More on OPEC Rig Counts

Posted by Stuart Staniford on July 5, 2006 - 6:34pm

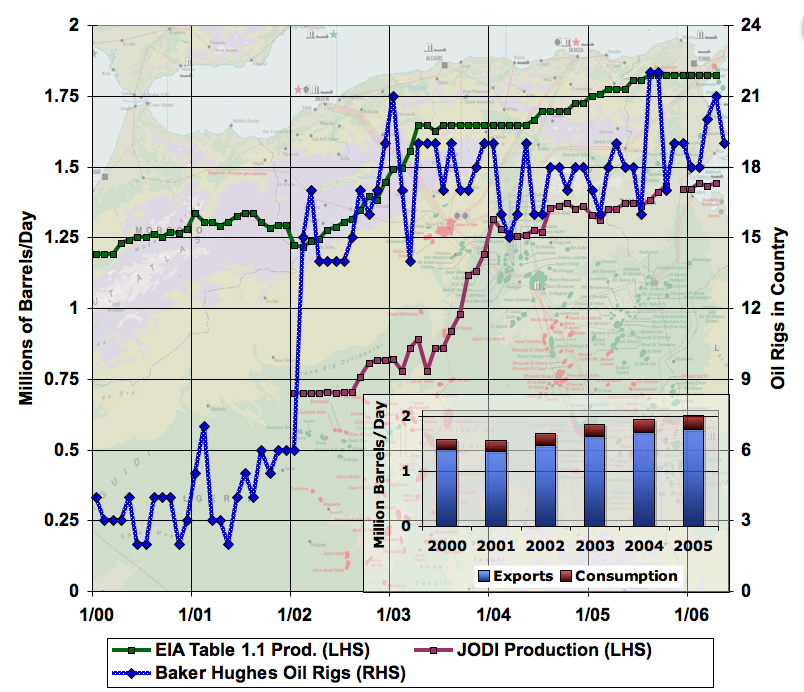

Production in Indonesia has been in decline for some time as the graph shows very clearly. The rig count was increasing in recent years, but that has gone into sharp reverse in 2006 - I don't know why. Perhaps the most important story is told in the inset graph however: Indonesia is no longer an oil exporter and probably never will be again. It's striking that consumption was almost completely unaffected by the declining production (Indonesia subsidizes fuel internally).

Next is Algeria:

Algerian rig count jumped sharply at the beginning of 2002, and this led to production increases. The rig count has been mostly fairly flat since, but production is increasing well, confirming that Algeria has fresh new reserves to exploit.

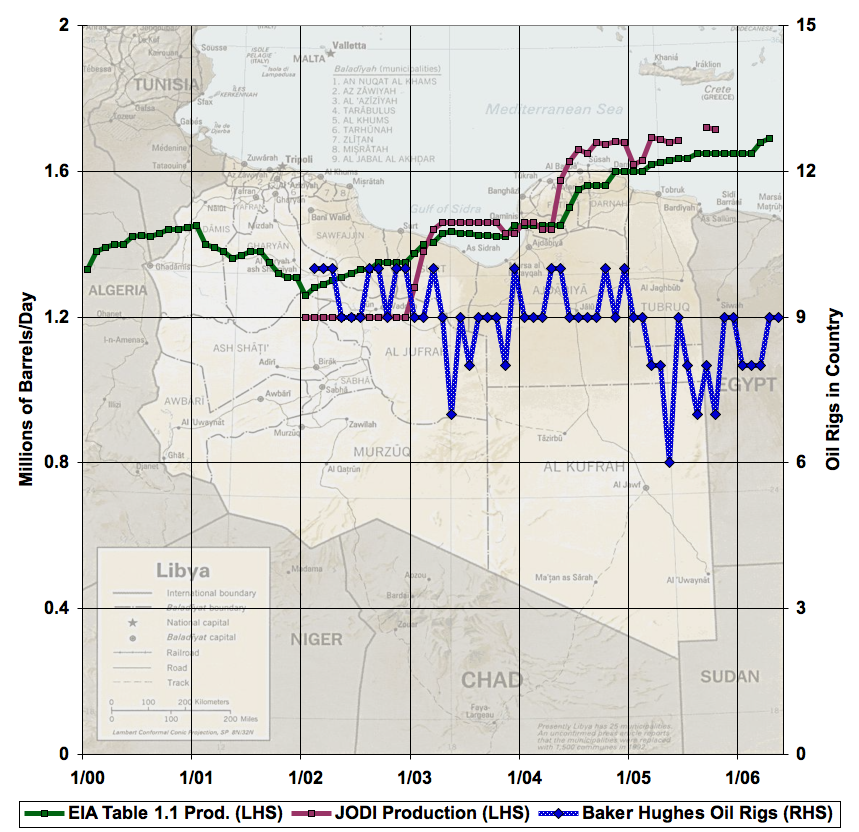

Here's the graph for Libya.

The situation is similar to Algeria: a flat rig count is leading to rising production, suggesting fresh high quality reserves to exploit.

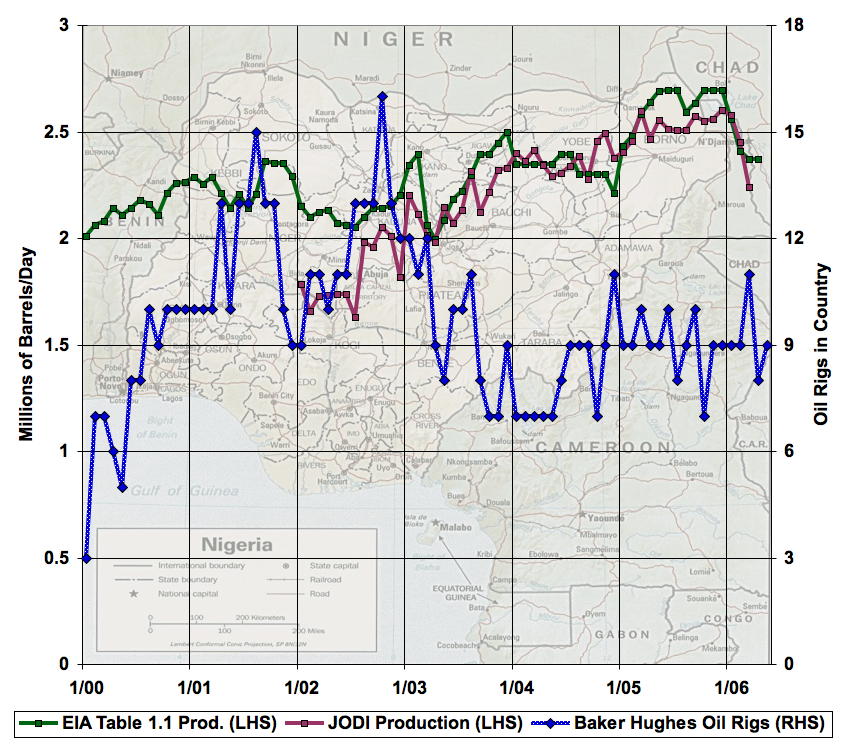

Nigeria is the same story, until the political troubles started to set in this year:

