Hofmeister: A Difficult Decade Ahead For Oil Prices and Supplies

Posted by Robert Rapier on October 19, 2012 - 2:20pm

I, along with my editor Sam Avro, recently conducted a broad-ranging interview with John Hofmeister, former President of Shell Oil. The topics touched upon included future oil supplies and prices, climate change, U.S. energy policy, and topics familiar to R-Squared Energy readers such at Peak Lite and the Long Recession.

I, along with my editor Sam Avro, recently conducted a broad-ranging interview with John Hofmeister, former President of Shell Oil. The topics touched upon included future oil supplies and prices, climate change, U.S. energy policy, and topics familiar to R-Squared Energy readers such at Peak Lite and the Long Recession.

I will present this interview in a series of stories covering some of the various topics. In this first story, I will discuss Mr. Hofmeister’s detailed answer to the question, “What do you feel is the potential for expanding global oil production, and the time frames?”

Readers may recall that I have put forth a pair of hypotheses with respect to future oil production and prices. One is called Peak Lite. (See also: Five Misconceptions About Peak Oil)

In a nutshell, we all know that peak oil is a phenomenon in which global oil production begins an irreversible decline, and the shortages that ensue drive global oil prices very high and cause widespread hardship. However, as I began to see spare global oil production capacity erode away over the past decade, I began to ask myself how that situation was really distinct from peak oil. Technically the difference is that production can continue to grow in that scenario, but if demand growth is higher than production growth, for practical purposes you have a situation that mimics peak oil. I referred to this situation as peak lite.

The Long Recession hypothesis is related. Historically, the oil industry undergoes boom and bust cycles. When oil prices are high, the oil industry invests more money into infrastructure, the economy slows (and often ends up in recession), and consumers begin to conserve. This results in a major correction — and often a crash in oil prices. This leads to underinvestment by the oil industry, and people once more are attracted to gas guzzlers. This ultimately tightens up supplies, and the cycle repeats.

But what if the supply situation was so tight that spare capacity could not be built out? In either a peak oil or a Peak Lite scenario, it will be impossible for the oil majors to build out sufficient spare capacity because it simply isn’t there to be had. So high oil prices slow the economy, and people begin to conserve, but supply can’t build out ahead of demand as in years past either because demand is growing too fast, or supplies are declining. This prevents a collapse in prices which previously enabled the economy to recover. Therefore, what’s waiting on the other side of the recession is more recession: The Long Recession.

Mr. Hofmeister’s views very much reiterated my positions on these topics. The first question I posed to him was:

RR: How great do you feel is the potential for expanding global oil production, and over what time period? Some people have suggested 100 million bpd of oil, some even higher. My former CEO Jim Mulva (at ConocoPhillips) was quoted as saying he didn’t think we could get to 100; he didn’t know where that oil would come from.

In response he reminded me of the studies from the late 1990′s and early 2000′s that claimed that oil production could reach over 120 million barrels per day (bpd). But he suggested that this was before a more realistic understanding of the nature of the resources evolved, and concluded “I think that 120 million bpd of global production probably remains on the outside of optimistic. So I am not sure we will ever get there.”

On the topic of Peak Lite, he stated “I think the course that we are on, with China growing rapidly, India not too far behind – I think that demand for oil is going to exceed the supply by the middle of this decade – the current decade. And I think we are going to be hard-pressed to keep supply growing as rapidly as it needs to grow to meet the demand.”

Gas Lines — U.S. At Greatest Risk

What might that mean? “And so what I actually anticipate is that even with the shale oil of North America, the Canadian oil sands, the bare beginnings of Arctic development, with Brazil coming in on time, which is late in the decade, and the other kinds of basin development that are taking place, I am not sure that in this decade supply will keep up with demand. And I anticipate shortages, gas lines — at any price — because of the growing demand, without alternative fuel technologies yet grabbing hold and picking up some of that demand.”

This is very much in line with my assessment of the upcoming decade, which thus far is playing out as I expected. Oil prices are high by historical standards, and I see little relief over the long term due to very strong demand in developing countries. Mr. Hofmeister agrees: “Possibly by 2020 and beyond we could see alternative fuels beginning to play a bigger role than they do today, which could ease the pain on the oil front, perhaps even ease the price on the oil front. But in the meantime I think this decade is going to be a struggle, and countries like the United States are going to be the greatest countries at risk from suffering the effects of not only high prices, but insufficient supplies.”

Mr. Hofmeister has been helping to shape content for the launch of Total Energy USA as a member of the Executive Committee. Total Energy USA is the groundbreaking conference and exposition that addresses the greatest uncertainty in the energy industry today — the cross-fertilization of energy sectors and technologies. More information about Total Energy USA, November 27-29 in Houston, Texas at www.TotalEnergyUSA.com

This post originally appeared on R-squared Energy Report.

Conventional oil production is what really matters, and that is still the same as in 2005, heading into a permanent decline which will be obvious by 2014, and the EROEI is plummeting. Poor Al Bartlett and Roscoe Bartlett have been waiting thier entire lives for this, and I hope they're still around awhile to see it. We are going back to 1900.

Any fellow peakists want to meet up to talk about the situation? I am still suffering withdrawal from the end of Matt Savinar's site.

Sometimes I wish I was American so I could meet people f2f for discourse about the doom.

After analysing the critical situation on the oil production and oil market, there is now time to act. There are several attempts especially in the USA but also in Europe to get the situation under control:

One attempt which is essential is individual electric transportation:

There are two very interesting manufacturers of electric bikes in the USA:

-BRAMMO www.brammo.com/

-ZERO www.zeromotorcycles.com/

Those bikes only consume between 4-6 KWh per 100km, or an equivalent of 1/4 gallon of gazoline per 100miles, they really need way less energy to drive. Those quantities of electric energy easily can be produced with renewables, at your home for example with solar panels, placed on your roof.

Electric cars are still expensive, but increasingly popular, they could help to achieve the break through. All of the major automotive giants have announced or are already producing one or two electric cars, mainly for commuting distances, but also for middle and long distances.

-TESLA http://www.teslamotorsclub.com/forum.php

Those cars consume more energy, about 15-20 kWh per 100km or between a half and one gallon per 100 miles, are quite expensive. In my opinion, they will remain a niche product. More efficient vehicles are announced, and we can hope that this german startup will finally succeed after about the fifth attempt:

-LOREMO http://www.loremo.com/index.htm

This car only will consume 5-7 kWh per 100km (7-10kWh per 100miles)

Electric cars can serve double purposes, not only to move around, but also they can store electric energy, captured through your solar panels on the roof of your garage or house, and deliver it for your home usage:

-NISSAN http://reports.nissan-global.com/EN/?p=5664

Besides of electric transportation, energy conservation will be crucial. A better insulation of the houses and energy convervation in the manufactory processes are urgently needed.

The critical point in all those attempts is to make them sufficiently popular and common. We all know here, that there is not so much time left to achieve a breakthrough on so many different levels. The Obama-Administration has funded several of the above mentioned manufacturers, and I hope they will continue and intensify their efforts!

Time is critical, and those technical breakthrough alone won't still be sufficient, we also will have to moderate our extensive lifestyle. It's important to get those efforts rolling, before the great recession is completely setting in. We also can only hope that the climat change won't come too fast and too catastrophic, because they also could cause a severe pressure on our societies.

I wish we would ditch this idea that demand will outstrip supply, it really is misleading. This statement has no basis in economic reality. The potential demand for oil is infinite. Most of us would love to have our own personal spaceships and go orbit the planet for a refreshing weekend getaway, but that isn't going to happen. If oil was 10 cents a barrel, maybe it would. The fact is, demand is tempered by price, and the two must come together over the long haul over the broad market. If price skyrockets then we won't see line-ups at gas stations, because demand will fall to match it.

The times when we see line-ups at gas stations are when there is some localized shock which hasn't had time to balance with the greater market environment, for example in hyperinflation where people turn to buy hard assets as a way to protect wealth. Another example would be if local or national supply chains are broken for whatever reason but the price is maintained at the greater market price by the government and gasoline gets rationed. But in this case there would be an opportunity for those who do get some gas to sell it at much higher prices than the government rate at the gas stations. Over a longer time frame this would present an arbitrage opportunity for the market as a whole and if the world price for oil was allowed to infiltrate that country then it would sort itself out, no line-ups needed.

"I wish we would ditch this idea that demand will outstrip supply, it really is misleading."

I usually present this argument in one of two ways. Over the past decade, demand growth has outstripped supply growth. That has had the impact of reducing spare capacity. Alternatively, you can say that demand for $20 oil has already outstripped supply, which is why we no longer have $20 oil.

