DrumBeat: February 28, 2007

Posted by Leanan on February 28, 2007 - 10:11am

Economic growth cannot continue indefinitely without conservation

You may have heard people talking about economic systems. You may also have heard of the energy of systems. The laws of thermodynamics state that the amount of energy in any system is finite—additional energy must come from outside. What you probably do not hear a lot about are the grim implications the laws of thermodynamics have for our economy.Growing an economy is like increasing the energy in the system - it can’t just spring forth from nowhere; it has to come from something. You can do more with what you have by using it more efficiently, but this places an obvious ceiling on growth.

The DCDC Global Strategic Trends Programme 2007-2036

A fascinating 91-page document that probably represents some of the best thinking by the global elite. Below are a few selections that might be of particular interest to Energy Bulletin readers.

An Early Environmentalist, Embracing New ‘Heresies’

Stewart Brand has become a heretic to environmentalism, a movement he helped found, but he doesn’t plan to be isolated for long. He expects that environmentalists will soon share his affection for nuclear power. They’ll lose their fear of population growth and start appreciating sprawling megacities. They’ll stop worrying about “frankenfoods” and embrace genetic engineering.

Motiva: expansion will mitigate train noise

The Sewaren terminal is a 5-million-plus-barrel refined products terminal that is strategically located to serve ethanol suppliers and consumers in the northeast region, Motiva representatives said."Ethanol comes from the middle of the country such as Iowa, Nebraska and Minnesota," said Murphy. "Ethanol traveling on water barges and ships were ruled out because it was coming from the heartland. Ethanol traveling through pipelines was determined not safe, so trains were deemed the most efficient way to transport the ethanol."

Ghana: Power plants to save energy crisis arrive

Government on Wednesday morning took delivery of 50 megawatts of power plants at the Kotoka International Airport as part of a first phase emergency power programme.

Life on Easy Street Coming to an End

The undeniable fact of the matter is that as the price of oil goes, so goes the cost of living.

New Daylight Saving Time not so bright an idea

"If people do maintain their daily schedules then spring and fall Daylight Saving Time extensions would probably cause a 2 to 5% drop in the evening peak load. Meanwhile, morning electricity use would grow some, but probably not enough to offset evening savings.""The net effect is small and uncertain: A best guess of total net energy savings is on the order of half of one percent, but savings could just as well be zero. Moreover, our statistical analysis leaves us with one chance in four there could be a very small increase in electricity use."

Pipeline aimed at oil sands raises green ire

The federal government should prevent the proposed Mackenzie Valley natural gas pipeline from providing fuel for oil sands production because of global warming issues, several environmental groups argued at a regulatory hearing yesterday in Edmonton.The amount of natural gas needed to power the oil sands could double by 2015, according the National Energy Board. The additional gas required in the oil sands is roughly the volume expected to move down the Mackenzie pipeline, a 1,200-kilometre link that would connect the Mackenzie Delta in the Northwest Territories with northern Alberta.

Pemex Reports Fourth-Quarter Loss as Sales Drop

Petroleos Mexicanos, Mexico's state- owned oil monopoly, reported a fourth-quarter loss as sales declined because of lower production.

Chavez Signs Law for Takeover of Orinoco Oilfields

Venezuela's socialist government took another big step along its sweeping nationalization path as President Hugo Chavez signed the law providing for state control of rich eastern oilfields previously in the hands of U.S., French, British and Norwegian firms.

Libya Faces Oil Rig Shortages, Calls on National Participation in Oil Services

According to Phoenicia Group, the leading U.S.-Libyan diversified business group, which is a strategic partner to key U.S. and international companies in Libya, Libya is suffering from an acute shortage of oil drilling and work over rigs, significantly delaying exploration programs of oil majors prospecting in the North African country.

Repsol in record Libya oil find

Spain's Repsol YPF said Tuesday the company had discovered its biggest oilfield ever in Libya.The field, with reserves of 474 million barrels of oil, will double Repsol's production and reserves in Libya, Spanish national RNE Radio reported.

Experts Call for Developing Saudi Energy Sector

A Saudi oil expert yesterday called for insulating the Kingdom from oil-price fluctuations, as this would enable diversification and developing the energy sector.

Total to Continue Gas Talks with Iran If No Int'l Ban

French oil giant Total SA will continue talking with Iran on developing a gas project in the Persian Gulf unless there is an international ban on doing business with the Islamic republic, Total Chairman Thierry Desmarest said Tuesday.

Nigeria elections may spur kidnappings

Rival Nigerian politicians are arming militias in advance of April elections, in hopes of rigging the outcome and gaining control of millions in oil revenue at stake.

China aims to diversify oil sources

In recent years, China has been making aggressive efforts to diversify its sources of oil imports, in an apparent move to reduce the risk of increasing reliance on oil from the Middle East.

The New Math of Alternative Energy

Alternative energy still can't compete with fossil fuels on price. But the margins are narrowing, particularly since oil and gas prices have been rising. The math looks even more favorable if you consider the environmental cost of fossil fuels -- which most purely economic calculations don't.

The Air Force, which in FY 2006 was the largest green power purchaser of electricity—more than 990,000 MWHrs—in the Federal Government, and 3rd largest in the United States is increasing its efforts to improve its energy efficiency and reduce fuel use.

Winter 'second warmest on record'

The UK has experienced its second warmest winter on record, with a mean temperature of 5.47C (41.8F), provisional Met Office figures show.

Stern urges China, U.S. to talk on warming

China and the United States, key to tackling the climate crisis, are both acting on global warming and must start giving each other credit for it, former World Bank chief economist Nicholas Stern said on Tuesday.

Climate pact is "no post-Kyoto answer"

John Ashton, Britain's Special Representative on Climate Change, said the six nations had little in common, making the chances of meaningful cooperation slight.

Large bioethanol project announced in Germany

A project to build a 130 million euro ($172 million) plant to produce 200,000 cubic metres of bioethanol annually was announced by three German groups on Tuesday.The plant will consume about 600,000 tonnes of wheat annually and when operational in the first half of 2009 should provide about a third of Germany's estimated bioethanol requirements.

Renewable energy not Ohio's forte

Among states, Ohio has lagged. It currently derives less than 1 percent of its electricity from renewable sources, but that is expected to change."Ohio has been a sleeping giant, but it's waking up," said William Spratley, executive director of the advocacy group Green Energy Ohio.

After uranium's record price jump this week, it looks like $100 per pound will come sooner than anticipated.

Does anyone have enough buying power to stock a market slide?

There was a time when banks could stop the slide in currency by stepping in and buying huge amounts of that currency. But with the advent of the FOREX, those days are long gone. The FOREX sparked a boom in worldwide currency trading and speculation. The average daily volume on the FOREX is 1.5 trillion dollars. That is such a huge number it is hard to imagine. That is 1.5 thousand billion dollars, or 1.5 million million dollars. No bank has even a single billion dollars to risk in such a venture. Besides, what would happen tomorrow even if they did stop the slide today.

Though the dollar volume on the NYSE is no where near that of the FOREX, the same principle still applies. And besides, like the crash of 1929, there is always tomorrow, or next Monday.

On what has become known as Black Thursday, October 24th 1929, the market surprised everyone by going into a nosedive. Panic selling was everywhere. 12.9 million shares changed hands that day at a time when 4 million shares was a busy day. But then:

Alas, it might have worked had not Black Thursday not been followed a few days later by Black Monday.

And the crash continued....for three more years. The market did not hit bottom until 1932. It turned out that Whitney lost a lot of money for the Morgan Bank with this bit of bravado. Which all goes to prove that market momentum may be paused but if it is strong enough, it cannot be stopped. But I digress.

My point is all this happened in days when market volume was less than 4 million shares a day. In 2005 the average daily volume was 1.61 billion shares, over 400 times as great. No bank vice president would dare walk onto the floor of the exchange and risk millions, or billions of his banks dollars in an effort to stop a slide. They learned a lesson from Richard Whitney, all it will wind up doing is costing you a lot of money. If it didn’t work when the average volume was 4 million shares, it sure as hell would not work when the volume is 400 times as great. No one has that much money. And if the market is really ready to head south, nothing is going to stop it.

