The Tragic Consequences of the High Discounting of Oil Extraction

Posted by Dave Cohen on October 23, 2006 - 2:04pm

Over the longest possible term, since 1870, oil prices have not reflected predictions made by economic theories of finite (fixed stock) non-renewable resources like conventional oil. Consider the following quote from On the Economics of Non-Renewable Resources by Neha Khanna, an excellent introduction to the subject.

Economists add another dimension to this distinction between renewable and nonrenewable resources. Since economics is concerned with the allocation of scarce resources, for an economist non-renewable resources not only have a fixed stock, they are also in limited supply relative to the demand for them. Thus, old growth trees with life spans of as much as 1000 years while renewable by the common definition, may be classified as non-renewable by economists due to their relatively slow growth to maturity and few remaining stands....This essay will ultimately argue for the startling hypothesis that what Khanna says regarding coal also holds for oil in the market and finally comment on the tragic near-term consequences for humankind of this false & misleading market signal.Similarly, while coal would be considered non-renewable by some, most resource economists would consider it renewable due to the vast remaining stock. At current rates of consumption of about one billion tons per year, it is estimated that there is enough coal to last approximately 3000 years. From an economic perspective, there is no immediate coal scarcity simply due to its fixed stock. It is as if it were renewable. There is no scarcity rent associated with its extraction.

A final section will defend the hypothesis that the scarcity rent for oil is zero or close to it because the recoverable reserves base is percieved as being inexhaustible due to unwarranted assumptions about reserves growth or the existence of perfect substitutes. This means that large discount rates are associated with conventional oil extraction and hence the oil price does not accurately reflect its real scarcity with respect to the cumulative consumption of an actually limited natural resource — approximately 50% of the recoverable conventional oil has been extracted, currently about 30 billion barrels per year are consumed (all liquids, mostly conventional oil) and the rate of consumption is rising exponentially. Given the existence of real constraints on the extraction (production) rate of conventional oil — about which the economic theories have nothing to say — the tragic consequences of this market failure are discussed in the final section along with a brief discussion touching on the nature of human social discounting of the future, which serves as an explanation for our self-defeating behaviour.

1. A Short Introduction to the Economic Theory of Non-Renewable Resources

The essential equation is given by Jeffrey A. Krautkraemer in Economics of Natural Resource Scarcity: The State of the Debate. The text below is from page 12 of that document.

Three economic measures have been used as indicators of resource scarcity: price, extraction cost, and user cost. These three indicators are related through a basic first order condition for optimal resource extraction: |

|

(1) P = Cq + λ where P denotes the extracted resource price Cq denotes marginal extraction cost λ denotes the user cost |

The user cost captures the nonextractive economic cost of current depletion, including the forgone regeneration for a renewable resource and the forgone future use of a nonrenewable resource. It also includes any contribution of the resource stock itself to the net benefit of extraction--for example, a more abundant resource stock may decrease extraction or harvest cost. |

The user cost λ is variously known as the opportunity cost, the royalty, the shadow price or the scarcity rent as defined below.

Definition 1 — Rent is a form of incomeAccording to the classical theory of Hotelling (1931), the scarcity rent for a exhaustible resource must rise over time at the rate of discount, which is taken in Hotelling to be equal to the interest rate r. It is necessary to discuss the discount rate at some length as defined here. The extension of this concept as concerns what the optimal social rate of discount should be will be discussed in subsequent sections.The concept of rent as a payment for scarcity goes back to the Classical Economist David Ricardo who used "rent" to explain why land (when scarce) earns a form of income that is best measured by its marginal productivity. Therefore the definition of scarcity rents would be the following:

Definition 2 — Scarcity Rent is the rent that accrues to the owner of a natural resource just because it is scarce.

The basic principle of discounting is that a dollar received or paid next year is worth less than a dollar received or paid this year. For example, a dollar received this year may be deposited in a savings account earning, for example, 5 percent interest. On the one hand, at 5 percent interest, the dollar will be worth $1.05 the next year. Looked at from the discounting perspective, one dollar received or paid next year is only worth approximately $0.95 today [the Net Present Value]. The discount rate in this situation is 5 percent, the interest on savings accounts. Other market interest rates, such as interest on bonds or corporate portfolios, may be used as discount rates as well. Such rates are based on the private opportunity cost principle or private time preference.In this case, if there is a fixed stock (amount) of a non-renewable resource R, and keeping in mind equation (1) above, Kronenberg states that

The difference between resource price P and marginal cost Cq in this case, is not a profit in the economic sense. It is a `royalty', or the in situ value of the resource. The latter term is derived from Latin, meaning "in place", so it is the value of leaving the resource in place instead of removing it. Expressed in more common words, it is the opportunity cost λ of extracting the resource, because extraction now means that less extraction is possible in the future.... We thus can see that actually it is not the resource price which grows at the rate of interest, but the in situ value of the resource [as shown directly below].So, adding the time dimension to our notation in (1), we see that price is a function of the opportunity cost and the marginal cost of extraction:

(2) P(t) = λ  + Cq

+ Cq

The resource price in the time series t is the opportunity cost, or royalty — which is growing over time t at the discount (interest) rate r as expressed in the term  — plus the marginal cost of extraction.

— plus the marginal cost of extraction.

Pulling all this together, for the finite non-renewable resource R, there are three cases to consider—ignoring, for the time being, the marginal costs of extraction—

- Under what condition would it be optimal to defer extraction of the resource R? Only if the price of R was increasing faster than the discount (interest) rate, thus making its Net Present Value less than its future value.

- If the price of R is appreciating at less than the discount (interest) rate r, then the Net Present Value is greater now than in the future. Therefore, it is optimal to extract it now rather than later.

- According to the Hotelling Rule, quoting from Khanna—

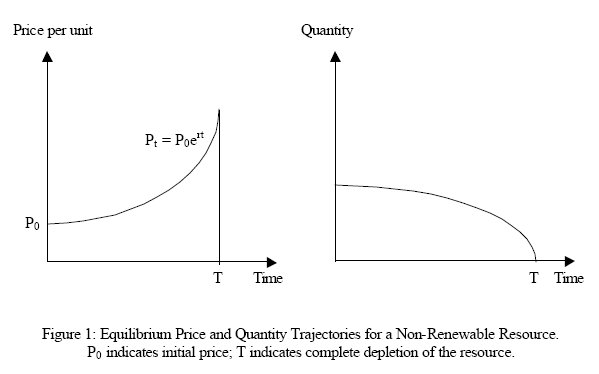

In a competitive market where there are a large number of sellers, and each seller can sell any quantity at the going market price, each resource owner would be faced with the same options and would follow the same logic. The result is that in this market the quantity extracted will be such that resource price will rise at exactly [the interest rate] r per cent per year.... If it were to rise slower, resource owners would begin to sell off current stocks and the current market price would fall [#2 above]. If the resource price were to increase at a rate faster than r per cent per year, all owners of the resource would hold on to their stock, decreasing the current supply in the market, thereby inducing the current market price to rise [#1 above]. The equilibrium price trajectory for a non-renewable resource would, therefore, be rising exponentially as shown in Figure 1.

Figure 1 -- Click to Enlarge

Now, it is time to get back to reality.

2. Examining the Failure of the Hotelling Rule

First, we must consider why the Hotelling Rule, when confronted with the empirical data, has failed for oil and other commodities. As presented in Kronenberg, "the evidence against the simple Hotelling rule is overwhelming." It is also very simple. Skipping the math—Let us assume that there is a certain stock of a nonrenewable resource which can be used to produce energy. In period t an amount E(t) of the resource is extracted and transformed into energy [consumed]. The remaining deposit of the resource is R(t)...However, over the course of the 20th century, resource extraction (consumption) grew over time and prices did not, as shown in figures 3 and 4 respectively.Assuming a demand function with a price elasticity of one ... it can be shown that the economy consumes a constant fraction of the remaining resource in each period. Let us call this fraction C(R)...

