Drumbeat: November 4, 2010

Posted by Leanan on November 4, 2010 - 10:08am

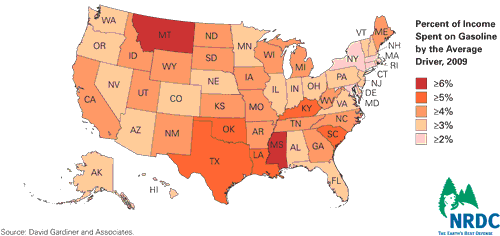

Which U.S. states are most vulnerable to gas price hikes?

Drivers in Mississippi spent nearly two and a half times more of their income on gasoline than those in Connecticut, finds a new 50-state ranking on the impact of gas price hikes.Some U.S. states are far more dependent on oil and vulnerable to price increases than others, and most aren't doing enough to lessen that dependence, according to the 2010 edition of the annual "Fighting Oil Addition" report by the Natural Resources Defense Council, an environmental group.

Observations on local governments’ preparedness for fuel supply disruptions

Fuel supply disruptions can wreak havoc on our transportation systems and overall economies. For example, the energy crises of 1973 and 1979 posed what one economics professor called a “state of disaster on world economies”. Gas lines formed, food prices increased, and the economy fell into recession. The traveling public became angry at the chaos that ensued. For those of us who help to manage and operate our transportation systems, a fuel supply disruption would represent a major crisis.In the wake of the oil supply shocks of the 1970s, the U.S. Department of Transportation (U.S. DOT) encouraged the development of regional transportation energy contingency plans. The U.S. DOT also conducted a number of workshops around the country to help regions and states develop these plans. But by the early 1980s, regional and local governments stopped developing transportation energy contingency plans as the threat of fuel supply disruptions diminished, as funding and support for the development of these plans discontinued, and as other more pressing issues emerged. Contingency planning at the state level has continued.

Marin Katusa Values Viable Technologies and Leadership

TER: Isn't it more a reflection of supply because you're hearing all about peak oil?MK: Yes, there's the peak oil concept. Look at natural gas. America's been so successful in unconventional shale gas technology, but that's just starting to hit Europe. The Middle East hasn't even started doing unconventional exploration. You've got these great, cheap world-class producers that have been producing the same way they did before I was born over 30 years ago that haven't seen modern American technology. When the American innovation hits the Middle East, you will see a lot more of this supply come online.

TER: To what technology are you referring?

MK: The unconventional shale primarily uses fracking techniques. The hottest thing in Europe right now is the unconventional shale sector. Big funds like the one run by George Soros are investing millions of dollars in the sector—these wells cost more than US$8–$15 million per well. But people are worried because each frack uses 2–5 million gallons of water.

In the old days, when you drilled a well for gas, once you spud—you produce. There's no way to contain it; you have to sell it. So, you dump it into your pipelines and get the price going at the wellhead. Today with the shale technology, you can frack it and it takes you about two days to complete the well. That way, you know how much gas you have and it's a new natural storage facility. You don't have to pump it out. The reservoirs can triple—quadruple if they're successful.

I used to work at the Oxford Institute for Energy Studies, which is primarily an oil and gas institute, back in the 1990s. I worked on electricity, but most of my colleagues were involved in fossil fuels. There were many discussions about the upstream, meaning where oil is coming from, and that fact that it is finite. It was clear that supply would be a problem at some point, although when I was there, oil prices were very low ($10/barrel), so no one thought it would be an imminent problem. I began to look into energy returned on energy invested (net energy) and realized the problem would be much closer at hand in net energy terms, and that we would see major declines in my lifetime.

Peak Oil Guru Robert Hirsch Gives The Definitive Guide To The Coming Energy Fiasco

There is no greater advocate of peak oil than Robert Hirsch, who directed America's nuclear energy program in the 1970s and authored the first major warning to the Energy Department in 2005.Hirsch repeated his warning at last month's ASPO-USA conference and said the time has come to adjust your lifestyle and portfolio.

His advice: Sell most stocks. Get out of bonds. Buy annuities and gold. Move closer to public transit and shopping centers, and get a Prius.

I’m going to begin by admitting to a questionable wish that, I believe, others may nevertheless also share: I wish for the coming of Peak Oil. The sooner, the better. Let’s get on with it. Enough of all this practice: when will it be game-time?In more reflective moments, or at least ones in which I focus on the practical aspects and likely consequences of Peak Oil, I am able to remind myself that my life, and those of my friends and family, are pretty safe and secure right now, and that after Peak Oil, they will become increasingly less so. But my visceral reaction to the news that oil is pushing $100/barrel, that Alaska reserves have been greatly overestimated, that Ghalwar is running dry runs in the direction of excitement and glee.

Policy makers should promote abundant and affordable energy, and oppose policies that raise energy prices and restrict energy access.

The U.S. military knows we are on the verge of an oil crisis. There are no new supplies ready to come on line before 2015. The President and his advisors know that an oil crisis is in our immediate future. We have military bases in Saudi Arabia, Iraq, and Kuwait. We have active fighting forces in Afghanistan and Pakistan. We have a naval armada of aircraft carriers in the Persian Gulf. Our forces completely encircle Iran. Is this a coincidence when the countries with the largest oil reserves in the world are noted?

Iraq attacks unlikely to deter investors

(Reuters) - Investors daring enough to snap up a piece of Iraq as it emerges from the chaos triggered by the 2003 U.S.-led invasion are unlikely to be deterred by attacks which rocked the oil-producing nation's capital, killing dozens.Iraq, starved of investment in virtually every sector, is trying to get back on its feet and lure foreign investors despite an eight month political impasse since an inconclusive election and frequent attacks and killings.

EU gives cautious welcome to Polish-Russian gas delivery deal

Brussels/Warsaw - The European Union's top energy official gave a cautious welcome Thursday to a gas delivery deal signed last week between Poland and Russia.The European Commission was looking for reassurances from Poland that the agreement would not breach EU competition laws by guaranteeing third party access to Yamal, the biggest pipeline bringing Russian gas into Europe.

Chesapeake Aims to Be Top 5 US Liquids Producer by 2015

Chesapeake aims to become a "top five" U.S. producer of oil and natural gas liquids by 2015, Chief Executive Aubrey McClendon said Thursday.In an earnings conference call with analysts, McClendon said that the Oklahoma City company aimed to produce about 150,000 barrels a day of liquids by year-end 2012, and 250,000 barrels a day of liquids by 2015.

Panalpina, Others Settle to End U.S. Bribery Probes

WASHINGTON (Reuters) - Six companies including Swiss logistics firm Panalpina and Royal Dutch Shell have agreed to settle foreign bribery investigations and will pay some $236 million in criminal and civil penalties, the Obama administration said on Thursday.

Transocean sees $200 million Q4 hit from drilling halt

(Reuters) - Transocean said on Thursday that it sees the effects of the U.S. offshore drilling moratorium knocking about $200 million off revenue this quarter due to downtime for rig retrofits and special rates negotiated with its clients.

French Port Workers May Resume Strike - CGT Union

PARIS -(Dow Jones)- French port workers may resume a one-month strike suspended last week if the government doesn't answer their concerns on legal retirement age, the Confederation Generale du Travail union, or CGT, said Thursday.Workers at France's Mediterranean oil port Fos-Lavera, the world's third- largest oil terminal, resumed work Friday after 33 days. The strike, combined with walkouts at the country's main refineries, led to a shortage of fuel in some French regions.

Petrobras may up gasoline output if demand rises

RIO DE JANEIRO/SAO PAULO (Reuters) - Brazilian state oil company Petrobras could boost production of gasoline at its refineries by 30,000 barrels per day to avoid imports if consumption rises, the company's supply director said on Wednesday.In February, Brazil imported gasoline after a cut in output of sugar cane ethanol -- widely used as a motor fuel in Brazil -- made gasoline better value for money in most places and led to a temporary local shortage of the fossil fuel.

Pakistan energy crisis to hurt feeble government

ISLAMABAD (Reuters) - Pakistan's energy crisis, likely to deepen as winter approaches, threatens to further undermine the credibility of a government struggling with a Taliban insurgency and an economy in tatters.President Asif Ali Zardari's U.S.-backed administration faces pressure from all sides on energy shortages, with the public and industry demanding an end to power cuts.

