Drumbeat: February 12, 2011

Posted by Leanan on February 12, 2011 - 11:06am

Gulf rulers shaken by Egypt, but will weather storm

(Reuters) - Gulf Arab rulers, eyeing the fall of a fellow U.S.-ally in Egypt, have lost a longheld sense of invulnerability to popular unrest and will only survive the immediate crisis if they offer concessions to their populations.From oil behemoth Saudi Arabia to majority-Shi'ite Bahrain and sleepy Oman, Gulf governments may be forced to offer political and economic reforms to prevent unrest from reaching their shores.

But they will also not hesitate to use force to stifle dissent if needed to maintain their hold on power.

Ex-Shell head says energy policies choke economy

WASHINGTON — Former Shell Oil Co. president John Hofmeister said Thursday the Obama administration's energy policies and regulations are strangling the U.S. economy and preventing the country from decreasing its dependence on foreign oil.Testifying before the House Energy and Power Subcommittee, the Houston businessman blamed the administration for restricting offshore drilling after the oil spill in the Gulf of Mexico last year.

"I believe that the decline" in drilling in the Gulf of Mexico "will be sharper and deeper than what anyone is currently projecting," he told lawmakers. "We have made a horrible error as a country."

Spill Commissioners Call for Review of Energy Policy

Two members of President Obama’s commission on the Deepwater Horizon explosion and spill said at a Congressional hearing on Friday that regulatory failures and industry overconfidence helped lead to the catastrophe and called for an overhaul of federal oversight of offshore drilling and a transition to safer, cleaner forms of energy.

Rich in Land, Aborigines Split on How to Use It

As resource companies push ever deeper into Australia’s remotest areas, however, Aboriginal leaders are leveraging their rights as traditional landowners to negotiate deals with companies and governments that are seeking to develop their holdings. They say the potential windfall — hundreds of millions of dollars — will rescue their communities from their long dependence on welfare and state subsidies.“These resources booms come along maybe every 50 to 100 years, big ones like this,” said Wayne Bergmann, 41, a lawyer and executive director of the Kimberley Land Council, the largest Aboriginal group here. “So if we don’t get positioned during this next stage, the chances are we’re going to be locked out of the opportunities that are going to help build the economic basis for our families in the future. We can’t sit back.”

Need to filter fact from fiction!

WHAT Saddad Al-Husseini said, or in fact did not say, is making rounds — all around. For what he said carried tremendous implications to the global energy order.

While much of Europe slashes spending to reduce deficits, surging oil prices are allowing Russia to splurge. The Kremlin’s choice of stimulus package is a bit of a throwback, though — among other things, a new fleet of warships to challenge China.Last week Prime Minister Vladimir Putin announced a whopping $678 billion package of new defence spending for the next decade, with a quarter of the money going to revamp Russia’s Pacific fleet. On the Kremlin’s shopping list: 20 new ships, including a new class of attack submarines, plus new missile subs, frigates, and an aircraft carrier.

Paul Erhlich interview- Humanity on a tightrope

In this wide-ranging interview, after 40 books, thousands of scientific papers, and 40 years after "The Population Bomb" - Dr. Paul Ehrlich talks about our dependence of fossil fuels, climate change, toxic disruption, and food.His new book "Humanity on a Tightrope" is not about population! Instead, Erhlich and co-author psychologist Robert E. Ornstein look into the human brain for a tool that could help us survive the multiple threats facing humanity.

The Norwegian company Protia is betting that a new approach to carbon capture, based on ceramic membranes, will make a big difference to efficiency and costs.

Nigeria presidential rally ends in deadly stampede

(Reuters) - At least 11 people were trampled to death on Saturday in a stampede at an election campaign rally for Nigerian President Goodluck Jonathan in the southern oil city of Port Harcourt.

Saudi Arabia to save energy through insulation

(Reuters) - Top oil exporter Saudi Arabia plans to cut up to 40 percent of its energy use, largely by enforcing investment in insulation, its water and power minister said on Saturday.Power demand in the top OPEC producer is rising at an annual rate of 8 percent, requiring investments of close to $80 billion by 2018.

Without reducing the rate of energy consumption growth, the kingdom could see oil available for export drop some 3 million barrels per day (bpd) to less than 7 million bpd in 2028, Khalid al-Falih, the chief executive of state oil firm Saudi Aramco said last year.

Obama Seeks to End $46.2 Billion in Energy Tax Breaks in Decade, Chu Says

The Obama administration will seek to repeal $46.2 billion in subsidies for oil, natural gas and coal companies in the next 10 years, to fund renewable energy spending, Energy Secretary Steven Chu said.The plan is part of President Barack Obama’s commitment to lower dependence on fossil fuels and increase to 80 percent the share of U.S. electricity from “clean” sources by 2035. Cutting the subsidies will help pay for $8 billion in “clean energy” investments, Chu wrote on his blog yesterday. The president is scheduled to present the 2012 budget on Feb. 14.

“Fiscal responsibility demands shared sacrifice,” Chu wrote.

Energy Department to seek $600 million in budget cuts

The Obama administration will call for deep cuts in the headquarters staff of the Energy Department next week but will seek $8 billion in investments in the research, development and deployment of what it calls "clean energy technology programs."

Oil Industry Urged to Pay $200 Million for Added Gulf Drilling Oversight

The U.S. oil industry should pay about $200 million a year to support stricter and more efficient oversight of drilling in the Gulf of Mexico, a member of the National Commission on the BP Deepwater Horizon Oil Spill said.The funding, which is about 7 cents to 12 cents a barrel of oil produced, would help hire rig inspectors and engineers to review energy companies’ well designs, Donald Boesch, a member of the panel, said today at a hearing of the House Committee on Transportation and Infrastructure.

Gas pump prices highest ever for this time of year

NEW YORK – U.S. gasoline prices have jumped to the highest levels ever for the middle of February. The national average hit $3.127 per gallon on Friday, about 50 cents above a year ago.The price is about 6 percent higher than on this date in 2008. The next day, pump prices began a string of 32 gains over 34 days. They rose 39 percent over five months, eventually hitting an all-time high of $4.11 per gallon in July.

Nigeria: Pirates Attack Foreign Ship in Lagos

Lagos — Pirates off the coast of Lagos have attacked an unnamed foreign chemical tanker in a bid to board and rob the ship in the Gulf of Guinea.A report Friday by the International Maritime Bureau showed the attack happened late on Thursday about 50 nautical miles off the coast of Lagos.

Crude Oil Falls to 10-Week Low After Egypt’s Mubarak Resigns

Oil fell to a 10-week low in New York after Egyptian President Hosni Mubarak stepped down and handed power to the military, reducing concern that crude shipments from the Middle East will be disrupted.

Midwest Gasoline Gains as Conoco’s Oklahoma Plant Flares Gases

Also in Oklahoma, Explorer Pipeline Co., based in Tulsa, canceled Cycle 5 on its oil products line because a destination “couldn’t handle” products. Tom Jensen, a spokesman for the line, said in a telephone interview. He declined to identify the destination.

Get the rigs warmed up. The deep-water drilling permits are on the way.

Report: Yemeni protesters clash with knife-wielding men

Sanaa, Yemen (CNN) -- Men armed with knives attacked more than a thousand anti-government protesters gathered in the Yemeni capital to demand reform, human rights groups said.The protesters took to the streets of Sanaa on Friday night to support the ouster of Egyptian President Hosni Mubarak.

Explosions hit 3 gas pipelines in Iran

Iran's semiofficial Mehr News Agency says simultaneous blasts have struck three pipelines near the holy city of Qom, cutting the flow of gas.Mehr said the blasts, which occurred at 5:50 a.m. locat time (2:20 GMT) outside the town of Salafchegan, 130 kilometers south of Tehran, were felt kilometers away.

Local official Majid Bojarzadeh said the blasts were not caused by technical failures, but did not elaborate if officials believed the explosions were acts of sabotage.

Mexican city tries to close Sempra LNG terminal

(Reuters) - A Mexican city ordered U.S. firm Sempra Energy to shut down its Costa Azul liquefied natural gas terminal, citing saftey concerns, but the company said it was protected by a court order and was operating normally.Sempra's terminal in Baja California, northern Mexico, was inaugurated in 2008 and pipes natural gas to local industry as well as across the border to California.

