Drumbeat: November 17, 2010

Posted by Leanan on November 17, 2010 - 10:00am

Petrobras oil exports to hit 800,000 bpd by 2020

(Reuters) - Brazilian state oil company Petrobras expects crude oil exports to rise to 800,000 barrels per day by 2020 as new oil production from vast offshore fields comes online, a company director said on Wednesday.Petrobras is currently both an importer and exporter of crude oil, but imports are slated to halt by 2014 as oil output from the offshore region known as the subsalt displaces light crude purchases from Iraq and Saudi Arabia, Petrobras Supply Director Paulo Roberto Costa said.

Steve LeVine: Peak or no peak?

Do you ever get the feeling that some people want the world to run out of oil, really really soon? That runs through my mind sometimes with the flood of peak-oil material at conferences, in books and in the media. Among the latest are a couple of new reports with yet more alarming findings. The headline: We're in trouble.

Crude Oil Tumbles to Four-Week Low on Signals China Will Increase Rates

Crude oil declined to a four-week low on speculation that China will raise interest rates, slowing economic growth in the world’s biggest energy-consuming country.Oil fell 2.3 percent after Chinese Premier Wen Jiabao said the government was drafting measures to counter inflation. Prices also dropped on concern Europe’s debt crisis is worsening as ministers considered a rescue package for Irish banks. U.S. crude supplies slid 7.29 million barrels to 357.6 million last week, an Energy Department report showed today.

Russia To Switch To International Oil, Gas Reserves Standards By 2012

MOSCOW -(Dow Jones)- Russia plans to harmonize its oil and gas reserves classification with international standards by 2012, the Resources Ministry said Wednesday."From 2012, Russia should introduce a new classification of hydrocarbon reserves in harmony with international SPE [Society of Petroleum Engineers] PRMS standards," said Grigori Vygon, head of the ministry's economy and finance department.

Russia checks claims of $4bn oil pipeline scam

Russia is checking documents that suggest at least $4bn (£2.5bn) of state funds was stolen during the construction of a big oil pipeline.Moscow blogger Alexei Navalny claims he has obtained documents that reveal the theft was uncovered in a 2007 audit of the East Siberia-Pacific pipeline.

Exxon Mobil agrees to $25 million settlement over cleanup of underground NYC oil spill

NEW YORK (AP) — Exxon Mobil Corp. has agreed to pay $25 million to resolve complaints over its handling of a huge underground oil spill in New York City.The deal with Attorney General Andrew Cuomo and the environmental group Riverkeeper will resolve several years of litigation over spills from refineries that once lined the Brooklyn waterfront.

BP spill fund rules would shift rights to company

(Reuters) - Claimants to BP Plc's $20 billion oil spill fund may soon be required to transfer to the company their right to sue other defendants, a move that could help BP's efforts to collect billions of dollars from its business partners.

Gulf oil spill report blames industry and regulators

A sorry catalogue of technical, safety and regulatory failures all contributed to the Deepwater Horizon oil spill in the Gulf of Mexico, according to an interim independent report commissioned by the US Department of the Interior and published today.

Report: Green building market booms in weak economy

Despite a deep economic recession, the U.S. green building market has expanded dramatically since 2008 and is projected to double its size by 2015, says a new report by McGraw-Hill Construction.

Analysis: In coal lockdown, China creates diesel snafu

Almost every winter, China's energy market suffers a new variant of the same no-win situation as state controls exacerbate supply shortages that only urgent and pricey imports can relieve. This year it is diesel that is scarce.A spike in demand for diesel-fired power generation has caused a supply shortage that could last well into 2011, forcing Chinese refineries to import the fuel for the first time in nearly two years and to consider tapping state fuel reserves.

Despite cold weather and rising fuel costs, a state campaign to stamp out energy wastage has prompted officials in many provinces to cut power supplies to factories, businesses and even homes and public facilities.

Many big power users have simply switched to stand-alone diesel generators, which fly below the radar of the official campaign focused mainly on coal-fired electricity.

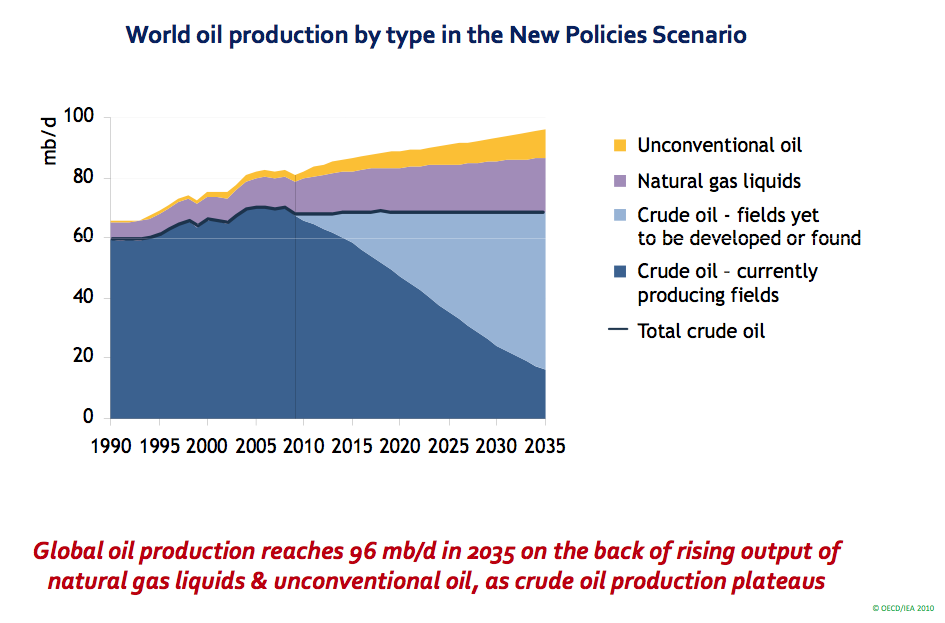

Oil Output Likely Peaked in 2006, Will Be Replaced by Biofuels, IEA Says

Global production of crude probably peaked in 2006, and increasing demand will have to be met from more-difficult-to-extract forms of oil such as tar sands, International Energy Agency Chief Economist Fatih Birol said.“The age of cheap oil is over,” Birol said at a conference in Madrid today.

Russia approves $32 bln state asset privatisation plan

MOSCOW (Reuters) - Russia's government approved a plan on Wednesday to sell around 1 trillion roubles ($31.9 billion) in state assets over the next three years to plug a gap in the budget deficit and lure foreign investors.Russian leaders need cash to ratchet up growth ahead of the 2012 presidential election, in which former president Vladimir Putin has hinted he may stand.

Economy Minister Elvira Nabiullina said following a cabinet meeting chaired by Prime Minister Putin that the plan -- which includes stakes in the country's two biggest banks, main oil producer and railways monopoly -- had been approved.

A team of engineers and forensic analysts Tuesday launched a high-profile autopsy of the blowout preventer from the Deepwater Horizon as part of a bid to find out why the 50-foot, 300-ton device failed to cut off flowing oil and natural gas at BP's Macondo well.

REDMOND, Wash. — "Your mileage may vary" ... That old phrase is even more relevant for the newfangled Nissan Leaf electric vehicle, which has an advertised range of 100 miles on a charge. In fact, the mileage depends quite a bit on your driving style, and the numbers can go up and down in the course of a drive.Yes, it's possible to get 100 miles or more from the Leaf. But if you're the kind of guy who keeps the car on the road even if the needle is near the "E" mark, you might have to change your ways.

Berlin Wants Wind Power Technology

Berlin operators are calling for Germany's first offshore wind farm Tuesday urging the German government to increase incentives to expand the generation of renewable power at sea.Utilities Eon, EWE and Vattenfall in a statement called on Berlin to improve the financial and regulatory framework so that more offshore wind farms can be launched in Germany.

Still a long road ahead for U.S. energy efforts

Some of the bickering about the energy crisis, the smart-alec gimmicks, and the "if" arguments make one wonder ... about the sturdy nature and future of our democracy.We advance matters which are interesting but academic - such as "if" we all had small cars, the problem would be solved. We don't all have small cars, and that kind of a conversion would take years. In fact, the years ... are such that by the time they passed the adjustment wouldn't solve anything. By then we will ABSOLUTELY NEED new sources of energy anyway ...

