Who has to conserve how much?

Posted by Stuart Staniford on May 6, 2006 - 12:46am

I don't 100% agree with this way of looking at things, though it's a piece of the truth. The part I agree with is that net oil exporters are going to have their economies helped by high oil prices, and that might lead to some increase (or at least reduced decrease) in oil uage relative to everyone else. However, I think just assuming that consumption in exporting countries will increase in line with their historical GDP growth or population growth, and only what is left over after internal consumption gets exported, strikes me as probably a bit simplistic.

I think firstly we can divide oil exporters into two groups. In countries like Norway and Canada, oil is not internally subsidized, and consumers will face the same price incentives as consumers elsewhere. High gasoline prices will have Canadians and Norwegians conserving just like Americans or Germans. In countries like Kuwait or Venezuela, internal oil usage is heavily subsidized. However, even here I expect economics will have some potent effects. The more the differential between the internal price and the external price, the more powerful will be the incentives to find a way to export more and consume less internally. This will lead to political pressure from the national oil companies, and their political patrons, to export more. If that doesn't work, it will lead to corruption and smuggling of oil. The oil will start to leak out of those exporting countries one way or another. I think these economic effects will tend to limit, though not eliminate, the degree to which exporting country consumers will feel able to increase their consumption while the rest of the world is being forced to conserve like crazy. The graphic at right shows some prices from last year to illustrate the variety of price incentives consumers face.

The more natural way to think about the situation to me is to consider what has happened in the last year or so, and assume that the future will be like the past, only a little less so when it comes to oil consumption. That is, countries that were able to sustain a high growth in their oil usage from 2004 to 2005, will probably have some oil usage growth from 2005 to 2006 also, though perhaps not quite as much. Whereas countries that were obliged to reduce usage in 2005 over 2004 will probably have to reduce even a little more in 2006.

To look at that data, the ideal source will be the new version of the BP report, but that's not out yet. In lieu of that, the EIA has Table 2.4 in the International Petroleum Monthly. It has consumption data, but unfortunately doesn't break out all countries, just some of them. However, I still think this is more useful than considering BP data only through 2004 (when the plateau hadn't really started to bite).

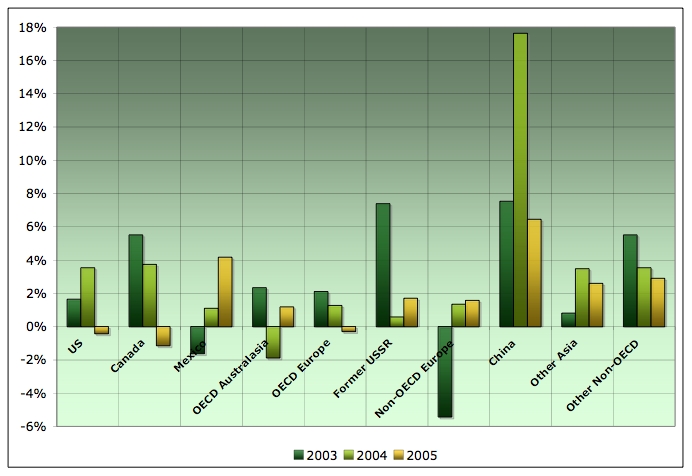

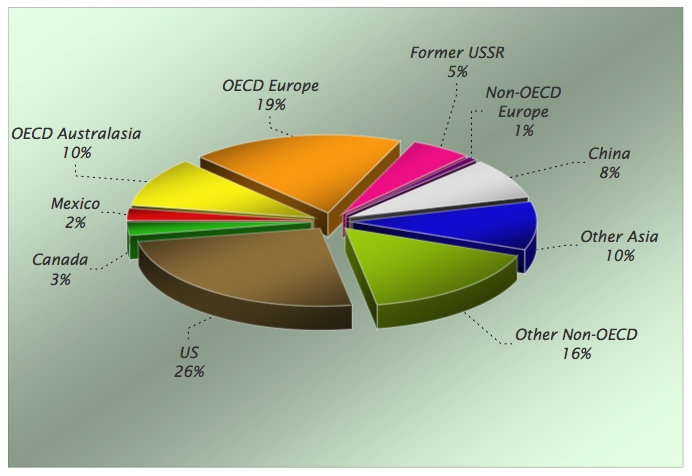

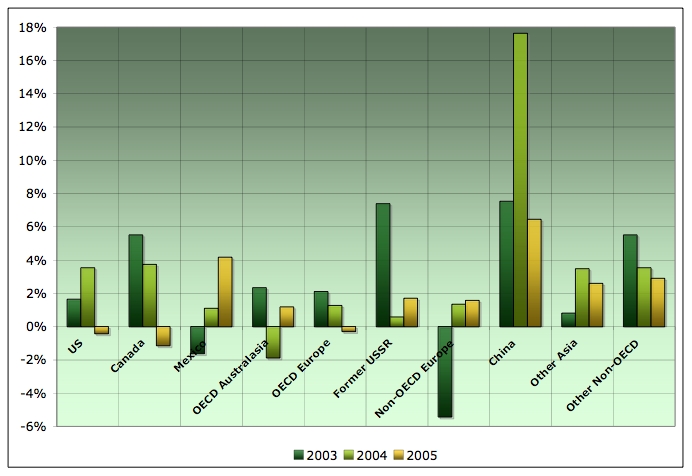

Anyway, I took the following countries and groupings: here is their share of 2005 oil usage.

Besides the named countries, "OECD Europe" is Britain, France, Germany, and other OECD countries in Western Europe. "OECD Australasia" is Japan, Korea, Australia, and New Zealand. "Other Asia" runs the gamut from rapidly industrializing countries like India and Thailand to less economically successful countries like Bangladesh and Myanmar. "Other Non-OECD" includes both almost all the OPEC countries, and also a mix of developing countries from Africa and Latin America. Obviously, this is far from the ideal way to group the countries for this purpose, but it's the best I could make of the data available.

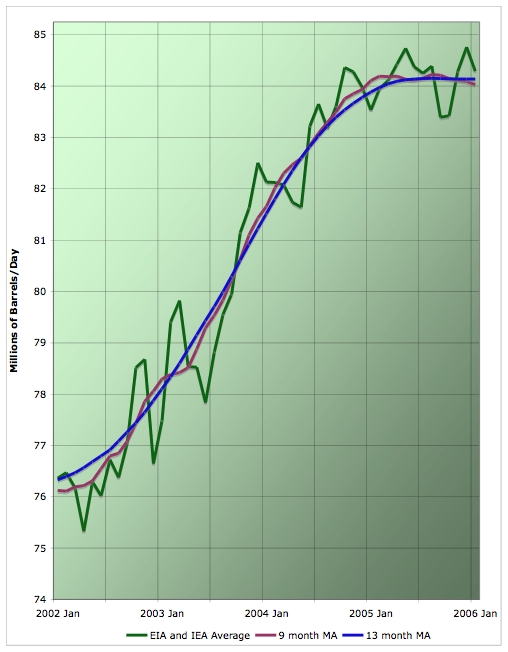

Let's remind ourselves of what the global production curve in the last few years looks like:

So from 2002 to 2003, global production increased very healthily. It started to slow down in 2004, and the brakes really came on hard in 2005. So now let's look at who got to increase/decrease their oil usage by how much as we came into the plateau. This graph shows percentage increase/decrease in usage over the prior year for 2003, 2004, and 2005.

