Tech Talk - Iran and the New EIA and OPEC Reports

Posted by Heading Out on December 16, 2012 - 6:14am

With the possibility that demand for Iranian oil may fall below 1 million barrels a day (mbd) as sanctions continue to bite, Iran has announced that it wants OPEC to cut back production to the agreed quotas, rather than the overall additional 1 mbd that is actually being produced and sold. Such a move would, of course, make it more difficult for those customers who have found a way to replace Iranian oil, and perhaps incline them more toward disregarding the embargo.

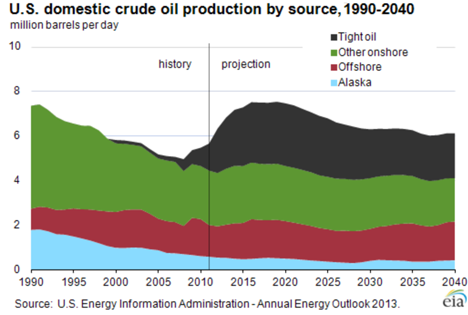

OPEC has just released their December Monthly Oil Market Report (MOMR) in which they anticipate that earlier projections for 2013 oil demand growth will still be valid at 0.8 mbd. (Though they note that December 2012 growth y-o-y was at 1.0 mbd as the US economy continued to improve). They expect that all of this increase will be met by non-OPEC increases in supply, and that demand for OPEC oil may even drop 0.4 mbd. Part of that projection continues to rely on increased US crude production, and the EIA TWIP of December 5th had the latest chart showing that projected growth, based on the newly released Annual Energy Outlook 2013.

Figure 1. Projections of future growth in US crude oil production. (EIA TWIP) from Annual Energy Outlook 2013)

As a footnote to that graph, the Alyeska pipeline pumped an average of 582,755 bd in November, which brings the annual average up to 544, 625 bd. It is clear from looking at that plot that the gains in production are assumed to come from increased production of the "tight" oil deposits that have produced the overall gains achieved to date. The optimism of this projection goes a little beyond the levels that I anticipate will be achieved.

Coming back to the MOMR - their projections do not include the recent news that Venezuelan President Chavez has had a fourth operation for cancer and has named a successor, although the operation was apparently successful. This may complicate decisions on how much to allocate among the OPEC partners, especially since all continue to need higher priced oil.

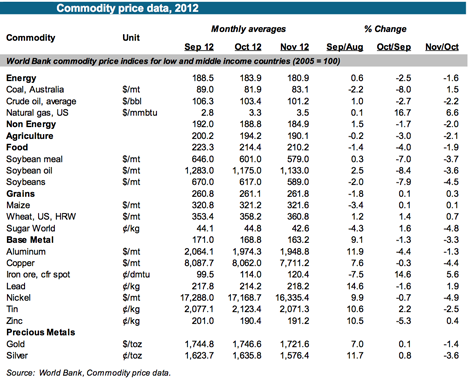

OPEC also give the price of various commodities in their report, and before moving on to discuss country production, examining those prices is informative. With the decline in overall global demand at present, metal prices in particular seem to continue to slide.

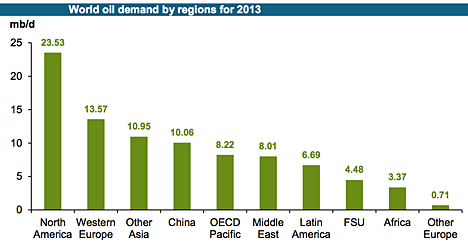

Equally informative is the demand that OPEC anticipates from the various regions of the world for oil in 2013.

In total OPEC anticipates that global demand will reach 90.83 mbd by the fourth quarter of 2013, with the greatest growth continuing to be from China and the other Asian nations.

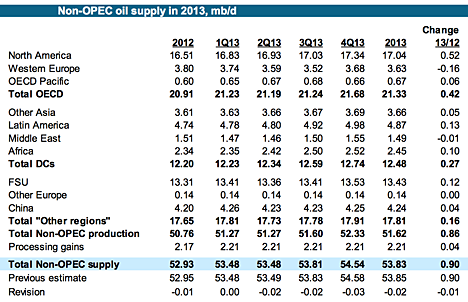

Looking at where this oil might come from, the main increase is still anticipated to come from North America.

