Countdown to $200 oil: $140 oil and speculation

Posted by Jerome a Paris on June 30, 2008 - 9:55am in The Oil Drum: Europe

| As you may have heard, oil prices have reached a new high above $140. I can already hear the outcry against speculators and their out-of-control games to enrich themselves at our expense. |

Never mind that speculators have been caught shortselling oil (ie betting on a fall in prices) more than a few times in recent months. Never mind that spot oil prices, which require actual physical deliveries of oil at the end of each month, have behaved the same way as paper futures. Never mind that oil storage seems to not be increasing.

Nope, it is just too convenient, too irresistible and, let's say it, too comfortable an excuse that speculators are to blame. It's not our fault, we have our scapegoat. Our price increases are temporary, we'll soon be back to "normal" lower prices, as soon as (take your pick) speculators have been punished/oil companies are taxed for their profiteering/"fundamentals" are left to set prices.

This is just denial.

There are A LOT of good reasons why oil prices are going up. Let me show you just a few.

A Countdown to $200 oil diary

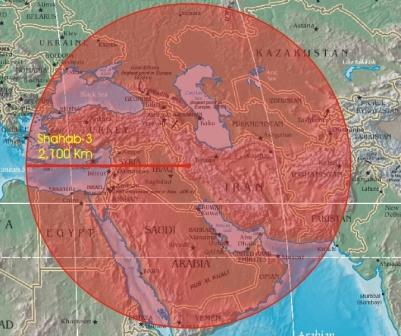

One you've probably heard by now is the "risk premium", linked to the prospect of a war with Iran. Let me explain how that works.

Say that the market price for oil, if there were no prospect of war with Iran whatsoever, were $100 per barrel.

Say that the market price for oil, should there be an attack on Iran, is estimated at $400/bl (because of production disruption in Iran itself, possibly a blockade of the Straits of Hormuz, etc...)

Say that the probability of such an attack is estimated, by markets, at 10% this year.

In that case, the price for oil will be 90%x100+10%x400 = 130$

A 10% probability of war with Iran which would tentatively quadruple oil prices increases the market price by 30%. Now you may quibble with the estimates I've provided here - but the point is, the market will sum up all the various hypotheses made by all players in that game into a single price, which will reflect the combination of war premium, and war probability that the market, as a whole, includes in the price.

So it is very much possible that 20-40$ in the current price are linked to worries about war. But speculators, here, are actually providing a valuable service: by betting on oil prices (in both directions), they allow all players to hedge that risk of war. Those that think war is more likely will be happy to buy oil futures at prices they think are very low; those that think that war is unlikely and that there is too much of a premium will be happy to sell futures into that market.

While this may create an increase in prices, it would only reflect the reality that a war with Iran would have consequences, and that it's not completely unlikely yet. However, I'd note that futures do not seem to change much in 2009 compared to 2008: so either the markets don't actually think that Obama will be elected, or they don't seem to think that it will have a material impact on the probability for war. Or there is no war premium now, and we're back to square one.

2) Chinese growth

This one has also been widely discussed, so I presume most of you are familiar with it. Still, a few graphs are worth showing here:

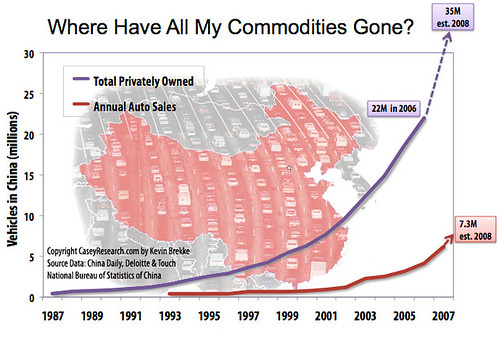

As discussed on Casey Research, China is enjoying staggering growth rates for car ownership.

Assuming that the 7.3 million new car owners in 2008 each drive 5,000 miles a year, and they achieve 40 miles per gallon, the result would be an additional 45.6 million barrels of crude demand, equivalent to 125,000 bbl/day. In other words, new Chinese drivers will devour 25-30% of the recently promised Saudi production increase in a single year.

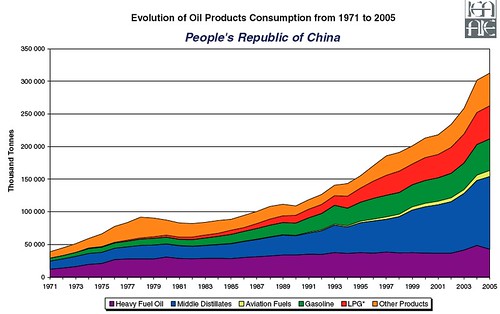

Looking at this over a few years (from the International Energy Agency (pdf):

The lighter blue bit is mostly diesel. Note that 2007 consumption was 347 million tons, ie 7mb/d.

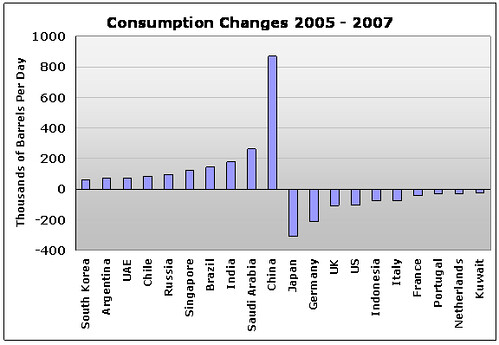

To put this in another perspective again (from Net Oil Exports):

Chinese growth in consumption dwarfs by far the declines noted in rich world countries like Japan, Germany and, yes, the USA (note that the decline in the US is still a lot smaller in absolute terms than those in much smaller economies in Europe or Japan).

So: Chinese demand growth is very real, it's very large, it's highly likely to continue for a number of years (when people finally reach the car affordability stage, they're not going to be stopped by the cost of fuel - not for a while anyway. The difference between no car and a car is so massive that the price of gas is a minor consideration - especially when gas prices are still subsidized...). and it certainly has an impact on oil prices by its sheer size, given the current stagnation of oil production.

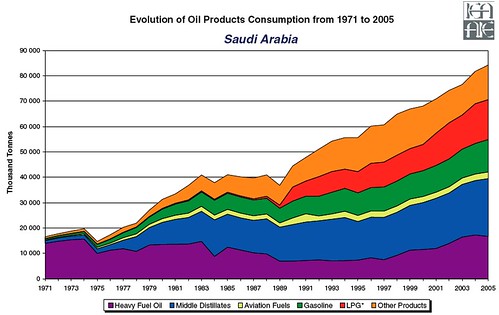

3) Saudi numbers

The previous two graphs, and this one above (from the IEA again (pdf), provide interesting information regarding oil producers: not only is their production stagnant, but their consumption is going up massively. And it's no wonder: they're flush with money, gas is heavily subsidized at home, so people drive more and more. Thus, the biggest increases in oil demand, beyond the "usual suspects" of China and India are almost all big oil producers: Saudi Arabia, Brazil, Russia, UAE. If you look over a slightly longer period, you'll also find Iran and Canada in there.

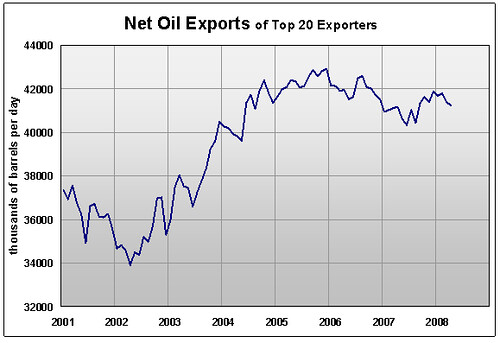

Which means that volumes available for export, and thus volumes available on the global oil market, are shrinking (from Net Oil Exports again):

The numbers don't lie (from westexas [ed: the table was actually provided by datamunger]):

The only major producers which have increased exports lately are Angola and Russia, and Russian production is now declining (while consumption is booming). The conclusion is simple: there is less and less oil on the market for us.

4) Production declines

Beyond Russia, it is striking to note how many regions we have been relying on are experiencing absolute production declines. All mature fields have a natural decline rate, and whole provinces are seeing absolute declines in their production.