[this tells us that] the remaining resource deposit will be falling at a constant rate, and this rate happens to be the consumption rate C(R)...

Thus, since resource extraction [consumption] is proportional to the remaining deposit, it also falls at a constant rate.

Real price development of four major natural resources

The graph shows how prices of four major

industrial resources evolved during the 20th

century. All prices are adjusted for inflation

and indexed with 1949 as the base year to allow

for graphical comparability. For the most

important resource, crude oil, we have

information only from 1949 on. For three

other resources, namely copper, zinc, and

iron ore, we have information from 1900 on.

Figure 2 -- Click to Enlarge

Long time series of average annual oil production

from various estimates. Believed to be all

liquids, except API line which is crude only.

From Stuart Staniford's Extrapolating World Production

Figure 3 -- Click to Enlarge

The original simple Hotelling model makes many simplifying assumptions. Since it predicts rising prices and falling consumption over time, and in so far as just the opposite is true, Kronenberg considers extensions and additions to the model to try to bring it into accord with the empirical data. Some of these are discussed below.

Not every aspect of the economic theory could be covered. This essay assumes perfect competition and hence skips over considerations about monopolies (single versus multiple owners of the resource) and uncertain ownership of the resource. In the real world, the assumption of perfect competition may be viewed as reasonable for a fungible commodity like conventional oil. Ownership is an interesting question in its own right. For example, there has been a large shift in control of the resource from national oil companies to state-owned companies. This trend is particularly worrisome to the large consumers of oil among the OECD nations. But that is a subject for another time.

2.1 Marginal Extraction Costs

Hotelling (1931) does not include marginal extracton costs at all. Kronenberg, following Krautkraemer—cf. equation (1) above— adds a positive value for these as a constant cost, but notes that "resource prices should still be growing, albeit at a rate which is lower than the interest rate" as per equation (2) above. He then goes on to add—So far, we have assumed marginal extraction cost to be constant. This may be unrealistic. It is sometimes argued that there are stock effects, i.e. the marginal extraction cost depends on the size of the remaining stock. This can be the case in mining, for example, when the initial extraction takes place close to the surface, and over time the mines have to go deeper into the ground. The effect is that marginal extraction costs rise over time. Since the resource price is the sum of the in situ value and the marginal extraction cost, and the latter is not growing over time, prices must grow faster than under the simple Hotelling rule. Thus, stock effects in the form of rising marginal extraction cost are even more contradictory to the empirical evidence of constant or falling resource prices.Much of Hubbert's original insight and the subsequent peak oil literature is subsumed by the economist as stock effects causing rising marginal production costs over time based on the cumulative production which steadily erodes the original reserve. These effects apply to old, large elephant fields like Samotlor, Ghawar, Cantarell, Daqing and Prudhoe Bay. Marginal extraction costs must rise because the per barrel costs remain the same as the production declines. Indeed, this costs rise more as improved oil recovery (IOR) techniques such as horizontal drilling are applied. Similar remarks apply to EOR techniques such as Nitrogen or CO2 injection. The next section has more to say about this concerning deepwater extraction.

So, one can only agree that marginal extraction costs, as any oil company will tell you, are rising over time and will continue to do so. This is what is meant when someone says, speaking of oil production, that the "low-hanging fruit" is gone and that the era of cheap oil is over.

2.2 Technological Progress

The mainstay of the economist's viewpoint on why commodity consumption has risen while prices have not is technological progress. From Krautkraemer—The empirical evidence to date for natural resource commodities is largely in favor of technological progress. The many predictions of impending doom have not come true--at least not yet. The discovery and development of new reserves, the substitution of capital, and technological progress in resource extraction and commodity production have led to generally downward sloping price trends for many natural resource commodities. If there is any systematic bias to past predictions of the future, it is an underestimation of the ability of technological progress to overcome natural resource scarcity. For example, petroleum supply forecasts have persistently overestimated the future price of oil and underestimated oil production (Lynch 2002). The picture is less clear for the amenity goods and services derived from the natural environment.The reference is to Michael Lynch's Forecasting oil supply: theory and practice. The fundamental insight, which Lynch and resource economists would defend, is that marginal extraction costs decrease over time due to technological progress which leads, in turn, to falling or relatively constant prices over time.

Consider the view of the World Energy Council in Deepwater Hydrocarbon Development in the New Millenium, written the the late 1990's, and Figure 4.

A list of technologies which have been important in improving the efficiency of the hydrocarbon extraction industry to date would include the following:

- Interpretation workstations capable of handling and visualizing large 3-D volumes

- 3-D seismic data and advanced seismic processing

- The use of seismic amplitudes for hydrocarbon and reservoir prediction

- Methodologies for basin analysis and predictive stratigraphy

- Magnetic resonance imaging for downhole logging

- Tension leg wellhead platform (TLWP) and other smaller floating structures

- Computer-controlled thrusters onboard dynamically positioned drill ships

- Global positioning systems (GPS)

- Automated pipe handling systems on drilling vessels

- Geosteering for control of wellbore placement in the reservoir

- Subsea systems

- Horizontal drilling and well completions

New technologies will help to further drive down the cost of finding, producing and transporting a barrel of oil in the future. New technologies can also increase the amount of oil recovered through improved exploration success, higher recovery factors and optimized well placement. Historically, new technologies have played an important part in reducing the average cost per barrel of finding and producing oil. [Figure 4] These lower costs increase profitability and government revenue and open up new frontiers in areas that were once prohibitively high-cost.

U.S. Oil Finding and Developing Costs

Figure 4 -- Click to Enlarge

The irony that U.S. oil production was falling during the entire time period shown in Figure 4 will be skipped over at this point. Certainly, technology has made economic recoverability possible in continental shelf deepwater basins in Brazil, the Gulf of Mexico, the Gulf of Guinea (West Africa) and elsewhere, but it can not be argued that marginal extraction costs are decreasing. In a 2003 Oil & Gas Journal article Worldwide finding and development costs on the rise, cited by ASPO here, we read

Although technological advances led to lower finding and development costs in the early 1990s, F&D costs have increased since 1997, Merrill Lynch analysts said in the May 29 report. Unless capital efficiency improves through renewed technology changes similar to those seen in the early 1990s, finding and development costs are likely to rise because of deteriorating returns within an aging resource base.Costs are so high for ultra-deepwater production that it is not yet clear whether some fields like Jack in the Lower Tertiary Gulf of Mexico will be economic to develop at all."Companies have already captured most of the benefits from earlier breakthrough technologies in mature areas, and are now required to increase their maintenance capital just to maintain production levels from their established production base," the report said. Lower costs in emerging countries and the deepwater areas partially offset the struggle to replace reserves in mature areas, but companies are opportunity constrained in these lower-cost areas, analysts said. "After a dip in F&D costs in 2000, costs have risen even more dramatically in both 2001 and 2002"...

Although technology has historically decreased marginal extraction costs, it is not now doing so and any recent downward price movements can not be attributed to this factor. Instead, in almost all cases, the impact of technology is to potentially increase the recoverable reserves stocks by making them economic to produce in the first place —a point to which we now turn our attention.

2.3 Reserves Uncertainty and Growth

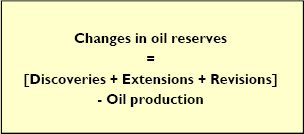

Anticipating the conclusions of this essay, the considerations discussed in this and the subsequent sections dominate the reasons for the failure of the Hotelling rule. This section discusses conventional oil which is taken to be crude oil, condensates and natural gas liquids. Everyone agrees on the simple calculation shown in Figure 5. This is taken from the Center For Global Energy Studies Market Watch Report of July/August 2006. This report was critiqued by HO and further comments were made by the author responding to Dr. Leo Drollas, the chief economist at CGES.

