Saudis announce oil production increases...again...and again...and again...

Posted by Jerome a Paris on June 23, 2008 - 9:29am in The Oil Drum: Europe

Saudi Arabia has announced, once again, that it was increasing production:

Saudi Arabia confirmed it would pump *9.7m barrels a day* next month, an increase of 200,000 and the highest level in nearly 30 years, as it repeated its standard offer of extra barrels if customers demanded them.

The kingdom also reiterated its promise to expand production capacity, noting that it expects to achieve 12.5m b/d next year and could add an additional 2.5m barrels – if needed – after that with a massive investment programme.

And of course, we can believe them! Just like when they announced this last year:

Saudi Arabia's oil production reaches 10.8 mln bpd

RIYADH, July 31 [2007] (Xinhua) -- Saudi Arabia's crude oil production capacity has reached *10.8 million barrels per day* (bpd), the country's state oil company Saudi Aramco announced Monday.

(...)

Saudi Arabia is the world's largest oil producer and exporter and plans to raise its production capacity to 12.5 million bpd in 2009.

Or this:

SAUDI ARABIA READY TO BOOST CRUDE OIL OUTPUT

Saudi Arabia, the world's largest oil producer, announced August 11 [2004] that it was ready to increase the Kingdom's crude oil production to help reduce and stabilize high oil prices. The Kingdom estimated that it could increase production by 1.3 million barrels of oil per day (BPD) if necessary.

"The Kingdom of Saudi Arabia, in collaboration with the other OPEC member countries, endeavors to ensure the stability of the international oil market and prevent oil prices from escalating in a way that may negatively affect the world economy or oil demand," said Ali Al-Naimi, Saudi Minister of Petroleum and Mineral Resources, in a statement released to the Saudi Press Agency.

Naimi noted Saudi Arabia already increased oil production during the past three months to meet the growing demand. The increases amounted to over one million barrels per day, bringing to over *9.3 million barrels per day*.

Or this:

Bush fails to persuade Saudis to cut oil price

[26 April 2005]

While the talks were taking place, a Saudi spokesman outlined a plan to the media that would involve spending $US50 billion ($64 billion) to increase production capacity to 12.5 million barrels a day by 2009 and to 15 million barrels a day in the subsequent decade. The Saudis currently produce *9.5 million barrels a day*.

The National Security Adviser, Steve Hadley, welcomed the announcement, saying that when the Saudis increased their production capacity, this was bound to have a "positive effect on oil prices".

Or this:

Saudi Plan to Boost Output Opposed by Some in OPEC

Sept. 11 [2007] (Bloomberg) -- A Saudi Arabian-backed plan to temper high oil prices by raising oil production at today's OPEC meeting in Vienna is meeting resistance from Venezuela, Algeria and Libya.

Oil prices above $77 a barrel are a burden to consuming nations, prompting some Persian Gulf producers to discuss raising OPEC quotas by at least 500,000 barrels a day at the meeting today. The group's biggest producer, Saudi Arabia, proposed an increase, Iraq's oil minister said before the talks started.

So we see that the Saudis seem to be regularly announcing or promising production increases to supply the market - and yet always seem to have production around 9.5 mb/d after such increases...

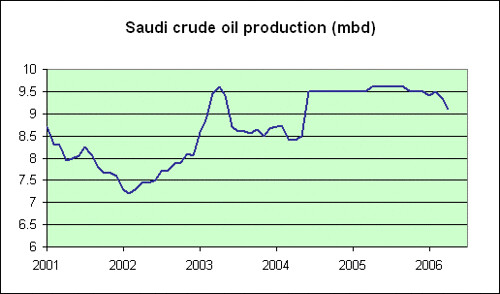

And it's no wonder: that's where their production has been for the past several years (graph from a 2006 Econobrowser post)

If you're wondering how it's possible to announce increases every other year, and still produce the same, it's simple: there are (more discreet) production decreases along the way.

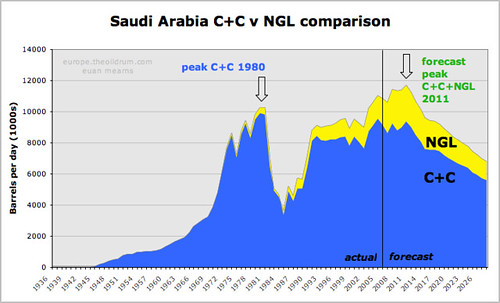

Also, the Saudis like to play on the easy confusion between different numbers. The graph below, prepared by *Euan Mearns* (and most recently posted by him in this thread) explains this:

There are really two different numbers: one is what is traditionally called "oil": it's the blue bit above, and it's also called C+C (for crude and condensate, condensate, to simplify being the oil found in gas fields). The other (in yellow above) is what is called "liquids": it includes oil and a number of other liquids that look like oil, including NGL (natural gas liquids: other oil-like liquids found in gas production) and many others - biofuels are included in that number in those countries that produce them, for instance).

Saudis repeatedly maintain the confusion between the two numbers. The 12.5mb/d capacity that they have promising many times for 2009 (which by the way means that today's suggestions that they will reach that level are nothing new) refers to all liquids, for instance, not just to oil. With overall liquids production above 10.5mb/d already, that means that either they have much less spare capacity than they claim, or that the increases in overall capacity by the end of the year will be insignificant.

An added twist to that is noted by David Cohen over at ASPO-USA in that the Saudis are currently making no efforts to supply the market with their existing available capacity, by refusing to compensate potential buyers for the lower quality (full of sulfur) of that crude:

Saudi Arabia is offering greater volumes of Arab Light (33.4° API, Sulfur 1.77%) and Arab Extra-light (37.2° API, Sulfur 1.15%) in the June/July production hike. Arab Light crude is called "sour" because of its high sulfur content. Refiners who can process this oil will take it only if Saudi Arabia lowers the asking price. US refiners see extra Saudi oil offer [as] too pricey tells the story (Reuters, June 16, 2008).

"They [the Saudis] can offer all the oil they want. The fact is they want too much for it. There's cheaper oil out there right now," said a trader with an independent U.S. oil refiner.

Saudi official selling prices for the United States currently list Arab Light ARL-OSP-N at a nearly $3 per barrel premium to comparable U.S. domestic crude grades like Mars MRS- -- even before the cost of shipping oil from Saudi Arabia is taken into account.