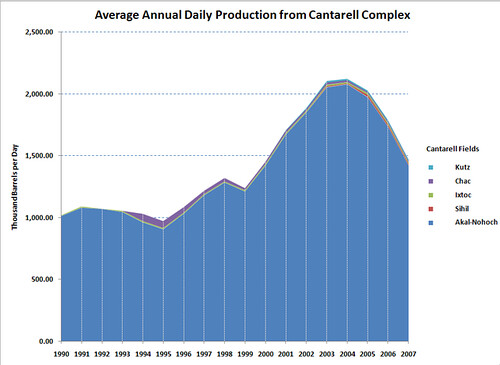

This is nowhere as spectacular - and worrisome - as in Mexico, where the supergiant Cantarell field has lost close to half its production capacity in the very recent past, thus threatening exports to the US from a (relatively) friendly neighbor: (from here)

Just like the decline of the North Sea seems to have caught the UK government unaware, and is leading to quasi-panicky behavior by the UK government (which one day blames the Russians, one day wants to go all nuclear, one day wants to go all-wind, and generally blames "uncompetitive" continental Europe for its plight rather than its own policies, or lack thereof), the brutal decline of the Cantarell field, and of overall Mexian production is likely to have brutal consequences, as the country loses its main source of exports and the Mexican government its main source of tax income. Social unrest, and massive migration toward the North could be one outcome...

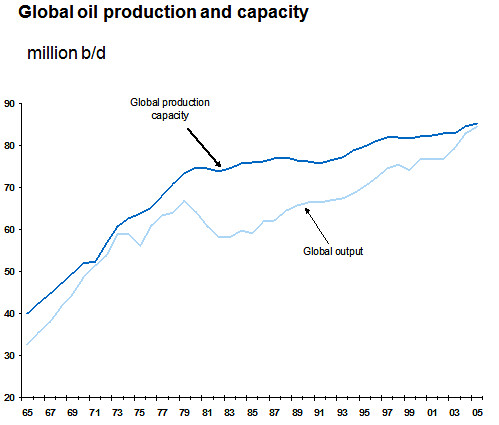

5) Lack of spare capacity

But let's come back to the oil market for a second: you have a combination of still strong demand growth (in particular in oil producing countries) and stagnant production combining into shrinking export capacity and, more importantly, into a quasi-permanent lack of spare capacity (from this comment by SamuM in a recent thread):

The significance of such tightness of supply cannot be overstated. In normal times, when demand varies, market equilibrium is reached by adjusting production to such demand, which is a relatively easy and cheap process. But when supply is constrained, as it is now, any brutal change in the market (whether on the demand side, for instance through a cold spell in winter requiring more heating, or a hot spell in summer requiring more AC, or on the supply side, for instance guerilla attacks in Nigeria, a refinery strike in Scotland, or a pipeline accident anywhere) will require market equilibrium to be reached by demand destruction, which is a lot harder and triggers much more substantial price movements: prices need to move high enough for some users of oil to renounce such use and "take their demand out of the market", whether by not doing what they wanted to, or by finding a substitute. In the US, people travelling less for vacations, or carpooling, have barely managed a couple percent demand destruction. Imagine that the Saudis and Venezualeans, with their subsidized prices, are immune fro msuch pressure, and that several percent need to be cut off demand abruptly: it will require much higher price hikes than have been experimented yet.

It's simple really: price will go high enough for the pain to translate into lower oil use in price-sensitive countries, the list of which is topped by the US, where consumption is high, oil price variations are not dampened by massive taxes (prices going from $3.50 to $4 is more painful than prices going from $8.50 to $9).

The lack of spare capacity certainly explains why very small variations in output or demand can have disproportionate impacts on prices: when you are right on the edge of the knife, any movement can make you fall off.

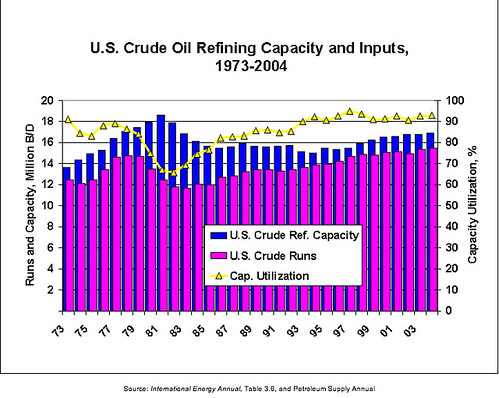

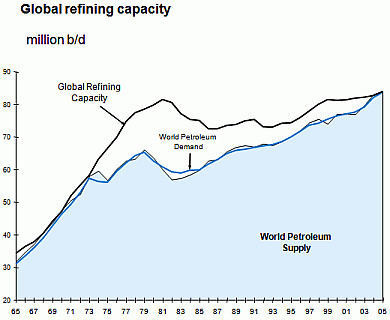

6) Refining issues

I thought I'd add just a few words on refining capacity in the US, as it is often blamed for gas prices as well.

Energy information Agency data shows that refining capacity has gone up in recent years even though no refineries were built, with refinery capacity use very stable at high levels. This has not changed much in the past 2 years, even as Katrina took its toll for a while.

And as the tables that are provided on a monthly basis by Californian authorities show (see 2008 numbers and 2007 numbers), refining margins are actually a lot lower this year than last (roughly down from a dollar per gallon to half a dollar per gallon) and have helped lower the impact of oil price increases in the past few months. So you certainly can't blame refiners this year, even though global capacity is tightening:

Altogether, it appears that they are a number of factors explain oil price increases perfectly well, with no need to go into conspiracy theories or market manipulations.

I'd like to see some probabilities and values in a chart--instead of what appears to be an arbitrary number of 200. For example, if production is declining by 5% a year, then we can expect to pay an extra 25 cents (or what?) over what we are paying now per gallon. Same for the attack on Iran (which may range from zero to 300 percent?).

As for Chinese consumption, you need to maybe lower your estimate a bit. For those who are making enough money to be able to afford a car, they may buy one (but keep the old foot-powered bicycle or electric bicycle), but not necessarily use it that much. When I was living and working in China a couple years ago, the "managers" and higher-ups bought cars (Chinese are very status conscious), but kept them parked most of the time, using the bus for work and the bicycles for errands. The car was a "show off" instrument, rarely used, and when used used to show off, like taking friends to dinner around the corner (but making a big fuss about the car and finding a place to park it, usually right on the sidewalk next to the restaurant). So maybe the Chinese buy cars but not that much gasoline. The same goes for other developing countries where it's far more convenient to walk than drive.

As far as chinese transportation using more oil, a lot of the increase in consumption is for diesel fuel. This is used by the trucking industry (many independant truckers there just like US), along with growth in railroad haulage of containers, coal and minerals. Many routes used for dense RR passenger traffic are electrified, but many heavy RR freight lines are diesel powered. This is based on the opinion of a friend of mine that has been to China several times in recent years.

I have heard that traffic problems are severe in Shanghai and I suppose other large cities. I know that where I live in Thailand there is no recent easing of traffic. To me this implies that even if some do keep their car parked there are still a great many out there driving. While it's hard to say whether Jerome has over or under estimated this I'd say with certainty that 40mpg is an over estimate on typically congestion bound car usage.

The single human being who comes up with a formula to accurately predict price response to each percentage shortfall in petroleum will be a multi-billionaire in short order. Your request is rather odd as no one has yet demonstrated any methodology capable of accurately making such a prediction. The only thing we do know is that there have been price responses to shortfalls in production and that the price responses appear to have varied greatly. In other words, the price response to the first percent of shortfall has not been consistent with the second percent or the third percent.

Your observation about Chinese behavior is identical to US behavior early in the adoption of the automobile. But as time wore on, people used their automobiles for more and more activities. That is already beginning to occur in China and how much higher prices moderate that changeover does not seem to be something we can easily predict. In other words, your anecdote is just an anecdote and is used by you to extrapolate to a guess. Jerome, on the other hand, is observing a statistical trend across a wide body of participants in China.

Buying gas in China is a 3 hour long venture as you go to a gas station and wait in an incredibly long line. I suspect they'll have a short term cure for that during the Olympics, but then return to status quo

It was mentioned a bit ago that China cut some of it's subsidies to gasoline. This was seen as a way to cut demand, but may in fact increase it because they'll have more fuel available to sell.

