Drumbeat: February 14, 2011

Posted by Leanan on February 14, 2011 - 10:19am

Administration to Push for Small ‘Modular’ Reactors

WASHINGTON — The Obama administration’s 2012 budget proposal will include a request for money to help develop small “modular” reactors that would be owned by a utility and would supply electricity to a government lab, people involved in the effort say.The department is hoping for $500 million over five years, half of the estimated cost to complete two designs and secure the Nuclear Regulatory Commission’s approval. The reactors would be built almost entirely in a factory and trucked to a site like modular homes.

Probe of Texas Outages Focuses on Preparation

NEW YORK—The Electric Reliability Council of Texas, the grid operator that serves 85% of the power demand in the state, said Monday that widespread outages seen across the state on Feb. 2 were caused by unusually cold weather that froze equipment at power plants."It is something we have never experienced before," Ercot Chief Executive Trip Doggett said about the number of plants that tripped offline at once. There were "dramatically more" plants shut at one time than ever seen on the grid and rolling outages helped prevent a statewide blackout that could have lasted at least 50 hours.

Gazprom cuts gas prices for some European clients

MOSCOW (Reuters) Gazprom, Russia's top energy firm, said on Monday it agreed to cut gas prices in its long-term contracts for some European clients in 2010 on the back of sagging demand and low spot prices.It also said it agreed to include a spot price element into its long-term contracts with some European companies, while raising take-or-pay obligations on some who received concessions.

Chile: energy measures shouldn't hit copper mines

(Reuters) - Planned energy-saving measures to reduce electricity voltages and save hydroelectric reservoir waters should not affect copper mines in south-central Chile, Mining and Energy Minister Laurence Golborne said on Monday.

The Philippines: Govt reserves power barges for Mindanao

THE Department of Energy (DOE) wants government’s remaining power barges to be privatized only if they are to be used in Mindanao.Energy Secretary Jose Rene Almendras said this would allow the region, which relies on hydroelectric power plants for half of its requirements, to secure its electricity in anticipation of low water levels in the summer months.

Enbridge proceeding with Bakken expansion

Enbridge Inc. ENB-T is going ahead with a $560-million expansion of its Bakken pipelines, adding 145,000 barrels per day of new capacity from one of North America’s fastest-growing oil producing regions, the company said Monday.Enbridge will expand its North Dakota and Saskatchewan pipeline systems in order to handle rising oil output from the Bakken field, which spans the Canadian province of Saskatchewan, and the U.S. states of Montana and North Dakota.

One of the most worrying issues that I’ve been introduced to since I started this position at IFandP is that of peak oil and resource depletion. Much of the discussion seems to revolve around the precise date at which we might hit peak oil. However, as many have pointed out what matters more is the point at which the total net energy we obtain from fossil fuels starts to decline. The situation is compounded by the issue of climate change, which will also act to accelerate the amount of free energy available to society, given the increased need to mitigate its effects and sequester carbon. This rings particularly true once you consider the complete storage of global CO2 emissions from fossil fuels would require an infrastructure of comparable size to that of the current oil and gas industry.

Peak oil believers put their faith in leaky arguments

Around 2004, others were also casting doubts on Saudi oil capacity. The most high-profile was the late Matthew Simmons, a US investment banker, who argued in his book Twilight in the Desert that the Saudis were facing serious technical problems in their fields.The then Bank of Montreal analyst Don Coxe opined that "the kingdom's decline rate will be among the world's fastest as this decade wanes". Paul Roberts, a resources journalist, focused on alleged problems at the Saudis' largest field, Ghawar, in his book The End of Oil.

The writings of the three men were littered with elementary technical errors and misunderstandings of the industry that a professional could easily have corrected. Nor did they present much evidence, beyond cherry-picked anecdotes of ordinary problems that are faced and solved every day in oilfields around the world.

Lawyer: Chevron Fined $8B for Ecuador Pollution

(CBS/AP) QUITO, Ecuador - An Ecuadorean judge ruled Monday that Chevron Corp. was responsible for oil contamination in a wide swath of Ecuador's northern jungle and fined it at least $8 billion, the plaintiffs' lead attorney told The Associated Press.Chevron said it would appeal and called the ruling "illegitimate and unenforceable" in a news release.

Pacific Herring Are Back in the Bay in Big Numbers, Three Years After a Major Oil Spill

The herring that have recently flooded into San Francisco Bay in dense schools have surprised fishermen and ecologists, who doubted that the generation of the silvery fish that was spawned during a devastating oil spill three years ago would survive.

Anger rising as Gulf spill claims process drags

NEW ORLEANS — President Barack Obama vowed during a White House speech last June that the $20 billion he helped coax out of BP for an oil spill compensation fund would take care of victims "as quickly, as fairly and as transparently as possible."Eight months later, that's not how things look to many people along the Gulf Coast.

Obama's DOE Budget Request Promotes Clean Tech, Slashes Fossil Energy

The White House continued efforts today to beef up investment in nuclear and renewable energy technologies in its $29.5 billion fiscal 2012 spending request for the Department of Energy.The clean-tech increases would come at the expense of fossil energy spending, including the perennial request to eliminate billions in tax incentives for the oil and gas industry.

Gingrich’s Energy Policies Rile Conservative Critics

In a speech at the Conservative Political Action Conference, the annual gathering of conservative activists, Newt Gingrich, the former House speaker, called last week for a radical shift in national energy and environmental policy, including the total dismantling of the Environmental Protection Agency, the relaxation of coal mining regulations and quick approval for offshore drilling projects in the Arctic.The reaction from some conservative commentators was swift and harsh. “Intellectually incoherent,” said Myron Ebell, the director of energy and global warming policy at the Competitive Enterprise Institute. “Asinine,” a blogger for the American Spectator opined.

E.U. Climate Chief Has Work Cut Out for Her

BRUSSELS — Connie Hedegaard embodies the way the European Commission would like to be perceived in the 21st century.Ms. Hedegaard, 50, leads the commission’s efforts on climate change, an issue with global resonance, and she is a confident and telegenic communicator, helping dislodge the commission’s image as a haven for graying politicians who settle fights over fish quotas.

China Works To Stave Off Wheat Crisis

HONG KONG — It is weather with global breadbasket implications.Even as senior Chinese officials exhort local officials to do everything possible to cope with a severe drought in the country’s wheat belt, the government is trying to reassure the public that food prices will not rise.

China’s drought-control headquarters posted a statement on its Web site on Sunday that described conditions as “grim” across a wide area of the wheat belt in Northern China and called for emergency irrigation efforts.

Kurt Cobb: secrets and treachery of the arrival of peak oil

Kurt Cobb is a Kalamazoo-based author and columnist who focuses on energy and the environment, and he's the author of a brand new novel called Prelude. It's about the secrets and treachery surrounding the arrival of peak oil."Peak oil is the point at which the worldwide production reaches its highest level that it will ever reach and thereafter it begins an irreversible decline," Cobb says. "It's a reality in the United States where peak oil occurred in 1970."

The price of oil is once again daily in the news. The Western Europe benchmark Brent crude has hovered near $100 / barrel for much of the last month, and the IEA is again warning of the burden of oil consumption. Is this a harbinger of things to come, or a mere statistical blip in a market that is "well supplied"? How will events play out in oil markets in the coming year or two?Certainly, oil prices have surged on the back on strong demand, of which some is structural, and some transient. The northern hemisphere has seen a strikingly cold winter, leading to increased heating oil usage. And the global economy is recovering from a deep recession, with demand bouncing off the recessionary trough. These are, to an extent, passing events. But in many respects, increased prices fundamentally reflect an oil demand that is increasing faster than supply.

China Is Paying Up in Push to Join The Shale-Gas Boom

Chinese companies are paying a heavy price to participate in North America's natural-gas boom in a bet on gaining vital new technology and access to a bountiful new source of energy.Technological advances have opened up massive new gas fields in North America, creating opportunity for Asia's energy-hungry countries. The technology taps gas trapped in rock, called shale gas. Energy consulting firm Wood Mackenzie Ltd. estimates that potential U.S. shale-gas resources total 650 trillion cubic feet. By comparison, proved U.S. gas reserves at the end of 2009 totaled 244.7 trillion cubic feet, according to the BP Statistical Review.

