Tech Talk - Some Thoughts on Energy in 2013

Posted by Heading Out on January 14, 2013 - 2:06pm

It is the beginning of a New Year, and belatedly, I hope that all readers find this new period to be one of prosperity, health and happiness. It would be encouraging if the portents for our energy future would point in that direction, but unfortunately I can’t see nearly as much optimism in that regard as do others who are similarly reviewing where the global energy supply numbers are going. This week the EIA's ”The Week in Petroleum” is illustrative of the optimistic vision.

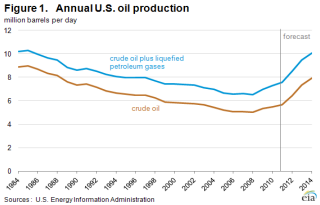

This plot is from the new Short-Term Energy Outlook from the EIA, which projects the numbers through to 2014, at which time: the Agency anticipates that US domestic production will rise to 7.9 mbd, the highest since 1988. Growth is expected to extend beyond just the Bakken:

In particular, drilling in tight oil plays in the Williston (which includes the Bakken formation), Western Gulf (which includes the Eagle Ford formation), and Permian basins are expected to account for the bulk of growth through 2014. Williston Basin production is expected to rise from an estimated December 2012 level of 0.8 million bbl/d to 1.2 million bbl/d in December 2014. Western Gulf Basin production rises from an estimated December 2012 level of 1.1 million bbl/d to 1.8 million bbl/d in December 2014. Within the Western Gulf Basin, roughly 0.4 million bbl/d of the oil production is outside of the Eagle Ford formation. The Western Gulf Basin accounts for more than half of the onshore domestic liquids production growth due to a comparatively large amount of liquids coming from both oil and gas wells compared with the other key production basins. The Permian Basin in West Texas, which includes plays such as Spraberry, Bonespring, and Wolfcamp, is a third key growth area. EIA estimates that crude oil production from the Permian Basin reached 1.2 million bbl/d in December 2012. Permian Basin production is projected to increase to 1.4 million bbl/d in December 2014.

The overall global concerns for production include a relatively small potential for production growth from the larger oil producers in the world (with the possible exception of Iraq), while there remains an increasing turmoil that began with the “Arab Spring” and continues to spread with ongoing and growing impacts that are likely on Middle Eastern oil production. But it is the story of American production that continues to gnaw at my worry bead string.

In context it should be remembered that when The Oil Drum was first produced in 2005, national attention was briefly caught by the TV movie “Oil Storm” in which a plausible series of events – a hurricane in the Gulf, a ship collision in the Houston Ship Canal, and a terrorist attack on the Saudi oil terminal at Ras Tanura combined to raise the price of oil to a peak of $130 a barrel, and gas reached a final price of over $7 a gallon, with all sorts of terrible consequences. The day was finally saved when Russia shipped the US a few tanker loads of oil, after the US outbid the Chinese for that oil.

Since then there have been pundits who tell us that these things would never happen. During the real price rise to $147 a barrel (without the disastrous causes) we were reassured that prices would fall again to the $20-$30 a barrel range, though they have not – and those same pundits are now again parading before the media as they reassure us that the US can soon cast off the shackles of oil price control by foreign oil interests. Of the roughly 10 million bd that the US imported in October, some 4.2 mbd came from OPEC, Saudi Arabia sending 1.25 mbd, and Venezuela 0.95 mbd. Outside OPEC, Canada supplied 2.68 mbd, Mexico 1.06 mbd, and Russia 0.55 mbd. KSA has shown itself adept and willing to adjust flows to ensure that OPEC oil prices remain adequate, and there is no indication that they need or intend to change their approach. Any global increase in supply is likely to be more than offset by increases in demand from China and India, though the reality will be that as US demand declines (if it does) that displaced supply will transfer to meet Asian growth – and it will not then be available were the US projections to fall short, and the country have to increase imports again.

There are some troubling signs on the horizon that suggest the future US supply is not as robust as has been proposed. Chesapeake Energy, who have been a flagship for the development of natural gas, is in sufficient trouble that CEO Aubrey McClendon will not get a bonus this year, amid a number of changes. Shares have dropped nearly 30% and as Art and others have noted, the economics are not as encouraging as the pundits would suggest.

The news from the Arctic is somewhat worse. Shell has been able to recover their drillship, which ran aground after losing its tow in a 70-knot storm with forty-foot waves, and it has now been moved to a safe harbor. The vessel must now be assessed and the program will be delayed. (This is particularly true as the investigations begin to line up, first was the Coast Guard, and now Interior.) The Alaskan Pipeline flows were averaging just under 583 kbd in November (December numbers are late), and that is up from the overall yearly average of 544 kbd, but is running at a 6% decline rate bringing problems in as little as eight years. Although with monthly flow changing to improve conditions in the winter months, there may be more of a problem than is currently discernable, particularly if future supplies to keep the pipeline flowing are now threatened by the future losses of potential production from the Chukchi and Beaufort seas.

And speaking of pipelines, the cancelling of plans for the Bakken Crude Express Pipeline for lack of customers tells more about the anticipated future demand than all the predictions from Dr. Yergin at Cambridge. Energy Research Associates. This also foretells that the Adelman prediction that technology will always return us to cheap oil, as touted by Phil Verleger is likely to continue to be proven false – not that these real events stop those who survive by predicting the future. Fortune tellers have been a facet of society throughout history, only the shape of their crystal balls has changed with time, and the size of their credulous audience.

Whether real or overly optimistic, the US potential increases in fossil fuel production are likely to impact to the potential for US renewable and bio-generated fuels, where the future production levels seem also to be losing their lustre. There is some talk of Dr. Chu leaving the Department of Energy in part perhaps because of this change in focus. However, among the names being floated are those of John Podesta, the founder of the Center for American Progress, who have just ranked their top ten Energy and Environmental Priorities for the first four years of President Obama’s time in office, as follows:

And most recently, the Secretary has been encouraging women and minorities to look at the wind energy industry as an opportunity for employment.

One other candidate is apparently Bill Ritter, the past Governor of Colorado, although the list at this point, ,seems to be growing rather than shrinking.

Whether under either individual or some alternate choice, the next four years of President Obama’s Administration will likely see many more changes than anticipated, as occurred during the first term. However, it is discouraging that there are so few possibilities for realistic optimism for that future.

