IEA World Energy Outlook 2010 Now Out; a Preliminary Look

Posted by Gail the Actuary on November 9, 2010 - 10:40am

The International Energy Agency issued its annual energy forecast today for 2010. It consists of a three volume report, plus an executive summary and a press release. The website can be found here.

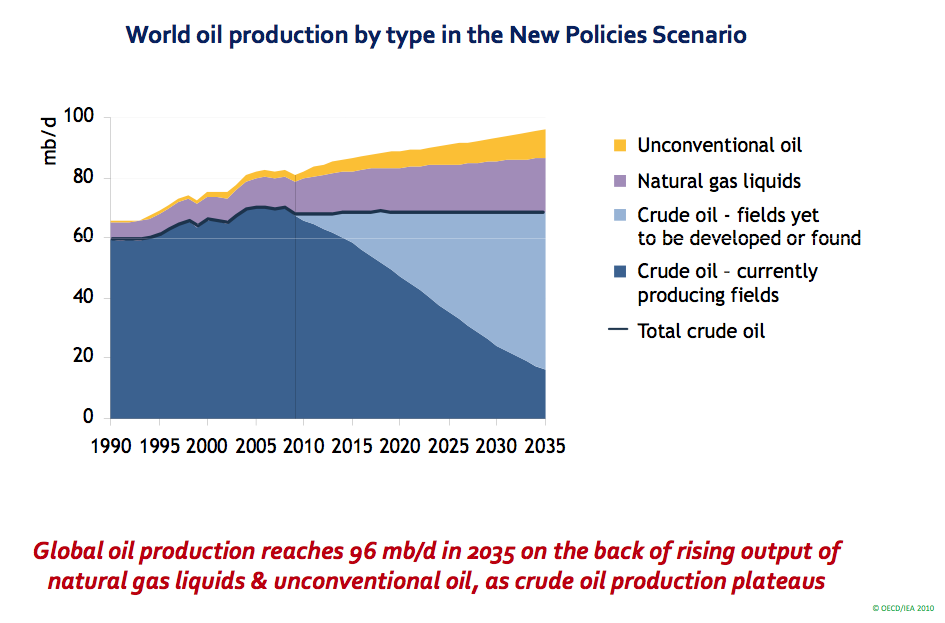

In the next few weeks, we will be analyzing the report. At this point, we can only point to a few of the summary findings. One clear concern is that demand will be rising--especially from China and India. Another is that prices (in inflation-adjusted terms) will be rising. A third concern is that conventional oil production will no longer be able to rise.

The above scenario shows conventional crude oil on a plateau to 2035 at a level below recent production. This graph is from the "New Policies" scenario, so reflects some cutback in demand as a result of governmental policies from what the reference scenario would assume.

With respect to rising prices, the press packet shows this slide, indicating that "real" prices are set to rise, unless there is a very major cutback in demand as would be required under the "450 Scenario" (referring to the CO2 limit aimed for):

The Executive Summary says:

The oil price needed to balance oil markets is set to rise, reflecting the growing insensitivity of both demand and supply to price. The growing concentration of oil use in transport and a shift of demand towards subsidised markets are limiting the scope for higher prices to choke off demand through switching to alternative fuels. And constraints on investment mean that higher prices lead to only modest increases in production. In the New Policies Scenario, the average IEA crude oil price reaches $113 per barrel (in year‐2009 dollars) in 2035 — up from just over $60 in 2009. In practice, short‐term price volatility is likely to remain high.

Oil demand (excluding biofuels) continues to grow steadily, reaching about 99 million barrels per day (mb/d) by 2035 — 15 mb/d higher than in 2009. All of the net growth comes from non‐OECD countries, almost half from China alone, mainly driven by rising use of transport fuels; demand in the OECD falls by over 6 mb/d. Global oil production reaches 96 mb/d, the balance of 3 mb/d coming from processing gains. Crude oil output reaches an undulating plateau of around 68‐69 mb/d by 2020, but never regains its all‐time peak of 70 mb/d reached in 2006, while production of natural gas liquids (NGLs) and unconventional oil grows strongly.

The plan in all of this is for OPEC oil production to rise.

The executive summary says:

Total OPEC production rises continually through to 2035 in the New Policies Scenario, boosting its share of global output to over one‐half. Iraq accounts for a large share of the increase in OPEC output, commensurate with its large resource base, its crude oil output catching up with Iran’s by around 2015 and its total output reaching 7 mb/d by 2035. Saudi Arabia regains from Russia its place as the world’s biggest oil producer, its output rising from 9.6 mb/d in 2009 to 14.6 mb/d in 2035. The increasing share of OPEC contributes to the growing dominance of national oil companies: as a group, they account for all of the increase in global production between 2009 and 2035. Total non‐OPEC oil production is broadly constant to around 2025, as rising production of NGLs and unconventional oil offsets a fall in that of crude oil; thereafter, total non‐OPEC output starts to drop. The size of ultimately recoverable resources of both conventional and unconventional oil is a major source of uncertainty for the long‐term outlook for world oil production.

The executive summary does not want to go as far as saying that oil supply will peak in the near future, unless policies are implemented to reduce demand significantly. The summary says:

Clearly, global oil production will peak one day, but that peak will be determined by factors affecting both demand and supply. In the New Policies Scenario, production in total does not peak before 2035, though it comes close to doing so. By contrast, production does peak, at 86 mb/d, just before 2020 in the 450 Scenario, as a result of weaker demand, falling briskly thereafter. Oil prices are much lower as a result. The message is clear: if governments act more vigorously than currently planned to encourage more efficient use of oil and the development of alternatives, then demand for oil might begin to ease soon and, as a result, we might see a fairly early peak in oil production. That peak would not be caused by resource constraints. But if governments do nothing or little more than at present, then demand will continue to increase, supply costs will rise, the economic burden of oil use will grow, vulnerability to supply disruptions will increase and the global environment will suffer serious damage.

The IEA seems to see a possible new role for natural gas:

The executive summary says this about natural gas:

Natural gas is certainly set to play a central role in meeting the world’s energy needs for at least the next two‐and‐a‐half decades. Global natural gas demand, which fell in 2009 with the economic downturn, is set to resume its long‐term upward trajectory from 2010. It is the only fossil fuel for which demand is higher in 2035 than in 2008 in all scenarios, though it grows at markedly different rates.

It has quite a bit more to say about natural gas than I have quoted here, especially about Chinese demand growing in the future.

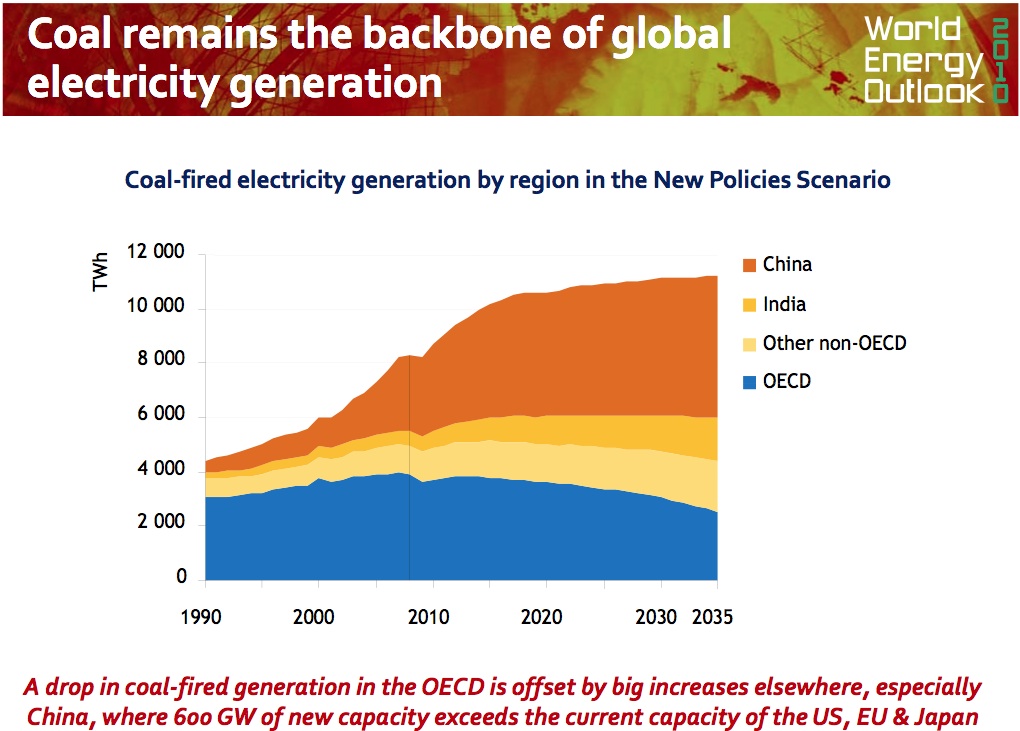

Coal use for electricity is seen as growing outside OECD:

The summary slide of the press packet shows these findings:

We will be examining the report in more detail in the near future, but we wanted to give you the "flavor" of what it is saying today.

