Tech Talk: pipelines, a help that can be costly

Posted by Heading Out on December 26, 2010 - 10:25am

I have written about the limitations in the free flow of oil because of the increasingly heavy and sour nature of the reserves that are now being developed, and the need for suitable refineries to process that oil. I then wrote about how it’s not just oil from oilwells, but also the non-gas-liquids (NGLs) that count toward the total volume of oil that is consumed in the world. There are other constraints to production, and the one that I’m going to talk about today is that of transportation. It seemed appropriate at a time when Chevron has just announced a doubling of the size of the pipeline from the Tengiz field in western Kazakhstan to Novorosslysk on the Black Sea. It will now carry some 1.4 mbd of oil to the port, whence it will be transshipped in tankers.

Transportation is, of course, a major problem for many energy forms, as Leanan caught, the Chinese are already facing problems this winter over the distribution of power.

Most of China's resource production bases, including coal and and oil, are either concentrated in the northern or western provinces, away from the key demand areas located in the southern and eastern region, such as Shanghai and Guangdong.

Any supply shortfall could prompt a surge in import demand as utilities and firms seek alternative fuel supplies to feed their power plants.

And it turns out that they are not the only ones. As the new snowfall wraps over the United Kingdom there are concerns over the distribution of fuel oil.

Downing Street was forced to respond to reports that heating oil might need to be rationed over the winter because of rocketing prices and restricted deliveries, admitting there was a problem moving it around the country.

The energy minister, Charles Hendry, sparked alarm yesterday when he warned the House of Commons that the situation could become "very serious" if there was further snow over the Christmas period. Thousands of public buildings and an estimated 660,000 homes rely on oil for heating and Hendry told MPs some had been told supplies would not be available for four weeks.

All of which serve to emphasize a point that I wanted to make today about how the presence of a pipeline can, but not always, help the situation.

The oil and gas industries flourish largely because of these pipelines, which carry liquids easily over long distances. Perhaps the most famous is the pipeline that carries oil from the North Slope to Valdez. It has survived the varying Alaskan weather conditions, passing over permafrost and rivers, or being buried, depending on the geology. It was the only viable way to effectively develop that reserve.

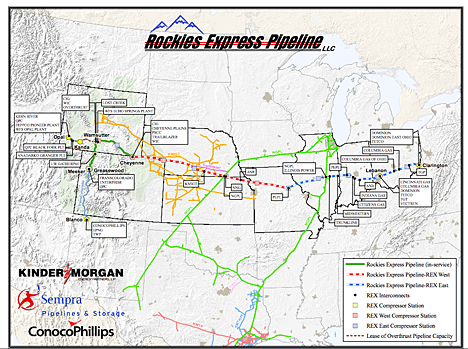

Pipelines don’t just allow reserves to be extracted, consider the Rockies Express Pipeline that is bringing natural gas from Colorado through the 1,679 miles to Ohio. Before it was installed Colorado would have a surplus of natural gas in the winter, while the North East had a shortage. To a degree (Caribou Maine being still some distance from Ohio) that has now been ameliorated.

Pipelines need to be sized for the volumes that flow. In order that the oil/gas flow down the pipe the fluid is pumped into the line at pressure, and at stages along the pipe, as the pressure is “used up” on overcoming friction from the pipe walls, there are booster stations that raise the pressure back to the driving pressure, to keep it moving. (And yes these use some of the fuel, particularly if it is gas, as a power source).

One of the problems with running the pipe under that pressure is that if there is any corrosion or damage to the pipe then the pressure may have to be lowered to stop the pipe from bursting. Since the flow velocity is a function of the square root of this driving pressure, then as the pressure drops so does the volume pumped.

As a result inspection to make sure there is little or no corrosion should be a regular feature of pipeline maintenance. Given that the pipe can run for miles above or below the surface, external inspection can be difficult, and, instead companies will run “pigs” down the line. (The name comes from the “squeal” as they move) These are put into the pipe at the “top” end and pumped down with the oil. Instruments and sensors within the central compartment can monitor conditions as the pig moves. Pigs are also fitted with wipers that ensure that deposits from the fluid don’t build up along the pipe and cause problems.

It is difficult to stop all corrosion, and over time segments of the pipe may need to be replaced because of damage that can build up in the normal course of operations. If inspections are not regular, then, as BP found in 2006, corrosion can lead to a leak, and big problems.

Unfortunately pipelines are not just prone to mechanical problems. Their presence is hard to hide, and thus, become targets for theft. Whether in Mexico this weekend, or Nigeria almost every day, theft by physically extracting fuel from pipelines can be a very dangerous game, with explosions and loss of life a not-infrequent result.

And that is just the small scale operations. On a larger scale the risk can be a lot less. Remember that Western Europe is becoming increasingly dependent on Russian natural gas for supplies, particularly in the winter months. That natural gas travels between the two passing down a pipeline through Ukraine. The financial woes of that country meant that it did not always pay its gas bill, and, usually in January, this led to confrontations between Russia and Ukraine, with Western Europe the frequent loser. To overcome this dependence Russia is now putting in place two smaller pipelines that will circumvent Ukraine to the North (Nordstream) and the South.

One of the key players in that game was Turkmenistan, which supplied its natural gas through pipelines that only went through Russia to their customers. Russia for years was able to dictate the price that it paid Turkmenistan, often considerably less than it was getting from Europe. But since it was the only game in town...

