World Oil Production - Looking for Clues as to What may be Ahead

Posted by Gail the Actuary on December 20, 2010 - 10:56pm

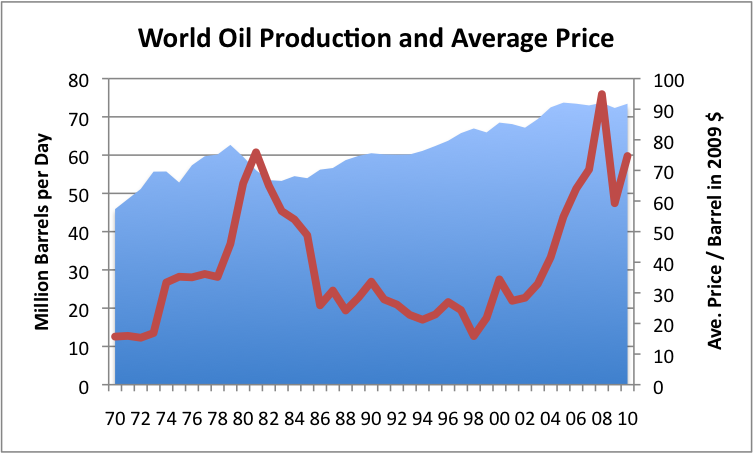

If we look at a graph of historical world oil production, we see a somewhat bumpy production pattern with two major price spikes (in 2009 $)–one peaking in 1981 and one peaking in 2008.

The first spike in prices occurred when Persian Gulf production dropped starting in 1980, so seems to be oil supply related. The second spike occurred when world oil production would not rise above a bumpy plateau, despite rising demand, in the 2005 to 2008 period.

In this post, I will show some breakdowns that I think give a little insight into our current situation.

All of the graphs that I have made are from EIA’s International Petroleum Monthly. The data I am showing oil production is “crude and condensate”. For price, I show US refiners average acquisition cost, since this is a data series that goes back to 1968. I have adjusted prices to 2009 levels using the US GDP deflator. The amounts shown reflect US prices; the price trend in other parts of the world would be affected by the relative value of the dollar, so would be a little different.

Persian Gulf Issues

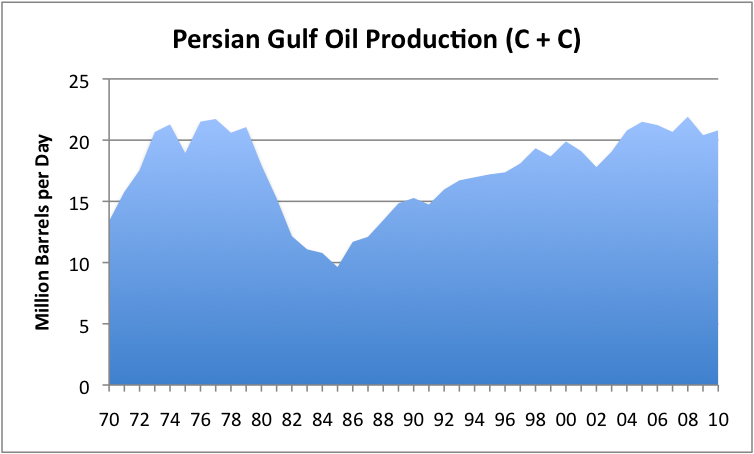

One of the breakouts the International Petroleum Monthly shows in its data is called “Persian Gulf”. It consists of the production from Bahrain, Iran, Iraq, Kuwait, Qatar, Saudi Arabia, the United Arab Emirates and the Neutral Zone. In Europe and Arabian counties, this grouping might be called the “Arabian Sea,” but I have used the naming convention of the EIA and US-made maps. If we look at a graph of Persian Gulf oil, we find that it has two big humps to it.

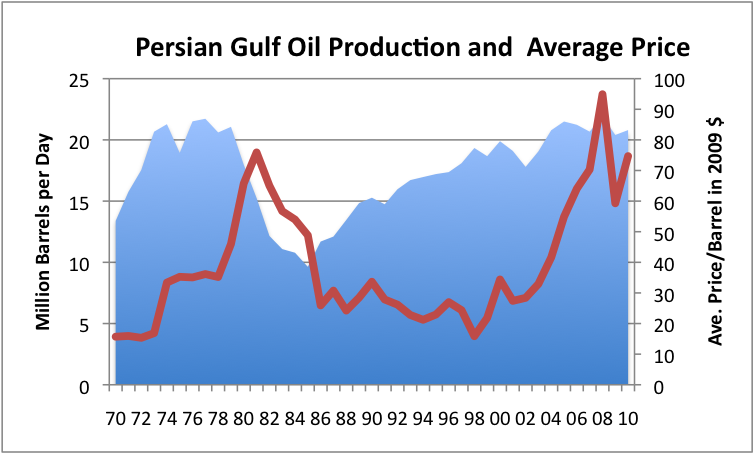

If we overlay the same oil price information as used in Figure 1, we see that a big drop in Persian Gulf oil production immediately preceded the 1981 spike in prices. We also see that there wasn’t much of a Persian Gulf increase in oil production in response to the 2003-2008 rise in prices, which is no doubt a big reason prices increased so much.

If we look at the prices in Figure 3, there is a big jump in prices occurring about 1974, (actually starting October 1973), corresponding an oil embargo by Arab members of OPEC. There was not really a major change in production at that time, however. The US was especially affected by the embargo, and the graph shows that US oil prices roughly doubled then.

What can we learn from this graph? For one thing, Persian Gulf oil production is now approximately at the same level it was at in the 1970s. While OPEC talks big, Persian Gulf production doesn’t really follow the upward trend line one might expect if the countries are really able to significantly ramp up production above the level of 35 years ago.

We also see that a drop in oil production from the Persian Gulf nations seems to have played a role in the previous price run-ups. We know OPEC played a role in the 1974 US price run-up. It is pretty clear from the graph that a reduction in oil from the Persian Gulf played a major role in the 1981 oil price spice (through cutbacks in production related to disruptions such as the Iranian revolution and the Iran-Iraq war). Based on these experiences, it seems as though leaders of the US would be worried about stability of oil supply from the Persian Gulf.

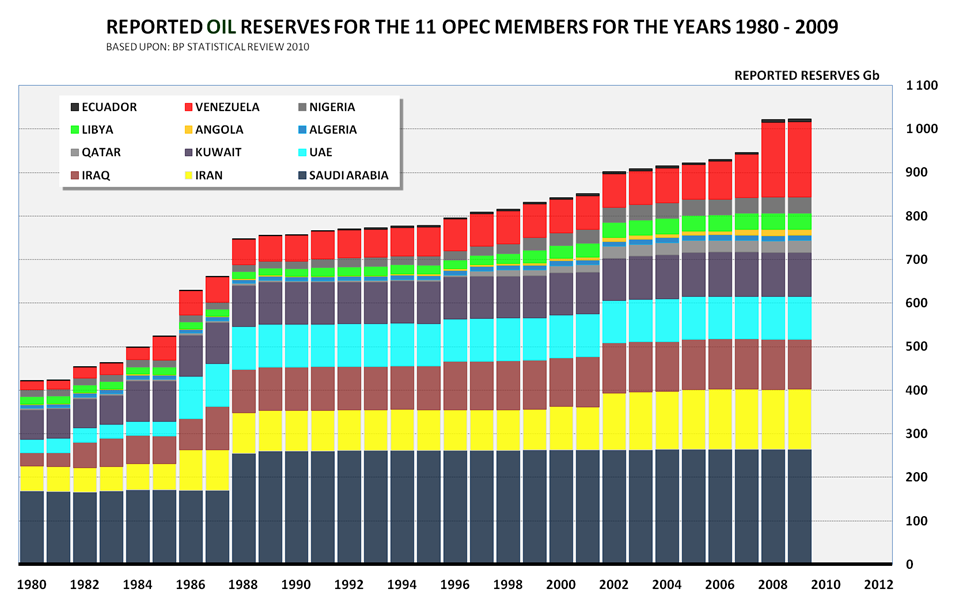

Not long after these problems, the Persian Gulf members of OPEC raised their reserves in the 1980s, without actually finding more oil–the increases seemed to be motivated by wanting higher OPEC quotas.

With the history of instability of supply in the Persian Gulf, and the apparent lack of physical explanation for the increase, it seems as though US leaders could have told the US people:

Don’t really believe the new reserve numbers. They are not audited, and appear to be politically motivated. The folks from the Persian Gulf have caused problems with world oil supply in the past. We need to be cautious in dealing with them.

But instead, we saw increased friendliness with Saudi Arabia, and increased intervention into Persian Gulf affairs. No one mentioned the possibility that reported oil reserves might be overstated. The American people were only told about the general dangers of imported oil, not the specific way that we seemed to be being misled. All of this seems more than a bit odd.

