Global Oil Risks in the Early 21st Century

Posted by JoulesBurn on March 26, 2012 - 2:24pm

This is a guest post by Dean Fantazzini, Moscow School of Economics, Moscow State University, Moscow, Russia; Mikael Höök, Uppsala University, Global Energy Systems, Department of Physics and Astronomy, Uppsala, Sweden; and André Angelantoni, Post-Peak Living, San Francisco, CA. This paper has been previously published in Energy Policy, Volume 39, Issue 12, December 2011, Pages 7865-7873.

Abstract:

The Deepwater Horizon incident demonstrated that most of the oil left is deep offshore or in other locations difficult to reach. Moreover, to obtain the oil remaining in currently producing reservoirs requires additional equipment and technology that comes at a higher price in both capital and energy. In this regard, the physical limitations on producing ever-increasing quantities of oil are highlighted, as well as the possibility of the peak of production occurring this decade. The economics of oil supply and demand are also briefly discussed, showing why the available supply is basically fixed in the short to medium term. Also, an alarm bell for economic recessions is raised when energy takes a disproportionate amount of total consumer expenditures. In this context, risk mitigation practices in government and business are called for. As for the former, early education of the citizenry about the risk of economic contraction is a prudent policy to minimize potential future social discord. As for the latter, all business operations should be examined with the aim of building in resilience and preparing for a scenario in which capital and energy are much more expensive than in the business-as-usual one.

1. Introduction

An economy needs energy to produce goods and deliver services and the size of an economy is highly correlated with how much energy it uses (Brown et al., 2010a, Warr and Ayers, 2010). Oil has been a key element of the growing economy. Since 1845, oil production has increased from virtually nothing to approximately 86 million barrels per day (Mb/d) today (IEA, 2010), which has permitted living standards to increase around the world. In 2004 oil production growth stopped while energy hungry and growing countries like China and India continued increasing their demand. A global price spike was the result, which was closely followed by a price crash. Since 2004 world oil production has remained within 5% of its peak despite historically high prices (see Figure 1).

Figure 1. Oil production stopped growing in 2004 while demand continued to increase. The result was a global oil price spike that contributed to the subsequent economic contraction. Liquid fuels include crude oil, lease condensate, natural gas plant liquids, other liquids, and refinery processing gains and losses as defined by the EIA. Source: Hirsch (2010)

The combination of increasingly difficult-to-extract conventional oil combined with depleting supergiant and giant oil fields, some of which have been producing for seven decades, has led the International Energy Agency (IEA) to declare in late 2010 that the peak of conventional oil production occurred in 2006 (IEA, 2010). Conventional crude oil makes up the largest share of all liquids commonly counted as “oil” and refers to reservoirs that primarily allow oil to be recovered as a free-flowing dark to light-coloured liquid (Speight, 2007).

The peak of conventional oil production is an important turning point for the world energy system because many difficult questions remain unanswered. For instance: how long will conventional oil production stay on its current production plateau? Can unconventional oil production make up for the decline of conventional oil? What are the consequences to the world economy when overall oil production declines, as it eventually must? What are the steps businesses and governments can take now to prepare?

In this paper we pay particular attention to oil for several reasons. First, most alternative energy sources are not replacements for oil. Many of these alternatives (wind, solar, geothermal, etc.) produce electricity, not liquid fuel. Consequently, the world transportation fleet is at high risk of suffering from oil price shocks and oil shortages as conventional oil production declines. Though substitute liquid fuel production, like coal-to-liquids, will increase over the next two or three decades, it is not clear that it can completely make up for the decline of oil production.

Second, oil contributes the largest share to the total primary energy supply, approximately 34%. Changes to its price and availability will have worldwide impact especially because alternative sources currently contribute so little to the world energy system (IEA, 2010).

Figure 2. Fuel shares of world total primary energy supply. The “other” category includes tidal, solar and wind generation. Source: IEA (2007)

Last, oil is particularly important because of its unique role in the global energy system and the global economy. Oil supplies over 90% of the energy for world transportation (Sorrell et al., 2009). Its energy density and portability have allowed many other systems, from mineral extraction to deep-sea fishing (two sectors particularly dependent on diesel fuel but sectors by no means unique in their dependence on oil), to operate on a global scale. Oil is also the lynchpin of the remainder of the energy system. Without it, mining coal and uranium, drilling for natural gas and even manufacturing and distributing alternative energy systems like solar panels would be significantly more difficult and expensive. Thus, oil could be considered an “enabling” resource. That is, it enables us to obtain all the other resources required to run our modern civilization.

2. The production perspective

It is commonly claimed that peak oil, i.e. the concept that oil production will reach a maximum level and then decline, is only about geology. To some extent this is a result of the polarized debate that has raged between geologists, such as Hubbert (1949; 1956) or Campbell (1997; 2002), and economists, including Adelman (1990) and Lynch (2002; 2003). In fact, peak oil is the result of a complex set of forces that includes geology, reservoir physics, economics, government policies and politics. However, a solid understanding of the peaking and subsequent decline of oil production begins with acknowledging the natural laws that create a framework for everything. The intrinsic limitations of these laws eventually affect all human activities because neither economic incentives nor political will can bend or break these laws of nature.

There are a number of physical depletion mechanisms that affect oil production (Satter et al., 2008). Depletion-driven decline occurs during the primary recovery phase when decreasing reservoir pressure leads to reduced flow rates. Investment in water injection, the secondary recovery phase, can maintain or increase pressure but eventually increasingly more water and less oil is recovered over time (i.e. increasing water cut). Additional equipment and technology can be used to enhance oil recovery in the tertiary recovery phase, but this comes at a higher price in terms of both invested capital and energy to maintain production. The situation is similar to squeezing water out of a soaked sponge. It is easy at first, but increasingly more effort is required for diminishing returns. At some point, it is no longer worth squeezing either the sponge or the oil basin and production is abandoned.

Another way to explain peaking oil production is in terms of predator-prey behavior, as Bardi and Lavacchi (2009) have done. Their idea is that, initially, the extraction of “easy oil” leads to increasing profit and investments in further extraction capacity. Gradually the easiest (and typically the largest) resources are depleted. Extraction costs in both energy and monetary terms rise as production moves to lower quality deposits. Eventually, investments cannot keep pace with these rising costs, declining production from mature fields cannot be overcome and total production begins to fall.

An additional factor plays an important role. In both models, regardless of the abundance of capital or high prices, an oil well is unable to deliver net energy at some point. Hubbert (1982) wrote: “There is a different and more fundamental cost that is independent of the monetary price. That is the energy cost of exploration and production. So long as oil is used as a source of energy, when the energy cost of recovering a barrel of oil becomes greater than the energy content of the oil, production will cease no matter what the monetary price may be.”

These physical trends conspire to make oil production increasingly difficult and expensive in monetary and energy terms. Economic incentives and technological advancement can slow these trends but they cannot be stopped.

2.1 Oil production today

Production peaks occur for many energy sources ranging from firewood and whales to fossil fuels (Höök et al., 2010). Currently, around 60 countries have passed “peak oil” (Sorrell et al., 2009) — their point of maximum production. In most cases this is due to physical depletion of the available resources (e.g. USA, the UK, Norway, etc.) while in a few cases socioeconomic factors limit production (e.g. Iraq).

Attempts to disprove peak oil that focus solely on the amount of oil available in all its forms demonstrate a fundamental, and an unfortunately common confusion between how much oil remains versus how quickly it can be produced. Although until recently, oil appeared to be more economically available than ever before (Watkins, 2006), others have shown this to be an artifact of statistical reporting (Bentley et al., 2007). Further, it is far less important how much oil is left if demand , for instance, is 90 Mb/d but only 80 Mb/d can be produced. Still, the most realistic reserve estimates indicate a near-term resource-limited production peak (Meng and Bentley, 2008; Owen et al., 2010).

Total oil production is comprised of conventional oil, which is liquid crude that is easy and relatively cheap to pump, and unconventional oil, which is expensive and often difficult to produce. It is vital to understand that new oil is increasingly coming from unconventional sources like polar, deep water, and tar sands. Almost all the oil left to us is in politically dangerous or remote regions, is trapped in challenging geology or is not even in liquid form.

Today, over 60% of the world production originates from a few hundred giant fields. The number of giant oil field discoveries peaked in the early 60s and has been dwindling since then (Höök et al., 2009). This is similar to picking strawberries in a field. We picked the biggest and best strawberries first (just like big oil fields they are easier to find) and left the small ones for later. Only 25 fields account for one quarter of global production and 100 fields account for half of production. Just 500 fields account for two-thirds of all the production (Sorrell et al., 2009a). As the IEA (2008) points out, it is far from certain that the oil industry will be able to muster the capital to tap enough of the remaining, low-return fields fast enough to make up for the decline in production from current fields.