That recently changed, however, with the construction of a pipeline from Turkmenistan to China and this broke the monopoly that Russia held over the sale of Turkmen gas. The pipeline is now being upgraded and the flow increased to 1.25 billion cu ft/day, four times the volume that flowed, on average, last year. The pipeline is 4,350 miles long. Ultimately the flow will be three times that size – about the volume that Turkmenistan used to sell to Russia. (The last reference has the picture of what may be the one Soviet attempt to extinguish a burning gas fire with a nuclear device that didn’t work).

The Russians haven’t forgotten the benefits that come from owning the pipelines and the control that this gives over the producers. BP learned that lesson the hard way. Gazprom is the Russian company that owns the pipelines (and on a slow news day I could always find a story by seeing what new machinations had been revealed in a Google seach for Gazprom). By controlling the pipelines they could dictate what flowed when. As an example let me remind you of the situation that BP faced in developing the Kovykta gas field back in 2007. The deal was that after BP developed the field, they had to produce 9 billion cubic meters (bcm) per year, as the license stipulated. But local consumers could only handle a small fraction of this, and Gazprom, who owned the only pipeline in town, was only willing to allow a flow of 1.7 bcm. Oops! You guessed it, BP was held liable for not meeting the terms of the license and...

You will note that Gazprom has been quite efficient at getting control of a large portion of the pipelines and (as a result) the distribution networks across Europe.

That story brings to mind another caveat, that illustrates the bind that pipeline owners can impose on their clients. Bear in mind that these pipelines are not cheap, and while they can be installed relatively rapidly, they have to be paid for. Thus, before they are installed the owners require long-term commitments from both the seller at one end and the vendor at the other. The Rockies Express has such commitments.

REX is a joint venture of KMP (we own 50 percent and operate the pipeline), Sempra Pipelines and Storage and ConocoPhillips. Long-term, binding firm commitments have been secured for virtually all of the pipeline's capacity. The pipeline is enabling producers to deliver gas from the Rocky Mountains eastward and is helping to ensure that there will be adequate supplies of natural gas to meet growing demand in the Midwest and eastern parts of the country.

There is an underlying point here that is sometimes missed when these projects are discussed, and that is that the agreements between all parties will usually establish a price for the product, at the time that the contracts are signed, that run well into the future. Those prices do not reflect the current market price of the fuel. It is a point that often gets overlooked in discussions over fuel distribution. But many of the ways in which fuel is shipped require considerable investments not only for the production, but also for the transportation, and then for the distribution. Thus the need for commitment and guarantees before the process of construction begins. (This has just been evident in the wait in starting new coal mines in Australia, for example, until long-term contracts with China had been signed.)

However, if the pipeline owner then changes the rules, there is not a whole lot that the other two partners can do – as a whole list of countries who have been squeezed by Russia would be glad to remind you.

But it is not just over Russia that the world should have a concern. One should not forget the new pipelines that are being constructed across Asia. Whether the Chinese pipeline from Turkmenistan, or the TAPI pipeline from Turkmenistan to India, these mark a switch in the destiny of future fuel production. It is a future that means that a considerable volume of the worlds fuel may no longer be available to the West. And where that fuel is natural gas, and the nations of Europe are building gas-fired power plants to back-up wind and other renewable sources, then if the gas isn’t there...

No problem, you say, old HO is being his usual alarmist self. Well you might want to note how many times this winter there is a “Gas Balancing Alert” action in the UK. Rune Likvern has already highlighted the start of a possible problem as stocks were drawn down at the start of the winter and it has not got any better. The first Alert has been issued for this season.

On Monday the National Grid issued a gas balancing alert (GBA) for only the second time, asking power suppliers to use less gas as more was sourced overseas. Extra gas - including supplies from Belgium and Norway - was necessary to meet rising demand after a 30% rise on normal seasonal use during the cold snap.

This is only the second such alert, the first coming last January.

Further information can be found on the National Grid Website. The normal daily usage at this time of year, according to that site, is 364 million scm (standard cubic meters). The trigger for a GBA is 452 mscm, and tomorrow’s demand is forecast at 463 mscm. Interruptions seem most likely to occur in the North.

Oh, and just to give you a better sense of the scale of some of these pipes - here is me beside the one in Alaska.

HO,

Thank you for the interesting article here.

Have any sections of TAPS's Main Pipeline needed to be replaced due to corrosion?

I wonder how that would be accomplished; how does one terminate a 'block' of oil flowing through a pipe? What pushes the 'end' of the oil 'block'? Does one use compressed air, or some other non-crude oil fluid? Even if this hasn't yet been done with TAPS, I imagine other pipelines have had to been emptied somehow to effect major repairs.

Has there been any breakage due to earthquakes?

Do the inspectors still occasionally find bullet holes, as I had heard occasionally in the past?

I wonder how many people are pipeline inspectors...driving up and down the service roads, walking the pipe, and I wonder what kinds of measurement/inspection tools they use? Sounds like a job for someone wishing solitude.

I'm guessing that sooner or later we will build at least one major NG pipeline from the arctic down to lower Canada and the U.S. Sounds like a once in a lifetime opportunity for welders, heavy machine operators, etc. to work their backsides off for a few years, stash their handsome paychecks, and be able to buy decent, modest homes outright with a stash of cash to pay the taxman for the rest of their days.

