Energy Prices, Inflation, and Personal Savings

Posted by Stuart Staniford on July 5, 2006 - 3:47pm

Annual income twenty pounds, annual expenditure nineteen six, result happiness. Annual income twenty pounds, annual expenditure twenty pound ought and six, result misery. --- Charles Dickens.

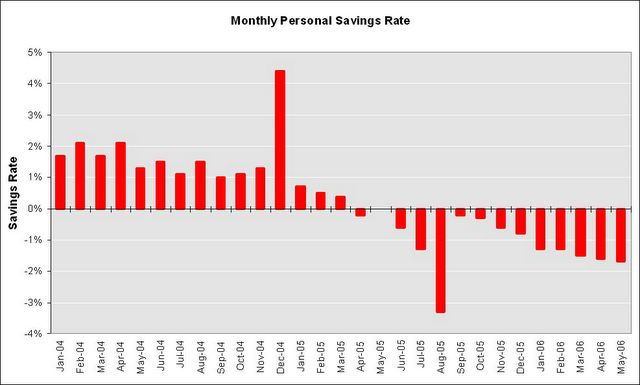

I was over today at Calculated Risk, and he had a post on the personal savings rate, which had this graph:

It occurred to me that the personal savings rate is a way to test my mental model of what's going on, so I investigated further. The idea is that if my model is correct that during a resource-constraint people are borrowing and/or liquidating assets in order to bid for the remaining goods and services, that ought to show up as a drop in the personal savings rate. To summarize the punchline, I discovered that there's some evidence that things are working according to my model at present, but no evidence that things worked that way in past oil shocks. So I am suitably mystified.

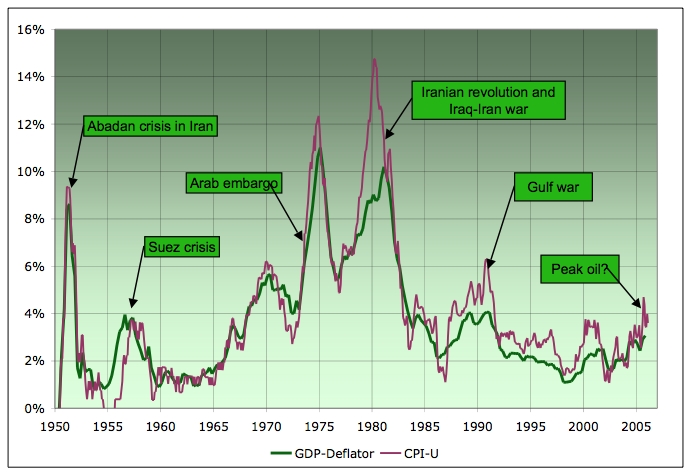

First off, given the controversy this tends to cause with various folks of the Austrian persuasion, I should say that what I mean by inflation is a change in the average price level in the economy, causing currency to be worth less relative to goods and services. This is measured by things like the CPI-U, the GDP deflator, etc (and to the extent they differ, I view that as an estimate of the measurement error in observing inflation). One can have short bursts of inflation, or large sustained amounts of inflation. (The US has not really experienced the latter at any time, but various developing countries have and do.) I'm not a fan of throwing away parts of the data under various pretexts (as "core" inflation does). You're welcome to use some other definition of inflation in your writings, but in my posts, that's what I mean by the term.

Firstly, why do I think there's this connection between inflation and oil shocks. Well, as I observed a few months ago, there have been six more-or-less significant oil shocks in the last 55 years (including the current plateau as a very mild one so far), and eight noticeable peaks in the US inflation rates. All six oil shocks coincide with one of the significant peaks, and the three largest inflation peaks are associated with severe oil shocks. The odds of that happening in the absence of a strong causal connection of some kind are miniscule, and it's sure hard to see how inflation could cause the oil shocks, rather than the other way around.

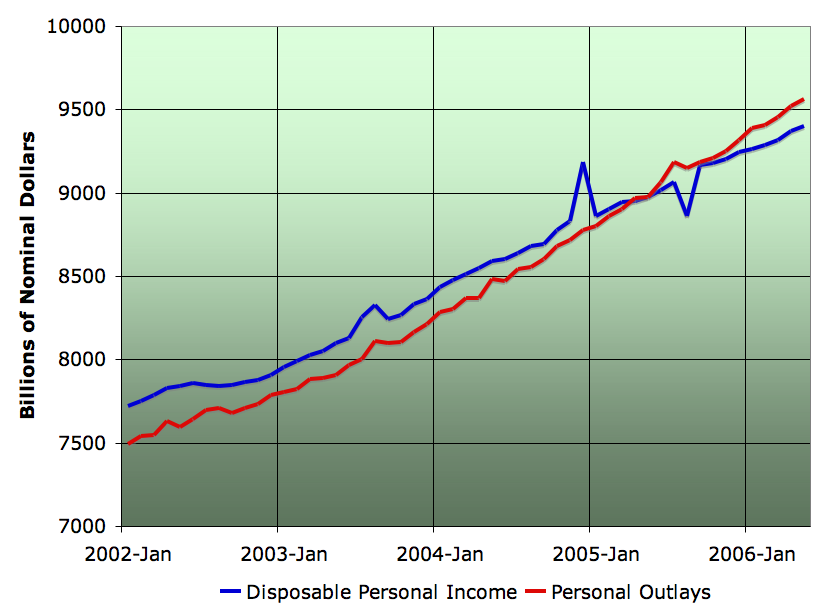

Anyway, I began by looking at the recent situation. The personal income data are available from the Bureau of Economic Analysis (eg see the most recent release, or go here for raw data). I was mostly working from Table 2.6 for monthly statistics, and Table 2.1 for longer-term quarterly and annual stats. The data cover the total amount of personal income Americans received (with some breakdown), the amount they spent, and computes personal savings as the difference. It's a nice series because it goes back a very long way.

I also went to the EIA, and dragged out numbers for gasoline consumption, gasoline prices, natural gas residential consumption, and prices. That allowed me to compute the proportion of personal disposable income (income after taxes and other payroll contributions) being spent on gasoline and natural gas:

As you can see, the proportion of income going on these has roughly doubled in four years. The gasoline calculation is a bit crude because it neglects both taxes (which would increase it) and the fact that some gasoline is bought by commercial and industrial customers (which would decrease it). Hopefully the residual error is fairly small. In addition to gasoline and natural gas, households spend a couple of percent of PDI on electricity but electricity prices have been fairly stable. There's also heating oil and diesel but these are a much smaller contribution to household expenses (on average - they are important regionally).

So given that the personal savings rate is the difference between income and expenses for the aggregate of US households -- their profitability if you will -- to the extent they hadn't had to spend money unexpectedly on energy, they might have saved more and borrowed less. Hence this graph which takes out the money spent on natural gas and gasoline over the January 2002 level, and puts it back into the personal savings rate:

(The spike up at the end of 2004 is due to Microsoft's special dividend, and the spike down in summer 2005 is due to hurricanes). As you can see, personal savings would have been fairly flat until the beginning of 2005 but for energy cost increases. And one might imagine that, now energy prices are starting to bleed through into core inflation, if we took into account the indirect effects of energy in the same way, personal savings might have been completely flat.

Of course, this isn't proof that there's a causal connection - it's just consistent with it and an interesting piece of evidence. Let's now look at the separate components of the personal savings rates: the after-income and the personal outlays:

As you can see, the problem is not that income wasn't increasing fairly briskly, it's just that we felt a need to increase expenses faster again.

