World Crude Oil Production Forecast using Current Fields and Future Megaprojects

Posted by Sam Foucher on December 28, 2006 - 1:18pm

This is a guest post by the ace.

Being an oil and gas investor, I have a keen interest in forecast world oil production and its impact on oil prices and the global economy. After reading Khebab's story about many different production forecasts, I decided to build my own model using Chris Skrebowski's megaprojects (each project > 50,000 bpd) database and some decline rate assumptions. The annual decline rates vary from 4% for new fields, 6% for mature field workovers, 7% for mature fields to 14% (for specific field decline rates eg Cantarell). The model has 95 new megaprojects/workovers and 120 existing fields.

Each production forecast for a

megaproject assumes simplistically that peak production starts on day 1 and

decreases according to the corresponding annual decline rate. The annual decline

rate is converted into a monthly decline rate.

I update the model for new EIA monthly data and new/revised project info. For example in Iran, Yadavaran and Kushk/Hosseinieh were counted as two projects on Skrebowski's database. Only Yadavaran is counted. Upstreamonline stated that they were different names for the one project. Indonesia's Jeruk which is on Skrebowski's list is not on my model as it's reserves have been downgraded recently to at most 50 mb and economic viability is no longer assured (link). Angola's block 31 NE was on Skrebowski's potential megaproject list. It is included in the model as Upstreamonline has recently stated that it will start production in 2010 at 180,000 bpd.

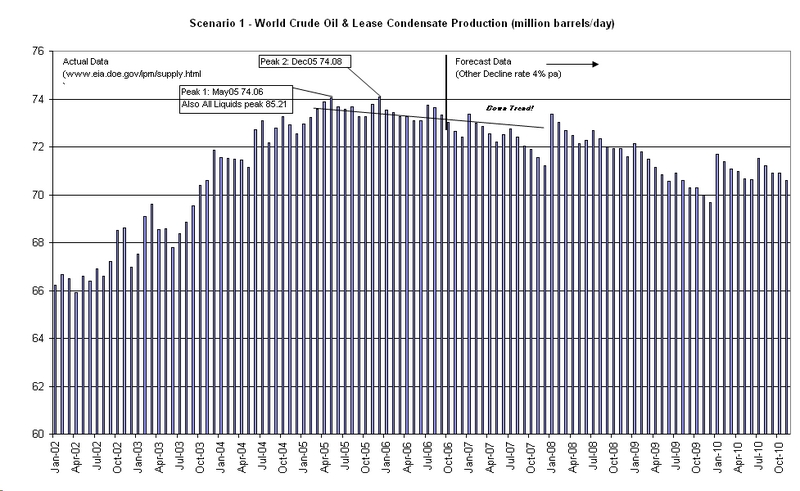

EIA actual data for crude oil and lease condensate (C&C) production are used. These data show a first peak of 74.06 mbpd on May05 as the beginning of the down trend.

Fig.1 A Slow Irreversible

Decline. Click to enlarge.

This scenario assumes that "Other" oil production declines at 4%/year.

"Other" oil production is from oil fields not on Chris Skrebowski's

database and not from the 120 specified existing fields

above. The "Other" category includes small field projects and small

enhanced oil recovery projects. This scenario forecasts that world C&C

production declines at about 1% per year from May05 to Nov10. The production on

Nov10 is forecast to be 70.6 mbpd.

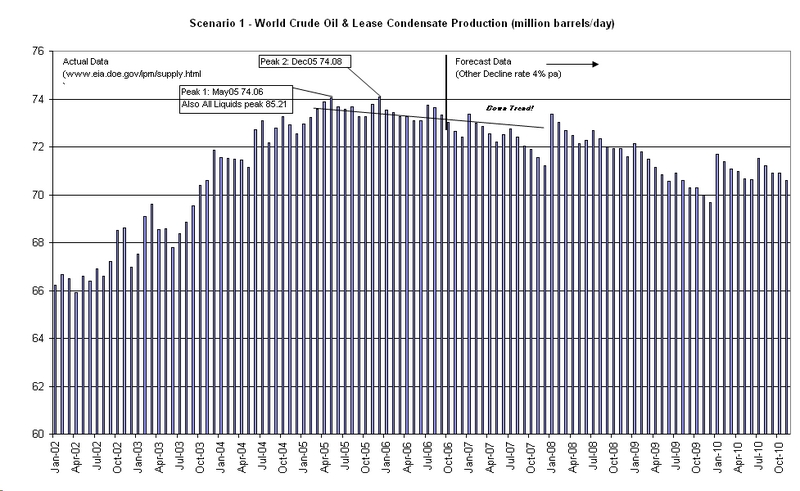

Fig. 2 A Long Plateau. Click to Enlarge

I update the model for new EIA monthly data and new/revised project info. For example in Iran, Yadavaran and Kushk/Hosseinieh were counted as two projects on Skrebowski's database. Only Yadavaran is counted. Upstreamonline stated that they were different names for the one project. Indonesia's Jeruk which is on Skrebowski's list is not on my model as it's reserves have been downgraded recently to at most 50 mb and economic viability is no longer assured (link). Angola's block 31 NE was on Skrebowski's potential megaproject list. It is included in the model as Upstreamonline has recently stated that it will start production in 2010 at 180,000 bpd.

EIA actual data for crude oil and lease condensate (C&C) production are used. These data show a first peak of 74.06 mbpd on May05 as the beginning of the down trend.

Scenario 1: A Slow Irreversible Decline

Scenario 2: A Long Plateau

This scenario assumes an optimistic decline rate for "Other" at 1% per year

which gives some upside for yet to be discovered fields which are developed

prior to Nov10. The production on Nov10 is forecast to be 73.6 mbpd

which represents no change from Aug06.

Key Points:

Based on optimistic Scenario 2:

- Saudi Arabia is forecast to produce only 8.4 mbpd on Nov10. This assumes that the large new projects (mostly mature field workovers) of AFK (Abu Hadriya, Fadhili, Khursaniyah), Haradh, Khurais expansion, Nuayyim and Shaybah expansion are developed on time and production targets are achieved. Given Saudi Arabia's lack of recent oil exploration success, the forecast above implies that Saudi Arabia will never produce over 9 mbpd again.

- Iran is forecast to produce 4.1 mbpd on Nov10.

- World C&C production is on a plateau until at least Nov10.

Based on Scenario 1:

- The increased forecast production from Nigeria, Qatar, Angola, Brazil, Canada, Kazakhstan and Azerbaijan is not enough to offset the forecast declines from Saudi Arabia, Russia, North Sea, Mexico, Indonesia, Iraq, China, India, Malaysia and the USA.

- Given lag times of at least five years for new megaprojects to start production, world C&C production has begun a slow irreversible decline which started on May 2005.

Comments or questions would be appreciated!

Folks, also consider this a reminder to positively rate these articles (using the icons under the tags in the story title) at reddit, digg, and del.icio.us if you are so inclined. Also, don't forget to submit them to your favorite link farms, such as metafilter, stumbleupon, slashdot, fark, boingboing, furl, or any of the others.

Cheers and Happy Holidays from The Oil Drum!

One problem I have had with Skrebowski's analysis is how he would have handled production from the East Texas Field in 1972, which was then showing a secondary peak in production. In 1973, East Texas, and Texas overall, started a terminal decline in production. In other words, how do you handle rising production from a very mature oil field?

Of course, my answer is the HL method, which Deffeyes--apparently accurately--used to predict a world crude + condensate (C+C) peak for late 2005.

And Saudi Arabia is showing lower production, as predicted by the HL method and the Texas historical analogue.

My prediction is that the world will show about a 2% annual net conventional decline rate from here. I expect Saudi Arabia to show about a 4% net annual conventional decline rate from here.

Chilling! But perhaps you could explain why you get different predictions than Skrebowski using the same data? Is it simply because you posit "6% for mature field workovers, 7% for mature fields to 14% (for specific field decline rates eg Cantarell)" whereas Skreboski just assumes a 5% overall decline rate?

Sorry, but what?

My understanding is that the nominal case is production takes a time to reach a value, maintains a rough plateau for a while, then declines at a rate determined by geology as much as economics.

