US Natural Gas: The Role of Unconventional Gas

Posted by Gail the Actuary on May 19, 2008 - 7:00pm

US natural gas production has been flat for a number of years. We keep hearing that US production is expected to begin declining sometime in the next few years, but it doesn't seem to happen. While it is not obvious from most published data, the reason production remains level is because unconventional gas production has been rising at the same time that conventional production has been declining. In this post, I will look at unconventional natural gas, since it plays such a pivotal role.

Introduction

One reason I am writing this post is because only a few days from now (May 20-21), I will be visiting BP's tight gas facility in Wamsutter, Wyoming on a trip sponsored by the American Petroleum Institute (API). I may have the opportunity to ask some questions. I thought that if I put together a post outlining a little about what we know about unconventional gas, and in particular tight gas, it might put me in a better position to ask reasonable questions, if I get a chance to do so. Also, readers may alert me to some issues I might not otherwise be aware of.

Unconventional Gas and Tight Gas

The major forms of unconventional gas are tight gas, coal bed methane, and shale gas. The production of all three have been rising in recent years. Tight gas is the largest of the three. Production of all three were encouraged under Article 29 of the Internal Revenue Code, Alternative Fuel Production Credit, which became effective in 1980.

One could write volumes on any of the types of unconventional gas. To keep this post from getting too long, I will focus on unconventional gas totals and on tight gas.

Production Forecasts

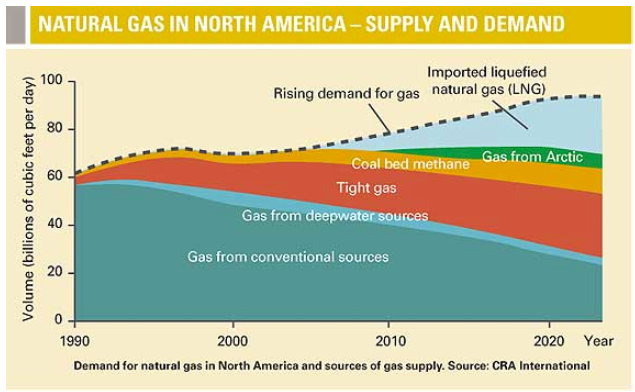

Figure 3 shows a natural gas production forecast that I found on a BP website. It is not too different from other forecasts that one sees for natural gas: Conventional natural gas production is expected to continue to fall. The various unconventional sources of natural gas will rise to keep production flat for several years. Demand for natural gas is expected to be greater than the amount that can be supplied using conventional and unconventional production. We will try to meet the supply shortfall with imported liquefied natural gas.

We all wonder, "How reasonable is a forecast of this type?" Can tight gas production be expected to continue to grow for several more years, or will it quickly reach a peak and decline? Should we be concerned in the next few years? Will unconventional gas actually do better than forecast? I am not sure I have an answer to these questions, but I will try to lay out some of the issues involved.

What has the EIA's track record on forecasting unconventional gas production?

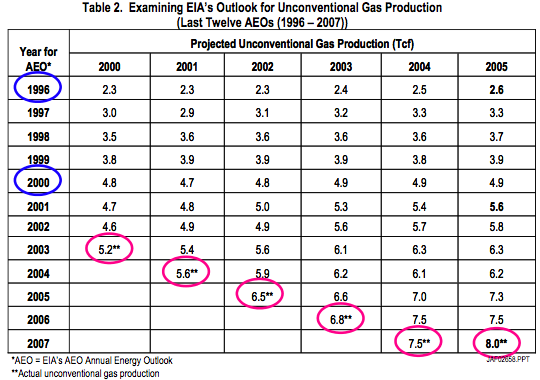

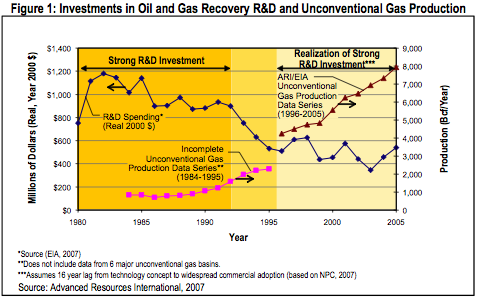

EIA's track record has been one of consistent under-estimation of the amount that would be produced. This is an exhibit from one of Advance Resources International's (ARI's) papers showing EIA's forecasts and the ultimate amount produced:

EIA's has also tended to miss the decline in conventional natural gas, so that its track record in total has not been as poor as for the pieces. Going forward, the EIA's forcast (from the 2007 Annual Energy Outlook) is shown in Figure 5. It forecasts some increase in unconventional, but not as steep a rise as in the past. In Figure 5, NA means not associated with oil production; AD means associated dissolved.

Doesn't natural gas production tend to peak and decline like oil production?

The United States has different sources of natural gas - conventional gas, both on shore and off shore -- and the various unconventional sources. Geological factors do play a role, as with oil, but there are other factors that are important as well. I think of natural gas as more of a "pump what you need each year" endeavor, until the supply runs low, rather than as having the typical peak and decline pattern that we see with oil production. This is part of the reason production has been flat for many years.

One can see the impact of geological factors when one looks at Figure 1, which shows the decline in conventional natural gas (offset by the rise in unconventional). Reserves for conventional natural gas have also been declining, and almost everyone believes that conventional natural gas production will continue to decline in the future.

Price and technology also play major roles in determining the amount of natural gas that is pumped, much more than we think of with oil.

The price of natural gas depends on supply and demand. Natural gas is fairly plentiful around the world. While it is difficult to ship natural gas, there are indirect ways the foreign natural gas can compete with US natural gas. Chemical industries can move to cheaper sources of natural gas. Also, products like fertilizer can be made abroad, and shipped to the United States. In recent years, pipeline imports of natural gas from Canada have helped to hold down US natural gas prices. Price is also affected by availability of pipelines and by competition with coal and with petroleum.

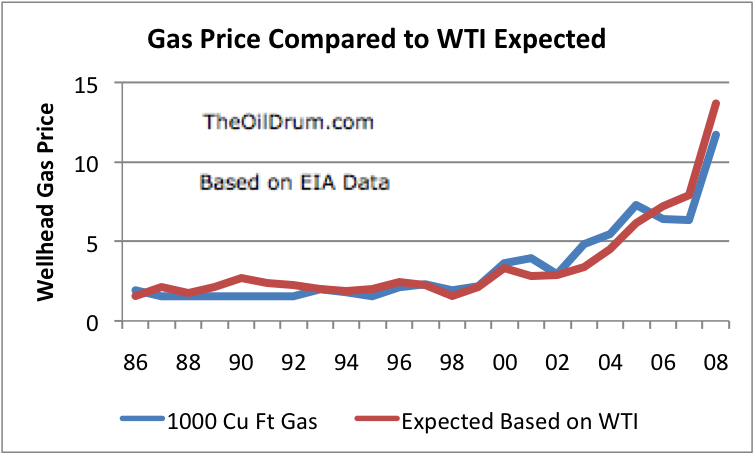

Historically, the price of natural gas has been highly correlated with that of oil (R squared = .82 for 1986 to 2007, comparing the wellhead price of gas with the price of West Texas Intermediate (WTI) oil.) On Figure 6, I show the wellhead price per 1,000 cubic feet of gas and an estimate of the price of gas equal to 10.9% times the WTI oil price per barrel. Figure 6 shows annual averages for he years 1986 thorough 2007. For 2008, the amounts reflect recent May 2008 prices (WTI= 125.83; natural gas = 11.71). Recent natural gas prices seem to be lagging behind their historical relationship with oil, leaving some room for natural gas prices to rise.

What is tight gas?

Tight gas is natural gas found in reservoirs with low porosity and low permeability (generally sandstones with less than 1/10th of a millidarcy permeability). Tight gas requires multiple fracturing to in order for any significant amount of gas to be available. Drilling for tight gas has been compared to drilling a hole into a concrete driveway--the rock layers that hold the gas are very dense, so the gas doesn't flow easily.

Until recently, tight gas was considered non-economic to produce. Recent technological advances in a number of different directions have made it increasingly possible to extract tight gas. The higher recent prices of natural gas have also tended to support unconventional natural gas production. There is a huge amount of tight gas in place. Even with technological advances, the challenge is finding a way to extract it economically.

Where can tight gas be found?

