Wikileaks on Peak Oil

Posted by Leanan on February 8, 2011 - 7:48pm

From today's Guardian:

WikiLeaks cables: Saudi Arabia cannot pump enough oil to keep a lid on prices

The US fears that Saudi Arabia, the world's largest crude oil exporter, may not have enough reserves to prevent oil prices escalating, confidential cables from its embassy in Riyadh show.The cables, released by WikiLeaks, urge Washington to take seriously a warning from a senior Saudi government oil executive that the kingdom's crude oil reserves may have been overstated by as much as 300bn barrels – nearly 40%.

The "senior Saudi government oil executive" in question is Dr. Sadad Ibrahim al-Husseini, a familiar name to those following the peak oil issue. He has been speaking about oil depletion since at least 2002. In 2005, he warned of a looming oil shortage in a feature article by Peter Maass in the NY Times. Dr. al-Husseini's views on Saudi reserves and production are not a surprise. However, it is interesting that at least some in the U.S. government believed he might be right, and that the information was considered sensitive enough to be classified.

The Guardian has the text of the Sadad al-Husseini cable, and some other related Wikileaks cables.

US embassy cables: Saudi oil company oversold ability to increase production, embassy told (December 2007)

According to al-Husseini, the crux of the issue is twofold. First, it is possible that Saudi reserves are not as bountiful as sometimes described and the timeline for their production not as unrestrained as Aramco executives and energy optimists would like to portray.

US embassy cables: US concern over Saudi Arabia oil production (May 2008)

Queried about Monday's record surge in crude prices to above $120/barrel, Prince Abdulaziz noted, "We are extremely worried about demand destruction, like in the early 1980s. Aramco is trying to sell more, but frankly there are no buyers. We are discounting crudes, now we're at a $10 differential between West Texas Intermediate (WTI) and Dubai Light, sometimes as much as a $12-$13 differential. Our buyers still bought less in April than they did in March."

US embassy cables: US queries Saudi Arabia's influence over oil prices (June 2008)

Our Mission now questions how much the Saudis can now substantively influence the crude markets over the long term. Clearly they can drive prices up, but we question whether they any longer have the power to drive prices down for a prolonged period. The May announcement of a 300,000 bpd increase in production barely dented price escalation. It appears unlikely Saudi Aramco could muster the million or more barrels which appear to be needed to make a dent in the normally upwards price trajectory. Saudi Aramco's ability to sustain such a production increase for a year or more raises serious questions.

US embassy cables: Saudi Arabia tackles western shift towards energy independence (November 2009)

Saudi officials feel under the gun, as they are aware that a number of other countries are years ahead of them in pursuing the same strategy. They are very concerned by the tenor of discussion in the West about shifting away from reliance on oil and gas, and moves to develop "energy independence." While they, too, want to develop a more sustainable economy and address environmental degradation, they are concerned that the world will turn away from their main source of livelihood before they have a chance to catch up.

I haven't looked at these cables or the Guardian article, but I'd like to offer a caution on Wikileaks cables.

Diplomats report information back to Washington for many reasons, only one of which is that it may be true. It is useful to know what people are saying. The people who are saying it may believe it, they may be slanting the facts, or they may be outright lying. The information they are passing along, even if they believe it, may not be true.

The Telegraph sensationalized a number of Wikileaks cables on nuclear matters last week, and their story was uncritically picked up by a number of outlets that I thought were reliable. In fact, they were, for the most part, nonsense.

I'll leave it for the experts here to apply the science and politics that are needed to evaluate these cables. Evaluation is needed; very few, if any, of the Wikileaks cables are self-validating.

Good point.

Sadad al-Husseini's views are not a secret. This is from 2004:

The cable could have been classified just because Husseini's views conflicted with the official Saudi position.

True, though I'd suggest if 'CG and EconOff' were to think/know that he was incorrect, they would note it in a comment, as they do other elements.

The subtext is that they embassy staff have no better idea of the reality than we do and are taking the pulse of various individuals to try to determine the truth. While it doesn't preclude others in the US government being more clued in - you'd have thought that these characters would be up to speed with US thinking on the primary interest in the region.

Cheryl, you should read them. The contents of the cables appear to be reasonable -- I think the information is real.

Frugal, I probably will. But there are others here who can interpret the cables better than I can.

I'm just very busy on other things right now; thought I was ending my day at the computer when I wrote that comment, but here I am back again printing stuff out for a meeting tomorrow.

It's useful to know that communication within the State Department expresses an understanding, very clearly, of the difference between reserves and flows. These cables are well written, pointed, and conversant. For anyone who has charted the course of the story these past 10 years, the implications here--of the actual state of awareness--strike me as relevant, meaningful.

G.

Just pulled out my Ouija board.

Made contact with the ghost of Matt Simmons.

My Ouija board has this message from Matt's ghost to us:

Told 'ya so.