Traders said they would be willing to increase purchases of Saudi crude, if prices were lowered.

Asian refiners like China's Sinopec, who are operating at a loss, are "choosy" about the the oil they buy in order to keep their costs down (Reuters, June 16, 2008). Many "simple" refiners in Asia would prefer a crude mix that includes more medium or heavy oil, not the pricey Arab light Saudi Arabia is offering. They also want these lower quality grades at a reasonable price.

Although margins for processing the kingdom's heavier grades have plummeted, Aramco has also cut the discounts it offers on these grades to their lowest levels this decade, while keeping prices of its lighter grades at relatively high levels. [emphasis added]

In addition to keeping oil off the market in 2007, the Saudis have raised prices on all of their crude grades beyond what the refining market can currently bear.

So, in short:

- Saudi Arabia is promising the oil (and/or production capacity) it has been promising again and again over the past 5 years;

- they are claiming to have spare capacity when numbers suggest that it is much lower than they claim, and made up mostly of "sour" crude that refiners might be interested in (if they can actually process it) only with deep discounts that the Saudis won't offer - so it's smallish, inconvenient spare capacity created by, effectively, offering it for sale at a price significantly higher than current market prices;

- they keep on playing with the various oil qualities to announce numbers that are not comparable to one another - but which they nevertheless proceed to compare in their announcements - not surprisingly enough, to make things look better than they are.

Dave Cohen makes an interesting comparison to the Texas Railway Commission in the 70s - go read it. He notes that the point where a cartel lets its members produce flat out is the moment when it becomes impotent to control the market. We seem to be at that point with OPEC today.

Which makes Bodman's announcement today all the more worrisome:

U.S. energy sec: more oil needed to tame price

Producers must pump more to ease the pain felt in the United States and elsewhere from record fuel prices, U.S. Energy Secretary Sam Bodman said on Saturday.

He blamed tight supplies for fuelling a rally which lifted oil close to $140 a barrel this week, sparking protests across Asia and Europe.

(...)

Bodman said prices would soar higher if more oil was not forthcoming.

"In the absence of any additional crude supply, for every one percent of crude demand, we will expect a 20 percent increase in price in order to balance the market."

This has been my theme for a while, but here it is, in stark terms: when supply is constrained and demand growing, market balance must be achieved through demand destruction; with a commodity as precious and necessary as oil, demand destruction is _hard_ to get, and requires massive price hikes.

And things are even worse that Bodman notes: the problem is not just the lack of additional crude supply, but the actual drop in exports as oil producers, which are all, unsurprisingly, enjoying huge economic booms, consume more of the stuff themselves - volumes that are directly taken out of the markets and not subject to price mechanisms.

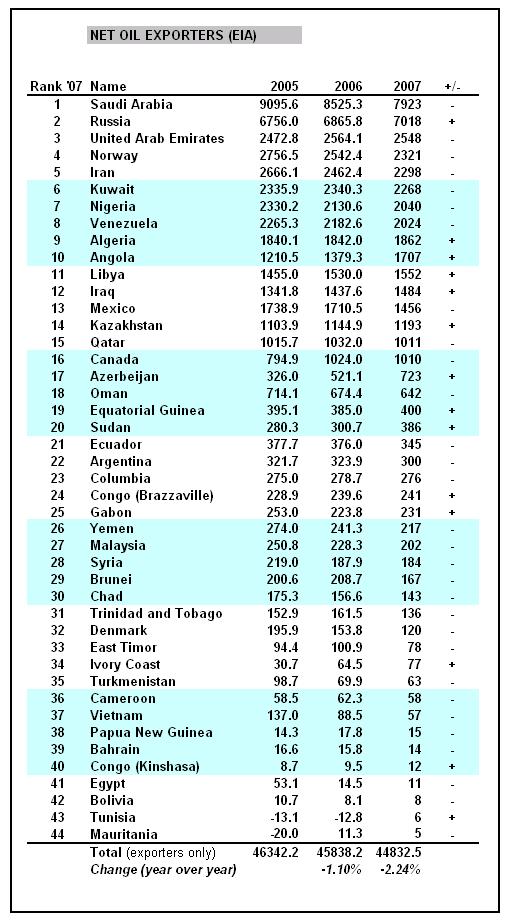

See this table (from this recent post by *Datamunger* and *westexas*), showing the main exporters, and their export volumes:

Production is stagnant, and exports are actually shrinking rapidly.

So not only the Saudis are blowing smoke when they repeatedly announce production increases, but their exports are actually been going down quite significantly lately.

And of course, as the FT article I quote at the top notes, there are additional worries:

Saudi Arabia’s decision to pump more oil than it has in nearly 30 years risks being completely negated by the sharp drop in output caused by attacks on production facilities in Nigeria.

Nigeria now pumps less than 1.5m barrels a day, its lowest level in 25 years, rather than the 2.5m b/d it has the ability to produce, according to officials attending Sunday’s high-level meeting in Jeddah, Saudi Arabia.

This post was written for the European Tribune, where it is part of the Countdown to $200 oil series

What I found interesting is that the King put current production at 9.0 mbpd (C+C presumably), when the media has been claiming 9.45 mbpd.

I've become of the opinion that there is a cultural difference at work here. While we attach more importance to the accuracy/precision of a number, the Saudis (at least the ruling class) focuses more on the symbolic value. Thus the tendency to always allot additional increments in blocks of 100,000 bpd. Call it creative rounding.

The King wants to emphasize the generosity of the increase. Therefore round down (way down) the current production to 9, round up the new production level to the nearest 100,000 increment, and call it good. Another twist is to backdate the starting production value and really come up with an impressive increase. Or, just muddle everything by using flexible definitions of what oil is, or what "capacity" means.

Oh please! Or with all due respect, I respectfully disagree.

Yes there are cultural differences but the nice thing about numbers is that they are universal and 2+2 always equals 4, in every culture.

The difference you are observing is the difference between a desire for accuracy and need to obscure accuracy, not the inability to understand it or achieve it in universally accepted terms.

It is actually insulting, not "understanding", to suggest that the Saudis don't understand what accuracy and openness is because of their culture. Let's all start from the assumption that they understand the reality of the situation as well or better than we do.... In that context we can interpret their statements to mean that they have an interest in obscuring what they know, and reducing the certainty of buyers about the reality of their production capacity.