Is the market ready to head south? Hell, I don’t know, but I have a strange feeling that it just might. It’s getting jittery and all it needs is a trigger. A trigger might be something like: “Confirmed: Saudi Arabian oil production in terminal decline!”

Ron Patterson

Black Thursday

http://mutualfunds.about.com/cs/history/a/black_thursday.htm

Black Monday

http://mutualfunds.about.com/cs/1929marketcrash/a/black_monday.htm

I guess the sheer volume of currency trades is why the Chinese yuan swings around so wildly. No central bank can regulate a currency anymore.

Ron, you keep thundering like Jehovah while making claims that are simply contrary to fact.

Old Hippie, The Chinese Yuan is not traded on the Worldwide FOREX market. China has it's own internal Foreign Exchange Market with $200 billion in funds with which to trade. This is really a farce. China still controls everything. This is supposed to be an open market for the Yuan yet it is still under the Chinese' control. The Yuan swings in spite of the fact that the Chinese are trying desperately to peg it to the dollar and stabilize the swings. If there is truly an open market for a currency it cannot be actively managed by its country or origin.

The US cannot actively manage the value of the dollar, nor can any other country do the same if their currency truly floats.

Two things Old Hippie. You should get your facts straight before you post. And second, you should have a reference, preferable a URL, to back up your claims.

Just declaring that my claims are contrary to the fact rings hollow. You must prove what you claim with a reference, or at least a logical argument. You do neither.

For all the Chinese Yuan – Forex news you ever wanted to hear:

http://www.forexblog.org/chinese_yuan_rmb/index.html

Ron Patterson

Stating that for instance the Fed has no control over the value of the US dollar, or the Bank of England over sterling, is the same as calling the people who have had absolute power over the issuance of a currency for a very long time, a fact that makes them the richest and most powerful people ever to walk this planet, a bunch of fools. Well, no sale here on that idea.

Leanan posted an article yesterday that gives some insight:

Zero Degrees of US Dollar Separation

and there are plenty of other files at the Gold Anti-Trust Action Committee

The control in 1929 was in the same hands it is in now, and the argument that the world economy is so much bigger now presupposes that the very people who issue the money and made it so much bigger, wouldn't have grown proportionally with it, that they "let" it grow to a size where they lose their control. Other then them being really stupid, how do we explain that?

SoFly, please, please, please do not put words in my mouth that I never wrote or spoke. I never said that the Fed has no control over the value of the dollar. What I said was:

The US cannot actively manage the value of the dollar, nor can any other country do the same if their currency truly floats.

The Fed, the Congress and the Executive Department can try to control the value of the dollar. The Fed can do it by changing interest rates. The Congress and the President can do it by trying to manage the budget and decrease the deficit. Though they appear to be doing a poor job of it at the time. But they cannot actively manage, (manipulate), the value of the dollar. They can only act responsibility and hope this stabilizes the dollar. But if the dollar falls today and rises tomorrow, that is entirely beyond their power to change it. The market determines the value of the dollar, not the Fed.

Ron Patterson

Manage, manipulate, try to control. Define terms as you go, swing a big bludgeon and win every argument. Tiresome.

Old Hippie, there is a tremendous difference between trying to stabilize a currency via responsible government behavior and trying to manipulate a currency by buying or selling huge blocks of that currency.

I think you, or anyone else for that matter, clearly recognizes that difference. You are just being obnoxious by pretending there is no difference. But if I am wrong, if you truly cannot tell the difference, then that says something entirely different, something not very complementary of your intellect.

Ron Patterson

I only locate markets so magically large the big players all bow down and worship or "responsible government behavior" when in seriously deep mystical trances.

I also don't think I outrank George Stephanopoulos. Handwaves all around.

I personally ran up against blatant PPT intervention in the stock market in 2004, 2005, 2006, that I finally gave up and bowed out. Each time, I was trying to buy PUTS on either GM, Fannie Mae, or Ford. For those not in the know, PUTS are a bearish bet.

Each time I was told "U R OUT" and my order was canceled. Each time I called them to find out why. All they would tell me is that "we are not allowed to open any new positions on that security." When I asked about the free market, i.e., "if you have a willing buyer and a willing seller, what business is it of yours?" I received NO answer whatsoever---just stony silence.

Just on a lark, I tried to open a CALL position each time on the same security. A CALL is a bullish bet. I put them in with a limit order that I was pretty sure would not get executed. Each time I did this, the CALL orders did NOT get canceled.

First hand experience. I don't need any more evidence to know that the stories of manipulation are true. And the currency is most certainly manipulated right along with everything else. It is done by creating new money (via the fractional reserve banking system and/or the presses) and by reigning in the same.

Also, just out of curiousity Ron, do you know what the leverage is on the FOREX exchange? I trade forex, and I can tell you that it is obvious whenever a central bank buys or sells a currency because of what it does to the price. The buy and sell such huge quantities, that combined with leverage, it has a huge impact on the market. After the fact, you can always tie these moves to the central bank currency disclosures.

I wish I still believed that we have the best government in the world and that we lived in Wonderland. But we don't. All governments are corrupt, and that includes ours.

Ckaupp, I am having trouble with your story. I know what puts are, I was a stockbroker for all of six months back in 1986. A put cannot possibly affect the price of the stock and neither can a call. A put is a bearish bet but it has no bearish effect on the market whatsoever. It is only a bet that the stock will go down. Purchasing a put or a call has absolutely no effect on the price of the stock.

Even if a PPT actually existed, why on earth would they care whether you buy puts are not. That just does not make any sense whatsoever.

Ron Patterson

I know EXACTLY what they are---I've been trading them for years. I did NOT say purchasing either a PUT or a CALL has ANY effect on the share price of a stock. 6 months versus 8 years of options trading....

I was there and experienced first hand. My impression was that it was about perception control.

You have 2 of the biggest US Corporations and a huge GSE (Government Sponsered Entity) -- all 3 of them having serious financial trouble. A HUGE number of BEARISH bets looks BAD when you consider the old saying that "Where goes GM goes the US."

Since they were willing to let me open CALLS, or BULLISH bets, but not PUTS or BEARISH bets, I was left with the impression that it was all about PERCEPTION CONTROL. Lots of people really do look at such things at PUT/CALL ratios. It was not about controlling the stock price, but it most certainly was about "managing the market" and perceptions of these companies. If foreigners really knew the state of our economy, they would bail on US debt instruments and we'd be in a world of hurt.

Ckaupp, I traded options for years also, I was a broker for six months.

A put is only a bearish bet for the buyer of the put. It is a bullish bet for the seller of the put. Likewise a call is a bullish bet for the buyer of the call but a bearish bet for the seller of the call.

But no one pays the slightest bit of attention of the put or call volume or the put/call ratio for any given stock. Hell, they are not even listed in the newspaper.

This is absurd! Puts and calls are market neutral since either is a bet by two people, one betting the stock will go up and the other betting the stock will go down. Do you think if you tried to sell a put, a bullish bet, that your order would have been cancelled. Well, if the cancelled the buyer they would also have to cancel the seller. That just makes no sense whatsoever.

Ron Patterson

In 2001, the SEC widely published new regulations preventing investment houses from selling shares short over which they had no control. The diminished supply was reserved for Preferred customers.

Rather than corruption, this is an issue related to novice participants.

This had nothing to do with selling short.

The leverage on the FOREX exchange is pretty amazing. A small time investor can purchase millions of any currency he wants with a relatively little account. I have at least 20-40 thousand of different currencies at all times sloshing around

A billion or so by a bank would hugely move the FOREX market.

Indeed. When I first opened my puny little forex account, I opened a regular account.

After my first trade, I watched the huge swings in my tiny account as the losses/gains swung back and forth precipitously to what is essentially a "margin" call (but not handled like in the stock market---in forex if your losses breech your margin they automatically close your position).

