Drumbeat: March 29, 2010

Posted by Leanan on March 29, 2010 - 10:27am

Herman Daly: What Is a “Green Economy?”

A green economy is an economy that imitates green plants as far as possible. Plants use scarce terrestrial materials to capture abundant solar energy, and are careful to recycle the materials for reuse. Although humans are not able to photosynthesize, we can imitate the strategy of maximizing use of the sun while economizing on terrestrial minerals, fossil fuels, and ecological services. Ever since the industrial revolution our strategy has been the opposite. Fortunately, as economist Nicholas Georgescu-Roegen noted, we have not yet learned how to mine the sun and use up tomorrow’s solar energy for today’s growth. But we can mine the earth and use up tomorrow’s fossil fuels, minerals, and waste absorption capacities today. We have eagerly done this to grow the economy, but have neglected the fact that the costs of doing so have surpassed the benefits – that is to say, growth has actually become uneconomic.In spite of the fact that green plants have no brains, they have managed to avoid the error of becoming dependent on the less abundant source of available energy. A green economy must do likewise – seek to maximize use of the abundant flow of solar low entropy and economize on the scarce stock of terrestrial low entropy. Specifically, a green economy would invest scarce terrestrial minerals in things like windmills, photovoltaic cells, and plows (or seed drills) – not squander them on armaments, Cadillacs, and manned space stunts. A green economy can be sufficient, sustainable, and even wealthy, but it cannot be a growth-based economy. A green economy must seek to develop qualitatively without growing quantitatively – to get better without getting bigger.

Arctic States Meet to Discuss Fossil Fuel Exploration

Five Arctic states meet Monday in the Canadian city of Chelsea to bolster regional cooperation amid concerns of a military build-up and opposition to the tapping of its rich resources.Representatives from Canada, Denmark, Norway, Russia and the U.S. will participate in the Quebec talks.

How the majors see ‘business as usual’ on oil and climate

The global push for action on climate change has put the long-term predictions of major energy companies in an oddly contingent light. Investors want to know about their long-term assumptions, but it is difficult for anyone to forecast how the wrangling over international climate policy will pan out; not to mention complex debates over peak oil, future price levels, and their interaction with the wider economy.Not everyone is happy with how the oil majors are making their forecasts. FairPensions, a UK campaign currently using investors in BP and Shell to force the companies to pull out of oil sands, argues that the companies are not adequately considering the effects of environmental policies, high oil prices, and changes in demand, as their briefing for investors shows. The economic argument has focused on the assumptions that the companies use for their long-term outlook on oil prices, demand, and the likely effect of climate legislation.

A look at a few of the oil majors’ recent remarks does suggest they very much favour a business-as-usual scenario in their own long-term outlooks, rather than one that foresees either a sharp change in oil pricing or strong action on climate change.

Oil 'will get more expensive' over the next five years

Stock market trading for oil could be impacted upon by peaks and troughs of price volatility for the next five years, it has been suggested.Oil prices will fluctuate as supplies fall short of demand for the commodity, said John Miles, group board director of Arup, part of the Task-force on Peak Oil and Energy Security, of which he is a spokesman.

He asserted there will be "a structural shift" in the pricing of oil - which could impact upon stocks and shares - and the commodity will simply get more expensive.

The collapse of journalism / The journalism of collapse

There is considerable attention paid in the United States to the collapse of journalism -- both in terms of the demise of the business model for corporate commercial news media, and the evermore superficial, shallow, and senseless content that is inadequate for citizens concerned with self-governance. This collapse is part of larger crises in the political and economic spheres, crises rooted in the incompatibility of democracy and capitalism. New journalistic vehicles for storytelling are desperately needed.There has been far less discussion of the need for a journalism of collapse -- the challenge to tell the story of a world facing multiple crises in the realms of social justice and sustainability. This collapse of the basic political and economic systems of the modern world, with dramatic consequences on the human and ecological fronts, demands not only new storytelling vehicles but a new story.

Am I the only one who senses it might be America's turn to go nuts? I don't mean a family squabble, like the Boomer-Hippie-Vietnam uproar that was essentially an adolescent rebellion against bad parenting in the national household. I mean a genuine descent into madness, with the very high probability of persecution, violence, murder, and mayhem -- all more or less sponsored by various authorities and institutions....In the background, of course, is an economy just barely holding together with political baling wire and duct tape. It has very poor prospects for continuing in the way it was designed to run, on cheap oil and revolving debt. The upshot is an economy now destined for permanent contraction, and nobody has a plan for managing that contraction -- which will include awful failures in food production, in disintegrating water systems, electric grids, roadway systems, schools... really anything that requires ongoing public investment. It includes a financial system that cannot come up with capital deployable for productive purpose, or currencies that can be relied on to hold value, or markets that function without interference.

The Sacred Demise of Industrial Civilization

As a historian, Carolyn Baker has a keen eye for current events that are indicators of the collapse we’re seeing all around us. But she’s also a psychologist concerned about how we personally navigate the turbulence and find meaning within it. The author of Sacred Demise: Walking the Spiritual Path of Industrial Civilization’s Collapse, she describes the old story that isn’t working anymore (humans are separate from nature), and the new story we must live by for real sustainability.

Stewart and Lee Udall: "A Nighttime Letter to the Grandchildren"

When Stewart Lee Udall died on March 20th at age 90, we lost a giant of a gentleman and a passionate former public servant. The Arizona native was perhaps the most influential U.S. Secretary of the Interior ever. He served in the Kennedy and Johnson administrations from 1961 to 1969, and played a major role in some of the nation's landmark environmental laws, including the Clean Air Act, the Wilderness Act and the Land and Water Conservation Fund Act. Said former Montana Congressman Pat Williams, “his passion and informed leadership persuaded both Presidents and the Congress to designate four new national parks: Canyon Lands in Utah, North Cascades in Washington State, Redwoods in California, and Guadalupe in Texas. He prompted the nation's first National Seashores, eight of them. He asked for and received the designation of six National Monuments and fifty Wildlife Refuges.” And Stewart knew energy. During the late 1960s and early 1970s, he lunched numerous times with geophysicist M. King Hubbert. Shortly after the turn of the century, Stewart and his wife Lee penned this letter to their grandchildren…and yours.]

The Tree that Changed the World

The author of A Forest Journey: The Role of Wood in the Development of Civilization, begins a series of articles on the world’s first energy crisis: peak wood.

Loans develop for Jubail oil refinery

AL KHOBAR, Saudi Arabia (UPI) -- State oil company Saudi Aramco was awarded a loan from the Islamic Development Bank to join Total in the construction of an oil refinery in Jubail.The Islamic Development Bank in Saudi Arabia granted Saudi Aramco a $120 million loan to build a refinery with French supermajor Total in Jubail on the Saudi coast of the Persian Gulf.

India and Saudi Arabia Deepen Ties

Visits by Indian heads of government to Saudi Arabia are rare. In fact, when Prime Minister Manmohan Singh arrived in Riyadh on Feb. 27 for a three-day visit, it was the first time an Indian premier had been to the kingdom in 28 years. However, this is one bilateral relationship where substance has clearly preceded style. Not only has Saudi Arabia emerged as India's largest supplier of crude oil, the desert kingdom is also looking to increase its commercial ties with a rising India as a way to diversify its economy.

S.Korean firms submit keen bids for Yanbu refinery

KHOBAR, Saudi Arabia (Reuters) - South Korean companies have submitted the most competitive bids for the construction of three big units for the Yanbu refinery state oil giant Saudi Aramco is building with U.S. ConocoPhillips (COP.N). industry sources said on Monday.

Saudi Arabia to spend $170bn on energy projects

Saudi Arabia plans to spend $170bn over the next five years on energy and oil refining projects, $90bn of which is to come directly from Saudi Aramco, while current and future capital investment will add the remaining $80bn of joint refining and marketing projects to the total. These investments are in line with the Kingdom's plans to increase production capacity as well as refining and marketing, in addition to directing an increased proportion of these investments to gas projects.

Pemex Performance Contracts May Fail to Attract

(Bloomberg) -- Petroleos Mexicanos, Latin America’s largest oil producer, may fail to attract companies to participate in new performance-based contracts that aim to stem a five-year slide in output and improve drilling results.