Police fire tear gas at Iranian opposition protesters

TEHRAN — Iranian security forces fired tear gas in central Tehran on Monday to disperse opposition supporters marching in a banned rally inspired by popular uprisings in Egypt and Tunisia, a witness said."There are thousands of people marching ... not chanting slogans ... Security forces fired tear gas to disperse them near Imam Hossein square," said the witness.

Will Egypt re-energize Iran's 'Green Movement'?

Both sides in Iran are claiming the cause of the Egypt protests as their own: The opposition “Green Movement” heralds the protesters' push for democracy, while the Iranian government says their demonstrations follow in the footsteps of the 1979 revolution that overthrew the U.S.-backed shah and put the Shiite Muslim clergy in power.

Kurt Cobb: The week of the game changer in oil, or was it?

This past week was supposedly the week of the game changer in the world of oil. Leaked U.S. diplomatic cables from Saudi Arabia called into question the ability of the globe's largest oil exporter to raise production to satisfy a world increasingly thirsty for petroleum. In the United States a technique called hydraulic fracturing--which has seemingly unlocked vast natural gas resources--will now be applied to oil trapped in shale deposits. Are these two developments really the so-called game changers they are claimed to be?

Aramco ‘unlikely’ to have fudged oil reserves by 40%

John Sfakianakis, chief analyst at Saudi Banque Fransi in Riyadh, said Saudi Aramco was unlikely to have risked exaggeration.“I don’t think they want to risk being proven otherwise,” he said.

He said that Aramco provided its own money for most of its investment in search and exploration, and that as such, hedging numbers would be detrimental to its own interests.

WikiLeaks, media distort oil estimates

As good as they are, I hope WikiLeaks cables will not become our reference for everything that goes around the world — including the evolution of the oil market.

Lilongwe City rejects fuel march

The Lilongwe City Council (LCC) has refused the Human Rights Consultative Committee (HRCC) permission to stage a protest march this Monday against persistent fuel shortages in Malawi.

Austin considers $50 a year, unlimited electric car charging service

Austin City Council members this week will consider charging Austin electric car drivers $50 a year to boot up their batteries from any Austin Energy plug-in.

Phoenix Solar to build PV park for Saudi oil company

Phoenix Solar has been commissioned to build a 3.5 megawatt (MW) PV park for the Saudi Arabian Oil Company (Saudi Aramco). When complete, it will reportedly be Saudi Arabia's largest PV installation.

All forms of government in recent times find themselves in the same predicament: the mismanagement of contraction. Too many people and too many enterprises are competing for a contracting resource base. In many poor countries it expresses itself plainly as expensive food, or no food at all for some. The expensive food part of the story is already being felt in the wealthier countries, too, but the contraction expresses itself more in terms of money - many people do not have enough, or else much less than they were used to having, and at the same time the money that does circulate seems increasingly worthless. So we have the great debate over whether the contraction is deflationary or inflationary.

There will soon be seven billion people on the planet. By 2045 global population is projected to reach nine billion. Can the planet take the strain?

Clashes in Bahrain before planned protest rally

DUBAI, United Arab Emirates (AP) — Bahrain's security forces fired tear gas and rubber bullets to disperse anti-government protesters Monday in advance of plans to stage major rallies and bring the Arab reform wave to the Gulf for the first time.The sporadic unrest since late Sunday underscores the sharply rising tensions in the tiny island kingdom — a strategic Western ally and home to the U.S. Navy's 5th Fleet.

Egypt Army Suspends Constitution, Meets Protester Demand

Egypt’s ruling army council said it aims to hand power to a democratically elected government within six months, after almost three weeks of popular unrest ended 30 years of autocratic rule by President Hosni Mubarak.The Supreme Council of the Armed Forces yesterday dissolved parliament, suspended the constitution and said it would rule until general elections take place. The council also formed a committee to introduce constitutional changes, according to a statement read on state television yesterday.

Two decades ago, Egypt consumed about half the oil it produced and exported the rest, about 450,000 barrels a day. Since then, however, its production has declined as its domestic energy consumption has increased, and today Egypt is a net importer of oil, based on data from the International Energy Agency.That concerns those who believe in "peak oil," the theory that global crude production has hit its apex and is entering a state of persistent decline.

"Egypt is just a perfect case history of export math," said Jeffrey Brown, an independent petroleum geologist in Fort Worth who writes frequently on peak oil issues.

Brent Oil Rises on Ongoing Mideast Tension, China Crude Imports

Oil extended gains in London and erased earlier losses in New York as protesters planned demonstrations in Middle Eastern oil-producing nations and after a report showed that China imported more crude.Brent crude advanced as much as 0.9 percent as China, the world’s biggest energy consumer, increased net crude-oil imports to the highest in four months in January as demand for diesel to operate irrigation equipment in drought-stricken regions rose. Protestors plan a demonstration today in Iran, OPEC’s second- largest member, while Algerian opposition parties prepared a protest on Feb. 19 following a weekend clash with police.

FACTBOX - OPEC, CEO comment on high oil prices

(Reuters) - Brent crude oil LCOc1 jumped above the $100 a barrel mark on Jan. 31 for the first time since 2008, adding to pressure on the Organization of the Petroleum Exporting Countries to pump more oil.Even U.S. crude CLc1, which is trading more than $15 below Brent, is slightly above the $70-$80 price range, which top oil exporter Saudi Arabia has said is the ideal for producers in need of returns on their investment and not so high as to damage the fragile economies of consumer countries.

OPEC has resisted calls to change formally its output policy and has said the market has plenty of oil.

Hedge Funds ‘Bearish With a Capital B’ in Gas

Hedge funds raised bearish bets on natural gas to the highest level since December 2008 as the fuel plunged on speculation that seasonal inventories will reach near-record levels at the end of March.

Why Is Gas Cheaper In Middle U.S.? Thank Canada

Gasoline prices have been on the rise for months now. As the economy improves, demand has gone up. But aside from that, something unusual is happening with gasoline prices in the U.S. this winter: Prices are rising faster on the East and West Coasts than they are in the middle of the country.

Russian Growth May Increase to 6% Next Quarter as Oil Climbs, RenCap Says

Russia’s economy may expand next quarter at the quickest pace since 2008 as companies boost investment and higher oil prices help the government ramp up spending before national elections, Renaissance Capital said.

Venezuela loses $1.5 bln a year in gasoline subsidy

(Reuters) - Venezuela's state oil company PDVSA loses around $1.5 billion a year through domestic subsidies that make the South American OPEC member's gasoline the cheapest in the world, the energy minister said on Sunday.At a cost of $0.03-0.04 per liter ($0.11-0.15 per gallon), most Venezuelans can fill their tank for under a dollar. And since deadly protests in Caracas in 1989, successive governments have been wary of changing the subsidy policy and hiking prices.

Gazprom to get $24 bln from local price liberalization in 2013

Liberalization of domestic industrial gas prices will bring an additional $24 billion income to Russian gas giant Gazprom in 2011-2013, the firm said on Monday.Gazprom expects the income to be higher than the volume of mineral extraction tax which rose to 237 rubles per 1,000 cubic meters this year from 147 rubles levied in 2006. From 2012, the rate will increase to 251 rubles and to 265 rubles from 2013.

Liquefied natural gas output from Indonesia's Bontang plant is expected to fall by 6% this year due to lower supply of natural gas from a Total field, the plant's operator PT Badak NGL said today.

Dutch oil and chemicals storage company Vopak will build a liquefied petroleum gas terminal in Indonesia together with Chandra Asri Petrochemical for an investment of $150 million, the Indonesian player said.

Syria, Iraq discuss cooperation in oil, gas

Syrian Oil and Gas Minister Sufian Allaw and his Iraqi counterpart Abdul Kareem Luaibi held talks here Sunday on cooperation projects in oil and gas, Syrian official SANA news agency reported.The talks focused on reopening the old Iraqi oil pipeline and enhancing cooperation between the two ministries to facilitate the purpose.

