Are We in a Speculative Bubble with Regard to Oil Prices?

Posted by Sam Foucher on October 31, 2007 - 3:30pm

Maybe the two most common explanations (or myths) about high oil

prices are:

- oil companies are manipulating prices

- speculators are driving prices up

"To increase by 500,000 or one million barrels, do you believe today it will bring back the price?" Attiyah asked. "I don't think so," he said, emphasizing his view that the price of oil had become almost wholly decoupled from supplies. Financial players "lost a lot of money on real estate, shares and bonds, and then they jumped to commodities," including oil, Attiyah said.

Herald Tribune

A few basics definitions are required for the newbies in commodity

trading (including myself):

The main findings of the Senate report can be summarized as the following:

However, correlation is not causation and Professor Graig Pirrong (Professor of Finance and Energy Markets, University of Houston) has offered a nice rebuttal to this report on his blog. He blasted the report as being "a farrago of facts, factoids, and falsehoods stitched together to arrive at a conclusion", in his view:

Dwight R. Sanders, Keith Boris, Mark Manfredo, Hedgers, funds, and small speculators in the energy futures markets: an analysis of the CFTC’s Commitments of Traders reports,

Energy Economics (26), 2004, pp. 425– 445.

looks at the relationships between market returns and trader positions (buying short or long contracts) and came to the following observations:

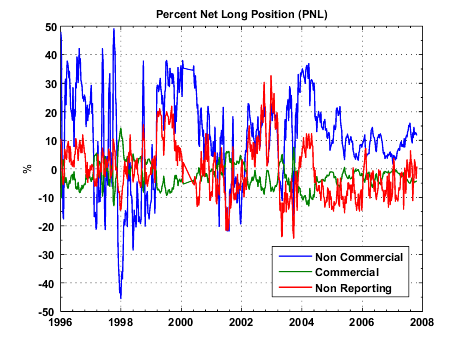

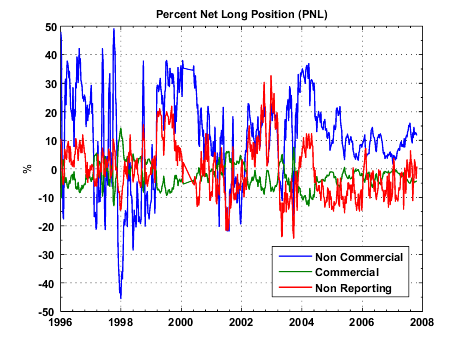

The commercial PNL (Percent Net Long position) is also called "hedging

pressure" and the non commercial PNL is the "speculative pressure".

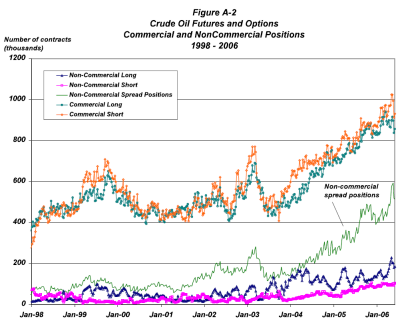

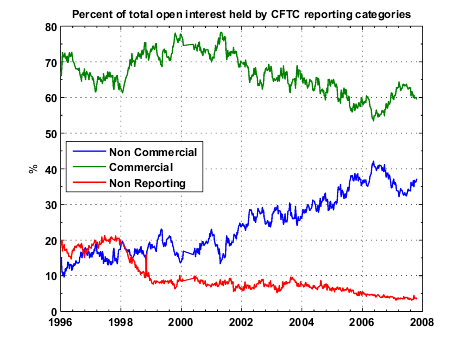

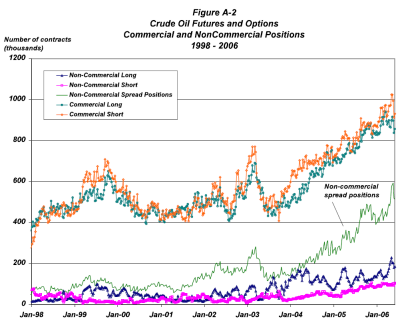

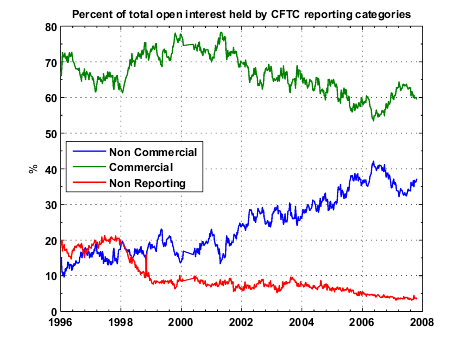

The figures below are showing the importance of each trader category as defined by the CFTC, we can see that the Non Commercial and the Non Reporting groups are a small portion of the total open interest and that their activities have significantly changed since 2002 (see Table I below). Positions held by non commercials have increased with prices and are now around 40%, we can see clearly that changes in positions or non commercials and commercials are antagonists.

Fig. 3 Percent of total open interest per trader category. Click To Enlarge.

Another characteristic is that non-commercial traders were switching from long to short all the time compared to the commercial group before 2003 but have consistently stayed long since 2003 which can explain the contango situation in the future market.

Fig. 4 Percent of total open interest per trader category. Non commercial PNL is also called "speculative pressure". Click To Enlarge.

Table I. Percent of total open interest and Percent net long

held by CFTC reporting categories.

aaverage over the period.

bstandard deviation over the period.

cThe minimum and maximum sample values are presented in parentheses (minimum, maximum).

Fig. 5 Charts from the Wall Street Journal (Where Has the Oil Gone? October 6, 2007).

Prof. Hamilton and Pirrong have also recently commented on this situation (here and here).

Gail the Actuary, What Can the Commodity Market Tell Us About Peak Oil?

Dave Cohen, Scarcity and Oil Prices Again

Dave Cohen, Predicting Future Oil Prices

Nate Hagens, A Closer Look at Oil Futures

Stuart Staniford, Is Oil in a Price Bubble?

And when you're done with this, don't forget to check out Robert's This Week in Petroleum

- Contracts: covers 1,000 U.S. barrels for crude oil. For crude oil, each contract expires on the third business day prior to the 25th calendar day of the month preceding the delivery month. If the 25th calendar day of the month is a non-business day, trading ceases on the third business day prior to the business day preceding the 25th calendar day. After a contract expires, the front contract for the remainder of that calendar month is the second following month.

- CFTC: The Commodity Futures Trading Commission (CFTC) is a federal agency that is collecting data on the composition of open interest for all futures contracts. The CFTC is charged with regulating futures and options trading to ensure that the markets are free from manipulation.

- COT: The Commitments of Traders (COT) reports provide a breakdown of each Tuesday’s open interest for market reports in which 20 or more traders hold positions equal to or above the reporting levels established by the CFTC.

- Open Interest: Open interest is the total of all futures and/or option contracts entered into and not yet offset by a transaction, by delivery, by exercise, etc. The aggregate of all long open interest is equal to the aggregate of all short open interest.

- Reporting Commercial traders: are associated with an underlying cash-related business and they are commonly considered to be hedgers.

- Reporting Non-Commercial traders: are not involved in an underlying cash business; thus, they are referred to as speculators (commodity funds). Boone Pickens, well known in the Peak Oil community, is also the head of one of the most successful hedge fund ever (BP Capital Management).

- Non reporting traders: small speculators.

- Spreading: For the futures-only report, spreading measures the extent to which each non-commercial trader holds equal long and short futures positions.

- Short position: When trading futures contracts, being 'short' means having the legal obligation to deliver something at the expiration of the contract, although the holder of the short position may alternately buy back the contract prior to expiration instead of making delivery. Short futures transactions are often used by producers of a commodity to fix the future price of goods they have not yet produced. Shorting a futures contract is sometimes also used by those holding the underlying asset (i.e. those with a long position) as a temporary hedge against price declines (src: Wikipedia).

Trading crude oil futures is done the same way as any other investment - by buying low and selling high. One difference with futures, however, is that it's just as common to sell "short" - to sell first, in other words - and then buy back later as it is to buy first, or "go long." With futures trading, if you think prices are going up, you simply establish a "long" (buy) position. If you think prices are going down, you initiate a "short" (sell) position. Once you've established your futures position, you have a couple of alternatives:

- Offset your position by taking an equal but opposite position. You can exit from any futures position before the contract expires by taking an equal but opposite futures position (selling if you have bought; or buying if you have sold). Most futures are offset in this way. You don't have to wait until the expiration date to complete your trade - in fact, few investors do.