P.S. we don't need no FF's up here in heaven. They use it only in Hades. But the heat from Hades is increasing --rising as high as up here and starting to melt the cream cheese my perfectly toasted bagel. We call it the Great Uncooling. Tell Tierney he may have won the bet, but he lost the war. Smirk.

We shan't meet again. Double Smirk.

We are all Hades-ians now.

There's some great stuff in these cables. It's well worth the effort to read them all. Here's a surprising quote:

Americans were some the of least affected citizens by the 2008 oil prices, yet complained the most?? The non-negotialble American lifestyle appears to be both sacred and fragile.

This is something I don't understand. Why aren't prices at the pump more volatile? If consumer's pockets aren't absorbing the full brunt of rising input prices, then what is?

The refiners and retailers.

Basically, they could not raise prices as much as they wanted to, because the consumer wouldn't buy at that price. Retailers sold gas as a "loss leader" to get people to their minimarts to buy other things. Refiners took a hit because the alternative was losing market share . (That's touched on a bit in the cables, when they talk about "refinery margins.")

Thanks for the informative reply! But I'm surprised they have large enough margins that they can do that - they must be betting a lot that the price will go back down.

For the refiners, part of it was that they were making unusually large profits before the price of oil got that high. There was a refinery shortage, which drove prices for refined products higher.

For the retailers, a lot of them were really hurt. Some even went out of business. But what can you do? You can't charge $5/gallon when the other stations are selling it for $4.

Consider also the impact of tax on the pump price. In heavily taxed countries (like the UK and most of N Europe) something like 70% or more of what you pay at the pump is a government tax. Therefore a doubling of the raw material costs only increases the pump price by a smaller percentage. (30% pump price increase.)

To put this in perspective - the current average UK petrol price is $7.81 US gallon at today's exchange rate.... (to fill my fuel tank today cost over $100 - and it is a 'small' car).

Yes, but you would expect that to mean Americans were more vulnerable to the rising price of crude. But oil became six times more expensive, while gasoline prices barely tripled.

For this, and other reasons, I still think that there is something fishy about that level of difference between increase in crude price and increase at the pump.

Read what RockyMountainGuy says. He keeps on stating that the Canadian oil sands supply has nowhere to go but the USA and it is suppressing prices by acting as a surplus. This explains the marginal difference in prices on the global market, but not completely between the pump price and a barrel, which doesn't make sense percentage-wise. Prices elsewhere (like in Europe) are more stabilized against barrel prices as the taxes buffer the increases in terms of percentage.

Obviously for gasoline the crude component cost is a very significant fraction, but other costs, such as refining, storage, transport, marketing, and so forth do not necessarily increase. Taxes do not either, even if they are smaller fraction of the total here.

I would imagine that in other countries the relative increase was even smaller, given higher duties and fees.

Certainly your point about refinery demand is part of it -- prices are driven by marginal costs in a glut, more than by marginal demand as for a shortage. Given the situation in Cushing, I'm expecting a local glut here for a long time!

leanan

The combination of crude transport, refinery margins, distribution, retail costs and taxes add to a larger component of the retail price of petrol than does the crude oil price. At least this is the case in Australia. There is a higher tax component here in Australia than you pay in the US but still even in the US the component of the price made up by these other elements will be close to 50%.

Vintermann,

You need to keep in mind that refining margins are a complex aggregate of the profits realized from many different products, all with variable margins depending upon demand and season.

IIRC, the highest profit product is ethylene (usually) and its sister propylene; both petrochemical feedstocks with nothing to do with fuel uses. Diesel fuel is another item with variable profit margins which is almost always in strong demand; if not here, then overseas. And the list includes all sorts of products; bunker fuel, asphalt, carbon black, etc.

We get a wide spectrum of products from crude oil. It really is the basic building block of our economy. This is why gasoline prices are not necessarily the be all and end all determinant for refining margins for any given year.

Wikileaks:

Saudi Net Oil Exports Versus US Annual Oil Prices:

2002-2010 (EIA, Total Liquids)

2002: 7.1 mbpd & $26

2003: 8.3 mbpd & $31

2004: 8.6 mbpd & $42

2005: 9.1 mbpd & $57

2006: 8.4 mbpd & $66

2007: 8.0 mbpd & $72

2008: 8.4 mbpd & $100

2009: 7.3 mbpd & $62

2010: 7.4* mbpd & $79

*Estimated

And actual Saudi production, consumption & net export numbers through 2006, along with Sam Foucher's projections, showing low case, middle case, high case, and the actual values for 2007, 2008 and 2009:

Can you point us at the original source for those frightening projections please Wes. Saudi oil exports halved by 2020 (just 9 years away).