U.S. lawmakers lend support to Keystone pipeline project

CALGARY - TransCanada Corp. said Friday it has received more support from U.S. lawmakers for its controversial Keystone XL pipeline project.The Calgary-based pipeline company said a letter has been sent to Secretary of State Hillary Clinton with the signatures of 30 congressional representatives from 18 states, calling for approval of the project.

Transocean nixes dividend for now

Transocean the world's largest rig contractor, has abandoned efforts to overcome a Swiss challenge against its 2010 $1 billion dividend payout, while setting out plans for another.

TNK-BP exec says BP offered it Rosneft deal role

KHANTY-MANSIISK, Russia - BP has offered its Russian venture TNK-BP a chance to join its partnership with Rosneft, TNK-BP's deputy chief executive told reporters, signalling a possible resolution to a row."We had an offer from BP ... about its agreements with Rosneft. Obviously a partnership would be interesting," Maxim Barsky told reporters on a visit to an oil-rich west Siberian region.

Obama to cut heat subsidies for poor

NEW YORK (CNNMoney) -- President Obama's 2012 budget will propose cutting $2.5 billion from a program that helps low-income people cope with high energy costs in the cold of winter and heat of summer, according to a source familiar with the budget process.The reduction is steep, and might impact millions of families. In 2010, the program received $5.1 billion in federal funds, which were then distributed to states that have both low average incomes and high energy costs.

BP fund to settle more than 2,000 claims of damage from gulf oil spill

The administrator of the BP escrow fund will settle more than 2,000 claims of damage from last year's oil spill from hotels, oystermen, condominium owners and others from Louisiana to Florida. Individual payments will range from $10,000 to $30 million, according to a lawyer for the claimants.

Is Oil Output Peaking or Not? Either Way, Cheap Oil Is Gone for Good

As investors and as drivers, most of us have an interest in the price of oil, and what it's going to do next. But if you're having trouble figuring out whether global oil production is about to peak -- an occurrence that will inevitably be followed by a surge in oil prices -- you're not alone.

Even whitewash won't halt Green machine

There is a fair amount of jargon in this document which will serve to confuse the ordinary voter, but one phrase that is explained is “peak oil”. This is the point at which the petrol pumps start to run dry because the maximum rate of production has been passed. The Greens argue that this provides Ireland with a chance to utilise our “bountiful natural resources” to develop alternative sources of energy and become an oil-free economy.Like the early Christians, the Greens have not always received a friendly or understanding reception, but the message they propound is likely to be heard for a long time to come.

Preface to a Prelude to Peak Oil

The stark reality that few have truly woken to is the high probability that we have already passed the peak of oil production and that it is all downhill from here. If this is a new idea to you, or even if you already have some familiarity with it, you will enjoy the new novel, Prelude, from peak oil analyst Kurt Cobb.

Ontario Halts Approval of Offshore Wind Energy Projects Pending Review

Ontario’s government said it suspended approval of offshore wind-power projects, citing concern that more research is needed on their effect on the environment.The Canadian province has also stopped accepting applications for its renewable energy subsidy program, its government said today in a statement.

Maryland Considers Legislation That May Boost Offshore Wind Energy

Maryland lawmakers are considering a bill that would require utilities in the state to purchase electricity generated at offshore wind farms built in the mid- Atlantic.The Maryland Offshore Wind Act of 2011, to be introduced before the state’s general assembly today, would require public utilities to purchase between 400 megawatts and 600 megawatts of capacity from wind farms in federal waters off Maryland’s coastline for at least 20 years, according to an e-mailed statement from Governor Martin O’Malley’s office.

Global Wind Turbine Orders Increased 75% in Second Half of 2010

The world’s wind turbine order intake rose 75 percent in the second half of last year, reaching the highest level of activity in two years, MAKE Consulting said.

U.S. must move past Yucca dump for nuke waste: Chu

(Reuters) - Energy Secretary Steven Chu on Friday reiterated the Obama administration's case against moving forward with a nuclear waste dump at Yucca Mountain in Nevada.

Once again, world food stocks are looking precarious. As Mr. Michael Richardson detailed in these pages on Feb. 3, prices are soaring for basic food products and the prospect of hunger, starvation and unrest are rising as well. There are several reasons for this spike in prices, but weather — and climate change — is the most important. It will be difficult if not impossible to insulate food production from weather-related problems in the short term, but steps can be taken to insulate prices from their impact.

Southwestern Water: Going, Going, Gone?

The glum projections of the growing gap between demand for water in the Southwest and the dwindling supplies have never been optimistic, but two new studies— one a research report based on satellite data, and the other an analysis of rainfall, water use and the costs associated with obtaining new water — make earlier forecasts seem positively rosy.

Planet Sludge: Millions of Abandoned Oil and Gas Wells Are 'Ticking Time Bombs'

Yeah, it's an eye-opener. Death by a thousand leaks.

An old friend of mine discovered an abandoned NGas well on the family property in Eastern Kentucky after he retired there. A contractor, grading for a new barn hit the buried well head. Fortunately, no explosion. Last I heard, he found a company to redevelop the well and is receiving a modest income from it. Lucky him, as he was going to be responsible for resealing the poorly sealed bore at major expense.

I wonder how many of these leaking wells go unreported by private property owners because of the liability. Many of the companies that drilled these wells no longer exist.

Is there no legislation in Kentucky regarding orphan wells? In Alberta, there are procedures for transfers or call-backs.(http://www.orphanwell.ca/pg_faq.html)

I don't know the specifics of my buddy's case or Kentucky law, but I believe he took advantage of something like this:

Alberta is relatively organized. As stated by the Orphan Well Association link, it has an organization to take care of these wells where nobody is legally responsible and/or financially able to deal with its abandonment and reclamation. It's funded by the oil industry.

On the other hand, if you want to personally take over one of these wells and produce more oil and gas:

If it is properly plugged, abandoned, and reclaimed, this is what it is supposed to look like:

I really like the greener grass, looks more like a water well draining the groundwater ;)

The greener grass is a bonus feature of having your orphaned well reclaimed. Any halfway decent environmental consultant can make an abandoned well site look much better than average scruffy farmland. And it produces better crop yields as well.

We used to dispose of drilling waste by spreading it on farmers fields. You would think that farmers would be upset by this, but after we had done this a few times, the farmers would notice that the crop yields were much better than before, and they would be lined up to have drilling mud disposed of on their farmland.

There's a trick to this, of course. Drilling mud mostly consists of Bentonite clay, which has tremendous water-holding capability, and we would spread it on sandy soil, which has poor water-holding capability. Also, we would also do soil tests, determine what the soil was deficient in, and put that into the drilling waste before we spread it. Result - bumper crops.

Rocky - Just today I finished pumping 12,000 bbls of drill mud from an old pit onto a farmer's field. He'll be planting corn soon and has reduced his fertilizer plans as a result of my mud. Needless to say he's a happy camper. BTW: Texas law requires written approval of the surface owner to "landfarm" a mud pit.

Thanks Rocky,

re: "Also, we would also do soil tests, determine what the soil was deficient in, and put that into the drilling waste before we spread it. Result - bumper crops."

Just curious - is there any downside to this? (i.e., Are there no undesirable components in the waste?)

Probably the worst contaminant would be rock chips. They might be sharp and puncture the tires of the equipment. Oil contamination is not generally a problem, and if it is, there is such a thing as oil-eating bacteria. It is quite effective in getting rid of oil.

Rocky - Good point. But we only pump the mud. The cuttings (rock chips) are buried in a slit trench typically under the pit. OTOH in my part of the world real rock cuttings are rare...usually sand grains and mud lumps.

Aniya - There are restrictions as far as salinity and oil content. Operators tend to follow the rules closely for at least on simple fact: a farmer can have the ag agent test the soil for free. Not difficult to detect either component...just taste/smell it. Beleive me: it's really diffficult getting away with spoiling the land (at least in Texas). The land owner has full access to all the operations and sees everything. And suing a sloppy operator is easy money. Despite popular opinion the land owner almost always wins.

Yes, salt water is the one thing that will really screw up farmland permanently. Oil contamination is relatively easy to mitigate, especially since they discovered oil-eating bacteria. If you get salt into the soil, nothing will grow, and there's no way to get rid of it.

