Is It Really Possible to Decouple GDP Growth from Energy Growth?

Posted by Gail the Actuary on November 21, 2011 - 11:00am

In recent years, we have heard statements indicating that it is possible to decouple GDP growth from energy growth. I have been looking at the relationship between world GDP and world energy use and am becoming increasingly skeptical that such a decoupling is really possible.

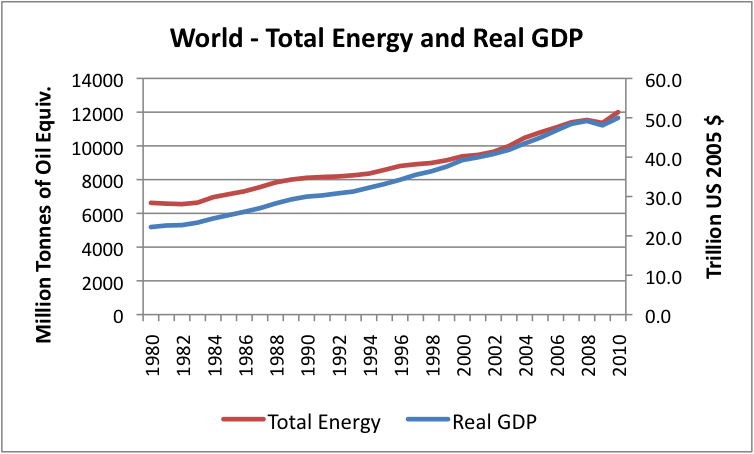

Prior to 2000, world real GDP (based on USDA Economic Research Institute data) was indeed growing faster than energy use, as measured by BP Statistical Data. Between 1980 and 2000, world real GDP growth averaged a little under 3% per year, and world energy growth averaged a little under 2% per year, so GDP growth increased about 1% more per year than energy use. Since 2000, energy use has grown approximately as fast as world real GDP–increases for both have averaged about 2.5% per year growth. This is not what we have been told to expect.

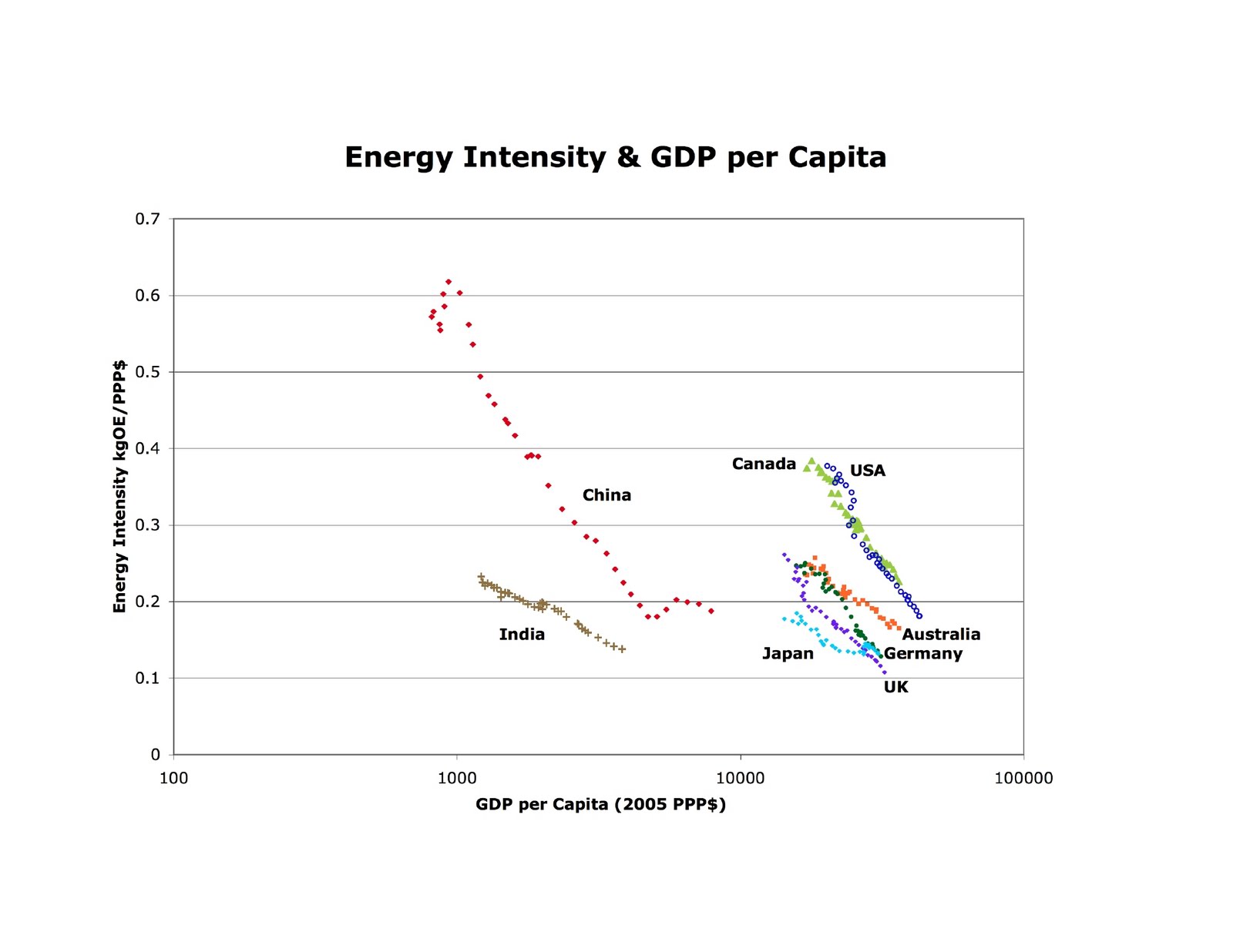

Why should this “efficiency gain” go away after 2000? Many economists are concerned about energy intensity of GDP and like to publicize the fact that for their country, GDP is rising faster than energy consumption. These indications can be deceiving, however. It is easy to reduce the energy intensity of GDP for an individual country by moving the more energy-intensive manufacturing to a country with higher energy intensity of GDP.

What happens when this shell game is over? In total, is the growth in world GDP any less energy intense? The answer since 2000 seems to be “No”.

It seems to me that at least part of the issue is declining energy return on energy invested (EROI)–we are using an increasing share of energy consumption just to extract and process the energy we use–for example, in “fracking” and in deep water drilling. This higher energy cost is acting to offset efficiency gains. But there are other issues as well, which I will discuss in this post.

If GDP growth and energy use are closely tied, it will be even more difficult to meet CO2 emission goals than most have expected. Without huge efficiency savings, a reduction in emissions (say, 80% by 2050) is likely to require a similar percentage reduction in world GDP. Because of the huge disparity in real GDP between the developed nations and the developing nations, the majority of this GDP reduction would likely need to come from developed nations. It is difficult to see this happening without economic collapse.

Real GDP Growth and Energy Growth for Several Countries

I started this analysis by looking at trends (1) in real GDP and (2) in total energy consumption for a number of countries, and was struck by how different the patterns appeared.

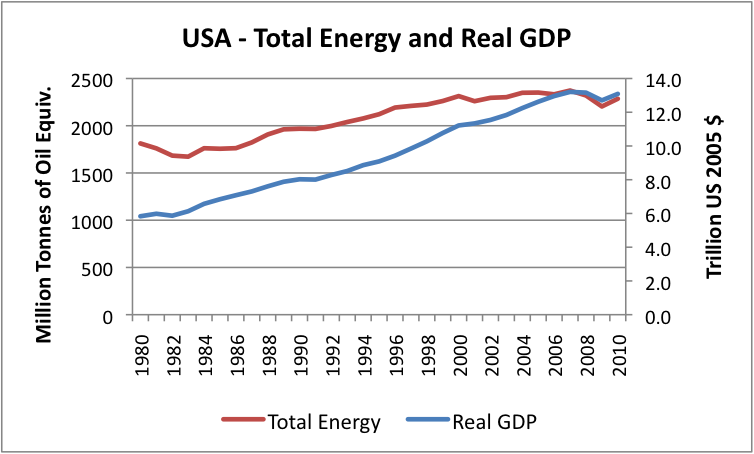

Up until 2005, the USA was able to increase real GDP by 3% per year, while increasing energy use by only 1% per year. The 2% savings would seem to come from some combination of offshoring and energy efficiency. Since 2005, the relationship between GDP growth and energy growth has been closer.

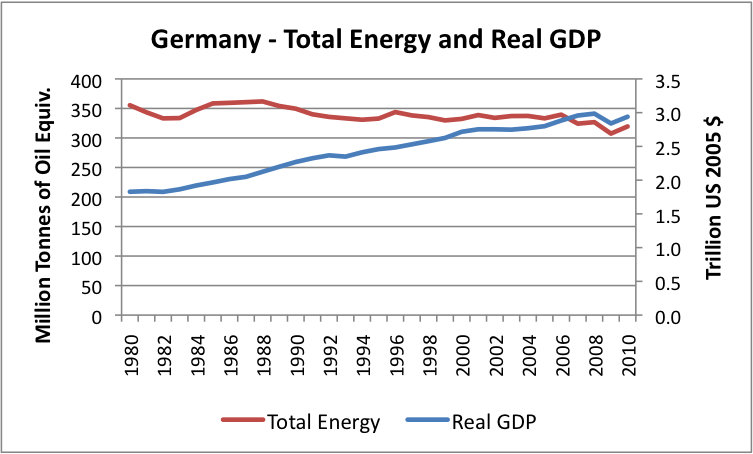

Germany is another example with much higher GDP growth than growth in energy use. Between 1980 and 2005, energy use was close to flat, while GDP rose by an average of 1.7% per year.

