Matt Mushalik: Links Between Peak Oil and Financial Crisis; also Updated Graphs

Posted by Gail the Actuary on February 1, 2009 - 9:39am

Matt Mushalik from Australia has in the past provided some graphs of crude oil production presented in an unusual way. The top of the graph is just what you would expect, but the layers within the graph show only recent changes in production for a given country. This post provides an update of two of Matt's graphs through October 2008, based on EIA data. It also shows a diagram Matt prepared summarizing connections between the peak oil and the financial crisis.

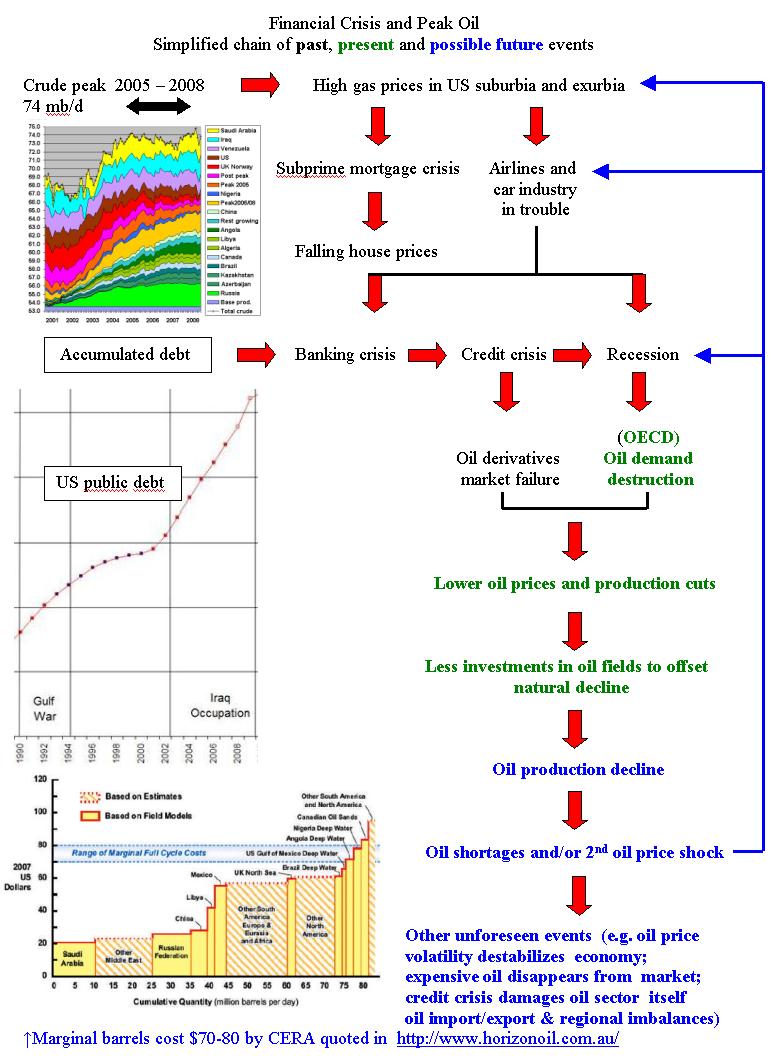

First, Matt's diagram showing his view of the connection between peak oil and the financial crisis. (Sorry, it is too big to fit in the header).

Connection Between Peak Oil and the Current Financial Crisis

Matt's diagram summarizing the connections between peak oil and the financial crisis (shown above) is in three colors. Black indicates past events; green indicates current events; and blue is some possible future events.

Most of us have heard about many of the events on the chart already, and speculation as to what may happen in the future. While the media is not aware of the various connections, there is considerable evidence that these connections are there, and are what have caused the current financial crisis. Of course, with peak oil as a cause, the financial crisis is likely to be far worse than anyone could ever have imagined. While the economy may cycle in the future, its long term direction is likely to be down.

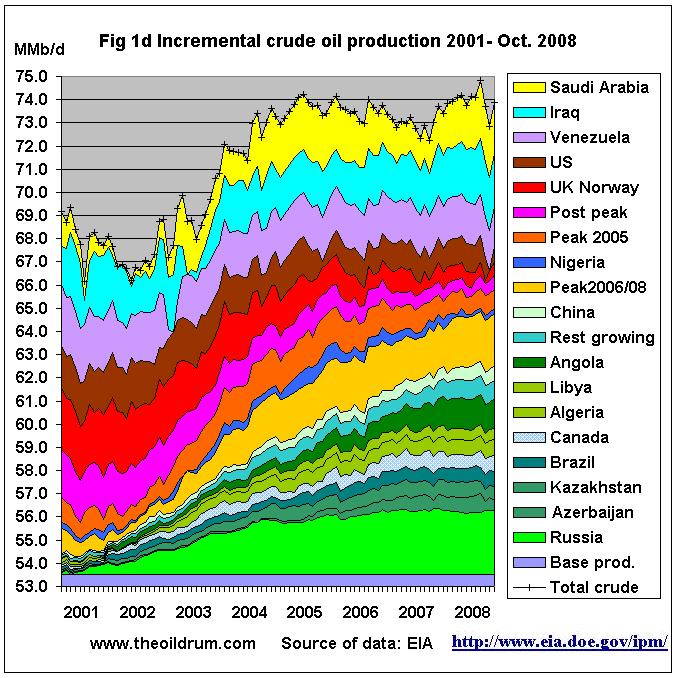

There are three graphs down the side. The first one is Matt's "Graph 1d" of worldwide crude oil production based on EIA data. This graph is described in more detail below. This graph shows that worldwide crude oil production has been flat at about 74 million barrels a day, since 2005. The "peak", to the extent there is one, is in July 2008,

The second is a graph of US public debt from Tom Millican's website. Debt of almost any kind has been escalating, so other types of debt, if graphed, would have also shown a pattern of rapid increases. Matt also notes the "Gulf War" and the "Iraq Occupation" on this graph, presumably also related to our oil related problems.

The third graph is one produced by Cambridge Energy Research Associates (CERA), as shown in this presentation by Horizon Energy.

_0.gif)

The CERA graph above shows the full cycle cost of oil production in various locations around the world. At the time the graphic was produced, the price of oil was about $90 a barrel, so I would interpret the band between $70 and $80 to be the highest cost new oil production that could profitably be added when oil was at $90 a barrel. Now, with oil in the low $40s per barrel, there is virtually no new production outside of OPEC, Russia, and China that can be added on a profitable basis.

Of course, production where most of the exploration and drilling costs have already been done will be cheaper since only marginal production costs are involved. Most of this production is likely to continue until it naturally declines; it is the new development that is likely to be cut off. Since there is a steep decline rate on post peak wells (6% or more per year, much more in offshore locations), without new wells, production from existing sources is likely to drop off rapidly, causing the problems Matt shows in the graphic above.

World Crude Oil Production

Below are Matt's crude oil production graphs, based on EIA data, updated through October 2008. These graphs show that at this point, the peak in crude oil production was July 2008. Many of us believe that that will ultimately be the final peak in crude oil production, because now with lower prices, there is no incentive to try to match the July 2008 amount, which was very difficult to achieve.

Note that these graphs relate to world crude oil, not "total liquids". Total liquids includes biofuels and natural gas liquids, and may have a slightly different peak.

In the first graph shown (labeled 1d), Matt shows the how production has recently changed, for countries and groupings of countries shown in the list. For example, the UK-Norway layer is thicker at the left side of the graph, and becomes thinner at the right side of the graph, indicating that its production recently has been falling. Russia's layer generally gets thicker as one moves across the graph, indicating that since 2001, its production has generally been rising (although not necessarily this past year).

In Figure 1d, countries with generally rising production are at the bottom of the graph. The middle group has declining production. At the top are Saudi Arabia, Venezuela, and Iraq (countries whose production has varied considerably from year to year).

From Figure 1d, one can see that production has generally been on a plateau since 2005, although there is a slight peak at July 2008. One can also see that without the top three countries (Saudi Arabia, Venezuela, and Iraq), even this slight peak in July 2008 disappears. One also can see that Russia's production has recently been quite flat (actually slightly declining), and that production for the countries at the bottom of the stack is barely growing enough to offset the decline of the group of declining countries in the next layer.