How can the IEA oil scenario be so different than the one made by the EIA-Glen Sweetnam? (http://bit.ly/d48IIF)

Everyone is issuing dire warnings about Peak Oil (USJFCOM, ITPOES, German Army, EIA-Glen Sweetnam, Chatham House…), but the IEA still argues that production can increase until 2035, why?

There is a lot of politics involved in all of these projections. I wrote a post a couple of years ago about the relationship between the IEA and the OECD. (The IEA is a small piece of the OECD. It is hard to see it as being very objective, if the role of the OECD is to promote economic growth.)

Also, the IEA has to have a way of making their past estimate not look too bad.

Indeed… When I talked about Peak Oil and the IEA with a team of the European Commission, they admitted that the US may be influencing the reports of the IEA, as they contribute to about half of its budget… But the problem I have is that the IEA insists that its reports are "objective". They are not...

The IEA leadership will be in trouble once we face a serious oil crisis (e.g. shortages) as politicians will have to find scapegoats for their passivity/incompetence.

The way governments work is by creating committees/authorities that come up with the 'right' information that the politicians want to hear. It has nothing to do with fact or reality. Of course at some point in the future when the prior information is proven to be completely wrong, the names and faces of both the politicians and the authorities have changed, excuses given and a new group/committee/authority set up to deal with the new problem.

This is how governments work in many different fields, with the information being totally contrary to what experts in the field know. Why do the experts here expect these 'authorities' the EIA and the IEA to be any different to the normal operation of governments?

"This is how governments work"

Not just governments, major banks, also. Its called 'IBGYBG' for "I'll be gone. You'll be gone."

Of course, you do realize that no one, not any gov't bureaucrat, not anyone here discussing has any implementable ideas on how to actually deal with the problem. There is a lot of disbelief and denial here on Earth.

Not all governments are equally bad. Look at Zimbabwe for an example of a really bad government. Look at Sweden or the U.K. or Germany for examples of much better governments than the U.S. has.

I sure don't.

"Implementable" has so many dimensions. One handicap is that "Rational" and "Obvious" have been taken off the table.

Ideas that implement themselves are called "emergent properties". These can be really unpredictable.

http://www.cs.washington.edu/homes/ladner/ca/ Click "Run-It"... "Behavior": select "game of life". Click/set three cells in a row. Click "GO". The system/machine has two states: three horizontal or three vertical. Click "STEP". Click/set three more cells sticking-out from the middle one. Click "GO". Who could guess? All kinds of states emerge. It stabilizes if you begin by setting the size to 128 X 128.

What is the goal to be met by the implementation? Benefit few or all? Right now or long-term? Simple survival or Business As Usual?

My HVDC power-industry friend says nuclear for short-term Business As Usual. Remember, BAU includes cheap with exponential growth.

Slavery is a system supplying energy and benefit to the few. This state may re-emerge as open and accepted. It is also BAU: Guest workers and sweat-shops make our salads and shoes, right now, in American commerce. We just look the other way, cursing them. Vehicles become very cheap: Introducing the wonder-car of a possible future, the 2035 Sedan!

http://www.cartoonstock.com/lowres/rmo0226l.jpg ...

http://www.corbisimages.com/Enlargement/AG001428.html

http://www.chinancient.com/category/cultural-relics/

"The IEA leadership will be in trouble once we face a serious oil crisis (e.g. shortages) as politicians will have to find scapegoats for their passivity/incompetence."

Yes could be, and the sad part in this story is that they dropped their potential of remaining more or less objective since 1998 by sacking the team that tried to remain objective from what I understand (fatih Birol being the last remnant)

(ps:btw, would l in lb stands for lio--- ?)

Hi, Yes, it’s Lionel.

By the way, there are several MPs across Europe which perfectly understand the situation with Peak Oil and the IEA. At the moment, there are only a couple of them, but this could change with a major oil crisis...

Hi Lionel, and bravo for your work ! which I discovered through M Auzanneau blog, just registered on your twitter (mine yt7509)

One MP who is very vocal and direct about peak oil in the french assembly is Yves Cochet

Thanks! Indeed, I was lucky to meet Cochet twice in Paris, very intelligent man! (he wrote a good book on the topic: Pétrole apocalypse, 2005)

I wonder whether some kind of legal action could be initiated towards the iea, not necessarily to put some penalties on these guys, but as a way to bring the dialog on the table.

What I find really strange in this whole story, is that there could be, or there already is, some type of legal actions or inquiries on the IPCC for being "over alarmist", whereas the iea is obviously way "under alarmist", and moreover they basically build and communicate all their rationale for decreasing consumption on CO2 and climate aspects, whereas they should just say : we will have less and must adapt, climate change or not (and I am not at all a climate skeptic or AGW denier), so they somehow use the IPCC alarmism to totally muddy around what their message should be, and confuse the public even more. (and this is somehow self feeding as the IPCC scenarios being based on iea consumption predictions, they are indeed often over evaluating the total CO2 to be released in the future).

This is even clearer in below slides from the iea in November :

http://www.seai.ie/News_Events/Previous_SEAI_events/Pathways%20to%202050...

Otherwise didn't read Cochet's book, but saw one of his conferences, he also had a very direct talk at the assembly on the subject

As a clear example of the IEA having "outsourced" the alarmism function to the IPCC, if you type "iea oil" in google news today, one of the first article that comes up is :

IEA fears oil spike if climate pledges fail

(from the financial times)

http://news.google.com/news/url?sa=t&ct2=us%2F0_0_s_6_0_t&usg=AFQjCNFpNv...

Didn't read the article, but the title only shows how twisted the perception of the thing is ...

When the crisis comes I'll wager that they run around repeating

"Who would have thunk? and

"unforeseen shortages" and

"unprecedented" etc. .

But please spare me "going forward" or

"in the context of".

All spoken in a deep, resonant, authoritative voice with all-purpose earnest gaze.

My secret fantasy is that someone sneaks up behind them with a frying pan.

Where do they find them? And why do they drive nice new motor cars?

The first graph "oil yet to be found" encapsulated the whole thrust of the piece.

Oh, I don't know, they seem to have had plenty of practice over the years, well not maybe not exactly with being objective, but lots of practice nonetheless...

So does the official EIA projection

How does Non-OPEC conventional go down and then magically turn up? Brazil? Will Brazil make up for declines in other non-OPEC conventional?

And the view differences from the new EIA since EIA shows no growth in conventional at all.

EIA projections have had to be reigned in more and more over the years, of course:

Same is true of the IEA, I'd expect. Note that some of these projections are off quite widely in a very short span of time - the 2008 forecast of 89.5 mb/d for 2010, for instance. EIA also has its AEO Retrospective Review, where they lay out how far off the mark they were for that year. Would that all bloated bureaucracies were as forthright.

That's quite the tale of declining expectations.

Thanks for the chart!

The chart tells everything.

Yeah, fascinating graph. It is interesting how it jumps sharply up from 2000 (Clinton) to 2001 (Bush) but then slowly drops year after year as reality sets in.

Actually this is what they really look like, with apologies to Steve Kopits

2016 forecast is when it redlines...

Nyuk. EIA needs some forecasting viagra, it looks like. Their low price case is tantamount to peak oil, too, as I recall anyway.

How about Forecast Forecasts? Can't believe I had to type that twice. Could've predicted it. ;) Any takers for 86.9 mb/d in 2015?

LOL!

Oh my,....it's that Peak Oil Squid, back again from the ocean depths to torture and eat us all, after capturing us in its long, colorful tentacles!

Pretty funny!

Very funny.

So what does the 2017 projection look like? Will they admit to a negative slope by then?

I believe the phrase is "The call on OPEC."

I believe the IEA is basing their optimistic predictions on this new breakthrough:

They seem to think that by applying this technology, they can multiply future fields production by projecting an equivalent amount of holographic production across the globe.

Regards,

Nawar

The top chart shows conventional oil on a flat plateau from now until 2035. No gain, no decline, just flat! Totally unrealistic of course, but I find it interesting that this is what they, the IEA, is now predicting.

Ron P.

I wonder how they made the graph... must have been very "scientific"

This flat conventional production graph reminds me of OPEC countries' reserve graphs. For a sustained plateau like that, forces that push production up would have to be perfectly balanced with forces that push production down. Therfore, reality is highly unlikely to follow the IEA graph.

Probably something similar to 'pin the tail on the donkey'.

Yes, and totally impossible. As the Uppsala Global Energy Systems Group demonstrated, for their 2008 assessment the IEA required that the depletion rate of the yet-to-be-found fields has to reach levels never before seen in the oil industry (14% overall, if my memory serves). They must also exceed their decline rate, another virtual impossibility. The EIA's models are even further from reality.

You can see how far from reality their assessment is in the graph below, which shows what their models require when compared to the production of the North Sea fields. Again, impossible.

This latest assessment no doubt continues this ludicrous modeling. If someone would like to crunch the numbers, the relevant method is laid out in the papers below.

