Tech Talk - Enhancing Production at Berri

Posted by Heading Out on April 22, 2012 - 9:38am

In the last post I discussed how changing technologies were improving the recovery of the final significant volumes of oil from Abqaiq. New technologies have also brought additional life to the Berri field, which lies along the coast north of Abqaiq. Berri is/was the 22nd largest oil field in the world.

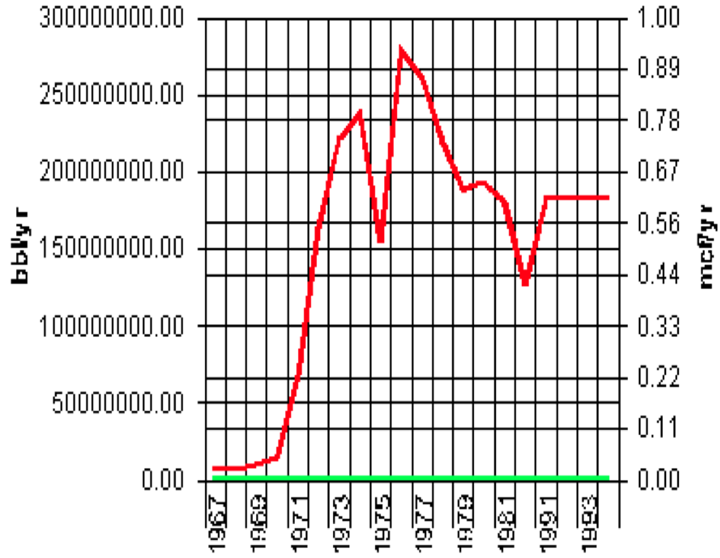

In the past, Rembrandt quoted the late Matt Simmons' "Twilight in the Desert" on the origins of this field and its future. The field was discovered in 1964, and the first wells to find the location of the producing reservoirs were drilled in 1967. The original estimate of the reserve size was made in 1978, at 8.3 billion barrels. In an earlier paper, Matt had plotted the production from the field and showed that it peaked in 1976, at 800,000 bd, when water flooding under the reservoir was introduced to maintain reservoir pressure.

This production came from the Hanifa, Hadriya, and Fadhili reservoirs, because at the time, the Arab horizons (A, B and C) had not been productive in this region, which has eight Jurassic-age reservoirs. However, the Arab D horizon has been developed since then and is now in production. That reservoir is anticipated to contribute 25% to overall field production and is anticipated to sustain a relatively steady production of around 85 kbd (giving a total estimated production of around 350 kbd) for ten years, after which the reservoir will see a rapid decline in production.

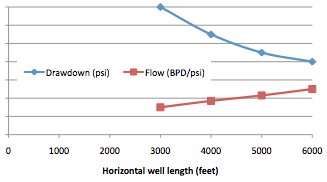

One of the problems that arises when long-hole horizontal wells are used to drain a reservoir is the need to maintain a significant negative pressure difference between the well and the surrounding rock, so that oil will continue to flow into the well. Up to a certain point, the longer the well the greater the production, but beyond that point, as the drawdown pressure differential falls, so production will also halt in the more distant part of the well.

Figure 4. Pressure drop and production with increasing horizontal well length (after Fischbuch et al ) (To fit the curves on one plot, there is no scale on the vertical axis, but the production increased from 29 to 50 bpd/psi along with the increase in length. Pressure values are discussed within the post).

In addition, the geological factors in the upper reaches of reservoirs that are now smaller than when these fields were initially developed, means that the horizontal sections are often limited to around 4,000 ft in length. Nevertheless, this length can still initially produce up to 4,000 bd per well. In the case of the Berri wells in the Arab D, the optimal length of each horizontal section was found to be 3,000 ft, based on geology. Further, this requires that a ratio of 1.2 barrels of water be injected for every barrel of oil removed to achieve the pressures needed.

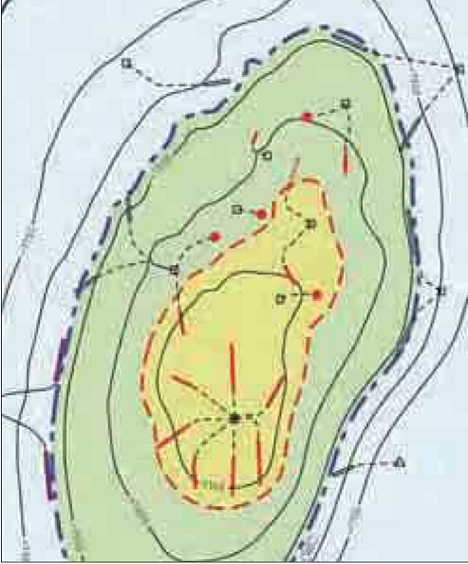

As I noted last time, and as the above plot shows, as horizontal wells get longer it becomes more difficult to sustain that pressure differential at the back of the well. The pressure may then fall to the point where there is little additional production in the rear sections. Therefore, greater production can be achieved from a series of shorter laterals around the well, rather than from a single, longer well. This is the case at Berri, where the new wells have been drilled to give Maximum Reservoir Contract (MCR) by using shorter laterals rather than single longer wells that reach further into the formation. However, because of the geology, these are driven as separate sidetracks from the main well, rather than as laterals from a single main horizontal well.

There is an additional snag that arises, because of the pressure drop problem, and that is that Aramco are using valving systems to isolate individual segments of the well. This is done to protect the rest of the well from premature water breakthrough in any one section, but each of those valves also creates a resistance that diminishes the available pressure drop beyond the valve. As a result only a limited number of valves can be used in a well, and this in turn limits the number of divisions that the well can be broken into. This is a particular problem for the Arab D reservoir since, as I noted in an earlier post, this carbonate is permeated with thin, high permeability paths that can, if not isolated or treated, lead to premature watering out of the wells. (One such horizon has been identified at Berri near the top of the field and was cased to isolate it from the well).