All oil sources are not equally easy to exploit. It takes far less energy to pump oil from a reservoir still under natural pressure than to recover the bitumen from tar sands and convert it to synthetic crude. The energy obtained from an extraction process divided by the energy expended during the process is the Energy Return on Energy Invested (EROEI). It is a return on investment calculation applied to a physical process. As Hubbert noted, regardless of the price the market is willing to pay for oil, just as we won’t spend a dollar to receive only a dollar in return, when we expend as much oil as we get back from a particular oil deposit, production will stop.

The EROEI of US domestic oil production (chiefly originating from giant oil fields) has declined from 100:1 in 1930 to less than 20:1 for developments in the 2000s, e.g. Gulf of Mexico,(Gately, 2007; Hall et al., 2008; Murphy and Hall, 2010). Since giant and super giant oil fields dominate current production, they are good indicators for the point of peak production (Robelius, 2007; Höök et al., 2009). There is now broad agreement among analysts that the decline in existing production is between 4-8% annually (Höök et al., 2009). In terms of capacity, this means that roughly a new North Sea (~5 Mb/d) has to come on stream every year just to keep the present output constant.

In 2010, the IEA (2010) abruptly announced that the peak of conventional oil production was reached in 2006. The IEA also again lowered their estimate of total world oil production to less than 100 Mb/d by 2035. However, it has been shown that the IEA oil production model is flawed. To reach the production level in their model, they assume oil field depletion rates that are so high that they have never been seen in any oil region before (Aleklett et al., 2010). The remaining oil simply cannot be produced as quickly as would be required to push the production peak as far into the future as they project, thus the peak must occur sooner than the IEA asserts. Miller (2011) found that the IEA had not addressed any of the recent critique and concluded that the IEA outlooks likely remain too optimistic.

Most discussions about oil focus on the size of the resource left. However, in the near term, it is far more important to pay attention to production flows and the constraints operating on them. Peak oil is the point in time where production flows are unable to increase. It is not just underinvestment, political gamesmanship or remote locations that make oil production increasingly difficult. The physical depletion mechanisms (increasing water cut, falling reservoir pressure, etc.) will unavoidably affect production by imposing restrictions and even limitations on the future production of liquid crude oil. No amount of technology or capital can overcome this fact.

3. The economic perspective

3.1 The economics of oil supply

One important feature of oil supply is its cyclical boom and bust cycle in prices and production. Maugeri (2010, p. 12-13) describes this phenomenon: “if petroleum becomes scarce and there is no spare capacity...oil price climbs. This rise in prices fosters a new cycle of investment from which new production will flow. It also triggers gains in energy efficiency, consumer frugality and the rise of alternative energy resources. By the time the new production arrives at the market, petroleum demand may have dropped. This vicious circle has been a feature of all oil crises of the past.”

However, oil production recently became less responsive to traditional economic stimuli. The first decade of this century witnessed a dramatic increase in oil exploration and production when the price of oil increased (Sorrell et al., 2009; 2009a). Unfortunately, as noted already, total world oil production seems to have reached a plateau nonetheless. To a large degree this is because the oil that remains tends to be unconventional oil, which is expensive and takes more time to bring to market. Some consequences of having extracted much of the easy oil are the following:

a) It takes significantly more time once a field is discovered to start production. Maugeri (2010) estimates it now takes between 8 and 12 years for new projects to produce first oil. Difficult development conditions can delay the start of production considerably. In the case of Kashagan, the world’s largest oil discovery in 30 years, production has been delayed by almost 10 years due to difficult environmental conditions.

b) In mature regions, an increased drilling effort usually results in little increase in oil production because the largest fields were found and produced first (Höök and Aleklett, 2008; Höök et al., 2009).

c) Because the cost of extracting the remaining oil is much higher than easy-to-extract OPEC or other conventional oil, if the market price remains lower than the marginal cost for long enough, producers will cut production to avoid financial losses. See Figure 3.

d) Uncertainty about future economic growth heightens concerns for executing these riskier projects. This delays or often cancels projects (Figure 4).

e) Most remaining oil reserves are in the hands of governments. They tend to under-invest compared to private companies (Deutsche Bank, 2009).

f) Possible scarcity rents have to be taken into account. Hotelling (1931) showed that in the case of an depletable resource, price should exceed marginal cost even if the oil market were perfectly competitive (the resulting difference is called scarcity rent). If this were not the case, it would be more profitable to leave the oil in the ground, waiting to produce it until the price has risen. Hamilton (2009a, 2009b) noted that while in the 1990s the scarcity rent was negligible relative to costs of extraction, the strong demand growth from developing countries in the last decade together with limits to expanding production “could in principle account for a sudden shift to a regime in which the scarcity rent is positive and quite important.” In this regard, the Reuters news service reported on April 13, 2008 that “Saudi Arabia’s King Abdullah said he had ordered some new oil discoveries left untapped to preserve oil wealth in the world’s top exporter for future generations, the official Saudi Press Agency (SPA) reported.” Therefore, a possible intertemporal calculation considering scarcity rents may have already influenced (i.e. limited) current production. Although the sudden fall of prices at the end of 2008 is difficult to reconcile with scarcity rents, the following quick price recovery to the $70-$120 range during the enduring global financial crisis indicates that this aspect cannot be dismissed. This is despite the assertion by Reynolds and Baek (2011) that the Hotelling principle "... is not a powerful determinant of nonrenewable resources prices," and that "...the Hubbert curve and the theory surrounding the Hubbert curve is an important determinant of oil prices." We agree that the Hubbert curve, which defines the depletion curve of a non-renewable resource, may be the prime determinant of oil price but it is not the only one.

Figure 3. Global marginal cost of production 2008. Source: LCM Research based on Booz Allen/IEA data (Morse, 2009). The unlabeled items, from left to right are OPEC Middle East, Former Soviet Union and Enhanced Oil Recovery.

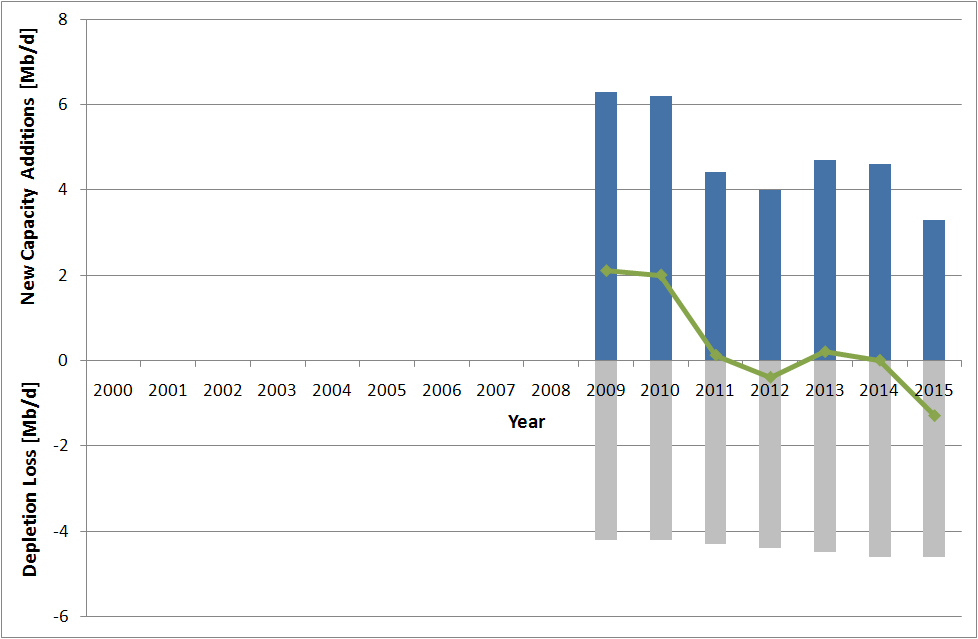

The consequence of these issues is that in the short-medium term the available supply is essentially fixed and thus relatively straightforward to compute. As Figure 4 shows, net production capacity will decline due to the difficulty in finding new reserves at an accessible cost while the existing capacity is steadily depleted. Just as occurred in 2004, by 2011 there is again no new net capacity while the world economy, and thus oil demand, has resumed growth. After 2014, it appears that global oil production will begin its decline (See the second report of the UK Industry Taskforce on Peak Oil and Energy Security (UK ITPOES, 2010), Lloyd’s (2010), Deutsche Bank (2009, 2010), the report by the UK Energy Research Centre (Sorrell et al., 2009a) and the 2010 World Energy Outlook by the IEA (2010).)

Figure 4. Global annual new gross production (blue bars), annual decline (grey bars) and net new oil production capacity (thin green line). Source: UK Industry Task Force on Peak Oil and Energy Security (2010)

3.2 The economics of oil demand

Now an important question is what are the consequences of high oil prices on world economic growth? In the economic literature, Hamilton (2009b) and Kilian (2008; 2009) attempt an answer, while in the professional financial literature, the report by Deutsche Bank (2009) is one of the most comprehensive.