How reasonable are oil production scenarios from public agencies?

http://www.tsl.uu.se/uhdsg/Publications/MDRM_article.pdf

The evolution of giant oil field production behaviour

http://www.tsl.uu.se/uhdsg/publications/GOF_NRR.pdf

It's clear to see with such internal inconsistencies that they are producing projections that "look good" but are not grounded in reality.

Okay, so their depletion rates are unrealistic. How unrealistic are their discovery rates? I can't tell from the millions of barrels per day from future discoveries what that implies about their expected discovery rates.

If this is the best they can come up with then the future really is as bleak as it appears.

The only explanation I can see to post an insane graph like that is that they want people to realize it is all bullshit, but they can't come out and say it, and they want us to realize that they can't come out and say it. No scientifically respectable organization could post that graph, it must be intentionally absurd.

Any question should be directed to Fatih Birol, Chief-Economist of the IEA, who has been in charge of the WEO since 2000…

TOD should interview him :)

(George Monbiot did a good one 2 years ago: http://www.guardian.co.uk/environment/video/2008/dec/15/fatih-birol-geor... )

Is this a clue?

http://omrpublic.iea.org/omrarchive/13oct10full.pdf

duplicate

"May the bird of paradise fly up your nose." The U.S. Navy man said into the North Korean interrogator's microphone. He had convinced his captors that this was a standard closing phrase. The hidden message was "This confession is bogus". It was reported on the American airwaves.

The Pueblo Incident:

http://en.wikipedia.org/wiki/USS_Pueblo_%28AGER-2%29#USS_Pueblo_Incident

The song by Little Jimmy Dickens:

http://www.youtube.com/watch?v=Dt_NjJk9gM4

Edit:

I remember this from long ago. I tried again today to find any reference to it on Google... nothing.

Tried "May the bluebird of happiness", too.

Anyone else remember this?

Cary Grant uses a similar ploy against the Nazis in the 1942 movie 'Once Upon A Honeymoon'.

http://en.wikipedia.org/wiki/Once_Upon_a_Honeymoon

http://www.carygrant.net/wavs/honeymoon/HoneyMMarines.wav

Translation:

If you can't see through this crap that we're putting out, you're even crazier(more disingenuous) than we are!

Alan from the islands

Ron,

It is even more weird that you say. It is not quite flat. There a short period of slightly higher production between 2015 and 2020! What is the justification for this tiny squiggle? No, don't try to guess. Surely you have something better to think about.

My interpretation is that "Crude oil - fields yet to be developed or found" is the code for "shortage," just like "Unidentified Unconventional" used to be, as related by Colin Campbell here. That's why they intentionally put it in as a wedge with an almost perfectly flat top line - if they had rearranged the order of the wedges, it wouldn't have stuck out as much in the visual sense. The small squiggles at 2013 and 2018 are to keep it from being too screamingly obvious, perhaps, or for amusement value?

By the way, our own Jerome a Paris has an article on this IEA report on the Daily Kos and the European Tribune.

Yes. Where in the world is all that new production coming from to replace decline. IEA even believes Iraq's projections 0f 12m b/d is a crock and that IS the ONLY source that could begin to help, but it would take three more Iraqs to do the job.

Maybe not as much as three...the thinking at the time was that Iraq could ramp up at an extraordinary rate. Here is the model Peter Wells was using with Toyota:

Only someone who wanted to be fooled could think that would happen.

Now obviously I wasn't in the room with him when he explained his model to Toyota so while showing this graph he could have said something like "If we're lucky this is what happens in Iraq. But we have to be really lucky and I don't think we will be. Say, have you thought about making electric cars?"

October is Busiest Month Yet for Rumaila Operations

http://www.bp.com/genericarticle.do?categoryId=2012968&contentId=7065973

Iraq: ExxonMobil on track with West Qurna production plans

http://www.energy-pedia.com/article.aspx?articleid=142634

I don't question that there are going to be some immediate increases in Iraq's production. Replacing pumps, pipes, etc. is all fine, but the increase in infrastructure to go from around 2.5m b/d to 12m b/d is enormous. It is my understanding from an IEA report that the Iraqis were initially shooting for a 6 m b/d increase over the next decade, but the oil companies in their bidding exaggerated greatly. Most oil experts believe a 6m b/d increase over the decade would be excellent progress. I still believe things are going to get bad when we leave. Those clans/tribes have been fighting for 5000 years. Why stop now?

and from today's drumbeat:

25,000 bopd increase from majnoon

100,000 bopd increase from rumaila

200,000 bopd from w. qurna(don't know what the baseline rate was)

I agree. I did not make myself clear. When I first saw Iraq's predictions, I laughed and then did some research. The infrastructure is a shambles, corruption is rampant, they have no Oil Law yet, and there are pipelines about to explode they are so old. When the US leaves, they will go back to even worse ways of not working together. I was really trying to make a point about the light blue area of future fields brought into production as being pie-in-the-sky. Iraq has the oil, but there is no way to help prevent Peak which I believe is already happening.

I'm new at posting comments so bear with me.

But, is the US really going to leave Iraq? isn't it more that they will 'leave' Iraq. I find it hard to believe that after spending all those billions of dollars on the war the US is simply going to walk away. Hasn't it built the biggest military base in the world there?

The prize is the oil there and, among other reasons, to keep China in check the U.S. will make sure it always has a presence there.

IEA:

BP shows Saudi consumption increasing from 2.0 mbpd in 2005 to 2.6 mbpd in 2009, a 6.8%/year rate of increase. For what it's worth, at this rate of increase, Saudi Arabia would be consuming 15.4 mbpd in 2035, versus the IEA's projected production rate of 14.6 mbpd.

Note that Saudi Arabia's C/P ratio (Consumption/Production) went from 18% in 2005 to 27% in 2009.

At the 2005 to 2009 rate of increase in consumption, Saudi Arabia would have to be producing 24.5 mbpd in 2035, if they wanted to maintain their 2005 net export rate of 9.1 mbpd.

Sam Foucher's most optimistic outlook for Saudi Arabia is that they will be producing about 5.5 mbpd in 2035 (all numbers C+C+NGL).

Very strange graph at the top. It looks like they picked the output numbers and then adjusted the inputs to make things fit. I wish my investments worked that way too.

As for SA, what the Saudis have said they intend to do with respect to production is not in keeping with IEA expectations.

And about the only way to know what might come down with Iraqi production would involve sterilizing the entire country of all biological life and resettling Iraq with nothing petroleum engineers, roughnecks, and roustabouts.

Byron, Does the term "Neutron bomb" mean anything to anyone.

Yeah, haven't the Saudis said "We'll hit 12mbpd but that is the top. No increases after that."

Did you find that Iraq plan on Dick Cheney's desk?

WEO: "... and we expect the Saudis to be pumping 15Mbpd by 2035"

Saudis: "We've told you, 12Mbpd and no more."

WEO: "Nope, 15Mbpd, its in a graphs"

Saudis: "We're not going above that, leaving oil for future generations and all."

WEO: "But if we cut 5Mbpd from our projections, then we are close to projecting totally flat production, even with the mythical 'to be found' wedge. You're good for 12Mbpd till 2035 though?"

Saudis: "...."

Am I crazy, or is that going to require an unprecedented amount of infield drilling? Imagine the amount of water that will need to be injected to push the oil up that fast. It's going to be collosal!!

I looked at Volume 1. Regarding GDP growth, I see:

and

Total production by the top 33 net oil exporters (accounting for 99%+ of global net exports in 2005) was 62 mbpd in 2005 (BP). The combined consumption by the oil exporting countries plus Chindia's net imports was 21 mbpd in 2005. This number rose to 25 mbpd in 2009. At this rate of increase, consumption by the oil exporting countries + Chindia's net imports would be 62 mbpd in 2030.

4.6% real global growth in GDP during 2010! Ludicrous. I wonder when and how they came up with that number.

Beware of all economic forecasts made by economists who believe Yergin and his gang at CERA, as I imagine most of them do. Too bad that so few economists hang out on TOD.

Don, while I agree that that number is ludicrous, and though I have no way to gauge the credibility of one Mr. Michael Mussa, senior fellow at the Peterson Institute for International Economics. that number actually jives with what he says... Go figure!

//www.ibtimes.com/articles/73120/20101018/gdp-growth-rate-2010-2011-emerging-markets-developed.htm

Methinks the emperor is butt naked and his cheeks are decidedly sagging!

Real GDP growth rate has been declining in China for months. Last quarter's 2% growth in real U.S. GDP was 70% due to inventory accumulation. Now inventory accumulation can be either a good or a bad thing. If it is voluntary, based on a realistic expectation of greatly expanded sales, then inventory accumulation is a good thing. If, on the other hand, inventory accumulation was involuntary due to sales falling below projections, then it is a good indicator of a coming recession. I think most of the inventory accumulation was involuntary.

In any case, I expect the third quarter U.S. GDP to be revised downward substantially. About three months ago I predicted on a Drumbeat that 3rd quarter GDP growth would be about 1% and certainly not above 2%/ I stand by that prediction.

What will real GDP growth for 2010 on a global basis be? I don't know; it is too soon to say. My GUESS is about 3%.