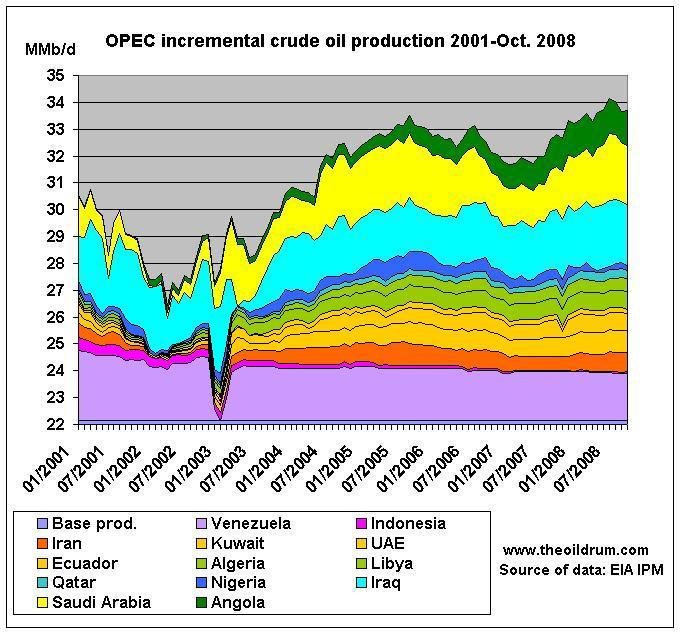

The above figure shows OPEC production on the same basis. From this figure, one can see that most of the growth in production since 2003 is from Saudi Arabia, Iraq, and Angola. One can also see the peak in production in July 2008.

Excellent Posting!

Questons: What is your best guess?

1. How long until an oil shortage or 2nd oil shock? 2 years? 4 years? 10 years?

2. How long until US oil imports go to zero? 10 years? 15 years? 20 years?

3. How long until the US government goes bankrupt and unable to pay loan interest???

Well, I'm not the poster, but looking at all the varied inputs and the overlapping nature of the feedback loops, I'd think that those questions are not answerable with any high degree of confidence.

It is interesting how the lines seem to indicate that the chosen solution to the economic problem may make things worse.

Since no one replied, I will submit my answers:

1. 4 years until the shortage or shock - based on a 3 year recovery and 1 year to push demand into the shortage level.

2. 20 years until US imports are zero - based on the top 5 net export analysis, but only 6 years until 50% of current imports.

3. 10 years until US goverment goes bankrupt based on current debt will double and interest alone will approach current annual budget total.

What does this mean? We will have a solution to peak oil in 10 years, or..........

Those are good questions. You will remember my financial forecast for 2009 was pretty pessimistic. Matt's financial / peak oil diagram touches on many of the same issues that I have touched on in some of my past posts.

It is not just the United States that is in poor shape. Governments around the world are in poor shape, and the whole system is networked. It seems to me that the there is a significant chance of major breakdown in the next five years. Even if it doesn't happen this quickly, it takes a long time to plan. Because of this, I think readers should be planning as if we will have very much less oil (as in very little oil imports), and our monetary system will no longer work, in the not too distant future. It is possible our electrical system will be affected as well, since electrical workers like to be paid, and a problem with the monetary system could affect them as well.

The current credit crisis is a major problem. It does not take too much imagination to see it spiral out of control, and countries stop buying nearly as many products from each other (to protect local workers, and because of concern about credit of other countries). I doubt that the US would formally become bankrupt, although we might have hyperinflation or massive deflation.

define 'formally bankrupt'...

Governments do not go "formally" bankrupt, they just lose the ability to pay obligations (default), and they lose their ability to make loans from other governments.

Then the currency crashes, and people go back to bartering or using other currency.

Look at the current state of Zimababwe - it takes trillions of their dollars to equal one US$.

If the US cannot pay it's obligations, then services will go away, social security, defense, health, welfare, etc.... Other nations holding the debt may attack to get their money back.

The states are already in bad shape and are now going to the US govt for help just to meet their budgets. What happens when the US cannot help the states? Budgets will get cut by default.

State services in California are about to go to IOUs for payment. Try to buy groceries or electricity with an IOU?

Seems like the states have been heading south ever since Ronnie's ever so popular fed to state block grant system went into play. I never really understood any of it.

The current financial crisis is first and foremost an ecological crisis. I'm still working on that, I can't get a formal handle on it, the "proof" still eludes me. Like proof of water eludes the fish. But Wendell Berry, in his essay on education, writes about how milk producers and milk drinkers need to speak about cows that make too much milk badly. About intuition. Cows that make too much milk are not something that only Monsanto biologists can discuss, but everyone who drinks milk, eats cheese or wears shoes made of leather or shoes that should be made of leather. Anyone that lives in those communities. [And related, we can no longer figure that "fair process" or "due process" produces good results, rather more the opposite, but I digress from my digression.]

Gail, I don't know that you were pessimistic. Zero degrees of separation. Volatility. It's already way "out of control". Hell, our economic system is designed to be "out of control". It's supposed

I suspect your preditions were optimistic. If only because what you and I don't see. We can't factor that in. Other than the suspicion that matters will be worse than we expect. Like the ice. Every dollar, less ice.

Talk to anyone in the 501C3 world. Precious few understand what's going on, but the narrative is the same. No money. Big cuts. Or the munis. No money. Big cuts. [States are different - hey, they are getting all this cash from Obama that they can spend on THIS YEAR'S OPERATING EXPENSES.]

Debt for operating expenses.

My girl, CFO at a largish community C3 is asking about "swadeshi". Yeah.

We're in the crash so we don't see the crash. It's well advanced. Right now, Maine is about to lose 150K acres of organic dairy because of the tanking of milk prices due to bankruptcies in the commodity milk chain. Milk. The budget is already 20% down and running up against all sorts of fixed constraints.

The network needs to be taken down. Keeping it up, $1T, $2T, $4T - hey, geometric growth in bailouts??? Doubling time of what, two months? All those charts at the newscientist a couple of months back - the use of every resource gone geometric. HAL 9000 can't handle that.

And it's not like our monetary system might not work in the near future. It's pretty clear that it has not been working - or that it's been "working" in a destructive manner - for some time. At least the 70s, though the trajectory goes back beyond that. Some literature suggests the concept of permagrowth didn't really get institutionalized until Post WW2. ["Friendly Fascism", Gross among them, also Henry Wallace] I'm not so sure that it's not the human condition, but I am sure that until about that time there were important figures that recognized scale. And now it's only Nate and Herman and Kirkpatrick.

We're not about to go into overshoot. We've been in overshoot since Apollo 13.

Me? I've got 5 trays of test-seedlings under the lights today. Different seedling soil mixes. All saved seed.

cfm, half-farmer in Gray, ME

"Like proof of water eludes the fish"

That is a classic quote. It sounds like something that came out of the Kung Fu TV show.

thank you grasshopper.

Cows Milk is for Baby Cows, not for Humans. Human Breast Milk is for Humans, and only for a few years at that.

Everyone would be much the wiser, and better off if all the subsidies stopped and all the milk (DAIRY) producers went out of business.

Grow veggies on that land, man.....

But it's so yummy!

As to the answer to number 1, I'd say that maybe the financial problems will lead to food shortages (empty shelves, closed supermarkets) long before you actually see serious gasoline shortages. So no one will really care that much about gasoline at that time, people will be focused on getting food for their families. Credit disappeared and the govt tried to restore it with bailouts. Food will also disappear and the govt may not be able to restore it even with a command economy since it can't print energy.

Umm..Maslow,s hierachy of needs?

http://en.wikipedia.org/wiki/Maslow's_hierarchy_of_needs

1. I've long felt that 2012/13 was going to be a time period when something pretty serious happens. It is pretty obvious from the present megaproject data that by then, new capacity coming on line starts to fall significantly behind what is needed to replace depletion. Given present oil prices and economic conditions, it is also very likely that we are not going to be seeing a lot more megaprojects entering the pipeling in time to make much of a difference in this. SO, by around 2012, there should be a pretty substantial supply shortage, even if demand continues to be constrained.

2. Based on some of the ELM analyses that westexas has posted, it looks to me that 20 years out for zero US imports is probably about the best case (although the US might still be getting a trickle from Canada then). I'm more inclined to think that China and Japan will use their massive accumulation of US $ and treasuries to lock in long-term supply contracts, thus shutting the US out earlier rather than later. (As for the US using its military to acquire by force what it cannot acquire through legitimate commerce, that is likely to destroy as much or more supply than it will secure.)