Rail woes cap Russia's northern oil product exports

ST PETERSBURG, Russia (Reuters) - Refined oil product export ports in northwest Russia are unable to use a third of their capacity due to rail bottlenecks and bureaucracy, forcing shippers to channel rising output via the Baltic states.

It’s time the UK had some atomic ambition

The biggest opportunity being missed is nuclear energy. In the West, with the exception of France, the nuclear industry has been stagnating since the 1970s. In India, Russia and especially China, nuclear energy is now undergoing rapid growth. But there is more to this than simply catching up with the East. The basic design of nuclear reactors has not changed much since they were first developed during and after the Second World War. There are many new possibilities waiting to be explored. For example, the ‘travelling wave reactor’, backed by Bill Gates, could turn what is now nuclear waste into fuel. The ‘pebble bed reactor’ is a modular design making deployment flexible and easy to expand. Other new designs could produce hydrogen as feedstock for the chemical industry to produce fertilisers, plastics and transport fuels for cars and aeroplanes. Investment can and must go hand-in-hand with innovation.

Natural gas: Fuel of the future

NEW YORK (CNNMoney.com) -- The world seems awash in natural gas....Forecasting agencies, long known to play it safe before touting new trends, are only predicting a modest increase in gas' share of the world's overall energy mix by 2030.

But some analysts are saying it could be much higher, with big implications for the electricity markets - and coal-fired power plants in particular.

Halliburton Hunts New Bacteria Killer to Protect Shale-Gas Boom

(Bloomberg) -- Halliburton Co. and Schlumberger Ltd., trying to forestall a regulatory crackdown that would cut natural-gas drilling, are developing ways to eliminate the need for chemicals that may taint water supplies near wells.At risk is hydraulic fracturing, or fracking, a process that unlocked gas deposits in shale formations and drove gains in U.S. production of the fuel. Proposed regulations might slow drilling and add $3 billion a year in costs, a government study found. As one solution, energy companies are researching ways to kill bacteria in fracturing fluids without using harmful chemicals called biocides.

Natural Gas Gaining 50% for Goldman as Exxon Bets $28.5 Billion

(Bloomberg) -- Exxon Mobil Corp. is making a $28.5 billion bet on natural gas, this year’s worst-performing energy commodity, just as hedge funds amass their biggest wager on prices falling.

Seismic shock as demand shifts east

As the decision-makers in the world’s energy sector meet at the International Energy Forum in Cancún, Mexico, this week, they represent an industry facing great change.How it reacts to this change is likely to define the landscape of the world’s energy demand and supply for many years to come. With that change may come geopolitical shifts.

First, some consumers in the west – and the politicians that represent them – are starting to view “green” sources of energy in a more favourable light than the fossil fuels that have hitherto largely powered the industrialised world.

Second, and perhaps more importantly, the oil industry – and specifically Opec, the producers’ cartel, is facing a significant shift in demand from west to east.

Oil wealth strains Brazil politics in poll year

A volatile mix of vast new oil wealth and election-year politics is straining relations between Brazil's states and complicating President Luiz Inacio Lula da Silva's efforts to pass a landmark oil reform before the October polls. An amendment passed by Congress' lower house this month that would take special income from Brazil's handful of oil-producing states and distribute it among all 26 states has sparked protests and outrage in the losing regions.

Oil’s ‘Dual Personality’ Prompts OPEC, IEF to Target Volatility

(Bloomberg) -- Oil producers and consumers, trying to avoid a repeat of the $115-a-barrel price swing in 2008, will seek a “broad agreement” on improving market transparency and curbing volatility, according to the International Energy Forum.Excessive volatility “is not good for producers, it is not good for consumers, and it’s killing for investments,” Noe van Hulst, secretary general of the Riyadh-based IEF, said yesterday in an interview in Cancun, Mexico. Producers, consumers and regulators must consider oil’s “dual personality” as both a physical commodity and a financial asset in weighing strategies to help prevent extreme fluctuations in prices, he said.

Oil above $80 as traders look to US jobs data

Oil prices rose above $80 a barrel Monday as the dollar weakened and investors waited for a key U.S. jobs report later this week for clues about the outlook for consumer spending.

Desire Slumps After Falklands Oil Well Finds ‘Poor’ Reservoir

(Bloomberg) -- Desire Petroleum Plc slumped in London after reporting disappointing drilling results from a well near the Falkland Islands, where exploration has provoked a diplomatic row between the U.K. and Argentina.

Company seeks first U.S. oil sands project, in Utah

Salt Lake City - An energy company with government approvals to launch the first significant U.S. oil sands project is trying to raise money to build a plant in eastern Utah that would turn out 2,000 barrels of oil a day.Earth Energy Resources Inc. has a state lease to work a 62-acre pit in Uintah County, where it has demonstrated technology that can extract oil out of sands using a proprietary solvent it calls environmentally friendly.

But first, the Calgary, Alberta-based company says it needs to raise $35 million, and it acknowledged that could be tough because private equity groups turned skittish after the 2008 economic meltdown.

Shell to boost Iraq Majnoon oil output

YAS ISLAND, Abu Dhabi (Reuters) - Iraq's Majnoon oilfield is targeting production of 175,000 barrels of oil equivalent per day in 2012, a senior Royal Dutch Shell (RDSa.L) executive said on Monday.Iraq's largest field is currently pumping at 45,000 boe/d, Shell's Mounir Bouaziz, Vice-President New Business LNG for the Middle East and North Africa, told an industry event.

Sinopec Buys Angola Stake; Expects Oil Refining ‘Challenges’

(Bloomberg) -- China Petroleum & Chemical Corp., Asia’s biggest refiner, announced its first acquisition of a foreign oil field stake and said it faced “challenges” in the oil-processing business as competitors expand capacity.Sinopec, as the Beijing-based company is known, said yesterday it will pay $2.5 billion to buy a stake in an Angolan field from its parent to boost crude oil production. “Refining capacity is being added both inside and outside China,” Sinopec said in a statement as it reported profit more than doubled to 61.8 billion yuan ($9.1 billion) last year.

PetroChina Plans $60 Billion of Overseas Expansion

(Bloomberg) -- PetroChina Co. plans to spend at least $60 billion in the next decade on overseas acquisitions, challenging Exxon Mobil Corp. and BP Plc in the race to control oil and gas fields.“Ten years ago, PetroChina was a state-owned oil company, but now we have a goal of becoming an international, integrated energy company,” Jiang Jiemin, chairman of the world’s largest company by market value, said in a March 25 interview, where he announced the investment plan.

Gazprom ramps up Asia energy trade presence

SINGAPORE (Reuters) - Russia's Gazprom is ramping up its presence in Asia to trade liquefied natural gas, oil and source carbon offsets, as one of the world's biggest energy players seeks to tap the fastest-growing region.

Shell Holds Talks on Iraq Plan to Capture, Sell Gas

(Bloomberg) -- Royal Dutch Shell Plc, which won contracts last year to develop two Iraqi oilfields, is still in talks on a plan to capture and sell natural gas there, the company’s Middle East vice president for new business said.“We are still in discussions and waiting for a new government to be in place,” Mounir Bouaziz said in an interview in Abu Dhabi. Shell could start exporting liquid petroleum gas two years after signing a final agreement, he said today.

Books about oil: Black gold is a rare inspiration

The oil business is full of great stories. From Upton Sinclair’s novel Oil!, which inspired the film There Will be Blood, to Daniel Yergin’s magisterial, sweeping history The Prize, the colour and drama of the search for oil have inspired some outstanding writing.As proof that “black gold” is just as potent an inspiration as it has always been, a crop of books in the past few months has given an equally vivid picture of today’s industry, and a sense of how it might finally come to an end.

The most powerful is Peter Maass’ Crude World: The Violent Twilight of Oil (Allen Lane 2009), a scorching vision of the damage done by oil production. Mr Maass, a writer for the New York Times Magazine, visits the majority of the countries most affected by oil – including Iraq, Saudi Arabia, Nigeria, Russia and Venezuela – and exposes the way it has polluted and corrupted their landscapes, economies and politics.

China’s Drought Raises Coal Prices, Lowers Hydropower

(Bloomberg) -- Benchmark coal prices at Qinhuangdao, China’s largest port handling the fuel, rose for the first time in 10 weeks after a drought in the south cut hydropower generation and raised demand from coal-fired plants.

Colo. gas-coal fight could preview national battle

DENVER - A plan to clean up Colorado's air is pitting two powerful industries — natural gas and coal — against each other in what could be a warm-up for a national fight over how to confront climate change.