Westerners aren't the only ones who can do math, oil field engineering, or economic projections.

I'm not questioning their ability to do math, or applying it functionally. You are essentially saying the same thing that I am, but maybe putting more of a value judgment on their obfuscation of the data. All cultures have their own way of twisting numbers to obscure reality. I just think that theirs is different from ours. The disjoint between production figures reported by different levels within Saudi Aramco and by the ruling class to me suggests something more than carelessness.

In any case, a value of 9 mbpd for current production should not be taken seriously.

We can apply the same logic to Washington, can't we?

The King wants to emphasize the generosity of the increase.

Either way, we need to stick to a consistent metric. If we haven't taken them at their word in the past - when they said they were producing more - why should we if they say they are producing less? If we like the IEA metric or the OPEC metric or the EIA metric, we need to stick with it. Otherwise, we can mix and match metrics and come up with funny answers.

This is just a conjecture. But could it be the Saudis are out of touch with reality? For twenty-five years they were the swing producer and kept the world economies mostly stable and growing. Now things have changed and the top bureaucrats in Aramco and in the KSA ruling class are perhaps like Halie Salasi--who in his last years still thought he was still ruling Ethiopia after he was deposed. They would like to keep the price lower but they can't just like Texas Railway Commission lost control of setting the oil price in 1973. Did the Texas oil tycoons in 1971 see they were going into decline?

Most of the oil patch types that I have talked to were surprised that production started falling in 1973, after the Texas RRC went to a 100% allowable in 1972.

Perhaps the claims of over 10.8 mbpd included NGPL? I don't know what the estimates were, a year ago, but current estimates for July 2007 (your second quote), put total Saudi production, including NGPL, at 10.04 mbpd. That's still short of the claimed 10.8, of course.

The king used an interesting form of words when "promising" to increase supply, if needed. The BBC reported it as:

How does Saudi Arabia expect demand to materialize, when there is not enough production to increase demand, or when prices are too high (because of restricted production) for people and business to afford to buy more?

Re-read the quote:

"Saudi Arabia's crude oil production capacity has reached *10.8 million barrels per day*"

You probably thought they were talking about production because that's what the first number was about. The juxtaposition of those two numbers - seemingly-comparable, but actually talking about apples and oranges - is unclear writing, and I suspect will inadvertently lead more than a few people to jump to the same wrong conclusion you did.

Quite right, Pitt. Perhaps the quote was included because the news headline claimed production reached 10.8 mbpd, not that production capacity reached 10.8 mbpd. I wonder if Jerome made the same mistake, since he highlighted the number but not the word "capacity".

Thanks for the correction.

Anyone can claim any production capacity they like. But it's meaningless until they actually produce something.

It's like if you apply for a job, "I can produce 1,250 hoodgiflops a day!" the potential employer will say, "Hmmm, okay, we'll try you out and see..."

Scotty says to Captain Kirk, "we can do warp 9.5 Skipper........ but not for long, we'll blow up".

I seem to recall that Bush went to Riyadh twice to ask for more. Perhaps the king doesn't see him as a customer?

Driving my kid to school this morning[Monday morning we all slept in and he missed the bus},had to listen to his god-awful radio station,cheerful young newsreader told me Saudi Arabia has agreed to boost production.Expect the price of petrol to come down...although it might take a couple of weeks to flow through.

Sounds like SNAFU.

Unleaded in Adelaide $1.67 per litre.

The Saudi Royals gallop around on prize thoroughbred horses, brandish gigantic sabers and travel the seven seas on 400 foot yachts. Who says they have to be in touch with reality? I mean they're basically the kings of the world as the western world grovels at their feet like lowly beggars begging for bread scraps, it is not their problem too baby along our civilization. I think the real oil began crisis began 40 years ago when we started importing oil in some sort of capitalist free-market drug induced hallucination, where we believed everybody could trade their infinite amounts of resources with each other into a magical world of prosperity and spaceships. We have all lost touch with our roots.. Those who don't learn the mistakes of their past are doomed to repeat them..

Beautiful imagery there, SoD.

Putting aside political and ethical issues, and taking as a given that the Sauds have mined their oil facilities to put a high price on invasion, how long would it take, at what cost, to rebuild them? Maybe with the fields as depleted as they are it just wouldn't be worth it?

Thanks, I would think that would depend on exactly how they mined their facilities and all, would they just blow up their infrastructure or the actual pipes in the ground themselves, making the invader have to re-drill every single field? Either way I would bet it would take more than three decades to get anything near previous extraction rates, because this is about the period of time it took for the saudi's to get expand their own production in the periods other than after the 70's and 80's when oil prices were low and not much effort was being made to increase production. The fields would likely be declining at ridiculous Cantarell like rates due to the fact secondary and tertiary recovery technology is being used, and you would likely have to replace all that salt water injection infrastructure, so It would be the most god awful desperate move in the world to invade KSA. I mean it would be like a starving Somalian child trying to swim to across the Indian ocean to find food. You might look at joules burns blog for information on Saudi oil infrastructure and look at the Iraqi Invasion and see how those fields were manipulated. I can't see how it would be worth it even purely economically because invading Saudi would collapse the world economy no doubt about it with supplies as tight as they are. Although being aware of history much less logical invasions have taken place.

http://satelliteoerthedesert.blogspot.com/

Two comments--As soon as oil became more expensive than ag products and weapons, the US became a loser in the game, but certainly didn't think that then, or even now. Second, it would take far more than 30 years to reconstruct as there's already a massive backlog in the logistics realm.

"It's not their problem to baby along our civilization."

Actually to a large extent it is, since our civilization is the only thing that makes their oil worth pumping.

Not anymore, if you ask westexas, you could see how Saudi's internal consumption rates are going to infinity and beyond.

Except the main reason they have increased internal consumption is because of their wealth, which exists only because other people consume their oil. Their economy has virtually no existence independent of "our" economy. Which is not to disagree with anything I understand WT to be saying.

So, I have asked it in the DB and will reiterate it here. Why have this meeting in Jeddah? What did it accomplish? If it was supposed to calm the markets and assure the world that everything is under control....shew...it was a bust. If this is the best KSA and the world leaders can come up with to mollify the masses, we are in for a sh*tstorm once things really go crazy with petro prices. As some have said about the financial markets, instead of being in the 7th inning in the game we are perhaps just getting to the 2nd inning. In other words, we are closer to the beginning than the end.

