Manifa Oil: Malodorous, But Really Not That Bad

Posted by JoulesBurn on April 16, 2012 - 11:14am

The development of the Manifa oil field in Saudi Arabia has been accelerated recently. This is the last neo-virgin field that Saudi Aramco has in its coffers with which it can increase production capacity (by 900,000 bpd in this case) - or just remain even in the fight vs. depletion of its existing fields. Although it was produced in a limited way 30 years ago and has been shut in since, there has been noise about its resurrection sporadically over the past decade. Much of the chatter has been about the supposed low quality of its oil. Phrases such as "virtually unusable" have been used or, more charitably, it has been described as being so heavy, so high in sulfur, and so vanadium contaminated that there are no refineries which can process it. If true, this would make the Saudi decision to spend the most money ever on this single project even more mysterious, given that there are other strikes against it as well.

In reality, the myth of unusable Manifa oil is just that. There is no evidence that it is as bad as has often been reported. In this post, I will briefly discuss what makes for low quality oil and show how Manifa actually compares to other crudes being sold by Saudi Arabia and elsewhere.

Birth of the Myth

If you do a web search for "Manifa vanadium", you will find a wealth of links which all say about the same thing: Manifa oil is really bad. Yet none of them provide any numbers which support this grim diagnosis. The semantic similarity of the reports suggests that they all have the same genealogy, with descendant articles repeating the received wisdom without question. I'm certainly guilty of having done this with this topic. But I believe the genesis of this myth lies with an article written by David Fleming and published in the year 2000 entitled After Oil. The story opens with:

Beneath the seabed off the coast of Saudi Arabia, there is an oil field called Manifa. It is a giant, and its riches are almost untapped. There is, however, a snag. Its oil is heavy with vanadium and hydrogen sulphide, making it virtually unusable. One day, the technology may be in place to extract and dispose of these contaminants, but it will not be for some time and when, or if, it does happen, it will do no more than slightly reduce the rate at which world oil supplies slip away towards depletion. However, even this field has advantages relative to the massive reserves of oil which Middle East suppliers are said to hold ready to keep oil prices low and secure the future of civilisation. Unlike those fantasy fields, Manifa actually exists.

It is not my intention to vilify David Fleming based on this excerpt from a paper in which he otherwise makes some valid points. But that Manifa characterization seems to have stuck like superglue. Before 2000, the web search above yielded no hits. The count rose slowly at first and ramped up in the last few years to about 100 (admittedly not a common topic). But is there something to the claim? Seems not. I will first review some qualities of oil which decrease its value, and then show how Manifa oil fares in comparison to other crudes.

The Good and Bad of Oil

What emanates from an oil well can be quite a mess. There is the complex brew that one normally thinks of as crude oil, that being a mixture of hydrocarbons of various size and shape. But there is also variable amount of dissolved gases plus perhaps some (or considerable) water and salt and even sand. To create value from this mixture, one needs to separate the more valuable parts from the less valuable parts. Of course, value is in the eye of the buyer, and the highest demand is for transport fuels. Crude oil (except perhaps for something such as Arab Super Light) doesn't really work in this capacity, though; you probably wouldn't want to pour it in the gas (or diesel) tank of your car. Much value is added to the oil by refining, and most of this is realized by extracting the light and middle distillates because that is what goes into gasoline, diesel, and jet and heating fuels. Thus, the goal of most refiners is to maximize the amounts of these produced. Different crudes will naturally contain different amounts of the fuel-friendly extracts, and other refining process can convert some of the lesser-valued crude fractions into the more valuable ones. Complex refining costs more money, however, so oil which can produce more valued products with less effort are usually sold at a premium. Also, oil usually has contaminants which can hinder some refining processes, and these will affect the crude market price.

Heavy and Sour

Heavy oil is defined by the USGS as:

Asphaltic, dense (low API gravity), and viscous oil that is chemically characterized by its content of asphaltenes (very large molecules incorporating most of the sulfur and perhaps 90% of the metals in the oil). Although variously defined, the upper limit for heavy oils has been set at 22°API gravity and a viscosity of less than 100 cP.

Heavy oil has a higher proportion of large molecules which vaporize at higher temperatures, under vacuum conditions, or not at all. However, it is possible to break (crack) the large molecules into smaller ones, and these can then be blended into the popular transportation fuels. This adds cost to the refining, however, so oil with a "heavy bottom" will generally sell for less. However, what counts as heavy oil is somewhat fluid. Saudi Aramco has been peddling something called "Arabian Heavy" for half a century, but its 28°API gravity would seem to disqualify it. When the Safaniya field from which this flows was discovered, however, the oil was thought to be unsellable:

Yet an Aramco refining man ruefully recalls that he was disappointed with the type of oil that flowed to the surface when the discovery well was drilled in the Safaniya Field in 1951. The first tests showed that Safaniya crude had an API gravity rating of 27, an arbitrary index that indicated its high fuel oil content.

'When they poked that first hole down," the refining man said recently, "we were aghast at the gravity. As far as we were concerned, we wished that the company would just let it lie there. At that time fuel oil was a headache. We were up against a surplus in world markets."

Arabian Heavy does leave quite a fraction of its volume left in the pot after vacuum distillation, hence the concern about fuel oil yield. When the Manifa field laden with similarly "heavy" oil was discovered six years later, it was put on hold until the market for such stuff improved. However, it had another problem:

Manifa produces a sour crude, so called because it contains hydrogen sulfide, a poisonous, highly corrosive gas which must be removed in a stabilizer before the oil can be pumped into the hold of a tanker

Way back then, the adjective "sour" was not applied to crude which would certainly be given such a moniker today.

Aramco was already exporting three types of crude oil: Safaniya Grade, a sweet crude (one that contains no hydrogen sulfide), produced in the Safaniya field; Khursaniyah Grade, a sour crude produced from the Khursaniyah field; and Arabian Crude, another sour crude with properties different from the Khursaniyah Grade, and coming from the rest of Aramco's fields.

...

Manifa zone crude proved to be similar to one of the export grades, the crude from Khursaniyah. Both are sour and both yield a high proportion of fuel oil when refined.

Under pressure in a reservoir, oil will generally have dissolved within it a number of volatile gases, including methane, ethane, carbon dioxide, and hydrogen sulfide. Historically, the "sour" label was tagged on an oil that had a high H2S content, irrespective of other, less volatile occurrences of sulfur in the oil. But a high H2S concentration in the "wet" crude is more an upstream problem, as it is mostly removed prior to loading on tankers. In current use, the term "sour" refers to the presence of sulfur in the oil to be refined. The problem with sulfur in oil is twofold. First, its presence hinders some of the processes used to crack larger hydrocarbons into smaller ones. Second, sulfur in refined products leads to environmental problems when the latter are combusted (formation of acid rain, for example) as well as fouling platinum and palladium in automotive catalytic converters. The allowable amount of sulfur has been reduced in the last few years, notably even for bunker oils used to power cargo ships.

Vanadium

Trace amounts of vanadium, nickel, and other metals are often found in crude oil, especially those which are heavy and sour. The metals are typically found as complexes with certain porphyrins. These are large, cyclic molecules markedly similar to biologically important molecules:

|

| Similarity of vanadyl porphyrin to chlorophyl-a (from Wikipedia) |

The amount found in crude is believed to be related to the depositional environment as well as the amount of requisite biological precursors in the forming oil.

Although the amounts found in oil are typically small (1-200 ppm/wt. range), they cause problems in both refining and use similar to sulfur. The metals form deposits on catalyst surfaces, decreasing activity. When combusted, V-laden fuels foul the insides of boilers etc. and release vanadium into the environment.

For more on oil refining and the factors which determine crude oil value, I refer the reader to these two earlier articles from The Oil Drum:

Refining 101: The Assay Essay by Robert Rapier

Global Refining Capacity by Stephen Bowers

Both discuss in detail how oil assays are used by refineries to compare the various feedstock options.