For years now, Tom Whipple, husband of our State Senator Mary Margaret Whipple, has written a weekly column in the News-Press on “Peak Oil,” the thesis being: “Wake up — the world’s running out of oil!”Week after week, year after year, Mr. Whipple reminds us of this inconvenient fact, apparently oblivious that we would prefer not to hear it anymore. We would prefer not to believe it.

We can’t afford to fail Bristol as the oil runs out

A week ago at the Oil, Carbon and Opportunity event held in Bristol, a presentation was given which underlined the challenges that a low-carbon, post-Peak Oil Bristol must face. Challenges that have to be tackled now in order that the city will prove itself resilient in a new era without cheap energy.What was surprising was that despite there being many people at the conference of considerable prestige and experience within the sustainability arena, including Ian Hutchcroft of the Energy Saving Trust, Tony Norton from Regen South West, Joshua Thumim from the Centre for Sustainable Energy and Alastair Sawday from the Bristol Green Capital Momentum Group, it was none of the above that gave the presentation referred to.

Instead it was David Bishop, Director of City Development at Bristol City Council.

Robots, space technology run Australia's mining miracle

Automation has long been a part of the mining industry, but advances in satellite, motion-sensor technology and robotics have made the stuff of science fiction a fact of everyday life.Machines which scoop the ore, dump it on a conveyor belt and hose it down are now controlled from the air-conditioned comfort of Rio Tinto's Perth operations centre, 1,500 kilometres (930 miles) away from the arid mine pit.

Russia, UN nuclear agency sign fuel bank deal

VIENNA (AP) -- Russia and the International Atomic Energy Agency have set up the world's first nuclear fuel bank.It will help countries bridge shortages caused by snags in deliveries of low enriched uranium for reactors.

It is meant to encourage countries looking to develop peaceful nuclear programs to depend on outside sources instead of developing uranium enrichment programs.

Siemens Plans U.K. Wind Turbine Factory After Brown Port Pledge

(Bloomberg) -- Siemens AG will spend 80 million pounds ($120 million) to build an offshore wind-turbine factory in the U.K. after Prime Minister Gordon Brown pledged to upgrade the country’s ports.The company is considering sites along the east coast and in the north east of England for the plant that will create around 700 jobs, Siemens said in a statement.

China became top wind power mkt in 2009 - consultant

COPENHAGEN (Reuters) - China became the No. 1 wind turbine market in 2009, installing a record 13.75 gigawatts (GW) of new capacity, and three Chinese suppliers ranked among the Top-10 turbine manufacturers, Danish consultants BTM said."The most significant trend in the market was the booming Chinese wind industry," BTM Consult said in a summary of its annual wind power market review for paying subscribers.

Automakers roll out all-electric vehicles

It's another one of those hectic weeks, and your gas tank is empty, so you find yourself in the long line at Costco gas station -- engine idling -- waiting for your turn.Imagine if you no longer had to sit in that line, wondering why the slowpokes in front of you take so long to fill their tanks.

Welcome to a new era of electric vehicles.

2,487.5 MPG Achieved at 2010 Shell Eco-Marathon Americas

HOUSTON, March 28 -- Extreme mileage was the goal this weekend on the streets of downtown Houston as 42 student teams competed in the 2010 Shell Eco-marathon Americas®, a challenge for students to design, build and test fuel-efficient vehicles that travel the farthest distance using the least amount of energy. More than 400 students were on hand to stretch the boundaries of fuel efficiency and participate in the first-ever street course challenge for the Americas event.

Indonesia's food estate project sparks environment concerns

Jakarta - Indonesia's ambitious plan to turn large swathes of fertile land in the easternmost region of Papua into a food estate has sparked concerns about potential forest destruction and the marginalisation of small farmers.

UN 2010-2012 Emissions Spread Widens to Record After Suspension

(Bloomberg) -- The spread between 2010 United Nations emission offsets and those for delivery in 2012 widened to a record on slower-than-expected issuance and after a regulatory board suspended certification companies.

James Lovelock: Humans are too stupid to prevent climate change

Humans are too stupid to prevent climate change from radically impacting on our lives over the coming decades. This is the stark conclusion of James Lovelock, the globally respected environmental thinker and independent scientist who developed the Gaia theory.

How many wheels can fly off this cart?

You have to feel sorry for NB Power; they seem to always hold the bag. The utility is struggling under a massive debt load that would make most third-world countries blush, and now that its sale to Hydro-Québec has fallen through, it has to dig its own way out of the hole. In 2001, the utility embarked on a $2.2 billion refurbishment of its 1,050 MW Coleson Cove generating station to allow it to burn orimulsion, a bitumen based product that was to be imported from Venezuela; unfortunately, NB Power was unable to secure a supply contract with the Venezuelan government so, ultimately, the plant had to be converted back to oil. Doh! In 2008, its Grand Falls powerhouse was extensively damaged by flooding. More worrisome, its larger, 672MW Mactaquac Dam will need to be decommissioned by 2030, some thirty-seven years ahead of schedule due to an alkali silica reaction in the concrete that was used to build its powerhouse and spillways. The Point Lepreau NGS refurbishment that was to be completed by the fall of 2009 has jumped the rails – now, if you believe the latest forecast, the plant will return to service sometime in 2012; meanwhile, NB Power is spending upwards of a $1,000,000.00 a day on replacement power. Today, there’s word that its 300MW Dalhousie generating station will close in June when its fuel supply contract with Petróleos de Venezuela expires, some fifteen years ahead of its planned retirement.

Source: http://www.cbc.ca/canada/new-brunswick/story/2010/03/28/nb-dalhousie-job...

However, it was this comment that caused me to choke on my coffee:

Source: http://dailygleaner.canadaeast.com/front/article/997360

Ten years!?! I can get more than ten years of service out of a pair of socks.

Please, Lord, let something -- anything -- go right for NB Power.

Cheers,

Paul

And after 10 years if you take them off and wash them you can maybe get another 10 years :-)

A related story about expensive nuke plants, versus currently cheap natural gas:

http://energyandenvironmentblog.dallasnews.com/archives/2010/03/efh-ceo-...

EFH CEO: Cheap natural gas makes it hard to build nukes

Why does anyone need any more electricity at all?

Between 1995 and 2008, electricity demand grew at 1.6% from 3400 Twh to 4200 Twh.

Conservation and energy efficient equipment and lighting to cut that down to zero.

More 'cash for clunkers'.

Instead of plowing money into expensive fuel burners, replace inefficient lights and AC.

Replacing a 3 ton 10 SEER AC unit in Texas with a new

14 SEER unit($900?) will save 2000 kwh per year or 0.8 kw of natural gas plant costing $.8 per kw.

Replacing a million such units would avoid the need for 0.8 GW, costing $640 million dollars and 13 mmcf of natural gas per year costing $585 million dollars over 15 years($3 per mcfh).

So buy the high efficiency AC for $900 per customer or build and fuel the NG plant for $1225 per customer?

The market fails again!

Subsidies and drooling the prospect of screwing customers causes utility companies to choose the less efficient option!

Nukes are even more stupid as they are purely baseload and don't help with variable loads like lighting and AC.

Lovelock is right. Humans are just too stupid.

When you build a lot of energy sipping things, you just move the energy use to some other product. I cut my energy use, beacause I understand the nature of what is going on, and I want to save money. Unless saving money is the driver, people won't save energy.

Yeah people at times don't think beyond the place they want to go to lunch today. Thinking about anything beyond next week, happens only in a soft fuzzy glow of what they are going to be doing, not what everyone else will have happen to them.

But that ties into the fact that it is hard for most people to deal with their own lives and also take on the responsibility of others as well. Most people I talk to, tell me that they can't worry about other people much more than a little bit.

I see positive signs out there, but I also see the bad things piling up. Here is hoping for a more aware populace to other people's needs.

Charles,

BioWebScape designs for a better future.

Perhaps they're just too greedy.

I have quotes for 2.5 and 3 ton off-brand HVAC, 14 SEER. More like $4K installed. $5-$6K for 16-18 SEER name-brand. Add $1K per ton for GSHP wells, more or less.

If you can get 3 tons 14 SEER installed for $900 I'll take 4.

Are those for a home, for central A/C?

If true, it is my opinion that in a way, it is still BAU.