H

Pipelines can be broken by earthquakes, especially when they are not expected and therefore not planned for.

http://www.australiangeographic.com.au/journal/land-of-earthquakes-and-v...

Australia may not have many earthquakes, but we did manage to lay a pipeline in 1986 and have it ripped in two in 1988. The actual ruptured piece/pieces are currently sitting in a museum in Canberra.

It is obviously a rare event but it can happen.

There are valves all along the pipeline, though back in 2001 when a drunk, recently released from jail, hunter shot a hole in TAPS quite a puddle had to be sucked up as all oil flowing down hill between the valves was trying join the stream jetting out of the bullet hole. Sections of the pipe have been replaced in the past. Its an ordeal that does cause flow to stop for varying time lengths, I just can't recall or find anything on how sections of the pipe are cleared of oil before they are cut out and removed--compressed air and pigs seem would seem to be involved but the air volume and pressure required to push oil up long grades would likely be substantial. I do know (second hand) that even when only a routine inspection/cleaning pig gets down to the Valdez terminal dealing with it is less than a fun ordeal for the operators.

This Juneau Empire article does address some of the fallout the lower oil temperatures resulting from the slower flow from the North Slope is causing or will cause soon. At its peak flow rate TAPS oil made the 800 mile trip in four days, now it take about thirteen.

Thanks for all posts sharing your knowledge here...TAPS is a most impressive engineering feat.

I don't think you're being alarmist at all. I think the vast majority of Americans are living in a fantasy world and, from what I read, most of the people aware of the issues are scarcely any better. As I watch the global chess game played, I figure the US is in for some rude awakenings. I see things like research indicates people need to be eased into bad news. That's great over a cup of coffee but when your axx deep in crocodiles, bad news needs to be dealt with now and the ones that can't cope, die. But we live in a fantasy world so we have to be treated with kid gloves. The death of the family cat becomes a national crisis.

As I talk with people, read blog comments, etc, it amazes me the lack of knowledge about the quantities of energy we need. Most think it will be solved with some ethenol, a pipeline from somewhere, making fuel for some kind of grass or some other naive conceptualization of the problem. So far, all I read is "how can I keep driving my car".

For those that pray, pray the crisis comes slowly because if it comes fast, god help us. But then, I'm an old cynic. What do I know?

There was another, smaller pipeline spill last summer in Michigan involving crude from Canadian tar. There have been additional pipeline leaks reported here, in the Midwest recently. Which got me to thinking. Are these spills related to lower quality Canadian tar? I had not heard of the company Enbridge, until last summer. I did a boolean search on google "Enbridge + Canadian tar" and came up with:

http://www.cnbc.com/id/39160909/Factbox_History_of_Enbridge_s_pipeline_s...

Is it easier for pipeline operators to just clean up their spills as they occur and pays fines rather than retrofit their pipelines to accommodate heavier, more sour crude? I want to know who owns and operates Enbridge. Which government agency is responsible for regulating these pipeline companies? How can we hold companies like Enbridge responsible for their environmental damages and make them maintain/upgrade their infrastructure?

Thanks for mentioning the Rockies Express. One of the interesting side effects of its opening was an increase in residential natural gas prices in Colorado. In fact, one can go back through the historical price records and pretty much identify the opening of each major pipeline leaving the Rocky Mountain region; a step function increase in local prices accompanies each.

One of the local curmudgeons with a column in the Denver Post writes, about once per year, that if the governor cared as much about helping poor people pay their heating bill as he says, he would send the National Guard out to blow up the pipelines. IIRC, the Texas governor threatened to do just that during the debates on natural gas price regulation in the later 1970s. Wyoming politicians fairly routinely refer to their state's status as an "energy colony" for the rest of the country, treated reasonably only so long as the fuels keep flowing.

I know I'm out on the lunatic fringe on the subject, but I can't help thinking that at some point in the next 20 years, there are going to be problems when the Rocky Mountain region decides that either (a) it doesn't want to be anyone's energy colony, or, more likely, (b) it decides it wants to be an energy colony for the West Coast, not for the Midwest or East Coast.

A question: Do states such as Co and Wy receive a tax or royalty or otherwise profit from the act of shipping their FFs (NG, oil, coal) to customers out of state?

If not, IMO, they should.

I mean, don't the states tax the product at the mine/wellhead etc?

If the states do indeed make money from the shipment of FF products out of state, then I have difficulty sympathizing with their 'resource colony' appeals.

If they do tax the production of the product or otherwise receive royalties, and they still feel put-upon, cannot they raise their levies until they feel justly compensated?

If huge arrays of PV and CSP were erected in the American SW states, I would expect them to take a cut of the action for electricity shipped out of state, same for states with wind farms.

I can see that I do not have enough information to understand the issues...

State severance taxes are a complicated issue. All the states that have a large extractive industry that I am familiar with have them. Usually, the tax is a fraction of the value of the produced fuel. When oil was $150/bbl, the states received (temporarily) increased revenue. The current NG glut and its effect on wellhead prices have greatly cut the revenue.

The extractive industries have been very successful in their lobbying efforts. When a state legislature thinks about raising the severance tax rate, be assured that there will a lot of high-powered lobbyists and executives testifying that if the state does so, the companies will drill in other states with lower taxes. Whether Shell or BP would actually do so is an unknown; suffice it to say that the threats have generally been effective.