- "Roll" the position over from one contract expiration into the next. If you hold a long position in an expiration month, you can simultaneously sell that expiration month and buy the next expiration month (known as a "calendar spread") for an agree-upon price differential. The opposite is also true - you can roll a short position from the expiration month to the next available trading month just as easily. By transferring or "rolling" a position forward this way you are able to hold it for a longer period of time. For example, if you are holding a June Gold futures contract, you can sell the June futures before expiration and buy a December Gold futures contract, thereby expanding the timeframe of the trade.

The main findings of the Senate report can be summarized as the following:

- Rise in Speculation. Over the past few years speculators have expended tens of billions of dollars in U.S. energy commodity markets.

- Speculation Has Increased Prices. Speculation has contributed to rising U.S. energy prices, but gaps in available market data currently impede analysis of the specific amount of speculation, the commodity trades involved, the markets affected, and the extent of price impacts.

- Price-Inventory Relationship Altered. With respect to crude oil, the influx of speculative dollars appears to have altered the historical relationship between price and inventory, leading the current oil market to be characterized by both large inventories and high prices.

- Large Trader Reports Essential. CFTC access to daily reports of large trades of energy commodities is essential to its ability to detect and deter price manipulation. The CFTC’s ability to detect and deter energy price manipulation is suffering from critical information gaps, because traders on OTC electronic exchanges and the London ICE Futures are currently exempt from CFTC reporting requirements. Large trader reporting is also essential to analyze the effect of speculation on energy prices.

- ICE Impact on Energy Prices. ICE’s filings with the Securities and Exchange Commission and other evidence indicate that its over-the-counter electronic exchange performs a price discovery function – and thereby affects U.S. energy prices – in the cash market for the energy commodities traded on that exchange.

However, correlation is not causation and Professor Graig Pirrong (Professor of Finance and Energy Markets, University of Houston) has offered a nice rebuttal to this report on his blog. He blasted the report as being "a farrago of facts, factoids, and falsehoods stitched together to arrive at a conclusion", in his view:

If anything, the entry of speculators affects the price of energy price risk. That is, it impacts the “drift” in a futures price to an expected future spot price that is based on expectations regarding supply and demand conditions at contract expiration, rather than affecting the price of physical oil. Put differently, derivatives markets are primarily for buying and selling price risks rather than for buying and selling the commodities themselves. The delivery process ensures that futures prices converge to physical spot prices, but the amount of activity in contracts with payoffs tied to a commodity price need bear no relationship to the amount of the physical commodity available, and if speculators (and others) act competitively, the physical spot price will be driven by supply and demand fundamentals regardless of the magnitude of the “side bets” on commodity price risk.

Relationship Between Traders' Positions and Prices

This recent study by Sanders et al.:Dwight R. Sanders, Keith Boris, Mark Manfredo, Hedgers, funds, and small speculators in the energy futures markets: an analysis of the CFTC’s Commitments of Traders reports,

Energy Economics (26), 2004, pp. 425– 445.

looks at the relationships between market returns and trader positions (buying short or long contracts) and came to the following observations:

- Traders classification is somewhat imprecise and subject to errors: there is no information about the motives of no reporting traders, commercial positions likely reflect a diverse set of motives. However, non commercial traders have no incentives to classify themselves as commercials.

- Between 1992 and 1999, non commercial positions are a small fraction of the TOI (~10%) but they are very volatile (i.e. they change from long to short on a weekly basis) whereas commercial are a large fraction (~70%) and are buying short positions.

- When prices rise, reporting non commercials are net buyers of long positions (i.e. they tend to follow trends and act as a group) whereas commercial traders are sellers of long positions.

- When prices fall, reporting non commercials are net sellers whereas commercial traders are long positions buyers.

- Commercial traders's positions do not lead price (funds do not increase long positions prior to rising prices).

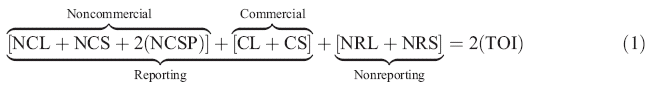

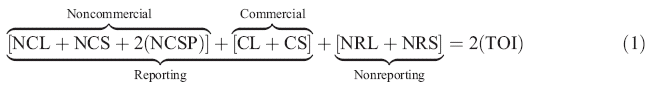

Reporting commercials percent of TOI = (CL + CS) / (2TOI)

Reporting non commercials percent of TOI = (NCL + NCS + 2(NCSP)) / (2TOI)

Commercial NPL= (CL - CS) / (CL + CS)

Non commercial NPL= (NCL - NCS) / (NCL + NCS + 2(NCSP))

The figures below are showing the importance of each trader category as defined by the CFTC, we can see that the Non Commercial and the Non Reporting groups are a small portion of the total open interest and that their activities have significantly changed since 2002 (see Table I below). Positions held by non commercials have increased with prices and are now around 40%, we can see clearly that changes in positions or non commercials and commercials are antagonists.

Fig. 3 Percent of total open interest per trader category. Click To Enlarge.

Another characteristic is that non-commercial traders were switching from long to short all the time compared to the commercial group before 2003 but have consistently stayed long since 2003 which can explain the contango situation in the future market.

Fig. 4 Percent of total open interest per trader category. Non commercial PNL is also called "speculative pressure". Click To Enlarge.

| 1996-2002 | 2003-2007 | ||

| Reporting commercials percent of TOI (%) | Commercials | 69.8a 4.0b (61.3, 78.3)c |

61.5 3.5 (53.4, 68.9) |

| Non Commercials | 18.3 4.19 (9.63, 29.2) |

32.8 4.6 (24.1, 42.1) |

|

| PNL (%) | Commercials | -1.71 4.41 (-13.0, 14.2) |

-3.63 3.19 (-33.4, 35.5) |

| Non Commercials | 12.8 5.55 (-33.4, 35.5) |

8.0 6.22 (-10.34, 25.0) |

aaverage over the period.

bstandard deviation over the period.

cThe minimum and maximum sample values are presented in parentheses (minimum, maximum).

Futures Trading and Inventories

There is also a strong relation between the speculation on future contracts and inventories levels. When future prices are higher than the front month contract (a situation called Contango), it becomes profitable to keep inventories high because you are guaranteed to make a profit. Conversely, when futures are lower than short contracts (a situation called backwardation), inventory levels will tend to decrease. The strong run up in prices since the beginning of this year has push front prices faster than future prices and we are now in a backwardation position. In addition, stock levels have started to fall.

Fig. 5 Charts from the Wall Street Journal (Where Has the Oil Gone? October 6, 2007).

Prof. Hamilton and Pirrong have also recently commented on this situation (here and here).

All of this illustrates how complex the energy markets are, the mechanisms are very often oversimplified by medias and appearance can be deceiving. In particular, we have to be cautious in our interpretation of the stock levels. A lower inventory situation does not necessarily reflect a real supply/demand inadequacy.

Related stories on TOD:Gail the Actuary, What Can the Commodity Market Tell Us About Peak Oil?

Dave Cohen, Scarcity and Oil Prices Again

Dave Cohen, Predicting Future Oil Prices

Nate Hagens, A Closer Look at Oil Futures

Stuart Staniford, Is Oil in a Price Bubble?

And when you're done with this, don't forget to check out Robert's This Week in Petroleum

CNBC reporting now,,US Crude supplies down 3.9 million barrels versus an expected build of 100,000 barrels. Refinery utilization down .9% to 86.2%

... and they are off to the races in the NYMEX pits, oil up $2.50+ as I type

It seems to me the situation is like this: big players are getting rid of the US dollar, because of the low interest rates, so there is lot of $$$ around, so the dollar is falling down, so those who have them are trying to do something with them, to buy some oil for example, so there is an increased demand, so the price of oil goes up, so the exporters fear they gonna end up with too much worthless dollars in the hands, so they are thinking of switching to the Euro and other currencies, which additionally motivates every one to get rid of the dollars, so they buy oil, and so on and so forth.. Something like that I believe.. It's accelerating.