Checking the opening numbers overseas...doesn't seem that anyone is buying the KSA boost or at least putting any stock in it(sorry couldn't resist).

http://www.upstreamonline.com/market_data/?id=markets_crude

TAPIS is over 140 again.

I'm not sure the meeting had to accomplish anything substantive. The press and politicians will talk as if it accomplished something. Bloomberg, for example, had a story up for more than two hours after oil opened today, with the headline "Crude Oil FAlls on Saudi Production Pledge, Nigerian Cease-Fire."

The problem is that I have a real-time Nymex ticker, and I was watching it when oil opened because I was curious. In fact, oil went up at the open, and it has stayed up ever since the open. Oil falling because of the Saudi pledge was a pure fabrication, presumably designed to advance the meme that the Saudi pledge will actually lower oil prices. In the "magical thinking" that dominates much of the world, it is the spin that matters, not the substance. So expect to see the crap spun out of the Saudi pledge over the next few days.

As I said in a post on the run-up to the conference, Saudi should have admitted Peak.; IMO, they wasted a golden opportunity by not. Perhaps they are waiting for Bush and Cheney to leave, which doesn't make sense as the Middle East Oil Grab is a funadamntal bipartisan policy. As I predicted, we will see the price continue to rise, followed by more recriminations, and then someone will call for another conference. And as I mentioned before, I think it a strategic decision on the part of Saudi/OPEC to keep the oil market just on the edge of chaos as it serves to deter more warmaking by the US Empire and its ally Israel.

I have to assume that Bush and the Saudi owners have more in common with each other than with the rest of us lemmings. My guess is they were discussing the placement of the cliff to the mutual advantage of their respective "constituencies". Would the President of the US sell out any number of thousands of US common folks for a wealthy bin Laden? In a heartbeat he would. It's all about "shared interests".

cfm in Gray, ME, Airstrip 1

The mideast culture is one of deception that has been developed to a high art form over thousands of years. They obviously think quite differently than the western world does. Kipling's quote that "East is east and west is west and never the twain shall meet" referred to the mideast and not the far east as most seem to think.

It's the western world that is out of touch with reality when it fails to take this into account and tries to apply the western thought processes to the mideast. If your shocked by the current example get over it. You probably haven't seen anything yet

And Western culture isn't "one of deception" too? Seems to me that the Neocons and Blair and those beffore them have developing it into "a high art form" as well

People are born naked, and therefore, born to deception. Every person from infancy on creates him or herself by the disguises he or she wears. Obviously, clothing is necessary, but not just for protection from the elements.

Deception is fundamental in the human species.

Again, another quick story from a friendly fence-sitter...

Petrol and oil prices have been all over MS this morning. A listener phoned in to Radio 3AW, Melbourne to let others know that a barrel of Ozzie oil is pulled out of the ground for $7 to $8. Then, 90% of what's pulled out gets sent off-shore to be refined (I understand it's a prohibitive investment to do it ourselves) and sold back to us at current exhorbitant prices.

When asked what his job was, his reply was he works directly in oil exploration.

When asked if he thought there was still plenty of oil out there (the only reference to PO I heard all morning), he replied, "Well put it this way: I'm thirty years old and I can't see it running out in my grandchildren's lifetime".

Such a comment out of the blue makes me question the "here and now" of PO (no disrespect to Todsters, of course). Yes, I believe PO is an obvious reality, that crude is finite. But maybe there's a perpendicular fence adjoining the one I'm sitting on; in one yard there's the "only a few years left of BAU", the other, "we have decades".

Though I know I'm "above average" in the awareness department, I'm still not sold on the idea that the top of Hubbert's Curve is only a few years wide. And if I jump now, with that other fence between my legs, I think I'll do myself an injury!

Regards, Matt B

This comment probably doesn't warrant a reply - indeed, many of your graphs and numbers only confuse me further (and I really don't think I have the capacity to soak up all the details anyway!). Again for the record, I'm merely explaining how I continue to feel, even after months of visiting TOD; that is, undecided.

Hi Hi Joe average. When this person says that Oil wont run out in his grandchildren's lifetime, he is correct. In fact oil will most likely never ever "run out" but the question you should be asking is, at what point will I not be able to afford it, and at what point will there not be enough to meet my, and others, needs. Note I said needs not wants. That point is upon us now.

I agree with Sthpacific. Average Joe and the one agreeing, what you have to keep in mind is the scale of oil production versus demand. You could have a trillion barrels of oil in the ground, but if the world needs 90 mbd and only 85 can be produced, then prices will skyrocket and production will fail to keep up with demand. At some threshold price the world economy will contract and the average Joe will not be able to afford to fill up the transport module or even the lawn mower.

The stuff will become like platinum. It exists but who can afford the stuff in any amount worth using? Very few is the answer.

Hi Matt,

I have been enjoying your posts ,I feel I am traveling a similar path to you ,and we are both going in the same direction.

Good luck on your journey

Will.

Hey, Will. Does this stuff keep you up at night as well? I still can't get my head around the fact that MS doesn't report on the bleeding obvious: That crude is finite!

Regards, Matt B

No Matt I sleep well[I seem to have a low capacity for worrying]

But when I first stumbled on to PO and read the peak oil primers,then investigated more deeply it was like being diagnosed with cancer.I'd walk around looking at things and say "well that ain't gonna last'.

I'm now at the stage where I've discussed this with my family and a contingency plan is taking shape.

But tonite I'm going to see the "Black Keys" so for the next 24 hours my ears will be ringing and all will be good.

Chris Judd is a genius.

Will.

It even seems to get that way with movies! Watching "The Mist" last night (a goodish Stephen King adaptation - same guy that did Shawshank Redemption), I thought much of the plot could have easily been about "when affordable oil runs out". Though, such a screenplay still probably would have needed hideous oil-suckers from another dimension to attract an audience.

The thing that struck me was the slow build up of anamosity, centred around an extreme form of religion, between two distict groups of Average Joes and Janes trapped in the supermarket. Could The Big Fella Upstairs make a come back in a post oil age?

Nice chatting with you.

Regards, Matt B

I don't know if 'the big fella' will make a return, but I suspect many of the adherents will become much more vocal, in a 'this is Gods/Allahs/Jehovas/whoevers punishment for homosexuals/increased sexuality/divorce/birth control/low-rider jeans/muffin pants/drugs/foreigners/technology/other stereotypical beat-up target' way. :(

Aussie oil is heavy stuff.