Saving our nation's energy by learning to use less

Let’s say you don’t like oil from countries that don’t like us, or from the oil sands of Canada. Let’s say that you don’t want any offshore oil drilling. Maybe you don’t like coal fired power plants. You may not want any energy from nuclear power because you believe it is dangerous or you worry about toxic waste. You don’t want any concentrated solar facilities on pristine California desert, or noisy windmills to disturb the peaceful island life of Vinalhaven, Maine. Maybe you want to zone your community to prevent unattractive solar panels from appearing on your neighbor’s roof. You may not like to use corn to drive to the store when the world’s per capita grain supply is dwindling. If you are uncomfortable with the trade offs of any or all of these energy sources, what can you do?Use less.

Two of the three North Shore mayors attended the conference along with mayors from Bowen Island and Lions Bay who discussed various plans for developing community gardens, farms or other agri-urban initiatives. But one of the most insightful comments came from Mayor Richard Walton when asked by members of the audience: What effect will peak oil and climate change have on food security? Walton said, "The next oil crisis like the one in the 1970s will show us just how important local food production is." Before I could pause to think, I heard someone near me say, "How will we get food onto the North Shore if there's no gas?" That was a startling comment delivered ad hoc from the crowd, but it gave everyone reason to pause and made the rest of day's discussions much more important.

As vote nears, 'locavores' fight over

WASHINGTON — A far-reaching food safety bill that could give the government more power to prevent foodborne illnesses has become a target of advocates for buying food produced locally.They worry the legislation's safety requirements could force small farms out of business.

There Will Be Fuel: Energy, and Plenty of It, for Decades to Come

THREE summers ago, the world’s supertankers were racing across the oceans as fast as they could to deliver oil to markets growing increasingly thirsty for energy. Americans were grumbling about paying as much as $4 a gallon for gasoline, as the price of crude oil leapt to $147 a barrel. Natural gas prices were vaulting too, sending home electricity bills soaring.A book making the rounds at the time, “Twilight in the Desert,” by Matthew R. Simmons, seemed to sum up the conventional wisdom: the age of cheap, plentiful oil and gas was over. “Sooner or later, the worldwide use of oil must peak,” the book concluded, “because oil, like the other two fossil fuels, coal and natural gas, is nonrenewable.”

But no sooner did the demand-and-supply equation shift out of kilter than it swung back into something more palatable and familiar. Just as it seemed that the world was running on fumes, giant oil fields were discovered off the coasts of Brazil and Africa, and Canadian oil sands projects expanded so fast, they now provide North America with more oil than Saudi Arabia. In addition, the United States has increased domestic oil production for the first time in a generation.

Oil Declines a Fourth Day on China Rate Speculation, Europe Debt Concerns

Futures retreated as much as 1.4 percent after Chinese Premier Wen Jiabao said the government was drafting measures to counter inflation in the world’s biggest energy consumer. Prices also fell on concern Europe’s debt crisis is worsening as ministers considered a rescue package for Irish banks. U.S. crude inventories dropped the most since September 2008 and gasoline demand increased, reports showed yesterday.“Risk is being taken off the table across the entire commodities complex as the dollar gets stronger,” said Carsten Fritsch, an analyst with Commerzbank AG in Frankfurt. “In such an environment fundamentals such as the sharp drop in crude stockpiles don’t matter.”

Coal's Two-Year High May Force European Utility Gas Switch

Coal in Europe is trading close to a two-year high as rising demand in China drives up prices around the world, making natural gas more attractive to U.K. and German utilities for producing power.

Inflation at lowest level since 1957

NEW YORK (CNNMoney.com) -- Consumer prices for everything other than food and energy experienced their smallest annual increase on record in October, the Bureau of Labor Statistics said Wednesday.

China to subsidize food after price spike

BEIJING – China's government announced food subsidies for poor families Wednesday as it tries to cool a double-digit surge in prices that communist leaders worry might stir unrest.The Cabinet promised to ease shortages of vegetables and grain that helped push up food prices by more than 10 percent in October. It promised more supplies of diesel to end fuel shortages that have disrupted trucking and industry.

BP North Sea gas field shut down over Iran

A major North Sea gas field has been shut down because production could break European Union sanctions against Iran.

Cameroon: Attack on Perenco oil vessel kills 5

LAGOS, Nigeria—Five people were killed in an attack in Cameroon on a boat carrying guards for an offshore oil field operated by French firm Perenco SA, the company said Wednesday.The attack late Tuesday night came as the vessel operated at an oil field abutting Nigerian territorial waters, possibly signaling that militants waging attacks in recent days from that country's oil-rich Niger Delta may have targeted the crew. However, no militant group immediately claimed responsibility for the assault.

BP deep-cleaning Gulf beaches amid new worries

ORANGE BEACH, Ala. (AP) -- What's typically a beautiful, quiet stretch of beach in the fall now resembles a construction site. Bulldozers and yellow dump trucks shake the ground; a giant sifting machine spits clean sand out one end, tar balls out another.With its Macondo well dead and few visitors on the coast during the offseason, BP has launched its biggest push yet to deep-clean the tourist beaches that were coated with crude during the worst of the Gulf oil spill. Machines are digging down into the sand to remove buried tar mats left from the Deepwater Horizon disaster.

Pittsburgh council bans natural gas drilling

PHILADELPHIA (Reuters) – The Pittsburgh City Council voted unanimously on Tuesday to ban natural gas drilling in the city amid concern about threats to water quality.By a vote of 9-0, the council adopted an ordinance that would prevent any energy company from drilling a gas well within city limits.

Some Exceptions to the Rule, but Pipelines Are Safer

UNDERGROUND oil and gas pipelines are an often-forgotten part of the nation’s energy infrastructure — until problems occur. This year has seen a spate of attention-getting accidents. In San Bruno, Calif., a gas pipeline exploded in a residential area in September, killing eight people. In Texas, two gas pipeline accidents within a day of each other in June killed three people. In Michigan, an oil pipeline ruptured this summer, spilling hundreds of thousands of gallons of oil into a river.Oil and gas industry experts say that despite these problems, pipelines keep getting safer as technology improves.

Experts: BP ignored warning signs on doomed well

WASHINGTON – BP and its contractors missed and ignored warning signs prior to the massive oil well blowout in the Gulf of Mexico, showing an "insufficient consideration of risk" and raising questions about the know-how of key personnel, a group of technical experts concluded.In a 28-page report released late Tuesday, an independent panel convened by the National Academy of Engineering said the companies failed to learn from "near misses" and neither BP, its contractors nor federal regulators caught or corrected flawed decisions that contributed to the blowout.

Massachusetts Companies Get Lion's Share of Oil Spill Contracts

Massachusetts-based companies received twice as much money in federal contracts stemming from the BP Plc oil spill as the combined total of the five Gulf of Mexico states where the oil washed up, according to data compiled by Bloomberg Rankings.

Spill Commission Defends Its Top Lawyer

The panel named by President Obama to investigate the BP Deepwater Horizon blowout on Tuesday rejected a call by a consumer activist group for the resignation of its chief counsel, Fred H. Bartlit Jr. The group, Consumer Watchdog, said that the panel should dismiss Mr. Bartlit because his law firm, Bartlit Beck Herman Palenchar & Scott, once represented Halliburton, one of the companies involved in drilling the BP well.

China's Cnooc Group Plans to Expand Overseas Oil, Gas Exploration in 2011

China National Offshore Oil Corp., the nation’s largest offshore producer, plans to expand overseas oil and gas exploration next year, the company said in a statement on its website.

In the Heartland, Still Investing in Coal

ON the coasts, states are limiting carbon dioxide output, banning new coal-fired power plants and building wind turbines to fend off global warming. But here in the heartland, thousands of workers are building a $4 billion new coal plant with a 700-foot chimney, 70 feet higher than the Gateway Arch in St. Louis.

State projects will drive funding for high-speed rail

The Obama administration plans to reallocate money designated for high-speed rail if the states granted the funds reject them.

Diesel, Cleaner, Is Set to Make a Comeback

Tougher pollution-reduction requirements, advances in diesel engineering and heightened interest in overall fuel economy among American car buyers are helping to burnish the otherwise dirty, smelly and highly polluting reputation of diesel cars.

Ontario loses out to U.S. on Toyota electric RAV4

The new, electric version of the Toyota RAV4 will be put together in California, the auto maker is expected to announce Wednesday, dealing Ontario another setback in its attempt to grab a slice of the growing investment in electric vehicles.