To rehash your argument, as I understand it, the Fed's lowering of interest rates increases the incentive to borrow from the Fed. This 'borrowed' money is not so much borrowed, as it is conjured out of the ether, which increases the supply of dollars. This increase in the supply of dollars devalues existing dollar assets, which gives the holders of these assets an incentive to exchange them for oil, in order to insulate themselves from dollar inflation.

The primary flaw I see in this argument is that it implies the purchase of excess oil, which will need to be stored somewhere. This is problematic because the buffer capacity for excess crude is fairly small compared to the rate of consumption. National reserves are typically measured in days or weeks, so there is not enough buffer capacity to hoard an appreciable quantity of oil. The excess capacity would be filled within a matter of weeks or months, after which the hording would no longer be a significant market force.

Secondarily, any concern over the risk associated with holding dollar assets for future oil purchases could easily be mitigated by purchasing 'long' oil futures contracts, which would guarantee a fixed price for the oil. This would effectively insulate the holder of dollar assets from helicopter Bernake's policies and concurrently solve the storage problem.

There is no doubt that the increasing supply of dollars is affecting their purchasing power, which is likely reflected in oil prices as well as the value of the dollar relative to other currencies. If the objective is to shield the value of assets from inflation, it would be much more straightforward to dump the dollar for the Euro, which also can be used to purchase oil.

If this were to occur on a large enough scale, the relinquished dollars would measurably increase the supply in circulation, further devaluing the dollar. This in turn would prompt other dollar holders to exchange them for something else. Once this positive feedback cycle begins, it is likely to result in a complete dollar meltdown. The big institutional holders of dollar assets know this and are looking for some way to quietly dump their dollars without triggering a panic.

1) Oil is priced in dollars NOT necessarily traded in dollars.

2) Big players can get rid of dollars just as easily by selling them elsewhere. The idea that they can dump them on oil producers depends on the assumption that oil producers put a different value on the dollar.

3) The basket of currerncies idea only refers to the oil price, not to the currency it is traded in - it makes no difference.

I tried to explain this here:

http://globaleconomicanalysis.blogspot.com/2007/10/basket-of-insanity-at...

Mish does a better job here:

http://globaleconomicanalysis.blogspot.com/2007/10/basket-of-insanity-at...

CNN.com starts out this morning with two idiotic news articles explaining how high oil prices won't damage the US economy because we're so much more "energy efficient" now. Some of my favorite quotes:

I guess the news "reporter" who wrote this hasn't noticed that fuel efficiency of US vehicles has actually gone down thanks to the SUV/pickup truck revolution. As for manufacturers being "more efficient," that has mainly to do with the fact that they've moved their factories to China. As China's energy consumption goes up, America's goes down, creating the false appearance that American manufacturers are using less energy.

Any news reporter who uses Daniel "$39/barrel" Yergin as a reliable source of information should get his head examined.

Ozonehole

If you take Yergin out of context and pay no attention to his past history as a prognosticator, then his observation is accurate.

I read on one of Leananan's links to the Financial times that China's imports were up over the last calender year 18.7%. Since the big mega-projects that were supposed to come on line didn't do so(the Caspian and the deep Gulf of Mexico projects, BP's Thunderhorse and Atlantis), I think Yergin's observation is fair. Then again, if frogs had wings they wouldn't bump their butts when they hopped. But it is fair to say that upper pressure on prices is demand driven.This is a different situation than anytime in the last 105 years, when Spindletop and the Lucas Gusher blew in at 70,000 bbl. a day. Since then the only shortages have been caused by war and embargos-"above ground considerations".

And we can laugh at Daniel Yergin all we want, but he's making huge money restating the obvious and keeping a straight face while telling the oil companies and right wing think tanks what they want to hear. And he's a good writer too-I think he deserved the Pulitzer, and also to have the oil price increases denominated with his name. We're hovering around 2.7 Yergins this week.

If we didn't have him to kick around peak oil would be mighty glum and discussed only by guys with pocket protectors for their ball point pens and scientific calculators clipped to their belt.

Bob Ebersole

I do have to hand it to Yergin - he knows which side of the bread is buttered. Seeing all the money made by right-wing attack dogs like Rush Limbaugh, Ann Coulter, Michelle Malkin, etc, I've wondered if maybe I shouldn't adopt a pseudonym and write trash-for-cash for right-wing stinktanks and then on another web site use my real name to refute the trash. I actually knew a guy who did this in the "letters to the editor" page of a major daily newspaper. One of his personas was a right-wing nut, and he had a left-wing alter ego. He kept launching rabid verbal attacks on himself. He was doing it just for fun, not for money, and nobody but a few of his friends knew what he was up to. We just fell over laughing every time we read his stuff. Even funnier was when some of his nutcase writing got quoted in news articles - the reporters were clueless.

regards,

Oz

People do get a little humorless sometimes. I guess I have my trollish moments, too. A couple of months ago Drumbeat was working itself up to the No Knothing position in reguards to the Mexican illegal immigants, the Lou Dobbsian pro Minuteman stuff. I got in a couple of serious arguments calling a spade a spade about the Minutemen-they are a bunch of drunken thugs, carrying guns and intimidating Latinos here in Texas and elsewhere. Allowing that kind of Militia was one of the primary causes of the American Civil War.

I think the immigration situation is a result of our energy and climate change situation, combined with Thomas Malthus. Spanish and Portugese speaking America is a real seat of the world population growth and climate change is hurting the productivity of the lands with chronic drought in the Amazon and the Chihuahuan desert. And, its only going to get worse if we don't help them out to become prosperous at home. At any rate, I started calling the illegal immigrants "Documentationally Challenged", which I thought was pretty funny and a pretty fair ribbing of the politicially correct verbal conventions we all adhere to these days.

Only on problem, nobody laughed or even acted as thougth I might be kidding . Oh shit, we are entirely too serious. And that's not a joke.

Bob Ebersole

The comedian Don Novello had a great series of books in his personna of Lazlo Toth, where he published his letters and replies from various places. I would love to read this set you describe.

Phil Hendrie on the radio does this in real-time where he fakes out his callers by creating fictitious guests with his own voice. But everyone knows the joke except for a few clueless that call in. But unlike oil, there is an unlimited supply of cluelessness.

I'm sure that the reporter also didn't note that a dollar today is worth much less than half of a dollar in 1980.

http://reddit.com/info/5zixl/comments/

http://digg.com/business_finance/Is_Speculation_the_Reason_for_Oil_s_Pri...

thanks for your support and thanks for spreading this around to interested parties.

A lower inventory situation with a higher price reflects a real supply inadequacy.

Incidentally, the current record high prices do not reflect record speculative long contracts. Net speculative longs actually decreased last week. The price went up because there was a decrease in commercial traders' net shorts.

Speculative net longs last week were only roughly half what they were July 31 of this year.

If you have speculators covering shorts, and refiners choosing to draw down inventories instead of paying $90 for crude (see Note 1 in my TWIP today), you can get mixed signals.

Just posted this from OPIS in the other thread:

We did NOT have speculators covering shorts last week. We had speculators closing LONGS. We had COMMERCIAL traders (industry people) covering shorts last week.

The reason prices are going up is because refiners can no longer choose to draw down inventories, because their stocks are already so low.

You appear not to understand the signals at all.

The year-to-year difference in speculative longs comes primarily from the reweighting of the GSCI in August 2006, in which Goldman caused a massive selling of gasoline futures by all funds using the GSCI. That was simply an artificial and temporary rigging of the market.

OK, I am handing out candy for a bit (it's Trick or Treat time in Scotland, where they interestingly emphasize the "Trick" part). I want to address this one.

You appear not to understand the signals at all.

Says the guy who thinks "stocks are already so low", despite the fact that they are above their 5 year average. Look at gasoline stocks to understand what low stocks really mean. This also from the guy who has some trouble with probabilities, for thinking that getting even money on something that the market values at a 17/1 longshot is a "bad bet." More elaboration on that in a later essay.