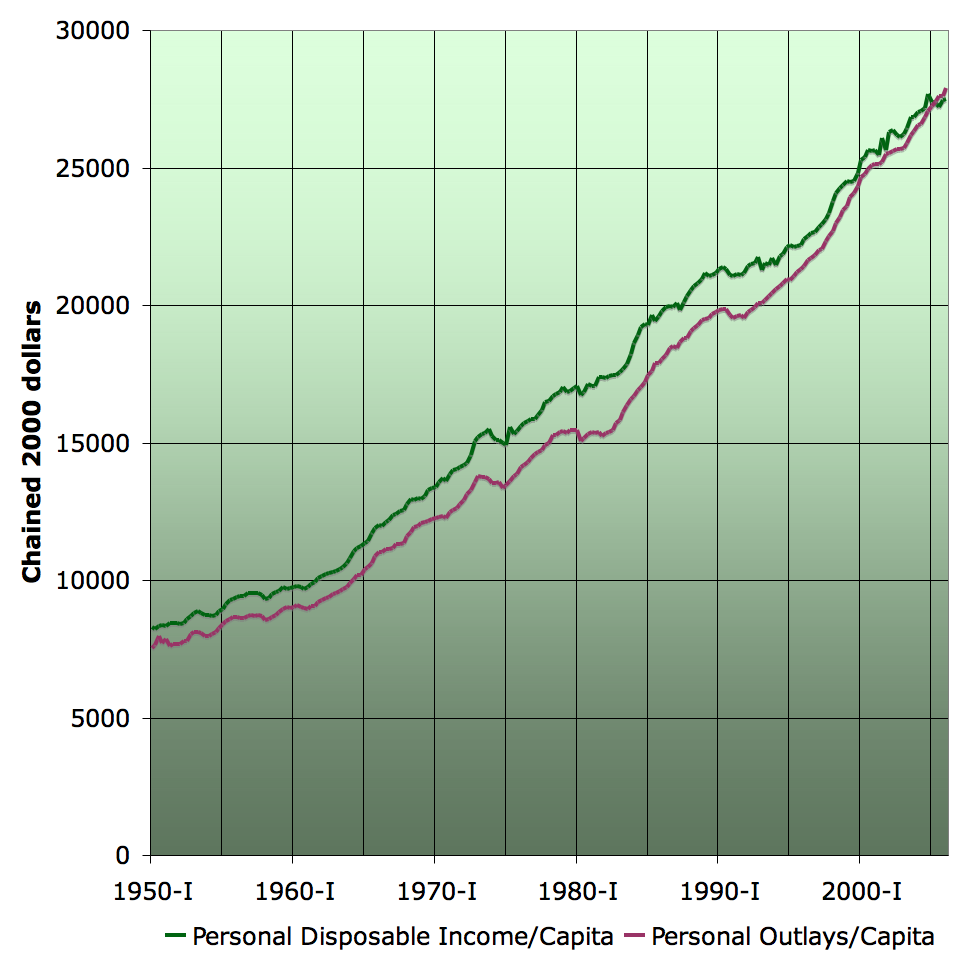

Let's pull back for a broader view:

Well! Is it that we are moral degenerates who live on credit cards instead of saving like our virtuous parents? Or that it's getting harder and harder to make a surplus, indeed even get by, now that globalization is moving our jobs to Outer Mongolia for the low wages? Or that all our jobs and heavy industry is moving somewhere they still have cheap energy since the peak of US oil and natural gas in the seventies? All of the above?

Whatever it was, around 1985, the rot sets in and things have been getting steadily worse ever since.

Anyway, we mustn't get too distracted by the big secular trends; our main mission here is a hunt for oil shocks. Let's start at the lower right. That giant dive in the personal savings rate in 2005 sure looks like it matches my model for oil-shock induced profligacy. However, I'm clearly in big trouble in the earlier cases.

For example, the Abadan crisis (where the British blockaded Iranian oil after Mossadegh nationalized the Iranian oil industry) began in mid 1951. It gives a huge (if brief) inflation spike immediately. But the PSR had dropped in 1950, and rises again through the oil shock. Likewise 1973 or 1979 are completely not there as big spikes downward from the prevailing rate. In general, past oil shocks seem to have had very little influence on the savings rate.

Here's per capita PDI and personal outlays in chained 2000 dollars (ie this is real, not nominal, dollars).

Hmmm. Are we really 3 1/2 times better off than our grandparents? Sure houses are somewhat bigger (though somebody's probably still living in Granny's house), cars accelerate faster, stereos sounds better, and kids have more toys. Computers and the Internet are really cool. But somehow it doesn't seem like a 3.5x improvement. I'd give it 1.5x maybe. How much would you pay, or need to be paid, to go back and live in 1950 instead of 2006? The furniture and clothing is nowhere near the quality of Granny's, we don't get to go to the symphony as often, and TV is execrable. But I digress again. The point I really wanted to make is that before about 1980, the two curves (income and expenditure) were almost exactly the same shape - every little wiggle in income was reproduced in outlays. But since then, they have increasingly diverged with the outlay curve getting smoother (including smoothly blasting through the flattening in income in 2005).

This next graph gives us a more precise look at the situation, at the expense of being more difficult to read. It shows the four quarter percentage change in both personal disposable income and personal outlays (economy-wide totals) so that we can see how both income and spending respond to shocks.

We can at least see the shocks now - remember in approximate severity order they are 1973, 1979, 1951, 1955, 1990, 2005. Each caused a sharp dive in income (though they are by no means the only things to do so). However, prior to this most recent one, all caused at least as large a dive in the personal outlay line. In some cases outlays fell more than income. But as you can see, since 1980, it's increasingly the case that when income stops growing, spending doesn't follow suit - we just borrow our way through it. Not always though - but obviously often enough that the personal savings rate is tanking.

So I think while my theory may have some value in the near term (as long as we remain such credit hungry spendthrifts) it doesn't appear to have much merit as an explanation in the past.

And that begs the question what does mediate an oil shock into such big spikes in the inflation rate?

My new hypothesis is as follows. When there's an energy shock, there's less energy (or at least less energy than households and businesses were planning on based on recent trends). Since it's very hard for anyone to use energy more efficiently in the very short term (before capital investments in more efficient equipment can be made), this means that someone is going to have to engage in less economic activity. The firms and households whose energy use will be dropped will presumably be those whose energy use is large compared to the amount of value they create with that energy. However, this process involves bidding up the price of energy (or it's most relevant subform: oil), and that affects the income statement for all businesses and all households, even those who win the bidding war to keep using as much energy as they were using.

Let's focus on the businesses for a moment; I now suspect they might be the more important actors. If 5% of a business's costs are oil and the price of oil doubled, and the business cannot use less in the short term, then expenses just went up by 5% over what was expected. Since pre-tax net margins are typically only in the range of 0-10%, that is a huge potential impact on net profits. Since shareholders hate that kind of thing, the business is now under huge pressure to either reduce expenses or increase revenues to increase profits.

Since all businesses are in variants of this dilemma, there isn't really an opportunity to increase real revenues on an economy-wide basis, so the only choices are to cut costs (which promotes a recession), or increase prices (which promotes inflation). The degree to which one or other occurs is going to depend on how much spare capacity there is. If the economy is already in recession, pricing power will be poor, and the effect of the oil shock will go more to deepening the recession. If the economy is strong entering the shock, pricing power might be good and firms will strive to maintain their profitability by raising prices. Households will tend to follow suit to the extent they have pricing power for their labor (demanding wage increases to compensate them for their increased cost of living).

If everyone does raise prices, and thereby spark a spike in inflation, the Fed is likely to notice (with some lag), and respond by increasing interest rates. This will then trigger a recession with some delay (if the initial shock was strong enough), and also bring the inflation level back down.

I'll check this storyline out in more detail in future posts at some time...

Note that if we look at debt as a ratio of debt to nondiscretionary GDP, it looks even worse. The majority of Americans live off the discretionary income of other Americans. During this Great Depression it was probably less than 10%. Perhaps less than 5%.

I think that we are going to see very strong deflationary headwinds--as overextended consumers and businesses try to sell highly leveraged assets. This is going to be compounded by the effects of home builders and auto manufacturers aggressively marking down the prices of new homes and autos in order to keep their businesses going.

Inflationary effects of rising food and energy prices will probably act to worsen these deflationary trends as consumers have less disposable income to support their SUV's and McMansions.

My key advice: cut spending, arrange your life so that you minimize your commute, and most importantly, look into becoming, working for, or investing in a provider of essential goods and services. Whether we like it or not, we are going to be forced to once again become a nation of producers rather than a nation of Jabba The Hut like consumers demanding that someone deliver food and energy to us at permanently low prices.

Perhaps we will have initial inflation when the recession begins, but once the economy spirals downward, deflation is more likely. There will be some items that are expensive, such as energy and some consumer goods, but prices are not going to inflate every year. Wait until you try to sell your assets, you can expect cheap prices.

I've been studying the future since 1989 and it's going to be worse than people imagine from 2007-2012. Here at TOD you don't realize how many people in the New Age community have know about this coming collapse. GNP is about to peak and begin a downward decline. Corporations are going to begin losing money and going out of business. Unemployment is going to skyrocket. It's going to get ugly, then uglier.

People think housing is going to drop 20-25%. That is way too optimistic. Housing will soon begin dropping like a rock. By 2009, prices will have dropped more than 50% and new constuction will have stopped because of excess inventory. Unemployment will be 20% by 2010. With such a huge collapse of the economy, I don't see how inflation can exist.

>Inflationary effects of rising food and energy prices will probably act to worsen these deflationary trends as consumers have less disposable income to support their SUV's and McMansions.

Excellent point. In the future we will likely see asymetrical ecomomic forces. Ultimately when oil and gas production collapses, the costs for food, energy or any consumpable product than requires energy to produce will rise. At the same time, over extended consumers will lack the ability to purchase durable goods and non-essential services even at reduced prices. Unemployment will soar and deflation will begin.