In the West, the tax rates are also somewhat out of the states' hands because of the very large federal land ownership. States can't tax oil, gas, and coal produced from federal land. The federal government makes a payment to the states in lieu of those state taxes, but the rate is determined by the federal government. Similarly, Wyoming might decide to emulate the Texas Railroad Commission when it set production quotas that kept the price of oil at the desired level; but even if a state quota from private and state-owned land passed Constitutional muster (today's Supreme Court has a quite different philosophical outlook than the Court had during the TRC's heyday), the federal government could undo that effort by allowing increased production from federal lands in the same county.

States often attempt to do things with the severance revenues in anticipation of the time when the valuable stuff is gone. It is not uncommon for a portion of the revenue to go into a permanent fund and the state spends only the income the fund earns. At least a couple of states fund part of their higher education system this way. The State of Texas ceded millions of acres of worthless high plains land to the University of Texas system under the terms of the land grant university program; worthless until it was discovered that it was floating on oil (in the 1920s, IIRC). The UT system has an enormous trust fund that covers a portion of its expenses.

In the Rocky Mountain region, the reality is that the severance tax revenue is largely spent mitigating the impacts of the industry. Roads that might have been good for 20 years otherwise are pounded into gravel in literally a period of months. The influx of labor is almost always accompanied by increases in violent crime, drugs, and prostitution. At one point, Wyoming had more meth labs per capita than any other state. The consequences stay on even if the extraction companies move on: Shell may move its operations from Utah to Colorado, but the 500 convicted felons are in Utah's prisons for decades.

Economists talk about the "curse of natural resources." Historically, it has been very difficult for areas with large amounts of extractable natural resources to develop a balanced economy that does well after the resources are gone. The US is so geographically large that it's a regional rather than national problem. Appalachia has struggled to move beyond coal, for example.

mcain6925,

Thank you very much for your detailed explanation!

The curse of natural resources indeed...Appalachia may have struggled to move beyond coal, yet coal clearly is so important to the local economies that most of the people tolerate, and some would defend strenuously, the mountaintop removal mining technique. Clearly any type of carbon tax scheme is DOA with the majority of folks in coal-producing states.

On can say the same about the folks who live along the GOM wrt GOM oil...some of them seemed upset about the recent spill, but many more seemed even more upset about a 6-month moratorium on ~39 DW wells (and any new wells)...and the ecological damage from canals cut through the wetlands for oil/NG ops are tolerated in service to the economic gains accrued.

I am from Central PA...the tri-axle coal trucks rumbling up and down the mountains do quite a number on the roads there, along with the freeze-thaw and road salt...and the Jake Brake noise can be exquisite. Interestingly, I was back home briefly about a month ago, and saw numerous wind turbines atop one of the ridges overlooking Altoona. The kicker was reading in the paper that the locals (the few who lived up in the woods on the ridge and objected to the sound and visual) were more than placated once the county/township whatever cut a deal whereby the wind farm operator ceded a percentage of their profits to the local government to help maintain their rural roads.

Then there is Centralia, Pa...

A friend of mine who lives in a small town (~40,000 folks and growing) in ND...related in an oblique kind of way that the locals up there were, let's say, ambivalent about the impacts of the Baaken formation boom. He described how the price of housing has increased, about the truck traffic on the rural roads west of town and the attendant road wear, and the construction of 'man camps' on the western outskirts of town. He also decried the influx of 'not from here' folks...code-talk for folks who were not German or Scandinavian or Lutheran, and especially folks whose skin tones were not of the great white North and/or who were more poor or urban-looking. I could see that he was conflicted...he wouldn't dare directly criticize the free market extractive industry (utterly against his nature), yet his provincial sensibilities were being upset by the changes.

Even before the Baaken boom it was widely rumored that the rural areas of ND had surprising (to us military transients) numbers of meth lab ops...apparently not too hard to conceal ops in the middle of a couple of sections of land...

ND is sitting pretty....low population, huge ag business, lignite coal to power their utilities, oil extraction, new wind farms, and the bedrock military presence at Mint and Grand Forks (I heard that Minot AFB was worth $400M to the ND economy). And a very well-run State-run bank, with the state have >$1B surplus. Hopefully Senator Hoeven will not be shy about sharing the concept of a well-run government financial institution.

Off to Alaska: I take it that Alaska cut a better deal than many states wrt making money off of the oil produced in their state, what with the Alaska Fund and all...

Is this because most of the oil is on state as opposed to Federal lands?

I guess the bad comes with the good...would the folks in CO really trade away the economic benefits of the NG extraction in order to get rid of the downsides? Would the folks in WY do the same wrt the coal industry?

H - Not only does the state receive some small tax on production they, along with private mineral lease owners, get royality payments on the production from land they own. Not sure about CO but Texas gets a significant amount of revenue from state owned mineral leases. At one time these monies funded the entire state college education system. Individual counties often receive a severence tax also. Additionally the states also collect fees for drilling permits. They aslo collect fees/taxes from the companies drilling the wells. The monies received by the private mineral owners are also taxed by the states. They also tax the profits of oil companies operating in their state. Bottom line: to varing degrees all the states benefit from oil/NG production. The CO "colonists" are completely free to not lease their lands to any company that would ship the NG out of state. They have the right to put such a provision into their mineral leases. But from some odd reason they prefered to get the money than save the NG for their fellow colonists. Go figure, eh.