The conflict in Syria is now reported to have led government forces to withdraw from the Omar and Al-Ward fields in the Deir Ezzor region, where much of Syria’s exports were produced. However, the rebels do not, as yet, control any of the refineries or export terminals and the result is that oil production is estimated to have fallen from 380 kbd to 160 kbd over the past few months. The regime is making up the shortfall in its needs by importing from Iraq.

Which brings us back to OPEC production levels. (Note that this is for crude oil and does not include the roughly 6 mbd in NGL that is currently being produced).

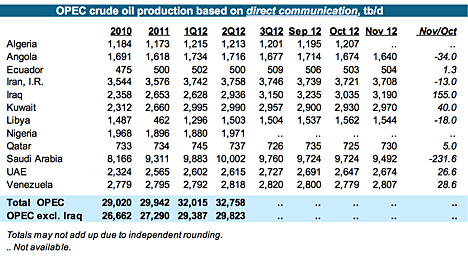

Firstly, this is what the various governments report that they are producing:

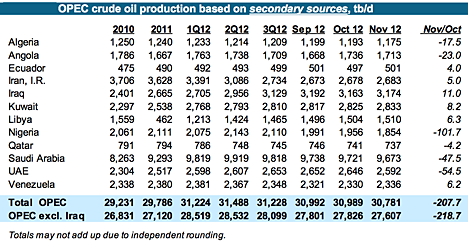

The total shows, among other things, how Libya has recovered from their “Arab Spring.” In contrast with the official figures, OPEC also posts the values from “secondary sources”.

The difference between the two figures for Iran is at around 1 mbd. Overall, OPEC production is declining with the increase in non-OPEC production, so perhaps Iran won't have quite as difficult a time persuading their colleagues to drop production a little more, to help them out. That won't be at the latest meeting of the OPEC Ministers, which was held in Vienna on December 12th, where it was decided to maintain the current ceiling of 30 mbd.

The meeting was largely distracted by debate over who should be the new Secretary General, with this decision "kicked down the road" to the end of May.

On the other hand, while Malaysia had promised to halt imports of oil from Iran last March, the IEA is reporting that they increased crude purchases from Iran in November. Whether this is oil ultimately destined for that country, or whether this is a convenient transshipment point from Iranian tankers bringing in crude that is then transferred to other carriers and a second purchaser is not clear, although a Chinese oil trader appears to be involved.

A move to make US natural gas available to NATO allies has begun in the Senate, with the intent that perhaps this could wean countries like Turkey from their use of Iranian and Russian natural gas. Whether this will ever amount to much is not clear, since Senator Lugar, the initial author, was defeated in the primary of the last election and thus leaves the Senate at the end of the term.

Dave, eyeballing the forecast for tight oil, the EIA has 2 mmbpd for about 25 years that works out at 18 Gb which seems doable. The forecast for offshore looks more suspect. Is there any reason US GOM should be more resilient to declines than the North Sea? Or are they factoring in new areas off the E and W coasts?

"....for tight oil, the EIA has 2 (Million barrels per day) for about 25 years...seems doable".

I think this depends on the price continuing to rise. Current Bakken oil is being sold at a $10 to $14 per barrel discount to WTI due to shipping logistics. Once Keystone XL is completed and perhaps refinery planned for Elk Point, South Dakota comes on line the price paid for Baskken oil will rise above WTI. Right now prifit margins for "tight" oil are slim as wellhead price is around $74/barrel and drilling/production costs are $60 minimum and $70 maximum. Same scenario for other shale plays: Unless local oil price can rise faster that costs are rising for drillers/producers, that output will not continue to climb. Output is now at about 1.2 million bsrrels per day.

Euan – OK…I’ll accept the optimism…if someone can throw a little support behind it. We’ve had a nice increase in tite oil production due to the surge in shale drilling the last few years. But the chart projects an increase more than double than what we’ve seen so far. The increase has occurred when the rig count had reached a recent record level (which has fallen 10% in the last 12 months) and when oil prices were higher than we’ve seen during recent months. There seems to be an obvious question: why should we be expecting a huge surge in the drilling rig count that would be required to see this huge increase in tite oil production? A huge surge in drilling that has to start immediately and continue for at least the next 3 years. If someone can provide a rational explanation for this to happen I’ll buy in. Otherwise there’s no reason to expect their projection of increased tite oil production IMHO.

