Drumbeat: February 23, 2013

Posted by Leanan on February 23, 2013 - 11:32am

U.S. Oil Demand Fell to 18-Year Low for January, API Says

U.S. January oil demand fell to the lowest level for the month in 18 years as a weak economy reduced consumption, the American Petroleum Institute reported.Total petroleum deliveries, a measure of demand, dropped 1.7 percent from a year earlier to 18 million barrels a day, the industry-funded group said in a monthly report today. Total consumption fell 2 percent in 2012, the API said last month. The U.S. jobless rate increased to 7.9 percent from 7.8 percent in January.

Stuart Staniford: OECD Oil Consumption

Global peak oil is probably not here, though I think it likely we are on the bumpy plateau. However, for the US and Europe, peak oil consumption has probably been and gone. We survived.

Peak oil down to war, depression and geopolitical shifts

Given the increase in the amount of oil that China and India are importing, it looks as if there will be no oil available for other countries to import in another decade.

Oil Prices Will Not Moderate for Long Periods of Time

Recent releases from the International Energy Agency tell of moderating growth rate of the global demand for oil – which was based on lower economic growth projections. And promises of “fracking” to boost oil supply are bouncing around cyberspace. Images of supply and demand curves flash in ones mind.Yet, the cost of oil today has little to do with supply versus demand – but is more about marginal cost of supply and producers ability to manipulate supply. Peak oil and anti-Obama rhetoric notwithstanding, oil production in the USA has been growing (see graph below).

All too often, people oversimplify things.Whether it's comparing our federal budget to a single household budget, or absolutely refusing to take a closer look at the various political one-liners we see every day in news cycles, we're constantly exposed to the facts being boiled down to a simple, black-and-white concept that can easily be forced down a feeding tube.

We see a perfect example of this in the energy arena, and nothing will be more destructive than oversimplifying (and, as a result, misconstruing) the concept of Peak Oil.

A Proposal for a Propane Tank Looms Large Over a Maine Coastal Town

SEARSPORT, Me. — In the winter of 2007, thousands of homes and businesses in rural Maine almost lost their heat because of a severe propane shortage.The shortage led to rationing and prompted Gov. John Baldacci to scramble for a solution, including asking DCP Midstream, a Denver company that already supplied propane to New England, to help increase imports to guard against future disruptions, company officials said.

...But a funny thing happened during the lengthy governmental approval process — the energy industry, flush with gas from hydraulic fracturing in the nation’s shale fields, did a U-turn and has cut back on imports in favor of exports.

“There has not been a ship that has brought propane into New England in almost a year,” said Joe Rose, the president and chief executive of the Propane Gas Association of New England. “At this point, the facilities in New England are in a state of being semi-mothballed.”

US shale may force more European refinery closures

LONDON: Europe’s hard-pressed refining industry faces more closures as its competition in the United States enjoys the double bonus of growing domestic shale oil supply and cheaper electricity bills from shale gas.Traditionally, Europe’s refiners have exported surplus gasoline to the United States and emerging markets and served their home markets with as much diesel as they can produce. But the US shale boom is changing the dynamic, with American refiners now enjoying profitable advantages.

Oil Rises on German Business Confidence

West Texas Intermediate oil rose, paring the biggest weekly decline since December, after German business confidence climbed to a 10-month high and the Standard & Poor’s 500 Index advanced.Futures gained 0.3 percent as the Munich-based Ifo institute’s business climate index increased, signaling that Europe’s largest economy is gathering strength. Equities also rallied on the report. Oil tumbled $4.26 a barrel in the previous two days. The drop accelerated yesterday after the Energy Information Administration said U.S. crude supplies rose 4.14 million barrels last week to 376.4 million.

India: Supreme Court may hear plea on pricing of natural gas

New Delhi (IANS) The Supreme Court is likely to hear Monday a petition seeking the quashing of a government pricing policy which allegedly gives cheaper natural gas to industry as compared to domestic consumers who use it for cooking.

Sri Lanka raises fuel prices to record to cut losses

(Reuters) - Sri Lanka raised the price of fuels to record levels on Saturday to prevent the state-owned oil firm suffering further losses due to increased global oil prices and a reduction in Iran crude imports, an official said.

China's energy consumption rises

Beijing (IANS) China's energy consumption has gone up, show statistics.China's energy consumption totaled 3.62 billion tonnes of standard coal equivalent in 2012, up 3.9 percent year on year, the National Bureau of Statistics (NBS) said.

PBF Sees Crude Oil Trains Boosting East Coast Refinery Profits

PBF Energy Inc. is betting that shipping discounted crude by rail from Canada and North Dakota can make its East Coast refineries profitable on the heels of several shut-downs in the region.

Barnett Shale rigs slip to 10-year low

Rigs working in the Barnett Shale kept declining this week, dropping by two to 27, the lowest in at least 10 years as producers continue to migrate toward fields with more profitable crude oil.

Gasoline Gains for First Time in Four Days, Pump Prices Rise

Gasoline rose for the first time in four days and pump prices edged closer to last year’s highs. Crack spreads and the April contract’s premium to later months increased.

Ethanol Snaps Streak of Gains Against Gasoline on Higher Output

Ethanol snapped the longest streak of gains against gasoline in five weeks as prices for the motor fuel rose for the first time in four days and production of the biofuel increased.The spread widened 3.01 cents to 71.66 cents a gallon, based on futures settlement prices, the first expansion since Feb. 14. Gasoline prices recovered a day after the Energy Information Administration said supplies sank 2.88 million barrels and ethanol production grew for a third week.

Forties Crude Loadings Rise in March Amid Swathe of Minor Delays

Seven cargoes of North Sea Forties crude were shunted further into the future by a few days each, reducing the number of February shipments by one, and increasing March’s tally by one, according to two people with direct knowledge of the schedule.

North Africa’s Prospects as Energy Goliath Are Fading

LONDON — A deadly attack by militants on an Algerian natural gas plant last month has dealt a major setback to a group of North African countries whose prospects as oil and gas producers were already cloudy.A few years ago, Algeria, Libya and Egypt looked like they would provide much of the solution to Europe’s declining natural gas production and its uneasy reliance on Russia for supplies of a fuel widely used in industry, power generation and home heating.

But well before the early morning assault by dozens of raiders on the In Amenas gas facility, deep in the Sahara, the difficult political realities of the region were creating doubts about how big a role North Africa could play in the world energy equation.

Iran says 16 locations selected as suitable for construction of new nuclear power plants

TEHRAN, Iran — Iran has selected 16 locations as suitable for new nuclear power plants it intends to build to boost its energy production over the next 15 years, authorities said on Saturday.The Islamic republic says it needs 20 large-scale plants to meet its growing electricity needs over the next one-and-a-half decades. It currently operates a 1,000-megawat nuclear power plant at Bushehr, a coastal town on the Persian Gulf, and is planning to build a 360-megawatt nuclear power plant in the southwestern town of Darkhovin.

Ghana advised to manage oil find transparently

Dr Ngozi Okonjo-Iweala has cautioned Ghana to illustrate greater transparency and accountability in managing the fledgling oil industry to avoid the challenges associated with the harnessing of the natural resource.

Enbridge Pipeline meeting scheduled for Feb. 28

BLOOMINGTON — Enbridge Pipelines will host an informational meeting Feb. 28 on plans to extend its pipeline system through Illinois.The 165-mile proposed Southern Access Extension Pipeline Project includes an extension of existing pipeline from Enbridge’s Flanagan Terminal near Pontiac and ending in Patoka in southern Illinois.

Exxon lifts force majeure on Nigerian Qua Iboe crude

NEW YORK (Reuters) - Exxon Mobil Corp has lifted a force majeure on the Nigerian Qua Iboe crude stream put in place on February 7, the company said in a statement on Friday.The company said that pipeline work had prompted the declaration.

Weak economy pinches Red Lobster

Darden's CEO specifically cited the payroll tax hike and higher gas prices as a problem. There are concerns that low-income and middle-class consumers will be squeezed by higher taxes and rising energy costs. Wal-Mart (WMT) warned Thursday of soft February sales too.

