Scarcity Rents and Oil Prices, Again

Posted by Dave Cohen on December 9, 2006 - 11:55am

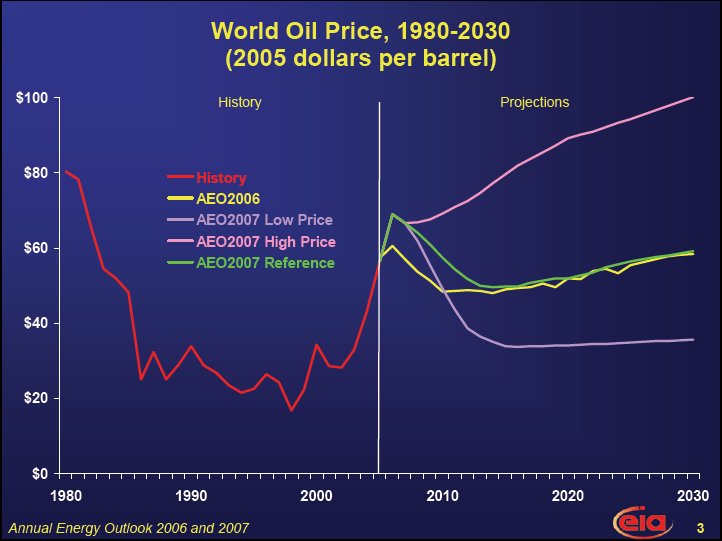

Figure 1 -- Click to enlarge

If Dave had gazed not at a century of prices but rather at just the last 15 years of the price of oil relative to the PCE deflator, would he have drawn the same conclusion? If all we had was the graph above, it would seem quite natural to conclude that a rising scarcity rent could well be one factor in the recent behavior of this commodity price...Not knowing of any good evidence to contrary, I'll just make the simplifying assumption that I'm right about the geology.... I am not at all prepared to dismiss the hypothesis that scarcity rents have indeed started to make a contribution to oil prices over the last five years, and will become more apparent over the next five...

Admittedly, if the oil price should fall from here down to $30, then I'll have to conclude that scarcity rents have had nothing to do with the recent price moves.

But if Dave is right about the geology, oil is not going to $30.

We'll return below to some of Hamilton's other observations as we consider what meaning to draw from the history of oil prices over the last several years.

Figure 2

So, the price got nowhere near the $30/barrel level Hamilton cites as invalidating the scarcity rent hypothesis for oil as discussed in [1]. Before re-opening the case as to whether the scarcity rent hypothesis holds, let's review some of our previous work on oil prices in order to evaluate where we are today.

The Future Oil Price Consensus

In Predicting Future Oil Prices (March, 2006) [2], I described the "new orthodoxy", or consensus, about where the oil price is heading. Within the context of developing substitutes for conventional oil, this standard story is summarized nicely in What's the Big Deal About Oil? from the Fall 2006 issue of Resources MagazineAlthough oil prices have risen to more than $70 per barrel in recent months, they have also averaged as low as $20 per barrel within the last five years. Having lived through the oil price spikes--and then dramatic declines--of the 1980s, oil companies typically use an expected oil price of less than $40 per barrel when making long-term investments. Most current forecasts by government and private analysts project oil prices in the $35-$55 per barrel range over the next two decades, whereas the large capital investments associated with many alternatives would last for several decades.Rather than go off on the substitutes tangent, however, I'll stick with main theme of this article — the conventional oil price. One thing should be pointed out, however. There are limits to the growth rate for these substitutes — oil from the tar sands or ethanol. As the world smacks up against those barriers to expansion, the current peak of conventional oil supply will be reflected in its price to an even greater extent than we have seen heretofore. But, I am getting ahead of myself.Only conventional oil, tar sands, and gas-to-liquids (GTL--conversion of natural gas to transport fuel) are clearly profitable at these prices.... The federal ethanol subsidy of 51 cents per gallon is equal to about $30 per barrel of oil equivalent (that is, energy equal to one barrel of oil), making ethanol competitive at oil prices as low as $20 per barrel of oil. Given these market signals, largescale commercial production of Canadian tar sands and ethanol has already begun and is expanding rapidly. One million barrels of oil from Canadian tar sands are being produced per day, a rate that is projected to almost triple over the next decade. U.S. ethanol production, virtually all of which comes from corn, has risen from 106,000 to 250,000 barrels per day since 2000. It is expected to roughly double again by the end of the decade at projected oil prices and with current government subsidies.

Figure 3, from another Resources Magazine article, Expanding oil Supplies, is helpful in understanding oil supply from the economist's viewpoint.

Figure 3 — Click to enlarge

Only the first two observations are salient in this context, although the other two points are of interest as well. First, the economics of oil production dictates that production operates very close to capacity. Second, long-lead times and the required large, up-front capital expenditures ensure that, in the short-term, capacity expansions are not enabled by oil price increases — ie. supply is price-insensitive.

The hypothesis of a near-term peak (prior to 2015) of conventional oil can thus be expressed in economic terms. The price elasticity of supply Δs, defined as the percentage change in quantity supplied / percentage change in price, is and will continue to be < 1 or effectively zero. What this means — in the face of a putative 4 to 5% decline rate in existing production — is that as the price moves upward, the world's ability to bring new conventional oil production on-stream to actually increase capacity will be impaired and, for all practical purposes, this is a permanent state of affairs. What is standardly seen by some economists as a short-term constraint is always true after the peak — a positive value > 1 for Δs in response to higher prices is simply not possible. At any given point in time, the flat or diminishing supply is perfectly inelastic, just like the available tickets to see Bono & U2 in concert.

When demand D1 is in effect, the price will be P1.

When D2 is occurring, the price will be P2. Notice

that at both values the quantity is Q. Since the

supply is fixed, any shifts in demand will only

affect price. From Supply & Demand — Figure 4

Viewing it in these terms, in the current plateau, Δs ≅ 0. Price has tripled (given the recent slide) since the beginning of 2002 but, nevertheless, the supply expansion ended, as we would expect, despite oil price increases since the plateau's inception, which dates to the beginning of 2005. Generally speaking, however, Δs ≠ 0. It's positive value will improve by small increments as the oil price rises over time independent of the decline rate in the tail-end of the global production curve. Therefore, more oil will become economic to produce as the price rises but this will not offset declines once they have overtaken incremental production gains.

[editor's note, by Dave Cohen] All of this will be obvious to some. I thought that many of our readers might benefit from this explanation — DC

Now, add to this the fact that the price elasticity of demand Δd is also low, as we have seen. U.S. demand has not shrunk significantly — if at all — while many still developing countries have rising consumption. Increases in Chinese demand continue apace. OPEC would not be defending a $60/barrel floor if prices at or above that level had adversely affected global demand, thus lowering the price significantly. There has not been a global recession. Another way to put this is: the recent plunge in the oil price was not driven by market fundamentals. Many countries (eg. Italy, Malaysia, the Phillipines, Peru, Belarus, even India) have been forced to curtail oil consumption but the overall demand picture remains strong.

Let's look again a version of the standard narrative as presented in an article cited in [2], Paul Horsnell thinks we are moving to a sustainable long-term price level from the Oxford Energy Forum, Issue 62 (August, 2005).