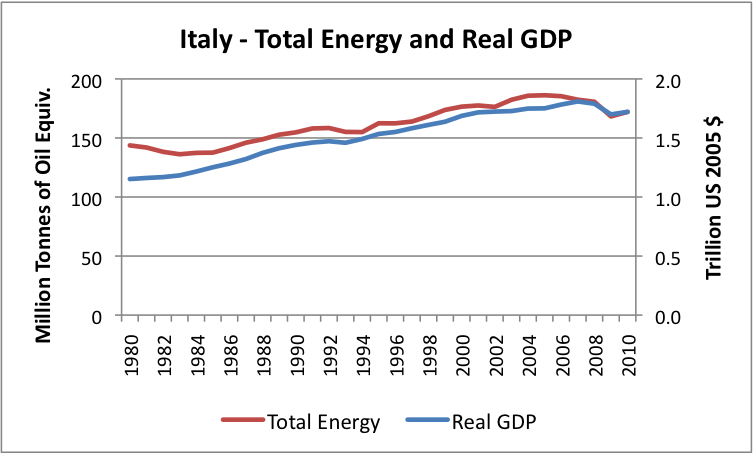

Italy’s real GDP grew by about 1.7% a year between 1980 and 2005, while its oil use grew about 1.0% per year, so it too shows energy efficiency/offshoring gains, amounting to about 0.7% per year. This gain is less than that of the USA and Germany, but Italy was also less industrial to start with, so offshoring was less of an option.

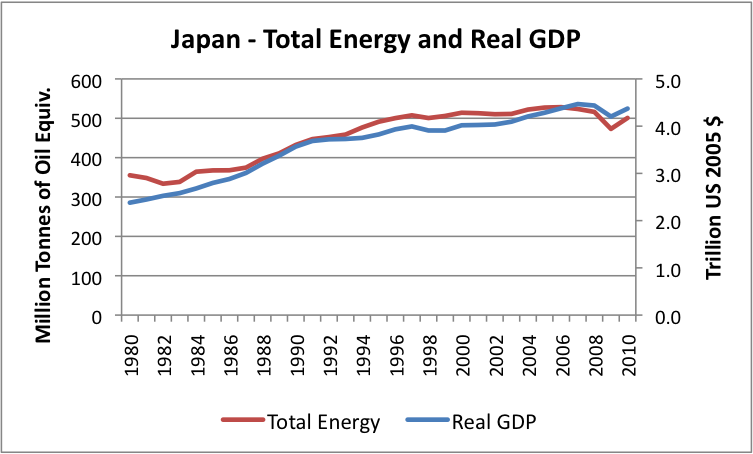

The tie between energy consumption and GDP growth has been much tighter for Japan, especially since about 1987. Since 1987, the two have grown at about the same rate.

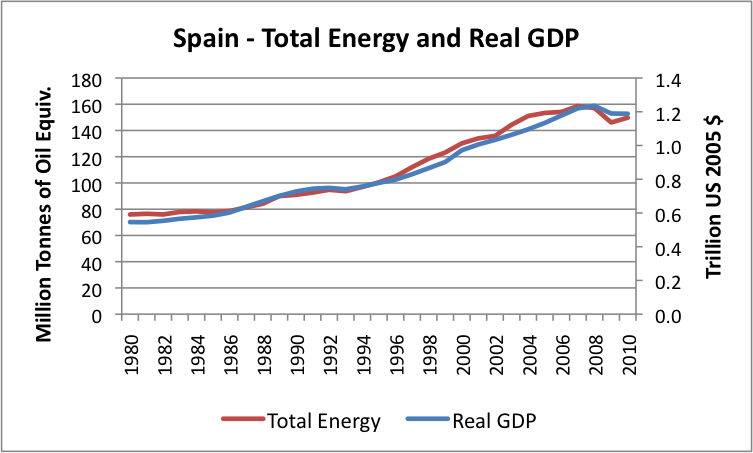

Spain has also showed a very close tie between growth in energy consumption and growth in real GDP, with both growing by close to 3% per year between 1980 and 2005.

Greece managed to grow its energy use faster than real GDP during most of the 1980 to 2005 period. This may contribute to its current economic problems.

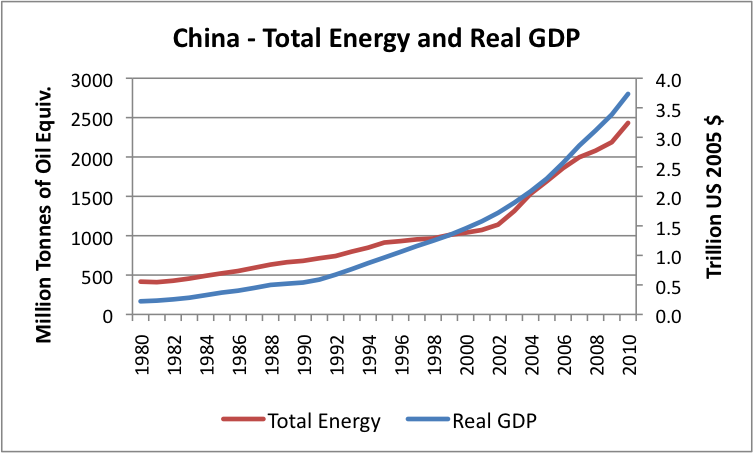

China shows more rapid growth in real GDP than in energy consumption. Its real GDP grew by about 10% a year between 1980 and 2005, while energy use grew by a little less than 6% per year. Between 2005 and 2010, real GDP continued to grow by about 10% per year, while energy use grew by about 7.5% per year. The country has been changing so rapidly that a person wonders how accurate the early GDP numbers are.

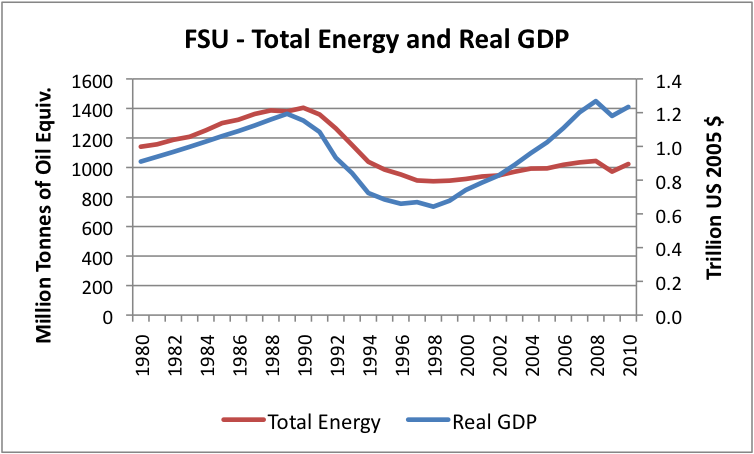

Figure 9 shows that the pattern for the Former Soviet Union (FSU) has been very unusual. Both energy use and real GDP collapsed after the collapse of the Soviet Union, but the drop in GDP was greater than the drop in energy use. Recently, real GDP has been soaring while energy use remains flat, suggesting that outsourcing of high energy manufacturing is occurring, or that new sources of GDP that do not require much energy use are being created.

Changes in Energy Intensity

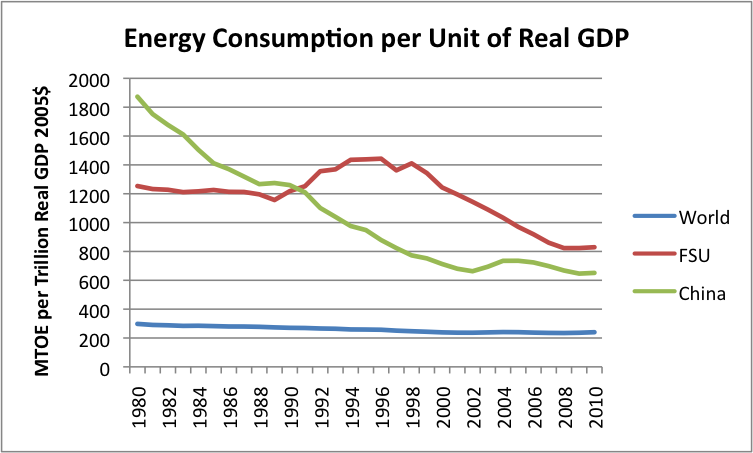

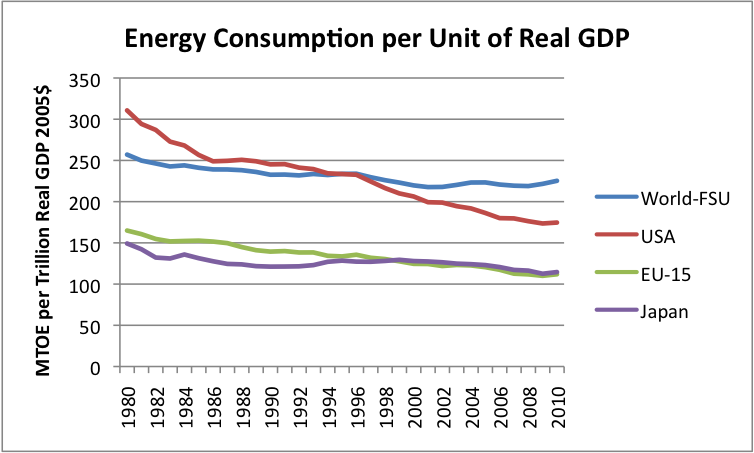

The usual way of measuring energy intensity is as the ratio of energy consumed to real GDP (the red line divided by the blue line in the above graphs), and these ratios vary greatly. In fact, it is hard to even put energy intensities for different countries on the same graph, because the amounts are so different.

