A Review of the Citigroup Prediction on US Energy

Posted by Heading Out on April 1, 2012 - 11:25am

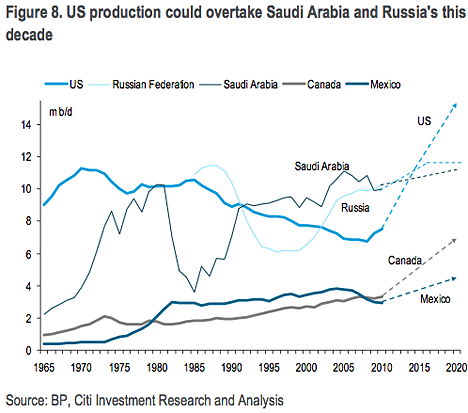

Gasoline prices remain high, and Reuters recently noted that there are enough countries with civil unrest, technical problems, and bad weather with around a million barrels a day of possible supply that are not getting to the market. Yet with Saudi Arabia continuing to reassure that it is willing to pump more oil if needed, there appears to be, superficially, little cause for supply concerns this year. By the same token, concerns over supply in the longer term also seem to be increasingly discounted. For example, Citigroup has just released a new report on Energy 2020: North America as the new Middle East. The report suggests that there is really no concern with future supplies of oil and gas, perhaps most clearly shown with this plot:

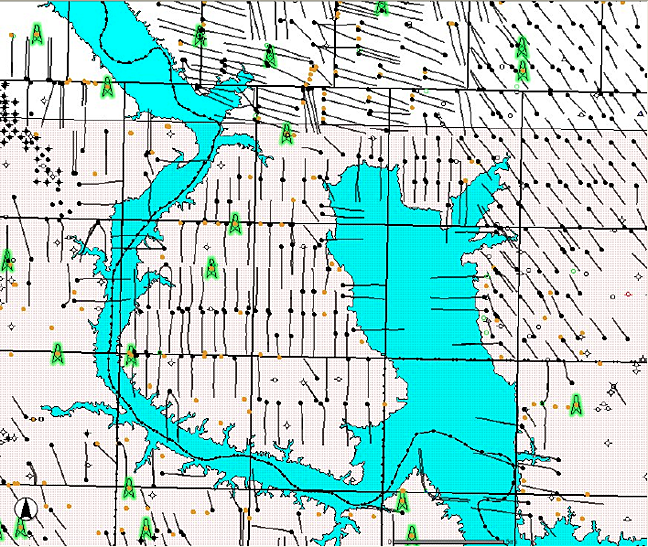

I would argue that the numbers for Saudi Arabia and Russia are difficult to realistically justify. For the Kingdom, which is reported to be producing 9.9 mbd, to increase production by another 2 mbd is optimistic, given the aging of their primary fields and the decline in remaining volumes that I will discuss in future posts in the current series on that country. The projection of an increase in Russian production is a similar concern. With the decline in production from Western Siberia, there is not enough new production coming from Timan-Pechora and Eastern Siberia to sustain existing levels, let alone see an increase in production – a point that has been made by Russian officials in the past. However, the real concern lies with the relatively unrealistic image that is being projected for US production over the next eight years.

The image projected by the above figure suggests that the country is covered in shale, all waiting to provide its wealth to the nation. But that is not the case and shale plays have been a hot topic for a number of years now. And while the map above shows a carpet of shale that has the potential to produce oil and/or natural gas, it does not clearly enough distinguish the considerable difference between deposits that are presently economic, and those that are not. (The small number of fields that are labelled as prospective does not speak well for the future).

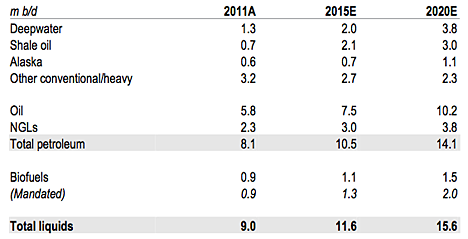

If one examines the prediction for future production, it shows that overall US growth in production of all liquids will rise from some 9 mbd at the end of 2011 to 11.6 mbd in 2015, and then go on to a figure of 15.6 mbd in 2020. Note that this includes natural gas liquids (NGLs), refining gains, and growth in the production of biofuels. The contribution of the various sectors is broken down into:

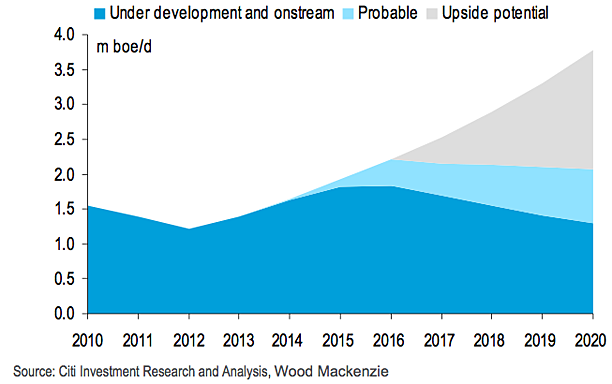

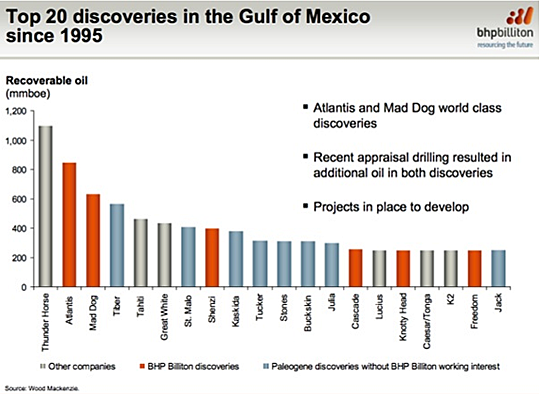

In the Deepwater category, Citigroup cites existing production from Atlantis, Perdido, Shenzi, Silvertip, Tahiti, and Thunder Horse. Future gains will then come from Big Foot, Gunflint, Hadrian, Jack, Knotty Head, Lucius, Moccasin, St. Malo, Stones, Tubular Bells, Vito, Tiber, Buckskin, Kaskida, Appomattox and Heidelberg. But the report sees gains in the Gulf of Mexico (GOM) total liquids as likely peaking in 2016 at around 2.2 mbd, and the gains projected in the above table that might come beyond that as being an “upside potential” based on a change in regulatory factors and the ability of oil companies to bring their reserves on line.

Part of my problem with this approach is that it seems to totally discount the declining production and fails to meet target projections from existing GOM platforms that, among others, has been well documented by Jean Laherrère (here, here and here) and by Darwinian at The Oil Drum (TOD). Looking at the fields that Citigroup has cited, it is pertinent to examine first their relative size, as Jean illustrated.