Is the XLS file around anywhere so that we can see what would happen with more appropriate shapes?

And on a related matter, the megaprojects data is all very well, but by the nature of planning cycles you wouldn't necessarily expect to have any data on new megaprojects past the 2012 timeframe as yet. To me that puts a big hole in predictions of 2011+ timeframes - which is just where we would need good data to access decline rates. How can that data be found?

It used to be that you would bring the first well into production and then drill step out wells, develop better understanding of the field and then bring additional wells into production so that the production profile showed a gradual increment toward a peak for that field.

It is current common practice to assess the field and establish an overall production strategy for the entire field and then drill all the required wells so that peak production is achieved much earlier in the life of the field.

The assumptions made by ACE are not necessarily incorrect.

Agreed, but it still takes time to drill those wells - they don't appear overnight. That's particularly true of a larger field (eg megaprojects). We are talking a minimum of 1-2 years to reach that plateau stage.

Compare the shape of these graphs with those others have provided for forecast production and you can see the impact the assumptions have on available production at any date. In essence its a convolution of "field coming onstream" events with curves for expected production volumes. Different convolved shapes will have a cumulative impact on total volume (eg not getting it right is a systematic rather than random error).

Hi ace, interesting post. I imagine it took some amount of work, thank you for that.

From these tow sentences:

I understand that once a field comes on stream it goes immediately into decline. That doesn’t sound very good, It was like this that you modeled it? It’s a bit awkward, even for offshore exploration there’s usually a production plateau, giving a “boot like” production profile.

I also think that you are using decline rates somewhat high. Decline rates in excess of 10% indeed happen, but it’s not usual to observe such numbers for the entire cycle.

Anyway a good effort and a good concept of introducing different decline rates for different kind of projects. Can you obtain data for the mega-projects of the last, say, 5 years? If so, you could try these models on that data to get an idea how they work.

I use a combination of maturation rate and extraction rates to model this situation. The end result is a convolution of two exponentials, leading to something akin to a gamma distribution of order 2. An infinite extraction rate would correspond to a situation where all the taps were turned on at exactly the same time and at full extraction rate. In practice, after construction completes each will get turned on at a slightly different deferred time and with different ramp-up times. This puts the production plateau away from Time=0, or which as Luis describes leads to a production plateau.

This has a basis in stochastic modeling, and of course works best when one considers a range of fields that can be described by a statistical average for maturation and extraction (as well as fallow and construction times). I call it the oil shock model.

BTW, the best example of something that doesn't follow this general trend is the North Slope/Prudhoe Bay where it looks like the late completion of the Alaska Pipeline allowed the taps to immediately start flowing which leads to an almost immediate peak in production, i.e. the maturation was obscured by the concurrent initiation of a high-throughput delivery mechanism, which essentially deferred the production from gradual to steep.

I think the most important point of this post is that assumptions about the decline rate have a big influence on the overall production.

Their seems to be a consensus that peak is in 2010-2011 time frame mainly because of projects coming on stream. I don't agree with this and the alternative decline rate scenario's point out that indeed we may already be in decline now.

Next of course a less optimistic view on the ability to bring these large projects on line simply adding in normal above ground factor point to even the pessimistic scenario as optimistic. The chance of not having a major above ground factor effect prices in the next 5 years is practically nil.

The only above ground factor that may save the day is if our world economy suffers a major recession which is possible.

Minor point here. This only covers conventional oil right? Even w/scenario one depicted, the unconventional stuff online now and likely to come online looks like it will stave off the real nasty declines for a few years more.

Hopefully that time wont be wasted with a business-as-usual approach to energy planning.

A 2% net decline rate would yield an initial decline of about 1.5 mbpd per year. Over five years, we would see a net decline of about 7.5 mbpd. Canada's total tar sands production is about one mbpd and growing slowly. I don't know what the bitumen production rate is in Venezuela, but I believe that overall production is declining.

There are some Gas To Liquids projects coming on line, and there some Coal To Liquids possibilities, but all of these are high cost, generally low production rate projects. IMO, they will serve to slow, but not reverse the decline in aggregate oil production.

However, the key point is the export picture. Net exports, IMO, are falling much faster than overall world oil production is falling, while what the US wants to import (total petroleum) is going up at close to 5% per year.

"There are some Gas To Liquids projects coming on line, and there some Coal To Liquids possibilities, but all of these are high cost, generally low production rate projects. IMO, they will serve to slow, but not reverse the decline in aggregate oil production."

This is an inaccurate statement. In fact, the projects coming online from these sources are very significant - and if oil stays at $60 per barrel you should expect more to follow. Here are two projects due in the next couple of years just from SA ALONE that add up to 560k per day:

Saudi Arabia Khursaniyah Gas New development 2007 250 bpd

Saudi Arabia Hawiyah New development 2008 310 bpd

So, we only need about 30 Khursaniya projects to meet the net decline over five years at 2% per annum decline rate. And again, net exports are falling much faster than overall production is falling.

A couple of points.

You are only talking about accelerating our rate of extraction of finite fossil fuels, in a desperate attempt to keep the supply of Liquid Transportation Fuels (LTF's) stable to growing. Fossil fuels can be viewed as a continuum, from natural gas to natural gas liquids, to condensate, to light/sweet crude, to heavy/sour crude, to bitumen, to coal. We can get LTF's from the endpoints, but the capital and energy costs goes up significantly, and again, all we are talking about doing is accelerating our rate of extraction of fossil fuel supplies.

In regard to Natural Gas, there have been several articles suggesting that world gas supplies are overestimated, and the US case history doesn't offer much support. Our all time record high natural gas production was three years after oil peaked. In any case, Saudi Arabia has already started curtailing some projects because of a lack of natural gas supplies.

"So, we only need about 30 Khursaniya projects to meet the net decline over five years at 2% per annum decline rate. And again, net exports are falling much faster than overall production is falling."

I disagree. There will 1000's of projects over the next five years. Some big, some small. Some oil, some ethanol. Etc etc. To say that "we need 30 Khursaniya"s may sound good for alarmists - but IMO it's not really looking at the bigger picture objectively.

I agree with you on the extraction of finite fossil fuels and that this will at some point peak. I just disagree with the timing.

Ethanol?

"

Exactly ..

The problems caused by post peak oil issues occur when supply becomes significantly less than normal demand. This only takes a few years post peak.

Lets assume that the "peak effect" occurs when supply is 2-3 mbd less than normal demand.

That's why I'm concerned about peak oil now since it only takes a few years at most after peak oil before major problems occur.

What is "normal demand"? Is the demand created by 5.8l V8s normal? Or is the demand that would be created by a fleet of Prius normal? Is the demand created by people commuting on bus and rail normal? How about the demand created by EVs powered by PV?

The reality of PO only collides with the imaginary reality of a world that drives ever larger and more cars. That particular reality is simply not going to happen. Major economic problems will not occur because there is an enormous amount of waste in the system that can be cut out. We are not truly dependent on oil for survival. There will be major financial problems for those who do not manage to reduce that waste faster than the true supply will collapse. But then... people who had a 50 year warning should not bitch about that. It simply looks silly.

Infinite: What you are saying is very politically incorrect on TOD.

LOL

But it needs to be said anyway.

"Oh, I see it's taken us 3 years since we became PO-aware(or at least acknowledged that prices are high) to shift our fleet to hybrids, looks like our costs are the same as before and our problems are sol.... wait, you're saying gas is gonna cost 20% MORE next year? and the year after that? and the year after that? WTF? How can you expect me to work in these circumstances? May as well go out of business."

See: that conversation repeated time after time after time, and then tell me that major economic problems aren't inevitable. In 1929, we'd concentrated too much wealth at the top of the ladder, and let the poor produce too much that they couldn't themselves buy on their income. Is that anywhere near as serious as a 5% decline rate in the product by which we built our landscape around?

The trillions of dollars that need to be written off by the time oil consumption is reduced to a half or a third of its current level by simple geographic obsolescence will of course affect our economy in a major way if it occurs over even a decade or two. A gradual elimination of all North American imports amidst dollar superinflation, a continued third-world economic awakening, and domino-effect oil nationalism (as the peak is made apparent) seems to be entirely possible, though certainly not assured.