The International Monetary Fund, which has kept Pakistan's economy afloat with a $11 billion package agreed in 2008, wants the government to take unpopular decisions such as raising tariffs to help generate funds for the power sector.

Such measures are essential for Pakistan's long-term economic health but may be a lighting rod for public anger.

Bridport police target heating oil thieves

PC Chris Forshaw, who co-founded the Stop That Oil initiative with fellow officer Tim Poole, said the force is currently working with local heating oil suppliers to install locks on residential and commercial tanks."This is another success for the scheme; myself and PC Tim Poole are hoping for a major take-up of tank alarms. We are currently working towards making the oil unusable once it's been stolen," he added.

As Host of Climate Talks, Mexico Faces Domestic Energy Paradox

MEXICO CITY – In the run up to this month’s COP16 meeting in Cancún, Mexico has poised itself as an eager champion of climate change initiatives by rallying its Latin American counterparts to bring environmental policies to the top of their political agendas.Rather than bolster its role as liaison, however, the country should first remedy its own domestic policy dilemma, local environment and energy experts argue. Even while Mexico outlines ambitious goals for climate change, the government is boosting the struggling economy by expanding the state-run oil industry and promoting car ownership.

Factbox: Views of Republicans to lead key energy committees

(Reuters) - Republicans gained control of the U.S. House of Representatives in Tuesday's elections, picking up at least 60 seats, and now will take control of powerful committees that will likely derail President Barack Obama's plans for comprehensive energy legislation.

John Michael Greer: The Preponderance of the Small

The core plot of tragedy, again, is that an extraordinary person attempts the impossible and is destroyed. The core plot of comedy, by contrast, is that a completely ordinary person attempts some equally ordinary task and, despite all the obstacles the author can come up with, succeeds in winning through to some modest but real achievement. When it stands on its own, comedy gets its effect by reminding us that, no matter how ordinary we are, and how embarrassing the tangles we create for ourselves, we can reasonably hope to stumble our way through it all and achieve something worthwhile. When it functions as a counterpoint for tragedy, this same effect is even more powerful; as the tragic hero in all his magnificence crashes and burns, the comic counterpoint scrambles out of the way of the flaming wreckage and finds afterward that, like Candide, he can at least tend his garden.Yes, I’m suggesting that this is basically the best we can hope for at this point in the turning of history’s wheel.

Norway best, Zimbabwe worst places to live: U.N.

(Reuters) - Oil-rich Norway remains the best country in the world to live in, while Zimbabwe, afflicted by economic crisis and AIDS, is the least desirable, according to an annual U.N. rating released on Thursday.The assessment came in a so-called human development index, a measure of well-being published by the U.N. Development Program for the past 20 years that combines individual economic prosperity with education levels and life expectancy.

Caribbean Fighting a Losing Battle Against Food Imports

ST. GEORGE'S, Grenada (IPS) - For much of late October, Caribbean ministers of agriculture, journalists, farmers and academics gathered in this tiny but picturesque south Caribbean island in a rearguard bid to refocus a region used to existing mostly for tourism on agriculture, given a mounting food import bill and fears of yet another global food crisis.

OPEC raises mid- and long-term oil demand forecasts

Vienna - Global oil demand is expected to rise slightly more than previously expected in the next two decades, the Organization of the Petroleum Exporting Countries (OPEC) said Thursday, in its annual forecast.The Vienna-based cartel also said fossil fuels would continue to dominate the energy mix, and that there would be no revolutionary shift towards alternatively-powered vehicles.

Demand was seen as rising to 89.9 million barrels per day (bpd) until 2014, rising 5.4 million from 2009. (One barrel equals 159 litres.)

This projection was 800,000 bpd higher than last year's.

'A recovery is clearly on the way, with the economic outlook far brighter in most parts of the world than a year or so ago,' OPEC Secretary General Abdalla Salem El-Badri said in the report.

OPEC also raised its forecasts through 2025, although the 2030 demand figure was nearly unchanged at 105.5 million bpd.

Saudi King surprises on Forbes Most Powerful People list

Abdullah bin Abdul Aziz al Saud, at age 86, controls a large portion of the world's oil reserves and has begun some very small liberalization initiatives (though Saudi Arabia remains one of the most conservative Islamic countries in terms of religious and political freedoms, but many people have to ask: why number 3? After all, this puts him one spot behind Barack Obama, and one spot ahead of Russian President Vladimir Putin.

FACTBOX - UAE oil and gas concessions

(Reuters) - Multinational companies hold large stakes in concessions that pump most of the oil and gas in the United Arab Emirates, the world's third-largest oil exporter.The UAE has said it aims to increase its oil production capacity to 3.5 million barrels per day (bpd) by 2018 from 2.7 million bpd now and it will be reliant on these concessions for the increase.

Iraq to sign over fields in weeks

Iraq's Oil Ministry expects to sign initial contracts for the Mansuriyah and Akkas gas fields on 14 November and for the Siba gas field on 15 November, a senior Iraqi oil official said today.

Entergy mulls sale of Vermont nuclear plant

(Reuters) - Utility owner Entergy Corp said it was exploring the potential sale of its 605-megawatt nuclear plant in Vermont, eight years after buying it from the Vermont Yankee Nuclear Power Corp.Entergy said while no decision had been made to sell the plant, it expects interest from "multiple" parties.

Cellulosic Biofuel Output Will Lag 2011 Requirements, EIA Forecast Shows

Oil companies won’t be able to get as much cellulosic biofuel as they might need next year, according to the U.S. Energy Information Administration.EIA, a unit of the Energy Department that compiles industry data, expects cellulosic biofuel production in 2011 to be 3.94 million gallons, according to a letter written by an EIA official. That’s less than 2 percent of the 250-million-gallon mandate for 2011. The government already slashed this year’s target by more than 90 percent to 6.5 million gallons.

Carmakers' next problem: Generation Y

Meet Natalie McVeigh, the auto industry’s latest headache.At 25 years old, McVeigh lives in Denver and has two good jobs, as a research analyst and an adjunct professor of philosophy. What she doesn’t have — or want — is a car.

A confluence of events — environmental worries, a preference for gadgets over wheels and the yearslong economic doldrums — is pushing some teens and twentysomethings to opt out of what has traditionally been considered an American rite of passage: Owning a car.

Baby Boomers' dilemma: When should mom, dad stop driving?

People in their 70s and beyond are often reluctant to give up their car, especially when there are no practical transportation alternatives. "Cars are the symbol of independence," she says. "But for most places in the U.S., the car is way more than a symbol. It actually equals independence."

UN report warns of threat to human progress from climate change

The United Nations warned today that a continued failure to tackle climate change was putting at risk decades of progress in improving the lives of the world's poorest people.In its annual flagship report on the state of the world, the UN said unsustainable patterns of consumption and production posed the biggest challenge to the anti-poverty drive.

"For human development to become truly sustainable, the close link between economic growth and greenhouse gas emissions needs to be severed," the UN said in its annual human development report (HDR).

Toyota Nears EU Targets, Leads Carmakers on CO2 Cuts

Toyota Motor Corp. led carmakers in cutting carbon-dioxide discharges in Europe last year and is closest to achieving its target under European Union legislation, an environmental transport group said.

Dutch shelve CO2 storage project but keep policy

AMSTERDAM (Reuters) - The Dutch government has shelved a plan to store carbon dioxide underground in the town of Barendrecht in the west but remains committed to CO2 storage.Economy, Agriculture and Innovation Minister Maxime Verhagen said on Thursday due to a three-year delay and local opposition he had decided to stop the Barendrecht plan.

Eat local and reduce your carbon footprint

Lexington — When Bill McKibben visited recently, he asked if we’d hold a global warming event at our garden. You may be wondering: What does a garden have to do with global warming?Many people think of food miles — the distance our food travels to reach our plates. You may have heard that food travels an average of 1,500 miles to get to our table. There are a lot of greenhouse gases generated during those travels.