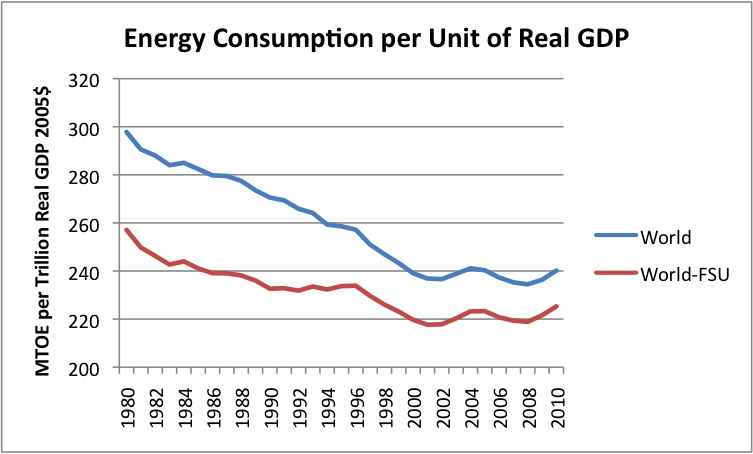

It seems to me that what we are really interested in is the energy intensity of the world, (or perhaps of the world less the Former Soviet Union, if Former Soviet Union data is totally bizarre, reflecting very high energy usage in the past that is now disappearing, and cannot be replicated elsewhere). We show these in Figure 11:

Figure 11 shows that energy intensity on a world basis has been flat since 2000. This is also the case when FSU data is excluded. We expected recent world energy intensity to be flat, based on Figure 1 at the top of the page.

Why does world energy intensity remain flat, while energy intensity for many individual countries has been decreasing?

We are dealing with a large number of countries with very different energy intensities. The big issue would seem to be outsourcing of heavy manufacturing. This makes the energy intensity of the country losing the manufacturing look better. Outsourcing transfers manufacturing to a country with a much higher energy intensity, so even with the new manufacturing, its ratio can still look better (lower). It is hard to measure the overall impact of outsourcing, except by looking at world total energy intensities rather than individual country amounts.

Looking at world energy intensities, it appears that the huge amount of outsourcing is resulting in pretty much comparable energy use to the original energy that was outsourced. It is hard to make a direct calculation of the difference in energy use, because much of the new energy use is indirect. For example, the government of the developing nation may build huge amounts of new paved roads and concrete homes with tax revenues, and individual workers may buy new cars with their salaries. These amounts are not captured in a simple comparison of the energy used in making a widget in the USA relative to the energy used in making a widget in China, for example.

Another issue is that the energy use of interest is per dollar of real GDP, and a savings in energy that results in a cost savings may not be very helpful in lowering energy intensity of GDP. For example, suppose that a manufacturer creates a new, smaller car, that is 20% cheaper and uses 20% less gasoline on an ongoing basis. More workers will be able to afford this car. Furthermore, a well-off worker who can afford this new cheaper car (and who could also have afforded a more expensive car) will have left-over money. With this left-over money, the well-off worker can purchase something else, such as an airline trip, food flown in from overseas, or a new iPod. All of these extra purchases take energy as well. So when the overall picture is viewed, the fact that more energy-efficient cars are being manufactured does not necessarily translate to lower energy intensity of GDP.

One issue mentioned in the introduction to this post is the fact that EROI for fossil fuels is declining because the easy-to-extract fossil fuels have mostly been extracted. As a result, we are now extracting the more difficult to extract fossil fuels, requiring more energy.

A similar situation occurs in many other endeavors, because we live in a finite world, and we are reaching limits. In mining, the quality of ores is getting poorer, meaning than more energy needs to be used in extraction. In farming, we are stretching our resources tighter, requiring more fertilizer, pesticides, and more irrigation, all requiring energy. We are running short of fresh water in some places, so water is pumped from greater distances or desalination is used, adding to energy usage. Pollution is an issue, so we require utilities to add scrubbers to old coal plants. All of these efforts require energy, and likely contribute to an upward trend in energy usage, offsetting efficiency savings elsewhere.

Another issue that tends to raise energy intensity of GDP is the long-term trend toward using machines and additional energy to do jobs, rather than simple human labor. For example, if a person chops down a few trees and builds his own house, most calculations would say that there is neither GDP nor (outside) energy used. If a person hires a builder to build a house, and the builder uses hand tools to chop down trees and human labor to build the house, the result is an increase in GDP, but little fossil fuel energy use. If the builder becomes more “modern” and uses earth movers and concrete to build homes, then energy use rises relative to GDP created.

Carbon Dioxide Emissions

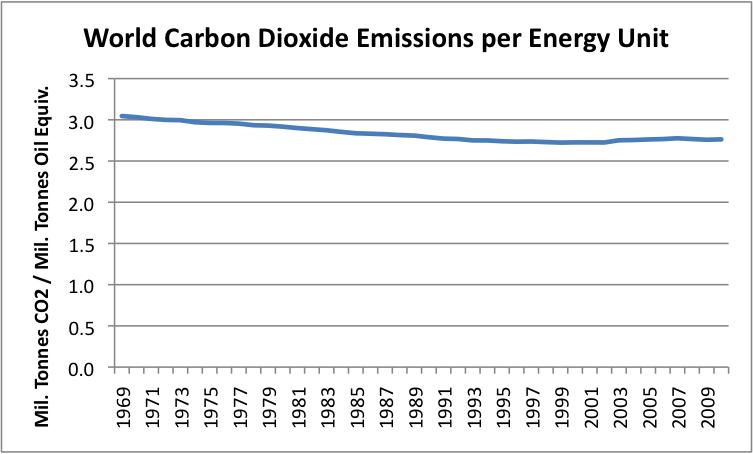

As might be expected, carbon dioxide emissions per unit of GDP are closely related to energy intensity. In fact,

(Co2 Emissions/GDP ) = (CO2 Emissions / Energy Used) x (Energy Used / GDP)

The ratio (Energy Used /GDP) is simply energy intensity, which was graphed in Figures 10a, 10b, and 11. The other ratio is (CO2 Emissions / Energy Used) graphed below in Figure 12. It shows a similar pattern: declining prior to 2000, and then leveling.

The ratios in Figure 12 reflect changes in energy mix over time, and their relative propensity to generate CO2. Since 2000 these emission per unit of energy use have, in fact, started to rise a little, because of the greater use of coal in the energy mix. The CO2 measurements used in this analysis are BP’s calculations, based on the types of energy used each year (including renewables*). They do not reflect actual measured CO2 in the atmosphere.

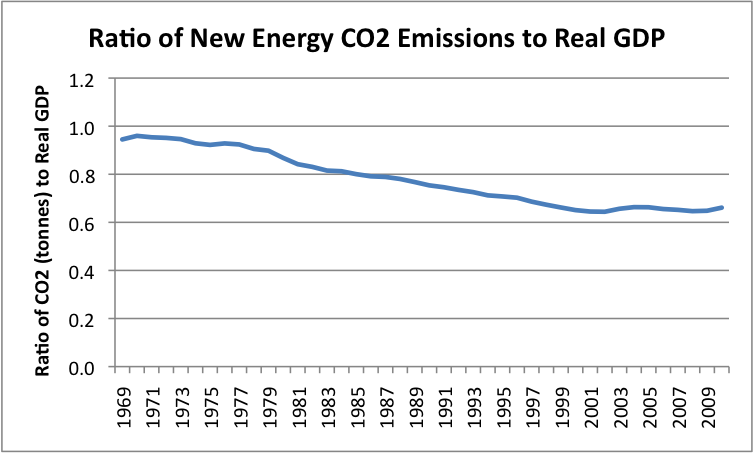

The ratio of new CO2 emissions to Real GDP reflects a combination of these ratios (C02/Energy and Energy/Real GDP) and is shown in Figure 13.

Figure 13 indicates what we would expect from Figures 11 and 12: A declining ratio of CO2 emissions to real GDP until about 2000, then fairly flat thereafter. In fact, there is a distinct upturn in 2010. Thus new CO2 emissions from energy sources have been rising about as fast as real GDP since about 2000, and a little faster than real GDP in 2010. This is no doubt discouraging news to those who adopted the Kyoto Protocol in 1997, thinking it would reduce CO2 emissions.

A Few Thoughts on Energy Policies

Carbon taxes and cap and trade policies seem to encourage outsourcing of manufacturing. The primary benefits of outsourcing would seem to be (1) a reduction in imported fossil fuels, (2) lower cost of manufactured goods to the consumer, because of lower labor costs, and (3) possibly higher profits to the company selling the new cheaper product. Offsetting these benefits are a loss of jobs for the country doing the outsourcing and a loss of control over what types of energy are used in the manufacturing process. It seems to me that we would be better off not encouraging this outsourcing, especially when essential goods are being created.

One misconception that seems to guide much energy policy is the view the biofuels will substitute for oil, and that use of additional electricity use will substitute for oil. Oil use is pretty much maxed out. Oil supply is very close of inelastic, regardless of price. Someone, somewhere, will use any oil pulled out of the ground, perhaps at a slightly lower price, even if a particular country can reduce its oil consumption through the use of biofuels, or if a car can run on electricity.

This means that any biofuel that is created will add to world energy supply, by using natural gas and coal supplies more quickly, since their use is still somewhat elastic. Similarly, by moving energy demand from oil to electricity, we what we are really doing is expanding total energy usage, by burning more coal and natural gas to make more electricity.

Thus, from a world CO2 perspective, biofuels and increased electrical usage are not helpful. Individual countries may still find biofuels and expanded electrical use helpful, because they can reduce oil imports, if oil use can be shifted to another country. There is also the hope that we can continue our motoring lifestyle longer, using electric cars.