BP Heads Into Spill Trial With Initial Court Victory

BP Plc heads into a sprawling trial Monday over who is liable for the biggest offshore oil spill in U.S. history with an early victory, after a judge ruled some documents related to its criminal conviction can’t be used.

BP Spill Pact Excluded Billions in Possible Loss Claims

Bill Floyd, owner of an upscale seafood restaurant near downtown Houston, is a poster-child for the type of damage claim BP Plc left out of its $8.5 billion settlement for the biggest offshore oil spill in U.S. history.When the energy company’s blown-out Macondo well dumped more than 4 million barrels of crude oil into the Gulf of Mexico in 2010, Floyd saw his costs for fresh shrimp, crab and oysters almost double overnight while his sales flat-lined.

Underground Nuclear Tanks Leaking in Washington State

SEATTLE — Six underground tanks holding radioactive waste are leaking at the Hanford Nuclear Reservation in eastern Washington, Gov. Jay Inslee said on Friday after a meeting with federal officials overseeing the cleanup of the nation’s most polluted nuclear site.

Md., D.C. utilities pay paper mills burning ‘black liquor’ for alternative fuel credits

Thanks to a wrinkle in the definition of renewable, the lion’s share of the money used to meet those standards is flowing to paper companies that burn “black liquor,” a byproduct of the wood-pulping process. Paper mills have been using black liquor to generate most of their power needs since the 1930s.Environmentalists are up in arms over what they see as a perversion of the intent of the law. Instead of encouraging new clean technology, they say, it is rewarding an old practice that emits as much carbon dioxide as burning coal.

Saudi sets out roadmap for major renewable energy programme

(Reuters) - Saudi Arabia has published a roadmap for its renewable energy programme, aimed at reducing the amount of oil it burns in power stations, and targets issuing final bids for the first plants within three months.The world's top oil exporter aims to install 23.9 gigawatts (GW) of renewable power capacity by 2020 and 54.1 GW by 2032, it said in the roadmap, which would make Saudi Arabia one of the world's main producers of renewable electricity.

Indonesia's Palm Oil Blues Spreading to Africa: Report

Major palm oil producers accused of destroying Indonesia’s forests and driving its iconic wildlife to the verge of extinction are now taking their practices to the relatively pristine forests of the Congo Basin, an environmental group has warned.

Biofuels Converting U.S. Prairielands at Dust Bowl Rates

WASHINGTON (IPS) - The rush for biofuels in the United States has seen farmers converting the United States’ prairie lands to farms at rates comparable with deforestation levels in Brazil, Malaysia and Indonesia – rates not seen here since the Dust Bowl of the 1930s.

6 in 10 people worldwide lack access to flush toilets or other adequate sanitation

It may be the 21st century, with all its technological marvels, but 6 out of every 10 people on Earth still do not have access to flush toilets or other adequate sanitation that protects the user and the surrounding community from harmful health effects, a new study has found. The research, published in ACS' journal Environmental Science & Technology, says the number of people without access to improved sanitation is almost double the previous estimate.

India and Nepal face struggle over water resources

In the west of the region, arguments between Pakistan and India over vital water resources in areas bordering the two countries continue.In the east tensions are rising as India expresses concerns about a spate of planned dam-building projects by China on rivers flowing into Indian territory, particularly on the mighty Brahmaputra.

There’s a chance we’re living in end times.

Canada has acted on climate as Keystone waits: envoy

WASHINGTON (Reuters) - Canada has taken action to protect the climate during the more than four years it has waited for U.S. approval of the Keystone XL pipeline, and there's little more it can do in the short term, the country's ambassador to the United States said.

The Case for Fossil-Fuel Divestment

It's obvious how this should end. You've got the richest industry on earth, fossil fuel, up against some college kids, some professors, a few environmentalists, a few brave scientists.And it's worse than that. The college students want their universities to divest from fossil fuel – to sell off their stock in Exxon and Shell and the rest in an effort to combat global warming. But those universities, and their boards, have deep ties to the one percent: combined, their endowments are worth $400 billion, and at Harvard, say, the five folks who run the portfolio make as much money as the entire faculty combined.

Rethinking Our Response to Climate Change: Carbon Wedges 2.0

By framing decisions and objectives narrowly, the wedges paradigm (at least as applied in scores of analyses like the 90×50 report) prevents robust consideration of the complexity and uncertainty inherent in responding to climate change.

Lifting a Town to Escape the Next Storm

HIGHLANDS, N.J. — If not for the most deadly natural disaster in American history, in Texas, and an innovative response to it, more than a century ago, one might briskly consign the proposal to save this oft-flooded borough at the northern end of the Jersey Shore to the realm of pigs with wings.But four months after Hurricane Sandy almost obliterated downtown Highlands, an unlikely idea with one enormous historical antecedent seems to be taking hold here: Don’t just raise the buildings. Raise the town.

'Canary in the coal mine': Living beyond the levees in Louisiana

"Leeville is washing away," Bryan said. "We're losing our marsh."Leeville's plight underscores a national debate over how much to build near water and what to save once the land begins to disappear, said Robert Lempert, a senior scientist at Rand Corp. who studies how coastal communities respond to sea level rise.

Boston Grapples With The Threat Of Storms And Rising Water

Since the drubbing that Superstorm Sandy gave the Northeast in November, there's a new sense of urgency in U.S. coastal cities. Even though scientists can't predict the next big hurricane, they're confident that a warmer climate is likely to make Atlantic storms bigger and cause more flooding.Cities like Boston are in the bull's-eye.

So Stuart, how do you analyze that plateau?

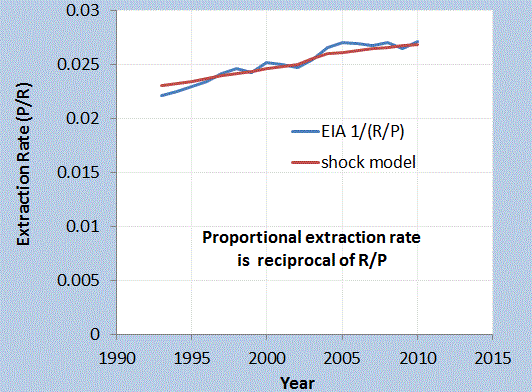

There is a direct line from discoveries to current reserves to production. The Reserves over Production ratio is shrinking as the plateau appears flat.

That's even before taking into consideration the declining net energy from new oil and the usually increasing environmental impact thereof.

It really is about doing the right kind of bookkeeping. We need to separate out the various grades of oil and not mindlessly lump everything together.

It won't get this bad, but just think if gold, silver, platinum were all placed under a "precious metals" category and sold that way. Or if diamonds, rubies, etc were counted under the same bucket as gemstones. Yet that is what is happening with the oil production numbers, as more and more is being counted as an Barrel of Oil Equivalent (boe). This only works if somehow the net energy is included.

Wait until they change the numbers from barrels to metric tons and they start mixing oil and coal together and report it as all liquids and solids (alas).

WHT,

Are you really making the case that the production over reserves ratio should trend in a straight line through the peak? If the production numbers stop rising and decline, and the reserve numbers are also declining (since we know there is a discovery time offset), then the curve should flatten - which is what the data appears to show.

Or are you saying we aren't at peak yet (in your model) and that's why the model output continues to climb.

Personally I think the curve should go up and down as different effects play out over different time horizons.

Mind, I would gain a different takehome from OECD consumption numbers than Stuart. The easy reductions are are the first reductions - cutting US demand from 20Mbpd to 15Mbpd should be relatively easy (given the waste). However, with China and India there to take up any slack (and more) the problem comes in the next tranche. The OECD has no easy cuts left, but its economies are relatively impoverished relative to Chindia. As the price spikes to drive out demand further, the strain brings 'breaks', not adaptation. We'd need to be making structural fixes now to avoid that, and that I don't see happening.