The reality of PO is a sustained decline rate in world supply. If that decline rate is 1 or 2%, we could probably manage with a mere acceleration of our current initiatives, like the much-lauded economic growth following the oil shocks. Relying mostly on imports makes our economy vulnerable to huge geopolitical positive feedback in the decline rate if it's anything over that, however.

And only 69% of consumption is transportation of all types: Slashing every SUV tire in the country can't really offset a significant decline rate for long.

""Oh, I see it's taken us 3 years since we became PO-aware(or at least acknowledged that prices are high) to shift our fleet to hybrids, looks like our costs are the same as before and our problems are sol.... wait, you're saying gas is gonna cost 20% MORE next year? and the year after that? and the year after that? WTF? How can you expect me to work in these circumstances? May as well go out of business."

But why is this guy giving up, instead of going to the next logical step, plug-in hybrids, which can double mileage again?

Plug-in hybrids won't solve the road problem. I've gathered and presented enough evidence I feel to prove that maintaining our road infrastructure post peak will be difficult and expensive.

People forget about the subsidies required to make personal transport cost effective but they are large. Next we can expect zero to negative growth post peak this will cause severe constraints on the amount of taxes that can be collected to continue to maintain our current infrastructure much less expand it.

So overall I don't see plug-in hybrids and being a solution for us. Certainly they should be part of the equation as oil gets more expensive but even looking out 15 years post peak we need to consider alternatives.

You need to identify the absolute best solution which is electric rail/trolley and potentially plug-in hybrid taxi's as the main transport system.

Plug-in hybrid cars would fit in this scenario as local runabouts for shopping/transport to the rail line. If that's the use scenario a all electric car could readily handle the less than 100 mile range needed for this use case.

Its questionable that they are even needed with effective alternative transport.

The end of this sort of analysis is that is far better to focus getting the replacement electric rail/trolley infrastructure in place and foster mixed use areas and basically revive the corner store. The medium term utility of personal transport regardless of power source seems to be marginal at best. Given the 15 year replacement time we can expect to replace the entire fleet twice in 30 years but in 30 years the amount of fuel available seems to be far less than needed for a hybrid fleet/road network. And this does not even account for the global warming issues around maintaining a scattered road based infrastructure.

I'd certainly buy a plugin hybrid if one was available that met my needs but I don't consider them a solution since their viability in even 15 years is questionable.

I'm relatively certain that numerous people have pointed out that asphalt can be recycled and new oil added via biofuel processes. Because of this fact, it will never become un-economic to maintain our roads as long as they are used. Besides, asphalt only uses a tiny fraction of our total oil supply. We wont be running up against that wall for at least 100 years...

This is fallacious logic. Gasoline only uses a fraction of our total oil supply. That does not extend the time that we need to think about the effects of a reduction in supply in gasoline, beyond the period when total oil supply peaks.

It's not like we can avoid thinking about asphalt for 100 years because we'll have no trouble eliminating all non-aphalt uses. Asphalt prices will rise along with everything else. Furthermore, oil currently used in asphalt may enter the energy side of the equation as a fuel, if that utility value ends up greater than the utility value of sitting in a roadbed.

>I'm relatively certain that numerous people have pointed out that asphalt can be recycled and new oil added via biofuel processes. Because of this fact, it will never become un-economic to maintain our roads as long as they are used. Besides, asphalt only uses a tiny fraction of our total oil supply. We wont be running up against that wall for at least 100 years...

We are not just talking about asphalt. A lot of other materials are used such as concrete and steel (or over passes), not to mention the energy inputs to transport materials and install them. To recycle asphalt and concrete still requires energy to transport it to the processing facility and energy to reform it. In the case of asphalt it needs to be reheated and concrete is even more energy intensive since it has to be pulverised and reheated to much higher temperatures.

In the near future road construction and maintainance materials will become considerable more expensive.

I agree to a point, but in this spoiled society if high prices alone are used as rationing tools there will be social unrest. If/when civil order breaks down it will not be pleasant for anyone.

False statement, ergo conclusions drawn therefrom are incorrect. Planetary population was near peak capacity before WWII and global starvation was a concern then. Since then the "green revolution" has allowed population to exceed that 1.5 billion cap and it is entirely dependent on fossil hydrocarbons for fuel, fertilizer, pesticides, etc.

Remove the fossil fuel subsidy and you kill approximately 5 billion human beings.

Now, you will argue that we have enough fossil fuels to feed the planet for a long time and this is true but at what standard of living? Further, you dismiss the move to alternative energy sources, alternatively powered transportation, etc., with a single sentence when in reality all of that represents tens of trillions of dollars of investment. So you are going to just write off all that decades of investment to support 6+ billion people with a wave of the hand and expect no repercussions whatsoever?

Sir, your post smacks of naivety that is laughable were the implications not so horrible.

The costs of moving to alternatives will be gigantic and will disrupt global civilization. Further, some societies will choose to not accept this at first and instead will decide to maneuver for what they perceive is "theirs", even as the US has already begun to do in the Middle East. It's already obvious that China and Russia are taking different but obviously energy related approaches to world affairs. India and Europe are showing these signs too. And if circumstances warrant, they will go to war over oil. In case you forget, the US entry into WWII was precipitated by the world's leading oil producer at that time (the US) placing an embargo on Japan, which then tried to secure alternative fuel supplies via military action. Note also that after the embargo by Saudi Arabia in 1973 that subsequently, Carter enunciated the "Carter Doctrine" which states that free access to fossil fuel supplies in the Middle East is a vital interest to the US. In case you don't speak diplomatic gobbledygook that means that the US has told the entire world that it can and will go to war if Middle Eastern oil supplies are threatened. (That's what a declaration of vital interest means. That's why Japan's reaction was so poorly taken by the world - because they had not declared the oil and rubber of Southeast Asia to be vital national interests to Japan yet they then attacked.)

In short, your post is absurd because it overlooks the ecological impacts of overshoot human population, the dependency of that population on fossil fuels, the global infrastructure investment that is centered around fossil fuels, and the historical documented behavior of homo sapiens when confronted with threats to that fossil fuel supply. You are the one that extols the economy, sir, yet in the next breath you ignore the tens of trillions of dollars of existing investment in the fossil fuel based infrastructure as if it will magically be replaced at the drop of a hat if anything threatens the fossil fuel supply.

Your contradicting assumptions are breathtaking. You have apparently ignored Stuart's documentation that it will take at least a decade and a half to turn over the entire fleet of vehicles and that is only if everyone recognizes and accepts the proposition that oil is in decline. Stuart's other work has shown that housing investment will take the better part of a century to turn over or have to be written off as lost investment. Do you even grasp the scope of the depression we are discussing by writing off the transportation and suburban housing infrastructure in almost its entirety? It seems not.

You, sir, are the one that looks silly.

GZ's casual "Remove the fossil fuel subsidy and you kill approximately 5 billion human beings." is yet another reason TOD and similar sites that push DIEOFF will never attain credibility.

Again we see an amateur futurist making brash statements w/o any sense of timeline. Like those that don't understand the Reserve/Production ratio and the concept that oil won't be at full production and then stop dead in the 40th year, neither will stock availabiltiy to the agri industry halt dead in its tracks.

The Peakster movement still hasn't grasped the work of its own advocates (campbell/laherrere/skrebowski/koppelaar) that oil won't stop on PEAK DAY. There will be flows for necessities until 2075 according to the most pessimistic of the future Outlooks (OPEC). Most of the others don't see exhaustion until the 22nd Century. The optimistic Scenarios see flow 'til the mid 23rd Century.

GZ's DIEOFF many happen. But it presupposes no alternatives at the decadal to centuric level. His post is plain nonsense with its sense of urgency.

Hello Fraudy. Good to see you still posting here. Trolling for more gullibles to pay you money for your unscientific (and not peer reviewed) bullcrap again? You might do better at some other site.

Good luck looking for more suckers for your "Fraudy" Hutter timelines.