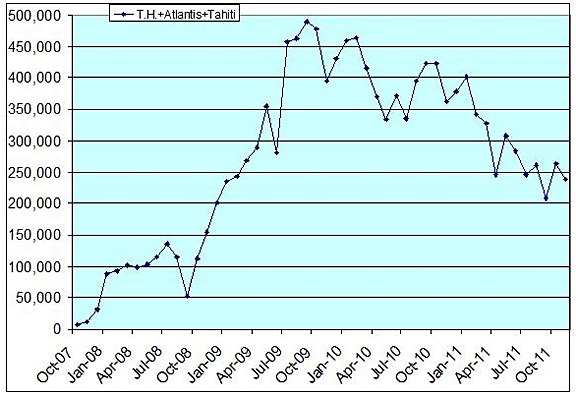

In this context it might be well to remember that as a rule of thumb (from the Russian posts) a 500 mmboe field may produce around 120 kbd. However, it should be noted that some of the GOM fields are having problems reaching their target, and that production is falling at a rate of around 20% per year, as Darwinian showed for the cumulative production of Thunder Horse Atlantis and Tahiti, which were projected to produce 550 kbd in total.

With production having already fallen 300 kbd from projections, mainly through lower production from Thunder Horse and Atlantis, it is hard to see how to justify the numbers that Citigroup is using.

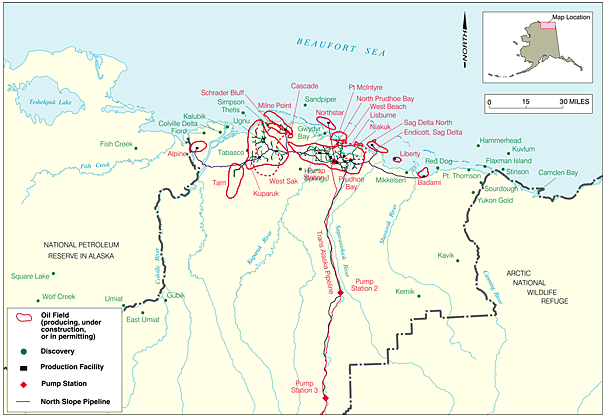

The Citigroup projection for Alaska anticipates possible gains from the Shell activities in the Chukchi Sea, although the exploratory wells have yet to be drilled and the geographical challenges to be met in bringing that oil ashore are not yet fully addressed. The Alaskan pipeline is currently flowing at around 609 kbd, which is high enough to prevent wax and ice build-up, but with ongoing declines in production and problems arising once the flow falls below 600 kbd how long it can continue to perform satisfactorily is open to question. They cite heavy oil operations at Milne Point which has been declining in production, and West Sac, which is a very heavy, cold oil that has raised considerable technical issues in achieving the production of around 15 kbd at present, with existing plans only adding 150 million barrels in total to reserves. The other source that is cited is to produce the light crude is from the National Petroleum Reserve in Alaska (NPRA). Given that the bridge from Alpine into the Conoco-Phillips wells in the NPRA has just been approved suggests that an increase in production from the region is still some time away. Put together, this suggests that the estimates for a 500 kbd increase in Alaskan production within the next eight years is not a reasonably likely occurrence.

And the third source that Citigroup cites are the oil from shale deposits shown at the top of the post. They see growth of 2.4 mbd in oil production and 1.5 mbd in NGLs from the increase in production from natural gas. The production gains are broken down as follows:

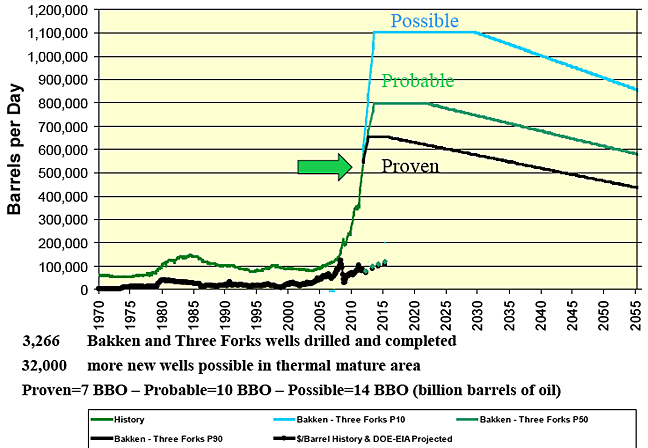

The plot, again, includes a large volume of “upscale potential” that might come from a change in regulations, government, and oil company attitudes. I have written about some of the more realistic views of the possible future production of the Bakken and the Niobrara, the Tuscaloosa and the Chatanooga. In this regard, it is worth noting that while Citigroup sees production from the Bakken rising to around 1 mbd in 2016, and being sustained at that level through 2022, this is not the view of the folk in North Dakota who are monitoring well production and permits.

It is instructive to this argument to note that Fidelity E&P has just celebrated reaching a production record of 3,500 bd in the Bakken, which it derives from 58 wells. As they continue to run 5 rigs, and have been able to drill a long lateral horizontal well in 28 days, they should be able to increase production this year, but they are fighting the rapid decline in existing wells, which requires that more wells be drilled every year as the better spots become drained, so the drilling activity must accelerate to sustain existing production.

Production from the Bakken in North Dakota reached 546 kbd in January, and this production came from 6,617 wells, which gives an average of 82.5 bd production from each well. Activity is such that some 250 wells are waiting on fracture services, and rigs capable of drilling 20,000+ ft are at 95% utilization in the area. And prices of natural gas are down to $1.89/kcf. Bear in mind that, after a while, it becomes harder to find a spot where no-one has already been.

On the ground it looks more like this:

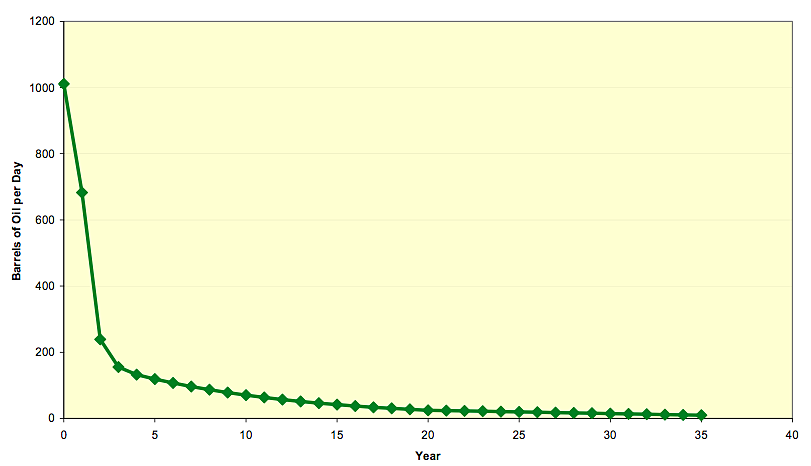

The North Dakota Department of Mineral Resources has a series of very informative presentations on the Bakken, including hydraulic fracturing, and the above were taken from the presentation to the Pierce Country Farm Bureau on March 15th.