Figure 5

The Hotelling model assumes that the total resource stock is finite and known with certainty. However, there is always uncertainty about reserves due to reserves growth (field extensions or revisions) and new discoveries as Figure 5 shows. For example, Stuart Staniford uses a Hubbert Linearization to calculate the world's remaining stock (see the reference in Figure 3 and arrives at these numbers:

- URR is 2250 ± 260gb (ultimately recoverable reserves)

- K is 4.93 ± 0.32% (world decline rate)

- the logistic peak is May 2007 ± 4.5 years

Kronenberg gives the resource economist's view of reserves here:

If there are stock effects, exploration can lower the marginal extraction cost by increasing the stock of remaining resources.... In the long run, however, exploration opportunities are limited, and exploration will run into diminishing returns. As new discoveries become less frequent, the basic Hotelling intuition holds again, and resource prices rise again. Thus, allowing for exploration also generates the possibility of a U-shaped price development (Krautkraemer, 1998).Bearing in mind Kronenberg's remarks, these stock effects—also known as reserve dependent costs—link the marginal extraction cost to the cumulative production which obviously affects the remaining stock (Khanna, page 6). These stock effects are indeed real as noted in section 2.1 above. In this case, the opportunity cost (scarcity rent, et.al.) λ is taken to include modified extraction costs in addition to forgone interest income. In theory, it includes "any contribution of the resource stock itself to the net benefit of extraction--for example, a more abundant resource stock may decrease extraction or harvest cost" (as quoted in section 1. above). Extensions to fields under production fall into this category. The converse could also be the case—a less abundant resource may increase marginal extraction costs. This is the case discussed in 2.1 for existing fields that have passed their peak of production.However, the existence of exploration opportunities will not go unnoticed, and will affect agents' expectations. Such expectations will be formed about the frequency and size of new discoveries, and also about the total amount of resources that will be discovered. Exploration becomes then simply a costly activity which can be added to marginal extraction costs, and agents will base their decisions no longer on the known remaining reserves, but on the expected remaining reserves. Expectations will be revised whenever new information is revealed, which will generate some volatility and deviations from the Hotelling rule. Nevertheless, the basic Hotelling intuition still applies, and the resource price must be increasing unless expectations are systematically incorrect.

If marginal extraction costs are rising due to stock effects, Hotelling predicts that the opportunity cost should rise at a rate less the percentage increase of extraction costs. But this is not observed in the historical price and consumption data. However, these real stock effects may be influencing the rise in price since 2002. Consumption, however, has not been affected (excepting the recent demand & price downturn) and the inflation-adjusted price is not at its all-time high.

The take home point is that reserves growth may be viewed as decreasing harvest costs. Does this account, in part, for the failure of the Hotelling rule? Here is what Kronenberg has to say—

If new discoveries [reserves growth] are the reason for the Hotelling failure, there may be a problem if expectations are not fully rational. If new discoveries occur, people will form expectations about the total available stock of the resource. This is not a problem if expectations are rational. The market will then price the resource according to the expected total stock, and will adjust to any positive or negative realizations. But if expectations are not fully rational, there is a problem. Under optimistic expectations the rate of resource consumption would be consumed too high, and under pessimistic expectations it would be too low. In theory, therefore, the bias can go towards either direction.This is a very important point. When Robert Esser of CERA testifies before that

In 1995-2003 global production of 236 billion barrels was more than compensated by exploration success and field upgrades that collectively added 144 billion barrels and up to 175 billion barrels, respectivelyhe is setting expectations that may not be "fully rational" because he is simply re-affirming something that all Cornucopians believe—reserves growth always outstrips consumption, despite the unacknowledged sharp observed decrease in newly discovered oil stocks. As Kronenberg says, the "rate of resource consumption would be ... too high". And this is what we observe in the world.

2.4 Backstops

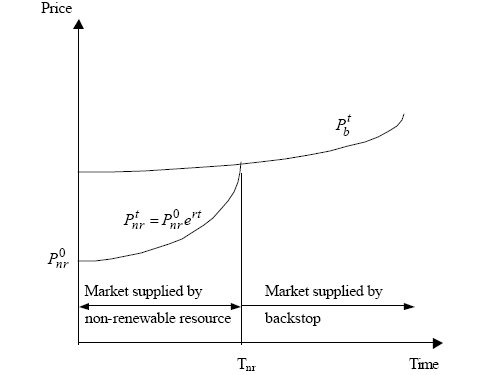

A economic theory of finite non-renewable resources refers to a perfect backstop. This is more widely known as a complete substitute for the resource under consideration, which is conventional oil in this case. If such backstop exists, then Hotelling theory predicts that the price should rise according to Figure 6 taken from Khanna.

Impact of Backstop Resource. Pnr indicates the

price of the non-renewable resource; Pb indicates

the price of the backstop. Tnr indicates the

depletion of the nonrenewable resource.

Figure 6 -- Click to Enlarge

The fundamental insight is that the price rises and the remaining resource stock is all used up prior to the switch because the existence of a perfect substitute renders the resource worthless. In theory, when the price reaches the backstop price, all of the resource would have been consumed and substitution occurs. Therefore, the perception that perfect substitutes actually exist increases the extraction rate of the resource.

Do perfect substitutes for conventional oil exist? The answer is "No". There is no perfect backstop but there are a plethora of imperfect substitutes—that we might call wedges—that might replace some part of the role conventional oil plays. The very notion of a substitute for oil is fuzzy. Note that in the general case, almost any abundant source of hydrocarbons, regardless of considerations affecting their production, is percieved as a backstop for conventional oil. Here is a brief list of the main wedges.

- Canadian tar (oil) sands

- Orinoco heavy tar

- Coal/Natural Gas/Biomass to liquids

- Oil Shales

- Electric transportation

- Wind, Hydro, Solar and Nuclear to support #5

It is important to remember that when one hears hyperbole about any of these substitutes, it is not the case that any of these backstops is perfect because they don't scale or their net energy return is low (if not = 1) rendering them expensive —and in the worst case— uneconomic to produce. This is just a partial list. The current enthusiasm for ethanol from a corn feedstock (as opposed to Brazil's use of sugarcane) is a good case in point. The hyperbole leads to a false belief that the substitute under discussion is a perfect backstop for conventional oil. Kronenberg states that for both the resource owner O and the resouce consumer C, this can lead to what he calls strategic interactions that lead to serious market failures.

2.5 Strategic Interactions

Here is a description of the game that Kronenberg terms strategic interactions.

- The resource owner O knows the total stock of the resource. The resource consumer C does not.

- C has the option of developing a backstop technology at any time

- O can delay the development of the backstop by influencing C's decision by lying about the stock of remaining resources

Thus, if there are information asymmetries between the owners and consumers of a resource, strategic interaction takes place, and credible announcements play a critical role. Specifically, resource owners will have an incentive to overestimate the resource stock, so as to delay the development of substitutes for the resource. To make this announcement credible, they have to follow an extraction path consistent with the overestimated resource stock, so extraction will be faster than socially optimal. Resource consumers will have an incentive to announce the development of a backstop technology, and resource owners will react to this threat by raising the extraction rate and lowering the resource price (if the demand curve is downward sloping). In both cases, resource extraction occurs faster than socially optimal.This interaction may be viewed as a reason for the failure of the Hotelling model. In fact, the suspicious OPEC reserves increases that took place in the 1980's is cited as a possible example and Kronenberg notes that resource (both national and state-run) owners have clear incentives to systematically over-estimate their remaining reserves which, in turn, leads to serious market failures. In order to manage consumer perceptions, extraction must remain higher than is socially optimal for a finite non-renewable resource in all cases.