Stocks have been drawn down from very high levels, where they have been since they recovered from Hurricane Katrina. At $90 a barrel, is it a surprise that refiners don't wish to hold as much in inventory? Don't forget, I have worked in refineries, and have a lot of contacts still there. I spoke with one about this today. She told me exactly what I figured; they are drawing inventories down somewhat, buying the cheapest barrels they can find, and are trying to wait out this price spike. That's one refinery, but I guarantee you it isn't the only one adopting that strategy.

I need to do a post on LP models that refiners use to guide their decisions. I think that would help clear some issues up. I see a lot of speculation about what's going on with refineries that is often incredibly far off the mark. Heck, I recently saw a post here where somebody didn't think there were any refineries in the U.S. that can process heavy, sour crude!

As far as the rest, that's verbatim from OPIS, one of the most respected names in the business.

The year-to-year difference in speculative longs comes primarily from the reweighting of the GSCI in August 2006, in which Goldman caused a massive selling of gasoline futures by all funds using the GSCI.

That's a nice theory, except for the little bit that August 2006 isn't between October 2006 and October 2007. Sort of like your theory that Saudi made a snap decision to shut down a refinery based on lack of crude. Even though they were making complex tie-ins during that shut down that take MONTHS to plan. I knew when you said this that while you might know something about the market, your understanding of what happens inside the fence leaves much to be desired.

Two questions, and I really hope you get time to answer:

1. How long can the continue to wait out the price spike while drawing, say 3mb per week from their inventories?

2. When they cannot wait any longer and decide to bite the bullet and pay the >$90 price, will that not cause prices to rise even further?

The heart of the Whack-A-Mole theory of post peak oil prices exposed :)

This is the new situation right now. Buyers that cannot afford to buy waiting till they have to and then forced to buy at any price.

How long can the continue to wait out the price spike while drawing, say 3mb per week from their inventories?

You could pull 3 million barrels per week for 10 weeks before you dropped below the bottom of the average crude inventory band. Remember, this is where gasoline has spent most of the year now. But....

When they cannot wait any longer and decide to bite the bullet and pay the >$90 price, will that not cause prices to rise even further?

That's the Catch 22 I mentioned. If the consensus in the market is that there is a supply problem, but oil companies think it's a speculative bubble (which they do for the most part), drawing down inventories while waiting for a price drop will just support the belief that there is a supply problem.

I have been thinking a lot about this. If I have a refinery, what I do with my inventories is going to be entirely based upon where I believe prices are headed. You have seen the comments from the major oil executives. I think they truly believe that $94 is not fundamentally supported. So, you pull down inventories. I pull down the oil I bought at $80, and hope that by the time I get low I can replace it at $80. That's why today's draw is not entirely surprising.

Robert, I get what you are saying, however, if you're so inclined could you fill in a couple of gaps for me.

I assume (and I'm happy to be corrected)

1) US crude producers are pumping at 100% capacity, so all that oil still flows in every week.

2) A lot of Mexican and Canadian crude supply is presumably fixed, and flow-rates into the US are probably not affected by refinery orders, at least in time-frames measured in weeks.

3) Most other supply has to come by tanker, which means a lag from order to supply of some weeks. Likewise, once a decision is made to draw down stocks, there will still be a fair chunk of committed supply in-transit

So, if the refineries are drawing down stocks, and those stocks are not being replenished, does that mean that a decision to rebuild refinery stocks must be taken several weeks before internal MOL is reached?

Actually, here's a simpler question: Is it the refineries who import crude, or is there another level of dealer; eg wholesale importers of crude who then on sell to refineries? (in which case, you'd think their stocks would be going up as refineries drew down on their's)

Cheers,

--

Jaymax (cornucomer-doomopian)

Wait until the PKK get tired of the Turk raids and light up the BTC pipe.

Speek,

how long a refinery can wait depends on its individual reserves. Most American refineries are keeping reserves at a low level and relying on the strategic petroleum reserve as a back-up. And yes, it will add pressure to keep prices high.

Bob Ebersole

Robert,

I'm amazed at the number of people who come on this site and spread misinformation with such an air of authority. Most of the time I just ignore their ignorance, but I'm beginning to think that when I do this I let other people take the fools as authorities because no one challenges their preposterous B.S. For people who don't know who to believe, Robert or Moe Gamble-

Robert is a chemical engineer and has set on the committee setting crack spreads and prices for his employer. We are very lucky to have his judgement on the crude markets writing This Week In Petroleum. He also reviews for his employer new technology dealing with chemical production, and wrote his Master's thesis in Ethanol. Robert is painfully honest in sharing his knowledge, and I've seen him change his mind when the scientific facts disprove his prior opinions-he seems much more concerned with truth than his ego in his research, in other words, he's a open-minded scientist first, and I respect his opinions as being honest and fairminded .

All I know about Moe Gamble is that he has a high estimation of his understanding of the commodities markets and has rude manners.

So people, believe who you want, but if you give an opinion please base it on your own research and be prepared to back it up or qualify the statement as your opinion.

I agree. That wsj graph showing "one year ago" contango doesn't sit right. I've been following crude for 3 years and I've never seen that.

Actually price by itself is the measure of supply to demand ratio. It is the price after all that makes sure that supply to demand ratio stays at constant one (demand = supply) long term.

Some minimum inventories are required to deal with minor spikes in supplies and just run processes, but anything above this absolute minimum is optional depending on prices. If spot price (price for the oil delivery right now) is smaller then future price, then it might make sense to buy now and store it rather then buying more expensive oil latter. But if spot price is higher then future price, then it makes sense to buy future oil and drain inventory to the minimum.

1) oil companies are manipulating prices

.... Robert Rapier already debunked the first allegation,

Hrmmmm. I can point to 1 firm and price fix'n. Just not companIES.

http://www.nytimes.com/2007/10/24/business/24oil.html?ex=1350964800&en=7...

http://www.smartmoney.com/news/on/index.cfm?story=ON-20071025-001027-1350

See Leanan's News posts on China diesel shortage.

China is just doing what we're doing.

Note that gasoline has dropped since May while

crude has zoomed to $93.

Remember when gasoline went up w/in two days of a NYMEX

Crude jump?

And just where is all of that gasoline being imported from?

http://www.eia.doe.gov/pub/oil_gas/petroleum/data_publications/weekly_pe...

"Over the last four weeks, motor gasoline demand has averaged nearly 9.3 million

barrels per day, or 0.3 percent above the same period last year."

And demand destruction is where?

There's a severe dislocation here.

Gasoline should be nearing $5 a gallon now.

Arkansaw of Samuel L Clemens

Eric,

Of course there are some people trying to manipulate prices at some companies. But its a mighty big stretch to get to the position that all oil companies do it in conspiracy with each other all the time, which seems to be your position. The multinational companies own only 12% of the current world production, and their ratio keeps decreasing. The rest is owned by national companies, but they do the manipulating right out in public as they don't seem to see price manipulation as a sin against the one holy god Free Market. Bob Ebersole

which seems to be your position.

Errrp. Thanks for playing Bob.

Bob,

Eric Blair's comments were directed at the propane market in the U.S.. As I understand it, that market is not influenced by global production, as there's little or no imports of propane. Where else does Propane come from, other than domestic supply or, perhaps, Mexico or Canada? It's not imported like LNG, is it? The wholesale price of propane has been going up since August and I'm still awaiting delivery that I requested back in September. The order was placed with a company that has served me for about 8 years and has been very good at delivering after an order.

E. Swanson

Propane is one of the fractions distilled in a fractionating tower, like naptha (gasoline), Kerosene (jet fuel), or fuel oil (diesel, heating oil). Its about the simplest kind of refining equipment, invented by ancient alchemists, but first commercially used in the Pennsylvania oil fields in the 1850's. When crude is heated it separates into various component parts, or fractions and by draining off various levels.

I am not more than a slightly educated amatuer about this part of the oil business. I'm in exploration and production. But, I'm from Houston and know a little about some of these processes. The Wikipedia article on Kerosene is my source for distilling crude being invented in 9th century Bagdad. I know from my readings about alchemy in the works of Carl Jung that distillation was an alchemical process. Since kerosene was isolated by an arab alchemist in the 9th Century from oil seep crude and it is also a fraction of distilling crude I infer he used distillation. Bob Ebersole

Holy DEJA VU Batman! Is it a Bubble or a Wave ?

I wish someone here who had the time and interest in this subject would review David Hackett Fischer's The Great Wave...Price Revolutions and the Rhythm of History (see link below).