This is a very easy summation to understand. I would think it would be common knowledge in our society. After some thought I conclude that the main reason why it is not accepted is because it is not what people want to hear, plus, politicians would never admit to a slow decline in the face of rebuilding "exceptionalism", as in the case of the US, or keeping the balls in the air in the rest of the '1st world'.

If it continues to unfold as per JMG indications, (and probably the best that we can hope for), then as Obama's next term winds down others will either seize on fear to keep the GOP out, or use blame to get them in, and the decline will continue.

Sure, catastrohpic events are always ready to unfold and lurch things forward, but absent of that will simply be this stagnant reality. I am astounded at what trivial indicators people seize to rah rah on. The last few weeks the US housing market is said to be building into a real economic strength for 2013, provided the Congress simply does what it is supposed to do and make things all better. We see the players getting blamed for the poor performance, when the script is simply so bad there is zero chance of a good outcome. We will not be entertained and pleased with this years production. And as for entertaining the masses and keeping them quiet and uninformed, it is ironic that the modern bread and circus are communication devices and marvels of electronics. I teach a high school metalwork class and just this past Friday, while grinding into shape a piece of steel for my windmill, I happened to look over and see a kid playing a stupid game on an iphone. He could be welding, machining, creating almost anything he might want and there he was thumbing some stupid avatar to go up a hill and blow up some kind of villian. Stunned, I told him to get the hell out and not come back. I see this almost everywhere I go. Parents travel in their cars with their kids plugged in so they won't ask questions or make noise. They are training future citizens who will one day look around and be misreable with their prospects and lives.

It is also interesting, in light of your article, to recall so many others who are now stating that the concept of Peak Oil is simply doomer nonsense, a kind of made up religion. "Since then there have been pundits who tell us that these things would never happen." Well, they are happening now and will continue to unfold. Peak Oil is scripted in by reality. There are few possibilities for optimism "for that future", as you state. That is why, more than ever, individuals who are aware of events must quietly prepare to the best of their abilities for the sake of their families and communities. If you see our journey walking into quicksand, would you not grab for the edge and struggle....try and get out? Each individual might be very limited in what can be done, but with many showing their small and personal ways of adapting, (thinking of Ghung's panels and gardens or Wimbi's stirling and other projects....folks insulating and installing panels), with such small individual steps movements are made.

Thanks for your article!!

regards Paulo

-Johnny Mercer and the [really?!] Pied Pipers

Thank you very much indeed for introducing me to Johnny Mercer and the (really?!) Pied Pipers. Never heard of him/them before. Been reading The Oil Drum for a long time now, but this is the first post that drove me to actually create an account and reply. So, more than incidentally: Thanks to all of you for maintaining this site!

Nicely stated Paulo. I see the same folks, with both children and adults stunted in perpetual adolescence with their flabby butts planted in front of their 46" lcds enchanted by cars going around in circles and brain damaged mesomorphs crashing into each other. In our house we long ago turned off the TV except for significant events. The news is all perception management BS from the statistics bureaus in the government and in the corporations. Last night 60 minutes segment of the US attempt at job creation:Robots! The good news: jobs are returning to the US from China. The bad news: they are robots, the new slaves.

Alternatively, the facts of the situation are common knowledge, but the conclusions people draw from them are different. It's worth being careful that you're not blinding yourself to the possibility that other people could reasonably draw different conclusions than you have.

It's worth noting that one of the primary job responsibilities of a teacher is to motivate their students. If it were simply about imparting knowledge, teachers could be replaced with library cards.

Regarding US crude oil production, I suspect that we are currently on the upslope of a tertiary peak, which will probably be lower than the secondary US crude oil peak that we saw in 1985 (9.0 mbpd) and therefore lower than the (so far) absolute US crude oil peak that we saw in 1970 (9.6 mbpd). Note that the 1976 to 1985 increase in US crude oil production, from a low of 8.1 mbpd in 1976, to the secondary peak of 9.0 mbpd in 1985 (primarily due to Alaskan production coming on line), only served to slow the rate of decline relative to the 1970 peak of 9.6 mbpd.

The two key questions regarding the current increase in US crude oil production are: To what level will production rise, and how fast will production decline after a tertiary peak? Note that our conventional production dropped by 1.5 mbpd in only six years, from 1970 to 1976. And most of us suspect that we ended 2012 with the highest overall decline rate from existing US wellbores that we have ever seen. In other words, the underlying decline rate from existing wellbores is almost certainly much higher than what we saw as conventional US crude oil production dropped from 9.6 mbpd in 1970 to 8.1 mbpd in 1976.

In any case, my bet is that in the US we are seeing the reverse of the global annual Brent crude oil price pattern (a succession, so far, of higher annual highs and higher annual lows). I think that we will continue to see a cyclical pattern of lower annual highs and lower annual lows in US crude oil production. For example, a high of 9.6 mbpd in 1970, followed by a secondary high of 9.0 in 1985. And a low of 8.1 mbpd in 1976, followed by a low of 5.0 mbpd in 2008.

However, as I have mentioned several times, a focus on production completely misses the critical depletion aspect, especially what I think is the catastrophic post-2005 rate of depletion in Available CNE (Cumulative Net Exports). This is the estimated total volume of (net) exported oil that will be available to oil importers other than China and India, after 2005. In round numbers, I estimate that the remaining volume of post-2005 Available CNE may have dropped by about half in only six years.

The question is not whether we are depleting post-2005 Global CNE (Cumulative Net Exports) and post-2005 Available CNE, the only question is the rate of depletion.

Link to a prior post with net export pics (scroll down to see the links to graphs):

http://www.theoildrum.com/node/9756#comment-937988

"...In other words, the underlying decline rate from existing wellbores is almost certainly much higher than what we saw as conventional US crude oil production dropped from 9.6 mbpd to 8.1 mbpd in 1976"

This fact of higher decline rates can only be offset by massive amounts of drilling, which due to inflation will require continued higher prices for the oil produced. Typical decline rates of 30 to 60% combined with progressively lower flow rates or greater spending per well (more lateral bores, more frac stages) mean declining production in less than two years unless oil prices can climb at least 10% per year every year, IMO.

If oil prices do in fact begin this ramp up, then the economy will not grow so fast if at all. When price then falls due to lower demand so does production, but with a time lag of perhaps a year.

In nutshell the EIA forecast is no better than a weather forecast two years out: a wild ass guess.

