Debating to the numbers (or more on Saudi production)

Posted by Heading Out on September 28, 2005 - 11:30pm

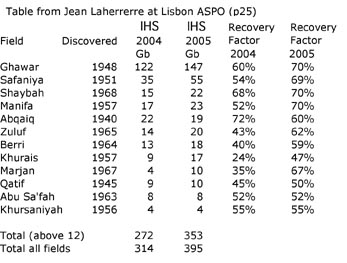

Saudi Arabia, the world's largest oil producer, will 'soon' almost double its proven reserve base, adding 200 billion barrels to the current estimate of 264 billion, said the nation's oil minister, Ali al-Naimi.And in that regard I thought I would post the numbers from IHS that Jean Laherrerre cited on page 25 of his presentation at the ASPO in Lisbon this summer. (available here ) (Site corrected - thanks Stuart).

It should be noted that IHS, I believe, owns CERA. Further that, as is noted in the article, the gain in reserves comes from a change in Recovery Factor, and, while I have commented on this table before, I did not give the entire list. This time I have only included the IHS numbers, since they are most relevant to the discussion.

The remarks yesterday about additional production having to be produced relatively rapidly were related to thinking that Saudi Arabia might be joining Canada, Venezuela and others in counting "tar sands' as potential reserves, since there is that tar mat on the Eastern edge of Ghawar that Matt Simmons writes about on pages 173 - 175 of his book. (It also appears in some of his slide presentations).

My point yesterday was that despite potential changes in overall reserve numbers for the next few years Saudi production is pretty much tied to current projections of performance, because of the lead times involved. Borrowing rigs to do more drilling in existing production fields, or to do more detailed exploration in their offshore fields, indicates how much they are willing to commit to trying to make even those targets. Since those numbers are now used by most in reviewing the levels of achievable production in the short term, nothing has changed. At least nothing for the better.

The difficulties in getting the metal for rig production, and the limited number of folk that can make to the technical requirements that Aramco must have to create their more sophisticated wells will also play a role in probably slowing the rate at which they can bring their new rigs on line.

UPDATED however, thanks to Leanan who cites this article apparently the first of the rigs has already arrived and it is planned that it be used to drill new prospects rather than existing fields.

"The Karan-6 location is actually one of the shallower prospects," said Mulaik. "Several of the locations will require more than 6,000 m of drilling. However, the Ensco 76 can drill up to 9,000 m." A second exploration rig will join the Ensco 76 during 2006 in drilling deep exploration prospects in the Gulf. The two rigs will drill 11 prospects scattered through Saudi territorial waters. The entire project will last from five to six years. This reflects a substantial investment by Saudi Aramco to discover new gas fields.However it should also be noted that these rigs are being used to look for new gas fields, rather than new oilfields. It does however note that an old rig has been refurbished and

SAR-102 is now back in action, drilling and working over oil wells in the Ghawar field and helping Saudi Aramco meet global energy demands.In talking about Ghawar the Minister said

Saudi Oil Minister Ali al Naimi who said production would increase by April 2006 and that the field had yet to reach its peak capacity. Saudi Arabia had planned to increase its crude output to 12.5 million barrels per day by 2009 but, according to Nawaf Obaid, managing director of the Saudi National Security Assessment Project, a government consultancy firm, “due to higher spending and soaring oil prices, the target will be met by mid 2008.”Well the article mentions that the Aramco drilling rigs will now be increased to a total of 110, which is 20 more than the last number we quoted, earlier this summer. And that, in itself, sends a message. The realisation that Rita did serious damage is now getting more coverage but unfortunately at a time when other political events are starting to grab the attention of the MSM, and thus the public. It may well be that this will make the next step up in prices that much more of a shock when it arrives.

Is there something unusual aabout the saudi oilfilds?

For those of you unfamiliar, I explained this kind of graph here.. It will be interesting to see if the Saudi's can raise themselves off that straight line to 180gb. A 180gb URR with the last pre-Saudi Aramco OOIP of 530gb would be a recovery factor of 34%. Looks a lot more realistic to me than believing with Mr al-Naimi that URR is going to go to 570gb (or even 370gb with the existing proven reserves).

picture here

so if this model is true, they are probably past peak right now and they will have a high depletion rate. Conversely, you can take their current production figure around 11 mbpd and compute the corresponding URR which gives 229 Gb.

HO, where are you getting your stats on Ghawar? (I looked at the linked page, and didn't find a cite there either).

Greg Croft has different stats:

http://www.gregcroft.com/ghawar.ivnu

Ghawar could be dug up and steam cleaned if the field is shallow enough. Think in terms of the overburden/ore ratio. If Ghawar is one hundred meters thick, ten thousand meters wide, and one hundred meters down, then it is doable. Most oil fields are much thinner, much deeper, etc. I have no idea how deep Ghawar is though I know it is thick and wide.

It isn't that simple. You have fires, rock bursts, degassing, etc.

The Russians build mine shafts under one oil field and drilled up into it to get the oil out, but it was not economic and they shut the project down.

Probably we won't strip or shaft mine Ghawar. Maybe some other oil fields. Not looking important on a global basis.

Right. No explanation is set forth in your remarks, HO, or from anyone else. Nor will we ever know until some years have passed. "Most reviewing the levels...." are talking to Aramco. It's what we call in the logic business a "closed world" -- basically a "Black Box".

However, our love for Ali Al-Naimi is undiminished by his latest shenanigans.

CERA believes that NGL/condensate will account for 18% of OPEC liquids production in 2010.

http://www.cera.com/news/details/print/1,2317,7453,00.html

NGL liquids play a very large role even today. NGPL (which does not include condensate) was 11% of world oil production in 2003. Saudi Arabia alone produced 1.2mbd of NGPL in 2003 (125kbd more than in 2002).

In his May 2005 discussion, "Forecasting Production From Discovery", he notes that the difference is important:

Further down, he concludes (among other things):