Spare capacity is something that has existed, several times in the past, when OPEC deliberately cut supply in order to support prices. There was no spare capacity in the summer of 2008 when world oil prices hit an all time high. OPEC, crude only production, at that point was was 31,673,000 barrels per day.

Nine months after that peak OPEC crude production had dropped by 3.589 mb/d and that was about how much spare capacity existed at that time. This past April OPEC crude only production was withing half a million barrels per day of that previous peak. It reached 31,619,000 bp/d in April. There was no spare capacity at that time, and there still is no spare capacity except perhaps for what Iraq could produce if the embargo were lifted.

Since April OPEC crude production has dropped just over .5 mb/d but there is still no spare capacity. Next year Saudi will bring the first phase of Manifa on line with about .5 mb/d and that will make up for Saudi's declining production in its older fields.

I know some may doubt that Saudi is currently producing flat out but a former Aramco executive let it slip that this is exactly the case.

U.S. Reliance on Saudi Oil Heads Back Up

On page 2 of this 2 page article:

Ron P.

I'd like to point out that sometime at the beginning of 2009 we have also run out of 1 trillion dollar oil (in Zimbabwean dollars).

In your opinion,would the (US) dollar printing (http://mises.org/content/nofed/chart.aspx) have anything to do with the fact that we no longer have the $20 (US Dollars) oil ?

There seem to be a slight correlation...

Have you tried charting the oil price versus a more stable measure of value (in gold for example?).

http://pricedingold.com/crude-oil/

If it were only inflation responsible for high oil prices then everything else would be more expensive than the past in more or less equal amounts. Your house would cost more, software would cost more, a T-shirt would cost more, etc. But they are NOT all up equally. Oil is up significantly more than other things.

Certainly inflation does contribute to the rising price of oil. But what is of interest to this web site is why oil has gone up in price more than everything else you buy.

Nope. That's not true. Oil has not gone up more than anything else...

I'll let you discover what has gone up more than anything else.

In meantime take a look at the price of soybeans...

http://www.indexmundi.com/commodities/?commodity=soybean-meal&months=300

or cocoa beans:

http://www.indexmundi.com/commodities/?commodity=cocoa-beans&months=300

We're surely on the cusp of "peak banana"...the 20 cent/kg banana is long gone:

http://www.indexmundi.com/commodities/?commodity=bananas&months=300

"Peak oranges" anyone? We seem to be on the "ondulating plateau"...

http://www.indexmundi.com/commodities/?commodity=oranges&months=300

"Peak sugar"?...the Ghawar of sugar must be dying...

http://www.indexmundi.com/commodities/?commodity=sugar&months=300

What about rubber?

http://www.indexmundi.com/commodities/?commodity=rubber&months=300

or copper?

http://www.indexmundi.com/commodities/?commodity=copper&months=300

or sunflower oil?

http://www.indexmundi.com/commodities/?commodity=sunflower-oil&months=300

or nickel?

http://www.indexmundi.com/commodities/?commodity=nickel&months=300

or urea?

http://www.indexmundi.com/commodities/?commodity=triple-superphosphate&m...

or steel wire rod?

http://www.indexmundi.com/commodities/?commodity=steel-wire-rod&months=300

and I could keep on going...

We're at "peak BS" my friend and that's despite the fact it could be produced at no cost and in unlimited quantity.

Well, he said "everything else", not "anything else". IOW, he was talking about growth faster than inflation.

Now, if you go back far enough you'll find that inflation-adjusted oil prices at this level aren't hard to find, but you have to back a little ways...

Well Nick,

the word "inflation" was nowhere in my posts.

Indeed - that seemed like an omission.

Otherwise, I'm not really sure what you were arguing.

NH, I agree with you. As Rockman often points out, demand and supply are in balance at whatever the current price is, ie about $90 today. If the price doubles, there will be less demand...

Yes, he is exactly right on that point. That is why it is so aggravating when some Saudi official says "The world is well supplied with oil". And it is more aggravating when so many wags agree with him. This rattles my cage every time they do it and I try to never miss a chance to rebut this silly assertion whenever it is made.

Yes the world is very well supplied with oil at the current price of about $111 a barrel. And whatever the price rises or falls to, the world will be well supplied at that price also. After all, that is what the price does, it is the arbiter that always assures that supply equals demand.

Ron P.

And why would they say otherwise when candidates of the Empire promise energy independence even if on a North American basis everyday ?

At least it is a way of saying : you'll have to do with that (before we say it's less), now go on with any stupid song you like.

(as long as the "west" keeps on calling the first oil shock the "arab embargo", they clearly are the most stupid of the bunch anyway, and by far, that's for sure)

In all fairness, we are trained from birth to be as stupid and beligerent as possible. By the end of 6th grade most of the hard work is done and we can coast through the last few years to our pinnacle as Wall Mart greeters.

But truly your rant is a first stage response. Wait till you hit stage 5, and like me you'll be drooling in anticipation of the "Zombie Apocalypse". I reckon that once it starts, the carnage will continue until it's a full days walk to your nearest next victim.

Good luck on all that. :)

It seems to me that some kind of a variation on an EV (hybrid, plug-in hybrid, extended range EV, or pure EV) is the sensible answer to reducing and then eliminating oil consumption for personal transportation.

Consumer Reports said that a Prius was cost competitive at $3 gas; Kiplinger just said that the 5 year Total Cost of Ownership of a Chevy Volt is within $1,500 of a much inferior Chevy Cruze.

Consider the Prius C: it costs 2/3 as much as the average US new light vehicle($20k vs 30k), and uses 40% as much fuel. If oil prices tripled the cost of fuel per mile in a Prius C would still be no higher than the average US light vehicle. As best I can tell (based on Edmunds data), the C has the lowest total cost of ownership for any light vehicle.

Then, if we add $10k in batteries to the Prius C (20kWh, assuming a conservatively high cost per kWh for cells of $500), bringing the cost only up to that of the average US new light vehicle, we'd have a plug-in with an electric range of 60 miles (3 miles/kWh x 20kWh), reducing fuel consumption to less than 10% of the average US light vehicle. That's a scale small enough to be covered by solely by ethanol.

Electric vehicles of various sorts will work very well (though some people will have to wait for them to become available used). The only thing stopping them now is artificially low fuel prices.

I only drive about 1,000 miles per year - I mostly use electric trains. Otherwise, I'd invest in something new and electric.

What do you drive?

This side of a major breakthrough in battery technology, and very clever people with serious money have been trying very hard to do this to no avail yet, the physics with regard to EVs remains the same: It's all about weight.

EVs are currently available, affordable, and competitive tech at <1/2 tonne. IOW very light vehicles; scooters.

Better to move to a place where you can scale down your private vehicle travel demands than expect a wholesale transition to EVs and life to go on as it is now. Or do everything to improve the electric transit and local focus of your current economy and society. Oh and buy a bike. Get very active in changing the direction of your local transport dollars towards transit and active modes and away from highways.

http://transportblog.co.nz/2012/05/30/futurissimo-the-new-city-street/

the physics with regard to EVs remains the same: It's all about weight.

Actually, that's not true at all. With EVs, it's all about aerodynamics, and weight has very little to do with it. Electric trucks are very feasible.

Electric trucks aren't here yet because commercial users are cautious, and trucks are sold in much lower volumes than light vehicles, so the economies of scale aren't as easy.

Electric vehicles will just take a little while to scale up, that's all.

"Actually, that's not true at all. With EVs, it's all about aerodynamics, and weight has very little to do with it. Electric trucks are very feasible."

No, indeed weight is a fundamental parameter in the energy required for a vehicle, and this is true whatever the engine and fuel technology is.

(in pure physical terms, the propulsion technology has no influence on the energy required)

And also true that as todays batteries have a much lower energy density than petroleum, this makes the weight aspect even more critical for EVs.