If our intent is really to reduce CO2 emissions, it seems to me that we need to look much more broadly at the issue. Maybe the issue should be viewed in terms of (1) fossil fuel resources that we are willing to use in each future year, and (2) how much real GDP can be created from those resources, given the issues we are facing. The quantity of fossil fuels to be used each future year might consider CO2 goals as well as limits on the amount of oil that can be extracted each year because the “easy oil is gone”. The amount of real GDP that can be created from these fuels would depend on a number of factors, including declining EROI and increasing efficiency.

If the plan is to reduce fossil fuel consumption, then we may very well be expecting real GDP to also decrease, perhaps by a similar percentage. In fact, looking at the experience of FSU in Figure 9, the GDP decline may even be greater than the energy decline.

Conclusion

We are facing a challenging time. This post seems to suggest that there is yet another story that we are being told, that isn’t quite true. It seems to me that we need to examine the issues ourselves, come to our own conclusions, and start telling the real story.

*I have not attempted to discuss the impact of renewables, since to date their impact has been small. The front-ending of energy use of renewable makes their impact on energy intensity of GDP less beneficial than standard comparisons would suggest.

This article first appeared on Our Finite World.

More on this topic....UNEP decoupling report http://www.unep.org/resourcepanel/Publications/Decoupling/tabid/56048/De...

As I look at the UNEP presentation that is related to the report that you are linking to, what has happened in the last ten years is a major shift in the trend of commodity prices. Between 1900 and 2000, these commodity prices had been trending downward; since 2000, they have been trending upward. To me, this could very well be related to falling EROI and to limits we are reaching of other types--cannot irrigate more land, for example, and land is becoming more saline where irrigation is used. A couple of exhibits of interest:

If a person believes that the last 10 years is just a random fluctuation upward in resource costs, then one can believe that the pattern of 1900 to 2000 is repeatable. But if the recent pattern represents a new trend, based on declining EROI and resource limits, then we are in a new world altogether.

Gail,

These two graphs from the report are interesting but I am surprised that UNEP made no effort to combine them somehow. As is, they are not that useful together: they cover different time periods; they are on different scales; one is composite while the other is individual components. One also wants to know which points were used in the linear fits and what the R2 is or whether they are "eyeball fits". It is impossible to say anything quantitative about the recent upward trend in commodities shown in figure 2.5.

Indeed, you are correct that IF the recent trend shift in commodities prices is due to EROI then our understanding of economics will have to change. But that's a very big IF.

I would like to remind people that commodity prices do not exist on some absolute scale measured in unassailable physical units. Price are an inherently 'squishy' concept when taken over longer periods of time. I have always been partial to price ratios as being more informative than "constant dollar" prices.

A quick google image search on "commodities vs. stocks" sent me to Cycles of commodities -vs- stocks, 110 years which has the following chart:

and the following description:

If I am to be convinced that declining EROI is the primary reason commodities prices are rising, someone will have to explain in great detail how this cycle is different from the previous three.

Don't get me wrong. I do accept that EROI is declining globally and that this will eventually affect commodity prices. But I happen to believe that the current rise is primarily driven by cyclical economic issues and only secondarily by EROI.

Jon

Thanks for your comment.

As I said above and in the post, I don't think the problem is just declining EROI. I think it is running into limits in other ways as well, such as fresh water. If one goes from collecting water from a stream to using a desalination plant as a source of water, clearly a huge amount more energy is used in the process, and the real cost goes way up. In fact, going from steam water, to water pumped from a deep aquifer, to water from a desalination plant represents the progression we are seeing.

When we saw spikes in commodity prices in the past, it wasn't because world energy supplies were hitting limits. The limits we are hitting now add a whole new dimension. I don't think I can quantify the effect in one comment, though.

Gail

I believe there is another effect that has been strongly evident in the last decade. That is the disparity between commodity costs and commodity prices.

In a free and fair market you would expect that prices will directly reflect the cost of commodity extraction. However, when you go through a period of rapidly rising consumption of any product companies expend large amounts on capital assets. They naturally want to see a rapid return on those assets, so prices rise disproportionately to the direct cost of production. Even for the market producers that do not make capital expenditure they will increase prices to match those that do. When/if the commodity returns to a stable production level then normal market forces return the prices to be relative to the cost of production.

The last decade has seen an unprecedented growth in commodity production driven by China and to a lesser extent India. I think you will find that this has had a much more serious impact on commodity prices than ERoEI or lower resource quality. That is not to say that these two effects will not come into play in the coming decade.

Not so. In a free and fair market the cost of any product will reflect always supply and demand. The cost of production or extraction is only the base line, or the lowest price any producer can take and still make a profit, or at least not take a loss.

The cost of extraction of oil varies greatly, from the dollar single digits for the old fields to over $80 a barrel for some deep water sub-salt fields. The highest price is the marginal cost or the lowest point that the price of oil can fall before production starts to eventually decline. (As Rockman has pointed out producers will often keep producing oil at a loss because they have already made the investment in the well because it is better to recoup part of their investment than none of it.)

But the world price of oil is over $100 a barrel because that is the price that must be paid in order to make demand down to equal supply.

Ron P.

Not quite exactly any of the above, in the sense that one be more specific than handwaving about "supply and demand".

In a "perfectly" competitive market, one would expect competition to drive the price down to near the marginal cost of production. That would be the cost of producing the most-expensive-to-produce barrel of oil actually sold. Some can produce oil quite cheaply, and that capability is tied to location, so they can can enjoy a sweet ride for the time being. OTOH with manufactured goods, the sweet ride often ends when the patents expire, since there are rarely huge permanent cost differences tied to location. (And since people privileged with sweet rides naturally want to keep them, there is constant lobbying to make patents and copyrights last ever longer and longer.)

Observe that the "marginal cost" formulation highlights a possible financial instability, since the marginal cost is usually lower than a total cost that includes capital expenses. Thus if demand growth slows or stops, the price may fall too low to carry the capital expense. One then sees a cascade of bankruptcies of the sort Rockman has alluded to, followed eventually by yet another price spike that goes high enough to attract capital again.

Middle East countries have to keep their population pacified as well, or they will have a revolt and overthrown government. So I would consider payment for social programs as part of the cost of production. When food prices are high, these costs are high. This is part of the reason the Saudis want high prices.

ME countries would have those costs whether they had oil or not, so I don't think you can consider it part of the cost of producing oil.

If they want to keep on producing oil, they have to keep their populations pacified. Also, rising oil production is what allowed population to rise to such an unsustainable level in the first place.

They really, really need to keep their populations pacified, whether or not they produce oil. Otherwise, the ruling classes just need to decide whether they want to live in the South of France, or Miami. And, whether to stash their money in gold or Cayman accounts.

OTOH, I know what you mean: countries like Iran, KSA etc need oil prices at a certain level in order to get enough revenue to pacify their people. Still...I hate to call that a cost of oil production - you can think of it that way, but it would be confusing things, I think. After all, if your people demand more money, has the cost of oil production gone up? Not exactly.

Paul, sorry to be so disagreeable but that is simply not the case. The price must always be well above the cost of production because farmers must make a profit, oil companies must make a profit, especially national oil companies. That being said however, there is nothing in any free market that would cause the cost of a scarce commodity to reflect the cost of production.

If the commodity is scarce the price will always be well above the cost of production, often several times the cost of production. After all that is the case of Saudi oil and Saudi oil is not overpriced. It cost less than $10 a barrel to produce oil from Ghawar but the demand for the scarce commodity of oil drives the price to over ten times the cost to produce.

If however there is a glut of any particular commodity then the price will more closely reflect the cost of production, but ideally slightly higher. Even if there is a glut producers must still make a profit.

But it is always supply and demand that sets the price, not the cost of production. Also, patented products are not usually regarded as commodities. We are talking about oil, gas, pork bellies, corn, soybeans and such, not medical products or electronics.

Ron P.

"The price must always be well above the cost of production because farmers must make a profit"

"Cost of production" includes a profit at least equal to the risk-free investments available, usually T-bills. If you can't beat a T-bill, there is no point in taking the risk of running a business. Now once you're committed, then you might find yourself in a position where all you can do is to lose as little money as possible. Yes, you could sell the company, but since it's losing money, you won't get much, and you still find you lose less by continuing to run it on on-the-cheapmode.

Been there, Management gets really grumpy. What's scary is that in a process plant, run it cheap means deferring maintenance, and that will get you in trouble later.

I think part of the issue is that the cost to develop new fields is very high, regardless of whether some oil is coming out cheaply from old fields. If prices are not high enough, it does not make sense to make the huge up front investments needed for these sources. As examples, there is the high priced project in Kazakhstan:

Biggest find in decades becomes $39 billion cautionary tale

The cost of exploration and drilling in the arctic has to be extremely high, and there are a lot of risks that things will go wrong in deep sea drilling. We are not growing oil production as fast as oil demand (as reflected by the long term rise in oil price, punctuated by recession), indicating that we are not really developing the new "Saudi Arabia's of unconventional oil" that are required, if we are to move production to the higher levels required by growing world demand.

I agree with the bulk of the responses above but, as per the original post, I was actually refering to the economics of commodities in general, not just oil. We were looking at a comparison of GDP/Equity prices compared to commodity prices over the last century. Oil only makes up a relatively small portion of overall commodity prices. The effect of large investment requirements has particularly hit other commodities such as coal,iron ore and other metals in a way that these products have not experienced in the past.

Oil pricing seems to exhibit the same trends as other commodities except on steroids. I suspect that this is a result of the relatively high return on investment criteria placed on oil development projects compared to other resources. This high hurdle rate in turn delivers price inelasticity. Price inesasticity leads to price volatility and the requirement for the rapid return on investment.