3. Extraction Rates and High Discount Rates for Oil

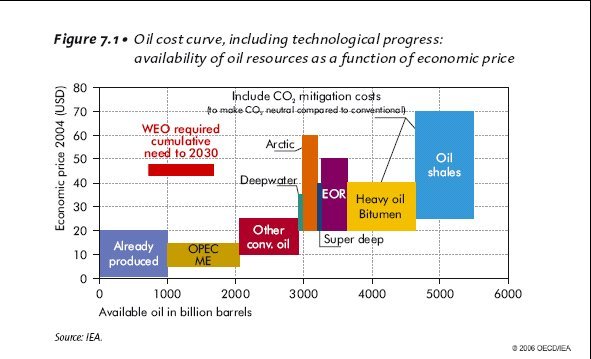

Congratulations if you have made it this far. It is hoped that you will have a greater insight into the meaning of this IEA estimate (Figure 7) of available oil resources, which includes both substitutes as discussed above and conventional oil reserves. The graph indicates that there are approximately 5.5 trillion barrels of oil available as a function of price.

Figure 7 -- Click to Enlarge

Let us sum up. Here are the main findings

- resource extraction (consumption) has risen exponentially over time

- marginal extraction costs are rising

- stock effects are real but not reflected in price

- technology is no longer decreasing marginal extraction costs

- substitutes are perceived to exist and be perfect

- reserves are stated as — and perceived to be — always growing

- the Hotelling Rule has failed over time and price has not reflected any real scarcity

Under the economic theory of finite, non-renewable resources as first stated by Hotelling (1931) and considering further extensions to this theory that attempt to bring it closer to empirical reality, there can only be one explanation for the findings listed above. It must be the case that the opportunity costs (scarcity rent, et.al) of oil are percieved to be zero or close to it. This means, in effect, that oil extraction is heavily discounted, despite rising marginal extraction costs, because there is a perception that, for all intents and purposes, there will always be plenty of resources available in the future. This discordance between the compelling logic of the Hotelling model and the observed data means that the conventional oil resource is not being treated as finite and non-renewable.

Are the Cornucopians right? Is there nothing to worry about? Almost certainly not. The economic theory has nothing to say about geological (physical) constraints on extraction rates. For example, there are such contraints on additional production flows resulting from CO2 injection even though the stranded oil resource base is very large. Other examples abound—heavy oil in ultra-deepwater, the Canadian tar sands, etc. The theory does recognize stock effects that obviously apply to old existing elephant fields like Samotlor (Russia) or Ghawar (Saudi Arabia). However, this only affects the marginal cost of extraction, not its rate, in those fields. Technology is seen as lowering marginal extraction costs but what about real cost limits on applying technology for extraction? As HO (only half facetiously) said, in the worst case, you could dig a hole in the ground and mine for stranded oil. But what would the marginal costs per unit of output (barrel of oil) of doing that be? And what would the extraction rate be? Clearly, it would include the cost of fossil fuels inputs to the production of fossil fuels just like the use of natural gas to produce the tar sands of Canada. These costs provide an absolute limit on production if the Net Energy (considered in the widest possible sense regarding boundary issues) = 1 or is close to unity. The resource is not reasonable to produce at any price. But again, this constraint is not recognized. Therefore—and tragically—the theory can not make predictions about the timing of the peak of oil production because real constraints on outputs over time are not accounted for.

All of this has to do with the social rate of discount as described in Chapter 7 of Economic Valuation of Natural Resources (same link as for discounts above):

In general, the application of discounting in a social value context incorporates the more complex concept of social time preference and is often very difficult to determine. The problem of measurement parallels that of market and non-market goods. The private rate of time preference [discounts] is revealed in markets, but the social rate is not. With respect to natural resources, the fundamental issue is one of defining a discount rate which reflects society's collective preferences regarding resource utilization or retention. The discount rate in the natural resource or environmental arena can be thought of as a measure of the opportunity cost of not having immediate access to a resource.A fundamental problem is that human beings are inherently myopic; they exhibit "impatience" and tend by nature to value the present and discount the future. In fact, the entire edifice of Cornucopian thought regarding oil and its extraction may be thought of as a rationalization for the human tendency to discount the future and thus deprive future generations of access to the resource.

This insight is stated explicitly in this interview with Michael Perelman, author of The Perverse Economy: The Impact of Markets on People and the Environment.

People are impatient; we don't like to have to wait for things. That's what road rage is often about, 'I want to get there quickly'. This impatience expresses itself in discounting....It is ironic that their evolution has set up homo sapiens to procreate and then nurture their offspring but, being shortsighted—which is expressed in their social time preference for large discounting of the future—can not see their way clear to support the viability of future generations by preserving resource for their use and allowing for substitutes to be developed.Discounting is supposed to be a reasonable way of doing things -- and this is what [Nobel Prize-winning economist Tjalling] Koopmans was saying about helium -- is because the economy is supposed to represent preferences. If these are our preferences, that's what value should represent, and the market should represent our values. But when you're dealing with resources, a fixed stock of irreplaceable resources, you can only run it down, you can't build it back up. Then this kind of thinking becomes destructive. And at present, there is no way that I can see of building a bridge to allow, say, the ecologist's understanding of resource scarcity in the future with the understanding of the economist for whom this discounting is second nature.

For me, this is probably the dominant reason why the future often looks bleak and forms the foundation of why I have diminishing hopes about the whole notion of Progress and our prospects as a species.

Dave Cohen

TOD Contributor

davec@linkvoyager.com

WestTexas summarised the best microeconomic plan-Economise, Localise, Produce. And right now I'm going to Houston to try to sell a reentry deal on a shallow piercement dome., so I can't participate in what should be a very interesting discussion.

Great work! I'm just sorry our leaders are so short sighted and venial that they won't pay attention.

Price ought to, and on occasion has, reflected scarcity: During the '70s oil shocks and recent price behavior. Another problem is that perfect competition mostly exists in textbooks, along with perfect information, which is requisite for both perfect competition and perfect markets.

Expectation theory also affects price as the so-called war premium shows so well: If Israel had met with success [from its POV] in Lebanon, would oil be under $60 now and the DOW over 12,000?

Lastly, externalities are NOT accurately included in price for any commodity--indeed, almost all products. For example, oil and gas extraction south of New Orleans is responsible for much of Katrina's devastation, yet that future foreseeable cost was NOT factored into the price of the resources extracted; nor does it appear that the massive environmental costs of bitumin mining is included in the pricing of its extraction; nor was the cost of climate chaos included in our past or current fossil fuel pricing.

I think that's enough information for the 18-year-old econ 101 student to argue against econ 101 orthodoxy regarding "infinite" "finite" resources. All that is needed is the courage to confront the "knowledge authority," not an easy task, one much easier for us "non-traditional" students.

The "Here's what I was lying about yesterday/lastyear in my noninteractive lecture" model of teaching is annoying. It's absolutely destroyed the study of history.

Supply has more than one definition:

Which one do you think your Eco professor was referring to when he spoke about "Supply and Demand"?

Was he talking about the population of lazy woodsmen who would be encouraged by higher prices to work harder and cut more trees each day, or was he thinking about the possibility of deforestration on Easter Island?

The reason being: smokers are price inelastic, they pay lots of taxes.

then they tend to die in the early years of retirement.

So you have the almost perfect fiscal mix:

- high (voluntary) taxpayers

- early death, thus saving on long term old age care, pension and medical costs

You can only make smoking a social evil, if you count the pain and suffering individuals (and their families) suffer as a result of it.(another angle might be the additional sickness that smokers undergo during their working life-- I have noticed smokers get sick more, and for longer. A third factor is the cost of unintentional fires especialy at home.)

One of my favourite ways to try to get people to give up smoking, is to point out to them how well the government does out of their habit. Since many are of a more libertarian bent, this usually does get their goat.