Weeden’s Maxwell: Brace For $300/Barrel Oil

When IndexUniverse.com Managing Editor Olivier Ludwig caught up with Charles Maxwell, Weeden & Co.’s senior energy analyst, it was to talk about so-called “peak oil,” the theory that holds that the day when oil production around the planet is no longer sufficient to meet demand is nearly upon us. Maxwell, who has been involved in the oil industry for more than half a century, speaks with the slow cadence and easy charm of a man who has mastered his subject. The problem is that if you take his message seriously—and there are plenty of reasons to believe it unreservedly—it can pretty much ruin your day. From having to eat more root vegetables in winter instead of enjoying oranges from Chile, to watching oil prices spike to $300 a barrel by 2020, a world of slowly but steadily dwindling supplies of petroleum would be very different indeed. But there is an upside, once the shock of it sets in: Peak oil will undoubtedly unleash a wave of technological innovation, most importantly in energy efficiency.

Oil Rises a Fourth Day After Fed Move Weakens Dollar, Fuel Supplies Drop

Oil rose to a six-month high in New York after the Federal Reserve said it will expand record measures to spur the economy in the U.S., the world’s biggest crude consumer.Prices climbed for a fourth day, the longest rising streak since September, as the Fed’s measures weakened the dollar and boosted investor demand for commodities. The central bank yesterday said it will buy an additional $600 billion of Treasuries through June. U.S. gasoline stockpiles fell last week to the lowest in almost a year, according to government data.

OPEC members differ on oil price target

Oil traded close to a six-month high yesterday amid a faltering consensus among Gulf oil exporters on a fair price for crude.The UAE yesterday stuck to its position that oil prices close to $70 a barrel are ideal for consumers and producers.

Oil ministers from Saudi Arabia and Qatar both said this week that crude should trade within a range of $70 to $90 a barrel, overturning a two-year consensus among Gulf states that prices should hold within a narrower band of $70 to $80.

The comments reflected new expectations within OPEC that prices will break above a relatively stable range that has been in place for 18 months, analysts said.

$100 Oil Looms for JPMorgan, Merrill After Fed Stimulus

Oil may return to $100 a barrel for the first time since the 2008 financial crisis as the U.S. Federal Reserve’s stimulus measures weaken the dollar, drawing investors to raw materials.Crude may rally to three digits next year as central banks pump cash into their economies to revive growth, according to JPMorgan Chase & Co. and Bank of America Merrill Lynch. The Dollar Index sank 7 percent in the past two months as the Fed moved closer to extending a bond-purchase program, luring investors to commodities including oil.

Green policies could lower oil price

A reduction of 10% in oil demand could knock about $20 off the price of a barrel of crude by 2035 if nations meet their climate change pledges and cut fossil fuel subsidies, the International Energy Agency says.

Strong margins boost profits at smaller refiners

BANGALORE (Reuters) - Three smaller U.S. refiners, Holly Corp, Frontier Oil and Western Refining benefited from wider refining margins and joined their bigger peers in posting strong quarterly results and signaling a solid finish to the year.Profits have risen at oil companies as U.S. crude prices rose 13 percent from a year earlier, while natural gas rose more than 30 percent in the quarter. A recovering economy has also increased demand for fuel, leading to improvement in refining margins.

Suncor profit up on higher production, prices

Suncor Energy Inc., Canada’s biggest energy company, said on Thursday its third-quarter net profit rose 10%, helped by additional upstream production and higher benchmark oil prices.Suncor, best known for its Alberta oil sands operations, earned $1.02-billion (US$1.01-billion), or 65 Canadian cents a share, up from a year-earlier $929-million, or 69 Canadian cents a share.

Norway says 37 firms apply for oil exploration

(Reuters) - Thirty-seven oil and gas firms have applied for exploration licenses off Norway, the Nordic country's oil and energy ministry said on Thursday. "The (ministry) has received applications from 37 companies," it said in a statement. "The ministry aims at awarding new production licenses in spring 2011."

Nigeria still aims to pass a bill this year that will overhaul its energy industry, but the timing of its next oil licensing round is uncertain, a senior government official said today.The Petroleum Industry Bill will re-write Nigeria's decades-old relationship with its foreign oil partners, altering everything from the fiscal framework for offshore oil projects to the involvement of indigenous companies in the sector.

USGS Drops a Bomb on Alaska's Oil Future

Even when oil prices shot up to $150 per barrel, Alaska's oil production dropped 5.4% over 2007 levels.I want you to take a look for yourself, and then tell me if you think the state will be able to keep writing checks to the next generation of residents:

A Probabilistic Assessment Of Short-Term Inflation, Deflation, Hyperinflation And Serious Deflation

Issues associated with peak oil/resources will not be a factor within the next few years.

Paraguay Titanium Find May Be World's Largest, Discoverer Says

The American explorer who discovered the world’s biggest copper deposit in Chile has staked a claim in Paraguay to what he says may be the largest titanium find.David Lowell, 82, the president of closely held CIC Resources Inc., controls mineral rights to at least 185,000 hectares (457,000 acres), according to Paraguay’s sub-ministry of mining and energy. That is an area the size of London.

PM Lee Speaks At Singapore International Energy Week 2010

On the demand side, demand is going up sharply. China, India and other rapidly growing economies have rising energy needs and although they may be using energy more efficiently, their growing appetite for more power as a result of rapid economic growth far outpaces any efficiency gains.But on the supply side, it is not all pessimistic news. There is hope for new sources of supply. Time and again experts have warned that oil and gas deposits will soon be depleted and they calculate the year beyond which mankind will be out of oil and gas. But such talk of peak oil has been proven wrong many times in the past. And they may yet proved mistaken again because each time you think you have run out, oil companies have consistently discovered not just new reserves but also developed new ways of extracting reserves that previously could not be taped. Drilling in deeper waters, innovations like drilling tight shale rock formations to get that unconventional gas, better management techniques on oil fields so that you get out not just one-third of the oil which is there but even two-thirds of the oil which is there, which can make a tremendous difference. And in any case, whatever the prospects with oil and gas, as far as coal is concerned the supplies are sufficient to last mankind for centuries.

Focus Changes for Louisiana in Oil Cleanup

Louisiana is scaling back and altering a project to construct sand berms along its coast to block and capture oil from the BP spill, the state’s governor, Bobby Jindal, said this week.

Coal still king as green power IPO struggles

MILAN/MUMBAI (Reuters) - Waning investor interest in clean energy contrasted sharply with enthusiasm for coal on Thursday as shares in Enel Green Power fell on their debut while Coal India's soared.

Solar Roads, urban mining, the Jevons Paradox and energy efficiency

It's one thing to develop new technologies but making them more efficient is increasingly the focus. But can the pursuit of efficiency actually be counter-productive? Ever heard of the Jevons Paradox?

Why Marxism Has Failed, And Why Zombie-Marxism Cannot Die - Part 1

Our workshop, entitled "The End of Capitalism? At the Crossroads of Crisis and Sustainability", was packed. A surprising number of people were both intrigued and supportive of our presentation that global capitalism is in a deep crisis because it faces ecological and social limits to growth, from peak oil to popular resistance around the wold. Participants eagerly discussed the proposal that the U.S. is approaching a crossroads with two paths out: one through neo-fascist attempts to restore the myth of the "American Dream" with attacks on Muslims, immigrants and other marginalized groups; the other, a path of realizing and deepening the core values of freedom, democracy, justice, sustainability and love.Despite the lively audience, I knew that somewhere lurking in that cramped, overheated classroom was the unquestionable presence of Zombie-Marxism. And I knew it was only a matter of time until it showed itself and hungrily charged at our fresh anti-capitalist analysis in the name of Karl Marx's high authority on the subject.

MBA in Managing for Sustainability at Marlboro College Graduate School starts in January 2011

The Marlboro MBA provides you with the knowledge, skills, and connections to manage for sustainability. To succeed in the new millennium, organizational leaders must understand the impact of management practices on their business and the environment, the workforce, local cultures and profits. At Marlboro College, this multiple-bottom-line philosophy is integrated into all our MBA in Managing for Sustainability courses, from accounting and finance to business law, economic theory and renewable energy education.

