Oil Watch - OECD Oil Production (IEA)

Posted by Euan Mearns on December 5, 2012 - 2:43pm

Executive summary

According to BP, OECD oil production (C+C+NGL) peaked at 21.67 million bpd in 1997. Monthly production data from the International Energy Agency (IEA) now suggests that production has been stable for 5 years at around 18.5 million bpd (Figure 1).

The North Sea (UK and Norway) is still in steep decline. This has been offset by growing production in the USA and Canada where non-conventional tight oil and tar sands production are offsetting declines in conventional crude in these countries.

Mexico, the other big OECD producer, has managed to arrest declines by switching nitrogen injection supply from Cantarell to Ku Maloob Zaap and has had stable production of just below 3 million bpd for three years.

Figure 1 Monthly crude oil production for the OECD countries. All data published in this interim report are taken from the monthly IEA Oil Market Reports.

From May 2007 to August 2010, Rembrandt Koppelaar published an e-report called Oil Watch Monthly that summarised global and national oil production and consumption data from the International Energy Agency (IEA) of the OECD and Energy Information Agency (EIA) of the USA. This is the third in a series of new Oil Watch reports, co-authored with Rembrandt and details crude oil production data for the OECD countries as reported by the International Energy Agency. Earlier editions:

Oil Watch - World Total Liquids Production

Oil Watch - OPEC Crude Oil Production (IEA)

Europe

European oil production is dominated by the North Sea and adjacent offshore areas. The big two producers are the UK and Norway with lesser oil production in Denmark, Germany and The Netherlands. Italy also has a small oil industry. The small producers are not documented separately by the IEA and are aggregated as "Other Europe".

European production has annual cyclicity where production is reduced in the summer months to allow for maintenance of aging offshore infrastructure (Figure 2)

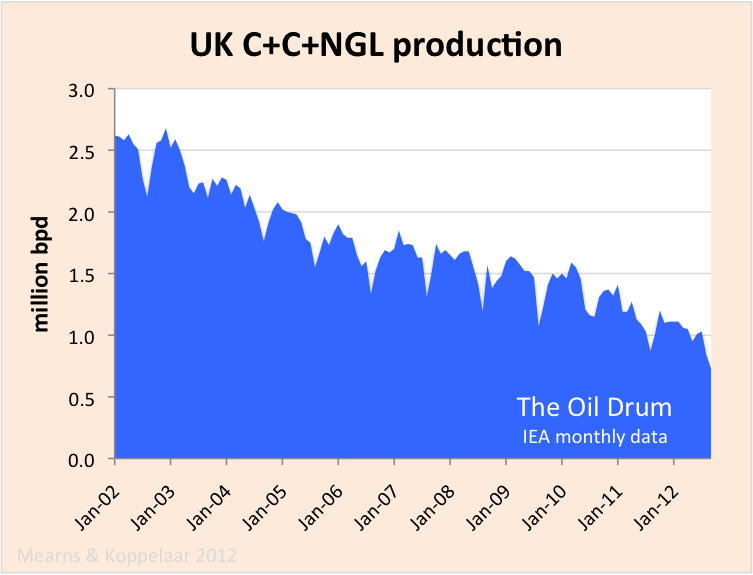

UK oil production is in a world of hurt with a decline of 17.4% between 2010 and 2011 reported by BP. This compares to an historic decline rate of around 7%. The 17.4 % figure is corroborated by the IEA data (Figure 3). One might have expected production to bounce back in 2012 but this has not happened. Jan to Sep production in 2012 is 12.8% below the equivalent period in 2011. In September, production hit an historic low of just 730,000 bpd.

In April 2011, a cash strapped UK government raided North Sea production for an additional £10 billion in tax and this caused activity to freeze over for a while. But the main cause of the free fall has more to do with installations being shut down for repairs such as Buzzard, Schiehallion and Elgin. In the wake of Deep Water Horizon there is hightened awareness of safety and the cost of disaster.

Much of the steel constructed UK infrastructure was designed for 20 years service and has ben out there for 40 years. It seems likely that other offshore provinces such as The Gulf of Mexico, Brazil and Angola will eventually succumb to the same fate as the UK.