Current plans anticipate that the Niobrara may reach 250 kbd of production by 2020. The problem, however, as Art Berman has skillfully pointed out, is that as the ND plot above shows, the current wells have a high decline rate, and production levels drop dramatically once the wells are brought on line. Art has explained the background to this for gas wells drilled into shale but the impact for oil wells, where the oil has a higher viscosity than the natural gas, can be significantly greater. Given that well costs are in the order of $10 million per well (depending on location DMR gives the ND price at around $8.5 million, and numbers for the Eagle Ford have been quoted at $8 million) the amount of oil that must be produced over the first few years to justify investment is significant. There are, for example, some 1,400 wells producing in the Eagle Ford play. The play produced 30.4 million barrels of oil in 2011, and is anticipated to add 200 kbd of production this year with the potential to reach 1.2 mbd by 2015. But the high decline rates mean that wells must be replaced rapidly to sustain those levels of production.

It is this disregard for the declining production from existing and future wells that appears to be neglected in the Citigroup study. Those plays which will yield rapidly in generating high initial well production will, in turn, be the first that decline significantly and need replacement. Yet replacement will, over time, have to be in poorer parts of the formation, requiring that multiple wells replace the initial producer, and so bounds on production will be reached, likely before the end of the decade. Citigroup anticipates that the risks in development of the shale plays, whether in Texas or California, come as much from an inability to transport the oil generated and from environmental policy; they see few geological risks – which is a pity, since it is the geology that will control production and its decline, and the ultimate profitability of these ventures.

And finally, Citigroup sees that cellulosic ethanol will come into its own this decade, and that it will provide half the 2 mbd of biofuels produced in 2020. Unfortunately the economics of large-scale production that have led to failures of ventures to date have over-ridden the mandated production levels that the group cites as their foundation, and there is no indication that this will change in the next eight years.

In short, though this is an interesting exercise, it is too full of “could” and thus will not make much of a useful contribution to meaningful discussion of future production.

Citigroup delivers, just in time for April Fools. Figure 8 is stunning.

I'm thinkin' more in line with this Classic from our friend Gary Larson...

http://www.google.com/imgres?imgurl=http://star.psy.ohio-state.edu/cogla...

Hope the Link shows...

I think Mr. Harris may be upset...

Well grounded analysis H O kudos.

Citigroup has a fine track record this last decade-how much tax money did it take to bail them out? Apparently none of that phased them a lick as they dream on.

That was too perfect had to put it up. Hats off to Mr. Harris.

This reminds me of my lab results in engineering, the lines on the graph always went where I wanted them to go.

Yes and no. Wall St have one role and one role only to the public: always be bullish on stocks and the economy(people will invest, good for stocks, good for bonuses).

On the other hand, and I ask this in the Susan Saradon-way like she did of the left vis-a-vi Communism at the end of the Soviet Republic, if you had read the ultrapessimists here at TOD(led by back-to-the-nature Gail) about shale oil in the last, say, 3-4 years and compared it to the bullish reports on Wall St, where would you have landed if you picked Wall St?

The answer is a lot closer to where we are today(albeit still short but not that much). Gail and company were telling all of us that Bakken was going to produce 150 kb at most. Maybe 250 if we're lucky. Now we're seeing it already over 500 and coming onto a million fast.

Peak Oil as a reality isn't changed, but the fact that the world hasn't ended and Saudi Arabia are close to record production in 2012 should give the doomers pause.

ucti

Reality is complex. And if we need anything now then it's humility when making dramatic predictions.

Not to mention how most of this group aggressively ignores NA natural gas production.

Good news is no fun when waiting for the end of the world.

Good news like the $45/barrel oil we were supposed to be swimming in at this point in time (that was the number oil was supposed to hold at for a long, long time or so was the accepted line early this millennium).

I'm most familiar with Alaskan production and the time-lines required to bring it online. Eight years to not only stem the steady decline (which had averaged 4.9% through 2009 but did jump to 6.3% in 2011, in spite of prediction made in 2009 that the decline rate was about to start dropping) but also to produce another half million barrels a day over and above what is shipping right now...they better find/have found some nice sized puddles real close to the oil handling facilities this season--nothing big in the news yet--the seasonal ice road transport window doesn't end too many weeks from now. You are aware that it is much dicier going constructing infrastructure on the North Slope than it is in North Dakota and Texas. Seasonal limitations give very little play if the ducks aren't in a row when they are supposed to be.

Pick apart this post by HO if you would, Gail's doomfest isn't generally rubber stamped here. Show us why we should trust an unimpeachable source like Citigroup more the North Dakota's Dept. of Mineral Resources for projections on Bakken and Three Forks oil production. Get specific, this particular TOD slot is all about specifics.

Meanwhile, the doomers have had plenty to smile about: the plunge in UK North Sea production, ditto for Cantarell, not much improvement in Iraq production, slow progress in the Caspian, Indonesia's emergence as an importer. Let's see how quickly those Elysian fields are brought online off the coast of Brazil.

It all depends, doesn't it, on whether we use a single point to make a projection - if you have two points on a graph you can always fit a straight line between them and use it to show what you want to, a bit like the Citi thought at the very start of this piece - imho.

I don't quite see what natural gas production has to do with oil.

Of course, innumerable uninformed MSM articles happily conflate the two, but anyone who seriously studies the matter sees tham as independent commodities with limited substitution potential.

PT in PA

Natural gas may not be fungible tactically, but it is strategically. For example, moving freight solely in LNG or CNG vehicle presents no significant challenges or extravagant additional costs.

The real question is always "At what price?". Bakken can be produced at $20 oil, nor can Marcellus at $2 gas. But you can produce both nicely at higher prices.

The shape of the peak oil curve will be dependent on price as much as geology. Of course, the harder and faster we produce at high prices to hasten the front ramp, the harder the slide down the back will be.

No one is denying that reality is complex, anyone grounded in science would likely come to the same conclusion. For many of us the tragedy is personal or local, many do not really care if the world is going to hell in a hand basket. What BAU enthusiasts should realize is that tragedies can also be as varied and complex as reality.

And what's a doomer anyways? I don't classify myself as one in any case. However I was not arguing about that, just take a look at that graph, it says US will produce 14 mbopd by 2022, and not one of those lines is sliding down, even Mexico is going up.

I must admit, I literally laughed out loud when I saw this "... and then, production skyrockets!" graph. Reminds me of an underpants gnome strategic forecast.

I wonder if they hired Pangloss for this one. They seem to think that things can only go up, everywhere, for the length of their forecast. I would call this an example of why current trends shouldn't be extended into the future carelessly, except they seem to be wildly more optimistic than current trends warrant, even with US production rising.

