most sources. Does your 5.5 million million bbl/day include the same liquids that GS is using? If your number is strictly crude oil then it seems you're predicting virtually no decline in US crude production for the next 9 years.

This mixing crude with other liquids gets confusing to say the least.

I'm generally in the same boat re: predictions as most things in life have far too many variables, too little data, and one severely distorts the truth by excluding or limiting variables in an attempt to calculate an outcome. With oil production, however, there aren't that many variables, we have (relatively) a lot of data, and industry has become quite familiar with both the variables and the data.

Sorry about my prediction. I should have specified that I was starting from Goldman's number which probably includes NGLs and biofuels and then ran it at a 5%/year compounding decline which I think is fair for a rough estimate. Under the same metric, convention crude oil production circa 202 should be around 3.71mbpd.

Here in adacemia, where we prepare the rising generation for the challenges they'll face, we have a Department of History but no Department of the Future.

Actually, you do. Sort of. It's called the economics department. Despite a miserable history of "predicting" they still train students to be "forecasters."

Actually, you do. Sort of. It's called the economics department. Despite a miserable history of "predicting" they still train students to be

forecasters"fortunetellers."ELM = Unix Ref. to email? Details get me sometimes ;-) Sorry and TIA - g

gusitar - Are you asking what ELM means? If so just pull up post by westexas in the archieves and you'll learn more about the Export Land Model than any human being ever wanted to know. But it is a very serious aspect of PO.

Did someone mention Net Exports?

Just do a Google Search for: Peak Oil Versus Peak Exports

Here is a missive that I just sent out to some media types about regarding my summary of the past five years and offering a preview of our ASPO-USA presentation:

Thanks Rockman - that was my other choice. My mind bent more toward the humor aspect of rust, loss & email never sleeping ";-^) You sleep and breathe in oil; so, I can see how ELM and email would be interchangeable. I've learned more substantive fossil fuel info in just over one year from reading your post than many previous in Wiki and hard-bound. More than a few decades ago a founding member of the Club of Rome used to try and smart me up about this site's topic from a different angle than yours. Though it dealt with different aspects & affects on groups - the message, population-wise & politically, is identical. It can get ugly out there and out there can be anywhere. People want what they think they need, often trumping those whom truly need.

And yes, I'm no chef but ELM and exponential population increase could make for a great s..t sandwich; especially since we are doing so much constructive proactive problem solving in that direction ;-) g

Rockman,

I don't agree with you that this is a "So what" event (obviously, or I wouldn't have written the post). It's part of the ongoing mystification of Truth in Energy.

While I agree with you about the tight pack of top oil producers, I wrote the post because of the branding effect it will have on the public (see EIA's AEO 2011). People read and hear this stuff and believe that the U.S. can be energy independent and the evil oil companies are conspiring to keep the price of oil and gasoline high by not drilling or producing enough.

Art

I used to think that ExxonMobil* was the biggest threat facing the US oil & gas industry, but in my opinion Aubrey McClendon, CEO of Chesapeake, who recently declared that the US could meet all of its energy needs from domestic sources, apparently in perpetuity, is contender for the title.

As you noted, when the infinite--and cheap--supplies of oil & gas (and food BTW) fail to arrive, US consumers are not going to be happy campers. On some days, I just hope that angry rioting consumers don't torture the food & energy producers, before they shoot us.

*ExxonMobil in 2006:

Incidentally, as noted up the thread, global crude oil production basically stopped growing in 2005. At the 2002 to 2005 rate of increase in global C+C production, we would have been at about 86 mbpd in 2010, versus the actual production level of 74 mbpd. But maybe it was a typo, and ExxonMobil meant to say that a peak will not occur this month, next month, or for months to come.

". . . I now have to bestow that title on Aubrey McClendon, CEO of Chesapeake, who recently declared that the US could meet all of its energy needs from domestic sources, apparently in perpetuity." Amen to that! As well, those halcyon ads with "socially responsible boomer" bots spouting the same drivel mostly during pundit round-table 'discussions' ;-) g

There are some good stories out there about rising Mid-continent production, and I do think that US oil & gas production is very important to the economy, especially since we are among a small band of real producers in the economy, but I think that the industry is collectively making a huge mistake when they, IMO, overpromise what we can actually deliver. I call it making in incremental difference (likely IMO), versus makng a material difference (very unlikely IMO).