In all, market behaviour this decade has been enough to make it clear what the correct level of oil prices is not, and in particular it has shown that there was nothing magical about the environs of $20. However, that does not in itself help us to tell what the sustainable average level might prove to be. Our view is the sustainable level of long-term prices is that which creates enough investment along the entire supply chain to maintain a reasonable degree of spare capacity, while also ensuring that producing countries are able to maintain some growth in employment and in per capita incomes. That would argue for a long-term price of at least $50, with higher prices needed into the medium term to allow for some catch-up, particularly in the downstream, from the last decade of the 1990s. Prices can of course move to lower levels and indeed in some circumstances to much lower levels. However, they would not be sustainable at those levels into the medium term. Indeed, the real bull case for oil prices would be that we have a period of lower prices and compound the longer-term tightness in the fundamentals of the market.There are a couple of interesting observations & assumptions in this quoted passage. First, Horsnell makes the assumption that there will be long-term sustainable price. Recent prices above $50/barrel reflect the oil producers playing "catch-up" based on impoverished past levels of investment and long lead times. This would imply that Δs is low only in the short-term. Given sufficient investment in new supply, enough spare capacity will eventually be brought on-stream to result in a sustainable price of at least $50/barrel. Second, Horsnell believes that a lower price level is not sustainable because it would "compound" market tightness by lowering the assumed price elasticity of supply as explained above.The view of the sustainable price is of course largely a function of supply and demand responses. Compared to the 1970s, it appears to us that the price elasticities of both supply [Δs] and demand [Δd] are significantly lower, that the income elasticity of demand is significantly higher. In addition, the increase in the rate of decline of mature non-OPEC production has become a major force in blunting supply response....

Cracks in the Facade

Although CERA remains steadfast, a bulwark against "peakist" pessimism, there are highly suggestive hints that the EIA and IEA are no longer sticking to their story about oil supply and prices. From Oil field delays mean higher 2010 crude prices published December 6, 2006 —The US government's top energy forecaster yesterday said it raised its estimate for world crude prices in 2010 by about 20% to near $60 a barrel due to delays bringing new oil fields on line.Caruso's remarks only make sense when considered as a revision to the consensus as described in the previous section. There are the usual delays, bringing new capacity on-stream is not going as smoothly as predicted. Therefore, estimates of future prices are starting to rise above those expressed in the standard narrative. Remember, in this context, the current higher prices are the storm before the calm — the price elasticity of supply will increase, today's higher prices will make increased supply capacity possible tomorrow. Or, maybe not.African producers like Angola and Nigeria and Latin American states like Brazil will be slower than initially projected in ramping up production from new projects, putting a squeeze on world supply, said Guy Caruso, administrator of the Energy Information Administration.

"It's clearly going to take longer now to bring on the new supplies and to have an impact on price than we were thinking a year ago," Caruso told reporters.

World crude oil prices are projected to average $57.47 a barrel in 2010 based on 2005 dollars, versus a year-ago estimate of $47.29 a barrel in 2004 dollars, he said.

"The front end of the curve is now much higher than we were thinking a year ago," Caruso said. "We were too ... optimistic of how fast the price would go down" due to new projects coming online," Caruso said.

[Update by Dave Cohen on 12/09/06 at 9:01 AM EDT] I have added the EIA oil price projections from Caruso's presentation on December 5, 2006.

Click to enlarge

Then, there are the remarks provided by the IEA chief economist Fatih Birol, as quoted in Investment in Oil Exploration and Production -- An "Above Ground" Factor and further elaborated in the Globe & Mail's Why Big Oil's slick accounting doesn't add up (article purchase required).

Data compiled by the International Energy Agency show that investment in the oil-and-gas industry was $340 billion in 2005, up 70% from 2000. But cost inflation for goods and services used by the industry accounted for almost all of that increase, according to the IEA, the energy club of 26 of the world's major industrial nations. Adjusted for inflation, the oil industry's investment increased by 5% between 2000 and 2005, the IEA, based in Paris, said...Investment has failed us. The new supply will not be there. And the oil price? From Platts' WTI likely to stay above $50 for 'next few years': IEA official —"That's almost nothing; it's inadequate," said Fatih Birol, the IEA's chief economist and principal author of the agency's latest annual World Economic Outlook...

Mr. Birol, the IEA economist, said in an interview that he expects the oil industry's production capacity will slightly outstrip demand through the end of this decade -- or by 1.3 million barrels a day [mbd] -- "if all the projects see the light of day."

Even then, when added to current spare oil-production capacity of roughly two million barrels a day, the total reserve of 3.3 million barrels a day still would be well short of the five million barrels a day needed to put the world into the comfort zone, he said.

WTI crude is likely to remain above $50/barrel for the next few years as spare production capacity remains tight and oil companies battle for access to upstream reserves, the IEA's chief economist Fatih Birol said Tuesday.As you can see, both IEA and the EIA are singing the same song, a tune that doesn't match the standard price narrative anymore but is consistent with a very low ( < 1 ) value for Δs, the price elasticity of supply of a scarce resource — conventional oil. Oh, don't worry, though, things will work out. The Good News has merely been delayed. With this background, let us re-investigate the scarcity rent hypothesis for oil and make some overly bold predictions about future oil prices."We do not expect prices will come down (below) $50/barrel in WTI terms," Birol told an industry conference in London. "We would like to see prices lower than that," he said, but "it would be a surprising trend if we see prices lower than $50 in the next few years."

The Sky's the Limit?

It is worthwhile to quote Dr. Hamilton again, at some length.My own view is that, for most of the past century, Dave's inference is exactly correct-- the resource exhaustion was judged to be sufficiently far off as to be ignored. However, unlike those whom Dave terms the Cornucopians, I do not infer that the next decade will necessarily be like the previous century. Certainly declining production from U.S. oil reservoirs set in long ago. And if one asks, why are we counting on seemingly geopolitically unreliable sources such as Iraq, Nigeria, Angola, Venezuela, and Russia for future supplies, and transferring vast sums of wealth to countries that are covertly or openly hostile to our interests, the answer appears to me to be, because we have no choice. Resource scarcity in this sense has already been with us for some time, and sooner or later the geological realities that governed U.S. oil production are also going to rule the day for the rest of the world's oil producing countries. My expectation has accordingly been that, although scarcity rents for oil were irrelevant for most of my father's lifetime, they would start to become manifest some time within mine. And I have been very interested in the question of when...Addressing Hamilton's second point, the dramatic plunge in oil prices appears to be over. Clearly, other factors, such as the geopolitical risk premium which pushed the oil up to $78/barrel last summer, have contributed to the price. As to the fundamentals, the only new information we have at present is that supply capacity will remain tight in the foreseeable future — this is now admitted by the EIA and the IEA. On the other side of the equilibrium curve, demand is still robust and growing. Therefore, the oil price must rise over time.To be sure, there are some facts that fit a bit messily into that picture. One is that, over the last several years, oil futures prices have exhibited backwardation at some horizons. This is less dramatic now that it was a year ago, with the six-year-ahead contract price of $64 a barrel now above the current $59 1-month-ahead price [on October 24, 2006]. It is not obvious how to reconcile the behavior of futures prices over the last several years with a scarcity-rent explanation, though possibilities to investigate might be option valuation, adjustment costs, or hedging or other risk premia.

A separate set of doubts of course arise from the dramatic plunge in oil prices over the last few months, which at a minimum must reflect either some substantial new information about the long-run fundamentals or else confirm that some factors other than scarcity rent have been contributing to the oil price peak of the last year.

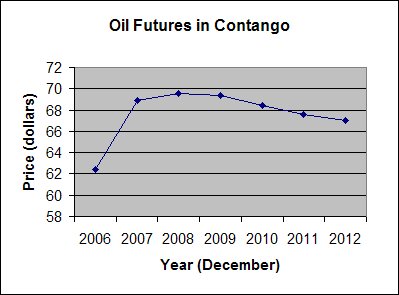

Hamilton's first point concerns backwardation in the oil market ie. the state where the current front-month spot price exceeds oil futures prices further out in time. The opposite is contango, which is the current state of things as shown in Figure 5 below.

Futures Prices ($/barrel) on December 5th

Figure 5

Based on a hypothesis of Jeff Vail, Professor Goose wrote about Peak Oil Contango? in March of this year.