Iraq to Sign Akkas Deal, Review Kurdish Oil Contracts

Iraq, seeking to rebuild its energy industry after years of conflict and scarce investment, will soon sign a delayed deal for the Akkas natural-gas field and review production-sharing contracts signed separately by the semi-autonomous Kurdish region, the country’s oil minister said.

Ecuador accepts US court decision favoring Chevron

Ecuadorean officials say they will temporarily block a potential multibillion-dollar judgment against Chevron Corp. for alleged environmental damages.The Attorney General's Office says in a statement that Ecuador will obey the order from a U.S. federal judge in New York even though officials "do not agree" with it.

Nigeria: Govt Rejects Oil Firms' U.S.$30 Million Gift

Lagos — The $30 million (N4.6 billion) promised by the oil and gas companies in Nigeria towards the training of some ex-militants in the Niger Delta has been rejected by the Federal Fovernment as it considers it too little in the effort to make the region free of restiveness. Some of the oil companies include: Agip, Shell, Chevron etc.

Navy urged act as Somali pirates hold 700 sailors hostage

The head of shipping at Royal Dutch Shell has called on the Royal Navy to launch military action against new "pirate motherships" off Somalia that have captured two $200m oil tankers this month.

Three books on the gulf oil spill

Just six months after BP stopped the oil that had been flowing into the Gulf of Mexico, a gusher of books about the spill has begun to wash ashore. The first wave includes three very different approaches to the disaster that riveted the nation most of last summer.

Wikileaks goes peak oil wild in Saudi Arabia … or did it?

Given the impending reality of peak oil production in both the world overall and Saudi Arabia, the rulers know that the oil wealth is not to be squandered and that leaving some oil in the ground is as good of a strategy as any.

Emirates Post issues stamp on OPEC’s Anniversary

The stamp was issued in recognition of OPEC’s significant impact on its members and the world community during the past 50 years. The organisation has served as a bridge between producers and consumers, creating a forum for discussion on issues like fuel supplies in the long run as well as technology, trade and environment conservation.

Investment and jobs boosted by North Sea boom

THE rude health of the North Sea oil industry was revealed by news from corporate financier Simmons & Company that its Aberdeen office has conducted $11 billion (£6.9bn) of deals.This was emphasised by an announcement by oil services company Production Services Network that it is hiring 100 more people.

Russia's Rosneft discovers two E. Siberian oilfields

(Reuters) - Russia's largest state-owned oil company, Rosneft discovered two new oil and gas deposits in Eastern Siberia, the producer said Monday on its web site.

Why you don’t want gas to get cheaper

Americans would like to pay less at the pump. But what would that take? How about another economic crash -- or perhaps you'd prefer an ecological one. However the next century shakes out, one thing's for sure: the ever-growing gap between world oil supplies and demand is making itself felt, and the longer it takes us to break our addiction, the more painful the coming decades will be.

Coal-to-liquids as a case study of how excessive optimism is our enemy

Confidence provides strengths for a society, but only when coupled with clear vision. Unfortunately modern America too-often sees the future only in terms of doomsters’ pessimism and advocates’ optimism. Here we have a case study of the latter.

Brazilian ethanol is the best hope for replacing oil, says BP's Bob Dudley

Ethanol derived from Brazilian sugar-cane offers the best hope of replacing oil as the world's main source of fuel when it runs out, according to Bob Dudley, BP's chief executive.He said Brazilian ethanol is the "best type of renewable energy" and offers the possibility of an "ultrapotent fuel that could revolutionise the market".

BP is channelling its research into renewable fuels accordingly, with 40pc of its $1bn (£625m) annual spend in this area targeted at Brazilian ethanol, Mr Dudley told the weekly Brazilian news magazine Veja.

"There will obviously a time when the oil runs out and with this prospect on the horizon, we will use more renewable energy sources," he said.

India May Save Money Replacing Diesel With Wind, Hydro, World Bank Says

India, which spent 1.7 billion rupees a day ($37 million) subsidizing fuels in 2010, could replace power produced from diesel with renewable sources at one-third the cost of generation, the World Bank said.The country’s entire wind, biomass and small hydropower potential of 68,000 megawatts could be produced at 6 rupees a kilowatt-hour compared with the 18 rupees a kilowatt-hour cost of diesel generation, according to a World Bank report.

Suzlon Energy Plans $392 Million Australian Wind Farm in New South Wales

Suzlon Energy Ltd., the world’s third-biggest maker of wind turbines, plans to build a wind farm in Australia’s New South Wales state estimated to cost about A$390 million ($392 million), government filings show.

Chrysler Considering Natural-Gas Engines for Ram Brand

Chrysler Group LLC, the U.S. automaker operated by Fiat SpA, is exploring the possibility of adding compressed natural-gas powered engines to its Ram truck brand, a top executive said.

Drivers express interest in hybrids, but many don't buy

About six out of 10 consumers say they would look at a gas-electric hybrid when the time comes to replace their current vehicle, a USA TODAY/Gallup Poll has found.Some 35% would "strongly consider" a hybrid; an additional 23% would "consider" it.

But while the results seem to indicate that hybrid gas savers are taking off, the results are at odds with what consumers actually are buying: only 4.3% of vehicles sold last year were hybrids, the Environmental Protection Agency reports.

Dominion proposes rate breaks for hybrids

RICHMOND -- Dominion Virginia Power proposed a pilot program Monday to offer time-of-day pricing options to encourage off-peak charging of electric vehicles.If approved by the State Corporation Commission, the program would offer reduced rates for overnight charging and higher rates during peak times to Virginia drivers.

China Profits From Solar Policy as Europe Backpedals

China, the world’s biggest electricity consumer, is figuring out how to capture a larger share of the solar-energy market without losing money.The government will spend at least a year studying Europe’s system of paying above-market prices for solar power before deciding if there’s a better way to spur clean-energy plants across China, said Wu Dacheng, an adviser to national power regulators. The delay has stalled projects planned on Chinese soil by developers such as First Solar Inc. of the U.S.

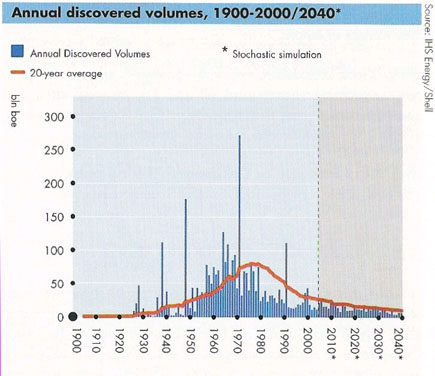

Examine this picture closely. It is the scariest picture you will see in a long time. It is from the International Energy Agency’s World Energy Outlook 2010. The IEA is the energy policy research agency of the Organisation for Economic Cooperation and Development (OECD), which represents the interests of the major developed market economies. Apparently.So what’s so scary about this picture? The growing light blue wedge representing “Crude oil: fields yet to be found” is real cause for concern. Eliminate that growing wedge, and we do not have much more than five years before overall supply starts to decline.

Carolyn Baker - Paradox: Linchpin Of The Long Emergency

When people ask me, “Will the Long Emergency happen quickly or slowly?” I answer, “Yes.” When they ask, “Will it be like rolling down a bumpy hill or falling off a cliff?” my answer is “Yes.” My response usually draws laughter or a knowing smile, and then I proceed to explain what I mean as I intend to do in this article. Answering “yes” to such questions underscores the paradox that is at the core of both the questions—and the answers, and without which it will be absolutely, unequivocally impossible to navigate the Long Emergency.

For India’s Farmers, a Bare-Bones Drip System

So, in effect many farmers are too poor to make the investment that could pull them out of their poverty.But there is a way out, argues Peter Frykman, the chief executive of Driptech, a start-up firm based in Mountain View, Calif.