WT,

I wonder if the US production peaks you mention (lower highs and lower lows) can reflect world production peaks as well

A distant mirror

Poly – Actually throughout much of history US oil production has moved independently of global production rates. Probably do in large part to a relatively large domestic supply that still required imports during lower consumption periods. For instance some folks seem shocked at the possibility that the US may one day produce as much daily oil as Saudi Arabia. But in the mid 80’s the US was producing twice as much oil as the KSA. In 1985: US – 9 million bopd; the KSA - 3.8 million bopd.

In fact, go back to 1950 and the US produced almost 40% of the oil on the planet. Even after the huge surge in ME production by 1970 the US still produced 1 out of every 6 bbl of oil in the world. And yes: the US has produced more cumulative oil than the KSA. The only stat that exceeds the great oil productivity of the US is our consumption.

Kurt Cobb on baseless forecasts

http://resourceinsights.blogspot.com/2013/01/not-at-that-price-why-long-...

While most of Kurt Cobb's reasoning is correct, there is one aspect which I think needs changing. Natural gas prices can be lower than production costs for quite a while because of associated gas from shale oil wells.

If oil production from the shale fields of Bakken, Eagle Ford, etc keeps increasing in the short and medium term, it can be expected that production of associated gas will also rise. This gas will be sold for whatever the producers can get for it and the well will be kept in production for as long as the oil price makes the whole enterprise economic.

This associated gas, however, is a drug on the market and, as long as it is available in quantity, it will depress the price of natural gas - even below the cost of production from gas-only wells. Gas-only wells will stay in production as long as they are providing positive cash flow, but there's a big difference between meeting running expenses and recovering the initial investment. In the long term, the price will recover, because nobody will be drilling gas-only wells at current prices and current wells will play out in due course. The price may, however, stay down long enough to ensure that some significant natural gas producers don't get to pay back their banks.

North Dakota's Bakken wells are flaring 40% of the produced gas due to lack of infrasructure to get it to market. If gas prices were more like $6 to $8 per mmBTU then pipelines might be built to bring this gas to customers. So, the current nat. gas price of $3.40 per mmBTU is not sufficient for many ND producers that would consider selling the gas. I think price must move higher for current nat. gas US production rate to continue.

North Dakota apparently flares 100 million cubic feet of gas per day. Given that one gallon of methanol requires 100 cubic feet of gas, the gas that North Dakota flares every day, if captured locally and converted to methanol, could produce one million gallons of methanol each day. Given that methanol can replace gasoline at a ratio of 1:1.6, those one million gallons, if blended with gasoline, could displace 625,000 gallons of gasoline. The gas being flared in North Dakota may be too expensive to pipe into the national natural gas grid, but it could be converted from "waste" to more easily transported fuel if captured and converted to liquid fuels in the field with appropriately sized conversion facilities.

Of course, we'd have to see the Open Fuel Standard Act passed before methanol could be blended in addition to or in lieu of ethanol...

bob - Thanks for the numbers. The only question that remains is who will finance the infrastructure required to do the conversion. It seems that the technology is well known as is the potential NG supply. I would have no idea how to estimate the investment cost to set up such an operation but I would think others have done so and so far no one appears willing to pull the trigger.

They can turn natural gas into synthetic gasoline by the methane/methanol/DME/gasoline process proved out by Mobile in the 1980s.

It would cost about $1 billion for a one million gallon per day facility, they can make $1 per gallon profit. That is not their business, they drill oil and flare natural gas.

Conversion process from CH4 to gasoline is 60% efficient, so if nat. gas costs per BTU is more than half of wholesale gasoline cost per BTU, it will not be converted to gasoline.

I have said this before:

The best use for nat. gas (CH4) is to use it for fuel in a combined cycle power plant (60% efficient) then use the electricity produced to run electric vehicles and machines (like frac pumps and drill mud pumps). Taking natural gas and converting to use in gasoline powered vehicle has overall 12% efficiency at best (chemical to mechanical energy conversion), versus natural gas to electric powered vehicle or machine being 55% efficient. We obtain 4-1/2 times the usefull work out of my suggestion versus yours.

I can take a gallon of synthetic gasoline and get 40 MPG in a mid sized Fusion hybrid. We have 200 million liquid hydrocarbon fueled vehicles in the U.S. and less than 100,000 EVs. We are not even projected to have 1 million EVs for many years, so I don't think EVs will be the salvation anytime soon.

That is some great circular self-defeating thinking. We don't have many EVs so there is no point in even trying to get more EVs. You can say that about any new technology.

BTW, why not get a Fusion Hybrid Energi . . . the plug-in hybrid version that gets around 20 miles on electricity before switching to gasoline. And Nissan just slashed the price on base model Leaf by $6400 such that you can now get one for just over $21K after the tax-credit.

Yes, we may have less than 100K plug-ins in the USA right now . . . but half of those were bought last year alone!

You attempted to distort my position. The assertion was that we should use natural gas in combined cycle power plants to charge EVs. To do much good, you have to have a lot of EVs, we do not and will not soon.

Make and sell as MANY EVs as you can, I think that would be great. In reality, TEN years from now we will not even have 1% of the cars in the U.S. EVs.

So the idea of natural gas to electricity to EVs does not reduce oil imports because almost NO ONE will be driving EVs.

However, if you make synthetic gasoline from natural gas almost EVERYONE will use it because they have cars that CAN use it.

This should be so obvious there should be NO debate, but I guess the obvious is not so obvious to everyone.

Well, I am not going to hazard a guess on what the plug-in penetration will be 10 years from now. It depends heavily on what happens to oil prices. If oil prices shoot-up, I think that plug-ins can start making a pretty big contribution to the new cars sold. There are finally many models available and more coming to market. Just a couple years ago, there were zero. Now you can get the Chevy Volt, Nissan Leaf, Coda, Tesla Model S, Ford Focus electric, Honda Fit EV, Toyota RAV4, Fiat 500e, Ford C-Max Energi, Smart ForTwo ED, Ford Fusion Energi, Plug-In Prius, etc.

But how much becomes adopted depends on the market and the incentive systems we, as a society, put in place. If we have decent incentives and the price of oil rises . . . we could hit tipping point. EV components still remain expensive because we don't have the same mass manufacturing scale as convention ICE components.

But creating gasoline from natural gas? I hope that doesn't become popular because it will lose some energy during the conversion and then be burned up in an inefficient ICE engine. It is more energy efficient to burn it in a combined-cycle plant and power EVs. I'd rather see that happen instead of perpetuating a less-efficient system just because that is business as usual and we don't want to change.