Nissan Will Sell 500,000 Electric Cars a Year by 2013, Says Chief

On the eve of the market debut of the Nissan Leaf electric car, Carlos Ghosn, chief executive of the Renault-Nissan alliance, said the only constraint on sales for the next three years will be how many battery packs the factories could churn out.

China's Use of Biomass Fuel Makes It World's Biggest Energy User, IEA Says

China’s biomass use, which the government excludes from its consumption estimates, placed the country ahead of the U.S. as the world’s largest energy consumer in 2009, the International Energy Agency said.Inclusion of “traditional biomass use” in rural areas, such as the burning of grain stems or wood for cooking, increases China’s energy consumption by four to five percent, Nobuo Tanaka, executive director of the Paris-based adviser said at a press conference in Beijing today. Biomass is material made from organic matter.

Spain's Solar Power Sector Falls into the Abyss

Madrid, Spain – The Spanish government has launched a new regulatory framework that will result in subsidized tariffs for ground-mounted solar energy projects drop 45% this year, killing future investment in the trade, which industry leaders expect will be frozen in the next few years.

When the economy hit the skids in 2008, one of the casualties was the federal government’s main mechanism for subsidizing renewable energy, tax credits.So to tide the industry over the recession, Congress stipulated in the Recovery Act that for the next two years, it would give the help in the form of grants instead of tax credits.

The two years are about over but the economic woes are not, so the solar industry is asking for a two-year extension.

The Benefits of Solar With the Beauty of Trees

Now a San Francisco company, CleanPath Ventures, is promoting a solution to allow homeowners to keep their trees and go solar at the same time. CleanPath plans to expand its existing solar farm on the city’s outskirts and then sell “garden plots” to homeowners who would own the electricity generated by their patch of photovoltaic panels. Apartment dwellers and other residents whose homes are not suitable for rooftop solar arrays would also be able to own a piece of the power plant.

Concerns as Solar Installations Join a Desert Ecosystem

NIPTON, Calif. - ON the construction site of the $2 billion Ivanpah solar power plant here, burly laborers slowly walk around their trucks, dropping to their knees to peer underneath before turning the ignition. Hanging on each rearview mirror is a placard warning workers to “Look under your car for desert tortoise before you drive away!”Road graders and backhoes crawl along at 10 miles per hour, led by biologists wearing green hard hats who scan for tortoises in a landscape studded with creosote bushes. “Nobody is allowed on the site without a biologist to escort them,” said Mercy Vaughn, the lead biologist for BrightSource Energy, the Oakland, Calif., company that is building the 370-megawatt power plant, the first large-scale solar thermal project to break ground in the United States in two decades.

Nuclear fuel bank seen winning backing at U.N. body

(Reuters) - Member states of the U.N. nuclear watchdog are expected to approve next month a U.S.-backed fuel supply plan seen as a way to help prevent the spread of atom bombs, despite misgivings among some developing countries.Western diplomats said the stalled proposal to set up a $150 million nuclear fuel bank run by the International Atomic Energy Agency (IAEA), which countries could turn to if their regular supplies were cut, was still being discussed.

G.O.P. Gains on Capitol Hill May Not Advance Nuclear Power

THE outspoken supporters of nuclear power are mostly Republicans, and the Republicans are about to take control of the House of Representatives and gain six seats in the Senate. Is this good news for nuclear power?Maybe. But the outlook for a new wave of reactors is still mixed at best.

EARLIER this month, Global X Funds of New York announced plans for two exchange-traded funds — one for gold stocks, the other, uranium. Initially, Bruno del Ama, its chief executive, figured he knew which would capture the market’s attention. After all, gold prices have surged in recent months.As it transpired, he guessed wrong. Global X’s Uranium E.T.F. — with holdings in companies like the Cameco Corporation, Paladin Energy and Uranium One — was a hit as soon as it went on sale Nov. 9, with early trading volume outpacing Global X’s gold E.T.F. by five to one. “I’m in shock, to be honest,” he said.

Solar Storm Risks Bring Disaster Plans

In a worst case, a major geomagnetic storm “could be perhaps the largest natural disaster this country could face,” said John G. Kappenman, a consultant to the power industry. It could cause regionwide or larger blackouts, potentially for months, and affect grids on other continents as well.

Supergrids, Caspian Gas Pipeline Listed as Energy Priorities for EU Bloc

The European Union outlined today its energy infrastructure priorities for the next two decades, paving the way for aid for supergrids to integrate renewable energy and routes to deliver natural gas from the Caspian Sea.

China Protests U.S. Green-Energy Probe

BEIJING—A Chinese trade organization Wednesday said a U.S. government investigation into subsidies China provides for its renewable energy companies was baseless and would hurt China-U.S. cooperation.

Jeff Rubin - G20: Look for even more friction in the future

The huge fiscal divisions that were already in evidence at the G20 summit in Toronto have morphed into even bigger and more rancorous divisions on exchange rates at the recent Seoul summit. With America at China’s throat about a record trade surplus and China at America’s throat over the Federal Reserve Board’s blatantly devaluationist policy of quantitative easing, little wonder nothing was accomplished.More importantly, it likely marks the end of the great China-U.S. economic accord which defined the apex of globalization. That once virtuous and self-reinforcing circle of trade and capital flows, whereby Chinese savings invested in the Treasuries market effectively funded U.S. consumer demand for Chinese exports, is clearly in both countries' gun sights these days.

Peak oil intrigue, at your bookstores now (Prelude)

The peak oil debate has spurred a tremendous amount of debate. Now it's spurred a book.

I was delighted recently to have a conversation with Maurice Poulin around the renovations he has undertaken in his family’s downtown building holdings. Poulin is a businessman — he’s not an environmentalist, he’s a pragmatist. While he concedes climate change and peak oil are happening, he does not believe we are in a crisis. But he does believe in reducing his long term risk. He has done that, and at the same time improved his bottom line, helped in mitigating greenhouse gas emissions and made life better for his tenants.

'Simplify' a call heeded by the Amish

I've been reading Richard Heinberg's book about peak oil. "The Party's Over: Oil, War and the Fate of Industrial Societies," helped me see that the Amish are definitely on to something. The peak oil thesis holds that because our civilization is rooted in finite energy sources, increasing competition for energy cannot help but trigger dangerous political and economic crises. The Amish can look at this and shrug while the rest of us must be deeply concerned.The logic of peak oil is compelling even if the date when that peak will be reached is a matter of dispute because both supply and demand considerations will affect the reality of peak oil. The International Energy Agency (IEA) predicts in its World Energy Outlook 2010 that oil demand will continue to grow until 2035 when it will reach about 99 million barrels per day.

Ag expo examines making green go

California agriculture is in serious trouble, while the state's population is ballooning, the head of a group that advocates sustainable agriculture told a conference in Seaside on Monday."How are you going to feed these people? We need to do something about this," said Dave Henson, founder of the Occidental Arts and Ecology Center in Sonoma County, during the Sustainable Ag Expo held at the Embassy Suites Hotel Monterey Bay.

All of us have a deep connection with our Earth

When looking at the challenges of peak oil and climate change it is important to consider a systems approach. A systems approach means that we look at all parts of the Earth, our society, our families and our lives as being interconnected and affecting one another.Systems thinking allows us to see that all our actions are connected and affect the whole.

EPA tells states to consider rising ocean acidity

(AP) -- States with coastal water that is becoming more acidic because of carbon dioxide should list them as impaired under the Clean Water Act, the U.S. Environmental Agency said.The federal agency's memo Monday to states recognizes carbon dioxide as not only an air pollutant but a water pollutant, and notes the serious impacts that ocean acidification can have on aquatic life.

Report: Warming threatens water supply

A new report concerning a warming climate's impact on Lake Tahoe comes with some worrying predictions, including that the Reno area could be cut off from its primary water supply for up to 20 years at a time.

Barclays, NRG Energy Reach First Cap-and-Trade Deal Under California Law

NRG Energy Inc., the largest U.S. independent power producer, and Barclays Plc have completed the first deal for carbon-dioxide permits under California’s planned cap-and-trade program for greenhouse gases.

India faces major climate changes

A report says global warming could make India two degrees Celsius warmer on average within 20 years, though some coastal regions could see much higher temperatures.Environment Minister Jairam Ramesh says the new report shows India is among the most vulnerable countries to climate change.