When it finally swung back near where I started, I closed the position and closed the account and opened what is called a "mini" account.

In a regular forex account, currencies are trades in blocks of 100,000 units, such as $100,000 at a time. You can get leverage all the way to 1% -- meaning you only have to put up 1% of the value of the trade. Can you see where this can go? With 1% leverage, you can control $100,000 with $1,000.

In a mini account, you trade in blocks of 10,000 units, such as $10,000. I also had them decrease my leverage to prevent heart failure.

Normally the margin is 2%.

http://www.interactivebrokers.com/en/trading/marginRequirements/currency...

There are accounts that require only 1% margin. These accounts automatically liquidated at .99%.

http://www.ac-markets.com/en/online-forex/fx-accounts.asp

Ron Patterson

I didn't say anything different that what you just said. I said you "can" get 1% margin, and I said they automatically close your position when you get close to breeching your margin. I just didn't give the actual number.

I think you like to argue just to argue. I'm done here. You win.

The margin requirments for the FOREX is 2% for the major currencies. But if the currency moves against you by 2% you lose your entire investment. A billion dollars would purchase 50 billion dollars worth of any other currency. Or you could go the other way and buy 50 billion dollars, in Euros or whatever, worth of dollars.

When you invest (gamble) on the FOREX you must bet one currency against the other an in USD/Euro. And if you bet the wrong way, you start to lose money very fast.

But the question is, why would any bank do such a thing. The truth is they don't. Banks don't really give a damn which way the currency moves. A FOREX member bank makes its money by taking both sides of the bet. They make their money by taking the difference between the bid and the ask. That is usually about three basis points, (three one thousandths), greater for the thinly traded currencies. Banks or FOREX brokers charge no commission because they make their money from the difference between the bid and ask price of the currency. A trade always involves two parties. The bank never takes one half of the trade, there is always a bid and ask price.

Banks are not in the gambling business and it is simply foolish to think they are.

Ron Patterson

Boy have you twisted this.

Yes, you can get margin to 1%. It isn't uncommon. And no, your calcs are not correct since a unit in one currency doesn't usually equal the $ units in your account. I'm not sure where commissions came into this discussion at all. But you are correct about commissions--there are none...it is the spread.

I did not say the banks were betting. Where did that come from? Methinks thou doth read things that aren't there.

I said they move the markets. I assigned no motive for moving the market. It could be for many reasons. They might want to lighten up on one currency or go heavy into another. They may also do it to help manage the market. For example, Japan might perceive that the Yen is getting too strong and it will slow down their export business--so they manage it lower. They do this, as I said before, through fractional reserve banking and the printing press. They also do it through the forex markets.

And there have been times, during this "management" process, where they've literally gotten their you know what in a wringer.

I dont disagree with this, but I've dug a bit deeper into that before and reached the conclusion that 1973 is THE year in terms of monetary policy. You may remember Nixon closed the bretton woods agreement ala no more gold standard for trade and free floating currencies. The monetary freight trail was out of control until Volcker. However onced he stablized the economy and left, the party began with Greenspan taking over and that leaves us here....

http://www.itulip.com/forums/showthread.php?t=292

Tate, I agree with everything you say here. It only reinforces my point that there is a tremendous difference between

trying to stabilize a currency via responsible government behavior

and

trying to manipulate a currency by buying or selling huge blocks of that currency.

The former is what you are talking about and is the mark of good government. The latter, in view that 1.5 trillion dollars exchange hands every day on the FOREX, is just not possible anymore.

Disclaimer: Very thinly traded currencies like the Zimbabwe Dollar, can be made to swing wildly by buying huge blocks of that thinly traded currency. My claim only applies to major currencies.

Ron Patterson

Ok then Ron, we agree on the data, but I dont agree on the conclusion. Go read that LONG @$$ article I posted and tell me why Aaron is wrong. I dont think there is a such thing as responsible behavior by govt. Govts are only needed for basic right/issues and everything else should be left to markets to work it out. Look aat what perversions our current govt gets away with and tell me govt is responsible.

It sounds like you my friend are now putting a bit too much faith in the your fellow man. Govt's are run by people. Stop and actually think about what that means. People can call up their friends and give me inside info and how would we know? We dont until ten years later and we're all paying for it because someone gave a favor ala spoils system. I think you're a bit too nieve if you think gov'ts serve the interests of their subjects. That may be true in principle and in the start, but as it marginally increases no one notices until you stepback and realize we're on the opposite side of the field.

I dont think I ever said currencies are manipulated but lets square some numbers. You're right about the forex market and the ability to swing it is low. However my point is more that central banks are more involved in day to day activities in our markets including gold (check gata for the good stuff) and possibly even the NSYE. If you check the rally since the summer, it's index led. It's as if large buyers were simply buying indexes and MOST stocks not associated with ANY index (S&P, Russell) did not do 15% gains! Its as if the bid was always there in the major indexes right when the carry trade starting unwinding LAST TIME (MAY).

Maybe a larger point we can all agree on is simple. The system is now so complex, we dont know where the blood spills first. However we do know what will happen once a catalyzing event does happen. Im on record as saying I think this is the first SMALL leg down. We're talking lesds than 3% drop and we get a 64% spike in volatility. The fun has begun for some of us.

Tate, you are going to have to be more direct. I looked over the Tate article; "What (Really) Happened in 1995" and I am not sure what I am supposed to disagree with.

And what on earth gives you the idea that I am putting too much faith in my fellow man, or the government for that matter. I have damn little faith in either! I thought I made that pretty clear.

When the computer triggers automatic buy or sell programs that this creates dramatic swings in the market. Programs sense a difference in the S&P futures and the actual market. If the futures are way below the actual market, the program will automatically buy the futures and sell the stock short. And they will close out both positions when the gap narrows. Almost instant profit.

The opposite happens if the futures are above the stock. They sell the futures and buy the stock. My point in mentioning this is that the market can be made to swing dramatically but it is all done in the name of profit. There is no effort to stop a plunge. In fact, it usually accelerates the move in the direction it was already going. So what is your point?

I agree 100% that the banks are involved in the market. They buy and sell all the time in an effort to make a profit.

Well not exactly. Automated computer buy and sell programs only deal with indexes and the stocks of those indexes! And unlike the oil market, the indexes follow the actual stock, not vise versa. Indexes always follow the market, they do not lead it. When indexes are way above or below the market, this automatically triggers buy or sell programs. When the index is above or below the market, this is what traders expect the market to do. But other than with automatic buy and sell programs, indexes cannot dictate what happens to the stocks that make up that index. It is the other way around. People buy individual stocks and the index follows accordingly. Understand that the index is nothing more than where that group of equities stand at any given moment. And people buy or sell the index futures, betting on the way they think those equities will move. But buying or selling futures in index alone cannot possibly move the value of the stock that make up that index. (Buying and selling the oil index does move the oil market, but that is an entirely different matter.)

Ron Patterson

Ron, thank you for your intervention this week. Discussions on currency, stocks, money supply and the Federal Reserve can easily get take on ludicrous proportions but your links and explanations served to ground the rhetoric.

China has an extraordinary problem with money supply in that hoarding is occuring. An upward revaluation of the Yuan has been expected for three years and everyone that can is accumulating or hanging on to hard currency. China has been keeping the Renminbi low to promote exports which enlarges its manufacturing base which in turn keeps the hordes who are moving in from its rural regions occupied. Busy, happy people are not revolutionaries!

Money supply has been dampened recently because their banks have been careless and current growth rates are unsustainable all things considered.