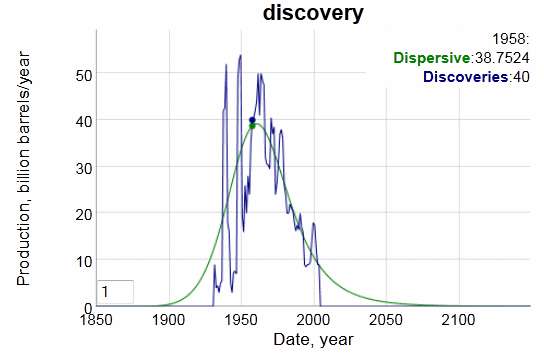

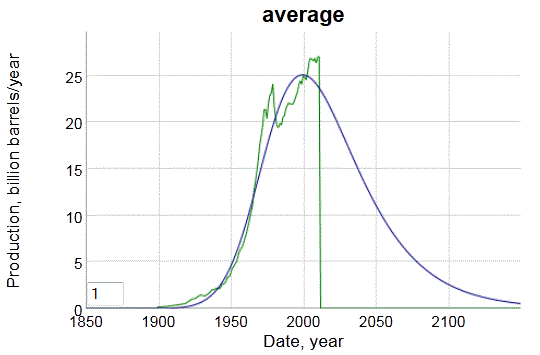

One can make quite a few points by looking at the system as a flow model. This is a statistical view of how long it takes to go from an initial strike to full production as a series of stages.

When the yearly reserve additions match the yearly production level the peak is near.

The peak growth rate in reserves happened very close to the shock in the 1970's.

The R/P ratio goes through cycles over a historical time-frame. It starts low and builds as discoveries accelerate. Over time the producers realize that they have too much oil and so need to throttle back on production. At some time the demand catches up and the oil becomes much more valuable, so production starts to accelerate. Since the market is very efficient, the collective sense realizes that this can't go on indefinitely and so the R/P ratio hits a minimum. Unfortunately, this will lead to a lull in economic productivity as production backs off and the R/P starts rising again. The last stage is when the reality of diminishing returns force the economy into hyperdrive as the oil becomes very valuable and the extraction pressure leads to a final decline in R/P.

So the R/P ratio profile is shaped like an upside-down W over time. The proportional extraction rate is the reciprocal of R/P and so that is shaped like a W.

How do you show this? Start with a discovery curve and a dispersive stochastic model

Then one applies a staged model to generate a reserve profile and modulate the production profile by perturbing the proportional extraction rate.

Note the middle of the W-profile appears very close to the highest yearly reserve growth rate. This is essentially when Pres. Carter had the future pegged.

If the R/P and extraction rate were constant over time, it would have looked like this:

but since geo-political and market forces exert an influence, we get the jagged production shape.

Nice series, WHT. But I'm a bit lost in your summary.

Then one applies a staged model to generate a reserve profile and modulate the production profile by perturbing the proportional extraction rate.

Would appreciate an expansion on any or all of the underlined points.

And ... then ... it would have looked like this: ... but since geo-political and market forces exert an influence

How are extraction rates influenced by market forces in ways not accounted for in your model?

A staged model is the figure labeled "shocked". The reserve profile is the green curve labeled "Reserve".

The production profile is the blue-green curve labeled "Model", which lays on the purple curve labeled "Data" (which drops at the last date). The production gets modified by the extraction rate which is applied proportionally to the amount of non-processed cumulative reserves available. The word perturbation indicates that the modification is around an average value. If it is not perturbed, then we get the graph labeled "average".

This is an inverse process because one wants to find the extraction rate by fitting a model to the data.

The analysis is often referred to as a multi-compartment model.

The forces do exert an influence in the model. The only influence on the "average" model is a steady extraction rate, which essentially places a constant maximally "greedy algorithm" to the reserve resource.

The W modulation is also external. The analogy is that of a person's life activity. When we are young, we try to do everything. We only slow down when we realize we have lots of time to pace ourselves. At mid-life, we suddenly get nervous and try to pick up the pace. This activity drops as we realize that we can't sustain this pace. Finally, at the end we realize that the bucket list is still unchecked and we try to get the last flurry in before we expire. These are all market forces because we do things based on an awareness of our environment.

No matter what data we do or do not possess, the tacit knowledge exists that tells us how the oil situation is evolving. The world knew in the 1970's that we were reaching the reserve peak and reacted accordingly. Models are important in allowing us to infer this explanation.

WHT,

Did you say on TOD a little bit ago that you are working on a book, or perhaps a paper?

I apologize for not remembering...I read a lot and lose track of all the things on my mental reading list...

Do you have your own web site/blog?

The book has been out about 2 years now as a PDF

http://TheOilConundrum.com

I am also creating a semantic web server that will provide environmental models, including fossil fuel projections.

As part of the tuning effort, I am testing the models in the book as web services. The charts that you see part of this process. It is kind of interesting to revisit the data and models and see how they are progressing.

WHT, sorry for me being dense...I went to your blog and clicked on the embedded link to The Oil Conundrum, but went to a mostly-blank screen...do I need to sign in to Google DOCs to download the PDF?

Also, do you (or anyone else) know if one can load a PDF onto a Kindle Fire?

Beats me. They must have changed the access criteria.

Once you are in go to File/Download for the PDF. Then you can email it to your Kindle account.

For those who think that increasing price of oil will eventually kill economic growth, then a graph of quarterly GDP plotted against the price of oil since 2002 may be of interest, since it suggests that real US GDP growth effectively goes negative as early as 2014 (for moderate inflation) and as late as 2018 (for low inflation such as the last 12 months).

However since I can’t just cut+paste my graph here, then I will just describe how to go about plotting GDP vs. oil prices, so that you can add a new data point every quarter (note that the 2nd estimate of the most recent quarter comes out Feb. 28).

For the oil prices, I average the Brent and WTI prices for each quarter. You can get the monthly WTI oil prices at: http://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=RWTC&f=M

And you can get the monthly Brent prices at:

http://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=pet&s=rbrte&f=m

To get the quarterly GDP numbers, go to the link below and click on “Current dollar and real GDP (excel)” [note that you want the nominal GDP numbers since you can adjust for inflation on the graph]: http://www.bea.gov/national/index.htm#gdp

I just annualize the quarterly changes. For instance, the 3rd quarter GDP was $15.811 Trillion and the 4th quarter estimate was $15.829.0 Trillion, for a .11% quarterly increase, and so a .46% annualized quarterly increase (yes, even before adjusting for inflation, the most recent quarter’s growth was essentially zero).

(Keep in mind that the first estimate of each quarter’s GDP is made about 3 weeks into the first month of the following quarter, with that initial estimate revised towards the end of the two following months.

At first, the graph of annualized quarterly GDP plotted against the quarterly average of Brent and WTI oil prices since 2002 will not make any sense, as the plot will look totally random. However, it becomes much clearer once the data for the last two quarters 2008 and the first two quarters of 2009 are eliminated. Once they are eliminated, the graph shows a very clear, though variable, trend and this trend shows the steady decline in GDP in response to the ever higher oil prices since the end of 2002.

(Why eliminate these 4 points of data? Remember, the purpose of this graph is to show how US growth responds to ever higher oil prices (how Y responds to changes in X ). However, during the 4 quarters eliminated, oil prices dropped due to the Great Recession (X responded to Y instead). In other words, unless one believes that low oil prices cause recession in the US, then those 4 data points are just muddying the waters).

Right now, the trend line through this adjusted graph shows that average GDP declines to zero when oil prices reach someplace between $122 and $150, depending on the inflation rate. In other words, if the inflation rate is what it has averaged since 2002 (2.84%) then it would only take $122 oil to drive nominal growth down to the 2.87% level. On the other hand, if inflation stays as it has the last year (1.7%), then it would take $150 oil to drive nominal growth down to 1.7%.

Finally, by plotting oil prices since 2002 (and assuming oil price continue to go up in a straight line as they seem want to do), then you can use the trendline through that data to estimate when oil prices will reach the price indicated by the first graph. When you do that, it can be seen that an oil price of $122 can be expected as early as late 2014, while a price of $150 would be expected sometime before the end of 2018.