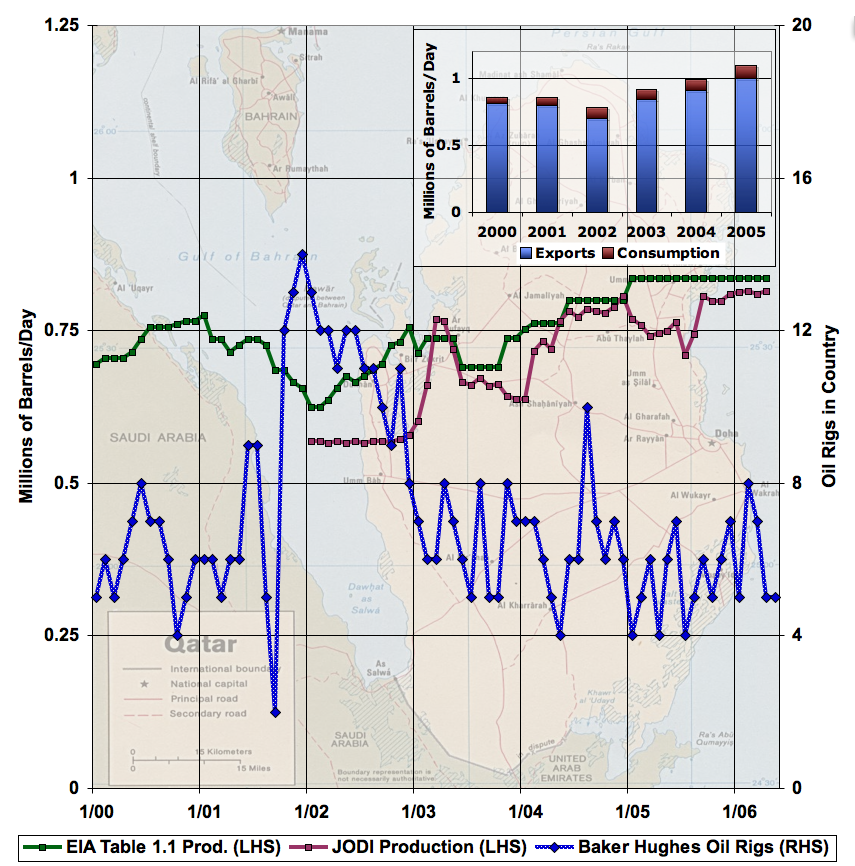

Here's Qatar: a very small rig count that is not rising, and production has leveled off. Could try harder.

United Arab Emirates is similar, though both the production level and the rig count are higher.

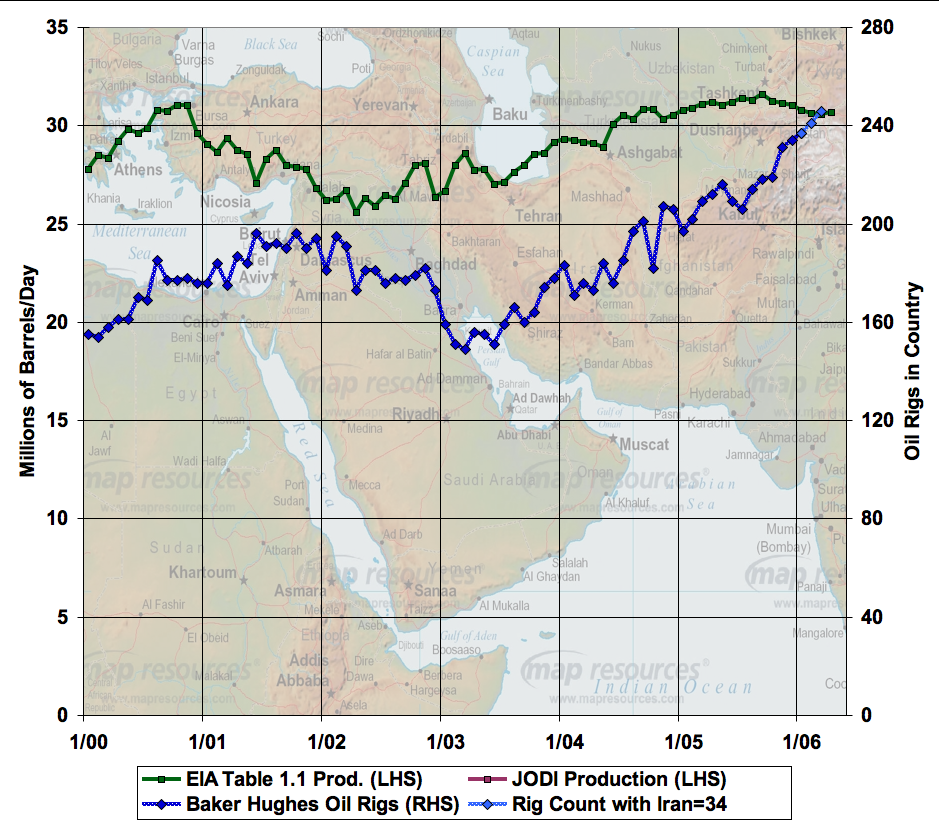

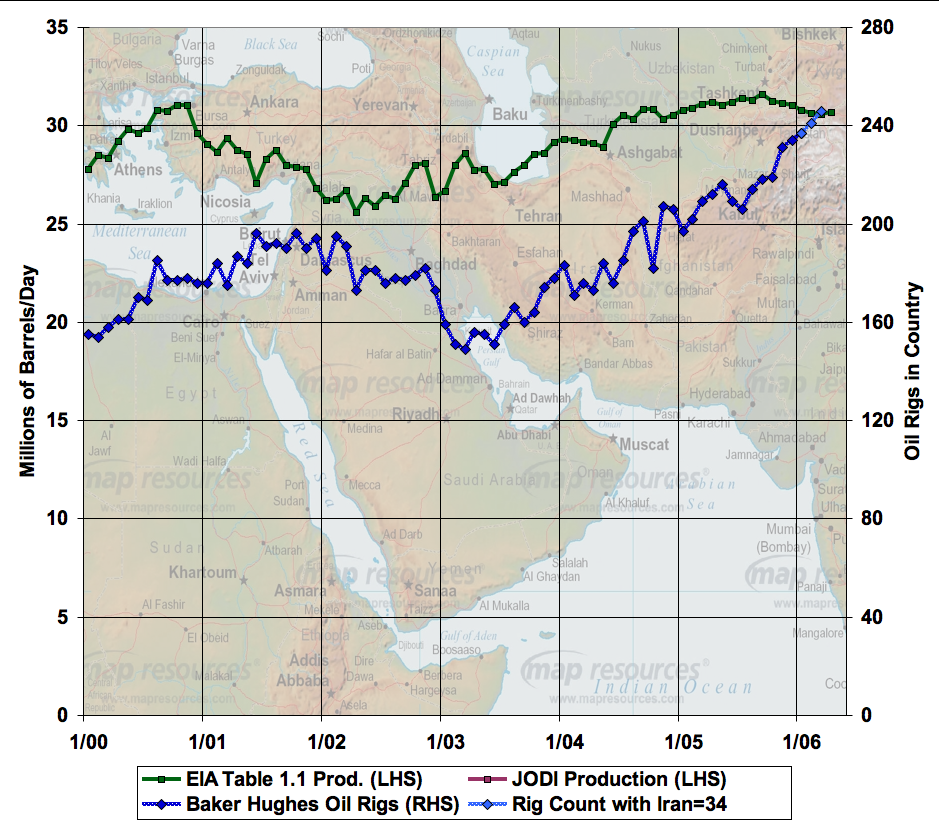

Finally, if we put together all the OPEC countries (excluding Iraqi and Libyan rig counts where there's not enough data, and extrapolate the last few months of Iran), we get this graph:

On the whole, although some of the smaller countries are not increasing their rig count, this looks like OPEC is generally behaving in a fairly reasonable manner. After the global slowdown that started in 2000, they cut production, and then cut rig count. As the economy started to recover in 2002, they increased production from their spare capacity and then began increasing rig count. Rig count has continued to grow rapidly and steadily, but production has been declining for the last seven or eight months. On the whole, it doesn't seem to me this is very compatible with the "There's plenty of oil but OPEC isn't making an effort" that some anti-peakoilers have been arguing (though you could just about still argue that the Saudis and Iranians are deliberately cutting production to maintain very high prices in the short term while increasing rig count to maintain more capacity in future).