The cheapest in cost, I think, would just to cool the room a person is in.

Perhaps via a single room ductless A/C, or even a US$99 5000BTU window A/C.

I went the window A/C route. We have two window A/Cs. My 1939 home has one in the family room so the kids/family can be cooled when watching TV, and one in the master bedroom (so I can sleep the few nights a year that stay hot over night).

I even measured each A/Cs power draw using a kill-a-watt meter. Each A/C uses 500watts. I usually run just one.

Are those for a home, for central A/C? (If not, then ingore me, as my thoughts would be based on bad assumptions.)

If true, it is my opinion that in a way, it is still BAU.

The cheapest in cost, I think, would just to cool the room a person is in.

Perhaps via a single room ductless A/C, or even a US$99 5000BTU window A/C.

I went the window A/C route. We have two window A/Cs. My 1939 home has one in the family room so the kids/family can be cooled when watching TV, and one in the master bedroom (so I can sleep the few nights a year that stay hot over night).

I even measured each A/Cs power draw using a kill-a-watt meter. Each A/C uses 500watts. I usually run just one.

Here ya go, paleo!

(okay it's only a 13 SEER.)

http://www.grainger.com/Grainger/items/1NXC9?Pid=search

In addition, you need the air handler, the evaporator, condensate pump, electrical controls and cables installed, a plenum, return air, hangers, drain pan, filter slot, thermostat(s), distribution and registers, Without insulation, your A/C is a money hole.

Add to this the licensed installer along with his overhead and profit and the price climbs to around $4500 for a simple system.

Nukes are absolutely neccessary to replace coal - if we are really serious about mitigating climate change. But we need Gen 4 nukes that can reprocess existing nuclear "waste" rather than the same old Gen 3 pigs.

Nukes are absolutely neccessary to replace coal

Lets pick todays hot buttons - Are you in support of North Korea and Iran having nuke power plants?

Yes. It appears that most of the Middle Eastern states plus Egypt are starting the process of building nuclear power plants, and all within the NPT.

At least you are being consistant with your yes.

Now....how about the original poster who was asking for fission?

I'd suggest Mr. Young better start looking a little further forward than next quarter. United Arab Emirates has just signed a contract, after worldwide competitive bids, with Korea to build four new nuclear reactors in the core of petroleum country. No company in the final bid round was headquartered in the USA.

Well, Venezuela is not sufficiently organized to produce orimulsion these days, and can't keep it's own electricity supply operating, so that wasn't a bright idea.

This is just a thought, but Nova Scotia, the next province over, has the huge Sable Island gas field offshore. Did New Brunswick Power ever consider going next door, signing a long term contract for Nova Scotia natural gas, and then building a few gas-fired power plants? It might have been expensive, but not nearly as expensive as this kind of mucking around.

Hi RMG,

A good chunk of Sable Island gas is sold to the United States; not sure if it's under long-term contract, but with these fields in decline, it may not be the best route to go. That said, Emera, Nova Scotia Power's corporate parent, owns and operates a 260 MW combined cycle facility in St. John (see: http://www.emera.com/en/home/ourbusiness/corporatestructure/baysidepower...)

Cheers,

Paul

Paul,

The whole NB power thing looks to me like a textbook case of why government should NOT be in the electricity business. They have bowed to political pressure for decades to "keep rates low" which has meant chronic under investment in the system. It is the equivalent of tenants demanding low rent, and the owner obliges, but at the cost of neglecting any non-cosmetic maintenance - sooner or later, the house will be unliveable, and a major repair job is needed, and a major rent increase to go with it.

Oil from Venezuela - what were they thinking?

NB has dined at the table of too-cheap power, and now the bill has come, and they tried to stick it to Quebec, who could see through the whole thing.

They will have no choice but to put it on their credit card, and stomach the debt payments long with higher power rates. Any parent who ever voted for lower rates can ask themselves how they feel about their kids now having to pay the price.

If there are no utility companies willing to come and and do projects, then it means they are not charging enough for electricity. And keeping those rates low means the taxpayers will pay for it through other means, effectively subsidising those who waste the cheap electricity (same as here in BC!)

Sounds like they should be starting to talk with Danny Williams, I'd rather import electricity from Newfoundland & Labrador than oil from Venezuela, but whatever happens, the bills are going up, that's just the way it has to be...

Hi Paul,

Successive governments have kept electricity rates artificially low to appease the electorate, but it's pushing the utility to the brink and passing on these costs to future ratepayers. The refurbishment of the Point Lepreau nuclear station is turning into another multi-billion dollar fiasco and now we're hearing reports that it may require a second major overhaul in another ten years time. It just continues to go from bad to worse.

Two-thirds of all homes in New Brunswick are electrically heated, so the pain will be intense.

Cheers,

Paul

When you shrink it down to this; "Successive governments have kept electricity rates artificially low to appease the electorate," it sounds just like the philosophy of a drug dealer - give 'em cheap stuff to get them hooked, then you can squeeze them for all they are worth!

BUt, no pain, no gain - the NB'ers will just have to suck it up. Would be interesting to see a comparison of the cost of buying and installing heat pumps for demand reduction, and other conservation measures, compared to fixing that nuke, or doing any new projects.

I just hope they don't come to the Federal government for a bailout on this one.

Too late, Paul. AECL (and that means you and me as taxpayers) are contractually obligated to pay for any cost overruns at Point Lepreau. For its part, NB Power pays for the replacement power. Ya hear that sucking sound? That's one of the wonders of nuclear power -- it has this amazing ability to pull money out of your pocket one way or the other.

I'm guessing electricity rates are 40 to 50 per cent below where they should be; possibly more. If I had electric heat in New Brunswick, you could be damn sure I would be installing a high efficiency ductless heat pump, pronto. As for the future of Point Lepreau, I think they've gone too far down the road to back away now. The billions of dollars they've end up pissing away could have bought a lot of conservation, which makes this all the more tragic.

Cheers,

Paul

Does anyone have any real data on what exactly has caused the schedule delays? The only information I could find was this blurb from the IBEW union whose workers are actually doing much of the work.

http://www.ibew37.com/newsItem.php?NewsID=115

In there, it discusses (paraphrasing) "delays due to necessity of troubleshooting brand new robotic equipment being used in the refurb." however IF that's referring to the vessel re-tubing robots, they have been used for both the two Bruce reactors refurbished so far (first was, agreed, somewhat behind schedule but second one was right on last I heard), and for the re-tubing job in the Korean CANDUs, which, as the IBEW note, is proceeding faster than the NB job. I've also heard, as the only hard news of a reason for a delay, that some small-time local NB sub-contractor had failed to deliver some very critical parts on time, and AECL has been forced to go outside the province to get another company to fabricate the parts, setting their timeline several months behind.

Read more: http://www.oilweek.com/news.asp?ID=20748#ixzz0jiyxLDHC

I also note this bit of news in Oilweek.com: "In October (2008), two huge turbine rotors destined for Point Lepreau toppled into Saint John harbour while being loaded onto a barge. They have been returned to Siemens in the United Kingdom, and a decision on whether they can be used will be made later this month. The new turbines were designed to spin faster, generating an extra $15 million worth of power each year." Should AECL be held to account for the work of NB dockworkers, if they were the cause? ( I should also note that the article also contains a lot of wording about the re-tubing being the cause of the delays, but could just be required politics eg. "we can't afford to be fighting with NB politicians" and see above.

Read more: http://www.oilweek.com/news.asp?ID=20748

This news bit just stinks of local political patronage. (Precision Nuclear was essentially invented from a small local workshop as part of the refurbishment contract.) "FREDERICTON - Precision Nuclear Inc. and its sister company Precision Metal Works Ltd., both owned by Fredericton-area businessman David Rioux, were placed under the receivership of Green Hunt Wedlake Inc. Tuesday.

... As one of only a handful of manufacturers in the world qualified to manufacture class-one nuclear products for CANDU nuclear reactors, Precision Nuclear was once lauded as a New Brunswick success story.

But court documents reveal the company has struggled financially since its inception for numerous of reasons, including last September when Atomic Energy of Canada Ltd. applied to have a receiver appointed when it became clear that Precision Nuclear was in bad shape financially.

The Crown nuclear technology and engineering corporation had awarded a contract to Precision Nuclear to produce parts for the Point Lepreau refurbishment and a second contract to supply end fittings for a nuclear reactor in Wolsong, South Korea.