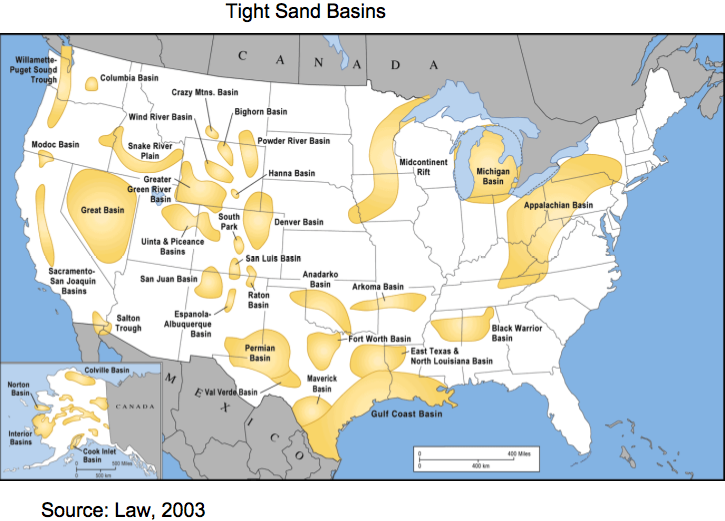

This is a map from the Advanced Resources International website.

Based on Figure 7, one can see that tight gas resources are very widely distributed. When wells are drilled, there is a very high rate of successful (not necessarily economic, however) wells--approximately 98%. With such widely distributed resources, the challenge is finding "sweet spots" that can be more economically extracted, and developing techniques that will do this in a cost effective manner.

I have not shown maps of coal bed methane and shale gas, but they are also very widely distributed.

How does technology come into play?

Some examples where technology has come into play with tight gas formations include:

• Better technologies to find the "sweet spots" within formations.

• Research on the optimal spacing of horizontal wells.

• Developing fracing fluids and proppants for stimulating the wells, and determining which is right for each well.

• Developing low-energy deliquification methods to separate water from the natural gas.

• Developing ways of reducing the ecological footprint, such as drilling multiple horizontal wells from the same pad.

• Developing methods for drilling wells more quickly and at lower cost.

In presentations, a person sees graphs such as this one, showing efficiency gains. (EUR is estimated ultimate recovery):

The effect of these changes is to improve Energy Return on Energy Invested (EROEI), relative to what it otherwise would have been. With small changes, the economics can be improved enough to make a larger portions of sites economic, increasing the amount that is economically recoverable.

How has the amount of research on unconventional gas production been changing?

The amount spent on research and development has been falling. The amounts in this exhibit represent a summarization by ARI of the expenditures of 29 energy-producing companies.

There is a long lag between research and its widespread benefit--estimated to average about 16 years by the National Petroleum Council. During the 1980s and early 1990s, the Gas Research Institute (a federal program) and the Department of Energy sponsored research programs. These programs contributed to the higher level of research spending during these periods. The research programs of the 1980s and early 1990s are now bearing fruit, in the form of increased unconventional gas production.

These research programs have been discontinued. Companies are continuing to do some research on their own, but the amount is lower. There is a very real difference between (1) a government program, with funding by companies and with applications tested at many different sites, and (2) each company doing its own research. If each company does its own research, it can patent the new application, and eventually use it to improve its own results. The present value of the benefit is relatively small, since it benefits only the company itself, and the timing is quite distant. It may eventually be able to sell the benefits to others, but this will take time.

If companies can work together on research through an organization such as the Gas Research Institute, the results can be shared widely, more quickly. These shared results benefit all, not just a single company. Because of this, the benefit to the industry and society as a whole is likely to come much sooner than with many small patents by individual companies. Because of the faster timing, the present value of the benefit of the combined research is likely to be higher than the sum of the present values of the independent research of the individual companies. The cross-fertilization of the combined research programs may also provide benefits. Anti-trust laws do not permit companies to work together in this fashion, without some federal program.

What are trends in well productivity?

One exhibit prepared by ARI shows declining well productivity.

Part of this decline in well productivity will be offset by the recent lower cost of drilling wells, because of efficiency gains. Some of it is expected--companies are now drilling more closely spaced wells, each draining a smaller area. The lower well productivity does makes it more difficult to maintain profitability, however.

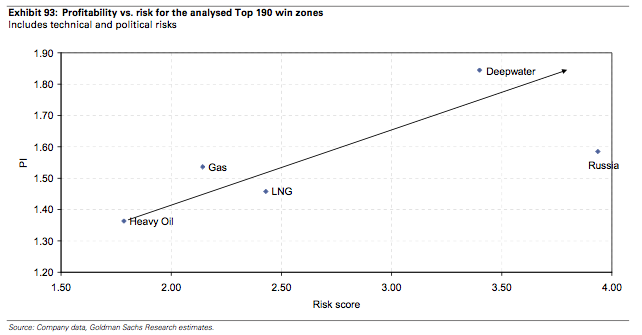

How is profitability of the unconventional gas industry viewed?

Figure 11 shows a recent profitability analysis by Goldman Sachs. It seems to indicate that the profitability of gas projects (nearly all unconventional) which are now underway is acceptable. Production of unconventional gas is viewed as low risk--the gas is easy to find; the trick is extracting it without losing money. Profitability is not expected to be as high as for some other types of ventures, because of its low-risk nature.

What are the prospects for unconventional gas going forward?

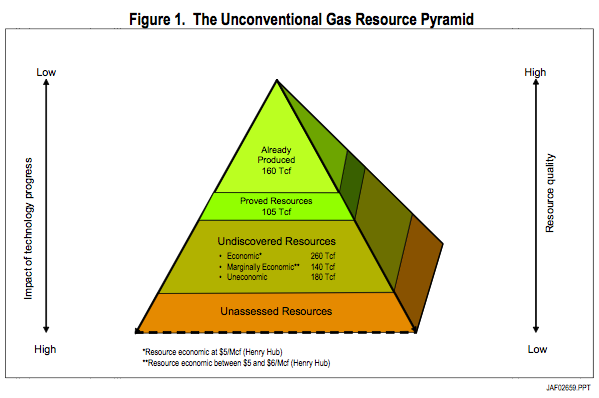

ARI shows this chart of its view of reserves and technically recoverable resources.

ARI characterizes the amounts it shows as merely a "snapshot in time" of its view of how much can be technically recovered, based on what is known about reservoirs today and current technology. ARI says its estimates are sometimes considered "aggressive". ARI has been making estimates of this type for several years, and their estimates have been trending upward. It seems to me that there is a reasonable possibility that ARI's estimates will prove to be accurate, or even low, with improving technology. They seem to have a good understanding of the industry, and the approach they use seems reasonable.

The third layer from the top of the pyramid is the amount ARI estimates to be technically recoverable, but that is not yet included in proven reserves. This layer totals 580 trillion cubic feet. The footnote indicates that 260 trillion cubic feet (of the 580 trillion cubic feet total) is estimated to be economically recoverable at a price less than $5.00 a thousand cubic feet; 140 trillion cubic feet is estimated to be economically recoverable at a price between $5.00 and $6.00 a thousand cubic feet; and 180 trillion cubic feet is estimated to be uneconomic at a price of $6.00 a thousand cubic feet. The current price is over $11.00 a thousand cubic feet, so some of the uneconomic layer may now be economic. Of the 580 trillion cubic feet of technically recoverable resources, ARI indicates 379 trillion cubic feet, or 65% of the total, relates to tight gas.

Other organizations provide estimates of technically recoverable unconventional gas resources using older data. In 2003, the National Petroleum Council put together an estimate using data through 1998. Its estimate, comparable to the 580 trillion cubic feet, was 206 trillion cubic feet. The USGS in 2006 estimated the amount of undeveloped continuous resources to be 306 trillion cubic feet.

How do the reserves and technically recoverable resources for unconventional gas compare to recent US natural gas production?

The pyramid in Figure 12 shows 105 trillion cubic feet of proven reserves for unconventional natural gas as of December 31, 2005, (second layer of pyramid). This level amounted to a little over half of US total proven reserves of 204 trillion cubic feet as of that date.

The latest date for which proven natural gas reserves are available is December 31, 2006. Proven reserves were then 211 trillion cubic feet, based on EIA data. Natural gas production for 2006 was 18.5 trillion cubic feet, so proven reserves amount to about 11.4 years of production. These are the published amounts, without consideration of future "resources".