Manifa Crude Assay

The simple statement that a particular crude is low value because it is "heavy with vanadium and hydrogen sulfide" has limited value in that, as it is merely a qualitative judgement; the reader must trust the author's judgement on that assessment. A more objective comparison is obtained by comparing crude assays. Unfortunately, while these are readily available for most crudes sold today, Manifa has not been sold for many decades. However, I was able to obtain data from assays performed by a major oil company in the early 1980's. This includes data for the two Manifa reservoirs which will be tapped in the current development project, as shown in Table 1.

|

| Table 1: Oil assays from samples from reservoirs in Manifa, Zuluf, and Safaniyah fields, Saudi Arabia |

The assays in the first three (non-label) columns are those obtained from samples in the 1980s. Note that the Safaniyah reservoir is not the primary source of oil from the Zuluf field. I have thus added data (second to last column) for Arabian Heavy, which is oil from the Safaniyah reservoir in the Safaniyah field. Somewhat different distillation temperature ranges were used in the latter (far right column), but a reasonable comparison can still be made.

The first four rows show all-crude values, although the metal concentrations are derived values (explained below). The TPB Yields section gives the fractions obtained (in % of total by volume) for each temperature range (in °F). The section with the subheading Vac Resid Quals lists the parameters for the oil remaining after vacuum distillation to 1000°F (or 1049°F), corresponding to the last fraction in the above section. This is often referred to as the "vacuum bottoms" or resids, and is usually processed further to obtain more valuable products. Although some sulfur and even some metal contamination makes its way into lower-temperature cuts, most of the bad stuff gets concentrated into the dregs of the distillation. Some assays will report concentrations of vanadium and nickel only for the vacuum resids, while others will have whole crude values. I have thus computed whole crude values for the assays above (top section of the table) to better compare with other values presented below.

Overall, the values from the two Manifa reservoirs don't look bad in comparison. The Lower Ratawi reservoir has markedly higher sulfur and a somewhat higher residual fraction, but the metal concentrations are lower. Certainly in comparison to Arabian Heavy (of which Saudi Aramco sells quite a bit), Manifa doesn't stand out as an inferior product.

Other World Crudes

Here is one resource which lists sulfur and metals contamination for various crudes which might make their way into a refinery near you:

|

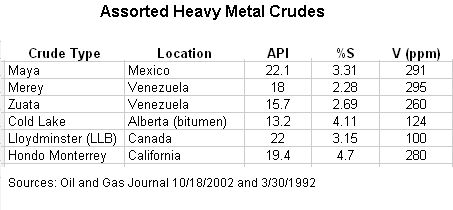

There is quite a range of values, even within countries. Note, for example, the range of 1-403 ppm vanadium for California. It is interesting, however, to identify some of the sources of the lesser-quality oils in order to see how much gets sold. Here are some values I obtained from the Oil and Gas Journal for oil from the Americas:

|

| Table 3: Selected heavy sour grades refined in the US |

Maya, a blend of oil from the Cantarell and Ku Maloob Zaap fields, makes up two thirds of Mexico's production. For awhile, there was Maya crude in the US Strategic Petroleum Reserve:

The Maya crude oil was acquired from Mexico in the early 1980s, as part of a purchase agreement between the Department and Petroleos Mexicanos, Mexico's national oil company. Since that time, the Maya has been segregated in a single cavern at Bryan Mound because its lower API gravity and greater sulfur content made it significantly different from the other inventory. This had the effect of reducing the site's operational flexibility, efficiency, and drawdown capability during an energy emergency.

One of the reasons that the US is exporting gasoline is that Mexico and other countries lack the heavy oil refining capacity needed to handle something like Maya.

Many producing countries export their best grades of crude oil, and consume the poorest grades at home. In Mexico, the lack of refining modernization over the years meant that large amounts of residual fuel oil or “resid” are produced. With the heavier Mayan crude as feedstock, the resid that was produced is particularly high in sulfur and other components. Without an export market for this commodity, Pemex provided resid to Comisión Federal de Electricidad (CFE) – Mexico’s national electricity organization – at very low prices. Electric power generated from this resid has contributed greatly to the extremely poor urban air quality in Mexico’s cities.

Pemex has thus invested in Shell's Deer Park Refinery in Texas, which now processes about a quarter million barrels of Maya per day. Refineries operated by Valero, Exxon Mobile, and Chevron also process Maya. Similarly, the Merey Sweeny Refinery in Texas has a 70k bpd delayed coker for processing the dregs from (of course) Merey.

Can it get any worse?

While these crudes are by far more heavy and metal-laden (and similarly sulfurous) than Manifa, the answer is yes. Here are some assays for various Venezuela crudes, and the winner so far seems to be oil from the Boscán field:

| Boscan | Characteristics | Units | Typical Value |

| Gravity | °API | 10.1 | |

| Sulphur | WT % | 5.4 | |

| Kinematic Viscosity at 100 °F | CST | 11233 | |

| Vanadium | ppm | 11222 | |

| Neutralization Number | Mg KOH/gr | .91 | |

| Pour Point | °C | 7 |

11.2 parts per thousand of vanadium! Of course, this has an upside:

An interesting suggestion regarding the presence of up to 0.1% vanadium in some crude oils, particularly Venezuelan Boscán crude, has been to use the resid bottoms as a source of vanadium ore as a byproduct of petroleum refining.

(quoted from the book referenced earlier)

Even without that business twist, Chevron must be selling some of it to somebody.

Hydrogen Sulfide?

Without question, Manifa oil in the reservoir has a high H2S content. Shown in Table 5 below is a comparison of the contaminant levels found in associated gas from oil production elsewhere in Saudi Arabia.

|

| Table 5: Selected contaminants in associated gas from Saudi Arabia oil fields (gas oil ratio (GOR) in CCF/barrel) |

Yes, Manifa seems to lead the pack with 16 mole% H2S. But hydrogen sulfide is mostly an upstream problem, adding health risks during drilling and production, and the risk is proportional to the total amount of gas dissolved in the oil as well as the fraction of the gas which is H2S. Note the much higher gas oil ratio (GOR) for the Qatif field. Even the Berri field, with an H2S mole% which is half that of Manifa, has more H2S per barrel of oil. Of course, problems in processing the sour gas from Manifa will be slightly more than for Qatif and Berri fields. But these are not insurmountable, and the crude oil shipped to refineries can be processed similarly to that from Safaniya.

To find a worse case scenario, we must travel about 1300 miles north to the Caspian Sea, where the much delayed Kashagan project is still running up the tab - now at $46 billion. Kashagan crude, while much lighter, bears associated gas with an H2S content of 16-20 mole%. Not much worse, except that the GOR is a whopping 1,900 - 2,200 cubic feet per barrel. Thus, if we take the crude from Boscán and dissolve within it the gas of Kashagan, perhaps then we would have something as bad as Manifa was portended to be.

Conclusion

That Saudi Aramco chose Manifa field as its next big increment still raises questions due to its cost (now at $17 billion) as well as the quality of the oil, even though it is nowhere near as bad as has been reported. Saudi Aramco has made the latter issue somewhat moot by, along with multinational partners, building new refineries (together costing more than the field re-development) to process Manifa oil into more valuable products. In a future article, I will take a closer look at the project itself and possibly speculate further on the why of Manifa.

So is this field the production increase that they've said that they've had all along? And just waited for the technology upgrades to coincide with it's being re-tapped?

Yes, this is the increase discussed for a decade or more. It is being done now due to a combination of factors. New technology has helped, but mostly, the continued high price of oil has made it economically attractive relative to other options for more oil. And coupled with the added refineries, they will be competing in the world diesel and petrochemical feedstock market rather than the heavy sour oil market.

I thought that Saudi was building a new refinery designed specifically to process Manifa crude. but that wouldn't be necessary based on what you've presented, would it?

They are building two new refineries, one on each coast. They are both equipped (designed) to process Manifa crude, and are both very expensive, but there are many refineries in the US and around the world that could process it as well. It comes down to what one does with the residuals from vacuum distillation.