FM,

not that it would alter the inevitable outcome, but would it be reasonable to model an extrapolation of the periodic spikes in discovery consistent with what has been observed? Note that each discovery 'spike/peak' since the apparent peak of discover ~ 1965 has exhibited a lesser peak than the one prior to it. Interestingly, the mini-peaks seem to be somewhat evenly spread out over the time domain...perhaps these mini-peak discoveries have followed, roughly, a log-normal distribution?

This is the latest in a long sting of articles which leads me to continue my previous guesstimate, made several years ago, that a combination of increasing efficiency, flat to very moderate economic 'growth', and a last, sustained, desperate push to get at every possible drop of oil (and all possible NG for that mater, and all possible bio-fuels to boot) funded by high and increasing oil prices, will succeed in sustaining the appearance of 'kinda-sorta' BAU through ~ 2020-2025-ish.

When I say 'kinda-sorta' BAU, I mean that the changes may be mostly gradual, with people's expectations slowly adjusting to the new reality as it continues to evolve year after year.

Then again, I may be full of condenses monkey milk.

There is that other metric which I occasionally mention.

ELM?

Stipulated.

A range of post-2005 Cumulative Net Export (CNE) estimates for Saudi Arabia:

Assuming that C/P approaches 100% ratio in the respective year:

2025: 33 Gb (2012*)

2030: 41 Gb (2014)

2035: 50 Gb (2015)

2040: 58 Gb (2017)

2045: 66 Gb (2019)

2050: 74 Gb (2020)

2055: 83 Gb (2022)

*Year that estimated post-2005 Saudi CNE would be about 50% depleted. My most optimistic estimate for the C/P ratio for Saudi Arabia in 2011 (27%) would have them approaching zero net oil exports in 2030, based on projecting the 2005 to 2011 rate of increase in their C/P ratio.

I think the economic policy also points to this. We have central banks priming the printing presses (digitally ofc) and keep asset prices up to make everything look normal with engineered stock market rallies and the like. But like many historical instances of currency debasement, this will end catastrophically after an extended period of creeping normalcy after which average citizens universally reject deteriorating conditions and we get widespread unrest and infrastructure destruction.

I guess the overall idea is to delay the critical crisis point as long as possible. By that time we'll likely be completely out of options in terms of constructing a peaceful transition .

Yeah I agree.

"Get yours and get out." I see this everywhere I look now.

Yeah, and a monetary collapse will mean that there will be very little oil being imported into the US, which is currently 2/3 of oil consumed, so even if Citi's optimistic projections come true, it's still a dramatic decline from today's consumption rates.

Only 1/2 of the crude oil is now imported due to increased domestic production (it did used to be close to 2/3s).

Loss of value of the dollar won't totally kill oil imports. It will hurt, but they still need to sell the oil so they can buy things. It is not like they have many other big customers that can give them much better currency. Some might say the Chinese but a lot of the currency they have is dollars and if we collapse then they collapse too (since we are a big export market for them).

So it is a big complicated system with lots of feedback loops. Collapses can and do happen but they are generally not as big as many doomers think they could be.

The Chinese could go to a gold standard since they seem to be gobbling up all the gold from "Fort Knox" at artificially low manipulated prices offered up by the criminal mafia ring in control of the USA right now. This would almost instantly hyperinflate the dollar, which is basically the basis for all other fiat currencies, so only those countries which could go to a gold standard would be spared.

The Chinese know their treasuries are fundamentally worthless, they are just busy buying up as many of the world's real assets as they can while they still can.

To pick a couple of nits: Imports are still more than half - 56% according to this TOD post by Art Berman. Also, the increased share of oil that is domestic vs. imported is due more to the decline in consumption (aka demand destruction) than it is due to the small uptick in domestic extraction.

Only 1/2 of the crude oil is now imported due to increased domestic production (it did used to be close to 2/3s).

According to recent EIA data, in 2011 the US produced 5,659,000 barrels per day of crude oil and imported 8,921,000 bpd for a total of 14,580,000 bpd.

By my calculation that means imports still represent 61% of the total. The idea that the US produces half the crude oil it uses is still something of a myth, which seems to be widely circulated in the media. The delusion of energy self-sufficiently still runs rampant in the MSM.

I think they might mean "total liquids", but that's not the same thing as "crude oil".

But shouldn't we deduct the net exports of refined products ?

Citigroup must have recently had a mushroom party--that's the only sensible explanation for their halucinogenic graphs and expectations, given HO's detailed exposition of reality. The zawya.com item is political trash, while the businessinsider piece at least quotes Citi's caveat, which IMO proves the "analysis" is fundamentally political wishful thinking. But those items do explain why the sudden upsurge in cornucopian fantasy I've encountered.

Nah, mushrooms would have 'opened their minds' and forced them to look at the problem. I think they were snorting white powder while celebrating their latest bonuses when they came up with these!

To infinity and beyond........

Well, the first graph is just totally delusional.

Mexican production went into steep decline with the veritable collapse of Cantarell, their biggest oil field, and since there is only one oil field like Cantarell in Mexico, there is no reason to expect oil production to increase. Mexico is reduced to developing old, tight oil formations, and their state oil company Pemex is not really good at that kind of thing.

Canadian production is slowly but steadily increasing - but the emphasis is on slowly. The Canadian Association of Petroleum Producers expects production in 2020 to be 4.2 million bpd, not the 6+ million bpd the graph shows. The main limits are the time and labor required to build the very expensive oil sands production facilities.

The biggest delusion, though, is US production. Certainly, high prices have resulted in increased production from the Bakken formation, plus increased production of NG liquids from shale gas formations as a result of increased NG production, but there is not the potential for the huge increase shown. There is, after all, only one Bakken formation in the US, and it is likely to hit its peak soon. Increases in production will not go on forever.

I wonder if CERA will provide a comment? As I recall, its last predictions weren't anywhere near Citi's.

CERA's prediction as of January per the WSJ:

http://online.wsj.com/article/SB1000142405297020462420457717709268793948...

As I recall, it was westexas's documentation showing CERA's estimations to be declining over time which was the newsworthy outcome from CERA's latest estimates. I suppose we shouldn't be too surprised as Citi deserved to go BK when it totally mismanaged its risk exposure and had to be bailed out by taxpayers against the latter's will.

CERA forecasts are clearly for increased all liquids production at least through 2020.

I am not an expert in this thing with oil and such, but I think this is the most overoptimistic article I ever seen that does not come from an abiotic oil source or conspirationist blog. The first graph is just... mind boggling.

US total petroleum liquids production (BP) increased from 7.2 mbpd (pre-hurricane) in 2004 to 7.5 mbpd in 2010 (and probably to about 7.7 mbpd in 2011). From 2004 to 2010, despite increasing net exports from Canada, the combined net oil exports from the seven major net oil exporters* in the Americas and the Caribbean fell from 6.2 mbpd in 2004 to 4.8 mbpd in 2010, down 1.4 mbpd, a decline of 23% in six years.