Norwegian oil production is also in steady decline though not yet as rapid as in the UK with declines of the order 5 to 7% per annum. The Norwegian industry is in fact less mature than in the UK with extensive areas of under explored territory where substantial new discoveries are still being made, and bringing those on stream helps offset declines in the first generation giant fields like Ekofisk, Gullfaks and Oseberg.

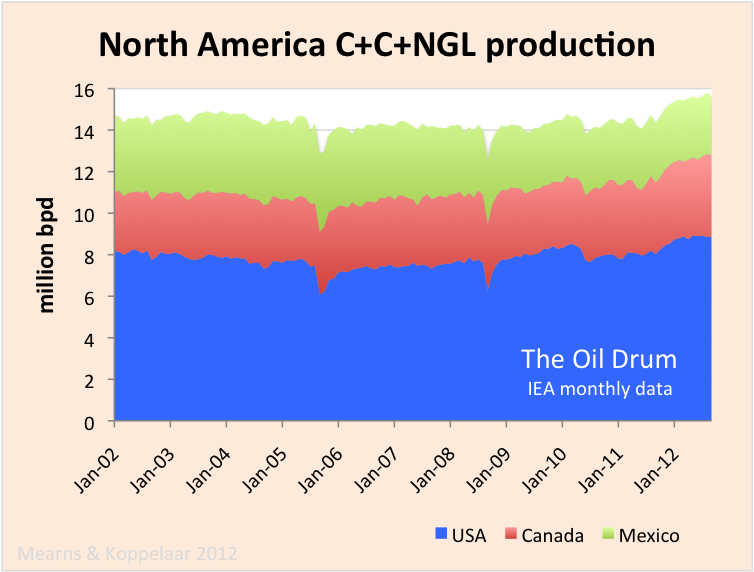

North America

North American oil production has been largely flat over the decade but is now clearly rising again (Figure 5).

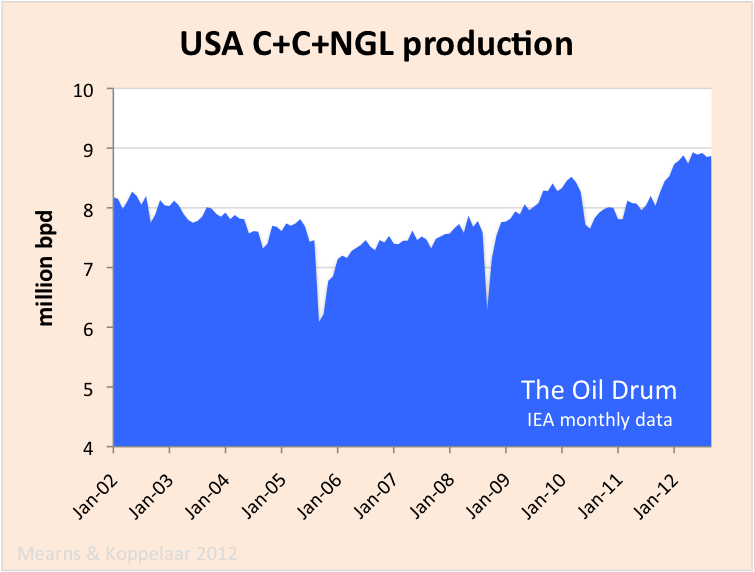

As pointed out by Tad Patzek in a recent Oil Drum post, USA production is best modeled as the sum of Hubbert discovery cycles. The recent rise in US oil production (Figure 6) is due largely to tight oil from formations like the Bakken and Eagle Ford which represent the most recent discovery cycle to be laid upon the production stack. Professor Patzek expects US production to resume its decline once production from tight oil formations peaks in the years ahead.