Here is a link to one of my favorite Kurt Cobb essays, which has a chart showing the remainder of the US economy resting on the shoulders of the food & energy producers:

http://www.energybulletin.net/node/32718

Westexas - yes, top heavy doesn't even begin to describe our state of structure at this time. Very well done job of using chart art properly, as well as showing how deceptive or harmless emergencies can appear by manipulation away from a perspective of vulnerability. I'll be back to read some more Kurt Cobb. Thanks! g

Hi Jeffrey,

Thanks for the Cobb link - nice chart (I haven't seen it before).

But, re: "I think that the industry is collectively making a huge mistake when they, IMO, overpromise what we can actually deliver"

Are you sure it's not Jeff and Co. to the rescue? :) (Just kidding.)

And, anyway, if you were really serious about helping the economy, wouldn't you just leave it in the ground for future use? Or, at the very least, dictate who's allowed to purchase? Pre-rationing rationing (or something). :)

Unfortunately, depletion never sleeps. The "Rock" and I are analogous to small organic farmers. Like farmers, we can be net producers and put people to work, but like a small organic farmer, we can't make a material difference in supplies.

Hi Jeffrey

Thanks.

re: "Like farmers." Except that, in theory, farms can be made sustainable. In theory.

Art - Understood. Speaking of branding the public I'll pass on the words of comic strip I just read" "Gil is relieved to find his sudden depression isn't about him. but rather a massive disappointment in the human race".

How many times do the TODsters develop that same feeling? LOL

This very short article actually came from Rigzone, who got it from The Sunday Times, who got it from Goldman Sachs. Nothing anywhere else from anyone. A search of CNBC videos comes up empty. Why did only The Sunday Times pick up this press release? Seems like no one is taking this very serious.

That being said there is a lot of flack out there about how US reserves are actually much higher than those of anyone else in the world. This report from Rense.com posted about 5 years ago has been picked up by the every ignorant blogger in the world. Perhaps some from Goldman Sachs read it also.

Ron P.

Speaking of email that NEVER sleeps - yeah, let's level the Rockies! ";-^)

Ron

I am sure you realize this but that old report from Rense.com was written by our old friend Porter Stansberry that we talked about so much yesterday. He has a long history of whoppers. But he is very effective at getting people to sign up for his expensive newsletters.

No TE, I never noticed that. Thanks for pointing it out. Don't you think the study of how the mind works is amazing? The way this guy's mind works certainly is. ;-)

Ron P.

This is going to creat an intresting juxtaposition between the sheeple taking heart on this 'news' and buying more SUV's and a stubborn yet upward trend in the price of liquid fuel resulting in a rather puzzled looking buch of sheeple. Of course the cocophany of the AGW brigade have fist fights with soccer mom blaming the greenies blocking drilling operations is just all going to add to the mess.

run run quickly run faster over the cliff... hoooraaaaaaaaayyyyyyyyy.

Marco.

It's not hard to see how they came to this conclusion.

1) The naive view of oil is only about quantity. GS Analysts may still be at that stage. More sophisticated and useful measurements like the EROEI/price ratio, or oil price feedback's effect on marginal oil costs over time may not have factored in.

2) There is a lot of spurious and innumerate information regarding oil supply and production in general. NOCs and large private oil companies keep stock prices high and financing flowing by exaggerating supply numbers and making "optimistic" assumptions about future production capacity. A GS analyst is unlikely to have factored this in, perhaps not even for obvious cases like Saudi Arabia.

3) The human factor. Frankly, nobody at Goldman Sachs who tells the truth about this is going to get their bonus. The announcement is more likely some sort of investment play. Any factual accuracy is likely to be coincidental.

I guess we might as well put tar sands development on hold for awhile...and the upgraded pipelines. For awhile, people were getting upset that NA actually wanted bitumen to refine for their cars. Good, my son can spend more time at home, now, fishing with the old man. I'll just go get the bait......

I went to a job fair recently sponsored by SLB and they guy doing the recruiting for the Baaken area said that the amount of oil in the Baaken is bigger than all the oil in Saudia Arabia. Why to they say things like this? What is the advantage to overstating your supplies from an economic sense? If you are an oil company don't you want to perpetuate that oil is running out and we must drill everywhere at higher cost? If I am CEO of any of these companies I am happy with oil around 80$ and it is one headache if it falls below $60.