So, just the regional decline in net exports, from 2004 to 2010, was about five times the size of the increase in US production. The 2005 to 2010 decline in Global Net Exports (GNE) was about 10 times the size of the recent increase in US production, and the 2005 to 2010 decline in Available Net Exports (ANE) was about 17 times the size of the recent increase in US production.

*Canada, Colombia, Venezuela, Mexico, Argentina, Ecuador, Trinidad & Tobago

Mainstream sources like citicorp have historically been much more accurate than the majority belief here.

If only we had put all of our money into Citigroup stock in early 2007.

What does that have to do with what I posted?

You guys are wrong on production year after year, and have the same snide comments for forecasts like citicorp's year after year.

How about someone write an article on the latest natural gas supply estimates, and it's potential impact on liquid fuels?

My apologies. I thought that you were posting an April Fools' joke.

Please show us your mainstream numbers.

Here is the most recent key post on US gas production I noticed on TOD

With Gas So Cheap and Well Drilling Down, Why Is Gas Production So High?>

I didn't notice any comments from you so you may have missed it. Have at it but probably should use the open Drumbeat forum instead of this post comment section--I rarely visit that Drumbeat so you won't have to deal with the likes of me there. You will note if you go through all the comments on the linked gas post that oil did end up taking center stage in much of the conversation--as it will continue to since it is the predominant fuel now used in transport and transport underpins every sector of the economy, but no arguing cheap gas has given the US economy a big boost the last couple years.

The post from Citigroup showed Natural Gas Liquids at 28% of the total production for 2011. How much of the NGLs is the kind of liquid that goes into a car or truck? Isn't a bit of it something else -- i.e., Butane, Propane et cetera. Also, don't the biofuels only have 85% or so of the power of gasoline. Sort of a little bit of adding water to the soup?

? Who here was wrong on production?

If anything people here were wrong on the effects of peak oil, which turned out to be much more complex than many might have imagined. It is manifesting primarily as financial instability and economic depression more than shortages or skyrocketing prices, per say.

I'd say that many at TOD have been pretty much spot on about the plateau that we've been on, calling for such a plateau until somewhere around 2015, during and after which we will have a dramatic drop off in global crude production, as well as rapid decline in net exports and even more instability.

The key point being that we are still on a plateau, which gives the illusion of normalcy. There's actually very little growth in the overall system, and unconventional sources of oil and gas are too expensive and problematic in many ways to make up for the declines we should expect in the long producing fields.

Not to mention mainstream cultural memes which are confused and contradictory. For example, somebody might report or say that the globe will experience econonomic growth forever. Just put your money in a 401k and sit on it! Then they'll go on to report that population isn't a problem, because birth rates are declining.

But answer me this: even if I concede that it's remotely possible that population may stabilize around 8-10 billion and then level off, that would still mean the end of economic growth and the implosion of our fiat debt system. For economic growth to continue forever, then the population of people must rise to infinity.

So...you can either have a human population that eventually levels off or declines, or you can have infinite economic growth. You cannot have both. And I know that the hucksters at Citigroup and Goldman Sachs are always rosy and optimistic in their projections, on, well, just about everything. We will have global human perfection and the Dow will rise to a trillion! This enables them to sell their junk to what they refer to as "muppets" and profit from the fees.

The fireworks will begin once global crude production begins it's long decline. We haven't seen anything yet. I'm again reminded of that overused Jack Nicholson line, "You can't handle the truth." One thing is for sure, I'd much rather come here for my information than believe anything that comes out of Citigroup.

I'm in general agreement. I would add that the striking thing is that the dramatic increases in the price of oil over the last decade have stimulated only a very modest increase in US production and, moreover, from a net energy perspective, the question could be raised as to whether there has been any actual increase. The situation is rather better for natural gas production, at least for the near term, and the substitution of natural gas for oil in the generation of electricity and home heating has probably helped avoid even larger price increases. The unusually warm winter weather over much of North America would have also helped.

There might be an interesting analogy concerning the economic impacts of the relatively inelastic nature of oil production. The effect would seem to be analogous to that of a throttle that is stuck partially open on an internal combustion engine. An automobile powered by this engine could gain or lose speed depending on the slope of the road, but, even going down a long hill, the gain in speed will be limited. In the economic analogy, conditions that would otherwise appear to strongly promote economic activity (e.g., financial stimulus) have less effect than would otherwise be expected since any increased demand increases oil prices. Conversely, a very weak economy, such as the one that existed at the end of 2008, gets some benefit from falling oil prices.

Robert

But answer me this: even if I concede that it's remotely possible that population may stabilize around 8-10 billion and then level off, that would still mean the end of economic growth and the implosion of our fiat debt system. For economic growth to continue forever, then the population of people must rise to infinity.

No that is not the only theoretical outcome. If resource uptake were to be somehow brought into a long term (many, many millennia) sustainable balance there could still be economic growth. I'll give you a real simplified scenario. Population stable with adequate water, food, clothing and shelter provided by long term viable methods. Dollar value of upper end services and tools requiring very little resource uptake can keep increasing as their utility is perceived to increase--this allows the economy to grow. Of course there would be the trick of keeping the basics affordable as this happens but that possibility is hardly less difficult to contimplate than that of a universe that started so incredibly small becoming so incredibly large.

We are very far from that now and I won't argue that the wealth accruing to those at the top in finance, entertainment and the practice of law is necessarily because of their increased utility to society, but that is all beside the point. Economic growth now dependent on increased population and resource uptake can shift gears away from that. It would interesting to see what resource uptake per man hour recreation is required for x-box and skateboard activities relative to muscle car drag racing and off road motoring activities. Rinse and repeat and see what results you get.

Overly optimistic for us primates, maybe, but keeping some glimmer of optimism alive is very good for the individual immune system, and healthier immune systems are not only of extreme value to the individuals who possess them but also are quite a boon to society as a whole. Longer life expectancy and lower birth rates do look to be related.

All that said I've enough other comments on this page to show what I think of the Citigroup projections. I may subscribe to holding out some long term optimism but shorter term pragmaticism is what has kept bread on my table.

You'll have to make it simpler, because I still don't see how it's possible. Break it down into small steps. I'll start.

1. Population in balance. (assumption)

2. Resource consumption (including exergy consumption) of the population in balance with renewables available and recycling of non-renewables. (assumption)

3. Economic growth continues without limit. (assumption)

4. 1 + 2 + 3 imply that consumption of food, water, energy, housing, transport, clothing and material goods becomes a vanishingly small part of the economy. If it doesn't, then their prices must rise in sync with income. This is inflation, not growth.

5. People each have a fixed 8766 hours per year. (assumption)

6. The rates at which people can absorb information and metabolise drugs have upper limits. (assumption)

7. 1 + 2 + 3 + 5 + 6 imply that consumption of personal services such as education, health care, entertainment, and legal services also top out at some point, and then also become a vanishingly small part of the economy as growth continues. Again, if they don't, then we have rising prices, not growth.