... According to economic theorists, backwardation is not normal, and is suggestive of supply insufficiency. For some time now, crude oil markets have been in backwardation.Backwardation suggests a temporary supply deficit which moves the oil spot price above the futures spread. When the shortfall is resolved, the spot price falls and the backwardation condition disappears. As Hamilton notes, the scarcity rent hypothesis implies that the futures prices should always be in contango as they are now. According to the Hotelling rule, the oil's future value v(ti+1) should equal it's present value at v(ti) + the rate of interest.Normally when a market switches from temporary backwardation back to contango, it is a result of the short-term supply problem that caused backwardation being resolved--that is, the spot price decreases. The interesting point from a Peak Oil perspective is this: a shift in fundamentals, such as a steady decline in world oil production, will make the commodity increasingly expensive in the future and will cause a market in backwardation to shift to contango without a decline in the spot price.

Have the oil markets moved into contango without a concomitant drop in the oil price? According to Bassam Fattouh's Contango Lessons, an interesting thing has happened in the last 18 months.

However, one striking feature in the current market has been the prolonged contango in the WTI forward curve. Figure 1 below shows that during the last 18 months or so, the nearby (delivery) futures contracts have been trading at a discount to the second month futures contract.

First Month Forward minus Second Month Forward

Figure 6 — Click to enlarge

Fattouh goes on to say —

Various explanations have been put forward to explain the current contango in crude oil markets. Advocates of the peak oil hypothesis consider that the current transition from backwardation to contango is due to a greater acceptance by market participants of peak oil. Simplifying greatly, peak oil theory predicts that oil production will reach a peak some time in the very new future after which production would start to decline. In the face of an expected growth in global demand, this implies that oil prices for future delivery should rise faster than prompt prices. This would imply a contango structure with the contango widening at the later segments of the forward curve as impending shortages become more acute ahead in the future. However, this implication is not supported by the data: the term structure of futures contracts for long term maturities is in backwardation and the volume of outstanding contracts is relatively low which indicates that investors place little weight on peak oil predictions. After all, if market participants adhere to the view of peak oil, then they would have the opportunity to make large profits by buying the longest maturity crude oil futures contract that the market allows.While it can certainly be acknowledged that investors have placed "little weight on peak oil predictions" in the past, perhaps they are starting to do so now. Indeed, in September, when Fattouh's analysis was done — during the midst of the recent sharp price dip — longer term futures were in backwardation. However, they are now in contango (Figure 5) and the oil price has risen since mid-November. This behaviour is consistent with the peak oil view as laid out by Professor Goose. Needless to say, Fattouh's own data show that the second month forward has been in contango for quite some time. We should bear in mind that using a futures-spot spread model ( discussed in [2]) to predict the future spot price has large associated uncertainties, as we would expect.

Conclusions

Whether a scarcity rent for oil is now part of its price is unknown at this time. Like the peak itself, an explanation along these lines can only be offered in retrospect. Also, nothing I've said here precludes future incremental supply increases before the peak of production. The price rises of the last 5 years have taken place outside any major oil shocks, though there have certainly been significant "above ground" disruptions as in Iraq or Nigeria. The expected large new investment in the oil supply has not yet occurred. The EIA and the IEA are now starting to acknowledge supply inelasticity as the oil price rises. According to any reasonable interpretation of the fundmentals at this time, there appears to be no reason why the future price of oil should not climb and climb. Despite great short-term volatility, which is really only an indicator of spare capacity tightness in the market, no persuasive evidence exists so far that the price rise since early 2002 will not be a permanent feature of the world we live in. As to next year's price, I believe the upward trend will continue as it has unless a major geopolitical event or a severe global economic downturn throws us into uncharted water.

Dave Cohen

Senior Contributor

The Oil Drum

davec @ linkvoyager.com

These posts are a lot of work, and the authors appreciate your helping them get more readers for their work however you can.

It took about 51 months to double in price from $15 to $30 in June, 2003.

It took about 25 months to then double from $30 to $60 in July, 2005.

12 months later, in July, 2006, the price was 30% higher, before we saw the break back to the recent trading range.

IMO, oil supplies--especially net oil exports--have been growing more slowly than demand, which has caused two doublings in oil prices, from $15 to $30 and then from $30 to $60, with the second doubling coming in half the time of the first doubling.

The most recent spike, in July, 2006, was half of the time of the second doubling.

I think that the price went up enough in the first half of 2006 to kill off enough demand that the price fell back slightly (plus the fact that hurricanes were not appearing).

However, this is not a static situation. IMO, 1/1/06 marked a transition from an exponential increase in world oil production and world oil exports to an exponential decline in world oil production and world exports. This means, IMO, a return to the price "doublings" pattern, until we again reduce demand enough to bring consumption and supply back in balance, and then supplies drop again. . .

I have two observations, probably unsettleable until history gives a perfect 20/20 hindsight;

1.Currency problems. Now that Iran is denominating its sales in Euros, and the US dollar weakens, we may end up paying a premium for oil in the US. I'm woried that we will see a flight away from the Petrodollar in foreign markets because of the Republicrat and Demican fiscal irresponsibility combined with Moslem repugnance for our foreign policy.

2. Economic theory gives very little weighting to the psychology of speculation. The most recent highs of $78/bbl were combined with the Hedge Funds trading oil to irrational heights. I'm pretty sure the Hedge Fund 30 something cowboys have been reined in by their bosses because of the collapse of Amarynth and the beginning of what may be a huge housing sparked recession. I'd bet money the pension funds who use the Hedge Funds are telling the boys to chill out. I'm assuming the Pension funds are smart though, and thats not a proveable assumption, and quite possibly dangerous.

At any rate, my guts tell me WestTexas is right. Things are just too unstable for energy prices not to double again in the near term.

General Motors is too big to fail.

I think the USSR is too big to fail also.

Oh wait...

The dollar is not all that important. Everything could easily switch over to Euros or other currencies. It will happen, but it will no doubt take many years time.

The weakness of the Euro is political. Not all countries in the Euro market are happy with membership. See Italy for one example. It would prefer a currency it could more easily inflate (devalue or debase).

Expectations of exponential production increases +

Reality of exponential production declines =

Explosive increases in oil prices

IMO, the only logical response to ERE is ELP:

Economize; Localize; Produce

(Richard Rainwater seems to think it's a good idea)

Despite stubbornly sticking to my long position in oil during the September-October energy massacre this year (despite a timely warning from SAT on TOD), I am still a successful commodities trader. My 2006 performance is looking to finish around +140%. So, I will let it all hang out and make a bold prediction:

NYMEX WTI will exceed US$120 (nominal) before January 20, 2009.

This will be due to a combination of a bear market in the US$ and a the next leg of the bull market in crude oil. (I would term the entire period from August 2005 to the present as a long irregular correction/consolidation pause in the secular oil bull market. Considering the double digit growth in M3, the $78 of summer 2006 was not a higher real price than the $70 of summer 2005) As westexas has noted, a price doubling in 25 months has happened earlier in the bull market for oil, and bull markets get wilder in their latter stages.

I posted a Reuters link on the open thread yesterday where an airline exec was quoted as saying that the current steep contango was now making it problematic for airlines to hedge fuel costs. As a result one airline was actively considering purchasing its own storage facilities for fuel (actually some old tankers) to try and smooth out costs.

Just goes to show (as you also have) that the forward price structure isn't merely of arcane interest to traders - it has real world implications and consequences.

I worked for, in and around the oil industry since about 1986 and realise only now that up until about 2002, that whole period was recession. The bumps were just that, bumps. I can't claim to undrstand the dynamic of how commodities are priced - "but I understand that I don't understand that". The problem is IMO the politicians and large segments of commerce think they understand but don't. They see recent price rises as a speculative bubble - and no doubt the speculators activities add noise to the oil price chart. And of course with reassurances of 4 trillion barrels just sitting there waiting to be developed - our largely ignorant and in many instances sub-intelligent politicians don't know any better and choose to believe the guys who say that energy will last forever - which of course it will - its just going to take a time out for the 21st Century - it will be back in 50 million years or so.