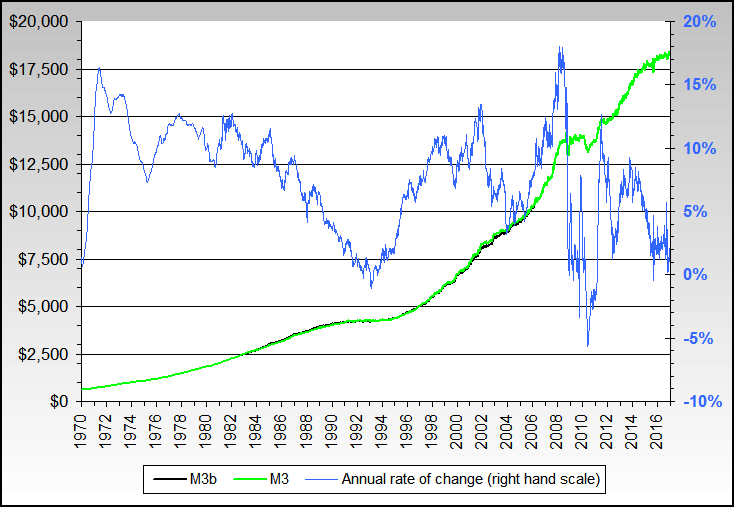

In the USA, the reverse is true on that subject. Money supply was broadly expanded in 2001 (21% annualize) to facilitate GDP growth (especially the new housing sector) coming out of the Recession. It steadily fell from 2002 until it bottomed at 0% in 2005. Continued real growth has required some liquidity and over the past months MZM money supply has been allowed to rise and is currently almost 5% annualized.

China recently announced that their rebalancing of Reserves will involve the spending of USDollars on imports rather than outright currency sales. China is seen to be slowly joining the *family of nations* as evidenced by their more conventional activities.

Really? Please show me on this graph where it as been dampened.

http://www.nowandfutures.com/key_stats.html

Or this one....

Pure and simple the credit in the system is/has been out of control and it's evident in M3.

According to this...http://www.bractwo.bbk.pl/strony/ang/ozlocie.htm

and http://www.physicsforums.com/archive/index.php/t-2774.html

there is only "It says all the gold in the world would fit into a cube of 10m.

At a density of 19,300 kg/m^3, thats 19 million kg. In dollars, thats around $130 billion."

TODAYS MONEY: Ounces/KG = http://www.google.com/search?hl=en&q=how+many+ounces+in+a+kilogram

= 35.2739619/kg * 19,300 = 680787.4647 ounces * $670 = $456,127,601.33.

My point: $11.5T vs $446B is way out of whack with reality.

Tate, you should read the post and try to understand what has been said before you reply.

Last Viking wrote:

Now do you understand where you screwed up? Your charts are about the US money supply. They have absolutely nothing to do with their banks or their money supply.

Ron Patterson

I should read huh? Try again.

Viking Said:

Now show me on those graphs where M3 decresed from 2002-2005....since the graph of the last ten or so years clearly shows it has increased at a decreasing rate from about 2003 until it bottomed in 2004.

China does not measure its money supply in american dollars. Your graph is fabrication; somebody is pulling your leg. Even if it had basis in fact, economists have not used M3 for years. It is a useless metric.

Same in the USA, the publishing of M3 has been reduced to quarterly offerings due to its limited utility.

The public perception and discussion of money supply is equivalent to its shock and awe confusion surrounding stock markets. Very few knew yesterday *or today* that the Shanghai market had risen 175% before its 9% correction and today's rebound.

Viking, Tate just screwed up by not reading your post properly. He thought you were talking about the US money supply when in fact you were talking about the China money supply.

The charts he posted are strictly US money supply charts, they have nothing to do with China.

ron Patterson

At TOD we talk all the time about what the MSM DOESNT TELL YOU. And now you're going to try and pull some "economists don't use this, so it's useless." Do you understand what the REPO market is?

So the quote from here... http://en.wikipedia.org/wiki/Money_supply#Money_supply_and_cash

is all a lie right? Somewhere it's published right? No it's not published to the public. It's having to be reconstituted by people since it's now hidden.

Last Viking tell me why M3 is useless. Does M2 on up include REPO's? NO. Why are REPO's important? Lets' see.

http://wallstreetexaminer.com/?p=799

This is from Tuesday morning. They were doing this in addition to the market caving on Tues. They have now said they will provide liquidity if the market strains.

Are you really going to argue that overnight lending aka REPOS, doesn't affect the MS? If daily, you leave more and more cash in the hands of large prime brokers (or in my example less), what the hell do you think they are going to do with? Put it to USE! This is precisely why M3 IS so important.

Really? Please show us the "important" correlation over time. Nobody else could find one that includes implied causation. Your documentation is basically tracking matching of funds issues wrt diff-date maturities. The Government often chooses to vary the mix betw short term and long term and yes, sometimes there are lags.

There is no conspiracy here implied or proven by your rant.

Tate, it is tres difficult to follow your line of thought or find anything meaningful in your argument. Sorry but I am exiting this thread.

Thought so....

Quite the rant. I wonder about this piece: "Govts are only needed for basic right/issues and everything else should be left to markets to work it out. Look aat what perversions our current govt gets away with and tell me govt is responsible.

It sounds like you my friend are now putting a bit too much faith in the your fellow man. Govt's are run by people."

Well, the design of markets, if not always directly attributable to governments, are only legitimate when mandated by governments via legislation and regulation. Illegitimate markets, those that govern the crack cocaine trade, or the human cargo trade, and so on, are ultimately also affected by government insofar as the traders will behave in ways to avoid the state.

Karl Marx had a utopian vision involving the withering away of the state. Perhaps when we no longer have much to trade, his vision will be realized. However, as long as we have a market-oriented society, we will have a busy, active government.

What you've go to do is to get off your lazy analysis and work to improve the quality of your government. It isn't going away.

what would you have tate do ?.......... hire a lobbyist ?

Exactly. The right to complain about your government is proportional with the effort you spent to improve it.

the first ammendment doesnt mention proportional

I know, but that one law, I mean precedant, says corps are people. In that vein, why does anyone believe there is anything REMOTE to resembling equality in any part of the govt? Money wins, period.

The man with the money makes the rules. Justice=Just Us

Ron wrote, "No bank vice president would dare walk onto the floor of the exchange and risk millions, or billions of his banks dollars in an effort to stop a slide. "

No, but the bank president would be more than happy to come in and buy undervalued stocks once stabilize. Yes, they will stabilize because the value of a stock is based on the value of the company. Companies have real value; people need to use toothbrushes, ethanol, computers etc. Markets are not controlled by a single individual, they are entities that develop from collective actions.

Ever done business in the real world? The value of a stock is based on the market's perception of the value of a company. Yesterday the market's perception changed. Today the market's perception is more positive than at yesterdays close. Does that mean stocks have stabilized? Are they undervalued? Based on the collective actions of the market participants at this (and any) point in time, companies are properly valued.

If "the market" has a gross underestimate of the value of a company, this makes it fodder for someone with better vision and enough money to take it private. If a company can make 15% return on equity every year, the market's refusal to see it matters not a bit; it takes just one person who can.

If you (or anyone) believes the market is undervaluing a company and you have enough money you can buy it which will bring it back to equilibrium. That is still the market - once you choose to participate. Now if I (or anyone else) buys a company at market because I think the market has undervalued it, and then manage it better its not so much that the market undervalued it - it was poorly managed.

What do you mean by a company making 15% return on equity every year? Is that 15% on its book equity or 15% on the market cap? If on book equity it will in all probability trade at a premium to book that grows over time, if on market cap it will probably be outperforming the market significantly.

There are lots of smart people with lots of money that do exactly as you suggest. There are also a surprisingly high number of not so smart people with lots of money that try to do the same thing. Eventually the smart people end up with more money than the dumb people and things get rational again. Interestin how a "market" works.

Before basing your assumption that the volume of the market is just to great to allow for manipulation to the upside, I suggest that you read the following document written by Sprott Asset Management.

Move Over, Adam Smith: The Visiable Hand of Uncle Sam.

http://sprott.com/pdf/pressrelease/TheVisibleHand.pdf

Now... the PPT will not jump in all the time, especially if the end goal is to allow for a market decline. A theory pointed out on the website iTulip.com, indicates that the Fed knows that the housing market is crashing and that and that the credit market is rapidly tightening. The stock market needs to "crash" before the fed can go forward with the necessary rate cuts to save housing and credit markets, without killing the dollar and bonds.

http://www.itulip.com/forums/showthread.php?t=1006

The PPT will be there if things get completely out of hand, but for now, the Fed needs the cover of a deflated market to lower rates and re-start the inflation bubble all over again.

