Saudi Oil Production and Reserves - Reasons Behind Wikileaks Concerns

Posted by Gail the Actuary on February 9, 2011 - 11:54am

The UK Guardian published an article yesterday titled WikiLeaks cables: Saudi Arabia cannot pump enough oil to keep a lid on prices, talking about the possibility that as soon as 2012, world oil production may begin to decline because of "peak oil". Saudi Arabia may not be able to raise production as much as claimed, and its reserves may be overstated by 40%. Leanan has put together a post with more about the cables. The Wikileak cables can be found here or here. In this post, we provide a few graphs, plus some links to (and excerpts from) prior posts by Oil Drum staff members about Saudi Arabia's true situation.

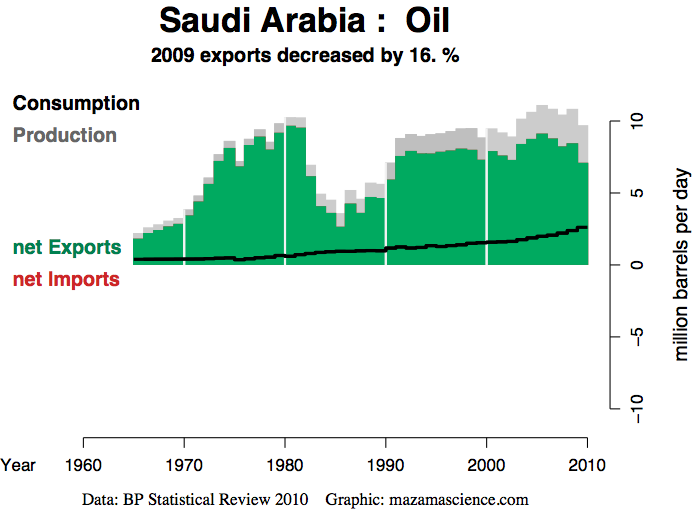

Saudi Arabia tells us that they have lots of oil, but if we look at graphs of their historical production, there is nothing that looks like an upward trend. In fact, recent production is lower than it was in the late 1970s and early 1980s. This is a graph of Saudi oil production, consumption, and amount of net exports, from Energy Exports Databrowser.

Exports, in green, are down because Saudi Arabia is consuming more and more of its own oil, so there is less available for others. This graph doesn't fit well with what we have been told.

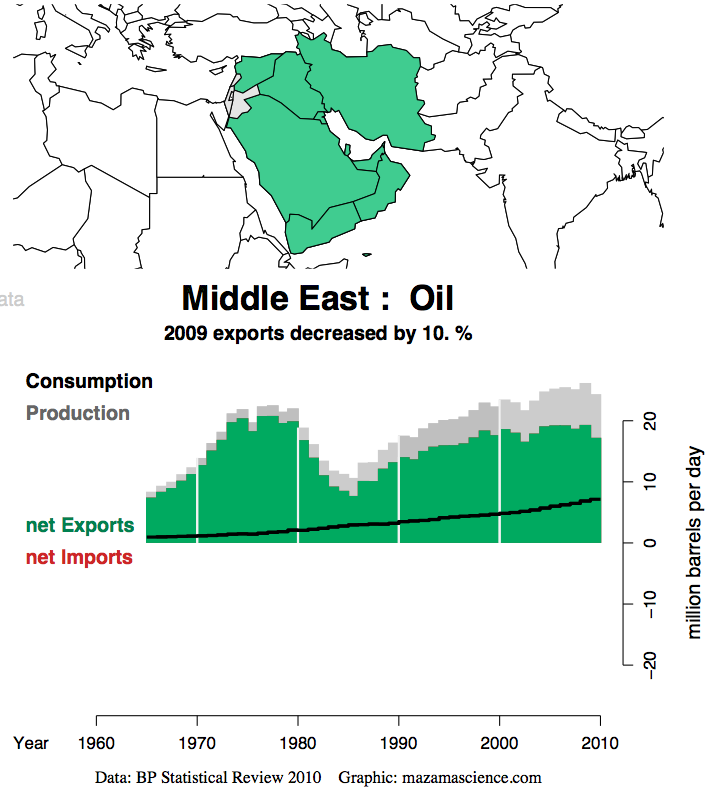

The rest of the Middle East claims huge reserves, too, but looking at the Mideast in total doesn't give a much more favorable picture. While production is a bit higher in total now, exports (in green) are down from the 1970s because of rising consumption.

It is almost certain that the Saudis are overstating their capabilities. The reserves for Saudi Arabia and the rest of the Middle East are not audited, nor are their supposed "spare production capacities." They may have some spare capacity, but not the amount stated. When oil prices spiked to $147 barrel in July 2008, Saudi Arabia and others in the Middle East increased their production a bit, did not really come through with a huge surge in production, the way one would expect from their suppose spare capacity.

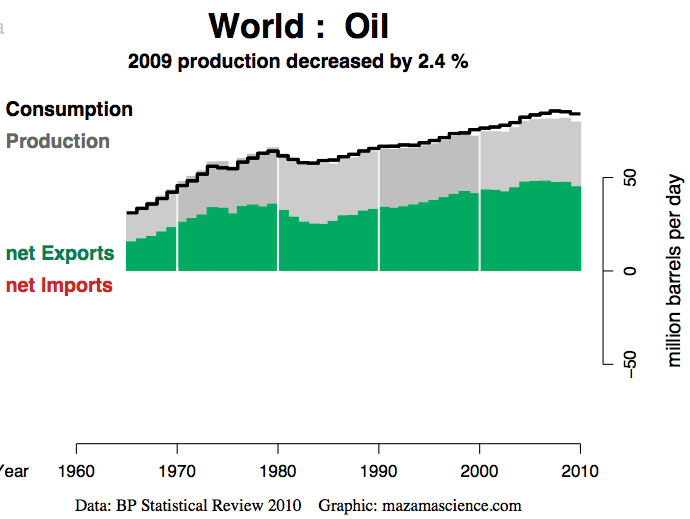

World oil supply has been roughly flat since 2005. Many are concerned that oil production will actually begin to fall in the next year or two - what is referred to as "peak oil" in the Wikileaks cable.

Links to a Few Posts Relating to Overstatement of Saudi Reserves and Production Capability

The Oil Drum has published many posts over the years relating to Saudi Arabia and the rest of the Middle East's likely inability to produce as much oil as they claim they can. These are excerpts from (or comments about) a few of them. Click on the titles to access the posts. You can access other posts by the same author by clicking on the person's name.