(Maybe someone like Khebab or stuart, or maybe sailorman or greyzone, ron, etc - someone with a brain, or who is at least funny).

The data he assembles for the past few hundred years is fascinating - there are dozens of graphics showing various correlations that occur during our growth waves and "collapses." Some of the best data are on commodity prices ...

Whether you take the time to consider his hypothesis or not, the data you can mine from Fischer's book will help put into perspective Where We Are in a grander scheme of things, so to speak... (personally, I think we are rapidly approaching "TimezUp" for our current growth wave...).

Yeah, one more genius in the bag.

SNORE.

What this genius *probably* underestimates is the process by which the middle class and the lower class have been having such a tremendous boost in life expectations since the beggining of the 20th century!

... OR I am not allowed to remember that my grandpa died old at the age of 55, living in a barrack called "house", no bathroom and no electricity with poverty all around?

History repeats itself, so yeah, I think it is fairly EASY to say that things go boom and then go bust, and that in booms people are happy and in busts people despair.

I don't need no PhD's to tell me that the sky is blue, bkay?

Thank you for the well written post, Khebab. Nice work!

This is the most important segment of the post. It explains extraordinarily well why the inventories have been lower day-by-day. As prices sky-rocket, they surpass the future oil prices, and doing so they incentive the market to use the oil bought instead of saving it. More than that, I add, it incentives the market to use more of the oil already stored, rather than buy the new one.

This has consequences in things:

1. Inventories go down as future prices lag behind present prices;

2. Less oil than usual is bought as more oil from the stocks is used, for it is cheaper to do so;

3. And more importantly, this should lead to less demand and thus lower prices. But fundamentals are way against this, there is too much demand for too little supply. In fact, fundamentals are what is guiding the process, and when the market understand this, it will try to stock up much more than they have been until now.

Then we will have a run up to 200$ per barrel.

Disclaimer (before some Darwinian thud whines up), I know NOTHING about this, this is just my reasoning based upon Khebab's findings.

2. Less oil than usual is bought as more oil from the stocks is used, for it is cheaper to do so;

Yes, US refiners are drawing from invtentory/buying less... but why is price rising? PUndits/commentators are routinely parochial, but the US 'only' uses 25% of world supply... a bit less demand here is quickly made up in asia. Note that tapis (malaysia) price is routinely higher than nymex this year.

ANd, china demand is temporarily down because controlled price is too low, leading chinese companies to export (smuggle?) product to much higher priced world market, and usefully pushing down US product price. Rationing in this way is very expensive to economies, eventually chinese price will rise pushing up demand, thereby increasig world demand/price.

So, at present supply is flat and demand artificially depressed; price looks very firm to me.

Amen, jkissing.

Point 3. The thing is, we should be witnessing, by this simplistic (and probably mistaken) reasoning, a lowering on prices, yet, price is rallying. So, what happens when the markets start to stock up again? Will they lower? :D

Did you see the oil question on the democrats debate last night? Obama says there is a 30% risk premium.

http://www.msnbc.msn.com/id/21528787/page/14/

Edwards will investigate those darn oil companies

and I can't tell what Clinton means when she mentioned the SPR

Does this make any sense ?

He's going for the votes on that. That's a reason to stop wars and pressures and the likes. It's not real, but if it works to get people that defend freedom and peace to be elected, I don't care even if he knows it's not true.

Amazingly, I think that if the troops in Iraq just stop spending the barrels of oil that they are just by being there, perhaps that could really displace 30% of the oil price.

But, by the time he or anyone else does that, oil will be already at 120, so it will take us only back to 2007 Q4 anyway.

Edit: It DOESN'T have to make sense. What did you expect? They are probably not even informed about the problem, or if they are, they are not going to sell hard-core situations to the people in 30 seconds. People don't want scaremongers in the debate, they want to know only if they are reasonable or not.

As far as making sense, I was referring specifically to Clintons comment

I thought the SPR was not being filled up currently.

She means exactly what she said.... "look at it". It got her past the question and sounded profound.

Come on, you don't expect her to say anything concrete, do you?

cfm in Gray, ME

They've been filling it up again for quite a while now... Not that the quantities are really significant.

--J

allrght folks!

Speculators drive up prices in a market when shortages are perceived!

This profit motive for the speculators drives up the price, we are all agreed here.

Now the producers see the new price and go find oil!

Supply increases!

Then price drops as a new equilibrium is reached.

IMHO we are in a slack period where growth continues, and oil production does not. Obviously Prices increases due to demand, and with low elasticity of many industries for oil their prices shoot up. This is not real growth because the companies profits are dropping (most companies are poor at covering forward contracts for deliverable commodities -likewise for producers, somehow lots of gold mines are losing profits in the bull market). Then production will crash, or supply will increase.

Take your pick:

1. Will the profit motive at current $/barrel be enough for more oil?

2. Will demand crash?

3. ???

1. can't happen

2. if crash means demand < supply, then no

3. oil peaks induces a recesssion and supply=demand down the slope. The value of oil is way too high to go back to horses.

Or, maybe not. They can only find oil if there is any oil to find.

Well, more to the point, now the oil producers will develop existing resources that weren't previously economically viable. Smaller fields, lower grades, less accessible, etc. The French company Total recently said that they'll now proceed with projects that require $60 oil to be profitable, for example.

Higher prices will bring additional oil to market, but it's going to take continuously rising prices to keep it up. My guess is that we're at the start of a long plateau in quantity, supported by a long slope up in prices.

peace,

lilnev

FWIW, Dante at PeakOil.com thinks there's a "short squeeze" now:

This is obviously true, but it is perhaps not obvious why they can do that - the underlying reason is because supply is constrained. When this happens price moves from that of the cheapest producers to that of the least wealthy consumers. In our modern market system, it is the speculative traders who amplify that movement.

Contrary to "expert" opinion, the traders are actually more accurately representing the fundamentals by pushing the price up, as opposed to creating a bubble divorced from fundamentals.

If it is a bubble then it will only collapse if there is a significant change so that a) supply increases or b) demand falls. I think we all know how that will turn out.

I posted this on another thread.

http://www.theoildrum.com/node/3167#comment-257126

Basically the idea is we are seeing increased panic or forced buying on the spot market that is resulting in a very strong floor on prices each time we see profit taking by speculators.

Whac-A-Mole buying means we are seeing at least one if not more regions on the planet forced into purchasing oil at any price or face outright shortages. As each region capitulates and buys it causes a higher price forcing another buyer to attempt to stay on the sidelines using reserves in hopes of lower prices until they are too forced to buy.

Basically we have a rolling oil shortage moving around the planet right now. Very similar to the rolling blackouts/brownouts used to conserve electricity when demand exceeds supply.

This comes from three types of people.

1. creationists - hoping high prices will create more oil

2. pessimists - knowing peaking will results in rising prices until collapse leading to electric transport or worse.

3. PR people and their employers - people who are in group 2 but trying to convince people to stay in group 1 so that they can make a buck.

Hillarious!! Good use of that word, realist!

When the average schmoe refers to "speculators", I think what is being referred to is not so much oil traders as what can be called "volatility" traders.

These players do not care what the price per se is, or even what the commodity is, what they are playing is the "spread" and the direction.

This is a well known aspect in financial markets. To get a glimpse of the mindset involved, check out books such as "Ugly Americans, The True Story of the Ivy League Cowboys Who Raided the Asian Markets For Millions" by Ben Mezrich, or the book or documentary "The Smartest Guys In The Room" about the Enron collapse, in particular the California power market manipulations.

The point being that there comes a point in which price has little connection to the real fundamentals of the market being traded. It is the volatilitility and the spread possibiliities that draw the players. No one can tell me that the situation goes from bad to good back to bad in a matter of days. Oil is a much longer term business than that.

The truth still is that if we are actually at real geological peak, $100 per barrel oil would still be a givaway price. This is shown by the fact that no real preperation or change in behavior is noticable yet.

RC

I've never understood why discussions of the price of oil are not routinely phrased in terms of "inflation adjusted prices" from a baseline year.

For that matter, even if the oil is priced in dollars, isn't the correct measure of price a weighted basket of currencies that reflects the proportionate GDP of the states in the world economy? (Certainly, OPEC states are thinking that is a good direction to go in as a practical matter... but my point is that it is a rational direction as a matter of econometrics.)