Bjorn Lomborg: Cost-effective ways to address climate change

There is no better example of how human ingenuity can literally keep our heads above water than the Netherlands. Although a fifth of their country lies below sea level - and fully half is less than three feet above it - the Dutch maintain an enormously productive economy and enjoy one of the world's highest standards of living. The secret is a centuries-old system of dikes, supplemented in recent decades by an elaborate network of floodgates and other barriers. All this adaptation is not only effective but also amazingly inexpensive. Keeping Holland protected from any future sea-level rises for the next century will cost only about one-tenth of 1 percent of the country's gross domestic product.

Biochar stoves could fight climate change

(CNN) -- Good news for everyone who loves a barbecue: soon you could be helping save the world as you flip your burgers.A new generation of small, barbecue-style stoves could soon be making it possible to sequester carbon while you cook -- with the added advantage of producing fertilizer for your garden in the process.

International investors issue global warming warning

A group of international investors responsible for more than $15 trillion in assets called Tuesday for the world's nations, particularly the United States, to move decisively to combat climate change or face economic disruptions worse than the global recession of the last two years.

Dire messages about global warming can backfire, new study shows

BERKELEY — Dire or emotionally charged warnings about the consequences of global warming can backfire if presented too negatively, making people less amenable to reducing their carbon footprint, according to new research from the University of California, Berkeley."Our study indicates that the potentially devastating consequences of global warming threaten people's fundamental tendency to see the world as safe, stable and fair. As a result, people may respond by discounting evidence for global warming," said Robb Willer, UC Berkeley social psychologist and coauthor of a study to be published in the January issue of the journal Psychological Science.

Colder Winters Possible Due to Climate Change: Study

BERLIN (Reuters) - Climate change could lead to colder winters in northern regions, according to a study by the Potsdam Institute for Climate Impact Research on Tuesday.Vladimir Petoukhov, lead author of the study, said a shrinking of sea ice in the eastern Arctic causes some regional warming of lower air levels and may lead to anomalies in atmospheric airstreams, triggering an overall cooling of the northern continents.

Our Warming World: Picking up the 'Glacial Pace'

The idea that the world's glaciers and ice caps move ever-so-slowly is so securely ingrained in our thinking that we have given it metaphorical status. To say that something moves at "a glacial pace" is a way of saying that it hardly moves at all.This is the way many people feel about our global climate as a whole -- something that is moving along at an almost imperceptible rate of change, possibly posing some nominal threat to somebody else in some distant future.

...For climate scientists, however, among people actually doing work in the field, a lot of the argument and the thinking about the pace of change is going in the opposite direction -- global climate is changing faster, bigger, and sooner rather than later.

"giant oil fields were discovered off the coasts of Brazil and Africa, and Canadian oil sands projects expanded so fast, they now provide North America with more oil than Saudi Arabia."

Wut? Tupi is online ? since when ? giant field off the coast of Africa ? I must have been sleeping , or not reading TOD properley

hang-on this is yesterdays news , and "Canadian oil sands provide North America with more oil than Saudi Arabia"

I guess Saudi Arabia really has dropped production lower than Canada then .............

Forbin,

Someone hand me some Kool-Aid......

Saudi export to the US has decreased a lot.

Worry Not, this all shall pass away... and sooner than anyone realizes.

Re: There Will Be Fuel: Energy, and Plenty of It, for Decades to Come

Yeah! The estimates for how much oil there is in the world continue to increase despite the fact that there is very little indication of flow rates and production actually increasing as well. 92.6 million barrels a day this year?! What exactly is included in those numbers?

Sure, Mr Colton, it's quite reassuring to hear that, “There’s enough oil to supply the world’s needs as far as anyone can see.” I have to say that it sure seems like a clear case of the willfully blind, leading the truly blind.

The New York Times' journalism continues its downward spiral with regards the quality of its articles. Another big '@#$%&*! FAIL'!

Damn right FM. The NY Times... 60 Minutes... all of the former "pillars" of investigative journalism are going (have gone) Goebbels on us.

"IHS CERA" is now the undisputed leader for the Ministry of Energy Disinformation now that the IEA is getting slightly more sober.

The NY Times... 60 Minutes... all of the former "pillars" of investigative journalism are going (have gone) Goebbels on us.

that may be the scariest yet true statement yet

TOD readers are so old-fashioned; they think you need to actually go out and drill for oil and find it before increasing reserves. But countries like Iran, Iraq, lots of other Middle Eastern countries and some elsewhere in the world have realized there is no need to be old fogeys like this.

heh - OPEC finds oil the same place the BLS finds jobs!

Has journalism failed? Are they bought and paid for? Or are they just being force fed pre-written scripts from oil insiders who want a certain message out there?

Very concerning trend.

I think the call that this one was simply the 'Equal and Opposite Reaction' to the EIA report makes sense to my ear..

I have the very slight inclination to believe that with the US elections behind us, and the recent upswing of PO news from the Bundeswehr and US Military, EIA, the $80's prices in the midst of continued lowish demand and so forth, that the idea of it might have grabbed a bit more territory now.

That article feels more desperate than usual to me.

Regardless, oil is being burned, and I hope you all are getting ready..

Forbin is referring to the link up top: There Will Be Fuel. I find the most interesting paragraph the next to the last one:

Demand peaked in 2007 and then declined, not because of increased efficiency of cars, but because of the worst recession since the Great Depression. And if it declines by 15 to 20 percent more it will be because the depression gets better. It takes a long time for increased efficiency to work its way into gasoline consumption.

The US population is increasing by almost 3 million per year. Increased efficiency would have to overcome that little fact first. Then there is the GDP growth rate... if we have any. That is if we ever come out of this recession as almost everyone predicts, then GDP will have to start to grow at about 3 percent per year or so. That means oil consumption would have to grow also. Not necessarily by the same amount GDP grows, but at least half that amount. There is just no way that we can have business as usual if demand declines by 15 to 20 percent.

Then there was his very last paragraph:

Hot Dog! We will be completely energy independent. Then we can tell OPEC to stick their oil where the sun don't shine... Well... I guess. :-)

Ron P.

I was posting about this the other day, and think I'll save this as a boilerplate response for the future: from 1978 to 1982 CAFE for passenger cars went from 18 to 24 MPG, and US gasoline demand dropped by 873 kb/d, only increasing slightly over the subsequent years. Whether the upcoming CAFE regs will have a commensurate effect on gasoline demand remains to be seen; as earlier gains are greater on a per number basis, moving from 23.1 to 35.5 MPG (cars + LDVs) won't save quite as much fuel; plus there are more registered drivers and a larger fleet, which is driving more per capita, IIRC. All of this will temper any savings in fuel.

Somewhat offsetting the greater fleet size is the fact that new vehicles contribute more to VMT. All of this amounts to a fairly complex system, which I wish someone with more chops would delve into. Staniford wrote some great pieces in the past for TOD about the US fleet and I wish he'd return to this topic, here or at his blog. I could cobble something together on it, given the time, but I'd really feel like I wasn't giving the topic its due - and it is a crucial one for determining how peak oil will play out, I believe.

Thanks, Ron, for saying what needed to be said.

-sTv

p.s. Wow! I read this whole thread plus the links, and I responded with not one (*&^%$ swear word...heh...oops...

Cleverly deceptive rhetoric. Total production versus imports from a source too far to account for much of a percentage of our imports. But the reader thinks, Wow SA is the worlds biggest producer! these guys are now ahead of them! This is how to lie while still being able to make a technical defense of your statement.

I believe that the four largest sources of imported oil into the US are Canada, Mexico, Venezuela and Saudi Arabia.

Venezuela's net exports started declining in 1998.

Mexico's net exports started declining in 2005.

Saudi Arabia's net exports started declining in 2006.

Only Canada has shown an increase, and their increase in net exports has not even been sufficient to offset the recent declines in any of the other three countries.

The four countries' combined net exports in 2005 were 14.1 mbpd, and in 2009 they were down to 11.0 mbpd--as Canadian net exports increased from 0.79 mbpd in 2005 to 1.02 mbpd in 2009 (BP). Granted, there was some level of voluntary reduction in production in Saudi Arabia in 2009, but I suspect that most of what they shut-in was what Matt Simmons characterized as "Oil stained brine," and the key point is that Saudi Arabia, Mexico and Venezuela are all showing multiyear net export declines, relative to recent peaks.