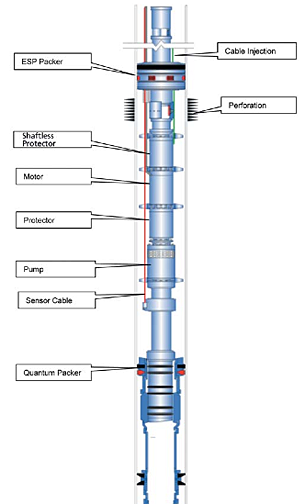

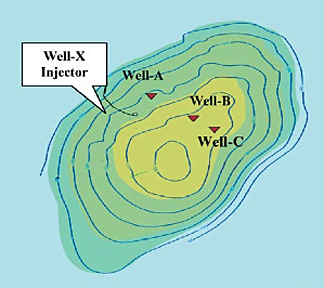

Seven production wells were initially drilled into the reservoir in developing the Arab D, but modeling of the reservoir suggested that the wells would rapidly fall in production, due to the inability to sustain production pressure, even with perimeter water flooding. There have been two solutions proposed for this, both of which involve the use of down-hole electric submersible pumps (ESPs). The first was to install these in the wells, to help with pumping out the oil, while the more recent study has been to see if using these pumps to increase water flow into the reservoir can help sustain production.

While the hope with the water injection pumps are that they will be able to draw water from overlying underground water reservoirs and use these as a water source, nevertheless in 2009 Aramco laid new pipes to carry more water to Berri and to remove the oil that it helped produce. (The new injection well array requires some 10,000 – 12,000 bd of water injection.)

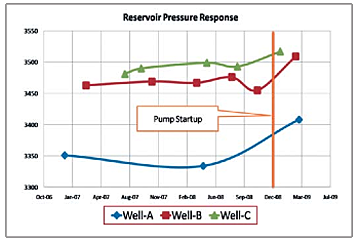

Calculations had shown that a drop of 300 psi within a well would be sufficient to drop oil inflow to zero and that this would occur within two years of bringing the reservoir on line. ESPs were therefore installed in each of the seven wells, and when brought on line were able to sustain production at a level of 70 kbd, which was above the anticipated value.

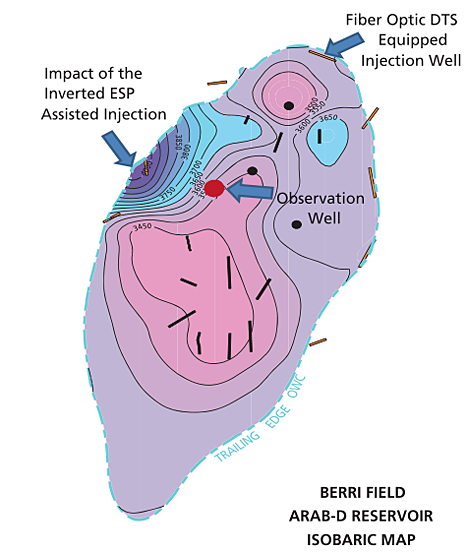

The more recent work to install an inverted down-hole ESP to draw water from the Wasia aquifer and inject it into the Arab D has been in service since December 2008, and has shown an improvement in the pressure in adjacent wells.

This improvement in technology may well provide a solution, as it allows production from otherwise undevelopable reservoirs and some answers to the questions that, for example, Jud has raised about the long-term viability of the field.

While the development of the Arab D does give a boost to the production at Berri, it should be remembered that this post has only discussed how “new” reservoir development has provided for 25% of Berri production for the next decade, and does not address the production from the main reservoirs of the field.

HO, I am a layman with very little knowledge of oil recovery techniques. However, reading your presentations, it appears to me that SA is utilizing all available technology just to maintain current production in their major oilfields, Can anyone provide a reasonable estimate of how long this can last?

Joe:

It varies from field to field, and for each reservoir. Abqaiq and Berri are the most extreme cases of the fields in Saudi Arabia, as I showed a couple of weeks ago, in terms of how close to being exhausted they are. But discussing them allows me to highlight the steps that Aramco have been going through in order to get the largest amount of oil possible from their reservoirs, and it applies equally well to the older regions of Ghawar, which are not far behind in terms of approaching the end of their high production days.

The ability to go back and extract volumes of stranded oil, behind the flood face, can produce significant volumes, but these are all much shorter term wells than the main producers at the top of the reservoir. As a result (and Aramco recognized this years ago) they are bringing new fields into major production (the next being Manifa) and these add hundreds of thousands of barrels a day, to offset the decline in the older fields. But the declines that will come from the North end of Ghawar will be more difficult to offset, and they are likely to start happening fairly soon, in my opinion.

Would not producing from the Manifa field incur significant production cost increases since it is offshore?

Part of Manifa is on-shore from memory, and the rest is in very shallow water.

Capital costs were higher to build artificial islands & causeways, but production costs from a nearly virgin reservoir should be among the lowest/barrel at Saudi Aramco.

The last statement is a general SWAG, not detailed knowledge.

Alan

Thanks HO

Any comments on Saudi efforts on Enhanced Oil Recovery by injecting carbon dioxide?

Is the water they are injecting from an "aquifer" potable water? If so they are sacrificing one valuable resource for another.

The paper HO gave a link to as "Shinaiber et al"

full link:

http://www.saudiaramco.com/content/dam/Publications/Journal%20of%20Techn...

describes this overlying aquifer as Non Potable Water (NPW),

"total dissolved solids (TDS) of 24,700 ppm"

(sea water is around 35,000 ppm TDS).

So this water is beyond brackish, it's frankly saline.

I think it's clever to just turn a pump over and pump water from 4,500 feet

down to 7,400 feet in the same hole. Since the NPW aquifer is closed, they don't have to treat it to kill any bacteria like they would if they used seawater or piped in water from elsewhere. And no pipe outside the hole needed either.

They did have to get a 4,500 foot power cable to handle 55 amps at 2490 volts!

And another cable to run some sensors at the pump.

They also have to pump a bit of corrosion inhibitor down to protect the pump & pipe from this water (pH 6 or so - slightly acid, along with the dissolved salts makes a good recipe for corrosion).

But I echo what other commentators have said - this seems like a lot of trouble to get some oil, e.g. the easy oil is basically gone, and this (not so easy oil) too shall pass.

The Saudi's pump more seawater into the wells, I think 11 mb/d than they get out in oil. For them to focus more on the Berri field is scary because they are supposed to be able to produce 12.5 mb/d which I find hard to believe they can do without damaging their fields... Imagine what will happen when Ghawar does what Canterell in Mexico has done the past few years i.e. collapsed. And Canterell was put on life support, nitrogen injection, to no avail....

MrEnergyCzar

I don't think that will be any problem with wells having a PI, discussed below, of 50 bpd/psi drawdown - 1000 bpd for 20 psi drawdown or 10,000 bopd for 200 psi drawdown 20,000 bopd for 400 psi drawdown.