Saudi Aramco makes almost all of its money selling crude oil. It doesn't make as much selling Arabian Heavy, and perhaps it just doesn't want to discount it enough to sell more of it. But it wants to sell more without depressing the market for AH even further, so it is going the route of, instead of selling it directly, refining it itself - hoping to make a higher profit on the downstream end. Saudi Arabia also has a refining shortfall (although these will produce diesel, so gasoline will still need to be imported), and it also has a shortfall in feedstocks for petrochemical plants.

Let's not forget some of the other refining projects being debated for Saudi such as Jazan. They either seem to be driven by the demand in the region and wider for petrochemicals (Asia mainly) or for internal consumption with big infrastructure projects such as asphalt for roads and electricity production. Future bets anyone - Saudi as refining capital using cheap feedstock to meet the rest of the world's needs as well as its own?

Here is more on the refinery output:

http://www.platts.com/RSSFeedDetailedNews/RSSFeed/Petrochemicals/8984510

Subsidized fuel for Saudis, subsidized feedstock for Saudi petrochemical plants.

Thanks JB that does seem to be the way. Perhaps it indicates why Aramco has been looking at working together with Sinopec as partners on investments outside of Saudi too as there is a cultural fit....?

Even though the Manifa oil isn't "that bad" from a chemical analysis, it's clearly pretty bad. And that is just one of several challenges that has made Saudi put it on the back burner for so long. Chief among those challenges is the difficulty of extracting the oil from shallow water which requires the building of artificial islands and causeways. Then there is the relative lack of refining capacity for that type of oil. The bad news is not so much the quality of Manifa oil but the fact that Saudi is developing it at all. It's surely a sign of end times for conventional crude production in that region.

According to Bloomberg

Moving up a project of this difficulty and cost by ten years is a major admission of resource depletion, IMHO. That is the real meaning of Manifa to me.

The 2024 refered to in the 2009 annual report looks like a typo:

Compare to their press release at the end of 2009:

Manifa in Focus: Saudi Aramco's Stewardship for Arabian Gulf

http://www.saudiaramco.com/content/www/en/home.html#news%257C%252Fen%252...

Indeed, that 2014 date seems to be a typo. In the 2007 Saudi Aramco Annual Report, the Manifa project is described in detail, exactly as it has been developed:

It was delayed with the great economic heave and then brought back, but certainly not with a 2024 completion date.

Bob, thanks for pointing out what appears to clearly be an obvious typo.

Kingfish- I am impressed with your willingness to admit an error and not even try to deflect it a little or change the subject. You even thank the person who corrects you! This is a wonderful personal quality that is so missing on the internet. If more people were like you, half of our problems in the world would be solved.

I agree that, all factors (oil, cost, environmental issues) considered, that this project rose to the top of the heap of their 260 billion barrel reserves is a bit telling.

No doubt, your comment looks to be almost deserving of bold face. On a most distantly related topic but as you were the author of the Elgin key post here is the latest I've seen on that.

Joules,

I am not sure if I agree with all of these conclusions. Aramco has been producing heavy crud for years and has been making comments in recent years tht it is difficult to sell. I doubt that it entirely tue and one should look at the discounts that Aramco offers to buyers which has fallen. Bloomberg provide a free hsitry of the crude discounts www.bloomberg.com/quote/SOSPAHEU.IND. . This stand for Saudi Official Selling Price Arab Heavy Europe. By changing the AH to AL one can get the Arab Light and changeing EU to AS or US gives the price discount for Asia or the US. The full range of Saudi crudes are available EL, SL and AM.The refence price for the US is the Argus Sour Crude Indx and for Asa the Dubai/ Oman average.

If we take the example above AH EE then the price in March 2012 was the Brent Ave Weighted price which for March was $125.33 minus the differential $4.3 making a total of $121.03 per barrel FOB Ras Tanura. Maybe that is why no-one wants to buy it. It is too expensive against other crudes.

I am more cynical as to why this is being done. SA has a perpetual problem with water and power demand and a distinct lack of gas. As a consequence, and especially in summer months they burn crude diirectly for power and water production, up to 1 million b/d. Now which crude would any sensible person burn. Answer th least valuable so it is the AH which is burned and to make the story stick they have jacked up the price by reducing the differential.

Most refineries can run small amounts of heavy crude without too many issues. Usually a crude blend is made where the heavy crude is cut with a lighter crude and the blend processed as normal. What is important is the hydraulic capacity of the CDU. The aim is to blend to match the capacity of the various draw-offs so that a hydraulic limit is not exceeded.

A refinery designed to run on heavy crude will normally have a much higher resdiue capacity and the vacuum unit will also nbe bigger compared with a refinery designed around light crude.In the 80's we ran AH blweded with a light sweet crude and had no problems. Care had to be taken with some crudes as asphaltenes could be precipitated, but it was a vey common practise and still is.

The important parameter for sulphur is not the H2S. Although the Manifa is produced with a lot of H2S most of this will be boiled off in the GOSP and crude stabiliser process. What is importnat is the total sulphur and where it is distributed. Mercaptans and sulphides are concentrated in the naphtha and jet fractions but the thiophene and the dreaded dibenzothiophenes are concentrated in the diesel and gas oils. Even heavier and more complex sulphur species are concentrated in the VGO and residue. The obligatory 10 ppm sulphur spec in transport fuels in Europe (15 ppm in US) is making things rather difficult for the middle distillates. Desulphurisation of diesl and gas oil containing benziothiophenes and dibenzothiophenes come at a cost, and refinersof heavy crude will be very interested in how the sulphur species are distibuted in the crude. This is becoming even more importnt now for the marine distillate fuels as new low sulphur specifications are being intorduced for these fuels. As a consequnece the refiners will look at the crude and decide if it is economic to buy it and process it. The discount has to be big enough.

As you have demonstrated Manifa is not that bad. The Venezualan heavy oils are very cahllneging as is the Mexiacan Maya and these really would be best processed on a hevay oil refinery. Manifa however has a 30 API gravity which is not that bad. I once handled a blended crude containing 24 API Souedie crude which was a challnege in the desalter, as it formed very tight emulsions.

Looking at the Manifa assay the Ni and v are not that high. For cracking it depends on how these metals are concentrated in the VGO.It would not be a good idea to residue crack this crude in an FCC, or a hydrocracker, but coking would be an option. The coke would only attract a low value as an alternative to coal.My guess is that Mamifa crude could be blended away quite readily with lighter crude, possibly Arab Light, without too many issues.

The SATORP refinery in Jubail (Saudi Aramco Total Oil Refining and Petrochemicals) says it all. The refinery will process heavy crude, most likely Manifa and has a petrochemical FCC designed to produce a large output of light olefines, which will feed downstream propylene consumers and the C4's will go to a large alkylation unit. Most of the naphtha fraction will be either cracked to olefines(light naphtha) or reformed to aromatics (heavy naphtha). Jet and Diesel will be produced for sale.If my memeory serves me correctly a delayed coker has been planned as an addition to the orignal configuration.

The other refinery in Yanbu will be an Aramco -Sinopec jount venture. Sinopec replaced Conoco Phillips who pulled out of the j.v.. Jizan refiniery will probaly be an all Saudi affair with local investors.The refinery developemnt will be phased and it will focus on fuels. All these refineries will be 400 kbd refineries and will refine heavy crude. i.e the entire Manifa output and some of the existing Arab Heavy.

As you said later, it is difficult to sell when you price it too high. The question is, why are they doing that? I agree that the burning of AH for electricity plays a role, but you are suggesting that they are maxed out on AH field production? In any case, long term, they believe they will find enough gas.

NOOOOOOOOOOOOOO!

Joules,

I never said that the Saudi were maxed out on AH, although in all likelihood it is possible beacuse most of the AH is currently produced from the ageing Safaniyah and Khafji fields which are interconnected.

The Saudis have had a gaas problem for years and have not allowed any new NG chemical plants for a very long time. Much hope was made for developing on-shore gas in the Khuff formation but it is no where near enough. Exponential growth in power and water demand have strained the infrastucture and for some time SA has had to resort to crude burning. Look here http://www.saudiaramco.com/en/home/our-operations/projects/jazan-refiner...