In many cases, people probably believe what they are saying about vast oil resources, but following is my "Iron Triangle" thesis from a few years ago:

http://www.theoildrum.com/node/2767

As discussed up the thread, the problem for the energy industry is what happens when they fail to deliver the infinite supplies of cheap energy that it has been promising.

Overstating your supplies keeps your loan financing costs down if you're a private corporation. If you're a country like Saudi Arabia, it maintains the status quo so nobody starts planning the next coup or next war to be timed with the drop in oil revenue. If you're a Gold Mansacks, you manipulate the futures market by promoting the idea that oil will still be cheap in 10 years and profiting from the spread on real prices which you know will be much higher.

As for the gentlemann discussing Bakken, yes, there's plenty of oil there. There's a little of it that's economically profitable and energetically positive. Very little, in relation to what's there. Unless somebody changes the equation (i.e. Much higher prices, much lower extraction costs, or much higher energy return), most Bakken oil might as well be on the moons of Jupiter.

sparky - Here's the cold hard truth about working in the oil patch that I've learned over 36 year: You're an indispensable part of the team with a big future helpING to generate the energy needs of a very appreciative public. Until, of course, YOU'RE NOT NEEDED. In which case they lay you off and you're on your own to figure out how to pay your bills. Why do they say such things? To a potential recruit they do it to provide a sense of long term security in a job with them. The fact that everyone of the recruiters know (probably first hand) there is no such thing in the oil patch and never has been. If you're the CEO of a public oil company there's a darn good reason you say such things: makes folks want to buy your stock and thus increases his wealth in the process. If I were a CEO why would I tell the public that my company had a very limited future and thus limited stock growth potential? The shale plays like the Eagle Ford make a small profit. But that's not why companies like Chesapeake are hitting them so hard. If they didn't they wouldn't be able to spend half their budgets on conventional prospect like my company drills. IMHO if it weren't for the unconventional plays half the oil companies would have to shut down for lack of prospects to drill.

"If you are an oil company don't you want to perpetuate that oil is running out and we must drill everywhere at higher cost?" Yes...if you're an individual like my owner who created our new company specifically because he understood PO. Of course, there's nothing in it for him to preach that to the public. OTOH he sold me and my cohorts on idea quit easily. But, then again, each of us has been doing this for over 30 years and he didn't need to sell us on PO. We work for reduced salaries so we can get a big piece of the pie when we sell the company. My company was started because of PO...not in spite of it.

Back to the recruiter. IMHO as we go down the road towards PO we'll have continued high energy prices. But that won't necessarially equate to a lot of jobs in the oil patch. Probably not nearly as many as there are today 10 or 15years down the road. Schlumberger isn't going to keep all their new hires because oil/NG prices are high. They'll keep them on if they have enough service contracts with the oil companies. Since the NG price bust in '08 there's been one acquisition of a weakened service company by a stronger one. Schlumberger has been a leader in this effort. And guess what their first move is to improve the bottom line: lay off the duplicate positions. Again, this is how it works in the oil patch today...and always has over the last 100 years.

If the companies can't find enough wells to drill (I'll not spend about $50 million of my budget this year for lack of acceptable conventional prospects) then Schlumberger won't get the jobs to justify their staff level. And they will lay their hands off in a heartbeat without a single word of honest concern. As I always say: it's not personal...just business.

Art,

I took another close look at the EIA International Energy Statistics page.

Their number for "Production of Crude Oil, NGPL, and Other Liquids" is 8.6 million bpd for the US in 2010. I expect this particular EIA product is the one that went into the report.

As ROCKMAN pointed out, the US, Russia and Saudi Arabia are way ahead of the rest of the pack in terms of oil production with Iran a distant fourth at around 4 million bpd.

I thought it might be interesting to use the data from this particular EIA data table ("Crude Oil, NGPL and other Liquids") to generate some "net export" plots on identical scales so folks can do a quick visual comparison. Here is the result in order of current production volumes for this particular EIA product:

Placed in this perspective, it's hard for me to take comfort from this announcement even if I thought it were likely to come true.

Jon

Very Nice. If one were to place Export Land Model graphs next to the first two graphs, these 5 graphs would be both compact and compelling.