Look particularly closely at the yellow bars, which represents the 2004->2005 transition as production plateaued out. You can see pretty clearly who had to do the conserving: the US, Europe, and Canada. I.e. Western economies with modest growth and non-subsidized domestic use of oil. The more car-intensive US and Canada had to conserve a shade more than Europe on a percentage basis.

China, and to a lesser extent the rest of Asia, continued to grow oil usage, though less than in 2004. Meanwhile, oil exporters like Mexico and the USSR increased oil consumption growth slightly from 2004 to 2005. Obviously the "Other Non-OECD" grouping hides a mixture of oil exporters who are probably growing consumption for the most part and oil-consuming developing countries who are probably having to conserve. But on average, that group increased it's oil consumption into 2005.

My guess, again, is that this will set the pattern for 2006 and 2007. Europe and North America are going to have to tighten their belts further still, and Asia and the oil exporting countries are going to continue to grow their usage. In the Asian case it will be less than they otherwise might have, and in the case of OPEC countries, it will be more than they otherwise might have.

But absent major oil shocks, the conservation required in the next few years should be relatively modest and manageable percentages. Of course, the risk of major oil shocks seems to get worse by the day, so who really knows?

Thxs again for your work! So the US consumption dropped just a little, but I surmise it was mostly 'painless' conservation where, for the large part, people just planned their auto errand trips around town just a little more carefully. If instead, a huge Energy Reform Policy [ala Hirsch Report] had been passed in Congress to rebuild the railroads and mass-transit [ala AlanfromBigEasy]-- the energy required to start accomplishing this, on top of the normal economic activity--would have probably reversed this percentage change bigtime.

The converse of this is China. If China had resisted the auto-craze, and instead, kept on the path of bicycles and mass-transit-- their percentage growth in oil consumption would have been much less.

It will take huge amounts of energy to re-engineer for the next paradigm if we wish to do it peacefully, yet every day we globally build and enlarge this faulty infrastructure. It would be much better for the world to proactively start choking production; to force an early Hubbert downslope vs. continuing the Fiesta, then having the geologic downslope imposed by detritus entropy. The production plateau, although reassuring, is just a short timeframe abberration-- it cannot last the twenty years or more that the SAIC Hirsch Report recommends to achieve maximum mitigation. The population Overshoot continues too, which is probably the worst force of all.

Solid and wise world leadership is required to peaceably guide the masses in the optimum Powerdown direction and voluntary population controls. As mentioned before by some other poster--we need a bunch of Winston Churchills who can only offer us 'blood, toil, sweat,and tears'. Since this does not seem likely, I fear the Thermo-Gene Collision is only gathering strength.

Bob Shaw in Phx,AZ Are Humans Smarter than Yeast?

Yep, that is the big question: what is the best way to help those that have economically fallen off the bottom rung of the detritus ladder? Bereft Indian farmers self-ingesting pesticide, newborns being found dead in the Zimbabwe sewers, the crisis in Sudan, people freezing from lack of natgas heat...on and on until the mind reels. Yet, detritus entropy dictates that this will only get worse with the passage of time. The 'trickle down' theory doesn't apply to energy as it can only be burned once.

When the US welfare and Social Security system collapses: how will we treat our elderly, sick, and disabled? The recent EnergyBulletin article talks about the possible future difficulty in replacing a worn-out water heater--How about the decision of choosing between feeding Grandpa or feeding your child? Will it be wiser to spend your money on family health insurance vs. spending it on heating oil when it is bitterly cold outside? What percentage of Americans will take in another family that cannot afford their own housing and the energy to run it? How willing are we to decrease from using 25% of the world's oil to the world average? Isn't that inherently fair?

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

I've been frantically trying to get the attention of influential Christians in my own little corner of the world, but, alas, to little if any avail.

Are you suggesting that, with oil production at a plateau, if the U.S. poor, middle and/or upper class, and industry conserved say 2% to 6% a year we could have a reasonable chance of avoiding a catastrophic situation?

Or is the plateau model one that leads to a cliff?

Also, sometime would you update the above 9-month center moving average graph.

Your work and wisdom is much appreciated. Your hard data balances off a lot of the doomers' speculation.

Internal political pressure for subsidization from countries that do NOT subsidize must grow as price pressures hit home to producing countries. As an example see: Bolivia. This is the equivalent of bread and circuses for the Romans.

Do you really believe that Norwegian and Canadian governments would be able to stay in power as the squeeze for their energy sources becomes more intense while at the same time they maintain an equivalency between foriegn and domestic consumers?

I see Venezuela using it's reserves for political diplomacy, SA keeping the blooming youth population at bay, Nigeria in civil/piracy war. When the benefits are not seen locally chaos reigns. The fungibility of energy MUST lessen as supplies grow tighter and costs increase simply because the local politics are what controls the well heads.

Yes, there will be black markets, wars, trade 'agreements' but it all just adds up to making the energy just a little bit harder to get, a little more expensive as each producer must use more and more of it's resource to assuage the pain at home in order to not be replaced by a more inward looking regime.

Westexas is more on target than even he dreams.

Gary

While Canada produces more than it consumes, it exports most of that production (about 70%) to the US. To meet its own requirements it imports about half of what it consumes from off shore suppliers, primarily Europe. This liability is shared unequally. Western Canada is supplied wholly from Canadian sources (primarily Alberta), while Eastern Canada is supplied primarily from imports. There is currently no crude oil pipeline connecting western and eastern Canada that traverses wholly on Canadian territory; the only east-west connectors pass through the USA.

When it comes to energy, geopolitics can override national self interest, especially for a small nation adjacent to the world's greatest military power. In theory Canada could take back control of is energy supplies by withdrawing from NAFTA, but at what cost? If Canada were to attempt to curtail exports to the US, would the US invoke the Carter Doctrine?

"The only kind of power that ultimately matters in this world is the power that comes out of the barrel of a gun."

Your points are extremely valid, and as a US citizen: I apologize for what our misguided leaders have done. I encourage Canada to withdraw from NAFTA if your country starts a huge biosolar habitat effort to do your best to extend your remaining supplies for internal use only for decades. This shrinkage in energy shared carrying-capacity to the US will help jumpstart conservation and the building of biosolar habitats in the NE & NW parts of the US, maybe elsewhere inside the US, too. The Carter Doctrine is only enforceable if our military has lots of energy, and the military knows that attacking Canada would be pointless because you could easily have detrito-terrorists constantly blowing up the pipelines and powerlines running south. The US & Canadian military should both understand that setting up mutual Earthmarines to protect the biosolars is much more energy efficient, humane, and protective of biodiversity and existing infrastructure than a continental war.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

Why apologize for US actions? If Canada perceives it's sitting on the short end, who's to blame?