There are a lot of oil projects that don't turn out as planned, or that the costs turn out to be a lot higher than expected. I expect this is part of the reason for the theoretically high return. They also need to earn enough so they can build up capital to do work on the next big project.

Phoenix, you did use the word "extraction" in your original post that I replied to, a word usually associated with oil production and not other commodities.

Well inelastcity is the opposite of volatility soooooo... you lost me there. ;-)

Ron P.

No, inelastic implies that neither supply nor demand respond to the price, i.e. if the price doubles, consumption and production stay the same. Of course that descibes perfectly hard inelasticity, in reality there is some affect on both supply and demand, so a market equilibrium price other than zero or infinity is possible. So the adjective inelastic in this context means that supply and demand are only slightly effected by price, which implies that a small change in supply and/or demand can have a large impact on the market price.

Phoenix's main point, was that someone planning to drill a well, doesn't want to lose their shirt if the price of oil is lower than the centerline of the price prediction. So we havea trusted report that says oil in 2015 will be $100/per barrel, with an uncertainty of $30. Our not so intrepid investor doesn't want to lose his short if the price is the lower one, so he won't drill the well unless his estimated price of production is less than $70. The implication is that future price uncertainty has an inhibitory effect upon drilling and investment.

Oh for goodness sake. Enemy, I know we have often discussed demand inelasticity on this list. That is demand, some say, does not respond to price. That however was not what Phonex said. He specifically said price inelasticity.

I was just joking, not nitpicking because Phoenix likely had demand inelasticity in mind when he wrote that. That is why I put a smiley face by my reply. I was just kidding him about getting price inelasticity mixed up with demand inelacticity. Because price volatility is the opposite of price inelasticity.

P.S. I think most folks who argue demand inelasticity got wrong, price obviously does affect demand.

P.S.S. I don't recall anyone ever arguing that supply does not respond to price, on the downside anyway. Supply does drop, and did drop quite dramatically from non-OPEC nations when the bottom dropped out of the price in 2008. Obviously both supply and demand does respond to price. But of course OPEC exports have not responded to higher prices since 2005 because they are simply unable to export more oil due to limited production and increasing internal demand.

Ron P.

Ron

Sorry if I got the terminology wrong. I am not an economist.

I had thought that the term "inelastic" refers to the link between price and the demand/supply balance. I thought that if this link for a particular commodity was termed inelastic then it realy does not matter if you state that the demand/supply balance is inelastic to price or visa versa. For a commodity to display inelastic price/demand sensitivity it would therefore be equally logical to say either, a large price increase will induce only a minimal change to the demand supply balance or alternatively a small imbalance in supply/demand will induce a large price variation. It would therefore seem just as logical to use the term price inelasticity as it would to say demand inelasticity.

This seems to be the logical way of looking at the issue. But if I have it wrong then I stand corrected.

Pehaps the key here is that supply elasticity and demand elasticity are very different, and "price elasticity" doesn't make that clear.

Oil, for instance, has pretty low supply elasticity lately, but demand elasticity is higher than many think - depending on sector and location, of course. For instance, plastic containers are getting redesigned very quickly to reduce hydrocarbon content, and heating oil is getting phased out pretty quickly.

And, short term and long term elasticities are very different: if you think that prices rose temporarily you just spend a little more and don't worry about it. OTOH, if you think prices are going to stay high you might replace your SUV with a hybrid sedan/saloon, and overnight reduce your fuel consumption by 70%.

The situation we are in now is much different than in the past for two major reasons:

1) Countries and companies that were running low on resources or had over-priced costs simply went to lower cost and resource-rich locations around the world. Those "New Worlds" are running out.

2) We are reaching true limits to growth on many resources besides just energy resources.

The low EROEI on our major energy resources is just a symptom of running low on the easy-to-get, low hanging fruit. Even a monkey knows that it takes more energy to climb up high in that tree to get more food.

Increasing efficiency requires increasing complexity which requires more energy to maintain. People have to be educated to, say, design, maintain and secure nuclear power plants. The computers that are able to continuously monitor sophisticated sensors and adjust multiple parameters in real-time require complex computer systems that require a massively complex supply chains to deliver such performance. Outrageous semiconductor fabs are now required to produce these computer "brains".

We are just digging ourselves in deeper, less resilient holes. We have already expanded out all over the world and there is really nowhere else to go. The US can claim that their GDP is growing while their energy use is decreasing but of course they don't take into account the fact that much of their manufacturing has been exported. If we just consider the world as a whole, many of the arguments about this topic would be muted.

It should be obvious that economic activity requires energy, just as life requires energy. Now that us humans have grown up, and into, our world we can no longer fuel our fantasies of endless exponential growth in a finite system.

That is what most of the yeast thought before they started to bump up against the walls of the Petri dish and feel the toxicity of floating around in their own waste.

It is sad that the yeast model so closely follows our current civilization model. Yet, the same rules apply. Mother Nature's rules are a bitch.

Perhaps we should consider Peak Efficiency like Peak Oil.

Jevons Paradox describes how increasing efficiency of a resource increases its demand. However, what are the costs of increasing efficiency and what is that point where the complex systems, required to support the higher efficiency, use more energy than is being saved?

Since the most demanded and hard-to-replace resources (namely, fossil fuels) are hitting their peaks, they soon will no longer be able to support the complexity needed to squeeze out more efficiency on a global basis.

Getting a rare earth metal from China using rare petroleum from the Middle East to deliver the required resources for that new, highly efficient power plant in the US gets harder and more costly every year as those non-renewable resources are consumed and as the world's population continues to grow.

It just may turn out that peak efficiency is another wall to growth that many people are not expecting. It also can be used to model how our civilization may deal with depletion. As we wind down and localize, we also lose the efficiency that was gain through the use of highly complex systems. A double whammy.

That is a good point. Your other point in your post above it is a good one too.

A lot of people seem to think that adding efficiency at this point in time will be easy. But if it means trying to convert the car fleet to plug in electric, with all of the complexity involved in that, we are probably kidding ourselves. There is always a reward for companies to find the most efficient solution, so we have been moving in that direction a long time, and are reaching diminishing returns without adding huge complexity. I think we may very well be reaching peak efficiency.

what about efficiency gained by simply driving less? there's the efficiency driven purely by limit on supply isn't there? not sure I'm understanding the 'peak efficiency' idea quite yet.

Driving less is usually called "demand destruction". People would like to think that there will be enough increased efficiency (cheaper cars, or cars that use less fuel per mile, or cars that use a fuel other than oil) to avoid most demand destruction.

The issue with adding efficiency is that it often adds complexity, and complexity adds cost. So it is possible to reach a situation where a new more efficient car is so expensive, that there really is no energy savings over the long run. This would be going past peak efficiency.

Medicine is another area where we can theoretically keep diagnosing diseases quicker, and treating diseases better. But at some point we exceed the ability of the population to pay for new, more expensive treatments. I am not sure this is exactly "peak efficiency". It is more, peak "what people can pay for". Things that theoretically could keep getting better, reach practical limits, so we can't keep adding more complexity to improve performance.

I would be careful with the equation greater efficiency equals greater efficiency. This isn't necessarily the case. A 1960's VW bug is far less complex than a Hummer for instance. Greater efficiency can be produced by high tech means (a super fancy more efficient engine maybe), or by choosing a different series of compromise (smaller size than the buyer would like, because of the cost of fuel). Of course scrappin an old vehicle in order to buy a new one, has a nontrivial capital cost. Thats why we generally assume any major change in fleet fuel efficiency will take on the order of the vehicle lifetime. People can adjust to a change in fuel price by selecting a more fuel efficient car, when they buy a new one. But this can't happen very frequently, so the old vehicles stay on the road for years.

Medicine is another area where we can theoretically keep diagnosing diseases quicker, and treating diseases better. But at some point we exceed the ability of the population to pay for new, more expensive treatments. I am not sure this is exactly "peak efficiency". It is more, peak "what people can pay for". Things that theoretically could keep getting better, reach practical limits, so we can't keep adding more complexity to improve performance.

But it's even better than that, Gail. "Better care" wasn't good enough to keep the profits going up in a hockey stick fashion. Now we invent new diseases as fast as we can think of them, and medicalize as many normal conditions as we can, including baldness, shyness, menopause, menstruation, etc. Yet there is not one positive diagnosis in the DSM Manual, for example, such as happiness. And since that is not enough to support hockeystick profits, we've extended the range of acceptable medications to toddlers for statins, antidepressants, and stimulants. The bogus diagnoses impact their whole lives. And since that is not enough to support profits, we've expanded indications creep to off-label use, which means giving drugs for unapproved uses. We've gamed cancer trials until $95,000 drugs are being used to extend lives by 4 months. We invent new hazardous scanners every year, and eventually the medical scanners leak out into general usage for other things within the MIC, such as terrorism of citizens in our airports. And so on. Are we getting too much damaging care in order to profit the corporation? You bet.

http://www.jstor.org/pss/2955358

http://www.nytimes.com/2011/11/04/business/glaxo-to-pay-3-billion-in-ava...

I have spent quite a bit of my life, not too far from the medical field (worked in medical malpractice insurance, father was a physician), and my impression is pretty much as yours.

Health care is a money making business. Providers may say that they are concerned about law suits if they don't do the latest/greatest, but the truth is that proper diet and exercise are the important things in keeping well, and doctors don't go out of their way to make this clear--would like to sell you as much services as possible. In fact, they would like to dole out pills and sprays for every little thing that might be sort of wrong, and have you come back frequently for check-ups. At the end of life, huge amounts will be spent to extend life only a few months, if that--and sometimes for people who are very elderly. It is almost difficult to get away from the system, because the expectation is that you will do as everyone else does.

Yep!