Personal electric cars are not the answer to our conundrum they just stretch it out. However speculawyer's point of converting natural gas to electricity can be used to

power Green Transit electric trains, lightrail and trolleys which is what will be essential in a sustainable future not more "Happy Motoring".

Personally I have a Prius Hybrid to save some oil and greenhouse emissions. But I would much rather that NJ Transit actually runs the trains just down the street from my house and

also does the same for other Rail lines. Rail can transport 10-12x the number of people in the same land as cars. Personal cars, whether electric or otherwise still waste a football field of asphalt for every 5 cars, are responsible for 30,000 deaths per year, waste huge amounts of materials in building the cars and other materials and energy maintaining all the asphalt, parking lots, ambulances, police cars, etc they need.

"..electric trains, lightrail and trolleys.."

How many passenger miles are done by these? How many turbines out there are combined cycle? When your plan is to convert many plants to natural gas combined cycle and get 200 million drivers to use electric trains, you may want to rethink your probability of success any time soon...soon enough to head off any world oil supply/price problems.

I'm the kind of guy who 'Hopes for the best, but plans for the worst". Okay, maybe I wish I could afford to 'plan for the worst.' That said I begrudgeonly agree with CalGuy on the smallness of effect one can hope to acheive with electric vehiles and such. Still, I would agrue whether success is relevant at this point. If one believes society is morally obligated to do whatever it can, then yes, let's do what we can. Full steam ahead.

However, one has only to drive in any mid-sized and above metropolitan area to grasp the reality of the magnitude of the tasks. Better yet, fly into these metropolitan areas... at night for a more dramatic effect. Then multiply that by the number of such population centers - think regional, think national, oh go ahead... imagine what that looks like gobally. At this point it would not be unexpected for one to ask, with all due sincerity, What can be realistically done? Not technically, but realistically. Not with some unheard of effort thus far unseen by humanity. Realistically. What. Can. Be. Done.

Unfortunately I fear most people are unaware that what they are doing now is all they will be able to do. And that is Wait. Wait and See.

I would like to have an EV with 150 mile range for $20,000, then have so much affordable, convenient mass transit that I really don't need a car often, but that is not the case.

I have heard people say that we will all drive electric cars on wireless roads and never need to charge. All those roads will be powered by wind and solar so that they go on forever.

Considering those roads would cost more than $1 million per lane mile and there are 8 million lane miles in the U.S. that is not likely.

Well today you can get an EV with 73 mile range for less than $20K in California (Leaf model S after incentives and tax-credit). Drive the EV back & forth to work every day and for short shopping trips. Go ahead and keep your current gas car for longer trips . . . . but you'll soon find out that you rarely need the gas car. Or instead of going all-out with an EV, just get a PHEV like the Volt, Cadillac ELR, the new Accord PHEV, the C-Max Energi, etc. and make sure you charge it up every night. You'll still use gas but the amount you use will plummet.

If large numbers of people did that for their next car then we could stop importing oil much faster than trying to ramp up the Bakken fracking.

"There were two kinds of people in the world; those who planted gardens for themselves & their communities, and traveled on 'bicycles', and those who waited to do those kinds of things."

Desert

Or in other words, there are two types of people in this world: Those who can extrapolate trends from incomplete data...

Not forgetting, of course, the important fact that there are two sorts of people in the world:

(a) The people who divide the world into two sorts of people; and

(b) The people who don't.

I can't disagree, but I'd sure rather see the stuff displace some corn ethanol than watching it flared. Of course, I forget myself: with current supply & demand trajectories, we aren't gonna displace anything until the economy tanks another notch.

Maybe we should be turning it into ultrapure ingots of plastic (synplants do pure things by nature, yes?). Might be more useful than gold if it's 'shelf stable' for a long enough period...better bury it to keep off the UV. Sounds way too much like gold to me...

Desert

Trans-Canada looks to be doing something about the depressed gas price. Royal Dutch Shell is having them build a gasline to Kitimat and Petronas just hired them to build one to Prince Rupert. I guess BC producers want to sell some LNG (from shale gas production) to Asia while the market is hot.

Cobb asserts that fracking is a new technology, and then launches into his 'new technology' meme. I think I have learned here at TOD from Rockman and many others that fracking is a fairly old and was already known to be very expensive before this recent boom in its use. If all additions to our reserves ( that is crude that can be produced at a profit ) is tight oil then the known high cost of fracking will create a new floor price for oil that is well above the wished for $20/barrel.

Recent indications are that the decline rate for fracked wells follows different rules than are followed by 'traditional' non-fracked wells. And that producing fracked wells can't actually be done at a profit even at today's somewhat elevated prices. Perhaps today's players in this game are deeply in debt and getting deeper. When the size of the debt of a debtor gets close to the borrower's collateral, foreclosures happen Some firms declare bankruptcy before the full value of their collateral is depleted, but there is no way in this scenario for there to be a happy ending. And all the while nothing adequate is being done in building up capacity to produce sustainable energy sources.

Final score of the grudge match of energy analysts, 2013:

Honest geoscientists: 1000

Cornucopians: 0

yes the geoscientists...

honest

hard working

clean living

Fair and Balanced

So you think so, eh?

I think your chart is in error. Current EIA stats for monthly oil production have only been reported through Nov. 2012. Chart says to Jan 2013, which is correct? And what is "Carpe Diem Blog"?

You're wrong. The current EIA stats is until Jan 2013 and exactly match what was graphed.

You need to check you sources to evaluate accuracy. The last couple months of data points on AC's graph may not be correct.

Monthly EIA data: www.eia.gov/dnav/pet/pet_crd_crpdn_adc_mbbl_m.htm

Here is what the EIA saya about its data:

"Crude oil production is an estimate based on data received from State conservation agencies and the Minerals Management Service of the US Dept. of Interior.

Estimates have to be made for crude oil production because complete and correct data from States may take a few months... Every month the monthly crude oil production estimates are updated in table 26 of the Petroleum Supply Monthly (http: www.eia.gov/petroleum/supply/monthly/ ) using reports from state agencies and the Berueau of Safety and Environmental Enforcement. The estimates are reported in Petroleum Navigator and the Petroleum Supply Monthly roughly 60 days after the production month." See page 130 of this report: www.eia.gov/petroleum/supply/monthly/pdf/psmnotes.pdf.

So weekly report used to make AC's graph is mostly based on projections, not actual reported data. The monthly data, issued 60 days after actual production is also partially estimated but much more accurate.