The US will need as much oil as it can get it's hands on when manufacturing starts to relocate back to the main land to avoid crippling freight shipping costs - no one as yet invented a way of powering freight ships on lithium batteries or solar PV cells as yet. R&D is my opinion is going into the 'sexy' areas ( eg e-cars) and ignoring the real economy - such as offshore production.

platinumshore: i am not an economist, nor an expert on anything, however I think that the U.S would have a few problems with re-locating industry on shore. 1. The physical plants to produce the products do not exist. 2. The manufacturing equipment for the products does not exist. 3. The trained people to build the physical plants, and equipment are not available. 4. Local sources for raw materials may not be available. 5. People to operate the factories and plants may not be available. 6. Money to accomplish the above may not be available as most industry profits exist offshore and the CEOs do not wish to re-patriate them and pay US taxes. However if transportation costs get high enough these problems willl be solved or not.

1. The physical plants to produce the products do not exist. True

2. The manufacturing equipment for the products does not exist. True, but the plans for the equipment do exist.

3. The trained people to build the physical plants, and equipment are not available. True at the moment, that will change if when the salaries in the financial sector implode. Then the brighter students will end up in engineering again. Also, you need fewer engineers than you once did, automation works there too.

4. Local sources for raw materials may not be available. Possibly true, but also true in China.

5. People to operate the factories and plants may not be available. Unemployment rate is over 9%, so that one is false. At worst you have to relocate people.

6. Money to accomplish the above may not be available. There is still capital available in the private sector. It's sitting there because no one sees a profitably place to put it. If all else fails, Bernanke owns a printing press, and is not afraid to use it.

I wouldn't put too much hope in transportation costs being high enough to change anything. Container ships are really cheap on a ton-mile basis, and the next generation will be built for low-speed and fuel efficient travel. That does not make them smaller, by the way. Hull speed increases with waterline length.

Yeah, I'm a bit perplexed at how much importance is put on money and debt here. Money is a tool and a lack of money should never be a reason to not utilize a country's labour and means of production.

Money and interest are analogous to the rate of energy return on investment. An investment in energy which repays its principle in 6 months is better in many ways than one which repays its principle in 5 years, even if the EROI on the first is 2:1 and the second is 12:1.

Well, if manufacturing does relocate here, wouldn;t we, by definition, have less stuff being loaded onto ships than before? Besides which, fuel consumption per ton mile for ships is less than half that of rail and one tenth that of truck, so shipping is not the issue.

The real issues with transport is getting more stuff (and people) from truck to rail - for a 75% reduction in fuel consumption. And then electrify to get the last 25%, and electrifying trains was invented more than a century ago.

You are correct that much R&D is going into the sexy areas rather than the areas that will make a real difference. And even attempts at R&D into real areas - like alternative fuels - is coming up very short on results.

I don't have hard numbers handy but over water shipping accounts for only a very small fraction of the total energy used in shipping a given weight of goods. (Ships are very efficient per pound.) The cost of rail transport from ports (or US factories) is significantly higher but even that is less than the "last mile" trucking costs.

Local delivery costs will become a problem long before ocean shipping costs do. That's why people are investing in battery powered delivery vehicles but not in battery powered ships.

Jon

I have figures for oil used by waterborne transport that says it's 2.5% of U.S. oil consumption for domestic and international. (Report titled: Major Uses of Petroleum Pruducts in the United States 2008) I think BP put this breakdown on a world wide basis in one of their statistical reviews in 2000 or 2001.

Forty percent of oil in the U.S goes to gasoline.

It's not the cost of freight transport that's the problem. After all, we shipped goods across the country with railroads and used horses and wagons to deliver it locally. The problem is that people are going to spend all of their income keeping their cars going. They won't have any money to buy non-essential goods. Oh, they won't have jobs either.

I believe it has proven cheaper recently to make steel in American plants than it is to buy it cheaper but pay the shipping from Asia, due to the fact that modern steel mills, being highly automated, need very few employees.

But imported high value items, such as electronics, will probably be cheaper for the forseeable future, due to the fact that shipping represents only a very small part of the final price- shipping costs being less than the increased cost of domestic manufacture.

For what it is worth, I can't see any reason why ships, being the largest of all mobile machinery anyway, can't be made to run efficiently on coal.I do know that a diesel engine can be built to run on coal, although to my knowledge this has never yet been done successfully on a commercial basis.