How do you arrive at 1/2? 2010 is estimated to be 7.4 mbpd, while the mid-case is 5+ mbpd come 2020; let's say 5.2 mbpd or 2.2 mbpd less than 2010, just under 30% less. Such a decrease will be bad enough, but Saudi isn't the whole oil regime. By 2020, Brazil ought to be extracting as much as Saudi, and Iraq ought to be close too. Real concern ought to be expressed for the years after 2030 when the gentle decline slope becomes a steeper incline. Thankfully, this event is still far enough away to allow for proper preparation.

I'm old and need optical aids, but "mid case" exports - the full blue line - crosses 4.0 at 2020, no? (Where do 5+ and 5.2 come from??) And net exports were consistently above 8 until very recently (2008, in the tabulated values). That is more than halved.

It looks to me as if karlof is the one who needs glasses (or needs to take off his rose colored ones).

I used a straight edge and tried to line everything up properly. I then tried to expand the chart, which didn't work. I then tried to find it elsewhere, which was a futile search. And, yes, I wear glasses. After 5 1/2 years of TOD membership, my glasses are certainly not rose colored. As I mentioned, the key is how Saudi decline fits with increases taking place elsewhere that will determine global net exports. Clearly, the initial prognostications of imminent doom when TOD started were quite incorrect, with the plateau period lasting much longer than most anticipated.

"Thankfully, this event is still far enough away to allow for proper preparation."

I wish it were so simple. Whatever happens in other oil producing regions will happen in the context of an unfolding disaster in KSA. Without exports, what will pay for imports of food? Does KSA have foreign investment income sufficient to pay for food? I doubt it. But if they do, who will have food to sell, or fuel to transport it to market?

There are other problems in the world besides food in KSA. This is just an additional problem in a world that has already failed to prepare properly for these other problems.

And all the while, other oil exporting countries will fall victim to Jeff's Export Land Model and add themselves to the list of local disasters in need of proper preparation.

"Proper preparation" is an alternative name for a planned economy. Who will plan? Who will submit to the plan that was written by others? We are really a long way from having a global world government, and now is an unlikely time for this new adventure in rational governance.

With a mega-drought happening in the wheat growing regions of China coming on the heals of the disastrous wheat harvest in Russia, we are likely to be in for some 'interesting' times in the coming months and years. The convergence of PO and CC is starting to hit deep and hard.

http://www.nytimes.com/2011/02/09/business/global/09food.html

One of the ramifications of this Chinese drought may be the U.S. corn-to-ethanol program.

It's gonna be exceedingly difficult to rationalize feeding cars when the 3rd world goes hungry.

Doesn't seem to have stopped anyone so far...

This award-winning editorial cartoon from 2008 sums it up nicely:

http://bbs.chinadaily.com.cn/viewthread.php?tid=607981

It's gonna be exceedingly difficult to rationalize feeding cars when the 3rd world goes hungry.

The elite in the third world rationalize it all the time. Go to India: expensive luxury cars on the road, real estate more expensive than Manhattan (at least in Mumbai), glitzy shopping malls are full, 5 star hotels are full, resorts are full, airline flights are full, and all this juxtaposed with grinding street poverty everywhere with millions living in huts and shacks with no sanitation. And no, it is not because of the "caste system"; you will see the same thing in Brazil, Mexico and many other countries.

It's hardly only the elite in the third world that do this!

I know. But the point is that if the elite (top 10%) in the third world can rationalize in spite of the mass poverty that exists right outside their doorstep, it is not surprising that the elite (top 60%) in the Western world do it.

(By elite I mean the class of people who have significant disposable income)

Nah, rationalizing is way easier than doing it any other way. You don't have to rationalize -- everybody just does what they can with what they have, and you end up with "haves" and "have nots", and the system evolves with no thought at all And really, that's the key -- just don't think about it.

Besides, if they have no bread, they can always eat cake.

karlof1, what is this ?

From Petrobras came this news, so that will be on the optimistic side:

While some think that Iraq can go to 12 mb/d, probably they have to be content with about 6 mb/d, although their proven reserves are stated at 143 Gb. Even when they would have those reserves, it will always be an unstable country with troubles between the three ethnic groups.

Unless Brazil, Saudi and Iraq are all producing 4 mb/d in 2020, in which case he'll be right. Just not in the way he expected.

That's exactly what I meant. At least someone can read English properly.

Nice try karlof. Now you are saying that you meant that KSA will extract about 4 mbd in 2020. That's not what the graph from westexas shows. There the middle case oil export scenario is about 4 mbd.

I presented Sam's projections at the 2007 ASPO-USA conference, and I did followup presentations in 2009 and 2010. Here is our paper based on the 2007 ASPO presentation:

http://www.energybulletin.net/node/38948

Here is a recent essay on Peak Oil Versus Peak Exports:

http://www.energybulletin.net/stories/2010-10-18/peak-oil-versus-peak-ex...

Thanks; very interesting. Not long to wait for ground-truthing.

Well DUH Homer...