Dbarberic, this was discussed, and I commented on it, in yesterday's Drumbeat. But in addition to what I said yesterday I would just like to call your attention to a line in the "Disclamer" at the bottom of the page:

In other words, this article is based upon stories from a lot of guys that they hope were telling the truth, but they do not gurantee that they were not just making crap up.

The story about George Stephanopolous revealing that the Federal Reserve directed large banks to prop up the currency markets is pure fiction. It never happened. And that leads me to doubt most of the other stuff in the article as well.

Ron Patterson

If you have nothing to lose, you have nothing to fear. The current regime (here I don't specifically mean the present government but the entire climate of globalizing capitalism) is creating people with nothing to lose at an astonishing rate. Wilsonian neo-liberalism is not producing the giant buy-in it was supposed to, and the resulting instabilities may be pretty unpleasant.

I attended the BC Oil & Gas Opportunities summit yesterday and was startled by the announcement made by the final speaker. He was Brian de Clare, President of Global Energy Horizons. He stated that the global energy perspective will change in the near future because of a new device called an ultrasonic generator. These generators are lowered into old capped oil wells and produce ultrasonic waves that shake the oil loose and allow the operator to double what the previous output from the well was. I talked to him after the presentation to get a little more info. He said that they have been experimenting with these devices for several years but could never get enough power out of them to get any results. In the last couple of years they changed the alignment of them, since before they had just lowered them down the hole, so that the device was horizontal. Apparently they require very little power to run. They tested it on some very poor wells and got very good results, so they expect much better results on better wells. Naturally, the implications of this for the world are enormous. He claimed that they would make the U.S. self sufficient in oil production once again.

I tried to find some more information on these devices on the web but could not. I didn't ask Brian what company produced these generators, but I will see if I can find that out. Has anyone on this site heard of these generators? Are these claims plausible? I asked Brian how much the generators cost, and he said they are still trying to determine what the price will be.

One thing that surprised me was that there wasn't a huge reaction from the the people attending to this announcement.

I will post more information about the rest of the summit on TOD Canada today if anyone is interested.

pkeber:

Do you have any links?

Yes please :)

I have a link to Gloabl Energy Horizons

http://www.globalenergyhorizons.com/index.html but there is nothing there about the ultrasonic generator.

This is a link to the summit agenda

http://www.seismicevents.ca/bcoilgas2007index.html

That's all I have for now.

This is the link to my summary of the summit on TOD Canada

http://www.theoildrum.com/node/2317#comment-164106

Have you E mailed Mr le Clare? I would have but I don't know the oil business well enough. One question I would ask is what sort of power they are putting in. I think it would have to be very large as see: http://en.wikipedia.org/wiki/Inverse-square_law. ,

to affect large volumes.

I guess a device could be left below for long periods of time and just let it 'cook'

Is there a Physicist in the house?

I have not emailed him yet, but he did give me his card. He said the device does not require much power. A reasonable size generator could provide the required power input according to him. I would be interested in knowing how much penetration the generator produces, 50 feet, 100ft, 1000? Also, does the field require CO2 or nitrogen injection to maintain pressure. I imagine it would. Any other questions that anyone can think of?

Let me see if I get this straight.

They want to drop a "microwave oven" of sorts down an oil shaft, and it "shakes" the oil loose with ultrasonic waves? And it doesnt even use much energy?

Call me skeptical.

Garth

I can only speak for low voltage/ amperage therapeutic and diagnostic ultrasound used for medical purposes. Various devices exist. Basic units consume 50 to 100 watts and can increase tissue temperature a few degrees centigrade to a depth of a few centimeters. the most powerful units consume 1000 watts and can heat a few degrees warmer and a few centimeters deeper. This is through skin/ fat/ muscle. Now imagine how much more it would take to heat/ vibrate through hundreds of feet of rock. Seems unlikely to me.

Gage, It was my impression there is almost no heat aspect to a therapeutic US. In additions US travel till it hits bone or air where it is reflectect or does nothing. Where are you getting your info on the increase in Temp? I have used US machines for trauma on abdomens and to start IVs and to check my liver for damage after a long weekend and have never felt heat.

matt

I think you mean there is almost no heat aspect to a diagnostic U/S. The abdominal scans (FAST?) you describe would be an example of diagnostic U/S. There had been some debate about this with diagnostic U/S which is probably unfounded. The biggest (and best studied example) is the case of fetal U/S with the worry being that one could fry the brain of the fetus or something like that. Temperature elevations have been shown to be insignificant.

Therapeutic U/S, however, is a different matter. The settings are different with higher energy. THis is typically performed by a physical therapist and definitely can heat tissue.

This emedicine article describes all types of deep heat, including U/S:

http://www.emedicine.com/pmr/topic203.htm

Only U/S is really used these days. Microwave and short wave diathermy have been almost completely replaced by U/S for deep heat for safety reasons.

I'm no physicist, but I do know an U/S will not travel indefinitely due to absorption by the tissue and by dispersion. You've noticed, I'm sure, that the image is not as clear on an obese person since the U/S must travel through more fat.

"I have used US machines...to check my liver for damage after a long weekend and have never felt heat."

LOL!

Phineas Gage, MD

I was an Ultrasound tech for seven years. The difference between diagnostic and therapeutic ultrasound is that and therapeutic ultrasound is constantly on--thus putting far more energy into the body tissues. Diagnostic ultrasound spends most of its time "listening" for the echoes. That is why the body's tissues are not heated with diagnostic ultrasound. Here is a nice comprehensive article. Lot's of new stuff since I quit the field 7 years ago.

Sounds to me like they have a bunch of stock to sell. Good buy if you do it early, it'll probably jump bigtime like Taser, but since the idea is absurd, you can bet the news that it doesn't work will drop the price to zero like a rock. Caveat emptor!

One problem is low power => low effect. Besides, the reason wells stop producing is not that the oil is stuck. Ask a protroleum enginerr, of which I'm not one.

It sounds like it might increas flow to some extent in extra heavy oil, but I can't see how it would help wells that are watering out

Try this Google search and some patents come up.

ultrasonic generator well oil

It's the Rumpelstiltskin effect. Twirling and dancing to turn straw into gold.

I know nothing, but this appears to match the descriptive device.

http://www.freepatentsonline.com/4164978.html

This is not exactly the same thing, but there is a company near me that has a patent on ultrasound assisted drilling. As it has been described to me, the high frequency waves cut right through the rock and the drill bit scarcely makes contact. For reasons I don't understand they can only drill about 600 feet with this technology. This technology is especially useful for environmental testing and core sampling, but obviously not for oil. Anyway, I don't know why the ultrasound technique cannot be carried on below 600 ft. Also U/S in human diagnotic testing cannot penetrate bone or metal. I wonder how much energy would be involved to get the waves to penetrate more than a few inches of rock.

Anyway, here's the link for prosonic drilling:

http://www.prosoniccorp.com/drill.html

Without knowing anything about the various technical apsects, I am very, very skeptical. I cannot believe that people in the oil industry haven't put a lot of effort into getting at the hard-to-get-at stuff. The chances of their having overlooked something with so much promise is extremely low -- just on the face of it.

If you have a mixture of a liquid and a solid, like mud, vibration will increase the viscosity and make it flow more easily. You see this effect during earthquakes, where "solid" saturated earth suddenly turns into a viscous liquid mud flow. I suppose if you could generate a continuous microearthquake with some kind of ultrasonic device,(Over a period of years?) you could get the oil left in the rock to flow more erasily, and it would gradually migrate to thre areas of lower pressure where the actual well holes are located. I can't imagine building ultrasonic vibrators powerful enough to do that on a large scale.