If as a smoker I had to pay for and use some form of technology to return the air I used to its composition prior to my lighting a smoke, smoking would become far more expensive and cumbersome than current, and we would all benefit by having a common resource protected. Smokestack scrubbing is the same thing mandated for the same reason.

Externalities are a form of subsidy to whatever is using a commonly shared resource, and they deserve to be heavily regulated and taxed; that they are not is a main reason we face a number of problems. This often gets grouped with market failure.

Gasoline consumption is lower, but so is GDP per head.

The gain isn't clear (perhaps most prominently, about a 10 mpg difference in the average car fuel economy). So perhaps 30% of gas consumption v. a doubling of average pump price. We drive less than you do (I think only about half as many miles pa) but this country is no bigger than New England and is an island.

Gas taxes are great from a fiscal policy point of view:

- high price inelasticity therefore limited distortion in final behaviour of consumers

- lots of revenue generation due to the above

But they don't cause people to consume less (or rather: income effects seem to outweigh substitution effects).This is my concern with most proposed forms of carbon taxation. We're going to need politically unacceptable levels of taxation to actually have a meaningful impact on consumption

and

income effects will tend to outweigh price effects in the long run (we get richer, we drive more, fly more, burn more carbon).

You can't have it both ways. If you have a tax that generates meaningful revenue, it doesn't discourage the harmful activity enough.

My conclusion is

- we'll have to go to a tradeable permits system. We are actually going to have to physically cap the amount of CO2 we emit.

The result will be some truly amazing permit prices. And whole industries built around trading those permits, avoiding those permits.

- regulation to induce technology change may be economically inefficient, but it will be important. A tax on carbon use is one thing, and has one set of costs, a regulation which specifies a higher efficiency fridge, house or car, will be a cost buried in the economic system as a whole.

Absolutely. There will be pain and perverse effects, but it's the only thing I can see that can work.

My brother is an expert in tradeable fish quota systems. They really do work as a tool for managing a common, finite resource (as long as you can keep all the actors honest).

In fishing, the perverse effect that I like the least is that it leads to industrial concentration, and squeezes out the artisan or small-scale fishing operation. At the beginning, you hand out quota entitlements based on historical catch. This gives existing operators a handout of capital, since the quotas are fully tradeable. The bigger operations -- factory ships etc -- can make more money per unit of quota than the small ones. It actually makes better economic sense for the owner of a small boat to sell his quota and invest the proceeds.

Has this sort of effect been analysed for tradeable carbon quotas, I wonder?

William Nordhaus (Yale University) who is the guru of carbon taxation and the economic effects thereof (one of), has switched to advocating a 'global Pigovian Carbon Tax'

(with revenue neutrality: ie the entire tax is rebated back through the tax system)

on the grounds that the traded permit system has failed to date (Kyoto implementation) and also the size of financial flows between countries is unrealistic (US will never stump up).

A third (key) factor is that the incentive to cheat is too high-- even in a 'good governance' environment like the US and US, let alone Russia or some other country.

When I read that the second or third largest illegal commodity in the US (after cocaine and marijuana) was CFCs smuggled in from countries still allowed to make them, I have some sympathy with that view.

Fish quotas: glad to know it's working.

The Canadian experience has soured me, though. White man exploited cod in the North Atlantic happily for 700 years, and the natives for thousands of years before that.

The cod is now gone, and shows no sign of ever returning-- the population has dropped below self sustaining

From what I understand this week, if we don't ban cod fishing in British waters, the same is sure to happen here.

When European governments refuse to go with scientific advice on allowable fish catches, I despair. It's a parallel to the Global Warming situation: politics dampens down the scientific conclusions. Politics drives science, rather than the other way around.

The right to properly manage their cod and other fish stocks is why Iceland went ot war, twice, against a nuclear power. After the herring catch crashed they feared the same would happen with cod and this was key to national survival ! (Fish were 90% of exports then, 2/3rds today).

Best Hopes,

Alan

My other problem with the Pigovian per unit carbon tax is that it is quite likely that some emissions of carbon will be incredibly price inelastic.

The necessary tax would be so high, and the perceived inequality so great (only the rich can afford to pay the tax) that the system would break down.

Whilst I think right now a sensible price per tonne of carbon is $100 ($28/tonne CO2), I have no doubt by 2050 or earlier, the price will be $1,000 (a combination of world economic growth and the need to keep ratcheting down the total emission level).

The basic right to emit carbon per person in 2050 will be 0.5 tonnes per person pa on a world basis-- 9 billion people, 4.5bn tpa. Which I cannot see the rich and the powerful in the developed countries (let alone China or India) subscribing to.

It's what makes me pessimistic, because I cannot see the political system producing that kind of (necessary) solution.

The only light I can see at the end of the tunnel is that, in the long run, technological progress surprises.

Now, such calculations are obviously difficult and uncertain, largely because the greater part of the impacts are far in the future. Greenland's not going to melt down tomorrow, but if it does eventually, that's going to be extremely expensive. The future is inherently uncertain so this makes the necessary extrapolations and calculations doubly difficult.

A number of researchers have attempted to put a numerical figure on it anyway, and there has been considerable variation in their results. Here is a paper from 2005 that surveyed over 100 such studies:

http://www.uni-hamburg.de/Wiss/FB/15/Sustainability/enpolmargcost.pdf

The median calculated impact, across all the studies, was $14 per ton of carbon. This is considerably lower than the $100/tC we often see bandied about. The paper also notes: "Interestingly, studies that are peer-reviewed have lower estimates and smaller uncertainties." In other words, the higher-quality studies generally have lower estimates, and the more extravagant estimates come from low-quality studies.

A $14/tC Pigovian tax corresponds to a gasoline tax of about 3 cents per gallon. This is, according to our best estimates and calculations, the correct amount of tax to compensate for the eventual costs of carbon emission, and to cause people to adjust their consumption habits so as to minimize net costs.

Of course, such a low carbon tax would have an almost negligible impact on people's behavior. Maybe some big companies would be willing to make a change in response to a tax of 1% or 2% on energy, but most people won't even notice it. Yet it is the correct level under the Pigou formulation of compensating for negative externalities.

This leads to a paradox, where global warming is a great threat, yet our best estimates of the cost of that threat lead to a policy which will not cause noticeable action to be taken. It is an interesting exercise for the student to try to resolve the paradox. I think the answer should be relatively obvious to anyone who is willing to accept the hard evidence of scientific research without prejudice. But I will refrain from giving my answer here and let others mull over this puzzle.

Or am I barking up the wrong tree here?

If a tax is meant to change behaviour, what is important is the rate at the margin which influences current purchasing decisions. You can get a high marginal rate without impoverishing the poor in several ways.

For an easily metered product like electricity you can have a low tariff for an amount sufficient for a frugal household and a high tariff for any extra. For other carbonaceous products you can provide a credit per citizen/household either in kind, with specific "carbon credits", or cash to help buy basic quantities. With very high prices this turns into a rationing system.

This is a bit like a carbon-trading system where the credits are distributed amoung the population who then sell them to utilities and industries which require them or use them for personal consumption, but is probably less bureaucratic.

Gasoline consumption is very inelastic over the short term, but quite elastic over the long term. It appears likely that carbon emissions are not unlike gasoline consumption (they are even strongly related). If the carbon tax was escalated on a known schedule over a period of years, people and companies would adapt and plan ahead.

If it paid $50/ton or more, American farmers would probably find a way to sequester carbon as charcoal in the soil (terra preta) and pocket the payment. The USA produces about 1.3 billion tons of waste biomass alone, sufficient to make about 0.5 billion tons of charcoal; burying even half of that would sequester about 0.8 tons/capita/year (the off-gas from charcoal production plus the remaining charcoal could be used for energy or chemical products). The sequestration potential increases if high-productivity biofuel crops are added to the mix.

We can do this.

I do know in the Southwest of the US (Arizona in particular) farmers have sold their water allocations and retired on the proceeds. The small farmers go first.