Recently, OPEC has been claiming a huge amount of spare capacity–now 5.6 million barrels a day, according to IEA. But in the 2004 to 2008 price run-up, the Persian Gulf nations didn’t come to the world’s rescue, except to a very limited extent – a bit over 1 million barrels a day. This adds further to the oddness of the situation.

Many people who are concerned about oil supply expect that the Persian Gulf nations will help us out in the future. But looking back, we need to understand that this is historically an unstable area. While there is a possibility of increased supply (especially from Iraq), we haven’t seen much recent evidence of the Persian Gulf’s ability to ramp up production by more than a small amount. If King Abdullah of Saudi Arabia should die and there were to be a problem with succession, or if there should be a Middle Eastern war, we could see a decline in oil production rather than an increase. Persian Gulf leaders talk “big”, but it is not clear that we should believe them.

Other Major Groupings

Apart from the Persian Gulf, some other major oil producing areas are the following:

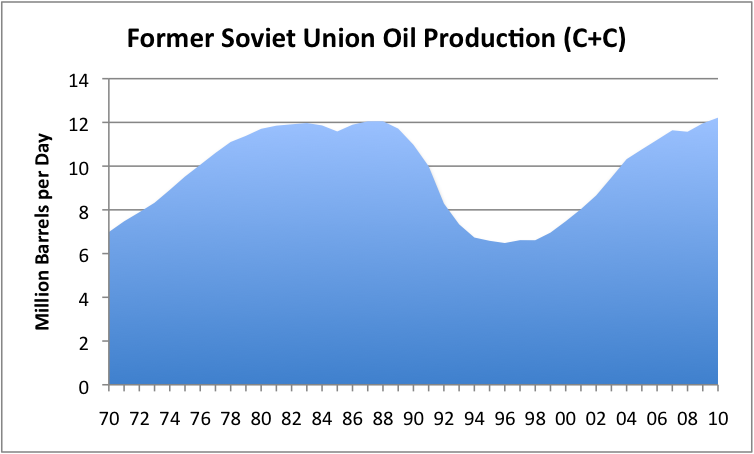

The former USSR:

The Former Soviet Union (FSU) saw a big dip in production at the time of its fall. This drop in production was no doubt related to the breakup of the FSU. In fact, it may have been a contributing cause to the breakup. The big drop in oil production occurred when oil prices were low. As oil prices rose, and as newer technology was added, the FSU was able to ramp up production to the same level it was prior to the collapse of the FSU. Production may continue to rise a bit if prices remain high. No one is expecting a huge additional ramp-up, however, because Russia seems to be running out of large new oil fields to put on line.

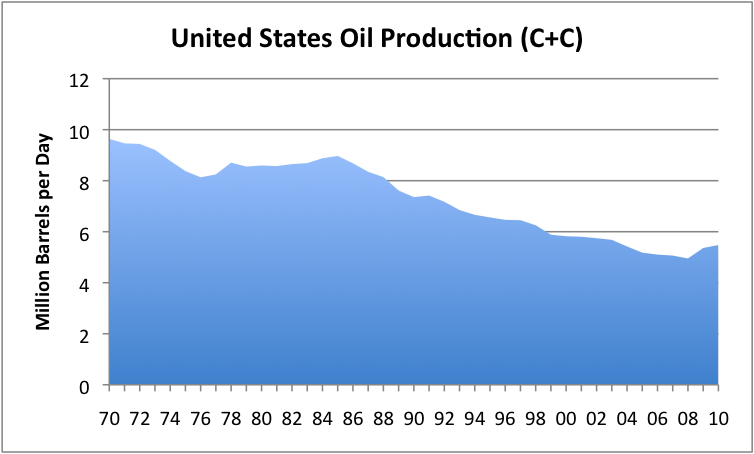

The USA:

Oil production of the US has been falling since 1970. Addition of oil from Alaska helped produce an upward “bump” in the 1984 -1986 time-period. More recently, increased deepwater oil production and increased production from the Bakken has produced a small upward bump of about a half million barrels a day. Most of this increase relates to deepwater drilling. We will need to maintain our deepwater drilling if this higher level of production is to last for a few more years. Otherwise, we can expect the downward trend in production to continue.

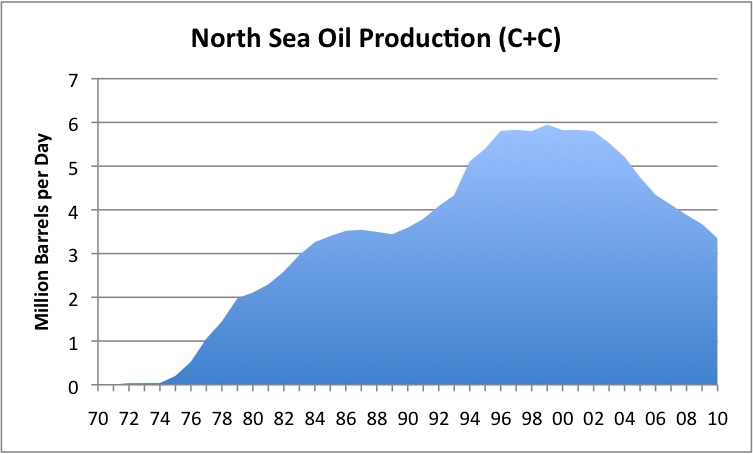

North Sea:

Oil production from the North Sea is Europe’s story–initially a happy one, but now a sad one. Oil production reached a peak in 1999, and now is declining every year, even with infill drilling. It is hard to see that anything can be done to make the situation better. Some platforms are likely to become unprofitable as production declines, and need to be permanently taken off line. Removal of platforms could result in a steeper drop in production.

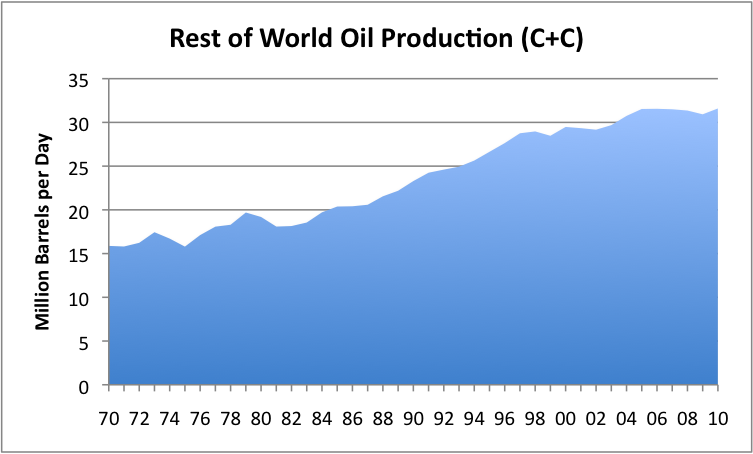

All of the rest of the countries in the world, combined:

This category includes all of the locations with smaller production amounts around the world. It includes areas such as Angola and Brazil, which have recently been growing their production. It includes Canada and its oil sands. It includes all of the new countries we have been hearing about like Uganda. But it also includes many countries where production has been taking place for many years, and which are now in decline, such as Mexico.

Production from this group of countries was rising until 2005, but has been pretty much flat since. It remains to be seen whether production from this group can rise again. If production does rise from this group, one might expect that it would rise gently, since individual new fields tend to add only a small amount, and since most of the increases that are being added are being offset by declines elsewhere.

If prices stay high, there is a possibility that production for this grouping might slowly rise, adding a few million barrels a day over the next 20 years. But given this grouping seems to already be on a plateau, there is also a possibility that production could start to decline within the next few years.

Summary

Countries in the Persian Gulf would like us to believe that there are great prospects for higher production from the area. Looking back at historical production and past changes in stated reserves, we should be a little cautious about believing what we are told. We should keep in mind that there are possibilities for disruption in oil supplies from that area as well possibilities for increases. The stories we are being told about higher productive capacity may be just that – stories.

The North Sea will no doubt continue to decline in its oil production. The US with its long-term decline also faces challenges. Unless a high level of deepwater production is maintained, it is likely that US oil production will again begin to decline.

The FSU and the Rest of the World have at least the possibility of increased production, but these increases are likely to be relatively small, based on past patterns.

In total, world oil production is unlikely to rise by much, and may fall in ways that are hard to predict in advance.

I always find it both frustrating and amusing to read this kind of analysis. Deduction based on reconstructing scores of individual pieces of evidence doesn't cut it. Since this is in totality all about numbers, we should really use more of the scientific method to infer from the 'clues' in the title of this post. So the best way to approach this is to apply a comprehensive mathematical model. I have a chapter called 'Facts in the Ground' that starts the statistical odyssey and I take it from there. I hope it fills the gap for those like me who feel frustrated by the futile atttempts at mental bookkeeping when much more powerful means are available.

The amusing part is that you can still treat this all as a Sherlock Holmes mystery and people still get a kick about reading as it were such. And that is why it is both faacinating and frustrating. The guy from Wikileaks coined the term earlier in the year - "scientific journalism".