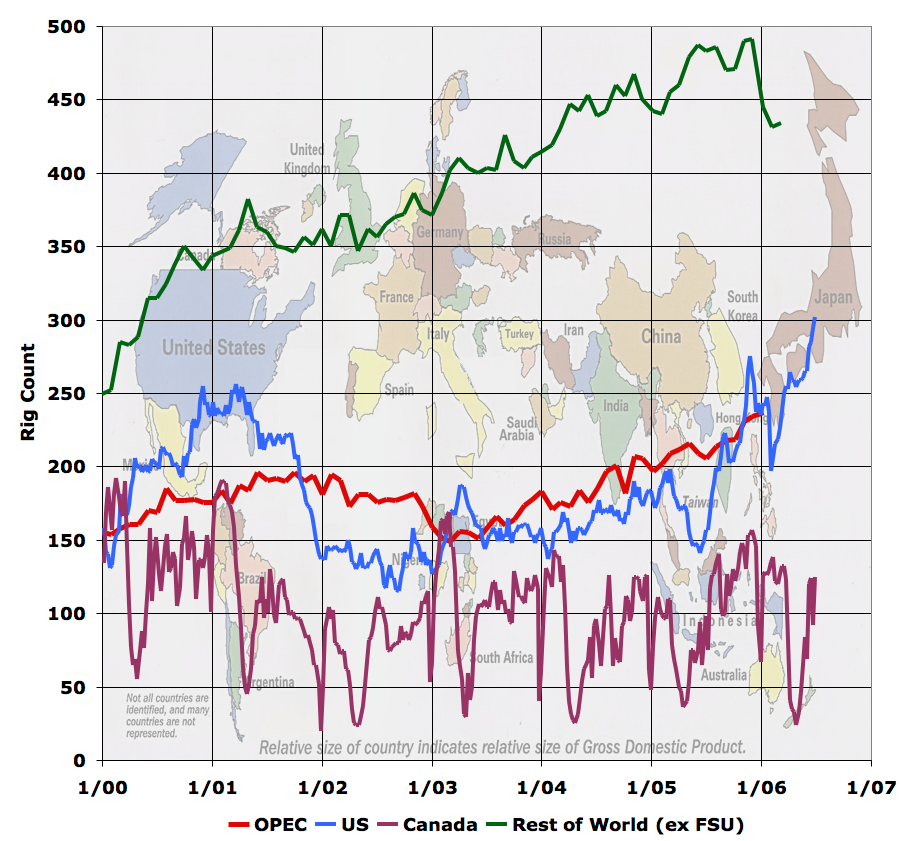

For further context, here's OPEC (in red) contrasted with the US, Canada, and the rest of the world (ex Former Soviet Union which Baker Hughes doesn't seem to track).

OPEC has a relatively small rig count for the large amount of oil they produce (probably because a number of the big Middle Eastern fields have historically had wells with very high flow-rates). However, the growth of OPEC rig counts in response to market events of the last six years seems well within the range of how other players are responding.

Thxs again for your hard work. I was rereading Duncan's Olduvai Gorge Theory Update again [PDF]:

http://www.hubbertpeak.com/duncan/OlduvaiTheorySocialContract.pdf

--------

By tallying the amount of primary energy used to

generate electric power we find that electricity wins

hands down as our most important end-use energy. To

wit: I estimate that 7% of the world*s oil is consumed

by the electric power sector, 20% of the world*s

natural gas, 88% of the coal, and 100% each for

nuclear and hydroelectric power. The result is that

electric power accounts for 43% of the world*s enduse

energy compared to oil*s 35%.

The critical role that electricity plays in the

United States is likewise telling. Out of the total enduse

energy consumed in each of the social sectors in

2003:

1) 0.2% was electricity in the Transportation

sector,

- 33.3% in the Industrial sector,

- 65.9% in the Residential sector, and

- 76.2% in the Commercial sector (EIA, 2004).

--------------[page 4, 2nd paragraph]

It struck me how these latest graphs seem to dovetail nicely into his theory. Duncan predicted a BRINK plateau 2004-2008 [note 5, page 7], your graphs seem to confirm. He talks about diminishing returns-- the rig counts vs FF outputs graphs again.

I googled electrical blackouts: from Hawaii to Africa to Israel and elsewhere, the power companies are having increasing difficulty keeping the juice flowing as it is politically difficult to raise prices fast enough to gain the maintenance cash and/or growth funding to make a more robust distribution network.

Is a Hubbert Linearization Model possible for all energy sources? Is there a way to graph power plant #s and uptime versus megawatts produced [like rigcounts and oil output]?

Duncan predicts circa 2008 is when the energy cliff starts, and then only seven more years [2015] to when the population starts declining fast from 6.9 billion [fig 4, page 8]. I hate to say it, but that seems to be where we are headed.

In short, can you or Khebab, or some other stat. modeler take a look at electricity? I feel Peakoil and PeakWatt are the same thing. Big Thxs.

Bob Shaw in Phx,AZ Are Humans Smarter than Yeast?

Thxs for responding. I just went to google news section, then typed in the words: electrical blackouts. Then I quickly skimmed a lot of articles on where power was out. I admit that this technique is not very scientific, but lots of places are having problems from thievery, insufficient maintenance, hard to get replacement parts, cash flow problems, and so on. Just running out of fuel is not the only thing that can cause electrical problems.

What struck me as key was Duncan's assertion that "7% of the world*s oil is consumed by the electric power sector, and 20% of the world's natural gas." When we go postPeak in these fuels: what percent of depletion will jeopardize a grid?

Phx has hydro, nuke, and coal power, but if we locally lose say 5% of our NG or oil by 2010, will our extra generators that run on these fuels bring the entire grid down? Or do we just start losing peak load ability? Or do we raise prices until we cutoff 5% of Phx residents and businesses. I think rolling blackouts and brownouts ARE NOT the solution, but quickly raising prices to assure reliability is the better path.

Then what happens as each year Phx will have less energy? I feel that the last thing people will want to give up is their refrigerators. But can a utility company make money distributing such a small power load to lots of people over a vast spiderweb?

What about a city that is entirely dependent upon oil or gas generated juice? Or a hydro dam with no water behind it due to global warming? How quickly will their lights go out for good?

I got lots of questions, but very few ideas on how to keep the juice on after Windmills, PV, and other alternatives are maxed out. I am not sure if we have enough time or money.

BTW, Jack, what are your links that reliable juice is less and less of a problem?

Bob Shaw in Phx,AZ Are Humans Smarter than Yeast?

I was told, some years ago, that providing service (excluding billing) cost the utility about $9/month/customer in an urban environment. Adjust for inflation, and this might be $12/month for the first kWh.

OTOH, cooling in a super efficient refrigerator* can be done daily and a small PV (perhaps w/o batteries) can do the trick to keep one's beer cold and milk fresh.

*Take a chest freezer, with top opening and very good insulation and set the thermostat at +2 C/35.6 F. About 100 kWh/year. Saw an Australian example on-line.

There are, apparently, a lot of existing technologies that can be used to distribute and condition power much more effectively and reliably than our current systems do (http://www.wired.com/wired/archive/9.07/juice.html). However, these require an up-front investment and continuous reinvestment, which our deregulated energy companies are disinclined to do; they are busier watching quarterly profit-and-loss statements than figuring out how to deliver "nine-nines" (99.9999999) reliability.