Using "peak oil depletion" as keywords, Google has my site at #12 this week. #8 at Metacrawler (world's best search engine). That was out of 1.1 Million results. I found yours, GZ, in the bottom percentile. Great place for the bottom feeders, eh...

I don't write a blog seeking handouts from people by peddling fraudulent and non-scientific data or by trying to pass it off as such. So you are high on the Google list? Whoopdeedoo, Fraudy. Lots of sites get more visits than yours does. Does that mean they are all constructive sites? No, and neither is yours.

Now go try to recruit fools for your "pay-me" schemes elsewhere.

I wouldn’t expect your standing to be anything less than it is, for the ratio of the gullible to the informed is about a thousand to one.

Khebab, great post, thanks a million.

Chris Skrebowski's megaprojects for Saudi Arabia will likely produce far less than half the barrels per day as projected. Only the Haradh III and the Shaybah expansion will come anywhere close to the numbers projected. Haradh III will likely produce near 300 kb/d and the Shaybah expansion will likely produce between 250 and 300 kb/d. Also Manifa is the only mystery there. It has never produced a drop because of very sour oil, so no one really knows what it may produce. But being very familar with the Saudi's predilection for gross exaggeration, I would be shocked if ever produced anywhere near 450 kb/d.

All those other projects are out in dreamland. They are all very old fields that long ago reached their peak. Khurais peaked in 1981 at 144,000 barrels per day then began a very steep decline. A gas injection program was inituated in 1983 to try to restore Khurais back to over 100,000 barrels per day with no success. The field simply kept declining.

The largest one, the Khurais expansion, project at first to produce 800 kb/d, then upgraded to produce 1,200 kb/d, will lilely never reach 200 kb/d. In fact, based on the field's former production history, I would be shocked if it ever reached its former peak of 144 kb/d. And the Abu Hydriya, Fadhili, Khursaniya project will likely never produce more than 150 kb/d.

I have no idea why Aramco has attached such unrealistic figures to these new projects on very old fields. But those numbers are absurd.

Ron Patterson

IMO both projections show very stable oil production going forward, without serious disruptions. This is optimistic, but possible. If I'm not mistaken even Srebowski had production nearing 100 mbpd before the drop off, and he was the most pessimistic of them all! I have been saying for the past couple of years, even he was too optimistic and everyone was like, well, wait and see. Ha! Yeah, we'll see. Thank Jeebus for them oil sands, eh?

Well no, you are a little too high with those numbers:

http://www.oilposter.org/blog/2006/07/aspo-5-day-1-chris-skrebowski-sees...

And you say "he was the most pessimistic of them all." I doubt that, but that all depends on who you regard as "them all" Westtexas and myself are far more pessimistic and I think you will find a few more with the same opinion. We believe the peak is already in the rear view mirrow and we are currently on the plateau.

And by the way, I think 92 mb/d in 1500 days, (from July 18th) is a totally absurd number. There is just no way the world will produce that much oil in that short a time. Hell, we will never produce that much oil.

Ron Patterson

Sorry to come off sounding like that. I know there are many here who think we are past peak. I'm still steaming from the lying industry and EIA projections.

I don't think the industry is really lying as much as they are in a defensive position. Their stock-holders need to hear good news all the time or will sell their stakes in hydrocarbons in an eye-blink if anyone should seriously consider to stand up and tell it as it is. It's very much the same situation as in "The Emperor's New Clothes". Our parents tell that tale in the hope we might actually learn something from it. Like "The Boy Who Cried Wolf" it is a tale that has a lesson built in. But it seems as soon as people buy their first shares, there is an automatic erasing going on of everything that tale tought them. (Just as much as many in the PO community are suffering from "The Boy Who Cried Wolf" amnesia...)

:-)

(Just as much as many in the PO community are suffering from "The Boy Who Cried Wolf" amnesia...)

Then I guess I'm suffering from amneia. The only premature prediction I'm aware of is Hubbert's 1995 prediction (made before the oil embargo, the fall of the Shah and the Iran-Iraq war).

What other premature predictions (if any) have been made?

We will have electricity too cheap to meter.

Hurin asks "What other premature predictions (if any) have been made?"

Well the EIA's favourite graph was posted at their website in June Y2K and it's still there!! 2006 supply is 31-Gb:

http://www.eia.doe.gov/pub/oil_gas/petroleum/presentations/2000/long_ter...

When that graph was made Russia (yellow line) was a basket case, they couldn't have known how Putin would manage to change the situation.

And I wouldn't call being a year off, being wrong. Rather I would call it an amazingly accurate forecast.

Why would I sell right now my stakes in fossil fuel producing companies if I knew, with certainty, that what they produce was going to become inevitably more scarce and thus more valuable?

I might choose to sell at a later point when their reserves drop sufficiently low that the value of the company as a whole declines but right now even with declining reserves or reserves staying roughly where they are these companies are an excellent investment because the increase in dollar value of those reserves still increases the dollar value of the company. Who wouldn't want to own a piece of a company that can produce tens of billions of dollars of profit and which is growing in value at the same time?

PP, Chris advised me earlier this month that his Megaprojecte target for Peak has been upwardly revised to 95-mbd in 2011 from 93-mbd in 2010. This makes his scenario the third most pessimistic of the 13 recognized Outlooks after OPEC & BP in terms of hurried exhaustion; and fifth lowest in terms of a target Peak Rate. The current low target for Peak Rate is 90-mbd by both Colin Campbell & BP.

Today's view by Ace has an indicated URR of 2475-Gb of C&C based on the 2% decline rate. This compares to 1900-GB by ASPO's Colin Campbell when he deducts non-conv liquids and NGL.

On our Scenarios graph, the Ace Scenario One would exhaust in 2106 and is best represented by the BLUE AVG line as it has an Post Peak Net Decline Rate of 2.25%. If Ace adds the "all liquids" component, his Outlook would be similar to Jean Laherrere's Scenario (fuscia) if we can assume that NGL plus plus adds about 1500-Gb to the URR.

While at first glance the Ace Scenario One looks pessistic, it is only because it is an academic exercise looking at C+C. If it is accurate, when augmented with concensus production rates and ultimate volumes for non-C+C liquids, it would be in the top five of TrendLines Scenarios presentation in terms of long timelines for ultimate exhaustion.

On our Scenarios graph

Fraudy, get a clue. Everyone knows you're a one-man show. What's the point.

Wow! Just WOW!

Fraudy, get a clue. Everyone knows you're a one-man show. What's the point.

Huh? Why is everyone so abusive around here?

Einstein was a one-man-band ... yet he seems to be respected.

Ace,

Given your analysis on supply, I'd be interested in your take on demand and prices.

How do you see that side of the equation?

Both the graphs show we have entered the "bumpy plateau" , aka PO. Given the doubts raised by the comments above on projected production, it is highly questionable that it is possible to dramatically increase production after Nov10. These graphs are stunning.

You will continue to hear denial from "optimists" who will interpret every little bump from here on as the beginning of a new rapid cycle of expanding production. High prices will be called "healthy demand" which will "inevitably incentivise" oil producers to invest more in production to satisfy the need of the world for ever more oil. The religion of the god TINOPO ("There is no peak oil") will continue to attract believers and they will gather on the tops of sacred hills to await his coming. The more sane ones will go and buy a higher efficiency vehicle for commute and drive that SUV only for fun.

:-)

TINOPO, ha! That would be a good name for a new corporation of wildcatters. TINOPO, that cracks me up.

TINOPO will *never* surpass the great Wie-Too-Kay! The greatest fear is of Wie-Too-Kay! Regardless of what the programmers say!

-- Wie-Too-Kay (aka Y2K).

TINOPO's motto is OO - opportunistic optimism!

Or the more likely scenario:

Oil + Condensates peak and the doomers pound their fists on the table wondering why society hasn't collapsed. Meanwhile, GTL, CTL, Oil Sands etc, Ethanol, etc continue to expand liquids production out to the middle of the next decade before sustaining a rather significant plateau.

Fine, if you prefer. Time will tell. You are entitled to your own opinion. It is certainly within the realm of possibility.