So, you want to wait and see. Fair enough. Will you go a step further and go on record assuming that the current estimates will be significantly revised downwards?

More likely to be revised downward than upward, but I simply stated that last two months data points were likely inaccurate. Its hard to make predictions, especially about the future. Yogi Berra.

You may regret saying that.

The weekly estimates for October showed:

10/05 - 6,598 thousand bpd

10/12 - 6,606 "

10/19 - 6,610 "

10/26 - 6,669 "

-------------------

Which averages 6,621 thousand bpd.

But the revised monthly number for October shows 6,820 thousand bpd.

In other words, the latest revision has been upwards. And by a good 200K bpd!

And BTW, the weekly estimates for September averaged 6,208K bpd while the monthly number was 6,484K bpd. Which is an upward revision of 276K bpd.

We see the same pattern for August, where the weekly estimates averaged 6,078K bpd, while the monthly figure was 6,283K bpd, an upward revision of 205K bpd.

As I said, you may regret saying that.

Yes, shale oil in the US has had a significant effect, but so far it's significant rather than earth-shattering. Everything depends on the decline rate of the wells. If they're similar to old-fashioned ground wells, it means that US oil production will keep rising and the US will achieve "energy independence". On the other hand, if they're anywhere near they're anywhere near the decline rates advanced by some of the Peak Oilers, production from the Bakken, Eagle Ford etc will soon peak and then decline, even if the "drill baby drill" lobby gets its entire wish list.

We will know the outcome of this argument probably by the end of this year and definitely by the end of next. My current reading of the situation is that the decline rates will be high enough to knock the cornucopians out of the argument for good.

A - "...if they're anywhere near they're anywhere near the decline rates advanced by some of the Peak Oilers..." IF??? There are no ifs about it. It has nothing to do with what any Peal Oiler advances or not. Even the biggest gung ho shale advocate acknowledges their high decline rates. The typical decline rate of any fractured reservoir has been well established for more than 50 years. Many thousands of Bakken, Eagle Ford et al wells have confirmed it over the last 4 years. If no more fractured shale wells were drilled starting tomorrow production from these plays would drop to insignificant levels in just several years. By "old fashion ground wells" I assume you mean production from conventional (non-fractured) reservoirs. Those reservoirs are at the extreme other end of production dynamics from the fractured reservoirs. An oil well in a conventional water drive oil reservoir might produce for several years with 0% decline rate and then perhaps decline at a rate around 10% - 15% per year for the next 10 to 15 years. I'm currently working on an EOR project in a trend of conventional oil fields. After more than 50 years the majority of leases in all those fields are still producing oil. Not a great volume but still producing. Compare that to the recently reaffirmed decline rates of 30% to 60% for just the first year seen in many of the shale plays. It ain't a theory: the stats are in very clear black and white.

The actual debate has more to do with future drilling activity in the shale plays. That will be the sole determinant in how close those efforts might bring us to "energy independence". A term many use incorrectly since what they are really trying to say in "import independence". In theory if enough shale wells are drilled quickly enough we could stop importing any oil. But that would take a great many more wells than have already been drilled. More important, the drill rate would have to be sustained since within a couple of years of a slow down the decline rates would lead us quickly back to being an importer.

We don't have to wait till the end of the year to prove anything to the cornucopians. Shale wells that went on production 3+ years ago have declined significantly...everyone of them. No cornucopian can deny that simple fact. Their argument would be that we can continually drill enough new wells for many years that would greatly reduce if no eliminate imports. That can be debated on an intellectual level. The decline rate debate, if there ever was one, has long passed.

And..." shale oil in the US has had a significant effect". I suppose that depends on how one defines significant. The shales have certainly added to domestic production. OTOH at current levels we are still importing over $325 billion in oil every year. I might start using the term "significant" when we get that number down at least in half. That would take a sustained increase in shale production of 5 million bbl/day above current shale production.

Yes...I'm not easily impressed. LOL.

http://www.resilience.org/stories/2013-01-15/crude-by-rail-does-it-reall...

Crude by rail: does it really make sense?

By Deborah Rogers

mbnewtrain already addressed the issue of why ship oil by railroad instead of pipelines below.

hello Ac!

yes I think so -the graph is from honest geologist ? yes? or perhaps not ? January hasn't finished yet for 2013 , please make this clear this graph is to Jan 1st - can't see that clearly

Oh and how are your predictions ? can you make one for the North Sea Oil ? be really interested if you have something on that , especially ones on how we can beat the depletion there.

I do love an honest debate but its so much better with facts and figures - I'll look forwards to your predictions though and what effect they will have on World oil price in 2, 5 and 10 year time scales . I cant make my mind up so I'd like your input, thanks.

and what do you think of Westexas Export Land model ? Interesting isn't it?

All the best

Forbin

Forbin - "...from honest geologists". It is a well established fact that an honest "geologist" can be one of the most dangerous components of oil patch activity. Honest doesn't mean correct. I are a geologist and when I really believe in my project I can turn into the Jim Jones of geology. Sorta like selling Ice cubes to an Inuit. The actual phrase we use:"Beware of the geologist who believes his own sh*t. Honestly everyone in the oil patch understands that implication. The best geologists I've ever worked with shared a common characteristic: they were bigger critics of their own product than anyone else. As soon as they have an "aha, now I fully understand what's going on" moment they begin to be suspicious of their conclusions. The pressure to create a prospect is tremendous. It not difficult to see what isn't really there. especially when your paycheck is on the line.

In my 37 years I've drilled two "sure shot...can't miss" wells including twinning a well that found a big thick Ng reservoir. And both wells missed. So I don't drill SSCM wells anymore. I drill wells that have a reasonable chance of success.

http://www.bloomberg.com/news/2013-01-11/bakken-oil-output-fell-in-novem...

Read it and weep. Despite over 100 new wells a month, Bakken oil production is now falling.

Breaking news: North Dakota oil production has fallen during the winter in the past, and then resumed its climb as warmer weather arrived. I would advise you not to get too excited from a month or two of data.

a-c: Thanks. I thought that was the case but didn't have time to dig for it. I think they also have a problem after the thaw starts: too muddy.

I think that some of the ND oil producers are concerned about costs inflating and are letting some frac contractors "sit it out" to relax demand for frac services, thus possibly reducing costs.