Sure, it is convenient to talk about the dollar price... but that's just a market price that is entangled in the economic well being and power of the dominant (if declining) consumer of the product.

How can we have a serious discussion of demand and supply (using price as a proxy) until we factor in long term inflation and a basket of international currencies?

Of course this is more complicated for most folks to understand, but it just seems basic to thoughtful and serious analysis of the relationship between supply and demand as reflected in "price."

It intuitively would better represent "what proportion of global economic power" is devoted to each purchased barrel of oil.... and since "global economic power" is what we mean by "wealth" today in the absence of a gold standard or other measure, surely "global economic power" reflected in a basket of currencies is what we should be using as the real measure of the price of oil on planet Earth.

Comments appreciated.

WEll, what you say makes perfect sense, BUT, it doesn't work so well as measuring in dollars. If you check on the right, crude price in dollars is measured by second. It is easier. And it somehow reflects reality measured in the US (apart from inflation).

Inflation is very difficult to measure (it depends on people to people, for chrissakes!), and a basket of coins introduces a variety of complicated maths.

But if a distinct programmer is willing to make such numbers automatic, hell I'd commend that, but sorry I haven't any money to back it up :).

And, I live in EU and oil is rising faster than the dollar is descending by a long shot (crude oil is at 65 euro, give or take, much much more than the 20 euro of 5 years ago, when euro was in parity with the dollar) so it is getting bad every day here too.

Hey O7,

I think your looking for a perfect measuring stick, let me check my crystal ball and get back to you. Seriously though, that is why we all participate on this blog, this is some of the best, if not the best analysis of what is really happening out there. You are as close to that measuring stick as any of us will probably get.

ns

I value what I read here and didn't mean to suggest that the author's post wasn't thoughtful or rational.

It just seems to me that even in a dollar denominated world economy, the meaning of "dollar" is changing constantly and that those two adjustments would produce a more meaningful analysis.... But I certainly don't know how to do that analysis!

I mean, hasn't the inflation adjusted price only recently climbed back to the post 1973 oil shock level? And isn't the dollar now a much smaller proportion of the world currency stock? Those are my questions as I read this post.

I pretty much agree with what you said.

The last time I checked, the US GDP deflator was around 0.8 in 1996 so I don't think it changes the picture that much for such a small time range (11 years).

Try this one on for size:

Oil is the lowest common denominator of our economy and its price fluctuations are manifested as higher or lower inflation.

FACTOID

If Hubbert Linearization is in the ballpark for world Crude + Condensate, we have used 1 trillion + barrels and we have about 1 trillion left. However, the second trillion will be harder to find, get out, refine, etc. for myriad reasons discussed on this site - so lets call the 'net' (after subtracting energy costs) of that trillion about 67% - or 670 billion barrels of oil.

With a world population of 6.7 billion, that is 100 barrels of oil left for each person alive today (and zero left for any future generations).

Yet for $3500, the initial margin for a future contract, one can control 1,000 barrels of oil, 10 times an individuals all time 'allotment'.

This one barrel can do the energy-work of 25,000 hours of human physical labor (12.5 years at 40 hours per week).

Cheap cheap cheap....

Our middle case for the top five net exporters is that their post-2005 net export capacity is about 100 Gb, which, at their 2005 rate of export, would be depleted in about 13 years. Of course this is not the way it works, but it does give you a good idea of what we think is happening. Our middle case for the top five hitting zero from the 2005 peak is 26 years.

As we have previously described, the single most lethal characteristic of net export declines is that they tend to show accelerating decline rates with time.

That's not really fair - for £3500 you just get control of an effectively worthless (at the moment of issue) contract.

To get control of the 1000 barrels of oil, you also have to stump up the ~$90,000 when the paper magics itself into the gloopy stuff.

Which is STILL cheap cheap cheap - based on your 25k hours/bbl, that's three man hours of work per penny!

--

Jaymax (cornucomer-doomopian)

No -you never have to come up with the money other than your margin, unless you actually want to take delivery, (which very few do).

And it would only be 1750 pounds, not 3500 (My keypad doesnt have a "L" like that....)

My accident, eights years ago I used to always $ when I meant £...

But anyway, I've got a handful of those contracts, and it sure doesn't feel in any way like I can control 1,000 barrels of oil.

All I can control is that scrap of virtual paper. So perhaps I misunderstood the point you were making, but

It's only a barrel capable of work, once it's paid up and delivered - up till then all it can do is make (or lose) $$.

--

Jaymax (cornucomer-doomopian)

OK

For $3500, one can control the FINANCIAL movements of 1000 barrels of oil..

Hows that?

I'm only being picky 'cos it's late and I'm bored...

But I don't feel like I've got financial control over my 9000 barrels. It's the other way around, the financial movements of those barrels greatly control ME!

Sure I can sell em at a time of my choosing, but that $3500 doesn't let me pick who to.

:-/

I guess my point is it's only $3500 because it isn't actually anything meaningful. Even that $3500 isn't actually buying anything, just a guarantee in-case the virtual paper loses a bit of value overnight... I don't think it's ever right to equate the contract with actual barrels, until it's due delivery, at which point the $3500 becomes irrelevant. It's important for those on the site just starting to think about investing in futures to get that - the contract has nothing, and will almost certainly NEVER have anything, to do with any actual oil.

--

Jaymax (cornucomer-doomopian)

Khebab - this is mind blowing complicated stuff.

I just worked out that the annual crude oil trade using 82 mmbpd and $90 / bbl is worth $2.7 trillion per year.

$2,693,700,000,000

Are you able to say the value of speculative trading and if this is enough to move the market?

Also, what effect does anchoring supply on the upside (i.e. no higher than 82-84 mmbpd) have on the trading paradigm?

Euan -see my post above.

With $1 billion in margin (chump change for some hedge funds), one can control 286,000 contracts, which is 285 million barrels of oil.

If one puzzles this around in ones head, one comes to a conclusion similar to an energy theory of value - finite amount of oil, infinite amount of money, etc.

I agree, the learning curve is pretty steep for an outsider, no wonder the mainstream media is oversimplyfing this stuff. It took me at least three attentive readings of Sanders's paper before beginning to fully understand what he was talking about.

My understanding is that most of the speculative trading is speculation on risk and deals with paper barrels. One conclusion of Sanders et al. is that speculative positions does not lead market returns (i.e. traders have zero predictive ability on prices) so I don't see how they could affect the spot price.

This is some great research Khebab. Thanks.

I frequently read this site. But I have never noticed if anyone has done an analysis of "Peak Exports".

Has anyone seen a graphical analysis of this?

The ELM has been discussed often, but I was wondering if there is a graph showing historical World Export levels in millions of barrels per day.

http://www.aspousa.org/proceedings/houston/presentations/

Scroll down to Jeffrey Brown, net exports, for Khebab's excellent work on the top five (half of world net exports, note that there are two slides per page).

I'm working, slowly, on the full written report. I've partly been waiting for oil to cross the $100 mark before posting, and it seems like we are getting new Peak Oil related bombshells on practically a daily basis. In any case, we should have it up within a week or so.

Also see Export Section (charts 18-24) from Rembrandt Koppelaar's OilWatch Monthly at http://www.theoildrum.com/files/oilwatch_monthly_october_2007.pdf.pdf.

And two excellent sites for graphical results are, for production http://graphoilogy.blogspot.com/, and net exports http://netoilexports.blogspot.com/.

Khebab: You must have been reading my mind. I was hoping somebody would post precisely this analysis. Nicely done!

This echoes a side conversation I've been having with RR about why the crack spread has been squeezed so low. He has stated his perspective clearly: Refiners believe that they can't sell enough gasoline if prices are a lot higher, so they have taken the hit of sharply reduced margins in order to stay in business...and they're none too happy about it either. Nobody can stay in business for long with only a 5% margin. In his own words:

But this leads me to want a broader understanding of ALL of the factors that affect the crack spread, the litany of which the press has been wont to cite.