Cantarell was put on nitrogen injection to accellerate gravity drainage of a 20 deg API crude.

Actually it was to a great deal of avail, when nitrogen injection was started at Canterell. From 1998 to 2000, Caterell daily production had declined from from an early peak of about 1.4 million bbl/day, down to 1.1m b/d. Then under nitrogen injection, production essentially doubled from 1.1m b/d, up to 2.2m b/d between 2000 and 2005!

Of course there have also been the huge declines since 2005 (currently stabilized, I believe). But during the 2000-2005 period, nitrogen injection certainly appeared to work some magic at Canterell.

Thanks HO, very informative post. One minor quibble that may cause confusion with the studio audience: the caption on fig 4 reads:"production increased from 29 to 50 bpd/psi along with the increase in length."

Fischbuch,etal stated:

PI (production index) is production, in bpd divided by pressure drawdown, in psi or bpd/psi.

Petroleum engineers use PI for everything from designing pumping equipment to well representation in reservoir modelling. Not really a complex concept, the units of PI (bpd/psi) suggest its meaning. Barrels per day production per psi drawdown. Drawdown is the difference between reservoir pressure and wellbore pressure.

Note that PI may not be constant, but rather a function of rate - 4Mbopd in this case.

It seems that longer laterals don't necessarily lead to proportionally more production unless the well traverses areas of greater pressure differential. I think HO's mentioning of enhanced water injection (using production pump in reverse down wellbore for water) explains how you could get PI higher. The diagram of Berri field with isobars show this.

PI increases as length of the lateral increases. On figure 4, the curve labelled drawdown shows that for a longer lateral produced at 4000 bpd, drawdown decreases and thus PI increases with a longer lateral. With the 3000' lateral and a PI of 29 bpd/psi, drawdown would be 138 psi, with a 6000' lateral and a PI of 50 bpd/psi, drawdown would be 80 psi.

In that model, reservoir pressure is the same for all lateral lengths. As HO's states, electrical submersible pumps are installed to create greater pressure drawdown and thus a higher production rate for whatever lateral length.

Bob:

Thanks for helping clarify what was my ham fisted way of trying to put a scale to the vertical axes of the graph, and thus give a sense of the levels that it was showing.

I have questions about Saudi Aramco as a company. They seem to be rather advanced and efficient in what they do. I often read about new techniques they are trying. They seem to take good long term care of their fields also (at least from what I have read). Yet, they are a state run company and appear to have a monopoly over oil production in SA. In other nations, Russia and Mexico come to mind, large state connected businesses do not seem to be very efficient or cutting edge. Are my observations correct so far? If so, what makes Aramco different? Can you shed some light on the organizational structure or incentive system at this company? Is it led by CEO's? Do they get fired? Who makes the decisions? Is it really a state run corporation? Thanks.

You can WIkipedia ARAMCO.. but I will tell you what sets it apart.. It's not called Arabian American Oil Company without a reason. I lived in Jubail as a kid, my father worked for Bechtel and we worked alongside a lot of Aramco people. I went to school with their kids, etc..

It is a Saudi owned company with a very large professional American expat management and engineering crew. When they nationalized it in the 1970's(??) they retained what made it successful. Very skilled individuals were not swapped out for a local needing a job. Many of their employees never come back to the United States. They are paid very well and given many perks.

The Saudi's are smart and know their limitations. They don't like having expats do the work that is vital for their survival, but they know they don't always have the skills to be successful. They will continue to train their own people and send them abroad, but when it comes to their oil, they will not settle for second best. So if an American can do it better, then that's how it will be.

You can google some of the images of their work and living conditions in Daharan Aramco compound. Looks like a suburb in Orange County, CA.

I think your post sums it up very well.

What sets Saudi Aramco apart, in my opinion, it their stated objective to operate fields to maximize recovery. That is not true for the majors that made up Aramco. The majors operate to maximize PV (present value). Maximizing PV can lead to production at a high rate and reduced recovery.

If Aramco had not been nationalized, these fields would probably all be severly depleted. That is the model the typical TOD poster is apparently basing their hysteria upon.

Many TOD posters seem to be cognizant that production at a high rate can reduce recovery, but fail to give SA credit for operating thier fields to maximize recovery.

Two words, Benjamin, just two words: 'gravity stable'.

I guess you can put me in the "hysterical" camp.

The most commonly used number for proven Saudi recoverable reserves is about 250 Gb (billion barrels), which never seems to vary as depletion marches on.

In 2004, the Saudi Oil Minister "conservatively" put total estimated recoverable Saudi reserves at 1.2 trillion barrels, or 1,200 Gb:

http://www.energybulletin.net/stories/2012-03-08/saudi-oil-minister-then...

In other words, the Saudi Oil Minister, in effect, claimed that Saudi Arabia would (conservatively) have in excess of 1,000 Gb of post-2005 CNE (Cumulative Net Exports).

The gap between what our modeling suggests for Saudi Arabia and conventional wisdom regarding Saudi Arabia is vast.

Regarding the IUKE (Indonesia, UK, Egypt) case histories (three former net oil exporters), note that based on extrapolating the first three years of increasing C/P (Consumption to Production) ratios, the combined predicted post-peak CNE for IUKE were 4.6 Gb, and the actual combined post-peak CNE for IUKE were 4.6 Gb.

Using the same C/P approach, and extrapolating the 2005 to 2010 rate of increase in the Saudi C/P ratio (18% to 28%) suggests that post-2005 Saudi CNE are about 30 Gb (36 Gb using the estimated 2011 data). And they have (net) exported about 14 Gb from 2006 to 2010 inclusive, leaving remaining post-2005 CNE of about 16 to 22 Gb (based on 2010 and 2011 estimates respectively).

Therefore, our modeling suggests that remaining post-2005 Saudi CNE could be about 2% of what the Saudi Oil Minister claimed, in 2004, for his (conservative) estimate of post-2005 Saudi CNE.

Some more info & graphics: http://www.theoildrum.com/node/9139#comment-889253

Saudi Net Oil Exports* in dark blue (Total Petroleum Liquids, BP) versus global annual crude oil prices (Brent):

*Estimated at 7.8 mbpd for 2011

If you want the hysterical camp, OK with me, I won't be reserving a spot.

Clearly, al Naimi was talking about resources.