Now the non-tite onshore oil projection. I assume they are referring to conventional non-fractured shale plays. Given the US conventional fields have been declining year after year for decades I can only assume they are predicting new conventional oil plays. So exactly where are those “new plays” and why aren’t they being discovered today? At the very least we must be developing new onshore conventional plays as

quickly as the old fields deplete. Their chart clearly shows this category has declined 30-40% in the last 20 years. I cannot point out even one significant new onshore conventional play being developed today. Or even in the last 10+ years. Where’s the beef???

Now let’s focus on the offshore. Everyone is aware of the great DW GOM play which has caused a surge in offshore production in the last 10 years. Hmmm….something is wrong. Their chart actually shows about the same and maybe a bit less offshore production today then before the DW development began 10 or so years ago. OK…DW additions have helped offset declines of existing fields. I’ll buy that. And, according to their projection will continue to do so for the next 30+ years. Given the high decline rate of DW oil fields they must be expecting a lot of new field discoveries during the next 30 years.

OK then…a little geographical perspective for those who have never seen a map of the DW GOM. It ain’t that big. It covers about half the area of the offshore GOM shelf play. And less than 1/3 the area of the onshore Gulf Coast regions of Texas and La. Notice that doesn’t include the very oil prolific regions of N. La. and west Texas. There have been big discoveries made in the DW GOM and more to come. But this trend is like every other play developed on the planet: it has geographic limits and eventually will be more or less fully developed in X years. I don’t know what X is for the DW GOM but apparently the EIA has secret data indicating the play will continue on at a significant level for much more than 30 years. A longer time span then seen in any other play ever developed in the US since the beginning of the industry. Hey…might happen…right?

Alaska: they don’t seem too optimistic about growth. OTOH they don’t anticipate much decline over the next 30 years. That must happen due to all those new Alaskan discoveries we keep hearing about that will replace the current depletion declines.

As I mentioned recently any chart projecting increases/decreases in future oil/NG production is meaningless unless it also includes all the assumptions, such as pricing, drilling activity, play limits, etc. In the case of the EIA chart I can’t agree/disagree with the specific assumptions they make to generate the chart because they aren’t offered. I had to speculate on what those assumptions might be and offer an opinion on such possibilities. Just my WAG but I doubt the chart was created with any thought to those points I just brought up. They just assumed, without a logical basis, production would increase.

Just my WAG but I doubt the chart was created with any thought to those points I just brought up. They just assumed, without a logical basis, production would increase.

I thought the curve to just shy of 2015 looked familiar.

Remember HO's Citigroup projection review?

I keep seeing the chart in the key post pop up and always notice the framing.

Look at the difference between this chart directly above and the one in the key post - notice how convenient stopping at 1990 is when compared to their projection? One would be led to believe that we're going to re-take our old all-time high, when the all time high was about 2 mb/d more than their projection and two decades previous to the last year they show.

Look at all the fun you can have with the above chart by starting your projection curve ~1991. Saudi Arabia increases production astronomically to infinity (see no worries) of course Russia would have stopped producing oil in 2002--no soup for them. Always fun to play with crayons?-)

Rocky,

I believe I've seen claims of increasing drilling productivity for rigs in ND.

Heard anything?

Nick - I've heard that concentrating more surface locations on one drill site has improved costs significant. Some rigs actually on tracks and can mob to a new hole in hours instead of days.

I should think both of those would significantly increase the number of wells one rig can drill per time period.

Any wild guess how much wells/rig might have risen?

Nick - Nope. Since I'm not trying to make money in the Bakken it actually bores me somewhat. If not for TOD I would never think about it. LOL

There is still a big frac backlog last I heard, seems that might be a factor affecting rig count,

I did hear from an ENI guy that water availability is an important issue in the Bakken--didn't get any specifics.

This is part of an email I received today from Energy & Capital. No link, sorry. Anyway I had no idea fracking took that much water.

Ron P.

[edit: fixed link]

Posted this link a week or so after the Mississippi navigation got notice

(5.2MB PDF) Water Management Issues Associated with Bakken Oil Shale. Not exhaustive but gives you a glimpse--right now the estimated ND oil field demand is 75.7 million liters/day or about 0.15% of the average daily flow of the Missouri past Bismarck.

It's been a long time since I looked for property where water rights were involved, but the issue has long been a contentious one in a whole lot of the US west.