Re posting images

1. Go to http://tinypic.com

2. Click on the "Choose File" button

3. Select a file and click "Open"

4. In the "Resize" option, select "Web/Email 320x240"

5. Select "Upload Now"

6. Enter in the phrase as prompted and select "Upload Now"

7. Copy the "HTML for websites" and paste it into a comment here.

8. And ... voila ... Du Rhinocerot

You might want the next larger size for detailed charts.

What really matters is "per capita" GDP, because if GPD is growing less than population, then, the population is on average getting poorer. The first image I show in The Investment Sinkhole post shows that for the six year period comparing 2011 to 2005, US GDP growth on a per capita basis was already slightly negative.

US population is growing about 1% per year. The US economy has been growing by less than 1% per year, so when we back out population growth, the result is slightly negative.

The situation with wages is even worse. Wages have not been growing as fast as GDP. In the graph below, I divide US wages (excluding government wages) by the total US population, and then take this dollar amount and convert it to 2012$ using the CPI-Urban cost index.

To read about the wage issue, read my post The Connection of Depressed Wages to High Oil Prices and Limits to Growth. On this basis, wages in 2012 are between the level they were in 1998 and 1999.

Gail:

Can you show where your wage data comes from?

I'm too dumb to figure out how to post my curves but using BLS data for wages and CPI I come up with weekly non-supervisory wages in the US peaking in 1971 at $114.85 (1967 dollars) and dropping to $97.62 in 2010. That's a drop of 15% over that time period. Most likely they haven't gone up much if at all since then. I use the 1967 base because at my age I relate better to those numbers!

Wow. Now that's something, a decrease in real wages since at least since 1947. I'm not surprised.

I wasn't able to reproduce EE's results.

1. I found no correlation between % change in quarterly oil prices (ave(wti,brent)) and % change in quarterly GDP from 1980-2012.

2. I found a very weak correlation between the two using the last 10 years of data (2002-Sep to 2012-Jun), but the trend was positive - a rise in oil_prices correlated with a rise in GDP. r = 0.41

3. Using the last 40 quarters but excluding the the last two quarters of 2008 and the first two quarters of 2009 (total 36 quarters) produced a data set with no correlation.

Script here

This kind of analysis raises lots of questions. A rise in oil prices could be related to increased economic activity (and therefore demand for oil) or to a supply shortfall. Possibly both these scenarios could apply at the same time. I've suggested before that, from the perspective of economic activity, oil prices could be considered as a negative feedback loop. There are also many other variables including the price of alternative fuels, such as natural gas, and the effects of efforts to stimulate the economy through monetary policy and other measures. It would seem that there are no constants - they are all variables.

The constant in my experience is spending power vs labour in hours. In other words how many hours does one have to work to pay the rent.

The number of hours I need to work to pay the monthly rent [for the same property I should add] as a commercial sector archaeologist has risen from 18.7 hours in 1988 to 52 hours in 2013. It should be noted that this includes the fact I have advanced in position from lowly site technician to a site supervisor role responsible for reports and analysis.

Thats an extraordinary hit on spending power. Now some may say commercial sector archaeology is an odd exception but if I compare wages in other jobs I have had in that time [archaeology has a record of intermittency since it is construction industry lead] which include bicycle messenger and sprinkler pipe fitter it is a similar story. I choose these two because I have done these jobs over a spread of years thus have temporal insight.

As a cycle courier in 1990 it would take about 48 "drops" "tags" or "dockets" to pay the monthly rent by 1998 it would take 70, in 2013 about 140. A frightening decay in wage power but some may say this is linked to the changing technological landscape [yes but what is your point?].

As a sprinkler pipe fitter [relatively high pay construction worker job] from 2000 to 2013 the hours required have risen from 37 hours to 48 hours. A job with inbuilt demand because large office/commercial properties have to have their pipe systems replaced every 12 years or so.

AFAIAC real wages have been shrinking a long time for manual sector work, even skilled manual sector work

I dread to work it out for energy prices

This would be happening with or without Peak Oil. Lots of manual work has been automated. Lots of other manual labor has been exported. Plus, in an enormous act of folly we've allowed tens of millions of low skilled immigrants to come in. Less demand for manual labor. More supply. The result is incredibly unsurprising: lower labor prices.

I keep telling people: You've got to move, make career changes, work harder, learn more and learn faster. This isn't the 1950s or 1960s when a rising tide really did lift all boats. That era is so gone and it is not coming back.

I am amazed at the level of complacency, denial, and sheer laziness. Declining buying power per hour worked is a loud signal. You've got to respond to it. Think it is bad now? It will get far worse at higher oil price points. Time to start training to get into a more lucrative line of work.

And, as everyone gets into that "more lucrative line of work", it will suddenly be another dead end, low paying job. Not a career. A job. There are too many people seeking work, and technology makes it possible for fewer people to do more work. It is so ironic, I think, that Karl Marx wrote about this so long ago. I've always been amused by that observation that Marx was right about Capitalism. Unfortunately, he was wrong about Communism.

Personally, I think those of us that focus on living with less and are rediscovering community are on the right track. But I don't know. And I'm not sure anyone else does.

I think you might consider that there are a lot of quite smart and energetic people out here who HAVE figured out this issue without your guidance, and that retraining only gets you that next nickel if there are some nickels to be got. My wife just lost out to Austerity/Tea Party-ism this summer, and managed to, with a too-excellent resume' and qualification, beat 99 others to get her next situation, a downgrade in every repect but for hours required.. my path is following the curve just as predictably, and I could easily blame myself, and sometimes do.. but I suspect it's not just individuals who are being 'complacent, lazy or in denial' ..

For the reasons we've all been looking at for several years now, the nickels are vanishing from the tabletop, and the tablescraps have apparently long since dried up and blown away.

There are now record numbers hitting our shelters and food banks, and the street corners have more and more become staked out with the next wave. This isn't generalized from the national news.. this is the streets around me, right here.

One retired tradesman I spoke with at the job I now enjoy was telling me that a search of the building permits pulled for the surrounding towns, which used to number in the hundreds per town, are in single digits now. He said like 'Six, seven in a town..' The million dollar days for such retailers as mine are ever more distant memories.

There IS work and training to do, but looking for 'more Lucrative lines of work' might not be the right way to angle for it. 'Far Less costly ways to live' is a more likely path to success now..

"There IS work and training to do, but looking for 'more Lucrative lines of work' might not be the right way to angle for it. 'Far Less costly ways to live' is a more likely path to success now.."

The catch is that certain fixed costs are eating people up. Mididoctors' example of rent increasing relative to wages is probably the killer of them all, as rent is typically the biggest fixed expense. It's very hard to find a 'far less costly way to live' when just having a PLACE to live is eating up any gains you may have made with not eating out, driving less, etc.

I think land/property reform is the final frontier of modern capitalism, the biggest thing nobody talks about. We had a mortgage crisis, but we didn't talk about what that really meant. What it really meant is that real property is increasingly in the hands of banks, speculators, and the rich, while those lower down the ladder live at the mercy of those above who get the luxury of setting rents.

FuturePundit has a point but the reality is that many are getting the shaft no matter what. A society needs even maids, janitors, and baristas. All these people need to be able to live. Not everyone is smart enough, ruthless enough, or has the right connections to climb the ladder. As it is we seem determined to ensure that those people have less and less. Ironically, in a limited collapse scenario many people who don't have much would be better off in some ways, as it would probably be much easier to get away with squatting!

Capitalism is increasingly looking more and more like feudalism to me, except instead of Dukes and Barons we have CEOs and VPs.

As far as rent goes, I get to hold the back end of that vicious circle, too. I have 4 units that we rent out, providing heat and hot water, and my tenants have not seen a hike for some time. We get to juggle with the balance of 'If I raise their rent to really reflect the price change in energy, do I risk losing great tenants, will I find any who can manage the new price or do I drop it again and risk bringing in new folks that much closer to their own wage sags and impending bankruptcies?

I've been trying to rework these two houses to assuage the running costs, but it's a very rocky race against time.

I think the Mortgage Lending standards we've all been indoctrinated to accept are a good example of the feudalism you describe. A big all or nothing, never-slip-up gamble with a one-sided endgame.

the rise in domestic workers has been noted where I live [Hackney N London.