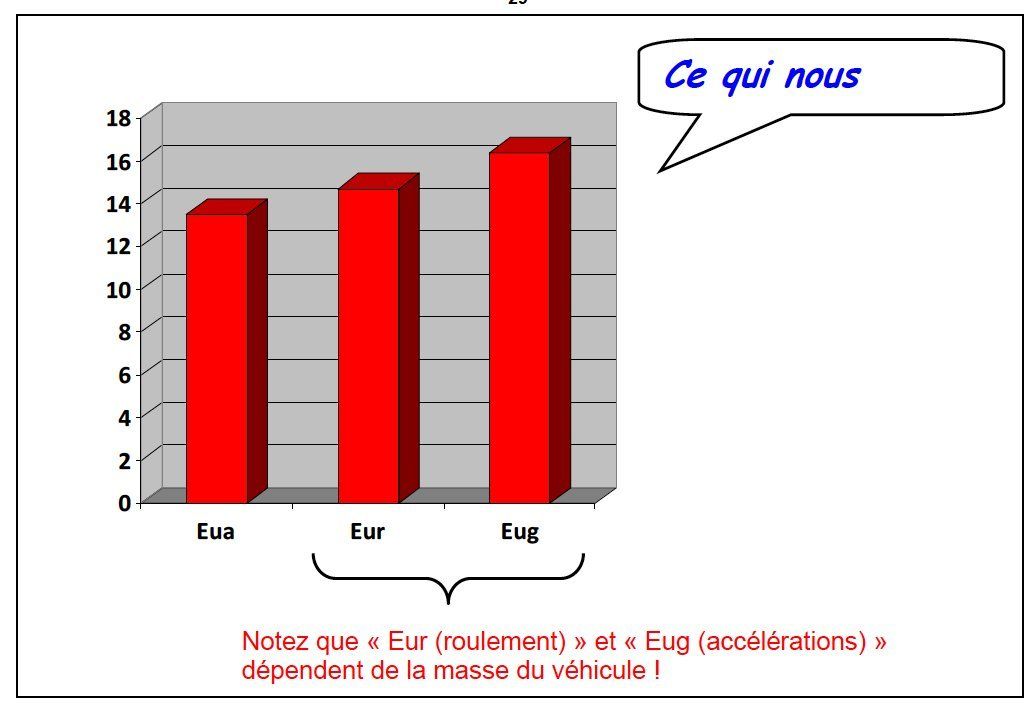

Below a formula for the power required for a vehicle :

(Taken from : http://www.hkw-aero.fr/pdf/energie_utile_voiture.pdf)

The first term is the power required from aerodynamics aspects (and so it depends on the frontal surface S, multiplied by aerodynamic factor Cx and v(speed) at power 3)

Second term the friction aspects (depends on weight(m), and speed)

Third term the acceleration aspects (depends on weight and speed)

And below the result in Energy required for a "standard" medium size current car (weight 1390 kg) on a "standard" run (defined by European agency) :

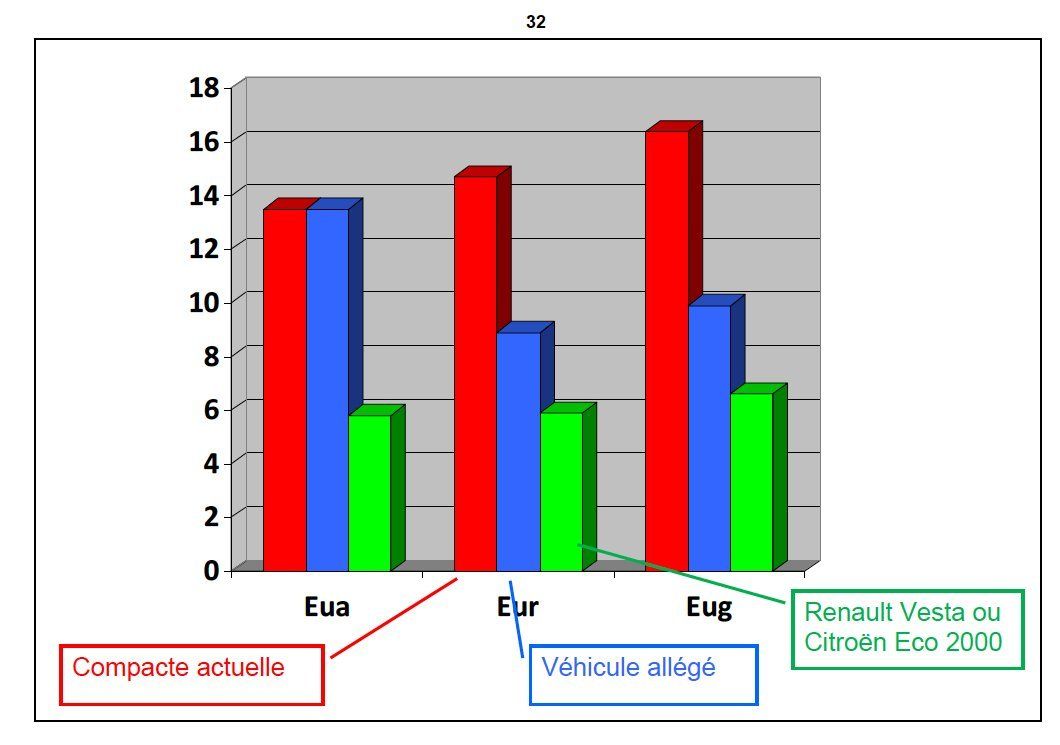

And below in blue same car less 900 kg, in green a car with less frontal surface better aerodynamics and also lighter than the blue one :

In the end aerodynamics becomes the main factor at high speed and on rather constant speed runs, on typical suburban or urban trips weight is by far the main factor (plus in aerodynamics, the key factor is also the frontal surface, ie more or less the size).

No, things change with electrification.

You see, electrification allows regenerative braking. That means the energy of acceleration isn't lost, it's recovered when you brake.

So, a vehicle with twice the mass requires twice the energy to accelerate, but if that energy is recovered on braking it just doesn't matter.

That's why hybrid electric vehicles get better fuel efficiency with city driving - with much lower braking losses frictional losses to wind resistance become the important factor.

Regenerative breaking is very far from removing the weight aspect for acceleration, no zero sum at all there.

You might want to provide a little more detail (evidence and logic) for your arguments, to move things along.

No, regen braking does a pretty good job. Li-ion batteries are 90%+ efficient. More weight will increase tire flex, but tht's not major. It doesn't change drivetrain or aero losses.

How about you providing numbers ?

By the way, logic is a very tiny bit in engineering, even if used throughout

(this fascination with logic always amuses me, ever heard of maths equations and physics ?)

fascination with logic always amuses me, ever heard of maths equations and physics

That's called "evidence".

We're not doing "engineering" here, we're doing "debate", even if the subject is engineering.

If you want to convince your audience, you have to provide good evidence (e.g., math & physics) and then pull it all together with a logical argument.

I've seen a really good, quantitative discussion of the various components of vehicle efficiency on the Tesla website - if I have time, I'll find it. OTOH, you haven't provided any arguments (math/physics evidence) at all, so the burden of proof is really on you at this point.

Sorry , not interested at all with this discussion.

(and don't believe you went through any analysis from you previous mesages)

hhmmm.. too bad.

BTW, it's not my analysis, it's that of the best in the automotive engineering world.

What exactly was the debate again? You seem to want to argue about arguing. Was it that weight has no effect on EV efficiency because of regenerative braking? As I pointed out below, you are both right. It does inevitably have an impact, but overall it is small and really not an issue of concern; it's less of an issue than with an ICE, as you mention because of regen braking. It's really not worth getting worked up about.

Nick your two arguments are poor:

1. Electric trucks exist, yes they do, but are not competitive. Whereas electric scooters not only exist but are widespread. What is the critical difference?; size of the vehicle and load in proportion to power and range.

2. Regenerative breaking is fantastic, but suffers from efficiency losses as noted above, and does not improve with the scale of the vehicle in proportion to the work still required. Which is to say with a big mass there is more resistance which can generate more power when braking but then more power is needed to move that same mass forward again. And of course this is further exacerbated by air resistance which as Yves has pointed out above is increases with the size of the vehicle..

Perhaps you are thinking that all of your journeys will only ever be down hill? I hope live at the top of a mountain and no longer wish to stay there. Actually that's quite a good test; if beginning at the top of a very high location with an almost flat battery, how far back up the hill could a particular vehicle take you on the energy generated on the trip down...? Smaller will get you further back up every time.

Here's another real world way of looking at it: What system solves the scale problem yet still is capable of benefiting from regenerative breaking?: Tethered EVs, usually trains, trams, or trollies. Unlimited power while connected and much less weight because the power source is not being carried, or at least not all of it if some storage is included for regen. capture.

So: Outside of a revolution in battery technology, principally the quantity of available power stored per kilogram, effective EVs will remain lightweight, small, battery ones, eg scooters, and large tethered ones, eg trains.

The Prius nor the Telsa have altered the laws of physics. Are not game changers.

Moving to within scooter range of a train station is a safer bet than investing in a big heavy battery of limited life in a clumsy metal box.

1), I think I see your objection. Yes, I agree, long-haul trucking won't go to pure EVs anytime soon, or ever. I haven't argued that they will. Instead, long-haul trucks will be replace by rail, with a much smaller contingent of EREV trucks.

Local truck delivery will happen.