The chart showing "Incremental oil production by key countries" shows the lions share coming from OPEC. 10 of the 13 countries showing large increases in production are OPEC nations. Only Ecuador and Angola are left out. They show these 10 countries increasing production by about 21 million barrels per day combined.

Combined increased production from these 10 OPEC countries is 17.3 mb/d if I am eyeballing the chart correctly. 9.5 mb/d increase comes from Saudi Arabia and Iraq alone. Non OPEC countries add another 7.5 billion barrels to the mix. That brings the total increase from this list to 24.8 mb/d.

The thing to take home from this is that for this scenario to play out then those vast OPEC reserves have to be true and OPEC has to increase their production by over 17 million barrels per day.

One note of interest here is that they have Iraq's production increasing by 4.5 mb/d by 2035, not the 12 mb/d that Iraq says their production will increase.

Ron P.

And BP shows Iraq's consumption growing at 6%/year. At this rate of increase in consumption, they would be consuming 3.3 mbpd in 2035. If they wanted to maintain their 2009 net export rate of 1.8 mbpd, they would have to be producing 5.1 mbpd in 2035. Or, in other words, they have to grow their production at about 2.7%/year from 2009 to 2035, just to maintain constant net oil exports (at their current rate of increase in consumption).

Existing conventional oil declining from ~60mbpd to ~15 mbpd

in 20 years is a 7% compound decline rate. To stay flat they will need to add 2.25 mbpd every year which is approximately the production of another Brazil, Nigeria or Iraq every year which is unreasonable. I think the IEA forecast is probably somewhat exaggerated in the decline but

basically correct. I also think their growth in NGL is much too optimistic.

That's only half of the story.

The rate of depletion necessary in their yet-to-be found fields has never been seen before and thus are pure fiction. See my comment above.

Can someone explain natural gas liquids (NGLs) to me? By my understanding, these are the heavier hydrocarbons such as propane and butane separated out when processing natural gas. So is the next great hope going to be running cars/trucks on propane and butane? Am I reading that correctly?

Hank hill would be proud . . . but I don't know if that is going to work. T.Boone's efforts to use natural gas for transportation don't really seem to be going anywhere and we have lots of cheap natural gas. I'm not sure changing the molecular weight a little bit changes things much.

I'm sure we will use more propane and butane in the future (as we use more of everything that is available to us) but I don't think it really affects the transportation fuels issue.

And of course, the BTU content per barrel of NGL's is much less than the BTU content of a barrel of crude oil.

westexas - what is the ratio between BTU per ngl bbl and oil bbl? Ta.

I think that propane is around 3.8 MMBTU (million BTU's) per barrel, versus about 6 MMBTU per barrel on average for crude oil--so a given volume of propane would have about two-thirds the BTU content of the same volume of crude oil.

The density and composition of crude vary, so your number is on the low side, although arguably the same as what I'd calculate from wikipedia type data. Density of liquid propane is 0.58g/mL, vs 0.80-0.95 for crude. Combustion energy is 46.4 kJ/g for propane and ~42kJ/g for crude. Thus...propane = 26.9kJ/ml vs crude= 36.5 (+/-10%) kJ/mL.....so propane has 74% (65-85%) the combustion energy per volume.

The oil refinery can turn butane, pentane, hexane, etc. into gasoline as well as methane and ethane in the isomerization unit. Most current refineries can turn any oil and gas, even coke into gasoline at a surprisingly small energy penalty. The syncrude plants can even turn bitumen into liquid fuels.

Natural gas associated with oil production is one source of NGL, the other is natural gas wells though the NGL are lighter propane and butane, a small percentage of natural gas production is NGL on a boe basis.

If oil production falls and natural gas production averages 1.4% increases(IEA) then NGL should fall but IEA projects NGL will increase--which does NOT make sense to me.

Ah . . . this is interesting. Of course going from propane/butane up to the gasoline hydrocarbons has to involve adding energy. Is this done by using electricity from coal? An arbitrage play of using cheap coal to change cheap natural gas into valuable gasoline? (Like the oil sands arbitrage of turning cheap natural gas and bitumen into synthetic crude.)

And yeah, I'd think that the shale gas would have a lower percentage of NGL than natural gas from oil production thus making the NGL not as easy to increase as it was done in the past.

Not much energy.

The sulfuric acid alkylation of isobutane and propylene makes isooctane. The amount of energy required is about 350000 btu per barrel isooctane or ~6%, mostly for steam.

Likewise heavy coke and tars can be catalytically cracked down and be hydrogenated with natural gas to make isooctane. This process actual produces excess energy on the order of 210000 btu per barrel.

Thank you very much for the info. Very educational. I certainly understand the IEA graph better now. I suspect the creation of gasoline from NGLs will be a growth industry then as way to supplement gasoline stocks.

Of course, it seems a little wasteful since you'll always lose energy in the conversions due those pesky laws of thermodynamics but since we value those energy dense liquids much more, it is the economically wise thing to do.

I'm almost surprised it costs 6% to combine alkanes....probably cheaper to burn some fuel than insulate the process. btw...sorry to be picky, but do you know more details of the processes? Isobutane and propylene don't sound like LPGs...where do they come from? Also...they are 4 and 3 carbons, but isooctane is 8...?

The syncrude plants can even turn bitumen into liquid fuels.

Conventional oil refineries can turn bitumen into liquid fuels, and that's increasingly what they are doing these days. It just costs a lot of money modifying the refinery to process very heavy oil.

The big problem is that bitumen doesn't like to flow through pipelines, and even that is a soluble problem if the price is high enough. You can dilute it with lighter liquids to get it to flow.

Diluting bitumen with NGLs is a very efficient use, since the refinery can turn all of it into gasoline and diesel fuel - at great expense of course, but you just have to get used to paying more money.

that light blue section seems to only exist in Fantasyland.

when I saw that I thought "yeah that looks like peak oil, roughly correct". Just REMOVE the light blue section from the graph :)

In fairness, there should be some light blue. There will be some new production in the future.

"Found anything yet?

Nothing yet, sir!"

http://www.youtube.com/watch?v=MtkK3eijBso

right....when I saw the graph my first thought was:"uh...oh, looks like we are in trouble", I mean it's obvious just from that graph alone....

Interesting header on Page 21 of the Press Presentation

LOL! What the heck does that even mean? What is the feast? Is peak oil just going to be a friendly guest at the feast . . . meaning that peak oil will be there. Or will it be a spectre that sucks our life-energy away? Those are our choices?

I keep getting the mental image of "the ghost of Christmas future" pointing to a Gravestone inscribed not only with Scrooge's name, but also inscribed with "the world as you knew it"...

Interesting:

Yes, I would say a specter, the source of terror and dread.

From the same page:

They are saying that oil demand will peak at 88 mb/d befoe 2020 then shrink to 81 mb/d before 2035. But the shrinkage in OECD countries will be even greater because demand in non-OECD will actually grow. With some latitude allowed, OECD countries are mostly developed countries and non-OECD countries are mostly undeveloped.

They are saying that demand in the developed world will shrink considerably in the decade of the 20s. If demand for oil shrinks then it will be because GDP shrinks. Which means we will experience one hell of a recession during that time?

How can the IEA put out such crap and not realize the magnitude of what they are saying. Don't they realize that liquid petroleum is the lifeblood of the world's economies? If your blood supply shrinks then that which it supplies must shrink as well.

I know, I know, some people say that we can have growth of GDP and still have a shrinkage of the oil supply because "alternatives" will take oil's place. Well I just ain't buying it.

Ron P.

Ron,

The conventional wisdom on the future of oil production is IEA, EIA, and CERA. They all say about the same thing. Government leadership and also most economists listen to the conventional wisdom. Of course they pay no attention to TOD or other sources of reliable information on Peak Oil. We are the fringe, or beyond the fringe. They are the AUTHORITIES.

Now that makes their graphs work . . . but what does that mean in reality? Why the plunge?

To me, it sounds like ~$7/gallon gasoline in the USA to cause that plunge. Thus, peak oil or no peak oil, the OECD is in for a really rude awakening on oil. I guess the popular phrase these days is "an oil crunch".

Yet meanwhile, we continue to buy big cars & trucks.

Half of European taxation would bring a change. $7/gallon is European price now.

I didn't find comparation of per capita oil comsumption, but the pic talks enough alone.

They are assuming energy intensity of GDP continues to decline, in OECD and elsewhere.

I have a hard time believing that there will be much of a decline. Perhaps there will be a bit, but not nearly what they are assuming. There are several reasons:

We have managed to get quite a bit of our decline by outsourcing heavy manufacturing. If some of that comes back, it would tend to send the ratio up.

Also, part of the change is just that we are adding more services to the economy - lawyers, and doctors, and personal trainers, and financial counselors and piano teachers. As we get poorer, I would think this trend would reverse, and so would its effect on energy intensity.

The report talks about carbon sequestration. That is a step toward energy inefficiency, at least on the coal part of the energy intensity of GDP. Coal to liquid would also seems to be a step toward energy inefficiency.