Tanking

wait, i'm confused - is there maybe a difference between increasing efficiency of a resource without limits (not without them completely, but with plenty of buffer) and increasing efficiency with them?

if supply is limited, can't demand force more efficiency without supply increasing? For example, if gas hits $10, a lot more people would telecommute who currently drive to work. That's less energy spent without using more gas. True, there's more demand for computers and internet, but is the cost of installing and maintaining that infrastructure comparable to the amount of energy spent by 80 million commuters per day?

sometimes i'm not sure that all the complexity of a global commerce system is necessarily more efficient at improving production as it is at creating markets, eliminating competition, and generating profit. Efficiency changes depending on where you stand along the supply chain. It seems like localization might improve efficiency by allowing local production to climb out from under the top-heavy system of oil fueled trade. Like, it can't be more efficient energy-wise to grow a chicken in China, freeze it, then ship it to the US for dinner, than to grow one in your home town. It's convenient, and there's a whole supply chain, and American economy that maintains its inefficient structure so that some company that buys and sells frozen chicken can turn a profit. But remove the cheap oil part, and suddenly dinner costs less (in actual energy spent).

Also can't technology make more efficient forms of energy accessible thereby increasing demand for them, and consequently reducing demand for less efficient forms? What if we start mining space rocks for rare earths using electric launchers and solar sails - that's more complexity, and more energy, but also bypasses the complexity of the fossil fuel resource. By simply using a more direct energy source as our supply, we can suddenly add huge buffer of efficiency to exploit.

IMO it seems like we are a long ways from Peak Efficiency - there's plenty of room at the bottom as they say. But maybe I'm not understanding what you're saying exactly.

"What if we start mining space rocks for rare earths using electric launchers and solar sails"

This is analogous to connecting up another Petri dish for the yeast to grow into. You are correct, if we do go outside our finite system and into the expansive universe, it is similar to how things worked out for the US when the global economy first opened up. So, if we gain the ability to get new resources from outside Earth, other than our daily dose of wonderful sunlight, it is back to Game On.

We must remember that the reason we humans go all over the globe to do things is not because we like long plane rides in cramped seats. We do that for a cost advantage, usually from cheap labor provided by governments that have yet to fully appreciate the phrase "human rights".

Making 50 million iPhones in China for the whole world is a lot less expensive than doing that in the US for our small population (relative). If we had to bring that home, nobody could afford that level of complexity due to increased costs that come mostly from lower production volume, which is far less efficient that churning these things out in massive factories filled with near slave labor.

Let us look at farming, for example. We now use only 2-3% of our citizens to farm. In the past or in developing nations that percentage can be way over 50%, just like it use to be for us. That complex infrastructure is fuel by fossil fuels and as those costs go up, the whole system can start to break down. When we then go back to local farms, more people are going to have to be taken out of their McDonald's and mall jobs to work the fields. The entire, high-tech and complex society returns to the good old days.

In summary, it is all about the resources and the energy needed to make them dance for us. As our population levels grow (or not shrink - 7 billion is a lot of mouths to feed and bodies to keep toasty), and as the cheap, easy-to extract resources fade away, we must work harder and harder for the same level of performance, assuming the complexity of the system can be maintained, which I, for one, dispute.

Tanking

yea, make that two, and i see what you mean now. You're talking about production complexity in terms of efficiency - growth in complexity is a result of more efficient use of resource, with the result being an increase demand. So peak efficiency is some point between the complexity of the system and the resources available - still sounds a lot like peak oil to me, or maybe just peak complexity.

But what you're saying is that we can't rely on more complex systems - automated electronic farm laborers for example - to pick up the slack. Even if these systems are more efficient, the cost of producing them becomes impossible - efficiency adds complexity, which adds demand, and due to pressure on supply, and so it never happens.

IMO I think this is a debatable point, although I absolutely value the topic. The reason I think there is plenty of room for efficiency is because I think that, while efficiency does add complexity, complexity doesn't necessarily add pressure to supply. I feel that the next revolution in technology will be a breaking of this industrial age model of "supply" as a point of entry of materials, torn from the natural world, and into the human production cycle. Fossil fuel is the ultimate champion of this model. In the future, (if there is one), instead of a production cycle fed by supply lines, the idea of supply will be more cyclical - like a digestion cycle of production, instead of some magical gift from the abundant divinity.

Wild Eyed Example: a tobacco plant is orders of magnitude more complex than a one ton pickup truck, but the production of one ton of tobacco is dramatically simpler, more efficient and less resource costly than the cost of making a pickup: the tobacco "self-assembles" while the pickup is assembled by hand. My question is, would it be possible for a pickup truck to self-assemble? According to our current idea of how a truck is made no - but in since it is dramatically less complex than a tobacco plant, shouldn't a truck be able to self-assemble much more easily?

OK, so don't flame me - I know that probably reads as goofy techno babble, but it's relevant to our topic here, as it's worth considering optimistic future beyond PO from time to time.

Electric launchers? You mean a giant magnetic rail, inclined up a mountain to shoot the spaceship into space? Not likely. And solar sails will only carry you away from the sun, not back toward it. And solar sails must be truly gigantic to move a large heavy ship, many thousands of miles in diameter. That is why they are only found in science fiction.

The only way to move in space, other than space sails of course, is to throw something else in the opposite direction. Spent rocket fuel is what our space ships throw. And the inertia you generate is dependent upon the weight of what you throw and the speed you throw it.

That is why mining space for anything has always been and likely always will be... science fiction.

Ron P.

Darwinian:

well yea i was using examples that were outside of what we currently consider to be practical to point out that peak efficiency is just peak oil by another name.

and why not? there's nothing impossible about using an electric rail to launch mining systems into space and it seems likely to be more efficient than building rockets. A quick search: NASA is purportedly looking at it - it only would take about a mile of track, and would cost ~$600/kg vs $15,000 for rocket - if we want a space system post peak oil, it seems like rail might be pretty viable - why the skepticism?

Magnetic sails, or other non-propellant propulsion are also feasible and efficient ways to get around the solar system for mining - long travel times are OK for minerals.

Yea, like submarines or airships? :)

Anyway, I'm not sure if you are skeptical because you don't think these things are a good idea, or if you just don't think we'll ever do them. I don't know either, and i wasn't proposing - just attempting to illustrate a world beyond PO.

Both! I don't think it is a good idea because the time and energy involved would exceed, by a hundred fold, the benefit we would gain. And that is the very reason we will never do them.

Non-propellant propulsion? And what would that be? Really tehChromic you have been reading so many science fiction novels that you have lost touch with reality. That stuff is fiction! Come back to earth, come back to reality. Mining space is the stuff of science fiction novels. It makes really great fiction but that's exactly what it is... fiction.

Ron P.

OK! heh, thanks for straightening me out Darwinian, lol.

Seriously tho, the original example had to do with talking about efficiency in the context of different energy resources - I was pointing out that energy efficiency means something different when we're directly using EM energy from the sun instead of fossil fuels. I was using hyperbolic examples to make a point!

But not you've got me into this debate, I gotta defend my POV!

Rail propulsion is non-propellant! So is a solar sail, and gravity and magnetic fields can be used for propulsion: field propulsion. A space elevator doesn't use propellants - it's an electrical/mechanical. There are plenty of ways to get around the solar system that don't require rocket propulsion. Why else are we experimenting with quantum particles, antimatters, and string theories if it isn't to discover more fundamental methods of getting around? Same reason we theorized about heat and energy, and experimented with metalurgy and combustion in the early days of the industrial rev.

But I guess that was the original point - we're talkin' economy of scale when we're talking burning miles in outer space - sure it's not feasible or practical in our current state or state of sophistication or complexity, but when we're talking about linking our energy supply chain to the sun, well it's a bigger game. I guarantee you there was a time when people would have called traversing the oceans for trade or supplies an impossible dream - what would we need across the ocean that we don't have at home!?! The answer in space is the same now as it was then about the ocean - exotic elements, new territory, and adventure, lol!

cheers, Darwinian, i must like debating with you, all in good fun.

Right, but there are no railroads in outer space.

Okay, solar sails catch the solar wind. As I said earlier it would take a sail thousands of miles in diameter and it would only carry you in one direction, directly away from the sun. You must be joking if you are seriously suggesting that as a mode of transportation for mining deep space.

Magnetic fields? I did not know we still had Dick Tracy fans still around. ;-) Seriously, that is not a mode of transportation, only stuff found in Dick Tracy and science fiction novels, and rather silly ones at that.

Field propulsion? Hell I never heard of that one. But then I stopped reading science fiction novels thirty years ago. I guess I need to keep up with science fiction better. But then why should I?

No, that is total nonsense. The ocean is something primitive people could cross in a reed boat, or a raft, or anything that floats. Space is totally something different. Really massive amounts of energy are required just to escape the earth's gravity. Then for millions of miles we are still under the influence of the sun's gravity. Then you fall under the influence of the gravity of the body you intend to mine, or whatever you intend on doing there.

It is totally silly to compare the ocean to space. Not even close. Different physics. The ocean is part of our planet, still covered with air we can breathe, and no gravitational problems and plenty of wind to propel our floating craft. A 50 square foot sail can propel a small craft across the ocean. A fifty thousand square mile sail would not be nearly enough to propel even the smallest space craft. And then as I said, you can only go in one direction, directly away from the sun.

Really tehChromic, as I said earlier, you have been reading way too many science fiction novels. You have actually started to believe some of that junk is actually possible. You need to come back to reality. It is fiction. Great entertainment but only that.

Ron P.

Darwinian,

OK, LMAO here, but the example was hyperbole - I wasn't advocating a practical approach to PO, just speaking hypothetically about complexity and efficiency in the post PO era with a colorful example.

Also, come on, you're making out like i've proposed wormhole drives or something - nothing I've talked about is even remotely impossible or hypothetical.