I know what you mean, but check the definition (i.e. the direction) of viscosity.

"WASHINGTON — Forecasters warned Tuesday that a La Nina weather pattern — the nasty flip side of El Nino — is brewing, bringing with it the threat of more hurricanes for the Atlantic.

Officials at the National Oceanic and Atmospheric Administration announced the official end of a brief and mild El Nino that started last year.

That El Nino was credited with partially shutting down last summer's Atlantic hurricane activity in the midst of what was supposed to be a busy season."

http://www.foxnews.com/story/0,2933,255340,00.html

That is a very wierd accounting and tax system in Mexico. Before tax profits: 106 billion pesos. After taxes, 6.9 billion peso loss. I wonder where they get their money for exploration and development.

The theme of my post is CERA. I have been mystified for some time about why any private client would pay them the amount of money they charge to produce the information they do. One would think that the type of clientele they service would not be so gullible as to fall for their claptrap.

This raises the following question: Does anyone in fact pay CERA for their information? Or is this supposed service they offer just a ruse they use to conceal their real purpose of serving as some kind of propaganda front that is financed in a hidden way by those with vested interests in seeing Peak Oil, etc., debunked? After all, the ruse, if it is a ruse, would serve the very important purpose of keeping the data they base their conclusions on out of the public domain, and thus beyond critical inquiry.

This is admittedly an entirely speculative conspiracy theory - but again, it is predicated upon my mystification about why anyone with the money and interest to do so would want to pay CERA to read what they produce.

Any thoughts?

Economic rent, in the case of natural resources such as oil and natural gas, is the surplus value, which is generated from the sale of the resource, above and beyond factor payments such as normal profit needs and employee compensation. A jump in the price of the resource normally generates significant economic rent. The question becomes: who is entitled to the rent?

This is the essence of the debate over windfall taxes, royalty regimes and the like.

The extractive/processing/distributive industry will argue that society will benefit if the industry receives, at least, the largest share of the economic rent, if not all of it, because, they say, increased investment is required to maintain the flow of the resource to the economy. And obviously in the case of the hydrocarbons, this is a valid point, since, as we know, the low hanging fruit is exhausted, or in a war zone.

But the industry's claim to the economic rent is undermined by the conception of an impending peak and relentless decline in the flow of the resource. This conception leads to scrutiny of the value of industry-directed investment. The policy maker is ultimately forced to confront the suitability of the existing arrangement which sees investment potential captured overwhelmingly by an industry that can no longer assuredly deliver the goods.

To head off changes to the current arrangement regarding economic rent, the industry will primarily emphasize the vastness of the remaining resource, the rising cost of its extraction, and its own privileged suitability for maintaining the flow of the resource. The industry might, in whole or in part (Beyond Petroleum), represent itself as the best vehicle to bring substitute resources to market.

The industry will systematically undermine any analysis pointing to a limited resource, to the opportunity cost of investments made to maintain extraction rates, and to the unsuitability of the hydrocarbon industry as the vehicle most able to deliver substitutes.

Intelligent industry insiders will also recognize that the credibility of the industry's claim on the economic rent is hurt by the conception of declining energy profit, or EROI. This concept logically leads the legislator/policy maker to wonder how the flow of resources to health care, education, recreation, roads and sewers and to a myriad of non-energy production-oriented activities and industries can be maintained. The opportunity cost of hydrocarbon industry-directed investment begins to loom ever larger in the legislator’s calculations. Thus, just as the industry benefits by banishing the idea of an inevitably declining hydrocarbon flow to the margins of the public policy debate, it also prefers to minimize the relevance of EROI in order to maintain its claim on the economic rent at issue. It does this even as it partially bases its claim on rising costs.

A lot of money and power is at stake. CERA and its ilk are paid out of the proceeds.

Phil, I am bewildered by your comments on CERA and I somehow sense that you have never read many CERA reports nor have a subscription to any of its database services.

When CERA was bought by IHS in 2004, its gross assets were over $50 million. It added $1 million in *monthly* revenues to IHS $39 million. Today, IHS has gross assets of $1 billion and no debt and its large subscription base is only part of its 55,000 customers.

There are several TOD members that would argue your conclusions if they had indeed been based on substance and not perception. Perhaps ASPO-USA's public displeasure of a snub in not being invited to CERA-Week is related to the commonly seen nuance of your commentary.

Read across as 2/23/07, 2/16/07, 2/23/06

Total Stocks (Excl SPR) (7) 1,000.4 1,009.3 1,038.3 -0.9 -3.7

Crude Oil in SPR (11) 688.6 688.6 684.5 0.0 0.6

Total Stocks (Incl SPR) (7) 1,689.0 1,697.9 1,722.8 -0.5 -2.0

Oil Market declines on another drop of approx. 9 million barrels in stocks a decline in imports of 220,000 bpd. and inventories that are 3.7% below a year ago. How can this continued erosion in inventories be bearish? We should be building stocks and we are reducing but the market continues to believe in cheaper prices?

Total commercial crude oil + product stocks are below last year this time, but above 2005, but of course consumption is up.

However, what caught my attention was the size of the decline from early October, close to 90 million barrels (from admittedly high levels).

But the problem is, how long can we continue to meet demand by drawing down inventories, while the current data show declining world oil exports?

Rat-at-tat-tat static to down goes production, Down go the exports, down go the inventories, I guess the oil markets must still be discounting an economic slowdown, a phantom increase in production, a calm geopolitical front and coming up with all things good. Granted we don't have $30 oil but we are still discouraging production and encouraging consumption at these prices. More importantly we are continuing the denial of taking appropriate action steps towards mitigation icluding ELP. Bang the Drum

Note that late February product inventories are the lowest since 2004, while Total US Petroleum imports (four week running average) for late February are also the lowest since 2004.

Since 1990, our Total Petroleum imports have been increasing at about 5% per year, because of increasing consumption and declining domestic production.

The EIA is flagging that the gasoline market is looking tight.

Imagine the havoc another Katrina in the GOM could cause this year.

Some interesting trends.

Total product supplied (four week running average) is up 5.3% over 2/06, and we have met the increased demand by drawing down total inventories at the rate of about one mbpd in February.

Note that three of our four top sources of imported petroleum into the US are showing declining production: Mexico; Saudi Arabia and Venezuela.

Canada is feeling the pinch:

At the Petro-Canada station that I filled up today at they had a sign stating that customers were being limited to 75 litres of fuel. Yesterday, I was talking to two co-workers in my office and they were discussing the idea of getting and filling 45 gallon drums of gas and storing at their homes. Even though, Ontario is Canada's largest province, it is only 1/30th the size of the U.S. Canada's oil market is somewhat integrated with the U.S. though. Canada is a large exporter to the U.S. from the Western Provinces. And most of the population lives close to the U.S. border. Over the years alot of Canadian's have gone across the border and filled up with lower cost American gas. (less taxes). It would be interesting if the EIA would include Candian inventory numbers in their weekly report.

There is an long, interesting, though ultimately rather chilling interview with former United Nations weapons inspector, Scott Ritter on the Antiwar.com website. There's a lot about Iraq and Iran and some interesting comments about the consequences for the oil-market in the event of war with Iran.

What still intrigues me, is what if Iraq and Iran don't actually have vast quantities of, as yet untapped, oil that we seem to believe they have? What if these oil wars are not only self-destructive, but also futile? Wouldn't that be truly tragic? A terrible, vile, cosmic joke played on us by Nemisis?

I was thinking about this and it occurred to me that maybe we ultimately "believe" what we have to, or need to believe. We desparately need more oil from somewhere/anywhere; so we convince ourselves that it must exist somewhere, and we're going to get it! It's perhaps not so much wishful thinking as delusional thinking, and at a potentially disasterous cost.

However, if our lifestyle really is non-negotiable, then, we will go anywhere, and do anything, to protect and maintain it for as long as possible. Our desparation for energy, drags us towards something that may turn out to be a mirage - vast, untapped oil reserves in the Middle East.