The government regulators are all over that issue though. The farmers have an awful lot of clout in the legislatures. And if they sue, well, who would have thought an old broke-down saddle horse was worth $25,000? Only the owner and the jury, apparently.

Thanks for that link, MT, very interesting. Here's an interesting brief: Environmental hazards posed by the Los Angeles Basin urban oilfields: an historical perspective of lessons learned. A gas leak blew up a Ross Dept store in 1985; in the wake of that a well which was installed to monitor gas seeps was P&A. And that's in the middle of LA, you couldn't do better for drawing attention to leaky O&G. This will be a problem that will be around for millenia.

Ghung - yep...from what you described that wasn’t an orphaned well…just a P&A’d well. Just last week I took possession of 24 wells from the La. orphan well program. None of these were improperly abandoned…they weren’t P&A’d in the first place. Companies just went bankrupt and disappeared. I obviously think I can re-establish commercial production. Will cost around $12 million to try. Regardless of each outcome I’m obligated to properly P&A each well eventually following very strict and monitored P&A requirements of the state. With the current price of oil there will be a great many such efforts taken across the country.

There is good ways and bad ways to heaven or wherever we end up ... I guess it was not time yet.

Ghung - I obviously don’t know if that well was properly P&A’d or not. But you didn’t say he found the well leaking or not…he just found the abandoned surface casing. All state and federal laws actually require the surface casing be left intact in the original hole. The primary reason is to prevent deeper salt water from contamination the shallow fresh water aquifers. Some operator apparently did re-enter the well and established production. I’ve personally dug out old surface casings and done the same more than a dozen times. Especially common with NG reservoirs: when first drilled NG prices are too low to develop. And then 20 years later prices go p and the well is worth salvaging.

I can’t prove it has never happened but I’ve been drilling in the heaviest drilled region for 36 years and have never heard of an abandoned well exploding. Given how oil field hands love to retell stories you think I would have heard about it. Let’s try this approach: let’s assume there are 1 million abandoned wells (they actually said “millions”). Let’s assume a failure rate of 0.01%...you gotta admit that ain’t that bad. So then 100 abandoned wells would have exploded. If so it should be easy to Google and find stories about a few at least. When someone finds those dozens of stories please send me the links. Thanks in advance.

By the way there are over 100 million situation around us every day that could lead to explosions and death. They’re called automobile gas tanks. Bet I can find a lot more links about folks being killed by those exploding than from exploding abandoned wells…wouldn’t you bet?

The Rise of Slime - by both land and by sea.

At the rate we are going we should be able to eliminate most complex life forms and give the planet back to the microbes. The Long Emergency turns into The Big Do-over.

Good find! Here is part of the abstract from PNAS:

Ecological extinction and evolution in the brave new ocean

http://www.pnas.org/content/early/2008/08/08/0802812105.abstract

In addition to the threats described here, I'm also reminded of the research of Univ. of Washington paleontologist Peter Ward, specifically his book "Under a Green Sky". He discovered that some, if not most of the known mass extinction events were probably caused by the oceans becoming anoxic. This not only killed off oxygen loving marine life, but also led to a new regime of cyanobacteria which produced such copious quantities of hydrogen sulfide that it suffocated oxygen loving terrestrial life as well.

He even speculated that the current regime we all know and love of blue oceans well oxygenated by a vigorous thermohaline circulation is the exception, with much of Earth's geologic past dominated by green skies of hydrogen sulfide and sluggish, anoxic oceans covered with mats of bacteria.

http://en.wikipedia.org/wiki/Anoxic_event

The bad news? The recent rapid increase of atmospheric carbon from human activities and subsequent warming of the oceans is setting the stage for a return to those green skies, in which case you can kiss 95% of life on Earth as we know it goodbye.

Cheers,

Jerry

The bolded probably only applies to the end-Permian events; most other major mass extinctions do not coincide with a major drawdown in atmospheric oxygen (it even seems to be in the middle of a steady rise during the end-Ordovician and Frasnian-Famennian). And even in the case of the Permian, oxygen was declining for tens of millions of years (and the oceans were apparently anoxic for a similarly long time) before the extinction events, e.g. Isozaki 1997; Wignall and Twitchett 2002. The oceans do appear to have been nastily sulfidic in mass extinction after mass extinction, but probably not on a scale that significantly affected terrestrial life.

The key recent discoveries in bringing together our understanding of (most) mass extinctions were really Grice et al. 2005 and Kump et al. 2005.

Hi Ashen Light,

Thanks for summing up topics I know nothing about.

One small Q:

re: "The oceans do appear to have been nastily sulfidic in mass extinction after mass extinction, but probably not on a scale that significantly affected terrestrial life."

If the oceans were sufidic, to the point of significantly altering the life in the oceans...would this not alter life on land as well?

Or, are humans the only animal that depends - (percentage of nutritional intake) - on ocean life for food?

And, is food the only oceanic contribution that comes into play?

Or, are there other critical dependencies?

Hi Aniya,

Oceans are critical:

http://www.amazon.com/Under-Green-Sky-Warming-Extinctions/dp/0061137928/...

Oh gosh no, I'm quite sure it didn't bother anyone the least little bit. I'll be sure and phone you up next time I take a holiday next to a "nastily sulfidic" ocean and tell you just how wonderful it is.

Cheers,

Jerry

Can we be nicer to each other? As I recall, AshenLight is a scientist who works with climate change issues. He knows what he's talking about.

You are correct of course. But we all occasionally make errors. AshenLight just neglected to put the word "local" before mass extinctions and we all just naturally took him to mean "ocean wide" mass extinctions.

Ron P.

Where can I put my hands on that data? It is grossly incorrect. Every mass extinction in the oceans have been accompanied by a mass extinction on land. There have been five of them, no more. Well six if you count the one that is happening right now. And it is happening on both land and in the sea. But of course this one is not caused by the oceans becoming anoxic.

There have been many algae blooms which caused localized die offs in the area where they happened, but they never caused any ocean wide mass extinction.

Ron P.

Thank you, Leanan. Though I'm actually a paleobiologist. My expertise is in marine invertebrates and the Permian extinction, not climate change.

No, there have been five major ones and a host of others. Here is a graph of extinction intensity; you can see for yourself there are far more than five peaks that are significantly above baseline.

What I said earlier can indeed apply to global mass extinctions as well as local ones. Consider what terrestrial life consisted of during the end-Middle Cambrian, the end-Cambrian, and the end-Ordovician: not much. There is no evidence of mass extinction on land for any of them. In fact, the earliest evidence of animal life walking on dry land came later; eurypterid tracks from the Late Silurian. But even after colonization by plants, insects and amphibians, the Frasnian-Famennian (late Devonian) mass extinction seems to have been exclusively marine. K/T was not caused by the mechanism we are discussing and is anomalous compared to the rest. The largest peak on that graph since K/T is the Paleocene-Eocene Thermal Maximum (PETM), which is a good example of a mass extinction where anoxic/sulfidic conditions apparently existed at depth, but not in the photic zone (where shallow water species survived just fine) and not in great enough concentrations to reach the atmosphere per the Kump et al. 2005 mechanism.

Perhaps what I should have said is that terrestrial and marine extinctions are not necessarily linked, and in particular, not usually linked by that mechanism. I should have mentioned also that the T/J event appears to have had relatively simultaneous marine and terrestrial extinctions--but again, likely not linked to H2S outgassing from euxinic oceans. I was trying to emphasize that the Permian was unique in having huge quantities of H2S in the oceans set against a backdrop of plunging atmospheric O2, which also put upward pressure on the chemocline, allowing the H2S to reach the surface. This probably did not happen during the others, even the biggies.