His company sells simple drip irrigation systems in India for as little as 6,500 rupees ($144) for half an acre. Unlike the Jain system, the Driptech product does not have specialized pipes or an emitter that releases a measured quantity of water.

The Conversation: 'Carbon Nation'

Is it possible to separate politics from the divisive issue of global warming?That's the ambitious goal of filmmaker Peter Byck, a self-described liberal who says that support for green policies shouldn't depend on whether you believe in climate change.

In his new film, "Carbon Nation," Byck spells out a common ground -- that smarter green strategy can save money and give the world cleaner air and water, in addition to addressing global warming. The film will be shown at screenings throughout the country and released in May on DVD.

EU could meet carbon targets more cheaply with gas than renewables, say gas firms

Europe could save €900bn (£762bn) and still hit its 2050 carbon reduction targets if it built fewer wind farms and more gas plants, a coalition of gas producers including Gazprom, Centrica and Qatar Petroleum has told the European commission.The industry is lobbying against the possibility of the commission setting new renewable energy targets and phasing out the use of gas. Next month, it will publish a draft "road map" energy strategy to 2050.

Australia: Climate cash goes up in smoke

MORE than $5.5 billion has been spent by federal governments during the past decade on climate change programs that are delivering only small reductions in greenhouse gas emissions.An analysis of government schemes designed to cut emissions by direct spending or regulatory intervention reveals they have cost an average $168 for each tonne of carbon dioxide abated.

Academics solve problem of sealing carbon dioxide leaks

ACADEMICS from Heriot-Watt University's Institute of Petroleum Engineering have developed technology which identifies and seals leaks that could occur in carbon dioxide storage sites.The development is designed for companies looking to develop geological carbon dioxide storage sites.

Climate Change: Why Ugandans are worried?

Ugandans are now in their hottest season with an average 30˚C of daily temperature. However, most of them are not sure whether the coldest months will come soon since everything regarding the environment has changed. Besides, unusually, night temperature has been increasing from time to time and water shortage is real in several areas.

West Africa: Food Crisis Imminent in West Africa, Warns Oxfam

As the Sahel region of West Africa is just coming out of what seems like a biting food crisis, Oxfam America points out that unfair product prices, climate change and outmoded agricultural practices conspire to foretell even more cases of hunger.

Food shortages caused by global warming may be cause of world-wide unrest

While the causal intertwining of climate change, food security and political upheaval may not be new to human civilization, recent world events have thrust the topic back to the center of public consciousness with a vengeance.Rising global food prices - which some believe are caused in part by a rash of severe weather - are at least partly credited with tipping the scales of popular ire that ultimately toppled autocratic regimes in both Tunisia and Egypt in the past several weeks.

As the UN's Food and Agriculture Organization's Food Price Index hit an historic peak in January, protests against swollen prices seemed to erupt in concert across disparate corners of the developing world, echoing the food riots of 2008.

Huff and Puff and Blow Your House Down

Global warming is most likely responsible, at least in part, for the rising frequency and severity of extreme weather events — like floods, storms and droughts — since warmer surface temperatures tend to produce more violent weather patterns, scientists say. And the damage these events have caused is a sign that the safety factors that engineers, architects and planners have previously built into structures are becoming inadequate for the changing climate.Dikes, buildings and bridges are often built to withstand a “hundred-year storm” — an event so epic that there is a 1 percent chance it will happen in a given year. But what happens when 100-year storms are seen every 10 years, and 10-year storms become regular events? How many structures will reach their limits?

Can anyone tell me what oil discovery was for 2010?

Turnbull - if you mean how much new global oil reserves were discovered in 2010 the very short answer is NO. Not every company (country) offers an estimate or even announces every new discovery. And the ones who do offer estimates have to be viewed very critically IMHO. Even when I make an oil discovery my estimate of that volume, even with all the data available to me, might not be terribly accurate. But even if we did have a solid gold number for the new reserve volume it still wouldn't be very meaningful IMHO. A 500 million bbl oil discovery in the Texas (that could reach max production in 18 months) would have a very different impact than a 500 million bbl discovery in Deep Water Brazil that won't reach max production for 7 to 9 years. Likewise a 500 million bbl heavy oil discover onshore reaching a max delivery in 18 months but at a rate that's only 25% of the rate of the previously mentioned Texas discovery will also have a significantly different impact.

I apologize if I'm adding meaning to your question you didn't intend. IMHO how much oil is discovered during any time period isn't very important. What is critical is how any new discovery will affect the oil rates we have access to around the globe. Many bilions of bbls of oil have been disocvered in Deep Water Brazil. This will add a great deal of production to global out put. But not next year and not in five years. But eventually, yes. It's the timing of the production that's important IMHO...not the volume sitting under 7,000' of water.

Thanks Rock

I haven't seen a copy of this chart updated in the last 2 years. So was just wanting the data to update one I'm keeping updated.

I know it's not a really a good measure, but whipping out this works good whenever someone makes the inane comment "there's plenty of oil if only(fill in the blank)".

turnbull - Charting is great...especially if I don't have to do the work. I'm sure there's a lot of BS in some of the numbers but from a "big picture" perspective that may not obscure the trend line. It is a very interesting chart especially how the production rate response seems to become very dramatic as new discoveries come on line. What's really striking is the projected increase from 2010 forward. You have to go back to 1950-1965 to see a similar rate of increase. This was the time period when a large percentage of big fields (especially in the U.S.) were discovered. Interesting that they are predicting another very major discovery boom in our future. Oh, wait, they aren't: they aren't predicting a discovery boom...or even a little pop...at all. Just an increase in oil production rates like we saw during the boom times we saw 50 years ago.

Hmmm....something doesn't seem right.

No, no, everything is fine look again...

http://i289.photobucket.com/albums/ll225/Fmagyar/FairydustProjection.jpg

If you google "the growing gap" this same basic chart appears in a variety of places, and with a wide range in the discoveries value after 2008.

I have 10 gb for 2009, nearly double what 2008 was. Any clue to what 2010 was? Anybody?

No idea T but there could be a valid basis for some (but not all) of that bump. Beside physical limtations oil recovery is also a function of price assumptions: increasing future oil prices does allow some legitimate increase in recovery. But I doubt that accounts for much of the jump.

Every January the AAPG (American Association of Petroleum Geologists) has a roundup of the previous year's big finds: Brazil Discoveries Set 2010 Pace - AAPG EXPLORER January 2011. 2010 was fairly outstanding, various trolls got into a froth about the curve being supposedly permanently bent out of shape by all these finds. But note what the AAPG has to say:

Two things stand out here: first the predominance of offshore, with its higher costs at all stages leading to more rapid production leading to subsequent rapid decline, plus longer lead times to initial oil, plus slower rate of extraction, and so forth.

Then the fact that this is boe, i.e., barrels of oil equivalent, i.e., not entirely oil per se. How much is oil is another matter.

The AAPG also notes:

So 2010's finds are by and large just a new region being opened up, expanding the scope of Brazil's operations. Brazil's existing offshore has very steep decline rates too, in 2007 they brought on a huge volume of new oil, ca. 800 kb/d IIRC, which showed as a very modest increase of ca. 200 kb/d, again IIRC. It was a very neat demonstration of decline rates in action; and these new finds are that much more technically challenging and expensive to exploit, and eventually will decline that much more faster.

The AAPG concludes:

With all of the above caveats in mind formulate your conclusion accordingly. Reclassifying the quality of the discoveries on the Growing Gap chart would be instructive - how much is offshore? How much is in giant fields? BTW Nate Hagens related on how onshore production peaked about 30 years ago. We are indeed running on fumes, or neglecting to change the oil in our engine, or whatever other metaphor illuminates this situation for you.

Excellent details KLR...you're man (or woman if so be). It's also good to remember as pointed out earlier: oil in the ground, regardless of how many billions of bbls there are, doesn't do much for the economy. It's when and how fast they produce it that's really important. I'm sure the Brazians have an estimate of that schedule. I don't know if they've made it publicly available with credible backup support. Now that would be a very interesting projection. Like our DW GOM it should come on in big gulps: hundreds of thousands of bbls/day at a time. But it could be quit a few years between each gulp. The world is to get a first hand lesson on just how long it takes to design, drill and impliment such projects. I think the world will be somewhat disappointed. Just my WAG.