To me this sounds like we are driven to 'rationalize' and create our own reality, when 'objective reality' begins to put contraints on us. There is always a new frontier for us to exploit - somewhere. It's only a question of finding it and gaining unfettered access and all will be well.

It also reminds me of the belief in witchcraft and witches that sent so many innocent women to the stake for a ghastly and dangerous fantasy.

Following on from that happy thought, there's another interesting interview on Democracynow.org, by Amy Goodman, with Chalmers Johnson, whose written a new book called 'The Last Days of the American Republic'. The core of his argument is that it's impossible to have an agressive empire and a democratic republic at the same time, one can choose one or the other, but not both!

I was thinking about this topic this morning. In reality Peter Huber, who believes that we can increase our consumption of energy essentially forever, represents the mainstream view.

To the extent that people think about energy supplies, most Americans think that there will always be alternative sources available to power the American way of life.

A lot of the people that did 100% mortgages were the ones that were stretching their finances--and probably their commutes--as much as possible, in order to get a piece of the "American Suburban Dream."

It stands to reason that these outlying suburbs are the ones being hit hardest, and with 100% financing, any drop in property values makes it impossible to sell and pay the mortgage off, especially with transaction costs figured in.

The New York Times profiled a group of American drivers last year when gasoline prices hit $3. By and large the only ones that curtailed their driving were the ones that could no longer afford to buy the same quantity of gasoline that they used to buy.

With the conventional wisdom that oil prices will fall and/or that we will have alternative energy sources, I think that we are seeing something similar in the suburbs--people, by and large, will hold on to the suburban lifestyle until they literally can't afford it any more. People generally won't move until it's too late, and even if they sell, it just unloads the mortgage on some other poor sucker.

Could they afford it if they used thier backyards to grow food saving money to provide admittedly decreased driving or mass transit? I wished they tracked food price increases, it has to be rising and this portion of peoples budget truely is "non negotiable" (cheneyism).

I was thinking about "looking back" from a previous thread and realized what could work is how my grandmothers house was built. There was a small portion that she kept heated during winter and there was a large portion that was essentially uninsulated and used during the summer similiar to the sleeping porches of old farm houses.

I look for future homeowners to double the insulation of a smaller area inside of the larger house, maybe even striping the insulation from the outer portion. I'm sure native americans "hunkered down" for winter into smaller warmer areas, future generations will do have to do the same.

Just thoughts from looking back to a less afluent time.

D

One of the worst things, DelusionaL, about these modern mcmansions is that they are designed with "great rooms" and cathedral ceilings.

When I was a kid, everybody hunkered down in the kitchen around the wood stove and wood-burning range. Upstairs was freezing, but we had down quilts.

I sort of liked it ...

Upstairs was freezing, but we had down quilts.

We have down quilts - oh man, they are nice!

D

People do that here in Hokkaido, Japan! Ever wonder why the Japanese consume so much less than the Americans while enjoying what looks like basically the same lifestyles? It's the little things, that aren't really so little. Here in the frigid north of Japan, people don't have central heating - a lag-over of building styles imported from the southern climate. Besides people making do with far less space than the avg. McMansion, most main rooms have a gas heater, and if you don't need a room, you close the door and keep the heater off. When people go on extended winter trips, it's not uncommon to give one's plants to a friend, drain pipes and shut off the heaters! A well-off but middle class family I know with a big house (modest by American standards) pays about 500 bucks a month for gas in the winter. And it's just part of life. The "American way of life" is not only negotiable, it's just plain ridiculous.

Please do continue to post on your perspective in Japan--I find these differences between countries and regions significant and fascinating.

The elderly gentleman whose 480 sq ft "shotgun" house# I am repairing and renovating (3 rooms (front living room, middle bedroom & back kitchen) + bathroom), heats two of the 3 rooms in the winter (bathroom is heated for 5 minutes before showering once a day with an old gas wall heater) and also cools those same two rooms in the summer. The bedroom is kept comfortable and the kitchen "tolerable". He only uses the front living room when the weather is pleasant.

It will be interesting to see the results once the house is tightened up and insulation added (R-13 walls, R-19 ceiling).

Best Hopes,

Alan

# 12'x 35' shotgun with 6.5' x 10' bathroom added on later in an "L".

My grandmother had a house like that, and her entire backyard was one huge garden. Trading with neighbors, I figure she and friends grew 50-60% of their food. Canning was a big season for her; I wish I learned even 10% of what she knew about it.

We have a small garden, grew a bunch last summer, but the deer ate it all one night. I've wondered why few of our neighbors have gardens, but realized that nobody is home! Dual incomes needed to pay the mortgages mean neither parent is home and the kids are either at school or extended day.

One plus side if TSHTF is it might bring the families back together again, even if one spouse is unemployed. Then we'll see gardens again.

FYI - EIA's NG monthly is out with the CY 2006 figures, though many are still estimates.

http://www.eia.doe.gov/pub/oil_gas/natural_gas/data_publications/natural...

US NG Imports 2006 down 5% YOY vs 2005, including LNG.

US NG raw production down but dry gas up (!!) because 700 Bcf less was used for repressuring. Does that mean less pumping of NG into oil wells to prop up production? Hmm.

US NG Consumption was also down - probably the mild winter. We got lucky.

When I looked dry gas figures last month, it turned out that the hurricanes of 2005 and the resulting loss of production was the reason for looking better this year, otherwise we're flat or slightly down (we're still below 2004). Don't have time to get the numbers right now, but you can't compare US production figures between 2005 and 2006 without accounting for 2005 hurricane losses.

We have a small garden, grew a bunch last summer, but the deer ate it all one night.

That is why people have dogs outside in the country. We had a large garden in a hamlet in northern Ontario where Dad grew 80% of our vegetables and a lot of raspberries and currents in the 1950s and 60s. There were lots of deer, bear and some moose about but enough dogs to discourage the deer at least. And about a six week frost free season. It is a lot of work to do even that and if you throw in chickens, goats, sheep etc even more. No one should think it will be a rustic ideal however it gives one a sense of purpose and responsibility.

Hello POBox

Re: gardens

I recently attended a workshop through an agroforestry center in upstate NY. The presenter offered the following solution to critters large and small:

solar powered electric fence - two single strands run at 6 inches and 4-5 ft above the ground around the perimeter of the garden. Just inside of this run a 2 ft high wire fence. The electric fence is to keep out the deer (the high strand) and raccoons / woodchucks (low strand - they can't jump) while the shorter non-electric fence keeps the rabbits out. A 6" fold (so it runs flat along the ground toward the outside of the fence)in the bottom of this fence also can stop rodents from tunneling under.

You have to condition the deer to recognizing what's going to happen when contacting the fence - spread peanut butter on the wire so they'll lick it off and get a good jolt that they won't forget...

PO can be quite a depressing topic. I like that there are at least some solutions being put forth and discussed. If the US gets into a bind I think it is vitally important to have a direction to point people toward. It will not be "easy" no matter what. I like all of the above comments!

D

Thanks Catskill, I might just try that. After it happened last summer we put up about 6ft high plastic netting, but the damage was done. We got a few tomatoes at the end of the season, but nothing else. Before developers built 7-8 McMansions down the street from us, chewing up a sizeable playground for the deer, they moved into the conservation land behind us and are grazing in everyone's yard now.

They're fun to watch, but I want my veggies!

Speaking of McMansions, what do folks think about their sustainability? They mostly have 2x6 walls, better insulation, but the inside volume is huge - 3500-4500 sf with vaulted ceilings in the FR, master bedroom, foyer, and they are all heated with propane or NG!

Most of the architects I know doubt they'll last very long (more than a few decades), and will probabably start degrading and delaminating relatively quickly. A lot of them are made out of chipboard, styrofoam and staples.

I have made the point that developers were very forward thinking. Modern suburbia & exurbia is biodegradeable, and will disintergrate without major repairs. The life expectancy has been steadily shrinking, so they will "fall apart" within a couple of decades.