8. So after a while all of the economy, apart from a negligibly small part, is made up of something that consumes no resources and takes no time to use. Recall that the size of the economy is measured in terms of final consumption - consumption by households. What is this intangible thing that households are prepared to pay for in infinite amounts? Insurance? I can't see it. This is where I get stuck.

9. Why would we bother with this thing that we can't experience in any way? I also get stuck here.

Of course I never said the economy didn't consume resources, but rather that it consumed them in a manner which was sustainable for many, many millenia--big difference (and the assumptions were necessary to isolate concept of economic growth). That allows large quantities of energy from long term (not indefinitely) sustainable sources to be used in extensive recycling. Every process developed that used energy and other resources more efficiently or that made a material available that could allow economic activity that previous material did not is capable of adding economic value and thus growing the economy. I did not specify the rate of growth. Capital available at a very low interest rate does not require much growth to service the debt.

Why would we bother with this thing that we can't experience in any way? I also get stuck here.

That of course runs counter to the necessity of increased perceived utility. I'm using this term in the broadest sense, but I do think it has limits as you'll see at the very end of this post.

But why use the economic growth paradigm in the first place?

Ah that is the tricky one-is it because we have already swum into this fish trap and can only go one way--deeper into it? Is the fishtrap an intrinsic part of human makeup? Or will a few crunches of greater and lesser magitude break out the other end of the fishtrap allowing us to swim out with a major paradigm shift?

Economic growth is theoretically possible for population that is stable, well fed and well housed as long as long term energy sources can be used to create more perceived utility...is there some point at which any use of energy could not produce something that was perceived to increase utility...who knows but we are very far from that now.

but yes in this situation in time with a stable population

1 + 2 + 3 imply that consumption of food, water, energy, housing, transport, clothing and material goods becomes a vanishingly small part of the economy

it is difficult to conceive how the utility added by new energy uses would increase the productivity of the population as a whole enough to allow them to be payed more so they could use energy in ever more fabulous ways...but as I said before, that is not as difficult as trying wrap your head around the big bang. And that is part of the why would we bother with this thing...we do get incredible advances in our understanding of the universe by focusing ever more expensive tools on it...full understanding is very, very likely this thing we can't experience in any way but the path that doesn't quite get there has plenty of potential for economic growth...the two have a very strong linkage in recent centuries that is sure.

Can the quest for knowledge proceed using ever more complex and expensive tools withoug economic growth...you tell me. The more complex societies which had ruler/priest classes to keep track of astronomical body movement had economic growth. Labor at the bottom of the social order supported the classes that organized the labor and kept track of the seasons and other important facts which allowed greater yields from the labor at the base of the economic pyramid. Of course to date none of these systems have found a truly long term sustainable way to use resources (as population growth has always been a part of the growth as well)...and the only way I see that happening in a increasingly complex techno world is with increasingly more efficient use of our more depletable resources in gathering energy.

Hunter gatherers always at the frontier.

Do I think that this scenario is where we are headed?

...I've been typing this looking out the window at light snow falling on the boreal forest long enough. I think I'll fill the bird feeders and take the dog for a walk...

Nat gas is a regional market. Oil is global.

Let us assume that there is a significant and sustainable NG production increase in the US. (I doubt the sustainability but never mind). Also assume there is a quick and easy way to convert cars from gasoline to nat gas. Let us also make the faulty assumption that this increase in supply will NOT lead to increase in consumption (wich it will, 100% probability).

With all these assumptions, oil consumption in the US will drop a bit. This means more oil will be freed to be consumed in other parts of the world. It will not stay in the ground.

Hence, the price drop from your nat gas will be diluted on the global world market. Maybe they will take a few cent off the global oil price?

Then remember that the majority (80%+?) of all crude oil come from fields that are in decline. You have to compensate for that to.

Exactly. NG ain't so cheap in the world market, it sure is cheap compared to oil but not as much as people in US would like to believe

http://articles.economictimes.indiatimes.com/2012-03-15/news/31196983_1_...

And this is the price at the point of delivery, imported NG costs more than that. So please send your NG glut to us, we'll take care of it. LOL

The Denver Post ran a story this morning about Chesapeake Energy backing out of almost 200 Niobrara shale oil leases in the eastern part of the Colorado. The article quotes a business analyst who says Chesapeake's cash flow looks to be about $8B short of meeting its previously announced expenditures for 2012.

mc – I haven’t posted on the subject until now. Most here know what I would say before I said it. But your Chesapeake statement is a good lead in. First, the oil-rich shale plays are adding to our reserve base. And IMHO will continue to do so to some extent as long as oil prices stay high. But the CHK situation may be showing the weakness of that expectation. From CHK’s own press release of a month or so ago their projected a budget requirement was $10-12 billion. Why so high? Most already know the answer: CHP added a great deal of fairly valid proven reserves to their books. And adding to those booked reserves is how Wall Street tends to value a public company. But the unique aspect of newly booked reserves from fractured reservoir is how quickly they disappear from the books: 60% to 90% reduction the first 12 months. So for CHP to just maintain a zero proven reserve growth they need to drill more wells during that period. And again, Wall Street doesn’t tend to hype a stock that isn’t showing growth. So in addition to replacement wells CHK has to drill even more wells to show reserve growth. But by drilling those additional wells they then have to drill more replacement wells for those rapidly depleting wells within the following year.

It should easy to see how this process could lead to ever increasing capex demands after just several years. And where does the capex come from? One source is the new producing wells. They do generate significant income FOR THE FIRST 12 TO 18 MONTHS. But most of that income is just recovering the cost of the well. So to drill even more wells then punched the previous year additional capex is needed. Borrowing from the bank is typically the source. But CHK acknowledged that the banks would only be lending them less than 10% of the budget.

So where is CHK getting the rest of their capex requirements? They’ve been doing it the last couple of years: selling off $billions of undrilled shale leases. The same leases they’ve been touting as the future of the company. Additionally, though not widely publicized, they are selling off some of their proven dry NG fields. Selling them in one of the worst markets for those properties in more than a decade. Everyone has a right to their own opinion and mine is this is a very desperate move.

I’m not saying CHK hasn’t made a net profit from the shale drilling…they have. My guess is around 2 to 2.5 times the money. The question isn’t whether their business plan is profitable but is it sustainable? And that’s if oil price stay high. Annd also remember that the "expert" analysts out here put CHK out there as one of the best players. The point I’ve made before: the bulk of the profit the shareholders make with companies like CHK is the increase in stock value…if they buy/sell at the right times. Last year the shareholders of another public shale player, Petrohawk, made a tremendous profit. But it wasn’t from their oil production: they sold their shares to another public company for $12 billion. A year ago I would not have had this thought: I wouldn't be shocked if in the next 12 to 18 months CHK is acquuired by another company. Maybe ExxonMobil.