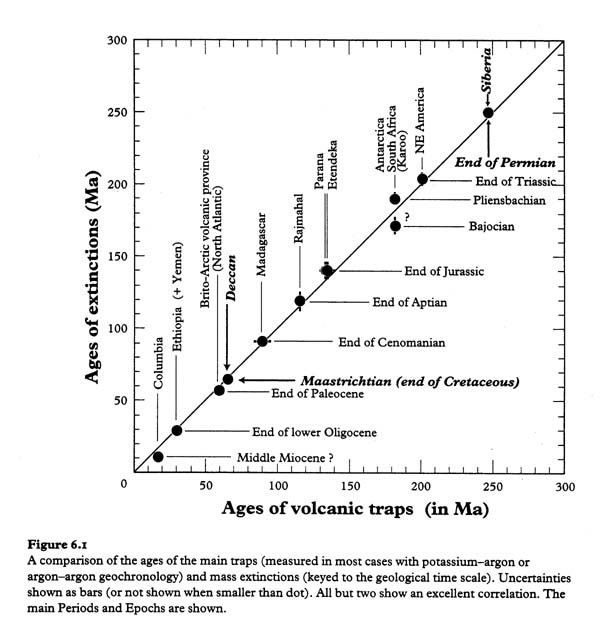

But of course there were many other factors at play. (I'm trying to find a neat figure I have that shows the close coincidence of major mass extinctions with major volcanic provinces... huge CO2 input, global warming, ocean acidification etc. from that can do plenty of damage on their own without invoking oceans filled bottom to top with euxinic water. I'll include it if I find it. That is perhaps the even bigger story. Even the oddball K/T has the Deccan Traps, although they do not appear to have been quite contemporaneous.)

Thanks AshenLight, I stand corrected.

Then you might be interested in this lecture: Princeton University Archived Lectures

Then scroll down to this lecture:

December 4, 2002 - Public Lecture Series (a Louis Clark Vanuxem Lecture)

Vincent Courtillot , Universite Paris 7: "Mass extinctions in the Phanerozoic: a single cause and if yes which?"

You have probably heard of this guy. He has a book on the subject available on Amazon. I have watched the lecture twice and have the book. He maintains that all major mass extinctions, including the K/T extinction were caused by massive volcanism.

Ron P.

My pleasure, Ron, always happy to discuss this stuff.

I'll check it out. I've heard the name but I don't think I know his work. There is certainly a case to be made for excessive volcanism as the main culprit. K/T is the most problematic. Gerta Keller and her supporters claim to have debunked the impact being the cause of the mass extinction, saying it happened some hundreds of thousands before the extinction occurred. OTOH, I have personally heard one well known paleontologist already named in this thread cracking jokes with other graybeard luminaries about what a terrible field geologist Gerta Keller is. So who knows. But there are other things that are anomalous about K/T; the selectivity of the extinction does not match the familiar pattern. In particular, deep water species were not impacted nearly as much as shallow water species, and that's certainly not what you see when a body of water goes anoxic from the bottom up. So very strange that ALL the ammonoids and belemnoids would be annihilated but clumsy old Nautilus survive to the present day.

I also wonder if there are suitable flood basalts for the Cambrian and Ordovician events. The end-O has been (somewhat fancifully) attributed to a gamma ray burst, and the TV shows certainly ran with that suggestion, but there's really no evidence for it. The many extinctions during the Cambrian are loosely attributed to anoxia and/or glaciation, but without strong evidence that I know of.

Here's the figure I mentioned:

Hey, I think I saw that exact same diagram in Vincent Courtillot's book. I am out of town and away from my library right now but I am almost sure that diagram is in his book.

I have argued, on this list and others, that the K/T extinction was likely caused by the Deccan Volcanism but I was not able to convince anyone. One person claimed that the Chicxulub Meteorite rang the earth like a bell and caused the Deccan Volcanism. Courtillot argues that the Deccan Volcanism started well before the meteorite struck and were still active when the meteorite hit.

Ron P.

Hmmm, perhaps I am more familiar with his work than I thought then, although I do not have his book.

You'd be amazed how often you hear this even in scientific circles (the "antipode" argument), particularly considering that a guy like Jay Melosh, who knows more about bolide impacts than anyone on Earth, has published multiple studies claiming that it isn't possible (e.g. Melosh 2001, Ivanov and Melosh 2003).

Here's a good example of such a paper: http://www.mantleplumes.org/WebDocuments/Antip_hot.pdf

I do not know what to think of K/T, personally. I don't have the geological expertise to tell who is right and so much depends on very precise radiometric dating of both Chicxulub and the Deccan Traps.

"sluggish anoxic oceans"

When sailing across the Arabian Sea, west of India, one crosses hundreds of miles of algae covered water. At nite, watching the black water and green foaming waves is visually disorienting. Like watching the daylight ocean, seen thru a color photo negative. Black sky, Green wave crests, Black water.

The light intensity is enough to read a book, with a green cast. The daylight reveals a green slime coated hull. Been this way for decades. Fishing gone. No worries, tho, still some fish in the Bay of Bengal.

Still, an increasingly popular destination for pirates, who are providing new opportunities for employment in a growth industry.

Local news; regarding capture of Thai fishing boat off India with pirates in control. Local people wonder how a single fishing boat, on the way to Europe could have a Thai Navy gunship escort and still be pirated. Also speculation that said fishing boat was loaded with coke grown in Burma. And why would a 120' Thai fishing boat be headed for the Med ? Damn pirates won't even give honest smugglers a chance.

Dave

"sluggish anoxic oceans"

I think that's where most of the world's oil originated. The conditions described don't actually sound like anything that hasn't happened many times before, on a large scale, over long periods of time. Nothing unusual here folks. Just move along.

Isn't the irony delicious?

And around we go...

Cheers,

Jerry

Of course, that's not actually what happens. Most mass extinctions are probably caused by 1) giant meteors (e.g. the one that wiped out the dinosaurs), or 2) massive volcanic eruptions (e.g. the end-Permian event that covered Siberia several miles deep in volcanic lava.)

Sluggish anoxic seas aren't anything that Mother Nature can't cope with, because if they hadn't happened before, on a large scale over long periods of time, particularly in the Middle East, we wouldn't have nearly as much oil as we do now.

Massive extinctions are the way Mother Nature "copes."

Well of course all mass extinctions of the past have been caused by natural phenomena. However I would not say that massive volcanism or meteorites from space was Mother Nature's way of coping.

Ron P.

I would not say that, either.

My point was that the fact that life on earth has survived extreme conditions in the past doesn't mean all the current lifeforms will.

Reminds me of this old post from dKos. I love the vision of life in the Carboniferous.

We tend to think that earth was equally hospitable to all forms of life throughout its history, but of course that's not true. Photosynthesis poisoned the earth with oxygen, which was bad news for previously dominant anaerobic bacteria but good news for the rest of us.

In the age of the dinosaurs, the atmosphere was almost 35% oxygen, vs. 21% now. If we really brought a T-rex into modern times, it might collapse, suffocating in our oxygen-poor atmosphere, rather than chasing us around trying to eat us.

Some geologists and oceanographers might point out, counter to Ward's arguments, that there are long-term telluric, or Earth based, changes to climate. Plate tectonics has rearranged the continents and erected land bridges and large-scale dams for ocean current flow, e.g. Isthmus of Panama. These redirected ocean currents have set up the present thermohaline circulation pattern in the global ocean. The long-term configurations are slow to break up once established. The progressive cooling of the Earth during the Cenozoic (since the end of the Cretaceous to present) is a result of the development of the present configuration of the continents. There can be regional and local changes to climate, of course, such as coastal and in restricted ocean basins such as the entire North Atlantic. We are in the middle of an interesting experiment to rapidly recreate the early Carboniferous atmosphere within the present telluric-based Ice House climate. Where this will lead is anybody's guess, and a lot of folks assume that an extension of the Holocene interglacial warm period (developed over the past 10,000 years) is the logical scenario, but maybe not. We do know that the Change in Climate Change is not a good thing for modern human civilizations.

Yes, the model experiments which have attempted to project the effects of our "atmospheric experiment" on the Thermohaline circulation project that a weakening or a shutdown will be the result. Thus, some say the climate of Northern Europe won't warm as much as the rest of the Earth, as the cooling from the shutdown of the THC would offset the overall warming from Greenhouse Gases. Theer's a problem with that, since we know that the models are wrong in their projection of the rate of decline of sea-ice and there is already evidence which points to a weakening of the THC, so the cooling might happen before the warming begins to dominate...

E. Swanson

Notice how it's always easier to argue for the cooling effects of climate change this time of year in the Northern Hemisphere? :)

I could not resist:

A couple more possibilities for the name of the next epoch of the Cenozoic, once we decide we've come to the end of the Holocene:

Weshouldhavecene

Ifwehadonlycene

Thefinalcene/Thelastcene

Itsabadcene

Link up top: Saudi Arabia to save energy through insulation

Well no, that couldn't possibly happen if they really have 265 billion barrels of recoverable reserves. That is about 90 years worth at current use. 2028 is only 17 years away. And why 2028? Is that the product of some careful mathematics?