If you download the annual report 2010 (latest) go to pages 47, 48 nd 50.

Crude produced 2887 million barrels (7.91million bbls day) excludes NGL which are reported separately.

Crude Exported 2020 million barrels (5.53 million bbls day)

Refined Products 499 million barrels

Difference 368 million barrels (1.01 million bbls day)

Where did the 368 million barrels go?

Hidden on page 50 is the liquids demand in lieu of methane at 250 billion Btu's per day. Very roughly this is equivalent to around 40 kbd oil but I suspect that it was other liquids than crude oil. The Saudis have a way with words. All is not always clear.

Growth in the demand for water and power is placing much strain on the energy supply. Two new off-shore gas projects are underway. Karan will produce 3 x 600 million scf/d of gas per day when completed and will connected to the Khursaniyah gas plant. Wasit will handle 2.5 bscf/d of gas and produce 1.75 bscf/d of sales gas (methane). When these plants are finished the combined gas output will be about equivalnt to 600 kbd of oil equivalant. Add in the growth prospeccts and SA will still have a big demand for oil burning to stisfy its appetite for power and water.

http://www.saudiaramco.com/en/home/our-operations/projects/jazan-refiner...

see link here

Last year at ASPO there was presentation by Chatham House a UK research group. They had been commissioned by the Saudi government to look at the energy situation in SA. The news was athat if the demand growth continued as at present then by 2038 SA would be a net oil importer.

I see that there are alos many commnets about Manifa and why did the Saudis wait so long. I think the answer is in Matt Simmons' book Twilight in the Desert. The Saudis had no imperative to produce Manifa as there way sufficent supply form the other fields and proices up until 2000 were so low as to not justify the investment. Remember that in the 1980's Saudi oil production had fallen back at one point to as low as 3 million b/d as OECD sources, particularly the North Sea, came on line and quelled OPEC's pricing power. No longer. But OPEC is not controlling the pricing now either. It is the likes of Goldman Sachs and the tiny amounts of oil that are freely traded( such as Brent and WTI) that now set the pricing. Saudi Arabia sells all of its crude against reference crude benchmarks +/- a differential.

Sharp observers will note that the Saudis have not fallen asleep. In terms of yield the inferior Arab Light crude actually has a much higher value to the European refiners than some other light crudes. AL has a higher yield of jet and diesel than Brent and to the refiner would make more money. Brent produces too much light naphtha and gasoline both of which are not money makers. Click on thsi link and click crack spread to see what I mean.

http://omrpublic.iea.org/pricesrefining.asp?select7=Northwest+Europe&Sub...

It is also possible to see the crack spread for other refineing centres.

To finish up. When Manifa oil finally comes on line my opinion is that most of this oil will be consummed in the 3 new refineries, as it is probably a better quality than the AH fromm Safaniyah. Whatever happen, it does not appear that the two new mega gas projects, Wasit and Karan, will slate the Saudi thirst for energy and that they will continue to burn crude directly, most likley the AH from Safaniyah which will be the cheapest heavy grade to produce. To deter buyers and maintain the storyline the AH price differential will be such to deter buyers.

The link you provided doesn't work. This one does:

http://www.bloomberg.com/quote/SOSPAHEU:IND

(apply variations as suggested above)

Curious, though: looking at the chart for Arab Heavy, why was it discounted more last summer (when they would be burning more for electricity for AC) than it was in winter? True, one would have to compare with other heavies to see if they were pricing it higher so it wouldn't sell.

Regarding blending at the refinery: it comes down to the eventual bottleneck of processing the residuals, correct? And even within that, the heavier oils will tend to have a heavier (lower °API) vac resid. Would that impact the refinability?

Joules,

Thanks for correcting the link and I apologose for the typos. I am not the best typist.

There was much sqawking about a year ago of even possibly longer about the the Saudi's reducing the heavy crude discount. I have a presentation from Total where they justified their investment in SA by the $10 price delta between light and heavy crude. That was when crude was $65 per barrel. I am convinced that this is a deliberate ploy by the Saudis - what we call in the petchem business as a f**k-off price.

The API gravity is just that. A density measurement. In the case of AH the vac resid is a little over 1.0529 density and the AL 1.0229. Blending 10% of AH into AL would have minimal impact on the density. What is important is the viscosity and even that would not be a problem. What would be the limiting factor is the capacity of the At res rundown and the vacuum unit. Can the VDU handle the increased flow and can it extract the maximum VGO. It all comes down to economics. The refinery may be able to accept a slight loss on VGO yield in the VDU if the price is right. Residual fuel oils have quite wide specs and the density is much less important than sulphur and viscosity. The latter parameter is frequently adjusted with a vis-breaker, which is a mild thermal cracker. Desulphurising RFO is very very difficult, and this is giving the shipping industry much angst at the moment.

What it cannot do is force more at res down the CDU AR rundown if it is maxed out. It is all about balancing the CDU and maximising the most profitable streams. In most consumming nations crude blending is a must and it is the resposbility of the refinery planner to blend crudes to match the demand profile whcih will vary from summer to winter.This has to be doen within the constraints of the equipement and hopefully at a profit.

Crude from Chevron's Boscan field is moved by pipeline to the Bajo Grande terminal on Lake Maracaibo where it is stored in open pits prior to being shipped out. As far as I am aware, the crude is not refined but used to make road surfacing material.

One interesting point: most of the in-field flow lines and the export pipeline are above surface and when it rains heavily (and the temperature drops) the exported volume can drop by as much as 20%! Shouldn't be such a big problem in Saudi Arabia.

Thanks. This article preview provides good sound bites:

and even better:

It seems Chevron really knows heavy oil.

Chevron has a lot of experience in heavy oil because it was formerly known as Standard Oil of California, and California, unbeknownst to most of its inhabitants, has a lot of heavy oil.

There is something of a disconnect between government policy and geological reality in California, because the California government is attempting to penalize the import of oil sands production into California, but in fact there is not much difference between Canadian oil sands and California heavy oil. This leads to fundamental problems with a state not being able to impose arbitrary barriers on international or even interstate trade.

Anybody in Los Angeles who wants to see what the oil sands look like can go to the La Brea Tar Pits and look in. The oil sands are just like that, but with a lot more sand, and scaled up to about the size of Florida.

Manifa oil is not overwhelmingly different, either. It is somewhat lighter, but it also has a lot more vanadium, and oil refineries really hate vanadium, hence their preference for cheaper Canadian oil sands production.

But Manifa doesn't have more vanadium...

The oil sands are just like that, but with a lot more sand, and scaled up to about the size of Florida.

It's the about the size of Florida part of that encourages the disconnects. Any idea how much of that is expected to be mined open pit and how much to be produced otherwise?

About 10% of the area of the oil sands deposits containing about 20% of the oil are shallow enough to be surface mined. Of course that's about equivalent of 10% of the area of Florida, so it would involve a frighteningly large area of surface mining.

The remaining 90% of the area, containing about 80% of the oil, will have to be produced using in-situ techniques involving steam injection and oil production wells. These don't look much different than the heavy oil production facilities in California, as a matter of fact - it's just that the area involved is much larger - about the size of Florida, as I said. IOW, just absolutely huge in scale.

Rocky, all you folks need to do is build a few solar water heating plants and you'll be just as green as Chevron in California. Since you have a lot of trees up north, you could build a few biomass boilers instead of the solar. Some environmentally oriented folks might object but as long as your forestry is "sustainable" your good.

Solar water heating doesn't work that well at the latitude of the oil sands - the temperature can be colder than 40 below in mid-winter and the sun is only up for 6-7 hours per day. If you've never experienced this before, trust me, it's very depressing.

It's all commercial forest in the oil sands area. The trees are already committed to the lumber industry and will be used to build houses in the US. However, there is a lot of very cheap natural gas available for firing the boilers in the oil sands plants.

the temperature can be colder than 40 below in mid-winter and the sun is only up for 6-7 hours per day. If you've never experienced this before, trust me, it's very depressing.