I cannot imagine the average US citizen being for our B-52s doing cluster-bombing runs on Canadian cities ala Dresden, nor for a blitzkreig military thrust to secure the Canadian energy resources. I would rather sweat to death in Phx than see our military attack Canada. The US should first prefer internal detrito-civil war between native-energy exporting states [Tx,La, etc] and non-energy states [Wa,Ma, etc] than to us attacking Canada or any other country cutting off our imports [as they inevitably will]. If our country adopts the 'Nuke their Ass--I want Gas' mindset of the '3 Days of the Condor' scenario and is willing to kill Billions for the non-negotiable American way of Life--I am ashamed to be an American. If all Americans understood Peakoil, we would proudly Powerdown from the 9gal/day avg to the Bangladeshi avg of 2cups/day, but Powerup biosolar energies to the maximum. Our wasteful burning of 25% of the world total detritus energy is unsustainable: America has a moral obligation to use this wealth to peacefully lead the world into the next paradigm. We can do it the easy way, or the world will impose it upon us the hard way. How much blood for oil will be lost before we get smart?

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

Surely you are joking!!

Give up our funded health care?? Give up our funded pension system? Give up our system or elected representatives who are actually elected by we the people rather then appointed by wealthy corporate lobbyists and then formalized via the electoral process?

What does the USA have to offer? A society engaged in class warfare where the top 25% of the earners get tax breaks and the bottom 25% go homeless? A country overrun by wacky religious fundamentalists? A country that turns its back on science and such scientific findings as global warming? That undermines its educational system, that has the highest incarceration rate in the world, that has a corrupt and biased press, a militaristic society that engages in jihad and crusade, one that condones and encourages state sponsored terror and undermines global institutions and conventions? Why would we want to be part of this?

My fear is that global warming and NG shortages will combine to make the southern states uninhabitable and Americans will migrate north. But you will not like it here at all, honestly. We are all gay and have abortions on demand, we drink mostly tea and we all speak french and our money looks funny.

Given the billions you are investing in Iraq, I suggest you move there.

We would have the Candian medicine program overnight. Think what more than a dozen senators would do to the Democratic/Republican balance in the Senate.

Regarding the healthcare - wish I had your optimism! The elites are already busy dismantling the safety net worldwide. USA becoming like Canada - wish that was possible... No, Canada will become like USA, guaranteed.

Even if Canadians were interested in joining the US, it's unlikely that the current administration would welcome them, since most Canadian provinces would enter as "blue" states. That would upset the current balance of power in the US. It's easier and cheaper for the US to get what it wants by indirect means. Simply threating to slow or halt Canadian (non-energy) exports is enough to terroize Canadian politicians and businessmen into making concessions, but we do tend to be stubbornly difficult about it. There is no need for military intervention.

Most Canadian politicians do not know or are not yet willing to acknowledge it, but energy prices and security are about to become major, divisive issues. When the Canadian government attempted to introduce a two price system and energy security strategy in response to the seventies energy crisis -- the National Energy Policy -- Alberta rose up in arms. There is no dirtier word in Alberta than "NEP".

At that time Albertans promised to "let the eastern bastards freeze in the dark". In a sense, NAFTA has become the instrument to make good on that promise. Albertans may yet get their wish.

On this...

If China had resisted the auto-craze, and instead, kept on the path of bicycles and mass-transit-- their percentage growth in oil consumption would have been much less.

Are we really sure that its all down to China adopting a car culture?

I have a hazy recollection of reading somewhere (I'll try to find later) that it might be the mechanisation of Agriculture in China that accounts for a large proportion of fuel use. As people move from the country to the city in search of a 'better job' those fields need a labour replacement - anyone with better info?

And, all that plastic in US shops comes from somewhere...

I think we also need to check what Chinas progress/policy on rail actually is.

Also, what is the most appropriate statistic to compare countries? The frequently displayed 'country consumption' type graphs or a 'per capita' graph? Or both?

According to Societe Generale, a major French bank, the spike in chinese oil consumption in 2004 and less so in 2005 was due to running thousands of extra diesel generators to meet zooming electricity demand. As China rushes to complete 500+ coal-fired power stations before the decade is over, such demand will certainly diminish and eventually reverse.

Also, is it correct that oil consumption increased in 2005 in China? Article from "People's Daily":

http://english.people.com.cn/200602/03/eng20060203_239901.html

excerpt:

"China's oil consumption and dependence on imports decreased last year as a result of the government's energy-saving efforts. The National Development and Reform Commission said recently that China's dependence on oil imports was 42.9 per cent in 2005, 2.2 percentage points lower than in 2004. It also said China consumed 318 million tons of oil last year, 1.08 million tons less than in 2004....."

As far as climate change goes, I guess we can kiss the Planet goodbye (a least as we've known it).

Adult Diaper Sales Soar in China

China Daily reports that some passengers have mental breakdowns from the conditions on the trains, and throw themselves from the cars.

The plan envisages (i) building 6,000 km of new lines to access

previously unserved areas, with the network reaching 74,000 km; (ii) providing 3,000 km of

double lines, and electrifying 5,000 km of key lines to increase capacity; and (iii) increasing

operating speeds on 5,000 km, with the total length of such lines reaching 15,000 km.

While it is true that there are large investments in the Highway system

Also, China is building a superhighway system, "which is where the bulk of the world's concrete is going today," says Schwartz. China, by one estimate, is now putting $40 billion a year into road construction. At the same time, China is overhauling its rail system, building separate lines for freight and passenger traffic.

In some cities they are introducing Rapid Buses with dedicated lanes, while encouraging smaller car use as...

... private cars in China nearly tripled between 2000 and 2005, from 6.25 million to 17 million. These vehicles now account for one-third of all oil imports. High vehicle fuel consumption has also contributed to the nation's oil shortage, with Chinese models manufactured before 2001 guzzling 20-30 (?) more fuel than their foreign counterparts.

66% of cars have a capacity less then 1.6 L and recently a consumption tax of 20% has been applied to large capacity (ie over 4 L) cars.

Not saying it's rosy, but... what's happening where you are?

For those interested, i released our April USA Reserves Report tonite.

http://www.trendlines.ca/economic.htm#USAReserves

http://www.theoildrum.com/story/2006/5/2/22318/01508#82

We track the 11 best modelers on the planet. With prices increasing over the last five years, almost all of them agree that URR is expanding rapidly due to both technological and financial (feasibility) developments. In short, we are on the way to 110-mbd due to the critical mass in exploration and investment.

Those in the USA are getting a rude awakening on prices that is somewhat related to currency exchange moreso than supply/demand. Your dollar has fallen 50% against our Canadian dollar this decade. You have a current acct and trade deficit problem and economic affairs are showing up in your import prices.

But even having said that, oil & gasoline are only now attaining their historic averages from an inflation adjusted point of view with your country and many otheres. Gasoline and oil have been an incredible bargain for several years. That caused cutbacks in exploration and refining dollars just as we saw in nat'l gas.

It's all about business cycles and the return to norms...

Across the globe, oil and gas supply at risk

It ends with this:

http://www.nytimes.com/2006/05/06/business/worldbusiness/06oil.html?hp&ex=1146974400&en=7b2f c59ec4c5551b&ei=5094&partner=homepage

While they don't use the words PO most of the article discusses it.