Since 1999 there is a pretty good correlation between oil demand and price - and I think that is the key to the near future - so long as demand keeps growing - which it will so long as the world population keeps growing - then the price will keep rising. I see ultimate peak as defined by the price which the world on average is not prepared to pay. Perhaps somewhere around $150 - at that price demand may collapse through large parts of the developing world - allowing us to continue "as before" while large parts of the world starve.

Are the cops in your town going to arrest a divorced mother siphoning gas to get her kids to school and drive 20 miles to work? I guarantee they are not going to do it in Galveston, we have a fairly compassionate bunch of cops who "bend " the law.

:-)

:-)

We are entering an era where the benefits will be highly concentrated, among the energy producers and related companies, while the pain will be very widespread, ultimately approaching, or becoming a widespread depression.

I put it this way--everything is fine for the energy producers until the angry soccer moms start rioting at the gates of the mansions of the energy producers.

Don't say I didn't warn you to ELP.

This was a factor in my choosing to work for an oil company. I figured with Peak Oil looming, oil companies (and their stock values) would do quite well. I know some people think post-peak that oil companies will be out of business, but I think just the opposite: They will be more important than ever, and still making money.

I'm betting on the remaining oil companies being nationalized shortly after peak oil esp in the US. So don't expect the party to last that long post peak.

I have been back and forth on this. You might be right, but I am not sure what the point would be. It's not like nationalizing them will produce more oil or make gas any cheaper. But nationalized or not, it will still be a critical sector and will still need employees. So, I still think it will be a good place to be.

Consider that we import over 2/3 of our consumption. The last thing we would want to do is to do anything that would reduce our internal production.

I'm not advocating nationalism, but as the majors have been such great corporate partners all over the world and are now being shut-out in one country after another where are all the jobs going to come from, where you going to drill?

I agree here, at some point the price of oil will crash the present global economy and that will create a new world, well before we run out of oil. I have to say, the weakest point of TOD is the economic claptrap everyone uses about the so-called oil markets. It may sound well and people may actually believe it, yet it is completely ahistorical, but then so is most so-called market economic analysis.

Outside the simple and correct notion that price will rise as supply declines, all the rest of it sounds like the market-economic babble it is. If you all could use this supposed knowledge on how price is set in oil markets, you wouldn't be posting here.

I agree it eco-babble but I don't feel I'm wrong. The problem is as oil approaches its peak and then begins to decline external factors will play a very large role in the daily price of oil. Trying to explain that underlying this babble is the intrinsic depletion of the worlds oil is difficult. By the time real depletion based price takes control I fear it will be too late to do much about it.

People need to recognize that the market volatility itself is cause for concern. My favorite is the people that first claimed the high prices last summer did not effect the economy then turn around this winter and claim that lower oil prices will help the economy. Huh ?

http://www.oldbaileyonline.org/

These are the court proceedings from the old bailey in London through the 17th - 19th C.

Example: Verdict of the day

Sending a felonius letter demanding about one Gunea:

Sentence: Death By Hanging...

Look up your Ancestors :-(....

Why relavent to PO?

Justice is likely to become as robust, and summary post - peak as 18th C England, or the US Frontier.

How much of our liberal and enlightend systems were manifestations of access to energy and the industrialisation it brought rather than enlightenment?

And will they survive ?

So if someone bought a crappy SUV three years ago and it eats all their income... so be it. That is called punishment for stupidity and is priceless because it teaches a lesson to think before buying. A person who has to suffer for a couple of years for their idiocy will become much more responsible in handling money. I actually think that is a good thing.

D&D

Doubleup & Drive slowly

That's nice to you to care for the "good" of the careless but it may not be that good to you if the "stupids" trash YOUR property in a vain attempt to recover.

It will be vain for them (at least in the short run) but YOU will be screwed nevertheless.

Life sometimes has downturns. Grow up or get a prescription for anti-depressants. Either will help to get a grip in reality.

I am by no means a cornucopian. In my opinnion the peak was, for all practical purposes, in 2006. But I also believe that for all practical purposes the peak of waste in the US was in 2006. From here on people will be (forced) to take a second look at their fuel and soon at all of their primary energy use.

Since we are looking at a 4% annual decline, replacing 10% of the fleet per year with 40% more efficient vehicles and a slight adjustment of miles driven is all it takes to get that problem off the table. Right now millions of people all over the world are buying vehicles which are twice as efficient as those sold on average in the US. The technology to counter PO exists for years. What does not exist, so far, is the willingness in the US to buy it.

:-)

If so you must have some form of multiple personality disorder or...

Smoking something too strong?

Because :

Right now millions of people all over the world are buying vehicles which are twice as efficient as those sold on average in the US. The technology to counter PO exists for years. What does not exist, so far, is the willingness in the US to buy it.

Is a typical bogus argument, all Americans switching to "vehicles twice as efficient" will not solve ANYTHING, just introduce a little delay.

http://www.theoildrum.com/story/2006/11/2/162019/324

Do you mean that you think ideas like "just doubling the MPG" or "using efficient light bulbs" or any other silly marginal improvements like those are worthy of consideration on TOD while throwing scorn unto this deserve censorship?

Please explain!

Here in California they drill a hole in the gas tank and drain it. Maybe the third world needs to learn from us.

And to raise needed capital there would have to be an estimate of proven reserves not to mention a discount factor as ten years down the road you will either be hung or taken over by the government.

Locks, shmocks...

Drills trump locks.

Memmel's right, here's the drill

Sorry, couldn't resist :)

Think!!

In the seventies gas crunch, I had a locking gas cap on my pickup--some bastard took a pipe wrench to it and twisted it off, then siphoned my tank dry.

NO!

What I mean isn't that "locks don't work" or that whatever "countermeasures" against crumbling ethics cannot be found but that the CUMULATED COSTS of the countermeasures + the cost of succesful thefts + the costs of ensuing disturbances quickly exceed the value of the preserved goods.

And this, ABOVE the already inflated value of the scarce goods (petrol or whatever).

The value of peaceful social consensus is greatly underappreciated.

Ordinary people will not start stealing gas just because it becomes as expensive as in Europe.

No need for "ordinary people", a large enough minority will do.

You also have to keep in mind that stealing fuel only generates income if you can sell it to someone. Ordinary people who want to stay out of jail will not buy black market fuel. They will simply buy a smaller car or share a ride with a colleague.

On the other hand, you guys are very funny with your Mad Max fantasies. Maybe Mel Gibson would be well advised to shoot another movie... there seems to be plenty of audience.

Of course, "ordinary people" never buy ANYTHING on the (various) black markets.

Black markets are all self-contained...

you guys are very funny with your Mad Max fantasies.

In the beginning it will NOT look like a Mad Max fantasy just "a bit corrupt" but will slowly (?) drift toward Mad Max world because the physical constraints will NOT ease with time but will strenghten.

The cops will ultimately be involved in black markets, at least enough of them to make the markets viable, look at Africa.

But it looks like the US will enter a severe recession in 2007 which should drop demand worldwide. So I think we won't see price hikes for several years. Maybe even out too 2010.

I don't believe the world economy is going to escape a major US recession unscathed. Another factor for the US and the Dollar price of oil is that it looks like the Feds have no problem crashing the dollar so far. So we may see the cost of Oil imports rise dramatically in the dollar while the world rushes to the euro from the petro dollar.

In any case all signs point to the hegemony of the petro dollar coming to a end soon.

However, in weighing whether to discuss a U.S. recession in this article, my judgement was that only a very severe downturn in the American economy would affect global oil demand significantly. I consider that unlikely. Also, I am impressed by the rising demand numbers coming from China and elsewhere, especially from the producing countries.

As in other things, I could be wrong.

To show even stable imports, we have to reduce consumption by a volume of oil equal to our annual production decline, and then do that every single year going forward.