But ships are staffed with highly trained crews,which would help a lot with a balky new engine technology, and it would be easy to expand the size of a ship enough to haul the necessary amounts of coal for propulsion.

Or if necessary ships could use coal fired steam turbines, which work just fine but are apparently less fuel efficient..

It does seem likely that any product that is expensive to ship in relation to its value might be a candidate for renewed domestic production.

Coal for ships has a few limitations: 1) The efficiency of marine steam turbines is well below, perhaps half, of diesel engine efficiency. This is because marine boilers are limited in pressure for safety reasons and cannot achieve the high pressures of utility boilers. 2) The fuel value of coal is 13,000 BTU/lb versus 20,000 for diesel 3) Before mechanized feeding it took a lot of labor to feed coal to boilers, but this was automated in the 1920s. Coal probably still requires more labor than fuel oil because of the mechanical equipment. 4) The extra weight of coal displaces freight. This is less of a problem than it was when steam engines operated at 6% efficiency and ships carried more coal than freight.

Coal is much cheaper than diesel. If coal costs $100/ton that's five cents per pound. If it takes 20 pounds of coal to match our efficiency corrected gallon of fuel oil that's about one-third the cost of $3.00 per gallon oil.

In addition to the bulk density issue, coal is not a liquid. The fuel tanks can be made all sorts of shapes, and fitted into odd spaces, with a very simple extraction system - - a pipe. With coal it is much harder to do this, so you end up using even more ship volume for fuel than the btu/lb alone would suggest.

And, currently, there are very few ports where coal is available - only the coal export/import terminals. It might work for coal carrying ships, where they have the fuel already, and separate fuel storage could be dispensed entirely, but for general freight, I can't see it except in some niche situations.

You are correct about freight shipping not yet being powered by lithium batteries or solar PV cells. But there was a time (roughly 200 years ago and with a history of some 6,000 years) when freight was shipped all across the world's ocean trade routes almost entirely by wind power, and the ingenious use thereof. There were also lesser contributions from human-powered rowing, more so in the ancient world. And when it was convenient, no doubt some use was made of ocean tides and river currents. In addition, there were once networks of man-made canals in England, Ireland, western Europe and the USA where smaller boats and barges were pulled by horses (and sometimes by humans) walking along dirt roads running just parallel to the canal.

While wind and sail were once sufficient for some fairly large ships, I have no idea if such wind methods could possibly power the massive oil supertankers and largest container ships of today?

What do you mean were? Those England canals are still very much in operation, it's just no one uses much now for goods transport. Probably the fact that you can out-walk the average barge speed.

I think that there are still 2,000 miles of canals in Britain at this very moment. Birmingham in the centre of the country has more canals than Venice. The trouble is that they are too small and narrow the locks are only 6 feet wide which limits its ability to take large loads. They are also too slow.This was a problem even 200 years ago when they were built so the tried a speed delivery service by having dedicated barges and crews that operated 24 hours and day and could deliver a load from Birmingham too London in 48hr a distance of over 100 miles. There has been extensive renovation over the last 20 years but that was aimed at the holiday market.The nice thing about them is the canal side pubs build over 200 years ago most have mellowed nicely with age. Nothing like sitting outside by the canal on a nice summer evening with a pint of real bitter and a plate of pickles, cheese, onions and fresh bread and butter. Let us hope that Motorway service station have mellowed in the same way in 200 years time, for that is what the pubs were, the Motorway service stations of there day.

The trouble with those canalside pubs is that you need to take great care when turning out of the car park. I think some companies have been trying to use them for deliveries but I have no idea how successfully. I suspect that some cargoes would be well suited to this mode of transport.

NAOM

My guess is that GS is using the EIA category or something very similar: Crude, Natural Gas Plant Liquids, and Other Liquids

GS is reported as saying 8.3mbpd for 'now' which is a bit low for EIA 2010. So either they have a slightly different data set or they expect 2011 to be a bit lower than 2010. I dunno.

But the EIA does include biofuels in "Other Liquids", based on their glossary from the now defunct IPM.

If 2011 is pegged at 8.3mpbd, then it takes about 4% annual growth to get to their 10.7mbpd by 2017. The EIA category quoted above, shows 8.5% growth from 2008-2009 and 5.6% growth from 2009-2010.