States can raise taxes anytme they want. Years ago WY (I think) raised the severence tax on coal to almost the price of coal itself. If I recall correctly WY starting losing sales to foreign sources. At one time in Texas we were shipping coal in from S Africa and Aussi land because it was cheaper than WY coal. WY cut there taxes but did't help much: coal contracts ran 10 - 15 years.

Bottom line: except for oil/NG under state and federal leases that oil/NG is no more Co or Texas oil/NG. No different than corn in Nebraska belongs to the state. Nor is gasoline refined in Texas "our gasoline". You can tell I'm not terribly sensitive about politicians complaining when the free market works against them while they love it when it works in their favor. Why did the folks in CO get sticker shocker with the new NG prices? Before the new export lines opened up some operators in the state were getting paid as little as $0.75/mcf when the national average was over $7/mcf. Those operators had a choice: sell their NG dirt cheap or shut their wells in and lose all cash flow. Didn't hear of too many tears for those companies.

Thanks, Rockman!

You are a wealth of knowledge.

I had a hard time believing that the states weren't getting their piece of the pie.

Sounds like some politicians are beating their chests to impress the uninformed local masses.

I was thinking about analogies...like Florida complaining about being the nations' citrus colony...but i like the Nebraska corn colony idea of yours...

H

H - You're welcome. In chats like this I also like to point out the royalty revenue from the offshore federal lands. Certainly there are politicians who do feel the pain of our consumers. But the pain is lessened somewhat by the fact that the govt received over $800 million in royalty from offshore leases IN JUST Oct 2010. That has been one of the criticisms of OCS management: conflict of interest. The folks that are suppose to protect the environment also make a nice income off its exploitation. The oil companies really don't need to spend much money on lobbyists to encourage the politicians to play the game. Another fact that surprises folks: consider the total revenue generated in the OCS. Total revenue in this case is defined as total lease bonuses paid to the feds (during boom times bonuses in a single sale exceeded $1 billion) + total royality paid to the feds + total revenue paid to the oil companies for their production. Of that amount the vast majority has gone to the govt that invested no capex in its generation. For the most part offshore operators have not made impressive returns on these efforts. In the early days efforts were conducted almost exclusively by Big Oil sourcing feedstock for their refineries. That's where they made their profits in those days.

Hi Rock,

Total revenue in this case is defined as total lease bonuses paid to the feds (during boom times bonuses in a single sale exceeded $1 billion) + total royality paid to the feds + total revenue paid to the oil companies for their production. Of that amount the vast majority has gone to the govt that invested no capex in its generation

That's a heck of a blanket statement--it would seem bonuses on a single sale would have to be averaged over the block's production life to have any meaningful context. I do know Alaska hasn't been to thrilled with the deal the fed is offering on its offshore oil--seems its not as sweet as Louisiana's, but I've not really delved into it. AK did get a special 90% of the royalty deal on fed land back at statehood but Alaska hasn't been able to hold them to it on any of the current National Petroleum Reserve dealings last I read.

I know you are an oil guy but seeing BP field an army of the world's highest priced tax lawyers and accountants every time it deals with Alaska oil royalty and oil tax issues makes a citizen resource owner like myself (and all other Alaska residents) realize just how outgunned his state government can be. The energy colony thing is not fiction, citizens of colonies do make a living from the business operations of the colonizers, but the lion's share of the profits are carried off (just as blanket as your claim with just as many figures to back it up). I doubt anyone has more colony master mindset than the good old boys in the London BP boardroom-'Brittania rule the waves' and all that-though I'm betting the Royal Dutch Shell bunch still oozes with the colonial attitude of the Dutch East India Company as well. BP displayed their colonial master arrogance in no small way up here when ARCO was being dismantled.

So we're all COLONIES OF CORPORATIONS?

Why not just say so?

I always point out that from the Rocky Mountain states west, federal land ownership has been a painful issue for a long time. The phrase "except for federal leases" has a very different scale in those states than it does in Texas. The federal government holds about 2% of the land in Texas, but it holds 36% of the land in Colorado, 49% of the land in Wyoming, and similar percentages in the other states. In those western states, there's a pretty good chance that newly identified resources are at least partially held by the feds, who have a reputation, somewhat justified by history, for being unreasonable.

Additional land is effectively off-limits even though it's not owned by the feds. Utah is currently trying to provoke a court case over one situation. Certain lands were assigned to the state when Utah joined the Union, to be developed to support the state's school system. One such area contains substantial amounts of coal and coal-bed methane which the state would now like to develop. The Department of the Interior redesignated federal land surrounding that area (Utah officials were given 24 hour notice that the redesignation was going to happen) so that the roads and pipelines needed for development are no longer allowed.

When the western states were created, the federal government agreed that they would be treated in the same way as the existing states. At the time, the western states understood that to mean that the federal policy of giving away public lands to the states or to private owners as quickly as possible, which had resulted in very small federal ownership of land in the existing states, would also be applied in the West. Didn't happen that way, and the resentment -- justified or not -- continues to the current day.

I acknowledge that there is also a vocal group in the West who believe that federal ownership is the only thing that protects the western wilderness areas -- that if the lands were transferred to the states, or to private hands, that the majority of the population would support rampant development regardless of the impacts.