The fed might act to enact a zero rate policy (aka Japan), but I don't see how that would help much, as most financial business will be buried under litigation and last thing they would want to do is issue more questionable loans. Any significant montarization of the dollar would also have serious ramifications, since I doubt many oversea trading partners would want to ship good to the US, nor would oil and gas exporters be willing trade with us.

>My key advice: cut spending, arrange your life so that you minimize your commute, and most importantly, look into becoming, working for, or investing in a provider of essential goods and services.

My advice would be to leave urban regions. Who would want to live in a populated area with soaring unemployment, reduction in local gov't services (police, fire, infrastructure), and soaring crime and drug use. If you're providing essential services in a high crime area, you risk your wealthfare and your life.

You can buy milk at the gas station, just 4 miles away. But you need a 4WD truck to get there in the winter.

Of course, the local meth lab is just two miles away, and they need some reliable help.

Urban areas will do better post-peak than rural areas for a VERY long time. Perhaps selected cities of 100,000 to 300,000 will do best, but not every one.

I really respect you but this is the most head up my ass statement I have read on TOD for a long time:

<qoute>Urban areas will do better post-peak than rural areas for a VERY long time. </quote>

My perspective may be blurred because I live in the boondocks but I don't need you urban people. We have the resources you need like food and firewood. You will starve in the dark.

Todd

"Old Urbanism" can be quite energy efficient. As long as we have an organized monetary economy, I think vital urban areas will be a better place than isolated rural areas. (Phoenix & Las Vegas not included).

I use 6 gallons/month and could cut that down to 4 easily and 2.5 or so gallons/month in a pinch. Supplying our stores can easily be done by rail (Union Pacific, NorfolkSouthern, CSX, Canadian National, BNSF, Kansas City Southern) as well as barge and ocean shipping. We have excellent food within 100 miles (salt, fresh & brackish water + rice & dairy & fruit & sugar).

If we trade food & cotton for fuel, it will come through New Orleans. If you want coffee, it will come through New Orleans. If we import steel or copper, it will come through New Orleans.

As for fear of crime (or much else), that is just not a major motivator for me.

And I informed the police of a 3 generation family from the Missouri Ozarks that are, apparently, dealing meth to construction workers. So drugs are not uniquely an urban problem.

And I can get through the winter without any heat at all if need be (note my last winter).

I spent 4 months helping a friend get his business going (he lived ~6 miles outside Searcy, Arkansas on 44 acres). I was shocked at just how much driving was required to live even with a decent sized garden. His job before starting his own business was in South Little Rock, trips to Wal-Mart were several times a week, etc.

I responded to Lou below.

Look, you are a mouth to feed. You do not produce anything unless I missed it in some post. I appreciate your intellect but that only uses joules.

Here are a series of reasonable queations, my answer to all of them is "yes." What are your answers?

1. I can provide for my energy needs.

Comment: I cannot provide mineral engine oil but I can limit my engine hours to preserve it and run my engines on wood gas.

2. I can provide my food.

Comment: Yes, I can. Boring but sustaining.

3. I can provide my power.

Comment: Yup, beside my PV system, I can run either my 8kW gas generator or my 23kW diesel generator on wood gas.

4. I can provide my household and irrigatation water.

Comment: Again, yes.

5. I can preserve the food I grow.

Comment: Barb had a post on this a few Drumbeats ago that I idn't have time to respond to. The answer is yes. We can steam can,waterbath can, dehydrate, vacuum pack and vacuum pack and freeze (remember I will have power even if the grid goes down).

I don' wat to run this into the ground but shipping coffee thru NO isn't an answer.

Todd

I grew up gardening and have a fairly good knowledge of orchard farming in different climates.

I have good ties to Iceland and Landsvirkjun (their national power company), so I can "bug out" there in extremis. The alternative, in extremis, would be my grandfather's farms in the Bluegrass area of Kentucky, But I will stay here in New Orleans as long as a monetary system stays functioning.

Rainwater cisterns are quite doable & easy.

Here's the crux as I see the urban versus rural debate and it comes down to complexity. And, maybe I should have approached your intial post from this perspective and left out all the ancillary stuff.

Most, but not all, rural lives are probably an order of magnitude less complex then urban lives/living, that is, they do not depend upon complexity (I am not saying that technology is unimportant.).

A simple example: It snows in the higher elevations here - even though we are only 20 miles from the Pacific Ocean. No one "takes care" of snow on the private roads, which encompasses most of the area because it is the boondocks. We have been snowed in for a couple of weeks and others we know of were snowed in for up to 6 weeks this past year. That's life.

Now, how would an urban are deal with this situation? How would those urban areas deal with being totally cut off from civilization for these lengthts of time? Especially, if it was the norm?

My point is that Tainter and, probably, Odum would say that urban complexity is doomed to fail.

Todd

My impression is that most rural living is much more energy intense (especially for transportation) and comparable or slightly less economic value added.

In a non-collapse environment, that will work strongly against rural living and make access to social services (for instance medical) much more difficult.

The rural life of today is not that of 1900. It has (appearances to me) evolved into a very energy intense lifestyle, with "driving everywhere". The "once a month" trip to town lifestyle is long gone. And drugs have migrated as well :-(

BTW, There is a particular type of weed that grows well on disturbed ground in New Orleans that makes good (if spicy) greens.

But if the collapse went to completion and urban living became completely untenable, then the rural areas are the only alternative. Not that rural areas would be good, just not as bad as collapsed cities in the midst of a terrible die-off.

If one is not in prime health and physical condition, you need a support network.

There will be plenty urban/rural squabbles if TSHTF. Conflict predictable, outcome unknowable

- the most long guns

- the best training (i.e. veterans)

- the best aim

Here's looking at you, babe . . . .However, my experience has been that I had less freedom to build a sustainable existence in the city than I do on my rural property. Things like zoning restrictions, small lot sizes and community standards organizations made it difficult to impossible to do many of the things I wanted to do to move towards a less energy lifestyle. The cost of living alone made it necessary to work full-time (ie. 5 days of commuting) to make ends meet in the city. This is no longer the case now that I'm in a rural setting.

I've tried to live sustainably in the city and in the boondocks. For me, it's easier in the boondocks.

That should do wonders for the value of this conversation.

Frankly, I think you're both wrong. The cities won't collapse because they have no food or firewood. The 'burbs won't evaporate because of higher fuel prices. And rural areas won't be left high and dry.

Everyone will have to make major adjustments, and at non-trivial costs (monetary and otherwise). But in everything that I've read about energy issues, I have yet to see anything even remotely approaching a thorough, fact-based analysis that any of the three location categories mentioned above will face extinction.

For example, hand-waving from people like Kunstler about how the 'burbs are doomed is so much balloon juice. Show me exactly your assumptions about 1) what the price of energy will be, 2) how quickly it will reach that level, 3) how people will respond, both individually and collectively through businesses, universities, houses of worship, and gov'ts of all sizes, etc., 4) how technologies currently very close to commercialization, like nanotech Li-ion batteries and far cheaper thin-film solar PV panels will change our situation, 5) how the continued aggressive rollout of utility-scale wind power and the rising interest in tidal and wave power will affect our circumstances, 6) what it would cost, in cash outlay, energy, and cultural change, to abandon the 'burbs and have all those millions of people in the US move into the utopia of densified cities, and how that would be cheaper than finding other methods for people to keep living in the 'burbs (or the cities or in rural areas).

Unless someone is willing to put together this level of detail about their assumptions and the underlying science and economics, then they're just blowing smoke and they don't deserve the attention of anyone on this site or anywhere else.

You sound just like JD.

Todd

Bigger sq ft = increased costs to heat & cool

Larger lots = lower denaity = longer to travel to get to essential services & jobs (on average, being within walking distance of a Super WalMart will be a major plus).

Building quality seems (to me) to have declined steadily and newer homes will require major & expensive repairs and are now "out of fashion" (no concern for energy efficiency, too many sq ft,, and just wrong style/fashion, isolated). 3,000+ sq ft homes built in 1984 will be prime board-up candidates in 2012 IMHO.

Based upon past US experience, demographic changes will be a death blow ro some suburbs. An investor buys one former McMansion from the bank foreclosure at a DEEP discount after a year on the market. He rents to a large group of Hispanic immigrants who take a minivan to work together. Repeat for a couple more homes, have dusty "For Sale - Reduced" signs in front of 1/5th of the homes and decline will be swift from there.

As usual, very well-stated and cogent remarks.

When I write about the future it is labeled science FICTION because that is what it is, namely, informed speculation about what might happen "if this [global warming, peak oil] goes on . . ."

The best post-apocalypse novel, by far, that I've ever read is George R. Stewart's "Earth Abides." In it, guess where a community/tribe of people flourish--Berkeley, California.

For what it is worth, I'll put "Earth Abides" #1 on my list of most highly recommended books to read for people worried about what might happen when TSHTF.