There is no doubt about what Saudi Aramco claims for reserves

Facts and Figures 2010

That is certainly the conventional wisdom approach. Meanwhile, virtually no one is paying any attention in the steady increase in the ratios of consumption to production in oil exporting countries, e.g., Saudi Arabia, which went from consuming 18% of total petroleum liquids in 2005 to 28% in 2010 (BP data base). (I estimate that 2011 was about 28%).

In the three years after their respective production peaks, Indonesia went from consuming 42% of total petroleum liquids production to 52%, the UK went from consuming 59% to 69% and Egypt went from 45% to 55%; as noted above, extrapolating the initial three year rate of increase in their C/P ratios accurately estimated post-peak CNE.

In the six years after 2005, Saudi Arabia went from consuming 18% of total petroleum liquids production to about 28%, and if we extrapolate this rate of increase in the C/P ratio, it suggests that remaining Saudi post-2005 CNE are on the order of about 20 Gb or so.

In other words, Indonesia, a founding member of OPEC, once was as Saudi Arabia, also a founding member of OPEC is now. Soon, Saudi Arabia may be as Indonesia is now.

Regarding Al-Naimi, I will agree that he "very conservatively" estimated Saudi URR at 1,200 Gb.

At midnight on the night of April 14th, most of the passengers on the Titanic who were still awake were probably having drinks and talking about dinner plans in New York.

My Titanic analogy:

And a case history of a senior international oil company executive knowingly making misleading statements about proven reserves:

http://www.nytimes.com/2004/04/08/business/oman-s-oil-yield-long-in-decl...

April, 2004: OMAN'S OIL YIELD LONG IN DECLINE, SHELL DATA SHOW

Thus demonstrating my point that operating to maximize pv can lead to reduced recovery.

Saudi Arabia, for the time being , doesnt appear to be suffering any decline.

If you don't count the net export decline. The cumulative shortfall between what the Saudis would have net exported at their 2005 annual rate of 9.1 mbpd and what they actually net exported for 2006 to 2011 inclusive was about 2.5 Gb. This is equivalent to about 3.5 times the size of the US Strategic Petroleum Reserve.

In any case, based on prior discrepancies between the BP and EIA data bases, I estimate that BP will put Saudi Arabia's 2011 annual total petroleum liquids production rate at between 10.5 and 10.8 mbpd, versus 11.1 mbpd in 2005. And of course Saudi total petroleum liquids production for 2006 to 2010 inclusive was below their 2005 annual rate.

Note that China & the US became net oil importers long before their production peaked (which only now might be occurring for China).

The fact remains that Saudi Arabia was consuming 18% of their total petroleum liquids production in 2005 (BP) and (I estimate) about 28% in 2011, about a 7.4%/year rate of increase in six years--on track to double in about 10 years.

At Saudi Arabia's 2005 to 2010 rate of increase in consumption (6.8%/year, BP), Saudi Arabia would approach zero net oil exports in 2030, even if they maintained a constant total petroleum liquids production rate of 11.1 mbpd.

However, the really aggressive net export decline rates kick in when countries, e.g. the IUKE case histories, show a sustained production decline. Given an ongoing production decline in an oil exporting country, unless they cut their consumption at the same rate as the rate of decline in production, or at a faster rate, the net export decline rate will exceed the production decline rate, and the net export decline rate will accelerate with time.

An introduction to Peak Oil Versus Peak Exports:

http://www.energybulletin.net/stories/2010-10-18/peak-oil-versus-peak-ex...

Today, Saudi Arabia (and much of the West) is in an economic war with Iran.

The Saudi role is to replace a significant fraction of Iranian oil exports.

Except that they aren't - and I strongly suspect because they can't.

Saudi oil exports are below their peak oil exports of a few years aqo.

And as northern Ghawar waters out, exports will decline even more significantly - and then dramatically.

Not Much Hope for Sustained Saudi Oil Exports,

Alan

That is patently absurd. Every major field in Saudi is in steep decline and they have admitted it. They claimed, several years ago, that they had gotten their decline rate down to almost 2 percent but that is doubtful.

What they have done is bring new production on to replace the decline rate. They have brought on Shaybah and Kharas. This new production has, so far, offset the rapid decline in their major fields.

Country Analysis Briefs: Saudi Arabia

Ron P.

How do you know they aren't lying ?

Saudi Arabia is a country. Did I say anything about any of Saudi Arabia's fields ?

Saudi Arabia(the country)crude oil production, million bpd - OPEC data

What is so

absurdpatently absurd about that ? Where is the decline ?By this calculation, Saudi Arabia(the country)'s decline has been less than 4 %. If it were as much as 4%, they(Saudi Arabia, the country) would not have been capable of producing 9.8 million bpd in March 2012 and would not have been capable of producing 9.1 million bpd in 2008.

I'm not directing this at any one person, but to all - please be more civil in your conversations. Attack the argument, not the person.

Commenting guidelines:

http://www.theoildrum.com/special/guidelines

[edit]

People just need to be more specific about what they mean -- and calm down.

Looking forward from 2008, these are predicted capacities. The notable changes are an initial increase in Arab Light (Khurais) followed by subsequent decline, and an increase in Arab Heavy (Manifa). The AL decline must include some contribution from Ghawar, as Abqaiq isn't enough.

In any case, these are two separate discussions: 1) Reserves deplete with production but can be replenished, and 2) Production can decline but can be increased by drilling new wells in existing fields (Ghawar) or from new developments. I consider the latter to be more relevant, as replacing produced reserves with new finds does not readily translate into new production.

That is captured in the table I posted above. A tabulation using 6% decline results in "bogus realizations" ,in other words production in excess of capacity, for almost every year 2004 - 2011. 2% decline fits best, with a capacity of 11.2 million bpd ("OPEC crude oil) at the end of 2011.

The 'Saudi Arabia is on the verge of collapse' model doesn't fit, and hasn't fit for at least 5 years.

But here you are talking about an absolute decline rate of existing fields, which is offset by capacity additions (i.e. megaprojects). In what Ron quoted way earlier:

the 6-8% decline is theoretical (or "natural") decline which would occur if they did nothing. With additional drilling, SA claims decline from existing is around 2% - consistent with your "fits best".