I see Bakken production climbing again, but not at the same rate as in 2011 and 2012. But increased well drilling and completion all depends on price of oil. With Global markets still tight I think higher prices ($95 to $100/bbl) more likely than lower prices.

Oh well, the abundence was just a concept.

The demand story is important, and it is not getting enough attention in the mass media. For instance the -0.5% per year in US vehicle miles travelled since 2005 is probably not very well known. Add that to the new CAFE standards, a surge in retirement, and stagnant incomes, and you get the impression that US demand will decline for the next decade or so.

That story is an optimistic one, when you think about it. The oil price won't rise as quickly as it would have, giving more time to adapt. The story needs to be told. (It won't be, though, because you can't reduce it to a 2-second sound bite, but the rejoinder is simple: "Less is more", you say? Yeah, right.)

But the linked article suggests that the pipeline project was going to be tied up in litigation for a long time, and that, probably, is why it was canceled.

Perhaps someone else will try, or perhaps the players know the real story about the Bakken by now, and they don't expect supply to be there long enough for the pipeline to be commissioned.

Of course, then there is the global supply & demand situation. The ratio of Global Net Exports of oil (GNE*) to Chindia's Net Imports (CNI, China + India's combined net imports) from 2002 to 2011:

Since 2005, the US and most other net oil importing OECD countries have been forced to take a decreasing share of a declining volume of GNE, as the developing counties, led by China, consumed an increasing share of a declining volume of GNE (relative to 2005). At a GNE/CNI ratio of 1.0, the Chindia region alone would theoretically consume 100% of GNE.

In my opinion, the shale oil plays should be viewed as our last chance to ease the transition to a less oil dependent future, as we continue to be gradually forced out of the global market for exported oil, as the developing countries, led by China, continue to consume an increasing share of a declining volume of Global Net Exports of oil.

Instead, the shale plays are being sold as a permanent solution to our fossil fuel problems and as a way to continue Business As Usual, as we see an indefinite and open-ended rate of increase in global oil consumption, "To infinity and beyond."

*GNE = (2005) top 33 net exporters, BP + Minor EIA data, total petroleum liquids

That's one scary linear trend. If it holds, by 2018 there will be about half as much oil available to OECD countries as there was in 2010 (if I'm reading the graph correctly). But the data points on the graph were generated during a time of increasing and then flat world oil production. If the world goes into overall decline, say post 2015, I wonder what that would do to the curve? My guess is that it would become a bit steeper because China and India have a much much lower per capita consumption.

Ratios are useful, but you need to remember that we are dealing with two different variables (which in turn are dependent on other variables). For example, the volume of Available Net Exports (ANE, or GNE less Chindia's Net Imports, CNI) rose from 2002 to 2005, even though the GNE/CNI ratio fell (because Chindia's Net Imports were growing faster than GNE from 2002 to 2005).

From 2005 to 2011, the volume of ANE fell from 40 mbpd to 35 mbpd, or about 13%, as the GNE/CNI ratio fell from 8.9 to 5.3, or about 40%.

There is probably a more direct correlation between percentage change in the GNE/CNI ratio and depletion. For example, I estimate that post-2005 Available CNE (Cumulative Net Exports) were about 48% depleted through 2011, as the GNE/CNI ratio fell by 40% from 2005 to 2011. And this is precisely my point. In my opinion, we are living in La-La land, with something close to BAU, only because of a catastrophically high rate of depletion in the remaining volume of exported oil that will be available to the developed countries.

In any case, the 2008 to 2011 rate of decline in the GNE/CNI ratio was faster than the 2005 to 2008 rate of decline, which in turn was faster than the 2002 to 2005 rate of decline.

By 2018 if anyone is still driving anything but a plug-in hybrid, EV, bicycle or public trans. in their daily commute they will be truly in deep sewage. Or walking.

Really? You think we are that close to an oil decline...people are like frogs in boiling water when it comes to oil knowledge; I don't see an oil decline that quickly ....2018 is just 5 years away. I would love to see that though...but for that to happen you would have to start having decline in oil production by the end of this year...

That graph is bad on several levels. First, why exclude China and India? Then, why choose the 2002-2005 period's unusual (I guess) rate of 4.5% increase per year as norm? That gap calculation is just silly.

The per-capita oil consumption has been about 25 barrels in the US and 10 barrels in Europe since at least the mid-eighties - remarkably flat until 2008 or so. After 2008, those levels have dropped less than 10%. That's the real "gap", if there is one. Good riddance, I would say, especially in the US case.

Regarding China & India, at the 2005 to 2011 rate of decline in the ratio of GNE (Global Net Exports*) to Chindia's Net Imports (CNI), in about 18 years the Chindia region alone would theoretically consume 100% of GNE. The Chindia region has been, at least so far, progressively excluding the net oil importing OECD countries from the global market for (net) exported oil, as the rate of decline in the GNE/CNI ratio has accelerated in recent years.

Regarding 2002 to 2005, global annual (Brent) crude oil prices doubled from $25 in 2002 to $55 in 2005, and they doubled again from $55 in 2005 to $111 in 2011 (with one year over year decline, in 2009).

So, I am comparing the production/net export response to the first (2002 to 2005) price doubling, versus the production/net export response to the second (2005 to 2011) price doubling.

Note that an extrapolation of the 2002 to 2005 rate of increase in ANE is consistent with what we should have seen if Yergin's circa 2005 prediction (about 3%/year) for increasing global production had been correct. Following are links to all five "Gap Charts," through 2011.

EIA Total Liquids, 14 mbpd Gap:

(2002-2005 rate of change: +3.1%/year; 2005-2011 rate of change: +0.5%year)

http://i1095.photobucket.com/albums/i475/westexas/EIA_total-liquids_02-1...

BP Total Petroleum Liquids., 13 mbpd Gap:

(2002-2005 rate of change: +3.0%/year; 2005-2011 rate of change: +0.4%year)

http://i1095.photobucket.com/albums/i475/westexas/BP-world-production_02...

EIA Crude + Condensate, 14.5 mbpd Gap:

(2002-2005 rate of change: +3.1%/year; 2005-2011 rate of change: +0.07%year)

http://i1095.photobucket.com/albums/i475/westexas/EIA-CC_02-11_gap-1.jpg

Global Net Exports, 18 mbpd Gap:

(2002-2005 rate of change: +5.3%/year; 2005-2011 rate of change: -0.7%year)

http://i1095.photobucket.com/albums/i475/westexas/GNE_02-11_Gap-1.jpg

Available Net Exports (GNE Less Chindia’s Net Imports), 17 mbpd Gap:

(2002-2005 rate of change: +4.4%/year; 2005-2011 rate of change: -2.2%year)

http://i1095.photobucket.com/albums/i475/westexas/ANE_02-11_gap-1.jpg

*GNE = Top 33 net exporters in 2005, BP + Minor EIA data, total petroleum liquids

westexas wrote:

Yes indeed!