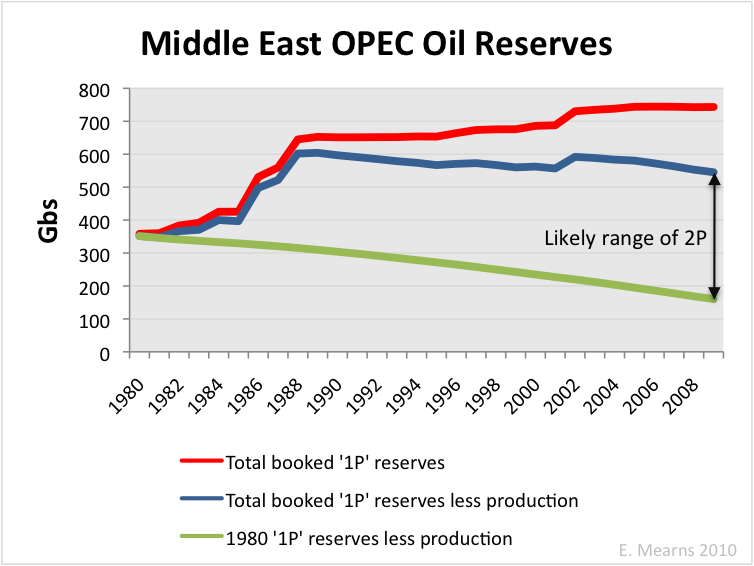

1. Euan Mearns-- Middle East OPEC Reserves Revisited-- December 3, 2010

Euan explains why Middle East OPEC reserves are likely overstated, and shows this chart of likely reserves at the 2P (that is, expected) level:

2. ace--Saudi Arabia’s Crude Oil Reserves: Particulars or Propaganda? June 15, 2008

Saudi Aramco has effectively used propaganda methods for at least the last fifteen years to convince many governments, corporations and individuals to believe their statements. However, Aramco’s statement that it is the world’s leading oil producer is now false as it now second after Russia since 2006. Nevertheless, Saudi Aramco’s repeated statement about remaining recoverable oil reserves being 260 billion barrels (Gb) is still generally accepted.

In 2004, Saudi Aramco stated that its oil initially in place (OIIP) has been growing steadily since 1982. There is considerable doubt about the validity of this increase, given the lack of new oil discoveries and the unusual nature of its steady continuous increase. Aramco stated the OIIP was 700 Gb at year end 2003 while a more realistic estimate is 580 Gb.

Aramco may have some high recovery factor fields such as Abqaiq and Shaybah, but an average recovery factor range from 30-37% is assumed for the total OIIP in Saudi Arabia’s fields. The trend of the recovery factor for Saudi Aramco indicates that there has been no effect on the recovery factor by recent technological advances in producing wells. Saudi Aramco has kept remaining recoverable crude oil reserves constant simply by artificially increasing the OIIP each year since 1982, accompanied by an unrealistically high average recovery factor of 52% since 1988.

3. Gail the Actuary -- President Bush Questions Saudi's Ability to Raise Oil Supply--January 17, 2008

Last night, on ABC's Nightline, Terry Moran interviewed President Bush in Riyadh, Saudi Arabia, during his trip to the Middle East. When discussing what President Bush might say to the King of Saudi Arabia to lower oil prices, George Bush said:

If they don't have a lot of additional oil to put on the market, it is hard to ask somebody to do something they may not be able to do.

We published a Press Release about this post, also.

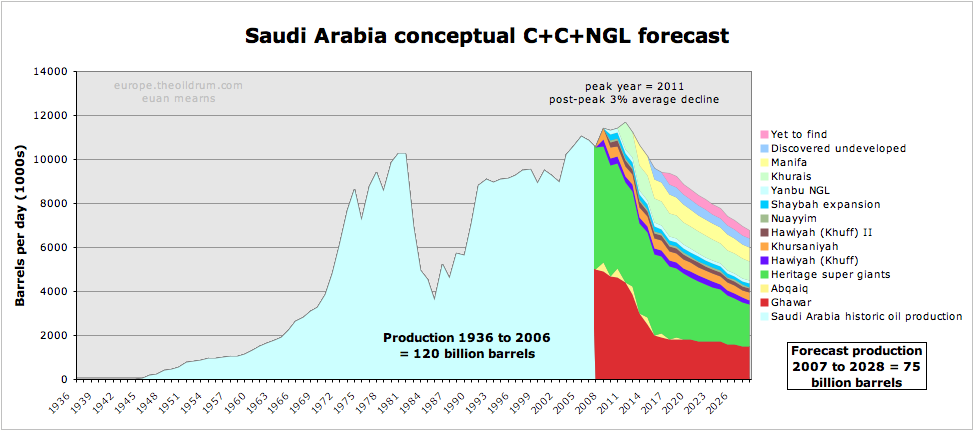

4. Euan Mearns - Saudi Arabia - production forecasts and reserves estimates--August 30, 2007

This forecast for is on a broad basis (Crude and Condensate and Natural Gas Liquids) for Saudi Arabia.

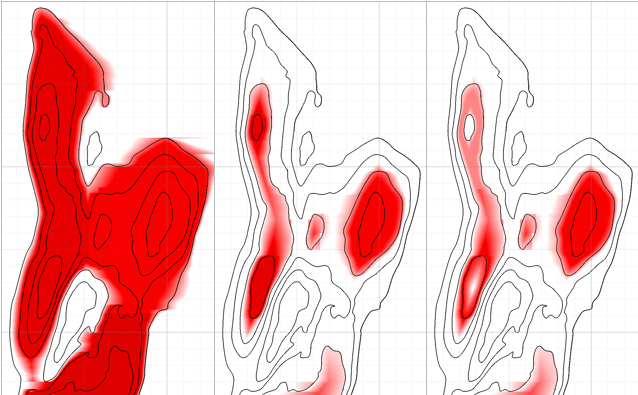

5. Stuart Staniford -- Water in the Gas Tank--March 26, 2007

Forensic analysis regarding how the oil/water mix that is extracted seems to be changing to more water, less oil in Saudi Oil fields. The red portions of the bands are oil.

6. Stuart Staniford--Depletion Levels in Ghawar--May 15, 2007

An attempt to understand depletion levels in Ghawar.

7. Joules Burn--IEA World Energy Outlook 2008 - Fuzzy Focus on Saudi Arabia--November 18, 2008

Throughout the 2008 WEO, Saudi Arabia is cast in a leading role -- both figuratively:

On present trends, just to replace the oil reserves that will be exhausted and to meet the growth in demand, between now and 2030 we will need 64 mb/d of new oil-production capacity, six times the size of Saudi Arabia’s capacity today.

(from the Forward and Executive Summary)

and literally:

Saudi Arabia remains the world’s largest producer throughout the projection period, its output climbing from 10.2 mb/d in 2007 to 15.6 mb/d in 2030. (Executive Summary, page 40)

Blackwhite: In Orwell’s Nineteen Eighty-Four, a word that has two contradictory meanings, used to convey how people have been propagandized to believe that black is white while never realizing that the reverse might be true. It is the ultimate achievement of newspeak that requires a continuous alteration of the past made possible by a system of controlled thought.

Maybe he was trying to say that he doesn't believe that peak oil (the observable phenomenon) constitutes a theory.

You beat me to the punch. In terms of semantics and language lawyering, he can easily argue it that way.

Perhaps a simpler explanation : he doesn't believe oil is going to peak for a very short while, followed by massive destabilization and breakdown of civilization. He seems to especially take affront to the breakdown part.

I seriously doubt many people would consider his view "plateau for 15 years, followed by slow decline, with oil replaced by something else" a reasonable "peak oil" view.

Or maybe he meant that he does not subscribe to peak oil theory (a sharp peak followed by decline) . . . but instead plateau oil theory. In any case, the sentence contradicts itself and is thus useless.

He has got a point only in so far as there is no real formal theory behind peak oil. It is just a heuristic as it stands. What I tried to do in The Oil ConunDrum is to place the argument within a strong mathematical foundation. The classical Hubbert heuristic may be strong and real but it never had a basis of a formal proof, which is how most scientists define a theory. This may sound like nit-picking but cornucopians will use the theory marginalization as a counter-argument so we have to get used to their talking points.

I'm with Euan here.. he might as well have said

"I don't believe in peak oil instead I think oil will reach a maximum production level then decline"

the theory caveat is weasel words on his part.. in my shabby but honest opinion

btw enjoying your oilcondrum thing

Of course, in Newspeak, "2+2=5" is a nice way to describe Saudi Reserve #s as well..