You have a chapter Where?

I have compiled all my blog postings from TOD and MOBJ into a single document which I will make available as a PDF this January. It has equation markup and full indexing so it should be more convenient to wade through. Should be interesting to see how it plays out.

are you claiming to have a equation that predicts pricing?

Pricing of oil is not too interesting as it serves only as a proxy for an arbitrary number that is some absolute value but only is important in relative terms, i.e. as a measure of productivity exchange. Labor productivity is what I have a handle on because it really shows understandable relative measures.

http://mobjectivist.blogspot.com/2010/04/extracting-learning-curve-in-la...

"Pricing of oil is not too interesting"

Not mathematically, perhaps, but it's obviously interesting to traders '-)

I would like to see a good measure of affordability. If gasoline is down to $3 from its high of around $4 but meanwhile the unemployment rate has gone through the roof, the price doesn't very well reflect how well people can access it.

I'm really looking forward to the straight dope. Keep us posted WHT.

WHT,

I WILL BE THE FIRST TO ADMIT that I know almost nothing about statistics or higher mathematics-I did get a year of heavy duty university level calculus back in the sixties but haven't used it in over forty years, plus an introductory course in probability because it fit my graduation requirements and looked interesting as an elective.

I have looked at your blog and quite frankly in my estimation it is well over the heads of the general readership, excepting those of us who are well educated in and make use of statistics, probability, and so forth, on a regular basis.I could probably more or less make SOME sense out of it , if I were to spend a GREAT deal of time on it, but the return would be poor compared to study of other subjects more nearly within my feeble grasp.

But I haven't forgotten EVERYTHING I learned even so far back as the sixties.

In ordinary langauge, patterns that repeat in a reasonably consistent fashion literally hundreds or thousands of times must indicate one of two things, basically:

One, there exists an underlying set of causes or reasons for the consistency, and the longer the pattern persists, the more compelling the evidence that the causes are apt to apply in all circumstances, barring any evidence to the contrary.

Given that the Earth is finite, and that it has been explored pretty well for oil and gas,I can see no "evidence to the contrary" in respect to the actual results obtained by conventional peak oil analysis such as is so often published here.As a matter of fact, it would appear obvious to me as a layman -but not an idiot-that such analysts are literally certain to be correct in their predictions, plus or minus a few years.

The other reason, "two" is that there has been and continues to be some sort of super conspiracy that has been in place and lasted for over half a century which invalidates Hubbert, and all his followers in principle -and there are among them some who are expert in statistics and probability, such as professors of physics.

I notice two things in particular about your comments- you post few if any predictions yourself, and you don't seem to actually say that other analysts are making bad predictions-even if their basic methodology is somehow faulty.

So I am humbly asking you for a Christmas present from you to all of us lesser souls (insofar as our math and statistics are concerned) so that we might sleep a little easier;how about some actual predictions, even if they are just couched in general qualitative terms?And how about -if such a thing is possible-a plain language, non mathematical explaination of what is wrong with the work of others who post analysis here ?

Yours are the ONLY comments that I have any difficulty following, as a rule;something tells me I am far from alone, although I might be alone when it comes to the point of admitting you have ME snowed under-most of the time at least.

Merry Christmas!

Mac, my sentiments exactly. I wrote the below post but then decided not to post it. But after reading your post I decided I must.

WHT is a real mathematical whiz, perhaps even a mathematical genus, but it is my experience that he is no great explainer. And if you are to be read, and understood, you must be able to explain things without going so deep into mathematical equations that only other mathematicians understand you.

Even if you are a genus, to be read and also understood, you must also be a great explainer. The late Isaac Asimov was a great example of a great explainer. He was also a great science fiction writer and many females he met say he was also an absolute cad but I guess everyone has their faults. He could make you understand the most complicated problems of chemistry, physics and astronomy without pages of numbers and strange symbols. Had he wrote with the aid of these long equation then he would have been known only for his science fiction works because no one would have bought his books of scientific essays.

George Gamow was another great explainer. He was a theoretical physicist and cosmologist who also wrote science facts and theories for the general public. He did not write fiction and he write deep scientific essays in a manner such that almost everyone could understand the most complicated astronomical problems he wrote about. One of his books, "Red Giants and White Dwarfs" was the book that got me started reading books and essays on astronomy.

Alas, the world needs more great explainers like Asimov and Gamow. They were both Russian immigrants perhaps that had something to do with it. Another Great Russian immigrant explainer is a man named Orlov, but that is another story and another subject.

But I am looking forward to WHT’s paper with hopes that I can understand what the hell he is talking about, but I am not getting my hopes too high.

Ron P.

Likewise.

The first time I took a look at WHT's stuff I thought "EH??" but after investing a little more time I quickly realised that he makes a great deal of sense and has probably the only really meaningful and potentially predictive model of oil depletion that I have seen. By predictive, I mean in the sense of being able to put meaningful numbers with error bars on. I look forward to his paper, and just hope I can get my head round it before TEOTWAWKI ;)

rovman. Half ROV, half man.

In most statistical analyses, groupings are very important, in figuring out how a model is to be structured. It is interesting that WHT is not too interested in these.

You really ought to look into the topic of superstatistics (google it). The best way to think about many of these problems is applying statistics to statistical groupings. This is what dispersion is all about and am ahead of the curve in this area.

Really what I am saying is that you can't just stare at the curves. There has to be a model that underlies the numbers, and that's where my head is at.

And Ron sorry to say that I am no math genius, just a plodder who doesn't give up.

"There are three kinds of lies: lies, damned lies, and statistics."

Attribution uncertain, but possibly Disraeli.

I know nothing of mathematics (much) but I can understand graphs, and also the concept of using up finite resources. We had a coal cellar when I was a kid and getting the last few lumps out from the bottom before the coal man arrived was very difficult, and dirty.

Simplistic soul that I am I see world oil supply like this, only without the coal man coming.

Statistics are useful knowledge of things -- using a sample to determine the wider phenomena.

The Brewmasters at Guinness (William Gosset for example) invented powerful tests to determine beer quality from small samples.

Now did he lie about it? No. Guinness beer profited from his efforts. Mark twain is perhaps referring to the ability to make arguments 9say political ones) from stats, which can be quite dubious admittedly.

Has your model generated a range of lengths for oil's peak production plateau? I understand how your broader analysis could flatten out short term political, fungibilitity and elasticity issues so it is the ranges your model generates that interest me--and a good many of the rest of us here. Some of us keep a great many tracks running in our personal 'dead reckoning' systems while trying to make sense of this universe, but then by doing that we are trying to minimize entropy and you've set out to prove that is illusion as all tends toward maximum entropy ?- )

"Red Giants and White Dwarfs"

I hadn't thought about that book for a long time. It was a favorite among my small group of nerdy friends in High School, one of which went on to become an astro-physicist at a major university.

Thanks for reminding me of it, Ron.

On explanation, it might be too much to expect the same person to always be good at both. Perhaps someone who can at least follow the math could give synopses of the basics of what is being said?

Years ago I was a huge fan of both Asimov and Gamow. An amusing story which I believe was admitted by Asimov himself. He was planning to go to medical school but was so obnoxious that he was not admitted. The world may have lost an outstanding physician but most likely gained on balance. Asimov was among the best on population.

--------------------------------------------------------------------

A George Gamow Memorial Lecture Award:

" Albert A. Bartlett is Professor Emeritus of Physics at the University of Colorado in Boulder. A distinguished and dedicated educator and widely published author, Dr. Bartlett recently received the first George Gamow Memorial Lecture Award in recognition of his "most significant contribution to the public's understanding of science." Besides an illustrious career as a physicist, educator, and activist for stopping population growth, Dr. Bartlett is perhaps best known for his lecture, "Arithmetic, Population, and Energy: The Forgotten Fundamentals of the Energy Crisis," which has been given over a thousand times, including repeat performances to members of Congress at the U.S. Capitol. NPG is honored to have Dr. Bartlett as one of our Board of Advisors."

Please, I do not want to offend anyone.

WHT's maximum entropy models are mathematical models based on certain ideas in statistics, thermodynamics and information theory. I do not think that one can actually simplify them to completely non-mathematical presentation, without trivializing them to the point of waving hand and "believe me". The mathematical models of physical reality at certain moment require use of mathematics as the only appropriate language, the concepts loose their meaning without the precise language. Simplifications turn into hand waving.

With that in mind, mathematics necessary to follow basics of WHT concepts are taught in grade 12 calculus course in some high schools and every first year science/engineering college/university math course covers the material thoroughly. Sometimes he refers to stuff from second/third year engineering/math/physics repertoire, but at the same time the problems he addresses are not first year university problems either. WHT seems to be trained as a physicist with a graduate degree and as such his math background must be solid, but no wizardry required here.

