Drumbeat: November 5, 2010

Posted by Leanan on November 5, 2010 - 10:38am

U.S. horizontal natgas rig count hits record high

NEW YORK (Reuters) - The number of horizontal rigs drilling for oil and natural gas in the United States rose by 24 to a record high of 943 this week, oil services firm Baker Hughes said on Friday.

Energy policy uncertainty seen as top oil and gas sector risk

Advisory firm Ernst & Young's latest ‘Business Risk 2010' report showed that uncertain energy policy had replaced access to reserves as the top risk facing the oil and gas around the world."Peak oil long defined the major concern of the industry, however, prolonged uncertainty in the direction of energy policy, dominated by the vague outcome of the Copenhagen climate conference and the inability of the US to adopt a clear energy policy, are now the dominant risks," said Ernst & Young oil and gas sector leader James Newlands.

Nevertheless, the study noted that ensuring sufficient access to oil and gas reserves at a reasonable cost, which was considered the top risk in last year's report, would remain a significant challenge.

Pakistan still likes Iran's gas prospects

TEHRAN, Nov. 5 (UPI) -- Islamabad has no intentions of abandoning a trilateral natural gas pipeline from Iran's South Pars gas field, a spokesman for Pakistan's foreign ministry said.Islamabad is struggling to stave off a looming energy crisis by courting its Asian partners for more natural gas deliveries.

State offers advice on avoiding winter utility disconnections

Augusta — The Maine Public Utilities Commission wants Maine consumers to know that the lights will stay on for those who make an honest effort to pay their electricity and gas bills. Maine’s winter electricity and gas disconnection rules begin Nov. 15. During the six-month “winter” period, Mainers who contact their electric or gas utility, or the Commission, to make reasonable monthly payments will not be disconnected.

Syria risks IAEA action over suspected atom site: U.S.

(Reuters) - The United States warned Syria on Friday it may face action by governors of the U.N. nuclear watchdog if Damascus fails to give its inspectors access to the remains of a suspected nuclear site in the desert.It has been over two years since the International Atomic Energy Agency (IAEA) was allowed to visit the Dair Alzour site in Syria where secret nuclear activity may have taken place before it was bombed to rubble by Israel in 2007.

The question is not whether we want to live in cities. Obviously, a growing number of us do—otherwise we would not build so many of them. The real question is: In what kind of cities do we want to live? Compact or spread out? Old or new? Big or small?Judging from the direction that American urbanism has taken during the second half of the 20th century, one answer is unequivocal—Americans want to live in cities that are spread out. Decentralization and dispersal, the results of a demand for private property, privacy, and detached family homes, have been facilitated by a succession of transportation and communication technologies: first, the railroad and the streetcar; later, the automobile and the airplane; lastly, the telephone, television, and the Internet. In addition, regional shopping malls, FedEx, UPS, the Home Shopping Network, and Amazon.com have helped people to spread out. Even environmental technologies—small sewage treatment facilities and micro power plants—have allowed people to live in more dispersed communities than in the past.

Rare Earths Stand Is Asked of G-20

HONG KONG — An unusually broad coalition of business groups in North America, Europe and Asia has sent a letter to the heads of state of the Group of 20 major economies, asking them to make a commitment at their meeting this month in Seoul that trade in crucial rare earths will not be interrupted because of industrial policies or political disputes.The range of countries and industries whose business groups signed the letter underscores the level of worry in corporations around the world about recent export restrictions placed on rare earths by China, which mines 95 percent of such materials. The minerals processed from them are needed for products and processes like cellphones, cars, clean energy and the production of missiles and sonar.

Oil Trades Near Two-Year High; Relative Strength Index Signals Reversal

Oil traded near its highest level in two years in New York as the dollar headed for a weekly decline against most major counterparts after the Federal Reserve’s decision to purchase more debt to boost the U.S. economy.Crude’s 6.6 percent rally this week, driven by the dollar’s decline, may be about to end, according to a technical indicator used by traders. The U.S. currency has fallen versus all but one of its 16 most-traded peers since the Fed said Nov. 3 it will buy about $75 billion of Treasuries every month through June.

“Underlying demand in the industrialized world is still not enough to justify these price levels,” said Eugen Weinberg, head of commodity research at Commerzbank AG. “But market sentiment is so strong that if the weakness of the dollar persists I couldn’t rule out higher prices.”

Oil May Rise as Federal Reserve Stimulus Plan Weakens Dollar, Survey Shows

Crude may increase next week after the Federal Reserve announced plans for bond purchases, weakening the dollar, a Bloomberg News survey showed.Twenty-nine of 49 analysts, or 59 percent, forecast crude oil will rise through Nov. 12. Thirteen respondents, or 27 percent, predicted prices will fall and seven estimate there would be little change. Last week, 54 percent said futures would decline.

Gasoline Exports to U.S. Sink on French Strikes

(Bloomberg) -- The profit from shipping gasoline to the U.S. from Europe slumped to a 20-month low in October as strikes in France caused domestic shortages, cutting exports.U.S. gasoline cost 8.05 cents less than Europe’s on Oct. 19, the lowest level since February 2009, and is still down 9.5 percent from its average of 8.41 cents more than Europe’s in the past year. As the premium disappeared, the number of tankers chartered to ship the motor fuel to the U.S. Atlantic Coast from Europe dropped to 10 last month, from 28 in September, according to data compiled by Bloomberg and Clarkson Research Services Ltd., a unit of the world’s biggest shipbroker.

Holidays might not be so happy gas pump

There's one place holiday shoppers probably won't find a bargain this year: At the gas pump.The Federal Reserve is taking steps to stimulate the U.S. economy, but those moves are also helping to push oil prices near their high for the year. That increase will eventually translate into higher gas prices.

Truck sales pick up pace, outsell cars

DETROIT — Trucks outsold cars by the highest margin in nearly five years in October, a small sign that the economy may be starting to improve.These trucks aren’t the tractor-trailers that haul freight. They were vehicles such as pickups, SUVs, minivans, and smaller SUVs, which made up 54 percent of all US vehicle sales according to industry tracker J.D. Power and Associates, while cars made up 46 percent of the market. That’s the biggest margin of difference between the two categories since December 2005, when trucks accounted for 56 percent of sales.

OPEC confident of current oil resources

The world's need for OPEC's crude oil will remain tempered over the next five years, the group says in its annual forecast.As a result, OPEC's unused oil output capacity is unlikely to shrink from the current level of 6 million to 7 million barrels per day (bpd).

For energy consumers, the group's main predictions in the report released yesterday should be reassuring: "Current investments should be enough to satisfy both demand for OPEC crude and provide a comfortable cushion of spare capacity, which already exceeds the very high level of 6 million bpd," OPEC said. "There are clearly enough resources to meet future demand."

Reserve estimates are rising as improved technology offers new ways of unlocking conventional and unconventional resources, the report said.

Ukrainian state energy company Naftogaz has paid Russia's Gazprom $1.063 billion for October gas supplies, Naftogaz said today.Cash-strapped Ukraine is trying to renegotiate its current gas deal with Russia under which it is paying $253 per 1000 cubic metres this quarter.

But Russia has indicated that would require giving Gazprom a stake in Ukraine's transit pipeline system - something Kiev has not been willing to do.

Shell sells stakes in 6 Gulf of Mexico oil fields

LONDON — Royal Dutch Shell says it is selling its interest in six oil fields in the Gulf of Mexico for $450 million.

Nigeria: Fresh Concerns Over Illegal Bunkering

President Goodluck Jonathan has raised concern over illegal oil bunkering in the Niger Delta. Coming from the Commander-in Chief of the country's Armed Forces, the situation can rightly be described as serious.

Interior dispenses $2.2 billion to states and tribes

WASHINGTON (Reuters) – The Interior Department said on Thursday it distributed $2.2 billion to states and American Indian tribes from energy production during fiscal year 2010, slightly less than the previous year.The money came from royalties and other fees the department collected from companies producing energy on public lands.