In Figure 12, ARI's estimate of technically recoverable, but not necessarily economically recoverable, unconventional natural gas resources as of December 31, 2006 was 580 trillion cubic feet. If we add this full amount to the proven reserves of 211 trillion cubic feet as of the same date, we get 791 trillion cubic feet of possibly available resources. 791 trillion cubic feet amounts to a little less than 43 years of production at the 2006 level. If we include only the 400 trillion in resources estimated to be recoverable at $6.00 or less per thousand cubic feet, the total is 611 trillion cubic feet, or 33 years at 2006 production levels (for all natural gas, not just unconventional).

Clearly, if these resources are available, it could make a big difference to the amount of natural gas which can be produced going forward.

Where are we headed going forward?

If peak oil is approaching, the price of oil is expected to rise going forward. The price of WTI oil is now over $120 dollars a barrel, and many are talking about oil at $200 a barrel in the next year or two. If natural gas follows its historical pattern, its price will tend to rise as well. One might argue that the price of coal will hold the natural gas price down, but with all of the concern about global warming, and all of the electrical power plants that use natural gas, I think there is a good chance that the price of natural gas will tend to rise with oil, especially in North America. Higher prices will tend to make more of the unconventional natural gas economic.

Improvements in technology have clearly made a big difference in the amount if unconventional gas that can be recovered economically. With the slowdown in spending on research, technology improvements are likely to be smaller, but there will still be some improvements. It is unfortunate that the recent energy bills have not included funding for combined unconventional natural gas research, similar to that done by the Gas Research Institute. Even if 100% of the funding were from the industry, it would be beneficial from the point of enabling research on a combined basis, so that society could get the benefit of the research more quickly.

Discovery is not really an issue with unconventional--we already know pretty well where the resource is, and tools are available (or are being perfected) to find the sweet spots. The industry complains that there are considerable problems in actually trying to develop the resources. According to a presentation by Laramie Energy at an EIA conference, one problem is speculators who lease land with no intention of developing it. Another is the fact that 50% of Western land in owned by federal or local governments, and cannot be developed. Another issue is the numerous permitting requirements which delay production. There are also many restrictions because of endangered species, surface use restrictions, and local ordinances.

We hear the oil industry complaining loudly about access issues. I think they may really have a point; it can be very difficult to get access to the land where tight gas is located and take the necessary steps to produce the gas. If some of these access issues can be resolved, this too will help natural gas production.

Whether on not unconventional natural gas production will grow in the future will depend on price, technology, and access. Liebig's Law of the Minimum may also play a role. While we often write off US natural gas, it seems like there is at least a possibility that the unconventional natural gas will make up for the decline in conventional natural gas. The rise in unconventional natural gas production may even permit a small increase in total US natural gas production, and reduce the need for imported LNG.

US natural gas production in 2007 was at its highest level in since 2001, and 2008 production is starting off the year higher than 2007. While no breakdown is available into conventional / unconventional, it is pretty clear that it is unconventional production that is giving the production boost. Natural gas proven reserves have been rising for several years. I think that production of unconventional natural gas is something we need to be examining more closely. The EROEI of unconventional natural gas is not very high, but there is a huge amount of it.

Gail

Many thanks for this informative and well-researched study.

The question really is, how much time will this unconventional gas give us on the 'Red Queen' treadmill before we slip off of it? Does this mean that home heating or electricity shortages are no longer in our 5 year horizon?

As you implied, the problem is the number of wells that we have to drill. For example, Texas natural gas production, from gas wells, in 2006 was the highest we have seen since 1981, but it took more than twice as many gas wells in 2006 to produce the same amount of gas that we produced in 1981:

http://www.rrc.state.tx.us/divisions/og/statistics/production/ogisgpwc.html

I think that the fourth quarter of 2007 was the real start of the permanent energy boom/crisis. Whether it is a boom or a crisis depends on what side of the producer/consumer equation that one is located on. The industry can and will make money from exploiting smaller conventional oil and gas fields and from exploiting unonventional resources, but the question is whether we can increase our total net energy output, especially with personnel and equipment constraints.

Gail:

Thanks - this is really helpful in putting things in perspective. If I can tie into Westexas comment about the number of wells that it is now required to maintain production rates, it might be informative, when you make the trip, to ask API about the current lifetime of the wells that are coming on line, the decline rate and the percentage that are economically successful.

I think Liebig's Law of the Minimum is likely to be a big issue also. These facilities are out in the middle of nowhere. Food and water need to be trucked in, I am guessing. Replacement parts will often come from overseas. I wonder how long the whole complex operation can be held together once oil supplies begin to decline, and we run into increased financial difficulties.

Don't forget the renewable methane resource - biogas. It is a mature technology, already in operation throughout the world.

I doubt that biogas has the potential to replace more than a fraction of our present non-renewable methane use. Nevertheless, it can provide us a floor to which we can level off once the non-renewable methane resources decline in earnest.

Biogas could surprise. I read, somewhere, there are 100 million cattle in the U.S. I don't know how many would be available for manure recovery, and anaerobic digestion, but I'm guessing the number is significant.

Of course, there is, also, landfill, sewage, and opportunities to utilize dedicated crops for biomass as is being done in Germany.

We're going to be on this little planet for a long time (we hope,) so it seems to me that it just makes sense to use as many renewables as we can.

We're working on this now in BC. Our first projects are using cellulostic feed stock (wood waste from saw mills), but this is a limited source. The process is being optimized for each feedstock source such as sugarcane waste, municipal organic waste, or sewage sludge.

However, our process is different in that we don't require gas scrubbing or the FT process. More importantly, the gas is a good output, but the main product will be bio-char (charcoal). Once thought a nuisance output (until I got involved), the oil outputs will have great applicability.

The light fraction is equivalent to #2 Heating Oil, the heavy fraction might be blended with Bunker C, or used in road paving, etc. BC has a large ferry fleet (larger than the Canadian Navy) and using this fuel will go a long way to help meet the renewable fuel mandates set out by the provincial government.

Still I advise extreme caution about the volumes that can be produced. We have to be careful about maintaining sustainability. Yet, this process might allow us to make a soft landing if we can power down and turn the corner.

Very cool.

Coal bed methane has a lower heating value so it must be mixed with a higher grade gas brfore it be sold. Also the wells tend deplete faster so drilling wells is a continual process.

It's true that CBM is very pure (better than 98%, IIRC). As you state, this means it has a lower calorific value than regular natural gas, not to be confused with Lower Calorific Value (grin). This doesn't mean it's not marketable. My domestic gas bill is quoted in megajoules, not cubic feet, meaning the gas supplier corrects automatically for the calorific value and the customer pays for energy received. So that particular problem has been solved.

Another thing to take into account is the Wobbe Number, which is a function of upper calorific value and density http://www.sizes.com/units/wobbe_number.htm - as described it is not a dimensionless number. According to the website, methane falls right in the middle of the Wobbe Number range for commercial natural gases in the United States. IIRC the gas from the Morecambe Bay field (offshore UK) had an out of spec Wobbe Number and had to be blended with nitrogen before it could be put into the National Grid.

If you change to a gas of dramatically different specification then you may have to change the burner tips to avoid flame blow-out. This happened in the UK in the late 1960s with the switchover from coal gas to natural gas ("High Speed Gas"), and was a huge logistical effort, though the world doesn't appear to have come to an end as a result. If the gas goes to a single large user (like CO2-rich Miller Field gas in the UK) then it's simpler.

I understand that one cannot just import any LNG and expect to use it, because of differences in gas around the world. Our appliances in the US are tuned for one specification. Different ones are used some other places.

Typing natural gas pipeline specification into Google led me to this interesting paper - see Page 4 http://www.beg.utexas.edu/energyecon/lng/documents/CEE_Interstate_Natura...

It mentions gas turbines as one end use that is sensitive to changes in fuel specification, for example with LNG. This is because GT burners run a lot hotter and therefore nearer to the thermal creep limit than most end uses of natural gas.

Natural gas, being a natural product, has a variety of compositions.

Mostly it is methane (CH4) but can have various amounts of propane, butane, and ethane (2CH3 + XCh2) plus non-combustibles like N2, CO2, and He that cost various amounts to remove.