Although you explain a few reasons why other factors account for the price increase, I do not see an explanation why speculation can't be a reason for the price increase. I got flamed last month for suggesting that speculation could very well be behind the high prices.

Those that suggest that speculation is the cause state a very sobering fact- "Assets allocated to commodity index trading strategies have risen from $13 billion at the end of 2003 to $260 billion as of March 2008". I've not seen anyone dispute this figure. I can understand that statement, and I can see that MUST have an effect.

Those that refute the speculation theory state their case in terms that I can't understand, which translates to obfuscation, for me anyway. I readily admit that I don't understand how the futures market works. And neither do many others, so it is easy to go with an explanation people do understand.

I do understand this though - if speculators can bid up the price of houses, and people do buy those houses though overpriced, and if speculators can bid up the prices of stocks (a-la dotcom, et al) and people buy those stocks even though overpriced, why can't speculators bid up the price of oil and refineries buy that oil even though overpriced?

As for the spot market, doesn't it just follow the futures market? Irrelevant of the (over) price?

I cannot discount the speculator theory as long as I don't understand why it can't be so.

I'd like to see numbers comparing how much of that index trading is simple derivatives that have no influence on physicals and how much actually affects the physical market. I can understand that when people are piling funds into side markets and not buying physical then they are not creating false demand for a commodity but actually more like bets on a race horse. The analysis I've seen doesn't really delve into this in any meaningful way. I think that money looking for a place to find returns doesn't automatically mean pressure upwards on the market but it's unclear. I think more and more these flows of money are more and more like gambling - people are so desperate for some place to put their funds since the dollar is so very unattractive. If you are a fund manager holding cash of declining value then your clients have no need for you - they can hold cash without your help.

"I think more and more these flows of money are more and more like gambling -" If this gambling is a bet on the price of oil will be going up, I think that's a very good bet. To bet the other side you have to believe the official line about peak oil.

http://news.xinhuanet.com/english/2008-06/29/content_8456576.htm

A report the U.S. Congress released Monday showed that, in January 2000, 37 percent of the NYMEX crude futures contracts were held by speculative traders; but in April 2008, the number has soared to 71 percent. Meanwhile, the proportion of contracts held by commercial traders greatly declined.

The U.S. Commodity Futures Trading Committee (CFTC) revealed in May that it began investigating potential price manipulations in the oil trading market in December 2007. The early findings show that since the sub-prime mortgage crisis large amount of speculation fund has turned to buy commodities like crude as a hedge against inflation.

Why not? More money piling into the same amount of product means higher prices. You said it yourself, if money is not bidding then why not just put it under the mattress.

What I meant by this is it's unclear how much of the money ends up buying product and how much ends up in derivatives of product. For example, when you buy stock options you don't actually buy or sell stocks and hence have no effect on the stock price. I'm not clear on whether options trading on commodities (or other fancy ass derivatives that seem to be the rage with wall street nowadays) are where the big numbers are or whether all this money is in the physical market. Even when looking at the physical market whether future or spot one has to look at the difference between long and short rather than just the number of contracts held by specs. If a heavy short position is squeezed by underlying commercials needing more product, then specs will losing money from a push upwards.

I know if I were a spec (and I'm not in the market in any way) then I'd be long but still one looks around the media and guesses that many people think we're at unfathomable heights ready to crash - one can't help but wonder if the media is playing a part for wall street in making sure that some specs are willing to take the losing bet.

Along the same lines, hedge funds and institutional investors tend to move as a herd because when something goes wrong they can all claim solace together that they did the right thing but lost out. ie. when all funds lose money, they blame the market but when a unique single fund opposing conventional wisdom goes wrong, well everyone knows who to blame.

"I'm not clear on whether options trading on commodities ... are where the big numbers are or whether all this money is in the physical market."

Not in the physical according to most TOD posters but I would maintain there is still a linkage with the physical via information.

The report says that 71% of future contracts was held by speculators. But does the report specify a date when this percentage was held? If I'm correct, at the end of each month (actually 3 bus. days prior to the 25th) the number of contracts held by speculators should approach 0%. If they where to hold on to these contracts they would need to take delivery, which I'm sure no speculator wants.

So you can't simply say that in April 2008 speculators held 71% of the contracts. Because on the 22th of April the number of contracts held by speculators would surely have been close to 0%.

Shit, I don't know.

I was just quoting the news article I linked to. That's my point exactly, I don't understand it, but I'm trying to.

I believe that there are clearly more investment dollars in the oil futures market (thank you, in part, Ben Bernanke).

Perhaps it is the case that there could be (insert your own percent)% speculators in the market at any given time, but based on whether they are long and/or short they may not have a corresponding effect on price - one way or the other.

On Friday Karl Denninger said this in his Frightful Friday commentary:

Moe Gamble said this on Friday's DB:

So, it seesm that if you know where to look and how to interpret that it is realtively "easy" to determinthe level and effect on specualtion in the market.

Perhaps the what, where , and how of oil futures speculation effect could be the suject of a guest post by someone who can walk (many of) us through this?

Of course this seems to be happening downthread ;-)

Pete

That may be 71% across all contract months - as speculators are closing out all their delivery day contracts, most they tend to be 'rolling over' into the next month (ie: taking out a new contract for the next delivery month)

So the OVERALL ratio of speculative contracts, across the board, is probably reasonably constant. Generally though, lots goes on on the last couple of days, and I wouldn't be surprised if these are routinely excluded from 'averaged' stats.

1) the SPECULATORS are not really who are being blamed. Actually, the speculators, like Michael Masters who recently testified before Congress, are net short oil, and net long equities, so they want oil to go down. Its the index funds that are net long commodities. ETFs and funds linked to the GSCI or other commodity indexes.

2) Index funds are also very long wheat and gold and other commodities. Yet some of these markets have crashed from where they were a year ago - wheat dropped 50% from its highs of last year. Reason? The actual producers came in because there was plenty of wheat to supply at those high prices and for every index fund/speculator who wanted to buy wheat above $12 per bushel, an actual producer said 'here you go - I am very happy to sell you my wheat at $12". In this case reality caught up with a frothy market... If a large portion (or even a moderate portion) of oils rise is due to speculation (and index funds), the same will happen. Actual oil producers will sell the 'freely available oil' at what are 'too high of prices' and oil will do what wheat did. Hasn't happened yet.

3)By the same logic, those corporations (e.g. airlines) that are buying long term contracts to lock in prices could be swamped by actual oil companies selling them contracts if future oil availability seems adequate (based on their own internal reserve and production estimates. Thus producers will sell forward more contracts than hedgers will in the long dated months and prices will drop into backwardation. We have seen just the opposite.

4)Part of the reason we are this high is that speculators are SHORT the market, e.g each time we rally 10% there is a positive feedback loop where they have to cover their shorts and the market spurts higher again, which then encourages other deep pocketed hedge funds, who don't buy into the general peak oil concept of limited flow rates, to go short. After all, there will be plenty of ethanol and tar sands to make up for the 'possible' decline in crude. This is all changing as firms like Wood Gundy, Goldman, Barclays, etc. have started to publish very realistic research on how dire our oil situation is (though they are writing from a profit/investment perspective as opposed to a social/policy one). So once everyone has gotten oil religion and the large funds stop 'shorting' the market (e.g. no shorts left), then we will be free to drop in price. In this sense speculators ARE influencing the market, but in a very sneaky, self interested way not being discussed 'before Congress'.

5) Finally, oil margins have recently been raised to $8,500 per contract:

Consider we are at midway point of URR and there are 1 trillion barrels left, this is 150 barrels per person living on the planet (and none for any of their children or grandchildren). For $8,500 one can control 1,000 barrels of oil, 8 times ones all time allotment for posterity (assuming that each human had equal rights to oil, which clearly isn't the case). Imagine what $85,000 or $850,000 or $8.5 billion could do. As I've written about often here, there is a paradigm shift coming between abstract wealth (paper currency) and real wealth (commodities, real goods, social, natural capital, etc.) Left to their own devices the deep pocketed institutions could run oil closer to its true value, in the thousands per barrel, but OECD trade and the economic system as we know it grinds to a halt before that time.