After much debate last fall among the secured creditors, Justice Peter Glennie ordered that a monitor be named to oversee the operations of the plant until the parts for the Point Lepreau and Wolsong projects could be completed.

But when the Crown corporation backed away from its second contract, the Mactaquac-based manufacturing company announced it would let go its entire staff."

Read more: http://nbbusinessjournal.canadaeast.com/journal/article/576102

I would suggest that, as much as the delays in the project have been due to AECL having been forced by the local politicians to use unqualified local sub-contractors and suppliers, THEN the federal taxpayer should not be put on the hook for the delays caused by the local politicians. Somebody should have informed them that fabricating critical parts for these complex machines is not just something you put out to some politician's wife's brother-in-law because he happens to own a couple of manual lathes.

Hi Len,

According to the CBC, "dismantling the old reactor took 32 weeks longer than expected as remote-controlled tools continually malfunctioned in the radioactive environment", so this would account for seven and a half months of the delay.

Source: http://www.cbc.ca/canada/new-brunswick/story/2010/03/10/nb-aecl-point-le...

Elsewhere, they reported:

Read more: http://www.cbc.ca/canada/new-brunswick/story/2009/04/01/point-lepreau.ht...

This item appeared in today's Telegraph Journal:

Keir hears of more Lepreau delays

See: http://telegraphjournal.canadaeast.com/front/article/999666

It seems rather odd that the Minister of Energy is being told one thing by AECL and something quite different by the plant workers. What should one make of that?

Cheers,

Paul

Thanks for the 32 week figure. I'd seen the issue but had no data on the significance. As far as site worker rumours, I've never yet seen a construction project where the line workers knew much if anything about the significance of any particular issue to the probable final completion date. The workers are always hoping for a project delay, because that means their present employment will be extended. It is project management's job to overcome that with performance metrics, forward planning (and on some projects where I've worked, simply loudly publicly demanding impossibly short schedules with the plan being to achieve a longer ideal schedule).

maybe I had it the wrong way around. The nuclear industry (AECL in this case) gets the province/customers hooked with "low costs" (from Fed gov subsidies), and then once it's too far to turn back, they squeeze the province for all they are worth.

Wonder why AECL hasn't sold any reactors overseas (or here) lately?

In any case, a rate shock of 100% increases is pretty much what is required to achieve significant, permanent changes.

From NB power's website "NB Power's customers enjoy electricity rates that are among the lowest in Atlantic Canada and north-eastern North America.". They pay about $0.095/kWh, which is very cheap. Now that they have had their "enjoyment", it's time to pay for the party.

They should take the chance to institute a thorough overhaul of their rate structure - particularly the use of off peak and tiered rates.

Billions eh? Lets see, assume $2bn wasted, and at 757,000 people, or, say 300,000 homes, that would have been $6.5k per house, enough to install two mini ductless systems (using local contractors) and still have about $1.5k per house left over. if you save 3kW per house, that is 900MW, which is just about the size of a nuke plant!

Well, I'm not sure of your references. eg. the same reactors are used in Ontario to supply most of the electricity for a much larger market, and Bruce Power (a private corporation owned largely by Transcanada Pipelines, a Nat. Gas transport company) is itself paying for the exact same work being done on several of the eight reactors it operates. Korea thinks the work is justified. China has just proposed purchasing additional CANDU for use in disposing of waste fuel from its lightwater reactors.

Hi Len,

Technically speaking, Gentilly 2 and Point Lepreau are the only CANDU 6 class reactors operating in Canada.

Cheers,

Paul

Ah, most of the presently operating CANDU's are essentially identical. The 6 in CANDU 6 simply refers to the 6 MW per fuel channel design of the units, and I'd expect that only the old Pickering 535 MW class units built in the 1970's and early 1980's are likely to be significantly different. The Bruce and Darlington units (740 MW) are approximately the same size as Lepreau though I can't find any specific numeric designation for them, and the Wolsong and Quinshan (? 740 MW) units are explicitly refered to as CANDU 6's. Any size differences among them are most likely due to number of fuel channels in the calandria, not the rating of each channel. Wonsong 1 will be done its retubing refurbishment sooner than Lepreau, on time and on budget BTW.

Hi Len,

AECL is replacing all of the reactor calandria tubes, pressure tubes and "at-risk" portions of the feeder supply pipes; this has never been attempted before. This press release speaks to how Point Lepreau is breaking new ground:

[My emphasis.]

Source: http://poweringthefuture.nbpower.com/en/News/ProgressReport/July2709EN.pdf

Cheers,

Paul

Hi Paul,

Point Lepreau has a rated capacity of 683 MW (and, potentially, 698 MW post refurbishment), so you might have even more spare change left over than previously thought.

Some of the "new capacity" I bring online by way of our lighting retrofits costs as little as $700.00 per kW. For what NB Power will pay for replacement power alone, we could theoretically go toe-to-toe with Lepreau.

Cheers,

Paul

If you can do any conservation for under $1000/kW, it's a great bargain. BC Hydro had estimated that, on average, money invested in conservation saved 3x more power than same $ in new generation. Problem is, conservation requires participation of many customers and is hard (not impossible) for a company to do as a business ( I work in water conservation, but used to do energy programs too when I managed all the utilities at a ski resort)

For a company, building a generation project is "easier", you only have to deal with one customer instead trying to convince thousands to buy/take your service.

For my water conservation projects, the water authority needs to make them free to the recipients to get meaningful participation. If they did that with heat pumps and the like in NB, they'd get knocked over in the rush.

Sounds like what NB power should have done, was sell off Pt Lepeau, without reserve, as is, where is, and if no one wanted it, decommission it. That would have been a much less risky approach.

Whenever politicians get involved, you know they are going to steer things in the exact opposite direction of where the market and common sense would move them...

Hi Paul,

Actually, now that the Small Business Lighting Solutions programme has expanded province-wide and is being more heavily promoted, the volume of requests has shot up dramatically. Given that Nova Scotia Power pays 80 per cent of cost of the retrofit and the customer can finance the balance over 24-months, interest-free, very few customers say 'no'. There is no upfront payment, no application forms to fill out (the customer signs a two page agreement should they wish to go forward) and we take care of the rest, e.g., pull the permits, get the materials and electricians on-site, complete the retrofit, clean-up after ourselves, and haul off the old lamps, ballasts, fixtures, cardboard, etc. to the recyclers. And if a lamp or ballast should fail within the next two years, we replace it at no charge.

This programme generates net positive cash flow from day one. Typically, for ever dollar the customer repays NSP as part of their 20 per cent co-share, they receive two, three or four dollars in energy savings. And after two years, every single dime saved is all theirs to use as they so wish.

The real beauty of all this is that everyone comes out a winner. The customer benefits from lower utility and maintenance costs, improved cash flow and improvements in the quality of lighting, which can generate secondary benefits such as increased sales or increased employee productivity and workplace safety. Ratepayers likewise benefit because conservation measures such as these are the lowest cost option to meet new demand (by far). And all of us benefit whenever we burn less coal and thus pump less of the nasty stuff into our environment. This is why I love my job.

Cheers,

Paul

Paul,

I take it that this program is your gig - well done. I operate similar ones in water conservation.

Now, a question on your favourite topic - heat pumps.

I have a a friend with an 800sq ft house, who has baseboard heat and is looking for alternatives. Naturally I recommended a heat pump. they are right on the water, lots of moist air, perfect conditions, I'd say. I like the LG Art Cool (SEER 13), but what are your favourites - I know you have mentioned Fujitsu before, anything else you'd suggest?

Thx,

Paul

Thanks, Paul. Congratulations to you on your efforts as well.

The Fujitsu 12RLS (http://www.fujitsugeneral.com/wallmounted9-12RLS.htm) with a HSPF of 12.0 and a SEER rating of 25.0 is the pick of the litter. In effect, for every kWh consumed, you receive, on average, 3.5 kWh of heat in return; mostly likely more in your milder climate. I also like the Sanyo 12KHS71 (http://us.sanyo.com/HVAC-Single-Split-Systems-Wall-Mounted-Heat-Pumps/Wa...). The HSPF and SEER ratings in this case are 9.3 and 17.0 respectively.

Assuming the bulk of the space heating demand falls within the more expensive second tier (i.e., 8.78-cents/kWh), the Fujitsu drops the cost of electric heat to just under 2.5-cents per kWh and for the Sanyo, it's 3.2-cents.