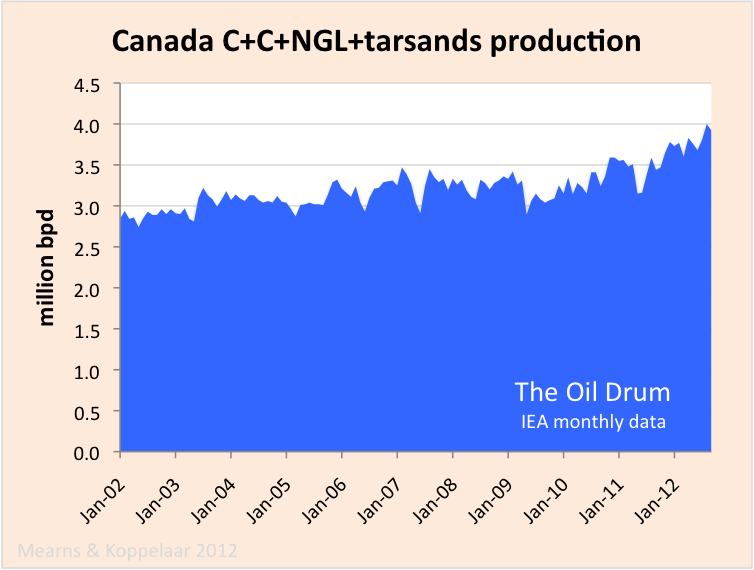

Canadian oil production has been rising steadily over the decade from <3 million bpd in January 2002 to 4 million bpd in August 2012. Canada now publishes detailed oil production statistics that shows conventional crude production to be flat / in slow decline. All of this growth has therefore come from the tar sands that produced 1.75 million bpd in January 2012. Tar sands production is dependent upon supplies of cheap natural gas, and for so long as this is available, it seems likely that syn crude production will continue to grow.

A significant part of Mexican oil production comes from the giant off shore Cantarell field. In the year 2000, state owned oil company Pemex, began injecting nitrogen in Cantarell to boost production and recovery. By 2007 the decision was made to divert nitrogen supplies from Cantarell to neighboring Ku Maloob Zaap. Starved of nitrogen, production in Cantarell (and Mexico) went into steep decline but since 2009 this decline has been arrested with the introduction of oil from Ku Maloob Zaap (Figure 8).

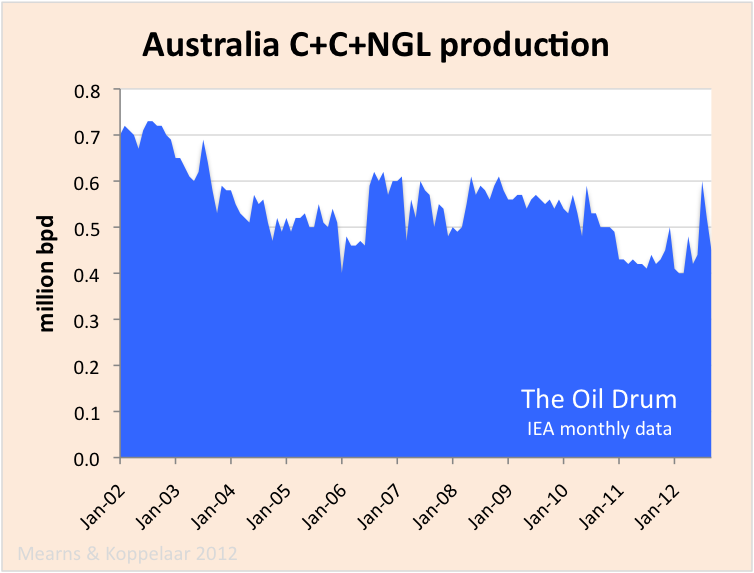

Australia

Australia is a small producer which has been in erratic decline over the decade. Recent production has been mainly <500,000 bpd.

Mexico's production around 3 mbpd seems to have confounded the sceptics, who straight-lined the decline of the 2000-1010 period. How long are they likely to keep this production level? Are we likely to see UK-type declines in the near future or do they have other fields / tricks up their sleeves?

Mexico's oil production is down to about 2.5 million b/d now, but the decline should slow because Cantarell's oil production is now so low. Cantarell has fallen from over 2.1 million b/d at it's peak a few years ago to less than 450,000 b/d today and it now represents less than 20% of total Mexican production whereas it once accounted for nearly 2/3.

However an increase in Mexican oil production would require an aggressive and efficient drilling program by PEMEX, and PEMEX has never been known for being aggressive or efficient. Most of its remaining oil is in fields that would be nearly as difficult and expensive to develop as the US Bakken, and the Bakken is being developed by a large number of small companies which are good a non-conventional technology and ruthless cost control.