Of course, what is going to happen, IMO, is that prices are going up so fast that we are going to literally be forced to cutback our consumption--year after year.

As Jim Kunstler said, If the American Way of Life is considered non-negotiable, we will soon get a new negotiating partner, reality.

But as I said in three replies it a race between recession causing demand destruction and depletion. Also oil could get expensive for America and stay relatively cheap for the rest of the world. Depends on if we allow the dollar to tank or not. I think we will.

This could even result in a finicially caused spike in oil prices in dollars as the petro dollar dies.

I'm a trained professional psychic, I even used to sleep with Shirley McClain in a former lifetime (thats a joke , you humorless SOB's). I'm placing my bets that WT is right, I think geology combined with the greedy senselessnes of the US Government and insane denial of the media spell disaster for the prices, we'll be over $100.00/bbl in the next year in constant dollar terms. All it takes is one speedboat sinking a tanker in the Straits of Hormuz, or some lightweight neocon asserting his masculinity by bombing Iran and we are all screwed. And, I mean all of us. I think the oil patch would be much better served by a constant price than high prices and the public ridicule and rage we will get when prices get out of control.

State governments could easily install new shuttle bus services in the metropolitan areas and ease traffic congestion (this making commute more efficient!) and cut down on driven miles for millions of commuters. The new bus fleets would produce many new jobs (drivers, mechanics etc.) and transform the way US cities operate.

Alternative energy sources could grow explosively at 50% instead of 30% annually. A single 5MW wind turbine keeps 2000+ electric commuter cars rolling. What is stopping us from installing a few hundred of those a year? Or a few thousand?

I think what this takes is a president with the spirit of FDR. Maybe someone should dig up the corpse and get some DNA samples for cloning. This country needs an injection of "Can do!".

For starters, the Lower 48 is about 85% depleted, and Prudhoe Bay is watering out fast.

Which is why I advoate Alan Drake's solution: http://www.familyoldphotos.com/tx/2c/chadbourne_street_trolley_san_an.htm

I might be wrong. I don't mind losing this one.

I think that people will respond at first as they already are, since we are in the 'at first' stage. People, at least on the margin, are already seeking more fuel efficiency in their choice of vehicle and through various forms of ride sharing. In addition there is an increase in transit ridership, mostly on buses, taking place.

But over a longer period, the race will be on to construct electrified rail transit, for many reasons including energy efficiency, reliability, and personal security, not to forget the lobbying of landowners who will have megabucks to be made by securing a rail line in their neck of the urban woods.

And for personal commuting... you would commute with colleagues to your company, anyway, so you know the person.

The "personal cab" idea is not feasible for many reasons. Insurance coverage and liability would only be some.

"But over a longer period,"

I agree... but that is over decades. I was more thinking about the initial years of the transition. And if the model implements itself succesfully, it might just stay in many places until the electric car and wind/solar energy will take over, again.

Folks with relatively normal work schedules drive to the park and ride, where they can either park or enter their car in the slug line. Those parking their cars line up for passenger seats, as well.

There's an informal system whereby someone at the head of the passenger line shouts out the destination of the driver. The first people going to that desination get in. Men must get in, but women may refuse any ride without question.

There's some general idea of the gas payment which is given over during the trip.

The reverse happens at certain locations in D.C.

Many who do it are government workers, because many of them have regular working hours.

In the future, a passenger could get to the pnr on something small, say a bicycle, electric scooter or a very small one or two seat electric car in inclement weather.

Those holding onto larger vehicles get to use them for necessary transport, but reach a much higher passenger mile per gallon standard, say 15 mpg X 3 passengers plus driver in an SUV or minivan gives you 60 pmpg, similar to the pmpg with one person in a Prius or VW TDI. On the weekend, the SUV owner would still get to use the larger vehicle for carting around a larger or multigenerational family or picking up rolls of insulation at a home-improvement store.

At least this used to happen 6 years ago, and it worked quite well.

People have to survive, and most people would rather work than steal. If the laws are broken, but its still fairly honest, they ignore the law, and so do the cops. I expect to see a big increase in non-violent, victimless crime as our economy gets worse; prostitution, dope peddling, operating small services without the proper permits are booming in many neighborhoods. There is a huge underground economy and its increasing constantly, particularly since we have allowed the so-called conservatives to marginalise so many people. How in the hell is a felon going to make a living now that computers and bad laws prevent him/her from getting jobs that pay a living wage? Illegal immigrants can't work legally, and many businessmen rely on their labor and ignore the law.And if the laws are Draconian and exceed any reasonable measure everybody, including most cops, just ignores them.

I don't know which way it will go. To be honest.

But oil supply is now tight enough the economic conditions will have a amplified effect on the price of oil.

I do expect a major spike to happen in the next 3 years by major I mean a run-up to 200 plus in today's dollars.

The underlying cause is of course when supply is less than demand but the spike can be triggered as soon as the cause becomes obvious. I don't think anyone is not concerned that their will be a spike.

The only question is how the price of oil plays out before we spike. In between games are definitely afoot and the petro dollar is not going to go out without a bang.

I just wish the world had switched to a basket currency a long time ago globalization without a global currency is bs.

Regardless the American middle class is going to take it in the ... no matter how things pan out.

200 bbl oil would be a spike price. At some point someone is going to get very nervous about supply and throw a lot of money at buying oil. The first whiff of actual shortages will be enough to set this off.

I may not know a lot about oil but my PhD work was in nonlinear semi-classical chaotic dynamics. So I do know a lot about nonlinear regimes.

Why a spike ?

First a primer

http://en.wikipedia.org/wiki/Pink_noise

http://mathworld.wolfram.com/StochasticResonance.html

http://en.wikipedia.org/wiki/Stochastic_resonance

They are closely related phenomena. In fact pink-noise or 1/f noise is often caused by stochastic conditions.

My favorite example is if you drop a piano out of a window when it hits the ground you will hear notes from the vibrating strings.

In any case the peak oil condition is breeding ground for a stochastic spike.

Googling sure enough the model is used in market analysis

not surprised.

http://www.if.pw.edu.pl/~apfa4/pre.html

I googled this.

Stochastic resonance commodity prices

In any case the driving force is fear of real shortages.

The moment it sets in it will cause a price spike.

The underlying wild price swings is the noise needed to allow a stochastic price signal to build.

The meta stable states or two conditions required is a world

where most people can afford oil and condition b where some one with deep pockets buys up enough oil to cause shortages even if they had to reach a high price to cause it.

This is the greedy buyer scenario. Basically the greedy buyer on hearing of a real or imaginary shortage buys up

all of some article resulting in high prices and real shortages. The other required condition is the noise so the market must be swinging over a pretty wide range.

I'd have to guess the range but it would probably be fluctuations of say 5/60 or about 8%. On this I'm not sure

I never did a lot of work varying the power spread of the noise and its effect on resonance. The only requirement is there as to be enough noise power to actually drive the system. Maybe someone else can comment on real noise levels required to get stochastic resonance to happen. In any case the price swings adds the other needed factor uncertainty.

Thus uncertainty and fear = stochastic resonance :)

I actually worked on this problem. SR and the Ice Ages.

http://www.sciencemag.org/cgi/content/summary/290/5492/697

Hopefully of course it will be a true spike but its basically at that point economic warfare. I'm only confident in predicting the front side of the spike god knows what happens on the back side.

Bingo !

Thanks. But in this case their might be real shortages after the attempt to corner thats the difference.

If this is the case, China might well be seen as both shrewd in looking forward and an aggressor in engaging in economic warfare?

I am pretty sure I have them all, over market capitalizations above $100M, traded on US exchanges.

Sorry for the late reply all I see is instability which caused me to decide it was a stochastic resonance situation.

So major price flux then boom in the stratosphere. See later posts.

We are seeing prices bounce almost 2 dollars now.