Also, if we are going to replace autos with electric autos, and replace power plants with new more energy efficient one ones, there will need to be a lot of investment done. Someone will have to buy the factories to make more efficient cars, and the more efficient vehicles themselves, and all the new power plants. All of these have significant embodied energy in them, and need to be considered in the overall energy intensity of the economy.

I perfectly agree with you about that. As shown by Wagner (2010), Energy Policy, forthcoming:

"This paper constructs a comprehensive dataset of oil and total energy embedded in

world trade of manufacturing goods for 73 countries from 1978 to 2000. Applying the

data to debates on the dependency on foreign energy sources makes clear that achieving

complete energy independence in the foreseeable future is unlikely to be feasible and

may not be desirable. Applying it to the discussion of environmental Kuznets curves

(EKCs) highlights an important distinction between production and consumption of

energy. Richer countries use relatively less energy in their industrial production yet still

consume relatively large amounts of energy indirectly..."

"While energy and pollution-intensive production migrates to poorer countries, rich societies do not alter their tastes accordingly. Trade enables richer economies to consume less energy yet still benefit from energy and pollutionintensive production...."

"...Applying this dataset to debates on the dependency on foreign oil shows that the oftencited

policy goal of independence from foreign sources of energy is increasingly difficult to

achieve, once one considers oil and energy embedded in goods crossing international borders...."

See the full paper here:

http://www.gwagner.com/research/energy_trade/Energy_Trade.pdf

Maybe the IEA assumes that our gasoline powered automobiles will become more energy efficient and that we will be converting to natural gas and electric powered vehicles. They are also assuming an increased use of ethanol. The U.S. is very wasteful with energy, and European consumption has been declining for a while.

What is the minimum operating level of crude oil consumption for our society?

A headline on MEED is as follows:

Up from 0.8-0.9 million. Not that they have to, of course.

There's no sense in dissecting these obviously inaccurate projections by the IEA, a politically motivated entity, with the apparent goal of making this report maintain the illusion of BAU until the far distant year of 2035.

When determining the accuracy of information, 'always consider the source'.

The bigger problem might be price. Since the 08 plunge from 147 to 35, oil price has solidly rebounded to over 87 as of today:

http://www.oil-price.net/

Price as it affects the economy will trump any projections of production.

KSA will have trouble replacing 5m bpd from Ghawar. It was a massive pool of oil, but it already exceeded recovery estimates. Replacing that production, and squeezing an additional 5m bpd from new fields is a pipe dream. Not gonna happen.

Iraq and Kazakhstan MIGHT see the gains envisioned in the report. A lot of things have to go right for that to happen. Since the ouster of Saddam Hussein, Iraq has done nothing to increase production. We'll be lucky if they've formed a new government by 2035.

The report also counts on big gains from Venezuelan heavy crude. Not going to happen while Chavez is around.

Someone please tell me we can do better than 4.4m bpd in biofuel production by 2035. That's the most depressing part of this projection. We sent men to the moon in 1969, for crying out loud.

They won't say where the oil will be found to sustain constant crude production through 2035. However, it is rumored that somewhere between Miami, Bermuda and Puerto Rico lies the greatest undeveloped field of all time. In fact, time loses its meaning in that region, so that we can pump forever, with an infinite EROI.

The problem is being able to get the men and equipment there, which keeps dissapearing from radar screens, never to be found again.

That's because the energy and oil density in that triangular region is so great it sets up its own time-space fracking vortex. Rod Serling has refused to film anywhere near that area.

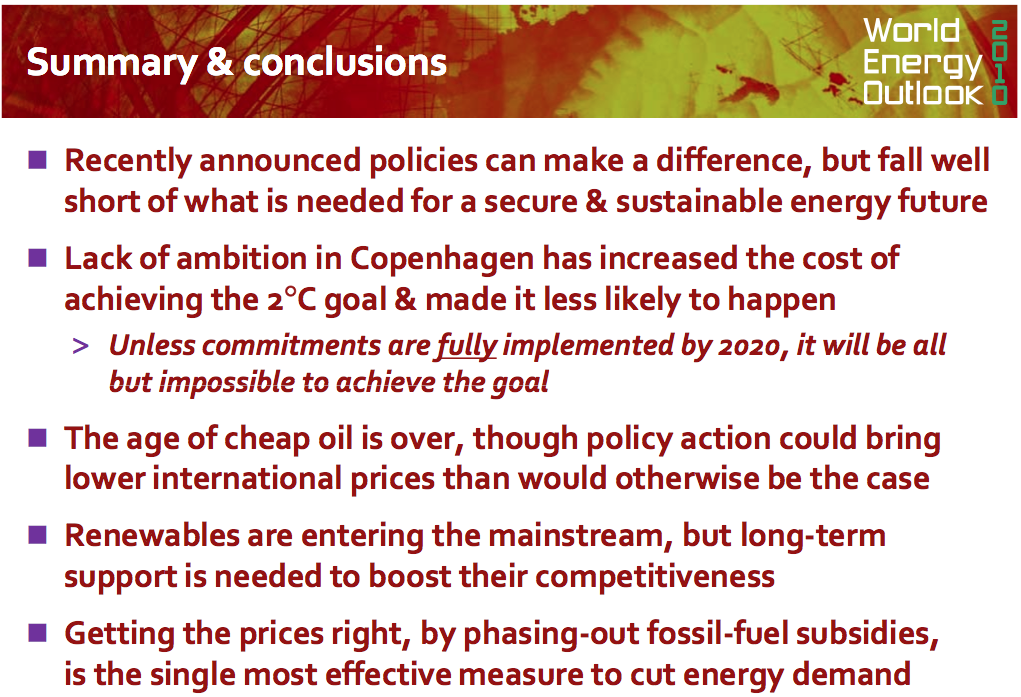

The summary is brutal:

-There will not be enough oil.

-Climate change at least the part originating from oil is real and wont be solved.

-Renewables will still be peanuts.

-Getting the price right, "TO CUT ENERGY DEMAND" is the way to go...

well, for what its worth they have spelled it out clear and loud.

And as long as we're focusing on this preposterous report, let's consider that cut in energy demand.

How would I do it ? Um, tax increase ? Nope, just have the military buying oil at higher rates and increase those purchases if the price drops.

Results; the price rises, citizens are forced to cut back,political cover provided by blaming speculators and Patriot Act violators . If the govt can print money and intervene in markets, why not kill numerous birds ? May even be able to turn a profit. Medals will be awarded.

Never happen , of course.

Just to remind folks how the EIA has seen things in their High Price Scenario over the years. Conventional Liquids under their definition includes natural gas liquids. The gradual upturn they now see after 2020 probably indicates the effect of Iraqi production & other sources.

This figure is really impressive!

So each of 2004, 2007, and 2010 have anomalously high upward slopes towards the far right, as compared to neighboring years. Is there some three-year bureaucratic cycle within EIA?

OK.. maybe it's just me. But when I look at that very first image/graph showing world oil production by type.....

does anyone else see the big light-blue area as "Gee hope that comes through"?

Notice that that is the only thing keeping the crude oil line "level".

Remove all or a portion of that blue area and crude oil production inevitably declines over the period.

When will the MSM finally clue in that we're running on a fantasy and the IEA is telling us point blank in the strongest words that it is allowed by its masters???

IEA whistleblowers tried last year, got good media impact... but we need more

http://www.guardian.co.uk/environment/2009/nov/09/peak-oil-international...

When will the MSM finally clue in . . .

When and only when gasoline prices go above a certain level ($6 per gallon? $8 per gallon? $5 per gallon?) and stay there for a matter of months.

See my comment above in response to Ron.

Exactly. IEA projections are too confusing and abstract. The only way people take interest is when they go to fill up and gas costs $4+/gallon. BAU until shock.

From and urban planning POV, the price has to be between $8 and $10 per gallon to change land use patterns. Less than that, and people buy more efficient cars. (Or the economy tanks, whichever comes first...)

I wish I could cite my source on that one, but the paper I read about the subject has long since disappeared from my inbox. I want to say the study was done by the university of Houston.

I think the economy will go into the dumpster long before we reach $8 per gallon gasoline. I also think we're about due for a major crash in the stock market, and that next year's real GDP growth will be about zero. In other words, I don't think QE2 will work to revive the economy from its pattern of stagnation. Chances of a deflationary depression withing two years I put at 50%.

It is hard for people to change from big vehicles to small cars when they still have three or four years to pay on their big SUV which is worth much less than they owe on it. A great many Americans have negative equity in their cars.

Nonetheless, the only sensible move for the US, would be to put a $1 or $2 tax a gallon, and this starting NOW !! (would still be the lowest tax level of all OECD countries)

Not doing it is not only pure economic suicide from the US, but also showing that it just has "given up"

(and please don't forget that tax revenues remain in the country exercising the tax ...)

Politically, there is no chance for a significant increase in the gasoline tax. That is one point on which both Republicans and Democrats agree. Hence, it is not going to happen.

I wonder at what point people will walk away from those cars & car loans.