The obvious question is recycling.

I should think that the value of the water to O&G operations is much higher than for farming (or most other uses) - what's the ratio of barrels of water input to barrels of oil pumped?

Nick - true: I've heard many farmers/ranchers in S Texas had much better incomes from selling water to operators than from agri uses. How much? Just a simple model: 5 million gallons per frac or 120k bbls of water. Recover 300,000 bo. Or 0.4 bbls of water per bbl of oil. Or 17 gallons per bbl of oil. I can buy 1 gallon of spring water at the grocery for $.77. So about $13 of retail water per bbl of gross oil. But I can buy a tanker load of water delivered for around $0.05/gallon or about $2.50/bbl of gross oil URR. Not free but doesn't look like a deal killer either.

If you need 17 gallons of water per barrel of oil, at 5 cents per gallon of water wouldn't that be $.65 per bbl of oil?

From how far away could that water travel at that price ($.05/gallon)?

If I recall you work in east Texas, curious what that truckload of water is worth in west Texas? Competition for water in the west is certainly not a new thing.

The oil industry's water demand in ND is not huge, but in lean water years it comes on top of water that is already fully allocated, and those allocations appear to be running head on with Mississippi barge transport more or less in your neighborhood. Looks like the debate between congressional districts will create competing demands on the the corps of engineers--not always the most accommodating bunch in the best of times.

Considering the massive amount of gas ND is flaring, resource conservation doesn't seem to be anywhere near the top of their priority list--it would be interesting to know just how much frac water they are able to/were willing to recapture/reprocess. Absent regulation (and it seems ND is about as absent of regulation as any major US oil province) it is all about dollar present value, a point you have hammered home here repeatedly,

If it cost another $.05/gallon ($.65/bbl) to bring the water from 1,000 miles away, that would be pretty cheap to do.

February 2012 piece on frac water [470KB PDF] which goes into savings from recycling-disposal cost money too.

I guarantee none of that water is being hauled anywhere close to a thousand miles.

Thanks for that info.

Well, they assume less water than Rocky did: .5M - 3M, vs Rocky's 5M. So, it appears consistent with the idea that the water input volume is smaller than the oil output volume.

Now, given that the cost of raw water is in most places far less than a penny per gallon, we're really talking about all the rest of costs, transportation and disposal being the biggies. One has to think that most of these costs are much higher due to the improvised nature of much of the work in N Dakota. Heck, water could be sent by pipeline in the long-run.

It just appears highly unrealistic to me to think that water availability is going to be a limiting factor to fracking, when the volumetric ROI of oil:water is greater than 1 and oil brings around $90/bbl. If costs become large enough, long enough, to be a real problem, they will be reduced in some way, whether it's recycling or finding alternative sources & transportation methods.

read the whole pdf, which does mention that some frac jobs use 200,000

bbls of water.

Of course oil can outbid food for water, though it might not be able to outbit Mississippi transport, which means it will have to trucked/piped in from somewhere that won't reduce Mississippi winter flow rates. Not sure how much can be taken from the Red River system as it flows into Canada--could be major treaty limitations there. Pipelines from the Great Lakes are also subject to treaty with Canada.

Water availability is already a big issue affecting the speed of Bakken development. It will remain so.

Now, given that the cost of raw water is in most places far less than a penny per gallon

There isn't much oil being produced in most places so lets use the actual cost where this oil is.

The cost to purchase raw water for use in the Bakken

play ranged from USD 0.25/bbl up to USD 1.75/bbl

For trucking water 1000 miles add in the minimum shipping cost below--add another premium to deal with winter freezing problems brought on by a 16 hour run.

Here: (mind you this doesn't even include the cost of raw water and wait time)

400bbls (approx tandem tanker load)

33.33 hours (2000 mile round trip at 60mph)

$100/hr (bargain basement truck time charge in and out of oil country)

$8.33/bbl minimum likely over $10/bbl just to get water to the well.

An extra half million or so a well probably won't kill things with prices over $85/bbl but no doubt water conservation will being looked at a lot harder the harder they have to look for water--a simple bottom line issue. I doubt they will be trucking it a 1000 miles. It would be even better if they started conserving the gas ND lets them flame off into the over heating atmosphere--but that likely will take regulation--$3mcf gas is hardly worth the oil drillers time it seems.