Trying to meet market specifications can doom a gas field economically. Nitrogen is especially expensive to remove with little co-product value, unlike helium.

That resource pyramid is just insane: undiscovered and unassessed? Without exploration drilling what is their model for the resource? All rocks of similar type have gas? This is most likely in the same vein as the USGS report from 2000 that was using a trivial statistical model to predict vast oil reserves off Greenland. Basically nothing more than wishful thinking.

I remember reading that in Canada there are vast tight gas reserves. The gas in Canada is much harder to extract than the tight gas in the US, but it totals several times the Worlds conventional natural gas reserves. The next great challenge?

There are tight gas resources around the world. Other than the US, I don't believe that much has been done with them, because other natural gas that was easier to extract has been available.

This is an exhibit from the National Petroleum Council's Facing Hard Truths report showing an estimate of the amount in place (not economically recoverable).

I don't know anything about how difficult Canadian tight gas reserves are to extract. US tight gas reserves were considered impossible, before a lot of research was done.

Regarding Canadian resources, AJM Petroleum Consultants from Calgary has good online pdf's (www.ajma.net then click on "about ajm", then "news and events", then "past presentations"). Also try www.rdfuture.com and click on "natural gas" and scroll down to the 5th graph. In general, AJM is predicting very expensive times ahead for Canadians and their cold climate. And the Canadian Society for Unconventional Gas indicates (if memory serves) that coal bed methane could only make up about 10% of the shortfall by 2020. I got to thinking a lot about this in February when windchill temperatures got down to minus 50 celsius just north of Calgary.

If nothing else, unconventional takes a long time to ramp up. Besides the infrastructure for the production, one needs the pipelines to take it to the users.

Some new US pipelines have become available in the last year. I think that is part of the reason for the increase in production.

Gail

I can't find the link to the site I found this info on. As I remember the problem had something to do with the holes bieng smaller than in US basins, and more difficult to fracture. They expected progress to be slow but the potential resource is immense.

The Wiki NG article on Canadian 4.1 Unconventional gas mentions the "Deep Basin" in Alberta as a massive source of tight gas; maybe that's the one? Low permeability. Dave Cohen's piece Canadian Gas - Decline Sets in likely has more info on tight NG.

Hi diss,

Those YTF ("Yet To Find") numbers are based on things like proven reserves per square kilometre in basins of known age and geological character, like the ones shown on the maps in Gail's posting, adjusted for track record in areas already explored. It's true that they are not precise, but that doesn't mean they are just pulled out of the air. A good explorer should be able to quote central estimates and error bars (traditionally P10-P50-P90).

It's not the case that all rocks of similar type have gas, but a given association of mature source rock, reservoir rock and seal ("hydrocarbon system") has a nonzero probability of containing producible hydrocarbon of a given type. That probability can be estimated from drilling history, in the same system or analogous systems if necessary, and the areal extent of the system can be mapped in a variety of ways. Subtract proven reserves and you've got YTF. You can do this with well penetrations or without - in the latter case, the error bars are larger, but not infinite.

If that YTF estimate was done bottom-up, i.e. by aggregating the estimates for a large number of basins and plays, then it could be quite accurate, even if the individual estimates are way off. Something to do with this http://en.wikipedia.org/wiki/Central_limit_theorem

How do you think oil companies decide where to explore, where not to explore, and when to stop exploring in a given basin?

Any chance they'll find some oil by the by?

Find some oil? Sure, all the time. Enough oil? That's a different question, as I'm sure you know.

If they are using actual drilling data then they do have an empirical model to work from. It is not clear from the various articles whether the yet to find reserves are associated with existing fields or are, like for Greenland, pulled out of the air.

Hi Diss,

Undrilled or sparsely-drilled basins are obviously more difficult, and this should be reflected in the P10-P90 range - which may include zero as a lower limit, meaning non-zero probability that the basin is barren for any of a dozen reasons. In the case of Greenland you would be able to work from analogy with the Jurassic and Triassic of the North Sea. It was the same basin before the Atlantic opened up, though the subsequent geological history would be very different - thermal history affecting hydrocarbon generation, and tectonic history affecting trap creation and destruction. You might have some approximate mapping from coastal outcrops and regional seismic.

It isn't a cookie cutter - every basin is unique, and the available data vary widely in type, quantity and quality. So does the amount of time and detail that you can put into the exercise. As you say, the popular press rarely bothers to mention this important fact.

Unconventional is fairly different from conventional with respect to estimation.

With conventional, one is trying to figure out whether there are fields available which have natural gas (or oil) that can be extracted in the conventional manner. These are discrete fields, and the world has been pretty well explored. It is difficult to find them. This is the reason why we are told that we are discovering less oil each year than we are extracting.

With unconventional, we know fairly well the extent of rocks in place which have natural gas trapped inside of it. I showed a map in Figure 7 for tight gas. Some places will have more sweet spots than others, but for the most part the resource is there. It has already in some sense been discovered, but it doesn't yet pass the proven reserve test.

As I understand it, the amount that is included in proven reserves is the amount that is located in areas which can be drained with existing wells, or has been specifically surveyed and tested. The area nearby in the same formation, which we have every reason to believe is similar to what has been fully surveyed, is "undiscovered".

Advance Resources International is a consulting firm that specializes in unconventional natural gas. They have an amazing amount of material up on their website. This is a link to a document that describes how they derive their estimates.

Thanks for the links and the explanation. Reading the second link the undiscovered category is really the uncertainty in existing plays. The unassessed resources, which have a volume comparable to the undiscovered in the pyramid figure, look like a stab in the dark.

Oh yeah, just speculating on finding the odd Black Swan while they turn the countryside into a pincushion.

The unconventional gas is very expensive to extract and prone to cost overruns when things don't work out.

This is an observation from the field and not the office. At times the pay-back if things don't work out could be in 5+ years !!!!

Correct, and for this reason it's a good idea to run a pilot before committing to large-scale development. These pilots can be quite big - multiple clusters of 5-10 wells each, to allow you to debug your completion design and data acquisition, and to give yourself a chance of hitting a sweet spot and some average reservoir. Then you have to operate the thing for a few years to quantify decline and interference (and dewatering rate in the case of CBM or shale gas) before making the final decision.

I've been wondering how rising oil prices will impact drilling - at what stage will it become unprofitable? Unfortunately in EROI on the Web part 2 of 5, (Provisional Results Summary, Imported Oil, Natural Gas) Charlie states that

“There is no readily available literature either on, or by which, one might derive the Energy Return on Investment (EROI) of Natural Gas. Published summaries of natural gas reservoir studies and general overviews of drilling practices are sparse. Even with such a broad study, it would be difficult to assess natural gas production generally because each kind of operation is very field- specific".

Not only is the EROI site specific, it is changing over time, if changing technology is playing a big role. I know John Freise has been looking into the EROI issue. It would be interesting to see more work done in this area. It is clear EROI is not very high. But can it be made high enough, in enough areas, that we can live with it?

I think the problem with cost over-runs is the reason why these sites tend to ramp up very slowly. There is a need to test whether what is being done is working correctly, and figure out ways to improve it to make it economical. Problems with extraction are likely, when one is right at the edge of what can be accomplished technologically, in an economical way.

Arthur Berman of World Oil has written a fair amount about Barnett Shale, and its profitability. He says that at last year's prices, most of Barnett Shale wells were not profitable, because decline rates were higher than what natural gas companies were expecting. I think the question then becomes whether some of the problems can be fixed with improved technology, and whether higher natural gas prices will help pull the wells up to a profitable level. If the answer is "no", we will see companies pull out of Barnett Shale, and whatever other unconventional natural gas plays are not really economic.

Which could take us right off the NG treadmill, unless the Gov steps in to subsidize drilling.

Incidentally I suppose Leanan or someone posted here about Chesapeake Energy Swings To 1Q Loss On Hedging Losses, about them pulling out of the Woodford Shale.

Interesting! We should be keeping a watch for these kinds of things.

My impression is that shale gas is generally a step below tight gas on the EROEI ladder, since it was later to develop and the amount produced has been smaller. It is possible, though, that there is enough variability among sites that this generalization doesn't make sense.