Fossil fuels will be needed in the buildout of Green Transit to run the bulldozers and other equipment needed to rebuild our Rail system. It is also vital for not wasting flared natural gas which requires some investment, PV and Wind installations etc.

This is what is so frustrating about the elites continuance of "Happy Motoring By Any Means" as Kunstler puts it with idiotic projects like an Autos only Tappan Zee bridge in the metro New York city area already laced with Rails and Green Transit waiting to be connected.

Green Transit, as during WW II would prove to be a positive feedback loop as it was then when Green Transit quadruplin saved huge quantities of oil, metals, rubber etc from Auto Addicted waste. If we cut our Auto Addicted oil usage by even just 5% this could be a huge benefit but surely 10% is easily doable.

IMO a better use for fossil fuel is to develop renewable energy. Once you run low on fossil fuel it makes it tougher to have an alternative.

Greg – Perhaps for the reasons you mention. But often the commitment to go forward on a p/l project requires a contractand binding agreement on the part of the producers to pay a minimum transport fee regardless of their actual thru put. If such arrangements aren’t in place p/l companies have their own engineers/geologists that estimate thru put volumes. If they don’t sign off the p/l doesn’t get built. Pipelines typically take quite a few years to payout but only if they move a sufficient volume. Insufficient volume = insufficient ROR = no pipeline.

Don’t know if those are the specific reasons for cancelling but certainly possibilities.

Rockman

Exactly what killed the Oneok PL. No PL company builds out today without long term contracts that guarantee a minimum volume to transport. Combined with the aggressive RR expansion in the Bakken and other PL projects, Oneok's proposed line was not attractive enough for the producers sign on.

Another company does have some commitments of around 250k barrels/day from the Bakken area and is going forward with a PL conversion and extension to Cushing.

According to the Tallgrass Energy Partners website:

Pipeline will transport domestic light crude found in the Bakken production area of North Dakota and eastern Montana through the conversion of a portion of an existing natural gas pipeline and the construction of a new pipeline.

The project will increase energy independence by adding capacity for safe and efficient energy transportation.

•Pony Express Pipeline will originate at Guernsey, Wyoming, go southeast crossing through the corners of NE Colorado and SW Nebraska before turning south at Lincoln, Kansas, Pony Express will terminate at an existing petroleum facility in Cushing, Oklahoma.

We still have obscene, and relatively widespread waste. Yesterday on my bike ride, I witnessed what I consider to be obscene waste -presumably mandated by federal or state law. I passed a construction zone, with maybe a couple of employees in the far distance, it was noon, on a totally cloudless days, three diesel generator trailers with pole mounted lights were running -competing against full sunlight -not a worker was even within 100 yards of these lights. And California is arguably the most energy efficient of our states.

And, just to be fair and balanced, shouldn't we put a little asterisk at the end of each and every utterance about production/consumption which drops our eye to a requisite note at the bottom of each page saying:

* "And do keep in mind if we toss all this carbon into the air, we will turn our planet paradise into a ball of hell for a hell of a long time coming." ?

It is depressing but should be no surprise that ending the Wars responsible for 5% of US oil consumption and most importantly shifting from Auto Addiction to Green Transit are nowhere on the radar for the Obama wimpocrats. Instead we have the idiocy of NY and the Feds wasting $5 Billion on a new cars only Tappan Zee bridge. $7 Billion subsidies for very expensive electric cars instead of restoring the 150 Green Transit systems cut since 2008.

There was this promising article finally in a progressive Website facing reality:

http://www.commondreams.org/view/2013/01/13-5

Alleged progressives like John Podesta may not deny global warming but they totally ignore both Peak Oil and the huge impact of Auto Addiction on US gluttonous waste of oil.

We have been kicked in the face with Climate Change in 2012 between the Midwestern drought and Hurricane Sandy. I believe 2013 will be the year Peak Oil really rears its ugly head...

Here in Wyoming we have the cheapest gas in the country $2.40 because of refineries and cheap Canadian crude. I follow ND monthly production and rig numbers and I see OCT/NOV numbers off more than 2% and rig counts down. And now we see the Bakken pipeline cancelled. curiouser and curiouser. All you hear from the MSM is that Bakken production is parabolic. I wonder . Given the rapid decline in frack wells, that does suggest a temporary plateau. Has anyone else noted this and is there an explanation like demand, maintenance, personnel issues etc?

I am astounded at what trivial indicators people seize to rah rah on

That excerpt came from Paulo's opening comment but it's antipode certainly applies to both you and Rune mentioning

the cancelling of plans for the Bakken Crude Express Pipeline for lack of customers tells more about the anticipated future demand than all the predictions

without bringing up the fact that the terminus of that pipeline is to be in Cushing, the center of the bottleneck for oil flow through the Great Plains. Until more crude can bypass Cushing storage and 'collect $200 as it passes go' (the Gulf Coast refiners) why would anyone want to commit to a pipeline to the heart of the bottleneck? It is my understanding that CN and BNSF are the best way around the OK price penalty at the moment--please correct me if I'm mistaken. An analysis of relative shipping/storage costs (for competing routes) of oil transiting the Great Plains would be a fitting topic for a future Tech Talk.

I think your analysis is essentially correct, except the Canadian railoaod involved in the Bakken is mostly CP (Canadian Pacific), not CN (Canadian National) which is more involved in the tar sands oil region.

A few days ago BNSF said their capacity to ship Bakken oil was at 400,000 barrels per day and were working to expand that to 500,000 per day by year end. The Chairman of BNSF said that the railroad could ramp up to 1,000,000 barrels per day over the next several years. They would have to add some second track along the single track sections on ND and maybe in Illinois and Wisconsin.

The draw back to pipelines is the lack of flexibility in a changing market. Railroads can shift destination at almost anytime. Sure, the transportation costs are more for rail but if one refinery at the end of a pipeline goes down, the oil has to transfer to another mode or get backed up in tank storage. Furthermore, the railroad tank cars themselves can act as short term storage if needed. And should the BNSF and CP get too high priced, perhaps a short 220 mile pipeline could be built to north east corner of Wyoming to access the UP (Union Pacific) railroad. With coal shipments declining I am sure the UP would welcome the oil business and maybe even invest in the pipeline.