A pretty straightforward interpretation:

"Peak Oil" proposes that the peak in oil production is very near and that decline will be sharp, while he's saying that decline won't start for about 15 years.

When he says he doesn't subscribe to the theory of "peak oil,", followed by a projection of a peak we need to think about what he means by theory of peak oil. It might be that the thing he doesn't subscribe to, is that peak oil will have calamitous impacts for civilisation, rather than the simply peaking in supply-rate itself.

I suspect you may be on right track here Chris.

Again, I'd say the obvious interpretation of what he's saying is simply that he disagrees that the peak will be soon, or that the decline will be rapid.

So, in his mind, "Theory of PO" = early peak and fast decline. "Not subscribing to PO" = later and slower.

Really isn't that pretty obvious? We've had all sorts of oil executives saying in the last 10 or 15 years that they expect oil to peak sometime in the next 50 years, but that they "don't subscribe to Peak Oil".

Peak oil is really the study of oil depletion. People should refer to Olduvai Theory or something similar to evaluate any dire ramifications. At least that's the way I tend to compartmentalize my own thoughts. It's not really smart to conflate the two because there are also Peak Oil optimists who think a not-so-dire renewable green revolution may occur.

Yes and no,

They are separated into different compartments in my mind but not in the minds of others. What the phrase 'peak oil' means is much vaguer then one usually supposes. Language is consensus based but there is no official arbitrator of what the consensus actually is.

In my mind peak oil means that any use of a finite resource will at some point reach a maximum. Its a logical certainty and I was tempted to object to your formal theory/heuristic up thread on that note but it seemed like splitting hairs at the time. Others may think of peak oil as a predictive model of how and when we will produce crude oil in particular or fossil fuels in general. Still others may understand peak oil to mean an unplanned energy descent and the ensuing chaos. There are lots of finer points mixed in like tar sands, oil shale, unconventional oil, biofuels, easy oil, cheap oil, net energy, the halfway point, and the associated economic consequences.

This is may seem like just semantics, and it is, but it needs to be understood because constructive dialog is only possible when people share an understanding of some kind.

Constructive dialog works well, and the way to solve problems usually involves some sort of divide and conquer strategy.

WHT, exactly correct. In fact there are some, (I count myself among them) who see "peak oil" not as a crisis per se (unless through policy errors and poor planning we make it a crisis) but instead see it as a transition, and one that any thinking person MUST have known was coming from the first day we began burning/consuming oil.

In one week it will be 5 years since I posted my first comment here. I said soon after that first post that if peak oil did not occur before roughly 2012 and if the decline was not very steep, almost no one would even notice peak oil had occurred, so fast is the technological development reducing the need for oil as the primary fuel of future economic growth. with each passing day, I am more and more certain of my original view. Economically, the coming demand side crash will be the news of the decade. We are indeed in fascinating times.

RC

Roger, that's 4 years 31 weeks for me. You are indeed an old timer.

Question is, would it happen if we could pump 150 mmbpd at $20 / bbl? This side of the pond the powers have done everything to stimulate growth, with some success, and now their attention is returning to energy prices perceived as a threat to that growth.

I'm less optimistic than you are about our ability to adapt - to higher energy prices and lower energy quality - but this depends on what is meant by "less" and "optimistic". Individual's and society's ability to adapt is often underestimated. I think we are in for 10 to 20 years of change - with a few black swans thrown in for good measure.

I think you are ignoring the many developing countries that are now feeling the pain and are being severely priced out of the market. Not in terms of C+C, but refined product, energy AND commodity whose value is underscored by the price of energy. Think food riots, petrol shortages etc......Most of this crap is being deliberitley shunted down the press list.

I am sure you are very comfortable in your western middle class bubble but look at the bigger picture (same as many of us here myself included i'm sure).

Marco.

I don't want to minimize the impact of higher energy prices, but what I found surprising is that it appears that the developing countries are outbidding the developed countries for access to oil imports. Normalized oil consumption (1998 levels = 100, EIA) for five oil importing countries:

Note the steady increase in Chindia's combined net oil imports, expressed as a percentage of global net oil exports (and note the increase in the C/P ratio for oil exporting countries):

If we assume a 5% decline in production among the oil exporting countries from 2005 to 2015 (0.5%/year decline rate), and if oil exporting countries' consumption continues to increase at their current rate, and if Chindia's net oil imports continue to increase at their current rate, then Available Net Oil Exports (exported oil not consumed by Chindia) would drop from 41 mbpd in 2005 to 27 mbpd in 2015, a decline rate of 4%/year.

I don't want to minimise the impact of your graphs but it appears that your graphs do not reflect the situation 'on the ground'. Maybe you should stand in a big food/fuel queue in one of those developing countires with a big placard with those graphs on them - that will get them back to our reality! You think they are all going to walk away saying "see told you there was plenty".

Bottom line is the metrics don't give us a full understanding of the problem. That's why the media are able to essentailly shut the problem out. Lots of nice figures to hide behind.

Quick edit as I feel my response was anecdotal: just checked google news for food and fuel shortage stories along with high wheat/ sugar / grain prices etc...You eventaully build up a good picture of where the problems are nad is sure as heck aint the developed countries. Now i'm prepared to admit some in the list appear to have political casues but I think that they still stem from the underlying high cost of energy.

Marco.

Marco - It seems to me that you and wt are making the same point. When I see his graphs I picture developing societies forced to out bid developed countries for energy resources for a simple reason: survival. As you point out many in these societies often exist at a near subsistence level. Who will be willing to pay more for an energy resource: a person wanting a $5 cup of coffee or someone trying to send their children to bed with something in their stomachs? Or more simply: an American can more easily give up that high priced java for one day than a Chinese father deciding to not feed his family for one day. Even more to a point: which govts will be bidding higher to attain enough resources to keep a growing and increasing more distraught public becoming more radicalized?

It seems you take wt's chart to indicate some level of prosperity. I see them as an indication of desperation. If you've ever watched two animals fight over a bit of food typically the hungrier one wins out. In the end it's all about motivation IMHO. Developing countries are much more motivated (as measured by actions...not verbiage) than the developed countries IMHO.

Great minds think alike, or on the other hand, perhaps we have lost similar amounts of brains cells due to sitting in a trucks in freezing weather, on drillsites in some remote corner of the Oil Patch. I decided that I had done enough field work, when I woke up after sleeping in my truck to find that moisture from my breathing had frozen to the inside of the windows.

Wimp. You know it's getting cold when you are driving along and the small area of the windshield that the defroster is keeping clear keeps getting smaller and smaller as you drive along. Eventually you have to drive with one hand while continuously scraping the windshield with the other to see at all. What you see is not particularly encouraging, usually involving large trucks upside-down in the ditch.

It's particularly bad when they don't put a scraper in the truck, and you have to scrape the windshield with a credit card. This is very hard on credit cards, but they are still useful for opening the door of the construction camp when you get there and find it is locked and no one is around. Only occasionally we did use our company credit cards for buying something, because there was usually nothing to buy.

And then there was the odd occasion when we called up the car rental company and said, "Your car is 400 miles up a dirt road, it has four flat tires, and the carburetor is cracked. Good luck!" Ah, the good old days, how I miss them, NOT!