But I understand people stuck with what they have . . . we are all in that position. What is shocking is that hundreds or thousands of Americans will buy a gas guzzler TODAY.

People won't walk away from their car loans in large numbers because when you do that you ruin your credit rating.

However, there are plenty of crooked new-car salesmen who will hide your being underwater on your two year old gas guzzler if you buy another new car (even a small one) from them. What they do is to roll the amount you still owe on your old car into a new loan on the new car. Car salesmen do this all the time; I know because one of my sons in law is a very successful Ford car salesmen. In good years he makes over $100,000 per year, but this year he'll probably make only $85,000 or thereabouts.

Well . . . a lot of people already have a ruined credit rating from a house foreclosure, so walking from a car loan won't be a big deal.

Ugh, that rolling over the car loan sounds absolutely awful. It sounds like our national debt. Your son in-law better be careful. He may find that some of those new Fords he sold start returning to the lot when people can't afford the gas and are too underwater on the loan.

No problem for the car salesman; he has already earned his commission and bonus. If the dealership goes out of business, my son-in-law just goes to another dealership. With his record of sales it is easy to get a job, even in hard times.

That would imply that the dealers (rather than the banks) are supplying the money. Sounds like creatve loan stuff, where a home owner can't find a buyer who can afford the house, so he sells it for a peace of paper, that says "I'll pay you back eventually (sucker)".

Banks supply the money; insurance companies supply money for car loans now, and of course there are corporations like GMAC who have car financing as their main business. No problem getting a car loan now with essentially nothing down, so long as you have a good credit rating. Indeed, by rolling your previous car loan into a new one, it is like the financing company is paying you money rather than you putting down a down payment.

Cars are repossed all the time; it is routine. You want a job? Try repossesing cars. It is dangerous, howeever.

Repo man is always intense.

Credit rating ...... sounds so BAU these days.

It seems that the best defense against identity theft is a poor credit rating.

Is that resuming? I know one car salemen pretty good. That used to be standard practice, but when the financial crunch hit, the banks started saying NO to such loans. And that tanked car sales big time. Apparently it was not uncommon for people to end up with loan balances at 150% or more of the cars purchase price. Do bankers have that short of memories to do that again?

"Apparently it was not uncommon for people to end up with loan balances at 150% or more of the cars purchase price."

Holy smokes. No wonder GMAC went up in flames. Here is a car . . . and here is $10K. Now please pay us.

The salesmen have to be more clever and discreet than they used to. It is not like the good old days. However, if you want a car and have a job and an income and a good credit rating, they will still get you into a car with nothing down.

Exactly, and this is precisely why the only way to pass the message is to increase the gas tax, saying that "Politically, there is no chance for a significant increase in the gasoline tax. That is one point on which both Republicans and Democrats agree." is really a bit easy, and won't make the issue or question go away ...

And this, not only because it would be in the US pure self interest to increase this tax, but also because whatever way you look at it, the big picture is still this :

and :

or :

And from a non American perspective, I can really sense the moment where the message towards the US will be : "have you looked at your consumption ? Are you serious ? really think you cannot take some fat out of it ? need some help maybe ?"

Do you think that a declaration such that "the american way of life is not negociable" will still get through easily in front of above top pic ?

Most economists who write on the issue have been urging a large increase in the gasoline tax for the past forty years. Economists advise. Politicians rule.

In answer to the question on how the IEA can be so different than Sweetman, the IEA just colors in the unknown production. THEY DON'T WANT THE FINANCIAL MARKETS TO COLLAPSE. THERE IS NO WAY THEY CAN MAKE THAT PREDICTION.

Do you really think that the markets would collapse if the IEA issued more realistic reports...?

I don't think so. The IEA leadership just lacks courage and IEA member states are unwilling to scrutinize what the Agency does...(they are very much happy with BAU reports)

No, they wouldn't collapse. The markets would just write off the IEA as being wrong.

I don't think a more pessemistic IEA report would collapse markets. The market is in complete denial. There might be a small drop for a day or two but then it would soon be forgotten. C'mon . . . we have magnets and technology!

Hahahahah! In this article (http://www.economist.com/node/15065719), Faith Birol states "that if no big new discoveries are made, the output of conventional oil will peak in 2020 if oil demand grows on a business-as-usual basis."

Then they put out the above WEO. I guess he's assuming 'big new discoveries' will be made...

The 40 million bpd of "yet to be developed and discovered" will NEVER happen.....

By 2030, the world will be living on 40 million bpd less than today!

Unfortunately, nobody will ask them why last year they said “conventional oil will peak in 2020” while they are now talking of: “its all time peak of 70 mb/d reached in 2006”.

That’s a difference of... 14 years.

Maybe next year they will say global Peak Oil will happen in 2012 or 2020 or 2008, who knows?

The IEA and its Chief-Economist, Fatih Birol, have lost any credibility they still had...

Going through the fact sheet they in fact DO announce that the peak for crude is history and happened in 2006 :

But it obviously would be a bit difficult to make a sentence more convoluted than :

We will reach a plateau in 2020 for crude, although we already have passed the maximum in 2006 !! :)

That one must have been talked over ... (and is quite hidden)

(and without even talking about the mystery of a 20 or 30 years long plateau at the world level, when this has never occured at any regional level ...)

Also in :

Being able to write that we reach a peak in 2020 due to ""weaker demand" caused by transition to renewables and hybids vehicules requires some serious guts !

especially when in some recent iea slides, GDP growth is forecasted as quite healthy :

http://www.seai.ie/News_Events/Previous_SEAI_events/Pathways%20to%202050...

(slide 28)

So oil production peaks from demand and not supply. How disappointing for the doomers!

Not at all. An abrupt collapse of real GDP to half its current levels would decrease demand for oil by very roughly half. Who can say for sure the fast-crash doomers are wrong? I think they are not right, but I've been wrong before.

Hmmm....I'm not a fast-crash doomer (cascading infrastructure failure and people streaming from the cities scouring the countryside for food) but I do believe this is our future:

which I suppose makes me a "mid-speed doomer." Doesn't have a very good ring to it. Need to think of something else.

How about:

"Declinist"

"Collapsist"

I know, how about "Realist???"

We have had two centuries of growth, every few years there was a "step-up" the energy staircase, these steps were enthusiastically taken as they made life "better".

Over the next few decades we will be pushed down the stairs, reluctantly one at a time and each step will result in giving up something that we've taken for granted.

Those of us who plan for this can walk down those who dont will fall!

I forgot Kunstler's term: "Actualist." Probably the best of the bunch.

twilightists they consider simmons a prophet, his word gospel. i asked the librarian why twilight in the desert wasn't cataloged under fiction.

Well, I suppose Matt could have made up the story he told us at ASPO 2009.

Matt said that when he met Saddad Al-Husseini the first time (in SA, IIRC) Al-Husseini spent some time at the beginning of the conversation determining if Matt had, in fact, read all the reports that Saudi Aramco, under Al-Husseini's direction, had published on their fields. It would have been a very big job to study them (there are apparently a lot of them) so it was warranted skepticism.

After satisfying himself that Matt had read them, Al-Husseini purportedly told him that he had had those reports made so that someone could follow the breadcrumbs. The clear indication was that Al-Husseini is not in a position to directly say what needs to be said. This makes sense since it is his life on the line (I imagine quite literally). I haven't checked but this is likely on ASPO.TV if you care to listen to the story yourself.

Now, given that Al-Husseini, now retired, repeatedly has said there are "serious problems of maturity in many of these fields" and has publicly and repeatedly said that PO is this decade, I'm far more inclined to believe that Matt's recounting is truthful and that Saudi production has a peak earlier than the Saudis claim.

If there is a common thread in this oil story, it is that officials of whichever institution you care to name will always delay, obfuscate or lie to avoid telling their constituents that there is a serious problem. They will do this until their fiction can no longer credibly be maintained — and very often even then.

Thus, if SA says their peak is 2033, chop off at least ten years and I think you're starting to get closer to the truth.

thanks for the links, i was just starting to look at what al-husseini had to say since i seem to remember he was referenced in 'twilight', not sure about that.

the writings of different people can be interpreted in different ways. i dont see anything in the jpt editorial referenced by joules burns that would differ from my preliminary conclusion: look somewhere other than saudi arabia for a shortfall in oil supply.

in my opinion, saleri rendered 'twilight' fiction in his presentations. i know, i know, saleri's statements have been interpreted otherwise by twilightists.

i am beginning to wonder if simmons was drunk or off his meds when some of that was written, positively gibberish. he could have used a good proofreader too.

edit: quoting from the aspo al-husseini interview:" I don’t think the problem is Saudi Arabia. I think the problem is the rest of the world."

Actually you come across more as someone who is intermittently declining, then suddenly collapsing into realism, then rinsing and repeating... I think the word I'm searching for is a 'Slinkyist' >;^)

lol

I'll add that to the list.

Though I do believe I've been consistent with my prediction of a major disruption in the world financial system i.e. a big step down. IIRC, I started discussing that with the first talk on PO I gave to Sun and eBay in January 2008.

n.b. I was scared as hell giving that talk. It gets easier but the first one was a tough one. Just spoke today at Sonoma State University and I laid out the landscape as clearly and as bluntly as I could. Good questions from the students. Their prof had started weeks ago with End of Suburbia and other material so it wasn't completely new to them.