Indeed, in most cases where governments nationalized their oil industries in the 1970's or have tightened the fiscal terms more recently, production has sagged: Iran today is nowhere near its peak production, nor is Libya, nor Iraq, and until last year, Saudi Arabia had not increased its production capacity in more than three decades. More recently, output from Venezuela and Russia has been stagnant or falling.

"The 1990's was the reverse of what we have today: there was competition for capital rather than competition for reserves," said Michelle Billig, director of political risk at the PIRA Energy Group, a consulting firm in New York. "Now that bargaining power has shifted."

"This totally affects the supply outlook for the future," she said.

"The world is depending on the continued growth of production. If there are fewer incentives to increase production, you will have continued tightness in the market."

Well, MicroHydro has given me a segway into my topic, complete with example...

It is always amazing to me how, even when showing charts of all the regions of the world, and discussing concerns and events of a "global" nature, the good old fashioned "America-centric" logic still creeps in, almost without notice.

The Americans seem to have a certain way of partitioning all existance: There are "conservatives" and "liberals", nothing else. There is Baseball in summer, and Basketball in winter, with Football in autumn, because that's the way the good Lord intended it, and dancin' is for sin and prayin' and worship is for Sunday (no real American believes in dancin to worship, and prayin' for joy, you got to have rules and catagories, you know....)

Such is it with our energy....propane is used to grill burgers, gasoline to run the lawn mower, and Diesel to get stuff to Wal-Mart, and natural gas? That's the heater, right?...there SIMPLY IS NO OTHER CORRECT ORDER OF THINGS!

Recently, I told a freind about something I had seen that didn't seem to be a bad idea, a propane lawn mower running on LPG. I wish you could have seen his face! I might as well have told him I found Martians in my yard! Then the look of bewilderment...will that actually work? A female friend looked at me when I talked about it, and just smiled with amusement....she was sure I was pranking her...and she waited for the punch line!

But long before we return to the horse and buggy, or to Ken Deffeyes "stone age by 2025" we will all become what you so elegantly called "opportunistic detritovores". It is easy to forget that for most of the world, natural gas will still be fairly common for quite a while (as will the LPG that can be produced from it) and despite the dream of a "fossil fuel free" utopia of happy aging boomers trying to steer plows behind mules, a generation used to having Starbucks down the street having to catch rainwater and make tea from Sassy' frass leaves...I don't think so... most will be overjoyed to go over to LNG, CNG, LPG, and even coal before they go back to the stone age....even if it means breaking out of the the above listed blockhead "catagorical" frame of mind....yes Virginia, you can use propane in a lawn mower, they do it China and Europe, because it makes sense...propane is counter season on demand in the summer, with the heating demand reduced...and you have a damm grill with a propane bottle on it sitting right on the porch a few freakin feet from the lawn mower!

Yes, you can run natural gas OR propane in a car, and it is counter seasonal too, as the vacation driving season starts just as the price of nat gas and propane go down.

America may be peaked on natural gas, but the world is not, at least not yet, and places like Australia have more gas offshore than people to burn it, their only problem will be trying to keep Americans from hogging it up....likewise South America, and much of Asia....it's the Europeans and Americans who are hurting on this one...

The Americans never get used to the idea that YAHOO (You Always Have Other Options) applies....it has to be GASOLINE IN THE CAR, PROPANE IN THE GRILL, IT JUST FEELS RIGHT!! It's either/or to us, never multiple options....the other day, I actually heard a poster on one of these boards saying that conservation of natural gas was cool, but had no application to the transportatin industry (!!!!)

If America installed readily available high efficiency appliances and lighting, insulated homes, and used solar hot water where it works, throw in a bit of wind, we could run cabs, buses and efficient cars on natural gas and LPG (which comes from BOTH oil and natural gas production anyway) and greatly enhance our market position...BUT THAT'S NOT THE WAY IT'S DONE.

Our whole society is organized this way....Buckminster Fuller once said "we have a very interesting arrangement...at the end of the work day, the people go back to the slums and sleep with the rats and the bad heating, while our office machinery sleeps with the good plumbing and climate control."

As I sit typing this post, I am glancing to an ad on TOD to the left column, "WHY WALL STREET IS WRONG ABOUT OIL! Click here to download!" It has a stunning photo of the oil industry at work, with three giant flarestacks flaming off millions of BTU's of....(?), gas, naptha, butane, acetane, who knows...but one can BET that it would burn in a lawn mower or a gas grill or even a car if there was a market for it....I worry less about "Peak Oil" than I do about "Peak brains"...we live in a world of totem and taboos worse than any ancient village people, where we would rather rail about "PEAK OIL!" than simply change a few habits.

Roger Conner known to you as ThatsItImout

Did you ever stop to consider that the choice of the word 'Segway' was deliberate, given the tone of the post? To move seamlessly from one mode to another- to substitute - and even if it wasn't why the pointless nit picking? The intention was clear. Why not pick up on the other spelling mistakes?

On this...

America may be peaked on natural gas, but the world is not, at least not yet, and places like Australia have more gas offshore than people to burn it, their only problem will be trying to keep Americans from hogging it up....

My parents recently went to some kind of investment seminar where the speakers had the opinion that for the first time in 200 years Australia was in a good geographic position... ie WRT India and China. The Gas mentioned above is mainly in the north west of Western Australia... I would suggest that none (or very little) will make its way to the US or Europe. You only have to consider the sailing times across the Pacific (to the US) as compared to under a week to India and maybe a little more to China. Other views?

(I hoep I splet everhtying corerctly?)

"Segway" is a brain-dead Amurrikan phonetic Newspeak version of the word, copyrighted and used to mean a commercial product.

I guess it's true that the only difference between Americans and non-Americans is the non-Americans are those who were not raised within the Empire and are differentiated only by their desire to be Americans. To live in a culture with no history, to speak a language where trademarked products are held holy, and to disencumber themselves from the baggage of irony, subtlety, and humor.

Welcome! Start processing your papers now, and here's a hint: Tell 'em you're Hispanic or something if you can "pass" at all, there's something about the Anglo-Saxon ideas of individualism (real individualism) and freedom (real freedom) that make the rulers of the Empire uncomfortable, so if you can seem to be an ignorant and enthusiastic 3rd worlder it's much easier to become a real Amurrikan.

What is going to undercut any switch to other fuels is cost. Take something as simple as switching back to coal for heat. I grew up with coal heat. First, you need a coal furnace. I'm unaware of any residenetial ones currrently available other then box-type heaters. Second, today's houses are not designed to house them. Third, no houses are built with coal bins and, of course, there are no longer any (perhaps a few still survive) residential coal suppliers. So, our esrtwhile aging yuppie has to build an addition for the furnace and coal bin and buy an appropriate furnace and re-do the ductwork. Lots of bucks.

The same high costs are encountered were someone to decided to switch to LPG for their vehicle. Sure, it's doable at a high price. Further, the only reason LPG is cheaper then gas today is that it's not loaded with taxes.

I honestly don't anticipate any of these changes occuring. It isn't that the changes are impossible but rather few will be able to afford them. To me it would make more sense to take the equivalent of these funds to improve transit, etc.