But even a plateau is not good enough say with a plateau in production it would take 4 years before normal demand outstripped supply by 3 mbd. The number I use to indicate "peak effect". Thus even a plateau is not good enough to maintain our current society.

The problem is our economy is based on continued growth. Increased oil supply is a cornerstone of this growth. Once oil production can no longer sustain growth it does not take long for our economy to start falling apart. Especially once the masses realize we are never going to produce significantly more oil than we do today. I suspect a few million chinese peasants will not be all that happy once they realize they will never get a chance to have economic prosperity. Peak oil or more correctly the peak effect is a social/economic problem.

I suspect the social unrest that will occur once people realize the party is over will be quit severe. Growth and the resultant chance to advanced ones standing in society is critical to the stability of our world society.

Remove it ...

Yep, I only say it is within the realm of possibility, not that I think the chances of sustaining growth in an oil depleted environment are anything but razor thin. Just trying to get along with the naysayers. Peace.

Memmel: IMO, we are post-peak already. Having said that, there appears to be a consensus on TOD that global oil supply plateauing or declining automatically leads to economic decline. There is never any data presented to support this belief. For the last 30 years, global oil supply growth has been mediocre (compared to previous periods). During this mediocre growth period: 1. globalization has boomed 2.globally, millionaires and billionaires have grown like weeds 3. China has come from nowhere to become a monster 4. The USA has steadily declined economically. Assuming we have entered a post-peak period of gradual decline, where is the evidence that trends like those noted above will discontinue?

Yeah, attack the messenger. That's right, everything will be just peachy.

Petropest: Actually, I have no idea how long the "peachy" period can last. I am just surprised that so many exhibit the fervent belief that the health of the global economy and the growth rate of global oil supply are perfectly correlated (when there is no data to back this up).

Well, there is obviously some correlation the way we do things now. I will not argue that it must be that way, but that seems to be the current thinking among the PTB, if the way they are acting is any indication. If we were making preparations for an alternative way of living now, while we still have plentiful oil, it would sure go a lot smoother for us in the event that the rosy projections fail to the negative side.

" The USA has steadily declined economically. "

Wow where do you live? The economy in Central Texas never been better than it is today.

Austex: I overstated the case. I should have said "the USA economy has steadily declined as a % of global GDP over the last 30 years".

China has horribly damaged its environment. Despite the hero worship in the West china "growth" is full of misguided project and bad investments and rampant corruption. Generally its based on 18 century slave wage concepts. China is at the end of the day only a monster to itself. Finally even the most optimistic person can see that their is little chance of china achieving a high standard of living for the vast majority of its population this will eventually result in major social problems and civil war. China is a land of empty gleaming office towers and fetid slums and horrible pollution. In short its a ticking time bomb.

The middle class in the US has been gutted globalization has reduced the earning power of the world resulting in the largest concentration of wealth since the great depression. For every millionaire a thousand people did not get wage increases to cover inflation. Financial manipulation and speculation instead of basic economic growth via production has overwhelmed the world economy and threatens to destroy it. How useful are these new millionaires are they building innovative new products and companies or are they marketing cheap crap made by slave labor or worse simply playing the money markets for their wealth ?

How many Henry Fords do we have today ?

Also a lot of the wealth today is wasted on marginally higher quality luxury goods and services that have a large markup. These products and services do little to expand the base economy and create real wealth.

I would say the Internet did add value but the speculation and misguided investment that occurred during the 1990's was a poor example of traditional capitalism. In fact the software and hardware industries continue to be hobbled by monopolies and collusion. On the capitalism score card I'd give the whole industry a big F. Probably the only reason innovation happens at all in the software/hardware industry is simply because the possibilites are so vast it succeeds in spite of itself.

In general innovation in our economies has stagnated since we turned to slave based manufacturing robotics and efficient automated factories and custom manufacturing and recycling etc have failed to come about.

We should be able to order a part/widget and have it manufactured as needed with waste goods recycled for raw materials. Instead we have separated consumption from production resulting and numerous open cycle manufacturing processes.

Next of course the decoupling of producer and consumer breaks the product feedback cycle required to both improve quality and drive the creation of breakthrough products. Any innovation is now driven by the sales office not the market. The damage done by not having the ability to create small runs of innovative products is huge and today hidden.

With the single exception of the Internet when I compare 1990-2006 to the preceding time period 1974-1990 the difference in innovation is huge.

Certainly maturation is a factor but we have not produced near the number of breakthroughs in the computer/globalization age as happened in the preceding period. Basically whats happened in the last 16 years is that instead of society continuing to advance with the average wealth increasing it broke down into a have and have not society with wealth increasingly concentrated and the consumer class falling into deeper and deeper debt and both the working and middle class driven to poverty via low globalized wage scales coupled with a huge global excess in labor. At some point consumption will fail to keep up with production and commodity prices will limit the ability to reduce the price of finished goods. So you end up producing way to many widgets for too high a price for anyone to buy. The only place you can reduce price is via cutting wages generally via outsourcing which cuts your customer base ...

Thats the situation we have today rising commodity prices esp for oil will force a lower bound on price and cause a unwinding of the global economy.

Memmel:Most of what you have written is accurate. Having said that, globalization/attack on the North American middle class appears to be proceeding quite effectively during a period of stagnant/slightly growing global oil supply. The question is: can it continue during a period of stagnant/slightly declining global oil supply? Re China, at the risk of overstating the case, the persons that own/run the USA built (and continue to invest money that could be invested in American capital investment) China.The whole structure of how the USA economy/country is set up is designed to benefit the 1%, and as a side effect, China (and to a lesser extent, India). Will this continue? Time will tell.

Remarkably cogent and succinct, Memmel... it fits what I'm seeing anyway. When are you writing a book?

The growth in living standards in China over the past thirty years( as seen for example in meat consumption per capita)has no precedent in history.

I don't see you acknowledging that fact.

Hunh? For starters try Cuba. 98% reported zero consumption of meat monthly under Batista. Or even try China the thirty years before your focus. Managing an economy works.

Oh, I'm not one of those who claim China's success is all down to Mr. Market.

"2.globally, millionaires and billionaires have grown like weeds"

IMO money has lost so much value that it is much easier to become a millionair and renders your comment to the absurd. Being a millionair with single family housing ave. $69,000 gasoline at $.94 is alot diferent than housing at $265,000 and gasoline $2.65.

Just an observation, I'm sure that I'm missing something...you tell me...

And here we go again with the gloom and doom! Haven't you learned by now that these wild predictions are never going to come true? Yet you continue to remain focused on the academic category of C+C. What matters is total liquids. If the 'doomers' are right, then production of C+C likely peaked back in Dec05.

That means we are one year post peak, and we should have witnessed a 1.5 mbpd or more decline in oil production globally.

This hasn't happened.

We should have experienced severe economic crisis and an implosion of the 'growth driven' market.

This hasn't happened.

We should have experienced a Dollar that was falling like a rock.

This hasn't happened.

In fact none of the crazy doom and gloom predictions that have been peddled here for the last year+ have come true. Yet you keep harping them over and over. By focusing in on one category, you are damaging the credibility of the PO movement as a whole by crying wolf! You should be focusing on the impact of total liquids and its peak on the global economy, not simply C+C.

And it is amazing how terms like 'peak oil' are now being reclassified as 'peak energy', and 'undulating plateau' are now being twisted into 'unstable global energy paradigm' that has no choice but to collapse in on itself like a black hole.

Peak oil is a LIQUID TRANSPORTATION FUEL CRISIS! Nothing more, nothing less. Its not peak energy, more appropriately its the 'peak of using the grossly inefficient ICE propped up in perpetuity by greedy short sighted automobile manufacturers' and the onset of an electrified future. You all have this one chance to help influence the future for the better and help us cut down on coal and hydrocarbon use while promoting renewable alternatives, conservation and efficiency improvements.

Don't waste it on radical 'Mad Max' harping.

We don't know what the 2006 production numbers are yet, but the EIA shows world C+C production to be down by about 1%, from 12/05 to 9/06.