Another problem is that Mexico is consuming increasing amounts of its own oil, which is cutting in to its exports to other countries.

The slowdown in the decline surprised me, but it did not surprise David Shields, who really broke the story on the size of the Cantarell decline. At an ASPO-USA conference, David predicted that increased production from KMZ would temporarily slow the decline, resulting, if memory serves, Mexico approaching zero net exports some time around 2017 to 2020 (his estimate). David also noted the significant differences between what Pemex officials said in private regarding Cantarell, versus public pronouncements.

Rounding off slightly, Mexican production basically stopped growing in 2003, and they maintained 3.8 mbpd for 2003 to 2005 inclusive (BP, total petroleum liquids).

It's interesting to see what an extrapolation of the 2003 to 2009 decline in the ECI ratio shows. Mexico's ECI ratio fell from 1.99 in 2003 to 1.49 in 2009 (ECI = Ratio of total petroleum liquids production to liquids consumption) . At this rate of decline, they would approach 1.0, and thus zero net exports, around 2018, resulting in estimated post-2003 CNE (Cumulative Net Exports) of about 4.6 Gb.

An extrapolation of the 2003 to 2011 rate of decline in their ECI ratio suggests that they would approach zero net exports around 2020, resulting in estimated post-2003 CNE (Cumulative Net Exports) of about 5.3 Gb.

Actual post-2003 CNE for 2004 to 2011 inclusive were 3.8 Gb. If we assume that a reasonable (ECI Ratio decline based) estimate for Mexico's post-2003 CNE is on the order of 5 Gb, then their post-2003 CNE were about 76% depleted as of the end of 2011.

Link to March, 2010 interview with David Shields:

http://aspousa.org/2010/03/interview-with-david-shields-update-on-mexico...

Cantarell's 2012 production is flat through November: 402 kbpd in January and 403 kbpd in November.

http://www.pep.pemex.com/Reportes/Lists/Produccion/Attachments/235/Ejecu...

Don't ask me how I located that report, I was lost when I found it !

Here's a recent op-ed by Shields: TOGY talks to David SHIELDS | The Oil & Gas Week. He states that KMZ is currently at peak.

Jeff,

If Cantarell is down to 450k b/d, what is KMZ running at?

My recollection is that the Mexicans, with the nitrogen injection, really pushed Cantarell

to give up the goods quickly at the expense of longer term production.

Is KMZ destined for a similar fate, goosed in the short run, gagged in the long?

Randy,

Excerpt from Steve's interview with David Shields (linked above):

FOR ALL

Every report I've seen on Cantarell Field describes it as gas cap expansion drive thanks to N2 injection. As such there really can't be any projection of future production rates based upon just past rates. As the N2 cap expands it pushes the oil down dip to the producing wells. When the N2 reaches each producer that well is shut in. How quickly producing wells are shut in is a function of where they sit structurally. If most are high on the structure then rate can be lost quickly. Lower on the structure than more slowly. But I don't know the well distribution in the field but I have no doubt PEMEX does. The N2 levels don't just bump up over night. Their increase can be plotted over time and projections made. I suspect by this time PEMEX has a fairly accurate model of the expansion rate vs. recovery. That info along with knowing where the remaining producing wells sit structurally should give them a decent production forecast. A forecast they don't appear to want to offer in detail.

If anyone has info that the drive mechanism is different I would be glad to hear it. Over the years many have described it as a gas cap expansion but I've never seen documentation.

Rockman, the Cantarell oil field is very unusual, since it is in the Chicxulub crater produced by the meteor that killed off the dinosaurs. The formation is the debris that filled the crater afterwards, and as a result it has very high porosity and permeability, and no doubt the rock is fractured beyond belief. It was the ultimate frac job.

Because of the high permeability, PEMEX was able to crank up production to extremely high rates by simply injecting nitrogen like there was no tomorrow.

I think the fundamental problem PEMEX has is simply that the oil column between the gas above and the water below is now very thin and that frankly there is very little oil left that can be produced. If there was any oil bypassed by the rapid gas injection scheme, it is probably lost for good.