No doubt at an industrial site it is. Been there done that--though not at a Florida sized site (yeah I know it's not all getting worked at the same time, but I'm guessing the sites are huge none the less)--but it's not quite the same at home. I personally find the long gray winter gloom of the North Pacific coast and of the west slope of the northern Rockies harder to deal with than the cold short days of the midwinter weeks deep in the interior of AK and we bottom out at 3 hours 36 minutes sunup to sundown. At Solstice we know in couple/three weeks we will be gaining six minutes of light a day, in NW Montana we knew it would likely rain and snow and snow and rain for a couple/three or four more months. Of course that losing light fast part from Halloween to US Thanksgiving can be a really great time to hit the tropics.

The long dawn and twilight help a lot. On a clear day--and midwinter they can be the rule--there is still a bit of glow in the the southeast a couple hours after the sun has gone down. Nautical twilight is over two and a half hours after sunset. The northern cycle of light can be quite addictive--so many many many hours of fine low angle light all through the year.

"The trees are already committed to the lumber industry and will be used to build houses in the US."

Ain't gonna happen. The housing bubble created by the Fed in the Mortgage Backed Securities debacle so completely destroyed the US housing market that it will take decades to "recover", if ever (if you define "recover" to mean building endless new unsustainable suburbs that are fully dependent on cheap fossil fuels to enable residents to exist in them, which of course the middle class will no longer have access to since oil will no longer be cheap -- so all those suburbs are now doomed).

They have to keep millions of houses off the market right now just to keep it from totally imploding.

So, that's the end of Canada's lumber trade with the US. Oh but there's still Asia, and since we seem hell bent on exporting every other aspect of our future to the rest of the world in return for fast jobs and fat profits, leaving us with nothing to power our sustainable future with, I suppose our "leader" will open the floodgates to that as well, now that the fuhrer can do as he pleases with zero roadblocks to his madness.

Oops, I'm getting a little off topic aren't I. We should be talking about vanadium and Manifa oil.

Yes, back on topic. Manifa - great place for solar water heaters. Not so much for biofuels.

I would really like to find some hard information about the actual vanadium content of the oil, but I haven't been able to find any precise numbers. That is usually a bad sign where Saudi Arabia is concerned because it means they don't want to talk about it.

You don't believe the numbers I presented in Table 1?

I don't know. I haven't been able to confirm the numbers from independent sources, which always causes me a bit of uncertainty.

The basic question that arises is "What is the REAL problem with Manifa, and why has it not been put on production before?"

REAL problem ? Have you considered the possiblity that SA has spare capacity now and don't see a need to bring any more capacity on line until 2013. I don't see that as a problem.

There could be a problem if you expect King Abdullah to be your momma.

I'll probably discuss this further in another post, but I believe a short answer is that it proved to be more problematic to produce than they predicted - similar to Khurais, but worse.

JB, can you comment on these numbers?

Chemical Characterization of Sediments from the Gulf Area after the 1991 Oil Spill, ABDULRAHMAN A. AL-ARFAJ and IBRAHIM A. ALAM, Marine Pollution Bulletin, Volume 27, pp. 97-101, 1993

Trace metal analysis in Table 1 was conducted at sites from Manifa in the northern Saudi shoreline down to Tarut Bay as shown in Fig. 1.

Metal concentrations (microgram/gram, Hg as nanogram/gram) in top sediments from the Gulf coast of Saudi Arabia (1985). (Each value is a mean of five samples).

I'm aware of that study (since it comes up when you web search for "Manifa and vanadium"), but the concern there was with possible contamination of the environmentally sensitive areas (particularly Abu Ali island) by the oil spilled into the gulf by Iraq in 1991. No relevance to Manifa oil itself.

Actually yesterday at work we half jokingly reasoned that all the waste heat from the coal fired plants in Alberta should be used in cogen to grow bananas in winter since there's lots of sun, then when the global monetary system collapses we'll at least still have tropical fruit to buy.

JD Rockefeller bought 40 million barrels of unmarketable skunk oil for 15 cents per barrel, hired Herman Frasch, and made a mint.

Joules, I applaud your effort to track down the source of the vanadium "myth", but I wonder if you can conclude that this is a myth based only the assay from the 1980s. I'm not saying the assay is wrong but I wonder if there might be more to the story than the assay states. Isn't it reasonable to think that David Fleming had a reason for saying that Manifa oil had high levels of vanadium? I mean, people don't just come up with stuff like that out of thin air unless they are complete frauds. I'm assuming he's not a fraud and was repeating something he learned from others. Therefore if it is a myth, it seems that the myth must have preceded Fleming in order for him to repeat it. He must have gotten it from someone else and one has to wonder if it has any basis in fact or not.

To posit some rhetorical questions:

So, if it is a myth, it's older than the 2000 article would imply and what could possibly account for its genesis? If it's not a myth and, in fact, Manifa does have high levels of vanadium, then how to explain the assay?

I'm not disputing your arguments, which are sound, but just pointing out how murky the entire issue is as a result of the secrecy imposed by governments.

I'm not sure in this case that it has anything to do with keeping a secret. Nobody has really cared about what kind of oil is in Manifa for the many years. I would not agree that the "myth" is older than 2000.

As for David Fleming, I don't know where he got the notion of high vanadium in Manifa. He is not a scientist. It seems more likely that he heard that Manifa has some, heard that it was a bad thing to have, and then made the illogical leap from "some" to "killer amount".

Some other factors:

If there were any evidence at all of Mr. Fleming's claims, one might take pause. But there is none.

Joules, I think you have done us all a big favor by not just dispelling this myth but making us more cautious about other claims we might hear without supporting evidence. We are used to being aware of the optimistic myths, but it seems there may be some pessimistic myths that also need uncovering.

Over the years there's been countless articles run here on Sauid oil production. The ultimate goal of course being to find their production ceiling as they keep their cards so close to their chests generally.

But given their production over the last 4 years it does seem that we have been conisistently overly pessimistic about their prouction and too quick to condemn their word.

Marco.

You must be joking. Saudi exports have declined since 2005 and now they have every major field in production, or soon will have with Manifa. They claimed, in 2008 when oil prices were over $140 a barrel that "they could not find buyers for their oil." They are searching every inch of their territory for new reserves even in the seismically tough Red Sea.

And they are so worried about the decline rate of Ghawar that they are hoping to use CO2 to boost Ghawar oil field output.

Yet Saudi has constantly claimed over 260 billion barrels of reserves and have hinted that their reserves may actually be in the neighborhood of 1 trillion barrels. If they had that much oil they would not need to explore the very seismically tough Red Sea or pump CO2 into Ghawar to try to stem the decline.

The oil from Manifa will be the most expensive oil Saudi has ever produced. And if they ever find any oil in the Red Sea it will cost even more to produce. If they actually had 260 billion barrels of reserves they could just poke a hole in the ground almost anywhere in the country and oil would come spurting out.

We have not been quick to condemn their work. We have done it over they years because their actions do not match their word.

Ron P.

Nevertheless the fact remains that they kept output fairly steady despite our dire predictions on their rate production decline. Granted net exports have decreased but reading the above carefully manifa could be to satisfy internal demand for refined product.

I would say the long emergency has become the "longer emergency"!!

I don't remember us 5 years ago putting caveats on HOW they produce re. advanced recovery C02 etc.., just that we made predicions on production rates.

Their actions support a higher price point. They are certanly shrewd.

Marco.

They have kept output fairly steady by bringing on new fields that had been mothballed because of problems. The latest was Dammam #7. Before that there was Khurais and now the last of them all, Manifa.

Now they are no more.

End of story.

Ron P.

Dammam isn't on production yet.

SA claims 320 or something reservoirs in 80 or something fields, only a small fraction of which are on production. Half their proven reserves are proven undeveloped.

Fifty-Year Crude Oil Supply Scenarios:

The story continues.

Well I guess that about covers it. If they have any luck in the Red Sea under that mile and a half of salt, then that would make 321... or something... reservoirs in 81... or something... fields. ;-)

Ron P.