I suppose that we could agree that real suffering is occurring in many developing countries, even as many developing countries show a long term increase in oil consumption, despite a generally rising oil price trend. I frequently compare two petroleum consumers--a real estate broker in Dallas, who needs to buy fuel for his SUV, in order to show prospective buyers McMansions in the Dallas area, versus a farmer in Kenya who needs to buy fuel to irrigate his fields. IMO, despite the suffering in Kenya caused by rising oil prices, the data suggest that the African farmer is effectively outbidding the Dallas real estate agent for access to petroleum.

In any case, the poor in developed countries are certainly being affected too:

http://www.huffingtonpost.com/2011/02/09/obama-poor-energy-cuts-kerry-le...

Obama To Cut Energy Assistance For Poor; Kerry Urges Him To Reconsider

An interesting coincidence regarding global net oil exports--If we extrapolate the recent rate of increase in Chindia's combined net oil imports, as a percentage of global net oil exports, Chindia's net oil imports would approach 100% of global net oil exports around 2025 and if we extrapolate the rate of decline in the US C/P ratio (below 100% means a net oil exporter, above 100% means a net oil importer), the US would be approaching zero net oil imports around 2023.

I'm scratching my head trying to understand the significance of your last point: presumably it's the slack in the system that is allowing the US C/P ratio to decline ie a shed load of 'stuff' consumed and burned that isn't really necessary for survival?

So this means that global energy/capity will all tend to the same value. However I would argue that the developing countries that you've picked out ie ChIndia are in a far stronger postion to be able to increase their energy/capity than most other 3rd world or developing countries.

So that the energy/capity is only going to start to balance out in only the developing countries with the higher growth rates. One would think.

Marco.

Freedom!

http://www.energybulletin.net/stories/2010-10-18/peak-oil-versus-peak-ex...

I'll use the same argument I use in regard to objections to the ELM--I keep getting qualitative objections to a quantitative model, so I ask for some quantitative counterexamples.

Up the thread, I showed oil consumption for four non-OECD countries from 1998 to 2009. I used 50,000 bpd as a minimum consumption level in 1998. US oil consumption in 2009 was below our 1998 level. Why don't you find four examples of non-OECD countries whose consumption in 2009 was lower than in 1998? Or better yet, why don't you compile 1998 to 2009 consumption numbers for all non-OECD countries, with 50,000 bpd or more of consumption in 1998?

Here is a good place to start:

http://tonto.eia.doe.gov/cfapps/ipdbproject/IEDIndex3.cfm?tid=5&pid=54&a...

And here is a quick recent snapshot (looking at total oil consumption) from 2006 to 2009:

OECD consumption fell from 50 mbpd to 46 mbpd, while Non-OECD consumption rose from 35 mbpd to 39 mbpd. This apparent ability of the developing countries to outbid developed countries is what I call ELM 2.0.

OK, en garde!

Central and S.America:

5.4mbd to 6.1mbd increase of 11.2% BUT popluation increased by around 5%. ie gain of about 6% enrgy per capita.

Africa

3.0mbd to 3.2mbd increase of 6% BUT popluation increased by 10% ie loss of about 4% energy/capita.

I know thats not 4 examples - actually 2 continents but the point i'm making is that any net gains in oil don't neccesarily translate as net gains in energy/standard of living and we know the 2 are closely dependent.

Marco.

I have cut our "loafering" trips to town from five or six a month to one or two as our income has declined and our expenses have gone up;shopping is now consolidated with necessary business trips, and pleasure drives are rare instead of frequent.

We traded to down size every time we have bought a vehicle since the seventies, except for the necessarily big ones used for heavy duty fetch and delivery work.

But our consumption of fuel for actual farm work is increasing, per unit of output, as we find ways to substitute mechanicalpower for labor and chemicals.

Even at ten dollars per gallon, diesel fuel would only a trivial amount, relatively, to the cost of producing an acre of corn or beans or apples.You only feed a tractor or farm truck while it is actually working, rather than daily 365 .....

Even in a depressed or emerging economy, the utility of oil is such that even impoverished people who use it for critical business purposes can easily outbid those who use it extravagently, such as a real estate agent. Houses will still sell if agents don't ride customers around very much, but crops won't make it to market without fuel;delivery correlates almost perfectly with fuel used for that purpose..

Given current food prices, you could easily pay twenty dollars per gallon for diesel to run an existing big truck to deliver grain cheaper than you could feed slaves to deliver it with cargo bikes.If each biker could haul five hundred pounds, and make a round trip of one hundred miles, it would take thirty bikers to deliver fifteen tons per day.I doubt if even an Olympic class athlete could manage this for more than a few days even on a good level paved road.

Such a truck can haul fifteen to twenty tons at a fuel cost of about ten to twenty gallons depending on the driver , the truck, and the roads in question;twenty gallons implies third world roads. Can you feed, clothe, house, and supervise thirty slave laborers for two hundred dollars a day? Keep in mind that as fuel prices rise, so will food prices.

Demand destruction can destroy a business as usual economy withoput a doubt;but in the economy that arises afterword, diesel will be p for all intents and purposes invaluable, so long as there are still machines still in operating order on farms and maintaining water systems, etc.

I would gladly pay a thousand dollar for a fifty five gallon drum of diesel if I seriously thought it might be the last diesel available for a couple of years-or five thousand if it would be the last barrel EVER available.I could jury rig a tractor and truck to run on homemade moonshine with just a tiny bit of diesel for ignition, and that barrel would last a very long time.

Biodiesel- I don't know how to make it, and don't grow the right feedstock crops , and there might not be any available for purchase at any price whatsoever.

There certainly aren't enough draft animals around to buy one for a price less than that of an attractive virgin daughter if tshtf in a dramatic way.

In the event that oil supplies become really restricted, the price of oil can cruise right on past two hundred dollars like "a steam car passing a tramp".Assuming enough bau survives to pump and deliver it of course.

The emerging economies basically have enough bau to pay two hundred dollars for oil to run their farms now.It would still be cheaper for them than using draft animals.

Some may find this programme relevant to the discussion.

http://www.bbc.co.uk/iplayer/episode/b00ykxg9/The_Chinese_Are_Coming_Epi...

The examples I often use are a greeter working for minimum wage at a Wal-Mart in Houston versus a software design engineer in an offshored IBM development shop in Mumbai. The Wal-Mart worker is driving 20 miles each way in a beat-up Ford F-150 truck with a badly-tuned V8, whereas the IBM software engineer is traveling 10 miles each way in a four-cylinder turbocharged diesel mini-van shared with 10 other people. Who do you think is better able to afford high-priced fuel?

These are extreme examples, but the point is really that fuel consumption in many developing countries is very high-value compared to that in the US. They can outbid Americans for scarce oil supplies if they have to.

As I said up-thread, I find "out-bid" to be a peculiar word.

If a realtor switches from an SUV to a Prius, they get around just as well, but use 25% as much fuel and reduce their fuel cost back to what it was when gas was $.75 per gallon. Has the realtor been "out-bid", or just gotten more sensible?

Nick, your point is exactly correct, but why go so down market as a Prius when said realtor could simply switch to say a Lincoln hybrid and get 40 miles per gallon, and travel up to 47 miles per hour in all electric mode.

40 mile per gallon luxury cars are becoming as common as cars with automatic transmissions, and we just now only at the front end of the development curve! The potential out in front is astounding. Major firms such as Toshiba, IBM and Johnson Controls are working on battery chemistry promising up to 10 times greater energy density per pound than even the best current lithium ion batteries...this would indicate theoretical possibilities of a car with 1000 mile range on electric, or 400 mile range with no increase in weight over a comparable gasoline powered car. We have not even touched the area of using natural gas turbines as the recharge engine. The confluence of technology is no longer "coming" it is HERE, now. Materials sciences are moving along so rapidly that even if the pace of development were to slow from the pace of the last decade by half, we would still be facing one of the most astounding periods of technical development in history. And China and India are right in the center of it, often leading the West in these areas.