Cheers,

Paul

That's one of the wonders of nuclear power -- it has this amazing ability to pull money out of your pocket one way or the other.

So much for "too cheap to meter".

That's what I find interesting about fission electrial power - all kinds of costs overruns, plants that don't open after being built due to design flaws, or even the "this country shouldn't have reactors" answer and yet people keep claiming that THIS time nukes will be different.

Given man's demonstrated inhumanity to man - I don't see how fission power is at all 'safe'.

Eric,

I think the biggest problem with nuclear is that that various companies doing it have never really been able to standardise their designs - each new plant seems to be custom designed, with the inevitable results. Compare a new GE or Siemens gas turbine, and they'll virtually give you the drawings for the foundations, buildings, etc.

Doesn;t help that on this continent very few have been built for decades, so there are equally few experienced people, outside the military (which standardised their reactors some time ago).

What really grates me about nukes is that, somehow, government is always involved with incentives/subsisidies or loan guarantees, meaning the taxpayer, not the investors, are always on the hook.

BUt that seems to be the way of all governments these days, they just can't keep their fingers out of these pies...

each new plant seems to be custom designed, with the inevitable results.

1) I thought that was because each was a test of a design.

2) Note how big they are. A whole economy of scale argument.

government is always involved with incentives/subsisidies or loan guarantees,

Government involvement with business is what the winners in business want. Having a large plant means more control.

How much of the implemented model was/is about control?

Perhaps what grates you is you have a pre-concieved notion of the model things are run under VS the model things are actually under.

And you did not address the 'Man's inhumanty to Man'. If "terrorist" attack a wind machine? A PV array? a coal/gas plant? A dam? Now - what if they attack a fission reactor?

Are fission reactors going to be off-limits to bombing in State-VS-State "terror" (aka a war)?

What about the fact man's creations do fail. What is the failure mode of the above list?

Prototypes always cost more than expected, big prototypes are even worse.

The problem with nuclear power isn't that it is nuclear power, it is simply that small, standard nuclear hasn't taken off outside of military applications. Every plant is a prototype, bigger than the last in a vain attempt to recoup costs with the scale of the individual plant rather than going for the scale of the aggregate and mass producing plants that are "just big enough".

And what about terrorists? Nuclear power plants are a crappy target for terrorists, shopping malls are much more appealing.

As military targets go, the fallout from a bombed nuclear power plant is likely to be less (and less damaging) than that from an ammo dump or fuel depot.

Yeah, yeah, I know "But Chernobyl!"

Chernobyl was an abomination of an early design reactor, handled badly on top of that. It was the worst that can happen. Chemical accidents kill more people every year than all nuclear accidents, ever.

"they just can't keep their fingers out of these pies..."

??

You've got it completely backwards.

Those pies would NEVER have been baked without Federal Guarantees.. and it seems the economics for Nuclear are only getting worse.

Russian Roulette is what this game is, financially and physically.

I love it when the "enviro" lawyers cause most of the delays and cost over-runs for nuclear, then moan and complain about the cost over-runs. I know, Lepreau appears at now to be being delayed due to political patronage and local incompetence, not environmental legalities. But certainly the 1990's Pickering mess was TOTALLY enviro / lawyer caused. The plant operator, Ont. Hydro, wished to do just a few minor repairs inside the containment, for which they planned a 3 month shutdown. The job was so minor they didn't even need to remove the fuel from the reactor. They planned and scheduled, prepared a $300 million budget, let out and signed necessary contracts, organized the supplies, then got hit with a lawsuit from an enviro. activist group demanding a complete environmental assessment with public hearings etc. on the work. At that point, the Federal Government decided to do a takeover of regulation of the nuclear industry in Canada, though to then such regulation had always been a provincial jurisdiction and the Feds had no qualified people, support staff or even offices. Took over a year to get the first hearing scheduled, and the lawyers were then able to delay for another two years arguing nonsense. After three years of this, with the reactor shut down, the final decision was "ok, no problem, go ahead", which Ont. Hydro then proceeded to do and six months later the plant was up and running again.

BUT during the three year shutdown, Ont. Hydro has to purchase $3.1 billion in replacement power from coal generating plants in the USA. So the planned $300 million repair would up costing $500 million ( additional was trying to keep qualified contractors and employees available during the hearings, mostly) + $3.1 billion in replacement power.

And what do the enviro nuts now say? Look at how poorly run and usless that reactor is, a $3.3 billion cost overrun on a $300 million job. (To top it off, they got half the executive of the company fired.)

All stupid politics. Doesn't happen in China, which is why AECL can build reactors at Quinshan on-time, on budget and at half the cost of here.

Yeah, sorry that Nature's interests have to be expressed through human bureaucracy. Inconvenient, isn't it? It hampers windpower and the sale of Alchohol and Cigarettes, too. Even Toy manufacturers have to show that they are creating safe products if they want to make a profit from the public. Of course, it gets harder for any industry that has regularly shown themselves to be vulnerable to secrecy and obstinance over these same safety issues.

Hard to win back that trust.. but at least it's easy to blame the environmentalists (messenger) for it all!

How, exactly, does blocking nuclear power plants help nature, especially in North America?

Neither Canada nor the US has, to my knowledge, had a systemic lack of generating capacity in the past 40 years, and until the last 10 every kW of that power that didn't come from nuclear power plants that weren't built came from coal, hydro, oil, or natural gas.

Admittedly, the ecological impact of hydro-electric is local, but it is still a dramatic impact.

More recently a small percentage has come from solar and wind, which is good, but not enough to keep up with increases in demand.

Yes, tapping into fission power is unnatural, but to object on those grounds is a religious position.

I didn't say it's 'unnatural' at all. I said it has to be regulated, just like Lead Paint on Toys, Meat Processing and WindTurbine Birdstrikes, but we're talking about a complex and leak-prone technology with a history of obfuscation and bribing the NRC.. those regulations and delays are pretty understandable with the dangers of the materials involved, and the historically relevant behavior of (some, but enough) of the Nuclear power industry.

Yes, it has gone haywire in many circumstances. And that Tango has been affected by BOTH sides.

Your 'Religion' (ie, 'Irrational') and Len, with his 'Eco Nuts' .. I'm not calling you names, am I? I've provided concrete reasons for everything I've put forth.

Good stab at invalidating my post, but it actually weakens your own position more.

And yet, you didn't even attempt to invalidate my point, and I didn't call you religious, did I?

My point is not only valid, it is uncontested.

Edit:

To be more concise: what has all the unbuilt nuclear been being replaced with that has a lower ecological impact than nuclear?

I'm not biting.

The point is that environmental regs are a societal necessity, and that this process, like anything involving big business and energy policy is going to be a bureaucratic hassle.. but that doesn't make it 'Environmentalists' Fault. 'Clean Nuclear' is about as cute a twist as 'Clean Coal'. Radioactive waste and construction quality will not be left to the industry to self-regulate. They are unwilling and unable to do a satisfactory job.

It's not a matter of what it's being replaced with. Each source, be it a renewable, nuclear or a burned fuel needs to be answerable to the public about any wastes and effluents and impacts that their industry is likely to produce.

The reactor in question had already fully answered to the public for all its impacts over a decade prior, before it was built. Making a minor repair inside the containment had absolutely zero possibility of causing an environmental impact IMHO, and definitely not one which might have been detected by a bunch of lawyers laying about hearing rooms in Ottawa for three years talking to swivel swervants who'd never even hear of a nuclear reactor before being patronage appointed to the brand new federal nuclear regulatory agency. The ENTIRE fiasco was just a political move by the federal Liberal government trying to embarrass the provincial conservative government, and the environmentalist were simply exploited by the politicians for the purpose. Dummies. What I don't get is that it worked. Voters don't get any of the information they need at election times.

And BTW, the present federal conservative are very likely now up to a similar game regarding "privatization of AECL". It wouldn't surprise me one bit to discover that the fed conservatives are / are planning to invest significant personal money into AECL after they do everything possible to drive its market value down to as near zero as possible, fully expecting its market value to rebound significantly once privatized. (I'd be interested to know how much individual members of the provincial Harris conservatives had on the line when ontario hydro was driven into the ground then privatized. Comparable reactors in the USA are being bought up at very good prices because they can generate huge cash flows long after they are paid off. Dummie ontario taxpayers held onto the assets only for the initial amortization period, then gave them away to "privatization" at huge losses.)