My Mother worked as a nurse in Bellview Childrens' Hospital for 50 cents a day. But she had a job, other people around, was provided meals and housing. Transportation was quite easy, with the bus and subway services. It was much better.

The problem is that most people have only seen pictures of breadlines that were set up in the city. What they fail to realize is that the city was able to concentrate the resources that it had and provide them to people that were in the city. It was much more efficient than rural. Services were much more available and life was a lot more flexible.

My concern is that there will be supply disruptions. The rest of the scenario goes without saying. Your assumption that energy will always be available at a price is wrong IMO.

If all else fails, Tahiti is a sailboat ride away.

;-), maybe if things get really bad you'll be congratulating yourself as you chop wood, and I'll be talking to those island girls.

I'm a few blocks from a railroad track, a bike trail that connects to others, grocery store, two gas stations, hardware store, gun shop, dentist and doctor plus bank and post office--all withing easy walking distance.

Just south of my sugar maple trees is one of the biggest fields in the county, currently planted in alfalfa because of chronically low corn prices. Most fields around here are planted in corn, and most things nontropical grow fine here, including some varieties of tomatoes. In my big back yard is a well-populated community of prarie dogs; wild turkey and pheasants stroll among my bird feeders, abundant good water is easily available from a shallow hand-pump well in my back yard.

My neighbors are armed and friendly (to locals:0)

- No need for dramamine, have never even felt queasy;

- Learned to cook by observing a master chef in the kitchen of St. Paul's Commodore hotel during the 1940s.

- Am really good at cooking to meet individual preferances, e.g. always offer choice of coffee, tea, or cocoa, always offer choice of sandwiches, always have stuff readily available for folks to make their own peanut butter and honey (or whatever) sandwiches.

Can we extend the trip to New Zealand? I have friends there. Also how about Hawai'i on the way back. More friends there.Do you allow fishing from your boat? I like to troll every now and then.

That one didn't make me sick, and I was hungry, so I totally get the importance of rough-water seacook. ;-)

I don't have a boat now, but I figure there would be some response time in any deep crisis ... but this is all "disaster movie" fantasy anyway (or fodder for your next series). I think we'll really get a slow, almost boring, and not always pleasant, energy adjustment.

BTW, if you would like some of my sea-going meal plans, I'd be glad to send them to you. It's funny, if we go on a cruise of three boats together, the people on my boat tends to gain weight, maybe five pounds in a week. The folks on the other boat generally lose several pounds.

Standing watch or navigating--shucks there are a lot of people you can find for that. I recommend beautiful highly educated women from university sailing clubs--especially those with "liberated" views. BTW, a big advantage of women as crew is that they eat only about two-thirds as much as the average man--which on my boats tends to be 4,500-6,000 calories per day, plus wine or beer.

I think a forty footer is a good length. I like Aalberg designed boats made in the 1960s, but there are a ton of others out there. Also, I prefer a yawl or cutter rig to a sloop. On a sloop the masts get too tall, and this can be bad, as your experience illustrates.

Also, I do not believe in engines. They tend to fail when you need them. A good alternative is a couple of hundred-pound thrust electric trolling motor with a few deep cycle batteries plus a small wind propellor/turbine to charge them.

For what it's worth, I once also read Desirable and Undesirable Characteristics of the Offshore Yachts. It's quite a double-whammy if you read it with Fastnet, Force 10. It kinda brings home what "undesirable" means.

For crew, here are my standards:

Best crew I've ever had was Pippi Longstocking. She is grown up now (young side of 30) is an actor and film maker. She got her start working as a body double for some hot actresses whose names you might recognize. She is awesome. One time, 40 knot winds, all the guys are seasick, head is occupied with vomiting fool and she has to pee. So, what does Pippi do? She grabs the leeward shrouds, drops her pants and hangs out to leeward with the cold October waves of Lake Superior slapping her butt.

BTW, she is an adoptive niece of mine and I screen all her male friends. The last one was not good enough for her--filty rich, handsome, owned a fitness club, buffed and even a Heinlein fan. Still, not good enough for Pippi.

She may not be the strongest one on a sailboat, but she may be the smartest. I've taken some hundreds of photos of her (clothed) and have been offerred up to forty dollars just for one snapshot. But I don't do commercial photography.

It would be nice to have a film maker on board.

One of the best places to by big sailboats for cruising the Pacific is in Honolulu. And for why? Because so many rich dunces do the Transpacific, have a horrible experience, and they just turn their yacht over to a broker and say, "Dump it."

HOWEVER, many of these boats are race/cruisers, and that category (IMO) sucks. Cruising boats are built for seaworthiness and comfort. Racing boats are designed to sail as fast as possible--on the edge of coming apart.

Also, I think a lot of yachties run out of funds in Honolulu, then sell their boats to get funds to return to the mainland and start a land life again.

Anyway, I've more than once seen comparable boats for sale in Honolulu for about 25% less than in Newport Beach or the San Francisco Bay area.

Every thing in Urban areas is usually trucked, flown, or barged in over thousand of miles. The average meal in a urban area travels over 1200 miles.

> And the nearest job that you are qualified for is 73 miles away.

Who says I am planning to commute a job? My intention is to become very self sufficient. I no longer see the current hi-tech/energy intensive economy as sustainable. I believe that in the future steady employment will be difficult to achieve, and I prefer not to end up being permenently trapped in area filled with a large group of miserable, unemployeed and desperite people. Finally I don't want to have to climb 40 flights of stairs or sleep in a hot sufficating apartment, which rolling black outs are the norm and its too expensive to run air conditioning.

>Urban areas will do better post-peak than rural areas for a VERY long time. Perhaps selected cities of 100,000 to 300,000 will do best, but not every one.

I have to strongly disagree. Urban areas are very dependant on cheap energy. Food, energy, and manufactured goods are all imported into urban areas. It wasn't until the availability of cheap energy that city populations took off.

Most of the US manufacturing jobs have been moved, or are in the process to relocate to rural areas becuase of the lower labor costs and taxes.

I have been searching for this statistic in the past and have not been able to find it. Can you point me to a good reference site for this info?

Thanks....

Tables L1-L5

This is a dip in the deep end of the pool for me as economic theory is not my strong suit compared to many here on TOD.

IF I understand your analysis correctly, an oil shock is tantamount to an aircraft encountering a sudden downdraft--the pilot hopefully applies power, which takes time to spool up, to resume the intended course. If insufficent power or spare capacity cannot be applied, the pilot to has best fly the lower altitude. But our negative National savings rate [the aircraft's fuel tank] is the leading indicator that the spare power capacity is largely depleted or rapidly heading to empty. It suggests that we collectively are drastically trying to lighten the load by pitching things outside the aircraft to help maintain altitude; liquidating assets instead of developing a broad consensus to improve conservation, then fly safely at the lower altitude.

This would seem to indicate that any more oil price shocks would be strongly recessionary for the US and tend to pressure the dollar down, because we cannot afford the time to be using our funds to make the aircraft's engine more efficient and powerful to regain altitude versus pitching stuff overboard now just trying to keep the aircraft from spiraling downward.

If China or Europe have a more positive savings rate than the US-- it will get increasingly easy for them to start outbidding us for energy-->> we don't have much choice but to start a drastic drive to cut wasteful consumption and improve energy efficiency to hopefully increase our savings rate to the positive.

Otherwise, we might see the worst case of oil fungibility: even our diminishing internal native stocks of fossil fuels will be sold overseas to the highest bidder [as Americans cannot afford it]! Yikes! Please tell me my thought process is seriously wrong!

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

If you stall, you may be able to correct it if you have enough altitude to start with.

Or, you may go into an uncontrollable spin and turn the plane into a plow.

Or, you may get the plane into an unusual attitude, panic, do something inappropriate and thereby cause a crash.

The correct things to do (in this order) are:

- Treat the throttle (i.e. increase or decrease power).

- Level the wings (so you don't get inverted)

3 Control the pitch (i.e. put the nose up or in this case, down)I could continue this analogy using money supply, fiscal policy, etc., but I've found that one gets rapidly diminishing returns when pushing the analogy too far.

Now, Helicopter Ben--how good a pilot is he?

That wouldn't happen. The Dept of Defense an others would strongly object on the grounds of national security. Beside US domestic production has slide low enough that it would be consumed, even in a severe depression.

The real question is will the US remain the US or will it become the Divided States of America? What happens to gov'ts when the store selves go bare and there is no fuel to heat homes in the winter?

On the other hand, as Kunstler likes to point out, it's a lot easier for China to invade the Iran than it is for the US....