Offshore Drilling Ban Lawsuit Dismissed

The New Orleans federal judge who had ruled the Obama administration’s moratorium on deepwater drilling to be illegal has tossed out the lawsuit challenging the ban, saying that the administration’s lifting of the moratorium last month rendered the matter irrelevant.

Scientists find dead, dying corals near BP well

PENSACOLA, Fla. – Federal scientists say they have found damage to deep sea corals and other marine life several miles from where BP's blown-out well spewed millions of gallons of oil into the Gulf of Mexico.

A misplaced tolerance for risk

The big oil companies love to say “too risky” when asked why they’re not investing more in clean energy, but somehow drilling kilometres under the ocean in harsh waters in a hurricane hotspot is viewed as less financially hazardous. How is that?

Clifton Scientist Looks at Transition Beyond Peak Oil (Virginia)

Environmental scientist Jackson D. Harper of Clifton will speak to area residents Wednesday, Nov. 10, from 7-9 p.m., in meeting rooms 1 and 2 of the Centreville Regional Library. He’ll discuss responses citizens can make to rising energy costs based on shortages expected to appear during the next decade.

Study: Big trees around homes help fight crime

Trees don't fight just air pollution but also crime, says a new study by the U.S. Forest Service."We believe that large street trees can reduce crime by signaling to a potential criminal that a neighborhood is better cared for and, therefore, a criminal is more likely to be caught," says lead author Geoffrey Donovan, a forester at the Pacific Northwest Research Station. He also linked large yard trees to lower crime rates.

In contrast, he found small yard trees might actually increase crime by blocking views and providing cover for criminals, so homeowners should keep trees pruned.

Reconsidering the lobster roll

Learning the reality of how most animals are raised for meat in books like "Fast Food Nation" led me to change how much of it I eat and where I get it from. I love hamburgers as much as the next person, but I will pass one up if the beef comes from a cow that was packed into a CAFO -- a concentrated animal feeding operation, the ubiquitous kind of factory farm that I once thought only existed in nightmares. If I do not get a chance to stop by the farmer's market, I will make do with a vegetarian dinner rather than buy meat from a supermarket. If I do not know where my meat comes from or how the animal was raised, I simply prefer not to eat it. While I try not to be didactic about my views, these are the choices I make for myself as a consumer. So if I feel uncomfortable eating factory-raised chicken or beef, why should I feel differently about the fish?

“I am a strong advocate of high-speed rail, but it has to be where it makes sense,” Mr. Mica told The Associated Press in a post-election interview. “The administration squandered the money, giving it to dozens and dozens of projects that were marginal at best to spend on slow-speed trains to nowhere.”Mr. Mica said he would like to redirect the rail money to the Northeast corridor, which he described as possibly the only place in the country with enough population density to financially support high-speed train service.

As it turns out, he might just be in luck: several newly elected Republican governors from states that received rail funds have indicated that they don’t want the money.

EDF Says Will Have More, Longer, 100-Day Nuclear Reactor Halts in 2011

Electricite de France SA, the world’s biggest operator of atomic reactors, said its nuclear plants will have more and longer halts in 2011 than this year as six reactors will undergo once-a-decade inspections.The halts are a regulatory obligation and could take as long as 100 days compared with typical 30- to 45-day reactor halts for refueling and maintenance, Philippe Torrion, Paris- based EDF’s head of optimization and trading, said today at a press conference.

Vermont Nuclear Plant Up for Sale

Entergy Nuclear, evidently convinced that the Vermont legislature will not allow the company to run the Vermont Yankee nuclear plant for another 20 years, announced on Thursday that the plant was up for sale.

The Coming Nuclear Subprime Rout

With asset leverage able to surpass 250 times the nominal value of an underlying security, the ballooning of paper assets due to the Nuclear Renaissance can quite quickly make the US subprime asset balloon seem rather small beer.

Mapping Ecosystems, the Better to Conserve Them

To ensure that the largely private efforts to set aside land do the most public good, the state Department of Fish and Game has just unveiled the latest and most elaborate version of its online BioMap, complete with instructions on how to use it.With both climate change and suburbanization built into the state’s biological future, the map, as its developers write in their introduction, “provides a framework for protection and stewardship of those lands and waters that are most important for conserving biological diversity.”

China says its car boom is ruining air quality

China's booming car sales have had a devastating effect on the environment, the national environmental watchdog has warned in its first-ever report on pollution caused by vehicle emissions.About a third of 113 cities surveyed failed national air standards last year as the number of vehicles swelled to 170 million, up 9.3 percent on year and 25 times the number on the roads in 1980, the ministry of environmental protection said.

A new path to a low-carbon economy

Politicians are loath to impose such a tax, fearing a political backlash. For years, this has stymied progress in the United States towards a low-carbon economy. Yet several European countries have successfully introduced the idea of a "feed-in tariff," which provides the core of a politically acceptable long-term solution.A feed-in tariff subsidises the low-carbon energy source rather than taxing the high-carbon energy source.

Soros Panel Draft Says Bank Taxes, Carbon Auctions Can Finance Climate Aid

At least $65 billion could be raised by taxing foreign-exchange transactions and auctioning pollution permits, a United Nations panel recommending ways to finance aid for fighting global warming will conclude today, according to a draft of its report.

Former British PM Blair touts green energy tech in California

GRATON, Calif. — The global economic downturn should not curtail the U.S. government's commitment to addressing the problem of climate change, former British Prime Minister Tony Blair said Thursday.Speaking to a gathering at the Sonoma Wine Co. in Graton, Blair said high-tech entrepreneurs and investors willing to take a risk in the clean technology sector will play a major role in developing technologies to reduce society's dependence on fossil fuels.

Global Warming Likely to Get Cool Reception in Congress

In 2007, the Supreme Court upheld the U.S. Environmental Protection Agency's (EPA) authority to regulate greenhouse gas emissions.That authority may be debated again in the new Congress. Sen. John Rockefeller (D-West Virginia) may push for a vote this month that would suspend EPA regulations for two years, according to Reuters. President Obama could veto the measure, however.

Tuesday's environmental impact

The Republican takeover of the House puts an end to hopes for a federal bill. But headway will still be made at the state level.

Central America Must Be Recognised as Especially Vulnerable

GUATEMALA CITY (IPS) - Having suffered the devastation of extreme weather phenomena in recent years, such as hurricanes Mitch, Stan and Agatha, the countries of Central America will head to the next global climate summit with an emphasis on their vulnerability and demand access to better conditions for dealing with climate disasters.

Mayors From New York to Johannesburg Meet in Hong Kong for Climate Talks

Cities are the world’s biggest source of carbon emissions and must embrace technology to clean the air and counter global warming, Hong Kong Chief Executive Donald Tsang said.

Hong Kong’s economic success story could be swiftly undone if the government fails to respond to growing flood risks.

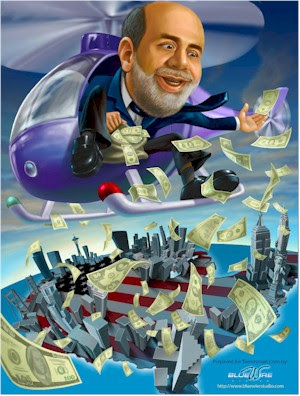

Six New Events that will Drive Oil to $130 by March

From Today's Energy and Capital newsletter. The web edition just says: The Six Events That Will Drive Oil Up" but the one that they posted to their email subscribers says it will drive oil prices to $130 by March.

I will not copy and paste any details but the six are:

1. Dollar falling

2. Helicopter Ben

3. OPEC Changes Forecast

4. Russia is tapped out

5. Oil supply decrease

6. Republicans take the House

Ron P.

By June we'll be back in recession if oil is 130 small towns and burbs are already on the bubble.I've been seeing the buying up of the inner belt of our city the money to be made imo on real estate will be the fifties burbs and in .This am on CNBC the ceo of Odesk was talking about the globalization of jobs by small and mid-sized companies of jobs done in an office being turned into contract jobs and can be done anywhere in the world.Maybe someone could post the vid and the US was number three on gains from this trend.Those that own large office buildings might need to be conserned.Cisco system two weeks ago had a survey asking workers "do you need to come to the office to do your job" 60% said I could do my job from anywhere.