As Amory Lovins points out, the end use is what matters, and focusing on end-use efficiency is a much better post-peak strategy than trying to push more energy into a system with huge transmission losses and inefficiencies. I just bought some more compact fluorescent bulbs to replace the last incandescent bulbs (I wonder why they are still being sold!); if they (as advertised) consume a quarter the electricity of the equivalent incandescent, then I can decrease my electrical consumption for lighting by 75% with no loss of amenity. And since there are are such huge losses in electrical generation and transmission, increasing efficiency at the point of use translates into huge "upstream" savings.

I was reminded of this by Tainter's comments at the "Peak Oil and the Environment" conference; I transcribed a section that caught my attention:

When I read Tainter's work, I wonder whether he distinguishes between "complex" and "complicated" systems. A number of system theorists do:

It seems that there are circumstances in which being more complicated -- i.e. the global system of oilfields, pipelines, terminals, tankers, refineries, etc. -- brings diminishing returns, but where greater complexity could create greater adaptability and robustness, i.e. dispersed generation by a great number of simple and solid-state renewable energy sources, networked through a super-reliable and efficient electrical grid.

I recommend Kevin Kelley's Out of Control: The New Biology of Machines, Social Systems, and the Economic Work as a good introduction to how complex systems work. On the darker side, the Global Guerillas site explores how complicated systems are vulnerable to deliberate infrastructure distruption.

Well done! Thxs. Yes, electricity is currently 'complicated'--the key question seems to be whether people will cooperate for 'complexity' changes to benefit all, or if the wealthy will prefer to self-interest 'simplify' the system grid model by going off-grid [helping to promote systemic collapse].

Richard Rainwater, Bush & Cheney, and who knows who else are voting for protective self-interest by building eco-tech PV housing instead of investing these funds into utility companies to help the peasants [Just as Jay Hanson predicted--thus he encourages everybody to prepare to go off-grid ASAP--"BE A NOAH, build an ARK"].

My google readings seem to indicate the wealthy in Africa prefer to buy gensets instead of grid investing too.

Bob Shaw in Phx,AZ Are Humans Smarter than Yeast?

I too am concerned about the richest folks bunkering down while letting the electrical networks decline. As Kunstler recently pointed out on his blog, most of the Americans who are thinking about peak oil at all are focused mostly on how to keep their cars running, with little thought to the electrical grid. I live in a compact city with good electrified transport; if oil is short, people can walk, bicycle, and ride the train; if the electricity goes out, things would start unraveling pretty fast.

Starting in the 1990's, a lot of towns have municipalized their utility networks. It would be interesting to know whether Municipal utilities are making smarter and longer-term decisions about infrastructure; I remember that during California's electricity crisis of 2000-2001, the municipal systems experienced less price volatility and fewer brown-outs and rolling blackouts than the big private utilities (PG&E and Southern California Edison). Many tech companies in the Bay Area, because their business is so dependent on electricity, sought to install backup diesel generators, and most companies I know of have made an investment in uninterruptable power supplies and computer backups. The better, and ultimately more cost-effective, investment would probably be to increase the reliability of the supply on a citywide or regional scale.

Your observation that maintaining widely distributed electrical networks as resources become scarce will become less tenable is an important one. Low-density suburbia and exurbia could find itself in an unpleasant infrastructure squeeze, as road, water, gas, sewer, and electrical infrastructure age and need to be repaired or replaced. Dense or clustered developments that minimize infrastructure, with good access to nearby farmland and energy-efficient rail and water transport, could be better places to live in a powered-down future.

Like so many issues in modern technology, when you start to think about sustainability you just can't get there from here.

I found as you did with the ones I bought from IKEA for example (various sizes and shapes all bad)

"Globe" are also fairly grim IMO

For what it's worth if you can find NOMA brand I think you should give them a try. Their 60 watt spiral is now the std. bulb around the house here. The one outside the front door is on all night every night and has been in service for 2 1/2 years.

But I'm still looking for a dim-able CFL that works, and at $10 Canadian a piece I don't want to gamble on any more junk. Anyone found one of these that does what it claims?

Yes, CFLs contain Hg, but the largest source (40%) of Hg in the environment is from coal-burning power plants. This is the nasty stuff that is in the air, water, and soil. The savings on electricity from using CFLs has a much greater impact on Hg emissions from power plants than the Hg potentially leaching into the soil in a land fill from a CFL (though most places have CFL recycling centers so you shouldn't toss them in the trash anyway).

As for dimmables, there are 34 listed at the energystar.gov website. I've used on (Greenlite) and it works as claimed (and full ignition in less than 1 second and full run up in 60).

Input to this block clearly is raw energy (oil, coal, hydro, etc).

Output of the process could be defined as the number of end-user connections X kW's served. One complication mentioned above works here: when will fixed connection cost and variable usage cost run out of balance? Or, when will the first kilowatt be so expensive, you cannot even get to bying the second kilowatt, whatever it's price is? This will lead to a spiral of fixed costs being covered for by less end-user connections overtime, sending more people off-grid, etc.

Then I've looked at the enablers of the process. Covered too in Duncan's paper, this includes the software, operators, relays and what have you in this terribly complex powergrid system. Installing equipment whith better EROIs would be a way to get more juice from the same raw energy. Well, in short, the nine 9's story and it's costs involved happen here [Since Seven of Nine is well underway, maybe she can come up with the last 2 ;)]

Next the process needs controls. Forcing prices so people can only decide to disconnect is a way to control the process by policy. The reason I think this is not a solution is because of the fixed costs issue above. OTOH, it then also seems a good way to force grid disconnections in a 'managed' way.

The last arrow working on the process is often referred to as noise/pollution or system external influences. Here you find the impact of stolen copperwires, hurricanes, lightningstrikes, dams without water, etc. This out-of-control part is what really gets me scared...

Applying such system thinking to the power grid part of OT helps me see where some of the comments fit in, but it hardly helps me in getting deeper understanding. Though, it does give me a better appreciation again for the complexity of what we discuss here.

Last remark about my former employer: "It took the Philips Incandescent Light Works (NV Philips' Gloeilampenfabrieken), officially founded in 1891, four decades to reach the top of the lighting industry. In the first two decades the company became Europe's third largest producer of light bulbs, with a turnover of some € 33 million in 1911 (3.7 million Dutch guilders, converted to Euros of 2003).".

1891 is 40 years before the industrial civilization started as defined by Duncan.....

I don't have any links, which is why I said it was my impression. I did try a bunch of sources but could get good data.

I do know that across Asia, the region that I live in, things are getting better.

I don't think that says anything about peak oil one way or the other. Natural gas shortages should limit generation at some point, but I have seen no indication of that happening. Peak oil (or even expensive energy) reducing government's ability to maintain infrastructure also does not appear to be a factor.

No, the population decline will be artificially jump started long before 2015. I just hope that Tamiflu is an effective antidote for the agent of choice.

Jay Hanson called this the Pandemic Powerdown method years ago. Yikes!

Bob Shaw in Phx,AZ Are Humans Smarter than Yeast?

I'm working on a post about the Hubbert analysis applied to coal which is the mainly used for electricity production.

I suspect that US hydrolectric development might follow an HL plot for new power coming on-line/year (I atill think we can get another 20%), but again the decline is only in new plants coming on-line.

Likewise we might one day see a saturation of wind turbines; but I doubt that I will live to see a y-o-y decline in wind production.

I am VERY unsure that exploitable renewable resource base follows the same distribution as oil & gas fields; and even less sure that the forces for exploitation follow the same curves. Solar PV may show a step function if a much better cell is invented, for example.

I agree, I don't think that the logistic curve should be applied on renewable ressources as Jean Laherrère did recently on biofuels.

Not that they are useless, but no panacea for electricity... except maybe solar with decent technology.