You hear this sort of argument a lot and it seems fairly common sensical at first glance. But it can not be the whole story. The reserve labour force in the UK has sat at pretty much the same level for decades.

If you look at cycle messengers in London the number is holding pretty constant. surprisingly so. In point of fact one odd characteristic of the UK economy is the lack of rising unemployment.

In archaeology there is a shortage of labour! you can not get anybody to work for the pitiful wage and despite increasing demand the buying power is still declining. The situation makes no sense in simplistic economic supply/demand terms. what is happening there?

there is a regulatory stipulation in planning law to deal with archaeological deposits and people are desperate to get it out the way? Why has the value of that labour declined. quite odd?

I mean it's not like one can outsource archaeological deposits to China.

Ron, first of all, thanks much for explaining how to post an image with Tinypics. I would never have figured it out in a hundred years if you hadn't explained it. One reason it took so long to reply is that I lso had to learn how to use Powerpoint to save images in a png format

And just to be clear, in my graph of quarterly GDP change, I am graphing quarterly %change in GDP against the ACTUAL quarterly average oil price (average of WTI+Brent).

OK, so the first graph below is my graph of GDP change vs. oil price, with the 4 quarters excluded as explained earlier. Now I do understand that the R-Sq. of this plot is poor, but then I don't think anyone expects oil price to be the only thing that affects GDP. However, what I have done is to go back and selectively eliminate the data all the way back to 2008 and it is amazing how consistant the trend line has remained since then. I think the trend line back then would almost overlay the present trend line

Just to explain, I have also added the inflation lines to make it easier to see when nominal GDP reaches potential inflation, at which time, of course, real growth would be zero. And I have also added the second graph plotting monthly oil prices since 2002, which should be identical to everyone elses plot of the same oil prices.

Of course, my one worry is that any time one finds a graph that verifies one's beliefs, that a mistake was probably made someplace, so I will be interested if anyone can find fault with this GDP-oil price relationship

Thanks again.

Oh, and just to explain that the yellow data point is the most recent data point while the 3 red data points are the 3 before that. The 4th quarter GDP will get revised next week, and usually the revision is upward, but not always.

Okay, so I'm following you now.

(A chart is worth more than a wordy post)

A couple of notes.

1) The effect of eliminating 2008Q3-2009Q2 decreases the slope of your relationship. The intercept without the exclusions is around $113 a barrel (ave(brent,wti)) and with the exclusions at a $184 a barrel. However, the correlation in both cases is pretty low around .35.

2) Using data from 2002Q3-2012Q2, but including a 2 quarter lag in which I check GDP growth 2 quarters following the oil price, increases the correlation to .59. And decreases the intercept to $91.

3) There is no correlation reversing the lag. There is no evidence that changes in GDP correlate with oil prices in the following quarters.

4) To understand the relation, understand the definition of GDP which is basically: consumer spending + govt spending + investment + exports - imports. As long as we are a net importer, higher oil prices (assuming constant demand) increase import costs and lower net GDP.

5) The .35 correlation for GDPgrowth-oilprice probably reflects the immediate effect of increasing/decreasing oil prices on GDP via import costs. I suspect that the higher correlation 2 quarter afterwards reflect the effect of increases/decreases rippling through the rest of the economy.

6) I think it's fair to say that this implies that the oil prices are supply driven and not demand driven. If demand was driving oil prices, wouldn't we see some evidence that rising GDP increases oil prices in the following quarters?

At what timeframes are you checking lead/lag effects? A jump in GDP from other causes would presumably be reflected immediately in consumer prices, and then later for upstream impacts. Going the other way, production issues would presumable flow the other way, as higher operations and recovery costs affect producers, then pipelines and refineries, blenders, and finally the consumers.

There is probably no way to completely decouple any analysis with so many obviously overlapping factors, but the regression you guys are doing against the core indicators seems pretty compelling, as it is logical as well as empirical.

Certainly makes more sense than saying "speculators" at every upturn and "energy independence" for every downturn in price.

I was checking 1, 2, and 3 quarters before and after.

My point 6) regarding price being demand driven -v- supply driven is wrong. We need to look at global GDP, not just USA, since demand and prices are set at a global level.

So the soft conclusion is that US GDP growth (ie ... US demand) is not driving oil prices.

Thanks for the reply, Ron. Although I don't quite understand why you think that deleting the 4 negative GDP/low oil price data points from the lower left corner of the graph has decreased the slope of the line , at least you don't seem to find the graph to be bogus.

Since the two graphs together imply that real economic growth goes permanently negative after 2018 (and probably before then, assuming higher inflation), and since they are both based on trends of hard data (not gut feelings), then that is the time frame I personally am expecting.

Of course, the graphs themselves really aren't making any predictions about Peak Oil, only that the steady, ongoing increase in oil prices will kill economic growth by then. But I find it also interesting that the only 3 "hard" Peak Oil predictions I know of also see Peak Oil occuring in that time frame as well, as follows:

Robert Hirsch [2013-2016]

Oliver Rech, formerly of the IEA [“between 2015-2020”]

David Demshur, CEO of Core Laboratories [production decline begins after 2015 or 2016]

So basically the crap hits the fan some time in the next 5 or 6 years. Not a lot of time to prepare.

Let's just say that you and I are drawing different conclusions from this data.

Recall the definition of GDP:

consumer spending + govt spending + investment + exports - imports

We've both seen that higher oil prices act as a drag on GDP growth.

And there is a both an immediate and a lagging component to that drag.

The immediate impact is that we spend more on oil imports.

But over time, we are both producing more oil and using less,

leading to a decline in oil imports.

And that decline should lead to an economy

in which growth/decline is not so closely tied to oil prices.

Thanks for the initial post. It's given me lots to think about and I'm not done with it yet.

Gas prices, which have risen every day since January 17th are pressuring the critical $3.80 level that has capped valuations for the equity market in the last three years.

http://www.zerohedge.com/sites/default/files/images/user3303/imageroot/2...

I still think that it is kinda funny considering all the "USA will be energy-independent!" articles that have come out in the past few months based on fracked tight oil.

Re: Underground Nuclear Tanks Leaking in Washington State, above:

Surprized? No threat? From Wikipedia:

"highly radioactive waste is traveling through the groundwater toward the Columbia River:

This vast agricultural area exists almost entirely due to the Columbia River water endowment. Just sayin'. No need for alarm though. From the first quote:

Repeat the mantra: ...no threat, no threat..

More, from CNN:

As a person whose irrigation water comes from the Columbia, I'm going to have to point out that the irrigation water you are referencing comes from above Grand Coulee Dam, which is well above Hanford both in river flow and elevation.

The irrigation flow comes down Banks Lake, past Moses Lake, to Potholes Reservoir, then down toward the Columbia River, with the leftovers meeting said river more or less across from Hanford. They can pollute everything downstream of the Hanford Reach to Portland and then out to sea, which would be bad enough, but the Columbia Basin is not at risk.

See map in the link;

http://en.wikipedia.org/wiki/Columbia_Basin_Project

By the way, besides the usual cesium and strontium, two other isotopes of interest are iodine 129 (the long-lived one, 15.7 million year half-life) and technetium 99, (211,000 year half life) That probably didn't cheer you up any, but it's better to know.

So I don't have to worry about my Walla Walla Sweets glowing in the root cellar. Good to know.

Looks like plenty of irrigation being done downstream of Hanford. Is all of this sourced from upstream of the site?

If it's East of the Columbia, then it is watered from the Columbia Basin Project, the Snake, or the Walla-walla.

Another system on the west of the Columbia is irrigated from the Yakima River. That is the green band from Yakima to Richland.

The other patch of green on the river south of Kennewick and and across from Oregon I'm not so sure about. A lot of them are center-pivots from wells, but whether they recharge from river water or from the hills to the north I can't say. Oregon's aquifer in the area is probably coming down from the Blue Mountains.