I'm a Man, as it happens.

There's also peakoil.com member "Oilfinder2" and his "Catalog of Recent Oil Discoveries," which he thinks renders the whole Hubbert/Deffeyes/Campbell/Laherrère pessimism laughable, and its adherents irrational cranks. Forget what he thought he'd dug up but seem to recall that in past years he was trumpeting his totals as approaching what the AAPG claims for last year, hence of dubious utility, given their caveat about 2010 topping anything in the 6 years previous; AAPG trumps bloggers. Of course we bloggers can document what they show for public edification. Compare their totals to OF2's Catalog to test his modus.

Even 26 bbo(e) doesn't change the game. That big spike for 2000 is Kashagan, which remains vaporware. A decade of sustained major volumes would be more like it.

Big spikes are predictable. Reservoir sizes are a fat tail distribution and because of that effect, big oil fields tend to stand out. If we average out the spikes, we are around an average of 8 GB discoveries per year dropping down to less than 2 GB by 2050. That would suggest that we have discovered (including any future backdating) a bit above 90% of the oil so far.

So the 28 GB spike from last year is not unheard of. Here is a sample Monte Carlo run.

Note that the spikes are even bigger that 28 GB for this run.

http://mobjectivist.blogspot.com/2009/12/monte-carlo-of-dispersive-disco...

This is all distilled in the on-line e-book The Oil ConunDrum

Nice, very succinct. I was about to ask where Kashagan was in there, but on that scale it's likely just one of the more prominent bumps. One could deny the veracity of Monte Carlo in the first place, of course, certainly there are ways of abusing statistical models of that sort; but all the first order evidence points in one direction as well, to me anyway.

Demand is a quite elaborate topic, though. I've been rereading Spencer Weart's Discovery of Global Warming, an excellent book. It's chock full of accounts of dead end or cul de sac theories, which seemed quite solid to their authors. Eventually with enough data piled up and methodology worked out, plus robust computing power, the case to be made came around, but it took almost a century. Energy demand has more facets than most realize, too.

I agree with dead ends and red herrings. What I tried to do, which I think was unique, was to fill up the TOC book with analogous explanations to a number of only tangentially related topics. The connecting theme in the topics was that of disorder and very similar math. It was one of those cases of preponderance of cascading evidence that after a while became overwhelming. Others may not see the same threads of connectivity but I think that is what science is all about.

Nice job with the book too, it's handy to peruse your whole output at once like that.

Although we're obviously counting "discoveries" different, both AAPG and myself have come up with a large spike in the same year (2010) - which tells me my methodology isn't that far off. I'm probably including things they would count as reserve growth and/or possibly discoveries that will show up in later years.

My total for 2010 was 45-59 billion barrels of recoverable discoveries, plus 91-92 billion barrels of oil-in-place amounts.

I notice their list doesn't include an addition to West Qurna which was announced in October as having 43 billion barrels, whereas previously it was listed as a 21 billion bbl field. If you take the average of my recoverable range (52 billion barrels) and subtract the 22 billion bbl addition to West Qurna I included, you get 30 billion bbl, which is darn close to the AAPG's figure of 28 billion bbl.

So don't mock my list, you've just demonstrated that it's pretty darn good, taking into account different methodologies!

One other thing I just noticed - the AAPG list does not include any unconventional discoveries. I've got at least a few in my list. By not including unconventional sources (Bakkens, tar sands, etc) in the discovery charts, that's going to leave a lot of people scratching their heads in a few decades why cumulative production is outstripping cumulative discoveries.

You are definitely working way too hard. I can get the same results by applying a Dispersive Discovery Model. All the discoveries are statistically expected. You will get spikes and then some of the discoveries will go into a backdated reserve growth. However, in the end, it really won't make much difference because the peak will still occur in the past.

I am working from a 2800 billion barrel global URR, BTW.

You probably didn't mean to say this but it is statistically true. Some people will never understand the concept of statistical fluctuations.

Not sure you understood what I meant. I was saying that, because a lot of (mostly unconventional) discoveries are not counted/captured as "discoveries" in the usual charts and graphs, and yet they contain real oil that is - or will - be produced, at some point in the future people will be adding up the cumulative discoveries and find that there has been X amount of oil discovered. They will then look at the cumulative production chart and mysteriously find that X + Y amount of oil has been produced. Whether this amounts to just a statistical fluctuation, or whether something somewhere just went really wrong, depends on how big Y ends up being (which would tell us how wrong X really was). I'm no statistician, but seems to me if Y is some significantly big number compared to X, then it is not a mere statistical variation but, instead, something went really wrong in calculating what "X" was supposed to be. And my point is that it's starting to look as if people aren't really capturing a true measure of "X". In my own work I'm seeing companies announce discoveries (or, should I say, "discoveries") that aren't showing up in the usual charts and lists. But I have no doubt this oil is real (would be happy to give examples).

I don't think you understand. In a chart upstream, I showed a simulation of a finite set of discoveries that tracks the actual size distribution of reservoirs. You end up seeing these large spikes due to the imbalance of the super-giants against the smaller size background.

This is as real as it gets, and it does happen because the data from 50 or more years ago is pretty solid by now, and the fluctuations occurred back then and they have continued to show up. The data from that long ago also includes the reserve growth components through backdating and that is what I used to generate a smoothed dispersive discovery cumulative. This turned into a 2800 GB URR. What do you think your URR will produce?

What is great is that I have this all written up in The Oil ConunDrum, and anyone can read it and make up their own mind on how the statistics manifests itself in real terms. No one has come close to doing anything like this kind of analysis, and it really does demonstrate the misguided approach of those that track fluctuations as if they were indicative of future growth.

The trouble is that the Canadian oil sands were discovered centuries ago. The first Europeans to see the Athabasca River basically stepped in them and got oil all over their feet, and the Indians knew about them long before that time. So, you can date their discovery to the 1700s, long before the first conventional oil wells were drilled.

The actual production is considerably more difficult than conventional oil, and is more like a manufacturing operation than conventional oil drilling. This completely screws up production forecasts if you treat them like conventional oil, particularly since the world has more oil sands than conventional oil.

Ahh, I misinterpreted that he was actually including the oil sands, thanks.

He might as well include peat moss if that is the abundance concept.

Funny that I already explained the concept of a moving baseline elsewhere in this comment thread.

http://www.theoildrum.com/node/7498#comment-767382

In that comment I explain how the most slimy management types that I encounter are the ones willing to use the shifting baseline argument to make the data work in their favor. They really deserve ridicule and scorn. One of the most memorable examples I recall seeing was a manager that decided to add empty lines (!) to a source code estimate to make it look like the software people were maintaining productivity. People in the know realize how ridiculous this is but others get the wool pulled over their eyes.

Mr. Abundance.Cooncept provides a great example of the kind of slimy bait-and-switch that we have to be aware of. First and foremost, the arguments have to come from a certain level of agreed upon logic and a fixed reference frame.

WHT, you're so oblivious to my point that you're oblivious that you're oblivious. So let me put it as succinctly as possible:

What if oil gets produced which was never counted as "discovered?"

And what if there is a lot of this?

Your casual dismissal of the oil sands is a perfect example (talk about slimy!). RockyMtnGuy sort-of got the point when he notes that it's hard to put a "discovery" date on it.

What if, like the oil sands, some oil does not occur in a "reservoir?" The peak oil bean counters tallying up the discovered reservoir sizes and putting bars on years representing that tally are going to miss a helluvalot of oil if they're only including oil discovered in identifiable "reservoirs" with identifiable "discovery dates." Not all oil occurs in an identifiable reservoir, and not all oil can be said to have been "discovered" in a certain year. Where would you put the bar for the oil sands? In the 1700's? The 1930's? Or maybe add smaller bars in recent years as companies add tar sands to their P1 reserves? Because of the size of the oil sands, depending on which of those 3 options you choose, it's going to make a big difference in the distribution of your curve - assuming of course you include the oil sands at all. If you choose to dismiss them altogether because they don't pass your smell test as "oil," then you're going to start wondering what the heck is happening a few decades from now when production figures are far outstripping what you thought was an accurate historical "discovery" tally.