Of course the Saudi's etc., are going to overstate their reserves, they like our protection (or any protection they can get for that matter).

As for the US Economy, we've been artificially subsidized and sheltered from Oils actual costs for many decades now. Our economy is like a junkie getting used to a "cheap fix", and it can no longer function without it. IMHO TPTB (irrespective of party affiliation), know this too and just how sharp that knife edge this country walks. Till proven otherwise, I'll reiterate my oft stated conclusion that "spooking the herd" is something they will try to prevent at all costs.

I think these reports on Saudi oil are erring on the conservative side. The actual sitaution is probably worse.

I mean we knew they were over-estimating but... nearly 40%? That's not lying, that's tripping with the fairies.

I think if the reserves are even less than that it isn't going to change anything, it's already bad bad.

Even if they were overestimating by 40% that still gives them about 160 billion barrels. If they are past peak, and I believe they are, that is still way too much. I would put them at 80 to 100 billion barrels. In April 2008, cumulative crude oil production of KSA was 114 Gb according to this 2009 Oil Drum posting. That would put them at about 123 gb today. I believe that is well above what they have left.

Ron P.

Sounds like Peak Oil Believer to me; however the following comment was interesting from the same cable.

Nevertheless the fact that rising oil prices have been met with declining exports from Saudi means that Saudi is on the downhill side of their total oil production, and have been since 2005.

And of course they are looking for oil in seismically tough Red Sea and making plans to inject C02 in Ghawar in an attempt to stem decling production in that very tired old field.

Have you ever notices that actions always speak louder than words? Looking at piping C02 across the dunes to Ghawar and looking at drilling under two kilometers of water and 7,000 feet of salt makes it seem that they are getting very worried about their ever declining exports.

Ron P.

Remarkably enough, when I confronted Rembrandt last year with these actions of KSA, he responded that that could be a matter of good management of Saudi Aramco, to guarantee sustained oil production in the future. KSA has some 80 small undeveloped oilfields left, with at least 50 Gb oil in total. It won't prevent their oilproduction to drop and they will leave many of them undeveloped.

Han, just think about that for a moment. Saudi claims 265 Gb of reserves. Even if 50 Gb of that is in small fields that still leaves 215 Gb of reserves in their giant fields. That is almost twice what they have already produced, even without drilling those tiny fields. They have over 70 years, at current production rates, before they have to tap those smaller fields.

Yet they are looking at producing some of the most expensive oil in the world under 2 kilmoeters of water and 7,000 feet of salt and perhaps a couple of miles or rock. Doing that over 70 years before it becomes necessary is not good management.

Also piping C02 over hundreds of miles of sand dunes in hopes of extracting a few more barrels of oil from Ghawar 70 years before necessary is not good management either. Drilling those 50 Gb of very small fields would make a whole lot more sense before doing these things. After all, all that would require would be to drill one well in each one. That would not be an expensive undertaking at all.

Sorry, with all due respects to Rembrandt, this just does not pass the smell test.

Ron P.

Ron, would this be true, then KSA could leave the Red Sea and all those small fields alone for many decades to come.

Yes, and KSA never will be like the U.S. From a Simmons article:

Are you sure ? Those small fields are in the desert in the middle of nowhere. It needs a lot of infrastructure to build and towns for the workforce, like what Venezuela wants to do in some places at the Orinoco belt.

I think that young man, whose world turned upsite down when he discovered Peakoil (that's what he wrote in his book), wants to keep some hopes alive.

Yes, that's my point exactly. That is why it is not true. But if it were they could pump for many decades then and only then they could drill those tiny fields...

I have no idea what is going on in Venezuela but Saudi does not build towns anywhere to support such a small workforce. You do not need a whole town to drill one well in one field. One crew and one rig could do it. That would cost but a tiny fraction of the expense it would take to support the equivalent of one Deepwater Horizon on the Red Sea.

And the small fields are very likely in a cluster like the Hawtha Trend fields. A small pipeline to each well and one larger one out. That's it. That's what they did for the very small Hawtha Trend fields and they could do it elsewhere. That would be one hell of a lot cheaper than drilling the sub-salt red sea. Of course we don't know if there is any oil under all that water, rock and salt. They are just looking... and hoping.

Ron P.

So the conclusion must be, including the facts of the rest of your comment (no roads needed, only small workforce needed), that if they would want some more (spare) capacity they would develop a number of small fields. However something seriously bad is going on and they are hoping to catch a (few) big fish in the Red Sea (apart from a red herring) and they are trying to prevent Ghawar production going down like a rock.

Last year on a press-conference in Venezuela in the presence of all those foreign companies that want to develop blocks from the Orinoco belt, Chavez said they will build towns there. I don't know how it is going on there now, but I recall several comments on Drumbeat from RMG who wrote that he doubts that foreign companies really will go ahead with these plans, regarding the bad economic situation in Venezuela.