Hydroelectric storage may shrink but the head rarely does. Run-of-river hydroplants are economic and relie on no storage (or a few minutes worth).

Wind deplete ? If wind patterns change, move the replacement WTs to a now better location in 20 to 30 years. Total wind resource should not decline significantly with GW.

Solar ? What if cloud cover and haze increase (quite likely BTW) and there are more frequent and severe dust storms in US solar's best location, the US SW ?

I'm looking forward to your analysis, particularly in looking at how you handle the fact that much of the production has been done in an environment where there were superior (or at least prefered) substitutes available: nuclear, petroleum and natural gas. Certainly generating plant construction and coal production would have been very different if there had not been nuclear in the 60s and 70s and natural gas in the 90s.

Utility-scale wind power produces 2.628 kWh/year for each $1 spent on wind farms. (Assumes $1/W of installed capacity (reasonable number, very likely to go down with the continued development of larger, more efficient turbines), and a 30% capacity factor, the standard figure used in such calculations.)

Cost to completely replace the world's oil-based electricity generation: $422B, for the US: $103B.

Given the dire circumstances Duncan is talking about, and the fact that the astoundingly misguided boondoggle known as the Iraq War will cost far more in cash flow than even the $422B, let alone the $103B, this is a relatively cheap fix for a huge problem.

Clearly, no one would suggest that we try to replace that 7% of our electricity with just one other form of generation, and we won't. We'll see a major ramp-up of thin-film solar, concentrating solar thermal, etc. in the coming years, as well as continued aggressive roll-out of wind power. This calculation is meant to show that it's not nearly the intractable problem it might seem to be at first blush.

Thxs for responding. Your input is much appreciated, but electricity availability will require much more than that $$$ amount as all FFs deplete and grid maintenance and security skyrockets.

[Duncan,pgs 4-5,sect. 3: "Permanent blackouts are coming"]:

----------------------------

The third catch, according to the Olduvai Theory,

is that sooner or later the power grids will go down and

never come back up.4 The reasons are many.

The International Energy Agency (lEA, 2004)

estimates that the cumulative worldwide energy

investment funds required from 2003 to 2030 would be

about $15.32 trillion (T, US 2000 $) allocated as

follows:

- Coal: $0.29T (1.9% of the total),

- Oil: $2.69T (17.6%),

- Gas: $2.69T (17.6%),

- Electricity: $9.66T (63.1%).

Thus the lEA projects that the worldwideinvestment funds essential for electricity will be 3.7

times the amount needed for oil alone, and much

greater than all of that required for oil, gas, and coal

combined.

The OT says that the already debt-ridden nations,

cities, and corporations will not be able to raise the

$15.32 trillion in investment funds required by 2030

for world energy. (Not to mention the vastly greater

investment funds required for agriculture, roads,

streets, schools, railroads, water resources, sewer

systems, and so forth.)

Furthermore, because of the rapidly rising cost of electricity, the increasingly impoverished customers

won*t be able to pay their electric bills. Worse yet, the

really desperate ones will illegally wire directly to the

low-voltage power lines, so without a wattmeter to

record their usage they won*t even have any bills to pay.

--------------------

Basically, he states that diminishing returns from all resources + increasing population is what will start to send local and regional grids spiraling downward over time.

Those companies/homeowners that can afford their own gensets/PVs will move off the grid instead of trying to financially support a system of increasing unreliability. This self-interest effort will only add to the cascading financial feedback problems of the utility grid. My google reading seems to support this trend.

Bob Shaw in Phx,AZ Are Humans Smarter than Yeast?

Brief example: If I owned an ice-cube company in a hurricane prone area, or in Phx, I would be begging my banker to loan me the money for gensets and big water storage tanks. Otherwise, when the local grid is disrupted, instead of making ice and maximizing profits, but most importantly saving lives, the owner is helpless as he just watches his limited JIT inventory melt away or sold off in a panic, with no prospect of making more. Deaths soon follow.

Bob Shaw in Phx,AZ Are Humans Smarter than Yeast?

It would certainly produce some significant problems if 7% of generating capacity disappeared overnight. Even then, however, grid management authorities would have contingency plans to put into effect. Peak Oil, however, wouldn't mean eliminating that 7% of generating capacity overnight. Instead, it would get slowly priced out of the market. The effects of this would depend on whether it was replaced by other sources (e.g. coal, renewables) or whether it wasn't. In either event, the results would be relatively marginal.

For the overall results of Peak Oil, the effects would be considerably more severe. They would still, however, be much more manageable than the doomers think. Certainly, "business as usual" would be impossible. That much is certain. The doomers, however, can't seem to conceive of any alternative besides catastrophe. In reality, there are many other possible outcomes & most of them are a good deal more probable.

First of all, the effects of Peak Oil are going to come on fairly gradually. I'll grant that there are reasons to be apprehensive about some of the major oil fields that have been pushed really hard with horizontal wells & water injection. Even if these field collapse in the near future, however, there are the many hundreds of other large fields (not to mention the thousands of smaller ones) which will be depleting at a more moderate rate. Any steep decline in the next ten years would, therefore, be followed by more gradual decline after that. This is very important in assessing the speed at which the world will have to adapt.

Second, there are many ways in which oil use can be made more efficient. This would not run into Jevons' Paradox, because the increased efficiency would be driven by rising prices and, while it would make the higher prices more affordable than they would otherwise be, would be highly unlikely to make it more affordable than before the price rose.

Third, Peak Oil will abolish the wastrel culture (a.k.a. consumerism), though possibly not at first. It is quite possible that some people will, for example, continue to drive SUVs out of bravado or as a status symbol ("I'm rich. Watch me drive my big SUV around. I light cigars with $20 notes, as well.") Most people, however, will recognise that spending half your pay packet on petrol is, as we say in Australia, "a mug's game" and adapt their behaviour to the new reality. SUV sales are already a long way below where they were a year or two ago. As the price climbs, the shift away from them will accelerate. In a fairly short period, the accumulated behavioural changes by the majority will lead to a much more censorious attitude to those people who continue to waste the oil that everyone knows will be needed tomorrow. There will certainly be a lot of pain in the transition, but while extreme examples like Phoenix may very well be abandoned, most other cities will adapt.

Fourth, the political credibility of the established elite in the US will be destroyed totally by Peak Oil. The space will be cleared for new forces to emerge. Some will be both crazed & depraved (imagine your favourite radio shock jock as a doomer), but most would embody the humanitarianism that still animates most of the North American people despite the inhumane society in which they live.

Fifth, Peak Oil doesn't equate to Peak Energy. That will be later. Peak Oil will result in a lot less geographical mobility, but not a great deal of other sacrifice once the transition is made. Food production, the favourite topic of the doomers, can be done a lot on a lot less energy intensive basis than currently in the US - & it is, in every other country in the world. Further, the response to Peak Oil will be the learning experience which will enable humanity to cope with Peak Energy. We will cope with Peak Energy by developing a society based on sustainable energy sources and keeping our manufacturing activities down to those that satisfy actual needs, rather than thoughtless desires.

Sixth & last, population is not the bogeyman that so many doomers think. Global population, even at current trends, is scheduled to max out at 9 billion in about 2050. Birth rates are falling in almost every country and some countries are already in total population decline. Russia, for example, is in free fall. So is much of Eastern Europe. Japan has reached peak population this year and will fall from now on. The rich industrialised countries, the ones with the greatest per capita oil consumption, will collectively have little or no population increase from here on. India & China, which are both industrialising at a rate of knots, won't have the same oil consumption because they won't have an oil intensive legacy suburban & industrial structure.

So yes, Bob, we are smarter than yeast. You're an example. And, once Peak Oil breaks the spell of consumerism, so will most other people be.