Interesting and important times. I agree with Jerome. Lets hope our leaders are mature enough to look beyond the easy scapegoats and make some uncomfortable but necessary planning choices. Its always difficult to admit that its our own fault...

That's enough for everyone currently in the world to drive a car 500 miles (or 800km)*

Write that on your bumper sticker.

That really puts the scale into something people can start to comprehend - and start to realize just how little oil left in the world...

Say what ? 150 barrels lets you drive only 500 miles ?

ok, typing on calculators is dangerous (typed 19.5x25 when I've should've typed 19.5x150)

150 barrels at 19.5 gallons per barrel and 25gpm is

3000 miles per person in the world (or 4700km)

and the common rebuttals to this type of statistic is:

1)but there are so many people in the world that don't use ANY oil that your numbers are meaningless

or

2) ya but your forgot about ethanol and oil shale

(n=5 from personal experience)

To (1), "Virtually nobody uses no oil, it's just that a few people use a lot. For example, Ghanans use about a barrel of oil each a year, and Americans use 25. So those 150 barrels each could keep Ghanans going for 150 years, but Americans only for 6 years. Anyway, put together Europe, Japan, the US - and that's about a billion people using 15 barrels each. Ten years if nobody else gets any."

At this point they go silent and look surly and obviously hate me already, so I add, "Maybe you should take the bus."

Since when does 15 barrels per person times 1 billion people times ten years = 1 trillion barrels?

I make 15 x 10 x 1,000,000,000 = 150 billion. Out by an order of magnitude.

You'd be more convincing if you could add up.

Why not just skip the maths and go back to:

We use 30 billion barrels per year.

We have about a trillion left.

That's 30 years supply.

...oh wait that wasn't the answer you wanted. Not dramatic enough. Now you'll have to explain flow rates. Damn.

.

Flow rates are derivative of available supply and demand. The bell curve is simply the normal derivative. So we don't have 30 years of oil left in the ground because supply and demand are not constant.

Actually, we probably have 100 years of oil left in the ground. It's just that 1/3 of it will be used up in the next 15 years or so.

That is the point where the bell curve (assuming we are already past peak) will go into negative curvature, and drop gradually over decades to a point where a tiny number of users can afford the remaining resource. After that point is reached, it will become a niche market commodity.

Prices may begin to fluctuate normally, but only because it will no longer be in mass demand as a consumer application. It would no longer be a question of marginal demand-killing, the price would be high enough that the utilization would drop off as the vast majority of users switched to alternatives and we'd have excess capacity again. As the utilization dropped off, so would demand for unconventional oil.

Unconventional oil will increase total reserves, resulting in a second supply peak or echo peak, further extending the time frame for remaining oil in the ground, possibly indefinitely. But this secondary bell curve for new, higher-price oil will be much lower (in annual output) and wider than the current peak.

So we would never get back to today's flow rates because of the expense (relative to energy and work) needed to replace conventional sources of oil barrel for barrel, so oil would remain available even as the cost of using it goes up and the number of users goes down.

that makes 73000 miles?

The people who actually buy oil, primarily refiners, hedge their purchases on the futures market. They are experts with inside info betting against amateurs with incomplete info. Guess who wins? According to an IMF study in 2005, real oil traders win their bets 75% of the time. If they didn't, futures couldn't be a hedge. Its the hedge funds and index funds that are the net loosers and their money actually helps keep the price down, not up. Keep in mind that there is a winner and looser for every contract, so it's a zero sum game.

And despite your observation you fail to mention how those funds are being invested. For instance, the AMEX president stated that for May that the large speculators (amongst whom are US banks) were short over $50 billion on oil and had to scramble to cover their missed shorts, which in turn drove prices higher. In other words, many of the big speculative players were shorting oil (betting on price declines!!) not going long. And they lost. And they appear to have lost again this last week.

To state again, the big speculative players bet against the fundamentals. And the fundamentals are roughly flat production over 4+ years (maybe 1.5 mbpd max more in certain quarters) now versus a near 8 mbpd increase in consumption by China and India. If we subtract out that 1.5 mbpd occasional bump up in production, that means China and India combined are taking 6.5 mbpd away from someone else who was consuming that oil in 2004. And that doesn't account for increases in consumption elsewhere in the world, which have been documented.

There is no doubt that some small part of the price increase is due to the falling dollar. But measured in other currencies oil is at record highs also. So a larger part is due to something else. You appear to be asserting that this is entirely speculatively driven. I will grant that some portion of the price increase may be speculatively driven but that fundamentals were going to lead to higher prices over time regardless. In other words, without speculation maybe we'd be at $120 or $110 or even $100 per barrel. But it would not have stayed at $80 or gone back to $60 per barrel. The fundamentals, the lack of production increases coupled with the changes in consumption (mostly who is consuming), argue against lower prices and for higher prices.

What no one has yet demonstrated is what proportion of today's price is due to speculation. I don't think you can accurately show that as a specific number, and since a large part of the speculation is in shorts I do not think you can even argue clearly what effect speculation is even having in this market.

Speculation is adding about a 6 dollar premium to the price of oil pretty much independent of the price flucations.

And no I won't tell you how I figured this out. Given that you know its six you can read it off the market charts.

Speculation is only an issue because supply is tight enough to make speculation worthwhile.

When supply was plentiful, it was only a dull futures day-in-day-out-grind.

It's the shortage, stupid!

cfm in Gray, ME

One of the functions of speculation is "price discovery". You can't say something is over-priced until you discover that people are not willing to buy it any more. When you go to a market and haggle over price both sides have an interest and when you decide not to buy the seller also loses a sale and is stuck with the product. For decades I've listened to Americans on high horses about self-interest is good, greed is good. This is the way they designed their markets and it's absurd that when it comes back to bight them they all cry foul. It ought to fall on deaf ears as cries from around the globe have for decades on American ears. Speculation may play a part in this market - but it's the role it was always intended to play, liquidity and discovery. I think people are just shocked to "discover" how much they really want, need oil, must have oil. When the public stops buying, the refineries will be ready to stop buying and the sellers will accept a lower price. That is barely starting to happen now but still most people believe by throwing a tantrum they can get their way.

Indeed, the market 'works'. People who blame 'speculators' for the high oil prices are fooling themselves in two ways: it gives them an excuse to ignore the fundamentals, the peak oil that is happening, and the ELM that goes with it. And secondly it is a play of huge hypocrisy...

Why should I not be able to put my money on the market, risk loosing it on my belief that the price will go up in the future? Isn't that the whole idea of capitalism? What about the airline companies? Aren't they allowed to hedge their fuel costs?

The sad irony is that the liberal free market advocates are crawling out of their caves of unreality to demand market controls and government intervention because this time the market isn't going their way...

People seem to equate 'oil speculators' to war profiteers who deny food and shelter from the hungry and homeless in order to extort all that they own from them. But if oil is indeed like food and water to us - then many would argue that trading it is like trading human lives - except that we already trade food and water in many countries...?

Peak oil brings us to an unprecedented situation, a world of paradoxes, where all the old ideologies become obsolete - both left or right - and people sticking with them are going to get ever more confused, paranoid, insane...

Now that the world of reality has come to put an end to all our ideologies we treat them like like the straw dogs they are, void of utility we discard them into the fire...

Hans,

This is a true statement

This is a false statement.

It is necessary for you to have some understanding of the futures market to understand why the first statement does not lead to the second. It is not reasonable to say that, since you don't understand, others are obfuscating.

You have three choices really:

1) either accept the expertise of those who you acknowledge understand something important to the hypothesis that you dont understand.

2) educate yourself so that you do understand [the oil drum is not the right site for this, but there are many trading sites with excellent tutorials - be aware that watching the market for a few months is probably required for this]

3) stay stuck where you are, and be perceived as someone who chooses beliefs based on an acknowledged lack of understanding.

Please understand I'm honestly not having a go here!

Even when they are known to be less informed - that way lies blind faith, counter-science, and foolishness.

And here is the one, critical tidbit, that might explain, or might leave you going 'I don't understand' - but I will try:

With houses, or dot-com stocks, there is a restriction on supply. This means that people can profit by hoarding (collecting/acquiring) the resource. While new dot-com companies came along, it was still possible to bid-up their individual share values.