Two things easterners often miss is that the Columbia is at the bottom of a ditch. Google Maps is less forthcoming about elevations than it might be, but at Richland the river is at 341 feet. Tricities airport is 407 feet. From there it climbs rapidly. Potholes reservoir, the mid point of the irrigation system is 1043 feet. Lake Roosevelt is about 1290, and Banks Lake is 1570. 12 Pumps of honking bigness (65,000 to 67,500 HP each) pump the water from Lake Roosevelt to Banks Lake. Six of them can run in reverse to generate power in pumped storage mode.

http://www.usbr.gov/projects/Project.jsp?proj_Name=Columbia%20Basin%20Pr...

The pumping station details are about 1/3 or the way down the page.

The other thing easterners miss is the concept of water rights. Just because you are sitting on a river does not mean you can run a pipe out and pump out all you want, or even any at all. Just because irrigated land is found near a river does not mean the river is supplying the water. Water rights out west are very complicated. When the State tried to enforce it's claim that they controlled all waters in Washington, the courts blew their case full of holes and sent them home. Which was fine as water-command empires do not have a good historical record.

This has been going on for more than 60 years. Furloughing some Hanford workers will make little difference. I worked at Hanford on the cleanup in the late seventies. The tanks were leaking then and now we have reports saying that they are still leaking. Hanford is more of predicament than a problem that can be fixed.

As I was leaving they were discussing a plan to encase the Hi-Rad waste from the tanks in glass. That is still the plan forty years later. Nothing is easy at Hanford: not the politics, not the management, and not the engineering. Unknowns are everywhere. Risk is discussed in unknowable terms of millenniums. Maybe in another forty years they will declare success and announce the creation of the Hanford Wildlife Refuge.

At it happened, I was associated with an environmental group that let me review the EIS for the Savannah River Plant back in the late 1970's. Their tanks weren't in great shape then either, although there weren't so many of them...

E. Swanson

Almost anything poisonous enough to keep people away are good for the wildlife.

We present, for your viewing (from a distance only) pleasure, the Rocky Flats National Wildlife Refuge, site formerly used for production of plutonium pits for bombs. The DOE declared victory in the cleanup effort in 2006, but records on the extent of the original contamination have been sealed and are unavailable. No public access has been allowed since the refuge was created. Recent reports have included the statement, "the contaminated ground may prove too dangerous for the U.S. Fish and Wildlife Service to restore."

Maybe it's a shame we DIDN'T go all Fallout-style nuclear happy. We would probably have more wild spaces left, if only because we can't enter them... As it is, we seem on track to wipe the globe clean of non-domestic life instead.

Part of the area bordering Hanford (drag NW) is the Saddle Mountain Wildlife Refuge. To the east, across the river, is all irrigated farmland. It's a bit surreal seeing that much food being grown smack up against one of the most contaminated sites on the planet.

"It's a bit surreal seeing that much food being grown smack up against one of the most contaminated sites on the planet."

Most of Hanford is not contaminated at all. The contaminated locations are small, at least by Western standards. Granted they are really really contaminated. But remember which way the water flows.

And hope they keep it out of the air. That intentional iodine release they did in the bad old days blew right over the farmland, which admittedly wasn't there then. But there was dryland wheat a bit further down wind.

I remember some people wanting me to go there in the late seventies when I was unemployed looking for me. Wonder how my life would have turned out if I had gone. I remember some sort of quote from a decade or two, something to the effect "it took the government Xbillion dollars to make this mess, now we have guaranteed employment forever, as they will spend $Ybillion trying to contain it. Maybe the latest press-leaks are just another attempt to keep the gravy train rolling?

I have a cousin who works for a company that develops plans for toxic site cleanups and oversees execution of those plans. He told me once that they had been asked to bid on developing a plan for some aspect of the Hanford job, but that after looking at the classified material, decided that some things are just too risky to be associated with. As I recall his telling the story of one of the early meetings, a company chemist got very pale and asked, "You mixed what together in the same tank?!?"

Repeat the mantra: ...no threat, no threat..

http://www.reuters.com/article/2013/02/23/us-usa-nuclear-leak-idUSBRE91L...

That is the mantra of the its all ok at Fukushima - no one died right away.

Link up top: Saudi sets out roadmap for major renewable energy programme

Saudi is looking to the future. They are going all out to produce solar energy now and nuclear energy in the near future. And with good reason, they look at their ever increasing consumption and declining production in their old giant oil fields and know that they need to do something drastic and very soon.

One thing concerns me about solar panels in Saudi, dust. Saudi is one of the dustiest places on earth. Winds sweep across the hardpan scrub lands and desert sands and pick up tons of very fine dust. Saudi is one place where you can see the wind. The dust settles everywhere. It settles in tiny piles inside your house just beyond every tiny opening in your windowsill or other cracks.

Saudi employs an army of "insulator washer trucks". Every high voltage power line has a road built under it. Trucks with water spigots travel up and down the line hosing down the insulators. They gather dust and the dew soaks the dust and creates shorts. So every insulator must be hosed down every few weeks to prevent arc-over. (No, the power is never cut off for this. The water is not one continuous stream but short burst.)

But wouldn't the solar panels need the same washing down? Wouldn't the dust accumulate and block part of the sunlight, degrading the output from the sun? Just a thought.

Ron P.

Yes, solar panels need periodic cleaning, though not as much as you would think, since the wind will blow some of the dust off as the Mars Rover team discovered. I think the real point is that the entire region is in no way able to support the 27 million people in the KSA. Limits to growth, overshoot, all that. Anyway, keeping solar panels clean will be the least of their worries, IMO.

Ghung, off topic question but can hail crack or even shatter solar panels?

Yes, hail can shatter PV panels. They (most) are tempered glass, and built tough. Mine have survived hail in the 2-3 cm range. While there is no requirement that manufacturers test specifically for hail resistance, most do for overall impact resistance:

I made sure that our homeowner's policy covers hail, wind, and other damages to our PV. I think it added about $20/year to the policy. Panel spec sheets have all of the various tests and certifications that the panels meet.

The Suntechs I just received show all of these, and more:

ISO 9001: 2008, ISO 14001: 2004 and ISO17025: 2005, IEC 61215

• Tested for harsh environments (salt mist and ammonia corrosion testing: IEC

61701, DIN 50916:1985 T2)**

Thanks Ghung. Just trying to understand the risk factors, before going forward. We have some friends that just had a solar system put in and they are off the grid, so we will be asking them many questions and possibly put in the same or similar system. Would love to go off grid to save money, to avoid power outages of which we get many in this rural area of CA and in case of you know what; collapse.

I have installed about 20 solar systems and three years ago we had a bad hail storm.... it broke a lot of windows on cars and big dents in the cars...but none of the solar systems had damage...just sayin...

They shoot solar panels with "hail" out of a big "gun" at something like 100 mph to

test them.

I've had 50 up for 15 years: no damage.

Seem indestructible. Real bullets no doubt different story.

Not Bushmaster proof.

Mars doesn't have dew though. From that earlier comment, morning dew might soak into the dust, dry off during the day and turn it into something like concrete.

Mars does get occasional frost (water or CO2). I can imagine some mornings the dust may have some ice crystals in/on it.

I've considered that. Cleaning systems can be developed fairly simply, a solar powered washdown system that recycles most of its water, or give some of those younger unemployed folks something to do. Sand erosion may be a bigger issue, but with PV at $0.32/watt per container load, who cares. Just replace them more often. Betcha the KSA is working deals with the Chinese at half that price. Cheaper than refueling a nuke. Send the old out-of-spec panels to Yemen or Africa.

I'm used to folks and markets holding PV to a higher standard than other generating sources, but there was a time I made a pretty good living getting repaired components to hydro, fossil, and nuke plants, tout de suite. It wasn't cheap either....

...and I don't mind cleaning the bird poop off of our panels periodically.

Ghung. I'll bet where you lived, if you never washed them, you'd still get 99% production. If it rains every couple of weeks, that usually does the job for you. [Of course I am a bit hyper about washing mine, as our water is notoriously "hard". But during our long dry (as in never ever) season, I do have to wash every 6-8weeks. I bet SA is dustier than where I live.