Most know I work for private company. We don’t have stock to promote. My owner has never been interested in the shale plays. He requires prospects with a potential of 5 to 1 or better. I began drilling and frac’ng fractured reservoirs over 25 years ago. I’ve been drilling horizontal wells for almost 20 years. My engineer partner and I can match the abilities of any active shale player out there to. We've been offered ridiculous sums to do just that which is why my owner had to put a great compenssation package in front of us. But great only if we succeed. We aren’t drilling the plays because we don’t have the ability or capex to do it. We don’t do it because my owner can make a better return in his other businesses. Again, I’m not saying we wouldn’t make a profit…just not a very attractive one.

Between this year and last I’ll probably not spend close to $100 million of my budgets. So why aren’t we out there drilling all those big conventional oil prospects? We would if we could find them. And remember we don’t generate most of the prospects we drill. There are hundreds of oil companies that generate prospects they never intend to drill thmselves: they do it to sell to operating companies like mine. Needless to say the best selling prospect such a company could generate is a conventional oil play. But I haven’t had such a prospect submitted to me in several months. I could write a check for $2 million tomorrow to buy such a deal, pay 100% of the cost to drill and complete the well and then assign 10% to 20% of the future revenue to the prospect generating company. And all the generators know who we are and that we have the money. So why aren’t there 10 such companies waiting at my door every morning? Because they don’t have the prospects.

And now with NG prices so low it’s difficult to justify most of those prospects. Another reason I’ll give back a lot of this year’s budget. Rockman et al may be laid off this year. Which is why Rockman has a proposal in front of his owner today to go after residual oil (via horizontal well bores) in some nearly depleted Texas fields. And even though I could sell that today for $120+/bbl approval of the project isn’t certain. Again, if the profit potential of this project isn't sofficient he won't provide the $100 million I'll need.

Granted the case I just presented just deals with my company. But with the exception of the pubcos playing the shales most of the operators I know are in a similar situation. Yes…even with $100+ oil I know unemployed geologists. Everyone can interpret that for themselves.

Rockman - A very honest and interesting viewpoint; thank you for posting. As someone working outside the US, it is a clear reminder of just how commercially driven and competitive the domestic US market is.

On a related note, with respect to media confusion (intentional or otherwise), on the issues of Peak oil and related issues:

I watched a piece on CNN at ~ 1300 Mountain today where candy crowley interviewed three people, with the topic being gasoline prices in the U.S.

In my opinion, all four of them were all over the map on these issues, with little of what they said being correct.

Statements said during the discussion (I am using single quotes to mean that I do not represent these to be verbatim, but to the best of my memory):

'The U.S. today has access to ten times the amount of oil [within U.S. borders] than it did 10 [maybe he said 15 or 20?] years ago.'

'The U.S. will be, in a few short years, a net exporter of oil and NG.'

'The U.S. exports more oil than it imports today.' (this was a different person from previous)

'The price of gasoline is going to steadily go up over time.'

'The price of gasoline will decrease as time goes on in the U.S.'

'The U.S. has enough NG for 200 years.'

'The U.S. has 12% of the World's oil reserves.'

'The U.S. has about 50% of the World's energy reserves.' (then this guy clarified: oil and NG)

During the conversation, the four were mixing and conflating talking about:

- The U.S. and North America;

- Crude oil and finished petroleum products

- Oil and oil and NG and total energy resources, including possibly coal and bio fuels

- Oil shale and Shale oil and gas shale formations

(...) !

With mainstream media presentation such as this, it is little wonder that most citizens have little correct info in their noggins about the energy situation...

...during the show, during the commercial breaks, were the ever-present 'I'm an energy voter' ads...stating that 'the next election is about jobs, and we need to make it possible to create 1M jobs in North America, and we need energy to grow...'

Folks who know better and could spread knowledge to the public are hopelessly outgunned...

Edit: I watched a little bit of the follow-up segment with Ali Velshi, in which they hailed the expansion of the middle class and extolled the virtues of the majority of folks in India who currently use motorbikes (2 & 3-wheeled) buying and using cars instead. They explaine this represented such a great market opportunity, and they crowed about how the Indians want FDI and that Ford and GM are responsive by building plants there soon.

One of them briefly blurted something about ' driving all these cars on what roads...' but they caught themselves and proceeded onward with the worship of 'economic growth'. Nary a metion of oil supplies to dampen the irrational exuberance.

I had to wonder where they were all going to go in their shiny new cars...to their pristine National parks and seashores? Will Disney build one of their franchises there? Where will they park the metal and plastic chariots? Hi-Rise car parks?

I tweeted a link to this comment to Candy Crowley. Perhaps she will visit or even become a member of TOD. Unfortunately I am embarrassed to admit that in my haste I first tweeted Monica Crowley

Robert,

My apologies, Christine Romans was the CNN anchor or host or whatever for the segment of 'Your Money' about the oil situation...Candy Crowley was on a previous segment, same show today.

here is the transcript...scroll down a ways to synch up with the segment about oil prices:

http://edition.cnn.com/TRANSCRIPTS/1203/31/cnnitm.01.html

FWIW, Christine Romans seemed to be the least off-base about the facts of the situation, but, in this group of talking heads in this oil price segment, being least worst is faint praise.

Petro-porn

Petro-porn ... right! Petro wishful thinking.

All the happy talk indicates enough petro-production or access to same to keep the facade intact for awhile.

Meanwhile, anywhere there is a TV there is demand. People around the world are willing to kill or die for a chance at a car. This is why the establishment lies, it's afraid.

It is clear the real problem in the oil patch is not high prices but the other kind. A lot of this expensive production is marginal and any decline in prices for longer than the shortest periods shuts it in. It looks today that $128 Brent will cause EU economic heartburn and demand destruction. With that comes the low, low prices and problems.

What would the Saudis do w/ $80 oil? They need $100 and the feedback loop says that a price too high kills demand. That price-too-far was $147 in 2008, $128 last year, this year looks like $126.50. It might be $100 in a few months if China hiccups. Then what?

You'd think a bank (!) would look at the finance side of the production fantasy but no ...

FOR ALL

I just noticed how the Citi graph was incomplete. Doesn’t show the full history of how US liquid hydrocarbon growth has occurred. The Citi graph predicts an increase of about 6 million bopd in the next 10 years or so. Actually the US has experienced such growth before so why not again? From 1940 to 1970 (30 years) US production also increased 6 million bopd. Granted that growth occurred during the time most of the major oil fields in the country were discovered. And of course both WWII and the post war boom added a tad of incentive to the effort.

So I think if Citi’s opinion is that we’ll develop additional production 3X as fast as has ever been seen in our country we should not be critical of their projection. We should acknowledge their courage to predict a growth rate several times greater than ever seen in the history of US development and greater than ever witnessed before in any producing area in the world.

Bravo Citi!

Best comment yet. Is there anything more to say?