Get ready for what has in prior years been called the "gale of creative destruction", but this time on a scale (world wide, developing nations included) and a pace (far faster than even the 1980's and 90's) unthinkable only a few years ago. Everyone will be involved in one form or another by this technical/economic/cultural revolution. And again, we are only at the very front of the massive changes coming.

This, it is exactly THIS that is fueling the political and cultural revolution in Egypt. Smart young Egyptians and other developing nations youthful populations are terrified, not of their old tired reactionary governments, but they are terrified of being LEFT OUT of the upcoming age of change, technology, prosperity and excitement. In America we don't really care, we are mostly old and past our prime, but for the hungry and ambitious youth of the developing world, being left out is terrifying. They will risk their lives to stay up to speed, because they know if they fall very far behind, they will likely never be able to catch back up.

RC

Hey Roger, great to see you commenting again!

John, member for 5 years 23 weeks

I agree - things are changing fast. The faster the better.

I hope to have a very wide range of EV, EREV and PHEV choices the next time I buy a car.

Chris, I don't know of anyone, even among the peak oil community, that would disagree with that. The peaking of world production will have no effect other than the price of oil rising to around $100 a barrel. Hell, that's where we are right now. And peak oil is also where we are right now. And just look around, there appears to be no calamitous impact on civilization. That won't come for several years yet... after we are a ways down on the decline curve.

Why on earth would anyone think anything calamitous would happen at the peak? It hasn't has it?

Ron P.

Reminds me of Bill Clinton's memorable phrase: "It depends what the meaning of "is" is. http://www.slate.com/id/1000162/

I read the Guardian article and then decided to see if it was also reported in any of the US press. Found nothing so far in NY Times, Kaplan Test prep, USA Today, or the consolidated news of Google.

Maybe its just me, but I think this is a real important story.

"These are not the droids you're looking for; move along."

I believe there will be much more news in the coming days as this spreads. Most journalists have no idea how important that Middle East overstated reserves really is. I have heard nothing on CNBC this mornitn however. News.google.com turned up a few in addition to the Guardian article.

Here's Why You Don't Need Wikileaks To Know That Saudi Oil Reserves Are Overstated

U.S. sees Saudi oil reserves as overstated: report

That being said this is really nothing new to TOD readers. Sadad al-Husseini's views have been posted here for years.

Ron P.

It's on Drudge this morning. That's significant.

Very credible story on Al Jazzera/English right now. Now that the Egyptian news has slowed down, they are cycling through features and world news so lots of people should see the report.

http://english.aljazeera.net/watch_now/

There were some brief comments about the Guardian story this morning on NPR (National Public Radio in the USA).

Of course, Sam Foucher and I have opined on this topic once or twice.

http://www.energybulletin.net/node/16459

Texas and US Lower 48 oil production as a model for Saudi Arabia and the world

May, 2006

Texas & Saudi crude chart, with updated Saudi points for 2006 to 2010:

http://www.energybulletin.net/node/38948

A quantitative assessment of future net oil exports by the top five net oil exporters

January, 2008 (2007 ASPO-USA Presentation)

Actual Saudi production, consumption and net export numbers (total petroleum liquids) and Sam's projections for same, with updated points for 2007, 2008 and 2009:

And a recent essay on Peak Oil Vs. Peak Exports

http://www.energybulletin.net/stories/2010-10-18/peak-oil-versus-peak-ex...

A fair consistent rule of thumb appears to be that half of a region's post-peak CNE (Cumulative Net Exports) are shipped only one-third of the way into the net export decline period. In the case of the 2005 top five net oil exporters--Saudi Arabia, Russia, Norway, Iran and the UAE--Sam's most optimistic projection is that they will have shipped half of their post-2005 CNE by the end of 2014.

The ELM model is very powerful as an explanatory tool. But note that it does not account for the natural feedback loop which occurs as prices rise: it becomes cheaper for oil intensive industries to relocate or develop from within the oil rich nations, thus increasing consumption at an exponential rate. This appears to be happening to a small degree now, and may explain why the actual consumption figures are at the high end of the band. There would also be a wealth effect, as prices rise, leading the oil exporter to consume even more. And finally, expect the oil exporter to spend even more energy on exploration and development of remaining reserves. I would expect all three factors to become magnified, as the supply crunch becomes more and more pronounced-- meaning that for an early peaking country, like UK, the slope is flat for consumption increase, but for a late peaking country, like KSA, the slope will go more aggressively parabolic than anyone imagined.

Also, the UK taxes energy consumption, while Saudi Arabia subsidizes energy consumption, at least at the consumer level--But in any case, unless an oil exporting country cuts consumption at the same rate as the production decline rate (or at a rate faster than the production decline rate), the net export decline rate will exceed the production decline rate, and the net export decline rate will accelerate with time.

WT just a question I am pondering. Where is the Oil that is, and has been used by the US military in Iraq from? If it is from the ME is it considered an export, or is it considered locally consumed? After all it was, and is being consumed in the ME. If it is not considered an export would it increase the amount of locally consumed oil and thus have an impact on the ELM export vs consumption numbers for the years the US military has been involved in Iraq?

um - Last I heard BP supplied most of the fuel used by our military around the globe. BP gets that crude used to make those products from wherever they are producing oil. Beyond that I don't have any specifics.

Here's Dave Cohen on the topic: http://www.energybulletin.net/node/45940

Dave wrote that in July of 2008. Here is his prediction from that article.

The peak, so far, has been 73.719 mb/d in 2005. Average this year will likely be around 73.5 mb/d. We could approach or perhaps set a new record in 2011 but that will be the peak if it happens. Production will fall off in the second half of 2011. So it looks like Dave is pretty close on the date even if he is off by at least 2.5 mb/d on the amount at the peak.

But we have actually been at the peak since 2005. That is we have been on the peak plateau. Any difference since then is within the margin of error. My prediction is that we will fall off the peak plateau in the second half of 2011 or early 2012.

Ron P.

Couple of things to note on the second global figure.

For global oil, the next export peak will line up fairly well with the total peak. This is largely just a consequence of how the measure is defined and the sensitivity to the import-export ratio in terms of a global market for oil. This alignment essentially has a great likelihood of occurring.

The consumption is higher than the production by a small but significant percentage. If you look at the EIA data, they define it differently! The consumption includes all the biofuels, etc, while production doesn't.

It depends how one defines "line up fairly well" and with what tolerances. You can see from Gail's chart for World: Oil that (so far!) the previous world net export peak appeared to be in 2005, whereas the production peak (so far!) came about 3 years later. This is an unavoidable mathematical consequence of the empirically proven fact that oil exporting nations experience faster oil consumption growth rates than the set of oil importing nations. The empirical proof was found in a study of production, consumption and net export data for all exporters and all importers, in the TOD post Verifying the Export Land Model - a Different Approach

The Saudi expert, Sadad-al-Husseini, gave a slide show at the Energy Intelligence conference "Oil & Money" in October 2007 in London. His slide on overstated reserves is here:

http://www.crudeoilpeak.com/?page_id=2402

I had included it in my slide show to the Municipal Association of Victoria in August 2009

http://www.loc-gov-focus.aus.net/index.php?view=editions/2009/june/smart...