Does anyone else recognize the implications of this statement by the Aramco CEO?

Ron P.

Sam's most optimistic projection (lowest rate of increase in consumption + lowest rate of decline in production) is that Saudi Arabia would be net exporting about three mbpd in 2028. Saudi net export data for 2007 to 2010 inclusive are falling between his middle case and best case projections:

http://i1095.photobucket.com/albums/i475/westexas/Slide1-6.jpg

A few years ago they were on track to be able to pump 14 million bpd. Then it was 12 million bpd. Now it's down to 7 million bpd "for export" for the middle term future. At this rate of decline they won't make it to 2028 with anything left to export.

He is saying that product will be unchanged at about 10 million barrels per day.

http://www.guardian.co.uk/business/2011/feb/08/oil-saudiarabia

3 mb/d divided by 17 years would be ca. 177 kb/d per year. YOY KSA growth for 2000-2009 averaged 95 kb/d - is this alarmism, failure to do the numbers, factoring in a production decline, access to better numbers than we have, factoring in an increasing rate of consumption...?

EIA gives numbers for both resid and resid used in bunkering; resid for other uses only amounted to 13.77% in 2006, the last year for which EIA provided detailed numbers for KSA. That was only 278.08 kb/d in 2006, seemingly a minor factor in the grand scheme of things. Now, distillate is also used for power generation, not to mention the raw crude they burn in summer peaks out of desperation, and World Bank data for total oil used for power suggests 425 kb/d. There was also that quote a few months ago from a CEO of a contracting company who said it was much higher - ca. 1.2 mb/d.

With every year it becomes more pressing for these guys to expand into something else - preferably solar.

When the Saudis are insulating and weather-stripping, I think that alone says a lot.

Whatever Happens in Egypt, Oil Will Hit $300 by 2020

Note that an increase in annual crude oil prices from the $79 that we saw in 2010 to $300 in 2020 would be an annual rate of increase of 13%/year over a 10 year period. From 2000 to 2010, the annual rate of increase was 10%/year, while the 1998 to 2008 annual rate of increase was 20%/year. So, an oil price in the $300 range in 10 years would basically just be a continuation of the current oil price trend.

I would of course expect there to be annual year over year price declines along the way, but if the current pattern (a series of doublings) holds, the next time that we see a year over year price decline, it would bring the average annual oil price down to the $120 range.

Maxwell previously predicted $300 by 2015 (in 2008), so this prediction is actually a more optimistic one.

http://seekingalpha.com/article/94294-charlie-maxwell-to-barron-s-300-oi...

Sadad Al Husseini has issued a pressrelease denying that he ever has put Saudi Arabian oil reserves or production into question.

"Press Release by Dr. Sadad Al Husseini

February 11, 2011

Dhahran, Saudi Arabia

The US Consulate note issued by Wikileaks in regards to Saudi Aramco’s oil reserves, based on a casual 2007 conversation with me, includes many patently inaccurate statements that have been further amplified by errors in the press.

I do not and did not question in any manner the reported reserves of Saudi Aramco which are in fact based on the highest levels of sound and well established engineering and economic principles and practices. Since Saudi Aramco’s proven oil reserves are 260 billion barrels, there is no way I could have said they are in error by 300 billion barrels, a number that exceeds the actual reserves estimate itself.

In fact the US Consulate staff who approached me socially stated that Saudi Aramco’s published proven reserves should be more than tripled to include non-producible oil and oil that has not even been discovered. I defended Saudi Aramco’s professional practices and official reports and confirmed that Saudi Aramco adheres to the highest levels of accepted industry procedures and practices.

In regards to Saudi Aramco’s oil production capacity, the giant multi-billion dollar expansion projects which were funded in recent years are now all a visible reality for the whole industry to see across the Saudi oil fields. This has been an extraordinary accomplishment by Saudi Aramco and its leadership spanning engineering, construction and operations from Khurais in Central Arabia to Shaybah in the Rub al Khali.

All these oil production projects were completed by the end of 2009 and the Kingdom’s total oil production capacity does in fact now stand firmly at 12.5 million barrels per day.

Sadad Al Husseini"

These words, if true, seem interesting, but not by themselves completely relevant, to the question of what KSA's net exports will be in 2028 (or pick some other future date).

Heisenberg, what KSA's exports will be in 2028 is not the subject in question here. What they could be is the point. And according to the Aramco CEO we are talking about oil available for export! And in that light the words of Sadad Al Husseini are totally relevant here. And they completely contradict what the Aramco CEO said.

Ron P.

The assertion by Sadad Al Husseini that KSA's production capacity TODAY is 12.5M bbls/day is not, by itself, enough information to provide an estimate of what KSA's oil EXPORTS COULD be in 2028.

So, I was trying to say that Sadad Al Husseini's statement did NOT answer the mail about what KSA's future net exports could/will/pick your word here be.

The other huge question is whether you we believe Sadad Al Husseini's assertion that KSA has ~ 265 Gbbl of conservatively stated (meaning 'you can bank on them') reserves.

~ 254 Gbbl of reserves at 3.65 Gbbl/yr extraction would last ~72 years.

Of course, that absurdly implies a 10M bbl/day flow rate from now till the end, and, it requires us to believe that KSA has, and will be able to /fully/ recover, ~ 265Gbbl of oil.

And he didn't address the question of future KSA internal consumption. Edit: OK, i the original article up top he said they were aiming for a 40% energy use reduction, but based on what? Meaning, is he figuring in the KSA future population increases?

So, I saw Sadad Al Husseini's statement (the one directly above that I was commenting on, the one stating 12.5M bbls/day...) as arm-waving.

Okay, here is the part of Hussein/s text that is extremely relevant: Since Saudi Aramco’s proven oil reserves are 260 billion barrels,... If that is true then their current R/P ratio is about 87 since they are currently producing about 8.3 mb/d.

Hey, you left out the most important part of what you actually said, you left out the "if true". You said:

Yes his words answered nothing because no one believes that last press release by Sadat Al Husseini. However his words if true are extremely relevant to what KSA can export in 2028. If you had just left out that "if true" then I would have had absolutely no problem with your statement.

The truth, Heisenberg, is what is in question here. We are concerned with the true proven reserves of Saudi Arabia. What they really have determines what they can really produce. If Husseini speaks the truth then that is indeed very relevant to what they will be able to produce and export 17 years from now.

Let me repeat the very obvious: How much oil a country has in the ground determines how much oil they can produce both now and in the future. If they have 265 billion barrels in the ground they can produce a lot of oil, even 17 years from now. If they have 70 billion barrels in the ground they will be able to produce a whole lot less in 17 years.

Ron P.

I have a hard time getting excited about the exact numbers of who produces what and when. Likewise the exact date of Peak Oil bores me to death.

What matters is Peak Oil per capita which is given less attention.

It happened in 1979 according to this article.

http://www.countercurrents.org/goodchild180710.htm

Each year there are many more drivers and many more vehicles that demand oil while the oil supply whether on a plateau, at peak or even somewhat increasing fails to keep up on a per capita or per vehicle basis.

I don't buy this argument.

1979 may have been the last time the average Joe could buy a V8 muscle car and take it on joy rides on open roads whenever he wanted, but the link between this activity and "standard of living" is dubious at best. In addition all manner of data show beyond any doubt that the standard of living around the world for many people, including in the developed world, has risen since then.

Where I agree is that that was probably the last time when we could have reasonably made alternative decisions to deal with oil depletion, population growth, and money and we didn't. We decided to have a 30 year party and now everybody gets to enjoy the hangover.

I would love to see that "all manner of data." At any rate there has been an increase in food riots in the last five years. Perhaps things got better from 1979 until oil peaked in 2005 but things have gotten considerably worse since then. From 2008:

Riots, instability spread as food prices skyrocket

Just google food riots and you will get a thousand hits like this one: Grain, Soybeans Rise as Food Riots Spur Demand for U.S. Exports

Ron P.

Hi Oilman,

re: "In addition all manner of data show beyond any doubt that the standard of living around the world for many people, including in the developed world, has risen since then."

It seems - (like the analytical framework of ELM) - the issue is who has what (in terms of reliable input) - and where.