Actually in the case of Alaska the state was granted 28% of the land from the fed at statehood, 1959. To date about 90% of that 28% has been patented. In 1971 the Alaska Native Claims Settlement Act, which paved the way for building the Trans-Alaska Pipeline System (TAPS), put another 10% of what the fed still held into the hands of that most unusual group of entities known now as the Alaska Native Corporations. All in all a whopping 1% of Alaska is in private hands, which considering Alaska's relative size, is about as much acreage as the fed holds in Texas.

Interestingly, most people here would not want to see all or even most of the state in private hands but we probably would be happier if the the state's share was larger than the feds. Alaska has a history of at least managing the wildlife resources in a much more responsible manner than the federal government ever did. Ah the glory days of fed 'regulated' rip and run salmon 'harvests' with profits heading to Seattle mostly. Trap one river system to death then move the cannery to next one. Alaska's fishery management, though far from perfect, is considered among the best in the world today.

So when you add in the exclusive maritime economic zone and consider that Alaska has more coastline than all of rest of the US combined you get some idea of how fed land/sea control issue here is in a league all by itself. Now of course federal payrolls and construction projects-especially military construction these days-is a very significant part of our economy. A tangled web it all is.

Heating oil in the UK is used primarily in rural areas unsuited for mains gas. The problem is that oil road tankers have been unable to get to houses due to the snow and ice. Options for affected householders include electric and wood heating. With the planned renewable heat incentive expect a major increase in heat pumps and a gradual decline in reliance on oil for space heating, due to both cost and reliability of supply.

How long have the roads been closed?

I really don't understand this situation as there should be a substantial margin before tanks go empty. I have propane here in the United States and my supplier refills whenever the tank gets down to 30% full--and often before it gets that low.

All the main roads are open, just a small number of minor roads now affected and a thaw is finally starting today

The pattern of oil buying in the UK includes topping up tanks in November/early December, in what is traditionally a mild period, before the expected colder weather in Jan/Feb. However late November saw a deep cold snap and snow, a few days thaw and then the coldest December on record with lots of snow. So demand went up, deliveries couldnt be made and some people ran out (usually the least prepared), though as always the media milks the story.

I'm sure many people will learn lessons, including keeping tanks topped up earlier. It might even encourage some to insulate better. Others may install bigger tanks, though I view that as a retrograde step. I suspect one reaction will be to accelerate move away from oil based heating to renewable heat, specifically heat pumps, which will qualify for UK govt RHI from next June. In my case I'm looking at a bivalent system, keeping current oil based system as back up and for coping with worst cold. From a few years back, when we were using 4,000 litres of oil pa, I expect to be down to less than 500 litres next year, and capable of doing without altogether.

Many just fill up at set times of the year or when it runs dry. Just this cold weather depleted the tanks much quicker than usual and those who planned to refill in January were caught out!

The idea in designing a pipeline or any pipe in an earthquake zone such as a long flare line is to allow the support to move under the pipe. The Chinese have an interesting way of accomplishing this. They support the pipe under a A-frame with cables and the cables allow the A-frame to move with the ground. The stiff pipe remains almost stationary.

The connection between a pipe and the structural support is called the pipe support. The pipe support rests on the structural support. The vertical loads on the structural support for a large line can be enormous. These loads are caused from snow, ice, gravitation, thermal expansion and some from wind. The coefficient of static friction between steel on steel is between .15 and .6. Usually a piping engineer will use .3. So if the load on the support is 25000 lbs down, the side load on the support is about 7500 lbs. If an earthquake occurs 7500 lbs will be exerted on the support before the pipe breaks away and slides. Kinetic friction is less than static friction so the worse case is the static case. As you notice the supports are round and this is because a round section has an equal section modulus on every axis. Since in place like Alaska it would be very difficult to predict the direction a force may arrive, a circular section makes sense. A structural shape on the other hand will have a strong and weak axis. Also this steel must be good for –50 degF. Most carbons are good for –20 degF so this is probably an exotic steel. At the lower temperatures, steel will break like glass.

For a very long pipeline the friction forces from a long string of supports, could be enough to move the line and overstress the shell. The Alaska line is probably very thin due to 30+ years of use so adding stresses from strains caused by movements to the hoop stress and longitudinal stress due to pressure, weight, and snow could be enough to cause failure. Pipelines are normally designed to the yield to save material.

One way to get around the friction forces is to add a slide plate under the pipe support and structural support. If you google slide plate, many companies will show up. Two slides plates are needed, one for the pipe support and one for the structural support. One side of the slide plate has a Teflon or graphite coating and the other side is steel so that it can be welded to the supports. Teflon on Teflon has a very low coefficient of friction somewhere around .01. During an earthquake the friction forces are low and the support floats under the pipe. If you look real hard you can see the gap between the pipe support and the structural support. This is where the slides plates are located. The plates are maybe at most a half inch thick and somewhere about a foot or foot and a half square. Teflon or graphite will handle huge vertical loads. These same devices are used under bridges to allow one end of the bridge to float with varying load conditions.

On thing to remember, this line was designed when pipe stress software was non existent. I don’t know the men who designed this line but they did an outstanding job.

Smart pigs are used to record the internal conditions of the pipe and can be 15 to 20 feet long. These pigs are usually rented and run down the pipeline once a year.