Slide #28 here, 1st item in my download menu http://www.crudeoilpeak.com/?page_id=280

Emergency planning after peak oil 2005-2008 3rd and final oil crisis

http://www.crudeoilpeak.com/pdfs/1

Note: the plateau cannot be achieved if there are only 900 Gb

Not to worry - the Wall Street Journal has looked into the matter. http://blogs.wsj.com/source/2011/02/09/saudi-oil-reserves-and-the-wikile...

By Angus Mcdowall

At first glance it looked like a story to shake the world: the WikiLeaks cable suggesting Saudi Arabia’s oil reserves -– the most bountiful on the planet -– may have been overstated by 40%.

It opened the door to a future in which oil would be depleted far more quickly than anybody believed -– raising the threat of sky-high prices and cut-throat competition for scarce resources.

But a conversation this morning with the man whose comments set off the furore, revealed a Chinese-whispers chain that ended up giving the apparent imprimatur of the U.S. diplomatic service to a misunderstanding over oil figures.

It's all a misunderstanding. Move along.

I agree.

I would be less concerned about the WikiLeaks item and more concerned about the actual data–-Saudi net oil exports versus annual oil prices. The Saudi’s ongoing post-2005 decline in net oil exports, in response to generally rising oil prices (annual oil prices showed year over year increases in four years out of five), is in marked contrast to their rapid increase in net oil exports, in response to rising oil prices, from 2002 to 2005.

This decline in Saudi production and net oil exports (relative to 2005), versus rising oil prices, is quite similar to what we saw in post-peak regions like Texas and the North Sea.

But the prevailing message from the MSM can be summarized as follows, “Party On Dudes!”

I agree.

According to a new report from Platts, the energy information arm of McGraw-Hill Co., OPEC crude oil production last month averaged 29.57 million barrels per day. That's the highest level in two years. The Associated Press said that the Saudis do it do keep the price of crude from rising uncontrolled.

Perhaps one of the more relevant comments in the leaked cable is

That was written in 2007, and as was noted on The Oil Drum last October, the Saudi Oil Minister has now put a 12 mbd limit on Saudi production. Future production limits also, of course, depend on what the KSA counts in that number, i.e. is this crude or all liquids?

Yahoo! has their short story on the Wikileaks about oil here:

http://news.yahoo.com/s/yblog_thelookout/20110209/ts_yblog_thelookout/wi...

The article is just a short summary . . . . but the reader comments are amazing. The ignorance and conspiracy theories are frightening. It is no wonder we can't act logically on big issues like this . . . those people are voters. Apparently, the whole story is a sham, the Saudis leaked that story to get higher prices, we just need to drill more and all our problems will be solved, and it will be great when that place runs out of oil because those bad saudis will all starve. Wow . . . the ignorance, conspiracy theories, and hatred are so sad and depressing.

Consider that the overwhelming message that they get is that we have virtually infinite fossil fuels, which is what most of them want to believe anyway.

People can be anything they want to be on the internet, say anything that they want to say. Yes, it's a disturbing look into the human psyche.

But let's not overblow it. Most of these idiots would fumble with a handgun and probably wouldn't have the strength or guts to pull the trigger, much less aim.

The danger is the big banks and the Pentagon. The financial establishment and the military. They have the psychology needed to kill and the weapons to do so.

Peace loving Americans with education and savings are next on the hit list. They're a big fowl ripe for the plucking.

A big reason that I've given up on this country is not because people can't accept peak oil or AGW or evolution - as bad as that is, it's relatively immaterial.

I've given up on this country because it's borderline fascist - a good chunk of its people are practically brownshirts for the banks and for the police/military, and I want nothing to do with it when you know what hits the fan.

"Support our troops" on a nice looking pink ribbon, plastered on a minivan.

What does that tell you?

Exactly. What he said.

I agree 100% Jay Gould said it best.

I can hire one half of the working class to kill the other half.

http://www.revolutiontruth.org/

A teaser (video) for Revolution Truth. Michael Moore(?):

Good piece.

Good piece. The argument against Wikileaks recent "diplomatic pouch" publications can only go something like "Our diplomats need to be able to act dishonestly with foreign nationals, so they must also be allowed to lie and conceal information from our own people". That's a corosive formula which has no place in a democratic system. Agreed there may be occasions when a state department employee serving overseas may feel it justified to warn a visiting dignitary that a particular foreign dignitary is a less than perfect specimen, and there's no reason that should get out onto the media, but such protection / secrecy should require the approval of a judge with specific application, and the judges should hold a very high standard on granting, similar to wiretaps (or the way wiretaps used to be).

That's a corosive formula which has no place in a democratic system.

give me a break. Oh, I bet you are still peeved the US got Isle Royale ?- ) Old Ben knew all the other islands showing up on the map were phony (invented by the map maker to please the powers that be) so he let the Crown keep them and the upstart US meekly went away with Royale. Lets see the only national democratic system going at that time was the one deceptive old Ben was representing. Looks like that corosive formula has been in place for about 225 years now.

Deception has always been an integral part of diplomacy as have been back channels which are sometimes extremely forthright but never see the light of day or they would dry up. Wiki leaks won't change that--eventually there will be a leak overload and no one will pay it much attention.

I am peeved that Isle Royale belongs to Michigan and not Minnesota. Those are Minnesota wolves that live on the island!

You sure all the Minnesota wolves didn't get there on Canadian passports in the first place?- )

Well if memory serves Isle Royale came to Michigan by being carved from Wisconsin Territory in the trade that let Ohio get the Toledo strip back in statehood days. 'Midnight' rides between polling places and all sorts of shenanagins were part of that game.

Michigan had less use for the UP (which I believe included the Isle) than the US had for Alaska when Seward later made the big buy from Russia. I think both were described as Thule in the press.

By the way I took a wack or two at downloading your book but was unsuccessful. Just don't get the simple save option so many other pdf documents on the web have. I might give it a go again when I've more patience.

So your argument is basically "We need to disable Wikileaks in order that our spy system can continue". No sale. That argument only serves in a system where people are pitted against people and nation against nation. Grow up already.

No I was stating facts about the nature of diplomacy. I never suggested disabling wikileaks. In my opinion a leak overload will disable wikileaks. Oh so often when rivers of information flow important and trivial both get filtered out and no real change in awareness occurs. Wikileaks does not need to be disabled, if allowed it will most likely disable itself.

I suggest a you come to grips with the fact we are primates, extremely cooperative ones at that, but primates none the less. 'Grand ideas' are a big part of us but we certainly do get "...the homicidal bitchin' that goes down in every kitchen to decide who will serve and who will eat."

True your most excellent poet, Leonard, is using the phrase to describe where he thinks 'democracy is coming' from, but I'm saying don't hold your breath. Just look inward and see how inflamed you became by a simple little paragraph or two.

Long live the primate struggle within each of us, it makes life worth living.

Just looking at the front page chart and extrapolating the declining production and increasing consumption it looks like Saudi Arabia could become an net oil importer sometime during the next 10 to 15 years.

"Saudi Arabia could become an net oil importer sometime during the next 10 to 15 years."

Import from where? Paid for with what? This will be interesting to watch; the KSA having to compete for oil on world markets along with the rest of the ex-oil-exporters (if markets still exist).

No worries, the IEA has it all figured out i.e., the Saudis will buy it from as yet to be determined sources and pay well, the central banks are as we speak turning the world's fiat currencies into sand; the Saudis are rich!

Sam Foucher has them approaching zero net oil exports between 2030 and 2036 (middle case and high case).