Voters are dumb sometines. Wish there was a way to control that crap.

China.. yes, exactly. They seem to be raising the safety-bar, but it's starting pretty far down.. products can be cheap when life is cheap.

Leaks reported at China mine days before flood

http://www.google.com/hostednews/ap/article/ALeqM5jtv5g3SogRCpX-mQE8lqlq...

"The disaster is a setback to recent, significant improvements in the dire safety record of China's mining industry, the world's deadliest, claiming thousands of lives each year. Shanxi province is China's top coal-producing region."

What, exactly, do you think is the relevance of coal mining's abysmal safety record, both here and in China, to nuclear power here?

Regarding the concept that wasting $3.1 billion of Ontario ratepayer's money on importing coal-generated electricity from stations in the US upwind of Ontario, so some ambulance chasers can get paid high fees to organize an absolutely pointless "environmental assessment public hearings" for a minor repair inside the containment of an existing reactor with an unblemished 10 to 15 year safe operating record is a GOOD thing, all I can say is to quote James Lovelock.

Hi Len,

This is a very damning statement. Can you supply us with evidence to support these claims?

Cheers,

Paul

See my earlier post, re: Precision Nuclear , or dropping the turbine generators in the local harbour.

Hi Len,

As I understand it, the mishap with the generators did not result in any slippage in the schedule as this work was being carried out at the same time the tubes were being removed from the reactor core and, presumably, if KC Irving was at fault, they or their insurance company would be held liable for any additional costs associated with this accident. As for Precision Nuclear, is there anything to suggest the company's financial problems have resulted in delays or cost overruns?

Cheers,

Paul

All I can say is I watched closely and listened carefully throughout the Darlington repair fiasco here and NEVER ONCE heard a single word of the real reasons for the delays. Not until after the >year-long inquiry report was published did I discover the real events (by piecing them together myself logically using the raw information contained. The report actually levelled a bunch of criticisms at Hydro's management for not having eg. detailed enough PERT and Gannet charts etc. Stupid, I've worked construction long enough to know that those tools are ONLY for people involved who don't have a clue what's really going on). You're very likely being fed garbage from all available sources.

Hi Len,

I'm putting you on the spot because if you make a claim like this -- and it's a bold one -- then it's only fair that you offer evidence to support it. If there's anything you can show me that suggests Precision Nuclear's financial difficulties have hindered this project in any material way, you will have my sincere thanks. If not, you should retract it.

Cheers,

Paul

I have seen what you're asking for, a news item from about a year ago. I'll try to turn it up again. Understand though that there's no-one on the inside with any incentive to lay blame on the politicians. All private businesses are dependent on them for something, from AECL hoping to sell another unit, to the sub-contractors all variously dependent.

http://telegraphjournal.canadaeast.com/search/article/542766

[QUOTE]The parts are only needed for the rebuilding part of the project which comes in the later stages of the project. As long as the parts are delivered soon, there will be no impact on the refurbishment schedule, said Coffin.

"They will be delivered to our facility in Saint John in plenty of time before they're required to be inserted in the rebuild phase," he said.

But when Precision Nuclear began having problems last year, there was a concern about delivery, which prompted AECL to demand action.

"They're very key components to the overall operation of the reactor," Coffin said. "If we didn't have the end fittings delivered on time for the insertion, then the whole project would be in jeopardy.

"(Precision Nuclear was) way beyond their contract committal time. AECL stepped in back in June and started to supply additional resources and funding in order for them to be able to start meeting their production quotas. The original delivery date was back in May 2008.

....

"The (Precision Nuclear) employees involved in fabricating these end fittings were starting to demonstrate excellent quality work by then," he said. "We had an indication they could do this, but we needed the right measures put in place to ensure that they could maintain a consistent flow of production."[/QUOTE]

My son works/(ed) as manager of QA at some midsized precision machining companies here in Toronto and I know how these contracts go. The fact that this company was loosing money on this contract means that their production was being rejected as out of spec. by the customer. At that point, the parts are scrapped and the job starts over, on a revised negotiated delivery schedule, all costs to that point absorbed by the shop and with a PO'd customer who's going to need some very strong salesmanship to place any other order. If the work is any significant part of the shops order book, they'll go bankrupt as input costs are a very large part of the selling price of a good shop. Hasn't happened to him but they must always keep a very diversified order book, a technical advantage which no other shop in the world can offer (eg. they had that on some extremely precise injection moulding parts), or risk the business. For them, all the ISO designations are just a place to start. And no, they'd have had no interest in this contract. They get as much work for the nuclear industry as they dare take already.

If this company was not holding up the project, it was only because some other process was doing so, eg. they're just lucky, (or the fact is being hidden).

HOWEVER, as I am unable to produce that documentation I claimed, I formally withdraw the charge that local contractors and politicians were responsible for the delays as you request. We'll likely never know.

Hi Len,

I appreciate this; thank you. I wasn't trying to be an ass, just wanted to be fair to trades people working on this project.

From what I gather, Precision Nuclear delivered the last batch of the end fittings to Point Lepreau on or about January 30th, 2009, and at that point AECL was still in the process of removing the old ones. The removal of the pressure and calandria tubes that followed wrapped up in July, 2009 and installation of the replacement calandria tubes is not expected to be completed until late April, 2010, barring any further delays. Thus, these end fittings have been sitting at the job site for over a year now and it will be presumably sometime yet before they will be required.

Cheers,

Paul

Postponing Peak Oil – with Fatih Birol, Chief Economist of the IEA

This is a 3 minute 35 second video. There seems to be a certain urgency in Birol's voice.

Note: Google news dated this video (8 hours ago) but it could have been published on some other blog earlier. If this has been posted here before and I missed it, I apologize. The reason I am saying this is that I cannot imagine how Leanan otherwise missed it in her links up top.

Ron P.

I think that speech is actually from last summer. If not, it's very similar to one he gave then.

Don't miss the fantastic interview with Stephen Fry on the same site:

http://bigthink.com/ideas/17864

I often rant about the importance of logic. Fry understands it. I found nothing in Fry's interview I could disagree with.

He's one of my favorite comedians and people. His interview out shines Fatih Birol IMO.

Gulf Stream 'is not slowing down'

There was a post about a similar story on Andy Revkin's Dot Earth blog last week. Here's what I wrote in reply:

The story from the BBC adds a comment about the UK RAPID Program, which utilizes an array of current meters strung across the Atlantic Ocean on a line at 25N. The distances involved are quite large and the number of instruments is limited, thus one might think the findings from this effort might be prone to errors. The net AMOC is calculated as the difference between two large numbers, each of which has error bounds, thus the resulting data has even larger error bounds, IMHO. I don't think it's wise to bet the planet's future on these data, although there is little else available...

E. Swanson

Re: Colo. gas-coal fight could preview national battle

During a committee hearing last week, one of the senior Republican members told the coal supporters, "If you think we're writing a bad plan, think about what you're likely to get if we don't fix the problem and the federal EPA writes its own plan."

Anybody know what's causing oil to jump today?

edit - Well, I mean, besides the obvious - "We've peaked!" ;-)

I think it's just general optimism on the economy. CNBC were so giddy this morning they could barely contain themselves. Consumer spending is up! Income is flat, and saving down, but who cares, as long as people are spending.

But this ship can't sink!

Titanic in five seconds:

http://www.youtube.com/watch?v=n5MRpELUZ18

Stocks, Commodities Gain as Yen, Dollar Weaken on Economy

Outright expansion coming apparently...

I received an e-mail from Rembrandt Koppelaar after sending him some remarks regarding his 'oilwatch monthly'.

He thinks oilprices are about 80 dollar because that is what OPEC state budget wants. He states that, because there is no clear information available, he has no reason to doubt his published spare capacity. He might be wrong with both statements.

there is undoubtedly some spare capacity and as we all know it does not take much of a supply/demand imbalance to cause wild swings in fossil fuels prices.

Rembrandt mentions more than 'some spare capacity' in 'oilwatch monthly', IIRC at least 4 mbd. Maybe if OPEC didn't cheat on their quota they would have 4 mbd or more.