From article sighted up top:

http://www.energybulletin.net/media/2011-02-12/paul-erhlich-humanity-tig...

"PRE: Oh, first of all. One of the complaints about 'The Population Bomb' was we said 'The battle to feed all of humanity is over.'

That was 1968. There were three and a half billion people. About a half a billion were hungry. Now we've got seven billion people, and about a billion of them are hungry."

More suffering - "hungry" (i.e., starving?) - in total.

I believe that those who fall in the category of "malnourished" are not counted in the "hungry." Malnutrition has long-term negative consequences, esp. for growing children.

See also figure 2.

Edit:

Agreed.

Peace

H

The Aramco CEO said that oil exports drop if KSA doesn't lower its own demand. What he said is not in contradiction with having 265 Gb in the ground. Not maximize the extraction rate is good oilfield management. But in most cases actions speak better than words. To the point is what Ron mentioned several times: searching in the Red sea and planning CO2-EOR in Ghawar doesn't look good. Even these actions don't exclude that they can extract 265 more Gb, however a lot of it, if ever extracted, will be with very low flow rates. The U.S. has about 89 Gb conventional oil that is planned to be recovered with CO2-EOR if only they had the CO2 available and even with enough CO2 it will take more than a century to recover that 89 Gb. For the timing of Peak oil and decline after it total conventional oil reserves says a lot, but not everything. Probably KSA has more than 100 Gb of that difficult and slow to produce oil. Think in quantities of for example 200.000 bpd from Ghawar. Still a lot of oil every day, but almost nothing compared to what it was.

Han - I'll add that how much oil anyone has in the ground allows just a very rough estimate of how much they'll ultimtely produce. But volumes of inplace reserves have no bearing on how fast it will be produced. I can document a long trend of oil fields in S Texas that will eventually recover 70% of their inplace reserves. But to do so will take well over 100 years from their initial discovery.

Back to the basic point some folks still don't get: Peak Oil has nothing to do with the amount of oil reserves in the ground or how much will be produced. It's about the max flow rate at any one time.

Hi Rockman,

re: "Back to the basic point some folks still don't get: Peak Oil has nothing to do with the amount of oil reserves in the ground or how much will be produced. It's about the max flow rate at any one time."

This is also my understanding, with a caveat, namely...

Isn't it the case that the impacts and negative consequences of "peak" do have a lot to do with the flow picture on the downside of "peak"?

I mean, either way, we hit resource limits, if not WRT oil, then some other critical input to "global industrial civilization."

However, the word "transition" might be more meaningful, if there was a larger oil supply in total (nicer-looking down slope), which humans could count on...maybe...perhaps...

Aniya - If I follow what you mean by “the flow picture on the downside of "peak" then I think we’re on the same page. Easiest way to explain how I see the downside is to use some generic source of oil. Doesn’t matter if its tar sands, Deep Water Brazil oil, etc. IMHO it matters little if these sources have a gazillion bbls of oil. It’s very difficult to imagine them producing at rates comparable to the Ghawar fields of the world. In addition to these sources costing more to develop they’ll take longer to generate the same cash flow. And cash flow is the same as flow rate. This is why these resources remain: they are inferior to the resources that have gotten us to where we are today.

And then as far as the U.S. goes there is the additional hurdle of ELM and increased competition from China, etc. And layered on top of these factors is the perpetual depletion of the existing fields. Every field, regardless of its size, obviously depletes. More importantly the delivery of its remaining reserves slows significantly at a certain point. A perfect example is Mexico’s Cantrell Field. Or another way to express this reality: in 36 years working in the oil patch I've never seen one field that didn't take considerably longer to produce the last 50% of its URR than it took to produce the first 50%. It varies but typically it takes 4+ times as long to produce the second half.

Assume at some point Ghawar Field has recovered half of its X billion bbls of URR oil in Y years. Given the drive characteristics of its main reservoir it could easily take 6X or more Y years to recover that other 50%. There are numerous water drive reservoir in Texas that I've studied that produced 2/3 of their URR at water cuts of 70% and higher. Depending on whose numbers you believe Ghawar is somewhere around 30-40% WC. That may well indicate that Ghawar may recovery significantly more oil than it has already produced. The bad news: it will take a great deal longer to do so. I have no doubt that Ghawar won't be depleted anytime soon. In fact I have no doubt it will be producing tens of thousands (maybe even 100's of thousands) BOPD over 100 years from today. And that's the problem.

Rockman, wouldn't most of this time take place while the field was in its "fat tail" period, or perhaps even skinny tail period in the case of the East Texas fields.? Decline rates found around the world, according to even the most optimistic analyst, suggest a much higher decline rate.

Giant oil field decline rates and their influence on world oil production

Ron P.

Ron – A bit complicated to lay out in a reasonable word count. “Decline rate” itself is a complex concept. DR can only be applied to a specific interval of a field’s (or individual well’s) life. I’ll offer an extreme example: the New Albany shale gas trend in KY. A well might start at 1 million cf/day and decline at 60%+ the first year. The second year…40%...etc. But it may produce commercially for 40 years with the majority of the NG being produced during the last 30 years. But what’s the typical DR during the later part of its life? It’s not uncommon for the DR to be ZERO! Yep…the well may have no decline the last 20+ years of its life. BUT…it’s only flowing 15 mcf/day for those 30 years. Yes…maybe only $10-15 profit per day. So how does one represent the DR of such a well? There are thousands of oil wells in Texas that are producing commercially right now with a ZERO DR. But these are water drive reservoirs that are producing with a 99%+ water cut…many netting only 1 or 2 bopd. About 50+ years ago that well came on at 120 bopd. So what’s the DR over its life? Obviously in excess of 99%. What’s its current DR? That’s easy also…zero.

So a decline rate that doesn’t specify how long and at what point in a field’s life it represents is rather meaningless IMHO. I’m not exactly sure where the fat and skinny tails your reference exist. In my world DR values have almost no meaning. We’ll look at a wells production history plotted on a log-normal distribution. Like you I can just glance at such a plot and instantly have a clear understanding of the dynamics involved. To be honest when someone says Field X will have a Y decline rate I don’t really know what they mean: in 36 years I’ve never seen a field with a constant DR. Even the most easily projected DR’s (pure pressure depletion NG reservoirs) typically have a bimodal DR.

IMHO the only way to paint a clear picture is to write many thousands of words with dozens of plots. Like the work you do that I'm far too lazy to take on. Get after it, buddy.

Bimodal is the origin of a fat-tail distribution. Having a wide variety of rates contributes to a fat-tail. Once the variety approaches randomness it tends toward hyperbolic.

Well, okay. By fat tail, or skinny tail I meant a field would have a decline rate of say six percent then when it got down to the bottom they could get a few barrels per day out for many years.

Anyway I just did the math on the North Sea. In the 8 years and 10 months since they peaked they have had a decline rate of 6.5 percent. Mind you that is the decline rate of existing fields minus any new production from fields that have come on line since that peak. And there have been several, Buzzard comes to mind. So if we could subtract the oil from those new fields, the decline rate would probably be 10 percent of greater.

And of course we see similar decline rates from Cantarell. And if you check Figure 4 in my PDF link above on giant field decline you will see that Prudhoe Bay, once it started to decline, went from 1.5 mb/d to .5 mb/d in 10 years. The Prudhoe Bay production profile had a flat top because of the restriction of the pipeline.

Bottom line, I think we can count on a pretty steep decline rate even though, as you point out, once a field gets down to almost nothing, you can count on a decline rate that is also near nothing.

Ron P.

In certain ways it is straightforward to explain a low-decline-rate fat-tail as you describe, Ron.

The natural diffusion and convection/drift of oil into a region can compensate for a very low extraction rate out of the depleted region. If these two effects were of the same magnitude they would essentially cancel out and you can imagine a state of close to zero-decline as Rockman described. In a sense, it is the same effect as the replenishment of an artesian spring.

I have a comprehensive section on transport in porous material in The Oil ConunDrum. Lots of interesting tidbits in there on a topic that hydrogeologists rarely consider important -- which is to consider huge amounts of disorder in the environment. This tends to explain much of what we observe, in particular some of the slow reserve growth like characteristics of Rockman's favorite long-running USA stripper fields.