I find it interesting that Goldman-Sachs does not believe that either Russia or Saudi Arabia will be able to increase production over this time period.

US conventional crude production has increased over the last couple of years largely due to frakking.

In the "other liquids" category, ethanol increased 170Kbpd from 2009 to 2010.

Not having seen the report, I suspect that these are the two trends that GS expects to continue for the next six years. (But did they model conventional depletion?)

If ethanol, which is nearly all from corn, increases at 20% CAGR for five years we are in deep trouble with our food supply. (That's 860 kbpd to 2.12 Mbpd.) Even a linear increase of 170 kbpd per year would be nearly as bad.

Fortunately I don't think the increase will continue. US producers can now fully supply the E10 mandate and have been exporting to Brazil, whose sugar cane isn't keeping up with growth in fuel consumption. Brazil recently cut targets for ethanol in fuel (bowing to the inevitable), so US exports are unlikely to keep growing at the same pace.

Unless, of course, the EU wants more, and China wants some...

Just a nitpick here, but there is no "e10 mandate" for ethanol.

What is mandated is the total annual volume of ethanol to be produced. This is laid out in the Energy Independence and Security Act of 2007, and section 202 lays out the mandated volumes of ethanol to be produced (in billions of gal per year, gasoline consumption is about 150bn gal/yr)

2006 .............................................................................. 4.0

2007 .............................................................................. 4.7

2008 .............................................................................. 9.0

2009 .............................................................................. 11.1

2010 .............................................................................. 12.95

2011 .............................................................................. 13.95

2012 .............................................................................. 15.2

2013 .............................................................................. 16.55

2014 .............................................................................. 18.15

2015 .............................................................................. 20.5

2016 .............................................................................. 22.25

2017 .............................................................................. 24.0

2018 .............................................................................. 26.0

2019 .............................................................................. 28.0

2020 .............................................................................. 30.0

2021 .............................................................................. 33.0

2022 .............................................................................. 36.0

Scary huh? Even more so when you consider that communist Russia and China do Five Year Plans, and here the US is showing them how to do central planning with a 17 year plan!

There are also schedules for "cellulosic ethanol" and "advanced biofuels" and to date, zero has been produced of either.

The ethanol can be blended as E10, or as E85. Not many people use E85, and the ethanol lobby has not pushed (and neither have the carmakers), so this is why we hear about the E10 "blend wall", and efforts to raise it to E15 and E20. The idea was that if there was excess ethanol, then they would discount it until enough people bought it. Instead, what is happening is that they are exporting it, after claiming the tax credit for blending it to E85!

Ron - Not picking on you. Yes...frac'ng some shale plays have helped increase our oil production. I just take the liberty to rephrase: higher oil prices (and the Wall Street demand for increasing reserves bases) have led to frac'ng/development of known but previously underdeveloped plays.

Though there have been some improvements frac'ng techniques haven't changed a great deal in over 40 years. And using such methods to produce these types of reservoirs isn't new either. Over 30 years ago the hottest oil play in the US was the Austin Chalk (a fractured "shale" made of carbonate minerals). Many thousands of wells were drilled, frac'd, produced and depleted decades ago.

The big tech improvement was using horizontal wells in such reservoirs. But that's not exactly new either. We were doing that routinely 20 years ago. Even "new" hot plays like the Eagle Ford shale iaren't new per se. I frac'd my first EF well about 25 years ago...and without impressive results. IMHO what has been a game changer has been higher prices combined with an essential component of PO: an ever decreasing number of conventional oil drilling prospects in the US. The public companies are driven to replace their reserves as they are produced. Reserve replacement is the #1 metric Wall Street uses to value these companies. How profitable these new reserves prove to be is not as important. Fortunately for the public oils recent high oil prices make the unconventional oil plays viable. If oil dropped somewhere south of $70/bbl the fractured oil shale plays would crumble. Which is exactly what happened to the unconventional shale gas players back in '08 when NG prices crashed. You may have noticed that the biggest players in these oil trends were the big players in the NG trends back then. And for good reason: it's the only game in town for those companies.

Literally the public companies have no choice but to chase these fractured oil shale reservoirs. My company chases conventional oil/NG prospects. And we can't find enough prospect to spend all our capex. And that's with $100 oil. And my budget is tiny compared to the combined budgets of the public oils. Just my WAG but probably more than half the oil companies in the US wouldn't exist today were in not for the shale plays.