The question to be answered WRT existing fields is how long that can go on. On an aggregate level, the question is hard to answer. I have documented the substantial "infilling" of north and central Ghawar about 5 years ago. But there are many reports of new wells having rather short lives. Another ominous sign is the need for a lot more water for injection into southern Ghawar, as discussed here:

http://www.theoildrum.com/node/9045

I'm not sure what you are getting at here. Clearly, capacity declines but Saudi Arabia's production has not declined for at least a year.

A year ago there was not the motivation to produce, and export as much oil as possible, as there is today.

There is a concerted international effort to reduce Iranian oil exports.

The role of Saudi Aramco is to increase exports enough to replace a significant fraction of Iranian oil exports.

If Saudi (or the UAE, the much smaller "swing producer") cannot increase oil exports, then Ms. Clinton's efforts will be much more difficult - most likely impossible.

For nations will not limit Iranian oil imports if they cannot be replaced.

Alan

Consider a single mature field like Abqaiq. As they produce the oil, certain well flow less oil and more water as time goes by. If they kept everything else the same, Abqaiq's total production would decline. This would be the 6-8% as estimated by Platts. But Aramco doesn't just stand by; they drill new wells, workover and sidetrack ones with high water cut, etc., such that the effective decline rate is 2%. Now, these numbers are averaged overall all fields, and probably doesn't include Khurais or other new developments. So, some fields might have higher numbers. But overall, SA needs to add additional production to maintain (or increase) production. So they did Haradh/Qatif/Khursaniyah/Shaybah,Khurais/Manifa.

Assume they have been successful so far. What about the future? The situation is:

I'm not claiming that the future doesn't exist, but rather that it won't be like the past. Aramco has, in the past dozen years, added capacity sufficient by itself to be the 4th largest oil producer in the world. But KSA production is about the same as it was. Do you believe they can duplicate that feat over the next dozen years?

The last of the old mothballed fields, Manifa, comes on line next year. Then that's it, unless they find something in the pre-salt Red Sea. That's unlikely. So no, they will not duplicate that feat.

Ron P.

As I have learned from the discussion here, and suspected, there are dozens of known small oil fields, plus Damman ("up to 100,000 b/day").

If they were large, they would have been on the schedule to develop for production. The King has said that they are off limits and should be saved for future generations.

But a new King may decide to develop them - X hundred thousand b/day of new production.

Alan

As noted up the thread, the cumulative shortfall between what the Saudis would have net exported at their 2005 annual rate of 9.1 mbpd and what they actually net exported for 2006 to 2011 inclusive was about 2.5 Gb. This is equivalent to about 3.5 times the size of the US Strategic Petroleum Reserve.

Using an estimate of 10.8 mbpd for what BP will show for Saudi total petroleum liquids production for 2011, their average total petroleum liquids production for 2006 to 2011 inclusive will be about 10.5 mbpd, versus 11.1 in 2005, while consumption probably increased by about one mbpd from 2005 to 2011. The net result is that they consumed 18% of total petroleum liquids production in 2005 (BP) and probably about 28% in 2010/2011.

Prior countries that have shown this kind of increases in their C/P ratios, e.g., US, China, Indonesia, UK and Egypt, are now net importers. There are of course counterexamples, for example Saudi Arabia in the early Eighties, when they cut production in response to declining oil prices, but the 2005 to 2011 decline in Saudi production corresponded to generally higher oil prices.

In order to just match their 2005 net export rate of 9.1 mbpd, the Saudis would probably have to average a total petroleum liquids production rate of about 12.3 mbpd this year.

For those who wnat to do a bit of sleuthing try this link to the OPEC Monthly oil report.

http://www.opec.org/opec_web/static_files_project/media/downloads/public...

Here you can see the OPEC production p42 and the ME consumption p31. Make what you like of the data, but the ME is consuming 7.5 million b/d, which will all net off the OPEC production.

Again, I do not want to join this kindergarten but.

The Saudis have by and large operated their oil reservoirs in a manner that will maximise recovery, especially post the nationalisation. This was partially helped by the collapse in oil pricing in the 1980's which allowed (forced) them to shut in much of the installed capacity. They have been able to husband their resources better than any other country and are no fools.

During this period the Master Gas System was installed and commissioned and much of the gas flaring was eliminated. The MGS has since been expanded to cope with the current levels of oil production, and probably a bit more. The methane and ethane(all) and NGL's are used nearly entirely within the country.

It is more than probable that the older oil fields are past their best and production costs have risen significantly as new technologies and waterflood programmes have been employed. But I agree with BB that the imminent collapse in Saudi oil production is highly unlikely. Just as unlikely is that their will be a massive increase in production. There is not the infrastructure to start with, nor the people , and nor the need in the eyes of the Saudi's , yet.

Most likely the Saudi's will maintain their current oil production without to much difficulty for some time; it has for the moment plateaued. A decade, possibly even much longer. But maintaining production will become progressively more difficult than today and they will have to work a bit harder each year and develop oil fields that are not as "sweet" (not meaning sulphur content)than before. Qatif and Manifa are good examples. The easy oil is gone, or it is nearly gone, but there is still a lot there to be had. But will it be enough for the world. The answer is no, a big no. The Saudis simply cannot be expected to make up each and every shortfall in supply. Why should they? Should they be compelled to expand their production to maintain the lifestyles of the US, or even Europeans? Personally I do not think so.

Year by year Saudi consumption is rising. 3 new refineries in the next 5 years will consume more than 1 million barrels/d of oil that is currently or could be exported. Some of the refined oil will be exported. Some will be consumed within. The oil demand growth in SA is significant and it has one the the fastest demand growth rates YOY. Oil products (and water) are subsidised in SA, which does not encourage best use.

Peak oil is about a peak in production. That does not mean that the oil supply will fall off a cliff. The decline may take some years to be noticed and it will be gradual. Realistically we are already their with conventional oil.

The real issue for the consuming nations is not the reserves or the absolute rate of production. It is the level of exports (supply) that SA (and others) will place into the world market, pure and simple.

You are confident that Saudi production will not "fall off a cliff".

I am not.

The primary reason is northern# Ghawar. Massive production for many decades - now with horizontal maximum reservoir contact wells. The large area of Ghawar will prevent all these wells from watering out at once - but the extraction rate from the attic oil can be intensified once the current MRC wells water out (various reports that some are already).

And the end could come quite suddenly - especially with production rates of 10+ million b/day. And, unlike Berri & Abqaiq, there is no way to replace northern Ghawar.