Well if oil production peaks due to low demand that means the price has probably gone through the roof. How is that not dismal situation? It is certainly not the food riots and societal collapse that some subscribe to (not me), but it is not exactly something to look forward to. Especially since most people will be completely unprepared.

If global real GDP goes down a lot, then demand for oil will go down faster than production capacity of oil is decreasing; hence substantial declines in real GDP mean falling oil prices. This could very well happen if we have a deflationary depression. This deflationary depression is likely to be global in scope. My odds of deflationary depression in the next two years, 50%.

Agree with that, however what the IEA forecasts/describes is :

1) governments policies : push to renewables, hybrids, electric vehicules, removing of fossile subsidies/increased fossile taxes

2) growth in GDP maintained (around 3% for the world in 2007-2030, 2.6% 2030-2050, in slide 28 linked above)

3) even with 2) above, due to 1), the oil production goes through a peak in 2020 following weaker demand !

I have to wonder who they are trying to fool or mollify. Under our current monitary regime, borrowing is the only way to keep the money supply increasing and banks profitting. Borrowing is based on the perceived ability to pay it back plus interest. This means growth. No growth in oil, no growth in the money economy. There is a big demand for good news on the oil front whether it's true or false. So it's probably more of a question as to whom the EIA and IEA must answer: us or the banksters.

Fundamentally, an economy is a process of generating claims on useful work. That work can be accomplished by raw human labor or by computerized control of some energy guzzling machine or by some combination of the two. All of those claims on labor exist as private bank credit for which we pay a rent in the form of interest whether on our own private debt or as tax toward interest on all public debts. Without these claim checks there is no economy save for barter.

The miraculous thing about hydrocarbons is that for the last century their use has allowed the bank credit side of the economy to grow at an exponential rate as demanded by the models of compound interest and fractional reserve lending. Now as we coast over Hubbert's Peak the foundation of all that growth in bank credit money will have no physical support in the real world. There will be fewer products of useful work for which one can redeem those bank credit claim checks. For those who believe there is no connection between bank credit and the real world, the solution is to just keep finding ways to produce more bank credit. That requires the manufacture of new fantasies about endless oil conjured up by throwing money down holes in the ground or pipedreams of other fuels that have all of oil's bountiful properties.

The reality appears to be that we are entering an era of constraints fundamentally at odds with the bank credit claim check system of money. We will be forced to change our relationships with our artifacts and redefine how it is we think of and issue our money. Reports like this one from IEA only delay the process by prolonging the fantasy of easy money from abundant oil. This message is consistent with what the banksters would want to hear. For the rest of us?

Bingo.

During the last 30-60 years we've created some very powerful individuals, families, businesses, institutions, corporations. The wealth and power they enjoy is ultimately derived from fossil fuels, and they call the shots. In their, and our, myopia, we believe that we will have energy growing forever, debt growing forever, population growing forever, etc.

Nature ensures that won't happen.

But the powerful people still call the shots, and they will keep us in the termite riddled house until the bitter end.

Want to escape? Sure, you can try, but you are risking a bullet to your head, starvation, or worse. Being a revolutionary isn't easy.

The most you can do is buy precious metals and other collectibles, and hope you don't receive a knock on your door from strangers with badges and guns.

Badges? We don't need no stinkin' badges!

Although I do agree with most comentors here about what looks like obvious manipulation of production estimates, I still think what they actually say should hit world media front page tomorrow morning.

They publicly admits oil prices will climb up to recession triggering levels, and stay there, for ever.

And they go on to say that regarding the climate, we are probably screwed there too.

How can such a document NOT be top news for the next week?

In an unrelated but still energy related side note; a hydro electric dam in south Sweden collapsed this sunday. The facility, plus a down stream bridge, is totally gone. I used to paddle canoe there as a child. That place looks a wee bit diffrent now. http://www.youtube.com/watch?v=CyHW7P57DTs

I predict the MSM will interpret the report as GOOD news: We don't have to worry about Peak Oil until 2035. If there is a story, e.g. in "The Wall Street Journal," that will be their interpretation. Or the MSM may entirely ignore the report; that would not surprise me.

Yep. It will be a five second glance at that first chart above. "Well, oil is going to keep flowing . . . no story here."

Actually - The IEA Report made Fox News (Sheppard Smith) tonight. I was not paying close attention but I did see one graph - one showing higher oil prices for the future.

Something that just caught my eye is the anticipated huge increase in China coal usage from 2010 to 2020. No wonder this report mentions in the Summary the lackluster results in Copenhagen. By 2020 we'll probably be averaging 3ppm CO2 added per year.

10yrs (2010-2020) x 2.2ppm (current) avg. is 22 + 392 (total in May 2010) = 414ppm

If 3 ppm avg. in period 2020-2030, then 10 yrs x 3 = 30 + 414 = 444ppm in 2030.

Presuming continued damage to the bioshpere to act as a carbon sink, figure 4 ppm added 2030-2040, is 10 yrs x 4 = 40 + 444 = 484ppm in 2040.

5ppm added 2040-2050, = 50 + 484= 534ppm

Wow, that gets up there real fast! Five Hundred and Thirty Four parts per million CO2 in 2050. You'll have to sit in front of an AC unit in shorts, drinking something with ice in it, dousing your head with a wet sponge from a bucket of icey water every 5 minutes.

I can hear some old guy in 2050 now. "I remember when I was a kid and this now defunct arm of the GOP, Fox news, use to tell us global warming was a hoax. Where are those jerks today?!"

If you think any of the near-term peak models are correct that isn't even remotely possible. At best (worst?) we'll likely be emitting 80% of what we are today.

Not likely we'll get to that level ever. Worldwide coal assessments are coming down fast and it's coal that makes the biggest difference.

Here is Rutledge's forecast; burning all sources doesn't even get us to the lowest IPCC Special Scenario:

The Uppsala Global Energy Systems Group found the same thing.

http://www.aspousa.org/2010presentationfiles/10-8-2010_aspousa_CoalQuesi...

Rutledge then plugged the numbers into MAGICC and got this:

which is a max of 455. Far from good news but at least there is a good chance we won't become like Venus.

http://www.aspousa.org/2010presentationfiles/10-8-2010_aspousa_CoalQuest...

Hi aangel, I hate to ruin your day but according to the latest data from NOAA global CO2 annual increase may exceed 2.7 ppm for 2010. Furthermore, positive feedback mechanisms will bring carbon currently naturally "locked up" in forests, peat bogs, gas hydrates, etc. into the atmosphere as CH4 and CO2, and it is this that we risk going out of control. So you can basically throw away most of your post above.

On the positive side, I agree that humanity's direct emissions from fossil fuel use will likely fall rapidly in the near future. But unfortunately if the positive feedbacks take hold, it will too late anyway.

Decarbonizer,

By 2020 I anticipate our economy will be smaller by something like a minimum of 20%.

Here is Hirsch's projection; it assumes we can mitigate with CTL, etc. but he acknowledges that it's a best case scenario:

CO2 emissions are directly correlated with economic activity so that's why I think we are at peak CO2 about right about now — even with the emerging releases of methane.

Now, they may catch up and exceed the savings that come from a contracting economy but I don't think that will happen for a few years more and if we're lucky won't ever.

Still, I agree the feedback loops are a real problem.

It occurs to me that billions of people will be burning whatever they can find to offset the increasing relative costs and decreasing availability of conventional fuels, burning in less efficient ways. How this will affect overall CO2 concentrations is unknowable, but it can't help. How many of you would think twice about burning pieces of the abandonded house next door to keep your kids warm or to cook that fat rat you caught this morning. Don't mind the paint; it adds flavor ;->

Ghung, I hear this all the time and possibly in three or four century's time we will have burnt up everything that could possibly burnt. I don't discount that.

However, in the short and medium term, a contracting economy due to declining oil production is going to greatly diminish the rate of CO2 emissions. It starts with less oil itself being burned followed by less natural gas and coal because a smaller economy doesn't need as much energy as it does now.

To understand the total emissions (cumulative) in the longer term, the easiest way and likely the most accurate way, too, is to calculate the amount of fossil fuel remaining, assume that its EROEI is high enough to warrant it all being burned (not a given, but at least a place to start) and calculate how much CO2 comes from that. Your concern about efficiency is explicitly included in that sort of calculation because you are simply assuming all the fuel gets converted to CO2 — whether it's coal, natural gas or oil.

(This is excluding methane emissions; just talking about fossil fuels atm.)

[fingers firmly crossed] I hope you are right, Andre`, as I have a third Grandchild due in Dec. Your take on declining CO2 emisions assumes that folks will accept (or can accept) a lower energy lifestyle being forced upon them. Historically, substitution seems to be more the norm. Societies are deeply invested in their current level of energy use.