Indian Solar Projects May Struggle to Get Funds for Development, ADB Says

Developers of solar-power projects in India may be unable to obtain loans to complete the plants because the government’s proposed stations are too small and tariffs may be too low, an Asian Development Bank official said.“Banks are very uncomfortable financing solar in India,” Don Purka, senior investment specialist for the Manila-based bank, said in an interview today at the Clean Energy Forum in Singapore. “The power purchase agreements must be modified for banks to lend.”

Nuclear watchdog resists deadline in Abu Dhabi plant evaluation

ABU DHABI // The independent nuclear watchdog will not be bound by pressure to meet any schedule when it begins evaluation of a proposed nuclear power plant project this year, its chief said yesterday.The nuclear plants planned for Abu Dhabi, the first of their kind in the Arab world, need to undergo a lengthy safety check by the Federal Authority for Nuclear Regulation (FANR), expected to begin in December.

China Should Focus on Steel, Chemicals to Improve Efficiency, IEA Says

China, the world’s largest greenhouse-gas emitter, should focus on steel, chemicals and cement industries to improve energy efficiency, an official with the International Energy Agency said.

China May Establish Carbon Trading by 2013, Climate Exchange's Sandor Says

China, the world’s biggest energy consuming nation, may have a carbon trading system in place as soon as 2013, said Richard Sandor, one of the pioneers of the carbon credit market.A cap-and-trade market in China may be in place by 2020 and could be functioning by 2013 to 2015, Sandor said at a climate change forum in Hong Kong today. He helped found London-based Climate Exchange Plc in 2003, agreeing to sell his stake in the company in April to Intercontinental Exchange Inc.

Woman Loses Bid to Lead Navajos

Lynda Lovejoy, a state senator in New Mexico, and her running mate, Earl Tulley, have lost their bid to become the first woman and the first environmental leader to lead the Navajo Nation, the largest American Indian tribe.

EU states express doubts over carbon offset ban

European Union member states may oppose new rules on how far their factories and power plants can offset their carbon emissions, to be proposed by the European Commission, environment ministries told Reuters.The EU executive is expected to propose in the next two weeks curbs or an outright ban from 2013 on the most common types of offsets.

Barack Obama's green agenda crushed at the ballot box

With a slew of new climate change deniers entering Congress, Barack Obama's environmental ambitions are now dead.

Climate Cues From the Next House Speaker

“The idea that carbon dioxide is a carcinogen that is harmful to our environment is almost comical,” Mr. Boehner told ABC News in an April 2009 interview. “Every time we exhale, we exhale carbon dioxide. Every cow in the world, you know, when they do what they do, you’ve got more carbon dioxide.”

Obama drops plan to limit global warming gases

WASHINGTON — Environmental groups and industry seem headed for another battle over regulation of greenhouse gases, as President Barack Obama said he will look for ways to control global warming pollution other than Congress placing a ceiling on it."Cap-and-trade was just one way of skinning the cat; it was not the only way," Obama said at a news conference Wednesday, a day after Democrats lost control of the House. "I'm going to be looking for other means to address this problem."

GOP win puts the brakes on energy, climate bills

WASHINGTON — The election that put Republicans in control of the House and weakened Democrats' hold on the Senate also slammed the door on sweeping energy, oil spill and climate change legislation for at least the next two years.But political leaders vowed Wednesday to seek consensus on some smaller proposals, including initiatives to expand natural gas production, give a boost to nuclear power and advance so-called clean coal technology.

Obama Needs China to Help Him Run Great Green Race

It was a happy accident that Barack Obama found himself in Beijing on the day the U.S. Senate kicked climate change legislation into the spring. Obama needs Chinese President Hu Jintao’s help to break the U.S. stalemate over global warming. And until Washington acts, there’s scant chance for a binding international agreement to reduce greenhouse gases.

New Energy Outfoxes Old in California

There are several ways to look at Tuesday’s overwhelming endorsement by California’s voters of the state’s global warming law: as a vote for clean energy over dirty, as a rebuke to carpetbaggers, as proof that good things can happen when a political leader — in this case, Gov. Arnold Schwarzenegger — leads.

Prop. 23 battle marks new era in environmental politic

Proposition 23, the oil industry sponsored initiative to suspend California's greenhouse gas law, was touted early on by environmentalists as a "David vs. Goliath" battle. "Its our slingshot vs. their oily club," said Steve Maviglio, a spokesman for opponents.But in the end, Proposition 23 failed by a stunning 61% to 39%, giving heart to national environmental leaders and signaling the advent of new players in eco-politics: high-tech entrepreneurs, mainly based in Silicon Valley, who see clean energy as an economic investment.

A Surge in Lawsuits Challenging E.P.A. on Climate

With many eyes on how Tuesday’s elections will affect Congressional action on climate and energy issues, a new report points out that the battle over greenhouse gas emissions has been raging quietly on another front: the courts.Litigation over greenhouse gas regulation is sharply on the rise, according to a report issued on Wednesday by DB Climate Change Advisors, the climate change investment and research business of Deutsche Asset Management.

Tropical agriculture "double-whammy": high emissions, low yields

Food produced in the tropics comes with high carbon emissions and low crop yields, according to a new study in the Proceedings of the National Academy of Sciences (PNAS). In the most comprehensive and detailed study to date looking at carbon emissions versus crop yields, researchers found that food produced in the tropics releases almost double the amount of carbon while producing half the yield as food produced in temperate regions. In other words, temperate food production is three times more efficient in terms of yield and carbon emissions."Tropical forests store a tremendous amount of carbon, and when a forest is cleared, not only do you lose more carbon, but crop yields are not nearly as high as they are in temperate areas," explains lead author Paul C. West, a graduate student at the University of Wisconsin-Madison, in a press release.

Scientists consider impact of climate change on coast

The initiative, which is being funded by a £6million EU grant, aims to develop a unified approach to safeguarding the future of European coastlines and will include strategies for flood defence and erosion prevention.

Rising Seas and the Groundwater Equation

Worldwide overpumping of groundwater, particularly in northern India, Iran, Mexico, northeastern China and the American West, more than doubled from 1960 to 2000 and is responsible for about 25 percent of the rise in sea level, according to estimates in a new study by a team of Dutch researchers published in Geophysical Review Letters.

Current Global Warming May Reverse Circulation in Atlantic Ocean, as It Did 20,000 Years Ago

ScienceDaily — Universitat Autònoma de Barcelona scientists have researched how ocean currents in the Atlantic were affected by climate change in the past. The study shows that there was a period when the flow of deep waters in the Atlantic was reversed. The results are relevant for the near future since similar changes are expected to occur in the course of climate warming over the next 100 years.

Water Flowing Through Ice Sheets Accelerates Warming, Could Speed Up Ice Flow

ScienceDaily — Melt water flowing through ice sheets via crevasses, fractures and large drains called moulins can carry warmth into ice sheet interiors, greatly accelerating the thermal response of an ice sheet to climate change, according to a new study involving the University of Colorado at Boulder.The new study showed ice sheets like the Greenland Ice Sheet can respond to such warming on the order of decades rather than the centuries projected by conventional thermal models. Ice flows more readily as it warms, so a warming climate can increase ice flows on ice sheets much faster than previously thought, said the study authors.

From the $300/barrel story above:

The only problems with this sentence are the verb tense, as technological innovation has ramped up since the beginning off the peak oil era about a decade ago, and its failure to acknowledge that the adoption of longstanding technologies will play a large role in the response to increasing scarcity of oil.

Better to unleash a wave of technological implementation. Meanwhile, the recent U.S. elections will unleash a new wave of peak oil and global warming denial. The first act of the new U.S. congress will be to apologize again to BP for all the hassle people gave them because of that little 'ol oil slick in the Gulf of Mexico.

Yeah, and to think just a couple of days ago on Oil Drum I wrote about the wonders of democracy .... but can these Tea Pary nutters really hijack US politics for any length of time? Lets hope some sense will prevail.

There can be little hope for the gov't to do anything productive when that's how you view the majority of voters this week.

There can be little hope for the gov't to do anything productive

You could have just stopped with the first half of your sentence and been spot on.