I believe that, it's a little hard looking at that little graph but still it makes you wonder.

This topic is so much fun. :-)

al-Husseini: Aramco official reserves are credible

What's that Shakespeare quote - Much Ado About Nothing?

Nope, I believe the quote you were looking for was "The lady doth protest too much, methinks."

Fundamentally, like much of Wikileak's material - these secret, confidential, classified, government communications don't really contain anything that a well informed, savvy, independent analyst couldn't have worked out for themselves. The most interesting think about Wikileaks is how unsurprising they've been.

We need to get away from the idea of an 'elite', a bunch of people with a grand plan, operating from a position of greater knowledge and understanding that the rest of us. Everyone is just muddling along, you, me and the president of the USA.

Well that tears it, here I was thinking that it was only a 99.9% Idiocracy and that a very small group might actually have all of the facts and at least have a "Plan" (any Plan at all, good, bad or indifferent). Now you're telling me that even that .1% percent of allowed Optimism is gone too?

Bartender, I'll have a few dozen bottles of that new "Mary Jane Cola" and the Launch Codes and Keys now. Might as well get it over with... I'll need one volunteer from the audience to turn the other key.

THANK YOU SO MUCH! I went on a laugh rant for a good 8 min! So much of this is awful, its the lil side comments that make all of this endurable.

However ,the disclosures just help to reinforce that the conclusions of those independent experts are indeed right, and that can only be a good thing. It makes any sort of denialistic "conspiracy" theory all the more absurd.

The crime is that the elites try to hide the truth that we already know. The truth is not hidden from view but might as well be. Why this crap was secret is the crime. It might,however, be a little helpful if the main stream press would ask questions about this at one of the regular question and answer sessions given by the presidential spokesman. In this instance, however, it would probably just be spun away as something not terribly important.

But as I said yesterday, no wakeup call about OPEC or Saudi production capabilities will amount to a hill of means with respect to policy. The drill, baby, drill crowd led by Sarah Palin will insist we can drill ourselves back to the level of U.S. production in effect in 1970. Sounding the alarm will be perceived as just the wailings of a bunch of Marxists.

The problem is -NOT- "Elites". Its that NO ONE wants to spend an hour of their life learning about flow rates and how it relates to gasoline prices, food production and debt. I can understand why, since they don't know the implications.

We all have say, in how "The word" is spread. $1 cans of spray paint from walmart and "Peak oil" written in high visibility [legal] places everywhere you live, would at the least, force some of the people who live near you to google "Peak oil". That's the most cost effective way to do this.

Research: "Gorilla marketing"

Then, act.

We must act now video from Monty Python's "Life of Brian."

http://www.youtube.com/watch?v=YawagQ6lLrA

"ROMANI ITE DOMUM"

..Right, now don't do it again!

Most people don't have the slightest clue. Talk to everyday people about peak energy and population growth. The responses you get will often be amusing. Here are a couple of examples from memory:

"Oh the oil companies have an engine that runs on water. They'll bring it out once they've sold all the oil."

"The population just grows. Thats what it does."

"What about oil?"

"What does that have to do with population?"

Most people are stolidly cornucopian. I think cornucopianism may even be the defacto religion of the western world.

But perhaps I'm just an ill-informed eccentric. I hope so. (But I wouldn't predict a sudden collapse. A long, slow, drawn out decline taking decades seems more likely.)

Saudi can not go to zero export because they import food. No export no food. They will have to begin a program of conservation and increased efficiency around 2025. LOL

ed - Perhaps the more pertinent question would be to whom will KSA exports go to zero. They are going to sell some oil to cover the expense of maintaining their citizens. But if, for instance, they swap large volumes of oil to the Chinese in exchange for food produced on those millions of acres of farmland that China is rumored to be picking up around the globe: the KSA oil exports TO SOME COUNTRES may fall to zero. That wouldn't be a great difference than the situation today: there are many countries right now that import no Saudi oil. Only one question remains: what other countries will be added to that list over the next 10 - 20 years? Someone said the Saudies can't eat oil. True...but Americans can't put wheat in their gas tanks and drive to work either. Oil will move in the direction of the leverage...always has and always will IMHO.

What KSA will produce has been done to death here, it it's 10mbld or 12.5mbld only shifts things a couple of years.

Whatever the figure is, doubt much will end up in Europe or U.S.

http://en.ce.cn/Insight/201102/10/t20110210_22201313.shtml

14 million poor Chinese bought cars last year, total vehicle sales 18.2 million.

http://blogs.wsj.com/chinarealtime/2011/01/18/road-building-rage-to-leav...

China spent as much on road building as States spent on military, which government is doing the right thing for it's citizens?

Never seen an article on China here, why is that?

Um... neither?

I am not bothered about roads and railways being built, but you only use tanks, bombs and guns for one thing. Many people are asking the question who is America going to attack next?

You have a good point re: the sole purpose of tanks, bombs, guns... But you didn't say 'railways' in your initial comment. So, US -10, China -1 for roads, +1 for railways. I still say neither is really working toward the long term interest of its people, to say nothing of the rest of life on the planet.

No, I agree, I used to think that the U.S. government were the good guys, but I realise now they ruthlessly manipulate the people they were elected to serve. With all that money the States should have the best rail system, electric grid and nuclear/renewables programme in the world.

History shows that no country builds up it's military like the states is doing without using them at some point. With a smaller military force counties try harder at diplomacy and fair trade.

No need to do a swap deal with China. Saudi Arabia itself is no slouch when it comes to acquiring well-watered farmland abroad:

http://farmlandgrab.org/cat/show/48

http://news.alibaba.com/article/detail/markets/100148256-1-saudi-based-p...

http://farmlandgrab.org/2773

http://www.theecologist.org/News/news_analysis/273844/extent_of_agricult...

Perhaps KSA will attack the population/food/oil problem from the demand side, and start pricing their oil in Saudi Citizens. Say, one citizen for every thousand barrels. If you want 1 million barrels, there will be 1,000 KSA citizens put on the tanker as one way passengers, for you to take in as immigrants.

Does anyone have the link with the video of Sadad being interview a few years back? It was posted on the ASPO website but I can't find it. I think Jeremy Gilber(from BP) was also interview.

I think it's the second video clip:

http://www.energybulletin.net/stories/2011-02-09/digging-out-truth-about...

716 bbl x 37% recovery = 265 bbl

I wonder if Aramco used a simple calculation like this to come up with their official reserve estimates. Plus since these reserves never deplete, we could assume that these are pre-extraction reserves. Deducting 123 bbl that have aready been produced gives a current reserve number of 142 bbl. Still sounds a bit high, but would mean they'll cross the 50% depletion mark in 3-4 years.

365 x 10 mmbpd = 3,650 mmbpy

142,000 mmbbl / 3,650 mmbpy = 38 years.

The 50% depletion mark in 3-4 years appears more dramatic at first read than it actually is, I guess. I had to study your statements for a while to figure out your meaning.

Predicting the percentage of recovery does add uncertainty. In general, it looks like the bigger the reservoir, the higher the recovery factor. I explained this and compared to empirical data in The Oil ConunDrum, see the section on Recovery Factor, p.147.

Web - We've discused it before for the benefit of others: don't get hung up on recovery factors as a terribly critical issue. I can show fields along the Texas coast that have a proven RF of 50%+ and are still producing and will likely exceed 60-70%. But you need to consider the time factor. These same fields went on production in the l930-40 period. And oil rates dropped to very low levels within the first few years. For example, 80% of the oil was recovered at water cuts of 70% or greater. Not only did this lead to a slow recovery rate but increased costs due to water seperation/disposal.