BTW, I heat with wood that I cut off my land using a, gasp, gas-powered chain saw. But if push came to shove, I do have a couple of 6' two-man saws - misery whips as the old-timers called them.

Allow me to segway (hee,hee, what real Amur I can would use some French lookin' word like, what was it, seque? That sounds like a food, "I'll have the pasta la'seque, please..." :-) back to the issue of price and cost...in one way, I think your right....if gasoline hangs around the $3.00 to $4.00 mark, and nat gas stays under $7.00 to $8.00 a MM/btu, not many folks are going to bother with change, it will still be a small part of overall income anyway...BUT, if it goes over $4.00 bucks, people start looking....and the cost factor comes in favor of flexibility....take the industrial/commercial propane mower you mentioned...Dixie Chopper makes one, it costs more than their gasoline model, but it is cleaner, easier on the engine....and here's the important part (even moreso than the taxes you mention) it is running propane out in the summer months when propane dealers are having to discount (especially after a couple of mild winters back to back). The cost of the mower becomes not such a bad deal.

Here in KY, a good number of natural gas/propane suppliers run LPG in all their delivery and service trucks, (our local dealer even uses in farm equipment on a small farm), because he has volume tanks and knows what the cost to him will be for the next year out in front, because he already owns the LPG. The costs are not that great, if the conversions are done in even moderate volume (in the older days, when there were real mechanics around, a lot of them built the kits themselves)

On the idea of using coal to heat a house, your absolutely right, it would be idiotic to try that...and an environmental nightmare to boot....so what to do?

Install a geo-thermal or ground coupled heat pump and good insulation. In many parts of the country, that effectively puts you on coal to heat with, from the utility. It costs, but if nat gas takes off again, it may not be such a bad deal.

But, if fuel (gasoline and Diesel) stay cheap, no, there will be no changes simply for the sake of gaining market leverage, and for having other options available in the case of emergencies, or for smoothing out the seasonal demand peaks and valleys....that would make too much common sense, and give us the consumer some clout in making the gas/oil/electric/coal suppliers compete against each other at least to some degree.

America seems to like to be a one store town.

(by the way, ignore any mispellings, I am in a hurry, and my Mac has a crappy sppell cheque! :-)

Roger Conner known here as ThatsItImout

"if gasoline hangs around the $3.00 to $4.00 mark, and nat gas stays under $7.00 to $8.00 a MM/btu, not many folks are going to bother with change, it will still be a small part of overall income anyway...BUT, if it goes over $4.00 bucks, people start looking....and the cost factor comes in favor of flexibility"

I heard this when gas went over a dollar in the '70's. I heard this when gas went over $2 last year. I heard it last month when gas went over $3. We know many people pay 5 to 6 dollars a gallon and still drive.

What proof do we have that increasing costs will dramatically reduce use? WalMart sales up 6% last month!

But for those who live hand to mouth...they are cutting down already. Take a look at a chart of the ratio of unspent personal income to personal fuel expenses and you will see what I mean...

Actually a lot of home owners associations require lawns as part of the CCR's of the development - can't have a scruffy looking yard; home values will go down.

In any case, I agreee with you. What is unfortunate is that most of these lawns are on crap, back-filled soil that aren't particularly useful for anything else.

TLS,

You dodged my question on the cost of alternatives. Sure, ground source heat pumps are nice. But, if you are strapped to pay the bills, as many of the McMansion ownwers will be and some middle class people currently are, do you seriously think they are going to give something up in order to pay for a system like this? And, if they choose to give up buying new junk (assuming they can), the economy goes to hell.

Here's a question for you: I have a 3.6kW PV system. The parts cost $40+ grand (However, I should mention that $6K of this is batteries). Are you ready to install a similar system?

I live in Kentucky where electricity prices are so cheap no one even looks at alternatives, it would be pointless (I once did price a PV system and at current electric rates in KY the payback period exceeded 60 years, but that was not including the fact that most PV panels only have an expected lifetime of 20 years, so the payback time was NEVER...Kentucky is not the place to look for alternatives to electric power as a first option, but instead look for options away from natural gas and and gasoline....ole KING COAL rules here, whether we like to admit it or not, and a plug hybrid in KY would be so cheap to run it boggles the mind (of course the CO2 issue will have to be discussed separately since most Kentuckians rank it right up there with killer bees as a real threat.... you asked,

<You dodged my question on the cost of alternatives. Sure, ground source heat pumps are nice. But, if you are strapped to pay the bills, as many of the McMansion ownwers will be and some middle class people currently are, do you seriously think they are going to give something up in order to pay for a system like this?>

Sorry, I ain't buying into that...it never amazes me how we can justify that nobody can afford alternatives, but they can afford everything else, and the predictions of the soon to be collapse have now been running for 25 years...let just try to give you a thought....I was at a convenience store fueling up my Diesel the other day, when a white Caddie rolled onto the lot....and I hear this POP, followed by, "PHHHHHHSSSSSSSS!!!" I thought I was in the middle of a drive by shooting...but then I see the Caddie drop about 5 inches to the pavement....oh, that's what it is....hydraulics.....

Now for those of you who are not familiar with the youth culture, Hydraulics are placed on the suspension of a car to make it rise, fall, bounce, wallow from side to side, and other odd tricks for cosmetic effects and showmanship. It consists of at least one hydraulic pump, and at least 2 to 4 recieving servos or shocks, and electronic switch gear and control valves, plus yards hydraulic high pressure hose. At least the above is required for only a minimal system, and to repeat, this is for "special effects" cosmetics only.

The above is a multi million dollar industry, and along wiht other "cosmetic" after market enhancements for autos, this is a multi BILLION dollar industry.

And yet, it is argued, that the Americans cannot, repeat, CANNOT afford any device that will save fuel or move people to more flexible alternatives.

Hybrid cars? Too expensive, we are told, too complicated, nobody can pay....

Hydraulic hopping suspensions? Too cool....have money, will hop!

What a pack of idiots.

Roger Conner known to you as ThatsItImout

Thanks for the reminder. Thanks also for generalizing. "The Americans" all fit your mold perfectly, simple-minded sheeple that we are. Baaaaaaaa.

First, Stuart is correct in making a distinction between oil exporters that subsidise domestic production and those that don't. In places like Canada & Norway, the population is fully exposed to the rising price of oil (I won't say high, because it would be cheap at twice the price), so they have a definite incentive to conserve.

Secondly, he is correct when he says there will be political pressures to reduce the gap between domestic & world prices for oil in the countries that subsidise it. One way that this may play out might be for governments to move away from a fixed local price & towards a fixed subsidy, so that local prices move in line with world prices, but at a lower level.

There is, however, a third consideration. This is that oil imports are a growing factor in the balance of payments of countries around the world. Countries importing oil will face balance of payments constraints and, in time, crises. This will reduce economic growth markedly. In exporting countries, however, higher prices will cause a boom. This means that people in oil exporting countries will, in aggregate, be more able to afford world oil prices than people in oil importing countries. The share of oil consumption will therefore shift towards those countries which are oil exporters and away from the importers.