2) yes, of course, regen braking can handle very large vehicles. Heck, a 10 ton truck can carry a 1 ton battery a lot more easily than a 1.5 ton car can handle a 1/2 ton battery!

Regenerative braking can recuperate a lot of that motion energy which partially offsets the extra weight penalty of an EV, but there is always an efficiency loss when energy is converted from battery -> motion -> back to battery, so in the real world a heavier EV is always going to need more energy than a lighter EV that's identical in all other respects. But, as someone who's done lots of bike touring with heavy loads on the bicycle, the extra weight isn't a deal breaker. Barrelling down the highway, it doesn't matter. It matters on acceleration and hills. It's not a real issue though.

Here is Car and Driver's review of the Tesla Model S. It's basically already competitive with its Mercedes, Audi, and BMW gasoline powered cohorts, assuming you can live with the limited range. Also note that the inherently better aerodynamics of an EV (no front grill, smooth underside) could offset the increased weight in terms of the energy needed to move it down the road (plus there's he whole issue of how much more efficient producing and using electricity is than oil).

http://www.youtube.com/watch?v=1kCG-WqpVnI

I just can't agree with people who pick apart the flaws with EV's and say they will not compete with gas powered cars - considering that we've had 5 EV's out in the market so far, and only for 2 years, I think there's still TONS of opportunity for advancement.

Seriously though, anyone who drives an EV will never go back, there is no comparison to driving a gas banger. The only real sticky points are the long recharge time, and uncertainty about battery replacement in 10 years.

Break even between aero losses (Eua above) and rolling resistance losses (Eur above) is about 40 km/hour (24mph) for the typical sedan. At 100 km/h (60mph), aero losses are six times greater than rolling losses. So the loss dominator is completely dependent on the makeup of whatever driving profile is selected.

Braking losses are, as suggested, dependent on percent recovered, and those figures have no been posted here yet.

That's a nice chart. Do you happen to have a link?

Do you know if it's for ICE or EV? EVs have much lower drivetrain losses, and tend to optimize other rolling losses as well. Of course, aero loss can be reduced as well...

I once saw a shock absorber that captures energy, instead of dissipating it into heat.

MacKay

http://www.inference.phy.cam.ac.uk/withouthotair/cA/page_259.shtml

Ah, yes, MacKay is pretty good. He used to be pessimistic, but after some good feedback (a bit from me) he's gotten pretty optimistic about what can be done.

Thanks.

His assumptions seem a bit off. Other "real world" (specific car models) I have seen show aero = rolling resistance in low to mid 30 mph, not 40 kph.

Yes, his numbers are kind've old and generic. Pretty good for illustration purposes, though.

MacKay's assumptions there for all to see.

cd*A car = 1 m2;

mass car = 1000 kg;

and Crr = 0.01.

And reading through his tome it is quickly evident that the goal to illustrate, not to exactly characterize the existing fleet on the road. Which would serve what useful purpose?

Break even at 25 mph for a typical vehicle versus ~30 mph for some specific vehicle mean his assumptions are off? Ok, so perhaps there are *some* vehicles out there with very low drag coefficients (i.e. sports cars), and with high handling performance tires which equate to relatively high rolling resistance coefficients (i.e. sports cars).

perhaps there are *some* vehicles out there with very low drag coefficients (i.e. sports cars), and with high handling performance tires which equate to relatively high rolling resistance coefficients (i.e. sports cars).

Hybrid and EV designers pay much more attention to those than do those of ICE vehicles. Further, electric motors have much lower drivertrain losses.

Of course, but that has no impact on the break even speed, aero vs rolling loss.

It could potentially change the ratio of aero vs rolling loss, which would would change the breakeven.

Aero is a little harder to reduce than rolling losses.

I like MacKay "theoretical enveloppes"(based on basic physics) a lot.

And clearly the best reference today in that respect with realistic numbers.

But on the car, seems that he misses the energy tied to acceleration periods (but didn't take enough time to reread the chapter in details maybe)

The energy scale on they y axis assumes an ICE, i.e. 25% efficient. Using an EV at ~80% instead only changes the energy consumption scale; does not change the shape of the curve or break even velocity.

Fuel efficiency vs. speed was hotly contested during the USA 55 mph speed limit fiasco of the 1970s. I recall Popular Science articles and advertisements saying that fuel consumption was proportional to trip length, i.e. the faster you go the less fuel is used. Not much explanation as to why, but I suspect the high displacement engines back then had large internal losses and were optimized for acceleration rather than fuel efficiency at highway cruising speeds.

http://en.wikipedia.org/wiki/Fuel_economy_in_automobiles gives a couple of examples where fuel efficiency at 65 mph tested higher than at 45 mph. So constant ICE efficiency may be a bad overall assumption.

Hybrid drives can optimize the ICE efficiency at some design speed and then use electric assist for acceleration, probably putting them closer to the theoretical break even speed.

saying that fuel consumption was proportional to trip length, i.e. the faster you go the less fuel is used.

The reason that usually fails is that increasing speed from, say, V to 2V gets the vehicle there in half the time but, since the energy loss goes as V^2, the losses due to drag don't just double with the higher speed they increase by a factor of four.

...couple of examples where fuel efficiency at 65 mph tested higher than at 45 mph

Well I'm skeptical (the wiki link to the report is dead), but I suppose it is just barely possible that an old ICE might have such a terrible efficiency at the lower RPM that it uses less fuel pushing against the exponentially higher drag forces at 65 mph.

Probably that data comes from

http://cta.ornl.gov/data/chapter4.shtml

Download the pdf link there for all sorts of interesting graphs.

http://cta.ornl.gov/data/tedb31/Edition31_Chapter04.pdf

Table 4.29 shows the 1997 Toyota Celica gained 1 mpg going from 55 to 65. Figure 4.2 is interesting, from 1984 to 1997 it shows the fuel economy flattening over the range from 35mph to 60mph, with a shift to slightly better efficiency at 55 mph.

Kiplinger just said that the 5 year Total Cost of Ownership of a Chevy Volt is within $1,500 of a ... Chevy Cruze.

Within $9,000, because those $7,500 tax credits don't scale.

Sure, they do.

They're a bass-ackward way of recognizing that oil's external costs are much higher than it's market costs. How can markets work well with bad accounting?

Of course, the credits are temporary. Fortunately, EREV costs are falling.

Which is to conflate the way one might want things with the reality that the resources of the federal government are not infinite. It is not feasible to scale a $7500 tax credit to ten million cars a year plus interest (since much of the money must be borrowed).

And I don't see a realized falling price yet. The only EREV in mass production, the Volt, has its 2012 list price as $39K (minimum) before the credit. Where's the decrease?

Which is to conflate the way one might want things with the reality that the resources of the federal government are not infinite.

The reality is that oil costs much more than the sticker price. That's not a wish, it's just a reality.

The US is in the process of spending around $2T on oil wars - every low-liquid-fuel vehicle sold reduces the need for such wars, and reduces the need for military & security spending.

Not to mention the reduction in health care costs, much of them paid for by government; reduction in climate change mitigation, such as sea walls, flood insurance, crop insurance, etc, etc.

These are all real costs.

I don't see a realized falling price yet.

Pricing is a messy beast. Cost, on the other hand, is much easier to analyze, even if it's not always visible. The cost of new tech falls reliably with volume and manufacturing experience. Battery costs fall reliably 7-10% per year, and the costs of the new engineering needed for EREVs will gradually be amortized.

Now, I agree with you wholeheartedly: we should simply tax liquid fuels and fossil fuels to internalize their costs. Unfortunately, this is the best we can do at the moment.

The US is in the process of spending around $2T on oil wars

Yes some military spending could be said to be allocated to problems caused by oil. But Afghanistan? Not so much.

Also, the US's oil import share from the Middle East has grown small. And should US imports go to zero some how, there's still China, India et al to keep the price up.

Afghanistan? Not so much.

We're there because we were attacked from there. That happened because of oil (we left troops in KSA after the 1st Gulf oil war, and more importantly were propping up many "client" regimes because of oil).

the US's oil import share from the Middle East has grown small.

If the US eliminated imports from the ME it (and it's allies) would still be vulnerable to oil shocks. That's why the UK and US have been so involved in the ME since WWI. I still remember the US trade balance going positive in the 1st quarter of 1991 because of remittances from our "allies" in the first Gulf war.

The 2008 recession vaporized what, $6T in wealth around the world? We still have a $1T annual output gap because of that recession. If that recession was partly caused by oil, shouldn't we allocate some of those losses to our oil consumption?

That happened because of oil (we left troops in KSA after the 1st Gulf oil war, and more importantly were propping up many "client" regimes because of oil).

