Tech Talk - Saudi Arabia and Natural Gas Liquids

Posted by Heading Out on June 10, 2012 - 5:06am

The price of crude oil has been shown to have significant impact on the global economy, and in the current and somewhat fragile state of the various parts of that economy, the lower prices help. Yet Stuart Staniford has commented that given the Saudi need for income to hold off “Arab Spring” dissatisfaction, they are unlikely to let prices fall too far before cutting production, since even a 10% reduction in output could raise prices 20%, thereby resolving their future income concerns. This reflects well the role of the Texas Railroad Commission back when it controlled US production in order to sustain an acceptable price for oil. But that role collapsed when overall US production was no longer able to spring to the rescue when demand rose and US production could not, passing the control over prices to OPEC and more particularly the Kingdom of Saudi Arabia (KSA), who have shown a willingness to control output to ensure that it proximately followed demand and has kept prices within an acceptable range for them. Their recent increase in production to offset possible Iranian sanctions, however, is likely to be transient, since – apart from annoying Iran, it has also driven prices below that benchmark.

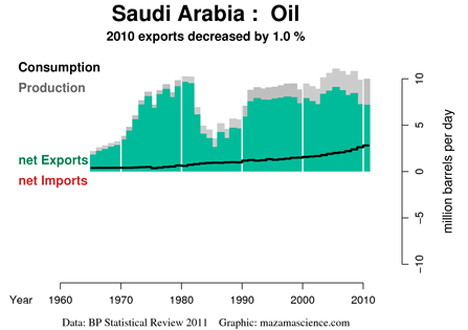

It is relatively easy to return to a more acceptable price by curtailing production, and as Stuart noted, this can increase KSA revenue at a time of falling global demand. However, in the opposing case, where the global economy requires a “reasonable” price for oil and will require them to increase production on a sustained basis, as they have done transiently to the limits of demand growth in the past year, that ability may be limited and of a shorter duration. It also occurs at a time that the internal use of crude is limiting the amount that the KSA can export. But while there is considerable discussion about this situation, there has been some increase in natural gas liquid production that is also important, and thus a main point of this post.

In the past, when the Kingdom has been challenged on the ability to increase production, it has listed the number of future fields that it would bring on line. Previous lists of future projects are, however, now reaching completion. Shaybah in the Empty Quarter, for example, raised production in January 2009 from 500 kbd to 750 kbd, and will soon raise it an additional 250 kbd to 1 million barrels a day.

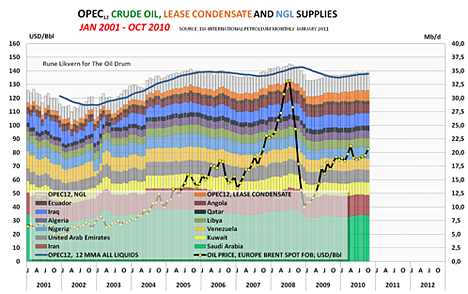

The increased production at Shaybah, however, also helps identify an additional source of increased production, since it is also increasing natural gas production to 2.4 bcf/day, with a concomitant production of 264 kbd of NGL. The increase in overall production of NGL from OPEC has, for some time, provided a significant volume of additional fuel. By the last quarter of 2011, OPEC as a whole was producing 5.42 mbd of NGL and NCF (non-conventional fuel), up from 3.89 mbd in 2006.

Rune has written about NGL production here and here, with the relative importance of this supply perhaps best illustrated with this graph from the latter post.

OPEC is anticipating an overall increase in NGL production from the 2011 average of 5.3 mbd to 5.7 mbd in 2012, with final quarter 2012 volume reaching 5.86 mbd. Apart from the increased supply from Shaybah, KSA is developing the Arabiyah/Hasbah offshore fields with onshore processing at Wasit. This will produce 2.5 bcf/d of natural gas, with 240 kbd of NGL production associated with that.

There is also the development of the Karan field that will, with the other programs in development, collectively raise KSA natural gas production to 15.5 bcf/day from the 10.2 bcf/d it was achieving in 2010. Unfortunately, the high sulfur content of the gas to be fed to Wasit is causing some problems and that project completion may now be delayed until 2015, though the problem of sulfur freezing in the lines is not yet solved.