I'm not very confident in PEMEXs ability to forecast the production, because their production forecasts in the past have been completely wrong. They didn't predict the sudden and steep decline the field underwent.

Why is that ? Has gravity been repealed ?

Diffusion takes time. Or, if they want to go back and drill for pockets, they have to be big enough to make it worth the trouble. So as usual, 'lost for good' means 'lost as far as we're concerned'.

Capillary forces exceed gravity / buoyancy acting on isolated oil droplets.

Nitrogen Injection in the Cantarell Complex: Results After Four Years of Operation

http://www.onepetro.org/mslib/app/Preview.do?paperNumber=SPE-97385-MS&so...

Sounds like gravity drainage. Consider also the decline profile:steep decline followed by very moderate decline. The reservoir fairly screams gravity drainage.

Certainly there will be isolated oil droplets, particularly in the matrix. That is why ultimate recovery is expected to be 50%, not near 100% from the fractures(at least the vertical ones) and below 65 -70 %, from a more typical gravity drainage reservoir. Well, that and the fact that the field is offshore, limiting economic recovery.

Tony - "Has gravity been repealed? Yes, actually. Although a better way to describe it is that a counter force has been induced by the N2 injection. As we all know the density difference between oil and water causes the oil to accumulate above the water. But the same relationship holds for N2 and oil: the N2 accumulates above the oil. Thus the gas cap expansion forces the oil to move down against the force of gravity, in essence repealing gravity just as you ask.

As far as recovering any oil left behind I suspect there is little possibility. A gas cap expansion drive is actually the most effective recovery method. Some folks don't realize that the pore space in every reservoir, even when it's producing 100% oil, also has water in pore space. Sometimes as high as 30% to 40% of the pore space is occupied by water. The ability of a fluid to move through a reservoir is a function of its saturation. When the oil sat is high and the water sat is low only the oil flows out. Which is why water drive oil reservoirs eventually produces water: as the oil is produced its sat goes down while the water sat increases. Eventually the water sat reaches a level where it begins to flow.

Eventually when the oil sat declines enough the oil will stop flowing. But there is still oil in the reservoir, sometimes as high as 40%. This is called the irreducible oil saturation. Which is the goal of all EOR methods: to change the IOS. Gas cap expansion via N2 injection is essential an EOR method and the most effective of all techniques. Much more effective than a water flood. The N2 gas cap probably still has an oil sat on the order of 15% to 25% (my WAG). About the only option they have would be to replace the N2 injection with CO2 injection. I don't recall that ever being done and I suspect the economics wouldn't be too attractive. The CO2 might reduce the oil viscosity some but all the N2 that has been injected will also have to be driven out with what oil might move. Even if such a plan might work to some degree on paper I suspect the capex costs would kill such a project.

You must live in a reverse gravity universe.

Why do you say that ? I don't see any reason why recovery wouldn't be in excess of 50 % of OOIP, as Pemex has estimated. Have you looked at Cantarell production for 2012 - flat as a flapjack. Certainly, that would not hold into the future but recovery would be extensive at 5% decline as Shields estimates.

How much oil in place, from where, and how much has been recovered ?

If you can document recovery already approaching 50%, I will concede - there is little possibility. Meanwhile, I will try to document OOIP and cumulative recovery.

I doubt CO2 injection, at this point, would be economically feasible. There is a possibility that Pemex could have done better with miscible CO2 - but that is water under the platform.

Given oil price history, Pemex may have shot themselves in the foot by accelerating production via N2 injection.

Gravity has not been repealed in my world.

Edit:Cumulative from Cantarell is about 13 Gb of 35 Gb OOIP, leaving another East Texas of possibility.

Tony - "Why do you say that ?" You misread me. I said nothing about URR. I said that when the gas cap expansion program ends I doubt there will be an economic way to recover the residual oil. Which you appear to agree with at the end of you post. I have no idea what the OOIP or current recovery is. But if their gas cap expansion drive is as efficient as others I've seen I suspect the recovery factor will be quite high. Based on your numbers they are at 37% now. If the remaining producers are low enough on the structure and spaced properly I wouldn't be surprised at a 50%+ RF. As I said before GCE drives usually have the highest RF's. I agree with you about missing the boat with CO2. Heck, they might have increased URR a percent or two by injecting liquid Tide detergent with the N2. Anything to increase oil mobility would have been worthwhile IMHO.