Honestly, how can you folks doubt the words coming from a too-big-to-fail bank? They're infallible, by definition. Just ask our president.

One figure that has remained unremarked upon, is the "other conventional/heavy" category. Citi sees a fall in supply from 3.2 mbpd to 2.3. Is this too pessimistic?

FOR ALL

Various argumnets have been presented that factors beyond geology will have greater influence than geology in oil development in the US. My response:

I have immediate access to $300 million in capex. My owner created our company 3 years ago for one reason: develop oil/NG reserves that we would sell in 5 years or so to take advantage of PO. My company has a staff of very experienced and successful geoscientists. My company has one of the most sophisticated seismic processing groups on the planet. I have ready access to every state of the art drilling/production technology...the same service companies every major oil company has access to. My focus area is the most prolific oil producing region IN THE WORLD…remember the US is the third largest oil producer on the planet. Regardless of the BS there are no significant regs preventing me from drilling. I drill in the most politically secure region in the world…no fear of the govt confiscating my production.

And I haven’t drilled one pure crude oil prospect in 3 years. As I’ve explained we don’t drill shales because there’s too low a profit margin for my owner. We buy prospects from companies (hundreds of them out there) whose sole reason for existing is generating and selling prospects to companies like mine. They all know who we are and that we have the capex. In the market area I drill I sell my current oil (condensate from my NG wells) for $120+ per bbl.

With ever advantage to drilling a crude oil prospect: I have exactly zero crude oil prospects to drill at the moment. The only factor preventing me from developing new crude oil reserves in the US is geology. The best chance of my developing crude oil reserves is an EOR project I've proposed to my owner. And even though the billions of bbls of residual oil volume is proven and I have all the same advantages I outlined above, I'll still have to do a pilot project to prove the economic viabilty of my proposal.

IMH and very experienced opinion it is the geology in the US that makes the Citi projection utterly foolish.

Citibank is definitive. Reality is frequently inaccurate.

(h/t Douglas Adams)

The only factor preventing me from developing new crude oil reserves in the US is geology

ROCK, ROCK, ROCK how could you say such ?-) If factors other than geology (a bit different than 'beyond' that's why added this edit) weren't there to make it possible for your owner to get greater returns elsewhere (in the world's economy) whatever return the US oil geology promised would of course be enough because it would be the best he could do. There is no winning this chicken or the egg argument but I understand your point perfectly and seasoned with my tongue in cheek criticism it has huge implications.

ROCKMAN, you need to speak with Newt Gingrich. He clearly knows where to drill. ;-)

ROCKMAN, you need to speak with Newt Gingrich. He clearly knows where to drill. ;-)

But seriously, a talking point that is used on the right these days is that drilling is down on Federal lands during the Obama administration (although overall oil production being up). Why is that? Is it because the best prospects are currently on private North Dakota lands? Is it because there are no good prospects on federal lands right now? Is it because the administration is slow in handing out permits to drill on federal land? (I know they had the temporary moratorium on deepwater gulf drilling but I don't know of any specific reason why land permits would be slower.)

Spec – During 2011 roughly 5.5% of US oil production came from onshore federal lands. If you exclude the oil production from federal leases on the North Slope onshore federal leases contribute less than 1% of our domestic production. During the same time period 25% came from federal offshore leases.

Granted the Macondo blow out slowed up offshore development for a while but matters are getting back on track. New lease sales are scheduled. Thus fed regs aren’t getting in the way in those areas. There are endless debates as to how much oil maybe in other offshore federal lands and North Slope federal leases that aren’t available. But those are speculative reserves…for from proven. Bottom line IMHO the onshore oil potential on federal leases aren’t being undrilled as a result of over regulation. There just isn’t much potential there. And never has been.

Thanks for the response.

I guess since oil production is hugely up, they add the qualifier of 'on federal lands' to the talking point. And if 'federal lands' includes Federal waters then of course it is down due the temporary moratorium after the Macondo blow-out. I was curious if leases on Federal dry land were down . . . but that appears irrelevant since almost no wells were being drilled on any Federal dry land before or now.

I still think Obama needs to do the 'Grand Bargain' and open up ANWR in exchange for royalties tied to market rates and using the money for alt-energy projects. Make everyone happy.

I actually suggested to my congressman that the dickering could come down to some urban mass transit money being tied to opening the most promising ANWR areas to 3-D seismic in the first go-round. Would that push the Transportation Bill through and end the deadlock...who knows but it's time for everyone to move off that dime. It is ridiculous to even argue about ANWR until we've a much better idea what is likely under which part of it. Some of the longer lasting tracks the 3-D rigs left on the frozen tundra might offend some wilderness purists' sensibilities but they will have precious little impact on the area's overall ecosystem.

It might be tricky to get someone to fund the seismic with no guarantees of actual well drilling being allowed--but then the state does have a couple bucks it could use to pay for the work. Owning the seismic certainly would give Alaska a more powerful future position and give it more control over how the seismic was carried out--we've thrown money at much worse prospects.

Citibank people is not stupid. They know what you are saying here. But, still, they keep presenting these invented graphs that can not be justified or explained. The question is...why?

Citibank is not stupid, but the research departments are in the business of generating business, whether it be M&A, trading or hedging. I've worked from some large, Citi-like organizations and somebody I know very well headed up the group which edits (for consistency of style) all the research generated at one of those large banks and I got to see a huge amount or that particular bank's research.

A lot of research is partially recycled from prior work and often done by relatively junior people although the name on the paper is generally the head of the group. There is a certain quantity which is expected per week/month/year and facts are not checked too carefully. The goal is not to write academic papers but to get (potential) customers to pick up the phone whether is because the customer agrees ("Great, then you should buy XYZ product") or disagree ("Great, then you should sell XYZ product"). Ultimately it's about generating an emotional response and from what I see here on TOD they have succeeded.

Rgds

WeekendPeak

"As our premier thought-leadership product, Citi GPS is designed to help our clients navigate the global economy's most demanding challenges, identify future themes and trends, and help our clients profit in a fast-changing and interconnected world." This is from the footnote on the cover of the document in question.

Biographies of the authors of the document show education in economics or international relations (Dr. Anthony Yuen also has Electrical and Computer Engineering degrees as well.)--pg two of document.

Has anyone on TOD been collecting data on the quality of oil/energy extraction analysis from economists?

Gail may be your "man".

Thanks, Jedi Welder.

Note there is no mention of accuracy, or any other type of statement as to the quality of information which the document contains.

Citi (and others like them) are in the business of providing just enough data presented in such a way as to trigger transactions. They are not in the information dissemination business, they are in the transaction business.

The fact that one person mentioned on the cover has particular degrees is borderline meaningless. He may have written just a hand full of paragraphs, or perhaps not even.

Rgds

WeekendPeak

I agree, WeekendPeak.

Conclusion: Just a bubble of gas and oil in the USA ?