You're so enamored with your fancy mathematical model you don't even know what questions to ask to feed into the model.

By your pretzel logic, all "oil" accounting should be based on whale oil. And when crude oil started supplanting whale oil in the 1860's, everyone was surprised when production of "whale oil" started outstripping the number of whales harvested. Seriously, that is the kind of silly argument you are making.

Often all that mathematics involves is sound logic. Work through the argument logically and it will become obvious. Moreover, every other applied use of mathematics starts out as a word problem; if you can't get the premise right, maybe you shouldn't be working the problem.

Really? Then by your bizarre "logic" we shouldn't count any discoveries of 8-10 degree oil because that happens to be the same grade as the stuff from the oil sands. It wouldn't matter if these discoveries were gushing out of the wells in California 100 years ago, or somewhere in west Texas from wells in the 50's, it shouldn't be counted ... just because of your arbitrary boundary. What kind of idiocy is that.

It's obvious you don't want to include the oil sands because it would make your nice-and-neat model a completely complicated mess.

And BTW, since it obviously didn't occur to you (another one of those questions you didn't think of asking yourself because you're too ensconced in your mathematical formulas), whale oil is not a fossil fuel and does not come out of the ground. Neither is ethanol, palm oil, or any other red herring you might think of. Oil sands are a liquid fossil fuel and they come out of the ground - just like light, sweet crude. Nice try, but that was the biggest failure of logic in this whole discussion.

You apparently can't stand logical arguments.

Types of coal from the top of my head:

Anthracite

Bitumuninous

Lignite

Peat Moss

People have kept track of the various grades because it is important from both an energy density argument and a EROEI/pollution perspective.

Oil sands is bitumen and falls into a different category, which one can count separately just like various grades of coal are counted separately.

I can't figure out your logical disconnect; is it a problem with some political stance you may hold?

Let's take it from a politically neutral angle. I could do a similar categorization of lakes around the world. Do I count salt-water lakes along with fresh-water lakes?

Heck, I can use the exact same math that I use for sizing of oil reservoirs to predict freshwater lake distributions across the globe. You can read about this in The Oil ConunDrum or here: http://mobjectivist.blogspot.com/2010/10/lake-size-distributions.html. I might be able to try this on salt water lakes as well but the biggest salt-water lake, the ocean, obviously screws up the statistics as it is not a random occurrence but a holding basin of the lowest elevation. The rest of the salt-water lakes and seas may hold some statistical pattern but the numbers aren't there to make it worthwhile to do. Freshwater lakes and conventional crude oil reservoirs follow good statistics because the counting numbers are in the 10's to 100's of thousands and the math arguments fit precisely to physical growth models.

I have no agenda apart from having the talent and skills to work with scientific models. OTOH, your agenda of "proving" abundance allows you to likely claim that Uranium is unlimited because it is dispersed in the ocean at some level of concentration and that we should act surprised whens someone says Uranium reserves never seem to deplete.

Perhaps you will eventually catch on. I also don't include biofuels because they are different and require extra EROEI overhead. I was able to use the whale oil analogy to extract that admission out of you.

You apparently still do not know how to ask the right questions.

No one - or almost no one - is harvesting peat moss as a fuel source. On the other hand, people *are* harvesting oil sands as a fuel source. Your attempt to analogize oils sands with peat moss failed miserably because clearly peat moss has little utility as an energy source (which is why no one is using it as thus), while the same can hardly be said of oil sands.

Of course you didn't think of that, just the same way it didn't occur to you how bad the oil whale analogy was. You just don't know how to ask the right questions.

Yes, of course you can. So what? But why are you doing that? To acertain the amount of freshwater in the world? OK, fine. But again you just did not think far enough: You're so busy thinking about the size distribution of freshwater lakes in the world, it did not occur to you that fresh water can also be found in underground aquifers; and that new lakes of any size can be made with reservoirs; and that freshwater can be extracted from salt water. Etc. This makes the potential amount of freshwater in the world an order of magnitude (*many* orders of magnitude?) larger than if one counted freswater lakes alone.

You clearly aren't reading well. I did not say you should include biofuels, and I myself would not include biofuels, because - I repeat - they are not fossil fuels. Oil sands *are* fossil fuels.

You clearly have talent and sills to work with scientific models. You also clearly do *not* have the talent and skills to reason what should go into those models.

Lignite -> Peat Moss is a continuum of grades, deal with it.

A model of underwater aquifers would likely follow the same distribution as oil reservoirs and lakes.

Some people have this inability to discern shades of gray. Obviously areas of tar sands exist and they can be counted. Most exploration funding does not have an objective of finding new areas of tar sands, instead the money goes into prospecting for promising areas of crude. That is what the dispersive discovery algorithm models. Right now it is useful to extrapolate future crude oil finds, and I have no doubt it will stand the test of time.

If somebody wants to model low-grade coal, low-grade tar sands, low-grade uranium, they can go ahead and try to extropolate future reserves. They are clearly independent of the model of crude oil, no matter how the grades get redefined by someone who doesn't want to face reality.

Why would one be so interested in modeling the size distribution of oil fields (or lakes, or aquifers, or whatever) anyway? There are small numbers of large items, and large numbers of small items. Most everything in nature is that way. What you spent a lot of time and effort modeling tells me no more than what I could figure out from common sense.

The one who doesn't want to face reality is the one modeling *just* oil in porous, pressurized sandstone and carbonate reservoirs, when that is almost certainly just a fraction of the world's total oil endowment. If one wants to know how much oil will be available for future generations, ignoring the other 80% of the world's oil makes about as much sense as figuring out how much water there is in the world by only modeling freshwater lakes.

When the peak arrives much later than your model projects, and when the world has consumed far more oil than your model says should be there, don't be surprised.

OK then smarty-pants, tell me one place in the voluminous literature of earth sciences that anyone has even worked out this math? You are discussing this topic with perhaps the only person who has decided that it was obvious enough to write down and document in a formal setting.

That's the way these arguments get resolved. We wear you down with logic and then you state it was obvious anyways. Don't worry, I am used to it. In my normal job I do visualizations and simulations for people that have trouble accepting some real-world behavior. Invariably when they finish with their project and come to some agreement, they no longer have any use for the simulations and usually tell their colleagues the behavior was obvious to begin with, and they really didn't need the help. Yeaaaah, sure.

80%?

How about Uranium?

Uranium disperses a huge amount:

Very high-grade ore (Canada) - 20% U 200,000 ppm U

High-grade ore - 2% U, 20,000 ppm U

Low-grade ore - 0.1% U, 1,000 ppm U

Very low-grade ore - 0.01% U 100 ppm U

Granite 4-5 ppm U

Sedimentary rock 2 ppm U

Earth's continental crust (av) 2.8 ppm U

Seawater 0.003 ppm U

Known recoverable reserves > 5,000,000 tonnes

How much does the earth's continental crust weigh? What is 0.00028% of that weight? It essentially puts your meager 80% to shame, that's for sure.

My math is all about dispersion, both characterizing it and making it understandable enough for other people to find useful in setting forth some kind of policy decisions. Can you put 2+2 together now?

What math? That, in nature, small things tend to occur in large amounts and large things tend to occur in small amounts? I don't know offhand of any specific papers, but it's so obvious I'd be willing to bet scientists have observed and written about it for hundreds of years. It's easy to visualize:

Q: What are the approximate world populations of:

1 bacteria

2 house flies

3 sparrows

4 leopards

A: Don't know the specific numbers, but isn't it obvious that 1 > 2 > 3 > 4? Yes, it's obvious.

Same thing would be true of oil fields. So what? There's no surprise there, you haven't told us anything we couldn't have figured out ourselves.