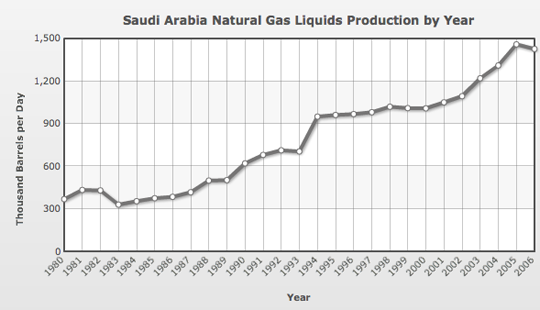

Saudi production of NGL’s has steadily grown over the years.

Last August, for example, it shipped 197,824 metric tons - roughly equivalent to 66 kbd - of exports through ports under the Saudi Port Authority – note that this does not include the amount used internally, but was 79% up on the previous year and does not include shipments from ports operated by Saudi Arabian Oil Co, or by Aramco.

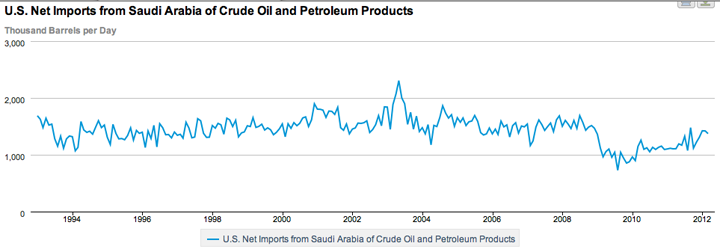

It should be also be noted that following the drop in consumption caused by the recession, the United States has increased the amount of crude that it is importing from KSA over the last couple of years.

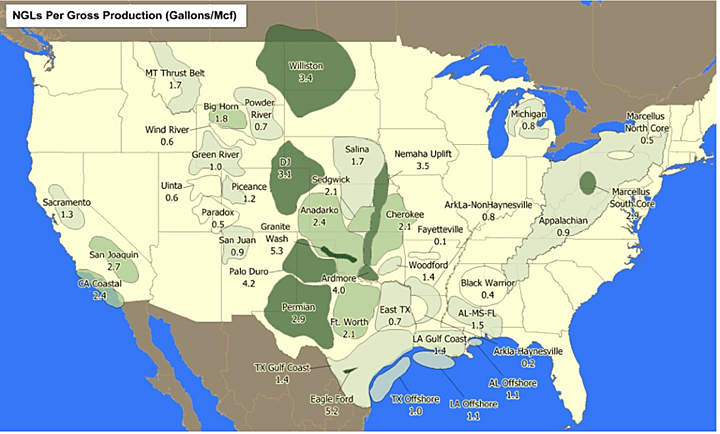

However, because of the increase in the volume of natural gas produced in the United States, there has been a concomitant rise in the amount of NGL produced. The volume of NGL produced varies with the field, with the relative differences shown in the following figure.

In 2010, the US averaged a production of 2.42 mbd of NGL. Were production of natural gas to rise to 110 Bcf/day by 2035 as has been projected by some, this will yield some 3.9 mbd of NGL with an additional 0.69 mbd from refinery production at that time. The US does not, sensibly, import any NGL and with rising production, will likely start exporting to Canada, where production is declining.

The Saudi market for NGL lies largely in Asia, with an export terminal at Yanbu. The terminal is connected to Abqaiq through a 1,170 km pipeline, and can handle exports of up to 2 mbd of NGL.

Yes they could cut the production of oil raising prices but what if you had an extreme deflationary cycle and to keep up they had to sell more oil at the lower prices. It does not seem as simple as cut production and increase prices in the current economic situation that the world is in.

The question, though, is how likely the extreme deflation scenario is. There are a lot of Chicken Littles around, who can't seem to see past the US & Europe. The BRIC countries, as well as other large developing nations like Indonesia and South Africa, are a lot less reliant on the US & Europe than they used to be. China, just for one, has the ability to launch the mother of all stimulus packages if needed.

''China, just for one, has the ability to launch the mother of all stimulus packages if needed.' Maybe they can have a stimulus the size of ours. That did not work so will in our country. You say that these countries are a lot less reliant on the US& Europe but if you don't have as much imports from these countries you have a lot, lot , lot less jobs. Also I hear that China is slowing down considerably. I wonder why? Also China manipulates their information so it is hard to see the truth there. I don't want to be a chicken little either but with the combination of debt deflation and oil in depletion I also don't want to be flatfooted when the sunami comes. I have been adjusting my lifestyle to prepare for both.

Can someone please explain to me how we can ever have deflation as long as various central banks have the ability to print money electronically? And since central banks are controlled by the people that make money trading, how does deflation line the pockets of traders and 'money men'? They are all looking to put any cash they have into another deal that's more lucrative than just the cash.