Wow, hopefully this won't hit the mainstream media in the states for a few more years. I've been preparing for peak oil for only 4 years and have a ways to go. I attached a video to help and show people what they can do to prepare for Peak Oil. There may still be time.....

http://www.youtube.com/watch?v=hHmXhgBhtWk

MrEnergyCzar

Let's remember, the main reason that the Wikileaks diplomatic cables are important (and please, do read them, they're verrrry interesting) is that they validate that peak oil is a credible US government perspective.

Sure, this information on KSA is not new, but as a source of perspective, it provides evidence for many of the other corollaries that have been posited about net energy and resource depletion--and also because of the sensational Wikileaks part of the story, it means that resource depletion will get a bit of attention for a while.

Re: oil itself, as Stuart and Joules and Euan (and...and..did I forget anyone?) have said previously and Jeffrey Brown (westexas) and others have said above, the rest of the pieces of the puzzle have always gone off the edge pieces of KSA. The validation of some of the ideas on KSA means that the logics of resource depletion, Export Land, and others at least has another notch on their respective bedposts, at the very least.

As Wikipedia helpfully points out:

You can download a 1.39 gb torrent of all the cables, but it's password protected - yes, people have tried "admin," "password," "freedom," etc. FYI, 'Y' being plural in this case, I hadn't really followed the Cablegate saga too closely.

Now, the offerings from the Guardian aren't the whole story either, as when you check the Cable Viewer there are obvious entries related to oil that don't show up with the Guardian's 'Oil' tag - check the CV for July '08, for instance, there's a bit about companies and Lybia, as just one example.

Big shortcoming with the CV: no explanation for the tags. The FAQ is just a bunch of intents and full disclosure babble. Here's one guy's attempt at a glossary: Current Events Inquiry: WikiLeaks cablegate tag glossary. Even he came up short for a few of the terms.

Kennesaw, GA (PRWEB) January 18, 2008:

On January 15, Terry Moran interviewed President Bush in Saudi Arabia on ABC's Nightline. When asked what he might say to the King of Saudi Arabia to lower oil prices, George Bush responded, "If they don't have a lot of additional oil to put on the market, it is hard to ask somebody to do something they may not be able to do." Nightline Presidential Interview

Bush's comments one month after the cable.

Yep, that's Gail's press release, here:

http://www.prweb.com/releases/peak/oil/prweb635891.htm

I've read the Guardian article but as there are no links yet to the cables I can't get a timeline for comparison, which would be helpful as there are a lot of inconsistent statements therein.

The first sentence declares: The US fears that Saudi Arabia, the world's largest crude oil exporter, may not have enough reserves to prevent oil prices escalating... It has been a while now since Russia has taken the top spot as the world's largest oil exporter, unless I missed something.

Also interesting was: In the last two years, other senior energy analysts have backed Husseini. Fatih Birol, chief economist to the International Energy Agency, told the Guardian last year that conventional crude output could plateau in 2020, a development that was "not good news" for a world still heavily dependent on petroleum. Which is a little odd as there was a declaration conceding late last year, finally, that conventional oil had already peaked in 2006.

Without the original cables to compare dates of these various comments and statements against it's hard to actually see these latest revelations in a clear light, therefore I wouldn't give the article much credibility. Some of us who've been watching this for a long time might assume it is yet another soon-to-be-ignored article that was intentionally made to look out of touch.. Anyone got an idea of what's going on here?

The article at Zero Hedge has direct links to the cables on the Guardian website.

That's right, and what is Saudi Arabia, around 20% of global production? That's significant but we always have to look at the aggregate. So even though we have a curious lack of understanding of 20% of the world's production, we have a better and better grasp of the rest of the world (or at least I think I do).

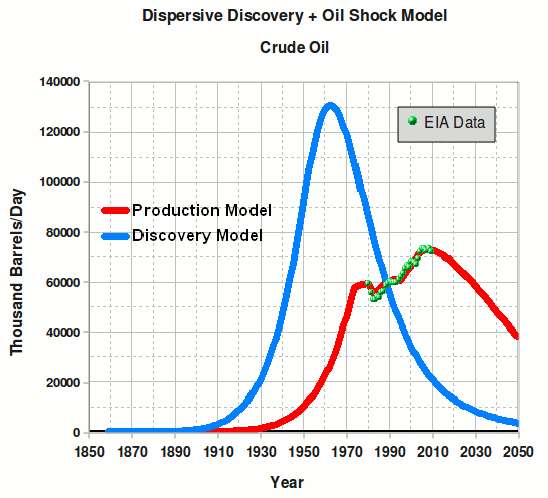

This model of Russia reproduces the ASPO production curve (brown) based on applying the Shock Model to the discovery data plus extrapolated dispersive discovery (green curve). This one is in yearly amounts and it readily shows how Russia battles with SA for significance, and because of the much better accounting and reserve estimates of Russia, we will get a better handle on how things play out.