I hope that everyone reading TOD knows that these "hedging losses" by oil and gas companies are generally not losses. The AICPA, about 8 years ago, in its wisdon pretty much fixed it so that most (but not all) legitimate hedges have to be "marked to market" each quarter. Illustration: A production company like CHK in 2007 decides to sell forward 60% of its 2008 production for $7.50/mcf at a time when 2007 prices are $6.00/mcf. In 2008, prices rise to $11.00/mcf. CHK has to put up margin for the price over the $7.50, but, never "loses" any cash since it ultimately delivers the physical product against the contracts. Of course, CHK has an opportunity cost because it nets only $7.50 for the gas it sold forward. However, since it insures a profit and assures the ability to pay off bank debt, hedging is an integral componenet of many companies. Nonetheless, for all outstanding futures contracts on March 31, 2008 that are priced over $7.50 a loss for the quarter is recorded.

Thanks. So really, they are probably not doing all that well for some reason or other--perhaps the reason they sold Arkoma Basin Woodford Shale properties. They obviously don't have huge profits they are trying to hide.

I hope that everyone reading TOD knows that these "hedging losses" by oil and gas companies are generally not losses. The AICPA, about 8 years ago, in its wisdon pretty much fixed it so that most (but not all) legitimate hedges have to be "marked to market" each quarter. Illustration: A production company like CHK in 2007 decides to sell forward 60% of its 2008 production for $7.50/mcf at a time when 2007 prices are $6.00/mcf. In 2008, prices rise to $11.00/mcf. CHK has to put up margin for the price over the $7.50, but, never "loses" any cash since it ultimately delivers the physical product against the contracts. Of course, CHK has an opportunity cost because it nets only $7.50 for the gas it sold forward. However, since it insures a profit and assures the ability to pay off bank debt, hedging is an integral componenet of many companies. Nonetheless, for all outstanding futures contracts on March 31, 2008 that are priced over $7.50 a loss for the quarter is recorded.

Gail

Thank you for the informative post.

It seems that we can transition to a secondary resource base across a range of energy sources:

Natural gas -> Unconventional gas

Oil -> Tar sands/Orinoco/Shale

Uranium -> Thorium

At each of these transitions, I'm assuming that the cost of the energy rises so that renewables become more competitive at each stage. To keep civilization running over a very long period of time, we would have to use solar/wind/tides/geothermal and fusion (if it ever works).

In the realm of high-intensity energy sources, no need to look to the fantasy of fusion for long term viability. Proven advanced fission techniques, specifically fast-spectrum reactors and molten-salt reactors can produce up to 100x's the energy from a given amount of Uranium as is the current practice. This means that existing depleted U and reactor "waste" sitting in cooling pools around the country could, in theory, fuel all the power needs of the USA for centuries without having to look for more Uranium. Then take the 50-100 years of estimated reasources at current wasteful consumption rates, and multiply that by 100... then consider that Thorium is approx. 3 times more abundant than U in the earth's crust... you can quickly see that advanced nuclear fission has the potential to supply high-intensity power for millennia (and without long lived radioactive waste as all that would be left are fission fragments with relative short half lives).

Maybe fusion will be viable by the time this runs out LOL.

Sounds great Steve001.

Will I be able to fit one under the hood of my explorer?

Yeah, a nuke under every hood! Just think of the possibilities: 1,000,000 mi between fillups, er, I mean core changes. LOL!

I'm afraid our right to have an SUV in every driveway is going to come under significiant pressure as the supply of liquid fuels comes into crisis. I know synthetic liquid fuels can be manufactured from any concentrated energy source with, for example, thermochemical hydrogen production from water, CO2 extraction from the atmosphere, creation of syngas from it and catalytic production of hydrocarbons. Others have talked about Ammonia, which is a liquid under modest pressure, a more dense carrier of hydrogen than liquid H2, and can by synthesized from air (N2) and water (H2). But, I assume using nuclear power to make diesel fuel, gasoline or NH3 will be very expensive? (Maybe others more knowledgeable can expand on that). I think either we have a revolution in battery technology or big personal vehicles will likely go the way of the dodo, sorry to say.

Comparable to cost of coal liquefaction, as most of the equipment is the same. The extra cost comes from nuclear/solar hydrogen production, which some have placed around twice the cost of reforming from natural gas. I couldn't imagine production costs for large volumes being unprofitable if you're selling at $150/bbl. While thats expensive certainly, it by no means kills liquid fuel for applications that demand it. (Air travel, military, etc)

I assume that the costs for nuclear would be lower than using solar, as you could use the equipment 24/7, but only part of the time with solar?

Of course, this might change if costs for solar plus storage dropped sufficiently, but that presumably would be the case at the moment.

Most of the cost is in the cost of the equipment, rather than any other feedstock or running costs I take it?

Thanks.

I estimate the feedstock costs for a nuclear CTG effort to produce, at 100% efficency, per gallon of gasoline or a bit less for diesel, 26 cents of coal, 2 gallons of water, and 6 cents of nuclear heat. In the real world, the yield won't be THAT good, but even doubling these inputs would still leave a lot of margin for fixed capital cost when amortized per gallon against current price of $3.00 a gallon before taxes.

The key is achieving 900 or 1000 deg C reactor exit temperatures. Then one can make a C + H20 process go endothermally. We're working on the temperature task now, doing component testing in South Africa. It's literally nuts-and-bolts engineering development for the pebble bed reactor.

If one runs out of coal, you can always use carbonate rock like calcite or even limestone although I think more nuclear energy would be needed.

I for one would like to learn some more on the chemistry of the process. I'd hope one doesn't need to make hydrogen first and then react with the carbon - a simple hot carbon/water reaction would be more desirable.

Thanks, Joseph.

To be greedy, any idea of how the costs of doing it with nuclear energy would compare to solar or wind?

I am talking ball park only, of course, but wonder how not being able to work 24/7 would be likely to affect costs.

On the plus side, producing the needed temperatures should presumably be no problem with concentrated solar power, perhaps in a solar tower, although maybe that would not get the heat to where it is needed.

It would be much more environmentally friendly to scrub CO2 from the atmosphere, rather than using buried carbon to provide feedstock for synthetic fuels production. Again, it comes down to $$$, but with oil heading toward $150 and beyond surely it must become economic at some point to make liquid hydrocarbon fuels for high-priority applications from captured CO2 and water using a GHG emissions-free energy source.

Atmospheric CO2 concentrations are 350 parts per million. That means a cubic meter of air contains 400 milligrams of CO2.

A cubic meter of coal weights 1,350 kg per cubic meter. That's a factor of over 3,000,000 in material handling on a volumetic basis.

Of course, the early process developers will probably prefer coke to coal just for a more pure input.

Nuclear CTG would be carbon-neutral relative to current transport fuels.

I'll have to do some more research and estimating to get the capital cost and amortization charges on a per gallon basis.

Here is a research project aimed at fuel from air using solar power:http://www.sun-powered.net/index.php/2007/12/11/sunshine-to-petrol-project-seeks-fuel-from-thin-air/

Solar Energy City | Liquid Solar Fuel – A fuel from thin air

Early days though.

Is this the Ford Nucleon Revisited ? :->

http://en.wikipedia.org/wiki/Ford_Nucleon

Calgarydude,

the reason why we arn't using Unconventional Gas, Tar Sands/Shal;es, breeder uranium, etc. is because energy has been far more cheaply extracted from the items on the left. We've built our society on the 'cheap' -and lots of it!

As we transition to 'expensive' IMO the real question is, can the society we have built on 'cheap' cope? [Think of the societal implications on a service based economy as all that discretionary consumerism dries up for example...]

Nick.

Deffeyes commented about fusion/fission hybrids in Beyond Oil; wonder if that cropped up in the recent spate of posts about splitting atoms. Apparently the two complement each other well but fusionthusiasts don't want all those filthy nucleotides messing up their elegance.

The Fusion-Fission Hybrid Revisited (PDF)

Thanks for the great post, Gail. A lot of information that I didn't know before. And it leaves me considerably more hopeful. In particular, your fig. 12 (the pyramid) suggests that the price elasticity of supply is quite high: log(505/365)/log(6/5) = 1.8. Now obviously there's a lag time to scale up the industry, but that suggests that quantity produced can grow with only modest price increases.

In turn, that gets me thinking about CNG as a substitute for oil, in transportation uses. If they're good substitutes, then the continued availability of gas should constrain the run-up in the price of oil -- the fuel with the higher supply elasticity will expand to capture market share from the less elastic supply.