What I *can* imagine is lots more volatility in inflation/deflation rates.. This is where traders (and automated trading) make money... push oil up & corn down one week, then switch directions. The average 'inflation' or deflation rate stays pretty damn near close to zero, so all that consumers notice is a continual slow increase in prices. But what happens on a weekly or monthly basis is 50% increase (or decrease) in the value of a particular good, depending on how accurate the supply/demand really is.

Those screaming the loudest about runaway inflation or deflation are going to be the first ones to get fleeced.

What is the basis for a statement "The US does not, sensibly, import any NGL and with rising production, will likely start exporting to Canada, where production is declining" ....Do you have any numbers to support this....

g - http://www.naturalgas.org/lng/lng.asp

" Imported LNG accounts for slightly more than 1 percent of natural gas used in the United States. According to the EIA, the U.S. imported 0.41 Tcf of natural gas in the form of LNG in 2010. However, due to increased domestic production, LNG imports are expected to decrease by an average annual rate of 4.1 percent, to levels of 0.14 Tcf of natural gas by 2035."

I can't comment on the potential export of NG to Canada. Predictions are difficult...especially about the future. It's important to understand that export/import of any commodity is controlled by more factors then demand. In some cases importing is viable if the infrastructure is already in place and there's an abundance of the product in the export region. There are truly huge offshore NG reserves in the Caribbean with little local market. The transit across the GOM is quick and the offloading facilities are in place. Thus we end up with odd situations: LNG imports from Trinidad to the US Gulf Coast at the same time as LNG is being shipped from the Gulf Coast to England.

Last summer the National Petroleum Council released a report "Prudent Development: Realizing the Potential of North America’s Abundant Natural Gas and Oil Resources" and since then has released the background papers to that report. The link that I cite:

http://www.npc.org/Prudent_Development-Topic_Papers/1-13_NGL_Paper.pdf

takes you to the background papers from which I drew the information that you are looking for.

Paper 1-13 contradicts the statement that "The US does not, sensibly, import any NGL and with rising production, will likely start exporting to Canada, where production is declining". It says:

It is true that Canada is now short of ethane and as its production declines will begin to import larger amounts of ethane from the US because it can profitably use more of it it in its large petrochemical and refining industries.

However, while Canadian production of propane and butane may decline, Canada will continue to have a surplus because it doesn't have large enough markets for those products and will continue to export it to the US (in declining volumes). This will increasing be in the form of diluent for heavy oil, and the fact that the US has a surplus of propane and butane is irrelevant for the heavy oil producers. They will make their money from the oil and sell the propane and butane diluent in the US at whatever price is needed to get rid of it.

OTOH Canada will need to import increasing amounts of pentanes plus ("natural gasoline") from the US to dilute its increasing exports of heavy oil. But, as the paper notes, this is really a "closed loop" system - The US exports NGL's to Canada for use as diluent, Canada uses it to dilute the oil, and then immediately ships the blend back to the US. The US refineries separate the diluent from the oil, and ship it right back to Canada again to dilute more oil. And around and around it goes.

I stand corrected, I misread the papers.

The Canada exports are related to the "mariner west" project that will take ethane from the Marcellus and export it to the petrochemical complex at Sarnia, Ontario. Right now all the Marcellus ethane is rejected and stays in the natural gas stream. Soon there will also be pipelines that allow it to be transported down to the gulf coast crackers.

What type of hydrocarbon molecule is the NGL? If it is propane, hexane, or pentane, aren't these also used in the petrochemical industry to make plastics? KSA is investing in building domestic petrochemical plants besides owning SABIC, a world wide manufacturer and distributor of plastic/polymer products.

I can see domestic demand for NGLs rising within KSA and fewer being available for export in the next few years. Besides, I don't think these NGLs can be easily be made into diesel fuel which KSA has had in short supply lately. So, more NGLs don't mean cheaper oil prices, especially when countries need diesel fuel in the end.

mb - The definition may vary between users but this is how Schlumberger defines NGL:

Components of natural gas that are liquid at surface in field facilities or in gas-processing plants. Natural gas liquids can be classified according to their vapor pressures as low (condensate), intermediate (natural gasoline) and high (liquefied petroleum gas) vapor pressure.

Natural gas liquids include propane, butane, pentane, hexane and heptane, but not methane and ethane, since these hydrocarbons need refrigeration to be liquefied. The term is commonly abbreviated as NGL.