To peg oil shocks to inflation on a graph is to ignore history itself. Don't forget that Nixon destroyed the Breton Woods agreement in 1971. This act allowed the central banks to start printing fiat money at astounding rates. If you read a "A Century of War" (http://tinyurl.com/jfm3e) William Engdahl solidly makes the case that the oil embargo was a contrived incident with collusion between Saudi Arabia and the US (Enter Bilderberg and Henry Kissinger). The resulting increase in oil prices lead to huge demand for US dollars, which allowed the US to expand its deficit spending, and created the "third world" by collapsing weaker economies. That leads us to the next blip which is the third world debt crisis which HUNDREDS OF BILLIONS of dollars were loaned to newly created third world countries only to have these countries default on the loans( Don't worry they knew that was going to happen). Who bailed out the banks? You guessed it, the US tax payer through inflation. Inflation that came about by, you guessed it, massive injection of liquidity into the system. As far as wars go, gulf war included, wars are financed by governments by printing massive amounts of money, MASSIVE. The result is, you guessed it, INFLATION. I just only scratched the surface here. INFLATION is caused by increasing the money supply FASTER than the increase of goods and services. The oil shocks you speak of have much more behind them than you think and had little or nothing to do with monetary inflation...

=AC===Snips

http://www.safehaven.com/showarticle.cfm?id=5348

"Every first-year economics undergraduate is taught that correlations are not the same as causal relationships. It is to be regretted that Mr Nugent, along with so many others, has forgotten that lesson. If Nugent and those who agree with him were correct about the 1970s inflation surge being caused by OPEC oil price hikes then the biggest oil importers should have suffered the highest inflation rates. They didn't.

For example, Japan and Germany are completely dependent on foreign oil producers yet after OPEC jacked up oil prices German inflation was only 7 per cent. But Japan's inflation rate leaped to 25 per cent while Australia's inflation rate rose to 17 per cent -- even though it was 75 per cent self-sufficient in oil. America's inflation rates was 12 per cent even though it imported 50 per cent of its oil. Great Britain's inflation rate was racing along at 25 per cent per annum even though she had become a significant oil producer thanks to the North Sea oil fields. Of particular interest is Saudi Arabia, the world's largest oil exporter, whose inflation rate at the time shot up to 35 per cent."

Therefore, oil price hikes are no more inflationary than a general wage rise. If unions succeeded in pushing up wage costs above the market level the effect is not rising prices but rising unemployment. This brings us to the fact that there are only two fundamental ways in which the direction of general prices can be altered: 1) through an increase in the money supply or 2) a reduction in the stock of goods. Number 1 is a money induced change in general prices and number 2 a goods-induced change.

This is why when a dirt-poor country is hit by famine causing food prices to rocket we never say that it is suffering from inflation generated by a sudden hike in food prices. It follows that if a country kept a constant money supply there would be a gentle decrease in prices if productivity were rising. This is precisely what happened in Great Britain from about 1874 to about 1896. As productivity rose faster than the gold supply the costs of production and consumer prices gradually declined."

Well, I simply don't know how to economically argue against this or soundly refute it... when politics interfere with normal market functions--> all bets are off. I will leave it for other TODers to have first crack at this. I think I know my limitations.

Bob Shaw in Phx,AZ Are Humans Smarter than Yeast?

Well not quite all bets. Politics may influence the money supply, but it can't do anything about the laws of thermodynamics nor the conservation laws of physics. My guess is that the HL calculations we have been seeing (and swapping) are essentially correct, give or take an Iraq or a Greenland ice sheet meltdown or two.

Those of us who are familiar with the Chimp's earlier posts from other lists know that to him everything is a conspiracy theory. Nothing major happens in this world unless it is the underhanded work of those dastardly, conniving, evil-doers in Washington or in some cases that other evil empire, Britain.

Chimp says:

Yes, it was all the work of that evil-doer Henry Kissinger and his other co-conspirators in Washington. Kissinger and company deliberately conspired to drive up oil prices, which they knew would drive up demand for the dollar, which created the third world by collapsing weaker economies.

So now you know it folks, the third world was created by Henry Kissinger and his co-conspirators in Washington. And in case you not familiar with Engdahl's work, he also makes the case that President Harding was assassinated by British spies working for Shell. The book is a plethora of nothing but evil conspiracies piled one on top of another.

Chimp's other bastion of knowledge is the Safehaven blog site which explains why high oil prices will not cause inflation. As if the inflation we are experiencing right now has nothing to do with high oil prices. Safehaven also lets us in on another secret, the Colorado oil shale. (Actually most of it lies outside Colorado but who cares...)

Yes, we have virtually untapped oil riches out west but there is a giant conspiracy by the government and/or oil companies to keep it all a big secret. Yeah right!

"Ye shall know the truth, and the truth shall make you mad."

~Aldous Huxley

Yes yes, re-read Stuart's excellent essay. The gods of statistical analysis, linear thinking, and Gaussian curves have spoken and the verdict is in. There is only one God and all must bow before him.

Close you eyes click your heels three times and keep saying, "everything is going to be just all right."

==AC

My position is: Every major event that happens to the world is not necessarly the result of some giant complicated conspiracy by those dastardly evil-doess in Washington. But almost every post of yours implies that it is. As Jay Hanson said of you, you have conspiracy on the brain.

As if you even understand my position by stating "those dastardly evil-doess in Washington". As if I think the so called "evil-doers" operate out of Washington. Again the work of a major asshole. You also slimily imply that I think EVERY major event was the result of some sort of meeting in a dark cave 2000 meters underground. Wrong again but what is to be expected from an asshole?

I'm glad you're a doomer and maybe you and I should stick to things we agree with.

As far a Jay goes he spent some time at AB discussing the NWO. Just a sample:

http://tinyurl.com/gy789

It seems to me that NWO could be a continuation of the ideals of the

Enlightenment using the Physiocratic doctrine as a handbook.[1] When

I read Fox-Genovese's book, I find the exact same shit I have been

hearing from economists for over a decade. It's all there!!!

It's not difficult for me to believe that a market cult (secret

handshakes, etc.) has existed since the time of the Physiocrats. It

would have been imported from France by Jefferson, Franklin, du Pont,

etc.

Has a "Skull and Bones" guy ever gone public? What is the content of

their rituals?

Jay

=============[1] THE ORIGINS OF THE PHYSIOCRACY: Economic Revolution and Social

Order in Eighteenth-Century France, by Elizabeth Fox-Genovese.

http://www.abebooks.com

If you remember he purchased "Tragedy & Hope: A History of the World in Our Time" on my advice. So I would say his interest was there but he did not want to delve too deep. I hope this doesn't shatter your image of your Idol.

Good Day sir,

==AC

"Bob, there is no need to refute Chimp's silly theory"

"Those of us who are familiar with the Chimp's earlier posts from other lists know that to him everything is a conspiracy theory. Nothing major happens in this world unless it is the underhanded work of those dastardly, conniving, evil-doers in Washington or in some cases that other evil empire, Britain."

"Chimp's other bastion of knowledge is the Safehaven blog site which explains why high oil prices will not cause inflation. As if the inflation we are experiencing right now has nothing to do with high oil prices. Safehaven also lets us in on another secret, the Colorado oil shale."

Answer what argument? The argument that you're an asshole? You did nothing but go on a rant and slander me and never addressed one thing I said in a courteous manner. You are a piece of work my friend. If you don't agree with me or you think my argument is completely silly you could have just moved to the next comment but you had to make it your personal crusade to make me look like an ass to the TOD community. I do apologize if the word asshole offended anyone. Upon reflection I may have been out of line. But I could not find anything more suitable to describe Darwinian.

Henry Kissenger and company created the third world via a conspiracy whth Saudi Arabia. Well, I am sixty eight years old and traveled much of the world before the advent of the Nixon Administration. Let me tell you the third world world was there long before Nixon and Kissinger.

What in God's name will the conspiracy theorists think of next. At least they are good for a good belly laugh once in awhile.

http://earth.prohosting.com/~jswift/engdahl.html

==AC

"On October 6, 1973, Egypt and Syria invaded Israel, igniting what became known as the "Yom Kippur" war. Contrary to popular impression, the "Yom Kippur" war was not the result of simple miscalculation, a blunder, or an Arab decision to launch a military strike against the state of Israel. The entire constellation of events surrounding the outbreak of the October war was secretly orchestrated from Washington and London, using the powerful diplomatic secret channels developed by Nixon's White House National Security Adviser, Henry Kissinger.

Kissinger effectively controlled the Israeli policy response through his intimate relation with Israel's ambassador to Washington, Simcha Dinitz. In addition, Kissinger cultivated channels to the Egyptian and Syrian sides. His method was to simply misrepresent to each party the critical elements of the other, ensuring the war and its subsequent Arab oil embargo.

Kissinger, who is by then Nixon's intelligence "czar", consistently suppressed US intelligence reports, including intercepted communications from Arab officials confirming the buildup for war. Washington scripted the war and its aftermath, including Kissinger's infamous "shuttle diplomacy," along the precise lines of the Bilderberg deliberations of the previous May in Saltsjoebaden, some six months before outbreak of the war. Arab oil-producing nations were to be the scapegoat for the coming rage of the world, while the Anglo-American interests responsible stood quietly in the background.