As I have outlined several times, the production/export response from 2002 to 2005, as US annual oil prices rose from $26 to $57, was dramatically different from the production/export response from 2005 to 2008, as US annual oil prices rose from $57 to $100. Annual US spot prices:

http://tonto.eia.doe.gov/dnav/pet/hist_chart/RWTCa.jpg

Saudi Arabia was perfectly content to (net) export 9.1 mbpd in 2005, with an annual oil price of $57, but they have been unwilling to (net) export 9.1 mbpd from 2006 to (so far) in 2010, with all post-2005 annual oil prices so far exceeding the $57 that we saw in 2005?

And why did the Saudis say in early 2004 that they supported the $22-$28 OPEC oil price band--and then take concrete action to bring the price down, as they significantly increased their net exports in 2004 and 2005--but then in early 2006, why did they claim that they had trouble finding buyers, a pattern that has continued as annual oil prices in all subsequent years have so far exceeded the $57 that we saw in 2005? To put it in the simplest terms, why did the Saudis increase net exports in response to rising oil prices from 2002 to 2005, but cut net exports in response to rising oil prices from 2005 to 2008?

I guess we have a new economic theory, high prices mean a lack of demand. I suppose that when and if oil prices cross the $200 mark, and Saudi net oil exports fall below 5 mbpd, people will be talking about weak demand for $200 oil and they will be talking about several million barrels of excess Saudi capacity.

westexas, I mentioned this, including the net-export story. I wrote him that if what he thinks is true it's a coincidence that their state budget now wants more dollars than a few years ago.

The average annual oil price to date for 2010 exceeds all prior annual oil prices, except for 2008, when we hit $100. Yet Saudi Arabia and OPEC are now content to keep millions of barrels of oil per day off the market--when they were delighted to add millions of barrels per day of oil to the market as oil prices rose from $26 in 2002 to $57 in 2005. I have an alternative explanation. I think that we are transitioning from voluntary + involuntary reductions in net exports last year to mostly involuntary reductions in net exports this year.

Westexas, I'm sure Rembrandt have thought on this scenario also, since he is writer of the book 'de permanente oliecrisis'. For some reason (mentioned above) he seems to stick to his believing of considerable amount of spare capacity at the moment. Maybe this summer allready it will become clear what cards OPEC has. Your scenario is logical and I would be surprised if it appears to be wrong.

Because they didn't want to cause demand destruction due to a temporary price spike. As sellers of a commodity they want to lock in their profit. They can profit from a price spice merely by leverage rather than by raising prices too much.

Yes, the Saudis are 'hording' oil as it is their only resource.

By contrast, the Russians began producing like mad during 2005-2008--which probably makes better sense for your viewpoint.

Does this means Russia has a huge reserve of oil left while KSA is running out?

Do you really want an answer to that?

Regarding Saudi Arabia, I will just quote myself:

Regarding Russia, to quote you:

Russian net oil exports (mbpd, EIA) and year over year rate of change:

2005: 6.73 (+3.2%/year)

2006: 6.84 (+1.6%/year)

2007: 7.02 (+2.6%/year)

2008: 6.87 (-2.2%/year)

Net rate of change from 2005 to 2008: +0.7%/year.

As I have occasionally noted, the (2005) top five net oil exporters--Saudi Arabia, Russia, Norway, Iran and the UAE--collectively increased their net exports from 2002 to 2005, but they have shown declining net oil exports, relative to their 2005 rate, in subsequent years.

I don't believe the Saudi's increased net exports in 2005. They just made it up. We are supposed to believe that every single drop of this extra oil was sent to countries where the IEA couldn't track it. Plus they even further reduced the flow of oil to IEA members so that they could also send some of that to anyone but the west.

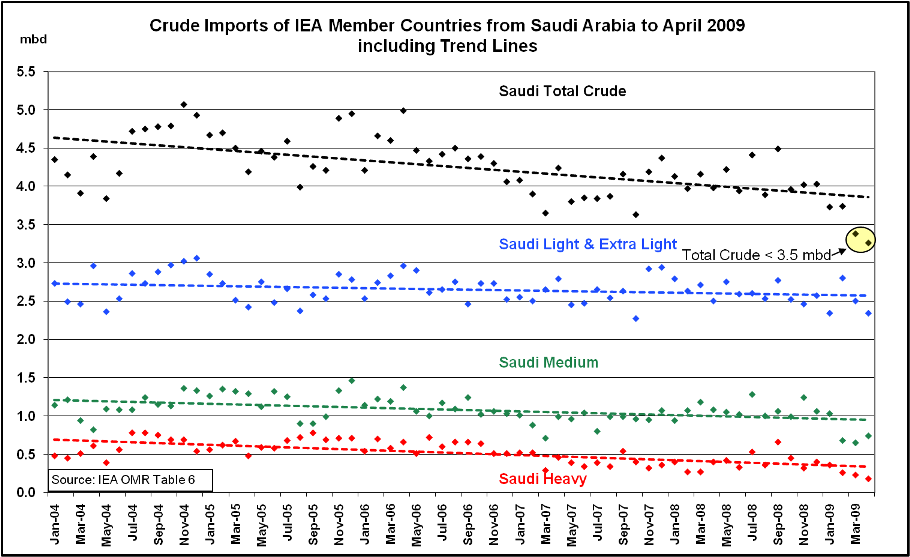

IEA data clearly shows that Saudi Light Sweet exports to the OECD peaked in 2002 and all grades combined in 2003. Imports in general from all oil exporters combined to the OECD peaked in 2005 but the Saudi's couldn't even keep pace with that.

KSA did manage to slightly increase exports of medium and heavy grade oil in 2005 and that was their peak year for exports of medium and heavy grade oil to OECD countries. But these slight increases could not make up for the decline in light. All data from IEA OMR Tables 6 and 8.

Chart by ace, http://www.theoildrum.com/node/5576/520854

Latest data from IEA OMR Tables (March 2010, pdf):

Dec 2009: 3.31 (2.43 + 0.72 + 0.16) mb/d (Dec 2008: 4.03 mb/d)

Undertow, Saudi Arabia does not publish either production data or export data. As the OPEC Monthly Oil Market Report states, all production data are "according to secondary sources". They don't even publish export data. So if the data is just made up then those secondary sources made it up. They don't name their secondary sources but there are several countries that supply that data... for a very high price. They count tankers and monitor all major nations imports, compile the data and sell it for about $30,000 a copy. At least that was the price a few years ago. It may have gone up since then.

OPEC's Monthly Oil Market Report gives production data from their "secondary sources" on page 34 of this report. Though they give export data on about every other nation in the world, they give no OPEC export data whatsoever in this report.

Ron P.

Yes, thanks Ron. I did think of pointing out the curious "secondary sources" issue but you've explained it far better than I would have done.

Also the contango is shrinking. Shouldn't we be seeing all that floating storage getting dumped onto the market?

Ok, so income is not rising, people are not saving as much but 'spending' is up. Mmmmm, let me see! Could it be that:

a) people are hitting the credit cards or

b) people are drawing down savings or

c) government statistics like this are based on nothing other than 'sentiment'

Tell me when sales taxes start to rise and I might believe spending is starting to rise.

The last time I heard, gasoline was part of the economy. IMO, a large part of any increase in 'consumer spending' is that gas is going up. Big deal!

Craig

Actually the reason put forth by the media as to why prices rose today has a kernel of truth to it - it does have to do with increased demand. More specifically, gasoline in parts of the US has picked up nicely, as well as overall oil demand. Worldwide, oil demand may be running about 2 million bpd over the comparable month last year.

Memmel might call this a reflexive bounce back from temporarily depressed. Call it what you will, the increase in demand is now clear. Well at least it’s been clear since last Wednesday, when I posted that the EIA made a major correction showing the oil product inventories were 7 million barrels less than previously thought.

I know there are many here that believe we are in ‘deflationary’ times, and that not only demand for oil can not improve, but prices will never again reach the levels seen. As most also know, I completely disagree with those conclusions - except to the extent that we are in a new era of deflationary economic circumstances caused by Peak Oil, but the end result will be ever energy higher prices and eventual oil product shortages as the ‘free‘ market fails.

But for now the simple answer is - gasoline and diesel supplies are not keeping up with demand. Refiners are already pushing back schedule maintenance:

http://www.reuters.com/article/companyNews/idUSN296285120100329

I know, I have said this before. We now have an oil-based currency. If you want to know the value of the dollar, check out the price of oil. High oil = low dollar.

The only reason anyone says the greenback is rising is because the Euro is doing so much worse. For now.