3. The most credible scenario is sovereign default. Nations elect to exercise sovereign default only when they are so backed into a corner that the pain of sovereign default looks to be less than the pain required to honor their debts. Of course, sometimes national governments miscalculate, or just plain make bad decisions.

For the US, sovereign default would mean instant loss of reserve currency status for the US dollar, and probably also almost instant curtailment of all oil imports. Needless to say, the minute this happens, the US becomes a 3rd world economy for certain, and probably forever. Some might assume that such a thing is unthinkable and would never happen. The question is, though: are there scenarios where the burdens of continuing to honor our national debts to foreigners would be so unbearably painful that the consequences of sovereign default would start to look preferable?

To answer that question, consider whether you think that TPTB or the American public would prefer that the US FedGov continue paying interest on that portion of the national debt owed to foreigners, at the expense of:

Having to withdraw all of our military forces from overseas, even if they are in the midst of a conflict, and of having to make huge cuts in our military forces?

or

Having to make huge cuts or even eliminating altogether Social Security and Medicare obligations?

or

Having to eliminate almost all other federal government programs?

or

Having to raise federal income taxes or implement at VAT, raising the AVERAGE tax burden to 50% or more?

We are probably less than 4-8 years away - and maybe sooner - from having no choice but to face up to one of these fundamental, painful tradeoff decisions. Maybe we'll have to accept all of the above in order to keep making payments on our national debt. Are we willing to do that? At what point does sovereign default start to look not quite so painful or unthinkable after all?

Of course, once TPTB finally realize that we've only got a few more years of imports coming in any case, and once they've finally come clean with the general public about this, then a lot of the downsides of sovereign default start looking a lot less painful.

My guess is that a US sovereign default is probably not in the cards anytime before 2015, and may not be avoidable anytime much past 2025 or so.

Of course military action will destroy more oil than it acquires. It will stop overseas transport altogether if not halted quickly. Then you see what economy will stand and what will fall or at least to what degrees all will fall without lots of oil.

Societal memory of the debacle and fixes surrounding the financial crash of 1929 faded almost completely by 1999, a mere 70 years, setting us up for our current financial pickle. 1945 + 70 is 2015. Assuming WWII left a deeper more indelible societal memory add 85 years instead of 70, that takes out virtually all of the WWII era participants and almost all those who grew up in its immediate shadow. Soceital memory of world war gone by 2030? Don't expect reasonable response when we are in a stranglehold. We have little time.

I think the current financial is related more to peak cash flow than to peak oil.

It would be interesting to see two graphs similar to your 1d: One for oil exporting countries, and one for oil importing countries, showing the dollar inflows and outflows.

I think they would show some pretty dramatic peaks and valleys.

It's much more complicated than that. Peak per capita net energy caused political and social pressures which resulted in credit overshoot. I wrote a preliminary comment on it a few months ago, and have something in peer review on how this phenomenon is finally resulting in the failure of financial capital as a marker for real capital - we are still in the early stages. Next step is the European bank dominos falling. Barclays, UBS, Credit Swiss, ING, Fortis, Nordea, etc. After that is the sovereign credits. What will Bretton Woods II look like? It's anyones guess, though linking to natural resources (which is what should happen), is of low probability - too many at the negotiating table still think the environment is part of the economy, and not vice versa. Milton Friedman lives on...

The conversation between Ravaioli and Friedman is interesting as it's par for the course when the physical science-minded converse with the economically-minded. Both parties are talking across one-another and, from each of their perspective, they are both correct and both wrong.

But I've had so many of these sort of conversations on exactly the same topic, that I've given up and have shifted focus to the immediately practical (building a sustainable home and a secure supply of food). There comes a time when one has to stop arguing about what to do so that it can just be done.

Do you realize that we may have gone up and past peak without any real analysis, either economic or scientific, that has gone beyond heuristics?

The issue is that we may hit the next problem with the same lack of insight. We still need to think, which inevitably leads to arguments.

Unfortunately, science has collectively lost its ability to keep up with events. Neither peak oil nor global warming, nor human brain behavioral science will ever be 'proven' before resource depletion mitigation and adaptation have long been necessary.

How could it be otherwise? Humans evolved to use heuristics. Science is a relatively new phenomenon. If everyone in the USA understood the derivation of the logistic shaped discovery model, would we suddenly change our behaviours?

And regarding the next problem - I agree. We still need to think, and argue, and act.

So, any votes or guesses on what "the next problem" will be?

I think it is the need to deeply reassess our basic goals as a culture and our self-assessment as a species. We have to move from trying to find new energy sources and other ways for humans to maximize themselves (thereby maximizing their negative impact on the living world), to discovering humane ways to limit ourselves and to move to a much, much lower state of energy and resource use.

I think the next symptom will be an explosion of social inequity. There is already a great deal of pent up anger on the one-sided nature of government bailout of banks and certain industries. The economic aftershocks are going to destroy the middle class in wealthy countries, and drop living standards for all but the very rich in the poorer countries.

If rich people were smart (or rather, could optimize on other than dollars), they would realize that unless some large scale distribution and allocation changes are made, they won't be able to enjoy either their wealth nor their superior social ranking for much longer. Lower resource affordability per capita is going to stretch social democratic principles to their breaking point, (and beyond, in my opinion)

Nate:

I'm sure you know of Dmitry Orlov's "Reinventing Collapse" about his observation of the breakdown of fhe former USSR. Every peak oiler should read this, and although I do not agree completely with Orlov, what he has to say will definitely challange the reader's thinking.

I know of it, but have not read it. It joins an ever growing list of things to read and things to do - can't I just take a pill and have it fuse into my awareness or some such?

In grade school we had an assignment to come up with an original invention, just to write about it and draw it. I came up with a homework machine. It read all your assigned material for you and then manufactured a pill you could take which contained the knowledge.

The plans, however, disappeared. Sorry.

As a short-cut, you can read my 1,000 word post about Dmitry Orlov's book, found here.

Similarities between the soviet empire's collapse and ours will likely be as similar as the U. S. westward expansion and Russia's great expansion to the east were. In other words they will be very dissimilar.

My totally American perspective had me misread what our breaking the USSR by upping the stakes in the arms and political dominance races. I figured if a man had a fairly poor field for crops and had to keep taking all of the profits he made off that field and spending them on defense of that field from his rival who had a very good field he would soon come to the point where defense would take up the resources needed to make the field produce. No more profit and lots of weapons, does he sit back and quit adding to defense and thus lose the perimeter areas of his field to his rival or use his weapons since that is what he has invested all his weapons in. I was wrong as I expected the later and as we all know the former is what actually occured.

So how come I so misjudged. Well I grew up in mid America, no enemies had been near our productive soil for over a century. Our country had grown rich picking off one failing empire after another. We just never think about giving up any of what is ours. If all we have left of our profits is the guns we have built with them, we will not sit by and watch our 'territory' dwindle without firing every shot we have. IMNSHO

But maybe as we early boomers fade this mindset will fade as well, one can hope.

Not everyone, but the people that matter would understand it.

Watch closely how the global warming/climate change discussion gets swayed by "heuristics" versus "real models". The heuristics crowd are basically the anti-GC people, who do not have real theories of their own, but they twist and turn trends to fit their agenda. The pro-GC people do have the real derivations on their side, yet the heuristics angle that the pearl-clutchers latch on to tends to sway them the other way. (i.e. "gee, its been warm for a few days in a row, heuristics say it will stay warm, and therefore GC is not real"). So it comes down to whether we believe the scientists or the others.

On the other hand, in the oil depletion debate, it is basically all heuristics. Each side, the pessimists AND the cornucopians, use heuristics to argue their correctness. Economists, like Milton Friedman, who gets quoted upthread, have a love-hate relationship with mathematics. If you read Naomi Klein's Shock Doctrine, you can get an idea of the weird attitude that Milton had with regard to economics as a science. In a sense, all he wanted to do was test all his "empirical theories", however he could. But he was modeling adaptive human behavior which is bound to failure.

Excerpt from book:

I agree that science is a relatively new phenomena. The math of stochastic processes only got popularized in the 1950's and early 1960's by some classic texts. This opened the field way up. I have debated in my own mind whether King Hubbert was even aware of these ideas. And since he was first, the inertia of his heuristics have gained some weight that has become hard to dislodge.