Admittedly, the discovery and oil shock models are on the complex side of his derivations. But to start, I'd recommend the following entry about dispersion of wind speeds. It presents the idea and the flavour of his work and the more complex models, are well... more complex models, following same lines of thinking, but more complex physical underpinnings.

http://mobjectivist.blogspot.com/2010/04/wind-dispersion-and-renewable-hubbert.html

The math in the first part takes literally three lines and the only thing required for the first part of the article is knowledge how to calculate derivative of an exponential function.

The second part requires knowledge of what are probability density function (PDF) and cumulative probability distribution functions (CDF) and how they are related to each other (see below) and how to calculate an integral of a function. The latter is a bit more difficult than calculating a derivative, but there are free computer tools to do that, e.g.

http://www.wolframalpha.com/

About PDF and CDF, copied from Wikipedia with apologies for copyright...

PDF: In probability theory, a probability density function (pdf), or density of a continuous random variable is a function that describes the relative likelihood for this random variable to occur at a given point. The probability for the random variable to fall within a particular region is given by the integral of this variable’s density over the region. The probability density function is nonnegative everywhere, and its integral over the entire space is equal to one.

CDF:

In probability theory and statistics, the cumulative distribution function (CDF), or just distribution function, describes the probability that a real-valued random variable X with a given probability distribution will be found at a value less than or equal to x. Intuitively, it is the "area so far" function of the probability distribution. Cumulative distribution functions are also used to specify the distribution of multivariate random variables.

There are many "requests" for predictions...As far as any predictions are concerned, one can not predict anything..., but only assign probabilities to events derived from the model and projected into the future. WHT uses Monte Carlo models of his own mathematical models, to see the size of the error bars. The above blog on wind gives a clear example how to use CDF to "predict" future outcomes in the second part of the entry.

The only predictions one can make are statements such as "There is 90% probability that the wind turbine will produce 1MWh of electricity in any 10hr period".

Finally, the scary and complicated sounding concept of Maximum Entropy dispersion is not that complex: In a nutshell, imagine someone gives you a coin and asks what is the probability of heads or tails. Without the examination of the coin, i.e. in the absence of any other information, the best GUESS ( as there is no correct answer) is that the coin is fair: A fair coin has larger entropy than an unfair coin. If the coin was not fair e.g. I could see one side is magnetic, then I have extra information and have to abandon the 50/50 idea and assume some sort of skewed probabilities - and this will have a lesser entropy (because I know more about the coin). WHT assumes, every time, that the probabilities of various events in his problem will follow the pattern that has maximum entropy. That is MaxEnt.

I hope it helps in demystifying the blog and reading it.

I am commenting on it way of coming in defense of..., because I am sharing with WHT certain aspects of education and approach to scientific problems and feel WHT does not get credit he deserves for his work, for example none of his posts made it to best of TOD 2005-2010.

P.S. This is a major edit of yesterdays's post

CuriousCanuck please rest assured that you are not offending anyone.

A few years ago, well actually many years ago, I read a book called The Universe and Dr. Einstein. I was absolutely elated. I almost turned cartwheels after reading this book. Finally I understood what the theory of relativity was all about.

What I am attempting to say Curious Canuck, is that if the general theory of relativity can be explained without massive long equations that no one understands then virtually anything can be understood without massively long mathematical equations, then virtually anything can. So when you say:

I then must say: Bull$hit! Read "The Universe and Dr. Einstein" then repeat those words. It can be done Canuck. Pretending that it cannot be done is nothing but pure elitism.

But that is only half the story. If a person understands that what he/she is trying to say can only be understood by a tiny minority of the readership, then why bother? Why post a long equation that only two or three percent of the readers understand. To do so only says that "I can fully understand these equations but the fact that you do not only means that I am much smarter than you!" I have strongly suspected that this was the motive of many who do post such things. WHT will have to decide for himself whether or not that is his motivation.

Thank you for your kind attention,

Ron Patterson

It may be possible for SOMEONE to explain in easy to comprehend language, but that doesn't mean that it is possible for a particular person to explain it that way.

In other words, understanding the math and being able to explain it well in layman's terms may be two different skill sets. This might mean that WHT might have the motivation of disseminating the knowledge, but not the ability to do it well.

There are two pieces here. One is the concept, methodology. This one can be done actually quite easily and clearly in a few sentences, as the concept is simple. The issue with following WHT is that you need the math to arrive at specific results. It's like with general relativity. I can talk about curvature of space but can't explain anomalies in Mercury orbit without some math.

Let's see whether I can present the idea using math accessible to everyone...(WHT, hope you are OK, that I am summarizing your idea and blog entry trying to be really simple, but still reasonably correct)

I described WHT's idea of MaxEnt using coin analogy, a post above, I think it is accessible to everybody. Now I need a few paragraphs about what are probability functions and one tying entropy and probability:

When there are many possible results/values/outcomes in a process when randomness plays a role, probability density function (PDF) is a list of values of probability of each result/value/outcome. E.g. for single throw of dice, PDF looks like this:

E.g. This indicates that probability of throwing a 3 is 1/6.

Cumulative distribution function (CDF) is a list of numbers that describes the (cumulative) probability of all results/value/outcome being less then or equal to given value. E.g. probability that a throw of dice results in less than or eqal to 2 is 2/6 -> 1/3 -> 33.3% (only throwing one and two counts); less than or

equal to 4 - 4/6 -> 2/3 -> 66.6% (throwing one, two, three and four counts, out of six possible numbers).

Probability of throwing six or less is 1.

Here CDF looks like that:

Each PDF has its own entropy. Entropy is a number that describes how little is known about the distribution and can always be calculated from a simple formula. So if I have two distributions to choose from for my coin:

and

I will choose 50/50 based on the fact that it has larger entropy (0.693147181 for 50/50 coin and 0.610864302 for the 70/30 one)

When looking at physical phenomena where randomness plays a role, the MaxEnt principle states that we will assume that the probabilities of these random events will follow a pattern (PDF) with largest possible entropy, just like I am choosing 50/50 for my coin. This randomness is sometimes called dispersion.

That is it. The rest is application. For WHTs blog on windspeed (referenced above) it goes like this: pick a process (wind dispersion -> randomness in wind speeds), pick a measurable value that is subject to randomness (kinetic energy carried by the wind), assume pattern (PDF) with maximum entropy (pattern where wind will carry low amounts of energy more frequently than large amounts of energy). Then one must do some math, usually at the 1st year university level to obtain values that can be interpreted by humans.

PS. Edit. I read it again, and am not finding it any simpler than what WHT writes in his blog, really. Maybe I am not the person to explain things simply...

Thanks Canuck, you did a fantastic job. There are ways to explain just about anything and everything however. And your dice throwing example is explained, in beautiful detail here:

John Mighton on The Ubiquitous Bell Curve TVO.org Video

I sometimes try to tell people that the measure of everything in the universe, both animate and inanimate, falls into a bell curve. This video explains that beautifully. I try to watch at least one or two of these videos every week. I have a list of University Lecture links but this one is my favorite. It is even better than Ted because the Ted talks are all only about 20 minutes. The lectures on this site are almost always over one hour long.

Anyway, I think I have figured out my problem. I am a fantastic fan of those explain very complicated things, like John Mighton in the video above. And I just have too little patience with those who fail at this task. I am sorry, it is entirely my bias. I just set my expectations too high. Some people are good at math and some people are very good at explaining things. I should not expect that everyone who is good at one be also good at the other.

I shall try to quit complaining so much.

Ron P.

I did not have time to see the whole 54 minutes, so I am commenting in general manner bases on pieces I saw:

JUMP Math is a really good way to teach early math (know first hand), it is based on learning skills, by repetition, so that when the kids come to the stage of "getting" abstract concepts they do not have to wrestle with the mechanics.

We must be careful with the The Ubiquitous Bell Curve. The point raised on TOD again and again is that ever so often we have physical phenomena with "fat tails" i.e. results with values far from the mean are more likely than accounted by normal distribution. Normal distribution is actually ...not that common, except when discussing "mature stable populations". In common language (as in the video) when referring to bell curve, people think "most in the middle, few on the sides, and symmetrical". That's heuristic.

My dice and his dice have not much in common:

In the entropy argument I had one coin, one throw and I discussed fair v. fake coin. In his presentation he has multiple throws of a fair coin and these DO NOT adhere to a normal distribution but something called binomial distribution. If he used my fake 70/30 coin, he would NOT GET a bell curve, but something skewed.

Here, again, "most in the middle, few on the side, bell curve"

When there is change or evolution involved, other distribution usually apply.

I never meant to apply the bell curve to the production of anything man controls, only the measure of everything in nature. Obviously production curves, whether oil, automobiles or cotton would almost never resemble a bell curve. Such things are controlled by man and would have no reason to resemble a bell curve.

Evolution? I don't think you truly understand nature's distribution here. Normal distribution, in nature, always resembles a bell curve. Saying the distribution resembles a bell curve is just another way of saying what you have is normal distribution. The Normal Distribution (Bell Curve)

Whether you are measuring the speed of cheetahs or the length of a giraffes necks, the results will resemble a bell curve.