It's like this, again I'll explain it in plain old Aussie terms. Think of oil as like football. Crude oil is the different blokes in different towns trying out. It's funny how some towns have lots of duds and not many athletic types, while others it's the other way around. So what you have to do with these blokes trying out is sort out the good from the bad to get your final team.

In a town with mostly drongos, it's a lot of effort to find the few useful blokes. So if you knew that some town were mostly good blokes, you'd go there, and ignore the towns of drongos, not worth the effort.

Aussie crude oil is like a town with mostly drongos in it, and no-one who can kick straight. That's why we export the stuff, let some other bugger sort 'em out and send us the good ones back.

More technically, crude oil is made up of different "fractions" - bits - some heavy (like asphalt), and some light (like kero). You have to split those fractions out to do anything with the oil. Different oil around the world is different stuff, some more heavy, some more light.

The reason Aussie oil is so cheap is that it's heavy stuff, and the reason the Saudi stuff is pricey is that it's relatively light. The more heavy the stuff is, the more effort it is to get the kero and petrol and so on out of it. The lighter it is, the less effort.

It's true that oil will never run out. But there will be a smaller supply. And so the price will go up, and up, and...

Thanks, Kiashu. And again I feel like one of those drongos that should have digested the stuff you explained (so interestingly!) by now. Dang!

All the same, this fella did sound genuine (though, now I think about it, he made no mention of the heaviness of Aussie crude - and no way the commentator, Neil Mitchell, would have thought to ask).

Thanks again, Matt B

Slowly, slowly forward.

Joe, peak oil has very little to do with how much is left in the ground - the interviewer asked the wrong question of the 'expert'!

It is the interviewer that doesn't understand peak oil, not the so called expert.

Before you make any plans for the future understand that nobody knows what the future will be.

But, you should realise that at some stage there won't be enough crude oil to supply the world with all it would like to consume. That 'some stage' has been 4 years in a row now - production should have been climbing by 2% a year, instead it is the price that is climbing.

At what stage will you have to start using less refined product? ... peak oil is mainly a transport problem ... make your plans accordingly!

IT is a transport problem, but food is linked heavily because of non-local production of food.

Don't assume you can drive less, and be OK!@!@!

Also, the financial markets will never be the same. Paper wealth will disappear. Retirement plans will diminish greatly. The middle class will become poor again. The American Dream will change from "Live greater than your father" to "Live. period."

Less than three weeks until I'm tested for a motorbike licence; though I do work from home already.

Regards, Matt B

Jerome asks: "Where are you on this MSM?"

You're asking the propaganda system to examine the past and to hold a power-holder accountible. It no longer does that, if it really ever did. Its purpose is to opperate more like Orwell's Misitry of Truth, to obvuscate the past so the present reality will seem correct. Like Wiston Smith, some of us have long memories and saved the documentation from the past, so we can easily see the present deception. The problem lies with the Proles not being able to see the deception, and thus not knowing they need to do something about it. And then there's the rest of OPEC not wanting to raise output because the market is well supplied.

When oil hits $672/bbl it will equal $1/8oz cup. Oil at $135 is just over 20 cents per cup. Gasoline at $10/gal is .625/cup. Will the US propaganda system point out that European motorists are paying over $330/bbl for their $10 gas?

One can also interpret the Saudi announcement as a desparate measure, a possibly futile attempt to 'manage' the market and 'force' prices to stabilize or even fall. Months from now it's unlikely that the MSM will remember or even care if the proposed increase in production never materializes, we'll probably have something else to worry about by then, for example, war with Iran!

The market is unimpressed as of Monday morning:

http://news.bbc.co.uk/1/hi/business/7468555.stm

It seems to have been floating between $130 and $140 for "a while" now. Does anyone think it will get to $150 by year's end (much less $200 as was touted a few months ago). Have things stabilised for awhile?

Regards, Matt B.

Balancing upside and downside risks this meeting hasn't worked to reduce prices.

Some downward pressure might happen as more refineries capable of dealing with heavy crude come on line over the next couple of years, but this is rather longer term than the year's end period you specify.

Since much increase in supply does not seem on the cards (don't forget wt's remarks on increasing demand in oil exporters mean that oil exporters have less to export if production remains constant) then the only thing that could reduce prices would be less demand - either the cessation of all subsidies in the developing world or a whacking great recession, probably both.

For pressure on the upside you have many possibilities, from more disruption in Nigeria, to traders taking fright as the implications that KSA can't substantially increase production sinking in, or any Israeli or American strike at Iran.

Prices then seem likely to rise, or remain fairly stable in the event of major recession.

Either way you aren't going to like it.

Hello there,

I`m not an expert on commodities prices or anything, but going by the changes in prices over the past few years the increase has been exponential. What was it, a 98 percent rise over the past year and 57 percent rise the 2 and a half years before that. The increase in prices is accelerating.

If that trend continued what would stop the price going above 250 dollars by the end of the year if there`s enough dollar bills sloshing around out there? If there`s no recession/depression I mean of course.

Actually, the average WTI spot price in May was $125, which doubled from Mary, 2007. This is an increase of about 6% per month, and in June we are on track.

$125 + 6% ($8) = $133.

For the time being at least, a price increase of 6% per month appears to be what is necessary to balance demand against declining net oil exports, and I expect to see a continuing parallel increase in delusional thinking.

And the reality is ... 6% a month ~70% a year to destroy ~2% BAU growth - so as usual, the politician would seem to be way too optimistic - it's currently a 35% increase in price, not 20%, to destroy 1% of growth, so that is a large error.

No wonder people get so annoyed around the world when price rises are constantly exceeding overly optimistic expectations of so called 'experts'.

Just a quick math note that 6%/month (compounded) works out to be ~100%/year.

--

JimFive

Sorry, I left out the rule of 72! - just trying to keep it slightly simple! - but you are correct, Brent is currently up about 86% on the year!

That makes it even worse ~40% to ~50% increase to destroy 1%.

http://www.business24-7.ae/Articles/2008/6/Pages/06242008_4d3a76cdcbf345...

UAE Business Magazine: Oil set to surge past $150 after divided Jeddah meeting

By Peter Cooper on Tuesday, June 24, 2008

Strewth...