BTW, that linked article by Gigerenzer uses heuristics as a way to adapt. It again does not explain anything, other than implying that humans do feel some intuition toward a good heuristic. After all, it does reinforce positive feedback (like the temporary warming trend would reinforce a positive feedback to dismiss global warming). I do simulations for a living and I can fake almost anything I want using visualization rendering, yet I do not claim to explain anything if I go that route. This is sometimes referred to as gaming physics as opposed to real physics. Gigerenzer is basically explaining engineering adaptation, not fundamental understanding.

Thanks WHT - I think that is the longest comment you ever made without a formula -(of course some of it was a quote...;-)

Heuristics are better explained in some of Gigerenzer's books - but basically what he is getting at (as well as many behavioral economists) is that we evolved to be adaptation executors, not rational utility maximizers. In English, this means we have a 'quiver' of short-cuts to think about and care about things that were important than our evolutionary past. 'Money' and 'markets' are not among those things, but 'danger' and 'social hierarchy' and 'relative vs absolute' are.

Regarding scientific method, I think even those that are trained in the scientific method often either don't use it as they were trained, or use it as a tool towards a (conscious or unconscious) desired end. So often in my brief academic career have I seen bad papers published because of who wrote them, and excellent papers be rejected because they were by unknowns or on an unpopular topic within the establishment. In sum, there is a fine line between science and pseudoscience. Combine this with our belief systems and one can't totally rely on peer-review as the gold standard of truth.

Regarding CC, I think that we won't know how other forcings add/subtract/interact with human carbon emissions fully for some time, so there are heuristics involved with that sort of modeling too. And overlaying it all are our belief systems - I watched a movie about the Crusades last night (of which there were 12 different Crusades, which I did not know), and it scared, though didn't surprise me how far people will go based on a belief.

I agree with the rest of your comments.

Aye, we'll see how this plays out. TOD, more than anyplace I have seen on the internet, has a chance to break out of this rat-hole and succeed based on pure merit. As a real meritocracy. This is so damn fun.

It seems to me that the world has come to believe that both science and economics have great power, and that they can develop models which will accurately forecast what will happen in the future.

We have started to see evidence that our modeling ability is not really as great as researchers would like us to believe. We have been seeing the economic models failing for a variety of reasons--one of them, the assumption that the economy can be expected to grow and grow, as more and more resources become available.

It seems like 99% of the world still believes the economic models, even though they are failing, because they have been drilled so much into our heads. (Will we have a U or V shaped rebound?) I fear the climate change models may not live up to expectations either, because of the inherent difficulty in modeling complex situations (together with finite resources), but that does not stop faith in the models. If nothing else, faith that the model is right gives us the feeling of power over our future, and this is very attractive.

I don't think economics is a science. You have to strip away the voodoo to get to a salient model. It's possible to do this but the discipline occupies a no man's land of uncategorized applied math. Econometrics has tried to break away from economics but the association between the disciplines is still too close. Bizarre how this works out and how wrong most of the stuff is.

Climate models have, of course, already failed spectacularly. Most recently, the IPCC models predicted that Arctic ice wouldn't approach total melt till near the end of the century or much later. Within a very few months, it became clear that this was wildly optimistic. Numerous accelerating ("positive") feedbacks had been overlooked.

"If nothing else, faith that the model is right gives us the feeling of power over our future, and this is very attractive." Very nicely put. I think there is a similar comfort to certain conspiracy theories--if you think you can put a face or a set of faces behind a calamity, it makes it more understandable and in principle controllable by some form of human agency. But if you think everything is just spinning wildly out of control because of general stupidity, cupidity..., it can seem too scary to contmplate.

This is one of the most chilling things I've ever read.

"My theory says that if there is a shortage, prices will rise. They have not risen, therefore there is no shortage."

"But Prof, physical reality says oil stocks are limited."

"Economically, they aren't."

Errr... Prof, if the model doesn't correspond with physical reality, you are supposed to change the model, not ignore the reality.

This is like the guy falling off the 30-storey building calling out, "All right so far!" as he passes the second floor.

In some weird, blinkered bubble of reality, he *is* 'all right so far.' And Milton Friedman might sell him life insurance; but I sure as hell won't, because I can see a bigger picture.

Economics theory is built around production of goods that are manufactured from supplies.

It assumes that production is unlimited, and that price and demand determine rate of production. When it becomes unprofitable to make something, the price rises or production stops. Substitutions occur when there are acceptable ones. At this point in time there is no price equivalent substitute for Oil. If you price oil in terms of horsepower it would be worth thousands of dollars per barrel.

Energy or oil is not manufactured and not unlimited. Energy is converted from one form to another.

Energy is not created. The conversion process or return on energy is important and limits the supply. Therefore traditional economics does not apply to specific energy resources.

What? Are you serious? Do you really think physicists are wrong in saying that fossil fuels were made in hundreds of millions of years, therefore, are practically non-renewable?

Oh yeah, and don't forget the geologists, chemists, biologists, ecologists, paleontologists...etc... then along come the economists and explain to the people why non of that matters and we can all just ignore reality and grow our economies forever.

Guess who gets listened to?

Friedman's argument reminds me of an analysis I read of why Hotelling's (sp?) Rule of prices breaks down - because oil has never been priced as a physically scarce resource.

That seems to be neoclassicism in a nutshell - economic theology unanchored from physical (or any other) reality.

Also, how can oil be treated as this easily substitutable good, as if it's just one of many kinds of beer you might buy, and if they're out of Molson Export, just get Molson Golden?

This physically vast, technologically intricate, and monumentally expensive infrastructure can't just be scrapped in a few weeks and replaced with whatever substitute economists are thinking of. This changeover clearly requires tremendous planning and investment far in advance of when the prices would chronically signal the market, "It's time to switch".

That is, if the change is going to be an orderly retreat rather than a rout.

Fascinating take on financial overshoot - bread and circuses on credit - sure looks that way.

But there's more than personal and public debt at work in the credit crisis: PO had nothing to do with the CDS explosion, which was more about deregulation of the markets, including repeal of Glass-Steagall in 1999. Now we have notional values of CDS's floating around that are apparently an order of magnitude larger than the global GDP, but no one knows for certain.

It's that uncertainty together with the potential for insurmountable losses that's paralyzed all the lenders. So IMO there's more than one source for financial overshoot.

Actually I think decades of steady growth in the net energy supply left powerful people with the feeling that regulation or any other kind of limits just get in the way of the apparently infinite wealth creation. Ever-growing supplies of liquid energy, I would say, helped foster an attitude that any investment will win, and that the less restrictions there were on investments, the more winning could happen. This was of course insanity, but an insanity in part induced by the giddiness of the ever greater availability of a certain energy-dense, black, viscous fluid.

These wild investments started to unravel when the infinite growth started to stall.

A friend of mine studied businesses in the oil-rich gulf states. Most of them were total shams, but their owners all knew that the sheik would supply them with more cash whenever they needed it. Clearly all these business will continue as long as oil revenues flow in, and all these businesses will go belly up soon after the oil revenues dry up.

Saying this is because of the bad business practices rather than because of the always-ready supply of cash is rather academic, IMHO.

A similar thing happened here, just once or twice removed. As it turned out, many of the banks could in fact go to the "sheik" (gov) for a bailout here too. But not all. And this sheik is already in hock up to his eyeballs.

But you are certainly right that the CDS's and other derivative-type scams are the big scary beast that people are still not talking about.

"..., but no one knows for certain."

If you think about it, this lack of knowledge also preceded the oil crisis. In that case, some people did know, i.e. Hubbert and a few others, but we never had the certainty because of the imprecise foundation of our knowledge.

OMG, I have never seen this particular exchange. Absolutely mind-blowing.

Aside from the usual moronic points re. physical but not economical...etc. What really got to me was that he doesn't seem to comprehend what pricing on the margin does!

I don't think Milton Friedman would get the idea of Diachronic Competition, us competing with our descendants. But luckily the new religion of economics has signed as all up to this great new experiment of infinite substitution which discounts Diachronic Competition at the margin.

Its a bit like the financial musical chairs that just finished! Luckily the politicians are now playing the game with great gusto.