In any case, the initial Lower 48 decline was very subtle, about 1.7% over the first two years, if memory serves. But the average long term Lower 48 decline rate was about 2% per year.

If you follow total liquids, it depends on whose numbers you want to use, as to whether or not they are declining.

However, again the key story is going to be net export capacity, which is falling, led by the estimated 13% decline in Saudi exports, from 12/05 to 12/06.

As I have repeatedly said, I think that the problems are first showing up in poorer countries:

http://www.energybulletin.net/22775.html

Published on 18 Nov 2006 by Wall St Journal. Archived on 23 Nov 2006.

As Fuel Prices Soar, A Country Unravels

by Chip Cummins

WT,

This is evidence of income transfer from oil importers to oil exporters, with the effects hurting lower-income people the most. We see this in the US as well - moderate income people are hurt, and their money goes to Russia, the ME, as well as Texas.

But...it's not evidence of systemic instability. That's the claim we hear: that somehow stagnation or decline of oil imports will threaten the stability of modern economies.

There are several questionable logical steps: that peak oil equals peak fossil fuels; peak fossil fuels equals peak energy;and that peak energy would stop economic growth. The final one is that economic stagnation will destabilize "fiat money" economies. I'm at a loss to find any support for this last idea in any mainstream school of economics. Am I missing something?

Main stream economics does not deal with the concept of loss of core resources.

In general the theory is that higher cost will lead to innovation that results in either substitute better utilization or greater production and in general all the above.

That's the premise of most people that dismiss peak oil. What they ignore is the thousands of years of examples of failed civilizations caused almost universally by resource depletion. Your far better off looking at the rise and fall of civilizations for examples of the economic consequences of depletion of a commodity resource than modern economics.

Consider the simple case of the effect of temporary gasoline supply disruption and

price swings on today's economy. This alone would have a huge effect on our economic growth. Other issues like a major increase in the cost of road construction decrease in the economics of suburban living etc etc.

But in general the major effect is psychological caused by the realization that your not going to get a chance to get your own McMansion and SUV. This will cause people to try and consolidate power at every level of society.

For example in California the recent housing bubble has left a lot of people reevaluating their desire to chase the American Dream. Some have decided that they are happy with rental living others leave the state to live in less expensive areas. Basically no one in the state is able to pay for housing at its current prices without the constant increase in valuation. Thus the horrendous burden of current housing prices resulted in a major change in the outlook of most people. Peak oil will cause the same sort of assessment and result in a general change in living strategy by people.

What people actually do will depend in a large part on how peak oil unfolds and what the exact monkey wrenches are. I assume that the worst issues will be shortages of fuel and these will cause the most disruption and damage.

I mentioned in another post that the generic economic effect is this.

Production is moved to the places with the lowest wage increases in costs for raw materials and transport plus basic living costs for the workers puts a floor on the price for any manufactured good further globalization seeking lower wages does not result in any decrease in production costs meanwhile globalization reduces the pool of workers able to buy the goods. Eventually rising costs along with the requirements of economy of scale result in the production of millions of widgets at a price that no one can afford. Peak oil or more correctly general price increases for raw materials transportation etc caused by resource depletion force our globalized economy into this no win situation. Its really just a matter of time before we hit this economic barrier.

To use the housing market as and example the recent explosion of 3000 sqft mini mansions built by illegal immigrants and priced beyond the reach of most consumers is a perfect example of this sort of whacked economic process which will play out across our economies as other goods fall into the same trap.

Rising production costs play a important role in unraveling of our "new economy". Since this is one cost that cannot be eliminated via globalization its actually the primary driver for the stagnation and eventual failure of the world economy. Thus its the centeral reason that globalization will fail.

That doesn't quite answer my question.

I've seen several writers about peak oil talk about the idea that our "fiat" money economy is based on lending, and that when economic growth stagnates that the economy will collapse. Kind've like a shark, that has to keep moving or die.

I'm not clear where this idea originally came from. Do you know?

I've seen several writers about peak oil talk about the idea that our "fiat" money economy is based on lending, and that when economic growth stagnates that the economy will collapse. Kind've like a shark, that has to keep moving or die.

I'm not clear where this idea originally came from. Do you know?

That is a good question, but the answer is somewhat complex.

Before Peak Oil doomerism, there have been plenty of other types of doomerism. One is financial collapse due to problems of fiat money, or more specifically debt not backed by "sound money". This one can be traced back to at least 1790, and the roots of the French Revolution. More recently, since the US and most countries abandoned the gold standard, there has been great unease in some quarters who don't trust a paper currency. This unease is unsurprisingly stoked by popular writers and traders specialising in gold (often the same people).

Financial doomerism joined up with PO doomerism in the following way. A limited resource can not support infinite growth (self evident). When resource utilisation reaches a maximum rate, growth must stop. No problem, you might think. But for doomers, who have to justify why cessation of growth leads to collapse, it has to be asserted that the current financial system relies on growth, and therefore will collapse when growth stops.

This assertion about the financial system is not widely supported. This is where theories about lending come in. I think because lending is sufficiently abstract and not very well understood (money is mysteriously created out of thin air), it is quite easy to come up with plausible sounding theories which impress the layman, but have little grounding in reality and are easily debunked by an expert.

While it is true that our money system allows financial bubbles to occur where future growth is expected, it is not clear that the corollary is true, i.e. that growth is required for the system to work at all. There are examples of economies that have had flat or neglible growth but which have not collapsed.

If this holds up, it will be a banner moment. Peak oil (or at least peak C+C) will cease to be a conjecture, and will become a discussion in the moment. I think that will change a lot of attitudes, and move some "should maybe plan" discussions forward to "should maybe act."

On decline rates, I played with some numbers pulled from this graph:

http://www.intnet.mu/iels/USOIL_Prod1.gif

and put in this calculator:

http://www.hughchou.org/calc/compound.cgi

It looks like US production decline has run 2-3 percent, depending on which numbers you use. That doesn't really scare me. That seems like something that "might" be managed, or is at least "possible" where higher declines might be right out.

And sure, export capacities matter a great deal. They are however harder to predict far over the hump, being contingent on all sorts of social, economic, and political factors.

If you are right, and production decline sinks in, 2007 will be a very interesting year.

"If you follow total liquids, it depends on whose numbers you want to use, as to whether or not they are declining. "

WestTexas, one point about SA..... You need to be tracking total liquid exports in future years versus C + C.

SA has made very clear that they intend to refine more at home, as well as significantly increase their GTL production from their huge gas reserves. Athough their crude exports may go down, look for total liquid exports to increase.

C + C = not including everything that matters.

Perhaps you should read the BP statistical review, and determine how much NG production and reserves SA actually has, and how this will affect thier GTL production in the future. It is always better to read too much than to talk too much.

Amen Hothgor -

Unfortunately, whether it's CERA, doomers, or whomever - people gererally want to be right more than they want to be objective.

Using C+C is a good way to proclaim peak has happened for the doomers - I was right - ha!

Meanwhile, SA and Quatar alone will combine put 1 million barrels per day of GTL production online in the next couple of years.

I don't think its so simple as choosing the numbers that show you are right (not that this is beyond plausibility).

C+C is a very reliable indicator of Peak oil. And it is oil we are concerned about here. c+c is very clearly defined and (I'm assuming) reported.

All liquids is a much fuzzier number. It also includes a lot of double counting since it includes the oil used to produce the liquids.

If you are worried about Peak something why would you look at production of something+something else when you have a clear number of the production of that something.

Come on guys - the concept of peak oil versus peak liquids is not really that complicated. Joe Smoe does not give a shit if C+C peaked in December of 2005. He cares whether or not he can go to the gas station, fill up his tank at a reasonable price, and hall his kids to baseball practice.

Which he can't predict several years off unless he can separate growth/decline rates in crude from growth/decline rates in other liquids.

He doesn't need to, because to Joe Smoe this does not matter.

austex,

Take a look around, this is a Peak Oil website.

Rethin,

One of the dumbest replies that I've seen yet on this message board. Why even include condensates in our calculations. Let's not so we get to 'peak OIL' as quick as possible.

The term 'Peak Oil' IS 'Peak Liquids'.