The problem is, I'm still very heavily entrenched in MS, as is my immediate and extended families, closest friends, tennis mates, colleagues and particularly my clients (I videotape weddings for a living and see that newly-weds, with their credit cards and dreams, are THE MOST entrenched in MS of anyone). So, $250 a barrel simply doesn't register. You may as well say a rump steak will cost $20 by Christmas. Oh, wait... Sorry, I actually believe that may happen!

Regards, Matt B

Guess all I can do is keep crossing my fingers that you're wrong. Then again, we are adding 200,000 more humans to the system everyday.

After Oil flirted heavily with US$100/bbl around Xmas/NY, it dropped into the 80's, before beginning the sharp climb to $130+.

Jerome, your post is an insane drivel mixed with rightful concerns.

For instance, the first news story says that:

Next year is 2009. And because you launch multiple "stories" one would expect to encounter contradictions, as in:

oops. There's no contradiction. Perhaps in the next story?

Hmmm nope. Just chewbacca's defense over there. Perhaps in the next story?

Goddamn! I can't find that damned contradiction! I must have some serious mental illness in me!

Nope. Can only find Chewbacca or confirmations of the same story...

But hey, don't let a pesky reality check undermine your doomerish trashtalk!

The story regarding production capacity is consistent. That is unrelated to the point regarding production.

As has been pointed out, there is no way to prove production capacity exists, short of actually employing it. They can claim any figure they want. If production still has not risen by 2009, the story will undoubtedly be the same: well, hey, we're ready to help out, see, look at all this extra capacity we have... but the market is well supplied, we just don't need to produce any faster.

(Personal nit-picking point: I wish the word "extraction" was used, rather than "production". The production of crude oil occurred over geologic time spans. You can't "produce" more crude oil, you can only extract what is already there.)

If you read Jerome's story with your brain shut down, you would think that the saudi's have been changing their goalposts since ever, as the lying scum bags they are. Ir's jerome himself who says that

, insinuating that they were lying, when they were clearly not.

Alas, you can say whatever you want regarding production, fact is, they are free to produce whatever they want to, and should not be subject to your or mine's "wants". They can be lying, yes, but they can also be just prudent regarding the unknown speculation inside the oil futures market, or are simply just hoarding profits out of the west. In a free market, why shouldn't they be able to do this?

But no. The obvious conclusion is that they are lying scum bags and they are desperate! desperate I tell ya! to find new oil production.

My point is that Jerome tries to make a rethoric case out of nothing whatsoever.

I think you're reading something into that story that isn't there.

It's not built on contradiction. Jerome addresses that the Saudis have been trumpeting 12.5mbpd production capacity for years, yet their actual production (or export) is not increasing by much.

Yesterday, every major media cheered over the OPEC meeting results when in fact there's 1) nothing new about it 2) no promises 3) nothing to cheer about. THIS is the issue Jerome rightfully points out.

Ok, so I guess that their promise to increase 200.000 barrels per day starting july 2008 is "nothing new" and shouldn't be regarded as a "promise". And considering that SA was dismissed as being running "off a cliff" by some years now, the news that they are actually in a upward trend isn't anything we should cheer about. Fair enough.

It may not be "news" to any person in the knows, but I wouldn't exactly call the saudis lying bastards because of the media's hype.

So how do you deal with the fact that Saudi exports were down in 2007 by 702,000 bls or 8.2%? They decrease production so they can claim to raise it?

*They* don't owe you nothing, so *their* reasons aren't our business.

Last year, a big headline that was up on Google for various months was "Saudi Arabian oil declines 8% in 2006". It's conclusions?

The comments on that thread? Listen up to Westexas from 2006 already feeling vindicated:

etc...

Now, given the scenarios wrongly presented by TOD, do you still think that 200.000 barrels, after some other positive changes over the past year in SA is a good thing, or a bad thing?

That's likely because there's very little in the story to begin with.

Jerome quotes 5 news articles:

All this tells us is that:

There's potentially an interesting point in there about how slowly production capacity increased betwen 2004 and 2007, but the "Saudi Arabia isn't making good on its production increase announcements" story that appears to be the piece's theme doesn't fit the news articles it quotes. Saudi Arabia has fulfilled its promised production increases; it's just also cut production at times, as the dominant member in a price-fixing cartel might be expected to do.

The piece strikes me as an angry and emotional "can't you see they're lying to you?!?" The problem, of course, is that the cited articles don't make the case that the Saudis aren't being truthful. None of the capacity targets have changed, none of the production increases failed to materialize, and none of the production increases were promised to be anything other than temporary.

That being said, I think calling it "insane drivel" is unfair, uncalled-for, and unhelpful.

You're probably right, english is not my first language and although I understand the expressions, I don't entirely grasp their strength. Nevertheless, not a single soul in this thread acknowledged the obvious that I and you are referring to:

This story is about nothing.

But that is becoming common in here. Take some Chewbacca's defenses, quote this and this fellow, ad hominem the hell outta him or her and them make a passional sermon out of it. And the masses applaud. Honestly, it's becoming sick to watch.

hey, don't I get a credit :-)

Yes, you absolutely should. I think he took it from Jeff's last GP. Fixed.

This is a very thoughtful group and I would like to see any ideas regarding a different way of framing the "production capacity" thread.

Accept for the moment the simplistic economic model offered. The consuming world is asking the producers to flow their wells at a higher rate. Given that there is a finite demand for crude on any given month, once those crude buyers have been satisfied, any additional production must go into storage. At a later time this storage could be used to satisfy demand but that volume untilized would reduce the production requirement to satisfy demand by an equal amount.

Correct me if I've missed the headline, but has any crude purchaser claimed they have been unable to acquire what they want to buy on any given month? If not, then there is no "need" for additional production from the KSA or anyone else. When there is a call for the KSA to produce more they cannot unless they have additional buyers. And we all know how you get market share in the commodity biz: you sell your product for less than your competitors. The KSA knows this biz plan quit well: that's how oil got down to $10/bbl in 1986. They were continuing to loose market share as other OPEC members kept reducing their bids. When the KSA got tied of maintaining oil prices by reducing their delivery to the market they opened their wells up and we all went out and bought big SUV's and pickups.