The numbers were approximate in 2004. SA has announced these additional oil reservoir discoveries since:

SA announces new discoveries nearly every year. There really is no reason to remain ignorant.

Saudi Aramco Home Page

Saudi Aramco has already discovered miocene oil fields in the Northern Red Sea.

And why shouldn't SA assess their resources ?

How can TOD possibly expect to be taken seriously wrt SA when the whole foundation is built on "They are lying" ?

And another thing: How do you decide which lies to believe ? That is easy, you believe what you want to believe and you seem to believe anything that might be interpreted, by you, as indicating desperation.

Show some real evidence "They are lying" and TOD may be taken seriously. I have seen the 'evidence' - that SA restated their reserves in 1989 and that they are more or less replacing their reserves on an annual basis - now show some 'evidence'. If that is all you have, please don't bother to reply - You must be joking.

Marco stated the obvious.

Bobba, they are lying. If they really had 264 billion barrels of proven reserves they could very easily produce 30 million barrels per day. They would not need look for oil deep in the Red Sea under 7,000 feet of salt. If they found that oil it would cost close to $100 a barrel to produce it verses about $5 a barrel for any of those 264 barrels of proven reserves on the mainland or in the shallow Persian Gulf. Well, a bit more for Manifa but that just proves my case.

Why spend so much on Manifa if you have 264 billion barrels of proven reserves because two thirds of those barrels would have to be on the mainland.

And it would cost billions to produce or capture CO2 and then pipe it to Ghawar and inject it. But they are really studying that plan.

Ron P.

Have OPEC methods of calculating reserves changed significantly since L. F. Buz Ivanhoe wrote Oil Reserves and Semantics 1n 1996

http://hubbert.mines.edu/news/Ivanhoe_96-1.pdf

I'm not sure about OPEC. Saudi Aramco adheres to standards established by SPE/WPC/AAPG, according to the link I gave above Fifty-Year Supply Scenarios:(p10). The standards changed a few years ago, but not significantly.

Reserve are restated all the time, based on performance, and in the case of Saudi Aramco, based of reservoir modeling.

NOT TRUE !

Saudi claimed reserves are the same year after year after year - no matter how much they produce.

Saudi Aramco lies about their oil reserves - and other things as well.

It is a simple truth.

Not Much Hope for Sustained Saudi Production,

Alan

You still haven’t done an audit of Saudi Aramco’s stated reserves.

Here it is again: Ending reserves = beginning reserves + additions – production.

Rearranging, additions = ending reserves –beginning reserves + production.

Additions include proven discoveries, extensions and restatements. That is all according to SPE guidelines.

Here is the data:

Facts and Figures 2010

I’m not going to do it for you.

Saudi Aramco Reserve math is much simpler.

2011 reserves = 2010 reserves = 2009 reserves = 2008 reserves ...

Not Much Hope for Sustained Saudi Oil Exports,

Alan

Do the math. There is no reason to remain ignorant.

I gave you the link to Saudi Aramco's website, just go in there and tabulate reserves and production year by year. What are you afraid of ?

Enough of the namecalling.

In my opinion, the official Saudi reserves figures are just political numbers meant both for domestic consumption and for OPEC leverage. An accurate assessment would include revisions of existing fields, new discoveries, and production. While Saudi Aramco reports the latter, they don't detail the former two, so there is no way to do "the math".

But it is not possible to look at the official reserves with a straight face:

2005 259.8 MMM

2006 259.9

2006 259.9

2008 259.9

2009 260.1

2010 260.1

It is not statistically probable for revisions plus discoveries to almost exactly equal the 3+ billion barrels produced year after year. It's one thing to be bullish on Saudi oil and Aramco's capabilities - or believe they have roughly 260 MMM reserves, but its quite another to take the above numbers at face value.

I agree there should be no name calling. Ignorant is used here as a verb, a state of being, not a name.

And the production for those years ? You are missing an important part of the equation. Ending reserves = beginning reserves + additions - production.

What about SA's gas reserves ? SA's gas reserves, have been increasing more or less steadily since about 1980. Why would SA use any different methods in assessing their oil reserves ? And don't forget, SA includes condensate in their oil reserve figures; in fact it is an important part of their reserve additions.

I have done the math and SA's reserve replacement has been 97 to 107 % of production on an annual basis, from memory. 100% replacement is the minimum objective of every company that wants to stay in business. What do you suppose SA is doing with the 50 or 150 rigs plus workover units they are employing ?

One thing many don't seem to get is that SA claims that half of their proven reserves are proven non- producing. Proven non-producing reserves wouldn't be expected to change at all until the fields are put on production - although they could change based on additional appraisal drilling or the discovery of deeper reservoirs for example.

Fair enough, you don't agree with SA's reserve numbers because they don't reveal the data that goes into these reserve estimates. Niether do other companies. I have often wondered what would TOD do with the data if they had it ?

SA's reserve replacement has been 97 to 107 % of production

Simply wrong. And I do not suspect you of being "ignorant'.

Saudi Aramco reserve replacement is, most years, 100.0% of production. Yes, that degree of accuracy, not "just 100%".

The next most common reserve replacement percentage is 100.1%.

Except for one extremely exceptional year, when reserve replacement was about 130% - and no new major discoveries or change of methodology was announced.

Reality and published Saudi reserve numbers are in separate categories.

Not Much Hope For Sustained Saudi Oil Exports,

Alan

Except for Manifa, the "proven non-producing oil fields" do not have names - much less numbers associated with these hidden reserves. They are, in a very real sense, "ghost reserves".

Investor owned oil companies are subject to SEC and other regulatory sanctions if they reported results like Saudi Aramco does.

Not quite true, Alan. He is dividing the YTY change (.1B at most) by the production (around 3.3B), which will give about 3%. But that is besides the point.

Proven non-producing will include the fields up north that have names (and a discovery well) but have not been developed into producers.

Interesting. Any independent evaluation of of these non-producing reserves ? At least to the point of saying that they are giant & super-giant oil fields ?

At first glance, like the fields near Riyadh, they would appear to be separate geology.

Alan

BTW, by percentage was based on total reserves. The statistical odds of such precision, year after year, are beyond incredible - another world for not believable.

And even the claimed range is beyond incredible. Aramco would have to stop drilling each and every year as soon as they found "enough oil".

Not correct. I used the term "revisions", because reserves can decrease depending on economics or further analysis. Remember Shell's big downward revision of reserves?

Note that, for the last 5 years, the reported change has never been less than zero.

But that is a trivial (almost meaningless) calculation, completely dependent on what numbers they fill in for "additions" and discoveries . They announce discoveries, and perhaps what flowed from the discovery well, but no size estimate (which would have a wide error margin anyway). They might say they found another reservoir in X field, but that is all. They reassess existing fields (and perhaps some undeveloped reserves), but they don't report on that either.

I can understand their desire to keep the discrete data under wraps, but when they roll it all up and it always is the same, it is a statistically improbable result. Discoveries come in different sizes and frequencies, and revisions will likewise give varying results.

If you have their reserves changes (and justification) and production broken down by field/reservoir, please share. Otherwise, there is no basis for you claiming to have "done the math".

Indeed, we have not been discussing gas reserves. But consider that a lot of their reserves are associated with oil production. If oil reserves are not increasing of late, then all of the increase must be due to discoveries and revisions of non-associated gas fields.

And consider the numbers themselves:

Considerably more variability in the increases. But they still don't have enough gas for domestic consumption, as a good chuck of those are dependent on oil production. Even more so than with oil, large reserves don't translate into comparable production - even if you want it to.

Some days they do.

Saudi Aramco testing new Karan gas units –sources

I do not wish two get involved in this kindergarten, but?

If SA has so much gas why does it choose to develop expensive offshore gas in lieu of onshore gas?

Then do the maths. Karan and Wasit when they get full production will produce about 3.6 bscfd which is the equivalent of about 0.6 kbd oe.

Nice but it not going to solve their energy thirst by a long way.