Yet of course the nature of the North Sea puts a kibosh on this consideration, as they cannot afford to maintain these rigs pulling off such meager returns. That's why those seem to drop off much more rapidly. No chance for this slow diffusive replenishment to occur before the operators decide to pull the plug and shut them in.

Thanks, Rockman, for the perspective -- particularly concerning the production rate after peak. I have been searching for a way to explain this concept to people for a while, now.

would you go ahead and do that ? i am compiling a data base of high recovery fields.

elwood - The specific trend I refered to was the Navarro sand fields that run south of San Antonio. Pure gravity drainage sandstone reservoirs. About 10 yeas ago I tried to talk folks into using in situe combustion (fireflood) to decrease the recovery time. Never could sell the idea. Here's a reference to get you started (http://www.onepetro.org/mslib/servlet/onepetropreview?id=00000404&soc=SPE). Another tend is the Frio "Greta Sand" fields along the Texas coast. Super strong water drive. As long as you can get rid of the produced water cheaply you can keep these 99% water cut reservoirs producing for evern. Or so it seems. The average field still producing is over 60 yeaars old. Typical recovery todate: 50%. But 80% of the rcovery has been done at 70%+ water cut. it's all about water handling.

You should have talked about the increased production not decreased recovery time and it had probably been sold. Who would say no to higher production if the economics are favorable.

I would not have bought. The same amount would have been produced and the same price should be expected. It would of course be nice to get the money faster but it cost more so I would get less total money.

In economics it's different because if I get the money faster I could invest them on something else. I am currently looking for some good stocks to invest some money in and do not have something else to invest them in but I may be a little bit different than most other people.

karl - Increased rates was the key to my pitch. But in situ combustion (fireflood/air injection) is the most complex EOR method IMHO. Besides being difficult for most to understand it also scares the hell out of many. Even though I could document several wildly successful pilot projects I just couldn't sell the idea. BTW...I've never been a very good salesman. LOL. Too much geek...not enough hustler.

I never had a good experience with fireflood. In one project, we kept losing control of the fire front and blowing up oil wells - they would blow the tubing string 100 feet into the air. In another, we completely screwed up the whole oil field, and at the end of it we had to abandon all the wells except one. We used to truck the oil out of its tank once a month.

In general, steam injection just seemed a whole lot more reliable.

When they invented Steam Assisted Gravity Drainage (SAGD), it was just a dream. Drill dual horizontal wells, one 10 feet above the other, for maybe a mile or two in all directions off a central pad, inject steam into the upper well of the pairs, suck oil out of the lower well using a positive cavitation pump. It was wonderful. Sometimes we could recover a million barrels of oil out of each SAGD well pair.

Of course, this was in the Alberta oil sands. It may not work the same everywhere else.

Damn it Rocky...there you go! It was folks like you talking about blowing up wells that made other folks afraid to buy my ideas. Thanks for nothing!!!!

Some pilot projects I've seen worked far better than any other EOR techniques. At least when it didn't blow up wells/pipelines/compressors. I was surprised to find out one of the most dangerous elements was high pressure AIR. Get a little lubricant in the mix and the air was an excellent rapid oxidizer (read: explosive). Chatted with one former Getty hand who literally blew his production facilities sky high one night.

But man when it works it is truly magical.

Well, I'm always glad to help out with anecdotes of how badly things can go when you are trying new technology.

We learned a lot doing fireflood projects. We monitored everything with computers, had temperature probes running up and down the wells, injected air, water, steam, surfactants, and soap (the soap freaked out visiting dignitaries who were looking at computer screen they weren't supposed to.)

We make a lot of major breakthroughs in computer monitoring technology in the process, and invented a lot of gee-whiz technology that is still in use in the oil industry today.

The conclusion I came to was that we should have given up on the oil business and gone into computer software instead. It would have been much more profitable. We really could have given Bill Gates a run for his money. Unfortunately upper management was focused on the oil business. As a result a lot of computer companies made a lot of money, and our old oil company is not there any more, or rather has been subducted into a British oil company which shall remain nameless but whose initials are BP.

Yeah, air was a bad thing to have get loose underground. That was one of the main reasons we blew up the oil wells. The soap just couldn't keep it under control.

Dumb question here. Did you (or anyone) ever try injecting O2? Doing so would result in a much smaller volume of (very) hot gas, since the N2 would not be included, thus making the situation less likely to explode...

E. Swanson

Injecting pure oxygen would have been expensive, and would have made the fire burn too hot. You can burn up a cast iron stove in a pure oxygen atmosphere - imagine what it would do to an oil field!

It is frustrating to see, even peak oil people, taking these numbers seriously. The 265 Gb the Saudis are talking about are not oil sands or something that could be extracted only at very slow rates. They are talking about ordinary reservoirs, like Ghawar, Abque or Safaniya, the only kind of reservoirs that they have.

It appears that very few people have any appreciation as to just how much oil this is. It is over twice as much oil as Saudi has produced in the past 65 years. If they actually had that much oil it would be a joke to say that they might not be able produce enough oil for their own consumption and then export 7 million barrels per day only 17 years from now.

Yes, you are correct, their actions with exploring in the Red Sea and looking at C02 injections for Ghawar are definitely a contradiction to having 265 Gb of reserves. But so is saying that they might have trouble exporting 7 Gb a day only 17 years from now.

Go here: OPEC Share of World Oil Reserves The data presented here is the big lie. What really frustrates me is the fact that the world, even many peak oil people, really believe the data presented here. I can only throw up my hands in disbelief when peak oil people hem and haw with this data. They say things like "If this is true then..." or "There is no contradiction between this data and blah, blah, blah...."

I give up!

Ron P.

Yes good point

As to OPEC reserves share, even if the total numbers are totally blown up, in terms of percentage where would you put them ?

(even if with the current crash coming doesn't matter much somehow)

I would put them at about 50% of world reserves. And I would bet money that that figure is not off by more than 5%.

One more point. The more oil a country has to produce, the more they do produce. A country can hold back a few barrels now and then, say 10 or maybe occasionally as much as 20 percent, but basically they produce what they can produce. M. King Hubbard based his whole theory on that concept.

Ron P.

Hi Ron, BP seems to think OPEC has 77.2% of the world's reserves (BP Statistical Review of World Energy 2010, p6). Excluding Canadian oil sands. OPEC's share then reduces to 69.7%.

Maybe you're saying that OPEC overstates its reserves by about 50%?

John

John, BP is stating what OPEC tells them. All reserve data in Saudi and all other Middle East nations are a closely guarded state secret.

That is what frustrates me so. People look at what BP publishes and just say; "Well, BP says so therefore it must be true." What BP publishes, what World Oil publishes and what Oil & Gas Journal publishes is what OPEC publishes or within a small percentage thereof because that is where they get their data. Does anyone on earth really believe BP has done seismic exploration of Saudi or Iran or...?

No, I am not saying that OPEC overstates their reserves by 50%. I am saying that OPEC reserves are very close to non-OPEC reserves or about 300 billion barrels each. (That is without counting the Canadian Tar Sands or the Orinoco Bitumen.) We have managed to postpone the decline from peak primarily because of the advent of horizontal MRC wells. That is Super Straws that suck the oil right off the crest of the reservoir and keep the production high right up until a few years, or a few million barrels from the end. The final profile of world oil production will resemble a shark fin. The decline will be much faster than the ascent.

Ron P.

Well, do you expect a Aramco CEO to say: "we have 265 Gb, but most of it needs massive tertiary EOR and takes more than a century to recover." That was my point, therefore I mentioned the 89 Gb conventional oil in the U.S. waiting to be recovered with CO2-EOR. And yes, conventional oil is in 'ordinary reservoirs'. If the U.S. would be an oil exporter they would say to the world: we have more than 100 Gb conventional oil in the ground, about half of what KSA has. Only the Peak oil insiders would be able to find out what that number means. Of course KSA mentions every possible extractable barrel, afraid as they are for EV's. By the way, from what I understand from the news on CNN yesterday: the U.S. seems planning to build EV charging stations in many states.

The number 265 Gb (the Saudi Aramco side now mentions 260.1 Gb) is less important to me than the fact that KSA had hard times to keep production flat. That puts the 265 Gb in perspective. One can get angry that for decades they come up with that same number and it is a dangerous tactic, but they have that groundless fear that an energy transition could be rapidly executed.

That's something different than ROCKMAN adding a comment on my reaction, on february 12.