I'm not quite ready yet to start celebrating. I think there are still a lot of issues out there.

Can we really ramp up natural gas production? It takes a lot of rigs to place of the wells that would be needed. There are limitations on the number of trained workers. Is profitability really as good as everyone thinks it is, or will cost over-runs be a major problem?

If there are limitations on oil production, will this in some way filter back to cause problems in the natural gas arena, perhaps through financial problems for the unconventional gas companies, or in difficulty in getting enough food and water transported to the areas where the natural gas drilling takes place?

If increasing natural gas production were a slam-dunk, I think we would be hearing from oil companies about it. Instead, we are seeing forecasts like the one in Figure 3. I think unconventional gas is worth investigating further, but I don't think we should jump to conclusions.

Here's the reddit and digg links for this story. Thanks for your help!

http://reddit.com/info/6jual/comments/

http://digg.com/business_finance/US_Natural_Gas_The_Role_of_Unconvention...

Onshore in Texas and Louisiana there are enormous amounts of methane dissolved in geopressured brine reservoirs. These reservoirs have been well-mapped, as they are a source of considerable problems for drillers seeking oil and dry gas. Some estimates of the amount of such gas are as high as 5,000 Tcf. Unfortunately, along with the methane, there are large amounts of various toxic materials, making the brine impossible to dispose of at the surface.

When I was in graduate school in Texas in the late 1970s there were considerable efforts expended to analyze methods that might be used to produce this gas. TTBOMK, the problem of producing the gas in an efficient and environmentally safe manner remains unsolved.

They were supposed to reinject the brines into shallow saline aquifers. It looks really nifty with the hot brines

used to generate electricity with the organic rankine cycle(ORC). You get about 30 cubic feet of methane per barrel of briney water), so you need to pump a lot of water.

A small town might build a 1 MW ORC generating plant and get maybe 300 million cubic feet of geopressured natural gas a year out of the deep aquifer(worth $2.5 million a year at current prices).

I'd say that the problem was who would buy into it. It's too small scale to interest either the gas companies or the electric utilities. If the government mandates renewable energy I think it would get a huge boost.

Most of our systems analysis looked at reinjection of the brine into the producing reservoir -- some of it was such nasty stuff that we shied away from looking at shallow disposal. The energy that could potentially be captured from the heat/pressure was just about enough to power the reinjection needs, assuming typical efficiencies, leaving the recovered methane as the "gain". Lots of problems, though. The brine is not only toxic, it's corrosive as hell, so really tough on equipment. Simple methods of getting the methane out of solution also caused a lot of dissolved solids to precipitate out, creating a whole 'nother set of difficulties.

I fantasize about some sort of down-hole device -- think big block of ceramic -- that would selectively pass methane at a reasonable rate...

Interesting! There is also the gas hydrates problem.

If someone ever figures these out, there could be a lot of methane.

From almost everything I've read hydrates are more likely to be a problem in a different sense than you're intending...

Agreed!

An excellent post - thank you.

This paints a rosier picture than most about North American gas reserves and future production - or at least a less gloomy one.

I've tried to follow the tight sands issue for a while and still don't see a technological path forward other than cheaper drilling. As you mentioned, exploration techniques that help with finding sweet spots would be helpful but seems a big challenge. Better and cheaper fracturing would help too but again, a difficult technical challenge since we still use brute force methods.

There is also what I call 'fried sawdust gas'

http://www.milenatechnology.com/

which unlike other wood gases doesn't contain up to 50% N2 and CO2. If a purity standard could be maintained perhaps blends of biogas and bio syngas could be stored in low pressure tanks. Their role could be to fuel CHP or microturbines for distributed peaking power in areas heavily reliant on wind and solar.

Thanks Gail. Every day TOD introduces me to another piece of the puzzle.

Agreed. Amazing amount of great information here.

Now I know why Chesapeake Energy has been running all these TV ads about our "abundant" NG reserves. One can hope that it will soften the coming blows.

It seems like I have been collecting "stuff" on this topic for a long time, and I only ended up using about 10% of it.

I am sure several more posts could be written on the topic.

Hi Gail. Production has been roughly flat for awhile, but # of rigs and # of producing wells have been increasing since around '00(clickable thumbnail):

Is that increase sustainable and if not what happens when it plateaus or declines?

Producing well #s data from here and drilling rig # data from here.

The switch to unconventional has resulted in drilling a lot more wells and using a lot more rigs. At some point we run out of rigs. I think this is one of the reasons no one wants to forecast a big increase in natural gas production. We can continue to build more rigs if we have the resources, and natural gas continues to look profitable, but that will take time.

In general at least from my reading the lifetime of unconventional wells is lower so as was mentioned in a lot of cases you end up with almost continuous drilling campaigns. And the financial margins are tight.

With oil the move from large long lasting fields to small shorter lifetime fields puts you on a treadmill with eventually steep declines once the large fields can no longer anchor production. Unconventional gas has the same dynamics as it makes up a large percentage of production we lose our anchor conventional production and the unconventional plays cannot be expanded fast enough to prevent a overall decline in production.

Also since the rate of return on investment is often longer the rate at which money will be spent in expectation of future profits while current investment is not profitable is much lower. And of course unconventional gas has to compete with LNG. As LNG production increases this increases risk on the financial side. The overall net result is once unconventional NG production becomes profitable in general it will lag demand ensuring high prices but capped by LNG imports.

Given that on a worldwide scale we generally have reasonable supplies of NG and its a matter of infrastructure esp LNG shipping to match markets we can expect US NG production to follow a path similar to oil. Technical innovation with lagging investment and expansion capped by imports resulting in a logistic decline in production. If LNG does not work out then probably at best a slow decline with higher prices.

In general since the rest of the world is also very interested in LNG and will be driving LNG expansion we can expect the US to build LNG terminals.

But note that even with a mix of imports and unconventional production its pretty hard to see NG supplies able to increase substantially pretty much regardless of price since any surge in LNG would be offset by a decline in unconventional production. Its almost a repeat of the same dynamics that faced oil production in the US vs cheap imports from the Middle East.

It would be nice to have a better understanding of the current state of the world LNG market to really understand how North American production fits.

This is a bit dated and predates the rise in oil prices.

http://www.eia.doe.gov/oiaf/analysispaper/global/index.html

http://www.bechtel.com/all_aboard_the_lng_train_48.html

I am having a hard time seeing how LNG will ramp up enough to supply all of the world who would like it. The belief is that natural gas will compete with coal. This keeps a cap on what suppliers think that it could possibly sell for. Also, there are other natural gas usages that would seem to require less infrastructure, like making fertilizer and making compressed natural gas for local use.

Regarding the continuous drilling campaigns, one company (I forget which one now) said they had developed skids so that they could move the drilling rigs from site to site, without disassembling them. This allowed them to get greater usage out of the rigs! Punch out new wells, as fast as possible, day after day.

Don't disagree on the LNG ramp up but its doable as far as building the terminals. Once NG prices are high enough political opposition will dissipate. I think we are setting ourselves up for pain not building them fast enough to compete on the world market for LNG like we do for oil. However the net result is that we probably won't see any significant expansion in overall NG supplies.

It's interesting that the way things seem to be working for NG is exactly the same that I've proposed for oil.

Technical advances -> flat to decline production at the expense of depletion. Of course for oil I argue it started back in the 1990's so we are on the verge of collapse down to a much lower production level.

For NG the same end result as conventional gas depletes we drop down towards about 50% of the current production and then slowly decline as we use up non conventional reserves. This gives non-conventional another 10% room to grow with LNG becoming very important part of the mix.

And of course as usual its a sure bet that the US makes exactly the wrong decision. We should be aggressively using LNG now and save our internal NG supplies until later.

However I suspect that the US will instead begin to seriously exploit its coal reserves displacing NG for electricity production. Still no cheap NG but I really suspect a big push to coal fired plants over the next few years.

A pretty good report here.

http://www.netl.doe.gov/coal/refshelf/ncp.pdf

I don't think it so much coal competing with NG going forward as coal making up for shortfalls in NG supply.

Yet again as usual we did not build enough coal fired plants when we should have before global warming became a serious issue. They should have built like mad to get grandfathered in. Its a good thing they did not from a climate perspective but as you know the US electric grid is not in good shape itself.