Hamilton (2009b) in particular highlighted the importance of the share of energy expenditure as a percentage of total consumer expenditure. When this ratio is too high, an economic recession tends to occur. Similarly Deutsche Bank (2009) showed how each country seems to have a “threshold percentage of national income at which crude pricing meets stern resistance and demand is broken.” Deutsche Bank (2009) asserts that for American consumers this point is when energy represents 7.5% of gross domestic product. This value is close to the one calculated by Hamilton (2009b) but is based on monthly data and uses a different methodology. In a more recent report, Deutsche Bank (2010) lowered this threshold to 6.5 % because "...the last shock set in motion major behavioral and policy changes that will facilitate rapid behavioral changes when the next one comes and underemployment and weak wage growth has increased sensitivity to gasoline prices. Last time it took $4.50/gal gasoline to finally tip demand, this time it might only take $3.75/gal to $4.00/gal to do it." However, they also highlighted that "Americans have become comfortable with paying more for gasoline, and it may take higher prices to force behavior change".

Kopits (2009) suggested that when crude oil expenditures exceed 4% of GDP, oil prices increase by more than 50% year-on-year, and oil price increases are so great that a potential demand adjustment should have to reach 0.8% of GDP on an annual basis, then a recession in the US is very likely. A similar outcome was found by Hall et al. (2009) who showed a recession in the US is likely when oil amounts to more than 5.5% of GDP. We remark that the difference between the 4% (Kopits, 2009) and 5.5% (Hall et al., 2009) is simply a wholesale versus retail difference, and the result comes out the same [1].

Finally, Hamilton (2011) highlighted that 11 of the 12 U.S. Recessions since World War II were preceded by an increase in oil prices. Unfortunately, there is no clear alternative source of energy able to fully substitute for oil (see, for example, Maugeri (2010) for a recent non-technical review of the limits of alternative sources of energy with respect to oil). It possesses a combination of energy density, portability and historically very high EROEI that is difficult for alternatives to match.

4. A timely energy system transformation not assured

As oil production declines, significant changes to the current oil-dependent economy in the medium term are likely to be needed. However, it isn’t clear that there will the financial means to implement such a change. For example, Deutsche Bank (2009, 2010) suggested that the widespread use of electric cars in the second part of this decade will be the disruptive technology that will finally destroy oil demand. Apart from technology and resource constraints (lithium necessary for electrical batteries is quite abundant in nature but production is currently very limited), the availability of sufficient financial resources to transition the entire vehicle fleet seems dubious. As Hamilton (2009b) demonstrates, tightened credit follows high oil prices and most vehicles are purchased on credit. Others suggest that natural gas is the next energy paradigm. Again, will be there sufficient financial resources to switch to it as oil production declines?

Reinhart and Rogoff (2009, 2010) found that historically, after a banking crisis, the government debt on average almost doubles (86% increase) to bail out the banks and to stimulate the economy. They also showed that a sovereign debt crisis usually follows: not surprisingly we saw Iceland, Greece, Ireland, Hungary and Portugal turning to the EU/ECB and/or the IMF for financial help to refinance their public debts to avoid default. The need to switch to alternative energy sources with the enormous financial investments that such a task would require — and the simultaneous presence of large public and private debts — may well form a perfect storm.

Additional forces will play a role. New regulations to be introduced by Basel III are likely to impact investment expectations, budgeting and planning. Basel III is a new global regulatory standard on bank capital adequacy and liquidity proposed by the Basel Committee on Banking Supervision following the recent global financial crisis and whose aim is to "...to improve the banking sector's ability to absorb shocks arising from financial and economic stress, whatever the source, thus reducing the risk of spillover from the financial sector to the real economy", BCBS (2009). Demography will also be extremely important in the next decade as well. Europe and the United States have aging populations and their baby boomers are entering pension age. China faces a similar demographic problem due to their one child policy, too.

The combination of declining oil production (and thus oil priced high enough to cause recessions), high taxes, austerity measures, more restrictive credit conditions and demographic shifts have the potential to severely constrain the financial resources needed to move the economy away from oil and to alternative energy sources. Another consequence of this combination of forces is the likely contraction of the world economy (Hamilton, 2009b; Dargay and Gately, 2010).

4.1 Energy transition risks

With higher priced oil, technology substitution (such as electric cars gradually replacing internal combustion engine cars) and fuel substitution (such as natural gas replacing oil) will occur. History is filled with many such examples and they are frequently highlighted in the debate. However, one must read carefully and not overstate the simplicity of an energy transition.

For example, whale oil was – technically – an energy source in the 19th century, but the economy was based on coal at the time. Whale oil was used only for very specific purposes (primarily illumination), and the transition to kerosene was easy and occurred very rapidly. Bardi (2007) explored this in more detail and made several important remarks that pinpoint how difficult it can be to substitute energy sources. In particular, he showed that resource scarcity often dramatically increases the amplitude of price oscillations, which often slow an energy source transition. Businesses and governments struggle with alternating circumstances of insufficient cash flow to handle price spikes and plummeting prices that don't cover their cost structure. Long term planning in this ever-changing environment becomes extremely difficult and investment — even highly needed investment — can drop precipitously.

Friedrichs (2010) also cautions that after peak oil countries have several sociological trajectories available to them, they can follow predatory militarism like Japan before WWII, totalitarian retrenchment like North Korea, or, ideally, socioeconomic adaptation like Cuba after the fall of the Soviet Union. Given the recent century of conflict and the extensive weapon stocks and militaries held by modern nations (especially the United States, which spends on its military almost as much as the remaining countries of the world combined (SIPRI, 2011), there is simply no guarantee that the relatively peaceful period currently experienced by developed nations that is conducive to rapid energy source transitions will continue much longer.

Koetse et al. (2008) showed that for both North America and Europe the capital-energy substitutability over the long term is large. In other words, if there is abundant capital, the economy can respond to higher oil prices with substitution. However, if declining oil causes a credit contraction similar to the crash of 2008, there may not be sufficient capital to replace existing equipment quickly.

Even if there is sufficient capital, substitution has thus far operated with high and even increasing EROEI fuel sources. Since the transition from whale oil, each subsequent transition has been to an energy source with greater net energy profit. The energy dense fuels we are using now have allowed us to build our civilization. The difficulty this time is that we must move from highly profitable, in terms of energy, sources to lower profit alternatives like solar and wind. Researchers are beginning to ask the following important question: what is the minimum energy profit that must be sustained to allow us to operate our civilization? And, assuming alternatives are up to the job (this is not yet proven), can we complete the move away from oil before the overall EROEI gets too low? (Murphy and Hall, 2010)

A further challenge is that, strictly speaking, for the last 150 years we have not transitioned from previous fuel sources to new ones — we have been adding them to the total supply. We are currently using all significant sources (coal, oil, gas and uranium) at high rates. Thus, it’s common but incorrect to say that we moved from coal to oil. In fact, we are using more coal now than we ever have (IEA, 2010). We never left the coal age. The challenge of moving to alternative energy sources while a particularly important source is declining, in this case oil, should not be underestimated.