Liquid fuels can be generated from coal, natural gas, shale, oil sands, sugar cane, soy beans etc. These liquid fuels are subsequently sold to chemical manufacturers and used as feedstocks, or sold to people like yourself at your local gas station.

You're not related to Hothgor by any chance are you?

You include condensates because they are oil.

Therefore all liquids makes a lousy indicator of peak oil.

Also all liquids also makes a lousy indicator af the amount of liquid fuels available because it double counts the crude used to produce these other liquids.

But again, this has been discussed at length. If you are a new poster (and not an old poster with a new name) I suggest you read some of the old drumbeats and articles.

The main problem the doomers have with 'total liquids' is that including them in their models would basically make them admit that there are viable substitutes to oil and that the economic 'invisible hand' is working. That would make sites like this one relatively marginalized in the bigger picture.

No one has proved that any viable substitutes for oil exist.

In fact quite the opposite Ethanol suffers a number of drawbacks in its production. CTL would if done on a large scale compete with electrical generation.

The long term viability of these projects as oil used to build and support these projects is questionable.

Is it possible to produce expensive liquid fuels sure. My take is that you will always have liquid fuel available at 10 dollars a gallon using today's dollars since this would make basically any organic source viable.

Can you run a economy with fuel at that price ?

I just don't see it. The main problem I don't see a easy solution for is the major costs of road infrastructure are currently born by a general tax right now. With fuel at 10 dollars a gallon a lot more people will use alternative transport in time the support for a extensive road infrastructure that is used by a few will wane. I just can't see a lot of support say 15 years post peak.

Note this is a problem even for all electric or hybrid cars since they would all face expensive roads.

Next I can't see alternative fuel sources ramping up fast enough to be viable replacements for oil during the critical initial 15 year period. It would be trivial to do a graph of the required ramp up and consider the logistics of replacing the oil as production wanes but I just can't see it happening fast enough.

The reason this is important is that the achilles heel of liquid fueled cars is shortages persistent chronic shortages of liquid fuels brings the viability of the car to zero.

So I see cars regardless of power source quickly becoming the transport choice of the rich. I see shortages effecting even this use case and I see the majority of the people moving to alternative transport and taking their tax dollars with them to support that transport at the expense of our current road infrastructure.

I'm not saying that a few wealthy Americans won't drive on a reduced road network but I can't see anything to prevent the majority from shifting away from the car towards alternative transport.

Also note that globalization has resulted in stagnant wages for 10 years their is no reason the expect that this will not continue or that wages worldwide will head to a world average. This will also limit the number of people that can even afford a car in America in the future. I bring this up because it prevents people from seeking higher wages to offset transportation costs.

Ahhhh, there's that word "quickly" again.

This time, a moronic statement by Mike. "So I see cars regardless of power source quickly becoming the transport choice of the rich."

No timeline. Why? 'Cuz he knows it will be decades 'til this absurd statement comes true. Decades.

TOD is "quickly" becoming the playground of the lunatic fringe ...

Freddy,

I think you are being a bit harsh. I'm not a doomer. I do not think that most of the commenters on TOD are doomers. However, those who are doomers do make some noise.

Note: Matt Savinar has not been here for the past week. Wonder why?

Ditto for me

There is massive overshoot of infrastructure and buildings being constructed. In 20-30 years when this stuff needs major repairs the energy is not going to be there to maintain it.

The Doomers completely omit any consideration of the codfish.

Once we squeeze the U-238 out of the cod fish flesh what we have left is mostly liquids. Add this back in to the C+C numbers and voila!

The entire process can be financed by selling off the other heavy metals( americanium, obscenium) also found concentrated in fresh cod fish flesh.

There are substitutes for the various uses that we currently assign to oil. When, where, how, and why they prove viable is determined in part by the geology of oil, and the economic reaction to supply changes. Peak Oil is concerned with the former, as we currently are heavily dependant on oil for our liquid fuels, and the downside of the curve is frighteningly soon and steep compared to how we expect alternative fuels to ramp upwards. Noone has suggested that oil production is the only number that matters for human quality of life, but it is the number that currently matters the most.

When the overall discussion goes "The peak is happening soon, look at evidence A, B, and C that the depletion rate will reach R % a year... They say that alternative 1 can ramp upwards at rate D, alternative 2 can ramp upwards at rate E, alternative 3 involves sacrificing virgins and is unsuitable, and alternative 4 costs too much.... D + E's replacement doesn't come anywhere close to R, we could see $200/barrel fuel at those levels of supply"

And you come in with "But the peak didn't include alternatives 1, 2, 3, or 4, which my invisible hand will make work. There can be no discussion of the peak without assuming that all the alternatives will work. Fucking doomers."

It's not very helpful.

The 'invisible hand' is a joke about how people assume that circumstances will dictate a change in the order of things, therefore negating those circumstances from ever happening in the first place. Post hoc ergo propter hoc. You illustrate the point nicely.

The main problem with total liquids is they are a scam. They are a horrible measure of the liquid fuels available.

The other problem with total liquids is they have no bearing on Peak Oil.

Now you can argue that other liquids might be a viable alternative to oil but I don't think you will get very far with that argument. Like WT says, demand for oil rises 5% a year while imports will drop by a similar number. Do you really think other liquids can ramp to fill this gap? Year after year?

All of this has been pointed out to you numerous times. Yet you insist on this childish charade of "doomers"

I don't know why oilmanbob thinks you have improved, you are as juvenile as ever.

And the All Liquids number is a really lousy way to measure that.

This has been discussed at length on TOD. While C+C is not the most ideal way to measure the above it is the best measure we have. And certainly better than the All Liquids measure.

"And the All Liquids number is a really lousy way to measure that."

I think this is arguable. The double counting/return on energy arguments rely on the premise that all of the energy inputs into non-conventional resources are from C + C. In reality, this is not even close to being fact.

You are correct, all the energy imputs are not from crude.

But you are incorrect when you say the "premise of all of the energy inputs into non-conventinal resources are from C + C."

Who said it has to be 100%?

Whatever crude is used to produce ethanol is counted first as C+C and later as ethanol even if ethanol gets some of its energy input from the sun.

"Who said it has to be 100%?"

Apparently you guys did - which is why you don't count these very significant and quickly expanding sources. Of course, finding, pumping, and getting C + C to your local gas pump takes crude inputs as well. On your premise, if we used this flawed logic on what to count and what not to count - we wouldn't be including C + C

I would like to see the exact calculations on a typical GTL plant, which will contributing a huge amount of supply in the coming years. I'm betting a similar amount of crude inputs are used in relation to a typical oil well to get a gallon of diesel to the local gas station. I may work out the calc for this over the weekend.

Oil sands, ethanol, biodiesel, CTL etc will use a larger amount of crude in the mining process - but not a great enough percentage to completely disregard them. The refining of these products, which is the bulk of the energy input - simply requires heat regardless of it's origination. Look for onsite upgraders serving as input in the future.

If you really want to get accurate, maybe a percentage of each type, including C + C since this requires crude inputs, could be used for peak calculations.

I will go take a look at some of the older threads that you mentioned. Hopefully the arguments aren't the debunked points regarding double counting and return on energy though or I'm going to be disappointed.

Of course other liquids are an important source of energy and are not disreguarded.

I can't recall any post on TOD saying this.

What has been expressed is that all liquids is a lousy metric for oil production.

Your other point about needing oil to produce oil has also been discussed at length. For example a deepwater offshore rig will take signifgantly more energy to produce a barrel of oil than a developed on shore field.

However on this point we are lacking a reliable metric. If you have a way of measuring this your contribution to the discussion will be signifigant.

I don't think you'll be disappointed. There are some very knowlegdeable posters on this site (myself excluded).

I am not a doomer, but I think C+C is interesting. Maybe that's because of an implication, an assumption: that the capital investment and needed to battle a C+C decline, and to maintain "total liquids" growth in face of C+C decline will be very large.

A doomer will tell you not only that it can't be done (growth can't be maintained) but that we are "doomed." That is, after all, where the word "doomer" comes from.