If you are measuring any characteristic of an animal, then after measuring all of them, the results will resemble a bell curve. If the animals that fall on either side of the mean have even a slight higher reproduction or survival rate, then this would cause the mean, for that characteristic, in the next generation, to move slightly in that direction, the direction of the highest survival rate. That is evolution!

Coin toss. Of course if you had only one toss, the results would not resemble a bell curve. Let's use a little common sense here. And a coin is either/or. Measure the size of grains of sand on a beach, find the mean, and plot the larger ones on the right and the smaller ones on the left, and your plot will be a bell curve. Ditto for the size of stars in the sky or the length of men's penises.

Ron P.

No, coin throwing is binomial. Just looks like a bell but is not normal . It happens many times for non-normal distribution for certain values of parameters. blood pressure - has a fat tail, cholesterol rates - has fat tail, changes in the stock maket - no (WHT made a blog on this one), prices and exchange rates - maybe, velocity of molecules - emphatic no, errors in experiments - yes. The bells look like bells, but are not normal. That is just recognition of the fact that most results fall in the middle and few around it.

Yes, if I measure giraffe penises, human necks and stuff like that, that is as I said a parameter in a stable mature population and things look like a bell. But even grain sizes are not normally distributed (log-normal is best approximation), and penis size distribution has - no pun intended - a fat tail. Symmetric distributions are not as frequent as they seem.

Using your evolutionary example, asymmetric distribution is a sign of a dynamic process preferring the values lying within the fat tail, and these might become next generations' average.

I would like your source for that information. I have read the sand example for the bell curve in several places. It is one of the favorite ways of explaining the bell curve. Google (The bell curve grains of sand) and you will see what I mean.

Sand: the never ending story

Mean, means not the average but as many on one side as the other. As many shorter as taller, as many smaller as larger. Find the mean of grains of sand and you will find that just as many are larger as smaller. Hell that is what the term "mean" means so it could not possibly be otherwise.

How would you know that Canuck? You are just making up stuff now. And that is also what you did in the sand example above. I noticed you never post links because no link would agree with what you just pulled out of your a$$. If this is the way you debate then we have nothing more to say to each other.

Ron P.

OK, I could not resist the temptation to extend the debate and get the straight facts:

wyjdsnvsl;v;dld;;kbkbhttp://www.mraverage.com/stats.htmdodjhodhpodhpodjv

I did my best to shield all the kids who frequent TOD...

Looks like, according to this purported survey, Curious Canuck may have a point.

Like this point. He said:

He just made that up! I googled it and found out. (Hint, a person who knows how to use google prevents a lot of very stupid mistakes.)

What Is Normal Blood Pressure?

I rest my case.

Ron P.

I basically don't think this has anything at all to do with how much oil will be extracted world-wide. The amount of oil that will be extracted world-wide has to do with how long our systems stay together well enough to do the extraction. Once systems start falling apart, extraction will drop dramatically, in my view. And of course, net energy will drop faster than gross energy.

In nature, things tend to follow the fractal distribution. This distribution has a much fatter tail than the normal distribution. Use of the normal distribution instead of the fractal distribution is a big part of why financial models have performed so badly.

Bravo! Gayle

We seem to have come full circle -- early posts on TOD asserted that the "stone age didn't end because we ran out of stones." Culture took off in a different direction, and the rest is history.

Similarly, discussions of the "normal" distribution of oil production or consumption are meaningful only in the context of a given oil-consuming culture -- and there will be only one of those, and for a short time at that, on this earth. There was essentially no oil use prior to middle 1850's, and for all the reasons you mention (failure of a complex civilization to hold together well enough to perform complex extraction processes) there will be none again in a few (10, 50, 100? -- not very many in any case). How are you going to construct a bell curve out of that? Fractal -- or chaotic -- is a better description.

I just don't see the point of the statistical arguments -- they are quibbling about the distribution of angels on a pinhead.

Yes, that is exactly what I have been saying. The oil extraction curve has absolutely no reason to resemble a bell curve. Humans and their politics determines the extraction rate. Nature limits but does not control the extraction rate. Bell curves are found in nature, and in the natural behavior of humans and all other animals but the production of any human produced commodity has no reason to resemble a bell curve.

Ron P.

http://www.mraverage.com/results.htm

I have to go now, will continue...

CC,

You are much bolder than I...

Ron, I understand your point and respect your knowledge...but...CC may have made a valid point on this one area of study...

And what was that point?

Blood pressure has a fat tail? No, that was wrong.

Grains of sand resemble a log-normal scale, not a bell curve? No that was wrong.

Or penis size has a fat tail? No, that was wrong.

Errr, exactly what was his valid point?

Of course only almost everything in nature falls into a bell curve when measured. The size of all the atoms in the universe would be way overloaded on the small size, 90 percent being hydrogen. And I might think of a few other things. But fat tails are caused by human intervention. Skewing the scale by hand in other words. I know of nothing in nature, unaffected by man, that has a natural fat tail. Perhaps your link above showed such a thing but that link doesn't work. Please fix it and we will discuss it. If you can show me a natural fat tail then I will agree with you. Mind you, I am not saying that such a thing does not exist, just that I have never seen such a thing.

Hint: You should always check your links before posting. This can be done with the "preview" button. Preview your post before posting, then click on your link. If it doesn't work then you can fix it before posting.

Ron P.

Ron,

Peace.

H

Peace mon. The classic TOD case of a non-Normal fat-tail distribution that is completely natural is in oil reservoir sizing.

Thanks!

I was trying to have a little fun with words wrt the graph of the penis-size distribution (which actually was /not/ normal), but...tough crowd!

Peak levity?

I was pretty sure I posted these links about blood pressure:

http://www.acponline.org/clinical_information/journals_publications/ecp/marapr99/changing_fg3.htm

and cholesterol, first image:

http://www.google.ca/images?hl=en&biw=1366&bih=541&q=cholesterol%20level%20distribution&um=1&ie=UTF-8&source=og&sa=N&tab=wi

But I clearly did not. Here they are.

Merry Christmas

Bolder by putting an unobfuscated link, or calling the skewness fat-tail?

Actually the point with blood pressure and cholesterol is stronger, the numbers show as billions of dollars spent in health care. But there is truth to the funny one too.

mean is another term for (arithmetic)average. median is the middle value.

http://www.purplemath.com/modules/meanmode.htm

The Normal distribution is just one example of a stable distribution that obeys a central limit theorem. The other non-Normal stable distributionns show fat-tails and often a skew. It is a fascinating subject area when you dive into it. Taleb describes it well in The Black Swan.

I think you are mistaking me for Nassim Nicholas Taleb and his books on the Black Swan. Lots of people pretend to understand his writing, while he berates everyone within 10 feet of his intellectual stature. It makes for interesting reading because many enjoy reading highly opinionated narratives. That's what will get to the top of the best-seller lists. If I haven't said this before, I am simply applying many of Taleb's assertions on 'fat-tail' probabilities to mathematical practice. He may have an inflated ego, but he is largely correct and I think it wise to try to apply his findings.

The same can be said for Edwin T. Jaynes, father of maximum entropy, who also had a flair for conflict in his writing. He had the gall to call his last book 'Probability: The Logic of Science' . His writing, like Taleb's is hughly readable because it maintains a sense of conflict, and if you haven't guessed, I apply many of Jaynes ideas as well.

One more guy is Murrsy Gell-Mann, who makes no bones about being smarter than the others combined. He better than anyone else has been able to explsin chaos and disorder. And i frankly don't care that his motivation is still trying to prove how much smarter he is than everyone else, even though he has a Nobel prize to put on his mantle.

I am not going to rewrite Taleb's books or Mandelbrot's coffee-table books on fractals or Jaynes writings or cofound Gell-Mann's Sante Fe institute on chaos. I am simply mathematically applying their ideas.

Besides, as Feynman once said thst 'nobody understands quantum mechanics'. I am OK with that attitude. I would probably be referencing Asimiv as well if he had said anythiing worthwhile on any of these subjects.

Web, thanks for the kind reply. And I take it all back, everything cannot be explained so that a layman can understand it. The works of Einstein can but the works of Niles Bohr cannot. At least I doubt it. Almost no one understands Quantum Mechanics. And no, Asimov never tried to explain quantum mechanics. I seriously doubt that he understood it.

Thanks again,

Ron P.

Its not always about predicting. Eveything starts from fundamentals. Only then can you obtain an understanding. I have plenty of predictions, its just that I have built up an argument in a nonlinear fashion over the years, with holes here and there that I have eventually filled in. Recompiling everything has allowed me to streamline the narrative. Above all else, this has been a hobby of mine and take it as nothing more than citizen journalism, with lots of editorial comments on the side. The models sit on their own terms and would eventually emerge whether or not I had anything to do with it.

How are you converting the trianglular oil-discovery curve into the production data?