I'm not trying to elaborate this discussion, rather I'm trying to summarize it. What I'm after here is sort of a "oil prices vs. gasoline prices for

dummiesjournalists" overview, which I have summarized as follows. I welcome all corrections & comments.1. Refining capacity. When refiners are running at high rates, they're consuming more crude, which drives those prices up, and producing more gasoline, which drives those prices down. This is straight supply and demand, and prices are relatively quick to respond to this factor.

2. Blending. Summer blends are more expensive to make than winter blends, so they cost more. Prices tend to anticipate this factor, by as much as several months, because distributors will purchase gasoline well in advance of the summer months.

3. Speculation. The prices of both crude and gasoline are set on the futures markets, which tend to be forward-looking. If traders think supplies are going to be low over the next three months, the prices of those contracts will rise, and vice versa. However the two markets are not necessarily connected. The pricing of gasoline futures contracts tends to lag that of the crude futures contracts by several months (or, if you prefer, crude contracts tend to presage the movement of gasoline contracts).

4. Manipulation. Oil companies manipulate the price of gasoline to maintain a healthy market, regardless of the price of crude, by manipulating their refining capacity. However the proof of this is hard to come by.

5. Backwardation & Contango. I have read somewhere (can't remember where now) that that some crude speculators, particularly the big banks, are taking advantage of the backwardation situation to trade contracts on oil they have in storage without ever moving the product. They bought up some idle tanks, filled them once, then went on a spree of continuously buying the rear contracts while selling the forward contracts, minting money on every trade without ever delivering any oil! The futures trade tends to prefigure the price on the street by a month or more. [Corrections are particularly welcome on this.]

6. The dollar. The petrodollar trade has made crude a sort of inverse proxy for the dollar. When the Fed loosens, it drives up the "price" of oil, just to keep things even. For this factor, I think the media are particularly telling: Just yesterday, the front page of Google News was emblazoned with the news that OPEC has no intention of changing its peg, but today, Reuters put out a story "GULF COULD DROP DOLLAR PEG IN UNISON" (see today's Peak Oil News), even as the Fed announced another rate cut. Sounds like jawboning to me.

In sum, I don't think the futures traders are looking at any one of these things; they're looking at all of them. Risk = uncertainty = higher prices, that simple. How's this for an idea: declining crack margin as an indication that uncertainty is greater with oil supply than it is with gasoline? Just a thought.

I think a lot of such discussions get mired in either/or questions when they should be about ands. Put those six factors (and whatever I left out) together and you've gone one interesting function. As expressed by the futures market.

--C

Energy consultant, writer, blogger www.getreallist.com

Refineries operate best in a fairly narrow range between about 75%-95% of production capacity. If they can't sell enough product to operate in that range they have to start shutting down parts or all of the refinery. So I think refining margins might be getting cut to ensure the refineries are not shut down.

So this means we now have excess refining capacity and thus refining margins are dropping. Until we shut down some refineries.

This has nothing much to do with the price of oil and it seems to answer why at the moment end products are cheap while crude prices are increasing. Excess refining capacity.

Notice how refiners are running below 90% capacity now ?

And refinery utilization has been low most of the year.

Total petroleum + products stocks including the SPR were down about a million barrels. Petroleum + products imports were up about 1.2% YOY. The U.S. population has not heeded warnings to lessen dependence on foreign oil and the net oil + petrol products imports this past week were about 12.079 million barrels per day. As the largest of oil fields continue to decline in reserves the prices go up. Higher prices will effectively ration limited supplies. At what level petroleum becomes overbought is subject to speculation. I do not believe we have reached a price that will cause substantial oil conservation in the U.S.

Thank you for mentioning this memmel. IMO this, plus the fact that there are any number of companies out there vying amongst themselves to maintain profitable refinery operations, against strong competition, is probably the single biggest factor keeping the crack spread down.

Which begs the question of course, what happened to the perceived need for more refining capacity of last May? lol. Those that bought into that must feel a bit foolish at this point.

I also believe that this is strictly a temporary situation. The next few weeks should alleviate it to a great degree.

Leaving us with the prospect of $4 gasoline before Thanksgiving? I don't know, it would be months sooner than I expected it, if so.

I believe that this must happen soon simply to keep demand in check so as not to outrun supply and draw down stocks below a dangerous level. Expect refinery utilization to dip a bit more soon as refined products rise in price.

I’ve read the piece by Khebab, some of the links and related posts.

On the Senate’s report,they pretty much say they lack the data to really know if the market is impacting prices. The data is so complex it is hard to determine if there is an impact from speculators.

On backwardation of the crude options futures markets, there is another explanation than some of those given. The volatility risk beyond a month or two is too high to hedge money a year out. Why lock up any money in crude for a longer play than a couple of months? The fear of losing that money is too great. To play the long-term futures market it is easier to roll your money, sell January and buy February. Sure, oil might go to $200, but if there is a serious correction of the economy it could go to $10 (as an example only of a significant drop.)

On the control of prices, referenced by Khebab, how can there not be control of prices. I can’t find anyplace where I can convert a futures contract for crude on ICE / NYMEX into a physical commodity, crude. Perhaps you can, but I can find anything that tells me this. I’ll refer to:

Dr Samsam Bakhtiari in his report to the Australian Senate July of 2006:

“I remind you that oil is a very special commodity, which is something that is very difficult to realize today. For example, you have no free market in oil. Naturally, you can go to the NYMEX stock exchange and buy as many barrels as you want at the price of $74 now, but these are paper barrels. If you try to buy 10,000 barrels a day of real oil, of genuine barrels, you will have enormous problems getting that much oil on a regular and sustainable basis. So that is one of the problems that we will encounter in the medium term.”

The Dubai Mercantile Exchange, in contrast, although new and quite small offers buyers delivery of crude against the contract. This emerging exchange by itself may have had the ability to change the course of some prices and supply. It offers Asians and others access to crude via real bidding and not fixed to WTI pricing, crude they may not otherwise have been able to purchase and have had delivered. Thus, as the price of Dubai Sour Crude increases, so must WTI and Brent. In addition, the exchange may allow for crude to be diverted away from the US market. There is an interesting correlation between the current spike in prices and the emergence of this exchange. It may have no significance, but the correlation is there. (There is also a correlation to a spike in empty VLCC and other size crude tankers but that is another topic.)

Blaming speculative buyers gives people someone to blame.

That doesn't add up to me - in what way are you 'locking up' money by investing in later delivery futures - you can sell at anytime, exactly the same as front-month.

The volatility in the later futures is also a lot less - While the front month bounces around like a yoyo, the later futures virtually always move more ponderously.

--

Jaymax (cornucomer-doomopian)

My fear with buying a long-term contract is further backwardation of the contract, the future price declining from the current price. If, as an example, there be signs of a future slowdown in the economy, the current crude demand would be high, since the economy is still running strong, but the forward contract would drop. If this were wheat, I would feel quite differently. People always need wheat but they don’t need crude.

The front end of the contract has the potential for more predictably and it keeps a person’s, at least my head, more in the game. When I invest in a long-term futures contract I would watch less and wait for my base fundamentals to hold true that caused me to bet the future. With crude I have no idea what that future is, $200 or $10.

I am not saying that my reason for backwardation is correct, however, it is how I view the market. Today, I would willing to pay similar or less for a long-term futures contract. If other investors should share my view when investing it would create backwardation. Fear of demand destruction is clearly in the eyes of investors. Plus, you have fear of this being a bubble. Whether that would correlate to backwardation, I don’t know.

In my experience (look at the credit crunch for an example) pretty much whenever the market reacts to anything, the initial big moves are in the close contracts - that gives a day or two for reflection. Also, long term threats to the economy are likely to build more slowly than sudden near-term threats.

Backwardation HAS BEEN increasing of late, but only because the far contracts have been going up less quickly than the near ones. They tend to move most of the time in the same direction.

Neither do I - a global depression could have a massive impact. BUT - I'm sure enough to be betting that they'll go way up BEFORE they go way down - and so long as I bail before they drop lower than the purchase price (which I will be able to do, because far dated futures won't fall through the floor overnight), fine.

--

Jaymax (cornucomer-doomopian)

Tapis Oil Price is in the lead!