Around Denali a large earthquake occurred somewhere around 8.0 This happened about 2 or 3 years ago. The earthquake occurred in an area where very little damage occurred. The pipeline was not damaged.

I think one place a weight savings could be gained is using pipe with a hydrostatic cord. This means it would be oval in section. When an empty pipe is on its side, the pipe tends as they say oval. As the pipe is pressured the pipe tries to become a circular section that causes stress in the wall. By using a hydrostatic cord the wall can be reduced and the weight. This would provide IMHO a huge cost saving on a very long line. A good reference is “The Hydrostatic Cord” by Raymond D Johnson presented at the 1910 meeting of the American Society of Mechanical Engineers.

wow, now we know. Great comment, thanks.

idontno,

Thank you for your great, detailed explanation.

I believe this is the book you mentioned:

http://books.google.com/books?id=wHGxwk4OWLIC&pg=PA521&lpg=PA521&dq=The+...

I believe it is a chord, vice cord.

"Also this steel must be good for –50 degF. Most carbons are good for –20 degF so this is probably an exotic steel. "

A-333 is a plain carbon steel good for –50 degF. It's not that much more expensive than A-106 or A-53. It just has less sulfur and phosphorous, and more manganese.

Below -50 things do get expensive as you have to an austenitic steel. 304 used to be the most common, but 201 (less nickel, more manganese) and 204 (even less nickel and even more manganese) have become more common since nickel prices have gone up.

Is there a risk that climate change could drop temperatures below the design safety margin? We are seeing record lows in the UK, could that affect the pipeline if the local temperatures dropped below normal?

NAOM

"Is there a risk that climate change could drop temperatures below the design safety margin?"

Yes, cold weather from any source could cool the pipe below its ductile to brittle transition temperature, and then any shock could cause a brittle fracture. As long as the oil is flowing and the pipe is insulated it should be fine. If not...

Look up USS Schenectady, and Liberty Ship brittle fracture. It's very famous.

Thanks for the correction. Exotic was the wrong term.

How much oil is actually in all the pipeline systems in the US? I've looked for data before but have not been able to find a decent guestimate. Any pointers are much appreciated.

Rgds

WeekendPeak

LOL non one really knows for sure :)

I'm not joking. Understand its not just pipelines but millions of barrels worth of storage tanks.

Also you have product pipelines and oil pipelines.

You have MOL.

http://www.energybulletin.net/node/30032

If you pay attention to pipeline stories on any given day some section of some major pipeline is probably offline for maintenance.

Now that article is about gasoline but I'm pretty sure that the MOL he was talking about was for oil. So 180 million barrels. As far as I know pipelines have problems operating under 60% or so of capacity. So assuming a MOL of 180 then peak capacity is say 300 million barrels. Probably figure 200-250 million barrels is the norm.

I think that these numbers also include storage associated with operation of the pipeline not just the pipeline itself. Obviously at certain points you have a significant amount of oil and products in holding tanks as its transferred in and out of the pipelines.

This is oil that for all intents and purposes cannot be recovered. As far as exactly what it is I'd not be surprised if the real error was surprisingly large on the order of 30 million barrels or so it should however vary pretty much randomly overtime. However I think that in general the total tends to be overestimated not underestimated. Heck given the extent of our pipelines volumetric changes with temperature alone are not insignificant not to mention density changes and other variables such as size of the various orders.

Also the pipeline system of Canada is unified with the US you can't look at them as distinct.

http://www.eia.doe.gov/cabs/canada/Oil.html

And movement to and from oil barges and smaller oil tankers and pipelines is a big part of the network. A lot of oil moves by ship around the gulf cost and up the Atlantic cost. And same for products.

Sorry for the rough numbers but my main point is actually nailing down how much oil is really moving in a system that can readily absorb a 10-20% change in overall movement that spans two huge countries is hard to determine with any precision.

And of course you have things like this.

http://in.reuters.com/article/idINN2125681520101221

The paradox is this backup in Canada can result in shortages elsewhere in the system.

Am I reading this right? The stockpile inventory is 197 million barrels, but of those, 185 million is locked in the MOL? Wich would leave an actuall buffer of 12 million barrels.

EDIT: The original article posted at Wednesday, May 23 2007 08:00:00 PM

Anyone else here a fan of The Lifeboat Hour?

In other weather/energy reliability news, the ice and still cold of Scotland has limited the output of thier flagship wind energy farms, leaving Scotland more reliant on French nuclear plants just when Scotland needs the power worst with record energy consumption due to the cold:

http://www.scotsman.com/news/39Green39-Scotland-relying-on-French.667202...

It is to me a bit of a mystery how the planners of the wind farms did not account for the icing and the possibility of still winds concurrent with record cold tempetures. This does not seem like an extremely unlikely confluence of conditions to have planned for.

RC

http://svt.se/2.22620/1.2281154/livsfarliga_istappar_fran_vindkraft

If you can read swedish, this link tells you some other thing about wind power and ice: when the ice fall off the rotating wings they become projectiles. 300 meters safety radius recomended. Yet so far no people have ben hurt, but cars have been damaged.