I tend to beat this point to death sometimes because cornucopians offer these big "new" plays as an example of how new tech improvements will save us. The current drilling booms and production increases didn't result from a big step change in tech. Just an insatiable desire of public oils to keep Wall Street happy with higher energy prices lending a hand. If they want to tout some new tech that will save us from PO they should focus on those big oil (kerogen) shale plays out west. All they need is some new tech to make them commercial. As been said about other "big potential game changers" these oil shale are just 5 years away from having a big impact...and have been for the last 40 years.

No hard feelings, Rock. Appreciate you trying to keep me on track and your gut checks on the sustainability of the frak trend. Here, I am just trying to get a feel for what GS is basing their estimates. No value judgments from me on their validity.

Been playing around with google charts today.

Grid lines don't line up with tick marks. :?

This illustrate that the recent US increases are mostly "non-traditional" oil

Y-axis is thousands of barrels per day

That graph of "crude oil, NGPL and Other liquids" includes ethanol, to the tune of 870,000 bbl/day. BUT this is the actual volume of ethanol, and it has only 2/3 the energy content of gasoline or oil. If it was done in terms of "barrels of oil equivalent", then the blue line would drop by 290,000 bbl/day in 2010.

Both lines include the oil that is produced, and then used in the production of oil/ethanol. it would be interesting to see a chart of the net oil production, after all the oil used for oil exploration, production (incl ethanol) and transport is deducted. In effect, we would have a mini export land model for the oil industry, which like the exporting countries , would likely show a steady increase in "domestic" consumption, as more efforts are spent drilling/producing in more places for less oil per well.

Ron - None here either. Hope you didn't misinterpret my intent. I don't like to argue for or against anyone's predictions on production rates as long as they keep it real. What I always want to do is make sure folks understand that we haven't discovered some new tech and potentially more magic bullets on the way that will save us from PO. We aren't doing anything significantly different today on a tech level we weren't doing almost 20 years ago. That's why I point out that it's not just higher prices pushing much of the new drilling but also the WWall Street demand that public oils increase their reserve base rgardless of lower profitabity. I'm not predicting why or even if it will happen, but if WS changes it's valuation metric we could see a very abrupt end to much of th unconventional resource plays. In case you missed it, my company is privately owned...no stock to hype. We don't drill any of the shake plays...not profitable enough. We stick with the more lucrative conventional plays. The problem we have is not eoough of those to drill. I'll have around $50 million left in my budget this year for lack of prospects to drill.

Bottom line: the drilling boom in the shale plays we see now isn't in spite of PO but because of it. And I think it's very difficult for many folks to get their heads around that.

My impression of things was way of because I've been looking at the Wikipedia page on Oil reserves. They list US production at 9 million barrels per day, Russian production at 99 million barrels per day and Saudi Arabia at 97 million barrels per day. For this information they listed EIA as their source which apparently means that the date includes more then just crude oil production. Also the information on the Wikipedia page is just plain wrong. Based on EIA data they've overstated every country's production except the US by around a factor of 10. I guess I should be more careful about trusting things I read on Wikipedia.

http://en.wikipedia.org/wiki/Oil_reserves#Estimated_reserves_by_country

You are reading it wrong. Russia is given as 9.9 * 10^6 bbl per day which is 9.9 million bpd not 99 million. It's the production for the US which is wrong and was broken in this edit probably by mistake http://en.wikipedia.org/w/index.php?title=Oil_reserves&diff=next&oldid=4...

Someone should fix it.

Looks like I was of by a factor of 10. Thanks for the correction.

To make up for my bad math I've tried to correct the wiki page. I used information from this site. If I made any mistakes please tell me.

What happened was that on July 15, someone at IP address 74.105.76.64 tried to reorder the list of countries by production and screwed it up completely. Unfortunately, nobody caught it. Among other things he renamed "Qatar" to "United States" and vice versa.

It works more or less as far as reserves are concerned, since they are in the same ballpark, but not production. If someone could track down 74.105.76.64 and punch him repeatedly in the face until he promised to be more careful in the future, it would be greatly appreciated.