Believe the SA reserves if you want to but they have been reporting 250 -260 billion barrels of reserves since 1985.

Their best fields are ageing. The queens are in production and the knaves are about to be produced.

30 million bd Kiss my a**. It would take 15 years to build the infrastructure.

Circle time!

Indeed, Karan and Manifa both invoke the same question: with all those reserves, is that really their best option?

Karan is apparently mainly dry gas, meaning they can just deplete it. Karan has up to 1000’ of ‘pay’. I haven’t been able to locate gas in place for Karan, but it must be a giant. Recovery will probably be very good. pv=znRT.

Currently, production from the permian Khuff formation in Ghawar is mainly in the dry gas area. Although Ghawar’s permian Khuff contains some very rich gas condensate (>200 bc/mmcf in some areas) Depleting a gas condensate reservoir is usually not a good idea because so much of the condensate can be left in place - not recoverable. Maximum condensate recovery would involve re-injecting hydrocarbon gas. Cycling hydrocarbon gas back into a sour gas reservoir presents economic and technology problems and is not widely used with current technology.

Saudi Aramco states that their objective is to maximize recovery.

Cycling hydrocarbon gas back into a sour gas reservoir would delay gas production by decades - they want the gas now. That is the short answer.

$5 B for 0.6 kbd works out to $16,666/boe/day. That is easy boe’s. And boe’s have real meaning here, because these boe’s can be used by Saudi Arabia as a direct substitute. There is your math.

1.8 bcfd here and 1.8 bcfd there and soon you have some real energy production.

Saudi Aramco restated their reserves in 1989, after nationalization. Aramco's reserves were nationalized based on ‘book value’. Why would SA want to pay more ?

What do you suppose SA has been doing with their 50 or 150 rigs they have been operating ?

Most of their fields are old and some have taken a 30 year nap. Saudi Aramco states that they operate their fields to maximize recovery -i.e. depletion at a low rate. That is one reason why their recovery of original oil in place has been and is expected to be so exceptional – gravity segregation.

That was a completely hypothetical scenario and reflected the hypothetical potential of their wells based on their reserves.

No thanks, you can kiss your own a**.

Better numbers here:

http://belfercenter.ksg.harvard.edu/files/NatGasDaily_160911%20new.pdf

Karan's cost is more like $10 billion and max production is 51 MMcm/day, so closer to 300k BOE and $32k/boe. But that's not really true, because only 67% of that is sales gas. The CO2 certainly doesn't count, and I don't know how much energy one gets upon recovering sulfur from the H2S.

More interesting info at that link.

Still a bit to to go.

That gets them a bit closer, but because:

and

Oil will probably still be burned for electricity for quite awhile.

But not nearly enough days.

Saudi Arabia burns quite a bit of oil - the amounts I have read are contradictory - to generate electricity. Reports are as much as 1.5 million b/day of oil is burned in the summer.

KSA is converting quite a few simple turbine generating plants to combined cycle - about 50% more electricity for the same natural gas, but cooling water is required. A few years too late, but better late than never.

But it is clear that Saudi Arabia is not - and likely cannot, produce enough non-associated natural gas and associated natural gas to meet even their domestic demand.

Karan will be nice - but not enough. Generating 10% of power from solar PV will also be nice, but not enough by the time it comes on-line.

Saudi Arabia will continue to burn large amounts of oil to generate electricity.

This implies, but does not prove, a significant shortfall in non-associated natural gas reserves, with associated natural gas production being coupled with oil production.

The alternative explanation is a major, and prolonged planning failure by either Saudi Aramco and/or their electricity & water utility.

Alan

OK. And this post was about the oil quality in a huge oil field not being as bad as some have been led to believe. I think some who comment (or write) on TOD err on the side of being too skeptical of anything Saudi Aramco does or says or is capable of. But most are interested in looking independently at the situation, comparing what they say with data obtained from someone besides Saudi Aramco. Things don't always come up roses.

For example, giga-cell simulations might translate into finer resolution when doing history matching, but whatever you come up with is still not a unique solution; you have not guaranteed any improvement in predicting the future, and this has been shown to be the case. The fundamental limitation is with how fine-grained your understanding of the geology is. And with wells 1 km apart, it is not very good. So after all the 3D seismic and giga-cell crunching followed by a well plan designed for a certain capacity, when the wells are actually drilled and put into production, they find they need a lot more of them. Not a catastrophe, by any stretch, but it says quite a bit about how well one can predict future reservoir behavior from the past.

Saudi Aramco has excellent engineers working on the best oil fields on earth. But don't confuse the information tailored to satisfy the House of Saud with actual data.

That is true. The more history matched, the more reliable the forecast. Models are updated from time to time, new history matches obtained and new forecasts made.

I agree with the limitations you describe, however 3D seismic can help define the geology between wells. 4D seismic can also be used to refine a history match.

An experienced modeler can get about any answer you want and make you believe it - that type of modelling is the domain of consultants - the second oldest profession.

Joules has copied the reserve data - and I have gone to the publication to which Bob referred and discovered:

(a) The figures are quoted correctly; and

(b) There is no data for additions - that figure has to be derived from reserves and production.

Evaluating the figures, firstly it must be said that the reserve figures demonstrate a remarkable co-incidence, with additions to reserves being almost exactly the same as production each year.

Secondly, the lack of detail in the figures on reserves is very suspicious. Quite obviously, Saudi Aramco's information is so sketchy that it is completely inadequate for verification purposes. In contrast, for several years I have looked at the Annual Report of Rio Tinto, a major global mining firm. It publishes reserve and resource figures by mine each year. Combined with regular reports concerning discoveries, evaluation drilling, etc, to the Stock Exchanges of Australia & London, you get quite a bit of information that makes it hard for Rio Tinto or other listed entities to do dodgy things with their reserve estimates.

Thirdly, and related to the second point, Saudi Aramco has the ability to tell lies. It not listed on any Stock Exchange, but is wholly owned by the House of Saud. If the House of Saud wants to lie to the world, it can do so, because it is not answerable to anyone. Within the Arabian country it rules, the House of Saud, as an absolute monarchy, has the power of life and death over everyone there, with the possible exception of diplomatic staff. If you displease them, you can be expelled from the country - and if that is all they do, you should count yourself lucky. Outside the country, the House of Saud can refuse to sell you oil or give you contracts, a very effective discipline on its corporate clients and suppliers. The people in the best position to have evidence of Saudi Aramco's lies, therefore, would find it in their interests to stay quiet.

Fourthly, Saudi Aramco has the motive to lie about its reserves. The following account follows that of Colin Campbell,a prominent early member of ASPO. In the 1980s, the price of oil plunged, provoking conflict within OPEC around oil export quotas. OPEC resolved this argument by saying that quotas would be proportional to reserves. If an OPEC member had X% of OPEC's oil reserves, it would be permitted an X% share of OPEC's exports. Shortly after this, the government of Kuwait issued a massive upward revision of its oil reserves. There was no news of new discoveries, or supplementary exploration of existing fields showing they were larger than previously thought. Just a much bigger number in the claimed Kuwaiti oil reserves. This higher number, of course, entitled Kuwait to a higher, and much needed, OPEC export quota than before. Given that the total OPEC export quota wasn't changed, Kuwait's reserve revision meant a cut in the export quota of every other OPEC country.

The next year, "Saudi" Arabia did the same thing - claim a much higher figure for oil reserves. In fact, that year and over the following two years, almost every OPEC member did it. In every case, the revisions were done without new discoveries or revised evaluations of specific fields that had previously be under-explored. There was just a large, bald, upward revision of oil reserves. By the time the cycle was complete, OPEC oil export quotas were roughly back to where they were before Kuwait kicked off the process - but the claimed reserves were a lot higher.

(Now, if there's anyone who, from my description, doesn't spot the blatant fraud that was going on in OPEC in the 1980s, please leave your E-mail address below. I have a friend who would like to interest you in a proposition to release $US10m from a bank in Nigeria. His English isn't very good, but he promises to give you a solid commission.)