Trying to bootstrap the move off of oil will be all the harder as we put in coal fired plants in a expensive post peak environment. For example rail expansion to supply the coal would have to compete with expansion of electric rail to use the electricity generated from the coal. And you have the danger in a real sense that CTL will take off misdirecting coal from supporting conversion to electric transport and move to renewable electricity generation.

Although overall prices are hard to predict I think we have passed peak cheap NG in North America in particular and probably most of the world outside of the middle east.

Here's my predictions of the way the US LNG market would go with a focus on electric generation, from 2004:

http://www.energypulse.net/centers/article/article_display.cfm?a_id=623

One big unknown was whether LNG suppliers would prefer long term contracts or would play the spot market. It looks like a mixture but many are wishing they had more for the spot market.

I don't exactly agree with the expectation that new NG fired plants will be built. I think that NG fired electric plant construction is pretty much over except for momentum so LNG imports would be geared toward supplying current NG plants with growth of coal fired plants making up any increase in electrical usage.

You still have a fairly big crunch in electricity generation looming it seems.

It takes time to build both the LNG terminal and the coal fired plants and I'm skeptical of any serious overall increase in NG supply.

I find it funny that the McMansion owners that somehow manage to escape the housing bubble bust are probably going to get wiped out with massive increases in electric bills over the next few years.

In Southern California where I live as you move off the coast you get into a desert region with very hot summers called the Inland Empire. These people are experiencing a 40% reduction in house prices this year skyrocketing gasoline bills and I'm sure massive electric bills with outages this summer. This situation is pretty much true for the entire central valley region of California. So although I don't know about the end of suburbia and the rest of the US I'm pretty sure it will unfold at least in California's central valley region. And of course once these homes drop under 200k it will suck the significant population of fools in California causing the coastal region housing prices to collapse. California seems to naturally attract the dumbest least successful people from the rest of the nation. Yes I'm here :) But the lack of common sense is amazing.

So we should have a good test of Kunstler's concepts unfolding in the central valleys of CA over the next few years. I've got high hopes that my own town of Irvine where the subprime loaned was create will soon get hammered. Although tough times are ahead for many, Orange county CA truly deserves to be vaporized. Sorry for the rant but its hard for me to feel much sorrow for Americans living here.

If they get wiped out due to rising costs for cooling they really are not thinking too well.

It is possible to rig passive cooling yourself, with a little ingenuity, for instance building yourself solar thermal hotwater collectors is on the level of popular mechanics stuff, and would not only provide the hot water but would decrease the heat on your roof by the same amount.

Building a rainwater collection reservoir is also not rocket science, and can act as a heat sink.

Air source heat pumps are not very expensive, and stretch electricity efficiency by between 2.5 and 4 times.

If they can stretch to a solar power system it is an excellent match to power a heat pump, as the hours when it is needed are pretty much the same as when it is abundant.

Insulation or just white paint can help a lot too.

Remember I said Southern California :)

Sigh you would have to live hear to understand. People will go into foreclosure before they turn of the AC.

Its all about appearing wealthy. What if the neighbors dropped over and your house was hot. And you deserve a cool house when you got back from that long drive in your air conditioned car. Who wants to step out of a nice air conditioned BMW into a sweltering house ? Also the Homeowner associations would never allow the types of modifications your talking about it would detract from the property values. The houses are built to close together for ground source heat pump field lines and you would not get a permit to put one in anyway even a vertical one.

I think Air Source heat pumps are used although I've never seen one. Physically to me air source heat pumps look a lot like air conditioners so its not obvious to me at least how to tell which is which just looking around out the HUMMER window.

I don't think the big builders put them in. Although I'll admit I can't find installation numbers. Certainly people that build custom homes on land they purchased look into these sorts of solutions but in general most of the land is sold and built out as large neighborhoods not piecemeal. So it depends on what the big builders do.

Whats sad is even with the hot summers given the amount of Sunshine and PV systems and some correct design houses in Southern California could be energy neutral or even positive overall. Also you get some good coastal breezes so decent wind power is possible.

Water is a big problem so probably not near the population level but your right a very sustainable community could have been created here. Probably will one day in the future I think thats what makes me so sad even with water being tough to come by it could have been a very nice place. But most of California is like that it would and one day will be a nice place for low density rural living with a few coastal sea ports.

As property values plummet I would have thought that homeowner associations might adopt a more liberal attitude to modifications when numbers of properties get abandoned.

In America (yes, I have stayed there) I can imagine it suddenly becoming fashionable to go for eco-living, and white roofs suddenly becoming the new trend , or better yet greenroofs.

The essentially conservative nature of American society makes new paradigms very powerful, and once they take hold can lead to faster change than in Europe, I feel - no one is going to want to be the last to display the new accepted behaviours.

One should never however underestimate the power of human stupidity.

You really don't understand southern California. Everyone here will keep going till it does not work anymore then leave for other better places. People live here for the lifestyle once thats gone they are gone.

Now the northern half of the state starting at say Santa Barbra does have a increasing percentage of people that genuinely care about the their community. And as you get into the central valley the farmers at least care about how they make a living. So as you head north it gets semi-normal at least for California standards.

To give you and example I used to work for a company that was on the other side of the 10 highway in Santa Monica. I live about 40 miles away when I was hired on they promised they would open a office for engineers south of LA which would map well to where all the engineers lived. Santa Monica for some reason discourages reasonable bus routes or a subway line out from town so commuting by train was not feasible. The area was really only reachable by car.

http://en.wikipedia.org/wiki/Santa_Monica,_California

The dropped the plans for the office because it was too expensive but the CEO who lived near me flew to work in a helicopter because the traffic was to bad to drive.

Thats a taste of how things work in southern California. Do you really think 5 billion dollars is to much money for Santa Monica ?

Ok, I'll give you SoCal! :-)

I do think you are painting with too broad a brush though.

If you are pointing to specific problems the US has, and using that to predict an inability to adapt, then other areas where those conditions are not so pronounced or do not obtain presumably have a better chance, or the conditions you give are irrelevant.

For instance, you point to the state of the infrastructure and dispersed suburbs as a major source of disruption.

Well, if they state of Switzerland's infrastructure is ruinous, it is news to me.

The same could be said of France, Germany, Holland and Sweden amongst others, not to mention Japan, and none of the above suffer from over-dispersed suburbs.

If you hold debt to be a problem, then China must be favourably places with it's massive savings.

Things are going to get gruesome, but not equally so everywhere.

memmel,

Your analysis seems long on resentment toward your town (and why?) and short on evidence to support your assertion about the Death of the Inland Empire.

Sure, hot summers make for expensive electric air conditioning bills. But compare that to heating bills in Maine, Vermont, Massachusetts, NH, etc. I do not see the inland areas of SoCal as having anywhere near the highest heating/cooling total costs per year. Plenty of East Coast places have hot sweaty summers and very cold winters. Ditto for some plains states and Minnesota.

What would be useful: a good table of heating and cooling costs for various regions of the US.

That is an interesting report you linked. According to the report, this is how EIA projections for US natural gas have changed over time:

Also, the EIA is projecting that only a tiny increase in electricity generating capacity will be needed going forward. FERC is projecting more. I suppose if I were the EIA, and I looked at the natural gas outlook and the realistic outlooks for increasing number of coal and nuclear plants in the next few years, I would scale back my view of what was needed for electrical production. It is embarrassing to forecast something that is needed that can't really be done. With the lower electricity generation needed, one also cuts back on the amount of new transmission lines needed (but not the replacements needed).

Yep you can see the fairly large gap developing in US electricity generation. The blackhole in road maintenance is even larger. Similar problems exist for our sewage and water treatment plants.

http://www.ens-newswire.com/ens/feb2004/2004-02-20-10.asp

Its interesting that when a economy takes the approach of growth at all costs it tends to not maintain any of the existing infrastructure. I guess to much money gets poured into new projects.

And in California at least the network supplying Southern California with water has serious problems.

http://igs.berkeley.edu/library/htInfrastructureProposal.html

I'm sure the entire western water management system is probably in bad shape.

Not only have we massively miss-allocated our resources but we did not even take care of the infrastructure correctly allocated or not.

So this is the strong foundation America has built for itself to support it as it transitions of oil.

Needless to say I always get a big kick out of the anti-doomer posts. About the only thing funny about whats coming is people believing we wont have serious problems.