Then why have both the Americans and the Japanese launched solar sails? Ikaros, the Japanese one, sailed past Venus in 2010, carrying a tiny spacecraft equipped with cameras according the sci-fi site Wikipedia - how big was that sail? 20m. Maybe it's you who needs to bone up on Sci-fi ;) Next you'll tell me that magnetic levitation is all hoo-doo and special effects.

Field propulsion: i'm not talking about magic - we use gravity all the time to get from space to earth. Planetary and/or solar gravity can assist in the propulsion of spacecraft - in fact it's done all the time, look here:

http://en.wikipedia.org/wiki/Gravitational_slingshot

I'm talking about using well known forces to get around the solar system, nothing fictitious about it. Why make out like I've suggested we power spaceflight with invisible pink unicorns. Sure it's speculation, but what's wrong with that? Now this I like:

That's the kind of statement I can get behind :)

That is absolute baloney! Venus is closer to the sun than Earth. You cannot sail toward the sun with a solar sail, you can only go directly away from the sun. Anyway you quote a site but you posted no link... strange.

Okay, you are a little confused here. Gravitational slingshot is not a mode of propulsion. The craft speeds up as it approaches the planet, then it swings around it and the gravitational pull of the planet slows it down by an equal amount as it heads off into deep space. Nothing is gained, only the direction is changed. Propellant is saved because it is not to be used to change direction. The gravity of the planet is used to change direction but it adds nothing to the speed of the spacecraft. From your link:

You cannot violate the basic laws of physics. Therefore there is no such thing as "field propulsion".

The only way to accelerate in outer space is to throw something else in the opposite direction. Of course you can fall into the sun, or another planet... but that is what you are trying not to do. Anyway any velocity gained by falling into a planet would only offset the energy expended by pulling away from the planed. There is no such thing as free energy.

Ron P.

OK Darwinian I can't argue with you again - you're too smart for me, besides I like you too much - you speak your mind, that's good.

besides we're disagreeing on definitions again: propulsion I take to mean "move forward", no matter what causes it, while you take it to mean movement caused by the use of a 'propellant'. By your definition there is no way I could be right. According to mine, using the gravity of earth to speed up my trajectory is a form of propulsion.

About solar sails, I'm not an astrophysicist so I don't know all the details about how to use them, but I know they can use them to steer as well as propel, probably based on calculating orbital trajectories - it's a whole different game than rocket power, but it works. I also know they are deploying real live solar sails - to your original point that they are science fiction. I'll let you look it up - the reason I don't leave a link is because of teh google!

I don't care to argue with you, it's all good, happy holiday.

The sail satellite was dropped off in Earth orbit by a probe on the way to Venus.

NAOM

Ron

I don't think you are correct here on two counts.

A gravitational slingshot can be used to increase the speed of a spacecraft. It has been done as a matter of course in most of the nasa missions to the outer solar system. I believe it can be used to increase velocity of the craft relative to the solar system as a whole. By decreasing the kinetic energy of the celestial body that you are using as a base of the slingshot you can increase the velocity of the craft. It most certainly does not defy the laws of physics.

You can use a solar sail to increase the velocity of a craft away from the sun and then swing around a planet or moon and travel toward the sun at increased velocity. In theory you should also be able to use a solar sail as a tacking device to increase or decrease the orbital velocity and thereby use the changed centripetal force to accelerate toward or away from the sun.

Phoenix, the Wiki article, Gravity assist, that I quoted from did not lie. But in case you did not read it let me quote it again.

Try as you may Phoenix, you simply cannot violate the laws of physics. Of course anything being pulled by gravity will speed up. But as it passes the planet it is moving away from the planet and the gravitational pull will slow it down by the same amount that it was sped up when moving toward the planet.

Of course anything falling toward a planet, or the sun, will be sped up by the pull of gravity.

The NASA spacecrafts you spoke of did use gravitational assist to change directions. That saved them a lot of propulsion fuel because a lot of fuel would normally be used to change directions. But they gained no speed whatsoever. Their direction or angle, relative to the sun, was changed and therefore their speed relative to the sun was changed. But the velocity through space did not change.

Okay, perhaps you did not understand the sun part. If a spacecraft is moving through space at 100 thousand miles per hour but is moving at a 135 degree angle to the sun, then it is moving away from the sun at something less than 100 thousand miles per hour. Then it swings around a planet and its angle away from the sun increases to 160 degrees. Then its speed relative to the sun would increase but it would still be moving through space at exactly 100 thousand miles per hour.

Hey, read the Wiki article. That guy explains it better than I ever could. But as he says the spacecraft entering and leaving its gravitational field, will remain the same—as it must according to the law of conservation of energy.

Solar sails can only be used for steering if you wish to move in a direction more directly away from the sun than the space craft is currently moving. In other words if a spacecraft is moving at away from the sun at a 135 degree angle and you wish the angle to be increased then they could deploy solar sails and cause the spacecraft to move at a greater degree away from the sun. (Moving at a 90 degree angle to the sun would be a circular orbit around the sun.)

I suppose that if you had a gyroscope on the craft that held the craft in one position relative to the sun then you could use the sails like a parachute and gain some directional movement. But the force of the solar wind is extremely weak and a very weak and it would take a very large sail to make any difference.

Ron P.

You're wrong. The velocity do change (kinetic energy is transfered from the planet), not just the angle, as the wiki article explains. This is because the spacecraft's speed relative to the planet is unchanged, but you used the fact that the planet was traveling at a certain speed. So it's not only the angle, but the speed as well. For instance, you could move directly away from the sun at a speed of 3 and then use a slingshot maneuvere around Jupiter and come out moving directly toward the sun at a speed of 5 (or whatever).

Read the wiki article again.

The nearest body to even possibly consider mining is the moon, and anything that is an asteroid or other planet is so far away, and in such different orbits, that the energy that it takes to go there and go down and up the local gravity well, and then to be able to bring things back is immense. And it is risky too. How many space missions have had problems from SkyLab to Hubble to Apollo 13, etc. And for anything that a shuttle and space walk can't get to for fixing won't be fixed. But just take the moon for instance, and consider the empirical evidence that we haven't mined it for anything and it is the closest thing to us. And the moon is a very friendly scenario with weak gravity and being in very close proximity unlike the much larger planets. We brought back some rocks for scientific study but at enormous cost. If there were profit to be made and useful resources to get from the moon, the fact that it hasn't been done yet should be strong evidence that doing so isn't cost effective and feasible from and engineering standpoint or from a business standpoint either. Using rockets to get to asteroids or other planets and moons takes many years to get there and those trips are pretty much one way because of the enormous energy that would be needed to send even a small lander back to Earth would be extremely cost prohibitive.

M.E: I just don't agree.

Read the earlier post - we were talking about complexity and efficiency. there's a relationship between the two. I was suggesting that the complexity of a solar energy supply chain would and could dwarf the current system. With complexity would come demand for all the heavy metals that are abundant in space rock as well as access to the massive EM energy fields up there in the big wide open.

It's idle speculation, true. But everything you've said about space was said about many frontiers before, and then the sophisticated technology was developed that made their exploitation possible, followed by an increase in efficiency, and demand, until once impossibly complex systems are now simply taken for granted as a way of life.

It's not going to save us from PO in any magic way, but purely for energy alone space is the place. What is all this X prize stuff and privatization of space about if there aren't riches and adventures to be had out there?

Anyway, just because it's about PO doesn't mean it all has to be all doom and gloom. There are other possible futures besides collapse however slim and unlikely.

Is it really possible to decouple GDP Growth from Energy Growth? No it is not possible. Growth in manufacturing requires more energy. Growth in the service industry requires more energy. More people being employed means more people driving to work, more trucks on the road delivering products, More airplanes in the air carrying business travel passengers. Everything we do requires energy.

Of course we can become more efficient. And for a while better efficiency can keep growth from requiring more energy. But this process can only continue for a limited amount of time. Sooner or later growth must overtake better efficiency. And it is a big IF as to whether better can keep up with growth. That all depend on how much growth and how much fuel better efficiency saves.

But better efficiency is a two edged sword. While it does save fuel it also saves labor. New technology has always saved labor. That is what it is all about. So while better efficiency can save fuel it can also save labor and that means more people out of work.

Ron P.

But what do we do with that saved labour? If we are to sustain full employment, we need to find more things to make and do, hence consuming more resources again. If we are to work fewer hours, then we have to fill our spare time with more energy consuming leisure activities. If we are to do neither, then how are we going to stop the food riots?

We need less labour efficient work. We need to redesign production lines to be less automated. Better still, reintroduce cottage industries. Let made by hand become a sign of quality, and to be a skilled worker a badge of honour.

First you need to remove the belief that more is better. Start by decapitating the pyramid of wealth, literally if necessary.

Looking after the elderly. social care

The system will have to break and reorganize first, from the bottom up, Midi. Repost from stale Drumbeat that won't be seen otherwise:

I know a lot of nursing friends right now working in hospitals who can't get off the treadmill, can't slow down, and are leading quiet lives of desperation as things get worse and worse. More hierarchy, more bureaucracy, more authoritarian control, more conflict, more rules, more computerization. Less patient time, less caring, less breaks, less autonomy. We are now at the point of sitting with our backs to the patient while we tap a keyboard to fill in a checklist or swipe a barcode to hand out a pill. We are dancing to the drumming of the military-industrial complex, and we'll dance until the flywheel snaps. Nurses and patients are cogs in the factory assembly line. The hospital bureaucracy is the floor manager. Doctors are customers, and the insurance industry and big Pharma are the owners. Each action that we take as cogs in the corporate system sends money shooting up the pyramid to come spitting out the top, and the owners take the money and buy meaningless luxury goods in a frantic race for status. Each year brings new feedback loops that add more technology, more power, more rules, more useless hierarchy, more medication, more insurance administration, and less patient care. If you can't get off the assembly line at this point, you probably need medication. And you're probably getting meds, if the Pharma sales numbers are to be believed.