Innovation like bicycles and walking shoes? Sooner or later people will be forced to drive even less and then finally not at all. I've always wondered will it be price increase ($5+ gasoline) or rationing?

In many other countries, $5/gallon would be cheap.

£1.23 per litre for diesel here.

that's: 1.23 * 3.785 = £4.7 per US gallon.

that's: £4.7 * 1.6082 = $7.56 per US gallon.

America, quit your winging! You've never had it so good!

;)

One of these things is not like the others...

(From the EIA table of gasoline prices.)

Oh! I know! I know! It's Italy!

http://www.infonegocio.com/xeron/bruno/italy.html

$5+ gasoline here in Wisconsin would probably cause riots... Not to mention higher costs for almost everything else.

You really think so?

Gas was over $4/gallon on average a couple of years ago. Dunno about Wisconsin, but Michigan had some of the highest prices in the nation. (Sucks to be at the end of the pipeline.)

Then there were the outright shortages in the southeast after the hurricanes. A lot of gas stations were out. Some were charging $6/gallon or more. People waited in line for two hours. A friend of mine in NC ended up sleeping at his office because he didn't have any gas to drive home.

There was a brawl or two about cutting in line, but nothing you could call a riot.

Yeah..but add into it now unemployment (very high here)... and the fact that people just seem very angry right now. Gasoline touched $4.30 here... if i remember correctly. It could have been higher in Milwaukee...its always cheapest around the Twin Cities. Although i don't recall prices staying that high for very long. Extended period (lets say a year) of $5+ gasoline and we'll see trouble.

Whats your number? $7? 8?... i doubt it can make it that high without huge problems.

I'm betting it will reach $10.00 a gallon in less than 5 years. With or without huge problems, what are people going to do burn down the gas stations and do without?

Of course we could have rationing by then and people will have even fewer jobs to drive to. They might be bicycling to the nearest ex parking lot farm to put in a few hours of weeding and harvesting. They won't have much strength left for creating trouble and a few turnips and potatoes probably won't provide them enough energy anyways. On the other hand they could be getting drunk on potato vodka in which case all bets would be off...

Have you ever walked past soldiers, with machine guns, sitting on tanks after a military coup?

I have, life goes on, there's usually a lot less trouble than you might imagine!

Cheers young un, may you live long and prosper!

If I had a million dollars, and only one million, I would bet the whole wad and give you two to one odds that it will never happen. How soon we forget. I was among those who thought oil prices, and gasoline prices, would go through the roof prior to the collapse of 2008. But I wuz wrong. And I will not make that mistake again.

But $140 a barrel oil prices brought the economy to its knees. And $85 dollar oil is right now keeping the economy in the doldrums. $10 a gallon gasoline would mean oil would be somewhere around $300 a barrel. Never! It just ain't gonna happen. The economy would totally collapse long before it reached that level and slap oil prices right back down.

Of course I am speaking in terms of the inflation adjusted dollar. Should inflation suddenly spiral out of control, and the dollar worth about 25 cents, then all bets ar off.

Ron P.

For the record, Ron, I really don't have a clue... just wanted to throw a little extra fuel on hot mom's fire. As for betting, I once bet 5 bucks while on a casino cruise that I had to go on for business purposes, after which I spent the rest of the evening watching bad movies until we came back on shore.

Cheers!

Ron,

Of course opinions differ - but here are various recent oil price pundits:

Robert Hirsch on CNBC: Gasoline will soon be $12-to-$15 per gallon http://www.youtube.com/watch?v=IWGsnW_NnxE

..............................................................

http://www.upi.com/Science_News/Resource-Wars/2010/10/28/Oil-grab-may-le...

Slater cited predictions that crude oil prices could climb to $150-$200 a barrel within two years as growth in supply fails to keep pace with increased demand from developing countries.

The price forecast was made in a 2008 Goldman Sachs Group Inc. analysis that said, "The possibility of $150–$200 per barrel seems increasingly likely over the next six to 24 months, though predicting the ultimate peak in oil prices as well as the remaining duration of the upcycle remains a major uncertainty."

....................................................................................

A mere 15% shortfall in oil production will spike oil prices by 550%

http://www.roadtransport.com/Articles/2008/01/30/129667/Is-the-UK-ready-...

...................................................................................

Another leading oil analyst Jeff Rubin laid it on the line: "We can expect triple-digit oil next year."

........................................................

http://www.theoildrum.com/node/7088

One of the inexorable results of the developing shortage of oil is that prices will rise. It is a prospect that does not particularly concern the Saudi Arabian Administration, Minister Al-Naimi having recently inflated the acceptable range for crude up to $90 a barrel, and JP Morgan has recently predicted an imminent rise to $100, a theme apparently now also taken up by Libya.

Ron - who gives a flying monkey's what the nominal $ value of a litre of petrol will be. If you cannae earn the $ in the first place, you cannae buy the litre.

Ron, I'm with you man. I made the same mistake in 2008. The economy, worldwide, went tilt when oil went over $120 per barrel. Adjusted for inflation, and you can not discount those words with helicopter Ben out there, get up around $120 again and the US economy starts to shut down. And we are still big enough to take the rest of the world down with us. $300 a barrel is a pipe dream.

I really doubt that. It would be labeled as "socialist" and that would be the end of that idea. Instead we worship at the free market alter, we will just let supply and demand do its thing. Probably throw in a few gasoline station owner price gouging show trial-cum-lynchings for poltical theatre.

How we forget. Please do recall the riots of the 1960s, where burning down (and looting) grocery stores, gas stations, and the like was precisely what (some) people did, while a great many looked the other way and quite a few tacitly supported the rioters. ("The strong man with the dagger is followed by the weaker man with the sponge. First, the criminal who slays; then the sophist who defends the slayer." -- Lord Acton)

After things calmed down, many of those who looked the other way spent the next 20 years - or more, sometimes to the present day - moaning and complaining about lack of convenient access to grocery stories in those neighborhoods. And what better illustration of the profound stupidity of the average person: what in blazes else could they possibly have expected? Why would someone open up a store if they're that unwelcome? And many of the moaners still look the other way when the stores that are still left are robbed or vandalized, presumably on the theory that the robbers and vandals ought to be celebrated as latter-day Robin Hoods.

More like, how people such as yourself make stuff up in order to confirm your prejudices.

How about some evidence that people who looked the other way, later moaned about the absence of stores?

Or is it just that those people all look the same to you?

Sick.

And completely unhelpful.

It's always easier to blame the poor slobs on the bottom, because they objected to bootmarks all over their heads, than to cast uncivilized aspersions against fine, upstanding citizens and how they choose to use their boots.

Steal a little and they throw you in jail, steal a lot and they make you king.

(Or am I just confirming your point, PaulS?)

Has it occurred to anyone that the problem lies at both ends of the pole - the bottom and the top? The oligarchs and the peasants?

Middle class values have died in this country.

Still, when push comes to shove, I am going to side with the oligarchs (as has virtually everybody working in the NYC and D.C. areas currently). The kumbaya crowd can live in the ghetto or trailer park if they so choose.

What the hell are you gibbering about?

People live in a ghetto or trailer park when forced to it. They don't "so choose".

The "peasants" as you so colorfully call them are trying to survive, and may be forced to adopt tactics and attitudes that offend your refined sensibilities. In order to survive.

As for your "kumbaya crowd" comment, WTF? Did you just have a need to write "kumbaya crowd" and so invented this ridiculous post to accomodate it?

'Was it over when the Germans bombed Pearl Harbor?!'

'Germans?'

'Forget it, he's rolling..'

Oh, come on. You know exactly what I'm talking about.

Our country consists of one half oligarchy, one half idiocracy. You know it's true.

I challenge you - can you name just one other nation on earth, just one, which has such an extreme combination of wealth and poverty, smarts and stupidity?

What's hilarious is that you keep painting it as 'The Rich and the Stupid'

If you can name what this country has a little better, maybe someone can meet your huffy challenge.

What exactly does 'Siding with the Oligarchs' mean, Sachs? Does it entail waving their banners? Making friends with them so they bring you along?

I'm not saying the poor folks are saints and the rich are all scoundrels.. but there is simply no shortage of the owning end of the spectrum (safe behind the banners of Corps and Industries) leaving the rest of the society in the fire.