What are the underlying functions that describe how oil is produced from the discoveries as a function of time?

Are you adding together a distribution of smaller production curves?

You could decide what you unit of time is. Then step through the trianglular oil-discovery curve and then convert that into a production vs. time curve and then add these together to make your production curve.

So I am just wondering what you production vs time equation is basically.

That is my point. Over the years of trying to understand oil depletion, I have transitioned from simple models such as triangular discovery (2005 timeframe) to more comprehensive models such as Dispersive Discovery (2007 timeframe). You can follow the narrative by sequencing through the blog posts but I figured it would be easier to recompile all this information into a more monolithuc form. When I got started I knew it wasn't going to be easy, and it still requires some intellectual investment to wade through. That's really the rationale for going through this entire exercise -- to have something writtten down cohesive enough that I can stand behind it as a thematic whole.

To answer your question in some basic terms, oil production is the time convolution of the discovery curve with an extractive profile. Something this fundamental hasn't been considered before and it forms the basis of the oil shock model. Explaining all this again in a continuous narrative was my goal.

Yes, I looked through your blog (briefly).

I saw that the oil shock model just needs you to first understand the simpler model (triangle) with single rate constant for depletion.

Oil shock has the time constant (k) changes at each shock -- reduces in rate.

Oddly there has never been the need to have an inverse shock in which the rate of depletion increases -- so does that mean the original extraction rate was the maximum figure possible? Also I thought that perhaps oil shocks were not political matters, but rather extraction rate (physical) matters and the politics was cover for a deeper problem (but that is conspiracy theory -- I know)!

So I would need to see the extraction profile function and then apply it to the triangle discovery curve to get the production curve.

Sounds like about 40-50 lines of a PERL script -- if I am correct -- it should be easy to replicate.

The multi-shock model looked very good to me in modeling the oil production real world data. Very nice work!

You should write it into a publication or a series of them.

It sounds like you have a good handle on the approach.

I think it is much harder to generate an increasing extractive force than a suppressive one. The former requires actual technology effort while the latter relaxes the effort. Therefore you may most often see suppressive shocks such as in an embargo.

That is what the math model suggestss at least, as we use it to gain the insight into what Gail seems to be just asserting. That is my point, and sorry to others for coming across as being too headstrong -- I truly believe and their are others that share this belief that some simple math models can go a long way to explaining the situation.

One of the reasons for doing this was to look at the shape of the "All other" piece, when one had backed out the pieces. The fact that its production is flat for the last several years is, to me, interesting, since it has most of the growth pieces.

I expect that there are quite a few readers who are not aware of how small a "blip" the addition of deep water drilling and Bakken production has made to US production. But this is the kind of additional production that perhaps we can expect from new projects.

I personally am not a fan of most of the modeling that is done based on past production patterns, because I don't see it as being very accurate. If nothing else, look at the diversity of patterns above. No model could have predicted them. The only grouping above that to me might be looked at from a Hubbert Linearization approach is the "All Other" piece.

There are other ways of looking at things. I show graphs of price vs production for OPEC vs Non-OPEC on this post on Our FInite World. OPEC production shows some response to higher price, but non-OPEC does not.

Deffeyes used HL and total C+C production to predict a global crude oil production peak between 2004 and 2008, most likely in 2005*. It's pretty obvious that his estimate of about 2,000 Gb in total ultimate global cumulative C+C production did not include nonconventional, but his assessment was that slowly rising nonconventional would not be sufficient to offset the decline in conventional production. As I said on the Drumbeat thread, "Slowly rising Canadian net oil exports could not even offset the decline in Venezuelan net oil exports, with their combined net oil exports falling by about one mbpd from 1998 to 2009 (BP). To paraphrase Pyrrhus somewhat liberally, based on recent data if the combined output from Canada + Venezuela is our salvation, we are truly lost."

In any case, so far at least Deffeyes has been right on all counts. Despite US annual oil prices exceeding the $57 level that we saw in 2005 for five straight years, with four of the five years showing year over year increases in oil prices, it appears likely that we will see, through 2010, five straight years of global C+C production being at or below the 2005 annual rate. This is in marked contrast to the rapid increase in global production that we saw from 2002 to 2005, in response to rising oil prices.

IMO, Deffeyes has been the most accurate of the current Peak Oil Prognosticators.

*His erroneous observation about a 2000 peak does not constitute a prediction; he never backed away from what his model showed, i.e., a peak in the 2004 to 2008 time frame.

I love your comment:

The EIA shows this graph for Venezuela.

Production has continued to fall since 2008, including Orinoco heavy oil production.

For Canada, EIA shows this graph:

Recent data indicates that production to 2010 has indeed been flat, as forecast by EIA. So Canada isn't saving the world either.

I think you are correct about Deffeyes using a 2000 GB URR in his early estimates. Seems like I've seen that somewhere before (or maybe it was Campbell in 1998). Besides, if you had charted the HL tail of global production starting with the annual production in 1983 through 1998, the HL line would have "predicted" a URR of just under 1950 GB.

The run-up of production from 2002 through 2005 shifted the HL regression to a URR of just under 2200 GB (during that same time C+C total oil consumed had increased by another 177 GB).

The HL URR calculated at the end of 2006 was ~2230 GB.

The HL URR calculated at the end of 2007 was ~2260 GB.

The HL URR calculated at the end of 2008 and 2009 was just under 2300 GB.

From all the data I've been able to gather, it looks like total global oil production is approximately 1160 GB as of the end of 2009.

When all the data for 2010 is figured in, the calculated URR is likely to decrease only slightly from 2008 and 2009, still just under 2300 GB.

But there seems no plausible scenario to take the URR up to 4000 or even 3000 GB.

In any case, we are and/or have been near the "halfway" point in the past few years.

Using a 13-month, centered, recursive MA, the "annual" peak in C+C production still sits squarely on September/October 2005 although the shoulder months from July-December 2005 are quite close and are not significantly (statisitcally) different from the Sept/Oct values.

Interestingly, although the February 2008 value and the "spike" (and thats what it was) of July 2008 were higher than the May 2005 peak monthly value, the 13-month MA value for 2008 is more than 100,000 BPD lower than the 2005 peak. Thus, longer term trends show a "wavy" decrease from 2005 values.

The current production increase "wave" for 2010 is once again flattening. So far, each new wave, when averaged in this way, comes out with a decrease of just about 100,000 BPD when compared to the previouos wave peak.

How many more ripples before we begin the long descent? It does not sound like many.

Of course, your mileage may vary.

I know you believe your model has predictive power, but I am not convinced of this.

Your model is developed for smaller parts of the world, with very different economic conditions than we are likely to have going forward. It seems to me that it presents an upper bound to what might be extracted, if investment is adequate, and prices remain high enough (and there is not a huge improvement in technology). More and more oil will be used in the production of oil, further adding to the shortfall in what is actually available, relative to what you are forecasting.

I know you believe your model has predictive power, but I am not convinced of this.

Your model is developed for smaller parts of the world, with very different economic conditions than we are likely to have going forward. It seems to me that it presents an upper bound to what might be extracted, if investment is adequate, and prices remain high enough (and there is not a huge improvement in technology). More and more oil will be used in the production of oil, further adding to the shortfall in what is actually available, relative to what you are forecasting.

Gail

It may help to look at the major transitions in fuel consequent to the 1973-81 OPEC oil crisis. Oil was cheap and was used for power plants. (From memory) after OPEC embargoed oil to Denmark, power production in Denmark was strategically transitioned from >80% on oil to >80% on natural gas. Similarly France shifted from oil to > 80% on nuclear power.

Recommend exploring those strategic shifts in oil use to fill in the major decline in oil use after the price spike and the resultant "slow" recovery.

You are right, there is a whole additional story to be told about the transition at the time of the 1973-1981 oil crisis. I thought about including the story in this post, but decided it would make it too long for a single post.

My understanding is that in 1970s Denmark transitioned from oil-fired power to mostly CHP (Combined Heat & Power), with District Heating, burning imported coal. They had multiple convenient coastal locations. Most of which still exist. I was told by one of their generating Directors that there was something of a panic at the time.

The French as you know, went nuclear.

UK promptly moth-balled recently built oil-fired power stations like the Fawley 1GW station where I had been a construction worker as a young man in 1965. That station came out of mothball only during the miners strike in 1984. UK still uses coal (mostly imported) for electricity, providing around 35%, but currently in this recent cold period, 44%.

EDIT: export databrowser gives a rough idea of the different timing for transitions through 1970s and 1980s. Interesting variations on timing in these 3 countries. http://mazamascience.com/OilExport/

Thanks Phil

Do you have any suggestion as to how many of those oil-fired power stations are still mothballed vs being converted to natural gas? e.g., if renewable fuels were available cheaper than oil?

Any suggestions on data distinguishing coal fired CHP vs natural gas?

David

This would need a bit of research to provide a proper reply.