I think I've had an OMG moment :(

That has been one of the few spots of hope for me of late, where my 20 something friends get up and tell the bastards at city council - my 50 something sometimes friends - that they know where they live. Because it's going to come to that. I'm all for issuing communities an adequate supply of tar and feathers. Better than AKs and dcit , though no doubt, being human, we will need some of the latter. Can TOD members get a discount on AKs? Is that a Professor Goose question?

The generation 30-50 something, needs to write itself off, to dedicate itself to the younger. Not as in momma-bear or poppa-bear feeding their own young, but to make the paradigm shift from entitlement to "pay it forward".

Out of all the trillions in the bank looting and plunder, what would $5B have done for permaculture, Martensen asked a little while ago? Permaculture aka the next generations.

cfm in Gray, ME

Remember, there is no Nobel prize for economics, just the Swedish bank prize in honour of the memory of Alfred Nobel. He didn't mention economics in his will, and you should not take the prize or their winners too seriously.

Here is my short essay that shows US oil prices versus net oil exports from the top five net oil exporters (inspired by similar graphs on TOD):

http://www.energybulletin.net/node/47541

Of course, I think that the really deadly danger facing the world economy is a long term accelerating decline in worldwide net oil exports. In any case, it's interesting to examine what really happened in the Thirties, worldwide and in the US.

It appears that world oil demand was only down one year, in 1930. After Texas controlled the output from the East Texas Field in 1931, oil prices rose from 1931 to 1937 (in August of 1931, production from the East Texas Field was on track to account for about one-fifth of total world oil production driving oil prices down to cents per barrel). Based on BP calculations, in constant dollar terms annual oil prices rose at 11%/year from 1931 to 1937. I haven't seen actual nominal prices in detail, but a price chart shows a clear trend of rising nominal oil prices.

Here in the US, as Downsouth has noted, there were three million more cars, many of them owned by first time buyers, on the road in 1937 than in 1929. Today, hundreds of millions of people worldwide want to buy their first car.

So, after one down year in consumption, oil prices and demand rose from 1931 to 1937. I suspect that 2009 is to the Greater Depression as 1930 was to the Great Depression. What then happens from 2010 to 2016? In contrast to 1931 to 1937, when we saw expanding oil supplies, I expect to see a renewed bidding war for declining net oil exports.

From the above linked article:

BTW, interesting article follows, with several good comments (the oil price chart is apparently for monthly data):

http://mjperry.blogspot.com/2008/11/oil-shock-of-1930s.html

Saturday, November 15, 2008

Carpe Diem: The Oil Shock of the 1930s: Another Factor?

Oil Price Chart:

http://1.bp.blogspot.com/_otfwl2zc6Qc/SR7wlGrkytI/AAAAAAAAHvE/aOVvsxq_fP...

A few days ago, I went to the book talk here in Seattle by Matthew Miller, host of NPR's Left Right and Center and senior fellow at the Center of American Progress. He was speaking on his latest book "The Tyranny of New Ideas" whose basic premise it is our "conventional beliefs that 'doom us'. To summarize, he was promoting a "kinder gentler" form of capitalism that takes into consideration more of the societal good rather than the individual good. For example, one of his "dead ideas" is that education should be funded locally through property taxes. While this may have made sense when property was the only true value of wealth, it did not make sense in a modern economy.

For those on TOD, he did mention specifically that "the idea that 'cheap oil' is good for the economy is a dead idea".

In the course of the talk, the subject of course turned to the work of Paul Krugman who was also in Seattle during the week. As a true-capitalist, Matt Miller expressed optimism that the economy would eventually sort itself out.

After the talk during the book signing, I asked him whether he had ever read in any of his books about the Great Depression the role that the east Texas oil fields played in the economy's recovery. I wasn't surprised when he mentioned that he hadn't.

But I myself am not aware of any scholarly work on the topic. Is there any available?

Good timing on that last question. What looks like a very interesting book that just came out is called "The Big Rich: The Rise and Fall of the Greatest Texas Oil Fortunes" by Bryan Burrough, Penguin Press.

Amazon $20

http://www.amazon.com/Big-Rich-Greatest-Texas-Fortunes/dp/1594201994/ref...

I happened across it from The Economist review of this last week:

http://www.economist.com/books/displaystory.cfm?story_id=13014080&fsrc=rss

Prior to oil peaking, there was a fundamental belief that energy was just another resource, that high prices beget substitutes and increased production. In 2008, this belief was shattered and real limits were harshly encountered. If this fundamental "law" of a market economy is wrong, then what's right? And what's next? And how does one decide to invest? IMHO, we are still sorting out the widespread recognition that the planet is, after all, finite.

Speak for yourself grasshopper. While you and I may have the socially unacceptable point of view that a finite world has finite fossil fuel resources, most people, IMO, operate under the assumption that we can have an infinite rate of increase in our consumption of a finite fossil fuel resource base.

I'm still trying to figure out how to arbitrage that datum into a more comfortable retirement for myself.

BINGO!

Depending on how you parse that, you will be shot or allowed to pass to the next gate, DIYer. The bullet will cost you $10. Otherwise the machete.

SO, are we really at the point where limits-to-growth matter? WHY CAN'T WE GET A NUMBERS HANDLE ON IT? That drives me nuts. Is the problem not defined by numbers? 20 amps to bring Apollo 13 home.

cfm in Gray, ME

Right- thanks for the correction. What about energy investment types? Or investment managers in general? Are there lasting lessons of 2008 for investment strategies? The sense I get from TOD and Drumbeats is that "the game" has entered a new phase.

My 2¢ worth: I would be inclined to favor food & energy producing assets, with some gold, but that is probably the same thing I would have said this time last year.

I have read most of your posts since the beginning of 2006. You have stubbornly repeated your way of thinking: It's all about food and energy, full stop, end of the story. You have convinced me and my family to invest accordingly - in our case - in a wheat farm in Australia in 2006. We also watched closely the opinions of Jim Rogers, who is PO aware. A big exception in the field of the so called money titans. Thanks to your comments and JR's our family is financially healthy. The current and future mess does not adress us in any way.

This might sound cynical, but euthanasia-pill producing companies might be a good bet. The aged population will increase, and all things considered, the standard of living will decrease. The pill is by my knowledge only legal in the Netherlands at the moment, but once the pension-wave hits, the standards of what is and what is not 'acceptable' will change, as it has in the past.

Anyway, betting on anything (affordable) the elderly will need is a safe bet, as much as renewable energy assets.

We mention "Soylent Green" regularly here - One of the features of the world depicted in that flick was the beautiful, peaceful exit that was offered to anyone that wanted it - A whole multimedia experience, replete with images of unspoiled wilderness, long since extinct. But the State insisted on control of the individual's destiny, to the last breath.

You can't just be handing out those euthanasia pills willy-nilly, or they'll end up in the morning coffee of cheating spouses and ex-financial advisors.

Me, I'm thinking about the future of what economists call "inferior products," things that we buy more of the poorer we get. Think lard, dry beans, cheap booze, maybe carpool/vanpool services and flea market networks.

It's not even that good. As WHT has pointed out, we could have an infinite supply of oil and it wouldn't be enough. To wit:

If you integrate the annual oil discovery, you get a function that can be fit to R~T^0.5 (that is, total oil discovered goes as the square root of time). note that extrapolating this implies an infinite supply of oil.

Oil production rate increases linearly, meaning that total oil produced goes as T^2.

Initially, the oil discovery will always outpace the oil produced (for small argument, a square root beats a quadratic). But it is guaranteed that, eventually, the quadratic will overtake the square root.

Even an infinite supply of oil isn't enough....

Thanks for pointing that out. That weird heuristic came out of a USGS paper, and the authors did not realize that even such a strong reserve growth factor wouldn't overcome increasing production demands.

Friedman said:

You said:

Evidently one can't increase production when the physical limits are reached, so one can't increase production of oil. However, note that Friedman's remark says that when that point is reached other energy sources come into play. The problem is, of course, is that, unlike when oil replaced coal, we don't have another source of energy that can replace oil at an affordable price or in sufficient volume or in a convenient form (i.e electricity is not a substitute for oil, although all-electric vehicles would obviously change that somewhat). And, by the way, I remain convinced that all-electric cars are exactly how TPTB expect Kunstler's "happy motoring" lifestyle will continue - hence the perceived need to keep building roads and bridges. After all, the assumption of growth implies there will be more cars because, as we know, there will always be more people (unfortunately).

That really is the key stumbling block for the economist -vs- "idiotic" Club of Rome.