How far is that from "your job could be done from someone in a far far away low wage country"?

I thought this day would come twenty yrs ago when manufacturing started there is not much difference from the factory floor to the office floor other than HVAC and nice carpets.

For who? Someone needs to buy the product.

What product? Most manufacturing jobs were outsourced years ago. Office workers do not really have a product other than the service they perform. That service could be performed from anywhere in the world, usually over the phone or internet.

Ron P.

Isn't that the truth. Most jobs today are clerks or office assistants. Nothing is made, just endless meetings, my big peeve.

If you want real inflation, try to buy something that is made here, say a real pair of boots, not imported. Or a US welded trailer. Talk about sticker shock. Between imports, subsidized food, and claims paid via "insurance", few see the costs anymore.

Don't want to break any hearts, but most jobs today are useless/worthless/unnecessary...fill in a word... I go to WalMart and i actively seek out the self checkout lanes. Even the checkout people are becoming replaced (I realize you need someone to look over the kiosks, but it seems like 1 person can handle 6 or so). The grocery store in Milwaukee i was at had the self checkout lanes. Wait until McDonalds has you grilling your own burgers!

edit to add: I say that about a lot of jobs because robots, automation, Mexican migrants seem to do all the real work.

And obviously the technology and complexity inherent in those self checkout systems will always be with us and never fail. Given the choice, I always use the line with the human.

+10

I like to get in and out of that place as fast as possible. I'd rather not spend a half hour in line. I'll stick with the complexity of the computer, as long as its not using Windows ME.

Just looking at the checkout itself and not the time in line, the self-serve kiosks usually take longer than the same purchase would with a checkout person. You just think you're doing it quickly because you're busy the whole time.

The advantage of the kiosks is that you can put more stuff in the bags, and people paying their groceries with third-party checks don't normally use them.

Kiosks work great if you understand their personalities, and the people in front of you do too. Checkouts work great if the clerk is highly competent and the people in front of you do nothing weird.

The odd thing I note is that they tend to close off kiosks using the same line-guaranteeing algorithm for shutting down checkstands.

If you have a credit card that scans well and all bar-scan groceries, you can fly through a kiosk without having to deal with people -- yet another plus. Kiosks are at least predictable.

"If you have a credit card that scans well and all bar-scan groceries, you can fly through a kiosk without having to deal with people -- yet another plus."

Yes, God forbid we should have a human interaction.

What I hate about the automatic checkout lines around here is that they mix your groceries with those of the people in front of you. It seems to be designed only for very small orders. The belt moves automatically, and you can't put a divider between orders. It very quickly dumps your groceries down a sloped counter, where they mix the those of the customer(s) ahead of you. Not too big a deal if you have only a few items each, but a pain in the butt if you have a lot of items. Especially if the second person has heavy items that smash the earlier person's fragile ones. It's simply not possible for the earlier customers to bag their groceries fast enough, since they don't start until they've finished paying.

Good lord. This all sounds like science fiction to me.I haven't seen an automatic checkout or bagger anywhere in Asia, including Indonesia, Singapore, Malaysia, Thailand, or Phil.

And yes I do shop at Lotus/ Tesco, Carrefour, and big box stores.

Just how far has this phenomenon penetrated ? I didn't see this in my visit to Switzerland either. Can anyone confirm this outside the US ?

Do you have self-service gas pumps, where the customer activates the pump with his credit card, pumps the gas into the car, takes the receipt and drives off?

Having the customer do the work is much better than hiring an employee to do it.

I haven't seen it in Malaysia ot Thailand, where you prepay , usually at pump to a guy. Can be charged inside. I'll radio for confirmation when propagation comes up.

Here you only go inside to get a drink, smokes, or lotto tickets. Even then the experience is optimized to be very efficient at the better stores. You can't beat a Quik Trip for pleasantly and efficiently overcharging you for convenience.

Except in New Jersey and Oregon, where self-service stations are illegal.

New Jersey has the cheapest gas in the country, but I hate their gas stations. It's a lot faster to pump your own than wait for them to get around to it.

Haven't seen those here yet, though I've heard of such elsewhere. Obviously a sub-optimal design -- next generation will probably be more efficient (just as the hand-scanners today work much better than the last generation).

Of course you have to stage your groceries for inept human clerks too, so your bread doesn't end up with canned goods, and your cold goods interspersed with room-temp items.

You don't always have to stage your groceries. If you're a regular, you get to know which cashiers know how to bag groceries (and many do). My mom will wait in a longer line to get one of her favorite cashiers - the ones who know how to pack groceries.

This is called "productivity". It takes but a fraction of the potential labor pool out there to accomodate our needs. We kept employment reasonable for decades by piling on the trivial, fun stuff, vacations, the service economy, whatever. But guess what? There are still only 24 hours in the day, and only so much crap that a consumer can consume.

When a machine came along that empowered people to do twice the work in the same amount of time, we didn't all knock off at noon. So some people work, some are unemployed.

We do not NEED everyone working. That's the real dirty secret of capital... labor has zero power.

Or everyone works less than current hours. This is easy - employers pay a per employee tax.

0-15hrs no tax

15-30 some

30+ more tax

The working week will dissolve to be replaced by 15 and 30hr jobs for all.

Wasn't that easy??

Good luck with getting something like that passed. Though it is an interesting idea...

Around here everyone starts screaming when they won't allow any overtime! A lot of people have a lot of monthly payments on a big mountain of debt.

Same thing happened in France with les trente-cinq, the 35-hour law. Only it wasn't so much the middle class up in arms as the low-paid. It saves on commuting cost to travel to one job instead of two, or to two instead of three. That's important at the low end of the wage scale.

The bigger dirty little secret is that the employer doesn't has to pay a half dozen taxes associated with an employee and fill out myriad of worthless government forms for a kiosk. When was the last time you heard of a kiosk needing health care?

When was the last time a kiosk bought something in the store?

Walmart, grocery store, Mickey D's. Imports and subsidized food. Maybe not the last as much. It works, but junk.

My American-made boots ate up the better part of $500. But they will last 5-10 yrs with a resole.

Good shoes are a good investment. I just buy a couple pairs and store them. I get about a year out of my running shoes. La Crosse boots use to be made here in La Crosse...along with some of the Danner line. Everything got sent to China...the building is just now being remodeled into office space. My aunt worked there for 30 years. I could tell you a story about the people that worked there, but i think i'm already close to being banned.

One of the best investments I ever made was in a custom-built pair of walking shoes built by a traditional American shoemaker. I got more than four thousand miles on those shoes, and oh--so comfortable. Yes I did need a few new heels and a new half-sole, but traditionally built shoes or boots are relatively easy to repair.

Alas, my shoemaker died, and I have not found another one. Now I wear U.S. made New Balance walking shoes that are O.K., except that I only get about seven or eight hundred miles out of them before they are worn out. And they are nowhere near as good a fit or as comfortable as the custom-made shoes.

Mile for mile, good custom-made shoes are not much more expensive than cheap Chinese shoes, because you get relatively little mileage from cheap shoes.

One little catch. In present-day real-world North America, how many people really need to get 4000 miles out of a pair of shoes? Honestly? That's on the order of a million trips between the couch and the fridge...

If you walk an hour a day at 3.5 miles per hour that is 3.5 x 365 = 1,277.5 miles per year.

Unless the weather is truly foul (icy sidewalks) I walk or bike an hour a day. I now live in a walkable urban neighborhood and can walk to the supermarket, library, two bookstores, my doctor, bank, several good restaurants, a movie theater. All I need my car for is to visit friends and relatives.

Don - a friend of mine with an antiquarian bent recommends Missouri Boot and Shoe. These are made for Civil War reenactors etc, so old-fashioned stylistically; but they're very solidly put together. Bespoke, too, of course - you send in your measurements, they use lasts and sew the things up on old industrial machines. Dunno how they rank in terms of ergonomics and all that twaddle. Perhaps there's a modern shoemaker that incorporates space age resins etc in bespoke footwear, but I'd wager that would set you back a lot more than the $180 or so MB&S charge.