With futures, there is an infinite supply of contracts that can be written - there is no way in which a contract can be taken 'off the market' in the way a share, or a house can be. For every new contract there are two sides, one party betting that the price will go down, the other betting that it will go up - the same is not true for houses or shares, where parties sell their holdings not because they are betting on a price drop, but because they want to realise their profits (perhaps to build a new house, or invest in different dot-com stocks). There is simply no real comparison between the futures market, and the stock market or the housing market, because one trades in a finite supply of something, the other in an infinite supply (CONTRACTS for supply/purchase of oil, NOT oil).

The reverse is more true, the futures market CAN lead the spot market to a degree, but much more the futures market FOLLOWS the spot market, and then adjusts for the average of what the market thinks is 'likely' or 'could happen' in the next 30, 60 days, five years, or whatever for the specific contract. The starting point though is TODAY's price, as per the spot market.

Neither should you give it any credence though. You either place trust in those who you acknowledge know better, or you learn for yourself (your responsibility to put the leg-work in - asking for help here is a cop-out), or you look gullible. I strenuously recommend the middle option, as you're obviously curious about this.

By way of analogy, I'm sure there is something than you are quite capable, perhaps expert in - I'm sure other people must respect your skill, or knowledge in this area. How annoying would it be if people told you that they didn't believe what you told them about something in this area, because they were not experts, and you being an expert meant they didn't understand what you were saying, and so they thought the absolute opposite made more sense. It's frustrating - especially from someone who seems genuinely curious.

Apologies for and rant-like bits - I HOPE this has been helpful - if not, all I can say is, if you want to understand more, you need to learn more - as with everything else in life

"The reverse is more true, the futures market CAN lead the spot market to a degree, but much more the futures market FOLLOWS the spot market..." Are you saying this "much more" is the general case or is true in the particular case of the current oil market. And if the latter do you see the possibility of continual official denial of the realities of oil can interfere with the speculative function of price discovery? The speculation sends a signal. But denial continues.

Hi again...

The general case.

The Oil futures market is the only one I feel qualified to talk about really. Having said that, it seems reasonable that the same mechanism would apply in all futures markets (for physical goods at the very least).

I do think the official denials are interfering with the speculative price-discovery function, particularly for long-dated contracts, mostly by damping it. Without the official denials, 2016 futures would I expect have found prices at least double 2008 prices.

[disclosure: I stand to profit when, if, and as, that interference starts to fail, and speculative price-discovery for long-dated contracts becomes unhindered by official denial (whether deliberate or ignorant)]

Thanks Jaymax. The problem I have with making such a post is that I will seem like I'm asking people to explain things to me for no other reason than to save me from the trouble of finding out myself. I am not, and tried to word it such that I would not come across this way. But the problem is, I have done many hours of research and I can't find any explanation of how the futures system works that I can understand.

And I'm not a dummy, either. I am an electronic engineer, and as you speculate, yes I am well respected in my particular area of electronics. I can grasp most concepts, physics being my outstanding subject.

But it's not justme, and that's what I wanted to point out. The MSM and others are going along with the speculator theaory because 'why it could be' IS easier to understand than 'why it couldn't be'.

You said that 'must have an effect on price' is a false statement. I don't understand why it is false, but I will not ask you to explain. I will find it out in time.

Another thing here, too. I must state that I am NOT asserting that the speculators are to blame, I was hoping that my wording made that clear. I am only stating that I am open to the belief that It could be. The simplistic arguments I have heard that 'it could be' have so far outwieghed the complex arguments that I have heard so far that 'it couldn't be'.

As for putting my faith in those who do know. I don't who they are. Everyone seems to be an expert.

Once more for the record, I am not asking anyone to explain to me that which I should be finding out for myself. I am just pointing out that if there was an easy way of explaining why the speculators are not the cause, the MSM and others might have their doubts put to rest. Even congress openly admits that the derivatives market is 'convoluted and unaccountable'.

Another thing you just added to my confusion. How can there be an infinite number of contracts? Surely you can only write a contract for something you actually intend to supply? I just don't understand this stuff.

Apologies if I sounded like I was lecturing!

Understanding this is the crux of the matter. Once you get this, you will see how speculation in futures cannot drive prices to any significant amount/duration.

Anyone can write a futures contract - there is absolutely no need to have any intent to supply whatsoever. And indeed, many speculators are doing EXACTLY this all the time. It is wrong to think that all that speculative money is going into the BUY side of futures contracts.

How is that possible? What happens when the contract is coming due and there are a hundred times more barrels of oil contracted for delivery than available? The answers are actually quite simple - once you get your head around them. But that is exactly the situation - it is EXACTLY the same as someone (like myself) who contracts to buy oil, but has no intent to receive thousands of barrels of oil in 2012.

So I could write a contract to sell a million barrels of oil, sell it on the futures market, and say 'so long, suckers'?

Remember that $260 billion?

Those million barrels require 1000 NYMEX oil futures contracts.

Exchange rules require your broker to have on deposit from you about $12,000 per contract in order to place your sell order. So yes you can, but you need to deposit $12 million up front! - Incidentaly, the figure (the margin requirement) is exactly the same for the buyers.

Furthermore, lets say the price of oil goes down $2 per barrel overnight relative to the price you contracted for. Your broker now requires you to cover that margin (ie: maintain that $12,000 per contract), so now you must pay your broker a further $2,000,000 by the end of the business day.

If you fail to do that, and lets say the market drops another $3 per barrel during the day, your broker will close off your position (by finding other 'sellers' to take it on at the market price). It's okay though, because your broker will still have $7 million of your $12 million margin deposit, and you can have that back no problem, you just lost $5 million in two days is all ... :-)

[nb: this is a little bit simplified, but pretty close to reality - there can be different margin requirements for day traders etc]

So, if I understand this 'infinite contracts' thing correctly -

I could create a contract, out of thin air, to sell a million barrels of oil, then sell it on the futures market.

I watch the price go up and down, and then before it expires and I would have to supply the oil, buy it back, screw it up and throw in the bin, and take the profit or loss.

What a scam! No wonder congress wants to put a stop to it.

On the other hand, if I bought a contract on the futures market that someone created out of thin air, and held onto that contract until it expired, the person who created that contract would have to quickly find some oil to supply to me. But if I sold it before it expired, he would be off the hook and would take the profit or loss.

Is that close enough? (I hope so, because I understand how that would not affect the 'real' price)

See, this is why you shouldn't look here for an explanation - when there are much better writers, because obviously I'm not being clear.

You cannot screw it up and throw it in the bin - your broker will transfer your obligation to someone capable of fulfilling it, and it will cost you dearly.

There is no scam!

If EITHER buyer or seller holds on to their end of a contract until it matures, and realises all their margin calls, they then become legally liable (it's a contract after all) for the supply of, or the paying for and receiving of 1000 barrels of oil at the contracted price. Failure to deliver your end of the contract will end up with you in court I imagine - certainly you will lose your entire margin deposit and any profits.

This is what separates speculators from commercials, speculators never hold on to contracts until delivery dates, commercials do (more so). A speculator who is long sells to a speculator who is short (or vice versa) and effectively, the two contracts become one. (I owe you $10, you owe X $10, what say I just owe X $10)

Also, whether you hold on to your end of a contract, has no bearing on whether the person on the other side holds onto their end - they may, and probably have, long sold it - this is the basis for any contract market. The two sides can be independently traded - this is how the market discovers fair value.

Incidentally, futures contract DON'T expire, they fall due. Options expire - but that's a whole 'nother story (and one that no-one AFAICT is accusing of manipulating prices)

In that case, I back to where I don't understand how there can be infinite contracts if there is not infinite oil.

But it's not me you have to educate, it's the MSM and elected officials.

its a chain of obligation

It's easier to look at things more simply, in my view, rather than worrying about the technicalities.

You can place a bet on oil, that it goes up or down.

If you are wrong, you loose, plus the transaction costs.

If you are right, you win, minus transaction costs.

So you are effectively betting against the house, and it really only make sense if you are buying for an airline, say, so if you are wrong you have just suffered some losses, but if you are right you may have saved your company from bankruptcy.