Water availability is already a big issue affecting the speed of Bakken development.

Have you seen anything concrete about actual delays due to water? I couldn't find any with a quick search. I did find this:

"To answer Steveragain, there are 2 major reasons why this technology would not be applicable to the Bakken and Three Forks plays in North Dakota. First is the delay in hooking up the wells to gas lines due to poor gathering infrastructure. Many of the wells up here are flaring gas a year after completion. Propane used in the fracks would be wasted. Second, water availability is definitely NOT a problem up here. I'm heavily involved in the Bakken drilling and completion and do not see geology as an impediment."

http://seekingalpha.com/user/5274781/comments

Just what the ENI guy told me. Only talked to him for a minute but it sounded like expansion plans were running hard up against water availability certainty issues. The state seems to have found water so far.

All the scuttlebutt inside these companies is that production could double again just as quickly as it just has so future water availability is a major concern (August) and Lake Sakakawea and other Missouri River withdrawls look to be on their way to court (October). That always provides a quick and timely solution, eh. I'm sure lower Mississippi barge companies and port areas are just sitting on there hands and not sticking their fingers in the issue at all, right. Can't imagine ND oil companies being at all concerned about how that will play out.

Remember ND isn't Texas where the federal govt has virtually no holdings or power (Texas was not part of the Lousiania purchase). Can't imagine the ND water issue getting cleaned up real easily, alternating drought and flood depending on the season/drainage will only make it that much more contentious. When an expanding industry heavily reliant on water is running up against a water withdrawl permit wall it's current investment decisions are affected.

Over breakfast my wife and I were just saying that we were so glad we will be producing oil rather than wheat and beef where the water demands for the two go head to head, oil is just so tasty on pancakes...made with wetland produced rice flour I guess ?-)

Well, beef requires about 2,500 gallons (60 barrels!) per pound!!

So, one can trade one pound of beef for about 100 barrels of oil!!

The amounts of water required for agriculture/livestock are hugely greater than the needs for oi & gas production...

The amounts of water required for agriculture/livestock are hugely greater than the needs for oi & gas production...

Obviously I'm aware of that, as I posted a while back the yearly water demand for the ND Bakken play is equal to about 1/2 of the average daily Missouri River flow past Bismarck

Doesn't make oil taste any better though ?-) Or an oilfield any a nicer place to hang around--though Prudhoe is probably a whole lot more attractive than a feedlot operation--but that huge industrial complex feels oh so out of place up there...

It does take a bit of more capex to turn that water into oil than it does to turn it into beef, especially grass fed beef (wonder how much water to grow a pound of moose or caribou?), and then if you want to start calculating embodied water in all aspects of each process...(that capex consumed a whole lot wheat and beef as it was growing up!!)...we can have all kinds of fun with those kinds of games...

Well, it tells us something that a $5-$10 pound of beef can justify a 2,500 gallon input. The rancher can't be paying more than maybe a 1/100 of a penny cost per gallon of water.

It seems the difference is a mature operation, vs a sudden in-the-middle-of-nowhere boomtown operation like the Bakken play, which has a hard time ramping up inputs of all kinds, whether or not their fundamental costs are low.

That's one reason I get impatient with people who talk about the high cost of Bakken wells - obviously much of that cost is due to the transitional costs of ramping things up, and those costs will decline as the area matures.

It seems the difference is a mature operation, vs a sudden in-the-middle-of-nowhere boomtown operation like the Bakken play

I'm afraid you've not a clue what a middle of nowhere oil field is if you think MT and ND have some. The deep water GOM is the middle of nowhere, Prudhoe is in the middle of nowhere. The Bakken is served by rail, barge and a mature highway and trunk road system. Don't look for well costs to fall too awful radically far.

Actually the cost of well completion is going up for some companies but their wells have a far fatter tail on the decline curve and which more than pays for the extra cost up front...a bit more water, a bit better propant and quite a bit more oil for the effort.

All that said a few real dry years in the upper Missouri and the water battles could get ugly--and the west really knows how to do ugly when it comes to water.

I'm afraid you've not a clue what a middle of nowhere oil field is if you think MT and ND have some.

Well, that's out of left field. 1st, if you're angry about oil related stuff, direct it at the right place, not your fellow people on TOD.