Finally, the effect of oil prices is not confined solely to oil exporters. It will also, though to a lesser extent, be found in net energy exporters like Australia. Australia is an oil importer, but a major exporter of coal & natural gas. Rising oil prices will also raise, to an extent, coal & natural gas prices. This will protect the balance of payments of Australia & other countries in the same situation and, therefore, allow economic growth to continue - at least for ten years or so until things get really drastic.

So, the solution to the iranian nuke crisis is simple, just as we could have earlier quickly, and bloodlessly, solved the hostage crisis - bolckade their oil exports. World oil prices will increase, but not drastically - say to $100/b - because some oil will leak through the blockade via pipelines. Meanwhile their economy will slowly collapse, and time is probably on our side.

Who wins? There are many beneficiaries; higher prices will promote conservation and reduce current consumption - leaving more for later - and slowing gw, as we all want; and, Bush's oil patch backers will be mightily (but very quietly) pleased. Meanshile, iranians will have less money for many things (not least terrorism), which their young and restless will not find amusing.

Will Bush seize the nettle? Does he retain sufficient political power to engage iran economically, when the engagement raises pump prices? Would the anti-bushies at tod support him on this issue, and would they help, or hinder, him in the mid-term elections?

Governments which most heavily subsidize

domestic energy costs are the most likely

countries for future civil unrest ..

Triff ..

I guess this reframes the ethanol question in an interesting way: is it better to grow ethanol for domestic use, or better to grow food to export in exchange for oil?

...or is it better not to export any food at all? Exporting food is essentially the same as exporting our topsoil-- not a good idea for the long run, and detritus entropy will eventually preclude this from happening anyhow [calories to move the food > food caloric value forcing localized farming].

If any country needs to import food to survive--they are in Overshoot and should be drastically reforming their agricultural methods and birthrates [if they are smart]. Abundant biodiversity, with clean, easily available water, and rich, loamy topsoil are the primary ingredients of security, whether at the family level, or scaled up to the national level. Then having huge PV installations to power the move of the foodstuffs and cotton from farm to walkable cities for processing, along with the return of humanure and other recyclables, is the next step. Biosolar generated energy slaves are vastly preferable to human slaves. I hope America has the wisdom to lead the way.

Saudi Arabia, and other ME countries, which are highly reliant upon food imports and high energy inputs for water desalinization are making a terrible mistake by not heading off these issues:

http://198.81.129.100/cia/publications/factbook/geos/sa.html

------------

A burgeoning population, aquifer depletion, and an economy largely dependent on petroleum output and prices are all ongoing governmental concerns.

...desertification; depletion of underground water resources; the lack of perennial rivers or permanent water bodies has prompted the development of extensive seawater desalination facilities; coastal pollution from oil spills.

----------

SA could quickly be brought to its knees, within mere days, if someone attacks these desalinization plants, and cutoffs food imports combined with some aerial defoliants. I could easily imagine SA trying to trade two barrel of oils for one barrel of potable water in a worse case scenario. SA, wealthy as it is, should stop deluding themselves and start building biosolar sustainability forwith. This would eventually allow them to become financially and militarily impregnable vs. their very exposed current condition. But sadly, I think that maybe the US milgov elite are counting on this SA weakness for some future time.

Bob Shaw in Phx,AZ Are Humans Smarter than Yeast?

I'd really like you to post an expansive review of what you consider to be "biosolar" living/a biosolar society. It comes up in your posts on a regular basis. Maybe the TOD PTB would let you be a guest poster.

I've been arguing that society needs a new paradigm. Unfortuately, the world is full of warm-fuzzy buzz words. So, what is biosolar living?

I'd like to know how it differs from my life. I have a highly energy efficient house. A PV system. Solar hot water and grow (and preserve) a lot of food. My heat comes from trees on my property and the water from my well. What am I missing? I want to be clear that this isn't trolling. I am very seriously interested in this.

There is a fourth consideration which WesTexas needs to incorporate in his model.

This fourth consideration is the fact that energy intensive production will tend to migrate to nations with the greatest energy reserves.

If you want to run a wafer fab which requires significant amounts of energy to maintain and manage the prodcution environment will you locate you $10 billion investment in a region of potential energy shortages or will you locate in a state with an assured energy supply?

If we look at Saudi Arabia we find a state with a growing population and an indequate number of jobs. Given current oil prices they would also be able to provide a subsidy to encourage industry to locate within their borders. The US has already lost a number of chemical plants which have relocated overseas to be more closer to an assured low cost supply of raw materials.

The importers, on the other hand, will get the shock treatment much sooner, and I think this is a good thing. The greater the initial pain, the better off you will be in the long run. For example, look at the economic performances of the contries of the former Soviet block. The ones that went for a quick, painful transition to a market economy are doing much better today than the ones who dragged their feet. For example, Poland is much better off today than Belarus.

The sad part is that the exporters, with their greater resources, would be in good position to transform their infrastructure. Today, only a few oil exporting countries are preparing for the inevitable, notably Norway and the UAE.

Thanks to direct injection, low sulfur standards and particule filters, diesel cars are just as performing as gasoline cars, consume less and pollute less. And the movement is encouraged by taxes which are much lower than gasoline in a number of countries. So gasoline consumption is down significantly, and diesel is up - but by less.

IT Energy Costs: The Quiet Budget Killer

The rest of the article is a list of tips for saving energy. Among them: switch to DC power.

This has the maybe unwelcome side effect of shielding the public from the most obvious indicator of oil price rises as a 10% oil price rise only shows up as about 3.5% fuel price increase - about 3p/litre which is similar to the difference between different stations

Also there was a table recently - can't recall reference - that showed that in US fuel cost is still a small proportion of total car running costs - most is depreciation, interest on loans for purchase, etc. So in either case crude oil price rises have a tiny impact on car running costs per mile, so people are not likely to drive a lot less. Also with more fuel efficient cars remember Jeavons Paradox - if you buy a brand new, fuel-efficient car you might as well use it a lot, by spending the same amount on fuel but travel further.

I believe the biggest impact on motor fuel use in the near future is likely to be economic slowdown which we are maybe just beginning to see in the UK and concern for personal - mainly credit card - debt which is huge. Keep that going and it brings - recession.

Many aren't doing the tough things yet - moving closer to their jobs, and buying smaller cars - but that will come.

However, compared to the same poll taken a year ago, it's kind of interesting. More details here.

Even if they're just saying they've cut back, and really haven't...well, at least it shows they're thinking about it.

Americans who are "middle class" and "higher income groups" saying gas costs will be a hardship?

I myself at something around the scut working-class flying under the radar, and I don't worry about gas prices.

And this exposes the actual truth: Almost all Americans are working class. If you're worrying about gas prices, there's not a whole lot seperating you from the gardener you're paying to keep your yard neat while you're away working your 50-60-70 hour weeks. I'd say we have about the top 20% being actual middle class & higher and the "Haves" a subset within that top quintile.

In 1980-81, during the last oil crisis, the expense for personal consumption of "gasoline, fuel oil and other energy goods" (as included in the Nat'l Income and Product Accounts) was 5.1% of disposable income. In 2005 it was 3.5%. At current oil prices, the expense will rise to 4-4.5%, still below the high of 1980.