Middle class values? What about the eradication of the Middle Class? The all-out war on labor unions, the upending of manufacturing jobs? The undermining of Public School Education, especially in the ghettos and trailer park parts of town, the easy use of insurance and healthcare (pharma) to further 'wring the sponge' and keep it all trickling up.. what values are you really talking about, that are somehow missing? The values of siding with the winners, cause they're, well, winners?

Hey, I know, they were just following the money. We were living high on the hog compared to most of the world, and now we're undergoing a great 'balancing out' .. Well, that may just be physics, but the 'neighbors' who were still willing to sell us out in this scheme might discover that their innocent role in all this is still going to come back to haunt them.

Keep sneering at the Kumbayaya's and the Doublewides, that's your role, you are SUPPOSED to pick them as your targets.. and pay no heed to the boots on your own head, but do keep paying your bills, please! (That can be YOUR way of 'siding with the oligarchs'!)

I think the point about siding with the Oligarchs, is to (hopefully) secure a position as one of their servants. We are probably headed towards a three class society:

(1) Oligarchs

(2) Servants, crasftsmen, working for the Oligarchs

(3) Serfs

I would guess the population of these will be roughly

1% group one, 10% group two, and 89% group three. I expect group two would live roughly middle class lves (economically), and the best of their kids have a small chance of joining group (1).

So a possible strategy for survival is to show enough loyaly to the (1)'s to be invited to become a (2) when the time comes. I think people implicitly undestand this system, and suck up to those with money.

"Don't forget that most men with nothing would rather protect the possibility of becoming rich than face the reality of being poor."

--John Dickinson, 1776

Yeah I think you understand.

You'll get no apologies from me for doing everything in my power to avoid becoming a serf.

Buy some vaseline, then. me? I'll stay a freeman thank you very much. What's your price then....as Churchill asked the 'oligarch'?

Dear "Oily Sacks",

If I was an Oligarch I'd mark you down right now as one of the first "up against the wall" as you are obviously not to be trusted and would sell even your own mother to the highest bidder. While that's acceptable behaviour for some oligarchs it is not acceptable from their servants.

If you were unlucky I'd leave you chained to the wall as a plaything as long as it amused me. If you were lucky I'd just shoot you.

Wishing you pleasant dream of the future.

Yours,

Olly Garch.

PS Here's a link with a picture of what those with unconstrained political power do to people they don't like posted by former British Ambassador to Uzbekistan - Craig Murray. Warning Highly Disturbing Content: http://www.craigmurray.org.uk/archives/2010/10/lib_dem_ministe.html

I don't really have a number. I think it all depends. A gradual rise would probably be less disruptive than a sudden one. But if there's a clear reason for even a sudden increase - like the hurricanes - people won't get too upset.

The events post-Gustav in the southeast made me re-think peak oil. In many ways, it was what we all feared. Long waits. Price gouging. Panic. Grown adults crying when they got to the pump after waiting for hours, only to find there was no more gas, or the phone lines being down meant cash only, no credit cards. People filling up every container they had, including their coffee mugs. Hoarders pulling up with 5,000 gallon tanks. Trucks unable to make deliveries in the south, because there wasn't enough fuel for them to get back. Cops not having enough gas to patrol. People unable to get to work. Buses unable to take kids to school. National guard units guarding fuel trucks.

On the bright side, despite the disruption, there was little unrest. (Perhaps the stereotype of the southeast being full of angry people with guns is unwarranted.) People managed.

OTOH, the shortages seem almost entirely forgotten now. People are buying trucks and SUVs, with nary a though of fuel efficiency any more. There was some talk about building a new pipeline so the area wouldn't be so vulnerable to shortages, but I don't think anything's happened on that front.

And it's occurred to me that this is probably what peak oil is going to look like, at least in this country. Complacency and panic, and very short memories.

Maybe "forgotten now" is key. Problems of that sort caused by storms tend to go away. Hence "yes" with respect to short memories - too many people seem to have the attention span of gnats, or they wouldn't build or buy houses in some of the places where they do.

But if it went on and on without respite, with people dissing each other in lines that grow faster in front of them due to cutting-in than they shrink, month after wearing month, would American exceptionalism still prevail? Or might we get theatrical semi-riots, as seem to happen in France almost every fall, but maybe more year-round as in the US in the 1960s? I dunno. People seem very passive right now, but it hasn't always been so. I guess wait and see.

$8 per gallon gas x 12000 miles per year/20 mpg is only

$4800 per year, those with hybrids pay $2400 per year.

You could solve some of it with car pooling.

A lot of secondary products will disappear--plastic bags, asphalt driveways, extraneous plastic packaging. Fewer grass lawns. More local food, less variety.

No more mass transit subsidies. Cost of shipping will go way up.

Definitely not fatal.

The good things would be people reducing mileage, cooperating more, maybe a lot of people getting off cars entirely.

I'd definitely look into an EV.

We should be cheering on $8 per gallon gas.

In the USA we should catch up to Europe and place a much bigger tax on gasoline - say $3.00/gallon. At the same time we could reduce income taxes - so the whole thing could be tax neutral. Much higher gas prices will jump start conservation. Shame on the wastrels with their SUVs and giant McMansion houses.

Income taxes are progressive or are realistically flat but gas taxes are regressive.

A $3 per gallon tax would add $.5 trillion and cover much of the shortfall in Medicare and SS.

People who own luxury SUVs and McMansions don't need to worry about the price of gas and for such a relatively small number of people to conserve wouldn't accomplish anything(6% made more than 100k in 2005).

If the rich lost their Bush tax cuts that would add $.07 trillion dollars.

Better these two, that's $.57 trillion dollars, almost half the amount of the current budget deficit.

Unfortunately the teabag republicans will never go for any tax increases ever so its all moot.

Thank God for Ben Bernanke and QE2.

This phrase has always galled me. I especially hate hearing it from people who claim to champion working class interests, as though the isolation of workers each in their own Ford or Toyota is somehow not going to undermine the solidarity people who sell their labour need in the endless struggle with a very coherent rentier class.

Automobile transport is regressive. The poor, the elderly and the infirm, not to mention children, have lesser access to it and/or are placed in a position of dependency on the good will of others. Moreover, widespread automobile transport has particularly limited the freedom of movement of children, especially those whose family poverty leaves them living in housing made affordable by its proximity to busy roads.

Narrowly defined, taxing the fuel for automobile transport is regressive. But in this case, two regressives make a progressive, to coin an awful phrase.

Progressive changes, that is, changes that increase the mobility of the most disadvantaged economically and which restore the freedom of movement children historically had,

depend on lower (much lower) automobile density and the formation of capital to build alternative systems. The gas tax is a good means to these ends.

Okay, have it your way---a gas tax is unfair. It penalizes transportation for people who have low incomes while upper incomes are not affected. That argues for a stratified, feudal system of haves and have-nots.

A democratic society would be a society of equals.

The Italian fascist economist Pareto argued that inequality was the

natural condition of society and sought to remove all governmental restrainst on the upper classses.

http://en.wikipedia.org/wiki/Vilfredo_Pareto

A feudal society would certainly use much less energy than

what we have now but most people would certainly reject it.

If you were to ban all cars, all people would be in the same condition.

We don't have a most people, we have mostly sheeple, who are easily fooled with slogans and ideology into supporting the transformation to fuedalism. It will be too late (probably already is) when they finally figure it out. The distracting "culture" war was very useful to get people to not notice the class war. I figured Obama was our last best hope to avoid this (which is one reason the effort to destroy him was so energetic), but he clearly wasn't up to the task. If I had a redo I would have gone for Hillary, I don't think she would have rolled over so easily.

I hardly ever agree with TFO, but I think I can agree to a point here. Gas taxes as they are often managed are regressive, but they don't have to be. If all collected gas taxes were collected en masse and rebated to all citizens individually, they become progressive. Those of lesser means can choose to drive less and pocket a subsidy. Those who can afford to drive more may choose to and pay extra to subsidize others. The gov't merely sets the level of taxation to incent the behavior desired.