As far as production being flat I've got no problem with that. As long as the N2 cap hasn't extended down to the next level of producers (and they maintain the N2 injection volume) the production rate should be flat. That's the point I made about being unable to use any portion of the past decline rate to predict future declines. The future declines will be a function of when the N2 cap reaches the rest of the producers. Since I have no idea where those remaining producers sit on the structure the rate could remain flat for years or go into steep decline in 6 months if a large number of the current producers are just below the current level of the N2 cap. Unless PEMEX discloses that data no one can make a logical projection.

And yes; I live in a world where gravity can be reversed. I do it every time I drive my car up a hill or walk up a flight of stairs. The Cantarell GCE drive is the same thing...except backwards. Kinda like pushing a ball under the surface of the water: using a force to counter the effect of buoyancy.

The force of bouyancy in this case assists the lower density fluid, N2, in displacing the more dense fluid, heavy oil, downdip.

Immiscible gas displacement, absent gravity assist, is just not very efficient. I'll repeat that:'Immiscible gas displacement, absent gravity assist, is just not very efficient'.

An ultra low viscosity fluid, N2 gas, cannot effeciently displace a viscous fluid, heavy oil, except where gravity drainage is effective. Cantatrell is a gravity drainage case in point - high permeability, steeply dipping rock units and a 7000' tall(real tall) oil column.

N2 injection at Cantarell was primarily an acceleration project.

Pemex is well aware of the gravity dominated flow of Cantatrell -reference the article I posted above:

If you have experience with effecient gas cap expansion recovery, then you have experience with gravity stable displacement.

Of course, some of us 'round these parts might argue that the key point is that one of our most important sources of imported oil may have already shipped about three-fourths of their post-2003 cumulative supply of net oil exports--in only 8 years.

'Round these parts', some of us are more concerned with the $20 discount to wti recieved because of an excess of the grade produced at Cantarell, (along with an exess of 'Western Canadian Select' or some such abomination).

http://www.paalp.com/_filelib/FileCabinet/Crude%20Oil%20Price%20Bulletin...

I don't really know what is going on in that oil field, but I suspect that it is quite a bit different than Pemex thinks is going on. It's somewhat unique - we don't have any other supergiant oil fields that were created by a giant meteor, and the highly fractured nature of the formations means that there could be all kinds of unexpected flows going on.

My dubiousness is just based on past experience. I once worked for a company that lost a major gas field. They estimated it had about 1 trillion cubic feet of reserves, so they drilled six wells which they intended to produce at a total 200 million cf/d. They put the first wells on production, and within a few weeks, the wells started developing a water cut. Within 6 months, all the wells were producing 100% water, including the ones which were shut in and not producing. It was one of the fastest decline rates ever seen - 100% in less than a year. What could they do? They abandoned almost all of the wells, removed all their equipment before the government could seize it, sold the field, and wrote off their $100 million investment.

Our geologists never did agree about what went wrong and didn't even want to talk about it. Other geologists speculated that it was a high-fractured water-drive gas field, if you can imagine, with the water formation sitting updip of the gas formation and held in place by anti-gravity or some similar force until the pressure on the formation was reduced, and then the water came flooding in through the fractures and stranded the gas. (I just made up the anti-gravity part, but there was definitely some weirdness going on). One or two remaining wells are still producing, but at about 3 million cf/d, and the company operating them won't commit itself to estimating remaining reserves.

Fields like that one exist for the sole purpose of preventing geologists from getting too cocky and thinking they know everything. Cantarell may be another one of those fields, and it is evident that Pemex has been too cocky about thinking they know what is going on there. They may have permanently damaged the field with their high-volume N2 injection project, and it wouldn't be the first time a big oil field has been completely screwed up.

You're making it way too complex. Except for the use of cryogenically produced Nitrogen, this is 60+ year old technology - gravity assisted gas injection.

Are you sure I'm making it way too complex? I thought I was oversimplifying it for the general public. Personally, I think that Pemex doesn't know what is going on in this field, but that's just a personal opinion.