I've done production acquisition for over 30 years and two of the least interesting numbers are recovery factor and URR. The key to the valuation of any oil/NG reservoir is the projected prodution rate (read: cash flow). There are fields in Texas that have a collective remaining URR of 100's of millions bbl of oil and I pay no attention to them. But I know a few dozen spots that can recovery 100,000 bo each that get me very excited. It's all about making a profit...not satisfying anyone's need for FF. No different for the KSA than me.

Yes, I realize this. My derivation is really a stochastic formulation in that it points to a likelihood or preference to recovery factors. So that a larger reservoir is only more likely to have a higher recovery factor. It's like saying a summer day is likely warmer than a spring day, but that doesn't always hold, so you can attach probabilities to the likelihood.

Web - I just wanted to make sure other folks understood the dynamics. One reason the bigger fields probably have better recovery is economy of scale. The infrastrucure for EOR tends to be pricey and doesn't tend to be very economic with small reservoirs. Also at some point lease operating expenses can't be reduced and smaller reservoir efforts are abandoned. There's also the ole "it takes money to make money". An operator with a large inplace recoverable reserve base will get credit easily. A small operator with a small reservoir won't have as easy a time getting the credit even if project looks as good on paper as the biggger one.

The more enlightening graph would be a plot of the change in recovery factor vs. time. The fields I referred to would show an increase in RF of about 1% per year. Yes....took 50+ years to reach a RF of 50%. Compare to the seemingly disappointing Thunderhorse. For sake of argument lets assume it hits a 50% RF. But it will have to do so in probably less than 10 years IMHO because the high offshore operating expenses won't allow low flow rates to be maintained.

Frugal - I doubt the KSA is using any sort of back-of-the-napkin calculation as a source for the numbers they throw out. IMHO TPTB in the KSA decide what picture they want to paint for the rest of the world and toss it out there. It's been a good 10 years since I rubbed elbows with the elite of the international reservoir analyists. A hint: none are Americans. For many years the KSA has had these folks, along with the most sophisticated software models and powerful computer systems, analyzing their fields. In fact, many years ago ARAMCO ran PSA commercials bragging about this effort. You won't find them out on the web these days. I have no doubt the KSA has a very accurate estimate of their reserve base and future production rates (subject to internal decisions). And no...this info will never show up on Wikileaks. Let's just say this info is guarded with extreme prejudice. If it weren't for too many scotches in airport bars I wouldn't know even the tiny bit I've heard.

Very simply: the KSA has the detailed production data some folks on TOD fantasize about getting their hands on as well as the best (read: most expensive) reservoir evaluation teams on the planet. If I were to apply this set up to any company's reserve base it would be easy to estimate within a few percent exactly what their future will be.

That's correct. I've designed software to do future production estimates for oil companies. They produce quite accurate estimates. The only thing is that, often, upper management doesn't want to believe the numbers. They don't want you to go to them and say, "You know, I think this company has a great future in software development, because it certainly doesn't have a future in the oil business."

Hopefully, the CIA has hacked Saudi Aramco's databases, sucked all the data out of them, and transmitted it to their headquarters in Langley, Virginia for analysis. That's what they are paid to do. The real problem is that the decision-makers in the US government may not want to believe the numbers.

Between Rocky and Rockman, I believe the question of Saudi reserves is answered about as well as it can be, except for one thing-somebody who knows how should be able to get a pretty danmned good idea by simply collecting and analyzing all the readily available data already out there in the public domain, although a lot of it is undoubtedly behind pay walls , or otherwise hard to access.

Somebody like WHT, working with a couple of oil pros such as Rock and Rocky, with a crew of researchers, should soon have a pretty good answer.

It seems obvious that the biggest and richest banks, investment houses, and individual super rich individuals would have such research underway.

No, the key information you need is well cores and well logs, plus seismic data and production information from individual wells. None of this would be publicly available since they are considered state secrets in Saudi Arabia.

OTOH, in Canada all this would be readily available. The provincial and federal governments force oil companies to release all the relevant information (except seismic) as a condition of being allowed to drill. So, if you don't trust a company's analysis, you can get the underlying data from the government and do your own independent assessment. The US doesn't force companies to release individual well data, so it's harder to second-guess them.

In the Middle East you are dependent on the Nation Oil Companies to assess the data for you, and you never know how honest they are. Your biggest concern may be that they are lying to themselves as well as others. You can't do an independent assessment, so you don't really know for sure.

This is where the CIA comes in, because they should be able to get the data whether the Saudi government wants to release it or not.

Well at least someone's having a go...

Hackers hit 'at least five oil and gas firms': http://www.bbc.co.uk/news/technology-12416580

When you work in the oil industry, you kind of assume your competitors will hack into your databases and extract all the relevant information from them. If you don't want your competitors to know something, don't put it into the databases, don't write it down where the cleaning staff might see it, e.g. by picking the locks on your desk drawers, and don't say it over the telephone.

OTOH, if you think there is something weird going on at your own company that might affect your career path, just go over to your opposite number at a major competitor company, buy him lunch and drinks, and ask him what it is, because he will know. He, of course will expect you to reciprocate when there is something weird going on at his company because you, of course, will have hacked into their databases and tapped their telephones.

The really weirdest part of the whole corporate experience occurs when you have to hack into your own company's databases and tap your own telephones to find out information that someone is concealing from upper management or otherwise screwing people around with.

I could go on and it could get even weirder, but I think the bottom line is that hacking into computer databases is not exactly unusual in the oil business.

So what the heck are they using to come up with their official reserves/future production numbers? It's pretty obvious that they're not using sophisticated reservoir models to come with official numbers. So it's gotta be either back-of-the-napkin calculations or pure fantasy.

Yeah . . . that is what he said with "IMHO TPTB in the KSA decide what picture they want to paint for the rest of the world and toss it out there."

In case you missed what ROCK said

IMHO TPTB in the KSA decide what picture they want to paint for the rest of the world and toss it out there.

They are using their conception of what the world really wants to see and making themselves look as good as they can in that picture when the paint it.

Luke - and just to prove I'm not a racist: I look at reserve estimates from other domestic companies done by guy's I've known and respected for over 30 years. And I don't accept anything they say about their reserves on face value. Those numbers are interpretaions...not calculations. And there's always a range of possiblities one has to chose from to make those interpretation. If I'm trying to sell someone reserves I'm going to chose the optimistic end. The potential buyer is going to chose the pessimistic end. I always have two reseve numbers: the ones I show to a potential buyer and the one I show to my owner. And this is considered ethical. So what numbers should we expect from the KSA? Granted, they may be psuhing the "optimistic" envelop way beyond a reasonable level. But that's their option. There is no rule requiring them to give us an honest and reasonable answer. If there were a case for "buyer beware' it has to be OPEC reserve numbers IMHO.

Is it common that companies selling equipment and services like drilling, platforms, pipelines also make reserve estimates?

karl - Typically no with one big exception: companies that build/own pipelines. A company spending a few hundred million to build a p/l needs to know that the operators they will be tranporting have enough reserves to justify the investment. It can take 5+ years to just recover the initial investment: they have to be sure there's enough oil/NG for them to make a profit...a pipeliner only gets paid for the volume he carries.

@joules burn yes your right in the middle east, but how come the oil prices still goes up to some countries. There are some leaks that can be prevented with the help of pipe repair defects are categorized by type and severity.Different pipe repair techniques are available to repair almostany type of defect