In mid-October 1973, the German Government of Chancellor Willy Brandt told the US Ambassador to Bonn that Germany was neutral in the Middle East conflict, and would not permit the US to resupply Israel from German military bases. With an ominous foreboding of similar exchanges which would occur some 17 years later, on October 30, 1973 Nixon sent Chancellor Brandt a sharply worded protest note, most probably drafted by Kissinger:

"We recognize that the Europeans are more dependent upon Arab oil then we, but we disagree that your vulnerability is decreased by disassociating ourselves from us on a matter of this importance... You note that this crisis was not a case of common responsibility for the Alliance, and that military supplies for Israel were for purposes which are not part of alliance responsibility. I do not believe we can draw such a fine line..."

Washington would not permit Germany to declare its neutrality in the Mideast conflict. But, significantly, Britain was allowed to clearly state its neutrality, thus avoiding the impact of the Arab oil embargo. Once again, London skillfully maneuvered itself around an international crisis which it had been instrumental in precipitating. One consequence of the ensuing 400% rise in OPEC oil prices was that investments of hundreds of millions of dollars by BP, Royal Dutch Shell, and other Anglo-American petroleum concerns in the risky North Sea could produce oil at a profit. It is a curious fact of the time, that the profitability of these new North Sea oil fields was not at all secure until after Kissinger's oil shock.

By October 16, the Organization of Petroleum Exporting Countries, following a meeting on oil prices in Vienna, raised their prized by a then-staggering 70%, from $3.01/barrel to $5.11. That same day, the members of the Arab OPEC countries, citing the US support for Israel in the Mideast war, declared an embargo on all oil sales to the United States and Netherlands -- the major oil port of Western Europe.

Saudi Arabia, Kuwait, Iraq, Libya, Abu Dhabi, Qatar, and Algeria announced on October 17, 1973 that they would cut their production below the September level by 5% for October and an additional 5% per month, "until Israeli withdrawal is completed from the whole Arab territories occupied in June 1967 and the legal rights of the Palestinian people are restored." The world's first "oil shock," or as the Japanese termed it, "Oil Shokku" was underway.

Significantly, the oil crisis hit full force just as the President of the United States was becoming personally embroiled in what came to be called the "Watergate affair," leading Henry Kissinger as de facto President, running US policy during the crisis in late 1973.

When the Nixon White House sent a senior official to the U.S. Treasury in 1974 to devise a stratagem to force OPEC into lowering the oil price, he was bluntly turned away. In a memo the official stated, "it was the banking leaders who swept aside this advice and pressed for a 'recycling' program to accommodate to higher oil prices. This was the fatal decision..."

The U.S. Treasury, under Jack Bennett, the man who helped steer Nixon's fateful August 1971 dollar policy, had established a secret accord with the Saudi Arabian Monetary Agency, SAMA, finalized in a February 1975 memo from US Assistant Treasury Secretary Jack F. Bennett to Secretary of State Kissinger. Under the terms of the agreement, a sizable share of the huge new Saudi oil revenue windfall was to be invested in financing the US government deficits. A young Wall Street investment banker with the leading Eurobond firm of White Weld & Co. based in London, David Mulford, was sent to Saudi Arabia to become the principal "investment adviser" to SAMA; he was to guide the Saudi petrodollar investments to the correct banks, naturally in London and New York. The Bilderberg scheme was operating as planned.

Kissinger, already firmly in control of all US intelligence estimates as Nixon's all-powerful National Security Adviser, secured control of US foreign policy as well, persuading Nixon to name him Secretary of State in the weeks just prior to outbreak of the October Yom Kippur war. Indicative of a central role in events, Kissinger retained both titles as head of the White House National Security Council and as Secretary of State, something no individual had done before or after him. During the last months of the Nixon presidency, no other single person wielded as much power as Henry Kissinger did. Adding insult to injury, Kissinger was awarded the 1973 Nobel Peace Prize.

Following a meeting in Teheran on January 1, 1974, yet a second price increase of more than 100% was added, bringing OPEC benchmark oil prices to $11.65. This was done on the surprising demand by the Shah of Iran, who had been secretly told to do so by Henry Kissinger.

Only months earlier, the Shah had opposed the OPEC increase to $3.01 for fear this would force Western exporters to charge more for the industrial equipment the Shah sought to import for Iran's ambitious industrialization. Washington and Western support for Israel in the October war fed OPEC's anger at the meetings. Kissinger's own State Department was not informed of Kissinger secret machinations with the Shah.

From 1949 until the end of 1970, Middle East crude oil prices had averaged approximately $1.90/barrel. They rose to $3.01 in early 1973, the time of the fateful Saltsjoebaden meeting of the Bilderberg group which discussed an imminent 400% future rise in OPEC's price. By January 1974 that 400% increase was a fait accompli."

For those of you that may be interested in this read "Confessions of an Economic Hit Man" by John Perkins. Perkins was a key player in SAMA which he termed the Saudi Arabia Money-Laundering Affair...

Relevant snips can be found here:

http://tinyurl.com/l96t8

Don't be afraid I won't hurt you. I'm just one of those crazies that see things in a much bigger context than mere coincidence. There are plenty of coincidence theorists out there, just watch CNN and Fox...

==AC

In other words, the most trivial knowledge of recent history proves their claims and underlying reasoning totally wrong?

In the face of a oil price shock I would say they government would turn the printing press on full steam to make dollars to cover the increased demand for US dollars to pay for the price of oil. All those dollars then end up back in the US as construction and weapons contracts that are then injected into the economy causing inflation. Petrodollar recycling. They are manipulating the monetary supply to their benefit the few instead of letting the market correct itself.

==AC

==AC

Where is H.K. now that we need him again?

http://observer.guardian.co.uk/business/story/0,6903,421888,00.html

The article says:

"At this point he makes an extraordinary claim: 'I am 100 per cent sure that the Americans were behind the increase in the price of oil. The oil companies were in in real trouble at that time, they had borrowed a lot of money and they needed a high oil price to save them.'

He says he was convinced of this by the attitude of the Shah of Iran, who in one crucial day in 1974 moved from the Saudi view, that a hike would be dangerous to Opec because it would alienate the US, to advocating higher prices.

'King Faisal sent me to the Shah of Iran, who said: "Why are you against the increase in the price of oil? That is what they want? Ask Henry Kissinger - he is the one who wants a higher price".'

Yamani contends that proof of his long-held belief has recently emerged in the minutes of a secret meeting on a Swedish island, where UK and US officials determined to orchestrate a 400 per cent increase in the oil price."

Also, the Washington Post reported the same claim about the US manipulation of this 'crisis' on 28 January 1974 in an article by the journalist 'Jack Anderson'.

So ridiculing Engdahl does not provide proof that the claim is wrong.

Of course this will be met with the "deniers" most potent weapon, SILENCE. If not it will be quickly followed up with their favorite finishing move, "CONSPIRACY THEORISTS"!!! How predictable...

==AC

According to the French book 'La face cachée du pétrole' by Eric Laurent which was published earlier this year, the investigative journalist and Pulitzer Prize winner, Jack Anderson, was shown Aramco papers which described meetings in 1973 between the company (then owned by Exxon, Mobil, Texaco and Chevron) and Sheikh Yamani in 1973. During this meeting Yamani was given the green light to greatly increase oil prices. Apparently, this was all described by Anderson in an article published on January 28 1974 which was entitled 'Details of Aramco papers disclosed'.

Would it be better if it was on CNN. Then would it pass the "reality" test??

==AC

==AC

"Since I entered politics, I have chiefly had men's views confided to me privately. Some of the biggest men in the United States, in the Field of commerce and manufacture, are afraid of something. They know that there is a power somewhere so organized, so subtle, so watchful, so interlocked, so complete, so pervasive, that they better not speak above their breath when they speak in condemnation of it."

~Woodrow Wilson,The New Freedom (1913)

==AC

ROCKEFELLERS

John Davison Rockefeller continues to be the most recognized (and perhaps most despised) rich man in the world even though he's been dead since 1937. During the past century, no one family in America has assembled such power and influence as the Rockefellers, thanks to their wealth and close ties to England.

Years ago the Rockefeller name continually cropped up in any discussion of secret societies, but today's mass media rarely speak of the Rockefeller role in world events. But at one time the name of John D. Rockefeller was on everyone's lips and his finances were known to all.