- Practical peak oil may not happen gradually, it may actually happen almost overnight, for example, if a major production area was effectively taken off supply for a few years.

- A relatively rational human response, on both individual and collective levels, is unlikely.

- Peak oil will mean the level of real wealth will reduce. This will require significantly greater proportionate reductions in wealth by the most wealthy individuals, communities, countries, since if a proportionate reduction occured a large number at the poor end would die. I think this will cause significant conflict, however it pans out.

- US policy is to secure access to the oil and energy supplies it needs by military means if necessary. That means war.

- There is a good chance that peak oil will fundamentally undermine our economic, financial and monetary systems. I think they will break - with significant and difficult to predict results.

- The steady reduction in oil and gas supplies and their increase in price will hamper our ability to take mitigating action. Mitigation will be much more effective and doable if started well prior to peak, we haven't.

- Global population of 6.5 billion is already probably unsustainable long term by the fact that it is degrading the productive capacity of the land and environment. 9 billion ain't gonna happen, we are already using more grain than we can grow and that can't go on long.

(The russian population is in 'freefall' because life expectancy has declined massively since 1991 due to poverty, disease, infrastructure failure etc.)So, if and only if,

the problem of peak oil is gradual,

is managed rationally, fairly, and with the overall benefit of the whole community on every level from local to global in mind,

doesn't largely destroy our economic and financial systems,

doesn't degenerate into widespread conflict,

only then is your rosy scenario likely.

I think that nothing less than a fundamental change in human thinking, attitudes and behavior are pre-requisite. I wouldn't hold my breath.

sector,

33.3% in the Industrial sector,

65.9% in the Residential sector, and

76.2% in the Commercial sector (EIA, 2004)."

First three figures add up to just under 100%, but with last one added it's ~176%. ?error or something I'm missing in terms of overlap between the figures.

As for the conclusion - GULP! Two years to build a "lifeboat".

Thxs for responding. No Duncan error--merely change your perspective [take each group individually, don't add]:

First consider all forms of transportation: primarily liquid fuels move them combustively, but a small portion [0.2%] are juice powered. These are electrified trains, subways, rechargeable golfcarts, etc. That is the main reason AlanfromBigEasy wants to help solve the coming liquid fuel crisis with more mass-transit.

At the opposite end, commercial businesses live and die on juice. GOOGLE, YAHOO, & MICROSOFT, need megawatts to power their equipment. A restaurant needs juice for lights, A/C, run the cash register, etc, but the ovens, grills, and hot water for the dishwasher comes from natural gas or propane.

Hope this helps other readers too.

Bob Shaw in Phx,AZ Are Humans Smarter than Yeast?

That includes the 8,000 subway cars in NYC, Amtrak's Northeast Corridor (Boston-Washington), The Long Island Railroad (massive commuter + freight traffic), SF BART, DC Metro, Philly, Chicago, Boston, Miami Metro, Atlanta MARTA, LA Red, Blue, Green & Gold lines, Light Rail in San Diego, Portland, Sacremento, San Jose, Salt Lake City, Dallas, Houston, St. Louis, Minneapolis and the streetcars of New Orleans :-)

Sure I missed some.

Why so much transportation with less than 1/500th of our electricity ?

Because of the inherent efficiency of electrified rail ! High efficiency motors (>90%) that generate electricity while braking combined with low rolling resistance steel on steel.

PATH was a major oversight !

San Francisco's Municipal Railway has five light-rail lines as well.

And SF Muni gets good ridership !

Turn the pool table upside down, nail (using nails left over from paneling) paneling against the legs on all four sides, install deck chairs for the paddlers and there we go !

Obviously we have more than two years before we "sink" !

Plenty of time ! >:-P

It is also useful to demonstrate what CAN be done.

O.K., Stuart, your going to have to help me out here....this type of involved chart reading is not my strongest suit, so I am approaching it as a layman and asking myself what would stand out if I were brand new to this whole subject.

On the last chart in the series, I am reading correctly I think that the green line is the chart at the top is the line indicating "Rest of World (ex FSU)?

This would be the line with the sudden drop off at about11th or 12th month, 05?

Does that strike anyone as interesting? With crude oil at some of the highest prices in history, why a rig count drop for the "Rest of World" right then?

One would think that the so called "new areas of development" away from OPEC (per CERA and others) would have inspired at least some extra rig count (?)

I would blame the hurrricanes, but that would be in blue line indicationg U.S., correct?

Just eyeballing, this means that rig count "rest of world" is now back to around the level of Feb. 04 (!!) quite a surprise given the price of oil. We should also note that even though prices are high, even with what is (again, eyeballing) about a 10% drop in rig count "rest of world", we still have seen no shortages.

Now if I am not completely misreading the chart (always a possibility with my chart interpretation skills!), I mentally combed through some quick possibilities:

#North Sea drop in count, and no real promising prospects there to sink new wells (?)

#Mexico, same story, no new prospects, but drop in wells on marginal or declining prospects (?)

#Price inflation on steel, and workforce shortages causing delays (?)

And of course, I can't leave out what you know will be a popular one among those who feel any oil "shortage" talk is a scam.....

#The oil companies simply sitting on their cash and letting the price run up until they find the topside limit on price before demand destruction sits in (demand having remained surprisingly strong in the face of high prices), in other words, the whole thing is about price and money, not supply and geology (?)

Either way, IF I were coming at this as a newbie, and really looked at the charts, that last one in particular, right now, I would be inclined not to see signs of a looming crisis, but for the moment at least, just more business as usual. Having been around this subject longer, I think it is more than that, especially in the longer view, but it could be hard to convince an outsider.

O.K., have at it.....tell me what I've missed! :-)

Roger Conner known to you as ThatsItImout

How about a chart showing world total rigs (perhaps split out by land and off-shore). At some point the rig count has to stop going up when all moth balled rigs are in use and rate of break down exceeds rate of manufacture of new rigs.

Libya and Algeria enjoyed successful exploration programs in the 1990s - both as a result of inviting foreign E&P companies back - and this has provided some of the fresh oil comming on stream today.

At some point US and European E&P companies will get to explore Saudi - whether they are invited or not.

Does anyone know when Switzerland will get to join OPEC?

If there were fuel shortages in the US I imagine that this will stiffen resolve back home.

In the UK oil production peaked in 1999 at 2.9 million bpd. Last year our production was 1.8 million bpd - almost the same as consumption. The only preparation I can see that our government has made is to set up military bases in and around the Middle East. Unpopular at the moment but when folks can no longer afford to fly to Spain on holiday, let alone start to go hungry, they will become more tolerant.

Here's a link to an interesting article in the name of Michael Meacher, a member of the UK parliament.

http://www.telegraph.co.uk/money/main.jhtml?xml=/money/2006/06/26/ccpers26.xml&menuId=242&sS heet=/money/2006/06/26/ixcoms.html

Here's his website:

http://www.epolitix.com/EN/MPWebsites/Michael+Meacher/home.htm

Please do check out his articles, you will probably be surprised at the strength of some of the things he says, some very negative about the US.

Just before the last UK general election in May 2005 I did a pretty thorough search to see which UK MPs had ever mentioned the words 'peak oil', he was the only one I found, so I emailed him suggesting that peak oil might be within 5 years rather than the 30+ years the official agencies say. I received a brief acknowledgement and left it at that. I do note he's been mentioning PO more forcefully lately.

Rumour has it that Michael Meacher may stand against Gordon Brown for the leadership of the Labour Party, and hence Prime Minister, when Tony Blair stands down. I really hope he does and that he makes the core of his campaign the need for profound change to try to avert the probable catastrophic impact of PO and climate change.

In the UK most interesting prospect is a Scottish PM (Uncle Gordon) running a Westminster Labour UK government against an English Conservative majority - propped up by Scottish Labour MPs from Glasgow - a hangover from 1745.