Where do you see $.32/watt? Current best manufacturing costs are more like $.50. I can't see China agreeing to sell gigawatts of panels at a big loss (unless they get a sweet deal on oil as a kickback). And SA is starting from essentially zero, as far as PV goes. They've announced impressive plans, but I think there are few panels in country as yet. That sounds a lot like Peru, a few gigawatts in the announced projects but only a few megawatts in country at this time.

I have to think it wouldn't be difficult to factor into the designs for Desert PV Farms, a sacrificial layer of glass above the panels, so that progressive dust abrasion can affect that layer.. or similar to animals that have extra underwater eyelids, some kind of shields that can slip in place over the panels when a designated dust level in the air is reached..

Everything you put over the panel reduces its efficiency, dust, glass, water, air...Bird droppings even

Sure it does, but you can choose how much efficiency to sacrifice in the name of extending your equipment lifetime. This is done all the time with basically all systems. This is partly why I suggested the option of having retractable but transparent storm shields, so that the Panels could be getting full sun when conditions were safe for it.

You can also build your PV farms with simple reflective components to compensate for and even surpass such losses, and these could be put within the Glazed Space, if they would benefit from protection from Sand as well, like the Solar Troughs being used at some Gas and Oil wells.. A PV panel boosted to even 2, 3 or 4 suns depending on its tolerances could find a new sweet spot to allow this additional, but Modular, Durable and Replacable added equipment to succeed.

There are some parts of this that are adding complexity, but not an awful lot. None of that is as involved as Turbine, ICE or even most Tracking technology.

The Moron's Guide to Global Collapse

Yesterday I posted, on Amazon.com, the following review for this book:

From your link, the author is "...a former Teaching Fellow in Music History at Juilliard." I suppose, somehow, this makes her uniquely qualified to write on the subject of dastardly government cover-ups and collapse.

Jenna Orkin...she's Mike Ruppert's friend, isn't she? Can't be too surprised at the subject matter of the book.

Well, if it turns out that they're on the right track they might deserve a few more stars...

Ron... I believe the title of the book should represent what is inside. That being said... conspiracies, manipulations, assassinations, cover-ups, military coups and etc only take place in movies and Hollywood, and not in real life.

However, this has nothing to do with energy.

That just the point, global collapse has everything to do with energy. That's why I bought the book. And there were chapters in the book, which I viewed from the "look inside" option, that talked about peak oil. I thought it was a book that discussed collapse as did Tainter, Diamond and others. And I assume there are others who may think this is a book about energy and might be inclined to buy the book. Hope I saved them the time and money.

Actually I bought the book along with another, both about collapse. I was steered to the other book by an article posted by Ugo Bradi: Cassandra's Legacy: Immoderate Greatness: the narrative of collapse. That is a very short book but a very good book. And it is all about collapse. I have read it once and am currently reading it again. It is that good.

Immoderate Greatness: Why Civilizations Fail Amazon.com

I will be writing a review on that one in a couple of days.

Ron P.

Ron... I realize collapse has everything to do with energy. My reference was towards the "Conspiracies et al". It was my attempt at sarcasm.

I caught that one. Actually, collapse will provide a particularly fertile ground for all of the things you mentioned. Conspiracies, coups, etc. Not that they don't occur regularly anyway, but severe conditions tend to lead things in radical directions. It's just a big mistake to see these as a cause of collapse when they are usually a result (though they sure can speed up the process). The most obvious one is the Arab Spring in Egypt - the US very publicly backed Musharraf for many years and only grudgingly turned away from him. If there was a conspiracy, who backed it, for what purpose?

As for 9/11 "trutherism", my retort is, "if they wanted to get the oil, they could have blamed the Saudis - 15 of 19 were Saudi, and there were ties between many "charity" organization and royal family members of SA and Al Qaeda. If they wanted to go to war in Afghanistan, they could have talked about the abuses of the Taliban and gotten the UN and NATO on board like in former Yugoslavia. So what was the point, again?"

Looking at what actually happens, it seems the emotions of the leaders are more important than any long-term goals. The invasion of Iraq was transparently driven by family politics. The Pakistani backing of extremists seems driven by a desire to get back at India and the US, but the extremists are much more dangerous to Pakistan than to either of these countries (see the Taliban takeover of Swat Valley and subsequent offensive). Heck, the early form of the Taliban was funded and armed by the US to fight the Soviets! There is no 'intelligence' showing there. There are plenty of conspiracies but they tend to be obvious, stupid, and short-sighted. Making up complex theories for why X is happening overestimates the cunning and intelligence of the people at the top.

Modern Islamic extremism, is very much a product of Wahabism. Wahabism originated in Saudi Arabia, and is the official religion of the country. That doesn't mean the power that been in SA were involved. But, their branch of the religion creates extremists.

Well, let me reword my comment. Collapse has everything to do with energy, and a lot of other things also. Or at least that is William Ophuls' opinion. From Immoderate Greatness, Bibliographic Note, page 73:

So that is where he disagrees with Tainter. Tainter argues it is all about net energy, EROI, and the like. Ophuls argues that energy is definitely one of the causes of collapse, but so are a lot of other things. He doesn't talk much about dept or inflation but I would include those things into the causes of collapse. Just look at what's happening to Greece or Ireland right now. Of course debt and inflation have their causes and declining net energy may very well be part, or most of the cause.

Everything is just so interconnected in our complex society that it is impossible to put your finger on any single cause. Everything is caused and is a cause itself.

I am now of the opinion that we are living in the last days of civilization as we know it. But collapse has not happened... yet. But when it does, due to globalization, it will be a worldwide collapse. Oh it will start with one government collapsing, then later another and then another, and soon the whole thing comes crashing down.

Oh well, have a nice day.

Ron P.

Really you think collapse is imminent? I take heart that it has not happened yet...look at all the pressure in Europe and it is still holding together...I am a little worried about my piers in The US though... if you talk about any of this most people don't want to hear it and stick their head in the sand...The wealthier someone is the less likely they are to believe that we have a huge storm coming are way but collapse I just don't know....maybe a restart...but not a collapse....some people like chaos and thrive in it and hope for it when it is not there...

Well the process has already started. We are already in serious danger of slipping over the cliff. Or a better analogy would be snow building up way too deep on a steep slope. Some event will trigger it and it will be a cascade from there. I have no idea when this is likely to happen but I would not be surprised if it were within 10 years.

I really cannot blame people for not wanting to believe in the eventual collapse. If I were a younger man I would very likely be in denial myself.

Ron P.

Well if we do not have a collapse then we will cook the planet with Co2 emissions. I do not think collapse is the true doomer view; the real doomers are the BAU crowd.

I have to agree with you 100% there Ron. When collapse comes it will be such a surprise to so many, yet it seems so obvious whenever I try to follow a logical sequence of what is likely to happen.

Of course any one logical sequence of events imagined will not happen exactly, yet the globalization you talk of is what will get us into the most trouble.

I believe that the final unravelling of civilization will revolve around lack of availability of food in cities. What causes this will be/can be any combination financial/energy related brickwalls, yet it will be lack of food that creates the anarchy.

Currently all the major Middle East exporters of oil are net importers of food, and most of the major exporters of food are importers of oil. There is a recipe for disaster right here, and Westexas's ANE shows trouble dead ahead.

As oil becomes more expensive, so does food, the oil exporters can easily have their own arab spring, the oil stops flowing, the farmers stop growing, eventually food stops flowing to the cities of the west, game over.

I wish you were wrong, but you are not.

"When collapse comes it will be such a surprise to so many..."

It's clear that we aren't wired to assess the amount of negative synergy acuumulating in our systems. We'll likely never know which straw broke the camel's back... I'm not sure how surprized folks will be, but I expect many will be horrified nevertheless. Best hopes for slow collapse.

The strange thing about humans (well, ONE of many) is our need to define a causality chain with an accompanying narrative. There always MUST be a proximate cause, and a simple cause and effect HAS to be found. If you look at reports of major catastrophes there are engineering reports that list all the contributing causes and overlapping issues, but somebody always pushes for the one-line cause: "operator error" or "equipment failure".