One other difference between what you're doing and the lakes analogy is that with oil discoveries you interject the element of time. Unlike lakes, oil fields aren't obvious to the eye, and take long amounts of time to discover. And even once you discover them, it often takes a long amount of time to figure out how big they are. Now, no one doubts that in the past, present and future, there will be a large number of small oil fields discovered, and a small number of large oil fields discovered. So what? That's a given. What you assume - and what I disagree with - is that the bulk of oil discovery has occurred in the past, when in fact you don't know that (and before you say anything, this has nothing to do with individual field sizes or their distribution, just gross volumetric totals). What if, for example, over the next 4 decades or so, they discover a trillion barrels of oil off the eastern coast of South America? And what if another 500 billion barrels is discovered in Bakken-like shales around the world over the same time period? I don't know if that will happen - but it *could* happen. And if it does it'll make your dispersive discovery chart with the declining discovery rates over the next 4 decades look a bit silly. You've spent a lot of time making some fancy mathematical model (which doesn't even include the majority of the world's oil) which attempts to forecast future oil production based on past discoveries, but the discoveries you include in your model don't even include the majority of the world's "discovered" oil.

In fact, I just browsed through your write-up from a few years ago on this topic and noticed the mentions of natural gas. That sure gave me a laugh! Natural gas is the perfect example of my whole point: When you wrote that (and Hubbert before you), you had no idea that - literally - hundreds of trilions of cubic feet of natural gas would be discovered in shale formations over just the next 2-3 years. In fact, this little blipvert is now pretty funny:

Just two years after you wrote that it jumped up to 1836 TCF and is almost certainly going to go up again the next time the Potential Gas Committee meets. In fact, this petroleum geologist here thinks the number could be as big as 32 quadrillion cubic feet - and that's just in the US (!!!!!!)

This is why I'm telling you you're a fool for excluding unconventional sources. They are far bigger than conventional sources, and they are already being put to the same energy uses that conventional sources are. If someone wanted to make a policy decision about future natural gas uses based on discovery rates, but decided arbitrarily not to include unconventional gas because they didn't like it or some other reason, they will make an idiotic policy decision because they've deliberately misinformed themselves about how much natural gas is available for future use.

The same thing applies to oil. The amount of oil in the tar sands alone (including both Canada and Venezuela) already exceeds your 2.8 trillion barrel figure. I guarantee you there will be hundreds of billions of barrels in the source rocks of the world (Bakken and other shales, there WILL be lots of those). What percentage of that will be recovered, nobody knows.

I don't know if these unconventional sources are 80% or whatever - I picked that number off the top of my head for illustration. But it is clear that there are larger quantities of unconventional resources than there are conventional one. This natural gas distribution pyramid is a good example.

If you're excluding these kinds of resources from your model, your model is useless.

Here's a challenge to you: Run your dispersive discovery model, but this time apply it to natural gas. Exclude all those shale and other unconventional sources. Maybe wait for a few more years of US production, and then come back to me and tell me how useless your model was.

So much for your methodical skills. The difference here is that you pick things out of thin air and claim that supports your "argument". Yet if someone goes through the effort of applying rules of probability it essentially gets mocked as silly.

BTW, you haven't really read the book. I have the natural gas pyramid referenced in the book and I talk about the issues of new sources of natural gas.

Again, you haven't read the book. I included an alternate discovery model which used the Shell Oil discovery data (labeled as "barrels of oil equivalent") and performed an analysis on that as well. That one had a URR of 3500 billion barrels, which was another 700 billion barrels higher than the 2800 conservative figure.

The problem is that, even though Shell comes up with a curve much like my (in your words) "dispersive discovery chart with the declining discovery rates over the next 4 decades look a bit silly", they did not tell anyone how they derived it! That is typical of the oil industry and oil academia mindset. No one wants to explain in some straightforward mathematical terms how this is derived! (note the "stochastic simulation" in the inset, that's some unexplained math) Yet you continue to mock dispersive discovery like it is either some bizarre alien concept that is "a bit silly" or in a prior paragraph rant about counting numbers between 1 and 4 like we are all perplexed pre-schoolers. You can't have it both ways and criticize the model as being both ridiculous and obvious at the same time.

The original post was here:

http://www.theoildrum.com/node/2712

I refined it here to take into account the distinction between the various grades of "boe" oil:

http://www.theoildrum.com/node/3287

See for yourself how much the peak shifts.

The greatest success of my techniques is that we are able to watch the slide of conventional crude oil with the highest resolution possible. We watch this stuff with an eagle eye as a counter to your hand-wavy pronouncements of a rosy cornucopian future. I wish it the outlook was better but we take advantage of the methodical scientific and mathematical techniques at our disposal and see what that gives us from a totally objective view.

The depth of comprehension is becoming more and more vast and it is not looking good on your side.

Let me join in this discussion, though I'm not an expert. Just read about it a lot the last few years. Abundance, The last decades the major oil companies looked for oil in all kind of places where, geologically, you can expect oil. Why do they wait for the Arctic to melt, why do they want to drill north of Russia and other (climate) difficult places when there is a chance to find so much oil in easier places ? They have used advanced seismic methods to find giant oilfields, so why to expect 1 trillion barrels east of South America ? That's about the amount of oil in place in whole the Middle East. For what reason oilcompanies now consider a discovery of 30-40 Gb a tremendous amount of oil ?

Abundance, an oil production model based upon conventional oil counts because that's the oil this economy depends on. If you make a flow rate model for fresh water that is used for industries and agriculture you take water from the rivers, lakes and water tables, not from seawater. It's important to figure out in what timescale oil flowrates go down from 75 mbd to let's say 40 mbd. The timescale wherein oilexports go almost to zero. A world depending on flow rates from unconventional oil is a completely different world, a world probably with a much lower population. That makes WHT's work extremely important. Of course you can use common sense to think it out, but it is better to have it backed up by mathematics. With the knowledge of the oil exploration history common sense also tells that it is very unlikely that they will discover 1 trillion barrels of oil in one region. Maybe dispersed over the world in the next decades, but that won't prevent the coming economic mess.

Unconventional gas, like unconventional oil is much more expensive to develop. Unlike tarsand oil, flowrates are high, but decline starts after a short time and is high. For unconventional gas to extensively develop you need an economy that can sustain high gasprices, otherwise it are just reserves in the ground.

Han, I actually have a quote from this other cornucopian from TOD and PeakOil.com named ReserveGrowthRulz, who thought global warming had the beneficial side effect of leading to new exploration chances! Not only was that an absurd statement but like you said, they probably have eliminated this area for consideration through advanced seismic techniques.

I don't see comments anymore from him on TOD for quite some time. His thinking must be like his writing: chaotic. At least I a lot of times couldn't follow him.

One of the (optimistic ?) estimates is that the Arctic contains 80 Gb of oil. Hardly worth waiting for melting to speed up and fighting for regarding the very difficult climate conditions, though they do. For example Russia put already flags to mark their territory.

BTW . . .

And . . .

You obviously didn't realize it, but in the 2nd quote you admitted that, contrary to the first quote, you *do* have a political agenda.

More contaminants due to lower grade of coal -> more airborne particulates equals pollution -> removal of particulates requires extra energy -> extra energy reduces EROEI.

Some people obviously would rather live in a Victorian-era London with that historically record level of pollution.

Wingers usually have trouble with shades of gray. To them it is all black and white and can no longer reason.

Oh the irony!

Or, should I say, "Oh the hypocrisy!"

Just a couple days ago he tells me:

Now he tells me:

So you do have an agenda - it's not an academic debate about how much oil exists in the world, and how much of it we've discovered in the past, and how much we'll discover in the future ... regardless of value judgments about whether finding more or less oil is good or bad (which would be the proper, detached, un-biased scientific mindset). Noooo ... of course not (typical peaker!). It's really all about not wanting to discover lots more oil, or using lower grades of oil, because you don't want humans to find a lot more oil and use lower grades of oil, because you don't like its effects.