Haven't ordered anything from them myself, btw - wear a nice pair of Doc Marten's from the Goodwill, which set me back, gasp, $10.

I think a top quality pair of U.S. handmade bespoke shoes is now at least $500--and that is a fair price. A U.S. tailor-made custom suit is about $1,000. I've had one for twenty years and it looks like new. Of course, I seldom wear a suit, though as I age more and more of my friends have funerals that I have to go to in a suit.

In the new electrified mass transit world of the post-oil future, how many miles can we expect people to walk each day?

In particular, this bears on the spacing of transit routes and stations, which has impact on capital costs, operating expense, average speed, etc of the transit system.

My guess is that people can be expected to walk on the order of 5 to 10 miles per day on average as an appropriate planning estimate.

Pre car, almost everybody walked, since horses and carriages were limited to the "carriage trade". In rural areas, the ploughman walked behind the plow all day. Of course, average fitness was a lot higher back then.

I've never indulged in "bespoke" shoes but I have recently bought New Balance running shoes, Red Wing work boots and SAS loafers, all made in the US and very fine quality, much better than any Chinese or other import products I have seen in recent years. I replace my running shoes every 2 or three years (maybe 1500 miles of power walking). The boots at $200+ will last the rest of my life, 10 or more years. The loafers (about $140)replace some SAS dress/work shoes at least 15 years old.

Oh, I understand about that math. It's the scalability among the present population that I was musing about.

$500 ?????

Wow. Dont get me wrong I know that it costs more to manufacture here and I try and buy local too. But at that price I gotta wonder if a big chunk isn't paying for a label.

I own an American made pair of very nice chainsaw safety boots. Matterhorn's. They cost around $300 but that buys a full steel shank and a Kevlar liner. And they must weight 10 lb.

I nice couple in southeastern Idaho make boots starting at $350 for your basic smoke jumper boots. The level of customization is exquisite! He takes foot prints to see where you place the most stress/weight. AS far as price goes, the sky is the limit, I suppose. Spent a day there two years ago, learning how to resole my boots. I learn that there are a lot of people who needs custom made shoes/boots usually prescribe by their podiatrist, but there are also a lot of people who wants a comfortable pair of shoes too. Having said that, I don't think a custom shoes necessary last any longer. It all depends on how you use it. You can use your shoes for quite sometime e.g. 4000 miles, but you probably had to resole it 4 or 5 times which drive up the cost.

A half-sole does not cost much, and I only needed one to get more than 4,000 miles on my custom-made shoes. Of course, the soles were very highest quality to begin with. Not all soles are equal.

"Not all soles are equal." Of course, and furthermore not all soles are made of the same material. I use my Asics running shoes long after they are retired from running - for walking and working in the office. I imagine wearing these shoes well into the future until of course the fabric starts to tear beyond repair, which is hard to do when all I do is walk in them about the town. 4,000 mile with one pair of shoes is hard to achieve if you have to use them for physical work.

An interesting thread.

I learned how to repair traditionally made shoes by watching my father (who was not a bootmaker, but grew up in a family with a tradition of repairing rather than replacing) more than sixty years ago. I haven't attempted anything like that for more than fifty years, but I still remember most of what to do. But I don't have the tools or materials, or a clue about where to get them.

£50 pair of Cat boots. Lasted me the best part of a decade. $500? I'll be getting me a new TV for that, ta. Or paying rising fuel costs.

Except with maybe cement mixers, weight is not necessarily an indication of quality.

This family company has made boots for loggers and ranchers for 80 plus years. And judging by the imitations you see anymore, that alone attests to their quality. They carry a less expensive line, made with lower quality leather-the market variety, and not the level of stitching. When you're moving on your feet all day, depending on your feet, the money becomes a secondary concern. They fit, and fit right. They size you. If not, they are remade to do so. No questions. They'll also make custom boots for more $, where each boot is fitted to an individual foot. For those that have a 1/2 size difference in their two feet, it makes quite a difference. I've tried Merrill, Danner, Wolverine. 18 month, glued boot and sore feet. And a $150-200 import.

Edit:

Keeping on the same theme, a while back, 2-3 decades, Jerry Jeff Walker had a song he used to sing about his boot maker. Catchy tune, wish I still had the record.

My 2c worth: I was terrible at choosing shoes/boots for years. Finally resolved to spend whatever it took to get a really comfortable and durable pair of boots. Got a pair made by Ecco in Denmark. The most comfortable boot or shoe I've ever put on (gave away my Doc Martens that were hurting my feet). Only problem with my Eccos is the soles wear out pretty quickly because they are soft, but my local shoemaker/repair resoled them fine. Got 2 pairs now. First pair is ~10 years old and the insides are Gore-Tex and doing fine.

But worth it, right. My son got a pair of the less expensive, about 280, for forest fire fighting. And they will go another couple years, even in that environment. Funny to hear him talk of the guys complaining how their feet hurt, and having to buy another pr of boots 1/2 way thru the season.

Didn't know there were Ecco shoe fans out there.

Count me in.

While not pretty or cheap, these shoes are comfortable and seem to last forever.

--Another highly satisfied customer

The song is called "Charlie Dunn." Dunno about the record, but it is online at YouTube, Napster and the like.

Thanks. I'll get over there.

Edit: Found it. Great tune

http://www.youtube.com/watch?v=_fg3y_PvUxM

I read that stores are hiring for the holiday shopping season. Will the new jobs last past New Year?

Wow. I thought the self-serve lines at grocery stores were everywhere now. They have been here in CO for several years.

Usually during busy periods the groceries will still have at least one "manned" express line. Amazingly to me, people will stand in the self-checkout line LONGER than they will stand in the human line. I have seen lines five deep for the self-check when the manned express line is empty. Go figure.

I am certain that the average transaction at the self-line takes at least twice as long as at the manned checkout, because people go very slowly. The self-check lines are limited to 20 items, probably because it would take some people 20 minutes to scan a full cart.

I don't think most "jobs today" are worthless or unnecessary, but I would agree that most are very different than they were twenty years ago.

If they would let me bag my own without a knock-down drag-out argument, I might go through the manned line. I know what I have, and I can put it all in my big ol' canvas bag so it sits flat and nothing gets damaged. If I let the employee do the bagging, I always seem to end up with bread on the bottom crushed under the heavy stuff, and two unnecessary partially-filled plastic bags in addition to my canvas. As this is a family site, I won't repeat what the ass't manager said to me the time I unpacked everything and repacked it -- except the egg carton with six now-broken eggs, for which I demanded a refund.

you will find this funny. my local wallmart actually got rid of the self checkout lanes. due to the amount of times they broke down they rather pay a employee to check people out. the only store in my area that still has them is home depot.

Why do you shop at Wal Mart?

I live quite well, on very little, and 99% of what I purchase is made in the U.S.

Why? There is a choice, in every decision we make.

Stop whining.

Choose wisely.

The Martian

The humans you use in the checkout line the less humans you will see in the checkout lines. I can't chit chat with a computer, I can't complain to it either, and I can't make a date with it for later.

So I don't use the atm, or the computers in the stores.

Not every job can be out sourced to a land far way, just some of them.

I tend to go to shops where I know the people behind the counter, where I know that they aren't going to get a self check out gizmo any time soon if ever.

Almost everyone in this working class neighborhood can't have their jobs outsourced. Though most of them took a hit with the down turn depression that we have been having recently, they still do the things that they did before, just less of them.

Charles,

BioWebScape Designs for a better fed and housed world.

A very good salary here is u$d 600/month

http://web.zonamerica.com/en/why_za/

A little browsing, you'll see some well-known names: Merril Lynch, Deloitte, Tata.

Their business, technical school

http://www.zonamerica.org/

Job Opportunities

http://web.zonamerica.com/en/trabajar_za/

"How far is that from "your job could be done from someone in a far far away low wage country?"

My company tried that once or twice already. It didn't work out so well for them. I'm not worried too much. :-)

Note that plumbers don't worry about this much, either.