Mexico is probably making political decisions which Pemex has to live with. I'm reasonably sure Pemex has access to all the latest technology and services needed to handle a field like Cantarell and competent professionals working in the industry. If you would read through some of their technical presentations available at OnePetro Search, I think you would reach the same conclusion.

Now about those political decisions, it is troubling how production took a seemingly unforseen dive. That fits the political decision overruling technical staff model. I have little doubt though, that the technical staff knows what is going on - it is just not that complicated.

After further study, it now appears that Cantarell(excluding Sihil) hasn't reached its equilibrium rate. Sihil is a deeper partial repeat of Akal. Production from Sihil is recently shown at 130k bopd, which is it's design peak. Sihil is included in production totals for Cantatrell. Sihil is a mega project that is not - not listed in the megaprojects.

Pemex is carrying 2 Gb proven and 4.8 Gb probable and possible for Cantatrell as of 1-1-2012:

http://www.ri.pemex.com/files/content/Reservas_2011_i_GRI_1203292.pdf

edit:The idea that N2 injection at Cantarell is some sort of exotic tertiary recovery technique probably is the result of what Simmons wrote in 'Twilight'.

N2 (at pressures used by Pemex) is essentially inert and not miscible with the crude oil. It boils down to decades old technology of displacing oil downdip with a relatively inert gas. The result is primarily an acceleration process.

Amoco used miscible N2 gas at Ryckman Creek and Painter Reservoir in Southwest Wyoming(Overthrust)in the '80's. Misciblity was possible in those cases because of the depth and volatile oil present in the reservoirs.

The major complicating factors at Cantarell,in my opinion, are the dual porosity nature of the reservoir and variable rock and fluid properties in the 7000' original oil column.

Tony - yes...a great deal of experience evaluating gravity drainage fields in S Texas. I can point to any number of gravity drainage (also called depletion drive by some) fields that will be producing at a flat rate for the next 50 to 100 years. Most have been producing at with no decline in individual wells for decades. But that happens when a well is only making around 1 bopd. That's life in a heavy oil gravity drainage drive: it takes about one hour pumping to get that bbl out of the tubing. And then the pump stops and it takes 23 hours for that next bbl of oil to flow from the reservoir into the tubing. Very high quality reservoir rock with good perm...reservoir quality isn't the problem. Just zero reservoir pressure. About 10 years ago I almost acquired one field so I could do a gas cap expansion program but financing fell thru. I still know the husband/wife that operate that field. These day they make over $600k/yr working 2 hours/day. And if prices stay where they are their portion of that field will make $600k/year for the next 50+ years. They've owned those lease for over 30 years and the production is the same as when they bought it. Of course, when oil prices were low they were getting $6/bbl...high sulfur discount. Such wells would flow 100-200 bopd initially but as the reservoir pressure was blow down rates fell to less than a few bopd. Water flood was a total failure: the high perm sands allowed the water to channel directly from the injectors to the producers with every little oil swept. That's why CGE drive is the only way to go. But the engineering is a lost art and many operators have neither folks that understand it nor can impliment it. I can point you to dozens of fields with billions of bbls of residual oil. Just like some of the "solutions" to AGW: a viable idea that won't be implimented isn't any better than a bad idea.

Waterflooding of a gravity dominated field should be not be expected to yield much potential. The efficiency of gravity recovery exceeds that of displacement by water(given sufficient time). On the other hand, waterflooding doesn't seem to materially interfer with gravity displacement. Pressure maintenance is another story, as at Ghawar where the oil is essentially volatile.

Yates field in West Texas is an example. Waterflooding didn't yield much except possibly acceleration. CO2 injection has been of limited success. I think the operator has also tried a chemical program - polymer or surfactant injection.

Other examples where waterflooding has neither materially interfered nor enhanced gravity recovery are Wertz and Lost Soldier in Wyoming. CO2 injection was of limited success, although Amoco claimed otherwise.

CO2 will undoubtedly mobilize fluids and there may be economic benifit to the acceleration aspect of that. The current operator of Wertz and Lost Soilder are encouraged by the process and are -last I heard- expanding.