Thus it's not important what the KSA's deliverability is at the moment. Down the road, of course, when we reach the point where supply demands are not being meet, then it becomes very critical. Are we not asking the KSA to undercut the prices of other producers so as to take their market share away? The KSA need not produce one more barrel of oil to accomplish this. All they need do is offer their existing production at a price below the other producers. Who would continue buying oil from Nigeria at $130/bbl when they can buy it from the KSA at, let's say, $120/bbl? Very simply, if the KSA put 5 million bbl/day of oil on the market next month would the consumers purchase an additional 5 million bbls/day? I think they would buy the same amount as they had forecast need for. Thus someone would have to shutin 5 millions bbl/day....or quickly build some very big storage tanks.

I've been a petroleum geologist for over 30 years. I know well the relationship between buyer and seller: you pay me what I want (to buy or sell) or I'll go to someone who gives me a better deal. Those who understand the diamond biz get my point for sure: if the diamond exchange were to put their surplus inventory out into the market tomorrow wedding rings would drop to $100/carat.

I assume the KSA is watching how the world economy is responding to the new price levels. The high oil prices of the late 70's lead to a worldwide recession that dropped demand and led directly to $10 oil in 1986. I just hope all those Swiss economists on the KSA payroll are watching very closely.

Honestly, I think their hands are tied. They can't single handedly do much to lower the price, even if they pumped flat out. The economy might tank anyway, in which case they are in the same position having earned less revenue.

But the main thing is their OPEC partners, who can't pump any more, and would suffer if prices were lower. The rest of OPEC have already expressed dissatisfaction with KSA for increasing output unilaterally.

The only thing KSA and OPEC can really do is talk positive and blame someone else. Meanwhile they are all banking the money and keeping their fingers crossed.

Hi Rockman,

I don't totally understand the question here. In my mental model it is assumed that supply and demand are balanced by price. Because supply is flat/declining and price is rising, we know that demand would have risen (had supply been available). If prices fall, we know the market is over supplied. If prices rise, we know the market is under supplied (more demand still exists for additional production).

Right now we know that those who can afford $140.00 oil are supplied. All those who could only afford $25.00 oil are either reduced customers or no longer customers.

Gail does a nice piece here where she shows what demand would have been in the US without the rise in prices. And she calculated the elasticity of demand (relation between price, supply, demand) for oil in the US. It is well worth a careful read.

http://www.theoildrum.com/node/3531

Rock, can you give a brief explantion of how Saudi sells its oil? Thanks.

I assume the KSA is watching how the world economy is responding to the new price levels. The high oil prices of the late 70's lead to a worldwide recession that dropped demand and led directly to $10 oil in 1986. I just hope all those Swiss economists on the KSA payroll are watching very closely.

I thought that this must be in error, that the $10 price would have come from increased production, and not decreased demand, but when I looked for proof of that I was surprised to find that demand did decrease significantly after the 70's run-up in price. Unlike what we have seen from the current price rise. Makes you really wish Walmart and Microsoft and all those other US business people hadn't been so rabidly in favor of massive job exportation to bring over 2 billion Chinese and Indians to the oil consumption equation. It seems that bringing jobs back from China and India would be a great way to deal with Peak Oil and its consequences.

http://en.wikipedia.org/wiki/Image:Crude_NGPL_IEAtotal_1960-2004.png

Thing is that the drops in consumption in the 70s happened over a number of years. Economics does rule and even as we speak every activity that used to be performed with oil is examining alternatives. Every SUV owner is looking for a more efficient car, every long distance commuter is looking for a place closer to work, pellet stoves are being installed in homes, etcetera etcetera. The 70s oil shocks did away with the muscle cars and replaced them with volkswagon rabbits, but it took years, the same will happen with the SUVs of today (hint, they'll be classics in a few decades if we live). Years over which fuel production recovered and over which no other nation was vastly ramping up demand. Neither of those is likely to be the case here, every joule we conserve here gets burned expanding china, and it is unlikely that production will ever much exceed the current quantity.

Yeah, I may be jumping the gun, but a few things worry me. I believe sometime in the 1970's is when the Europeans (smartly) added big gas taxes magnifying the actual price increases that took place. This time I don't think they will add anymore and I think I heard talk of taxes being repealed (at least politicians in Australia and the US are floating this). And in the 1970's China and India were not flush with the money from massive job exportation - euphemistically referred to as "globalization". How much of the activity in China and India that is using oil will be curtailed by price increases? And then you have the Arab states consuming at a great pace now as well. And I thyink some countries are still subsidizing oil which will work against any demand destruction for them.

Interestingly, gas seems to have been highly taxed long before that, at least in the UK, with tax representing about 40% of the price since 1930, about 50% since 1950, and about 70% since 1990. Percent price from tax dropped substantially in the 70s (from ~70% to 45%), suggesting taxes didn't rise much as the price of oil did.

Things may have been different in other parts of Europe, of course.

Loads of countries are, but non-exporters are progressively lowering their subsidies for economic reasons - India and (I believe) China are recent examples. Price increases will filter through the importing world, although government subsidy programs will delay the effect of price signals somewhat.

Exporting countries can keep up their subsidies for much longer, of course, and probably will. Many exporters, however, have few or no subsidies (Russians, for example, pay about $4/gal), suggesting that only a small minority of oil demand will be protected from price pressure for long.

Yeah, because we all know that if we maintain the rest of the world poor and starving, we can all buy our cheaper gasoline to feed our SUVs.

It is this type of crackpot thinking that creeps me up in this site. Seriously.

I don't know what they gain by pretending to have more oil than they do (ditto for the oil companies) but better for them to lie about increasing production that to actually do it and cause damage by overpumping.

Bob/Jon/Research,

I read all of Gail's posts...she's one smart cookie. But I like to keep it simple...perhaps too simple at times but simple is easy to defend or defeat so I offer either to the audience.

With respect to supply/demand:

I don't follow the world comsumer market. If you do your insight would be interesting. But like the rest of us in the US I see no one shortage of product. No "no gas signs" at the stations, no utility cut backs, no jets grounded for lack of fuel, no maufacturing facilites shut down for lack of fuel, etc , etc. The refiners are keeping inventories very low but that's understandable...who knows when there might be a price drop.

Perhaps our buying power is overwhelming other markets. I see truckers in Spain protesting high diesel prices but not fuel shortages. I see British fisherman protesting high fuel prices but I see no stories of boats sitting at the docks because there is no fuel available.