80% of California's water consumption is still for agriculture, apparently. A truly shocking amount in what amounts to a desert. Also there is now evidence that California goes through periodic droughts that last for 150 years. At which point, only mass desalination, or mass migration, is likely to prove to be a solution.

What is most intriguing is that at least in theory, it would actually be possible to come up with a round number (very round, with an incredible number of variables and constraints) for how much those lies were worth to the people controlling the flow of oil from the mid-80s until today.

But what would also be interesting to examine is how many people believe in boundless oil supplies - speaking broadly, Germans don't. Which isn't the same as saying they have come up with a backstop, or that quasi-monopoly energy companies here have any interest in anything but extracting maximum profit from their customers.

The point about not understanding something if your salary depends on not understanding it comes to mind - Germany doesn't have much of a petroleum industry, after all, nor does Japan - and both countries seem to have less problem in imagining a future where oil is scarce and expensive. And trying to come up with answers to deal with problems - obviously, answers which involve things which people don't want, like living within their means. Wind may keep the lights running in schools - it won't be powering everyone's DVD player attached to the home theater with the AC humming in the background.

Couple of thoughts. Has complexity overwhelmed human abilities to create an efficient market ? One or two wise long range investors do not a market make.

Substitution CAN be done, but it takes time. One example, we owe a great debt to "The California Wind Rush" (and the Danes). It sorted out concepts and got engineers to improve wind turbines. It also got decades of operating experience started (yes, with minature WTs, but it still helps; operationally and financially. The $ people want a track record before sinking many $$ into a developing technology).

Absent the actions of California & Denmark in the past, we could not now be talking about what % wind can our grids tolerate. Just more NG demand with conservation & demand destruction & coal the only options.

Wind is the only maturing technology that can actually affect the outcome (all others are still speculative). Mature rail, mature nukes, mature coal, etc. will also have an impact.

We are facing a cliff. Our mature or maturing options are few in the next decade. We could have a non-oil transportation alternative in the US, but we chose not to build one.

Public economics/political decisions for Urban Rail.

I have found from private discussions that at least 5 major railroads have looked at electrification, but none made the investment.

There are limits to how quickly we can respond. "The market" thinks that we will have plenty of time; and indirect guess of a slow depletion rate. But a guess not based on facts or the evidence but biased assumptions.

We could have, we could have and now, will we ?

Alan

I have found from private discussions that at least 5 major railroads have looked at electrification, but none made the investment.[/quote]

This has the makings of a good article.

2)if companies started looking at decision thresholds for investments based on energy returns instead of immediate dollar returns, things might sort themselves out. One way to accomplish this is through first, education and second, a realization that though volatile, prices are headed up, inexorably. Investing in the best energy infrastructure will then make sense, even if it costs more today

Solar energy has been demonstrated succesfully to heat, cool and power homes. It can be used on the smallest of scales, for powering a wristwatch, to the largest, MW sized solar power generation has been demonstrated abundantly.

That it usually falls short in a discussion is hard to believe, since the ONLY renewable and abundant energy source of this planet (within its lifetime) is solar energy.

And what is the cost? Currently $5/Wp in quantity, i.e. we are talking about approx. $30/Wc (continuous) at sites that should be developed first (like the US Southwest). Given the fact that a person can live comfortably on a 2kWc consumption budget, we are talking no more than $60k/person of investment per person. This will be falling to $20k/person over the next one or two decades and thus amortised over 20-30 years the sun is going to be a very affordable energy source.

Hydroelectric

Wind Turbines

Geothermal

Tidal

Wave

Biomass (some forms)

Geothermal is not abundant when utilized at costs comparable to photovoltaics.

Tidal/wave energy can not be accessed at more than a few spots on earth with reasonable energy density.

Biomass is the result of photosynthesis, which is also a form of solar energy. And since photosynthesis is very inefficient (1% or less), biomass can not compete with photovoltaics on any level.

No offense, but nothing compares with solar energy, except maybe nuclear fusion... which is the source of solar energy.

Wind provides several hundred times as much electricity as solar PV today (x1,000 ?) Wind typically peaks when heating is needed most, while solar goes away and hides (and is covered by snow).

As does geothermal.

Wood heats millions of times more homes than solar PV. And even solar thermal is a VERY poor second to wood.

Nothing compares with solar PV. It the "back of the pack, almost out of sight" in the competition between renewables.

Wanting it to be different does not make it so.

Alan

Yes, conventional silicon solar right now is dead in the water due to costs as far as any major percentage of generation - but third gen solar is heating up - both CIGS thin film and multijunction concentrators are suggesting an 80-90% cut in the cost of production in volume. I'll believe it when I see it, but we could see major volume in a year or three.

The energy costs of solar cells are generally not calculated correctly. You can consider another similar high energy item.

Aluminum. Its cheap because generally it made at hydroelectric facilities where energy is cheap. Solar cells can be made the same way the plants can easily be placed new cheap energy sources such as hydroelectric or excellent wind locations.

In general these electric sources would not otherwise be captured since the sites may not be near a large population center or for some other reason transportation costs are prohibitive. Another obvious source for powering one these plants is in desert regions. They do use a lot of water but its not part of the product so efficient recycling could dramatically drop the water requirments. Plenty of sites for producing solar cells exist on this planet worst case a few nuclear reactors could be used for production.

The point is the energy costs for producing solar cells can effectively be assumed to be zero since it can be provided via sources that have little impact on the population.

The same holds true for aluminum. Anything that requires large amounts of energy to produce but is a high value product and easily shippable can be manufactured at a cheap energy location and transported. Iceland is a good place and once the Greenland ice cap melts some more it will also be a place where abundant hydroelectric energy is available but not a lot of people. Of course there is no shortage of desert regions.

This concept does not work that well for other high energy material that need to be cheap like concrete and steel.

It makes no sense to not assume that future solar cell plans won't locate near cheap sources of electricity and water.

And more you can assume that these will be location where you won't be in competition with say a large local city.

Wind Turbines could be build under the same conditions for example although they are so large transport is and issue.

Other goods like automobiles for example that require a extensive array of manufacuted parts are not candidates for this type of manufacture.

I accept your point, and it has broad ranging consequence. It makes simple EROEI inadequate without providing a readily usable alternative. EROver Fossil energy Input? Is corn ethanol more appealing if we use nuclear power to produce anhydrous amonia for fertilizer, dry the corn and produce the ethanol? (It still destroys our soils and pollutes our rivers with the corn monoculture.)

Not easy, because substitutes (coal) that contribute to global warming are still not benign (not that this is relevant to the PV cells discussion), even if the energy is plentiful.

Persons, furthermore, who think the future looks bleak base that view on knowledge I don't think they can possess. Such persons thus look to me to reside on the arrogant side of the spectrum. YMMV.

Individuals know they are mortal, some day they will die...

But they don't know when that day will come.

And they may well, even if only sub-conciously have "life goals" i.e. they might want to breed before they die, or travel the world, or whatever.

Even if I might speculate that one or more of my life goals might have a better outcome in the future. i.e. in 5 years from now I might have more money to take that trip and thus be able to visit more countries, or have met a mate with better genes to breed with, or whatever, which is an argument for waiting, its also true that if I make that decision to wait 5 years, and happen to get hit by a bus next week, then I will not just sub-optimally realize that goal, I won't realize it at all!

This then suggests that the more important a life goal is to me the more "impatient" I might be about it, to maximise my chances that it at least gets realised to some degree.

"life goals"...they might want to breed....or travel the world.

YES!! (and isn't this alot of our problem.)

Sorry I couldn't help myself...

It's not at all clear that other societies in history, with elaborate theologies and expectations of future life (the wheel of karma etc.) did not have more 'conservation' oriented views of their natural environment.