Thanks for the CP to CN correction--crossed my mind CP might be in the picture. But I knew CN was involved in bitumen game and that the tar sands bitumen was no small contributor to the price penalty so I just plopped 'Great Plains' on the page and let more up to speed carry the ball.

Luke

While Oneok's pipeline did not receive producer's support, another company (Tallgrass Energy Partners) has commitments for a pipeline project that would move around 250K barrels/day from the Bakken region

As for the situation in Cushing- TransCanada is building a Gulf Coast Project that will have the initial capacity to transport 700,000 barrels of oil per day and can be expanded to transport 830,000 barrels of oil per day to Gulf Coast refineries.

Due for completion in late 2013.

Thanks for the update on th Gulf Coast Project. It will be curious to see how all this plays out as Continental moves to the next phase on its extensive Bakken holdings.

The obvious retort to all these optimistic stories on plentiful fracked-oil is . . . "Well, happened? WTI is at $94/barrel today. If oil is now so plentiful, why as the price been going UP instead of down?"

spec - The price of WTI has gone up. But that's not the only oil sold in the US. Check out the decline in Light La Sweet prices. Remember there was a time when I was getting WTI + $25 or so for my Texas oil I was barging to La. and getting LLS. Maybe no one believed me when I said every Gulf Coast producer would be glad to see the bottleneck at Cushing hold for ever. Now you see why. It's never a question of oil being plentiful but how much oil is available in what market at what price. That differential can have a greater impact on prices than the absolute amount of total oil in the market place. And that knife cuts both ways depending on market the consumer is in.

What happened was that a Canadian company bought a pipeline carrying crude from the GOM to Cushing, reversed it, and boosted its capacity to 400,000 bpd. And guess what happened the day after it started up in reverse at its new, higher capacity? The price of oil at Cushing suddenly shot up closer to the price of oil at the GOM.

People who think the price of WTI at Cushing represents the world price of oil are bound to be mystified by changes in its price.

Enbridge's Seaway affiliate reverses pipeline flow to help move oil southward

Now the pipeline bottlenecks are moving to the Canadian border. Western Canadian Select is trading in Canada at $55/bbl, or nearly $40/bbl under the price of WTI. The situation is only going to get worse because Canadian oil sand production is rising steadily, ND shale oil is going into the same pipeline system, and new pipeline approvals have been stalled by politics.

Yeah, I am going to laugh so hard if they build the whole Keystone pipeline and then gasoline prices in the mid-West and Mountain west all shoot up because that oil can then be sold at Brent prices. All these people who support the pipeline and think it will lower their gas prices are going to be in for a rude awakening.

Of course, instead of admitting they were wrong they'll just blame OPEC, speculators, tree-huggers, who ever the scape-goat du jour is.

US refined product prices are much more closely linked to the Brent price than the WTI price.

This morning (1/17/13), the gap between Brent and WTI is about $16, which is quite close to the $15 crack spread gap between Brent ($9) and WTI ($24).

In other words, Mid-continent refiners are paying WTI based prices for crude, but largely charging Brent based prices for refined product, and pocketing the difference.

There still is a discounted price for oil in the mid-continent and it shows up in the cheaper gas prices in the center of the country:

http://www.gasbuddy.com/gb_gastemperaturemap.aspx

Sure much of the difference is from higher taxes in other states and gas mixtures but that doesn't explain the whole difference. And you can read all about the Canadians whining about how they are giving the USA a huge 'subsidy' with cheap oil.

It will just be really ironic if the people supporting a project because they think it will give them cheaper gas end up with higher priced gas because of that very project that they supported. But tricking the people into supporting something that really won't benefit those people is just the way the world works.

The majority of gasoline buyers will probably see no change in gasoline prices, since they are determined more by Brent prices than WTI. Some states will see an increase in the Mountain and Midwest regions, but those are among the least populated states in the US. The people most affected will be the refiners. The Mountain and Midwest refiners will see lower margins as their feedstock prices rise, and the Gulf Coast refiners will see higher margins as they get access to feedstock at the same prices.

Western Canadian refiners will get very low prices on feedstock, but that doesn't do them much good because they are all also oil sands producers. End-to-end, ground to gas pump, they will see the same amount of money. The only difference is whether it falls out on the production or refining end of the accounts.

Canadian governments are indeed irritated about the money that they are losing in taxes and the oil companies are losing in profits because of the bottlenecks. Alberta is particularly P.O.d because it has a $3 billion deficit in this year's budget, and that deficit would disappear completely if Alberta oil companies got WTI prices for their oil.

Alberta scans the compass for crude oil export options

As Rocky noted, the fact remains that as of Friday morning, the gross profit from refining a barrel of crude linked to WTI was $24, while the gross profit from refining a barrel of oil linked to Brent was $9. (And some Canadian refiners are really making a killing.)

spec - "...then gasoline prices in the mid-West and Mountain west all shoot up because that oil can then be sold at Brent prices." Might shoot up a lot and then maybe not so much. Those midwest refineries may take most of the loss in their margins.

And none of that oil will be sold at Brent price IMHO. With the pipeline expansion Cushing Canadian oil and west Texas oil will be selling at LLS prices. LLS prices which will be significant lower because of the competition from WTI and Cushing oil. And "Cushing oil" may have to be how we refer to it instead of Canadian oil. As RMG says the bottleneck has now appears to have moved to the US/Canadian border.

There is loads of room for Cushing Canadian oil to push out imported heavy oil at gulf coast refineries. Any of this oil that makes it to the gulf will be directly competing with Saudi and Venezuelan heavy oil for space in gulf coast refineries. Thus it's price will be linked to world sea born crude ie... Brent---minus the typical world heavy oil discount to Brent.

Now the light crude might become disconnected from Brent but I don't think by too much. Valero has just started importing eagle ford crude into eastern Canada and it looks like most eastern Canadian refineries will be trying to get into this game. I think there will be enough demand from Canada and the Gulf refineries to keep the LLS discount to Brent from getting very high.

Since the Keystone corridor pretty much matches the national wind resource map, I'd like to see it approved under the condition a couple thousands megawatts of turbines be co-located along with transmission line -- preferably something 21st century like an underground superconductor.

Then let both play out over 50 years and see which was the better long-term capital investment.