H - I suppose "relevent" is in the eye of the beholder. I've evaluate the reserves of dozens of companies over the last 35 years. In my analysis if verifyable support data isn't presented with the reserve numbers then they are completely irrelevant IMHO. It doesn't matter if it's a small independent company in Houston or th KSA. If the data isn't available then there is no reserve value.

Many folks on TOD have tried to work a number out. I applaud all those efforts...there is some value to their difficult chore. But my position doesn't change: no hard varifiable data...no useful reserve numbers.

I think that a gaffe in Washington, D.C. is defined as an instance where a politician accidentally tells the truth. In any case, I think that we can safely assume that Al Husseini had no expectation that his discussion with an American official would ever be made public.

I wonder what Al Husseini would have pubicly said if he and his family were living outside of Saudi Arabia. An American geologist, of Chinese descent, was recently imprisoned in China for gathering and releasing historical data about Chinese oil production.

My "Iron Triangle" thesis:

http://www.theoildrum.com/node/2767

News reports from Europe are also adding worry to the total export picture:

Denmark's oil production dropped %16 last year.

http://www.indexmundi.com/denmark/oil_production.html

Total recently reported that their profits had jumped 23% while oil throughput dropped 7% year over year.

http://www.reuters.com/article/2011/02/11/total-refining-idUSLDE71A0W320...

Other European refineries have reported similar drops in refinery throughput.

As North Sea production continues to drop, the more crude oil they will attempt to obtain from OPEC to make up the shortfall.

The EIA has the following rate of change numbers for Denmark (total petroleum liquids) for 2004 to 2009:

Production: -8.0%/year

Consumption: -2.2%/year

Net Exports: -15.5%/year

Even though Denmark has been cutting their petroleum consumption it was not nearly enough to keep their net export decline rate from accelerating. Given a production decline, if an oil exporting country does not cut their consumption at the same rate as, or at a rate faster than, the rate of decline in production, then the net export decline rate will exceed the production decline rate, and the net export decline rate will accelerate with time.

This has the troubling appearance of an exponential decay curve.

There appears to be a pretty consistent "Half-life" characteristic to net export declines, to-wit, generally half of post-peak CNE (Cumulative Net Exports) are shipped one-third of the way into the post-peak net export decline period.

In the "What If" department, if we extrapolate Chindia's recent rate of increase in net oil exports, as a percentage of global net exports (11% in 2005 to 17% in 2009), they would be consuming 100% of global net exports around 2025. Continuing with the "What If," this suggests that post-2005 Available CNE (global net exports not consumed by Chinda) would be on the order of 150 Gb, with about 57 Gb (38%) of post-2005 Available CNE having been consumed in 2006 to 2009 inclusive.

If Chinindia keeps getting a higher percentage of net exports each years, wouldn't this mean less oil flowing into other countries, and therefore slower economies with proportionally choked demand? If you look at the oil imports of most other countries, during the recession, they mostly all showed drops in oil imports, along with increasing debt levels.

The U.S. in particular has had less and less oil coming into it since 2005-2006, after the wild gyrations in 2008, there has been a steady increase in money leaving the country to pay for petroleum. In fact it appears that the trade deficit will become entirely composed of petroleum in the near future.

http://cr4re.com/charts/charts.html?Trade#category=Trade&chart=TradeDefi...

http://www.eia.doe.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WTTNTUS2&f=W

Clearly we are heading for a breaking point, Either the U.S. is paying all it can afford for the petroleum it is getting, or some kind of price controls have been artificially imposed resulting in decreased supplies coming into America.

Bernanke can only print money for this situation for so long, in order to fund a deficit of only petroleum products. It won't take OPEC countries long to start demanding something more substantial than printed paper dollars for their black gold.

We haven't hit peak imports yet

US trade deficit widened by 33% in 2010

http://www.bbc.co.uk/news/business-12431066

Imports from China, simply represent oil which has been converted into finished goods and then sent here. As our own oil production has dropped, we have been forced to either import the crude oil itself, or products made from it.

For a while, we were able to borrow the money to pay for it by "cashing in the equity of our houses." The Chinese did us the favor of recycling their earnings by purchasing CDO's which were supposedly AAA rated and bringing the money back to the USA to further drive up the price of houses and the cycle was repeated over and over again, until the shadow banking system and the housing market both crashed.

The Chinese learned a big lesson from this fiasco which was really just a huge collapsed Ponzi scheme. They are keeping their earnings within China, building their own infrastructure, and slowly diverting the world's available oil exports to their own industrial base.

We have switched from a cycle which was growing the strength of America, to one which guarantees that China will eventually consume the bulk of world oil exports.

I think that the WTI-Brent spread is an indication of just how weak the U.S. has become. The amount of money China is willing to spend on oil is more important to the world now, than what we are willing to give.

I believe that in the near future, we will be exporting our own crude oil to pay for our debts.

A couple of items from 2005 (note the state secrets observation):

http://www.energybulletin.net/node/9498

Steve Andrews: Sadad al Husseini sees peak in 2015

"Sadad al Husseini, recently retired head of exploration and production for Saudi Aramco, offered very insightful comments during an interview with Peter Maass in Saudi Arabia. Maass reported Husseini’s perspective in his August 21, 2005 piece “The Breaking Point” (posted under “Articles” on this site) in the New York Times Magazine . In a follow-up email exchange with ASPO-USA’s Steve Andrews, Husseini said he would be unable to attend and present at the November 10-11 Denver peak oil conference, but he did offer pointed commentary about peak oil production. While his comments are more optimistic than those of Colin Campbell, Matt Simmons, Chris Skrebowski and a host of others, they certainly strike a vastly more realistic chord than the typical fare from Saudi Aramco press releases and presentations."

http://www.energybulletin.net/node/8112

Peter Maass: The Breaking Point

So, in other words, US Consulate staff are encouraging the Saudis to lie about their oil reserves, and the Saudis are too ethical to comply with US requests. That tells you something about the ethical standards of the US government, does it not?

It also seems to be the standard that the USGS adheres to. Just take the oil you know you can't produce, add it to the oil you don't know exists, and you have enough oil that future supplies are not going to be a problem. Great planning technique.

It's just prompting to probe for the response. You propose some over or under estimate, usually one that insults the individual subtly, and hope they will 'put you right'.

Frankly the US consul was curiously specific for getting the wrong end of the stick in a game of chinese whispers. Much less a casual conversation (if you read the cable) than someone who was taking notes.

I do wonder if Mr Husseini is playing fast and loose with which conversation he's denying/reporting to take the heat off. It would be easy to say "this cable is based on a casual, social, chat at a sanctioned event"; and not report on the sit down meeting you had a few days afterwards. Particularly if people might be annoyed that you were briefing the US consul against the official line.

Remember, KSA regards oil figures as 'state secrets'...

I've been waiting for someone somewhere to point out what al Husseini actually said, iirc, 3.5 years ago: that world reserves are inflated 300 billion barrels.

EDIT: http://www.theoildrum.com/node/3235

'In addition, al-Husseini said, “The major oil-producing nations are inflating their oil reserves by as much as 300 billion barrels. Global oil and gas capacity is constrained by mature reservoirs and is facing a 15-year production plateau.”'

TOP LINK: http://www.sctimes.com/apps/pbcs.dll/article?AID=/20071113/OPINION/11113...

Much ado about nothing.

FOR ALL: "The U.S. oil industry should pay about $200 million a year to support stricter and more efficient oversight of drilling in the Gulf of Mexico"

Back in the BP spill days we joked about the best engineers in the oil patch working for Rockman Inc that could provide this service. The $200 million fed budget should cover it. I've estimated it would cost $82 million for Rockman to do the job (I suspect a tad better than feds). That, of course, includes an $8 million profit margin into the Rockman's pccket). So given the govt's inefficiency in such matters the $200 million/year budget will hopefully get the job done.

Where do I send my resume? :)

Aniya - I have no doubt you're very trainable. But, alas, I suspect you don't have nearly enough gray hair. BTW: my engineers would get $1,200 per day for working 14 days out of the month. So a bit over $200,000/yr and 26 weeks vacation (unpaid, of course). My guys would be very good. And very good is very expensive.

Hi Rockman,

Thanks.

Well, I was thinking along the lines of PR/cook/bottle-washer...