Most taxes COULD work this way, and welfare and unemployment COULD be fairly managed as a negative tax, and healthcare COULD be supported via a tax-deferred multi-year flexible spending account with gov't matching (and with some private catastrophic plans payed through it).

It's not that solutions cannot or do not exist, it's that they will not as long as the gov'ts primary goal is to grow its size and power.

So somebody(you maybe) making minimum wage pays $1000 in gas taxes amounting to 5% of his income

and somebody else(me maybe) making a million dollars also pays $1000 in gas taxes amounting to 0.1% of his income.

Would you be hurt more if they took 5% of you income away from you for a years time or if they took 0.1% of my income away?

That's why there's a progressive income tax---ability to pay.

Now the government return to each of us $1000 in light rail passes.

Now as a millionaire, I never ride the light rail so that money is wasted.

You as a hamburger flipper, you'll use some of those light rail passes and assuming you like the light rail you'll end up driving less and then you'll receive fewer light rail passes. Will you eventually you'll go back to driving just to get more light rail passes?

The whole subsidy/negative tax idea doesn't make sense.

Better to take the tax to pay for healthcare or social security.

If the goal is to reduce oil consumption, just outlaw high

gasoline consumption cars, subsidize EVs/hybrids or maybe eliminate cars altogether.

Not to mention that oil at $150 a barrel works out to $3.57 a gallon for the raw material. Add on $1.00 for processing and delivery and road tax and the total is still less than $5 a barrel. That's why I've suggested that some sort of direct rationing must be adopted. Rationing with a white market for trading allocations would likely cost the average consumer less per gallon than allowing the market to set the price, but would punish the large consumer for his/her profligate ways. It would be hoped that the large consumers would respond by buying more fuel efficient vehicles, thus reducing demand below BAU...

E. Swanson

Do you have 'Red diesel' in America?

Here farmers and some other categories of diesel users are allowed to buy diesel which has a red pigment added to it. The red dye will stain the inside of a tank. The purpose of this is to allow the farmers to purchase red diesel for use in their farm machines but at a significantly lower cost as there is no added tax. If a regular car is caught with the red dye then the owner is prosecuted.

This is one good way to bring about rationing. Just ratchet up the tax for regular users but allow certain groups like farmers a tax break.

Yes, we do. During the price spike, a lot of people were using it illegally for non-farm uses. In some cases, stealing it from the farmers' tanks at night.

Red diesel is also used as home heating oil. My brother in Boston heats with it. About 175 gallons a month. If his heating system is anything to go by, a lot of it is being burned very inefficiently.

Yes, technically the red stuff is for "off road" use, and doesn't have to burn as cleanly. It's higher in sulfur, I believe.

I bought 7 gals. of off-road tonight. ($2.72/gal.) We mix it with biodiesel for our diesel genny and tractor for colder weather and it's usually about 10% cheaper than highway diesel around here. Mixing our own B-50 using off-road is cheaper. I don't know if the dye emissions are toxic, but it smells different, perhaps by design.

We do have it in Spain, too. The Red Dye is quite good stuff, very difficult to get rid of -I know, I tried! Out of curiosity, of course. It resists pure sulphuric acid, solid NaOH, conc. H2O2. My congratulations to the chemist that invented it.

Owner I know of a gas station in the highway Alicante - Madrid had a distillation plant to purify the agri fuel then sell it. He got caught, eventually, spent a year in jail. We don't need that kind of clever people in our country.

Ahh, all those things we don't have a moment to ponder.. and now I'm wondering what that persistent dye, which burns in some 80% of the houses in my state is doing to my daughter's lungs?

I should be more trusting. They'd never do something unsafe, when it's the health of their own people on the line.

Isn't it rich? Are we a pair?...

By your ratio of $150 a barrel equaling $3.57 a gallon today's $86 a barrel equals $2.05 per gallon for gas. Add a dollar and in theory we should be above $3, but we are not. (At least most of us are not) I think the national average is 20 to 25 cents lower than that.

Any idea why that might be? I guess the $1 for processing and delivery would not be totally fixed since energy costs would impact that price, so perhaps that's the explanation.

Odd to me is that the local prices for gasoline have utterly tanked today. I mean they've dropped aboot 8 cents/gal for each grade. Is there a specific reason for this that I missed? Did gasoline stocks surge? It certainly doesn't jive with the surge in oil prices lately.

$3.08 yesterday at my weekly 9 gallon fill up. So that's a good ballpark estimate for WA state at least.

It's amazing that they can refine and transport that stuff to end users, add a bunch of taxes, and the total is still only $1 over the raw material cost.

It just hit $87/barrel. :-/

Of course, it could be a bubble caused by QE2. If the trade return to focusing on supply levels it will drop.

I suspect that any "rationing" scheme would get very complicated in an attempt to level the playing field:

1) size of ration dependent on vehicle (golly, a Prius driver doesn't *need* as much as a Suburban driver) Note: this is done with tier sizes for electricity...baseline in Palm Springs is considerably more than in LA)

2) Long commuters get more (Same arguemnt...*need* to drive 40 miles to work)

Ration per vehicle or per driver? Quick, honey, get the kids a driver's license. Or go buy two more cars!

If we had leaders we would (would have long ago)immediately get a ~$4/gallon tax on fossil fuels. But we all know how likely that is.

Ration by odd/even license plates? OK, honey, time to swap the license plates.

The games will just go on and on and on.

Why not ration by price as follows ..

Every licensed driver that also has a registered vehicle

gets a card good for say 500 gallons at the prevailing pump

price per year .. Once you exceed the 500 gallons the price for the next 100 gallons is the pump price plus 25%; the next 100 gallons at pump price plus 50% .. etc etc ..

This would give everyone a fair allocation at the base price

and encourage the purchase of more efficient vehicles over time

Triff ..

OK, unless this is accompanied by some kind of "white market", then, howdy neighbor, it's time to get out the siphon and do a deal...

You can't win, you might lose, and once this sort of thing is started, you can't get out of the game.

And, I don't have a problem with that -as long as it's done safely. The one who conserves, gets to make some money on the side. I think that would help your poorer classes quite a bit.

I recall in high school, I lived outside of the distance limit, where I got "free" bus passes. I was able to get a ride in the morning, so I could sell the unnedded tickets at a nice profit to those students who lived just inside the limit.

My utilities (which are easy to measure) work that way, both water, and power. Now that I have PV, I never pay anything other than tier 1.

I disagree. With a white market, those who "need" more fuel could buy it if any were available. But, someone (ideally: everyone) would need to reduce their fuel consumption, especially as there would be a rather hard limit after Peak Oil becomes obvious, a limit which would likely decline as the supply is reduced. As for "mom", many of her sort are actually working these days and thus using fuel when they commute to their jobs. No problem with "the kids", limit the allocations to adults, i.e., people older than 18, who might be entering the job market and starting their own households. Poor people or retirees who don't travel much could sell their excess allocations for cash, which might allow reductions in welfare or retirement payments to them.

Perhaps most importantly, I would require that corporations receive no direct allocations, but instead be required to buy what they needed from the white market. This would keep the market "liquid" and reward those corporations which used less energy. I don't intend to punish corporations, it's just that they have the ability to pass on their fuel costs and can offer reduced prices to the consumer as they become efficient. Wouldn't this approach meet the "free market" test so much in demand from conservatives these days?

Edit: I forgot to mention another important part of my rationing concept. I think the allocations should be given out frequently, say, every 2 weeks, with a staggered issue such that there would be a new issue every week. Then, I think the allocations should expire at the end of the allocation period and be returned to the market for sale, the holder being credited with the current value of allocations in the market. This approach would minimize the possibility of hoarding and gaming the market by individuals or organizations. Of course, one might use their allocations to buy and store fuel, but not in large enough quantities to profit from resale. Corporations not ordinarily involved with fuel sales would need to be banned from resale, thus limiting their options to hoard.

E. Swanson

I don't foresee any rationing plans unless we hit a Marshall law type of situation. Nixon is hated by conservatives for the gas rationing. That just is not going to happen again.

Rationing will be done by gas price. The price will be raised until the demand equals the supply. Poor people are going to be screwed. But at least if you are unemployed, you don't need gas to drive to your job. (Gallows humor.)