Best Hopes >:-)

Alan

Modern suburbia & exurbia is biodegradeable, and will disintergrate without major repairs.

Then there must be something "special" to the US suburbia & exurbia.

In Europe suburbia & exurbia are certainly degradeable but NOT biodegradeable, they will disintegrate into contaminated garbage dumps not into any kind of wilderness.

Metals will be scavanged (copper first). Almost all chemicals are UV degradeable "over time" and fire gets rid of them quickly. Even asphalt disappears over decades. Termites get wood & wood/cellulose products left over. Concrete will endure (in fragments). But modern construction is minimizing concrete use (thinner slabs, etc.) As will granite countertops.

Silvaculture (trees) are the only likely agricultural use for much of suburbia.

Best Hopes for orchards replacing exurbia,

Alan

Electric fences, solar or otherwise, can be useful but they can also be a pain in the ass. You have to maintain them very regularly (weekly at least) to keep grass and weeds from shorting them and draining off the current. I have electric fence run on house current around my yard and have seen deer actually crawl under it while it was on.

For a small enclosure, it is easy to maintain. If you have a few acres, don't count on it 100%.

I have never known an electric fence to deter any but well fed, lethargic deer, with or without the peanut butter.

The only thing I've found that works is an eight foot tall woven wire (field fence) that completely surrounds the garden. Gate should be same height. A dog placed inside this helps.

I've tried a 4 foot tall, 12 ga, field fence topped with barbed wire every 9 inches to seven feet total height to try and cut costs on an orchard. No dice. Erecting an additional 36 inch tall welded wire fence 15 inches outside of the main fence seems to have worked, but it would have been cheaper to go eight foot woven wire in the beginning.

And the woven wire isn't that much higher than the charger, posts and wire for electric. Paid $110 for a 165' roll last summer. Posts around $8 each, HD steel.

ET and doug fir -

Thanks for the info about the fencing. I should have been a bit clearer and stated that I really have no idea how the configuration I mentioned works in practice. The guy that presented this solution didn't hesitate at all when someone asked him about keeping deer out of the garden so I'm assuming it has worked for him in the past. You may be right about the lethargic deer - the growing season is short enough up here that the deer might just make it through the winter and can't be bothered with the hassle of that set-up. They probably just move along to the neighbors unprotected plot...

The info about weeds draining power off the fence is interesting - certainly makes sense but I hadn't really thought about that aspect. All these seemingly little details to be considered...

doug fir it sounds like you've nearly installed a fortress around your garden while experimenting with ways to keep them out. Well I guess they won't be much of a worry after the effects of PO become serious - there will be a strong demand for venison...

Where the deer want to go, they will. I've tried numerous methods over the years, especially in the orchards. For the garden, it's smaller, so the 8 foot fence went in years ago. The orchard is several acres, so I tried different methods to cut cost. And I use electric fencing for our livestock, including new solar chargers that are fairly effective in shocking through weeds. They just don't work when the deer want in. There is always those animals that either won't train, don't care for peanut butter, or just charge through. Other methods I've heard include soap hung from trees-waste, coyote urine-waste, lights on motion detectors, dogs in orchard-you name it, I don't give them any credence. The deer will jump most anything to eight feet. I've watched them jump the 7 foot fence from standing still. After spending several years grafting a whip, nursing the new shoot, and finally planting the young tree out in the orchard, it is very frustrating to have a buck come and break off 4 or 5 trees in a night, scraping his antlers. Once the trees are old, ie 6-8" dbh, their predations aren't that bad and you can handle them, but not before.

I'm not sure you can grow much of anything in modern housing developments. When they build a sub division they strip off all the top soil, then level and compress the earth.

The only top soil remaining is a couple of inches deep, just enough to grow grass.

I bet airdale could comment on this. I wish he would come back.

Soils can be ammended. Leaves, lawn clippings, compost. I assume this would be a required habit.

This was what I was thinking of

http://www.gardenrant.com/my_weblog/2006/10/why_well_never_.html

I don't know anything about farming. But I'm not sure compost will make a difference.

The article you cite does mention adding organic matter. I'm not trying to debate that builders leave a mess, I agree with you on that point.

Suburb soils can be in any condition. Most equipment today uses tracks which have lower ground pressure than wheeled vechiles. Moving or "working" overly wet soil is probably the greatest sin these guys do. Moving really wet soil turns it into hard rock like crap that is hard to break back down.

The article mentioned root circling. This can be a problem with the plant they bought not the soil, circling roots must be broken up and the top of the plant should be trimmed to maintain "balance" between roots and tops. With really big plants in small pots- be very careful-they can get all kinds of problems and are often sold cheap to box stores to get rid of them. The better value might be the younger plant that will hit the ground running. With new transplants I recommend trimming the top back quit a bit so that the root system can easily support the top part of the plant. The first couple of years are critical to plant establishment.

Boring round holes the size of the root system is a no no. Dig at least 2-3x the size ammend with compost. Deal with drainage problems before not after(this is vital).

Being in the plant industry my obsevation with homeowners is that the majority are not gardeners. It takes years to train someone how to grow plants consistantly successfully(IMO).

Landscapers come in every variety as well, often pushed to bid low they cut corners. My father-in-law hired a landscaper that had been in the bussiness 15 yrs. The landscaper and I disagreed on several key points to which I kept my mouth shut to keep the peace and waited. The guy did things wrong that are taught correctly at the local community collge landscape program. I helped my father-in-law afterwards and kept my "I told you so's" to myself.

I recommend buying a college text on horticulture they are better than most and not that expensive.

Why is no one talking about this....?

http://news.bbc.co.uk/2/hi/middle_east/6404609.stm

Watching BBS last night they talked about this for almost 10 of their 20 miutes last night and it's not even really in the MSM. WTF!

and this one

http://www.washingtonpost.com/wp-dyn/content/article/2007/02/13/AR200702...

has totaly dropped off the radar

It's in the MSM. I read it in the NYT this a.m.

It's just not a good story as things go now. Threat and bluster and confrontation between good guys and bad guys is a story. Talks without conclusions known in advance is not a story. Murky possibilities are not a story.

"What still intrigues me, is what if Iraq and Iran don't actually have vast quantities of, as yet untapped, oil that we seem to believe they have? What if these oil wars are not only self-destructive, but also futile?"

Absolutely! Iraqi deaths in hundreds of thousands. Deaths and injuries of the occupiers. Increased borrowing. Years squandered while avoiding the inevitable power switch. Courting wider conflict. And futile to boot?

Your question may imply that TPTB believe bad reserve data. (Iran couldn't possibly need a reactor for electricity, they are floating on oil!) This might be WMD all over again.

Matt Simmons has done everything but stand on his head to try to get us to think about just how much oil may NOT be left in the Mid-East just so we can avoid making this tragic mistake once more.

Is that the reason Simmons wants to know so very badly? Or is rather because Simmons and Company is being asked for billions of dollars by his regular clients and as an Investment Banker he shudders at the thought of going ahead with several projects only to find out half way through construction that Saudi Arabia (his Nemesis) has just come on stream with one or two million barrels per day of additional supply?

Would SA take glee in embarrassing and bankrupting such a sincere player? The anticipation hurts.

hothgor must die

edit: it's been so nice since hothgor's been banned

HothViking has been trying so hard to minimize the use of his new sockpuppet, but the hothgorinus is starting to spew

Exhibits B & C: earldaily and enviro attny.

The evidence that Hothgor, IP and Freddy weren't the problem continues to mount...but then it was always there in spades for those with eyes in their heads.

Yeah I know it's a bit novel to suppose that someone in his position might behave out of sincerity. But he could be especially if he does not want to see America twisting in the wind in the Mid-East.

He is on record with peak now. He didn't have to go that far in order to manage his business. If anybody has an extra 2mbpd he stands to be embarrassed on that point alone. That is if they can bring it on line before declines catch up to it elsewhere.

With oil sitting above $60 there's probably lots of projects that work. The driving season and the hurricanes are ahead. The giants are watering out. China's economy isn't dead by any means.