Yes Bin Laden mentioned US troops in SA, but that makes an excuse not a cause. All US troops pulled out of SA in 2003; did AQ's jihad go away or even slow down? No. Bin Laden wanted a caliphate, as does his successor Ayman al-Zawahiri, as does the Taliban, as does the radical component of the Muslim world.

If that recession was partly caused by oil ...

Which is to idealize that which you would replace oil as somehow eliminating future recessions because its automatically less expensive, a big reach. And as far as I know the the recession was caused by a huge bubble in a bogus mortgage market, bubbles being something an EV filled future are unlikely to replace.

Bin Laden wanted a caliphate...

Yes, the radicals are...radical. But, they wouldn't exist without US/UK interference in the ME (caused by oil).

replace oil as somehow eliminating future recessions

No, just that oil imports contributed to the recession. The RE bubble was the proximate cause, but the RE bubble was a distortion caused in large part by very low interest rates, rates that had to be low to stimulate an economy slowed down, in part, by oil imports.

Remember, the RE bubble was created in part by CDOs which were in large part a way for oil exporters to lend directly to US consumers.

Oil imports, over the last 50 years, have caused enormous harm to the US.

Yes, the radicals are...radical. But, they wouldn't exist without US/UK interference in the ME (caused by oil).

I can't conceive of any possible (accurate) reading of history that makes than true, that radicals would cease to exist but for the fault of US/UK interference. No because Chomsky said so does not it make it fact. Was the Ottoman empire's arrival at the gates of Vienna also because of interference? The point being: one will look in vain for an Islamic philosophy that says, in effect, "leave us alone and we will remain peaceful inside our borders."

The Ottoman empire was quite a long time ago - painting Islam as the cause of ME violence is an enormous red herring.

Radicals would still exist, but no one would pay attention to them.

Iran had a functioning democracy until the US suppressed it in 1954. That was the cause of the 1979 eruption - the Shah was a direct imposition by the UK/US, and everyone knew it. The Shah's regime simply folded when Carter withdrew his support.

The KSA monarch couldn't/wouldn't exist without US support.

Egypt's Mubarak regime was a direct and obvious client of the US.

Most of that is free from the constraints of logical or historical argument, or relevance ...

Radicals would still exist, but no one would pay attention to them.

Until AQ fly planes into buildings, blows up subways, an IRA car bomb injures 220, or an Egyptian group massacres tourists at Luxor, or a string of movie theater's in Karachi are burned down on "Love of the Prophet Day" just because they were movie theaters.

Egypt's Mubarak regime was a direct and obvious client of the US.

And Egypt was propped up because it was an *oil* client? C'mon.

Most of that is free from the constraints of logical or historical argument, or relevance ...

I don't understand that. US/UK interventions in the ME aren't relevant?

hhmm. Do you agree that the US and UK helped overthrow a fledgling democracy in Iran in 1954, and install the Shah?

Yes Eisenhower and the UK intervened in Iran* sixty years ago during the cold war, and yes the intervention is not relevant to the risible claim that radicals, like Bin Laden or al-Zawahiri, "wouldn't exist without US/UK interference in the ME (caused by oil)."

*The Iranian PM at the time, though popular and received approval from the parliament, was appointed by the Shah, not elected.

US/UK interference in the ME (caused by oil)

Well that does leave the creation of Israel question open. How much of that was about oil (putting hard working colonists, western style govt and a strong ally in the neighborhood of the big oil producers)?

Must be some decent books that rely heavily on source material (memorandums and the like) out there but then again maybe not.

I don't recall the subject getting much attention in Churchill's little exercise in dictation The Second World War. I did find the source material at the end of each of those six volumes more instructive the Winston's official version in the front half of each.

...Israel question open. How much of that was about oil

Apropos, per Wright's The Looming Towers, Bin Laden cared nothing for the Palestinians, assassinating the one Palestinian member of his own group. His interest in the region carried only to the reestablishment Islamic control of the relevant historic cites now in Israel.

You aren't going back far enough. Bin Laden was not raised in a complete vacuum. The creation of the State of Israel has affected thought in the region in a big way since it occurred. What I am really interested is good source material from the 1940s. I would love to hear the conversations of the real power brokers of that time or at least to see a representative collection of their memos.

The radicalism of that region may well have risen without Israel's existence, but very likely having such a handy nearby focal point to despise helped it congeal and come to the fore much quicker and with much greater force than it otherwise would have. Bin Laden seems a more of a symptom than a cause in my eyes.

It is amazing what you can glean out of source material when you read it yourself. It became obvious to me as I read Churchill's volumes that he was mostly worked around and kept out of the important loops by sometime in 1943--and I picked that up reading material he allowed included after he'd told his version of the story.

Does The Looming Towers include large tracts first hand attributal to Bin Laden and his cronies or only chopped up little excerpts?

The wiki article is pretty good. Wright starts with Sayyid Qutb's visit to the US in the 1940s, Qutb being the father of the radicals in Egypt.

http://en.wikipedia.org/wiki/The_Looming_Tower

The book won the Pulitzer. To my mind it is extensively researched.

I'll take a look. Have you read The Prize (also a Pulitzer winner)? It provides a nice history of oil's influence in the ME and over US foreign policy.

It seems to me that a good history has to start with the end of the Ottoman Empire, look at the French invasion of Egypt in the early 1800's, the creation of British Petroleum in Iraq, WWI, the partition of the ME after WWI, etc.

At first glance the book appears to be a bit too narrow, with it's examination of irrational personalities rather than overall history. I wonder if it captures that Bin Laden crystallized a regional/nationalist sentiment that was already very strong, and had perfectly rational historical origins?

Why should we be surprised when the pawns in the Great Game start to object to being moved around the chessboard?

Have you read The Prize (also a Pulitzer winner)? ...

Yes, when it was fist published, and The Quest, and many of his company's energy reports along the way.

Bin Laden crystallized a regional/nationalist ...

Not nationalist, in part tribal (Sunni), but mostly Wahibist Islam. The latter was not crystallized by BL but by those he came before him like Qutb in Egypt. BL enabled AQ with finance.

intervened in Iran* sixty years ago during the cold war

We can choose to frame it that way, but no one in the ME does. The UK wanted to intervene because BP had been nationalized. The cold war was only relevant because of US-USSR conflict over control of ME oil. Just because it was 60 years ago doesn't mean that anyone in the ME has forgotten. We may have, but they haven't.

the intervention is not relevant to the risible claim that radicals, like Bin Laden or al-Zawahiri, "wouldn't exist

Well, Bin Laden was a child of the royal family. Given that the royal family would not have been in power without western support, I'd say he wouldn't have existed in the same way.

I didn't say radicals wouldn't exist, I said they wouldn't have popular support. Bin Laden was royalty. al-Zawahiri was a doctor. They didn't arise because of poverty, they arose because of middle class revolt against an elite, and nationalism (Bin Laden was trained by the CIA to oust the Russians in Afghanistan).

As long as the US supports dictators it will be the object of radicalism.

but no one in the ME does.

Self attribution for the entire ME, not just Iran?

The cold war was only relevant because of US-USSR conflict over control of ME oil.

No doubt oil was a factor in 1953 at least for the UK. The cold war was also relevant because, post 1944, a dozen non-USSR countries fell to Marxist-Leninist communism and Soviet influence, and Iran shared its northern border w/ the USSR.

Bin Laden was a child of the royal family. ... Bin Laden was royalty

No. Bin Laden's father was a Yemeni immigrant who became wealthy and has no blood relation to the Saudi royal family.

Bin Laden was trained by the CIA to oust the Russians

No, Afghans, not Bin Laden's Arabs who were ridiculed and isolated.

I'll stick to engineering discussion of electric transportation going forward, as I'm interested in your ideas there and you've clearly run the numbers. The above has become conspiratorial and dogmatic and thus unproductive; I half expect the next claim to be that Bin Laden worked for the Koch brothers.

Self attribution for the entire ME

Residents of the ME probably do blame the West excessively for their failures. Nevertheless, wouldn't you agree that the US & UK did intend to engage in "regime change" in Iran, and they did intend to quash a fledgling democracy that was acting in ways they didn't approve of?

The cold war was also relevant because, post 1944, a dozen non-USSR countries fell to Marxist-Leninist communism and Soviet influence, and Iran shared its northern border w/ the USSR.

But, why did the US care about USSR influence over Iran? Mostly because it and Afghanistan gave entree to the ME. Why was the ME important? Mostly because of oil.

Bin Laden's father was a Yemeni immigrant who became wealthy and has no blood relation to the Saudi royal family.