Appologies to all US TODers who may not understand any of this - in the UK called the Westlothian Question - completely irrelevant to you now - but in 3 years time the relevance of this may become clearer when the UK dissintegrates.

All the oil, gas, whisky and fresh spring water is of course Scotland's. We also have great scenery and welcome foreign vistors with open arms - fly now while you still have the chance.

PS Germany 0 - Italy 2 was the final score

Hopefully one benefit of climate change will be scope for a wider range of crops in Scotland, if only most of the natives would eat more sensibly, lol.

I guess I should be glad I didn't bet on Germany to win it.

I probably don't agree with everything he says but he is about the only UK parliamentary voice who is saying anything real on this subject.

However, taking Saudi Arabia alone, as you plotted the other day, the view is not so comforting.

The Saudi rig response is very large, particular in the context of the broader OPEC response.

Is it possible they are industriously building spare capacity? How could we tell? On face value, the Saudi case looks scary to me.

In the last graph by Stuart, the purple line for Canada's rig count is jumping all over the place, but overall is not increasing or decreasing much. Is this due to the damn cold winter weather or some other factor? You would think that with the tremendous demand of natural gas for the growing projects in the Athabascan oil sands, not to mention NAFTA exports to the US, that the rig count would be steadily increasing. I am confused.

Bob Shaw in Phx,AZ Are Humans Smarter than Yeast?

Big Thxs for clearing this issue up for us fellow TODers! Do you have anyway to tell if global warming is lengthening your 'thaw shutdown season'?

Bob Shaw in Phx,AZ Are Humans Smarter than Yeast?

I've heard they have lost almost 100 days per year because of early thaw in Alaska

http://www.savearcticrefuge.org/2005/iceroads.pdf

this says its down from 204 to 124. Canada is probably similar.

Yikes! Great link, thxs. Nature's thaw is trying to tell humans to backoff, give it a rest, but we refuse to listen with our grey-matter! Our genes are not our friends!

Bob Shaw in Phx,AZ Are Humans Smarter than Yeast?

Scientists in Siberia have noted that an area the size of Germany and France combined has thawed for the first time in god knows how long. I fear that the rollercoaster train known as global warming has just crested the cogwheel hill and is about to head into a spectacular freefall.

The last thing we need is the development of more fossil fuel for carcult growth or for economic growth in the form of increased electricity use via coal burning.

I fear the Bob Shaw may be right in citing the Oldavai Theory and its result -- dieoff. Hope not. Give me three more years so I can get the first of my royalty checks.

Yesterday, I wrote that OPEC may be up to something and the straightforward interpretation through the "lens of peak oil" of a higher rig count & flat production may not be correct. Here's what is really behind my thinking....

Preparing for War

So, you're Saudi Arabia and issuing statements like this

And from somebody in the Israeli press ... OK, now let's throw in the Iranian (Shia') nuclear stand-off, planned gasoline rationing there, the virtual civil war in Iraq with their large Shia' majority, Kurdish independence movements, Turkish troops on the Iraq border, the Taliban comeback in Afghanistan ... and finally the United States -- which has been effectively shown to be a "paper tiger". Let's face it: Hugo has been giving America the finger for a couple years now and our crippled government can't do a damn thing about it other to send Condy out to make a few veiled threats that no one takes seriously. Finally, let's throw in the China/Russia opposition in the Security Council to strong actions or sanctions imposed on Iran.So, if you think the Middle East "Rapture Index" is getting pretty high, do you start investing lots of money and pumping oil like there's no tomorrow ... OR do you accumulate rigs, flatten out your production and batten down the hatches? If the general Middle Eastern conflagration occurs and you think that is probable, oil will cost $$$ later. A straightforward calculation tells you that lost revenue now given the interest rate will still turn into positive gains on "the other side".

I'm just throwing out a hypothetical scenario. I'll leave it up to our able readership to decide for themselves.

We need to think about what the extra rigs might be doing:

- Some will be used for exploration - no early impact on production

- Some may be used for work overs - marginal impact on production

- Some may be used to drill water injectors - marginal impact on production

- Some may be used to drill multi-lateral horizontal producers - which probably take quite a time to drill and complete.

If the latter produces only oily water - then the impact on production might also be marginal.In the North Sea, the rig count is way ap and production is still falling!

Maybe in Saudi 1+1=2

An additional observation, might the Saudis be hoarding drilling rigs to keep them off the market? Less drilling anywhere else means they can develop the SA fields, and the competition can't drill.

Since rig count has been going up since 2005 at least I don't think that current geopolitical factors are important.

In fact tying short term political factors to long term projects like drilling oil wells makes no sense.

The western press loves to blame geopolitics always for prices the truth is its more complex but the layman has not been taught about world oil production.

Maybe not the layman but that doesn't describe me, does it? As I said, the scenario is completely hypothetical. What is happening is consistent with that thesis but it is also subject to other equally consistent interpretations. As far as blaming geopolitics goes, never underestimate the power of a severe oil shock. Tensions in the Middle East are escalating. Planning on "business as usual" does not appear to be an option. I am sure Saudi Arabia is "gaming" the hell out of this situation. So is Iran, Qatar, Kuwait and the UAE. Interestingly, the North African nations (Algeria, Libya) are better positioned since they are not geographically in the region. These nations are thus in better shape to handle possible future geopolitical disruptions.

As far as rig counts starting to rise in 2005, that isn't unsurprising. I didn't say this scenario just came on the scene recently. It has been laying out there for at least a year now. The seeds of all this lay in the invasion of Iraq in March of 2003. As was predictable at that time, de-stabilization of the region has progressed apace.

best, Dave

I'm not saying people are not playing games. But I really think that there may soon be more serious problems with the worlds supply of light sweet crude and it looks like the root of the problem is Ghawar.

What really pisses me off is I think the US government and the Saudi's know whats going on there are way way to many foreigners in Saudi in sensitive positions or with access to sensitive data for me to think that the US does not know exactly what the state of Oil supply is in SA.

So the move into Iraq really the only gem left in the middle east. One important factor is it would provide bases to support the Sauds if there productions start to collapse.

Everyone keeps looking at Iran and that may actually be the wrong direction entirely.

Not that having direct access to Syria and Iran is not important but that in the next few years we could very well be moving into SA to contain insurgents there.

I guess I've increasingly become a Ghawar watcher :)

I would argue that the US military capability is a "use it or lose it" proposition. It's expensive to maintain that level of capability, even if you don't use it. As our economy declines (which I believe it's about to), and the opposition to us grows stronger, the opportunity may well pass. It's in this time period that we will be our most dangerous.

We didn't spend that money building such a military machine just to watch it wither away, we made to be used. And I believe we will, to everyone's great misfortune.

Only countries that can't fight back with natural resources might qualify. Iraq really stands out as the only good prospect. I'm fairly certain that cutting the DOD budget in half would benefit us more than starting any more wars.

GWB todo list.

1.) Invade Iraq take there oil

a.) Don't forget to kill Saddam

2.) Invade Iran take there oil.

P.S.

Don't forget to invade North Korea so people don't think were invading countries to take there oil.

The Middle East is the key. I think it's obvious to everyone now that we no longer have the upper hand there. We are in a quagmire that might be better described as a "failed police action" to secure the region for the free flow of fossil fuels. I am particularly concerned with the recent Israeli/Hamas escalation that has taken place since the Palestinian elections. Why is Hosni Mubarak running around the Middle East making desperate attempts at mediation? What has been the response of the Bush & Company? Silence, complacency, confusion, ineffectiveness.

Questions, questions. No real answers yet.