Hi WHT, so what is your projection of the aggregate picture up to, say, 2050? Either crude and/or all liquids? Couldn't find it in your book...

John

I concentrated on global crude for the aggregate picture. This is the same figure that I included in the book originally posted to TOD in 2007, only rescaling it and entering recent EIA data. See p. 140.

The book is a description of the method and a snapshot in time and now that it is done I will continue to update the data.

Notice that the discovery data is smoothed out. I did that to extrapolate for all the locations such as SA and elsewhere where accounting procedures are not the highest quality. Russia has pretty good accounting and accurate reserve growth estimates off of discoveries so I left that data alone, and only extrapolated discoveries for the future. The total URR for the above graph is 2800 billion barrels, which will surprise a lot of people.

Thanks WHT. What does you category of 'crude oil' include and exclude?

For example, Colin Campbell's last ASPO newsletter (PDF) has 'regular oil' at 36 Mbpd in 2030 but then adds in 7.7 Mbpd 'heavy oil' (tar sands and shale) plus 4.7 Mbpd deepwater plus 2.3 Mbpd polar plus 5.6 Mbpd NGL/refinery gains. For a total of 55 Mbpd.

This is not far off your (eyeballed) number of 58 Mbpd in 2030. So does your number include all of these categories? If not, which are excluded?

Thanks, John

Edit: p139 of The Oil Conundrum implies you exclude NGL/refinery gains from 'crude oil'. Is this correct? And what about the other categories? Thanks again...

John, he is using the EIA data which peaks at almost 74 mb/d. That definition is Crude + Condensate. That does include tar sands oil but not NGLs or anything else like ethanol of palm oil.

Ron P.

Thanks Ron. This leads to another question for WHT. What is the 2800 billion barrels URR composed of? Is it just conventional oil? Or does it also include:

a) heavy oil?

b) extra heavy oil?

c) oil sands bitumen?

These categories are from RockyMtnGuy's picture of URR components on Wikipedia.

TIA, John

It is a dispersive model fit to what is in the discovery profile from ASPO. So whatever has been added to discoveries is included. I don't have the resources to accumulate all the data so I rely on others to provide that data. The model essentially does the data extrapolation.

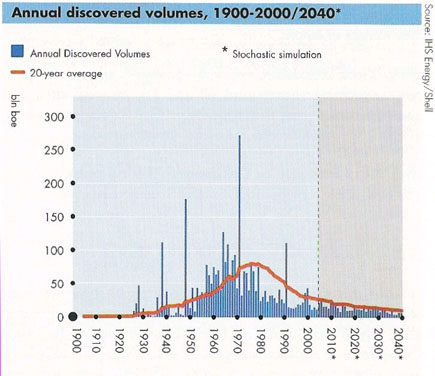

Shell Oil has a different discovery profile that must includes some of those extra categories. I have to infer that because it certainly contains larger discovery spikes than the ASPO model.In the book you can see one that one of the spikes might be the oil sands discovery. See figure below:

Perhap Birol was talking about peak crude for KSA?

Craig

The Guardian article has links to the cables in its sidebar. They're also posted up top.

13/8/2010

Saudi Arabia lost production share to Russia

http://www.crudeoilpeak.com/?p=1800

And now we know, which we've known all along, why the Saudis did not produce any significantly more than they had did previously in the first half-year of 2008 as prices spiked considerably. They just didn't have anything significant to offer the world - which Bush spoke of in 2008.

And now we also know why the total secrecy. If they'd be open about things, everyone could have known this for sure since years back. Now, however, they can still fool the easy-to-fool(for a while further).

Once we climb out of recession we'll hit a peak again. It's within the 2012-2015 timespan that Hirsch et al predicted and after that, second, peak, depletion will be so serious that there will be no way out but to mitigate, converse and prepare for the worst. Resource wars etc.

As Jeff Brown and Sam Foucher has shown, you can't just look at Saudi production, you also have to look at their internal consumption.

The Guardian article does contain information that electricity use will increase 10 % per year and internal oil consumption is increasing too, in part of energy needs but also for desalination plants for ever scarcer water resources.

Even if Saudi Arabia would increase production by about 2-3 mb/d(which is probably most they can achieve now), it would still make very little difference due to their own increasing consumption as well as the higher world demand.

We are going to see a lot more of these articles in the next 2-3 years with furious pushbacks from the vested interests until it simply becomes plain Saudi Arabia is what they were always described by independent analysts: liars and overestimated producers.

I thought it was painfully obvious in 2008, while prices were going up and KSA was drilling > 500 new wells without any increase in production, that they were tapped out. Since then they have placed a new relatively small field into production, and Ghawar has gone into big time depletion. Net result seems to be steady to slightly diminished production, and little if any excess capacity. At least that is the way reality looks from the universe I live in, where actions really speak louder than words. Also, notwithstanding the statements of Aramco officials, Saudi princes and EIA and IEA (and EIEIO).