Yes, that looks correct. Nevertheless, my point stands: Bin Laden came from a wealthy family, not from poverty. My larger point: He was part of a middleclass/upperclass revolution against an elite supported by outside countries, not a poverty driven movement.

"The bin Laden family (Arabic: بن لادن, bin Lādin), also spelled bin Ladin, is a wealthy family intimately connected with the innermost circles of the Saudi royal family. The family was thrown into media spotlight through the activities of one of its members, Osama bin Laden, who was involved in the September 11, 2001 terror attacks on US government and commercial buildings. " http://en.wikipedia.org/wiki/Bin_Laden_family

Bin Laden's Arabs who were ridiculed and isolated

Interesting. I don't have time to look that up, but does it matter? The CIA would have been happy to train him, and he would have been happy to be trained by them.

conspiratorial and dogmatic

Well, the question of whether the US's conflict in the ME has its origins in oil seems awfully important to me. I appreciate your engagement.

“I am saddened that it is politically inconvenient to acknowledge what everyone knows: the Iraq war is largely about oil”

Alan Greenspan, in his 2007 memoir.

Apparently you are both right:

"On 28 April 1951, the Majlis (Parliament of Iran) named Mosaddegh as new prime minister by a vote of 79–12. Aware of Mosaddegh's rising popularity and political power, the young Shah appointed Mosaddegh to the Premiership"

http://en.wikipedia.org/wiki/Mohammad_Mosaddegh

Yeah, there isn't much oil in Afganistan but there might be a couple of trillion dollars worth of our berylilium, lithium, tantalum, niobium, etc that apparently somehow ended up under their land! Of course I'm sure that has absolutely nothing to do with it, eh?

You don't suppose, do you, that your version of Tesla and Chevy Volt BAU, might benefit just a wee bit from all those rare earths? Nah, It's all about being attacked from there...

Lithium isn't a rare earth, and it isn't especially rare.

As best I can tell, it's mainly the Chinese that are benefiting from Afghan mining...

And neither is oil but I guess that little detail was completely lost on you.

The problem is attempting to maintain BAU with limited resources from a finite planet, my guess is that we will continue to see all kinds of resource wars under the convenient guise of some terrorists from somewhere attacking us... but that's probably just me.

neither is oil

Oil as a commodity behaves rather differently from most others. We're misled if we assume that we can extrapolate from oil's problems to other commodities.

The problem is attempting to maintain BAU

The BAU that is attempting to maintain itself is mainly the oil & FF industries, trying to maintain their economic position. The sooner we get rid of them and their wars, the better off we'll be.

...neither is oil ... with limited resources from a finite planet,

An illustrative point for comparison of elements (mass) with oil (energy):

o The amount of lithium on the planet today is the same as it was a hundred years ago, and will very likely be same amount a hundred or a thousand years in the future.

o The amount of fossil oil on the planet today is some trillion barrels less than it was a hundred years ago, and the energy from that oil is gone forever.

Falstaff,

While it may be that lithium is not all that rare and that a thousand years from now the mass of lithium on earth will still be the same as it is today, it is still a disingenuous statement!

For starters recycling lithium from batteries is a rather energy intensive and uneconomic process.

http://www.altenergystocks.com/archives/2011/05/why_advanced_lithium_ion...

http://sf.france-science.org/2011/03/25/the-lithium-used-in-electric-car...

http://www.transportation.anl.gov/pdfs/B/644.PDF

A Review of Battery Life-Cycle Analysis:

State of Knowledge and Critical Needs

Dwight Bradley

U.S. Geological Survey

4210 University Drive

Anchorage, AK 99508 USA

Current Research:

Lithium resources. When lithium emerged as a critical element in the transition from gas-powered to electric cars, it became clear that lithium itself is a finite resource and that lithium deposits have never been a high research priority in global metallogeny. It became one for me starting in 2009. I’m working on ore-genesis models for the two deposit types that account for virtually all of today's lithium production: brines and pegmatites.

That first article by Petersen is kind've amusing.

The article contends that recycling is uneconomic, but actually shows that material costs are very low for new generation batteries. His metal values are suspect - $25k of cobalt per ton of 1st generation li-ion battery looks too high, still, they claim $3-400/ton for LIMN/LIPO 2nd generation li-ion batteries, which is only $2.4-3.2% as much!

That means that li-on batteries have very low material costs. Now, if lithium got scarce, recycling would be incentivized...

Another TOD contributor feels quite strongly that Petersen is just trying to pump up his Axion Lead Acid battery stock. Here's the disclosure on a linked article: Disclosure: Author (Petersen) is a former director of Axion Power International (AXPW.OB) and has a substantial long position in its stock. He also holds a small long position Exide Technologies (XIDE).

I took a quick look at the other articles: I don't see any showstoppers. Do you see anything specific you'd like to point out?

lithium is not all that rare and that a thousand years from now the mass of lithium on earth will still be the same as it is today, it is still a ... is still a simple statement of the conservation of mass law, no more, no less.

...became clear that lithium itself is a finite resource

A truism. Everything is finite. The relevant questions are i)how much ore is available now, and ii) how much manufactured product can be recaptured later?

Scrap steel, including in the form of discarded autos with lingering brake pads, paint, used oil, etc, sells for only $150-$250/ton, half the price your link gives for non-cobalt Lithium compounds. Yet 75% of steel manufacturing in the US comes from recycled metal, all without some grand government program to save the world from 'BAU'.

Robert,

I don't expect you to cover it with Hofmeister who is a supply side expert, but the demand side needs to be looked at as well, especially when talking about the possibility of a Long Recession.

The evidence so far seems to be that US households feel the pain when gasoline costs get above 5% - 7% of their houshold budget. High prices kept the gas slice of the budget at or above that level for several years now.

In short, what matters is not the cost of a gallon, but the weekly spend on gas. A subtle difference but a crucial one.

As a result of the increased weekly cost, people are slowly adapting. Vehicle miles travelled is falling. People are switching to smaller cars. The effect of the Obama administration's accelerated CAFE standards will start to show up in the statistics in a couple of years, too.

If and when these adaptations pick up enough speed so that they outrace supply problems, the result would be to drive spending on gas back down below the 5% zone of pain. Because of the delay built into the adjustment process, it could well overshoot, leaving people with an extra 2% or 3% of their household budgets for other things, starting soon. The Long Recession could be postponed for a decade or so.

I've used a few "ifs", "coulds" and "mights" in there. As I said, the demand side needs looking at -- I don't have the answers.

Looks like Californians at least are reacting to the price of fuel in their state. So the pricing mechanism works given time and the correct range of products are available to the market.

http://www.bloomberg.com/news/2012-10-18/toyota-prius-dominates-californ...

Yes, this is the way it happens. As you say, given time.

Here are two predictions: there will be "Peak Oil is dead" stories in the US media in 2022, full of the usual fallacies and falsehoods. But -- this is the main prediction -- they won't say that the US's liquids consumption is 15 million barrels per day, the same as it was in the late 1960s. And falling.

Edit: Bill McBride at Calculated Risk has published this chart, from the US Dept. of Transport. As the baby boomer population bulge ages, we can expect an increased rate of decline in vehicle miles travelled. Time is helping all by itself.

No, the US will not go down that adjustment slope easily.

The people who buy new vehicles have larger incomes so the cost of gas is a smaller percentage of their income. They tend to buy all the bells and whistles in more impressive vehicles and don't worry about resale when they buy. When you add up the insurance, capital costs, depreciation and maintance costs the fuel costs are not that much for them.

Those driving to their jobs at Wallmart are driving used vehicles. A used SUV with non functioning AC looks to be better value than small car without AC that can't carry Honey bo-bo and her whole family. If you can only afford one car then it better well be big enough. GM, Ford etc doesn't sell to them.

Remember- one candidate said he was going to scrap the mandated fuel requirements, we got lots of oil...

When you add up the insurance, capital costs, depreciation and maintance costs the fuel costs are not that much for them.

It's true - gas is badly underpriced.

one candidate said he was going to scrap the mandated fuel requirements, we got lots of oil...

That's the Koch financed candidate.

Why would EVs be "the answer" when their production and use also hinge on a fossil fuel based economy?

Why not ditch the auto paradigm altogether? Oh yeah, Americans.

Because their production and use don't hinge on fossil fuels in the economy.

I like electric trains - they account for most of my travel. But, personal vehicles are far better for many things.

They aren't dependent on fossil fuels? Really? They aren't made of metal? They don't have rubber tyres? They don't run on electricity generated by coal-fired power plants? Even your electric trains have an inherent fossil fuel cost, in production, operation and maintenance.

They aren't made of metal?