I'm a really good theoretician but this was a tough call to many inputs ( chaos ).

Now if I figured out the timing I'd be a rich bastard. But I don't know how to do that. By that I mean any initial conditions chosen diverge exponentially.

See

http://physics.clarku.edu/~akudrolli/clover.html

The current stable point is free trade of oil.

The other stable point is hoarding or greedy customer situation where supply or availability is more important.

Another similar situation is how much is the Vatican worth ?

Answer: Its priceless. Or to go back in history how much was Alexandria worth ? Once oil becomes priceless obtaining oil will not be done on the free market.

Dunno when we will transition just know we will.

And I thought my degree was advanced basket weaving :)

Hint: US spending for the holidays $450 billion, US oil imports $300 billion. In other words: US citizens spend $1500 per capita on mostly useless Christmas gifts. For a family of four that amounts to $6000 which is an easy downpayment on that shiny new hybrid...

I don't see the economy tanking... but I might see next Christmas being a little less expensive than last Christmas. But then, I don't have a crystal ball, only a tree ornament.

If we are--as I believe--entering a new era of exponentially declining world production and imports, how high do oil prices have to go, when almost everyone is determined to maintain mobility, especially since the Huber/Lynch/Yergin Cult is promising that more oil is right around the corner?

Consider the fact that most of Europe is paying $6 to $8 per gallon. Have you been to Rome lately?

Then there is China to consider.

Mobility can be maintained without waste. Nobody says that 20mpg is a gold standard. 40mpg is perfectly feasible mainstream and 60mpg vehicles are commercially available. They might not be popular right now, but then... gas prices talk. They just haven't raised their voice, yet. Wait until you hear the roar and then see the mice run to the Toyota dealership.

My parents live in Europe. They complain about the $6/gallon they are paying and about the rapid rise in natural gas prices for heating. I keep telling my Mom that she can call me any time and I will help them to finance a solar water heater and some solar panels and if needed get them a new, more economic car. Big deal, not. Will it hurt me financially? Sure. Will it kill me finacially? No. I will simply not get another useless toy for Christmas and behave like the adult that I should be rather than the child that I like to be.

I think the lesson is that sometimes in life you have to stop running, look down on yourself and, if your shoelaces are untied, take a second to fix them. That second lost will come handy when you are at the finish line and you can run instead of tumbling over loose ends.

In the end religious beliefs do not trump reality. Gas prices will rise, with or without gas tax. People will have to buy smaller and more efficient cars, with or without gas tax. With gas tax the economy could be kept in better shape than it will be without. It is really that simple.

This is another reason I talk about fracturing in terms of America's future - the disjunction between what is believed and what is real will not be seen as a reason to change beliefs, it will be seen as a problem to be solved, if only the right answer can be found. But if the only right answer is to change your beliefs/how you live, then will it be rejected as being unacceptable - that has certainly been the experience of the last 30 years.

For example, I don't waste too much time on the American politics of Iraq at this point, since it tends to be just a now years long show to avoid discussing reality - oil is the prime motivation, and the rest is just window dressing to keep that reality away. Until Americans start living in a way which reduces their 'need' for oil, the reality is, America will kill and destroy in the Middle East to keep the American Dream alive. This was a prediction from the late 1970s, from a nuclear trained Naval Academy graduate, who just happened to be president at the only time America actually reduced its use of oil - the period most Americans consider a low point in their history.

Though your prediction is rational, I'm not sure that America is that rational anymore. After all, it threw away several decades of preparing for a future where energy will be more expensive, even if other industrial societies didn't. We will see.

This is what Tainter describes as "complexity." We pray to the gods for a good harvest [belief structure] and the rivers run dry [reality] so the problem is that we are not properly committed to our prayer [response consistent with, and reinforcing of, existing belief structure] so we create additional layers of organization, or laws, or required action [complexity] none of which is truly responsive to the core issue [the reality of the situation].

In psychological terms, there are increasing amounts of cognitive dissonance but rather than revise the incorrect belief structure the response is an attempt to reinforce and actualize the incorrect belief. When reality does finally make itself felt the outcome is a complete collapse of the belief structure and the society that it once supported.

However, a number of belief systems seem to have withstood essentially all challenges over millenia, being able to adapt to differing societies.

I try to use 'fracture' in a neutral sense - maybe, just maybe, America will become a better society after such a fracture, without having to abandon many of the ideas which did make America a true step forward in creating better polities. After all, not that long ago Yankee frugality was considered a worthy American trait, not something a vice president sneers at as a personal virtue, as if personal virtue is something he doesn't understand.

Certainly, everything I think worth preserving in America (the truly revolutionary idea that government has no role in religion, and religion no role in government, for example) may be swept away - and will be anyways, since I believe in entropy, if not catabolic collapse.

NO, this isn't complexity and this isn't Tainter.

Please don't spread nonsense, it is already difficult to argue with the trolls in residence.

Complexity is an EFFECTIVE problem solving strategy, not delusion, beliefs or cognitive dissonance.

The problem with complexity is the DECREASING MARGINAL RETURN on investments in ever more complex solutions.

For oil, as an example, deep water drilling versus onshore drilling.

It's not that deep water drilling doesn't "work" it is that its EROEI is lower.

This could have been said by Tom Hanks, Forrest Gump, remember the box of chocolates? !!

Also, being a USA-centric audience, most here do not understand the price escalation includes a large component related to the usa currency devaluation of 30% since Jan/2002.

Supply does not have enuf spare capacity (save the last 2 Q's). Demand projections were based on Real global GDP of about 2.25% not the over 4% stuff we've been witnessing. All economic regions are firing on all cylinders ... usually one or two are in recession or flat while others are in peaking cycles.

And that brings us to the juvenile talk of usa Recessions and Depressions. Very few here at TOD have knowledge of business cycles. The web, the Fed and analysts like Deutsche Bank are awash with articles that illustrate the business cycles as promoted by the monetary policy of the Fed and most of the G-20.

Interest rates continue to rise 'cuz the business cycle has not peaked. The prevention of plus 4% real growth is dampened by higher interest rates (and higher energy prices). Greenspan was aided immensely in his quest to calm the waters last year by the rising energy prices. And as they have come down over the last few weeks we have seen the reverse effect.

The American Dollar fell (from Jan/2002) due to the rising Deficit and the increasing Trade Deficit. While headway has been gained in the Deficit reduction, efforts to address the SS imbalances will likely stymie further deficit reduction. Thus further devaluation of the buck is required to address the Trade Deficit. China is unlikely to initiate desired revaluation of their currency until after the Olympics as employment stability is a high priority for them at the moment.

The oil sector must maintain the present spare capacity to allow for unpredictable disruption. Present bottom-up studies are positive in that regard. Prices have fallen twenty bucks even tho stock building was in play. We don't know whether demand destruction will continue to modify the big picture. We don't know how much SPR activity will come to fruiton in the short term in india and china.

But the ingredients are in the mix to see the present $55 contract prices fall another 10-20% as we enter another soft heating season in the usa. Long ago, most thot our $53-contract price for yearend/2006 was outrageous. But the world has unfolded as it should...

In short, watch the stock build & capacity cycles and trends.

Greenspan was able to manipulate a soft landing in Y2K. 2008 is Bernanke's foe as the present biz cycle unwinds. Fortunately he and congress have many options with most of the global Central Bankers on the same page.

:-)

At first I thought it was a tongue and cheek skit.

Enjoyed the post !

Esp this

And that brings us to the juvenile talk of USA Recessions and Depressions.

Classic...

I'll even give you the event that will result in the greatest financial crisis since the depression.

http://biz.yahoo.com/ft/061207/fto120720062004177556.html?.v=1

Juvenile I know, but since your such and expert you can explain first why I say this and then why I am wrong I'm not going to spell it out for you.

If you can't explain my argument and the counter then we will see who is juvenile here.