Craig

You just took the words out of my mouth.

And now we know, which we've known all along, why the Saudis did not produce any significantly more than they had

We, the shepherds of the oil for the people of the Kingdom of Saudi Arabia produced no more than there was market demand for at the price offered thus showing how well market economies work.

And you do not know, you are only repeating a theory about what the mentally unhinged think the Kingdom of Saudi Arabia is conspiring to do.

And now we also know why the total secrecy.

Once again, you do not know nor do you understand market economies. Firms do not release all their information to others, so why in a functioning market economy would you expect that we would release information you do not need.

It is like you think we are conspiring to keep you in the dark - and only the mentally unhinged engage in conspiracy theories no?

Resource wars etc.

Why would there be wars over resources, is not the leader of the free world a man of peace? He has a prize to show his peaceful nature.

Saudi Arabia is what they were always described by independent analysts: liars and overestimated producers.

You meant to state the unhinged conspiracy theorists, for we in the Kingdom of Saudi Arabia produce to meet market demand. And in a market economy, you need not worry about access to resources as there will always be a supply for the market price.

Praise be to Allah.

Signed - KSA spokeman.

http://blogs.wsj.com/source/2011/02/09/saudi-oil-reserves-and-the-wikile...

So there you go.

What's ironic is that the accuracy of the WikiLeaks cable (WikiLeaks cables: Saudi Arabia cannot pump enough oil to keep a lid on prices) is self evident when one looks at Saudi net oil exports versus US annual oil prices.

Party On Dudes! My Iron Triangle thesis:

http://www.theoildrum.com/node/2767

"...what I really meant to say was...."

Is that the same Wall Street Journal that mis-reports climate science 93% of the time?

WSJ reports selected items, based on what they and their sponsors want reality to be. Their sponsors also support conservative 'think tanks' (an oxymoron, IMO) that selectively find data in context that would improve the markets for their providers. These data are then reported by WSJ, on a selective basis, to maintain the status quo and to make sure BAU goes ahead without interruption.

WSJ makes money doing this... it is their rationale and their raison d'etre.

Craig

Excellent. With a re-definition as "oil in place" everything falls into place:

I was immediately puzzled when I read in the 2007's cable that al-Saif talked about

"total reserves, of which 51 percent are recoverable". This would be a contradiction in itself as reserves are defined as the recoverable part of the oil in place.So I can well imagine that the dipomats have no clue about these definitions and mixed up reserves, resources, oil in place etc like most others do, sadly - thus resulting in an unvoluntarily inflated number.

And I can even imagine that the probably inflated official reserve number is the result of such a "confusion" - and Aramco not bothering to correct it.

So we can be glad that WSJ journalist asked back to get the right wording - but sad that he didn't understand what this means.

And obviously they didn't read the cables in detail, because the do contain new information. For me the most alarming news is from the 2009's cable:

This goes in line with a comment about KSA classifieds at Gail's Wikileaks Wish for Oil Data last October. Gail may check back how far her wish is satisfied now ;-)

BTW: There seems to exist a separate telegram (septel) about the heavy oil stuff. I hope that more info about this issue will be dug out, too

The Iraq situation throws a spanner in the works as far as the Saudi's are concerned.

Traditionally the Saudi's have maintained a substantial 'reserve' production capacity, but with Iraq green lighted to produce 'all they can' then the Saudi's are reluctant to spend a lot of money on 'reserve' production capacity without the Iraqi's agreeing to production quotas.

It's always useful to look at the data. Iraqi net oil exports fell in 2009, and they were probably flat to down in 2010.

No, you don't understand. Spare production capacity is not something you need to spend money on, it is something you just open a valve and deliver. From 2004 when Saudi was producing about 9 mb/d:

Spare world crude oil production capacity

Now since then the IEA has greatly expanded Saudi's spare capacity and they have defined it as oil that could be brought on line within 30 days. That is still oil that does not need to be drilled but oil already available if needed, not something that Saudi would need to spend a lot of money on at all. Well, not right away anyway. The drilling would come later if they decided to hold production at that level.

Ron P.

The sky is falling, the sky is falling!

The story says that the Saudis claim 716 Gb of oil which is overstated by 300 Gb. Of that 50% is recoverable or 208 Gb per

al-Husseini. I think the BP 2010 gives Saudi reserves as 264 Gb.

Saudi Arabia produces 9.7 mbpd ~3.5 Gb.

Then there's the part about the 15 year plateau followed by a slow decline; 208 Gb = 15 x 3.5 Gb/yr + .5 x 3.5 x 90 years or about 1% per year straight line decline.

Saudi Arabia is still very big and will produce a lot of oil long after we're all dead.

And so the Saudi oil Death Watch goes on.