Again, it is an earnest and honest question: who has seen reports of ready buyers with cash in hand unable to buy the fuel they want? Yes...there are those that can't pay $130/bbl. But then 10 years ago there were those that couldn't pay $30/bbl (I have worked in some crap holes in the world and have seen such shortages first hand.

As to how the KSA sells oil I haven't a clue. Probably much is on long term contracts with price escalation built in with buyer options to not purchase. But I'm sure it's much more complicated in the details. Any one know????

100 people are waiting in line for a bar to open. Each one wants to buy, on average, 2.5 drinks that night, which is the same amount this bar has averaged per patron since it opened. But it turns out that on this night the bar only has enough alcohol for 100 drinks. So they give each person a ticket for only 1 drink and send every bartender home but one. There are long lines and the patrons scream of shortages. Clearly there was not enough alcohol to meet the demand. The next night the same situation takes place - 100 patrons but only alcohol for 100 drinks. But this time the bar keeps all bartenders on the clock and triples the price of drinks. Most people grumble that the prices are outrageous and most can only afford to buy one drink, with a few people not buying any, while a few buy multiple drinks. In the end 100 drinks are served to the 100 patrons on the second night as well. However, no one on the second night was seen with cash in hand trying to buy a drink that they couldn't get. Did the second night have enough supply to meet demand?

FiniteQuantity,

Yes...the second night there was exactly enough drinks to meet demand. So there is no booze shortage. Because there were enough folks there with the current market price of the drinks. And yes, there were folks there that could't pay that price. But your analogy leaves out the fact that on the first night there were 1000 people standing outside the bar that couldn't afford the price the first night.

Several years ago when oil was selling for $40/bbl the great majority of folks in the world couldn't afford to by oil. Yes....less than now but they were still the majority. Many in the US don't really appreciate what life in like in the "third world". I've worked in some hell holes where the majority of the population couldn't afford $10/bbl for oil or $.30/gal of gasoline. We use 10X as much oil as the average person in the world but that doesn't really describe the imbalance because there is no "average consumer": there are those that can compete with us and those that can't.

You may have missed my point about supply and demand: asking the KSA to produce more oil so the price will go down is a false assumption. Just like your story, the bar could sell 10 more drinks but why would they sell them for less then the first 100 drinks if the customers who desire those extra drinks have the money to pay. What we're really asking the KSA to do is bid their production for less so they can take market share away from other OPEC producers thus pressuring them to lower their price.

So let's assume, for some unknown reason, the KSA starts offering 500,000 bo for $20 less then the current market. I don't think it would necessarily push other producers to lower prices. Yes...they would collective loose 500,000 bo income but they would still be grossing much more income then they had expected two years ago even with the new lower sales volume. All the other OPEC members have publicly announced that they have reached PO. Knowing they have a decreasing asset why would they drop their prices now knowing the value of the oil left in the ground will grow. They would drop prices to keep their market share if they were in need of the revenue but, again, they are receiving something close to twice the income now then they would have expected 2 or 3 years ago.

If you were one of these OPEC producers what would you do?

Good point about the people who couldn't afford $10 oil. So if the second night had no shortage of supply, then there is never a shortage of supply - only times when producers haven't risen their prices high enough. The gas lines of the 1970's would have never occured had the oil companies and Congress had the cajones to allow prices to rise to where they should have been to cut demand to meet supply.

To my memory Saudi Arabia has pumped more oil to lower prices many times in the past. If they did it now it would not be anything new. The only difference is that in the past they'd start pumping when oil hit $35 or $40 thinking that was too high a price. I seem to recall them fretting about oil hitting $60 during this recent run-up.

If I was an OPEC producer I would treat my oil as a finite exhaustible resource and remain uncowed when the brutal bully of the west tried to force me to pump faster. At least I would try too - I don't know what exact threats that bully makes. I have read that in the 1970's the US had the military "looking into" taking over some of the oil countries. That type of threat - post Iraq invasion/bombing/takeover carries even more weight and would likely see me as a leader who didn't want to get ousted or have my country destroyed - pumping more - if I could.

But Saudi Arabia doesn't have to start selling oil at a lower price than the market to lower prices - they just need to sell more oil at the current market rate - and the increased supply will influence the current market rate. Anyone selling still tries to get the highest price they can and buyers still try to get the lowest price they can with the price responding accordingly.

If any oil producers can afford to "take their house off the market" so to speak, during a price drop due to increased production/decreased demand, then more power to them. We certainly are going to need all the withdrawn supply down the road.

[duplicate post]

Well, the world of oil consumption is certainly larger than the US, and at times Leanan has dug up stories from around the world of fuel shortages.

More importantly though, if the "market" is functioning smoothly one ought not discover "Sorry no gas today" signs. Pricing mechanism, if allowed to work, will destroy demand before the hapless soul pulls up to the station.

Injapan,

Certainly there are instances where folks can't buy products because they are not available but the few I've seen details on were related to distribution problems and not a lack of oil deliveries to the refiners. As you say, given time the market will adjust to supply/demand issues. The pain to many economies could be heart breaking. Lots of folks in the US are upset by the higher prices but I think many do't understand the great advantage we have over the great majority of the world. Back to the old story about the man with no shoes....

You right Finite but I'm not sure i would take it as a given that there wouldn't be an offset in production by other OPEC'ers to compensate. And you remeber correctly about the KSA taking hits to support prices. Here's a repost of mine with the details:

I can give you a first hand account of how far and quick oil prices can drop. When the oil price spike of the late 70's sent the world economy into a recession it took only a few years for oil to drop by 70% to $10/bbl. And the only reason it didn't drop any faster was Saudi reducing their production to maintain price supports for the rest of the producers. Eventually Saudi was looking at shuting in 100% of the production stream. At that point they told OPEC to screw themselves and cranked their wells wide open and flooded the market.

We can be certain Saudi hasn't forgotten this history. I've been a petroleum geologist for over 30 years and I know we can't add enough new production to cause this kind of price regression. Nor will altenatives/voluntary conservation/killing all crude traders/etc. knock down the price of oil anytime soon. But knock the legs out of the world economies (China has been on the verge of imploding for a couple of years) and it's possible to drop demand 15 or 20 million bopd. At that point there will come another test for OPEC to show the measure of unity that did not materialize in the early 80's.