Another benifit to be realized with CO2 injection is:producing wells can be converted to flowing. Salt Creek in Wyoming is an example. Anadarko has converted most or all the producing wells to flowing. Salt Creek is over 100 years old.

Nearly any field with even modest relief will benefit from gravity segregation - given enough time. I could cite dozens of examples in the Powder River Basin, with heavier oils.

Back to Cantarell - given the description of Cantatrell- I suspect incremental oil could be mobilized by water imbibition into the low permeability matrix. Implementation is problematical.

@RockyMtnGuy

I wouldn't be so sure about PEMEXs ability to forecast production well, one of the key issues is politics here where they probably have known all along how production would play out (within error margins) given various scenarios, but opted to show a certain scenario the outside world. My 2 cents also informed by talking to a PEMEX official (on board of directors) who visited ASPO Brussels.

Rembrandt

I do find it curious how it is that over and over again I run into things that suggest the last story's been told concerning ancient phenomena and their impact - such as the above explaining the disappearance of the dinosaurs. While it's a great theory, there's so many other reasons the dinosaurs could have disappeared it seems silly to rest one's laurels on any one ultimately non-provable theory. Personally, I'd rather believe nothing than something that might be false.

Today, yet another theory was presented:

http://www.msnbc.msn.com/id/50119631/ns/technology_and_science-science/#...

Matt - Along those lines long ago I saw paleontological reports indicating that many dino lines appeared to be dimishing long before the big hit...perhaps just another tipping point example. Perhaps an analogy to what were doing to ourselves today.

After the giant meteor theory was introduced, somebody went back over the records and theorized that the supposedly slow extinction was the result of statistical errors. The extinction might have been very sudden, but the dates might have been smeared out by analysis errors. It's hard to tell the difference between one year and 1000 years in the fossil record, particularly as regards extinction dates.

You never find the first individual or the last individual of a species, you always find one fossil from what might be from somewhere near their beginning, and another from somewhere near their end, and a bunch more from in the middle. However, if you don't find any fossils, that doesn't necessarily mean they weren't there - but it might mean that. That's why physicists hate paleontology.

The extinction of the dinosaurs coincides with the iridium layer on the K-T boundary, and iridium isn't normally found in the Earth's crust, so physicists theorized that an extraterrestrial object hit the earth at that point in time. The Chicxulub meteor crater was formed at the same time, so they theorized that it was the extraterrestrial object that formed the iridium layer and that it also killed off the dinosaurs. It's not conclusive proof, but it is a smoking gun.

However, the Deccan Traps were also formed by massive volcanic activity at about the same time, so now we have two smoking guns and only one dead body. I'll leave it to the paleontologists and physicist to figure it out. It could be another Murder on the Orient Express scenario.

They both did it!

Seriously, the impact of the ET object must have been ginormous, and perhpas could have caused the Deccan Traps volcanic activity?

http://www.offshore-technology.com/projects/kumaloobzaap/

269,301 (K) + 264,115 (M) + 297,868 (Z) = 831,284 b/d (Oct/2012)

http://sie.energia.gob.mx/bdiController.do?action=cuadro&cvecua=PMXB1C03

rudall:

Re-reading this article, this clip caught my eye:

OECD oil production (C+C+NGL) peaked at 21.67 million bpd in 1997. Monthly production data from the International Energy Agency (IEA) now suggests that production has been stable for 5 years at around 18.5 million bpd (Figure 1).

Production has been stable at 18.5 MBd...

That's almost exactly what the US is burning right now.

So, hallelujah!, energy independence, as long as we take over Norway, UK, Mexico, Canada, Denmark, and few other entities before

tackling Iran.

Salvation at last.

Near's I can tell, the UK is the place to be to watch independence day fireworks. They will be operating without energy any day now, by the looks of things.

Isn't that what energy independence is all about? (I recently read in the WSJ that the health of the US economy is no longer dependent on oil. I s'pose economics works like that in the old country too.)

Has anyone told the Queen about this? Maybe she could make a few quid selling sparklers for the celebration.

EIA predicts $268 a barrel oil by 2040 ..

http://www.biofuelsdigest.com/bdigest/2012/12/06/8-gasoline-268-oil-ahea...

January 2000 to August 2012

January 2000 to August 2012

January 2000 to August 2012