Agreed. WHT's decline chart above is about 1% per year (about 0.82 Mbpd) straight line decline from 2010 to 2050. For the whole world.

In the best of cases that would be what might happen. But it is extremely unlikely that this will happen. Once the decline becomes obvious then you will get hoarding as well as other things, other than natural decline, that will affect oil production and oil particularly exports.

The decline as well as the collapse that follows will, very likely be, herkey jerky, nothing smooth or straight line about it.

Ron P.

So true maj. Just like the U.S. is still the third largest producer of oil on the planet after over 100 years of production history and many hundred of thousands of wells drilled, depleted and abandoned. And will still "be producing a lot of oil long after we're all dead". Unfortunately that "lot of oil" won't be sufficient to keep all the economies humming right along just as the oil we, the third largest oil producer, cannot met all the demands of our own economy. So the question IMHO isn't really whether there is a lot of oil left to produce but rather who will be using that oil. "A lot of oil" is a lot of oil for sure. But it's still won't be enough for everyone.

The Persian Gulf region is an ocean of oil, a geological freak

(bigger even than Texas) but our consumption rate is a bigger freak.

The Saudis/OPEC won't raise production to fight Peak Oil but will putt along for the next 15 years.

In 2050 with +9 billion humans , when I'm dead the world will be down to ~50 mbpd, still a lot of oil, as much as was pumped back in 1970 when there were 3.7 billion humans.

Sometimes I think we should look at bpd per person to get the right perspective.

The only thing that could change this is unconventional oil--Orinoco, oil sands and shale.

People complain about the energy density of ethanol(coal and C/LNG have comparable density) but ethanol will look like gold when oil runs out.

There's nothing like it which is why I think we're totally stuck with unconventional oil.

IMO oil and FF are more valuable as plastics than fuel but Katie bar the door when oil gets scarce.

People are addicted to it.

With the addition as inserted, I agree. 'Though I don't think we'll be getting to that 9B...

Rockman, Westexas, Darwinian or anyone - how does the OOIP for the US compare to the OOIP of KSA? I've googled, but OOIP brings up nothing pertinent. Not that I try to educate people much anymore, but when the mood strikes, it occurs that a useful tool might be the ability to point out that the US originally had nearly as much/more(?) oil as KSA, and look at the production curve...

Any data/sources would be appreciated.

What KSA will produce has been done to death here, if it's 10mbld or 12.5mbld it really does not matter. Europe and the U.S. will not see very much of it in the future.

http://blogs.wsj.com/chinarealtime/2011/01/18/road-building-rage-to-leav...

China spent the same amount building roads as the States did on it's military, who is looking after it's citizens best?

http://en.ce.cn/Insight/201102/10/t20110210_22201313.shtml

14 million poor Chinese bought cars last year, the question is no longer high production can go, in other words, how much we can use, but how little we need to run our society.

Not yet seen a good article about China done here, why is that?

If this is a response to my comment/question, I don't see how, really.

And I'd say that neither China nor the US is looking after its citizens' best interests, via military spending or road building.

Did you united states oil ooip - Google Search? Perhaps this isn't "pertinent," but some 2006 article in the first dozen hits refers to US having 582 bbo. Some other hit from NETL says 600. Not a database of course but hey.

What I'd like to know is how much of the US story can be chalked up to our unique mineral rights laws, and all the stripper well production therefrom; and how much of a liability that will be to other nations. Perhaps a study has been done already, in the SPE or the like.

"via military spending or road building"

I recall that road building in USA was given a big push during the Eisenhower administration. The expense was justified as a military defense measure. The Chinese maybe have just as confused a government as USA. A good article about both China and USA could be very interesting reading.

Seems so, and also: the U.S. has a lot of private companies or people that can afford to extract from very small fields. Fields that the IOC's and NOC's have to leave undeveloped and not even are searching for. Some time ago I also was wondering why articles mention that the U.S. has only a few percent of world oil while still producing so much oil. Part of the picture is those private investors and the other part is that a lot of other reserves are inflated, especially in the Middle East. I leave it to the geologists to explain why the Middle East could potentially contain a lot more oil than most other places in the world.

US known reserves = 21 Gb US (BP says 28 Gb) unknown potential is 49 Gb.

The extraction rate for the US is probably around 50% on average

so OOIP might be 140 Gb.

Not including 400 Gb of Colorado oil shale.

Saudi Arabia seems to claim 467 Gb of reserves. This might be OOIP, who knows. BP says their reserves are 264 Gb.

http://en.wikipedia.org/wiki/Oil_reserves

http://www.bp.com/liveassets/bp_internet/globalbp/globalbp_uk_english/re...

You're welcome!

I'm not sure if ethanol will look like gold then. Could be that when oil production declines it becomes obvious how small the contribution from ethanol really is, Brazil excluded. Especially crop yielded ethanol will come more and more under pressure when food gets more expensive and unemployment rises.