# Southern Ghawar was developed @ 2000 with three 300,000 b/day projects. I am confident that if left at that level, the southern 30% of Ghawar can maintain that rate of production for at least a half century.

The second reason is a combination of superb petroleum engineering with political decisions.

ATM, Saudi Arabia (the country) is highly motivated to produce and export to replace Iranian exports - and generate enough income to prevent an "Arab Spring" at home.

If Saudi Aramco is told to produce 10 million b/day for as long as possible - I am sure that they can do it. But this dictate carries with it the more or less simultaneous collapse of production from northern Ghawar and a couple of other fields.

One indication of this philosophy is that the last major field developed started production from all 5 reservoirs simultaneously, contrary to earlier Aramco practice.

The lack of veracity on reserves and the generally opaque details of production and reserves, makes a rapid decline in Saudi oil production, and an even faster decline in Saudi oil exports, a very real, and quite frightening, possibility.

Not Much Hope for Sustained Saudi Oil Exports,

Alan

What field would that be? In Khurais, they are producing from 2 of 3, and that is because those two are connected through fractures. In Manifa, it's two of six.

From memory, it was Shaybah. If I am wrong, I stand corrected.

Alan

Only the Shuaiba reservoir for that field.

My error then.

And that the other fields are only developing some of the reservoirs works against my fear of simultaneous severe production decline of multiple reservoirs.

With Pet E's as good as Aramco's, they could maintain high levels of production for an extended period - but at the price of multiple fields declining more or less simultaneously.

The question is - are they ?

And, as with every other question @ Saudi Aramco, we only have hints, or in this case, the lack there-of.

Best Hopes for Ghawar, Berri, Abqaiq et al NOT rapidly declining all at once,

Alan

And since it will take roughly 20 years of planning and investment to offset the rapid decline in Saudi, and other, oil exports (already started BTW), you are among those guilty of helping destroy our economy, and perhaps our civilization, by helping delay reasonable precautions against the inevitable.

If we start a few years too early - very little harm is done.

If we start too late - which we have - then the impacts will be devastating.

Not Much Hope for Sustained Saudi Oil Exports,

Alan

Alan, I think calling Bob guilty for being honest is a bit unfair. I may not agree entirely with his view on the extent of the Saudi Reserves, but an imminent collapse of Saudi oil production is not likely; only a limited number of Saudis know the true extent of their reserves, but they are still extensive. Those "guilty" of helping destroy the US economy, are those dumb Americans who have voted for the even dumber political clowns and incompetents for decades. The average American citizen has zero idea of his/her dependency on energy consumption for their daily life, little interest in reducing it, and their only concern is the price of gas at the pumps. Maximise present value mentality.

It is hardly better in the rest of the world, especially when even slightly intelligent persons believe that biofuels are a viable option, only the technology is holding it back from being realised. The sad truth is that biofuels could never support a population of 7 billion, even at a subsistance level of existance.

Sadly the point of no return was reached long ago. When tractors ploughed fields and Fritz Haber developed the fixation of nitrogen mankind was done for.

It has allowed unchecked population growth that politicians and religous leaders refuse to accept as the root cause of the most significant problem facing mankind.

I agree with most of your post.

I vaguely remember pre-nationalization plans to increase production to 18 million b/day - which the ARAMCO fields of the 1970s could have supported for a decade or maybe more.

And yes, absent nationalization, Saudi oil production today would be much lower than it is.

But the life extension from maximizing recovery only goes so far. And when Ghawar follows Abqaiq & Berri, and Manifa is in full production, then production will drop significantly - dramatically from the perspective of oil exports.

The key is northern Ghawar.

Not Much Hope for Sustained Saudi Oil Exports,

Alan

Ummm... shouldn't the Y-axis of Figure 3 be labeled "KBOD" rather than "MBOD"?

I don't think Berri is quite THAT productive!

PT in PA

MBOD in petroleum engineering lingo is KBOD in everyday lingo. SPE adopted this nomenclature, m = 1000, in the '50's ala roman numerals. MMCF is a million cubic feet.

I stand corrected... learn something new every day!

Slap forhead with hand. Duh!

Berri gives an expample of how Saudi Aramco has managed to replace decline.

From Saudi Aramco's 2009 Annual Review:

I dont believe this Arab D increment at Berri showed up on any megaprojects list, so this would have to be included in the 'maintain production' drilling Saudi Aramco has been doing to keep decline of their field base to their stated 'close to 2%'.

While Saudi Arabia's reserves cant be independently confirmed, I see no real reason to make the alarmist, inflamatory and dogmatic claim that: 'They are lying'

The challenge Saudi Arabia is facing, in my opinion, boils down to being able to maintain production from relatively smaller fields and reservoirs(barring the discovery of additional giants or super giants of course). I have stated on here previously that Saudi Aramco will need to become more nimble.

Hey, thanks Bob, that says it all:

In other words, they looked at their reserve data and said, something to the effect of: "Hey, lookie here, we got more oil in the ground than we thought we had. We have about as much more as we pumped out this year."

And they do that same re-assessment every year, year after year after year.... Case closed.

Ron P.

Ron - Hey, youse got a problem with that, bub? LOL. I've made a damn good living at times during my career doing just that for public company clients. Rarely black and white choices in geology/reservoir engineering. There's always a range...sometimes narrow and sometimes not. There is always a give and take between the analyst and the auditor re: how far you push your assumptions. Have I convinced an auditor to accept an optimistic assumption that I didn't really believe myself? Hell yes...that's how I got away with charging a high consulting fee. LOL. I never lied or presented false data...just used my bully pulpit effectively.

Unfortunately with the KSA and all the NOC's there is no give and take on their analysis because they don't allow us to see their assumptions and calculations. That doesn't prove, in and of itself, that the KSA is lying or even being overly optimistic about their reserve analysis. But there is a good reason why independent third party auditing is done: credibility. IMHO the KSA and all the other NOC's/private companies that don't allow such auditing lack much credibility. Which doesn't mean you can't accept their numbers. Doesn't mean you can justify calling them liars. But it does mean that they have offered proof of one dang thing either. If the KSA really wanted the world to believe their reserve numbers all they would have to do is allow a third party audit. If they don't does that prove they're lying? Not really IMHO. Maybe they just don't care if everyone believes them...at least not enough to spend $millions for an audit. OTOH neither I, nor you or anyone else on the planet is under any obligation to accept their numbers as fact. Sorta like belief in a God: has to be based upon faith more than fact IMHO.