Quote: "By June we'll be back in recession if oil is 130..."

Why? Because people in the U.S. are unwilling to change their habits. In Europe, gasoline id above 7 Dollars and people have a good life.

For many, it's about more than mere "habits". You've been here long enough to know that proposals for dealing with this issue often include radical rearrangements of the built landscape. Abandoning suburbs for "walkable neighborhoods", building expensive train lines, that sort of thing. Or they call for extensive rearrangements of people's schedules, with many additional hours away from family to cope with the immense wastage of time waiting on car pools, buses, or trains. No matter how many glib, moralizing pronouncements one might choose to make, none of that will happen overnight by waving a magic wand, and some of it will not happen voluntarily.

Please also remember that Germany has about six times the population density of the USA; some other EU countries even more. That means, approximately, that the train or bus can come six times more often. That is a huge difference, often the difference between something useful, and something useless, good only for the mayor to preen about at "conferences" ("look at me, I'm a great guy - I run a real city, we have a train.") It is often also the difference between something that runs on weekends, and something which closes down, and is therefore of little use to anyone (often receiving a low wage) who has to work at odd hours, and of little use for the rest of life beyond commuting to work. (Can't go to the hardware store on the tram when it's not running.)

If you remove Alaska and the vast land west on Mississippi, you get a similar density. As for frequency. It is only going with the square root of density.

Germany has a population density of 593/sq mi.

Only the states of New Jersey, Rhode Island and Connecticut are more densely populated that Germany. Together, they cover less area than Maine, which has about 43/sq mi.

For most people, the habit they need to break is as simple as buying a Prius instead of an SUV.

A lower dollar may do what the lack of gasoline taxes don't, raise the price of fuel in the US to European levels. The only difference is that the money will leave the US.

The US would have to be in hyperinflation for 12 years and oil demand would have to stay relatively level before that would happen. Impossible, IMO.

Ironicly, it's money leaving the USA that will cause further amounts of money to leave the USA, unless the parallel monetary and currency exchange system the BRIC countries and their allies are busilly creating negates the latter half.

What's 2. Helicopter Ben?

Just answered by own question by doing a Google search: Ben Bernanke's new nickname is 'Helicopter Ben', because of the spinning printer presses he has constantly making more money.

Maybe a humorous number 7 could be added. Although it's completely bogus, the GOP claims Obama is spending 2 billion on a trip to India, using 34 naval ships and renting 3500 suites at a 5 star hotel. Gees, those guys sure can spin a yarn.

It's not a new nickname. He got the nickname "Helicopter Ben" or "Blackhawk Ben" back in 2002.

From Wikipedia:

I'm surprised you haven't heard that nickname before. We've been calling him that here since this site started, and it's frequently mentioned in the MSM as well.

I've seen 'Helicopter Ben' used on too many sites to count, financial, blogs, political, etc... it's pretty common.

2007

Ron,

I don't disagree with you but you should remember that most of the world doesn't use USD. e.g for Europeans the crude oil price is not rising - it is falling. I believe what we are seeing at the moment is a result of the crazy actions of the Fed causing a devaluation of the USD. This obviously causes an increase in the price of oil in USD - but not an increase in the price of oil per se.

See:

http://www.theglobeandmail.com/report-on-business/top-business-stories/o...

Interesting to see how the oil price is trending upwards in USD but trending downwards in Euros.

Eh? Yes the price of oil fell from the peak in May in all major currencies but the last couple of weeks have seen a substantial rise no matter what currency you were talking about as the increase in WTI greatly exceeded the drop in the value of the dollar.

Are you expecting the oil price to fall in Euros over the next few months? If so I suspect you will be sadly disappointed.

By the way one dollar now is still worth considerably more in euros than it was at the time of the price spike to near $150. In the UK, I should add, it is even worse and the pump price is now getting very close to the peak price paid in 2008 as the pound is now worth approximately 20% less in dollars than it was then.

The jobs report was much better than expected.

And there's "cautious optimism" about holiday shopping.

I said before I thought this little bounce would last through the holidays, and I'm sticking with that forecast.

The Grinch that stole New Years is going to be severe budget cutbacks by states and cities in 2011.

I think that will be a problem, but mostly in the second half of the year.

Some states, like New York, have fiscal years that start in April, but most don't start until July. Texas is really late, and doesn't start until September. That's when it will really start to bite: when they have to come up with a new budget.

I hear this alot and don't disagree. But like all financial issues we face it seems we just have to sit back and let them re-write the rules. I've heard that part of the re-purchase by the Fed might be aimed at the municipal bond area. So doesn't that mean that states and municipalities can issue unlimited debt and have the Fed pick up the tab. Much more discreet than another $XXX billion stimulus like last time. And the Fed's balance sheet is unlimited, we may never know how much they absorb.

I'm just saying we keep waiting for the next financial shoe to drop and they always seem to have a rule change one step ahead. Me thinks this can and will go on much longer than common sense would dictate.

Most state budget crises right now involve their operating budgets, and most state constitutions don't allow them to borrow money for operating expenses, including payments on already-existing debt. Colorado, where I live, carries it to an extreme: the constitution requires that bond sales, even for the limited things where bonds can be used, be approved in advance by the taxpayers at a regular November election.

The Fed can't do what the states need most: drop $50B in cash that doesn't have to be repaid into the states' General Funds, roughly in proportion to population. Colorado's share under that formula would fill the budget hole, at least for a year, but Colorado has had serious restrictions on its budget growth for the last decade. California's and Texas' shares wouldn't fill their holes, although for different reasons in each case.

Yeah, I think a lot of Republican governors that just won are going to see their wins in a different light soon. The stimulus package bail-out states for a couple years but that is history. These are going to be very difficult times for state governments.

Depends. Do they really believe their party's platform about "starve the beast" and rolling back social spending? Medicaid is not a mandatory program; states may choose to participate, or not (Arizona did not participate for the first 20 years). The Republicans won control of a number of state legislatures and governors' offices this week; they may never have a "better" opportunity to vote to withdraw their states from Medicaid than they do in 2011.

LOL. Like that is gonna happen.

Today's (Sunday's) New York Times story: Texas Considers Medicaid Withdrawal. They probably won't do it, but the Republicans are going to at least talk seriously about it. I've seen at least a couple of pieces of analysis that suggest many states could run a chain of Kaiser-style health clinics for their poor for less than it costs them to be a health insurance company (which is what Medicaid requires of them).

"The Grinch that stole New Years is going to be severe budget cutbacks by states and cities in 2011."

Only in states that failed to raise taxes on corporations and the wealthy, as us Oregonians did.

Seasonal (temporary) hiring has started; it'll end in January.

I do hope the sugar (crack) high from the Fed's liquidity injections get us into the new year. By then I'll be old enough to bail out of the rest of my equity holdings without penalties before the next crash.

They do their best to "correct" for seasonal factors. But, if you think the statistics makers are hopelesslt corrupt, then nothing can convince you otherwise.

"The jobs report was much better than expected."

except that it's a lie designed to allow the masses to maintain their denial and delusion.

"The Labor Participation Rate dropped to 64.5% of the labor force from 64.7 percent the previous month. The number of people actually employed dropped by 330,000."

"Then there's the CES birth-death model which estimates jobs into existence: that added 61,000 jobs to the economy for October, only 11,000 in the prior month."

and

Americans On Foodstamps Hits New Record In August, Increase By Over Half A Million To 42.4 Million, 17% Increase Year Over Year

and

People Who "Want A Job Now" Jumps To Second Highest Ever As Persons Not In Labor Force Reaches Record

I'm not saying it won't work just that it's all lies.

Exactly... I'll wait to hear Ilargi and Stoneleigh's interpretation of these latest numbers - I'm sure that a fair amount of 'cooking' went into these stats... stay tuned as more and more stats come forth to show Mr Market's approval of the latest election results...

The illusion will be reinforced that all is well with the world for a while... just enough time to allow us to hit the accelerator and come up to nice cruising speed prior to impacting that final financial wall.