And back then Freakshow Friedman would have said the same thing we hear too much yet today - that Science and Technology will save us... have faith... man-god-pig will prevail.

Ever since Reagan, economists, harlots and astrologers have held undue influence over the white house.

Not to mention Tony Blair...

Let them eat bytes - Tony Blair, Davos 2000

Great eh? We just replace oil with information - how silly of us not to think of that.

"Prior to oil peaking, there was a fundamental belief that energy was just another resource, that high prices beget substitutes and increased production. In 2008, this belief was shattered and real limits were harshly encountered."

Actually, Friedman wasn't wrong in the sense that scarcity begets pricerises, begets substitution. But higher prices = increased production is of course false given (physical) limits. Substitution will however necessarily be a real phenomenon, yet leading to lower use. Other enegy sources will increasingly be used, of course they won't be as convenient and cheap as oil.

Friedman wasn't wrong, but the posted dialog might incorrectly imply BAU.

Of course Friedman wasn't wrong; they never are. Inhabiting his own universe, he was completely right. He was just misguided.

Nice work.

The country-by-country graphs really show how important both Russia and Iraq are right now for world oil production. Russia looks to be peaking now, and Iraq remains a powder keg that could rip itself to pieces at any moment. And of course even SA could suffer from instability with these low prices.

Saudi Arabia showed a year over year increase in production in 2008, almost certainly to an annual production rate below their 2005 rate, but the key metric is net oil exports. I estimate that their 2008 net oil exports will be about 700,000 bpd below their 2005 rate.

No commodity in history has ever had a huge price spike, over it's historic price, and established a new permanent higher trading range. Not a single one. This thought occurred be me over and over as the oil bubble developed last year. I reached two conclusions. Either there was going to be significant long term demand destruction from an economic disaster or there was going to be a series of technological miracles which replaced oil.

Overwhelmingly I opted for the first conclusion, mostly because the systematic economic disaster had already started. The seeds of the disaster were the same ones which caused the world to need 74 million barrels of oil a day. A binge of debt driven consumption. To me the analysis that peak oil caused the financial disaster is exactly backwards. It was the financial bubble which brought on peak oil. Brought it on before technological advances were made which started the process of replacing oil demand. In the same vein. greenhouse gas driven global warming was an effect of the debt driven consumption binge.

Our economic system which might be dated from the immediate post WWII period should be seen as the cause of peak oil and climate change which are obviously entwined phenomenon. I pick the end of WWII because that is when a new world monetary system was codified and the American centric financial system was made universal except in the Communist states. If that system was totally flawed or perhaps just went off the rails at some later date is subject to debate. Unresolvable debate for now.

While many have looked at peak oil through an Apocalyptic lens and seen a massive possible dislocation of societies and cultures few have thought about that dislocation starting with the economic and financial system. It's time to think in those terms. A total financial system collapse is a distinct possibility. Most scoff I know.

Gail the Actuary did - a year ahead of time.

so did ASPO, in broad terms, declare the financial system vulnerable to PO; specifically as regards to debt instruments and interest, in 2004.

"No commodity in history has ever had a huge price spike, over it's historic price, and established a new permanent higher trading range."

Hmmmmmm.

Well, oil traded for under $30/bbl for most of it's history, but since 2004 it has traded above that figure consistently. Is that a "new permanent higher trading range" or nor? Do you think we are headed back below $30 soon? What do you think will happen with prices as we continue down the post-peak slope?

US oil prices averaged an annual rate of increase of about +20%/year from 1998 to 2008, with one down year. If oil prices average $50 in 2009, the average rate of increase would be about +12%/year since 1998, with two down years.

Help me with the math. What is the rate of doubling for each of those (20% and 12%). I know enough to see that a 20% annual increase means a doubling of prices in under five years, since you don't just add 20% of the '98 price each year--it's cumulative; so closer to four years, I'm guessing? How many years does it take for prices to double at 12%? A bit over six years?

The Rule of 72:

http://www.moneychimp.com/features/rule72.htm

Rough guide is to divide 70 by the % to give doubling times.

Thanks much for the on-going free education I get here. Very much appreciated.

So that would be roughly a three-and-a-half-year doubling time for the earlier 20% rate, and a six-year time for the new 12% rate?

So going from here, what would that mean? Presumably we don't start with the current ~$40 price. Do we average it over the last year, giving something closer to $100? So we should expect a sustained price in the $200 dollar range for six years? Of course, the dollar may not be a valid currency by then.

(log 2) / (log 1.12) = approx 6.1 years for a doubling with 12% annually, so yup to your first question.

In any case, Peaks Happen, e.g., Texas and the North Sea. These two regions were developed by private companies, using the best available technology, with virtually no restrictions on drilling:

Mathematically, based on the HL (logistic) models, Saudi Arabia in 2005 was at about the same stage of depletion at which the prior swing producer, Texas, peaked in 1972, and the world in 2005 was at about the same stage of depletion at which the North Sea peaked in 1999. Saudi Arabia almost certainly showed three years of annual production below their 2005 rate and world crude production will be about 74 mbpd in 2008, versus about 74 mbpd in 2005, with two years below that rate in 2006 and 2007.

I think that the financial meltdown was inevitable, but I think that the bidding for declining net oil exports, relative to the 2005 rate, triggered the meltdown and acted as an accelerant.

So we have Nate on one side saying that PO is causal (or at least one cause) of the financial collapse, Ilargi on the other extreme saying there is no evidence that PO is related at all to the current crisis, and WT thinking trigger.

Clearly, the financial system of one year ago was a house of cards, but "Shock Doctrine" notwithstanding, I don't think anybody wanted this collapse to occur. But it spun out of control anyway - Does there have to be one overarching reason, or can there be elements of all three interpretations operating in the many affected national capitals and capital flows?

there IS one overarching reason. It is the CAUSES of that reason that are probably multiple. The reason is the dramatic decoupling (via credit) of abstract marker assets from real capital. Productive 'work' occurs when energy is combined with materials, labor and some technology. A higher and higher % of SP500 'profits' were from financial companies that produced nothing - eventually the music stopped and there were too few chairs. I think Ilargi meant that high prices resulting from Peak Oil were not directly the cause as the credit expansion and subsequent collapse were baked in the cake well before the oil price spike. What is little talked about (and can't be proven because we don't have the data), is the likelihood that net energy/materials per capita peaked in 1998-2002 timeframe. Our data not only just shows gross not net, but also just shows the energy, and not the non-market limiters - water, soil, land, etc. Resource constraints cause social/political responses - 'printing' of more money (via credit relaxation) was a natural perceived low cost strategy using the rules of the old system that backfired. The next responses are going to be considerably more nasty unless we reduce consumption dramatically and link currencies to natural capital.

Nate

I'm not an economist, but I agree with you, the fact that the price signal of oil trailed the credit growth/collapse is irrelevant. I see it this way, net energy was/is declining (due to declining EROI), This was being lead/chased down by increasingly efficient energy use. Logically if the economic system was stressed by an increasingly scarce resource you would expect a correction however since the 2 biggie economic indicators (GDP & Inflation) seemed to be okay BAU continued.

Normally an increase in credit/money supply would be reflected in inflation, but the growth of Chindia meant that western economies could import a proportion of deflation (ie cheaper goods) from these sources. GDP also was false as GDP measurements make no allowance for net production within an industry (just the Gross!) In this case the the culprit is the energy industry. I did like Friedmans comment about energy, evidently if you need more you just produce it!

So my theory is that declining net energy (and rampant globalization) created the environment where a burgeoning money supply could occur without detection, the fact that this bubble has burst is no surprise but it required other favourable conditions to existin the first place.

I'm sure that Historians will argue about the causes for centuries, and I now understand how difficult a definitive answer will be, because we are here now and no-one can agree on the cause.

Neven

Nate,

We know that gross per capital energy use in the US peaked between 1996 and 2000.

We know that US per capita oil consumption is unlikely to rise again, because imports are becoming a larger and larger share of our total energy use, and we are unable to pay for them (because we are not producing enough high-value goods to export with the energy we import.)

Because EROEI is declining, one would expect net per capita energy to peak before gross. Net per capita energy likely peaked in perhaps the 1994 to 1996 range (earlier than you were thinking).

It may be that increased efficiency (approx. 2% a year in the US) helped disguise the decline in per capita net energy. Once the decline in net energy became too steep, even increased efficiency could not offset it.