What is interesting about Goldman Sachs, and all those in the banking industry these days, is that they love fiat dollars and actually despise gold, thereby making the name "Goldman" defunct and rather ironic. In the past, the hoarding of gold formed the basis of the banking system.

It's the same with economics. It was once "the dismal science" precisely because they understood resource scarcity and population dynamics. Today, the vast majority of economists are cornucopians.

The modern world is insane.

Actually, I think the cornucopian economists are right.... the majority of the economy has shifted from energy & food production to services, entertainment, and high-tech gizmos. We continue to shift to a virtual economy with computer games, software, social media, etc.

What's interesting about all this is I think we might be moving to a point where jobs are obsolete. If farmer owner-operators can vertically integrate into renewable energy production (wind & solar), then really it's just a matter of getting the resource (food & energy) from the midwest of the US out to the coasts. Then it's a matter of what are people paying attention too that's really the scarce resource that Goldman (and big media) are competing over.

Goldman & company can inflate, deflate, or otherwise mess around with the fiat currency & commodity markets all they want, but the farmers are still going to plant stuff and grow it. Goldman can go on perpetuating larger societies fixation on money and hoard the attention, but it doesn't make that much difference. Farmers that get fixated on money and overextend themselves and get on the wrong side of a market swing won't be farming in 10 years.. But that's only a few of them. At least some of them are like me and planning for a 30-60 year outlook.. which in my case means waiting to pick up some farmland at a good price, then paying it off.

That's a simplification that really works only for grain products, which are largely grown in the upper midwest. However, agriculture also consists of fruits and vegetables, meat and dairy, as well as other categories like oils and spices, etc. When considering overall agriculture production, the traditional #1 state in the USA has long been California. And most such government stats will not even include what some observers consider to be America's #1 cash crop, which is marijuana, and much of the domestic output for that crop is grown in the wilds of Northern California.

The number #2 agriculture state in recent years has been Texas (which is both a coastal and a midwestern state) at least prior to this summer's horrible drought. And this raises another factor, which is that global warming could very well alter much of the common wisdom about what grows best where - and this effect may be starting to take effect already. It's true that the rest of the top ten is largely composed of the midwestern grain belt states. But North Carolina and Florida are also top contenders (NOTE: I believe they do count tobacco) along with other states in the southeast. My point is that overall agricultural production is not really centered in the midwest, with the exception of cereal grains. And the very latest official U.S. medical advice on diet emphasizes fewer grains and breads, with much more fruits and vegetables (no more food pyramid).

Regarding petroleum output, Texas is once again the #1 state (after a brief reign as #1 by Alaska) in both current production (with gradual increases in recent years) and arguably also #1 in terms of production outlook for the near future. Alaska is #2 and dropping, followed closely by California which is at #3 but dropping more slowly than Alaska.

And here's a surprising stat for you: Texas is (by far) the #1 state in wind energy output, with nearly 3 times the wind energy production of both #2 Iowa and #3 California in 2010.

They probably think Canada is a US state.

or that it will be by 2017. Canada produces close to the 2.6mbd they are talking about, so just redefine Canada as part of the US production and there you are. Much cheaper than actually exploring for new oil....

Paul you will know that, when the American Government starts referring to Canadian oil resources as Continental resources.

Indeed! Actually, Canada started down that path a few years ago, with some private think tanks putting out reports about a "continental energy strategy".

But, given how Canada is currently getting such a raw deal on WTI oil pricing (currently costing $20bn a year), with the hand wringing over the Keystone XL pipeline, Canada's focus on energy markets is moving towards China. China has invested over $10bn in oilsands projects, and is quietly backing the proposals for two new pipelines to the west coast.

So, for the US, if they want to actually keep getting Canada's oil, they need to wake up, otherwise it will be going off the continent in short order, regardless of what they "claim"

GS makes two kinds of reports, the public one which is full of inconsistencies and mistakes and is usually targeted at the Sheeple. Then there's the one targeted for their private clients, that's the one report worth killing for, I am quite sure that report contradicts everything this one says.

For me all credibility went down hill as soon as they used stock technical on oil production charts, this death cross, triple bottom stuff doesn't work for real world resources.

GS seems almost like a mob boss placing bets on a boxing match. He appears to publicly place a big bet, then everyone else follows it (assuming he's bought off a boxer to take a fall in the ring), while he secretly bets against his public play and makes a killing on what he really believes will happen.