Nuclear powered CTL will save us yeah right and this is supposed to make all the steel, tar and concrete we need to rebuild with. If its worthwhile to turn coal into liquids and tar into gasoline it seems to me concrete and steel won't exactly be cheap. Dream on as your prius is crushed by a badly decayed bridge and falls into a sewage filled creek. I don't think people really can grasp the full extent of what we have done. But I'm pretty sure we will be the evil ogre's in our grandchildren's plays.

One slightly irritating tendency is that of Americans to generalise from their own circumstances to that of the the world.

It is inevitable in a continent wide superpower, but just the same the failure of America to maintain it's infrastructure should not be universalised, although there are problems elsewhere to be sure.

Compared to the resources which have been poured into McMansions,massive shopping malls, SUVs and so on those needed to build infrastructure and power are slight, even in a constrained environment.

Priorities would have to be got right for once, but as Churchill said, Americans always do the right thing, after they have exhausted all the alternatives.

I would not be too ready to abandon all hope.

It is usually self-defeating.

I'm not talking about abandoning all hope. But the first thing we have to do is face up to the fact that we i.e the entire globe has really screwed up and we will pay a painful price. Then at that point we can figure out ways to ease the pain. Its like Alcoholics Anonymous the first step is to admit your an alcoholic. Only then can you recover. The US is the worst but other countries are not all that much better.

No one wants to admit the obvious and without that we won't make the painful choices we need to make to get better. Their is no easy way out now its pay now or pay more later. The longer you wait the more painful it will be.

And as far as the rest of the world goes its a game of toss the hand grenades in a crowded room sure the US is setting on a big pile of them while playing, but everyone is playing the game.

I hadn't really thought about the connection between growth at all costs and failure to maintain the infrastructure. Clearly, we will have so much money later, that we can do the repairs later. It is like paying back our debt on loans - only a different kind of indebtedness.

Gail you should check some of the numbers on our roads using even todays numbers they are mind boggling.

Post peak costs are simply beyond.

Also consider that by the point this gets serious its post baby boomer retirement and we will have a tremendous debt in unfunded social security and bankrupt private pensions to deal with.

In short within 15 years post peak the US government is probably technically in default along with almost all the private and state pension funds. Once growth goes negative all the pension schemes blow up.

We are going to be lucky to put in absolutely needed rail infrastructure and stop gap coal fired plants.

Sure they might inflate away the pension debt etc and go in default but we still need hard cash for the rail and plants. You can't inflate away infrastructure costs only debt and attempts at old fashioned money printing will only send imports soaring.

The only solution is to embark on electric rail yesterday. And I hate to say this coal fired electric plants today. I don't like the idea at all but our backs are to the corner and if we don't do them now it will be all the harder later. Wind, Nuclear etc can be brought online but we have to buy some breathing room.

If I thought we really had a choice to not do coal fired plants I'd suggest it but we don't. Waiting just makes it harder and more expensive to put them in. And they won't be fancy plants just basic ones.

Also if you think about it on the C02 level if we flipped to electric rail and coal with a strong wind power program the overall CO2 budget is almost certainly lower than driving cars and doing CTL schemes.

Use todays scrubbing technologies to do our best. But I think if we simply let the roads degrade and/or flip them over to expensive toll roads and do rail/coal fired the C02 emissions won't be all that bad.

And the wind power push should start bring the number of coal fired plants down within say 50 years at most.

You would have to look but overall it might not be as bad as it looks at first glance.

In any case we can of course wait till the last minute and I think still pull this off as the last resort but with the pension thing and other monetary instabilities it bothers me to wait.

You have heard me say some of the same things about pensions. I am not as sure about electric rail. By the time we get them built, I am afraid we will have major problems with electricity, especially in the Northeast and California. I doubt very many coal plants will get built. We will need additional rail, just to transport the coal.

Correct but its still doable. And of course big PV/Wind tax credits and serious peak usage and max power charges would help along with a aggressive tax on large cars. So you have ways to begin to force other demand downwards. Basically hefty energy pig taxes. Keep the economy limping along and we should be able to slowly work of the pension burden plus supporting dense living and pensioners apartments could easily dramatically cut the cost of retiring. So missing pension money could be made up via pensioner's apartments in exchange for no money. So you get a choice take the apartment or pray. These apartments would do double duty as a WPA like work project for the decimated building industry. Same for the railroads. Then you could move on to workers apartments. Hopefully better than soviet era flats but pretty much the same approach. I'd hope that if the workers where rewarded we would get decent buildings. These pensioner flats don't have to be in vital business centers but could be located in some of the closer in former suburban areas.

In short the US should be able to do a better version of soviet housing and transportation network.

If they are nice enough they may act as new town centers and draw in a real downtown and increase in value

giving those that want to sell a chance to retire back into the now cheaper countryside in exchange for their flat.

A cluster of downtowns model works out about the same as one central downtown area from what I can tell.

And its actually the reality in most large cities.

One country which appears to be in a bigger hole than the US is the UK, my own country, having arrived there by monumental standards of incompetence.

We have a huge energy gap opening which they intend to fill with LNG imports, having built the terminals at a cost of many billions.

Unfortunately they have neglected to secure the supplies, and so far they are unused - the financing was set up so that that did not affect the people who ordered them.

Many Gigawatts of nuclear and coal plants are reaching the end of their lives in the next few years.

Short of building off-shore at monumental cost we have limited wind resources, and whatever may be the case in California for the foreseeable future solar power at this northern latitude is an expensive distraction, contributing almost nothing when it is most needed.

Nuclear takes a while to build, and TPTB display no sense of urgency whatsoever.

I had imagined that in practise they would build more coal plants, but it seems that the build time for them is almost as long as for nuclear, so it looks as though we will be very cold very soon.

I wonder if you would comment on coal plant build times?

Nice to see the EIA finally getting close to reality. They now need to move their production peak back from ca 2016 to 2008. Murray

Back in the late '70s there was a major surge in drilling that had little impact on production, but left a lot of mothballed rigs. Back in 2004 when I started investing, close to 40% of "available" rigs were not operating. Most of the surge since has been getting all those rigs operating. If you look at the monthly rig numbers for 2007 you will see growth in H1 followed by flattening in H2. My conclusion is that there is little to no spare rig capacity, and that therefore the growth of unconventional production of the last few years will now plateau, and by 2009 will no longer offset declines. This is one of the key issues for you to discuss Gail.

One of the first EIA graphs you presented had LNG getting to near 6 Tcf/yr by 2020. That number needs to be quantified in terms of ship cargoes/yr, and then compared to actual shipping and shipbuilding capacities, (for these highly specialized ships). The EIA projection for 2010 made ca late 2003 isn't going to happen, mainly for lack of shipping capacity. Note that far the bulk of the worlds LNG tankers are dedicated to specific routes, and not available for spot cargoes.

Congressional testimony in 2004 mentioned unconventional well production rates declining up to 60% in the first year. If memory serves, the global average decline rate for all USA wells went from 18% the first year in the late '90s to about 28% in 2004 or 2005. It could be above 30% now, and is surely growing.

Perhaps these thoughts provide some other areas for discussion. Murray

Good thoughts - thanks.

Getting the mothballed rigs producing again seems like a big thing. Little question -what's H1 and H2?

I wasn't aware of the congressional testimony on decline rates. The Wamsutter facility is new, so I am guessing that they don't have good information about decline rates yet.

First half year and second half year.

Hmm what about profitability ? I can see that getting mothballed rigs making money again makes sense but to grow from here on out NG would have to be fairly profitable. Its not unlike the big surge in oil production once prices increased. This was spare or easily brought on line capacity and made sense but we see little growth once serious investment is needed.

We saw the same big drilling campaign then pull back when the US peaked in oil production.

It seems to be a common pattern. It seems that for some reason the oil/gas industry has a hard time raising money for the big expansions needed to keep production up down slope. I guess the risk/reward must drop off.

One thing we have never had a post on is the various ways projects both large and small are financed and the competitiveness of the oil/gas industry vs other investments. The payoffs must be such that infrastructure expansion i.e new drilling rigs etc is hard to accomplish.

Also of course you have a sort of cannibalism effect where its more lucrative to buy existing fields then expand into new ones. This takes money out of expansion. Expansion of existing fields that are producing to offset declines per field becomes a better investment vs new fields which tends to slow growth.