A robust complex system can tolerate multiple faults, so a catastrophic fault generally means there are mutiple simultaneous events acting upon a system already under stress. That gets you to the "straw" we crave, but such thinking distracts us from noting there are overloaded, tired, old camels all around us.

Me, I don't look for certainty and straws anymore, but for major factors and big events causing statistical impacts. A pity the human brain is bad at statistics...

I speculate.

Following the logic of recent years, the most rapid manifest symptom might be a sudden forced retreat from the very recent huge expansion both in world trade and financial globalisation?

If that were to happen it is not clear to me who might feel the result most keenly. It could be that many regions might covertly benefit from a sudden and drastic re-balancing of world trade. Diminishing available net oil exports draws an increasingly tight noose around the USA, and could set the scene for something rather sudden?

The EU seems set to burn Algeria's resources, but must cut deals with Russia and my guess also is that the EU would also be very diminished if the USA lost its position as chief beneficiary and hegemon of global trade and if all its overseas trade contracted?

The USA imports and uses vast amounts of most industrial world resources, but it holds the international food-related export trade apparently as a trump card. (This is important, even when only about 10% of world cereal grains are internationally traded, and when a lot of that goes for animal feed. About 20% of world wheat enters global trade and is critical for some counties although this year an increased proportion of US wheat is going into domestic animal feed because of poor harvests, I assume.)

There might be, however, future ways round USA grains exports at least for larger key players?

"We'll likely never know which straw broke the camel's back"

We won't, but people in the 22nd century should be able to figure it out.

On the other hand, the anthropologists still don't know what caused the Late Bronze Age Collapse.

http://en.wikipedia.org/wiki/Bronze_Age_collapse

Empires dropped like flies, and people were on the move on a grand scale. But why remains elusive.

There are factors in place that slow this scenario: tankers in route, stock piles, strategic petroleum reserves, fuel rationing, luck and geopolitics. The scenario played out in 2011 with the revolution in Libya (disruption), crude oil stocks drawn down, Tohoku earthquake and tsunami in Japan (timely luck reducing demand), the EIA SPR release in Summer and NATO air strikes to timely end the Libyan revolution (geopolitical action). Decades of pressuring and degrading the system will be required to weaken it enough for your scenario to play out. For collapse to occur in the near term, a huge disruption would be required, such as 1/3 of world crude oil production suddenly being shutdown and stranded from a war between NATO and Iran.

Ron,

You and I are about the same age and share most views of the future. I'm beginning to wonder whether our ages (mid-70's) has a bearing on how we arrived at our beliefs. Is it because younger people simply have not had the actual historical experience we have?

They have not experienced a "Depression", a world war and subsequent smaller wars, economic and societal change, etc. I know one reason I'm a prepper is I saw the impact of the Depression on my parents and their families and I swore I would do everything I could to avoid a similar situation.

We experienced "reality" whereas younger people are only guessing about possible futures. By this I mean, they haven't experienced living in a low/lower energy world, living where someone else didn't provide for their entertainment, knowing that more doesn't have to be associated with a less happy life and so forth.

The same thing applies to skills. I won't belabor this but people took care of what needed to be taken care of themselves without relying upon an outside "expert".

From my/our vantage point it is impossible to not see the collapse as it proceeds.

Todd

It has also occured to me that, as we get older, we may be projecting our own sense of pending personal doom onto society at large. Then again, I've been wrestling with the doomer thing since I was a child; perhaps started when my father was building a bomb shelter under our house when I was five; duck n' cover,, all that. That said, I've also factored these things into my assessments, which haven't changed much. The trends are pretty clear.

I've seen that accusation made many times against doomers: they're old people who just can't stand to think of the world going on without them.

I don't buy it, and I don't think this is a particularly fruitful way of thinking about things. Lots of old people are cornucopians. Indeed, research suggests that on average, older people are more optimistic (or maybe it's that optimists live longer). And lots of young people are doomers (if "Doomsday Preppers" is any indication).

Todd, I was born during the depression, 1938, and don't really remember it. However I remember so many stories that my Dad told and the stories of the others who sat around the pot bellied stove at the local country store near the farm I grew up on.

And I must disagree with Ghung, above, who suspects that because we are so close to facing our own doom, that we are more prone to see the world as being doomed. Actually I am far more optimistic than many doomers. Some may call me a wide eyed optimist but I believe there will be survivors ;-)

Actually I have been a doomer since my late 20s when I began reading lots of non-fiction books on nature, history and scientific subjects. And I became more hardened in my doomerism as the years rolled by. I have seen the population of the world triple in my lifetime. That, in itself, should make anyone pause and contemplate the trajectory humanity is taking.

And since I am a science and nature reader I know what is happening to the world. Everything is going from bad to worse. Water tables, because of irrigation are dropping in China and India by meters per year and almost that much in the rest of the world. Forest are disappearing, deserts are expanding, ocean fisheries are disappearing, species are going extinct. And of course I could go on and on but you have heard it all before. And I didn't even get around to declining fossil fuel.

And the cornucopians say... "but the world population will level off at about nine billion." That is truly absurd. Seven billion people are destroying the earth and they think it will just be all okay if we can hold the population to nine billion? We will never make it to nine billion, not even close.

Ron P.

And notice those cornucopians never factor in per capita consumption. This is despite the fact that most assumptions cornucopians make is people will become more prosperous in the future. This just makes this assumption of sustainability even more silly.

Here I am having a nice Sunday, and you push a button, so the dark scenarios play over again.

Given where we're at, all the potential futures look bleak. Population is a major factor, probably the largest one, and the least discussed and dealt with. The most direct paths for population control are brutal and abrupt - pandemic, major nuke war, etc.

I've given up on reasonable collective action, but I still want a good life for my kids. That means a whole bunch of other people need to exit stage left. I can only assume that as rationale beings, they would say something similar.

Take a few steps further and ugly options abound. Most individuals can't incite a nuke war but there are a bunch of people who could smuggle out a few bugs or bio-engineer their own, and the overcrowded slums and feedlots are rolling their dice continuously. It's only a matter of time before a pandemic comes about.

The meme, touted hourly on networks like CNBC, is that there are no limits as far as the eye can see. Just get the right formula and deregulate everything and there are blue skies forever. This just encourages criminal exploitation and neglect of the foundation of our economics -- our dwindling natural resource base. They are not even having the right conversation.

Most cornucopians seem to decry the idea of the population levelling off at any point.

A lot more of our stories are written, then we have left to write... and that does bring a certain perspective. Eventually it does get pounded in that you alone are responsible for your actions and you cannot count on anyone but yourself to do the right thing. Having survived this long, and everything the culture could throw at us we've begun to put more faith in our own judgement than that of others or our culture or our government.

My father till he died this year always grabbed that package of crackers that was extra, a hold over from the depression, I came of age when my government decided I could go kill for them whether I wanted to or not. The "80s" recession did me in and I headed "back to the land" I saw a lot of people fail at that and was surprised somewhat that I was stubborn enough to keep on. So when the wind and snow howl up here we're snug in our mortgage free home, wind&solar provide the power, wood from the woodlot the heat. I have a tendency to listen and just smile a lot now... doesn't seem much sense in wasting the words nowadays.

Don in Maine

Most people I know in their 70's don't want to believe that there are problems...probably because they are so invested in the system....gotta keep those checks rolling in.gotta another trip to Europe planned etc..this is especially true if they are Obama fans....look how great the stock market is doing and housing prices are up as the greedily count their fake money...I personally feel like the route we have been on is unfairly tilted in their favor and I am developing resentment to older generations. Why should we have to keep supporting their medicare and SSC when there is very little chance we will get it in the future? Our political parties are promising everything under the sun just to get re-elected...there are no jobs for the young in this country and it is the young that start revolutions and topple governments.

On the one hand you are mad at the older well off. But then the only thing you propose is screwing the older not well off who need medicare to survive. I think that the right wing has you right where they want you. It is called misdirection and they have been immensely successful at it.

Start by redistributing the wealth from the rich before you start attacking medicare as the solution.

Yes, it is always possible that no one will be supported in the future with respect to income or health care. However, your approach will guarantee that.