Note that the increase in US production (C+C+NGL) from 2005 to 2009 was about 0.3 mbpd (and of course 2005 was suppressed because of the hurricanes), and the increase in Canadian net oil exports from 2005 to 2009 was about 0.2 mbpd. So increased US production + increased Canadian net oil exports from 2005 to 2009 was a combined 0.5 mbpd. Over this same time frame, 2005 to 2009, combined net oil exports from Saudi Arabia, Mexico and Venezuela dropped by about 3.3 mbpd.

The good thing about this article in the NYTimes is that it provides the public with a version of the briefing notes that oil industry lobbyists provide to Congress and other government entities.

EIA released 28 October 2010

http://www.eia.doe.gov/pub/oil_gas/petroleum/data_publications/company_l...

Canadian production is highly predictable. Conventional production is declining and oil sands production is increasing. Fortunately, the rate of increase in oil sands production has exceed the decline in conventional production. However, the people who are counting on a huge increase in Canadian production are fooling themselves - oil sands is not at all like conventional oil. You can't just drill a bunch of wells and get a sudden increase in production.

eyeballing the eia data and disregarding the noise: "8 million bpd" gives a general description of saudi's exports since 1991. meanwhile, saudi arabia's gas production has been steadily increasing since 1981.

similarly, eyeballing wti price and disregarding the noise: "$75/barrel" gives a general description of wti since 2006.

Saudi Arabia's net exports started declining in 2006.

That's the disconcerting part of the oil price spike in 2008. SA has a target price range for oil, and adjusts its production to keep world prices in that range. It does so to keep oil prices below the range which would cut demand too much, and also to keep non-conventional oil projects uneconomic. It is all about having a monopoly and trying to maintain that monopoly by keeping consumers hooked on oil while driving competitors out of the market.

It was very much contrary to SAs objectives to cut production when prices were rising. The fact that production fell when they wanted it to rise suggests that they could no longer maintain production levels despite their best efforts. Their biggest oil field is probably going south as the financial analysts say, or watering out as the geologists say. They will deny it to their last breath because if investors could put a finish date on SA oil production, they would have hundreds of billions of dollars worth of oil sands and oil shale projects built and ready to start producing oil the day after that.

This game of monopoly that SA is playing is getting harder and harder for them to play. Ultimately they will lose because they don't have the reserves to keep playing forever, but unfortunately the people who expect to have an endless supply of oil will also be big losers in the game.

paraphrasing what al-husseini has said: "look outside saudi arabia for declining production capacity".

Too bad the cost of Canadian oil sand oil is not the same as Saudi oil....

And oh by the way, Canada cannot deliver 10 million barrels per day!

And Canada has to import oil for its own use (on its East Coast), if it is to export to us (from the West part of Canada). I expect at least some of those imports come from Saudi Arabia.

It won't be nice if the Canadians can't get oil imports and are still expecting to export oil to Canada.

Is this a political thing that the US imports from Canada and Canada then imports from SA or is there a fundamental economic explanation for this seemingly futile circle.

Actually, the Canadian Atlantic coast refineries specialize in importing oil from countries that the US is not particularly friendly with, and then exporting most of the refined products to the US.

An example is the Irving Oil refinery in New Brunswick. It is the largest oil refinery in Canada, and New Brunswick has only 730,000 people, so obviously it is not focussed on the local market. From Irving Oil's web site :

And what have they got going for them that an oil refinery in a small Canadian province is exporting large amounts of ultra-low sulphur fuels to California?

The US hasn't built a new oil refinery in 30 years, and California, although it has very strict air quality standards, is a particularly hard place to build refineries. So it imports its fuel from New Brunswick, which refines it from Arab oil.

Doesnt the Northern california chevron refinery specialize in California-grade (low sulfur) product? i know a petroleum refining engineer (now retired). he said they were pretty advanced.

I guess it is always a matter of volumes and California is using more than it can produce.

Chevron has suspended upgrades to its Richmond California refinery because of environmental lawsuits and has talked about closing it. It's become impossible to build a new oil refinery in the US, and in California it's become almost impossible to upgrade one.

So, people build refineries in other countries and export the products to the US.

Less oil > Fewer refineries needed.

The more refineries that are closed in New Jersey and California, the fewer in Louisiana.

Alan

Is the market price determined by some kind of average or is it, as I often hear, based on the price of the marginal barrel? If the latter than the prices we see should be determined by expensive oil such as the Canadian tar sands and have no relationship to the production costs of Saudi oil.

The difference between those two should primarily affect the number of Porsches bought by Saudi princes.

edit: grammar (I hate other people's rotten spelling and grammar. Its worse when I do it!)

jj - The price any particular bbl of oil sells for (excluding those with long term contracts) isn't based upon anything. It's a negotiated price between buyer and seller. Your basic supply and demand. When oil dropped from $148 back down to around $50/bbl nothing changed with respect to marginal bbls or any price averaging. The buyers cut back their purchases so the sellers had to compete against each other on a price basis. Same dynamics brought oil prices back up into the $80's. When I sell oil in Texas on a monthly basis the crude buyers post what they'll pay and I decide to sell it at that price or keep it in my tanks for another month. Obviously when the Saudi's sell oil it's a more convoluted process but still hinges on supply/demand dynamics.

There have been times when some operators sold their oil for a good bit less than it costs them to find it. And sometimes sold it for much more than they had ever planned.

Is it worthwhile to point back to this "crazy" economist's view back in 2001: ??

link to source is here

The price of oil may be be quoted in dollars per barrel in the US, but that is not universally true.

In Canada, the producers' costs are in Canadian dollars and their volumes are in cubic metres. However, when it hits the border, there are custody transfer meters that automatically convert it to barrels, and accountants that covert the bills to US dollars.

When a refinery buyer in Chicago calls up a seller in Edmonton and asks for a price of a barrel of crude delivered in Chicago, the seller looks at the current price in Canadian dollars for a cubic metre of equivalent quality oil delivered to Edmonton, hits a button on his computer, and gets a price in US dollars for a US barrel of the same oil delivered to Chicago. And that's what he tells the buyer.

Similarly the traders in Europe will have their prices in pounds or euros or rubles, and quantities in tonnes or cubic metres, but if a buyer in Chicago calls up and wants a price f.o.b. Chicago in dollars and barrels, that's what they'll give him.

Ultimately, prices in the US are based on the price in US dollars of a barrel of West Texas Intermediate delivered to Cushing, Oklahoma, but that's just a benchmark for figuring out the conversions.

In reality, there are far more cubic metres of oil-sands oil produced in Canadian dollars and delivered to Edmonton than there are barrels of West Texas Intermediate produced in US dollars and delivered to Cushing, but that's irrelevant to the process. All the traders know what the conversion factors are.

Canadian oil sands provide North America with more oil than Saudi Arabia

More accurately, imports of Canadian crude oil have been showing a slow but steady rise over the last 30 years:

Whereas imports from Saudia Arabia have been jumping all over the place:

I think the key issue is that Canada cannot increase its production on the spur of the moment (it takes a long, long time to build a 100,000 bpd oil sands plant), and based on their exports through the 2000s, neither can Saudi Arabia any more. Despite George W's pleas, SA could not send enough extra oil to the US to make the crisis go away.

Indeed, damn the mainstream intelligentsia and their Orwellian language!

Clifford Krauss, the author of the NYT article ("There will be fuel") is actually a pretty sharp reporter, and I had a couple of long conversations with him a few years ago, and he is certainly aware of the Peak Oil/Peak Exports argument. You would think that he could have at least noted that global crude oil production has so far not exceeded the 2005 annual rate. Maybe the pressures that reporters are under makes it very difficult to do anything but report some version of the CERA outlook.

In any case, following is my email to him (I also referenced the CERA Koolaid):

What bothers me most about this reporter is his omission of discussion of the fuel's price. When he mentioned the Bakken formation in ND and MT growing from 100K barrels per day to 300K in ten years he did not mention the oil price going up 300% over that time. If oil and gas will continue to flow the price will remain high, while a majority of the US citizens see income stagnate or decline.

Sure, the world has a lot of oil and gas, but at a price that the US economy can afford? If oil in the arctic costs $150/bbl to produce can the US consumer afford $5 gasoline?