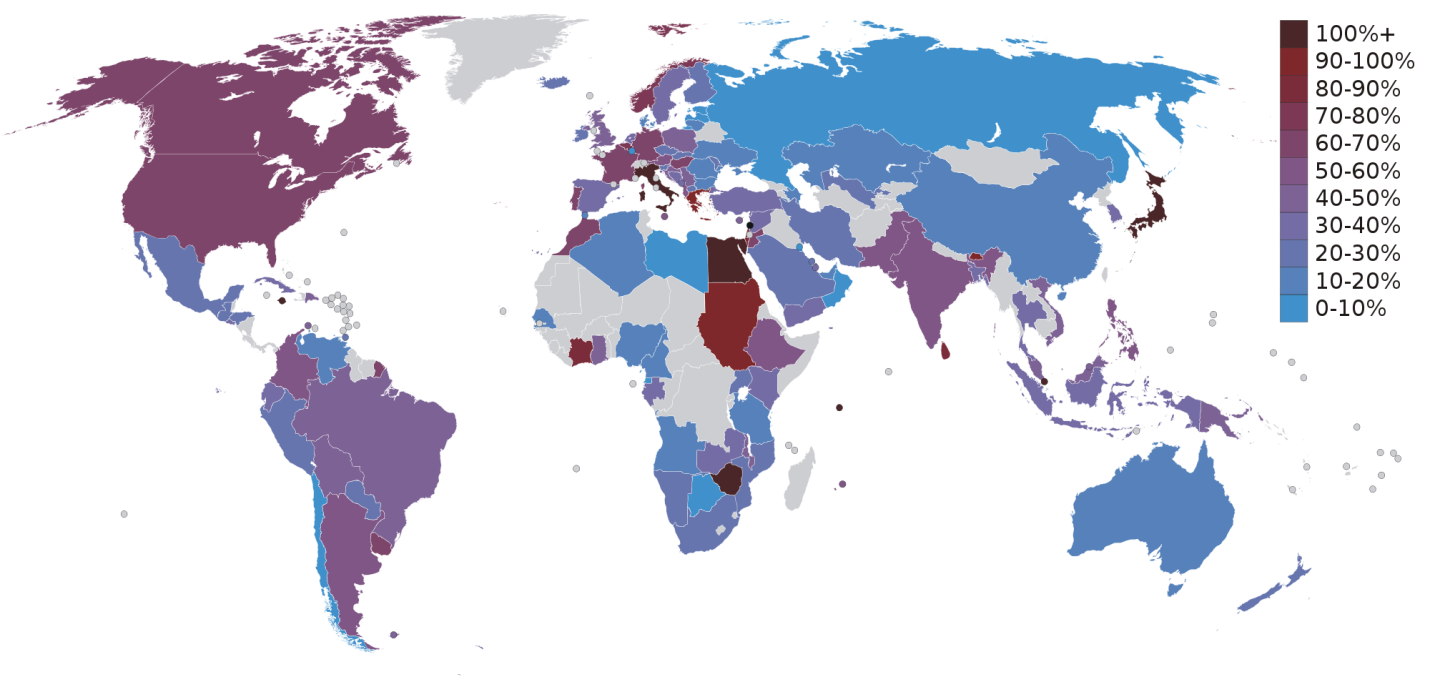

4.2 Net oil exports decline faster than overall production

The challenge may be greater still because net oil exports are set to fall more rapidly than overall oil production. Rubin (2007) points out that before the financial crisis many producer countries were experiencing economic booms. These countries export only the oil they don’t use themselves. The Middle East saw annual consumption increases of 5%. Russia was increasing at a 4% annual rate. It was only Russia’s increased production during the same period (accounting for 70% of the increase that came from OPEC, Russian and Mexican production during the early part of the last decade) that oil prices did not break records sooner than they did. Although the IEA has projected that oil use in OECD countries may already be declining (IEA 2010), they think that the oil appetite of non-OECD countries, which includes the producer countries, is not even close to being satisfied.

Brown et al. (2010b) show how significant the squeeze of declining gross production and increasing producer country consumption can be, which they have named the Export Land Model. Increasing producer country consumption due to population growth acts as a strong “magnification factor” that removes oil very quickly from the export market. Using the top five exporting countries from 2005 (Saudi Arabia, Russia, Norway, Iran, and United Arab Emirates), they construct a scenario in which combined production declines at a very slight 0.5% per year over a ten year period for a total of 5%. Internal oil consumption for these exporters continues to grow at its current rate (2010). In this scenario net oil exports decline by 9.6%, almost double the rate oil production declines.

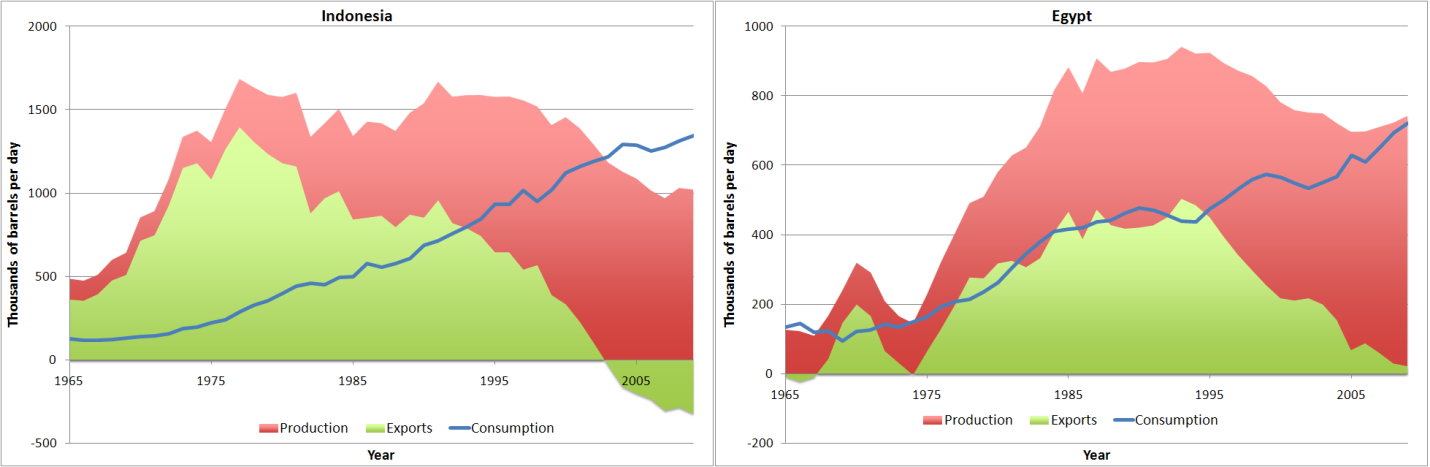

This accelerated loss of exportable oil can be seen in many producer countries that have passed their peak. Figure 6 shows the typical cases of Indonesia and Egypt. Indonesia has withdrawn from OPEC because they have no more exportable oil to offer the world market. Egypt is already incurring a public debt and is on the cusp of becoming a net oil importer, which will exacerbate already stretched public finances. As producer countries continue to grow their oil use even modestly and production declines (again, even modestly), there is an extremely high risk that net exportable oil will decline much faster than most observers are currently expecting.

4.3 Crash program may eventually replace declining oil

Hirsch (2010) points out that a crash program to create liquid fuel savings and additional liquid fuels may be able , at some point, to make up for declining oil production (Figure 7). While the alternatives are ramping up and as oil production is declining, Hirsch (2008) estimates that the world economy will contract at approximately a one-to-one ratio. In his best-case scenario, using a 4% per year decline rate, an idealized crash program to produce liquid fuels does not pause contraction sooner than ten years after the onset of decline.

Other mitigation efforts like increased solar, wind and geothermal production may not be prioritized since they do not help the situation — they produce electricity and the world’s 800 million transportation, food production (i.e. tractors and harvesters) and distribution vehicles require liquid fuel.

If the peak of oil production occurs this decade, there is insufficient time to avoid contraction because of how long it takes to transition the vehicle fleet. Even in their moderately aggressive scenario, Belzowski and McManus (2010) estimate that in a healthy, growing economy by 2050 still only 80% of the vehicle fleet in Europe and the U.S. would operate on alternative power trains.

5. Government risks

A contracting economy presents governments with a host of problems that are not easy to resolve. Promises made to the citizenry, some in the form of social welfare programs, pensions and public union contracts, will be impossible to keep as the energy base of the economy declines. Downward wage pressure and reduced business activity will lower tax revenue. With lower revenues and greater demands in the form of social welfare support by an increasingly poorer citizenry, it is difficult to see how the accumulated (and growing) government debt can be paid back without rampant inflation. Though it is still unclear whether the government response will be hyperinflation (to minimize the debts) or extensive and massive debt defaults — or both — it is not likely that business as usual will continue as oil production declines.

In business sectors that are highly dependent on oil, such as the automotive sector (Cameron and Schnusenberg, 2009), ill prepared companies that lack understanding of how price volatility may impact their firm will likely fail. In the case of the car companies some may fail a second time because their products are still not yet ready for a high-priced oil environment (Wei et al., 2010). Governments may not be willing to spend the money to rescue these businesses (such as the car company bailouts in the U.S.) and should be prepared for increasing unemployment as vulnerable sectors contract. To minimize potential future social discord, governments should immediately begin planning for contraction and educating their citizenry of the risk of contraction.

Because poverty reduction is highly correlated with capital availability (World Bank 2001), as contraction occurs due to oil production decline, some countries may see the reversal of poverty reduction gains made in recent decades. Some governments may also have to contend with food and fuel riots as they did in 2007 and 2008. Other forms of crowd behavior, namely hoarding of fuel and food, may exacerbate the situation and governments should prepare accordingly.

6. Business risks

In a joint report, Lloyd’s of London and Chatham House have advised all businesses to begin scenario-planning exercises for the oil price spike they assert is coming in the medium term (Lloyd’s, 2010). These planning exercises should scrutinize a company’s operations and balance sheet in fundamental ways.

Like governments, businesses of all sorts may experience similar difficulty paying their debts as sales decline. Banks may see asset values fall further. Manufacturers in particular will have to contend with increased difficulties making and delivering products as oil production declines (Hirsch et al., 2005). It will prove imperative that business addresses this Schumpetarian shock (a structural change to industry that can alter what is strategically relevant) in a timely fashion (Barney, 1991).

A significant benefit of cheap oil was that distance was relatively inexpensive. It is possible now to manufacture goods using far-flung operations. However, as oil declines, distance will, once again, become increasingly expensive, and oil price may begin to act as a trade barrier for many products.

Another risk as oil production declines is the possibility of oil supply disruptions. If this should occur, much modern manufacturing may be impacted. Just-in-time manufacturing systems in which warehoused parts are minimized through the frequent replenishment of parts by parts suppliers — sometimes with multiple deliveries a day — have little tolerance for delivery delays.