Right Rockman, but could you get away with doing it every year for decades, always coming up with new reserves that matches almost exactly the amount you extracted that year? You could of course, if you worked for a national oil company that did not allow any outside audit of anything. And you are correct, no one could prove that you were lying. But anyone would be justified if they called you a liar, don't you think?

Ron P.

Ron - I could do it for decades if they kept paying my day rate. LOL. Now whether anyone would have continued confidence in my numbers for decades is another matter. In fact years ago even the SEC got tired of that part of the game. Eventually companies were limted as to how long they could keep PNP's (proven nonproducing) and PUD's (proven undeveloped) reserves. Basicly produces it or lose it.

And no...they couldn't call me a liar unless they proved the lie. But they would be justified in saying they don't find my analysis credible unless I provide sufficient supporting evidence. And let me be blunt: I work with a group of very skiled and credible engineers, geologists and geophysicists. We make our decisions after peer review as a committee. And our big payday will be determined by the value of our successes less the cost of our failures. IOW we each have a great incentive to be accurate/honest. And I don't accept one damn interpretaion from any one of them on face value. We don't pull our punches in the peer review. Either the data supports the proposal or it doesn't. If I don't blindly accept the analysis of guys I've known for decades and who have the same desire to be correct as I do then it shouldn't be a surprise that I don't accept the KSA, USGS, ExxonMobil, etc numbers on face value either. And it's not just a question of being honest but also being correct. I've said it before: there is nothing more dangerous than a geologist who truly believes his own sh*t. LOL. He'll spare no effort to convince you to drill that next dry hole.

I suspect that such an audit need not cost Saudi Aramco a penny. A group of OECD nations + China & India should be willing to pay for such an audit.

I you were an auditor (as you were at times), and you had a company that declared reserve replacements as close to production as Saudi Aramco (and one drop, four zeros and eight increases in total reserves) would you not approach the audit job with "utmost skepticism" ?

In other words, "I know these SOBs are fiddling with the #s, I just need to find out where and how".

Alan

I don't think you can say that there has not been any auditing.

International Projects Evaluated by Professional Staff of Ryder Scott Company, L.P

Anyhow, Rockman, thank you for expressing your opinion.

I believe that those studies are not public knowledge, but are part of the internal, superb Petroleum Engineering at Saudi Aramco.

They know, they are just not telling the whole truth.

Not Much Hope for Sustained Saudi Oil Exports,

Alan

bob - "I don't think you can say that there has not been any auditing." Didn't say there has been no auditing. Every field in the world has been audited...by someone. I've worked with Ryder-Scot many times...on both sides of the fence. IMHO they are the most credible reserve auditors around. When you get your copy of the R-S independent audit of the KSA fields please copy me. LOL.

And to Allan: I will have to side with Bob as to having little expectation of KSA production "going off a cliff". Granted that's a rather undefined metric but we all have a sense of what that means. I've seen individual wells go off a cliff. Had one do that two years ago: thought it would produce for years...depleted in 37 days. Still not sure how it happened. A field can deplete years sooner than expected. Mexico’s Cantrell Field is a rather unique in that regards. They have a huge N2 generating plant that allows them to inject more N2 into the field than generated by all the other N2 plants in world COMBINED. The faster the N2 goes down the faster the field depletes. But did it go off a cliff? Depends on the eye of the beholder IMHO. A trend of fields can take decades to show significant decline. An entire geologic basin can take many decades. An entire country of multiple basins…that much longer.

So I don’t anticipate KSA production going off a cliff. But that doesn’t mean they haven’t peaked. The US peaked in 1971 and most wouldn’t say we went off a cliff. Declined a good bit though for sure. But that also doesn’t mean they have even half the proved reserves they claim either. But if they can ramp up production or even just stay on a plateau for many years that won’t mean they have the reserves they claim either IMHO.

Rock,

Per claims, Ghawar still produces @ 5 million b/day (I am still trying to grok that !). 900,000 barrels/day of that is from the southern 30% of Ghawar - stable production till long after I am dead.

That leaves very roughly 4 million b/day from MRC horizontal wells in a very mature field. As some of these water out (as they are per reports), the watered out wells can be replaced by going after attic oil. Expensive & short lived. Drill harder and more as the water rises to maintain production.

And then that runs out. If 4 million b.day declines to <1 million in five or six years (I would consider that "falling off a cliff"), can the rest of Saudi Arabia make up the difference ?

Not from producing reservoirs. Not likely from all the small reservoirs they have found.

*MAYBE* from unproduced reservoirs above or below producing reservoirs. But the "runts of the litter" tend to be smaller, with thicker oil, perhaps in tighter rock. There are good reasons that they were not produced first.

Making up 3+ million b/day in a half dozen years is an enormous deal. The rest of Saudi Arabia (outside Ghawar) supposedly only produces 5+ million b/day.

Subtract from this falling production, rising Saudi domestic demand. Another 1 million b/day or so in a half dozen or so years.

I know how long it takes, best case (Americans work with the speed, efficiency and determination of French bureaucrats) it is almost a decade to make substantial structural changes in our oil demand. Better to take two decades of hard focused work.

In summary, I believe that northern Ghawar can deplete faster than we, or the rest of the world, can adjust, given everything else.

We would be the ones "falling off the cliff". And that cliff, *IF* it is there, is very well hidden in secrecy.

Alan

PS: I personally hope that northern Ghawar is down already to <2.5 million b/day out of the 10 million b/day they are producing today - and Aramco is just hiding that fact. This would imply more production from other fields and less impact when one field collapses.

Well, except for the rest of the sentence.

There, I finished the sentence for you, and defragmented it here:

Anyhow, Ron, thank you for expressing your opinion.

Bobbarnett. I note that you have been a member of TOD for less that two weeks and have essentially limited your posts to discussion of KSA fields. Do you have other petroleum interests such as ANWR, oil shale, shale oil pipelines etc.? Have you published at other oily sites? How long have you been aware of TOD? Why the obsession with KSA. Please ignore my questions if you have privacy concerns.

My knowledge of ANWAR is limited to what is available on the internet. My knowledge (and royalty interests) in shale oil is limited to the ND Bakken.

Published at other oil sites ? Well no, I have posted a few sarcastic comments on the Bakken Shale Discussion Group(BS Discussion Group).