I have not figured it our exactly, but looking at the annual price data it looks like the cumulative money, in dollar terms. paid for oil from 2005 to 2008, inclusive (four years), was about equal to what we paid for oil in the previous 13 years (1992 to 2004, inclusive). How could this not have had a detrimental effect on a highly indebted growth addicted world economy?

And where did the money go exactly?

It is the constant draining of the lower income part of the economy that has precipitated this crisis. This was all started nearly 30 years ago by Reaganism/Thatcherism tax cuts for the wealthy. It is this infamous trickle down capitalism that has failed. Today's trickle down socialism with bailouts for the too big to fail will also fail.

What has happened over the last 30 years is that the effective lower income tax rates have been higher than high income tax rates largely because of the Social Security Tax but also because of tax loop holes and investment incentives like Sec. 179 deductions. The Social Security tax is just like the income tax since it goes into the general fund and is used for whatever like wars, more tax cuts and other gimmicks. But the net effect over time is a wealth transfer from the bottom to the top because the S.S. tax stops at about 100K at the moment.

At some point just as in the 1929 crash or in the former Soviet Union where the Central Committee and the Secretary General were de facto the wealthiest people, lower ranks can no longer support the concentration of wealth at the top.

In the American case wages discounted for inflation have been mostly stagnant for decades while jobs have been sent en mass to cheaper labor markets. In addition to job loss and regressive tax structure the lower incomes pay a higher percentage of income for imported oil. This wealth is drained from the economy when the oil is consumed. Wealth is also drained from the economy to pay for wars for oil security while nothing is actually produced for lower incomes levels to use. The wars raise havoc with peoples plans for mariage, work and family life in general.

Furthermore, ever larger amounts are drained by the regressive tax structure to pay ever increaseing interest on the national debt which has ballooned ever higher during the last 30 years. A lot of this money either goes to upper income groups or to foreign lenders who bought the debt.

The result of all this heavy burden on the bottom is increased stress and attempts to cope by taking on more debt. Of course as time goes by the load becomes unbearable and defaults accelerate. As we now know, many of the defaults are in real estate which people who could not afford it bought either out of desperation as house price seemed to increase without stopping or out of speculative greed.

The defaults at the bottom drag in the banks and the wealthy who were oblivious to the developing situation at lower income levels since for the most part they do not move in those circles.

Now wealth is being destroyed big time at the top, but at the bottom things are about the same. Few jobs, low income jobs and ever declining standards of living.

This is the legacy of Reaganism and trickle down capitalism with Peak Oil thrown in as icing on the cake. Trickle down socialism will not work either. While some socialism may help (not too much) it has to be given at the bottom which the powers that be are loath to do. They think that it is wealth redistribution downward, but it is the wealth redistribution upward that is the root of the problem.

You stated the problem very well. Here is the rest of the story:

The Kondratieff cycle draws to a close when the masses are hopelessly in debt and wealth is concentrated at the top. Then the depression wipes out all debt, which is held by the elite. The wealthy cannot collect the debt and the value of their stocks and other assets plunge. Deflation sets in. Many are wiped out. The debtors are free to start over, but the economy is in shambles.

Years of poor returns on capital led to excess speculation: The stock market in 2000, real estate in CA, FL, NV, AZ, oil at $147/BBL, copper at $4, etc. The poor returns and substandard growth are due to a lack of driving force in the form of innovation.

People look around and say that information technology or something else will save us. Most don’t realize that the computer revelation took place in the 1960’s and 1970’s. Those early computers IBM 360,370, and a host of others now long forgotten, were not powerful, but did not need to be because there were no memory and processor applications involving graphics and communications. However, they revolutionized accounting, inventory control, payroll and other back office functions, and put man on the moon!

For all the marvels of personal computers and the internet, we pay a high price in terms of electricity, perhaps the equivalent energy that goes to producing fertilizers. In a real crisis where you could have either personal computers and the internet, which would you choose, assuming an immediate 50% decline in food.

The depression will continue until we come with a revolutionary new technology. Something like the phenomena known as cold fusion, for which we have no conclusive evidence and is considered pseudoscience. I have no opinion on it; I am only mentioning it for illustration.

x, I thought you were supposed to be a troll. :-)

cfm in Gray, ME

You think trolls don't lose their bridges when they can't make the mortgage?

I think a better analysis is non-linear dynamics (chaos theory). As one part of the system gets more stressed other parts of the system become more unstable, therefore a relatively minor event can be biblical in its outcome - I was thinking of the straw that broke the camels back.

Really? Where? Is that a negative proof in that he and Stoneleigh don't link it or more positive in the sense that they are saying these are the reasons why it makes no sense? I take away a different understanding from TAE, though they are not really focused at that level.

I'm entirely convinced this crash is all about ecological limits. I've not figured out how to "prove" it. There is just too much synthesis. My high school calc professors told me I got the right answers, but my proofs were "unconvincing". Grrrrrrrr.

cfm in Gray, ME

The fundamental problem is the credit crunch. This was caused by bankers lending money to people unable to pay it back. They continued to do this because they thought there was no risk -- the loans were insured -- and they bundled the loans and sold them to investors to get yet more money to lend out.

When oil prices rose, many more people became unable to service their loans. The oil price was an accelerant, using westexas's term, not a root cause.

Milton Friedman would say, if something's going wrong, prices should signal it.

The missing price signal in this picture is the cost of insuring the individual and bundled loans. If the loans were getting more risky, the cost of insuring them should have risen. But it didn't. Why?

Books will be written on this.

My 2c worth -- there were three main reasons:

a) BLIND STUPIDITY. Like Milton Friedman above, the people who make the decisions in the big financial and insurance companies put their faith in their computer models. They didn't due due diligence by going out and checking a sampling of Joe the Plumbers to see how they were doing financially, or worse, they knew the facts but discounted them because the models said it was OK.

b) SHEER GREED. The mortgage originators and high street bankers knew for sure what was going on, and chose to continue writing dodgy loans because they were making too much money in commissions and fees. They knew they would be safe if the loans defaulted because the people they sold the loans to were assuming the risk.

c) OUT-AND-OUT FRAUD. The ratings agencies like Standard and Poors were assessing the bundled subprime mortgages and giving them a AAA investment rating. Any damn fool knows that a thousand pieces of crap together make one big pile of crap. But that AAA rating is gold, because it means the big institutions will invest in the securities. Effectively the ratings agencies were counterfeiting securities, just like putting the Rolex name on a cheap watch. They actually admitted afterwards that their ratings were not an indication of how safe the investments were. I can only assume they did this because they earned enormous fees from the process.

Too many variables in play to be very confident, but I think there is a real possibility (>20%) that the all time high in (publicly traded) oil prices will happen to have been the same month we hit the highest crude+condensate production (July 2008). We just can't afford it and don't have the required double barreled assets of time and energy gain from other sources to afford it in the future. "We" being the current social system.

The next paradigm - which takes less energy - will therefore take more time. Therefore, the paradigm that uses the most energy will arrive first. Assuming it can arrive at all, eg if it has enough energy. Nevermind that it might still be DOA.

That means the next paradigm can't replace the current paradigm until it is too late. Until Maine loses the 150K acres of organic dairy. OK, I can see the logic now. Decline really sucks. We get the worst of the worst of each possible level on the step down before we take the step down.

That's a system trap. Better Shiva than guaranteed grey goo. Does the decline of a system somehow require the most destructive path of decline? Linear programmning would tell me that IF that is a parameter, then yes, it could well be one of the solutions. Mathematically. [But only integer solution of a life work.]

cfm in Gray, ME

A total financial system collapse is a distinct possibility.

Basically, this is happening now.

The Western nations' economies have implemented most of the massively tranformational scientific discoveries, such as electricity, chemical fertilizers and petroleum, and do not have anything in the pipeline that can produce the kinds of growth that China is now undergoing by adopting the same technology we implemented decades ago.

Nuclear energy is the reaining underexploited technology. It can only be viewed as a replacement and not a driver.

We failed to recognize this and resorted to economic stimulus in the form of low interest rates and inflation, which caused the current economic crisis.

The next thing to expect is the collapse of the economy (Depression II). Hopefully the government can survive after that. Not a good thing to loose tax revenue when the government is broke.