An 1897 edition of a rural Texas newspaper reported, "John D. Rockefeller sleeps eight and one-half hours every night, retiring at 10:30 and rising at 7. Every morning when he gets up he is $17,705 richer than he was when he went to bed. He sits down to breakfast at 8 o'clock and leaves the table at 8:30, and in that short half hour his wealth has grown $1,041.50. On Sunday he goes to church, and in the two hours he is away from home his riches have grown $4,166. His nightly amusement is playing the violin. Every evening when he picks up the instrument he is $50,000 richer than he was when he laid it down the previous night. These little facts give some idea of the relentless growth of this man's fortune."

One insight into the forging of John D.'s business philosophy might be gained by an anecdote told by Nelson Rockefeller. It seems when John D. was a small child his father, William "Big Kill" Rockefeller, who sold cancer "cures" from a medicine wagon, taught him to leap into his arms from a tall chair. One time his father held his arms out to catch him but pulled them away as little John jumped. The fallen son was told sternly, "Remember, never trust anyone completely, not even me."

At the start of the American Civil War, Rockefeller was a young agricultural commodities broker in Cleveland, Ohio. He quickly recognized the potential of the fledgling petroleum industry there, and in 1863 he and some associates built a refinery. In 1870 he incorporated Standard Oil Company of Ohio.

"The National City Bank of Cleveland, which was identified in congressional hearings as one of three Rothschild [the dominant European banking family] banks in the United States, provided John D. Rockefeller with the money to begin his monopolization of the oil refinery business, resulting in the formation of Standard Oil," noted a recent investigative video entitled, "The Money Masters."

Rockefeller, who was quoted as saying "Competition is a sin," ruthlessly eliminated competitors by either mergering or buying them out. Failing that, he cut prices until his competitors were forced to sell. He also managed lucrative railroad rebate agreements, which ensured him a near monopoly on the transportation of oil. Standard Oil--the direct ancestor of Exxon--prospered enormously, and by 1880 Rockefeller owned or controlled 95 percent of all oil produced in the United States.

Trouble for Rockefeller began in 1902 with the publication of a series of articles by Ida Tarbell, the daughter of a Pennsylvania oil producer run out of business by Rockefeller. Based on five years of research, Tarbell's series was published in McClure's Magazine and entitled "The History of Standard Oil Company." One reviewer proclaimed her work a "fearless unmasking of moral criminality masquerading under the robes of respectability and Christianity."

Tarbell's expose resulted in government and court actions, which appeared to break up Standard's oil monopoly. However, as early as 1882 Rockefeller had moved to mask his business dealings by creating the first great American corporation: Standard Oil Trust. "The trust embraced a maze of legal structures, making its workings virtually impervious to public investigation and understanding," explained The New Encyclopedia Britannica.

Such maneuvering continued in 1892 when the Ohio Supreme Court ordered (he trust dissolved. Instead, Rockefeller simply moved Standard's headquarters to New York City. In 1899 all assets and interests were transferred to a new creation, Standard Oil Company of New Jersey.

In 1906 the U.S. government charged Standard Oil with violating the Sherman Anti-Trust Act. Although apologists argued that Standard was simply caught in an emotional tidal wave of public discontent over the excesses of big business, the U.S. Supreme Court on May 15, 1911, couched its decision in these clear terms: "Seven men and a corporate machine have conspired against their fellow citizens. For the safety of the Republic we now decree that this dangerous conspiracy must be ended by November 15th."

Eight of the companies formed after the dissolution retained "Standard Oil" in their names, but even these were soon altered to present the image of diversity. Standard Oil Company of New York first merged with the trust company Vacuum Oil to form Socony-Vacuum, which in 1966 became Mobil Oil Corporation. Standard Oil of Indiana joined with Standard Oil of Nebraska and Standard Oil of Kansas and by 1985 had become Amoco Corporation. In 1984 the combination of Standard Oil of California and Standard Oil of Kentucky had become Chevron Corporation, while the old Standard Oil of New Jersey in 1972 became Exxon Corporation. Other former Standard companies include Atlantic Richfield, Buck-eye Pipe Line, Pennzoil, and Union Tank Car Company.

Ironically, the breakup of Standard only increased the wealth of Rockefeller, who now owned one fourth share of the thirty-three different oil companies created by the breakup of Standard. Shortly after the turn of the century, Rockefeller became America's first billionaire.

Continued Rockefeller control was confirmed in the late 1930s by the only study of true ownership in America's largest corporations ever made by the Securities and Exchange Commission. The study, The Distribution of Ownership in the 200 Largest Nonfinancial Corporations, was published in 1940. It concluded that Rockefeller holdings, while seemingly small--most were under 20 percent of outstanding stocks-- nevertheless when compared to the remaining widely dispersed ownership were considered sufficient "to give the Rockefeller family control over the corporations."

Once again, interlocking directorships allowed the Rockefellers and others to maintain control over the oil industry. "All of the eight largest oil companies were interlocked in 1972 through large commercial banks with at least one other member of the top group," wrote Dr. John M. Blair, former assistant chief economist for the Federal Trade Commission. "Exxon had four such interlocks--with Mobil, Standard of Ind., Texaco, and ARCO. Mobil had three--with Exxon, Shell, and Texaco--as did Standard of Indiana--with Exxon, Texaco, and ARCO--as well as Texaco--with Exxon, Mobil, and Standard of Ind.--and Shell with Mobil. Whenever all of the six [largest] commercial banks--exclusive of Bank of America and Western Bancorporation--hold their board meetings, directors of the top eight--excluding Gulf and SoCal--meet with directors of, on the average, 3.2 of their largest competitors."

Ironically, by the turn of the new century, the old Standard monopoly was being reformed by the anticipated merging of two of the world's oil giants: Exxon and Mobil. This $75 billion "megadeal" was quickly called "Rockefeller's revenge." At this writing the consolidation of oil companies has continued with announced plans for British Petroleum PLC to acquire Amoco.

By the time of his death in 1937, Rockefeller and his only son, John D. Rockefeller Jr., had not only built up an amazing oil empire but had established such institutions as the Rockefeller Institute for Medical Research (established 1901), the General Education Board (1903), the University of Chicago (1889), the Rockefeller Foundation (1913), the Lincoln School (1917), where the Rockefeller children began their educations, and Rockefeller University in New York City.

The Rockefellers also were greatly interested in the eugenics movement, a program of scientifically applied genetic selection to maintain and improve "ideal" human characteristics, including birth and population control. This idea grew from the writings of the Victorian scientist Sir Francis Galton, who after study reached the conclusion that prominent members of British society were such because they had "eminent" parents, thus combining Darwin's concepts of "survival of the fittest" with the class-conscious question "who's your daddy?"

If this sounds like a Nazi experiment run wild, consider that in the late nineteenth century, the United States joined fourteen other nations in passing some type of eugenics legislation. Thirty states had laws providing for the sterilization of mental patients and imbeciles. At least sixty thousand such "defectives" were legally sterilized.

Of course, to determine who was dirtying the gene pool requires extensive population statistics. So in 1910 the Eugenics Records Office was established as ë branch of the Galton National Laboratory in London, endowed by Mrs. E. H. Harriman, wife of railroad magnate Edward Har-riman and mother of diplomat Averell Harriman. Mrs. Harriman in 1912 sold her substantial shares of New York's Guaranty Trust bank to J. P. Morgan, thus assuring his control over that institution.

After 1900, the Harrimans--the family that gave the Prescott Bush family its start--along with the Rockefellers funded more than $11 million to create a eugenics research laboratory at Cold Spring Harbor, New York, as well as eugenics studies at Harvard, Columbia, and Cornell. The first International Congress of Eugenics was convened in London in 1912, with Winston Churchill as a director. Obviously, the concept of "bloodlines" was highly significant to these people.

In 1932 when the Congress met in New York, it was the Hamburg-Amerika Shipping Line, controlled by Harriman associates George Walker and Prescott Bush, that brought prominent Germans to the meeting. One was Dr. Ernst Rudin of the Kaiser Wilhelm Institute for Genealogy and Demography in Berlin. Rudin was unanimously elected president of the International Federation of Eugenics Societies for his work in founding the German Society for Race Hygiene, a forerunner of Hitler's racial institutes.

Eugenics work, under more politically correct names, continues right up to today. General William H. Draper Jr. was a "Supporting Member" of the International Eugenics Congress in 1932 and, despite or because of his ties to the Harriman and Bush families, was named head of the Economic Division of the U.S. Control Commission in Germany at the end of hostilities. According to authors Tarpley and Chaikin, "General Draper (in later years) founded 'Population Crisis Committee' and the 'Draper Fund,' joining with the Rockefeller and Du Pont families to promote eugenics as 'population control.' The administration of President Lyndon Johnson, advised by General Draper on the subject, began financing birth control in the tropical countries through the U.S. Agency for International Development (USAID).

"General Draper was George Bush's guru on the population question. . . . Draper's son and heir, William H. Draper III, was co-chairman for finance--chief of fundraising--of the Bush-for-President national campaign organization in 1980." The younger Draper went on to work with population control activities of the United Nations.