To prepare for this risk requires more than the drive for manufacturing efficiency that has generally characterized business. Supply chains should be examined with the aim of building in resilience and greater agility (Bunce and Gould, 1996; Krishnamurthy and Yauch, 2007), implying the loosening of tight and often brittle couplings between suppliers and manufacturers (Christopher and Towill, 2000; Towill and Christopher, 2001). With little or no slack in the system (fewer warehoused parts, etc.), just one supplier failing to deliver a part or supplier hoarding can shut down a production process.

7. Conclusion

The Deepwater Horizon incident demonstrated that most of the oil left is deep offshore or in other difficult-to-reach locations. Moreover, obtaining the oil remaining in currently producing reservoirs requires additional equipment and technology that comes at a higher price in both capital and energy. In this regard, we reviewed the physical perspective of peak oil and some of the limitations on producing ever-increasing quantities of oil were highlighted as well as the possibility of the peak of production occurring this decade.

We then briefly discussed the economics of oil supply and demand, showing why the available supply is basically fixed in the short-medium term, and highlighting the importance of a high energy expenditure share as a percentage of total consumer expenditures sounding an alarm bell for economic recessions. Moreover, we remarked that the potential financial resources available in the future to switch to alternative sources of energy will be limited due to several factors ranging from the high levels of debt (both private and public) to the aging of the populations in Western countries and China. We also noted that, even with very slight production decline rates, net oil exports decline significantly faster than total oil production as the economies of producer countries grow.

In such a context, risk mitigation practices are called for, both at the government level and at the business level to prepare for high and likely volatile oil prices. Governments should begin educating their citizenry of the risk of contraction to minimize potential future social discord. Businesses should examine their operations and balance sheets with the aim of building in resilience. It also implies preparing for a scenario in which capital and energy are much more expensive than in the business-as-usual one.

Acknowledgements

We are grateful to the reviewers and colleagues who provided valuable comments on drafts of this paper. Special thanks to Simon Snowden for outstanding assistance.

References

Adelman, M.A., 1990. Mineral depletion, with special reference to petroleum. Review of Economics and Statistics, 72(1), 1–10.

Aleklett, K., Höök, M., Jakobsson, K., Lardelli, M., Snowden, S., Söderbergh, B., 2010. The Peak of the Oil Age — analyzing the world oil production Reference Scenario in World Energy Outlook 2008. Energy Policy, 38(3), 1398-1414.

Bardi, U., 2007. Energy Prices and Resource Depletion: Lessons from the Case of Whaling in the Nineteenth Century. Energy Sources, Part B: Economics, Planning, and Policy, 2(3), 297–304.

Bardi, U., Lavacchi, A., 2009. A simple interpretation of Hubbert’s model of resource exploitation. Energies 2(3), 646–661.

Barney, J.B. 1991. Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99-120.

BCBS Consultative Proposal, 2009. Strengthening the resilience of the banking sector. Available from: http://www.bis.org/publ/bcbs164.htm

Belzowski, B.M., McManus, W., 2010. Alternative power train strategies and fleet turnover in the 21st century. University of Michigan, report no. UMTRI-2010-20, August 2010.

Bentley, R.W., Mannan, S.A., Wheeler, S.J., 2007. Assessing the date of the global oil peak: the need to use 2P reserves. Energy Policy 35(12), 6364–6382.

BP, 2010. BP Statistical Review of World Energy 2010. See also: http://www.bp.com

Brown, J.H., Burnside, W.R., Davidsson, A.D., DeLong, J.P., Dunn, W.C., Hamilton, M.J., Mercado-Silva, N., Nekola, J.C., Okie, J.G., Woodruff, W.H., Zuo, W. 2010a. Energetic limits to economic growth. Bioscience, 61(1), 19-26.

Brown, J., Foucher, S., Silveus, J., 2010b. Peak Oil Versus Peak Net Exports — Which Should We Be More Concerned About? Association for the Study of Peak Oil and Gas presentation in Washington D.C., 8 October 2010, http://aspousa.org/2010presentationfiles/10-7-2010_aspousa_TrackBNetExports_Brown_J.pdf

Bunce, P., Gould, P., 1996. From Lean to Agile Manufacturing.IEE Colloquium Digest, 1996, Issue 278.

Cameron, K., and Schnusenberg, O., 2009. Oil prices, SUVs, and Iraq: An investigation of automobile manufacturer oil price sensitivity. Energy Economics, 31(3), 375-381.

Campbell, C.J., 1997. The coming oil crisis. Multi-Science Publishing, Brentwood.

Campbell, C.J., 2002. Petroleum and people. Population & Environment, 24(2), 193–207.

CIA Factbook, 2010. The World Factbook. See also: https://www.cia.gov/library/publications/the-world-factbook/

Christopher, M., Towill, D.R., 2000. Marrying the Lean and Agile Paradigms.Proc. EUROMA Conference, Ghent, 2000, 114-121.

Dargay J.M., Gately, D., 2010. World oil demand’s shifttoward faster growing and less price-responsive products and regions. Energy Policy, 38(10), 6261-6277.

Deutsche Bank, 2009. The Peak Oil Market — price dynamics at the end of the oil age. Deutsche Bank Securities.

Deutsche Bank, 2010. The End of the Oil Age. 2011 and beyond: A reality check. Global Markets Research.

Friedrichs, J., 2010. Global energy crunch: How different parts of the world would react to a peak oil scenario. Energy Policy, 38(8), 4562–4569.

Gately, M., 2007. The EROI of U.S. offshore energy extraction: A net energy analysis of the Gulf of Mexico. Ecological Economics, 63(2-3), 355-364.

Hall, C.A.S., Powers, R., Schoenberg, W., 2008. Peak Oil, EROI, investments and the economy in an uncertain future. In: Pimentel, D (Ed.) Biofuels, solar and wind as renewable energy systems. Springer, New York.

Hall C.A.S., Balogh, S., Murphy, D.J.R., 2009. What is the Minimum EROI that a Sustainable Society Must Have? Energies, 2(1), 25-47. http://dx.doi.org/10.3390/en20100025

Hamilton, J., 2009a. Understanding crude oil prices, Energy Journal, 30(2), 179-206.

Hamilton, J., 2009b. Causes and consequences of the oil shock of 2007-08. Brookings Papers on Economic Activity, Spring 2009, 215-259.

Hamilton, J., 2011. Historical oil shocks. In: Parker, R.E., Whaples, R.M. (Ed.), Handbook of Major Events in Economic History, Routledge, ISBN: 978-0415677035

Hirsch, R.L., Bezdec, R., Wendling, R., 2005. Peaking of world oil production: impacts, mitigation, & risk management. See also: http://www.netl.doe.gov/publications/others/pdf/Oil_Peaking_NETL.pdf

Hirsch, R., 2008. Mitigation of maximum world oil production: Shortage scenarios. Energy Policy, 36(2), 881–889.

Hirsch, R., 2010. The impending world energy mess. Association for the Study of Peak Oil and Gas presentation in Washington D.C., 8 October 2010, http://www.aspousa.org/2010presentationfiles/10-8-2010_aspousa_KeynoteEnergyMess_Hirsch_R.pdf

Höök, M., Aleklett, K., 2008. A decline rate study of Norwegian oil production. Energy Policy, 36(11), 4262-4271.

Höök, M., Bardi, U., Feng, L., Pang, X., 2010. Development of oil formation theories and their importance for peak oil. Marine and Petroleum Geology, 27(9), 1995-2004.

Höök, M., Hirsch, R., Aleklett, K., 2009. Giant oil field decline rates and their influence on world oil production. Energy Policy, 37(6), 2262-2272.

Hotelling, H., 1931. The economics of exhaustible resources. Journal of Political Economy, 39, 137-175.

Hubbert, M.K., 1949. Energy from fossil fuels. Science, 109(2823), 103–109.

Hubbert MK, 1956. Nuclear energy and the fossil fuels. Presented before the Spring Meeting of the Southern District, American Petroleum Institute, Plaza Hotel, San Antonio, Texas, March 7–9, http://www.hubbertpeak.com/Hubbert/1956/1956.pdf

Hubbert, M.K., 1982. Response to David Nissen http://www.hubbertpeak.com/Hubbert/to_nissen.htm

International Energy Agency, 2007. World Energy Outlook 2007. See also: http://www.worldenergyoutlook.org/

International Energy Agency, 2010. World Energy Outlook 2010. See also: http://www.worldenergyoutlook.org/

Kilian, L., 2008. Exogenous oil supply shocks: how big are they and how much do they matter for the U.S. economy? Review of Economics and Statistics, 90(2), 216-240.

Kilian, L., 2009. Not all oil price shocks are alike: disentangling demand and supply shocks in the crude oil market. American Economic Review, 99(3), 1053-1069.

Krishnamurthy, R. and Yauch, C.A. 2007. Leagile manufacturing: a proposed corporate infrastructure. International Journal of Operations & Production Management, 27(6), 588–604.