For the UK, oil has been less than 2% of UK generating capacity for decades. Apparently, (by 2007), 3 oil-fired stations were retained for emergency, including Fawley. The latter saw a permanent closure of 1GW in the 1990s and the remaining 1GW has a 'standby' role. That site now has 2 gas turbines for on-demand peak/load balancing as required by the grid. The grid also retains access to a large number of emergency diesel generating sets owned by institutions and private companies across UK, for example water utilities.

There are currently planning applications for a number of dedicated smaller power stations planning to burn imported vegetable oil (palm oil). IMHO a lunatic maneuver; could make money but devil take the tropical rainforests and world food etc.

For Denmark, I would need to make a personal request to my friend the retired Director, but I remember his talk of 3 years ago that suggested that lack of grid control of CHP output was still relatively recently a complicating factor in integrating wind-generated supply. From databrowser you can see that NG has been part of DK's energy mix for a while now.

For me it is interesting that "Transition" started around 1973/74 but took a while to ramp up, especially for example, French nuclear. Big gas from North Sea started to come ashore in UK but not Denmark: the really big NG phase did not replace coal much until 1990s, both countries. N. Sea oil on the other hand appears not to have played a part in electricity generation. Again see databrowser for broad picture of history of comparative energy use.

If you want details from present situation in DK, I can make my contact on your behalf. Let me know

phil

The article is neither frustrating nor amusing. You probably have not read it at all since your comments are irrelevant. The above article plots the past oil productions of countries as they are reported by the producers. Hence, no scientific method is needed here. Scientic methods are perhaps good if forecasting is done which is not at all the aim of the article. It looks like your harsh comments are the introduction for peddling your own blog.

Yeah, we all know that when it comes to the scientific method, anecdotal information, circumstantial evidence,and subjective assertions always win, hands down.

Its amusing in the same way that if climate scientists started relying on anecdotal temperature readings and circumstantial evidence ("boy, its been an awfully warm winter") to further their arguments. Please explain why I can't push for something more substantial without me getting accused of peddling some agenda. We all know that oil depletion analysis has barely any scientific toehold as it stands and its not doing us any favors to argue over anecdotal information and treating the subject as some sort of whodunnit, solved by making assertions where no cause over effect has really been established.

Can you briefly describe the techniques you think will produce better analysis, and give the results of your analysis?

The technique is too think logically about the situation, get a paper and pencil and work it out like a word problem using probability concepts. The result is that you can eventually start to understand how the numbers came to be. The results of the analysis to me is always about an understanding.

Do we ever work in numbers that reflect the CO2 increases per cubic meter of oil, as we move from light crude to tar sands?

Here is some recent research. The second link is the key image of charts.

http://pubs.acs.org/doi/full/10.1021/es1019965

http://pubs.acs.org/appl/literatum/publisher/achs/journals/content/estha...

The study is highly technical, but it seems to ignore the fact that the vast majority of greenhouse gas emissions (about 80%) occur when you burn in in your car (the well-to-wheels analysis). The processing and distribution (well-to-pump) is just part of the big picture.

Also in the modern world there is a lack of alternatives. There is not a great deal of difference between Arabian Heavy, Venezuelan Extra-Heavy, and Canadian Bitumen. Comparisons with Arabian Light and West Texas Intermediate aren't helpful because those are becoming increasingly scarce on the world market.

huh ? what saudi aramco calls heavy crude is 26 to 29 deg api. manifa 26 - 29 deg api, safaniyah 27 deg api, for example.

http://www.allbusiness.com/mining/oil-gas-extraction-crude-petroleum-nat...

Okay, maybe not Arabian Heavy. 26-29 degrees API is not considered heavy oil in most parts of the world. Substitute California Kern County Heavy Oil (12 degrees API).

Uhmm, that was the point. With constantly decreasing EROI well to wheel, doesn't CO2/useful work increase with denser crude? Did Karras mention 42 api somewhere? What's the EROI on tar sand SCO, what with steam extraction, backfilling the holes, etc.

It's not just that we're using up the oil, we're using up the easy less polluting oil. And not just CO2, but real pollutants. Did I mention I live a few hundred feet from Richmond Chevron Refinery? And Greg Karras is the technical driving force behind the blocking of Chevron using heavy crude input to it?

I think that what these studies miss is while the CO2 per cubic meter of oil increases, the number of cubic meters of oil produced each year goes down. The forecasts based on BAU assumptions thus substantially overstate the effect of a shift to heavier oil. It seems like if we looked at it at TOD, we would want to combine the two trends. I would think the downward trend in oil production would quickly overwhelm the impact of rising CO2 per cubic meter.

if the motive was to increase quotas by lying about reserves, only iraq was able to pull off an increase in quota proximate to a (lied about)reserve increase, uae saw their quota decrease with increased (lied about) reserves. not very successful criminals, imo.

could you explain how saudi arabia had a motive to increase quota by increasing reserves, ca 1989 ?

saudi arabia may have had a motive to understate reserves prior to 1989, as that is the year nationalization was complete, according to chevron. nationalization was accomplished by paying chevron, etal book value for their reserves.

http://www.chevron.com/countries/saudiarabia/recordofachievement/

and on the subject of how reserves can increase by means other than exploration:

http://www.saudi-us-relations.org/energy/saudi-energy-reserves.html

ghawar is another field that has already produced previously estimated reserves.

A country might want to increase reserves, just so the leaders look good in the eyes of the citizens, and so that the people of the world look up to the nation. Without oil reserves, Saudi Arabia is pretty much a pile of sand in the desert. There is no way that it could support its current population (especially as they now live) without the sale of oil.

People assume higher reserves means the possibility of higher flow, and this doesn't necessarily go together. Some of the oil in the Middle East is very heavy. There may not be much chance of high flow, even with high reserve amounts.

Gail, as you obviously know, and everyone else on this list should know by now, OPEC never based quotas on reserve numbers. In the early 80s there was some discussion of doing this but such a plan was never implemented. However just the belief that OPEC might do such a thing in the future was enough to get the massive reserve increase ball rolling.

At this late date I doubt that any OPEC member really believes quotas will ever be based on reserve numbers. Now it appears, as you suggest, it is mostly a matter of prestige. One ups-man-ship is a way of life in the Middle East. Of course every OPEC member knows exactly what is going on here. What is shocking however is that the rest of the world seems to be totally oblivious to this fact.

Ron P.

I know that OPEC never based quotas on reserve numbers. In fact, I agree with everything you are saying. The reserve amounts seem to me to be mostly a game of one ups-man-ship, with little connection to reality.

I've posted an excerpt from the NYT in 1990 which mentions Iraq making noises about increasing reserves another twofold, which was met with appropriate ridicule. This just goes to show that these numbers can be fiddled about with at will, lest there be any doubt. By the same token reserves are certainly not static - the US has produced more than its past reserves numbers, too. The whole concept isn't of much value, imo. Better to work out ways of ascertaining when a nation will peak based on other criteria. One can visualize a model based on length of time producing, age of various major fields, length of sustained output, discovery curve, etc. An actuarial approach, in other words, rather than relying on infinitely malleable assessments from geologists and suppositions about the future of oilfield tech.

the us oil reserves have been exploitated based on rule of capture and maximize pv principals. saudi aramco's exploitation decisions have been based on maximizing ultimate recovery. therefore a model based on 'length of time producing, age of various major fields, length of sustained output, discovery curve,etc.', using the us as an analog, is invalid.

applying a depletion rate to 'calculate' reserves for saudi arabia is as a$$-backward as a 'calculation' can get. half of saudi aramco's proven reserves are proven undeveloped and therefore have a depletion rate of zero.

applying an hl to a country producing at less than capacity, such as saudi arabia, is equally invalid.

you want a forecast of future production ? use the megaprojects approach, only this time make provisions for omissions and less than mega-sized projects. do so by history matching past megaprojects(yeah, include the thunderhorses and everything else) with actual production to calibrate the forecast.

There is a shocking fact in Wright's "The Looming Tower", where he mentions that since at least the 80s the Saudis have massively inflated their population numbers for the purpose of looking big next to their Arab neighbors. In the 1980s a U.S. study determined that out of a claimed 12 million citizens there were really only around 5 million. If a country is willing to lie this brazenly about their own population, how does anybody trust their oil reserve claims?

I think of Matt Taibbi. His book blames the 2008 oil price shock on speculation by Goldman Sachs, but then naively quotes OPEC to prove that oil supply did not cause the prick shock. As shady as Goldman is, they got nothing on the Saudis. The fact that so many otherwise level-headed people believe them is an odd blindspot in our national psyche.

The influence of Saudi Arabia in international politics is proportional to its capability to control the oil price. This is obvious. And therefore the motive for Saudi Arabia to inflate its reserves, and its production capacity, is also obvious. They wish to control the foreign policies of the powerful oil-dependents, the US and Europe.

saudi's reserves and production remained rock steady through the '08 - '09 price girations.