Rudin's eugenics work was to a large part funded by Rockefeller money. "These wealthy American families, like their counterpart's in Britain, feel themselves to be racially superior and they wish to protect their racial superiority," commented author Icke.

Nepotism proved a connecting link in these family chains. According to biographer Alvin Moscow, "Starting in the year 1917 and continuing over the next five years, the elder Rockefeller handed over his fortune to his only son and heir with no strings attached."

John Jr., while dealing primarily with philanthropic activities, nevertheless followed his father's mode of business practices, particularly in his opposition to unions. This stance softened, at least publicly, following the Ludlow Massacre of 1914 in which Colorado militia members fired on strikers at the Rockefeller-owned Colorado Fuel and Iron Company, killing forty persons.

Rockefeller Jr. helped create the United Service Organization (USO) for soldiers during World War II and supervised the building of Rockefeller Center in Manhattan. After the war, it was Rockefeller who donated land in Manhattan for the headquarters of the United Nations.

Rockefeller Jr. sired one daughter, Abby, who died of cancer in 1976 at age seventy-two, and five sons--John III, Nelson, Laurance, Winthrop, and David.

The eldest, John III, became chairman of the Rockefeller Foundation and guided millions of dollars to international agencies such as the India International Centre and the International House of Japan. His personal money went to his fabulous Oriental art collection and the creation of the Population Council, a center concerned with overpopulation and family planning. He died in 1978, but his son, John "Jay" Davison Rockefeller, carried on the family's political interest by serving as governor of West Virginia.

Nelson Aldrich Rockefeller also carved out a career in politics. Prior to World War II he journeyed to Venezuela, where he discovered the culture of South America, as well as the lucrative oil business. Because of his knowledge of the area, President and fellow New Yorker Franklin D. Roosevelt set Rockefeller on his government vocation by appointing him coordinator for inter-American affairs. Rockefeller also served as a four-term governor of New York state following various posts in the family oil and banking businesses.

In 1953 the Department of Health, Education and Welfare (HEW) was established, and Rockefeller was named undersecretary upon the recommendation of Secretary Oveta Culp 1 lobby. 1 lere Rockefeller was able to push through many social programs as detailed by author Alvin Moscow, who wrote, "Oveta Gulp Hobby was out front as the Secretary; Nelson worked behind the scenes, finding key personnel to head various programs, promulgating research and studies, putting together new programs and then trying to steer those new programs through the Eisenhower administration and through a sometimes skeptical Congress." Eisenhower even appointed Rockefeller special assistant for foreign affairs, the same office his close friend Henry Kissinger held under President Nixon.

He continually sought the Republican presidential nomination, but his plans were thwarted by Nixon in both 1960 and 1968 and by Senator Barry Goldwater in 1964. Rockefeller eventually was appointed vice president of the United States in 1974 by President Gerald R. Ford, himself an appointee of President Richard Nixon, who was forced to resign over the Watergate scandal. Rockefeller died at age seventy in 1979 under controversial circumstances involving a young female staff assistant.

Laurance Spelman Rockefeller became the most business-oriented of the brothers and enjoyed a successful career as a venture capitalist. Developing an early interest in aviation, he invested in Eastern Airlines in 1938 along with famed aviator Captain Eddie Rickenbacker and turned the airline into one of the world's largest. Rockefeller also invested heavily in the dreams of a young Scotsman named James McDonnell Jr., who went on to launch what became McDonnell-Douglas Aircraft Corp. He entered the realm of environmentalism and became chairman of the Citizens Advisory Committee on Environmental Quality, president of the American Conservation Association, and chairman of the New York Zoological Society.

Winthrop Rockefeller was considered the maverick of the Rockefeller clan. Dropping out of Yale in 1934, he made his way to Texas where he worked as an oil field roustabout. During World War II, he served as a combat infantryman in the Pacific theater earning a Purple Heart and Bronze Star with two Oak Leaf Clusters. Returning home, he developed a taste for drinking, women, and New York cafe society. But in 1953, tiring of this lifestyle, he suddenly moved to Arkansas where he was voted "Arkansas Man of the Year" in 1956. His famous name allowed him to gain the office of governor in 1967. It was then that a young Arkansas Democrat, Rhodes scholar, and DeMoley member named Hill Clinton may have gained the attention of Rockefeller. Winthrop, too, died of cancer in 1973, just two months before his sixty-first birthday.

David Rockefeller was the youngest of the five Rockefeller brothers and the one who became the most powerful, if not the most prominent. After earning a B.S. degree from Harvard, he entered the London School of Economics, a school largely funded by the Rockefeller Foundation, the Carnegie United Kingdom Trust Fund, and the widow of J. P. Morgan partner Williard Straight. Here he came into contact with the teachings of Ruskin and other socialists, including Harold Laski. Educated at Oxford, Laski early on advocated political pluralism but later turned to Marxism and became a luminary in Britain's Socialist Party. He once wrote that the state is "the fundamental instrument of society."

Returning to the States, David Rockefeller exhibited his deep feelings for England in a letter to the New York Times in April 1941 in which he stated, "We should stand by the British Empire to the limit and at any cost. ..." Just before the outbreak of war, he obtained a doctorate degree from the University of Chicago. His doctoral thesis was entitled "Unused Resources and Economic Waste." Perhaps articulating the driving ambition of the Rockefeller brothers, he wrote, "Of all forms of waste, however, that which is most abhorrent is idleness. There is a moral stigma attached to unnecessary and involuntary idleness which is deeply imbedded in our conscience."

During the war, he entered the U.S. Army as a private but was soon working in North Africa and France with the Office of Strategic Services (OSS), forerunner to the CIA. This experience, along with his schooling in England, strengthened a lifelong concern with foreign affairs. It was most probably during this time that Rockefeller developed high-level intelligence contacts which later brought him insider knowledge of many top-secret operations.

By 1948 David Rockefeller was chairman of the board of trustees of the Rockefeller Institute. The president of the institute was Dr. Detlev Wulf Bronk, a biophysicist specializing in the human nervous system. According to the controversial MJ-12 documents, Bronk not only was ë member of MJ-12--reportedly a supersecret group in charge of the UFO issue--but leader of the team that autopsied "extraterrestrial biological entities" recovered from a crashed disk near Roswell, New Mexico, in July 1947.

After the war, Rockefeller joined the staff of Chase National Bank of New York, where his uncle, Winthrop Aldrich, was chairman of the board and president. Chase traced its history back to central bank advocate Alexander Hamilton's Bank of the Manhattan Company begun in 1799, and by 1921 it had become the second largest national bank in the United States. In 1955 Rockefeller played a major role in the merger of Chase with the Bank of Manhattan Company, which resulted in Chase Manhattan Bank. In 1969 the bank became part of Chase Manhattan Corp. in line with the trend of establishing holding companies to avoid banking laws prohibiting certain activities, such as the acquisition of finance companies. That same year David Rockefeller became the company's board chairman and chief executive officer, thanks primarily to his preeminence in international banking.

His connections to the world of international politics as well as intelligence were improved when his uncle Aldrich retired as chairman of the bank in 1953 to become U.S. Ambassador to the Court of Saint James (England). Aldrich was succeeded by John J. McCloy, a former chairman of the Council on Foreign Relations. McCloy, who has been called the "architect of the postwar American intelligence establishment," served as assistant secretary of war from April 1941 to November 1945, president of the World Bank from 1947 to 1949, and U.S. Governor and High Commissioner for Germany from 1949 to 1952. McCloy also served on the Warren Commission, helping mediate disagreements with members who were troubled by the controversial "single bullet" theory of JFK's assassination. According to author Alvin Moscow, David Rockefeller soon became "the undisputed protege of McCloy."

David Rockefeller had already joined the Council on Foreign Relations in 1941 before war came, and by 1950 had been elected vice president.

His interest in foreign affairs could not have been entirely altruistic, since it has been estimated that the multinational banks, with Chase leading the way, loaned more than $50 billion to developing nations between 1957 and 1977. Even sympathetic biographer Moscow admitted, "David's fascination with international relations, necessitating intricate knowledge of the governmental, social and economic policies of nations throughout the world, on both sides of the Iron Curtain, dovetailed uniquely with his interest and concern in expanding Chase Manhattan's business in the international banking market."

To say that David Rockefeller may be one of the most important men in America would be an understatement. According to Gary Allen, in the year 1973 alone, "David Rockefeller met with 27 heads of state, including the rulers of Russia and Red China." In 1976 when Australian president Malcolm Fraser visited the United States, he conferred with David Rockefeller before meeting President Gerald Ford. "This is truly incredible," wrote author Ralph Epperson, "because David Rockefeller has neither been elected or appointed to any governmental position where he could officially represent the United States government."