The tragedy may be that in the era of cheap energy, western oriented capitalism was the triumphant model*. But in the era of resource scarcity and/or global warming, that may not be the case.

* I'm not someone who believes that the victory over fascism, or Soviet communism, was inevitable. As Wellington said of Waterloo 'it was a damned close run thing'.

Great post.

However i take exception to the following:

You said at the end of your piece, (yes i did get that far!)"It is ironic that their evolution has set up homo sapiens to procreate and then nurture their offspring but, being shortsighted--which is expressed in their social time preference for large discounting of the future--can not see their way clear to support the viability of future generations by preserving resource for their use and allowing for substitutes to be developed."

Yes that is true for our culture, however human beings have lived within their resource base for millions of years and have allowed for future generations. The current short sightedness is IMO rather recent, the last 10,000 years or so.

Naresh UK

THE ECOLOGICAL INDIAN: Myth and History, by Shepard Krech III; Norton,

1999; http://www.amazon.com/exec/obidos/ASIN/0393321002

[pp. 76-77] "According to archaeologists, American Indians often so

pressured or depleted basic resources like land and trees that they

had to switch from one type of food to another or move the locations

of their villages. Native farmers throughout North America transformed

landscapes (as farmers everywhere did), not just by burning and

clearing woodland for conversion to agricultural land, but through the

steadily escalating demand for wood for fuel and construction matching

growing populations supported by domesticated crops. In the East, they

cleared fields by slashing and burning forests, then hoed the fields

into washboard-like ridges or small hills in which they cultivated

crops. If they had a total of one to three acres per person either

under active cultivation or in fallow, as has been estimated, then in

1500, at least one-half million acres (and perhaps many more) showed

the effects of agriculture in the East alone. In many places, farmers

used fields year after year, until declining yields pushed them

elsewhere. With soils rendered infertile, fields choked with weeds,

fuel exhausted, and game scarce, Indians left their villages behind

for more favorable habitats (perhaps in the knowledge that they could

return one day when the ground and trees recovered). Iroquoian people

apparently moved their villages every ten to twelve years for these

and other reasons, including insect infestations. Wood, one of the

most crucial resources, seemed particularly susceptible to overuse. In

the Northeast, more than one observer was awed by its extensive use

for domestic fuel. The newcomers from Europe were no different;

Narragansett Indians theorized that the English came to Rhode Island

because they had no firewood in England. 2

"The depletion of wood might hold the key to the disappearance of some

notable people: the Anasazi, who lived in the Southwest, and the

residents of Cahokia, a site located across the Mississippi from

modern day St. Louis, Missouri. Many scholars use superlatives in

speaking about both people. The Anasazi are renowned for multistory

villages in Chaco Canyon and in striking cliff-site locations at Mesa

Verde and elsewhere, and for their interest in the solstices and

equinoxes) Cahokians, who inhabited the largest pre-Columbian site

(part of the most densely settled community) in North America, are

admired for the construction of large-scale works, including 120

mounds. One mound measuring 700,000 square feet at the base and one

hundred feet high, and containing twenty-two million cubic feet of

earth, is the most massive earthen structure in pre-Columbian North

America. 4 Some nineteenth-century observers mistakenly considered

these cliff dwellers and mound builders (especially the latter) as

mysterious races unrelated to contemporary Indians. But these Indian

people were farmers who supplemented diets based on maize, squash, and

beans with other domesticates, gathered foods, and animals and fish.

The Mississippi floodplain was much richer than the arid Southwest,

and the leaders of Cahokia were powerful people who guided massive

public projects and, following death, were interred with lavish care. 5

"The Anasazi abandoned their sites in the twelfth century; Cahokians,

theirs from the twelfth through fourteenth centuries. 6 Explanations

have ranged widely; with disease, feuds, warfare, and other ideas new

and old unsupported convincingly by evidence, they have settled in

recent years on environmental change, population pressure, and

resource depletion. In the arid Southwest, where trees take many human

generations to grow an expanding Anasazi population could easily have

stripped their lands of trees for house and kiva construction and for

fuel, and to produce arable fields, bringing about a deforestation

with various adverse repercussions on all aspects of their lives, just

prior to debilitating drought. In Chaco Canyon alone they used over

200,000 trees in multistory buildings and denuded the land, inviting

erosion and destruction of arable lands. 7 At Cahokia, full canopy

forest was probably rare and trees inadequate to meet the estimated

demands of a rising population for fuel, construction, and other ends.

When the population was near and at its height, Cahokians imported

wood. Perhaps they had no choice. They could easily have stripped the

estimated 600,000 flood-plain trees growing within a six-mile radius

of the Cahokia center in a matter of decades, inducing

deforestation-related runoff, erosion, sedimentation, and silting.

Their population was in sharp decline before they fell back on local

wood. Abandonment provided ample time for trees to replenish the

Mississippi flood plain before Europeans first laid eyes on this great

center's ruins. 8"

We really ought to stop trying to harp on misty eyed about some non-existent golden age when man lived in harmony with the ecosystem - we are, and as far as I can see always have been, a rapacious consumer of pretty much anything thats available.

While ancient peoples typically were not living in balance with nature some ancient (but by no means primitive) cultures had developed methods to limit their consumption of the available resources. Certainly I think it is legitimate to compare modern man to the polynesians who discovered New Zealand. Both cultures had plentiful resources and felt no need to limit their consumption. On the other hand there have been societies that must have found a much less rapacious way of living since they were able to exist for thousands of years on the same plots of land. For example, the Egyptians have lived continuously off the bounty of the Nile for over seven thousand years.

I would argue that the reason Egyptian culture lasted so long was due to the Nile fllods - without this they would have exhausted the soils, and would have had nowhere else to go.

Firstly you state they were moving constantly. Well the mound builders were not moving constantly. They were as you state not hunter tribes. They planted basically corn,beans and squash and sought fish and others creatures from the nearby rivers. . They built the mounds and stayed in place. What made it viable was the bottom lands which replenishes the soil , exactly as it does to this day. They lived and built mounds on the high ground but used the lower ground which was only right down the river bluff away.

They did disappear mysteriously and then we find mostly the Woodland Indians tribes extant. They may have been killed off or some great catastrophe occurred,similiar to the great quake of 1811/12 that occured along the New Madrid fault.

The mound builders had very extensive earthworks and you may see them and listen to their known history , as a result of much investigation, at the town of Wickliffe, Kentucky right near the banks of the Mississippi and Ohio confluence.

I live near there. I have studied it quite a bit and listen to lectures by the profs who do the archelogy on the sites.

I have found much of their pottery since many of these sites are not known and are tilled by farmers. Living near the rivers they did not have to relocate. Fish and mussels were plentiful and in fact still are. We eat a lot of river fish and even though commercial fishing has died back it was not due to loss of abundance. It was due to laziness by our present generations.

There is a major reason why they might have disappeared but its not 'politically correct' to state, though I think it is as valid nonetheless as any other theories.

When I was young you could view the actual mummies and skeletons. Now you will see casts made of plaster and the remains are treated with a great deal of respect. Murray State University is the mainstay of the local archelogists.

AFAIK they are referred to as Mississipians but that may have changed with time. They also built mounds on other rivers further inland. I know of several mounds that still are discernable on private owned farmland. The main one at Wickliffe is owned by Murray State ASAIK.

They have excellent documentation and books available as well as reproduced artifacts.

Perhaps it was different in other parts of the USA, maybe the East but I somehow doubt it seriously.

I think you have perhaps sat in too many wasted college classrooms listening to professerial BS.

The native tribes worshipped the earth and its wildlife.

Who the fuck slaughtered the buffalo then????????

Who chased many species to extintion? Surely not the native americans. It was us.

Where does that blather come from?

I have indian relatives and some of my ancestors fought with Daniel Boone at Fort Boonesborough. We owe the native americans an apology. Read some real history.