I think C+C decline (if and when we get there) will provide a lot of practical tests for the many theories thrown around.

At a minimum, I think it will lead to higher pump prices for Joe Schmoe ... do you disagree with that, given the higher capital investments needed for non-traditional liquids?

I agree that C + C is extremely important - but it's not the whole story.

"At a minimum, I think it will lead to higher pump prices for Joe Schmoe ... do you disagree with that, given the higher capital investments needed for non-traditional liquids?"

No doubt - I agree with you and believe this is a given. However, the higher prices should also result in increased investment in these non-conventional sources, as well as investments into technology for greater efficiencies on the producing and consuming ends of the supply chain. These investments do have a significant lag time, however depletion rates should be rather slow if the future is anything like the past, which I don't see why it would not be. I dont' think anyone should base their lives on the premise that the sky is going to fall tomorrow. This should be a very slow process barring any catestrophic events.

IMO the doomers are very short sited, and along with the perpetual optimists - fit the assumptions regarding the base data to match their expectations. Take the assumptions regarding this post for example. Makes no mention of non-conventional sources and assumes a new field will immediately go into an extremely high depletion rate. Well of course liquid production is going to crash if you look at it this way.

Like the author I can say that I'm an energy investor as well, but the premise of my investments fall under completely different assumptions.

Let's assume a "couple" of years is two though it might be three or more. But I'll be generous. So SA and Qatar will put 1mbpd of GTL online. Yet a 1% decline rate in C&C for 2 years is a loss of about 1.5mbpd... and a 1% decline rate is absurd, as I told you previously when I referenced the CEO of Schlumberger in a response to you.

Do you see where this is going? Alternatives have to ramp up, in total, faster than decline. There is no evidence that this can or will occur. The rate of increase in tar sands production, even at its most optimistic is pathetically below the global decline rate, even if you hold global decline to 2% to 3% per year. All discussion of CTL is just hot air until it happens and as others have noted elsewhere, there are serious issues with CTL. And ethanol? I think you need to take that debate up with Robert. Let's just say that I believe Robert's numbers on ethanol more than anything I've seen from you so far.

Amen Hothgor -

Unfortunately, whether it's CERA, doomers, or whomever - people gererally want to be right more than they want to be objective.

Using C+C is a good way to proclaim peak has happened for the doomers - I was right - ha!

What a clown. I suppose people said this when we exterminated the passenger pigeon population. If you two lived back then, I can picture you prancing around telling everyone that don't worry we still have a bunch more species to exploit. Objectively true, but sad and idiotic.

other than those irritating dispatchs from reality (you keep recieving) how are things in polyanna land ?

In response to several posts above - “World output of goods and services increased from $7 trillion in 1950 to $56 trillion in 2004” (Earth Policy Institute.) From 2.5 to 6.5 billion people (50-06). That is quite some ‘growth’.

How much of it was fuelled by or dependent on the availability of high quality energy isn’t something one can figure. For example, the Green Revolution; new strains of wheat plus mechanised agri plus agrichems plus irrigation plus...led to pop. growth (coarse grain production multiplied by 5 or more? since 60) and to desertification and deforestation, higher class disparities (small holders dying off) but also to better education, sanitation for many (not all)... and just to more people producing more widgets and poetry, though new ideas, as memmel points out, have been thin on the ground recently.

Anyway, the system is so complex and feedback loops so numerous that the correlation between ‘growth’, measured however on likes, and the drawdown of fossil fuels is gross, over a long time span, and need not be robust, it is more a matter for a systemic diagram than a spreadsheet - energy as an input to a system, not ‘oil consumed’ as GDP (or whatever) increases.

8 people are standing in an elevator, among them a doomer and a pornucopian. The elevator has a sign on the door saying it can't carry more than 8 people. A 9'th person wants to enter the elevator, the doomer thinks it's a bad idea but the pornucopian disagrees. The 9'th person enters and nothing happens, the pornucopian begins to laugh at the doomer. Then the 10'th, the 11'th and the 12'th passenger enters, still nothing happens, the pornucopian's laughter gets louder and louder. Finally the doomer can't take it anymore and leaves as he listens to the pornucopian calling him a false profet and a coward.

Then passenger number 12 and 13 enters the elevateor, the cable finally snaps, and everyone except the doomer gets killed.

Hurin: Your analogy doesn't match the way the USA (and the global) economy is currently structured. More accurately, if the elevator is weighed down, passengers who cannot pay the new increased rider fee are thrown down the elevator shaft.The elevator continues (some of the Americans thrown down the elevator shaft have their places taken by newly wealthy Chinese and Indians).

Nice analogy, except for one thing: elevators don't work this way.

http://en.wikipedia.org/wiki/Elevator

Now, should this mechanism activate you may be stuck in an elevator with people you don't want to be stuck in an elevator with, but that's really the worst of it, assuming absence of criminal negligence of course.

>Oil + Condensates peak and the doomers pound their fists on the table wondering why society hasn't collapsed. Meanwhile, GTL, CTL, Oil Sands etc, Ethanol, etc continue to expand liquids production out to the middle of the next decade before sustaining a rather significant plateau.

No doomer to my knowledge has ever said that the society would *IMMEDIATELY* collapse after PO. PO mere represents a turning point where growth comes to an end and poverty begins to rise significantly. At some point, a significant loss of cheap energy takes its toll on society eventually leading to a collapse, because the current system is no longer able to function. For instance if the cost of gasoline rises about $10 a gallon its extremely difficult to imagine that the American way of life can continue.

>Meanwhile, GTL, CTL, Oil Sands etc, Ethanol...

1. These projects don't scale. Its easy to build a single plant capable of producting a few hundred Kilo/bd, but its nearly impossible to scale them beyond one or two MB/D

2. These projects are extremely expensive and they average three to four times their original projected costs. Maintainance and production costs are also considerable more expensive. To produce a Oil equivalent barrel using GTL or CTL is between $80 and $150 per barrel today (depending on the source fuel and the location). These costs will also rise as global transportation and the cost of capital rises (higher interest rates) since the contruction materials and equipment come from all parts of the world (using the cheap oil and gas of today to deliver them).

The costs per barrel presented in the media are simply to attract investment dollars. They do not reflect real world prices. For instance in the Canadian Tar Sands project they are using *FREE* natural gas for oil recovery. Eventually the supply of Free Natural Gas is going to be depleted resulting in significantly higher production costs (thats assuming that they continue extracting tar sands). The Canadian Tar Sands projects are nearly maxed out because there are running into significant limitions that makes it prohibitially expensive to increase production. About a year ago Shell announced that it would cost them about $11 Billion to expand production by another 100 Kb/d from tar sands in Canada.

3. Ethanol and Biofuels have Negative EROEI and are simply a politically driven fade as Washington uses Ethanol subsidies to buy votes in the farm belt. Virtually all Corn Ethanol plants operating in the US either use Natural gas or Oil to process the corn. Biodiesel has even a lower EROEI than Ethanol, since very oil is contained in plants. Plus the fertializer inputs are also provided by fossil fuels (many natural gas).

What you have is alternative Energy projects( GTL, CTL, biodiesel) subsidized by cheap oil and gas. Eventually the subsidies will disapear and these projects will no longer be economical (at least for the average and slightly above average consumers). A few years ago, the Air force did a detailed study on the costs of Jet Fuel from CTL and GTL projects. They estimated the costs would be between $4 and $6 a gallon. A recent test to fuel B52 using Jet Fuel from GTL cost them a mere $23 a gallon.

If you truely believe there is no problem ahead, why bother reading and posting message here or any PO site. After all, we are all aledgely wrong and you would just be wasting your time.

"1. These projects don't scale. Its easy to build a single plant capable of producting a few hundred Kilo/bd, but its nearly impossible to scale them beyond one or two MB/D"

Why would these projects need to produce one or two MB/D to significantly contribute to world liquids supply? This doesn't make sense, and it's not how oil fields work although there are still a few fields that produce over 1 mbd per day. The bulk of oil output comes from many smaller producers. I do not see your point here. Between only SA and Quatar, over a million barrels per day will be added with GTL's over the next few years.