Don't you think that you're falling a little short of reasonableness. The stats in question are generated by a methodology and process that would have given you the same numbers whether or not an election had been held. If anything, the numbers demonstrate that Obama's wild-eyed muslim-hindu-socialist takeover of the American economy hasn't been all bad for the American worker, errr, middle-class.

The markets are flying on QE juice. Which points to a bigger worry: that another bubble is in the making, but one without much impact on the trend to long-term unemployment, much less any good news on the carbon overconsumption file.

I totally agree with your last paragraph there toil - I was just implying that the loop will be closer to being closed now that more "market friendly" forces have been installed (via Citizen's United ruling)... so while I have no doubt there may have been real increases in employment due to Obama's stimulus, just stayed tuned for truly inspirational "growth" which will then be paraded about by the new Congress as to how tax cuts and less regulation works to "create jobs"... which will be a lie because they will have used every trick in the book to "goose" the numbers, despite very little support from underlying fundamentals.

BMW unveils $500 million electric car investment

Yeah, I think the uptake of the Nissan Leaf has slapped some reality into all the car makers. Honda also just came out and said "Gee . . . I guess there is an EV market after all."

http://green.autoblog.com/2010/11/04/honda-ceo-looks-like-there-will-be-...

Nissan has acquired some 20,000+ pre-orders for the Nissan Leaf (where people did put $99 down) thus selling out its entire first year of production.

And the high price of oil probably isn't helping.

20,000 EVs isn't a market. It's a rounding error.

100,000 per year is a hobby (Steve Jobs' term).

500,000 starts to get interesting.

1,000,000 out of 10 million is a real market.

But you do have to start somewhere. Too bad it wasn't started, oh, forty years ago.

Indeed. I have to say, when I heard Nissan's Leaf was experiencing sell-out, I was curious what the number was. Twenty-thousand? Really? Gee, we're... saved?

They're at least and order of magnitude out for any real change.

You gotta start somewhere is right. And going from zero to some 30,000+ vehicles (between the Leaf & the Volt) is a good start.

EVs are not really economical today . . . forty years ago they made no sense at all. 20K is a market. It is a niche market but still a market.

It is a $33K ($25K after tax-credit) economy car. Unless you are interested in EVs, that isn't going get much attention when you can buy comparable gas cars for $16K.

It is going to take higher gas prices and lower battery prices to make them more attractive . . . but both of those things are happening. It is not a question of 'if' but of 'when'.

All cars will be electric within 20 years. Range is increasing so fast that soon the range for electric cars will be double that of petrol cars.

http://electric-vehicles-cars-bikes.blogspot.com/2010/10/audi-a2-electri...

http://www.motornature.com/2010/10/lmp-batteries-from-dbm-energy-376-mil...

"They did it in barely 7 hours, driving 376 miles. What’s really incredible is that to avoid traffic, they drove by night, so the lights were on, and the heater too! These guys must know something I don’t! I was not expecting such a record to happen before at least 2015. But it’s real. If you speak German, you may check this video. There’s also a website dedicated to the event, and members from the German government were at Berlin to greet Mirko Hannemann, the driver, and head of R&D at DBM Energy, after his trip."

ps. Average speed 90 km/h.

I wish. Battery prices are not dropping that fast. But even if the batteries were free, you would not be able to charge up fast enough. Even with a pretty high amp 240V charger, you are not going to be able to put more than 240 miles in a car overnight. Right now, it is more like 100+ miles with a 240V charger at 30 Amps.

Completely wrong! :-)

The charging time for the new batteries is 6 minutes for a full 600 km charge. (Using a high voltage supply).

Looks like this could be a dramatic game-changer!

Ok. Ok. I admit I don't know what the time would be for a home socket - but 100 kwh = 240 V * 30 = 14 hours

Pennycress Could Go from Nuisance Weed to New Source of Biofuel

Paul Krugman comments in today's New York Times

http://www.nytimes.com/2010/11/05/opinion/05krugman.html?hp

And sure enough, the grid-lock-is-good guys are coming through for Goldman and friends:

http://yglesias.thinkprogress.org/2010/11/what-i-would-have-said/

No real surprise there. The Fraud will continue until morale improves.

The same games going on in Europe - it sounds amazingly like the Fed when "audit the fed" was in season.

Too many "TBTF People" in high places over the past decade have been aware of the fraud, or actively involved in the fraud, for it to become public.

The whole deficit-hawk/Tea Party thing was just a stunt.

(Aw cumon, you all knew it was phony, right?).

We're back to 2007 with barely-regulated capitalism turned up full blast. Big business will get a green light and regulators will be told to shut up.

Wall Street is 25% of the economy.

So it's only a matter of time till the next crash.

Part-tay.

I suspect that the Tea Party tapped into a lot of real taxpayer frustration about the bank bailouts. Granted, I tend to ask people who tell me they voted Republican because they thought the Democrats were too soft on the banks, "I know what a few of the new candidates say, but have you listened to what the Republicans who will be chairing the House committees have been saying for the past year?" I think those voters are in for a rude surprise, but I also think their frustration is probably real.

Re: Gasoline Exports to U.S. Sink on French Strikes: Energy Markets

Yet according to the EIA weekly supply estimates this drop by almost two-thirds in tankers resulted in an increase in the volume of gasoline imported!

4 week average US gasoline imports to 1st October = 772 thousand bpd

4 week average US gasoline imports to 29th October = 839 thousand bpd

In the last two weeks of October gasoline imports are estimated by the EIA as 999 and 871 kbpd

Or else it didn't arrive in October but the EIA hallucinated it and counted the hallucination as "product supplied".

Interesting. Stocks have dropped by 4 million barrels in PADD I last month. If Canada didn't boost supplies to the US then the EIA numbers are garbage?

Gasoline Supply On The East Coast

MasterCard says that gasoline sales are down over 2% on the same period last year in their latest report. The EIA says gasoline sales are exactly the same (9,019 versus 9,020 kbpd last year - 4 week averages). I think the EIA does a worse job than your average 5 year old in estimating weekly import/export data to be honest.

Hmmm... well, it would be more transparent if the EIA published exactly how they calculated the numbers.

U.S. Cuts Europe Gasoline Imports on Freight Cost, Goldman Says

Pick numbers that bias the weekly report headlines in the direction they want then quietly adjust the numbers to the correct figures months later? Quite possibly the EIA will revise current gasoline demand down a couple of percent in a few months time when monthly data comes out or in a later annual revision. That's been the historical pattern. But the media never looks at the revised numbers.

I am always suspicious of statistics unless I know a lot about how they were collected (and adjusted), exactly what they mean, and also have good reason to believe in the honesty, competence, and integrity of the agency creating the statistics.

For example, I have had advanced graduate seminars on the topic of sociological statistics. Thus I feel competent to judge the validity of statistics published in the field of sociology, e.g. on the topic of social stratification. I have also had advanced graduate seminars in economic and business statistics, and hence I know enough to understand the limitations of the statistics in economics, e.g. the ones on inflation and unemployment.

Although I have been studying the articles and comments on TOD for more than four years, I'm still pretty much a layman when it comes to interpreting the reliability and validity of statistics on oil. For example, how can the high degree of consensus on Peak Oil on TOD be reconciled with the much different numbers that CERA is putting out? I have learned, at least, which article writers and which commenters on TOD have the best understanding of the numbers available, and I tend to follow their interpretations of the data.

I think the U.S. government data on unemployment is honest, but it is complex, and you need to know a lot about how economic data is compiled and what exactly the various classifications of unemployment include and exclude. For example, did you know that the unemployment statistics are gathered by using a stratified random sample of only 60,000 households? Did you know that retired people receiving Social Security and pensions are still counted as being in the labor force if they are employed or actively seeking work? Did you know that you only have to be sixteen years old to be counted in the labor force, if you are employed or actively seeking work? To understand and correctly interpret economic data, you almost have to have had post-graduate classes and seminars in economics.

So what's your opinion on the world relying on OPEC production statistics from mysterious "Secondary Sources"? Yes the EIA and the IEA might tweak these a little but basically their figures at the end of the day are close to those published by OPEC and attributed to "Secondary Sources" by OPEC itself.