Lastly, it should be pointed out that none of the Arab OPEC countries which revised their reserves upwards during the 1980s have changed their reserve figures materially since then (with the possible exception of Kuwait, which may have repeated its earlier stunt - my memory fails me at the moment). This is quite predictable, since OPEC export quotas are allocated on the same basis, and to admit that your reserves were declining would be to surrender some of your export quota.

In conclusion, I think that the above demonstrates that Saudi Aramco has the motive, the method and the opportunity to lie about its reserves. In fact, if I had the time to verify every assertion I made about OPEC and its members, I think that a jury would find the evidence beyond reasonable doubt and convict it of fraud.

Now, unless the Bob Barnetts of this world would care to put forward evidence that anything material in my account is incorrect, I think we could consider the case closed. Saudi Aramco is a bunch of bare-faced* liars and we need to look for independent supporting evidence before accepting any of their statements as fact.

* OK, maybe some of them have beards.

Discovered ? I stated that several times. This table shows Saudi Aramco's reserve replacement going back to 1998:

Only if you consider 8% 'almost exact' as in 2004.

Your timing for restatements of OPEC reserves are way off.

Your claim that all OPEC countries restated their reserves if false.

None of OPEC's reserve restatements resulted in any increase in any countries' quota, except Iraq following their temporary withdrawl from OPEC quotas. In one case quota was reduced following a reserve restatement.

OPEC quotas are a joke. No-one has ever paid much attention to them. Your motive is a joke.

With respect to Saudi Aramco, the subject of this discussion, there is evidence that SA's reserves were grossly understated prior to the 1989 restatement.

Could you just drop the hyperbole ? In my opinion 1) it is not all that clever 2) no one will be impressed 3) it adds nothing to the discussion 4) if I were thin skinned, that could be interpreted as ad hominem.

8% is unbelievable "exact" for reserve replacement as a percentage of production. If Saudi Aramco had been within 8%, no closer, in reserve replacement since 1998, that would be prima facia evidence of "manipulating the numbers" !

1999 2.655 production 2.655 reserve replacement *FOUR* digit accuracy !

It is clear to any fair minded observer that Saudi Aramco lies, constantly and consistently, about it's reserve replacements.

Your position that they are completely honest richly deserves ridicule.

Not Much Hope for Sustained Saudi Oil Exports,

Alan

You are reading something into my post that isn't there.

Is what is NOT TRUE !

That says nothing about whether Saudi Aramco adheres to SPE guidelines or not.

The average replacement within 3 percent of extraction for thirteen years running. That is impossibly close. Way too close to be true.

Ron P.

You changed your post before I could reply, yes 3%.

This discussion started with my statement that SA claims to use SPE guidelines.

There is nothing in the SPE guidelines that requires a reserve evaluator to regognize (book) reserves in any one year.

There is easily adequate evidence to indicate that SA has replaced their maybe 65 - 70 Gb production since reserves were restated in 1989 following finalization of the nationalization of Aramco.

Bob, replacement reserves is new reserves that you discover or prove that year. To replace reserves almost exact, or within 3 percent average, for 13 years is simply not within the circle of possibility.

I really don't think you have any idea just how improbable that is.

Ron P.

We appear to be crossing in the mail.

Reserves are recognized(booked) at the end of each year. Resources that are discovered are not necessarily recognized as proven in the year of discovery. Sufficient information from deliniation drilling and/or testing must be completed to recognize these reserves as proven.

Other restatements include revisions to previous estimates, extentions and testing of deeper or shallower reservoirs

Except at Saudi Aramco, and some other OPEC members.

There they look at last years production and make up this years impossibly close "reserve replacement" number.

One interesting statistical observation.

One year negative change in total reserves.

Four years ZERO change in total reserves

Eight years positive change in total reserves.

That is highly statistically unlikely.

Also, the reserve additions are tightly coupled with the production for any given year. Look at 2002, 2003 & 2004 production & reserve replacement for example.

These numbers are clearly "fudged", or completely fabricated.

Not Much Hope for Sustained Saudi Oil Production,

Alan

As I posted above:

That post was edited slightly to a more accurate estimate of SA's production. (Just so I dont get accused of anything nefarious).

Bob, it simply doesn't matter when you book the reserves. It is virtually impossible to get that close year after year after year. Obviously they are linking proven reserves to production, raising reserves by the amount produced year after year after year. It is so obvious it is laughable.

Ron P.

Saudi Aramco reserve replacement 1989 through 2010 = 103 %

Non OPEC reserve replacement 1989 through 2010 = 105 %.

Non OPEC includes NGL's and excludes FSU.

Do you also find non OPEC laughable ? or 3/5 laughable ?

or 2% less laughable ?

The non-OPEC reserve replacement does not equal production for 4 of 13 years, or have such a tight - Year after Year coupling.

Also "non-OPEC" has the Law of Large Numbers working for it.

Dozens, if not hundreds, of new oil fields are discovered in "non OPEC" every year - not so in Saudi Arabia.

Not Much Hope for Sustained Saudi Oil Exports,

Alan

We appear to be crossing in the mail.

Reserves are recognized(booked) at the end of each year. Resources that are discovered are not necessarily recognized as proven in the year of discovery. Sufficient information from deliniation drilling and or testing must be completed to recognize these reserves as proven.

Other restatements include revisions to previous estimates, extentions and testing of deeper or shallower reservoirs

My thanks to Bob for giving us the figures for reserve additions of Saudi Aramco. They weren't in the publication to which he originally linked us and, not having been to their web site before, I had no idea of where to find it and little idea of how long it would take to do so - or to rule out their presence if they weren't there. And I'm doing this late at night (Australian time), with an honest job to go to in the morning, so my time is limited.

That said, however, the figures don't take us much further than we were yesterday. As Alan said, the reserve addition figures are so amazingly close to production that they invite not merely disbelief but mockery. In two years, 1999 and 2001, reserve additions equalled production, down to 4 significant figures. I simply cannot believe that, given the necessary uncertainties in drilling for oil, that the coincidence of additions virtually equal to production can be kept up for so many consecutive years. The only explanation that holds water is that it is Saudi Aramco policy to book reserve additions almost equal to production each and every year. Further, for this to be an accurate reflection of the facts, Saudi Aramco would have to controlling its drilling "discoveries" with an amazing precision never before known in the industry.

Finally, there is the little matter of the same amazing maintenance of reserves, for years on end, happening in a range of other Arab OPEC countries.

In response to some of Bob's comments:

1. Given the inherent uncertainties in drilling for oil, I think 108% of production is very close, just for one year. Keeping it up, year after year, and averaging much closer to 100% is unbelievably so.

2. If my timing was off, I apologise. Owing to shortness of time, I was relying on memory. I would be happy to be corrected.

3. I didn't claim that all OPEC countries restated their reserves. I said almost all.

4. According to my memory of the time, and backed up by ASPO bulletins in recent years, the official position of OPEC is that quotas are calculated on the basis of the share of OPEC's reserves. A brief search of the OPEC site doesn't reveal any useful information on that point. Bob hasn't denied my statement, though. He has merely stated that none of the restatements resulted in an increase in quota. If so, I can readily understand that being the case. It is easy to imagine the scene at an OPEC meeting when some oil minister pulls out the first dodgy upward revision of reserves. A few sceptical comments, developing into a collective refusal to let the so-and-so get away with it, and a few oil ministers going home with the idea in their heads that "This is a game that more than one can play". What counts in this is the motive of the players in the game, rather than a pure examination of the results. Was this part of a struggle over entitlement to OPEC quotas? I believe the answer is YES.

The word for which Bob is looking is sarcasm, rather than hyperbole. And in my opinion:

1. While it's not brilliant, it is actually a little clever.

2. My wit is highly regarded by my friends.

3. It was an indirect way of illustrating my point that only the extremely gullible could take the statements of OPEC countries about oil reserves at face value once the history was revealed.

4. It was aimed at a hypothetical naive reader. Bob seems to be more in the category of a dogmatic cornucopian, who was not in full possession of the facts at the time.