But there is a crucial difference this time: American currently spend 97% of their total income, vs. 86% in 1980, so they have less cushion to absorb higher energy expenses. Putting it another way, Americans' annual unspent income could buy them 30 mos. of fuel expense - today just 9.

Consumption is almost certainly being cut as we speak.

One way people are cutting personal auto expenses is to reduce auto insurance coverage to the state-mandated minimum, or going without insurance at all. Thus, it is forcing higher premiums on those motorists, desiring to protect themselves, to pay for un-insured or underinsured motorist coverage. It should be required that insurance is totally prepaid for a year upfront in order to get your license plate tags. Instead, what happens is poor people setup their insurance on a monthly pay basis, get their license tags, then cancel the insurance a month later, but keep driving their cars. If the ins. requirement was to prepay for the year ahead first, many would be forced to use mass-transit, taxicabs, or bicycles--helping to conserve energy and create walkable cities. It would also help reduce the pollution and the carnage on the roads as most of these vehicles are old, poorly maintained, and many drivers exhibit bad driving practices.

So what happens as a result of the current plan is that a pedestrian or vehicle get hits by a non-insured motorist, then the driver leaves the scene of the accident. If not, the driver has no networth anyhow to pay damages to the mangled accident victim. The state has to pickup up the tab of medical and disability costs.

I like the idea of no fault insurance purchased at the gas pump. The state could vastly increase the mandated minimum liability protection to help financially protect all citizens, and paying for both gasoline and ins. by the gallon prohibits any driver from not being covered. A gas tax to further induce conservation could be included with this plan. This might be the best way to setup a fair plan, and create walkable communities as gasoline could go to $10-15/gallon overnight. The roads would be much less congested with all the car-pooling, buses, and scooters--making it vastly safer for increasing numbers of pedestrians and bicyclists.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

Will the India/China slice be allowed to grow? If yes, who gets a smaller slice? EU or US?

I can't find one of your more outstanding posts. My recollection is that it went up last summer or early fall. Assuming a declinining oil production (peak oil), you projected what effects three different decline rates might have on the world economy (mild, moderate, severe).

That kind of analysis seems to be missing from this article. Am I missing something, or doesn't this article presume a continued plateau or a gentle decline? You do raise the possibility of an "oil shock" but that is not the same as month over month decrease in oil supply.

At any rate, your response is very helpful, and frankly not reassuring. It does require a rational political response in the US. I think there are any number of reasons why this won't happen anytime soon.

- Mexico -- consumption up, production declining

- Canada -- probably OK for now except there is growing resentment there. Tar sands slow to come online

- Saudi Arabia -- ??? recent attacks on oil facilities including Abaqaiq

- Nigeria -- enough said

- Venezuela -- talk about a stable producer! Not! Hugo! Buying oil from Russia to meet contractual obligations.

So, I am not as sanguine as you about our situation. Who are we going to invade next to keep the pumps primed? I know you are taking oil shock into consideration but still, this looks bad to me.best, Dave

Frankly, although the media is beginning to pay attention, joe public is not. In most of my discussions with others, all intelligent, well educated and generally liberal, I find that listeners a) have not heard of po and b) have no interest in it.

The past did not feature year over year oil production declines. When this happens, we will have entered a new world requiring wise and cooperative planning, as Matthew Simmons argues. For example, he argues for the switching from trucks to trains for the bulk of freight hauling. This kind of decision would require nothing less than a huge government intervention in the status quo.

True, there will be adjustments by many, but many other "hidden hands" will be looking out for interests that will cause others great suffering. We will be entering a zero sum game--if we haven't already.

This is definitely something to be concerned about from the American perspective when we also consider that Nigeria and Venezuela are #4 and #5.

Just to add a humorous note, I see that we got a whopping 450/kbpd from Iraq (that thousands folks) in February, down 82/kbpd from January. W, Dick, Karl, Don and Condy's plans are working out big time. Maybe it's time for W to bring out that codpiece and make another speech on an aircraft carrier.

Remember guys, you've got two choices, you can laugh or you can cry.

Life is complicated. Perhaps because of the vast unknowns that I face in oil and gas exploration, I try to simplify models as much as possible.

There were two parts to my "Export Land Model," falling production and (slightly increasing) consumption. Assumptions: (1) a country producing 2.0 mbpd, consuming 1.0 mbpd, exporting 1.0 mbpd; (2) production falls by 25% to 1.5 mbpd over a six year period (based on North Sea); consumption increase 10% to 1.1 mbpd, net exports fall to 0.4 mbpd. Therefore, as a result of a 25% drop in production and a 10% increase in consumption (over a six year period), net exports fall by 60%. Note that increased consumption only accounts for one-sixth of the drop in exports. Falling production accounted for five-sixths of the drop in exports.

IMO, falling production is going to be the big driver regarding falling exports, while increasing consumption will be a significant, but minor factor. However, key point: even if an exporter has flat production, rising domestic consumption = falling exports. If production is even rising at the same rate that consumption is growing, this would equate to no increase in exports.

The Lower 48 and the North Sea reserves were developed by private companies. The only restrictions on production were regulatory restrictions and prudent reservoir management (Texas was politically constrained, but this was a minor factor on Total Lower 48 production). Based on the HL (using crude + condensate) technique, the Lower 48 peaked at slightly less than 50% of Qt, while the North Sea peaked at slightly more than 50% of Qt.

So, again using the simplest possible model, what we would we expect to see after the 50% mark worldwide? Record high (nominal) oil prices? Falling production? Falling imports?

Again, the HL technique suggests that the top exporters are more depleted than the world is overall. Just look at the ages of the top oil fields in the exporting countries. IMO, we are only at the beginning of a ferocious bidding war for a rapidly declining net export capacity. In the short term, we may be able to outbid some other importers, but increasingly the question that exporters are going to be asking is what thing of value can we offer them in exchange for their oil.

I cannot emphasize enough that you need get yourself on the side of the economy that is producing essential goods and services.

http://www.mosnews.com/money/2004/11/09/oilproduction.shtml

Russia's Oil Exports Reach Maximum, Decline to Start in 2 Years -- Official

Created: 09.11.2004 16:38 MSK (GMT +3), Updated: 17:11 MSK

MosNews

Excerpt:

Russia has almost reached its maximum level of production, the head of the Russian Union of Oil and Gas Producers, Yuri Shafranik, said on Tuesday, Nov. 9.

Speaking at a press conference Shafranik, quoted by Interfax, said: "We are currently producing almost the maximum amount of oil possible. Further growth can happen only if the [world] prices continue to rise, but [since that is unlikely to happen for much longer] Russia's production and subsequent export will be automatically limited in two years' time."

The Russian official quoted experts from the International Energy Agency who predict that oil production in Russia will continue to grow for another two or three years, then the volumes of production will stabilize at a certain level, and then will begin to fall. "Only direct investment can change this situation," said the head of the Oil and Gas Producers' Union.

He did add that the IEA underestimates the fact that Russia has a number of unexplored oil deposits which can guarantee the growth of production for a while longer.

Nuclear now provides 20% of our elctrical power geneartion, and having it means we did not increase our coal burning by 1/3. What percentage of us electrical generation do you hope wind will eventually provide? And, consider we must almost immediately replace the 10$ of the total we get from ng.