Also why did not one drop of extra Saudi oil turn up in IEA import stream tracking since 2003 even as they claimed to be increasing production and exports? This is in marked contrast to Russia for example (which did turn up).

It is harder to get good numbers on oil production and reserves than it is to get good U.S. data on sociological and economic statistics.

I do not believe OPEC numbers, but I do not know the extent of their lying. For example, in regard to excess production capacity I recall that Saudi Arabia claims roughly 4 million barrels per day. That number is almost certainly wrong. But what is the correct number? Half a million barrels per day? Two million barrels a day? Or perhaps they have no excess capacity at all, just a surge capability for increasing production temporarily.

I am not competent to judge the quality of EIA or IEA statistics, because I do not know enough about how they are gathered, compiled, and adjusted. However, some on TOD do know enough to properly weigh the validity of oil statistics, and over four years I've figured out who these people are, and I pay close attention to their interpretations of oil statistics.

Note that facts (data, statistics) are meaningless in the absence of interpretations. Thus the data never "speaks for itself."

OPEC is very confusing. Would they really brag that "As a result, OPEC's unused oil output capacity is unlikely to shrink from the current level of 6 million to 7 million barrels per day (bpd). " if they were going to run out of excess capacity in just two years? This forum seems to say "don't trust OPEC." I don't, but I'm perhaps wary of discounting them completely. The quote was from http://www.thenational.ae/business/energy/opec-confident-of-current-oil-...

I don't believe OPEC "excess capacity" numbers but I do believe the production numbers published from "secondary sources" in their Monthly Oil Market Report. OPEC nations do not publish their production numbers but they do publish what other firms say they produce. And these numbers are always very close to what Platts and MEES publish.

Another reason to believe these numbers is that Venezuela is always bitching that these numbers never reflect what they actually produce. Venezuela says the numbers published in OPEC's OMR are one half to one million barrels per day too low. One would think they would be complaining that they were too high instead of too low but then Venezuela has been producing flat for years now.

It was last year when Venezuela was complaining a lot about their production numbers being too low. I could not locate a link back that far but I did find out one Venezuelan complaining that the data published by Nation Master was almost 1 mb/d too low. They had their 2007 production at 2,667,000 bbl/day. This pretty well agrees with what OPEC's OMR and the EIA says they produced. The OPEC OMR has them averaging 2,384 kb/d crude only and the EIA says they averaged 2,433 kb/d C+C. So adding natural gas liquids to the mix then 2,667 kb/d would be about right.

Ron P.

Trucks Outsell Cars by Widest Margin in 5 Years

http://www.cbsnews.com/stories/2010/11/04/business/main7023595.shtml

I continue my prediction that we are in the midst of a gas guzzler expansion. In 3 to 5 years the used vehicle market is going to be flooded with gas guzzlers that people can no longer afford to drive. I'm not sure if I should feel angry at these people or feel sorry for them.

Gas is hitting $3/gallon now. $4/gallon will definitely be passed in the next 3 to 5 years (unless we have another serious economic drop . . . which is definitely possible).

I think it is disgusting and these same people will be screaming for their own personal bailout when gas prices go through the roof again.

Yep. The gas guzzler bubble will pop when gas approaches $5/gallon. And people will whine like crazy but they've got no one to blame but themselves.

An interesting mathematical analysis of disordered systems with respect to correlation and variance (volatility) with potential applications to peak ‘everything’.

'Anna Karenina principle' explains bodily stress and stockmarket crashes

Original paper: http://arxiv.org/PS_cache/arxiv/pdf/0905/0905.0129v3.pdf

Obama to launch clean energy initiative in India

The United States and India will announce during Obama's trip the creation of a center for joint cooperation on developing clean energy, including solar power and biofuels, according to two people familiar with the plan.

Both nations and the private sector will fund the center, they said. The United States is also expected to announce help for India to map out shale reserves, the deep-underground gas source that has triggered a boom in North America.

On the High Speed Derailment article:

I just got back from picking up my last check for the season at the farm where I work. My boss, who is on a rail advocacy committee, was railing (pun intended) against the idiot republicans who want to return stimulus monies for rail service.

Then I logged on here and found confirmation of it.

My response to my boss: "They're simply going to drive us over the cliff."

This is no surprise. Maybe they're doing us a favor (a la Dmitry Orlov) of hurrying on the collapse.

This is the perfect illustration of why voting for the 'lesser of two disappointments' is a much wiser path than striking out on some 'plague on both their houses' tangent.

But that "strategy" didn't work, did it?

Perhaps it's actually a "perfect illustration" of what most people want.

Amen, Toil.

Unfortunately, the folks who cooked up these rail schemes sold them by out-and-out fraud. There was much excitable talk about high-tech leadership and what not; they even insisted on calling it high-speed rail. But in the event, it turned out to be 1930s 79-mph-max cr*p, running the kind of heavy ancient-design cars, almost unique to the USA, required by the FRA's parasitical plushbottomed tenured bureaucrats, immovably ensconced in the 1920s. I'm not even clear whether the Wisconsin (Madison-Milwaukee) line was to be electrified, for crying out loud, or just more noisy, stinky, rumbling diesel. And it appeared that it would be subject to random "freight delays" of unlimited duration just like the rest of Amtrak. Oh, and it was going to slice one of the few somewhat walkable Madison neighborhoods in half, since nearly all the railroad crossings were required to be closed - FRA again - engendering extra opposition from an unexpected end of the political spectrum. What a joke. What a pity. What a heap of fetid rubbish.

The same apparently applies to the Ohio lines, connecting Columbus, Cincinnati, and Cleveland - useless garbage from the dead past that hardly anyone will want to use because the overall trip time is just way too slow and random.

And let's not forget that for most people, the overall trip does not end at the station. There remains the vexing issue of the last miles. Not one of those cities has eight or ten million people, like metro Paris, London, etc. So for lack of madding crowds crammed in wall-to-wall, local transit to get to one's final destination will often be rubbish that may not even run at all on evenings or weekends. No masses, no mass transit. Many train riders, maybe most, should expect to be slammed with gargantuan taxi fares on top of the train fare.

Truly, the concept wasn't thought through at all, not even for a nanosecond. Truly, it was 'marketed' fraudulently and incompetently to the taxpaying public. Typical behavior for politicians, who hardly ever seem to be able to get anything right as they flit aimlessly from one undeveloped bright-spark Big Idea to the next like moths orbiting a bug-zapper. And unfortunately, there's no way to leave the politicians out of it. These trains seem to cost at least as much per passenger-mile as driving alone, while the overall trip takes far longer. That makes them dead on arrival without substantial political subsidies.

To repeat: a pity. But there it is.

AND depressing.

Well, at some point Republicanism becomes a self fulfilling prophecy. They get into government, say "government is the problem," slash taxes on the wealthy and corporations, put the government deeply into debt, and gut the government's ability to do anything, and then go back on election day and say "see, government is the problem."

Well of course it is, if the people elected are hell bent on destroying it!

I'm afraid we've reached that point in American society.

Yes, government is worthless. But that's only because we've elected people for the past 30 years (including many Democrats) who were intent on making sure it was.

Republicans pander through tax cuts. Democrats pander through give-aways. Both finance through debt. Only a few of us would rather have less debt, spend less, and tax to match.

The pattern with US national rail legislation is that some pork has to be passed out to enough states and legislative districts to win enough votes for passage. The result is a shambles of bad projects that really don't accomplish much economically or technically, and which can be pointed to in the future as examples of why government funding doesn't work.

Although there has been some mention that the funds from Ohio, Wisconsin, etc., should be focused on true high-speed rail projects in the BosWash and SanSan megapolises where high speed rail actually makes sense, that will probably not happen since those areas are not majority Republican areas.

The Wisconsin governor-elect wants the money for roads and bridges; I suspect something similar might happen in Ohio. Under current law that supposedly can't happen, but some years back there was a similar situation and the funds did get diverted in the end.

http://www.dot.wisconsin.gov/projects/recovery/docs/rail-grant-13.pdf

There is a section of the grant application, under "Detailed Capital Cost Budget and Annual Capital Cost Budget," labeled as "electric traction." Perhaps next time you should try looking up the facts instead of repeating whatever talking points happen to be circulating (quaint concept given the prevailing political sentiment these days, I know).