And another thing, how many of those oil producing countries are eliminating their subsidies for liquid fuels? Not one mentioned in this article. So people in most OPEC countries will continue to buy very cheap gas and diesel while ELM is still in full force.

There are two prices that are increasing with the development of "unconventional" oil reserves. There's the market price and the environmental price. Both have shown increases in recent years.

Folks have been able to ignore the environment price for a long time since that was usually hidden from view. Now days, that environmental price is starting to wash up on the doorsteps of the consumers. I believe this will also start playing a much more major role in acceptance of "how far will we go" to keep our addiction fed.

I have not turned into a cornucopian, but I find myself increasingly unsure about most things these days.

After all...nobody really knows how much energy is needed to maintain our present industrial civilization without growth; it could be very little. We won't be building many new things, but we won't starve either.

And the relationship between prosperity and energy is a tenuous one, at best. Consider the Soviet Union which was an energy superpower, but they collapsed nonetheless. And present day Russia suffers from terrible levels of corruption.

So to me the main questions still remain firmly grounded in the anthropological sphere. The question is what kind of society do we want to be. And judging by the theatre that is American life, we are going nowhere fast.

This NYT reporter isn't asking the right questions, but then again few people are. The right question would be this: if Alberta has such a large oil resource, and if we have oil shale, and if we can be more efficient, why are we pissing away so much money in Iraq/Afghanistan? Another question to ask would be this: why do we allow the Federal Reserve to create money and then hand it over to big banks so they can paper over their fraud and continue rewarding themselves with bonuses? Or how about this: why, when we have 300 million people and close to 20% real unemployment, do we continue to allow so many more additional people to enter into the country? Why do we even allow illegal immigration in the first place?

When you start to ask these questions, you increasingly see that they are only peripherally related to energy. The truth is that America is now a hopelessly corrupt, bankrupt, declining Empire. This would be true even if we had all the oil in the world.

So what drives my pessimism is not solely energy, though that's a part of it. It's our dysfunctional political and financial situation.

And there are very few mainstream people who are accurately reporting on these things. It's mostly confined to the blogosphere. The tide is swelling, but it's happening slowly.

Actually there are people who have quantified such things already. Watch this video: Peter Victor - Managing without Growth

http://vimeo.com/16906655

I suspect that it will take a surprisingly large amount of energy -- certainly more per-capita than I would classify as "very little". To start with, the capital base -- fixed assets and infrastructure -- has to be maintained. If you're going to have integrated circuits with >10M transistors -- and a surprising range of today's level of tech depends on such chips -- then you have to build a new fab from time to time, and you have to maintain the entire pyramid of technology and equipment that allows you to build a fab. Lots of stuff that gets consumed in a relatively short time has to be replaced -- the food, fabric, clothes, paper, containers, and so on.

A related (I think) question I've been wrestling with is how large a population does it take to sustain today's tech. My current guess is that the minimum is in the range of 30-50 million people. That's based on the number that I think it takes to dedicate enough of total production to maintaining the capital base and to maintain enough highly-skilled specialists to keep things running. 100 engineers or doctors don't exist by themselves; they sit at the top of a pyramid of workers that produce a large enough surplus of all the other things the specialists need so that they can spend their time being IC designers or brain surgeons.

Productivity, which has a large energy component, counts also. In the 20th century, moving from 50% of the workforce in agriculture to 2% freed up people to do manufacturing; automation freed up more people to build infrastructure, or become doctors and engineers. If the trend were reversed, if it took 25% of the workforce to produce the food, that whole process gets reversed and you likely fall below the critical mass of doctors and engineers needed to maintain today's level of technology.

It's moderately interesting to note that every science fiction author who writes a story about humans colonizing a new planet deals with this question in some fashion (whether they realize it or not). Some assume magic technology, a la Star Trek's replicators (which can presumably replicate themselves). Some assume automation of everything below a certain level -- robots grow the crops and make the clothes. Some assume a benevolent home planet that keeps shipping tech in until the colony is large enough to sustain its own tech. And some have their colony slowly (or quickly in some cases) revert to much lower levels of tech.

Worldwide? Never-ever! Our actual technological level needs at least 1 billion with an avarage IQ of ~95-100 to sustain our technological level. With a median IQ of 110 (Ashkenazi Jews outside Israel) you may be able to go to 300 - 500 million. With a median IQ below 90 even 10 billion are not enough, because you lack the highly skilled ( IQ> 125) in the upper asymmtote of the Gaussian ditribution...

Think of it:

- China makes (actually) most low till middle class consumer goods (toys...)

- Japan/ Korea (South) / Rep. China makes most higer electric harware

- Germany / Japan / Korea (South) / US of A / Italy / France makes cars

- Vietnam / Bangladesh / China / India makes clothes

- Germany / Japan make most (higher level) machinery

- US of A / India makes most software

- US of A / EU / Brasil / Canada makes planes

- ...

Combined we are allready talking about > 3 billion in the actual Global supply chain. Of course you may reduce this to some degree because not all people are inclusive the chain (my guess: 1 billion), but never to 30 - 50 million.

By the way - what is the UK producing? Fish and Chips :-)

I think that Scandinavia could maintain the current level of technology and advance it slowly.

Offshore clothing manufacture (perhaps to the Baltic states, Poland, etc.)

They can build planes (Saab), write software, build nuclear reactors (old ASEA), build cars and machine tools, genetic research, wind turbines, etc.

Colonies elsewhere to supply mines, extra food, etc. but the technological island could self generate the required technology. Implied is a massive die-off in most of the world with chaos/local warlords in control.

Embargoing technology transfers (like the Chinese did for silk for centuries) to the chaos areas would give the technology island(s) a very large technology advantage that would increase over time. Good for trade, colonization for resources and for military supremacy. Two dozen Swedes with a hundred local recruits with modern weapons could defeat thousands of war lord troops (who would be down to handfuls of ammo after a few decades of chaos, so mainly archery & spears).

Significant economies of scale would be lost, which would likely require longer work hours to compensate. But Sweden, Denmark, Norway, Finland and Iceland could continue as a technology island if the rest of the world collapsed. <25 million people.

A separate/conjoined island core of Germany, France and Switzerland, (plus neighboring nations or parts of nations added as needed) could also exist as an isolated technology island.

One could see a half dozen such technology islands surviving a world collapse, and extracting food & raw materials from the chaos of the rest. My guesses would be Scandinavia, the old EU + Switzerland, Japan, parts of China, Brazil (not 100% self sufficient for tech but can trade food for balance), parts of the USA/Canada (perhaps SF Bay north to Vancouver).

Some competition between said islands, but not much, over extraction of resources from "the chaos areas". Perhaps joint operation and protection of Suez and Panama Canals, joint anti-piracy efforts, etc.

So I think 25 million people could do the trick.

Alan

Alan,

Don't forget that Sweden has colonized Minnesota. We have lots of timber, taconite, turkeys, corn, sugar beets, and other resources--the most important of which is more than two million people of Scandanavian ancestry. We still have towns where either Danish or Norweigian is the main language. The Swedes assimiliated better, and now are mostly in the Minneapolis suburbs. There are also lots of Finns on the Iron range, and I think I can find you a bar where the main language is Finnish. Alas, the average age of the customers is in the eighties or even low nineties. The young people (with a few exceptions) are no longer fluent in the mother tongue. My mother was raised in a Danish speaking household, and she taught me some Danish. It is an easy language, especially if you already know German.

And the unemployment rate will rise... continuously. You just don't understand Oilman. Our current economy requires growth else it collapses. There is no middle ground, not for more than a few years anyway.

Also another thing all you "no growth" advocates fail to understand is there will be no static state of fossil fuel production. When the supply of oil starts to drop, then coal and natural gas, is that it will drop forever... or until it becomes uneconomical to extract it. Therefore the unemployment rate will rise... and rise... and rise... forever. Or until the population stabilizes at somewhere around half a billion people for the world.

Ron P.

There will never be a good answer for this. It is some unknown combination of paranoia, daddy issues, bad intelligence, support for Israel, oil, delusions of 'spreading democracy', revenge, intentionally biased intelligence, etc.

In many cases like this it is not the reporter but the editor who forces the decpetive writing. The editor has probably been instructed, "My god, we are trying to sell full page adds for SUVs, don't rock the boat!"

Westexas,

Where can I find a graph showing production back to 2005 that includes 2010?

This is a graph of world oil (crude and condensate) production through August, from EIA data.