33% wind; 33% solar; 33% biomass. After a 25% overall reduction via efficiency and carbon tax measures (a la westexas).

Quick calc: 3,970,555 million kilowatthours -25% x 33% = 992,638 M kWh. This requires 340 M kW of generating capacity ie 340,000 MW. Latest wind turbines are 4MW (6MW are in the works) -> 85,000 turbines. But, only 21% availability -> 404,761 turbines required. At about $1m per MW, that works out at approx $100B. A few weeks in Iraq?

PS: I know, excludes storage costs and transmission lines, but isn't this imaginable?

PPS: That's one turbine every 9 square miles. On average :)

Solar is better in many ways because it is more reliable and, just as good, generates power during peak air conditioning demand. The problem here is the cost, which will hopefully continue to decline at a hopefully more rapid rate. However, even solar does not work so good in the morning, at night, or during winter. Solar may indeed some day provide 1/3 of elctrical generating power, but I doubt much more.

Bio has been debunked on this site as a myth. The cost, both in energy and $, of hydrocarbon fertilizers implies it will never produce significant net power.

So, we need large, dependable plants for most of our electrical generation for the forseeable future, just as we do now. We can continue to depend on coal, as we do now, for a while, but will probably lose much low lying land over time, including FL and much of the gulf states, as well as quite a bit up the atlantic seaboard - it would be sobering to see a map of the us when the sea is 100 ft higher. The alternative is nuclear, specifically those that burn all the actinides as opposed to those that only utilize a fraction of their uranium fuel. I suspect that gw will be widely accepted by 2010, as well as the slim number of alternatives available to us. Sadly, there are not enough trained professionals to run a large number of new nukes, certainly not of the new types that will ultimately be necessary, and current professionals are nearing retirement. I would advise graduating hs seniors to take up nuclear engineering studies - they will be able to name their price, just as oil field workers do now.

How about doing something really stupid, like

borrowing hundreds of millions of dollars to

cover some prime agricultural land with a

chemical conversion plant that turns natural

gas into petroleum at around 50% energy

coversion, and then depletes the nation's

biggest gas field, just to keep the current

transport system going. Be in such a frantic

rush to build it that you pay over the odds

for everything and run into massive cost overruns.

Borrow so much money you cannot pay it back and

have to endure a currency crisis. Deplete the gas field so much

you have to shut down the plant and write off

the investment. Is that stupid or what?

Yes, it's exactly what NZ did after the

late 70s oil crisis, when it would have been

cheaper to have given every motorist a CNG

conversion kit. It tends to suggest that

corporate big business in conjunction with

corrupt/inept government will implement

whichever energy solution maximises short term

corporate profit at the expenxse of the

ordinary citizen.

And don't get me started on global warming,

please.

The 05 (yellow) bars in your graph for the us and china are more similar than they appear. The us gdp rose around 3%, china's was up 9.5%. So each country, goaded by higher prices, reduced consumption/unit gdp around 3.2%. It would be interesting to see the change in oil consumption plotted against their respective change in gdp for each group.

As you know, the us has traditionaly wanted another 2%/year while gdp rose around 3-4%, so even a small decline in consumption shows that higher prices are guiding us towards greater efficiency. I confess I am by nature optimistic, but I think we can cope indefinitely with flat or modestly declining supplies, in part because both the us and the undeveloped world waste so much.

I wonder what the UK public's reaction will be to the government's likely forthcoming plans for a new fleet of nuclear stations, when they have just had a hiding in the local elections?

Will GWB try to follow the UK Conservative leader's success in going green? (some humour!).

What this means is that what something really costs you is what you give up in order to get it. We think of costs in dollars but it makes more sense to think of the costs as all the other things you can't get because you spent the dollars on this.

From this perspective, an oil importer has a choice between dollars and oil. He can hold onto his dollars, or he can give them up and get oil. A bushel of dollars or a barrel of oil, that's his choice. The price of the oil is what he gives up to get it, the foregone alternative: the bushel of dollars he could have had instead.

But if you think about it, an oil exporter faces the same choice: dollars or oil. He can hold onto his oil, or he can give it up and get dollars. It's the same choice: a bushel of dollars or a barrel of oil. The price of the oil is the foregone alternative: the bushel of dollars he could have had instead.

Therefore, the incentives for oil exporters and oil importers are much the same. Both are part of the same market system, which allows them to exchange dollars for oil. It's like they all have a magic wand that can turn dollars into oil or oil into dollars, at the current market price. Faced with the same incentives, their decisions, if they are economically rational, will be much the same.

Consider the top two net oil exporters, Saudi Arabia and Russia (SAR),and the top two oil importers, the US and China (USC).

I know energy prices are subsidized in Saudi Arabia, and I believe that energy prices are somewhat subsidized in Russia, i.e., less than the world market price in both cases. This will of course cause demand to increase faster than it would have otherwise, especially when combined with the torrents of cash flowing into SAR from export sales. However, IMO declining production will be the biggest driver of falling exports.

At least while SAR is still exporting oil, it's probably better to be a net energy consumer in SAR, than in USC.

In USC, it is far better to be a net energy producer than a net energy consumer. In USC, the energy producers are facing an interesting challenge, trying to meet a demand that can never be met (absent a massive economic collapse, which is possible).

I was at Kinko's yesterday making some color copies, and I ran into a landman working the Barnett Shale Play. I asked him what day rates were up to. He said $500 per day, plus expenses. He is working seven days a week, $15,000 per month. (A landman secures oil and gas leases for oil and gas companies, acting as an agent for the oil and gas companies.)

I have suggested ELP as a response to Peak Oil--Economize; Localize and Produce. By produce, I mean be a producer, or work for a producer, of essential goods and services--especially food and energy. In the food sector, I think that you should aim toward organic farming/gardening, since conventional agriculture is a huge energy consumer.

In regard to energy, almost anything makes sense--oil, gas, coal, wind, nuclear, (some) biofuels, energy conservation, the list goes on. But the key point is to put yourself on the producing side of the ledger.

Cheap energy has made it possible for the majority of Americans to live off the discretionary income of other Americans (think of all the entertainers getting multimillion dollar salaries). We are facing wrenching changes as American's discretionary income falls, and as Americans are going to be forced to look for work producing essential goods and services. The sooner that you adjust, the better off you will be.

The anger of the formely well off energy consumers is going to be something to behold. We ain't seen nothing yet.

you've named an equilibrium condition, when both parties feel they have balanced quantities of oil/dollars, and are deciding at the margin.

in a dynamic situation, in which a developing country starts with much oil and few dollars, and a developed country starts with much dollars and less oil, it is a lot more complicated.

certainly that complexity is compounded by the oil being consumed (converted to "goods" that are often transitory) more quickly than the dollars (which are often invested in equities).

so no, i don't see the motivation as being the same at all. the oil holder is primarily diversifying long term investments (oil or equities). the dollar holder is primarily funding current operations.

The point remains. The largest and most advanced economies in the world have shown in 2005 (a boom year) that they can reduce their reliance on oil. Could it be that oil is a real commodity after all, sensitive to price?