This is a very different thing from speculation in property, where rental income covers part of the cost and so can more properly be counted as investment, and it is only to the extent that the real reason for the investment is in the hope of profit from rising property prices that it is speculation.

Fundamentally those who are saying that it is a speculative premium causing high oil prices are arguing that the bet that oil prices will continue to rise is wrong.

Any investment is a speculation, as profit is dependent on certain conditions coming true.

At the peak of a speculative bubble stocks such as high tech in the last bubble trade at silly premiums to any forecastable earnings.

If you want to know whether the present price of oil, which as I have tried to indicate when you hold it is not generating any income at all, is speculative or soundly based you only really need to look at what you consider is the likely supply and what is the likely demand.

So the people who are arguing that there is a lot of speculation in the price are saying either that there is plenty more oil out there which will come on stream or that conservation or recession will drastically reduce demand.

I know the MSM troll TOD a bit, but still...

on one hand, this is a convenient break from study, on the other, it's a useful exercise in working out what works explanation wise and what doesn't.

Also, I've given up on the MSM and authority - they have a responsibility to educate themselves - if they fail, I feel sorry, but not responsible, for all the people they hurt in the process.

Last try (probably) :-)

See if this makes sense

P is producer

C is consumer

U, V, W, X, Y and Z are speculators

V and W take out a contract between themselves (V is long)

X and Y take out a contract (X is long)

U and P take out a contract (U is long)

C and Z take out a contract (C is long)

So

V<-W ; X<-Y ; U<-P ; C<-Z (where <- is one contract)

The day before the last trading day of the month W and X take out a contract. Then Y and U take out a contract.

V<-W<-X<-Y<-U<-P ; C<-Z

Now, W's contracts with X and V may be for different prices, but any loss will have been covered by W's margin calls; same goes for X, Y, U.

W, X, Y, U all take their profits (or loss) and thier contract positions are 'closed' by the market, as they hold offsetting short and long contracts (like the I owe you; you owe X)

V<-P ; C<-Z

The last day of trading, V closes off position too (in reality of course, the market matches buyers and sellers, rather than any of the traders having to identify the trader on the other side of the contract

C<-Z<-P ; as before, Vs positions is cancelled by the market, V take their winnings or remainder of margin deposit.

So, Z is left with two contracts, at different values, Z neither want to take delivery nor supply any oil, Z must exit the market, again, in reality the market mechanisms handle this automatically, and by showing a single chain rather than a morass of trading. If you imagine Z being the net speculative position at this point, Z is either net short, or net long; Z must find either real-world buyers, or real-world sellers depending on Z's net position; this forces the price Z ultimately gets to what the physical market will pay for his surplus contracts.

C<-P

Contracts fall due ; from many contracts at the start of the month, very few remain, and all of those are held by traders who actually want to trade gloopy stuff.

Infinite contracts available at the start, and remain so in the market as a whole, but NOT at the closing date for the front-month contract. As the number of contracts nominally available moves from infinite to finite, so the speculators are pushed out of the market, and the price moves to that determined by physical traders.

[Now, if you have physical oil speculators - you can keep the game going - BUT those speculators have to take delivery and store the oil - the moment they sell it, it pushes down the physical market - this is the basis for the no inventory build, no speculative driver argument]

Post exams and holiday in the UK, I'm going to think about an animated diagram, with running account totals, or something.

OK. I understand that. The speculators are only making - or losing - money off each other. Thanks for your patience with me, Jaymax.

I wasn't aware of the 'infinite contracts' before, so I assumed that speculators were bidding for contracts from producers, and then accepting bids on those contracts from consumers. I imagine that is what the MSM and EO believe. They will need to be corrected, too.

It seems to me that it would be far better to only allow producers and consumers to trade, but I have read that speculators bring stability to the market. I don't know how, but if that is the way it is, then very well.

Thanks for bearing with me to an extent as well.

It's not so much stability that speculators bring, as fluidity and honesty - by having lots of people interested in what a commodity is worth, theorising and betting on the price, we all get the net benefit of the net of all that knowledge.

By having many fewer parties trading, especially big parties (like OPEC, or refining operations) and trades much less often, there is hugely more scope for market manipulation (think of the commodity markets where manipulation has occurred) and also much more scope for information to be hidden if it's not in a particular players interests.

Speculators are like lubricant, sometimes a cog can be spun too fast, but it corrects easily, vs everything locked in place, inefficient to operate, and you need to hammer it until it suddenly gives way, or breaks down completely.

This may seem a dumb question, but what happens if an oilsheikh or a sovereign wealth fund used a lot of dummy buyers to buy secretly a heap (say a few hundred million barrels) of contracts a few years out.

When the month of delivery comes around then instead of closing out for a prorit/loss they insist on delivery.

Sure millions of barrels will be delivered but IIRK the contract even specifies the specific type of oil ( Cushing?). So what happens then when there isn't the possibility of supplying the specified oil?

BTW I'm assuming the buyer has booked a heap of tankers to store any delivery.

I'm not sure what you mean by "secret" but I guess you mean the buyer isn't identified, since the trade certainly isn't secret if it's executed on the commodity exchange floor.

What your'e saying is that someone wants to buy that quantity of oil - real oil, that's called "demand" and the price goes up according to how available it is. It doesn't matter who the buyer is, if they are going to take delivery then they are buying oil and then they have to store it or use it. But what's the point? If some sheik is buying oil for a higher price then he's going to pay for it. He's going to sell or use it? Your'e back to the argument that a speculator can drive the price only if they are going to store the oil. This secret sheik of yours is going to store the oil, right?

The point is the buyer is cornering the market as the Hunt brothers tried to do with silver circa 1979. If the Iranians can store 30 million barrels of heavy crude at the moment then storage is possible.

The Hunts cornering drove silver to $50oz but was undone as their funds were not unlimited and a thousand years of silver production was available ( plenty of fine tea pots got melted down at that time).

My point is if a huge number of these contracts for oil were exercised and the other parties cannot physically deliver then would the price for the contracted oil rise exponentially? WHAT HAPPENS THEN?

75 million barrels of oil are produced every day. It is physically impossible to corner the market for oil. Even if you bought enough oil to affect the price on a given day, 75 million barrels are produced the next day and the next day and the next. The effect of your one day will diminish over time like ripples in a pond. So you need to buy (and store!) oil every day to keep the price up. If you were to try to store 1% of oil, that would be 750,000 barrels a day, every day. If you had been doing that ever since prices spiked up last fall, you'd be talking about something like 150,000,000 barrels of oil. It isn't going to happen, and that was only to sequester 1%.

The market is just too big. At $140/barrel the annual world oil market is 38 trillion dollars. That's 3X the size of the US GDP. Only big producers have the clout to manipulate a market that big by controlling supply. There just isn't enough money in the world to do it with cash.

Yes, I realize it is 75 million/day. but that is worldwide for all types (WTI, Brent, Tapas etc) . But (correct me if I'm wrong) I have been lead to believe that the contracts specify the type of oil for delivery at Cushing, so if the buyer insists on that particular type and no other then is it down to a million barrels/day? (anyone got the correct facts and figures?)

Sure the buyer will need deep pockets and the storage facilities to pull this off, but if it happened and the other parties cannot meet the contract then what comes next in the days and weeks that follow after expiry?

Well, if your'e asking what comes next then I think the answer is there would be some kind of default and the exchange carries insurance to cover unfulfilled contracts. I'm not up on the details of that but it's my understanding that this is one of the purposes of a commodity exchange - that both sides of contracts are covered regardless. I don't believe that happens because of various requirements to be met before contracts come due such that the exchange ensures it is very unlikely for their own sake.

From what JayMax has been saying I take it that a futures contract is a bet on the price at some future time. A futures contract is not guaranteeing delivery of oil at the time the contract comes due. The bet can be legally settled with an exchange of cash. No oil involved. So the Sheiks can't demand delivery of oil.

I wish we'd make a better distinction here between options and futures. If I buy an option to take delivery on oil at a future date the delivery of actual oil is part of the deal. A futures contract is a side bet the value of which is based on the price of oil.

The rule I'm using from now on is to just substitute "betting" for "futures." The side bets of the gamblers tend to inform the market but their gambling does not directly result in a change in supply of the underlying good.