The question of course remains, if not rail, then what? Most of the Republicans who oppose rail plans say the money is better spent on upgrading and maintaining roads. Although, never mind the whole long-term sustainability of rubber-tired transport issue, most of them don't even seem to have concrete plans for what they'd like to see happen to the road system, and oppose any specific projects that are proposed there as well. Then again, they've never been good at coming up with "ideas" and "proposals" - much more fun, and politically effective, to tear them down.

It's going to be a long next couple of years.

"There is a section of the grant application..."

Well, when the well publicized renderings show no third rail, no catenary and no apparent place to put it, and no current collector (pantograph) on the locomotive roof, it didn't seem important go snark-hunting through endless bundles of bumf to try to find an obscure line item 27 pages deep in the entrails of one of them, over a blog comment. So I'm OK with that, assuming that the line item implies electrification of the whole line and not just a zone near Milwaukee, as on some lines around Chicago and New York. Apparently no one thought electrification worth mentioning or including in the rendering, much less an important selling-point.

It remains that the public was sold a bill of goods, with endless well-rehearsed, well-publicized happy talk about advanced hi-tech high speed rail, only to be presented with 79-mph rubbish, with vague promises of 110-mph pie in the sky by and by. Even that 110mph would be well short of the 130mph introduced in Japan all the way back in 1964. 110mph was deluxe high speed between New York and Chicago in the very late 1930s before the war intervened.

Now, if our lying politicians want to sell ancient, outdated technology on the grounds that we're so far into hell in a handbasket that the 1930s is all we can possibly ever again aspire to, well, let them have at it. I'll get out the popcorn and watch the show. On that basis it will be hugely entertaining, more "fun" than a barrel of monkeys, and more surreal than anything the best Saturday Night Live writer could dream up.

But please, irrespective of any or all of this, and irrespective of whether 1930s rail might somehow be a good idea notwithstanding any of it, no more bait-and-switch. Again: no more bait-and-switch.

N.B: at least in Wisconsin, they've had little trouble spending on roads. When NIMBYs resist in Place A, they spend in Place B. When the traffic finally grinds to a crawl in Place A, then they typically go back and spend there, even if occasionally a project does die. (Since this all proceeds at government speed, i.e. a snail's pace, and that's an insult to snails, these projects sit so absurdy long in the queue that apparently they have plenty available to resequence.) Not long ago, they spent $800 million or so (same as for the rail project) on, count it up, it boggles the mind ... drum roll ... one interchange. I don't know about Ohio, although a substantial stretch of the Turnpike was widened fairly recently.

Or perhaps, no one involved was sufficiently clueful about the visual appearance of an electrified train. That it is different from that of a diesel electric. Those are "electric" too, aren't they?

"Those are "electric" too, aren't they?"

Um, yeah, I guess. Eyes roll. Aieeeeeeeee!

But OTOH the kind of folks who do such renderings often pride themselves on how urban, sophisticated, and cosmopolitan they are - note well that the picture caption in the article I linked refers to it is a "train shed", a hoary nineteenth-century Americanism I've encountered in European International English, but not from American speakers, not even growing up in New York.

Now I'm remembering one such prideful individual trying to teach me how to pay fare on the London Underground. ROFLMAO, a little spark to brighten the evening.

I don't know how you can Assume so many facts that just are not so. First, the line was to be upgraded to 79 mph starting with the section from Watertown to Milwaukee being double tracked - thus eliminating the freight interferance problem. The balance of the route, Watertown to Madison has almost no freight traffic (run by WSOR, not CP) and would have passing sidings.

Second, the line was to be raised to 110 mph later in areas where the speed would allow largely outside Milw. and Masison urban areas. Any increase in speed above this is largely wasted capital for a route that is only 80 miles long and would have a suburban stop in Milwaukee, thus having only about 65 miles maximum between stops. Going 155 for 55 miles versus 110 mph only saves five minutes and would cost over twice to three times the per mile cost of infrastructure.

Third, the technology is not 1920's but TALGO tilt trains that are designed to run at maximum of 135 mph (IIRC) and are only about 2/3 the weight of a conventional diesel locomotive train on a per seat basis.

Fourth, The FRA is NOT predicating closing all grade crossings, only a few that are redundant (some cities have them every one or two blocks) and the balance would be upgraded with four quadrant gates and approach speed timing to prevent delays when slow trains pass.

Fifth, Madison is a rather compact city with quite good bus transit - I'll bet you never set foot in that town have you? Milwaukee has a good bus transit system also and has plans for more commuter rail to Chicago and studied (but yet funded) light rail in two directions.

Lastly, where do you get the idea that only large cities in Europe, and thus the most US cities warrent rail service, either high speed or conventional routes feeding high speed. Maybe you better look at a map of Europe and see how many cities much smaller than Madison and Milwaukee have routes that feed into larger cites with and without high speed rail routes.

You really don't know much about rail as you claim. I make my living by offering engineering consulting services to railroad companies (large and small), state DOT's, rail finance firms, and railcar repair shops/rebuilders.

So your claims are mostly without fact or basis.

Next time you make statements, check the facts. I can give you contacts at FRA, Wis. DOT and Talgo if you doubt anything I have said.

Mark S. Bucol

Mark-

I'm in La Crosse, which sits on the Amtrak line...the plan was to extend this "high speed" line through here and then on to MSP. I'm not sure if this train would make stops along the way, but i assume it would. I'm really not sure how much of an upgrade it would be over the current Amtrak? There is a lot of misinformation out there on this whole train deal. I've talked to a few people here and its split, with some saying its a huge waste and others liking the idea. Personally, i'm not that big on the idea, although i figure its printed money from Obama that will likely go to NY if we don't spend it, so spend away!

About distance..the Maglev line in China is 19 miles and goes 270mph. So it would have been nice to see this train go a little faster then 110mph...some people on I-94 already drive that fast.

First, the line was to be upgraded to 79 mph starting with the section from Watertown to Milwaukee being double tracked - thus eliminating the freight interference problem.

Check. No freight interference, like on the rest of that bundle of lame excuses called Amtrak. Maybe, but I'll believe it when I see it.

Second, the line was to be raised to 110 mph later in areas where the speed would allow largely outside Milw. and Madison urban areas.

Yup. That's precisely what I meant by vague promises of pie in the sky by and by. Maybe it will take the same 80 years as the yet-to-be-completed Second Avenue Subway in New York, or maybe it will just go the way of most political promises.

Third, the technology is not 1920's

Oh, ye of literal minds. No, the rendering did not show a steam locomotive. But in terms of the eternity it will take to complete a door-to-door trip between Madison and Milwaukee, it might just as well have. When our lying politicians call it high-speed rail, they intend to evoke the Shinkansen or the TGV. That's a ridiculous insult: a Talgo creeping along at 79mph, tops, is no Shinkansen, nor a TGV.

The FRA is NOT predicating closing all grade crossings, only a few that are redundant (some cities have them every one or two blocks)

And having them every one or two blocks is precisely what you need for good walkability, for the street grid to be connected. Once you start forcing people to go on lengthy hikes just to travel 150 feet, they start driving.

Madison is a rather compact city...

Utter rubbish, in this context. Paris proper would fit about twice into Madison proper, which would put 3.6 million people where 220,000 now live. Metro Paris numbers around 8 million, metro Madison around 400,000 on a similar acreage. That's why Paris has Metro trains every few minutes, plus the RER, plus fairly frequent TGVs to here there and everywhere, while Madison has a desultory bus once in a blue moon.

...with quite good bus transit

only by absurd, utterly undemanding U.S. standards. Sorry, a bus once an hour (or half hour during the "rush") when it feels like it - oh, and in many neighborhoods they never feel like it on Sunday - doesn't count as "good" transit. Nobody has that kind of time. And some people need to get to work or other places on Sunday.

Milwaukee has ... plans ...