My comment about less efficiency goes to rate of burn, near to mid term. Folks will burn more of whatever they can find, in less efficient ways, when their current sources of energy begin to dry up. In a slow decline, alternatives can be offered to fill the energy shortfall and minimize "guerilla burning" of whatever is available, but I see neither the political will nor level of awareness to prevent wholesale burning of stuff in a desperate attempt to hold on to our high energy lifestyles. Humans burn things, always have.

Your view of the future is more hopefull it seems. My take is that climate change is, indeed, baked into the cake, so we are only discussing the severity/longevity of AGW.

Oh I still think climate change is going to be a mess. I too have my fingers crossed that methane doesn't make things worse than they are already destined to be.

The best Doomer is an equal-opportunity Doomer. ;-)

DD

You mean my still plump, ex banker, the rat, neighbor? Catching him is the easy part and while I don't mind the extra flavor from the paint on the fire wood, I'm still wondering if I should put him on the spit whole or if it might be better to roast him piece meal?

On the other hand, since I like solar, perhaps cutting him up into thin strips, salting and sun drying might be in order. I could always use his pinstripe suit as a cutting template...

Grind him up, cook well and mix in some refritos, veggies, cheese, salsa on a nice steamed tortilla.

Bankerito! Collapse cuisine at its finest.

Carnitas for the dogs.

I used to agree with you, but lately I've come to belive we will start the transition towards high-CO2 energy, such as tar sands etc. A few days ago I read some place in the USA they will build the worlds largest CTL-plant. Only Germany and South Africa have built them before. In poor countries they will accelerate de-forestation for fire wood. We will do whatever it takes to get that energy.

Although energy output will decline, I am not certain CO2 output will. At least not that fast.

As for the PPM-levels, we must also add natural sources, such as methane leaks from the arctic regions etc. That last bit may very well accelerate GWO faster than IPCC would ever dream about.

A contracting economy means a lot less fossil fuel is burned and it will take decades to build enough CTL plants that can even come close to the CO2 that is saved from a contracting economy. I actually doubt we will ever build enough CTL and equivalent plants to exceed the CO2 emission rate we have now.

Methane is another story, as you point out.

Does anyone have good, recent links for estimates of methane release at certain temperature levels?

That CO2 decline after 2050 in the second graph is hilarious nonsense. Supposedly we have less than 90 ppmv of CO2 that we could ever add to the atmosphere and it will dissipate in a few centuries. This is delusional thinking at its worst. The CO2 sinks are shrinking as global warming progresses. Based on current trends they would go to 30% of today's level by 2100.

There is simply no evidence that there is an upper bound of 90 ppmv of CO2 addition in the next 90 years. Just 50 gigatons of CH4 from the East Siberian Arctic Shelf (ESAS) would be equivalent of over 2000 gigatons of CO2 on the timescale of 20 years which would kick the system into a transient CO2 doubled state and ensure that the CO2 sinks decline. But the ESAS CH4 would trigger the permafrost CH4 release in the Arctic which would add hundreds of gigatons more. The IPCC scenarios ignore serious CH4 releases and are unrealistically conservative. Only the A2 scenario can be considered realistic if one considers it to be CH4 boosted.

Peak oil and coal won't save us from AGW. There is still plenty of coal and both conventional and unconventional oil and natural gas to give us more than 90 ppmv of CO2 net addition assuming current CO2 sink levels. Current total oil reserves are over 2 trillion barrels or 640 gigatons of CO2. There are around 850 gigatons of coal available for extraction, which is basically 2430 gigatons of CO2 (let's make it 2000). World proved gas reserves are about 6300 trillion cubic feet. Taking 55.6 kg per 1000 cubic feet of CO2 production, this gives us 350 gigatons. So I see over 2500 gigatons of CO2 produced (assuming not all the oil is extracted) and not the 600 gigatons claimed in the first figure.

Right on. Most people don't understand the nature of impulse response functions.

CO2 residence times are huge and they override the responsiveness of rapid changes in CO2 emissions.

Also, many people don't understand that light (of the IR kind) travels in a straight line.

Therefore it is not the Parts Per Million (PPM --a 3-dimensional measure) of CO2 that counts but rather the projected parts per square cm (--a 2D measure) on a median spherical shell in our atmosphere that tells the story regarding blockage of exiting IR light.

Rutledge and the Uppsala Global Energy Systems Group came to similar conclusions about fossil fuel availability. (Just concentrating on that for the moment. I acknowledge methane is a huge problem.)

http://rutledge.caltech.edu

(Watch the 40 minute presentation.)

http://www.aspousa.org/2010presentationfiles/10-8-2010_aspousa_CoalQuesi...

http://www.aspousa.org/2010presentationfiles/10-8-2010_aspousa_CoalQuest...

Validity of the fossil fuel production outlooks in the IPCC Emission Scenarios

http://www.tsl.uu.se/uhdsg/Publications/IPCC_article.pdf

Future coal production outlooks in the IPCC Emission Scenarios: Are they plausible?

http://www.tsl.uu.se/uhdsg/Publications/PCC_Article_2010.pdf

Where did they make their mistake, in your view?

The IEA's best case New Policies Scenario approach of increasing renewables and nuclear

and reducing coal from 41% of electricity to 32% by 2035 still has CO2 concentrations reaching a final 650 ppm or 3.5 deg C.

Plus thy already state that unless full radical action is achieved by 2020 we won't hold to the IEA 450 ppm Scenario.

Aleklett-Rutledge projections looks just plain wrong. They are just tayloring projections to fit their 471 ppm maximum.

Again: point out where they made their mistake. They are pointing out that the IEA estimates are faulty (something I agree with) so in the spirit of good science, now you can demonstrate why their correction is wrong.

The papers are listed above. Rutledge makes his spreadsheet available on his website and you can download MAGICC for free.

I think Rutledge guesses the world has 600 Gt of coal, 5000 Tcf of natural gas and 800 Gb of conventional oil of which 90% ends up being burnt or 1640 GtCO2 total.

2/3 of CO2 emissions are from burning fuel.

The world produces ~30 GtCO2/yr so 20 GtCO2/yr is from FF burning.

1640 Gt CO2/ 20 Gt CO2/yr = 82 years of fossil fuel left at a constant rate. Burning fast just increases the upward slope.

If atmospheric CO2 increases by 20 ppm per decade for 9 decades

we go from 391 ppm to 571 ppm.

If we go for 4 decades we end up at 471 ppm, Rutledge's number.

Now tell me you believe fossil fuels will be nearly depleted in 40 years.

Just doesn't add up.

His graph shows a CO2 Peak at 2050 so at that point fossil fuel CO2 is pretty much exhausted. Fossil fuel is likely to last until 2100.

majorian, it's going to take me a bit of time to get back to you so that I can do some digging...it may be in a future thread.

A late comment in an almost dead thread. I found this interesting and can only add:

We emitted around 2004 49 Gt CO2 EQUIVALENTs per year.

see http://www.ipcc.ch/publications_and_data/publications_ipcc_fourth_assess...

SPM report, figure SPM.3.

The problem with looking at CO2 from fossil fuels only is that it is only 56% (not even 2/3!) of the total CO2 EQUIVALENT emissions, and that there is CO2 from other sources (ag, deforestion, biomass decay) which is about 20% of CO2 Equivalent emissions. So by reducing the fossil fuel emissions to zero say 2050, there will still be ca. 0.6 ppm CO2 in concentration increase from other sources then, still.

And still other emissions (non-Co2) of about 0.5 ppm Co2 equivalents at 2050, just comparing things if they stay equal as today (which they wont ofcourse, as discussed in comments above).

So it is unreasonable (almost dishonest) to assume that the warming forcing of anthropogenic emissions will stop increasing 2050, as the comment from Aangel at 11:42 pm above indicates. It only shows the fossil fuels part!

If I plug this into an excel sheet, I end up on about 450 ppm CO2 equivalent at 2050. Sure. But after that it still goes up with about 1 ppm Co2 equivalents per year!

Extremely simplified ofcourse, only to show that the assumptions in any scenario needs to be carefully defined and clarified. And shown clearly, before the result is told to be "no worries"...

You can add Wigleys carbon model to this and so forth, but that if we reduce Co2 equivalent emissions from 2-3 ppm per year now to about 1 ppm 2050, that we should have enough sinks then to start reducing CO2 I seriously doubt,personally.

Cheers

I noticed an faint line on the first chart which shows, alas, that net oil energy continues to drop steadily.

Oh wait, that line is only a reflection of the distant purple and gold mountains in the tranquil blue, and very deep, lake.

This is so predictable.

Before The Oil Drummers ridicule the forecasts of the IEA, they should take a look at some of their own past forecasts which are now worthy of ridicule.

This one here is looking pretty funny by now, too.

And this quaint little relic here is already off by about 3-4 million bpd.

Why should anyone take your criticisms of the IEA's forecasts seriously when your own forecasts have such a poor track record?

Tu quoque fallacy. Ignore.

Hi Abundance,

This is what I see:

Between 2005 and today 2010:

World Liquids Fuel: . flat at 85 mbpd (±1%-2%)

World crude oil: ........ flat at 73 mbpd (±2%)