Koetse, M., de Groot, H., Florax, R. 2008. Capital-energy substitution and shifts in factor demand: A meta-analysis. Energy Economics, 30, 2236–2251.

Kopits, S., 2009. Oil: What price can America afford? Douglas Westwood Energy Business Analysts, Research Note, June 2009

Lloyd’s of London and Chatham House, 2010. Sustainable energy security — strategic risks and opportunities for business. Lloyd’s of London white paper on sustainable energy security. See also: http://www.lloyds.com/~/media/Lloyds/Reports/360%20Energy%20Security/7238_Lloyds_360_Energy_Pages.pdf

Lynch, M.C., 2002. Forecasting oil supply: theory and practice. The Quarterly Review of Economics and Finance, 42(2), 373–389.

Lynch, M.C., 2003. The new pessimism about petroleum resources: debunking the Hubbert model (and Hubbert modelers). Minerals & Energy - Raw Materials Report, 18(1), 21–32.

Maugeri, L., 2010. Beyond the age of oil. Praeger, New York.

Meng, Q.Y., Bentley, R.W., 2008. Global oil peaking: responding to the case for ‘abundant supplies of oil. Energy, 33(8), 1179-1184.

Miller, R.G., 2011. Future oil supply: the changing stance of the International Energy Agency. Energy Policy, 39(3), 1569–1574.

Morse, E., 2009. New oil market realities.National Association of State Energy officials conference presentation in Washington, D.C. 2009, LCM Research using Booz Allen, IEA data https://www.naseo.org/events/summer/2009/Ed%20Morse.pdf

Murphy, D.J., Hall, C.A.S., 2010. Year in review — EROI or energy return on (energy) invested. Annals of the New York Academy of Sciences, 1185, 102–118.

Owen, N.A., Inderwildi, O.R., King, D.A., 2010. The status of conventional world oil reserves — Hype or cause for concern? Energy Policy, 38(8), 4743-4749.

Reinhart, C., Rogoff, K., 2009. This time is different: eight centuries of financial folly. Princeton University Press, New Jersey.

Reinhart, C. Rogoff, K., 2010. After the fall. Federal Reserve Bank of Kansas City economic policy symposium “Macroeconomic Policy: Post-Crisis and Risks Ahead” held at Jackson Hole, Wyoming, on August 26-28, 2010.

Reynolds, D.B., Baek, J., 2011. Much ado about Hotelling: Beware the ides of Hubbert, Energy Economics, article in press

Robelius, F., 2007. Giant oil fields — the highway to oil: giant oil fields and their importance for future oil production. Doctoral thesis, from Uppsala University, http://uu.diva-portal.org/smash/record.jsf?pid=diva2:169774

Rubin, J., Buchanan, P., 2007. OPEC’s growing call on itself. CIBC Worldmarkets. http://research.cibcwm.com/economic_public/download/occrept62.pdf

Satter, A., Iqbal, G.M., Buchwalter, J.L., 2008. Practical Enhanced Reservoir Engineering. Pennwell Books. Tulsa.

Speight, J., 2008. Synthetic Fuels Handbook: Properties, Process, and Performance. McGraw-Hill Professional,

Sorrell, S., Speirs, J., Bentley R., Brandt A., Miller, R., 2009a. An assessment of the evidence for a near-term peak in global oil production, UK Energy Research Centre, London.

Sorrell, S., Speirs, J., Bentley, R. Brandt, A., Miller, R., 2009b. Global oil depletion: A review of the evidence. Energy Policy, 38(9), 5290-5295.

Towill, D.R., Christopher, M., 2001. The supply chain strategy conundrum ~ to be Lean or Agile or to be Lean and Agile. Proceedings of the International Logistics Symposium, Salzburg, 2001, pp 3-12.

UK Industry Task Force on Peak Oil and Energy Security, 2010. The Oil Crunch — a wake-up call for the UK economy. Second report of the UK ITPOES.

Warr, B.S., Ayres, R.U., 2010. Evidence of causality between the quantity and quality of energy consumption and economic growth. Energy, 35(4), 1688–1693.

Watkins, G.C., 2006. Oil scarcity: what have the past three decades revealed? Energy Policy 34(5), 508–514.

Wei, Y., Wang, Y. and Huang, D., 2010. Forecasting crude oil market volatility: Further evidence using GARCH-class models. Energy Economics, 32(6), 1477-1484.

World Bank, 2001. Finance for growth: policy choices in a volatile world - a World Bank Policy Research Report. Washington D.C.: World Bank.

[1]We want to thank Gail Tverberg for pointing out this difference.

Looks like mostly a useful and thoughtful analysis.

One nit pick for now--the graph in figure 1 shows "total liquids" along the side, but the caption talks about oil.

I try to discourage folks on this site, at least, from participating in this type of confusion--it only encourages those who want to see the peak as having been pushed back by technology, and so presumably potentially delay-able for ever.

If you just go with Crude and condensate, you may find that we actually entered the plateau in late 2003.

Figure 1 caption lists "crude oil, lease condensate, natural gas plant liquids, other liquids, and refinery process gains and losses". Can the author please clarify what is included in "other liquids"? Does it include biofuels? This graph seems quite dramatic and I think it could be useful to begin to awaken the still slumbering population who remain unaware of any problem. But the details are important. I looked at the Hirsch reference and there is no more information there.

EIA Appendix C. Glossary

Orimulsion is no longer being produced and production from oil shale never will be produced. ;-)

Ron P.

Predictions anyone? Exactly when is it all going to fall apart?

Who can say, but as things move along, the doomers and the techonocopians are getting closer together. IIRC, even CERA is talking about peak oil within this decade.

It is pretty clear to me that conventional oil has already peaked, having entered its plateau almost ten years ago. Rockman's now off to Africa, but (again iirc) he used to talk about the 2013-15 period.

The more immediate question is when the next big economic step down will be. Economists are starting to admit that we may never really recover from the recession.

The next step down will put even more people out of work, reducing demand and bringing the price back down a bit. There will be fewer and fewer people able to afford gas and diesel regularly at even the reduced levels that an economic crash will bring.

But predicting the exact timing of an economic crash is not something that many have been able to do reliably.

Yes those will be the two opposing forces -- economic collapse from energy shortages causing oil prices to collapse, versus skyrocketing oil prices due to scarcity. We will likely bounce along between the two, both on a generally rising price trajectory. Of course if the monetary system collapses, as I see as inevitable, then oil price will go to infinity pretty fast.

I see the next economic collapse as being a fairly sudden cliff. All economists know how to do is print money and drop interest rates to 0%. Kind of like threading a needle with a club. It will work for a while ... until it doesn't. They don't fundamentally understand how economies work, so therefore when the rules of the game change enough that their traditional economic theories (based on unlimited energy) no longer apply, then they will no longer be able to prevent the inevitable. I predict later this year or 2013, but who knows.

Hi, Null.

That might put you in the fast-crash camp. Personally, I'm in the stair-case camp:

Of course, when it's your time to lose your job, it will feel like a fast-crash to you (relatively speaking).

So one chart that we did not include, because it was beyond the scope of the paper, is the following:

We are living in the tail end of Greer's Abundance Industrialism. We can watch the most valuable company in the world emerge in just ten years (Apple). Amazing! But this period is coming to a close, and in my view, that has already started and will accelerate this decade.

Regarding the Staircase Model, Greer and others have posited that the first step was in the early '70's, and my sense is that the next step will be more like the third one in the graphic. It's a bit like a group of buildings that were built too close to an eroding river bank. While mitigating structures have limited the buildings to settling a bit over time, perhaps a bump down now and then, eventually the underlying foundations erode to the point that the temporary supports are overwhelmed when the next even minor flood occurs. One building gives way creating instabilities that cause the others to collapse.

I see our current support structures: alternative liquid fuels; "green energy initiatives"; QE1, QE2... the bailouts in Europe; deepwater drilling and other ER schemes; attempts by modern agriculture to trick nature; increasingly costly, complex and overriding legislation (i.e. healthcare); etc., all as attempts by a clueless society to shore up against an eroding and progressively overtaxed foundation. The basic stuff that we rely on for support continues to be washed downstream and out to sea, gone forever. Our damage control strategy is doomed to fail. The buildings settle slowly, but only at first. In the meantime, folks are still moving in.

I fear we underestimate the fragile nature of our situation.

I think one of the differences between those of us who expect a shark fin collapse and those like Andre who expect a stair step decline may actually relate to our physical reality.

I'm in the boondocks, outside looking in. People like Andre in an urban area (IIRC) are inside looking out. By this I mean he is not personally responsible for most of the infrastructure that allows him to live in an urban area. Whereas I provide my own water, heat, some of my electricity and maintain my own road (plus a lot more). But the people inside looking out aren't personally responsible for these sorts of things, therefore, they can't see the tenuousness of society, i.e., its fragility and lack of resilience.