Recognise that 'reporter' are storytellers; first and foremost. Their own mythology says they 'find and illuminate truth' - but the reality is they tell stories for cash; like a wandering minstrel of old. Reality and facts are malleable to that end.

As a storyteller you adapt and fashion the story to meet the desires of the audience. Things in the big wide world are bad, and people don't want to hear it will get worse. They want to hear that the worst is over, that the sun is coming up.

You can't be surprised that these storytellers will craft fantasies from positive viewpoints - they want and need the money.

Yeah, this is very true. You can see from the get-go that he had a thesis of "Energy is abundant! Woo-hoo!" Then it was just a matter of listing the facts that support the narrative and ignoring the ones that don't.

couldn't help myself....

"For those of you outside of the industry or issue, Jeffrey Brown is one of the better known, if not the best known, Geologist in the world."

levity aside....what is wrong with all these people with access to so much information? The only bright spot of the last few conversations I've had on this topic is that my conspiracy theory friends are starting to suspect that the Guv and MSM might not be telling the whole story on PO. Doesn't matter what the production numbers and prices are...what matters is that certain people are saying "no problem", therefore there IS a problem. But hey, I'll take allies anywhere I can.

-dr

Holey smokes! This article is a goldmine....for anyone preparing a dissertation on the impact of denial on proper reporting practices.

The "100 years of NG left" is just one of many warning signs that this article is not on the up and up. Anytime someone leaves off the context "at current rates of consumption" it shows they either are being deceptive or naive. Either way, not the person you want to be accepting critical insights from.

But I truly enjoyed this article for its purity; no counterarguments at all were presented. Way to go NYT! Glad to see you keeping the Judith Miller flame burning bright. How's the whole profitability thing working out? Not that hopelessly slanted reporting and falling profits have anything to do with each other...

:)

Yep. Every parapragh was disingenuous. As I read it, my first thoughts were that the NY Times wanted to publish a 'balance article' to the "Is Peak Oil Behind Us" article from the 14th.

http://green.blogs.nytimes.com/2010/11/14/is-peak-oil-behind-us/

Exactly! That was my initial thought as well.

""at current rates of consumption""

That is the my pet peeve too. These people are too intelligent for this kind of childish assumption. This is deliberate propaganda.

"At current rates of consumption" I have plenty to eat well into the next century!

Yes. Tupi is online. Production started on April 25th:

http://www.bwoffshore.com/News1/News/FPSO-BW-Cidade-de-Sao-Vicente-has-a...

OK. Now you will tell me its not a high rate of production. But that's changing your argument when you realise you are wrong. Tupi production will gradually be ramped up over the coming years.

North Sea oil fields whose first full year of production was in 1999 or later showed a combined production peak of about one mbpd in 2005, versus a total North Sea production rate of about 6 mbpd in 1999 (C+C). Tell me, how did the increasing production from these new (1999 and later) oil fields affect total North Sea crude production?

I was simply commenting that production from the Tupi field has started. Nothing more nothing less. As expected however, somebody asked some other question as an answer to my answer.

I think the answer, Nordic, is that TUPI was mentioned amid a collection of these wonderful new discoveries in order to say 'Are these fields, together, really able to step up and pull this off? Stem the decline that is otherwise gaining steam..'

.. So yes, you did answer a piece about 'One Tree' that he mentioned, but his comment was really about the forest.

Weather isn't Climate, after all.

This is a good point. I think production proper started relatively recently though, late Oct 2010:

http://www.telegraph.co.uk/finance/newsbysector/energy/oilandgas/8094279...

I'm very much pro-peak oil but we should be checking our facts before making flippant remarks - it does a disservice to our stance.

The only "fact" is the price at the filling station this morning was $2.99.9 for regular. I'm kind of a here and now guy and all the rest is someone else's SWAG. I expect that price to go down a little in the next week or two because crude is down to $81 or so from $88.

The fellows at coffee who drive diesel pickups were bitching a little because the refinery split put the price up 25 cents in the last few weeks. Fuel oil without road tax was $3.49 last week. YMMV

More random data points:

I filled my heating oil tank a couple of weeks ago for $2.79/gallon (#2 heating oil). Gasoline at the nearest "crossroads store" (we're in the country) is now $2.88. This is in rural NH.

There's a bit of a price war going on which has depressed fuel oil prices locally -- our average cost is currently in the range of 87.8-cents a litre or $3.32 a gallon. In other parts of Atlantic Canada, it's running closer to 97.1-cents or $3.68 a gallon.

Our last fill was August 24th, 2009, some 450 days ago. The gauge is between the 3/4rd and 7/8th mark, so we've used perhaps 150-litres/40-gallons during this time, and if all goes well, our next fill won't occur before 2016.

Cheers,

Paul

Using the data I found on the largest oil fields in the world and their output, I estimate that the Tupi field MIGHT produce around 0.5 mbpd if it gets going strong. Not much more than a drop in the bucket. Anyone want to bet whether Brazil ever becomes a net exporter of oil?

BP and the EIA are in conflict regarding Brazil. BP shows them as still being a net importer in 2009, while the EIA shows that they were a small net exporter in 2009.

I wonder if they treat biofuels differently.

The difference within the "All liquids" category is really just within the margin of error. Both the EIA and the IEA show that Brazil's total production of "Liquids" and total consumption to be about equal in 2009 with the EIA showing a small surplus and the IEA a small deficit. Both project that in 2010 Brazil is a net exporter.

If you ignore biofuels then Brazil is still a clear net importer.

Here''s the EIA total liquids figure for 2009 (mb/day)

And IEA

In 2009 Biofuel production accounted for just under 0.5 mb/day of the above production figure.

The BP "Production" numbers do not include biofuels. Here's BP's definition of what it included in their total for Brazil.

However when it comes to "Consumption" the BP figures do include biofuels

Brazil are a net exporter now and will be a large exporter in the future. Don't understand what you are trying to say?

He is trying to say that Tupi will not be a game changer. There is a conflict as to whether Brazil was a net exporter in 2009 or not. BP said they were not, the EIA says they were. At any rate their net exports in the next few years will not amount to a hill of beans when compared to total world exports, and what the world demands to keep business as usual chugging along.

Ron P.

Actually that may be correct, I don't have a link handy but I believe that in 2009 Brazil was a net exporter of crude while at the same time they were a net importer of refined petroleum products. While Brazil has refineries it appears that they are not set up to refine all the crude they produce. I looked at some trade balance figures which seem to back this up. To be clear I don't have a high confidence in either BPs or EIA numbers.

Fred, this was my mistake. I thought Nordic was responding to WT and framed my response accordingly. But then I realized he was not responding to WT but to Kram’s post. So I quickly deleted my post and changed my response entirely. But unfortunately you copied part of my post and framed your response around it before I could make the change.

At any rate your response is appreciated, and I agree completely with your conclusions.

Ron P.

The net export metric is domestic production of total petroleum less domestic consumption of total petroleum.

Here is what BP shows for Brazil for 2009:

Production: 2.0 mbpd

Consumption: 2.4

Net Imports: -0.4

Here is what the EIA shows for 2009:

Production: 2.6 mbpd

Consumption: 2.5

Net Exports: 0.1

The real difference is production, and I suspect that the EIA must be incorporating some ethanol volumes into the total petroleum number.

Note that the BP and EIA numbers are quite close for Saudi Arabia, 9.71 mpbd and 9.76 mbpd respectively (2009 total petroleum).