The problem is they are going to give us all a real life lesson.

My best guess right now is we see a slow run-up in oil prices next year then a financial crises. How this effects the price of oil in dollars is unknown.

My guess and this is only a guess is we will relatively low prices in US dollars between 50-70 in today's dollars until the economy tries to rebound then price spikes will prevent economic expansion.

So I figure major recession 2007+ with recoveries truncated by the lack of oil and price spikes from here on out. The economic recession is going to buy us some time for sure but not much I think and their is no assurance that American won't be paying a much higher relative price for oil.

The little picture problem is that the American worker will not see a wage increase and probably see there buying power cut in half ( If they have a job ). So for the American worker we have a strange event a recession with rising prices. That's what happens when you import everything this is the first time America has entered a recession and relied so heavily on imports. I don't know of a historical example of such a situation. Maybe someone can point out a time in history when a economy tanked and imported most of its durable goods. Needless to say its not a pleasant position.

Outside the US you may see the price of oil increase greatly in dollars but the other currencies will rise against the dollar offsetting the price increase to some extent. Third world currencies will probably tank also.

So Oil exporting nations will be okay.

China and Europe will be okay for a little bit. Japan will probably go down in flames same with S Korea and Taiwan.

Now the question is will demand decrease faster or slower than depletion. Dunno. I am confident the price of oil will prevent any economic recovery that tries to start in 2009-2010. At best a economic crash will lower demand about the same as the depletion rate. If not then spiking oil prices will kick the economy while it is down sooner than I think and my predictions are to mild.

Either way I think the party is officially over we might see a small indian summer in 2009-2010 but that it.

To focus on the topic of this thread. Considering the current state of the world economy not including recession effects in the model and price shocks 1/f noise makes it hard to apply short term. I don't see any reason for the price of oil not to o be chaotic at peak and intially go down during the comming recession.

Thus the price of oil over the next few years will be generally down and controlled by economic/currency issues not underlying supply and demand. Once this unwinds then we will finally clear peak oil effects which will prevent economic recovery.

The real problem or tragedy with this situation is their will be no money to move off a oil based economy. Oil prices will remain too low too long because of external effects.

The fed always trys to take out inflation by laying off working people, so hard times are on the way for the working class and lower middle class.And we can expect our do-nothing Congress to do nothing! Its in the Democrats interest to watch everything collapse and blame it on Bush, and in the Republicans to take care of the rich at the expense of evryone else. Anybody for revolution yet? Solidarity forever!

Except I think the Chinese and Indian economies are still tightly tied to ours so we can expect growth to at least reduce in these two if not stop. So expect some demand destruction in these two also esp China. China and India growing without a healthy US is a myth at best. Neither is anywhere near the point of being able to "unhook" and peak oil will ensure that their attempt to grow western economies with large internal markets is aborted if they try.

If I'm right then overall demand destruction will probably balance depletion for a while. In any case its a close call for a few years. I don't expect world oil prices to increase dramatically because of depletion at least not next year.

In any case we will know pretty quick in 2007 which factors are going to be the strongest depletion or tanking economies.

My bet is on tanking economies but its a very close call.

In any case if I'm wrong then peaking oil prices will ensure the recession continues.

Now back to numbers I agree a 10% reduction in the US is probably not going to happen but world wide 2-3% ?

Its easier to just assume a general 2-3% worldwide decline.

This is pretty close to the initial decline rate if we are post peak. Since prices are a mix of demand and supply I think we must begin looking at demand factors now and not just supply esp since demand is probably decreasing from now on out.

I guess my magic crystal ball has a coating of grease Kidding aside, I really do think intuition trumps statistics that are off. And with the unclear production figure from the FSU and Iraq, and the haziness of the Saudi Reserve figures, I wonder if quantitative analysis is any more correct than Tea Leaves. I really think pronosticaton has more to do with the personality and cognition processes of the analiser than the real future. So your prediction of $200/bbl and Freddie's of $40-45 bbl are both probably off. I'm going to guess the next run-up will leave us at $95.00/bbl peak, and $70-$80 as the next trading range, and this will be before next June. My reasoning is that every run-up sems to be in the 15%-20% range over the previous high price ($78/bbl recently) then drops to slightly below the previous spike price. I also think $100 is a huge psychological barrier. Unless the sky falls, then anything is possible.

How's that for a good psychic prediction! Its even hedged, my shaman would be proud of me!

Nearest example I can think of would be UK and most of Europe in the immediate post WWII period.

Of course the primary means of correcting Europe's post war economic problems was US intervention in the form of the Marshall Plan. If your scenario plays out I am not sure what nation, or group of nation's, would fill the prior historic role of the US. Iraq? China? KSA? The nation you derided for it's Freedom Fries?Who are America's friends?

The other point of interest is that most of the classical economic policy responses (significant deficit spending, cutting entitlement programs, cutting taxes, militarizing the economy, flooding the economy with liquidity) already form part of US policy.

If Memmel is correct we are in for a world of hurt.

Thanks for the tip. Hmm your right but on the same hand it was also a unique situation. And we don't really have a big brother like Europe did. Also in a sense Europe had a wild west type growth potential same with Japan so although I agree its the closest modern scenario I'm not sure it fits.

The other one I thought of was Rome near the end of the Roman Empire they basically imported everything and lived off of taxes. That may be a closer fit. Ancient India and China may offer similar examples.

The other case I was thinking was at some point the British Empire must have met a similar situation i.e most goods were imported from colonies. Local control was monetary and

military. Maybe conditions in 1776 or later ?

I'm not sure anyone has paddled this far up sh*t creek before maybe its uncharted territory.

I am sure we would help if USA were in ruins after a war although a small 9 million population country can only do so much. But the post peak oil hardship is no war, its the effects of stupidity and bad planning.

I dont think it would be easy to rally people to help the stupid while we have to do our own adaptions. But you would of course be one of our most important trading partners as you have been for a long time and in that we can help each other. We can probably for instance export some critical supplies for your farming and food industry and then can you feed more of your population.

It is in Norwegian and the new thing is the rumour that there should be a Norwegian intrest to invest in infrastructure in Sweden to get this rolling. The idea is several years old. It is suggested in Sweden for the fairly small earnings on transit traffic, income financing better infrastructure and we could exchange some containers in the flow making our own trade more efficient. The route is now being upgraded to high axle load and probably wide loadprofile and electrified single track in Sweden ti the Finnish border. The Norwegian suggestion is to make this and then iron ore railway double track.

An intresting point is to minimise the sea shipping distance to get faster transit of the goods. I guess running on electricity and not bunker fuel will be an additional plus in a few years.

The bottleneck might be the transsiberian capacity. Adding tracks etc would require a major effort. Strenghtening railway lines in Norway, Sweden and Finland is probably easier. The enviromental permits etc gives some delay but there is no significant corruption.

I have for national selfish reasons for some years hoped for Norwegian investments in Swedish infrastructure for their transportation needs to the south and easy. They got plenty of oil cash and there are investments that would give them long term benefits such as a railway tunnel to Denmark in addition to the car and railway bridge.

I read about the environmental legislation issues with Norrbotniabanan... Seriously, we have got to eliminate that BANANA (Build Absolutely Nothing Anywhere Near Anything) legislation.

If we had had these absurd laws a hundred years ago, Sweden would still be poorer than Uruguay.

Ps. You gotta love the new I(ron)ORE locomotives, 10,8 MW each and having that wonderful fulsnygg (ugly-pretty) look.

http://www.sjk.se/tag/lokbild/tmab_iore.jpg

I like BWR90+, maybe because of sentimental reasons.

http://www.ydinenergianuoret.fi/img/fin5_bwr90+.jpg

It was beaten by the EPR for the Finland order, but I have a feeling that was much due to the Swedish government not being interested in providing the kind of attractive financing that the French extended.