Todd

People use the Titanic analogy, but I fear we're more like a fully loaded jumbo jet with no idea of where to land. As long as the crew can keep up the velocity of fuel to the engines, everything is ok. The alternative is to slow the plane and begin to jettison cargo and passengers, maybe cut an engine or two, but at some point the stall comes and nobody planed for a soft landing. Whoops, there's a limited number of parachutes...

It's the velocity of energy, money and resources that keeps our overloaded jumbo jet flying.

I have the same image, except mine is an overloaded helicopter...

You make a good point, Todd.

The staircase diagram that I included should probably be shrunk and then repeated to be more accurate of my view i.e. lots more stairs and quite a few big ones with various small ones in between. The brittleness of our interconnected systems is not lost on me.

Noah Raford's presentation on Collapse Dynamics holds much merit:

http://news.noahraford.com/?p=48

I'm sympathetic to the shark fin, too, and convinced Greer that we should use it in the other graph. How sharp the decline will be is still to be seen but I certainly don't expect it to match the ascending part of the curve.

Raford's approach holds a lot of merit!

In these discussions about which curve one prefers I think what gets left out is that you need to either have a theory or data that generates the curve, not a preference on some vague ideas. Now since the future can't supply data that means you need a supportable theory. Both the curves you supply above appear to be based on mental models vs. theories that generate those shapes. A stair-step model is unknown in most dynamic processes unless you explicitly build in feedback loops that have pulsed dynamics separate from the dependent variable (BTW, what is the main variable; one shows fossil fuel use, the other "the economy"). Could you tell us what model you are using that generates that kind of curve?

The shark fin curve has a bit more justification in that there are dynamic models of peaking processes (like Hubbert's original) that are asymmetric about the peak. Greer's version looks like some extended tail models based on relatively smooth transition dynamics (totally unlike Raford's phase transition-based collapses). My own model is asymmetric but has a much steeper fall off resulting from the exponential diminishing EROI effects for all non-renewable energy sources (I equate "the economy" to exergy flow) offset against a slower decay rate for embodied energy assets (e.g. buildings). I also make it clear that my model is an outer boundary one, expressing the "best case" if we were able to extract all of the available raw energy we possibly could. I suspect financial considerations such as what Gail Tverberg writes about will cause a "worst case" that will look like falling off a very steep cliff.

I would urge all who want to speculate about what shape (timing and degree) collapse will take to try and develop first-principles based models rather than choose a shape that sounds about right. The reason is that such models can be argued for their principled merits rather than be voted for in a popularity contest. If we were to reach an early consensus about a model based on scientific criteria then that would be useful to make predictions with. That could be a basis for useful policies and preparations.

George

Picture of my model at this link.

If you assume a can opener ... assume that the current petroleum output is mature if not completely developed and that demand exceeds output: a stairstep can be imputed by examining the price- (click on chart for bigger version):

If Hoteling's rule does not effect the price then increased demand for crude will cause an increase in price and price declines represent declines in demand for crude (rather than new supply).

There is no point in examining the 'waste-ware to vapor-ware' transition or 'increased efficiency' pablum. We are cowards who cannot face reality but require comforting lies like small children: that the fat man will always come down the chimney and bring everyone a shiny new car.

Marginal petroleum cost + credit = price. What causes demand to decline is collapse of credit (caused by high crude prices). The feedback is through the credit system not at the gas pump. What the pump represents is the petroleum-cost of money only.

Note: demand can be infinite, consumption can never exceed supply.

What is being indicated are ongoing collapses and revivals of macro credit. Deleveraging takes place and prices fall for both crude and other goods then, central banks step in with more credit and the derelict economies find a second wind. Also, nobody in the world wants a collapse so there is institutional bias to doing everything possible to keep the current regime in force: bailouts.

As marginal petroleum costs increase the credit burden becomes unsupportable by the consumers of both credit and petroleum. Decline in nominal price of petroleum is no cure: temporary declines allow price-thwarted demand to rush back into the markets and push up the price. This decline-push dynamic remains in force until the ability of customers to meet the high price price is exhausted, when the credit runs out. The producers must then lower the price to meet a diminishing cash market.

What supports a price also supports the ability to meet it, the gap between what fuel costs and what can be returned by wasting it persists and continues to expand. Marginal costs swell to become the entire costs. Before that point is reached the system stops working as inputs cannot be had at prices users are able to afford.

The weight of costs are borne by those most dependent upon both cheap credit and cheap fuel: real estate, cars, airlines/airplanes, military/government and shipping. These sectors are failing/have failed or have been (continually) bailed out by 'outside' credit. Firm-level credit is replaced by sovereign credit which is in turn replaced by super-sovereign credit.

Peak oil and credit stripping has already torpedoed Greece. That hapless country collapsed pretty fast, but the other fuel-waste nations are still alive to waste another day ... there is your model.

The world is falling down the stairs: this will continue until credit is exhausted. W/ cheap oil long-since burned up, none of the 'high-tech' forms of petroleum will be affordable. The system stops working as inputs cannot be had at prices users are able to afford.

This last fatal step appears to be underway right now. The world is too broke/credit constrained to bid up crude past last April's $128/barrel. Once the marginal barrel price is below the cost to bring that barrel to market the game is over regardless of EROI. That looks to be $100/barrel: any link in the 'to the market' chain can be the weakest: refining, transport, distribution, finance/futures ... any link.

Hitching economies to burning up the gold for fun was and is a stupid idea.

Thanks for adding that, Steve.

Yes thanks for explicating a model that could provide a stair step dynamic. However, it seems to me a relatively short-term version. It might be a better explanation of the bumpy plateau but fail to predict a complete and rapid collapse at some time in the future (which a phase transition or chaotic attractor basin jump or a catastrophe theory might do). The stair step graph that Andre presented shows a repeated pattern of step downs and stasis all the way to the bottom. How does this model you have presented (which basically sounds like Gail's model) do in making longer-term projections to a global equilibrium? That is what we need to project what sort of actions will be needed and when.

George, you are trying to trick me into producing an unsupportable theory!

:)

Here are three things:

- From the top of each step it looks like a cliff. Any particular step can become non-linear context as the Bundeswehr put it. I have used the same chart along w/ Ugo Bardi's material to argue a cliff, the arguments work both ways! Cliff-step is a matter of scale. Japan has been bouncing sideways for 20 years, managing energy insolvency by recycling credit and arbitraging its energy flows -- turning fuels into cars that it exports -- up to the point of Fukushima, that is.

- The bottom lines are a) net energy constraints or, b) related gross credit constraints. Once that oil barrel requires more than a barrel to lift it will not be lifted. At the same time, complexity is baked into the crude supply chain. When market participants are broke because their banks have closed or there is no lender of last resort, the effect is the same as inadequate energy return.

Greece is indicative: there is oil in the ground (not in Greece) and available on crude markets but Greeks cannot afford any because they have no money. If the oil industry depended upon Greek customers it would collapse.

JoulesBurn's preceding article on Saudi Arabia's Khurais field development illustrates inelastic supply-side costs: without billion$ flowing into the country every year to service the costs of the infrastructure Khurais and Ghawar output will decline instantly.

The Greeks are thrown into the furnace so that the other states can waste Greece's share. To Greece, the process is a cliff-like collapse. The rest have that illusion of more 'growth' and 'progress' ... until the next state is heaved into the fire.

- The third item is that voluntary de-industrialization would have much smaller fossil-fuel footprint, 'collapse' would be redefined. This is impossible to imagine under current management regimes but one way or the other there will be de-industrialization, like it or not. At the cliff or the stair there is the bottom.

Your self-sustainability is admirable Todd, but you can only provide for yourself as long as you are physically able, and when other people - providing the current technological infrastructure - are not available to help you are going to be in trouble. Maintaining your own road is all well and good, but it has to link to other roads to be any use, and who will maintain them I wonder? You are aware of this of course. Collapse has happened before: ancient Rome, for example, had at its most populous (around one million people) fourteen aqueducts supplying water to the city. Political, economic and military failure, and then the subsequent population crash resulted in just one aquaduct being left functioning, and that did not supply the highest parts of the city which became depopulated and eventually turned into wastelend and eventually quarries. Water was now gathered, with difficulty and inadequately, from the Tiber and from wells. Dirty, impoverished medieval Rome contained just a few thousand people. Ancient Rome depended on political organisation, security and economic prosperity to maintain itself and yet it failed totally when the economy could no longer support a standing army; most importantly, the ruling classes were fatally complacent. Ours are too I'm afraid.

I suppose I'm in the large staircase camp. Even if the monetary system collapses next year we'll still have fossil fuel left so obviously there will be lots more stairs to fall down later on...

But I'm definitely not in Greer's gradual decline camp. The monetary system is literally the greatest ponzi scheme in the history of the world, and ponzi schemes generally don't end gradually...