Business as usual is finished. We now face great social issues. Do we want masses of homeless drifters, or should we give people houses? The government now owns millions of houses. At the same time we have old, energy inefficient housing. What if we tear down some of the obselete houses and give retirees who now rent free use of a government house?

We need to start thinking ahead, and with an entirely different perspective. We have some serious issues staring us in the face.

"Nuclear energy is the remaining underexploited technology."

This is assuming there's nothing more to discover, but few people saw the information age coming either.

There are still massive efficiency improvements to be made in our current economy (e.g. better use of waste heat in industrial processes), not to mention improvements in the second and third world economies we rely on so much as a fundament to our own economy.

I'm not saying there is nothing left to discover. However, there are only four elemental forces of nature (electromagnetic, strong atomic, weak atomic and gravity) and our modern economy is based on our very good understanding and exploitation of these.

Information technology, as marvelous as it is, had little impact on standard of living compared to the basic technologies like electricity, heat engines and fertilizers, without which we'd have no modern conveniences, or food. Our lives today resemble the 1950's, but are nothing like 1900.

As for making better use of industrial waste heat, I did that for a living and do not see it having much impact because they extract every BTU possible. That technology was well developed by the 1930's, and was mostly exploited by the time pinch analysis was developed:

http://en.wikipedia.org/wiki/Pinch_analysis

Combined heat and power for single family residences may be possible, but unlikely, because the typical homeowner can't even change his own HVAC filters and keep air in his tires.

You are correct about developing countries having a high "energy intensity" for manufactured goods. See V. Smil "Energy at the Crossroads" which discusses this in detail.

Combined heat and power for single family residences may be possible, but unlikely,

$30,000 for a 2kw stirling back in 2000. $10,000 last time I checked for a whispergen. Now in 2004 the co-gens were looking to be $5000 a unit - according to press releases. (Hint - they are not)

The cost fact looks like the limiting factor to me. Even a Lister style 6 HP engine and generator was $3000 and you should replace the bearing in the generator/lister and make sure the 800 lbs lister is all cleaned up before operation. Oh, did I mention the lister can't be imported to the US anymore due to the air quality laws?

"Pay it forward." Swadeshi. Swadeshi or [google schumacher buddhist economics] might suggest that those "retirees" only move on to another stage of life where they give back to the community too. A tall order knowing some of the retirees I know. [If not all, will half be enough???]

Rip down those houses, Paul_the_engineer

cfm in Gray, ME

I am a life long Republican and for me to advocate something like "free housing" is a complete change of character. However, these are not ordinary times.

At the time Social Security was devised, many people did not live to retirement age. The average Social Security recipient lived about 18 months. The downside of modern medicine is that the retiree now lives many years, sometimes two or three decades.

Many of these people are capable of contributing to society; however, we do not make it easy for them to do.

Perhaps labor shortages will develop when worker to dependent ratio gets too low.

I am a life long Republican

For their actions, for their claims, or because you 'pheer' the other party label?

If it was for the claims - did they ever deliver?

If for the actions....hows that working out?

Entertain the thought that the present Republican/Democrat support for most people is like some people support "their" sports team. Filter the "and then X party member did Y" like you would filter a sports team. See if it fits. And if Rep/Demo support is mostly like sports team support - then ask yourself if that is government or entertainment that enriches the entertainers and makes you a poorer man.

More like professional wrestling (WWE)-these guys shout and yell at each other on the stage then go out for drinks later-the referee (the law) is looking the other way as the crowd boos and roars. So Obama talks about Wall Street greed and fraud as he watches the SB with Robert Rubin on the couch, the Clintons vacation with the Bushes, on and on it goes.

Now that is an interesting idea, and one I have not seen expressed before - at least not so succinctly. Are you suggesting that our development post-war might conceivably have run along more sustainable and rational lines had the bankers and their globalist allies not held sway over most of the large economies for much of the time ?

I do not understand this at all. Gasoline costed 27 cents a gallon in 1949. I thought all through the 60's we had a price range for gasoline of 20 to 30 cents per gallon. Which means it basically got cheaper, negating the effects of inflation for at least 20 years. In the 70's, depletion in the US caused the oil price to spike, as OPEC started to exert authority, and we stopped using oil like it was water and started to become more conservation oriented. The price thus settled as we throttled our consumption rate into something a bit more sustainable.

To me we are just repeating now what happened in the 70's, but it is now on a global scale and not restricted to a localized crisis. Unless by "financial" you mean the ordinary inexorable increase in productivity and consumption. In which case, everything is financial and we wouldn't have a problem if everyone just stopped consuming.

No commodity in history has ever had a huge price spike, over its historic price, and established a new permanent higher trading range. Not a single one.

Perhaps history has something to teach us. At the time of the US Civil War the blockade against Confederate States effectively stopped cotton exports and the price rose astronomically. The mills in England sought supply from new growing areas, which became possible at the new prices.

By the end of the war the original causes of the war no longer existed. The southern plantation owners, who had been the wealthiest people in the world, had lost their cotton monopoly, as well as their political influence. Slavery was no longer economical. Wealth and power moved to the North where heavy manufacturing was being established.

http://seelouisiana.com/planti.htm

A new beginning is always just around the corner. Starvation was both the cause and result of continuous wars in Europe, such as the French Revolution and Russian Revolution, the blockade of Germany WWI, and there was mass starvation during and following both world wars.

The Haber Bosch process to produce nitrogen could have prevented this by eliminating the hunger. Ironically, it enabled Germany and later all powers to produce explosives.

A new future is always just over the horizon. What we lack is vision and the will to change. Failure to plan ahead and take effective action will produce the same results as in the past.

A question on the graph 1D:

What do the bands "post peak", "peak 2005", "peak 2006/2008" and "rest growing mean"?

I would hazard a guess that they are the rest of the reporting countries that fit into one of those categories. Unfortunately, the categories don't seem completely orthogonal, as "post peak" overlaps "peak 2005".

Our original article (October 2007)

Did Katrina Hide the Real Peak in World Oil Production? and Other Oil Supply Insights

http://www.theoildrum.com/node/3052

contains all the definitions.

The "post peak" and "peak 2005" groups are separate to show that the "peak 2005" group defines the beginning of the bumpy production plateau. I was looking for statistical evidence of Bakhtiari's transition phase T1 (from growth to decline). The groups may have to be re-defined in future.

The 2nd article in this series is (April 2008):

Bumpy Crude Oil Plateau in the Rear View Mirror

http://www.theoildrum.com/node/3793

Speaking as an oil speculator, the 2004 and 2005 hurricanes, of which at least five disrupted oil and gas production in the Gulf of Mexico, were the wake up call for peak oil. From that point on the world realized that there was no spare capacity.

Do not underestimate the impact of demand destruction. It lasted for years in the 1970’s. Some of the shifts were structural and permanent, like fuel oil being phased out of power generation. Cars became more efficient (but of course then came SUV’s).

Asia uses some fuel oil for electricity and industrial heat, and maybe this will be phased out.

It will take a while for the markets to rebalance before we know the new level of demand.

Hello Matt & Gail,

Thanks for the work in this keypost--Kudos. When combined with the work of Nate's net energy cliff and WT's ELM: it doesn't paint a pleasing postPeak picture; the Munch masterpiece, "The Scream" comes to mind. Especially if one considers the 'Fried-mind' of the Friedman economic set [see Friedman quotes by Nate upthread].

How could Milton Friedman possibly come to his conclusions without considering the concept of hunger; the scarcity signal of a body's net energy status and desire to import/ingest nutrient calories? Do substitutes to food shortages magically arise by sheer economic force when now one billion [source: UN FAO] are now getting a daily scarcity signal?

The Friedman global economy sure didn't work at 100 million, 300 million, 500 million, 750 million hungry...maybe it finally kicks into gear at 6.7+ billion starving [sarcasm]?

Instead, we see the opposite of Freidman's economic projections occurring; food donations are shrinking both globally and locally, and I-NPK production is Credit-Crisis curtailed which means global grain reserves will probably shrink even more than the current 9 week supply. Hell, I don't even see a huge full-on ramp to O-NPK recycling and minimal water usage strategies, which should be very robust by now, according to the Freidman econ-theory of scarcity signaling.

IMO, Obama & other leaders are making a huge mistake unless ecological economics [Daly,Pimental,et al] becomes the basis for postPeak planning. Isaac Asimov would be appalled at this lack of Foundation for Optimal Overshoot Decline.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?