Tupi Schmupi. I've posted it before and I'll post it again: There is a helluva lot more oil off the coast of Brazil than just Tupi. Multi-billion barrel oilfields don't exist in isolation: If you've found one, there are almost certainly others, and maybe many others. Tupi itself may turn out to be just a "drop in the bucket" of Brazilian oil, at the rate they've been discovering things since I started following it in late 2005. Here is my list to date:

Brazil Oil Discoveries: Name - Size - Month/Year

Papa-Terra - 700 million - 1 billion barrels - 12/05 (LINK)

Xerelete - 1.4 billion barrels - 7/07 (LINK)

Tupi - 5-8 billion barrels - 11/07 (LINK)

Golfinho - 150 million barrels - 7/08 (LINK)

Iara - 3-4 billion barrels - 10/08 (LINK)

Additions to Jubarte - 1.9 billion barrels - 10/08 (LINK, LINK)

Tiro - 150 million barrels - 10/08 (LINK)

Sub-salt layers of Baleia Franca, Baleia Azul, and Jubarte - 1.5-2 billion barrels - 11/08 (LINK)

Aruana - 280 million barrels - 8/09 (LINK)

Guara - 1.1-2 billion barrels - 09/09 (LINK)

Vesuvio - 500 million - 1.5 billion barrels - 10/09 (LINK)

Caricoa - 681 million barrels - 11/09 (LINK)

Well OGX-2A - 400-500 million barrels - 11/09 (LINK)

Addition to Marimba - 25 million barrels - 11/09 (LINK)

Addition to Well OGX-2A - 600 million-1.5 billion barrels - 12/09 (LINK)

Well OGX-4-RUS - 100-200 million barrels - 02/10 (LINK)

Well 1-OGX-3-RJS - 500-900 million barrels - 02/10 (LINK)

Well 4-PM-53 - 25 million barrels - 02/10 (LINK)

Additions to Barracuda - 65 million barrels - 2/10 (LINK)

Maastrichtian section of Well OGX-5 - 30-90 million barrels - 2/10 (LINK)

Piranema - 15 million barrels - 3/10 (LINK)

Wahoo - 300 million barrels - 4/10 (LINK)

Franco - 4.5 billion barrels - 5/10 (LINK)

Pipeline and Etna (well OGX-6) - 1.4-2.6 billion barrels - 5/10 (LINK)

Waimea and Fuji (wells OGX-2 and OGX-8) - 600 million-1.1 billion barrels - 5/10 (LINK)

Carimbe - 105 million barrels - 5/10 (LINK)

Brava - 380 million barrels - 6/10 (LINK)

Libra - 3.7-15 billion barrels - 10/10 (LINK)

-------------------------------------------

Running total: 28.506 billion - 48.866 billion barrels

Mr.Abundance:

It is so much fun to counter these arguments. Let me quote Darwin first:

Darwin understood abstract thinking and the fact that you needn't count beans to reason about the world around us.

We have fundamental probability arguments that can answer these kinds of questions of potential oil finds based on the rate at which we have discovered fields in the past. The approach effectively analyzes the dispersed swept volume of the earth and can tell us exactly where we are riding on the declining tail.

You can look this up by doing a Google search on "dispersive discovery". Yet I do want to thank you for providing more data to verify this model. You see you are not wasting your time because any data is good data. Unfortunately based on your attitude, you may not be able to see the forest for the beans.

I realize your obsession with models WHT, but I was simply responding to a particular comment about a particular oil field in a particular nation. That is all.

I don't think it is an obsession with models so much as an obsession with the truth. There are only two approaches to look at data, a model-based approach and a heuristic-based approach. Only the first is scientific, and only science will get at the truth.

1. All models are wrong

2. Some models are useful

Models are a valuable tool that can be used by scientists or others to perform analysis. But they are not, of themselves, science or analysis.

Name one aspect of science that doesn't apply a model. You can't.

A scientific theory is a model of reality.

A controlled scientific experiment is a replicated model of reality.

You have experiment and theory, there is nothing else to science. Scientists are either experimentalists or theorists. Therefore they deal with models all the time. Any "scientist" that doesn't fit into one of these categories is a wannabee.

A heuristic is a model where the person essentially punted or created a placeholder for his lack of understanding.

That saying by George Box just grates.

He might as well have said:

1. Life will eventually end.

2. Live life.

Again name one aspect of science that doesn't use a model.

abundance.concept and Jack, idiots. Isn't it obvious that the most (super)giants with easy to produce oil will be discovered first ? That was many decades ago. What complicated models are necessary for common sense ?

Even ten 40 Gb regions with deep offshore oil (recently and in the future discovered)doesn't change much the timing of PO. Read also ROCKMAN's comment on this Drumbeat on costs, infrastructure, manpower and time needed to start up production from those fields. Among other things to connect the dots not to forget the increasing oil consumption from oil-exporting countries.

Without models, you have no science.

Would you like me to state the scientific method:

1. observe and determine a question

2. state a hypothesis

3. test hypothesis and collect data

4. analyze your data

5. interpret the data and state conclusions

6. publish to have others retest your findings

Thus you have two options. Refute the peak oil hypothesis with data or abandon your hypothesis for lack of reasonable support for the abundance hypothesis.

Without science and models what then will you do -- simply rail against models -- sounds like a climate science denier tactic (probably there is a relationship between the two camps).

Good luck.

Oct,

With due respect, your model of the scientific method is not in accordance with what really happens.

This is what happens:

1. Person who claims to be a "scientist" has a given "model" in his/her head of how the Universe works.

[ i.mage.+]

2. Person who claims to be a scientist proposes a new hypothesis to add to the model, which hypothesis must include the notion that it is "universally applicable" and thus it is falsifiable with one example that eviscerates its "universal applicability".

[ i.mage.+]

3. Usually, the proposed hypothesis is in accordance with the pre-existing model and seeks to merely tweak the model slightly so as to improve the accuracy of the model.

4. The same person who claims to be a scientist (and fellow self-proclaimed scientists) use the models they currently have in their heads to devise "experiments" (e.g. Large Hadron Collider) which they believe will push the new hypothesis to its limits and thus break it if indeed it is breakable.

5. They carry out their experiments.

6. They use their pre-existing models to observe and interpret what they observe.

7. They use their pre-existing models to determine if the hypothesis has been falsified.

8. They keep trying to falsify the hypothesis, but only with aid of the pre-existing model of the Universe that they already have in their heads.

That sir, is a false choice menu.

Peak Oil is based on the following, currently accepted models of our Universe:

1. Conservation of Mass

2. Conservation of Energy

3. Lack of a Creamy Nogut center at the core of our Planet

4. Mathematical definition of the area under a rate curve (URR= area under the completed resource production curve)

If you succeed in busting one of the above, you may have succeeded in busting the Peak Oil "theory" and perhaps winning a Nobel Prize.

Good luck.

Models are a mix of hypotheses and theories.

Plenty of elementary behaviors that still require explanations and therefore good models.

WHT:

There is no such thing as "truth".

There is only the projections of the external Universe which cast as shadows on the back wall of each of our individual minds (ala Plato's Theory of the Cave) and the "models" that we individually use to interpret those silhouettes.

[ i.mage.+]

____________________

Venn the truth turns out to be lies,

And all hope within dies,

Den Yat?

WHT: No doubt you remember my obsession with the movie: A Serious Man

But perhaps you don't appreciate why.

In the first couple of minutes of the movie there is this old-country dark shadows sequence where an old man enters from the cold into a woman's house.

--She serves him a bowl of hot soup.

He declines to eat it.

--She pulls out some hairs from his beard

and studies them.

--She sticks an ice pick into his chest.

He says he doesn't feel too good anymore and leaves

____________________

After the movie is over, a number of us gather outside the theater and someone finally breaks the ice and asks: But about that first sequence with the ice pick into the heart, what did it mean, what did it mean?

At the time, I could not say why it was so disturbing to all of us (Oy vey).

But now I can.

You see, the old lady was performing "scientific experiments".

From her point of perception, it was all very legitimate.

And it proved to her beyond a "shadow" of her doubts that the old man who came in from the cold was a Dybbuk (a Jewish demon who took possession of a dead Rabbi's body).

And who are we to say otherwise?

She had her internalized models of how the Universe operates.

She performed a set of experiments all in accord with her models.

She drew logical conclusions based on her observations and based on her models.

That is why the whole thing was so disturbing. Because even in this modern day and age we do the same thing. But at the time of viewing the movie we couldn't say why it was so disturbing.

_________________________

And by the way, I wasn't crazy. Somebody else posted the same thing. I saw what I saw. In the movie, Professor Gopnick does scribble p^2 minus p^2 on the blackboard. That version doesn't show up on the screenshot. But it does happen in the movie. I had a chance to see the movie again and the p^2 minus p^2 appears on the blackboard again when Gopnick is scribbling fast. The inner physics student within me couldn't resist but to scream silently, "Wait a minute "teech" that equals zero!" Of course the students in his course are all asleep --except for Sy Abelman.

And a second later he corrects it. I remember plenty of professors who would write out complete sentences without crossing t's and dotting i's. Then they go back and cross the t's and dot the i's. I think it is a matter of them wanting to get their ideas out before they evaporate. Working out a solution is a sequence of epiphanies.