2nd, I would guess that you're Alaskan perspective is misleading you little, here. It's perfectly obvious that ND suffers from Boom & Bust problems, from labor (and housing for labor) to transportation of oil & gas to markets.

Sure, they have mature rail and highways. But, those rail & highways weren't designed for this. Further, a mature area would have proper pipelines and services for both inputs and oil & gas outputs. Almost all costs would be significantly lower - vendors of services like fracking (and all the other services needed for drilling) can charge more in this situation.

All that said a few real dry years in the upper Missouri and the water battles could get ugly

See Rocky's recent comment. As you know, agriculture is the big user, by far.

Now, in an unsettled political environment there are risks of stupid decisions, especially when it comes to water. But, it would be remarkably stupid for water to be a limiting factor for oil drilling. Furthermore, I mentioned bringing water from 1,000 miles away to point out that even if there are local problems, water is so cheap and so available around the country relative to small needs like this (despite the big noise that comes from the very big users who want to "hog" supplies) that a source will be found, whether it's recycling or more distant farmers.

It's easy to jump from reading warnings of upcoming challenges to thinking that there is a serious, unsolvable problem, but it's rarely the case.

My my are you touchy when someone says you haven't a clue about something about which you really do not have clue. You were specifically speaking of the world of oil fields and in that world NONE of the oil fields in ND and MT are 'in the middle of nowhere'--that you used that term so pejoratively merely highlights an upper end suburban perspective. My route to Alaska has encompassed a lot of ground and I'm familiar with the Bakken region, and the Chicago metropolitan area--very unlikely you are near as familiar with 'middle of nowhere.'

No doubt the Bakken has boom issues but resolving them will not drive prices down that far as the sweet spots (and the two counties the writer of the Red Queen rebuttal I linked analyzes are sweeter than the whole by a fair piece) dry up. The long term trend in the Bakken will very likely not take it to Eagle Ford price levels--the area is just too big. Towns will get built (and need water) wages will drop but the frac stages may well keep multiplying. All sucking in capital now that will pay off somebody who is still holding the properties out at the highly profitable tail on the production curve. That won't be most of the investors pumping in money now--have to play the swings to make a buck on it for quite a while

By the way speaking of the Red Queen rebuttal series and playing the swings, interesting that the writer was long on KOG at the outset of the series but out of all Bakken related stock by the end (and still out in Dec). Looks like the series did the trick for him. Yes he is a trader and in and out, but recently I read a piece on the oil price KSA uses for its budgeting (you know all the social programs it must fund for the family to keep power). This years price used was $95/bbl. Not surprising, but the number KSA used for next year was was $65/bbl. As no comments were directed toward that in the drumbeat I let it pass, it could have been a mistake in the article, but if KSA is using that sort of oil price for its budget that would send tremors through the market of Bakken securities that is certain. Just a thought.

So back to the center of this debate. There are myriad other reasons (many of them good--just not good enough for oil addicts 'go methadone') not to drill eight wells on every section of land (the overall plan for the better producing regions of the Bakken) besides its potential water conflicts with existing users, but I guarantee you all the scattered forces opposing Bakken development (and all unconventional FF development) will find a core to rally round if water use confict escalates. My point, and one which all planning to invest in the Bakken should be aware of. Time is money and nothing ties up time like multiple court challenges. That is the reality of our world, calling it stupid doesn't make it go away. Yes I think the water needed will be found, but that can't be certain until we know the big player's intent--Continental's. As far as I can tell it is Continental's Bakken holdings that inspire the sudden upward US oil production lunge on charts up page--but I'm out here in the middle of nowhere so take that with a grain of salt ?-)

touchy

I just hate to see a relatively calm, evidence based argument decline into personal comments. I know my disagreements sometimes frustrate you (though I don't know why), but usually we do better. Of course, I probably shouldn't have commented on your Alaskan perspective - that didn't set a good example. BTW, I don't live anywhere near suburbia.

NONE of the oil fields in ND and MT are 'in the middle of nowhere'

In the world of the lower 48, 700k population in an area of 70k sq miles is pretty close to as remote as it gets. I didn't mean it pejoratively. I just meant that it's a Boom Town which doesn't have mature infrastructure.

Oddly enough, if you take the spirit of my argument, you'll see that I'm really arguing that ND is reasonably closely connected to a lot of resources that will simply take a little time to ramp up. The fact that it's not "in the middle of nowhere" is the reason that water limits will not be a real problem in the long run.