Metal doesn't require fossil fuel. Mining and smelting can be done with electricity (although I suspect synthetic liquid fuels may be handy for a small % of uses like certain forms of mining).

Mining is a common concern. Much mining, especially underground, has been electric for some time - here's a source of electrical mining equipment. Caterpillar manufactures 200-ton and above mining trucks with both drives. Caterpillar will produce mining trucks for every application—uphill, downhill, flat or extreme conditions — with electric as well as mechanical drive. Here's an electric earth moving truck. Here's an electric mobile strip mining machine, the largest tracked vehicle in the world at 13,500 tons.

don't run on electricity generated by coal-fired power plants?

They certainly don't have to. Even now, wind and nuclear are rather more important at night, when EVs would mostly charge. There's a very, very nice synergy between wind and EVs.

your electric trains have an inherent fossil fuel cost, in production, operation and maintenance.

No, they really don't. Manufacturing is mostly electric. Where fossil fuels are essential to operation and maintenance I really can't imagine.

The windmills and nuclear power plants don't have to be built, run and maintained? You honestly don't see the fossil fuel component ingrained in these activities? You're not convincing me that the auto paradigm doesn't need die.

We currently need fossil fuels to manufacture things but if our energy supplies can be switched over to renewable then there may be other ways of manufacturing. It's easier to say that than to do it though, it's a monumental challenge. Electric transportation is not about continuing on with BAU, although many will see it that way, and many of the BAU haters will by extension hate EV's because they see them fulfilling that role. If even 10% of current automobiles are eventually replaced with EV's I'd consider that a huge success. It's not about maintaining BAU, it's about maintaining basic mandatory services that society needs in order to continue functioning. Yes, there are huge problems and challenges, as you've noted. But we basically have no other alternative since bicycles, by themselves, simply aren't gonna cut it.

It won't "cut it" no matter what.. The doom has us.

It's easier to say that than to do it though, it's a monumental challenge.

It's really not that hard. The Koch brothers would like us to believe that, but it's not true.

The windmills and nuclear power plants don't have to be built, run and maintained?

Of course, but you don't need fossil fuels to do it. That's like saying that because the first ICE trucks were built with parts that were transported by horses that we'd always need horses for freight.

I don't see many horses transporting freight, do you?

AT PRESENT you need fossil fuels to do the aforementioned activities. There's nothing that suggests this fact will change. Maybe if one gullibly believes that since we moved from muscle power to fossil fuels there will be something grander on the horizon, when in fact we'll just return to the medieval past or succumb to doomish circumstances altogether.

People who are pessimistic about dealing with Peak Oil wonder: which processes happen to use oil today, because of historical accident, and which truly have to do so? What part of manufacturing, transportation etc, is specifically reliant only on oil?

So many things run on oil - can we possible replace oil in all of these applications?

The answer is yes, primarily through electrification of surface transportation and building heating. Aviation and long-haul trucking can be replaced with electric rail and water shipping, and aviation will transition to substitutes.

This will proceed through several phases. The first is greater efficiency. The second phase is hybrid liquid fuel-electric operation, where the Internal Combustion Engine (ICE) is dominant - examples include the Prius and, at a lower price point about $20K, the Honda Insight. The 3rd phase is hybrid liquid fuel-electric operation, where electric operation is dominant. Good examples here are diesel locomotives, hybrid locomotives, and the Chevy Volt. The Volt will reduce fuel consumption by close to 90% over the average ICE light vehicle. This phase will last a very long time, with batteries and all-electric range getting larger, and fuel consumption falling.

The last phase is, of course, all electric vehicles, which are are slowly expanding, and being implemented widely (Here's the Tesla, here's the Nissan Leaf). Electric bicycles have been around for a long time, but they're getting better. China is pursuing plug-ins and EV's aggressively. Here's an OEM Ford Ranger EV Pickup, and a EREV light truck (F-150).

Here are electric UPS trucks. Here is a hybrid bus. Here is an electric bus. An electric dump truck. Electric trucks have much less maintenance.

Kenworth Truck Company, a division of PACCAR, already offers a T270 Class 6 hybrid-electric truck. Kenworth has introduced a new Kenworth T370 Class 7 diesel-electric hybrid tractor for local haul applications, including beverage, general freight, and grocery distribution. Daimler Trucks and Walmart developed a Class 8 tractor-trailer which reduces fuel consumption about 6%.

Volvo is moving toward hybrid heavy vehicles, including garbage trucks and buses. Here is the heaviest-duty EV so far. Here's a recent order for hybrid trucks, and here's expanding production of an eight ton electric delivery truck, with many customers. Here are electric local delivery vehicles, and short range heavy trucks. Here are electric UPS trucks, and EREV UPS trucks. Here's a good general article and discussion of heavy-duty electric vehicles.

Diesel will be around for decades for essential uses, and in a transitional period commercial consumption will out-bid personal transportation consumers for fuel.

Mining is a common concern. Much mining, especially underground, has been electric for some time - here's a source of electrical mining equipment. Caterpillar manufactures 200-ton and above mining trucks with both drives. Caterpillar will produce mining trucks for every application—uphill, downhill, flat or extreme conditions — with electric as well as mechanical drive. Here's an electric earth moving truck. Here's an electric mobile strip mining machine, the largest tracked vehicle in the world at 13,500 tons.

Water shipping and aviation can also eliminate oil: see my separate post on that topic.

Here's a terminal tractor that reduces fuel consumption by 60%.

Farm tractors can be electric, or hybrid . Here's a light electric tractor . Farm tractors are a fleet application, so they're not subject to the same limitations as cars and other light road vehicles(i.e., the need for small, light batteries and a charging network). Providing swap-in batteries is much easier and more practical: batteries can be trucked to the field in swappable packs, and swapping would be automated, a la Better Place. Zinc-air fuel cells can just be refueled. Many sources of power are within the weight parameters to power modern farm tractors, including lithium-ion, Zebra batteries, ZAFC's and the lead-acid developed by Firefly Energy (before their demise), and others.

It's very likely that an electric combine would be an Extended Range EV: it would have a small onboard generator, like the Chevy Volt. Such a design would be more more efficient than a traditional diesel only combine, and would allow extended operation in a weather emergency.

Most farmers are small and suffering, but most farm acreage is being managed by large organizations, and is much more profitable. Those organizations will just raise their food prices, and out-bid personal transportation (commuters and leisure travel) for fuel, so they'll do just fine. As farm commodities are only a small %of the final price of food, it won't make much difference to food prices. The distribution system, too, will outbid personal transportation for fuel. Given that overall liquid fuel supplies are likely to only decline 20% in the next 20 years, that gives plenty of time for a transition.

Even hydrogen fuel cells could be used, though they're not likely to be cost-competitive soon with the alternatives. PV roofs certainly could be used to extend battery life, though the cost effectiveness of that will depend on how much of the year the tractor is in the field. Electric drive trains are likely to be much more cost-effective than liquid fuels, but locally produced bio-fuels would certainly work. Also, fuels synthesized from renewable electricity, seawater and atmospheric CO2 would certainly work, though it would be rather more expensive than any of the above.

Any and all of these is several orders of magnitude cheaper and more powerful than animal-pulled equipment. One sees occasionally the idea that we'll go back to horses or mules - this is entirely unrealistic.

The easiest transitional solution may be running diesel farm tractors on vegetable oil, with minor modifications. Ultimately, farmers are net energy exporters (whether it's food, oil or ethanol), and will actually do better in an environment of energy scarcity.

Iron smelting currently uses a lot of coal, which isn't oil, but is a fossil fuel which we'd like to eliminate. Iron used to be made with charcoal, and iron oxide can be reduced with hydrogen from any source - about 30% of all smelting is done with electric arc furnaces (http://www.worldcoal.org/resources/coal-statistics/coal-steel-statistics/ ). Most of the steel used in the USA is reclaimed from scrap (and when industries mature, essentially all of their steel can be recycled); all it takes is an electric furnace to re-melt it, and the electricity can come from anything.

The US Navy plans to go reduce it's 50,000 vehicle fleet's oil consumption by 50% by 2015. They plan by 2020 to produce at least half of its shore-based energy requirements on its bases from alternative sources ( solar, wind, ocean, or geothermal sources - they're already doing this at China Lake, where on-base systems generate 20 times the load of the base), and it's overall fossil fuel consumption by 50% by 2020 with EVs and biofuel.

Some question the stability of the electrical grid, in an environment of expensive fuel. Utilities like the idea of "eating their own cooking". Here's an electric utility boom lift. Here's a consortium of utilities considering a bulk purchase of plug-ins (and a good article). Here's an individual utility buying electric cars. Similarly, utilities are buying hybrid bucket trucks and digger derricks. Here's a large commitment by two major utilities .