It's always been known these wind-farms would be producing virtually no electricity when the UK is at its coldest. However the article is incorrect when it states that Scotland was importing French electricity. The UK as a whole was but Scotland's coal, gas, nuclear and hydro plants were exporting surplus electricity to the rest of the UK as well. Had the French interconnect failed National Grid could have compensated by bringing stand by generation capacity on-line - but that said I would rather not see this tested on the coldest day :-)

However some years down the line we won't have any surplus to export and probably will be importing power into Scotland on the coldest days if we continue with the planned shutdown at end of life (with no replacement) of many of our power stations including our remaining two nuclear power plants.

I believe this issue will be an important issue in the upcoming Scottish Parliament elections in May. The current Scottish National Party government (anti nuclear power) is likely to be replaced with Labour (pro nuclear power) if the polls are to be believed.

The comments so far have largely focused on technology, safety and infrastructure issues. Heading Out's comments on international agreements and gamesmanship are also worth a little elaboration.

HO already mentioned how Russia has squeezed Turkmenistan in the past but the reality was more of a "strangulation" than a "squeeze":

(chart from Gas Trends databrowser)

Between 1991 and 1998 Turkmenistan's net exports of natural gas dropped from over six billion cubic feet per day to zero. Yes, this was a time of upheaval in all ex-Soviet states but this severe pullback in production and exports was almost entirely due to Russia and Gazprom playing hardball with Turkmenistan because they had the only export pipelines. Ultimately, things backfired as this pushed Turkmenistan, desperate for another export route, directly into the arms of China.

The natural gas pipelines between Chile and Argentina present an entirely different example where it was not the pipeline owner who reneged on the agreement but the natural gas supplier. Argentina cut Chile off quite rudely only 10 years after the first of five separate pipelines between the two nations was opened. That is why Chile is currently developing its own LNG terminals.

As the world relies more and more on natural gas as a primary energy source and as supplies of natural gas eventually become insufficient to meet demand we can expect all sorts of international agreements to be "revisited". We should expect contracts for delivery of natural gas over 20 and even 30 years to be honored primarily in the breach.

Forewarned is forearmed.

Jon

In only a slight aside, the brief mention of Refineries and Refining Capacities,brings up the discussions only a few years ago about the need for more conventional Refineries (with of course the arguments of "not in my backyard", Government regulations, etc. as being the reason for no new ones being built). After all the arguments had died down somewhat, the best and simplest answer was that the Oil Companies just found no pressing need for them...

Just seems to fit way too well with the theory that the numbers for what they say for Proven Reserves vs. their best numbers for what actually remains, are two different beasts entirely. I'm sure that numbers meant for public consumption remain a whole lot more popular than the latter set. I'm just wondering how long they'll keep the game going...

Hi Dave,

Couldn't recognize the house on TAPS but it has to be just over the hill a mile or few away from where I sit and type at the moment. It should be noted that what we are seeing in the picture that shows you under the pipe is an aluminum sleeve that covers the insulution that wraps the 48" steel pipe. Readers probably noted the slide rail mounting system as well, it handles temperature caused pipe expansion and much more...

Perhaps the most famous is the pipeline that carries oil from the North Slope to Valdez. It has survived the varying Alaskan weather conditions, passing over permafrost and rivers, or being buried, depending on the geology.

That geology thing put the engineering to a test on November 3, 2002. A 7.9 earthquake, on November 3, 2002, cracked and offset the Richardson Highway where both it and the pipeline cross the Denali fault.

An aerial photo of the Trans-Alaska Pipeline System (TAPS) line near the Denali fault, looking west. This is where the line is supported by rails on which it can move freely in the event of fault offset. Here the line has moved toward the west end of the rails. Alyeska Pipeline Service Company reported no breaks to the line and therefore no loss of oil. Note the transverse crack on the Richardson Highway in lower left. Out of view to the left (south) of this photo is a 2.5 m right-lateral offset of the highway where it crosses the fault.

Photo courtesy:

Rod Combellick, Alaska Division of Geological & Geophysical Surveys, November 3, 2002

This is how the pipe was centered on the supports around the time of construction.

You noted the Alaska pipeline was now carrying less than a third of the volume it was designed to handle. I've heard that when the volume drops another 50% or so to around 300,000 bpd TAPS will have reached the lower limit of what is was designed to carry. Do you have any info on that--mine is merely hearsay. Reduced pipeline volumes from declining oil and gas fields would seem to be an engineering problem that has been addressed many, many times in many, many places.

Bob

Is anyone familiar with Red Leaf Resources? They were the hit of the 30th annual Oil Shale Symposium a few months ago....

Luke:

Thanks for the photos, they show much better than any words of mine what is meant to happen.

The photo that I took was just north of Fairbanks at the tourist display site - though I did follow the pipe up to the Yukon along the Dawson HIghway once - just to get that certificate from the hotel/restaurant.

Dave

Dave:

Did you make it all the way up the Dalton Highway to Deadhorse? I've never driven the section from Toolik Lake (science station north of the Brooks Range) to the north end of the road, though I've flown into Deadhorse and there abouts several times.

Here is a link to a fairly recent article on some of the lower oil flow issues. Slower flow, colder oil, more fallout--literally.

I did find this pdf. file, Useful Life of the Trans-Alaska Pipeline. Interestingly it predicts oil flow of about 500,000bpd through 2034 using what is called a conservative scenario. The paper looks, from the citings, to have been written shortly after 2000. The projected North Slope production graphed for 2010 is 800,000bpd, while the 600,000bpd level at which it now produces is not projected to occur until about 2015. So much for projections ?- )