Your referenced author, in the comments:

"Costs have been dropping and should continue you to in the short term. As more water depots are up and running, pipeline is layed and more ceramic proppant is produced from other areas like China we will see costs creep back."

the number KSA used for next year was was $65/bbl.

I noticed that. That was odd, and IRRC it came from a slighly odd source, and appeared to be for PR purposes. I think we can disregard that, and be assured that KSA is planning on $95, and will act to keep prices in that region.

all the scattered forces opposing Bakken development (and all unconventional FF development) will find a core to rally round if water use confict escalates.

Are their forces in ND opposing Bakken development? I haven't seen any sign of that - as far as I've seen, ND is a very pro-development place, and money will talk. If drillers can't find water directly, they'll buy water rights from farmers, or bring it from out of state, or recycle it, etc, etc etc. Again, water is relatively so cheap and plentiful compared to the water needs for fracking that this seems highly unrealistic as a serious, long-term problem.

Thanks for working out your differences.

Best to all,

K.

All the guy you quoted might be saying is that they aren't in a west Texas drought at the moment--if he is a production guy and can get water now it is not an issue--not much can be taken from a one paragraph blog reply. I was talking to a guy more into future production planning--but although his company is in on the play he was not working directly on the Bakken himself so his information wouldn't be considered definitive either.

read the whole pdf, which does mention that some frac jobs use 200,000 bbls of water.

Of course oil can outbid food for water, though it might not be able to outbit Mississippi transport, which means it will have to trucked/piped in from somewhere that won't reduce Mississippi winter flow rates.

200,000 barrels (31,800 m3) may sound like a lot of water, but it's about 8 seconds of flow at the Mississippi's minimum flow rate of 4502 m3/s and 2 seconds at its average flow of 16,792 m3/s. I don't think frac jobs are going to put much of a strain on the Mississippi River. See http://en.wikipedia.org/wiki/Mississippi_River

A bigger problem is that the Mississippi doesn't run through ND, its main tributary the Missouri River does, and the Missouri River has a minimum flow of 17 m3/s. As they say, the Missouri is "a mile wide and an inch deep." However at average flow it could supply the big frac job in 13 seconds, and at max flow in about 1.5 seconds.

The big culprit there is agriculture, which basically uses up the whole river.

As far as natural gas is concerned, if you look at the satellite photos of North Dakota, you will see the bright lights of the gas flares stop abruptly at the 49th parallel, although the Bakken Formation continues on well into Canada. For the reason, see Saskatchewan Upstream Petroleum Associated Gas Conservation Standards. Alberta has similar standards.

I guess I don't understand the comment that 18GB seems doable. The last USGS survey of the Bakken that I am aware of estimated that the 2P probable reserves was about 3.5 GB, the Utica Shale was about 1 GB, and the Eagle Ford was about 3 GB. (unfortunately I am going from memory).

There must be some assumption of big new finds.

TE - In the case of the shales it will take more than some big new finds. It's going to take at least twice as many rigs as running now as well as twice as much capex. Given the rig count has fallen 10% recently and I keep hearing more stories about companies having trouble funding current ops, I have serious doubts. One thing for sure about the projections: someone will be proved very wrong in the next 18 months.

The USGS didn't estimate 'reserves' per se. The USGS used 4.35 Gb as the mean value of 'technically recoverable resources' for the US portion of the Bakken/Three Forks total petroleum system. Technically recovable resources aren't subject to the constrict of being economical to recover.

And it seems Harold Hamm's 'reserve' estimates aren't subject to the constrict of having a source to account for the oil in place. Hamm's estimate of oil in place is about 2x Liegh Price's most optimistic estimate of oil generated by the Bakken shales. More mystic than optimistic.

Actually to get the true reserves from US shale plays you should take the average estimates from numerous sources. ;-)

Peak Oil or Peak Energy? – A Happy Solution

Ron P.

Ron - once again it looks like deception is trying to rule the day. They first use the term "reserve" which requires a specific area of production as well as the price assumption. They don't appear to provide either. But they next go on to describe their number as "technically recoverable" which we all understand has no basis in an economically viable volume. I actually think their estimate of the technically recoverable RESOURCE is much too low. Shales make up the vast majority of the rocks on the planet. How much of that is economically recoverable under specific price assumptions is another matter as you know so well.