The gas rationing is one of many interesting observations about Nixon-era "socialism", including expanding welfare, creating the EPA and OSHA, taking us off the gold standard, and *gasp* nearly instituting universal healthcare. If Nixon ran for office today, he'd have to run as a Socialist, because he would be seen as far, far too left-wing to be a Republican or modern-day Democrat.

The nation's electorate has measurably shifted, quite dramatically, far to the right within my short lifetime.

We'll be back into the $130+ range within 18 months at the rate Bernanke is turning trees into money. In a 2008-esq rerun speculators will probably drive it on up to the Inflation adjusted $147/bbl ($170?) b4 the whole thing collapses again. Place your bets -sometime in 2012-14 timeframe?

Nick.

Technically, Bernanke is turning electrons into money, but... point taken. Question is, can the Fed's continued attempts to create inflation by QE keep up with the massive debt destruction already well underway? What are we up to now? $7 Trillion in bank loan defaults since 2008 and counting.

http://jagouldworld.blogspot.com/2010/09/deflation-and-us-consumer.html

Mish and the deflationists were well ahead of the curve on predicting this well before the housing bubble had poppoed.

For what it's worth, the July to year-end monthly oil prices in 2007 and 2010 seem to be quite similar so far.

EIA spot monthly crude oil prices:

http://www.eia.doe.gov/dnav/pet/hist/LeafHandler.ashx?n=pet&s=rwtc&f=m

If the "Cyclical Annual Oil Price Decline" pattern holds (the 2001 price level was about twice the 1998 price level and the 2009 price level was about twice the 2001 price level), the next year over year price decline would bring us down to the $120 range (average annual).

EIA spot annual crude oil prices:

http://www.eia.doe.gov/dnav/pet/hist/LeafHandler.ashx?n=pet&s=rwtc&f=a

IEA warns Iraq will miss 2017 oil target

This was originally published yesterday by the Financial Times but FT has blocked links to their stories. However I found the headline and first paragraph elsewhere.

Looks like the IEA is getting a little smarter. Or perhaps they just decided to be a little more honest. They published this chart last June.

Ron P.

Ron,

You may already know this but the FT allows you to register for a free account. The free account gives you the same access as a standard subscription but you are limited to only 10 articles per month. As long as I use it sparingly for articles I really want to read the full text of, it is enough for me.

You can also get around the limit by deleting your FT.com cookie.

Here is the direct link to the ft article:

http://www.ft.com/cms/s/0/def69f28-e76c-11df-b5b4-00144feab49a.html

I posted that one first, then had to change it because it would not work anymore. I guess I was given one free access to the article then the link ceased to work. At any rate the link you posted no longer works for me though it did the first time I found the article through Google News.

Ron P.

Thanks for taking the trouble to post that chart, Ron.

I would expect Iraq's increasing internal consumption to utilize most if not all of that production rise.

Re: Current Global Warming May Reverse Circulation in Atlantic Ocean, as It Did 20,000 Years Ago

When I see second hand reports such as this, I wish that I still had a subscription to NATURE. For example, the story doesn't describe what is meant by "reverse circulation". But, if this finding holds in future studies, the likely result will be some serious changes in the understanding of paleoclimate and also the changes which may result from AGW. For reference, one must understand that 20,000 years ago was the time of the Last Glacial Maximum (LGM) when vast ice sheets covered much of North America and the sea level was some 125 meters lower than today...

E. Swanson

I read Nature at the library weekly.

Radical Democracy in action.

Reading magazines for free at the public library isn't democratic, it's down right socialist! Have you no shame?!

Then why do all those Libertarians hang out at mine?

Shouldn't there be a law that you can't SHARE an Ayn Rand book?

Thanks for a good morning chuckle!

+1

Nyuk. Actually next time someone posts some blobulous pearls of wisdom from Ms Rand you could point out that by all means some free market actor should have conceptualized far more insightful notions by this point, if her theories had any merit in the first place...

Re: That short quote above by Speaker - elect Boehner where he demonstrates his vast knowledge of climate science...

Then he refers to CO2 as a carcinogen - which then somehow ties into climate change - WTF ?

We are in real trouble here.

Listening to Boehmer in the video at this link Climate Cues From the Next House Speaker is a real laugh. But it does give you a deep insight inside his sneaky methods. He is not saying that CO2 is a carcinogen, he is insinuating but not saying, that those who believe in AGW are saying that CO2 is a carcinogen.

Tricky!

Ron P.

Well you know what Mr. Boehner, I'll take that bait and run with it... while CO2 isn't the carcinogen it is the toxic byproduct of malignant growth (humans) on the organism that is our planet - the true carcinogen (fossil fuel addiction) clearly exploits a genetic defect in the otherwise healthy organism.

P.S. I will not refer to Boehner as Congressman or whatever the proper term would be - that is supposed to be a show of respect - of which I have none for this ignorant blowhard...)

Hey Rep. Boehner, Carbon Monoxide (CO) isn't a carcinogen either. But, if the concentration in the air you are breathing were 1%, you would be dead in about 5 minutes. And this idiot is from a coal mining state to boot.

Maybe we can talk him into putting a plastic bag over his head so he can directly experience the effects of high concentrations of his carbon dioxide emissions...

E. Swanson

Here's the link : www.youtube.com/watch?v=EpSRAvBNtfA

I doubt Speaker-to-be Boehner is either ignorant or stupid. He just knows much of his audience is and chooses his comments accordingly to suit his goals.

In other words, he is an evil, lying, sack of sh*t.

Wow. Strong words. I think the one who got the most from the election was Sarah.

Sarah Palin's 'Take Back the 20' PAC scores a bull's-eye

http://news.yahoo.com/s/ac/7122292_sarah_palins_take_back_the_20_pac_sco...

Day after the election I read the GOP's biggest post election goal is stopping her. It's sets the party on edge to think of a Obama-Palin race. Politics I think by definition is depressing. I usually refrain from any comments on it, they are all self centered __________. (Fill in the blank)

So to end on a much more upbeat note, this couple is amazing. Gave away nearly 11 million dollars to their community and other charities they felt worthwhile.

http://news.yahoo.com/s/yblog_upshot/20101104/od_yblog_upshot/nicest-can...

He may be a morally bent orange mutant, but he's a hell of an "unintentional singer."

Comment on Jevon's Paradox (one of the above stories) -

In the context of increasing availability of cheap energy from coal, oil or natural gas, increased efficiency in any application of that energy will indeed be followed by increased demand for that source of energy.

In the context of limited and decreasing availability of a given energy source, which of course will result in higher prices for that source, increased efficiency will serve mainly as an adaptation to the higher price. Demand, in the economic sense of buyers willing and able to pay the market price, will decrease as the supply decreases. Increased efficiency in this context will slow the rate of price increase slightly, but it will not and cannot increase demand.

In other words, Jevon's Paradox, properly understood, is no paradox at all. If the supply is increasing, it is possible for demand to increase, and for fossil fuels it historically has increased until recently. If the supply is decreasing, demand will decrease. For oil in particular, the supply is currently not increasing, and most of us expect it will soon significantly decrease.

It's not hard to understand unless you are determined not to understand it.

In aggregate that's true of course, but what's curious is that most developing countries have shown significant increase in oil consumption, as oil annual oil prices went from $14 in 1998 to $100 in 2008, falling in 2009, to $62. US oil consumption in 2009 was down to below our 1998 level, no surprise here, but China's consumption in 2009 was about twice their 1998 consumption.

It would appear that the global net export peak was in 2005/2006, with subsequent years being lower (and with annual oil prices so far all exceeding the 2005 level of $57). Yet "Chindia's" net oil imports increased every year since 2005, with their net oil imports as a percentage of global net exports rising from 11% in 2005 to 17% in 2009.

I agree that in regions like the US that are reacting to rising oil prices with falling demand, increases in energy efficiency will probably not result in a net increase in energy consumption; however, the very advances in efficiency that allow developed countries to moderate their consumption will probably cause a net increase in consumption in developing countries. In other words, if China is already increasing their oil consumption, despite rising oil prices, wouldn't increases in energy efficiency cause their rate of increase in oil consumption to accelerate?