I like three things with EPR, the double aircraft crash proof containment, perfect for Barsebäck or a new plant near Södertälje south of Stockholm where there already are four 400 kV lines, it seems to be designed for easy replacement of the heavy parts given a very long life for the building and the fuel efficient core, efficient for a non breeder of course.

I would like to see a BWR90+ with double containment and provisions for changing out the heavy parts when they wear out in 60 years or if something is faulty with the manufacture or design.

A non nostalgic reason for prefering a BWR90+ is if large parts of the Swedish nuclear industry could be resurrected, or rather a larger part then for an EPR. We once could complete a 1000 MW plant every other year, such a capability could probably be revuilt in about 10 years if there is demand and it need to be international demand.

The downside with these 1500-1600 MW behemots is that they are on the upper edge on what our grid can absorb and distribute. If you make combined heat and power plants with those you would like to have two for redundacy in heat delivery and then you ask the grid to absorb +2500 MW in one spot. This oculd also upset the electricity market unless we have more exports but more exports would be envromentally sound in any way. Another nice reactor is the smaller SBWR, pairs of those could be good combined heat and power plants for our largest cities.

And when it comes to upsetting the electricity market, I have always been in favor of reregulating it. Deregulated power markets are a very bad idea. And it's not entirely Mrs. Sahlins fault, as even my own party sadly supports that insanity. Exports are a great idea, as soon as the power market is reregulated.

And it would feel... wrong, to build smaller reactors than O3 which is being uprated to 1450 MW. I know this is an entirely emotional argument, but still.

SBWR, that's the Areva boiler?

Pro BWR compared with PWR.

Fewer preassure vessels and lower preassure in the core.

There are no steam generators that wear down, instead you switch out much lighter internal components inside the main preassure vessel as they wear down.

The recirculation pumps give fairly quick output power control.

Good control of the active region by removing reactivity on the top via steam and in the bottom via control rods.

Smaller containment building volume.

No need for boron in the core circulation for core wide reactivity control (not 100% sure)

Con BWR compared with PWR.

Core preassure vessel is larger.

Since you have steam/water droplet separation equipment above the core you have to insert the control rods from below the core. This means that emergency insertion must be done against gravity wich means more complex redundant systems.

The recirculation pumps might draw more power then the inner loop pumps. (I have no formal education in this field wich makes me unsure. )

More complex internal preassure reliefe thru steam condensation pools inside the smaller containment.

The turbine plant circulation is hot making it a very bad idea to run with damaged fuel elements, but that goes for a well managed PWR too.

I guess the main reasons for choosing either design are:

Local tradition.

Percieved safety, PWR:s have one more barrier between the fuel and the condensation cooling water. BWR:s trust that

the low condensation preassure gives leakage into the core circulation and not vice versa and that the radioactive elements in the core circulation are short lived.

Capital cost.

The Swedish and Nordic deregulation of their electricity markets are probably the words most successfull but few large companies and regulations hindering and slowing down establishment of new production have given an oligopoly situation with needlessly high prices. I would not like a complete reregulation since that might destroy the chances for new producers, big and small, to enter the market. I have no finished ideas on what a better system would be but I think it would be good if manny electricity consumers owned enough power plants or shares in power plants for their own needs and then some. The good thing with our price gouging(?) oligopolists is that they are quite active in investing in grid upgrades and some new prodcution.

Larger reactors are usually cheaper to buy and run per kWh produced and larger reactor cores are usually more efficient in utilizing the fuel in them and generators and transformers are more efficient if they are bigger. But from a reliability standpoint it would be better with 3 x 500 MW then 1500 MW. I would from total efficiency reasons like to have combined heat and power plants for district heating and then it is good to at least have two reactors per plant. You dont have too use all of the condensation power for district heating, you can bleed off steam at a lower expansion for condensing for district heating hot water.

Wonder btw how much hot steam in kW a medium size refinery uses? There is one fairly large refinery in Sweden and it would be nifty to run it on nuclear steam and make hydrogen for it with steam heated electrolyzers using off peak electricity from our grid. Nifty but probably not profitable until oil and natural gas is quite expensive and oil products even more expensive.

General Electric SBWR, the Areva boiler have not stuck in my memory yet. Areva SWR 1000 seems to be built one the same kind of ideas, safety thru passive systems.

Hope this helps...

The nordic deregulation being the most successful in the world says something profound about electricity deregulation in general, considering the farce it has been here.

Actually, all the places that were once hailed as "the worlds most succesful power deregulation" (Texas, California, Alberta) were all sooner or later understood to be disasters. And the Nordic situation is also considered a disaster by industry and small consumers. By everyone except power plant owners. Fancy that.

I have also thought about consumers owning the power plants, and I think it is a great idea. In that way you create a privately owned regulated market within the deregulated one and can make vast profits by utilizing the cost gap between regulated and deregulated power as regulated power will always be cheaper.

I don't think security of supply due to having a few big nuclear units compared to many small is a problem for Sweden as we have so much hydro capacity able to pick up the load if nuclear units go off line for some time.

Nuclear cogeneration is a great idea as it is the biggest energy waste in Sweden, almost as big as the entire electricity generation. And the cheapest kWh is the saved kWh. We should immideatly utilize the waste heat from our current reactors.

China wishes to move more manufacturing inland.

An interesting point is to minimise the sea shipping distance to get faster transit of the goods. I guess running on electricity and not bunker fuel will be an additional plus in a few years.

While electricity can be made from non-oil sources, sea transport still remains the most energy-efficient form of transportation.

I have for national selfish reasons for some years hoped for Norwegian investments in Swedish infrastructure for their transportation needs to the south and easy.

Isn't it just sad that today the opposite is true, meaning Sweden is more likely to invest in Norwegian infrastructure than vice versa. If you have recently seen a Norwegian road or railtrack you would know what I'm talking about. (The iron ore export railway from Kiruna to Narvik may be an exception).

All of this is pure speculation and I am hardly a trained climatolgist or anything. It just wouldn't surprise me if this winter was much harsher than expected. If that's what we need for oil prices to go down (weather above normal temperatures now for several years running) then that tells you something in itself.

We usually don't see anything like this for extended periods of time until mid-January.

Dragonfly41, same here in KY. Last year, I didn't even turn the nat gas heat on until after the first of the year! A space heater well placed and an electric blanket, very localised heating was enough, on KY electric...meaning a full switch to coal! Sorry, but the good part is, it was not much electric consumption, being so local in the house. This year, the house would have been unbearable without some gas heat...as I write this it's in the high teens, and last night went to 9 degrees officially (colder in outlying areas). I am curious to see how the nat gas extraction will look :-(

(going to bed in a sec', that electric blanket is waiting for me! :-)

Roger Conner known to you as ThatsItImout

Well for climate this is the scariest thing I've ever seen.

http://arctic.atmos.uiuc.edu/cryosphere/IMAGES/current.365.jpg

House OKs oil, gas drilling in Gulf area

Full argument with graphics at my last blog post HERE

The problem with your argument is their is not enough storage for 5 years worth of oil in large quantities and you did not include storage costs over five years.

The other problem I have with this idea of buying long futures or even stockpiling is that you are not just taking a bet on future supply being short, you are also gambling on future demand staying steady. If you factor in the risk of recession, then you might end up selling at a big loss. So it becomes a trade off between greed and risk. Some traders will take big risks, but most won't.

There is a theory by Kelly about how much should be invested, which roughly states the investment should be inversely proportional to the risk. This places a limit on how much people will invest in future events, given that the future cannot be predicted with 100% accuracy. This principle is fundamental, but I've never seen it mentioned as a factor.

Some have said a US recession would drop demand by 2-3% which is not enough to make a difference, but a drop in supply of 3% caused previous price spikes. Being a major consumer, recession in the US always has a knock-on effect.

Therefore I think it is pretty reasonable to assume that a recession would cause a significant drop in prices.