So now you say they were the ones who depleted the country?

Bullshit , we are polluting it, destroying it and now have practiced ecological destruction on a massive scale and you want to blame the native americans?

What a fucking crock.

A list:

Woolly & Columbian mammoths

Giant armadillos

3 species of camels

American mastodons

3 types of ground sloths

Glyptodonts

Several species of horses

4 species of pronghorn antelope

Giant deer

Several species of oxen

Giant bison

BTW, I am descended from Squire Boone, Daniel's brother

unfortunately that is not what caused those species to go.

the change int he climate(it was warming up due to coming out of a ice age) and the resulting shifts in plant life was what killed them, granted a apex predator like a human coming on the scene did not help things at all. though it is a big leap to say they outright killed them.

i suggest you read up on the subject, those animals were already on the brink if not over it by the time humans showed up.

<http://news.nationalgeographic.com/news/2001/11/1112_overkill.html>

There is little doubt that humans hunted and killed mammoths & mastadons (butcher marks, spear points in the midst of bones, etc.

However, there was no apparent extinction in anything but megafauna (some antelopes were not quite mega).

There had been a series of ice ages without mass extinctions until the last one. Usually species would migrate to adapt to climate change. Did not happen this time. The only delta apparently was humans.

A pretty clean slate. Left buffalo, moose, caribou, elk and smaller deer & antelope. Not one of several species of horse or camel made it.

Given the minimal to zero losses in prior ice ages and the near total loss of ONLY megafauna, man's hands look bloody to me.

Alan

The next time around, it's appearing that "normal" climate shift + GW will be a far more major tipping point for life on earth.

Also I can see where the article states the Mississippians 'moved around' - the references to them are all in the second half and refers to their building etc

It is actually an article being quoted not the posters own views on the matter - you seem to have gone overboard in your condemnation.

I dont think for a moment the poster is trying to defend the environmental destruction which took place once Europeans arrived, but attempts to suggest older indigenous peoples lived in some miraculous harmony with their ecosystem are often IMO deeply flawed.

Whew!!! Outstanding Keypost--very concentrated info density--a gusher of data for consideration. I will go to Reddit and post something to help increase the eyeballs.

Being a fast-crash doomer: when the world finally realizes that no perfect substitutes will ride to the rescue--TSHTF when our vast Overshoot is taken into the discussion.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

Switzerland voted in 1998 for the TransAlp project package. Some items would appear in a decade, but the key piece will not open till 2020, 22 years after the vote and 31 billion Swiss francs.

Adjust for population & currency, and this is equivalent to the US spending $1 trillion on a 22 year payoff with limited results till then.

A multi-century asset, yes. But a low discount rate till it opens.

Best Hopes,

Alan

it is 'conservative' with a small c (in some really unpleasant and xenophobic ways), but also deeply concerned about the environment. It's not a place an Ayn Randian libertarian would necessarily feel comfortable with (military conscription, intense local control of your way of life and your citizenship, etc.) but it is definitely a conservative society (eg everyone self funds their own pension).

Their alpine climate makes them feel particularly vulnerable to climate change eg the loss of ski slopes.

If you look at something as trivial as ground source heat pumps, the Swiss are really driving these (behind the Austrians and the Swedes, but ahead of most other countries). Even though the payback periods, given the 50' hole in the ground, are typically 10 years or more.

Yet for the Swiss, who move house seldom, that seems like an excellent guaranteed return.

The best model that I've ever known regarding prices of fuels is one that is bi-stable --

In other words, I believe the best price model must take into account producers, inventory-ers, and consumers and look at the motivations and constraints on each group in the face of falling or rising prices. To me, this model accounts for the boom and bust cycles that we have seen.

It may specifically be the existence of inventories which cause "false" signals to conveyed to the consumers even with the existence of resource depletion. Any "air pocket" in demand, however temporary, can send the price crashing, as similarly "supply disruptions" spike prices.

At some point after Peak Oil, case "A" above will rule and the model will likely change to something else forever. It appears though that consumers are still able to mitigate recent prices levels.

How any market particpant reacts to price shifts is (theoretically) already predictable based on their curve (supply for sellers, demand for buyers). Of course any individual market participant will not have knowledge of others curves (and may not even have considered their own outside a narrow range). So any price change reflects a change in the market's supply and/or demand curve. This is where Kronenberg's "Strategic Interactions" come into play. (Some) buyers and sellers will use disinformation (or could I use pretexting?) to influence the others curve to create a better price for themselves. Ultimately its a poker game and until everybody lays down their hand you don't know who is bluffing. In the meantime having deeper pockets is always and advantage. Those of us without real deep pockets should however be well aware of the ability of those with deep pockets to be able to afford many bluffs.

So, this all makes for an odd supply chain. There may be a "line", as you say, but it has a step function in it.

BTW, I could argue that this is true for all commodities in the sense that the normal behaviour of them is for backwardated prices rather than contango. Inventories matter.

Also, many times the last 10% is profitable (since the fixed costs can be ignored) so runs stay up when it seems counterintuitive. I've seen major trading houses laughing at big oil for running in low/negative margin periods. Once they owned processing facilities they did the same thing. Was kinda fun to point that out to the boss.

and you can fiddle a bit with capacity -- enough to make a real difference-- by adusting crude slates and shifting from max distillate to max gasoline modes depending on pricing. There is an amazing amount of flexibility in the world's refining industy. Leads to mucho arbitrage, speculation etc.

trying to apply straightforward econ 101 to a system this complex is tough. Just trying to estimate weekly stock level changes is almost impossible and I've seen very, very bright people try to do it.

I agree that econ 101 is tough to apply -- especially the version that oversimplifies to producers and consumers. I image the same modeling problem would happen in a retail environment. There are producers, consumers, and all these middle men (the retail supply chain). When econ 101 leaves out the middle men then the model fails to enlighten.

A perhaps better model is two railway cars connected in-between by a large spring or some other more complex mechanism. It's makes the model much more complicated. The two railcars can actually move in opposite directions at times. Practical examples might include over or under-investment in refineries, or in training personnel, or in drilling rigs, or signing leases, or getting financing. Production may not be *able* to respond to price signal in any given time frame and this reverberates in the supply/demand system in complex ways. It *is* an over-simplification to merely say there are buyers and sellers. In the complex system supply could be rising while price is rising, or vice versa, or whatever.

Wasn't the initial question about why producers are not pricing the future of supplies correctly? Aren't we trying to figure out how/if *ultimate* supply affects current price?

"(A) When demand is "exceeding" supply (as measured by inventory deltas), prices rise, and inventory values rise thereby passing perhaps amplified demand toward production. Producers budgets are usually slower to shift so production can be cut at higher prices while maintaining revenues. All this provides feedback to higher prices until demand is destroyed, so to speak."

and restate it thus:

When the demand curve shifts (assuming price on x axis, quantity on y axis) to the NE and the supply curve remains stable more product is sold at a higher price. Since production probably was not increased inventories decline. If sellers shift their supply curve to the SE meaning they are willing to sell less quantity at a given price (as you point out they can maintain revenue at a lower quantity with the higher price) the price (intersection of supply and demand curves) rises and the quantity falls. We may (or may not) end up at the same quantity bought and sold but with 2 price increases. If production and consumption (not the same as quantity bought and sold due to inventory deltas) remain unchanged we have seen a higher price as a result of changes in both the supply and demand curves. In other words buyers (in aggregate) became willing to pay more for the same quantity of oil. The "in aggregate" is important - maybe every indiviudal buyer had no change in their individual demand curve but a new buyer (probably from China?) entered the market. When this happened the price and quantity increased. Now maybe this new buyer in the market an incredible appetite for oil because it can combine oil with cheap labor to produce "things" very attractive to the rest of the world. In fact its labor may be so cheap (or productive) that it can afford to pay an incredibly high price for oil and still be better off.