$US96.27

http://www.upstreamonline.com/market_data/?id=markets_oil

It's $97.57 right now.(1:35 AM EST)

And over on the futures market, NYMEX is $95.63

Speculation in the oil market is anything other than Joe Buyer for operation X purchasing oil to make paint or gasoline with or to store for future paint making (the pure supply/demand price setting). All other buying and selling is best guessing about the future direction and operates under the Efficient Market Theory. This is the theory that says many thousands of busy researchers and thinkers pooling their efforts into buying and selling in a market are smarter than any one person can be. This means that the market price is right where it should be regardless of your opinion. But some traders may look at a lot of information, and are also complete idiots, you may think. Well, that's true. But even if you are an intelligent, rigorous thinker, you are not perfect and you may have a just one tiny flaw in your reasoning and be a little off (hopefully not as much as the complete idiot). But think about it. All baseless conclusions and numbskull thinking is just as likely to be wrong bullish as it is to be wrong bearish. After all, it's baseless - like flipping a coin. So the error all tends to cancel out. Everything gets looked at and market prices wind up being very efficient. So if you subscribe to the theory, you would have to say that the market price for oil doesn't stray very far for very long from what current supply/demand says it should be. No market is 100% efficient, of course, so we have excursions like the $77 to $52 trip made about a year ago when the supply/demand probably didn't change by that much in just 5 months. But now we've gone from $52 to $94 in just a little more than the same time span when obviously supply/demand hasn't changed by the same amount. And obviously supply/demand doesn't change by $3 or $4 worth in an 8 hour trading period. This is all what technical analysts (at least the good ones) call short term random noise and it has very little investable predictability. The bigger picture trends, however, can't be brushed off as "speculation" as the U.S. Congress and oil pundits in the media have been doing since $45/bbl and will be doing when oil is $200/bbl.

I am not as well informed as most others are here, but I will say the following:

#1. During the East Asian meltdown, the Oil Price started at the then-high of (around) US$25. Without the TINIEST reduction of Oil use (look at the graphs for World Oil Use 1995 ~2001) the price of Oil dropped to US$15, then US$10, then (very briefly) US$5.65 then bounced back to US$9 (Approx.) per barrel. It stayed that way until the markets "discovered" some missing barrels and the price moved up in late 1999 and has not stopped that upward trend since then. This downward price movement was driven by speculation, certainly, and the expectation of a downturn causing a reduced Oil Demand caused by reduced economic activity in the East Asian Tiger Economies (Remember that phrase? Don't get used much, these days). Yet the reality of the precarious Oil Supply situation caused the speculators to lose out to reality when it was realised that the Oil Supply, rather than increasing, was actually getting tighter. It also shows that even in a vast recession, Oil demand drops not the tiniest bit.

#2. It is undoubted that part of the Oil Price is due to speculation, but the WHOLE Oil price is certainly not. What part, then, is due to unalterable reality? There have been posts here at the Oil Drum which show that in 2001, the price of extraction of a barrel of Oil was about US$5 per barrel on average. Obviously this average was exceeded in some places, and was well above the cost of extraction in others. Now the price of extracting a barrel of Oil in 2006~2007 is stated to be around US$20 per barrel on average. This extraction-price increase (surely) cannot be due to "speculation"?

#3. The cost of shipping has shot through the roof in the period since 1999. It is said that ships, on average, used to cost US$100,000 per day in 2001~2003 (those who know more than me can correct me on that). Recently, the media has stated the same cost is around the US$275,000 per day and rising and will likely rise past the US$300,000 per day sometime in this calendar year. While this price is (no doubt) influenced by speculators, surely some of the price represents the shipping capacity squeeze caused by the dopey downsizing of shipbuilding and shipyards which sees one shipyard in South Korea make 50% of the world's ships?

#3a. If a ship carries 500,000 barrels of Oil (say...to make the calculations easier) and it takes 6 or 7 weeks to go from the Middle East to the US (the biggest Oil Market) then the cost of shipping is as follows:

2001 price:

US$100,000 per day x 6 weeks = US$4,200,000

2007 price:

US$275,000 per day x 6 weeks = US$11,550,000

Dividing by the number of barrels:

US$23.10 per barrel (in 2007)

#3b. Add the cost of extraction to the cost of the transport:

US$20 + US$23.10 = US$43.10

This is the price below which Oil cannot go. (this is how many Yergins?)

#4. Now, the above does not factor in any of the handling costs (such as paying for Pipelines) or the costs of harbour handling fees for ships, or the myriad costs associated with the actual movement of Oil. It also does not take into account the re-investment costs one presumes the downsizing dimwits in the Oil Companies may be undertaking (and may not be) in order to "grow" their business. If Daniel Yergin is correct and the world has "oceans" of Oil waiting to be discovered, they'll need to be extracted, right? And they are going to extract them without paying for it...how? I'm assuming the Daniel Yergin cannot be wrong. Yes, I'm being sarcastic. The above cost also does not take into account the profit the oil companies are making nor the "guvermint" excises, duties or other payola at the place(s) whence the Oil is extracted. How much does THAT add to the Oil price? I think we'd be approaching the US$70 per barrel by now.

#5. If the above calcs are correct (please feel free to shoot me down in flames, I'm sure someone will want to...it doesn't seem to make such people any happier, but it does prove the old saying that misery loves company) then the last US$25 of the US$95 per barrel is what is being discussed in terms of speculation. But even THAT is not as great as it seems - think of the falling US dollar. How much of the present price of Oil is simply the fact that Oil is being sold in a declining currency? THEN...

#6. What's left after all that (above) is what's actually being "speculated" on. How much is that? Anyone? Personally, I believe that the "price floor" is around the US$85 per barrel at this stage, thus the "speculation" is actually around 1/9th of the price (about 11%). Sure the unofficial "floor price" will go up and down a bit. We might well see US$60 per barrel again, when the US stock market falls of the cliff that seems to be looming in a 1987-style crash. But I also think that price will vanish shortly afterwards as the bargain hunters drive the price up again.

Your point #1, ubercynicmeister, brings up another big problem with the oil market - bad or missing information. This was the topic of a whole section of Matt Simmon's book Twilight, p82. The brief price collapse in 1999, the biggest in 50 years, was started by an OPEC production increase to balance a short term non-OPEC shortfall to keep the global supply balanced. But analysts seized on the OPEC increases ignoring the total global numbers, and fabricated the "glut" story, which even made the cover of magazines. As soon as these stories were published, OPEC responded with a massive production cut because their economies could not withstand sub $10 oil. Per Simmons, "The problem with this large physical reduction, though, was that it occurred when the real global oil markets were essentially in balance. As a result, oil prices soon spiraled up over threefold in a short 18 months. There was never an oil glut. There was merely a glut of bad data." Bad data is why the price climb since 2000 doesn't jive with the Saudi claims about capacity, reserves and what not. The discounting efficiency of the market soon adjusts for bogus information given to it.

Even if the huge price increase was due to speculation - isn't it so that economists would claim that speculators are the canaries in the mineshaft and that they have a vital function in markets to alert to trends?

Have we seen such speculation waves at other times in oil history? Maybe, but certainly not of this sustained magnitude - or am I missing something?

Davidyson

I found the summary of the derivatives market, as presented in the article, to be a bit confusing -- this is certainly a confusing subject --, so I have attempted a more intuitive explanation of this very unintuitive market. I hope the following helps and I welcome any corrections, as I am not an expert on this subject.

A consumer of a commodity may be concerned with the price volatility of that commodity. He knows how much he will need at some later date and has a finite budget to purchase it within. If the spot price were to rise above the budgeted level, he would be priced out of the market. To mitigate the risk, he purchases a 'long' contract, which guarantees a fixed amount of the commodity for a fixed price at some future date. If the price of the commodity rises, he comes out ahead and can still purchase it within budget. If the price falls, he could have saved some money, but this is an acceptable concession for being certain he will get what he needs, when he needs it, and within budget.

A producer of the same commodity may have similar concerns. If he can be guaranteed a specific sale price, this will greatly reduce future budgetary uncertainties. This producer may be inclined to purchase a 'short' contract. If the price falls, he comes out ahead and within budget. If the price rises, he forgoes potential profits, but he is still within budget.

In practice, the buyers and sellers of these contracts are rarely either the producers or consumers of the commodity. They are speculators, who are placing bets on what the commodity will do in the future. For these players, it is a zero sum game. For every dollar gained, someone else must pay for it.