Like all pseudo-scientific peakers, you cloak yourself in an aura of objectivity and pretend you're simply doing "science," but in reality you're about as objective as the average creationist.

You know what I am talking about. Exogeneous variables have a huge impact and you can't dismiss this just by associating particulates with a political motivation.

Pointing out the fact that unmitigated release of dirty carbon, etc. into the air will detrimentally impact standard of living is essentially stating the historical record. China is grappling with this problem right now.

Obviously touched another one of your nerves.

But that has nothing to do with the topic. I might even agree with you that spewing excess carbon and other particulates into the air is a bad thing which should be avoided, but what does that have to do with the rate of oil discoveries? Absolutely nothing. As soon as one digresses from the topic "the rate of oil discoveries" into "oil is bad because it pollutes the air," that immediately sends up warning flags that the person telling us the rate of oil discoveries will continue to go downhill probably has some ulterior motive for telling us this. You clearly have an ulterior motive, and despite your pretense of being some objective scientist, your ulterior motive is affecting your "scientific" conclusions (or, more specifically, affecting the inputs and assumptions of your model).

I've debated peak oilers too much and for too long to be duped into believing they don't have an agenda. Their agenda varies somewhat, and it's stronger in some than in others, but in almost every case, it's nonetheless there.

You are full of it. The topic veered into discussion of categories of oil that differ. I was explaining why they differ and why the discovery search is directed to high qualities or grades of oil. The search for oil with low EROEI or oil with huge amounts of contamination is not the driving factor to seeking new deposits.

You can see my real agenda in The Oil ConunDrum. I have a chapter devoted to cornucopian arguments and if you read it, you will learn how to argue against cornucopians like yourself. So my agenda is to defeat the stupidity that exists in the land of cornucopia. But then one should eventually realize the fight against stupidity exactly aligns with the objective of doing good science. So I kill two birds with one stone.

You really don't understand your own absolute ignorance. Say that you were tasked with counting oil discoveries from day one in 1858 and you were hypothetically immortal so could do that job forever. So you go ahead and do your bean counting exercise for the next 150 years, and you get the data free of charge from every country. So here you are today and you claim that you will need more time to make any conclusive statements. There are still "numbers of discoveries" so you don't say a blinking thing. Since you are in charge of watching the numbers and refuse to commit pending more information, everyone assumes business as usual and things continue on as before, accelerating along with technology. But then some other fellow comes along that is curious about the effects of finite resources. He develops a model and shows how the model reflects reality. Using the principle of maximum entropy and some logic he is able to derive a Logistics sigmoid curve to describe a peaked discovery curve. He explains why the numbers fluctuate from year-to-year due to the sizing and rareness of reservoirs. He shows how the production lags the discovery profile by a number of years and what can cause deviations from perfect symmetry. OTOH, you keep toiling away while putting your fingers in your ears, claiming that the other fellow has an agenda!

In your case, ignorance is a virtue because it does not allow any kind of introspection. So you blithely ignore your own limited vision, and rail about the other guy claiming he doesn't know how to count.

This would make for a nice Dr. Seuss story if you replaced all the important scientific principles with nonsense rhymes (see the Seuss story of The Bee Watchers for instance).

It would be nice to see a cumulative version of this discovery/production chart. Has anybody produced one?

It would be nice to see a cumulative version of this discovery/production chart. Has anybody produced one?

To answer my own question: WHT did produce a comulative discover curve here http://www.theoildrum.com/node/2712

It would be nice to see a cum. production curve with it.

It would still be very nice to see. That standard graph (in an above post) should now include a spike in it showing a big discovery year (or two?) for all the Brazil discoveries. Maybe even enough to meet current production for a year? The Brazil discoveries will take a while to get going but they are significant.

From a discovery perspective they are. I don't think they'll have access to all the capital they will need to get at it, though. I suspect that a large amount of that oil will stay underground forever or in the very least the production will spread over five decades or longer instead of the timeframe they are looking at now.

Once the credit bubble we are in pops, we will no longer be able to assume that if the resource is there we will just go get it if the price is high enough. People will become very skittish about long term investments.

Iran Protests: http://www.irannewsnow.com/2011/02/live-blog-iran-25bahman-feb14-2011/

Despite the fear it looks like some have made it onto the streets after all. I imagine the protests in Bahrain and Iran will look to complement each other?

Can't see things taking off as much as they did in Egypt/Tunisia, but never say never..

Iran has no Western backers to moderate their brutal response. After stealing the election a year ago the government has tolerated no dissent. Their legal system is at best a lottery and has resulted in show trials and executions of protesters. The regime is much more powerful, and they still have significant oil exports.

I do not know enough about other countries. Egypt had relatively free if unofficial opposition groups in a loose secular coalition with tech savvy controllers. They reacted quickly to rapidly to changing events and caught the regime off guard. I doubt that other countries regimes would make the same mistakes. Mubarak was a figurehead and easy focus for Egypt.

Bahrain is an absolute monarchy and deeply spit on tribal lines. Any revolution is likely to be religious and bloody in nature.

I've been to Bahrain a few times; perhaps the most important sandbar on the planet about now. At less than 300 sq mi / 750 sq km, if things there get dicey, there are few places to hide. I expect that, due to its importance (major oil infrastucture, military, financial), US involvement will be more pronounced than it was in Egypt if TSHTF there. Reform movements in the Persian/Arabian Gulf could have a more immediate effect on Western economies than what is happening in Egypt, demanding a more immediate, physical response. While I've been excited about the recent, mostly peaceful events in Egypt, developments in Bahrain, Iran, Yemen, etc. beget a more nervous sense of reality. Exciting times indeed.

In Bahrain the protesters are native Shiites. The regime is Sunni, and according to reports, the protesters are accusing their forces of not being native to Bahrain.

I'd guess that the regime will import however many Sunni mercenaries are required to put down the demonstrators.

Why import Sunni mercenaries when they have infidel mercenaries, doesn't the Americans have a large Navel base there. I very much doubt that they will allow Bahrain to go under, it would show too the rest of the Gulf state rulers that America was not to be trusted. If Bahrain goes down you will see the rest of the Gulf states putting as much distance between it and America as quickly as possible Qatar just across the water has a ridiculously large American air base out in the desert just south of Doha which is the command centre for all of the American forces in the Middle east. Check it out on Google maps, the loss of this would certainly put a crimp in Americas style if they were forced to abandon that. There are a whole set of Dominoes here ready to fall. This is just too frightening for words.

There are large, restive Shiite populations, even majorities, in the areas along the southwest coast of the Persian Gulf. But, as you point out, there are large interests in keeping the status quo there. At least, I think, so long as the oil lasts.

Yemen is a more likely place for the next regime to fall. It has a long and troubled history, since North Yemen became a state following WW I, while South Yemen was a British colony. South Yemen eventually became independent and socialist. Later there was the unification of North and South Yemen, followed by civil war in the early '90s. North Yemen also has a Shiite minority in the northern part of that country, which they have periodically opressed.

http://en.wikipedia.org/wiki/South_Yemen

(Note interesting bit about the British wanting Aden as a base to stop piracy of Suez shipping bound for India.)

http://en.wikipedia.org/wiki/Yemeni_unification

Seems the tempo has piked up a bit in Yemen

from the BBC: Street battles hit Yemeni capital in latest protest

and Iran

from CNN Heavy security surrounds demonstrators in Iran; clashes reported

Same here. I'm somewhat anxiously waiting to see how this pans out.

I suspect that this has previously been posted, but Jeff Rubin has a 2/9/11 blog post on food prices as a key contributor to unrest in Egypt:

http://www.jeffrubinssmallerworld.com/2011/02/09/food-what’s-really-behind-the-unrest-in-egypt/

Chinese shoppers struggle with spiraling prices

Jordan revokes restrictions on public gatherings

Iran, Egypt Caught in the Churning of a Mideast Democracy Wave

Looks like the genie might be out of the bottle in more ways than one. Unfortunately this new found sense of pseudo freedom doesn't really free anyone from the as yet generally unrecognized realities of population overshoot and resource depletion.