Given the size of the market - 80+ million barrels a day of actual consumption - it's hard to imagine any financial agent with deep enough pockets to "throw the fight" by actually manipulating the market.

Given the Federal Government's fine history of market management it's a good bet that anything they do to regulate the speculation in oil will result in oil going higher faster. From what has been explained in this thread, speculation may well be holding the price of oil down right now. The simple fact is that the spot price of oil is $139 a barrel. If I want a barrel of oil then that's what I have to pay. Once I have it I'll refine it, sell it and soon enough it has become CO2. It's a consumable vs: gold or houses or stocks. Gold has to be mined but once in the economy it stays in circulation. Houses have to be built but stay around for years. Stocks can be printed like money at zero cost.

Linearity is the lamp that illuminates the search for our lost keys. We seem to think the world is a place of smooth gradations when it's quite evident that rapid non-linear transitions are the common truths.

The Iranian government is in a pickle because of high unemployment and gasoline shortages. The US government is in a pickle because of a financial debacle. Israel is in a pickle because they are scared of Iran having nukes.

I'm feeling pretty confident that oil will see $200 quite soon.

Thanks, I didn't know that the buyer couldn't insist on delivery of actual oil.

It's interesting you mention that, it goes a long way to explaining why people misunderstand the role of speculators. I had never realised that this hidden assumption was there.

rick santelli telling the same story

http://www.youtube.com/watch?v=6oGAX1g60HU,

sorry i didn't manage to capture the vid audio only

Hans, Jaymax, Great exchange, that last comment you made about the speculators only making money off one another clarified it immensely for me.

And as delivery date approaches, more margin has to be put up, product

supply has to be identified.

yes but someone would end up without a chair when the music stops...

and since the spot price doesn't show any lack of buyers for the real thing it means what?

it means the price is pretty much there

Boris

London

Hans,

I know finding stuff in the "discussions" at TOD threads can be unnerving.

However, this issue has been dealt before here at TOD and in other places..

Quick summary follows

All in all, speculation can have some effect on the price, but it cannot (AFAIK) override the basic price formation of physical supply vs actual demand, which is settled daily on the spot markets.

While futures market can provide signals (false or not) to the spot sellers/buyers about future availability/demand, they do not dictate spot prices on the market such as oil futures.

Again, I'm not a futures/commodity trader and I could be wrong, but all the data (not just conjecture) I've been able find points to the above explanation.

Further, I'd love to be wrong on this! Nothing would make me more happier. But I will not try to believe what I want to, but what the numbers tell me.

Summary: there may be some 'speculative' premium on the price, but it is unlikely to be the majority of the price rice since $60-70/brl, like some claim

Such is the nature of reality, it doesn't stop existing even if I stop believing in it (paraphrasing Philip K Dick).

PS One could also try and think through reduction ad absurdum: In order for the speculators to hold their positions for this long at this level of high prices without cracking at the ranks, one would have to assume either tightly coordinated pack of speculators or a single speculator of gargantuan proportions. Either option, imho, leads to really absurd conclusions. While this is not a full proof on it's own, it would appear to support that such huge speculation is unlikely to be the cause for the price rise.

If its any consolation, I started studying oil trading last September. It took me a good six months before I really got a grasp on it. I never did find any good summaries but essentially had to figure it out for myself based on what bits and pieces were available.

I would add that oil futures are different from many other futures, say grains were real grain is more frequently exchanged via futures whereas for oil it is almost none. Farmers have been complaining about this because when real product is involved, it does affect the price because it becomes an actual sale.

Blix, you need to understand that with futures you can offer something for sale that you do not possess. Its called short selling. If you get caught short, then you have to buy it and provide it at the current price. Does this make any sense to you?

Good post, Jaymax. I would like to add a few more things. In a recent column, Paul Krugman showed a chart of spot prices for oil over futures prices. The spot price has consistently been higher than the futures price. Clearly spot prices have been leading futures prices. Speculators are actually holding back the price of futures and preventing them from keeping up with oil.

Secondly, money flowing into futures doesn't mean futures have to go up. One can sell oil in futures as well as buy. If you invest "long", you will have a tendency to push the futures price up. If you invest "short", you will have a tendency to push the futures price down. The ratio of long-to-short contracts has actually been shrinking in recent months and is down to only about 3%. What that means is that most of the new speculator money is shorting oil and putting downward pressure on futures prices.

Finally, it is important to understand that speculators don't buy oil. They buy pieces of paper. Buying and selling pieces of paper do not affect the supply or demand for oil, so they have little effect on prices. The one exception to that is that if futures prices are higher than spot prices, a producer (not a speculator!) might elect to keep oil off the spot market by storing it somewhere and sell it by contract instead on the futures market. That way they temporarily lower the supply of oil (but only temporarily) on the spot market. However, we can be pretty sure that is not what has been driving up oil prices. First, there's no evidence of increased producer storage. Secondly, futures prices have NOT been higher than spot prices, so producers are going to sell it on the spot market and not keep it off the market for future sales.

There is no magical force that will pull oil prices up just because some speculators have bid up pieces of paper. Futures are derivatives that derive their value from the price of oil. If oil moves, the futures will follow. What speculators do is lay bets on which way oil will move. The ones that bet right make money. The ones that bet wrong lose. But betting doesn't affect oil prices. Supply & demand affect oil prices. Unless speculators are affecting the supply or demand for oil, they are not having an effect on prices.

Good post back at you!

One tiny clarification for readers, just 'cos it's something that had me confused for months:

This is the ratio of long-to-short for SPECULATIVE traders - non-speculative traders, who actually also provide and/or take delivery of physical oil, are called COMMERCIALS.

At any point in the market there are exactly the same number of LONG and SHORT overall (each being one side of the total number of contracts) - however sometimes speculators are more long, and commercials more short, and sometimes vice versa. Whenever the 'net long' or 'net short' ratios or figures are given, that almost always refers to the total speculative position; and the commercials will have the opposite.

Observation: This means that since only 3% of longs are "speculative" that 97% of longs must be commercial.

Corollary: This means that 97% of shorts are speculative.

Interpretation: The commercial buyers (oil companies - the ones who actually have production data in front of them) believe in the current price of oil.

Further observation: The speculative shorts have been betting for at least 2 months (May and June) that oil prices will fall. They have lost large amounts of money both months.

P.S. Did anyone notice that The IMF has informed Ben Bernanke that the entire US economic system will be audited? Are the crows coming home to roost finally on US economic policy? Exactly at the same time as resource constraints are exploding across the horizon? Are we going to be dead broke at the exact moment we need to rebuild?

Shargash, I agree there is liitle 'above ground' storage going on by anybody and hence the rising spot price isn't caused by trading paper contracts in future price speculation.

But, can you explain why the flat world crude production for the last ~4 years is not due to producers deliberately deciding to store oil underground by not producing it at maximum rate, rather than geologic reasons.

Why can the speculators not be the oil producers - not just nations like KSA who do actually claim to have extra capacity, but oil cos like Exxon? It seems logical to me that the speculators are, in fact, the producers, not the futures traders - especially if there is a geological constraint due to the need to maximise profit from each well drilled.

Speculation is taking a calculated risk that you can make a future profit from some investment made today, and is the essence of any business.

Talking of oil cos, if the price increases in oil futures were being driven by speculation, would we not see speculation in oil company share prices too?

Is this happening?

Xeroid,

Sure, you are absolutely right. This has been going on for as long as OPEC has been in existence. Until recently, I think the price of oil would have been around $10/barrel since the 1980s, if everyone had been producing all out. However, increasingly since about 2005, the producers have been getting closer to flat out production. I think they hit it in early 2008. The only spare capacity now is sour and/or heavy stuff that there aren't enough refineries capable of handling.

But I think you're broadening the definition of speculation beyond what is being used in the general public discussion. The Evil Speculators(TM) are people who neither produce nor consume oil, but profit (or lose) by the moves in oil prices. By a broad definition, buyers speculate all the time. Recently, SouthWest airlines speculated that aviation fuel prices would go up, so they bought futures contracts to lock in the price. Many other airlines speculated fuel prices would go down, so they didn't (or did it to a lesser extent).