Basically, the problem is that there are WAAYYYY more dollars (or debt bonds) in existence right now than could ever possibly be redeemed for real world resources. This is a result of 30 years of continually forcibly decreasing interest rates down to 0%, and the Federal Reserve forcing the world's capital into these bonds by manipulating markets to prevent the true dynamics from being expressed. There are only two ways the fundamental value of the dollar could be reconciled with the real world of Peak Resources -- through massive inflation, or by outright debt default, either one of which is a catastrophe worthy of the greatest monetary collapse ever.

I think what we'll see is ever-more heavy handed capital controls being forced on everyone. We will see restrictions on moving money out of the country, and limits placed on how quickly people can redeem their retirement savings, in order to prevent such a rapid run on the bank. But those draconian measures will merely reinforce a loss of confidence, and when the average person loses confidence in money, watch out because the whole system is hanging together with the scotch tape and rubber bands of "faith" right now.

One way or another, the current monetary system will end, fairly fast, at some point in the not too distant future. Then one has to ponder what kind of social ramifications this will lead to since the US will immediately no longer be able to buy the oil it used to. This will drop oil consumption by 2/3. Now consider that the average person won't be able to buy the remaining oil because they won't have a job because the economy isn't growing, and because the work week isn't being reduced to more equitably distribute the remaining jobs...

The possibilities for war here are easy to envision, especially given the hostile political climate pervasive even today, and an almost universal misunderstanding of the problems by the average person. It will be much easier to lynch scapegoats than rationally discuss the true cause which is the running out of resources. I guess I'm coming across quite gloomy here, maybe humanity will display greater maturity than this, who knows, I'm just exploring the logical steps that seem likely to me based on our behavior up to this point.

Just looking at ecological systems (of which we are one), Malthusian Collapses aren't pretty and orderly.

Null, you seem to have the monetary end of things worked out pretty well. Add in a geopolitical element and the picture will be more complete. Watch Iran along with China, India, and Russia. How that plays out will give you an idea of how long the current system can continue.

Yes, but when this monetary system fails (and I agree that it will), we'll replace it with another. And then possibly another after that. That's why Greer sees this process taking a century or more, and in that regard I think he's correct.

I think the ramifications of a monetary system collapse will be far greater than people realize. Historically, like a hundred years ago, people were wise to the antics of the bankers, and didn't rely so much on pieces of paper or digital bits for their personal wealth and their daily "productive" activities. Back then people were more resilient, more rural, and could take care of themselves better (which is why many survived the Great Depression as well as they did). Now, literally millions of urbanites are fully dependent on a functioning monetary system for their very survival. When it goes how will places like LA and New York be sustained? It will require rationing and military control, either that or a mass exodus of millions to the countryside.

What a monetary system collapse entails is that everyone who believed they would be getting a pension, or who has saved up a nest egg in 401K's buying bonds, will see that vanish. Of course a new monetary system will be brought in but 1) it won't be a debt based fiat currency because growth will be dead (a gold standard will have to be instituted at some point), 2) no one will trust it as a store of value for a long long time, 3) the average person's wealth will have been dramatically reduced as a result.

This will be a major downward step down the staircase, the slap-in-the-face wake-up call for the masses that things are not right. I think this will precipitate many of the other problems that are currently waiting in the wing, but not brought to the forefront yet because we are still living in a fantasyland reinforced by the previous 100 years of relatively stable growth; that will end.

Not much to quibble with in your assessment, especially "This will be a major downward step down the staircase." That's precisely why I put the big step there. That step is the failure of our monetary system.

I definitely share your view. Industrial civilization was built on cheap energy stimulating growth that was unequaled in world history. As we have run out of cheap energy and hit a decline in oil per capita, debt allowed industrial civilization to lumber on. When our monetary system fails, any replacement will face the same conditions that bought down our current system. Lack of cheap energy will force the new system to print endless money, and the FAITH in that money will have been lost forever during the death of the first system.

"and the FAITH in that money will have been lost forever during the death of the first system."

Not forever...the cycle will begin again.

Yes forever is to strong. I still feel in the short term that a new economic system would have to face the fact that there is not enough cheap energy to run industrial civilization.

What the doomers ignore is the ability to become greatly more efficient in the use of energy. The US, for example, is grossly inefficient in energy use, precisely because oil is cheap. When Europe is examined, per capita oil consumption is far less. The difference is largely because of the price of oil, which is taxed heavily there but hardly at all in the US. Further, it is a mistake to treat Europe as if no waste occurs there. Europe is simply the obvious proof that it is possible to have a rich & civilised society with much lower oil consumption.

If we assume that US per capita oil consumption will be in 10 years what it is in Europe today, that would greatly increase the room for consumption to increase in producing countries, India & China, without any "breakdown" effects. The transition, of course, would necessitate much investment in public transport, which would not be an outcome of pure market mechanisms, but there would be many other changes that would occur in response to high prices. Capitalism is an appalling system, but you can't argue that people don't eventually respond to price signals. To adopt more European lifestlyes:

1. When moving home (which happens frequently in the US), people will increasingly take the length of the commuting distance into account.

2. When buying vehicles, people will increasingly take their capacity to afford the running costs into account.

3. Recreational driving will greatly decrease.

4. House insulation will be greatly improved.

Next, there will be changes brought on by improved technology in many countries, not just the US:

1. Telecommuting will greatly increase for white collar workers.

2. Video conferences will replace a good deal of business plane travel.

3. Transformations in the manufacturing process through computerisation, miniaturisation and nano-technology will greatly reduce the level of material inputs needed and thus the energy inputs to support their production.

Jeavon's Paradox is often raised as an obstacle to transformation through greater efficiency. This is the idea that increased efficiency of use often leads to increased total use rather than decreased total use. This is true when the efficiency is being led by technological progress. When increased efficiency is being led by higher prices, however, the increased efficiency through technological change instead operates to enable the outcome (e.g. affordable transport) to be maintained in the face of input price rises.

What this means is that we have a good deal more time up our sleeves than the doomers believe we have. We will have the opportunity to make a transition to a sustainable economy with sustainable energy systems. Certainly, some extremely wasteful activities (e.g. recreational driving) will go, to be followed by spectacularly wasteful cultural phenomena (e.g. Formula 1 car races), which will become uneconomic through the loss of cultural support rather than directly from increasing costs. We will, however, be able to live civilised lives.

And I'll continue to get around on my bicycle.

You seem to think that oil production will decline to a plateau and sit there forever. And all we must do is adjust to that lower production level and things will be fine. That is the great cornucopian misconception. No, once fossil energy begins to decline, it will decline forever. Increased efficiency will be forever chasing declining supply but it will never quite catch up.

Another thing that cornucopians ignore is that decreased use of oil use will mean decreased employment. When people drive less and fly less the people involved, especially in the vacation industry, will be out of work. And when people buy fewer petroleum products there will be fewer jobs for those producing those items.

Ron P.

Another thing that cornucopians ignore is that decreased use of oil use will mean decreased employment.

How does that theory hold up against oil consumption figures around the world in the present or the past? Do you mean that, say, a 10% decrease in the use of oil will decrease employment one for one, i.e. 10%, or 0.01%, or collapse the system, what? What would a 50% decrease in oil consumption do to the US economy?

We might get some idea from looking abroad. US oil consumption was 68 bpd/1000 people in 2007 (down since then). Germany however was half that, ~30 bpd/1000 people. UK consumed 29 bpd/1000 people. Does this mean that German employment is about to collapse? That tourism will cease in the UK? On the other hand the Virgin Islands consumed 845 bpd/1000 people, Gibraltar 810 bpd/1000, while Haiti, the poorest country in the Western hemisphere, consumed 1.4 bpd/1000. Should the VI's or Gibraltar be expected to be the wealthiest countries in the world?

Historically, looking back at the oil crisis of '79-80, US oil consumption dropped ~17% from '79 to '83, yet the economy grew strongly '81 to '83 and after.

http://www.nationmaster.com/graph/ene_oil_con_percap-energy-oil-consumpt...

Falstaff, nothing in the economy is linear. However there is no doubt that a 50% decrease in world oil consumption would devastate most economies of the world. Anyway the below chart shows the recession starting in 1980 and lasting through 1983. WSJ, Financial Times Raise Issue of Oil Prices Causing Recession. The chart ends in 2008 so the extent of the 2008 recession is not shown.

And the chart of world oil production shows oil production, then, peaking in 1970 and bottoming out in 1983, the year the recession ended.

World Crude + Condensate production in thousands of barrels per day.

Ron P.

And of course we need to use a little common sense. If recreation travel is cut in half, then many of those employed in the recreation industry will lose their jobs. Not necessarily 50%, it may be less or more. As I said, it is not linear. And as it gets more expensive to manufacture goods using oil and wages do not go up as prices go up, then people will just purchase fewer goods. Well of course they will purchase fewer goods because fewer goods will be manufactured. But those people who manufacture those goods will just be made unemployed.

Ron P.

Ok, I'll bite.

there is no doubt that a 50% decrease in world oil consumption would devastate most economies of the world.

That depends on how long it takes. If it happens in 3 weeks then yes, that would be devastating. If it takes 3 decades, not so much.