Most important news is that its still Germany 0 - Italy 0 (World Cup Semi Final).

What you raise are serious questions about democracy - Algeria, Iran, Palestine and US elections all with very unpalatable results in recent years. Democracy works well in some places - other countries are simply not ready.

My main worry at present is Iran - cos I believe most of Iran's oil goes East - make sure your military planners are aware of that before getting adventurous - a strike on Iran may be seen as a strike on China.

Also we are building a broader energy security based on floating bombs that pass through Hormuz - not just oil but also gas now, that in the UK will be used to make electricity.

Totally crazy - but there again our finance man Gordon Brown is taxing oil producers instead of oil consumers - DUH!

Also, I don't think a military approach will be effective, just that it can still have a major impact on the world energy situation - one way or another.

That being said, yes the US military is impressive in its size and amount of destruction it can do. However, occupations historically have one of two outcomes:the occupier moves in and either kills everyone of displaces them, or it tries to occupy and live with the locals. The latter almost never works out, for obvious reasons, one of which is guerilla warfare or asymmetrical warfare against a large and slow moving force is easy pickings and quite demoralizing. This has been played out countless times thru out history, why anyone is suprised I dont know. I have a theory that the neocons knew this and went in with an understrength force and zero counter insurgency plans just to draw out the war and stay in the "war business". They cannot achieve their agenda without perpetual war. Their goal was to control the oil bearing nations in the mideast and establish permanent bases there, they have done so, the oil hasnt started flowing yet (oops ! ), but the bases are there !! The secondary benefits of those in the war business have been enormous, billions of $$ unaccounted for, weapons makers running full tilt boogie for going on 3 years now, they have problems just keeping the 7.62mm ammo in supply !! Its a bonanza for them. Ya, the military of the US is broad, but it also lacks depth, that too is showing its ugly head. Thats one aspect im not sure they planned for, we will see.

The comments from Saudi Arabia are perfectly normal, concordant with their perception of the situation, and not utterly unreasonable IMO.

Syria and Egypt are the two major arab nations in the Mediterranean area of the Mid East, Syria is by far the more amenable to Russian involvement. One could say it is perfectly understandable that Russia is taking such actions, the US does it all the time (Israel, Saudi, Kuwait, bases in other Persian Gulf states, Iraq). One could also interpret it as Russian 'positioning' but what would you call US behavior?

I take issue with the implication that the US should 'do something' about Chavez and Venezuela. The US has no damn right to do anything about Chavez, Venezuela can sell their oil to whomsoever they choose. If they sell it for 1 cent a barrel to Cuba or China that is their choice.

Iraq is and will remain a mess. Best hope is a loose federation, a slow reduction in violence and the exit of most US troops as soon as conditions permit. The odds are against that.

The jump in Saudi rigs is probably best explained by one of two alternatives:

- to compensate for falling production

- to increase production so Saudi remains the swing producer

Time will tell.If you want a "So it's war then" scenario try the 'Premptive Energy Security...' paragraph on this page at EnergyBulletin:

http://energybulletin.net/17811.html

I read the original, interesting and pretty sick in its conclusions except for a few final comments.

In no way do I think the US has the right to "do something" about Hugo Chavez. I only used this as an example of American impotence. The US history of intervention in Central & South America demonstrates clearly enough what our foreign policy has been in the past, a foreign policy which I regard as immoral. My point was to say that the American government can no longer engage in such reckless, cynical and pernicious acts even if they want to (which no doubt they do).

I'm sorry you misunderstood my point. Perhaps I wasn't sufficiently clear in stating it.

uhmm... I didn't say I wanted a war scenario. I said there appears to be one out there and proposed that some Middle Eastern oil & natural gas producers may be considering it... I am a bit annoyed.

How you read your interpretation of what I said into my actual remarks would be seem to an issue between you and yourself. But I see this all the time on TOD.

Ending on an upbeat note, thanks for the link.

Q = 288 Gbb

URR 828 Gbb

now at 35% of URR

Includes estimated 20 Gbb produced before 1965, added to match 1997 cumulative production given in table here:

http://dieoff.org/page133.htm

A 50% decline in 12 years equates to a 5.5% annual, cumulative decline, starting now. Is Simmons wrong?

If anyone missed it, Simmons' presentation is here: The Energy Crisis Has Arrived. The image above was swiped off page 44.

Thxs for posting this. Simmons has much better sources than any of us, so he might be quite correct in his assessment, but I wonder if he overlooked possible future Iraqi production. Maybe Iraqi production might be 4-5 million barrels/day in a few years, and going up even more than that in the future:

http://money.cnn.com/2006/07/04/news/international/iraq_deals.reut/

I really have no idea on what the true state of Iraqi oil potential is. Perhaps the TOD principals will take better look soon.

Bob Shaw in Phx,AZ Are Humans Smarter than Yeast?

Stuart - HELP!

PS Still Germany 0 - Italy 0

Come back when you've read that whole thing.

What does seem to be the case is that only Saudi Arabia is showing the massive spike in rig count. No-one else is expressing any urgency in this particular way.

I think you are right in considering long periods of shut in production. The UK might provide an analogy with significant involuntary production shut in following Piper Alpha - giving rise to Twin Peaks.

In addition to this I think the assymetric field development program may also play a role. In Saudi, only the 6 biggest fields or so have been fully developed. What would the UK production - reserves profiles look like if only Forties, Brent, Piper, Beryl and Ninian had been produced for the first 20 years, followed by development of everything else?

I think the overall field developemnt strategy also plays a role, in latter years dominated by multi-lateral horizontal producers according to Matt Simmons. And it is the anticipated watering out of these producers that leads Simmons to fear production might collapse.

My best guess would be Simmons on the right track near term, followed by a period of massive re-investment, developing fields that produce 100,000+ bopd that results in a second smaller ME peak -some time post - world peak.

This is a great site and I will continue to contribute if thats OK.

back to lurking,

I, for one, welcome his lightheartedness and (sometimes surreal) humour (the post above about reading the whole EIA site is a good example of this).

He also has a huge amount of level-headedness that he brings to discussions here. Something I also appreciate.

Just another colour in the TOD spectrum.

To elaborate on Jack's comment, the EIA has a horrible reputation amongst TODers mainly for their tendency to do what we call "drawing straight lines." They take past historical trends, and with a ruler it seems, simply extend them into the future. In other words if oil usage has been increasing over the last 10 years by 1.5% per year, they project future usage in 2020, let's say, as the result of 1.5% per year increases. Pretty simple. They then assume that production will be the same as that usage in 2020 years. At least nobody has figured out how else they come up with these numbers which appear to be utter insanity to most observers. And apparently their record on future projections going back a few years is sufficiently bad to highlight this folly.

On the flip-side, we all tend to use their historical data as the standard for computing whatever we compute. But this is probably because there is practically nothing else to use. The IEA's data is the only data that is comparable. BP's data only comes out once a year. The EIA's data is fairly complete and comes out every month for the month two months previous. How accurate this data is is the subject of considerable debate here.

The main point I would make is that on 12 May 2006 world markets began a serious wobble. The reason that emerged was concern over higher interest rates stemming from high energy prices. Higher energy prices that may just keep going up and up.

What is going to happen next? My feeling is that instead of a rational acceptance of fact, our politicians (including your DOE and our Lord Browne) are driving the train full speed to the buffers. Two options, it runs out of gas before it gets there or it crashes head on.

Debate moved on to Khebab's post on Norway.

This report by MK Horn and associates shows the 53 oil fields in Iraq at Figure 3. Further down below Figure 17 under Table Caption if you click on Table 1 it shows the 28 major oil fields for Iraq with proved reserves of only 41 billion barrels and this was reported in 2003. I wouldn't count on too much more being found there.