What happens when the ponzi scheme blows up, the money stops, and the status shifts? There will be a LOT of people standing around scratching their heads wondering "Who moved my cheese?"

Below, from my dissertation, what happens to the spinning flywheel over time. This is happening in every industry, but is especially rampant in government, academia, and healthcare, the last three bubbles. They're broken, and the inequities become exponential over time. Even Rockman admits it:

http://www.theoildrum.com/node/8639#comment-852085

Yeah no doubt. I think the bone of contention is/will be defining what a ground up rebuild entails. a lot of what you outline is similar to a tainteresque complexity return collapse

The way I see it everything will end up being rationed in the end anyway[even if by proxy]. So working for your allowance will have to be in areas such as social care because efficiency will actually dictate higher level of automation in traditional jobs... there will be no jobs for all.

We are all going to have to look after each other

what you're saying about the health care industry is right on, but some of the complaints, and even some of the systemic evils, like more hierarchy and bureaucracy, seem to me to be temporary symptoms of the change that's going on in HC right now:

I'm sure that is the situation, but do you really blame computerization for less patient time and caring?

I thought it was pretty well accepted that computerized systems will prove to be more efficient and infallible in the long term. The trouble is that in the short term there's tremendous competition between software vendors and contractors to position themselves in this temporary, lucrative transition period, and this means that there's not a simple standard and incremental improvements, there's huge pressure to jump into new systems as fast as possible.

There's also tremendous confusion going on in digitization and restructuring of data and responsibility around changes in distribution and access. That chaos benefits interests that have nothing to do with patient care or the vocation of nursing, but instead specialize in extracting money from the established system. There is also a lot of disruption as established administrations and hierarchies fight tooth and nail to maintain their positions, in spite of being redundant or unnecessary.

But this is a transition period. If it doesn't fall apart completely, the system will eventually settle down, and a return to vocation over automation will be inevitable. Resource limits ought to have a positive impact on vocation in general and esp health care. Institutional solutions will simply not be worth it when resources are tighter, and therefore there will be fewer corners to cut. There will simply have to be more home care, and systems will have to be standardized and made more efficient. The madness is all about profit/plunder.

I'm sure that is the situation, but do you really blame computerization for less patient time and caring?

That's a fair question, Chromic, since I lumped it all together for simplicity's sake. At the local hospital that I am most comfortable with, they have added multiple layers of bureaucracy and put all quality improvement and research initiatives on hold for 6 months while they add a new computerized health record and tried to integrate it with a new lab system. Staff nurses now have additional administration requirements, additional integration requirements, and more difficulty looking after the big picture, with the same staffing. More time is spent staring at computer screens and less time seeing the patient. Physicians have dispensed with any physical assessment or laying on of hands, and rely on tests almost exclusively. (Many of these tests are dangerous.) In recognition of the problem of dissociation, dumb terminals are placed in the patients' rooms, at which point the nurses spend more time with the computer and the patient gets to spend more time with the nurse's back. And computerized records are a guarantee of less privacy over time. Computerization is a barrier to care in many ways.

As you say, healthcare will have to be decentralized, using much less technology. Insurance is history, just like every other profiteering, self-fulfilling, hockey stick industry in the US (see my figure). In this country, we pay twice as much as everyone else in the world to get care that is ranked 40th in the world. I agree that the madness is about profit and plunder. But computerization is a piece of the problem, and it contributes lots of profit and plunder with little added value. The complexity will be unsustainable as our economy contracts. When we relocalize, centralized computerization will become much less important and may be abandoned.

, dumb terminals are placed in the patients' rooms, at which point the nurses spend more time with the computer and the patient gets to spend more time with the nurse's back.

Nursing has always spent more time on paperwork than with the patient. Isn't dealing with the chart in the patient room better than doing it at the nurse's station? At least you're in the same room with the patient...

Iaato

I agree with you. i've seen it from inside. it's inane.

For record keeping and diagnostics, and administration, computers will help immensely once the system settles down a bit though. For replacing physicians or nurses in terms of hands on care - it shouldn't be considered. The opposite should be the case: computers and automated systems should be used where they replace repetitive activity that keeps providers from patients.

As for computerized records being a guarantee of less privacy, I'm not sure I understand why that is necessarily the case, although I can see how it could be an outcome. It's a question of implementation, isn't it?

The important thing IMO is that standards and open source systems are put in place, over private, for profit systems. The "barrier to care" of computerization has to do with A. a profit being involved, and B. implementation of new, clunky systems that will improve over time.

And I agree that contraction will also help improve the health care system over the long run if simply because with less plunder to be had means less administrative overhead (provided it doesn't also cause some kind of massive collapse). Ironically in the short term belt-tightening is causing the opposite as invested interests dig in. Look for things in HC to get worse before they get better, if they ever do - just like in everything else.

It is not just healthcare. Every field of endeavor is experiencing increasing complexity on all levels of organized society. Ask anybody, it's easy to find examples. It is fueled by our abundance of wealth. Most of the complications are to make sure who gets what. Pull the plug, and life will begin to get simpler very quickly. It's not a comfortable ride, though.

I speculate this is the reason for the outlier FSU GDP and Energy data. What I think happened is the underground economy, well developed by meeting shortages under the Soviets, simply absorbed even more of the 'Real' economic activity. I think it's comparing apples and ourangutans. All the Real Money fled into crime.

We have come to expect complexity. We don't think the Doctor is really, really, trying unless we have the latest and most advanced treatments. We demand complex solutions, because they are the only thing we trust.

As a therapist who has worked with nurses, a common complaint I hear is that nurses are spending more time documenting with the advent of computerized charting because expanded data gathering becomes a fetish. Nurses are expected to chart while performing complex tasks or to complete extensive charting after a surgery with no additional time allotted for charting. This leaves little time to attend to the patients.

Yes, Sponia, that was my point for drilling down into the details of a specialty in Gail's thread. This is happening in all bubbles, and that includes the FIRE bubble, of which insurance is an illustration. Even though the insurance industry is opaque and resists analysis, the control of powerful institutions at the beginnings of the pipelines result in exponential growth of the profits, with a winnowing out of the functional social system, even as the complexity grows. The paper/digital nature of the system just potentiates the imbalances. It will be interesting to see what happens when the monetary system blows up. AIG/Buffet were certainly sweating it two years ago, and they are in a temporary lull right now, but they are debt men walking.

. . . because expanded data gathering becomes a fetish.

I'm going to remember that line, Rdberg, thanks, for the hospital I consult at (on a volunteer basis). I certainly see it, and the problem extends to other fields. I call it the Studer mentality, because in most facilities the data gathering is accompanied by authoritarian top-down control and a winnowing of empowerment. Since nurses really run hospitals, whether they have the power or not, it results in hospitals heading completely off track, because the shirts/MBAs are making the decisions with no basis. Healthcare is now about making widgets and collecting data :-{ I'm out. It's toast. Nurses who can't get out are very, very unhappy with a broken system.

"because in most facilities the data gathering is accompanied by authoritarian top-down control and a winnowing of empowerment"

this is really right on - too much information becomes a barrier. IMO this is the challenge of the information era that the open implementation of data interfaces must solve - but I still think that computers represent a form of democratization that interrupts administrative controls when they are properly implemented - and that's the problem. It isn't the computers, it's the way they tend to make administrators obsolete - the reaction to that possibility is what's causing the problem.

My case rests, Chromic, with this timely addition to previous serious violations of healthcare privacy due to computerization of records. We can assume from here on out that computerized records will eventually escape and start to wander, as knowledge wants to be free. What were they thinking, beyond the fetish of gathering data for industrial uses? What is the point of HIPAA except to excuse our bad behavior?

http://www.adn.com/2011/11/23/2186749/sitka-clinics-medical-files-show.html

What is the point of HIPAA

Health care providers won't volunteer this, but a big part of the purpose of HIPAA was and is to make access to your own medical records easier.

Interesting. I gave up working in hospitals for many of the reasons you list, and have vowed to never go back.

50% of healthcare in the U.S. is real and genuine, and about 50% is scam. But it's not as if blame can be assigned to any one area in particular. Americans think they can live forever, and if they don't live forever, their family members sue people who were working tirelessly to cure them from complex diseases and alleviate their suffering. Lawyers are all too eager to join in on the fun.

Combine this with the American love affair with technology, and you get high costs with little actual return.

Look at all the hoopla and controversy that is surrounding the fact that we are now discovering PSA's and mammograms to be all but useless. Things are slowly changing, if only for cost reasons. You can count on Americans to change when money is involved. Hospice care is growing, for example.

..."Logan's Run" as our future goal?

Ralph, you throw the "we" word around like it represents real people who can act to change policy. What do "we" do with the saved labor? Nothing, that is what growth is all about. If we have growth in the economy then those people laid off by labor saving devices will find new work. But if there is no growth then they are shi* out of luck. The fact that new technology, in industry, always strives to do more with less cost and labor. That is one of the three main reasons that we must have growth or else the economy collapses. The other two are population growth and debt service.

Strange, I did not see a smiley face after those sentences but you must be joking. What company with a CEO in his right mind is going to design his factory so that it takes more workers to do less work?

Anyway you talk like an idealist. We do not live in an ideal world. We live in a world where everyone is looking out for number one. Talking about what we need to do while knowing full well that it will never happen is just a waste of time and effort.

Ron P.

Clearly any CEO that sees the cost of running and maintaining an automated system becoming more expensive than the equivalent labour costs would be irrational not to deautomate.