Saudi Arabia's production did move up and down a little during the '08-'09 price gyrations. The biggest move was down, when the price dropped. According to the EIA, Saudi Arabian oil production (C+C) hit a high point of 9.7 million barrels a day in July 2008, the month with the highest prices. It was lower both before and after July 2008, dropping to 8.1 million barrels a day in February 2009. It is now back up to 8.6 million barrels a day.

Gail

Thanks for this useful summary.

(Will also be useful additionally to see WHT's update of his discovery / probability model in due course :)).

You do say regarding Canada as part of 'Rest of World'

As the post is about Crude + Condensates, your numbers actually exclude oil that is processed from very 'heavy' sources, which I understand almost entirely rely on Canada's Tar Sands and Venezuelen Tar? Such sources would need a separate analysis?

best

phil

The way the EIA assembles its data, what it calls "Crude and Condensates" includes all Canadian production, including Tar Sands. So Canadian tar sands is included in my numbers.

It appears that Venezuelan tar is not part of Crude and Condensate, but it is a smaller quantity. According to EIA's Venezuela Energy Profile, for 2009, Venezuela produced crude oil of 2,239,450 barrels per day, and total oil (presumably including tar) of 2,471,500 barrels per day, so the tar portion was about 232,000 barrels a day.

Canada's bitumen has not been increasing much--it only keeps Canadian production level, helping offset decline elsewhere. I expect heavy oil around the world will be growing, but there is no easy way of getting it from EIA data, since some of it is buried in a lot of the production. Even in OPEC, some of the planned new projects is very heavy oil.

Canadian production and exports are steadily increasing, and have been for some time, as shown in this graph from the EIA.

What the graph shows is that Canadian conventional production peaked in the early 1970's, and then started falling with most of the decline coming out of exports to the US. Exports went almost to zero in the early 1980's.

However, in the 1980's oil sands started coming on production in large volumes, with most of the incremental production going to the US market. Canadian production is now mostly non-conventional, and most of that non-conventional oil goes to the US. As I am fond of pointing out to people, Canada now exports more oil to the US than it consumes itself.

Canada is a big importer of petroleum coming to ports on its East Coast. It is these imports that allow Canada to have enough oil to export to the US.

Once Canada starts running into problems with oil imports, it is hard to see that its exports to the US will continue to rise (unless somehow oil sands production is growing a lot more than it has been recently). Either Canada will demand that the refined products needed by Canada be exported back to Canada, as a condition for the US even getting a part of them, or Canada will start figuring out ways to keep more of what it produces (perhaps shipping bitumen East by rail car, and reconfiguring refining capacity to handle bitumen).

These are a couple of graphs from a post I wrote in September 2009.

My forecast at that time, based on hoped for increases in oil sands production, suggested that in total oil available to Canadians might remain flat:

Canada is a big importer of petroleum coming to ports on its East Coast. It is these imports that allow Canada to have enough oil to export to the US.

The big East Coast refineries in Canada export 2/3 of their output directly to the US. It isn't as if there are a lot of consumers in Canada's Atlantic Provinces, and the refineries are some of the biggest in Canada. They are really just processing imported oil for the US market, since the US doesn't have enough refining capacity of its own.

Once Canada starts running into problems with oil imports, it is hard to see that its exports to the US will continue to rise (unless somehow oil sands production is growing a lot more than it has been recently).

Note that 1 million barrels per day is about what the entire state of Texas is producing these days. And that's just the production of one oil sands company.

Either Canada will demand that the refined products needed by Canada be exported back to Canada, as a condition for the US even getting a part of them, or Canada will start figuring out ways to keep more of what it produces (perhaps shipping bitumen East by rail car, and reconfiguring refining capacity to handle bitumen).

Under the NAFTA agreement, Canada can't do that. However, it would be economically inefficient to do it as well. What would be economically more efficient is to move the population West rather than the oil East, which is basically what is actually happening. However the Easterners don't like to think in those terms. Alternatively they could start stringing power transmission lines down the East Coast from the hydroelectric sites in Labrador.

My forecast at that time, based on hoped for increases in oil sands production, suggested that in total oil available to Canadians might remain flat

Note that in the graph, the total production (all liquids) increases from about 2.3 million bpd to about 4 million bpd. In reality, almost all of that incremental production (1.7 mmbpd) would go to the US. Certainly imports decline, (it looks like from around 800,000 bpd to 400,000 bpd) but that would be economically efficient.

Other energy sources (of which Canada has huge amounts) would back oil imports out of the market. At the prices oil would be trading at, Canadians would not want to use any more of it than absolutely necessary. They might have to take public transit to work, but Canadians are used to that. They'd just bring back electric trolley buses and streetcars. Except in Toronto, which never gave up streetcars.

I don't really expect NAFTA to hold for the long term. If push comes to shove, I expect those with the power (or rather oil) to set the terms, and those in need of oil to accept the term forced on them. If the US doesn't do as Canada wants, I expect Canada will see if it can get better terms selling the oil to China (shipping bitumen to the West coast by train). Alternatively, I can imagine Canada figuring out how it can refine the oil itself, and use it in Canada.

I would caution against believing company plans regarding increases in oil sand production. Actual ramp up has been much slower than hoped for. I would not be surprised if future plans to have similar ramp-up problems.

The main reason Canada signed the NAFTA production-sharing agreement is that many Canadian politicians prefer it. The provincial governments, which own the resources, don't want the federal government interfering in their marketing of it.

Canada may very well start to market the oil to China. However, the fundamental reason they don't ship it to Eastern Canada is that it is too expensive to ship it that far. There would be no fundamental problem modifying the refineries to handle it, except for the cost.

I would caution against believing company plans regarding increases in oil sand production. Actual ramp up has been much slower than hoped for. I would not be surprised if future plans to have similar ramp-up problems.

Actually, it has ramping up quite nicely.

(thousands of barrels per day)

Note that is an increase of 1 million barrels per day in 14 years, or an average of 9% per year. Suncor's plan to increase production involves an increase of 10% per year for 10 years. It's not a serious stretch of the imagination.

The production scale up is still a lot less than what initial plans were for. In the whole scheme of things, production is still tiny.

Total oil sands production is still 1.5 million barrels a day, while US imports from Canada are 2.3 million barrels a day. Thus, as you pointed out earlier, quite of bit of the US's imports from Canada are still oil that Canada has imported from elsewhere, refined, and exported to the US.

I imagine increases in production going forward will depend a lot on investment conditions. If loans are difficult to get, there may be very little scale up in production.

The production scale up is still a lot less than what initial plans were for. In the whole scheme of things, production is still tiny.

Some developments have been deferred, and it is true that in the global context oil sands don't amount to much. If the biggest oil producing field in the world, Saudi Arabia's Ghawar, follows Mexico's Cantarell (formerly the second biggest) and falls off a cliff, oil sands will not save consumers from a major hit in the pocket book.

However, it's important to the US. The oil sands are now producing more oil than the entire state of Texas. If American refiners can't get oil from Canada, they are really stuck. They don't have alternatives. Venezuela and Mexico certainly aren't good alternatives.

I imagine increases in production going forward will depend a lot on investment conditions. If loans are difficult to get, there may be very little scale up in production.

I don't think they intend to borrow money. They intend to fund their expansion through cash flow and joint ventures with international companies.

Suncor Energy unveils ten-year growth strategy

Reading between the lines, they've run out of exploration opportunities internationally and offshore, and Total (the big French multinational) is in a similar position, so they're pooling their money and putting it into oil sands. The alternative is to go out of business, which is what I think a lot of oil companies are going to do in the not-too-distant future.

RMG: I think NAFTA applies only the federal gov't jurisdiction i.e. bulk water. Private company exploiting oil in Athabasca can sell the oil to whomever it wants.

http://www2.parl.gc.ca/Content/LOP/ResearchPublications/prb0633-e.htm#interpreting

Here is what the EIA shows for Canadian net oil exports (BP shows a slightly lower number):

As you noted, the gross exports number to the US does not take into account East Coast imports into Canada. From 2005 to 2009, the EIA shows Canadian net exports increasing by 370,000 bpd. BP shows an increase of 220,000 bpd over the same time period. I suspect, but don't know for sure, that part of the difference may be attributed to biofuels.

To put the 2005 to 2009 increase in Canadian net oil exports in perspective, over the same time frame BP shows that Saudi domestic consumption increased by 600,000 bpd. In other words, based on recent data, it would take the increasing net oil exports from two to three Canadas to just offset the recent increase in Saudi consumption.

What you show is net oil exports from Canada.

If one looks at net oil imports that the US gets from Canada, it is a fairly much higher number, because it includes the oil that Canada has imported, refined, and shipped to the US as refined products.

This seems to be leveling off at 2.3 million barrels a day or so, presumably since the imported and re-exported oil is down.

As I said, the chart is "Canadian net oil exports." I'm not sure what the difference is between "Canadian net oil exports" and "Net oil exports from Canada."