Here's a good quote from the Governor of Michigan: "For automakers, replacing the internal-combustion engine with an electric powertrain is both revolutionary and daunting. In a world where economic Darwinism threatens slow adapters with extinction, U.S. automakers know that they can either lead this historic transformation or become history themselves. Even today, as they engage in a struggle to survive, the Big Three are leading the way: General Motors, Ford and Chrysler are scheduled to introduce electrified vehicles next year."

France is planning for a market share for EV's of 7% by 2015, rising to 27% in 2025.

http://www.greencarcongress.com/2009/10/france-20091002.html#more

------------------------------

What if our current system is less like a train running out of power, where it will just slow down and stop, and more like a jetliner running out of power, energy which it crucially needs to have a safe landing? Do we really have the resources to build out an alternate energy infrastructure?

Well, at least in the US, there's so much energy used for things with very marginal value that we have a very big cushion. We have an enormous surplus of energy (used for single-commuter SUVs, for example) , so we have quite a lot of flexibility.

EVs don't require significantly more energy than ICEs to manufacture. Wind turbines have a very high E-ROI.

Even if PO reduces the energy we have available, we currently have such a large surplus that we have plenty of leeway to reduce consumption in some places to free up the oil needed for such an investment.

Isn't this a tricky transition, with fragile balances between politics, communications, labor, logistics, public-calm, etc?

It's true - a transition away from oil will put stress on a lot of institutions. On the other hand, this isn't any bigger than similar transitions, like going from coal to oil, or from mules to tractors. And, isn't it good to know that there technical solutions?

Where will the needed electricity come from?

From wind, mostly. Wind has a very high E-ROI, and is plentiful. Solar, nuclear, geothermal, etc will also be important. Coal is extremely abundant, but we have to hope that we don't use it.

Aren't we going to have to live within the limits of our environment?

Sure. Fortunately, energy isn't one of those limits. I'd say that climate change and species extinctions are much larger problems.

What about the invested-in infra-structure for our oil-based life style and what it will take to tear down the old infra structure and replace it with an entirely different one? Won't we have to tear down the suburbs, and similiar infrastructure?

Yes, we'll have to toss out some ICE trucks and cars before the end of their natural lifetime. On the other hand, we do that all of the time: the average US car/SUV/pickup gets 50% of it's lifetime mileage by the time it's 7 years old. They could last 25+ years, if we wanted them to, but we throw them away. The premature retirement of commercial trucks will hurt investors in some trucking companies, but that's a sunk cost.

The real question is, can we afford to build new infrastructure, and the answer is clearly yes: new rail tracks and rolling stock aren't that expensive, and EVs are no more expensive than ICEs.

We won't have to toss out housing - Kunstler is just wrong, completely wrong. A Nissan Leaf will allow a 50 mile commute, or 100 miles with workplace charging.

EVs can be built with the same factories - for instance, the Volt shares a factory with 2 other cars. They drive on the same roads.

Except.. no, it won't happen.

Except...it's already happening now.

The US reduced oil imports by 25% in the last 5 years, while GDP rose.

From Congressional Research Service April 2012

http://www.fas.org/sgp/crs/misc/R42465.pdf

Edit According to World Bank http://data.worldbank.org/indicator/NY.GNP.PCAP.CD/countries/US--XS?disp...

GNI per capita, Atlas method (current US$) hardly changed at all overall 2008 to 2011, having dipped in 2009. (US population still growing @ 0.7 to 0.9% per year).

Yes, oil prices have risen.

The point remains: we have made some progress by reducing consumption by about 10%, and increasing production a little. We could eliminate imports entirely if we wanted to. The problem: the oil industry doesn't want to, and it has bought enough politicians to prevent it.

It is unrealistic to say that eliminating oil imports would be hard, or bad for the economy, and agreeing with that idea only strenghtens the misinformation created by the Kochs of the world, and disseminated by Fox News et al.

Have to say I agree entirely. And this election has been nothing more than a protracted power grab by those very oil special interests. And, I believe, should they manage a return to power, they will reinforce policies and conditions that make economic decline certain. The old model of trading pollution and cheap fossil fuels for growth can't work any longer. The pollution sinks are full and overflowing. And all the new fossil fuel energy is more expensive. Costly environmental damage and costly fuels do not a formula for growth make.

Well I don't agree Robert. We still import about 8 million barrels per day. To say that we could eliminate imports if we wanted to except for the fact that the oil companies have bought enough politicians to prevent it is the most foolish thing I have read in years.

A lot more things would be involved in reducing imports to zero than just paying off a few politicians. And how could they possibly pull it off if all politicians agreed? Absurd!

US total net imports of petroleum from the EIA in KB/D. Last data point is May 2012.

Ron P.

Ron,

That was me, not Robert.

Read the rest of my comments to see why I argue for elimination of oil imports.

By the way, that's a striking chart: we see that imports have dropped from 12.5M (2005) to 7.7M(4th qu 2011, 1st qu 2012), or by 38%!

I know it was you but Robert agreed with you. I was just shocked that anyone with agree with such nonsense.

Ron P.

You might want to be more specific with your objection...

Are you serious? How can one be specific with objections when all you give is vague generalities. For instance:

"We could eliminate imports entirely if we wanted to."

Really? How about some specifics?

"The bottom line is that there are wide range of effective and cheap ways to eliminate oil."

Oh boy, that is really specific. All you do Nick is wave your hand and make vague and really absurd assertions. Get off oil? Yeah, a wide range of effective and cheap ways to do that! Yeah right. How about a few specifics?

You cannot name one because there are none. We are locked into oil and there is no way off without massive die-off.

Ron P.

I've given a wide range of specifics elsewhere. Here are just a few:

http://www.theoildrum.com/node/9560#comment-924574

http://www.theoildrum.com/node/9560#comment-925068

http://www.theoildrum.com/node/9560#comment-924469

http://energyfaq.blogspot.com/2008/09/can-everything-be-electrified.html

http://energyfaq.blogspot.com/2008/09/can-shipping-survive-peak-oil.html

a wide range of effective and cheap ways to do that! Yeah right. How about a few specifics?

You cannot name one because there are none.

In my forthcoming chapter on freight in "Transport Beyond Oil" (Island Press, release March 2013) I go into some specifics.

"Cheap" in comparison to maintaining BAU.

$50 to $80 billion to electrify the main lines - life expectancy 50 years.

Expansion to carry most truck freight faster and more reliably - depends how far you want to go. Low end perhaps $80 billion, high end pushing $200 billion.

Life expectancy 30 or so years for electric locos, 40 years for ties, all else longer lived.

We subsidized cheap gas with $101 billion in non-transportation taxes in 2010. Burning almost 2 million b/day of refined diesel for haul intercity freight. So I see the capital investment #s as "cheap".

I wish I could quote some specifics from the chapter - but ...

Best Hopes for Realizing the Possible.

Alan

France is 1/5.75 the population of USA.

22 billion euros for 1,500 km of new tram lines in almost every town of 100,000 and larger.

21 billion euros to double the Paris Metro (+200 km, 2 million more daily pax).

Convert euros to $, multiply by 5.75 and I see that as "cheap".

We could certainly eliminate imports of oil entirely if we wanted to. But we don't want to! That would be unbelievably unpopular and all the politicians that tried to do that would be swiftly kicked out of office. And not because of the oil companies but because of the people.

People are lazy, greedy, and cheap. Oil provides the cheapest & easiest way to move people & things around. So if you tried to take it away people would go nuts.

We need to provide incentives for alternatives since that puts a ceiling on oil prices and provides us with something to transition to. But just banning foreign oil is a bridge too far.

Absolute nonsense! How could we do that? I find it astonishing that anyone could make such a sweeping statement without one word of explanation as to how we could pull that off.

But of course. We enjoy sending money to other countries for all that oil. Oil Economics

The government cannot do anything without serious and very dire consequences. Banning foreign oil would send gas prices to $20 a gallon, send the nation into a depression that would make the 1930s look like a picnic. Unemployment would go well over 50% and we would likely never recover. The nation would sink into anarchy as starving people rioted in the streets.

Ron P.

TOD Oct 24. Shale Oil: The Latest Insights, Rembrant.

banning foreign oil is a bridge too far.

I would never suggest that. Just tax oil properly.

Oil provides the cheapest & easiest way to move people & things around.

It really doesn't. Oil is more expensive even now. For instance, what's the cheapest car on the road over it's full lifecycle? The partially electric Prius C. If we didn't subsidize oil then hybrids, PHEVs, EREVs and EVs would be clearly cheaper.