My knowledge of Saudi Arabia is mostly limited to the internet as well. I became aware of TOD in 2006 and was absolutely convinced that Saudi Arabia was on the verge of collapse. My research and many of the posts on here lead me to question most of what was posted on TOD. Twilight in the Desert convinced me the much forecast collapse of Saudi Arabia was hype.

I don't have much interest in climate change, fuel economy, biofuels, and definitely not collapse of civilization *, pestilence, or the lack of toilet paper. I post mostly on Oil and Gas. Saudi Arabia seems to be the most common topic of discussion - displaced, in my opinion. Oh yeah, politics, I like to discuss politics but only if I can do all the talking - that doesn't work very well on here.

I don't have any privacy concerns, I am a retired Petroleum Engineer and this is a hobby.

* The part I play in the collapse of civilization is vastly overstated, in my opinion.

Joules typed:

I don’t see why not.

From my previous post:

Running my so called ‘model’ in forecast mode:

Give a group of competent engineers, geologists and geophysicists a budget and resources to develope 240 reservoirs somewhere in Saudi Arabia, and they will get the job done, in my opinion. I don't think they will be relying on any nattering nabobs of negativism though.

No pusillanimous pussyfooters or hopeless, hysterical hypochondriacs of history either.

By endlessly factoring in 2% decline, you are ignoring my point about what is required to achieve that. It until now required a lot of drilling in updip areas that are now no longer virgin. You can keep drilling in a field forever, I suppose, but that doesn't mean that the oil continues to flow as before.

There are reservoirs in some produced fields which haven't been tapped. Sadly not in Ghawar, however. And in all cases, these are lower quality reservoirs. What is left of the "107 fields" may be impressive on a spreadsheet, but it will be a lot more expensive to produce.

No, I am not ignoring your point about the difficulty of replacing a field like Ghawar. I am saying that Saudi Arabia has enough Resources to do just that (over time).

Well, I'm not so sure about that. From SA's 2009 annual review:

Whatever that means.

I assume they may be talking about the Silurian there, which contains sweet crude in what appears to be stratigraphic accumulations on the south and east flank. The Permian Khuff also contains potentially large volumes of condensate resources.

I can't figure out where this idea that SA will drive their oil production off a cliff comes from. I don't think they are that dumb or delusional.

I'm referring to the increasing difficulty of maintaining production in Ghawar.

Ghawar has been poked and prodded extensively down to the Khuff and Jauf where the gas is. There is a bit of oil in the Arab-C, but nothing substantial. Condensate? Yeah, in the Khuff. But the gas is Permian, so oil below that would be a bit unusual. "South and east flank" is where the Jauf is.

If you really have been paying attention since 2006, you should recognize that not all here have the same view on that. But there is a lot more to learn than what you will find in the SA annual reports.

Sorry but I don't consider that to be an entirely civil comment.

Yes indeed there is.

Old Sandstones:New Horizons gives considerable background information on the Ghawar paleozoics.

What you know about The Ghawar Oil Field, Saudi Arabia has a lot about the Khuff.

AAPG Memoir 74, Petroleum Provinces of the Twenty First Century may open some eyes(or raise some eyebrows) on the paleozoic source rocks of the Arabian Plate.

There is also a lot in SPE.

I think it is time to continue this discussion later.

Apologies, but I was pointing out the disparity of opinion.

I have those papers. Regarding "Old Sandstones", it is interesting that - although not in Ghawar, there is some oil in the Unayzah at Tinat, which is southeast of Ghawar, and in Abu Jifan, which is west of Khurais. But they describe the later Unayzah oil discovery at Hawtah as "first firm indication of possible oil reserves".

Numbers of oil fields and reservoirs is an absolutely meaningless metric !

I daresay Rockman has been involved is drilling 350 reservoirs. And I can infer, since he is still gainfully employed and not retired, that the sum of them all do not equal one Ghawar, or even one Berri or one Abqaiq.

Your link to the company doing reservoir analysis mentioned a one well oil field in Saudi Arabia that their analysis suggested should have a second well drilled if it goes into production.

Several producing oil fields in Saudi Arabia have additional unproduced reservoirs. But in every case the unproduced reservoirs are the smaller, inferior ones. Perhaps a giant replacing a super-giant in at least one case - but a step down in every case.

So I disagree that hundreds of small reservoirs can replace one northern Ghawar watering out.

And all the large fields have already been developed - the small fry# is what is left.

I have slightly more hope for unproduced reservoirs in developed fields. Some of these could be multiple 100,000 b/day producers.

# In the eyes of Saudi Aramco, 80 or 100,000 b/day is "small fry", Which makes me wonder why Damman is showing up with "up to 100,000 b/day).

Not Much Hope for Sustained Saudi Oil Exports,

Alan

Exactly Alan, exports are what matters. And Exports are what matters. There is just no denying that Saudi Exports are declining.

Saudi Arabia Oil Exports to Decrease Due to Increased Domastic Demand

Ron P.

Ron

Correct on both accounts.

It is not what the middle east is producing that matters.

It is what the Middle East is exporting and it does not look good.

Sam Foucher's modeling (constructed using annual data through 2006) of Saudi production, consumption and net exports (BP, Total Petroleum Liquids) is shown below. Subsequent data points, for 2007 to 2010 inclusive are circled. I am estimating that BP will show 2011 annual Saudi production at about 10.8 mbpd, consumption at about 3.0 mbpd and therefore net exports at about 7.8 mbpd, versus respective numbers of 11.1 mbpd, 2.0 mbpd and 9.1 mbpd for 2005.

Note that at Saudi Arabia's 2002 to 2005 rate of increase in production, their production would have been at about 17 mbpd in 2011 (Total Petroleum Liquids), and at the 2002 to 2005 rate of increase, their net exports in 2011 would have been at about 14 mbpd.

The cumulative shortfall between what Saudi Arabia would have net exported at their 2005 annual rate of 9.1 mbpd and what they actually net exported for 2005 to 2011 inclusive is about 2.5 Gb, about 3.5 times the size of the US Strategic Petroleum Reserve.

If this is an example of an exporting country "Not noticeably in decline," with more such examples, we would--to paraphrase King Pyrrhus of Epirus--be truly lost.

Let me put it this way: If Saudi Arabia were the sole net oil exporting country in the world, global net exports would have fallen by 21% from 2005 to 2010, versus the 6% decline that our Top 33 data table shows.