Also, there is a point at which producer "speculation" as you've described merges with "intelligent management of a scarce resource". Take ANWR for example. Should the US open drilling now, or should we save it for when oil is much scarcer? Should the Saudis pump Ghawar dry so Americans can drive SUVs, or save it for future generations of Saudis?

Increasingly, as Peak Oil awareness spreads around the world, we're going to see countries make deliberate decisions to not pump the oil flat out to try to preserve some for an oil-scarce future. I think that would be the intelligent thing to do, but it is going to accelerate the decline in oil supply.

The solution to the crisis is to use less oil, preferably by turning to renewable alternative, preferably not by economic collapse and die off. If humans were wise, we'd be doing that simply because we must. But humans aren't wise. High oil prices are our only hope at this point for forcing a reduction in consumption and accelerating the conversion to something other than oil. I think it would be a disaster if TPTB were actually able to bring down the price of oil. I don't think it is high enough yet. The demand destruction in the US caused by $4/gal gasoline is trivial. It needs to go much higher, or we need to spontaneously become more wise than we've demonstrated so far.

Hell, in that case we are all speculators. But it doesn't really help to clarify the issue.

If suppliers restrict supply, then it clearly becomes an issue of supply and demand, regardless of the reasons why suppliers choose not to supply.

Exactly, but this is the opposite of what classic economics theory and people like CERA and the IEA would predict, rising prices are supposed to bring on rising production but evidence from places like the North Sea shows the exact opposite! Classic economic theory clearly does not apply to things like food or oil that have inadequate alternates.

Since it looks like suddenly it makes business sense for all producers to resrict production, I suspect we have reached a stage where overt membership of OPEC now has little value (maybe negative value since everybody thinks they are deliberately holding back production even if they are not?) - IMO this has very serious implications for the rate of decline of 'net exports' or put another way, the demand for very expensive 'net imports'.

People who talk of decline rates around 4% or 5% may be hopelessly optimistic if new rules suddenly apply to the oil business for profit maximising reasons (let alone political reasons) - it looks like existing western oil company business models might be somewhat broken and need tweaking to cope with the new reality. Maybe not so good as expected in the future for the rest of us!

I saw this article over at LewRockwell.com that puts the whole speculation theory to rest.

While the rest of the article is pretty bad (the author naively blames government regulation as the primary cause of higher prices), I think the explanation for why it is not speculation is an excellent one.

If the sell price is the same as the buy price, there wouldn't be speculators in the first place. This does not make any sense. It does not put anything to rest, it just adds to the confusion.

It is not saying the sell price is the same as the buy price, but that the force acting on the market from the contract is neutralised.

The trader may have made a profit or a loss due to the market moving while they held their contract from ALL the net forces at play on the market, but each month, as many contracts are bought as sold, therefore the forces buying and selling are neutralised once everything netted out.

If loads of speculators pile into the market one month, and were all on one side (long or short) that could move the price for a short while - but in reality, that doesn't happen significantly, because as the price moves up, more speculators start betting it will go back down - and vice versa - and ultimately, they all sell off their positions, applying an equal and opposing force, pushing the market in the other direction.

It might be possible to construct a 'model' using acceleration, velocity and displacement, where cart position is price and each buy or sell of a contract is a transient force applied in both directions simultaneously from an offset position. I'll have to think about that.

He is correct, for every long there is a short..

Jaymax,

I don't think you have proven your point. The diatribe on what action and motivations Hans has or should should follow are irrelevant to the question of understanding the problem.

I do not feel you have addressed the problem, namely why and where have the "Establishment" got this opinion that the speculators have driven the price of oil Up.

In my opinion you need to start with how the 'false' perception could have appeared meritorious in the first place and then explain the incorrect turning points that seem to be accepted by possibly millions of intelligent people.

Graham

My sentiment too. I am in conversation with Jaymax, and I thank him greatly for trying to educate me. I just thought I had it figured out, but alas I am totally wrong again.

I'm well educated, and if I can't grasp this, how do we expect the MSM, general public, or elected officials to grasp this?

Once again, I'm not asking TOD memebers to educate me. As Jaymax said earlier, it is laborious to educate someone for no other reason than to save them the trouble of educating themselves. What I am saying is - if there was a way of explaining, in simple terms, how the speculators can't be driving up the price of crude oil, then we would have something with which to educate those who believe that they are. And I don't have enough of an understanding of this to formulate a simple explanation for others.

They see the same thing I do. Massive funds going into the futures market, and assume, as I do, that this money must be having an effect. Of the dozens of stories I have read regarding speculators and oil prices, almost all of the 'speculators are causing it' stories just quote the money going in, and the 'speculators are not causing it' stories do not explain why not.

Surely someone has the answer.

And even this article here of Jerome's doesn't bother to explain why it's not the speculators, it does just the same as all the other stories I have read, just go on to blame something else, in this case Peak Oil.

(Yes, I know this is a 'Peak Oil' website, and that's the party line.)

And if you tend to be dismissive of Peak Oil, which the MSM and elected officials seem to be, well, it's then easier to dismiss the claims that it's not the speculators.

By the way, where is Jerome? Why isn't he here weighing in on all of this?

After all, it's his article.

the amount of money going in is not a measure of how much oil there is.. the money is just moving around with in the market in question.

changing hands

This is part of your problem. The funds are not massive. They are peanuts. At $140/bbl, the annual world oil market is 38 TRILLION dollars. That's 3 times the size of the US GDP. The few billions pumped in by institutional investors are anything but massive.

There is not enough cash in the world to manipulate the oil market by buying & selling. At this point, only actual producers of oil could manipulate the market. And at this point it is really impossible to know whether oil production is flat because oil producers choose not to pump more, or because they can't. That's really what the entire PO debate is about.

Giddaye Shargash,

Your comment seems to hit the perverbial nail (for me at least).

Thanks, Matt B

Er, no.

According to your calculations the oil market is around the same size as the total world economy - not too reasonable, is it?

At 86 million barrels a day, you are actually talking about around $4.5 trillion a year - a sizeable chunk of change, but a lot smaller than the US economy.

Dang! I hate it when you guys get the figures muddled. Because I end up passing on bad info to my immediate circle (at least, those who want to listen!).

Regards, Matt

Right even expanding the futures markets to make oil act as a real store of value can only protect a fraction of the wealth in the world. The rest will be demand destructed to use our phrases. Debt will be defaults cash investments heavily devauled etc.

You can see that even if the price of oil increases 4-5 times from todays values the overall real economy supported by this with oil say taking a 15-20% of the Global GDP is about 1/10 of the current world economy.

Regardless of the price of oil this is what I call the "real" economy dealing with staying alive and its obviously only a fraction of the other economic modes if you will that we have created.

The vast majority of the rest of the economy is not relevant to a population trying to survive. To see this you can take the range of the economy in say a poor village in India and compare to a small middle class town in the US. Almost all the jobs being done in the Indian village are directly related to survival and needed while when you look at the small town America maybe 1 out of ten are critical.

So this gives you a sort of ballpark for the type or scope of contraction thats possible. And it shows that contraction of the real oil economy as supplies falter is a minor part even though its the causative agent.

Let me try. In the US we bet on football. Normally, one bets on a team and receives or gives points. That is you bet that team A will win by more than x points. In making that bet someone is accepting your bet so someone will win and someone will lose. So far no one has suggested the volume of betting on the Super Bowl has influenced the score of the game. Likewise the $10,000 bet by Simmons that oil would hit (average?) $200 does not drive the price of oil up. In some sense, future contracts are like bets on games.

All this begs the question as to what IS the actual cost of crude. Obviously getting it out of the ground... from an existing rig only depends on labor and energy costs.

This would seem to indicate that if the cost of extraction is relatively stable, or at least in line with "inflation" and the energy and labor costs are relatively small, it would seem that the cost is demand driven; that the price is being bid up by the demand and without capacity to match the demand the commodity becomes "scarce".

But of course this means that producers are laughing all the way to the bank. One cost them $1 to produce costs them $1 tomorrow (more or less) but the selling price... at least in the last 5 years has increased 5 times.

Demand is clearly up as shown in the graphs above. But it's not up 5 times (or whatever the point was that crude spiked.