IEA Oil Forecast Unrealistically High; Misses Diminishing Returns

Posted by Gail the Actuary on November 16, 2012 - 3:30pm

The International Energy Agency (IEA) provides unrealistically high oil forecasts in its new 2012 World Energy Outlook (WEO). It claims, among other things, that the United States will become the world’s largest oil producer by around 2020, and North America will become a net oil exporter by around 2030.

Figure 1 shows that this increase comes solely from the expected rise in tight oil production and natural gas liquids. The idea that we will become an exporter in later years occurs despite falling production, because “demand” will drop so much.

The oil price forecasts underlying these and other forecasts in the report are approximately as follows:

One reason the WEO 2012 estimates are unreasonable is because the oil prices shown are unrealistically low relative to the production amounts forecast in the report. This seems to occur because the IEA misses the problem of diminishing returns. As the easy-to-produce oil becomes more depleted, and we need to move to more difficult reservoirs, the cost of extraction increases.

In fact, there is evidence that the “tight” oil referenced in Exhibit 1 is already starting to reach production limits, at current prices. The only way these production limits might be reasonably overcome is with higher oil prices–much higher than the IEA is assuming in any of its forecasts.

Higher oil prices cause a huge problem because of their impact on the world economy. The IEA in fact mentions that current high oil prices are already acting as a brake on the global economy in its first slide for the press. Higher oil prices also mean that investment costs required to reach target production levels will be even higher than forecast by the IEA, adding another impediment to reaching its forecast production levels.

If higher prices put the economies of oil importing nations into recession, then oil prices will drop lower, reducing the incentive to invest in new oil production infrastructure. In fact, we could find ourselves reaching “peak oil” because of an economic dilemma: while there seems to be plenty of oil available, the cost of extracting it may be reaching a point where it is more expensive than consumers can afford. As a result, some oil that we know about, and have been counting as reserves, will have to be left in the ground.

The IMF has recently done modeling that is relevant to this issue in a working paper called “Oil and the World Economy: Some Possible Futures.” This analysis may provide some insight as to what the real situation will be.

The Problem of Diminishing Returns

One issue that the IEA has not properly modeled is the issue of declining resource quality, leading to diminishing returns and a rising “real” (inflation adjusted) cost of production. This situation is often described as reflecting declining Energy Return on Energy Invested (EROEI).

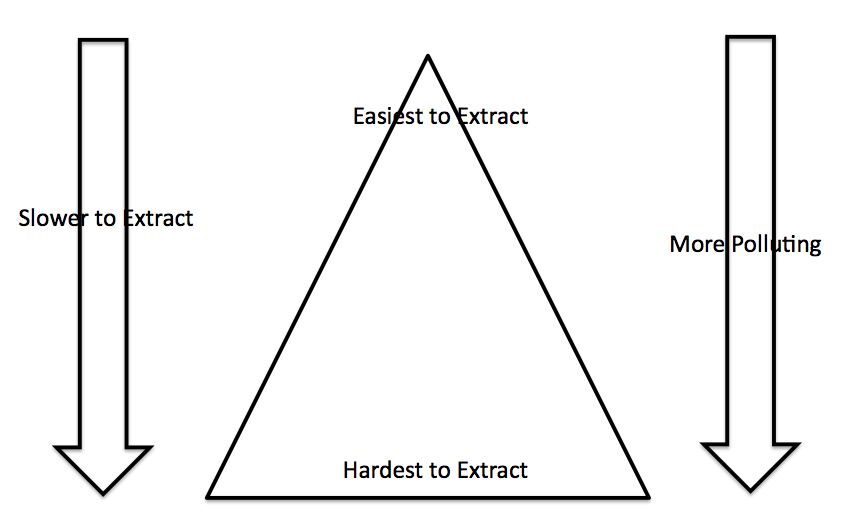

The reason diminishing returns are a problem is because when a producer decides to extract oil, or gas or coal, the producer looks for the cheapest, easiest to extract, resource first. It is only when this resource is mostly depleted that the producer will seek locations where more expensive, harder to extract resource is available. Thus, over time, the inflation adjusted cost of extracting a resource tends to increase.

In terms of the triangle shown, producers tend to start at the top, with the “best” of the resource, and work their way toward the bottom. One result of this approach is that the cost per unit of production tends to rise, even as there are technology advances and efficiency gains, because the quality of the resource is declining.

Reserves tend to increase over time with this approach, because as producers work their way down the triangle in the diagram, they always see an increasing quantity of lower quality resources. The new reserves are increasingly expensive to extract, in inflation adjusted terms. There is no flashing light that says, “Above this price, customers won’t be able to afford to purchase this resource any more,” though. As a result, the increasingly low quality reserves get added to reported amounts, even though in some cases, the cost of products made with these reserves (say gasoline or diesel) will send economies into recession.

It should be noted that the issue of diminishing returns exists for almost any kind of resource. It exists for uranium extraction, since there is always more available, just harder to reach, or in lower concentration. Diminishing returns exists for gold, copper, and for nearly any other kind of metal. This means we often need more oil for metal extraction and processing, as we dig deeper or find ore that is mixed with a higher proportion of waste product.

The problem of diminishing returns also seems to hold for renewables. The first biofuel developed was ethanol from corn, since the process of making alcohol from corn has been known for ages. Newer approaches, such as ethanol from biomass and biofuel from algae, tend to be much more expensive. As a result, when we add new biofuel production, it is likely to be more expensive, and thus harder for the customer to afford. If we want it, we will need increasingly high subsidies.

Wind energy is also subject to diminishing returns. Onshore wind was developed first, and it is far less expensive than offshore wind, which was developed later. Early units of wind added to an electric grid do not disturb the electric grid to too great an extent. Later units of wind energy add increasingly large costs: long distance transmission lines, electrical storage, and other balancing–something that is generally overlooked in making early cost analyses.

Diminishing returns seem even to happen for energy efficiency. We have been working on energy efficiency a very long time. We have a tendency to pick the low-hanging fruit first. Later expenditure for efficiency may be less cost-effective.

Why Light Tight Oil Won’t Increase as in Figure 1

Tight oil, also referred to as “shale oil,” is supposed to be the United States’ oil savior, if we believe the IEA. The Bakken and Eagle Ford plays are the best known examples.

Rune Likvern of The Oil Drum has shown that drilling wells in the Bakken already seems to be reaching diminishing returns. The choicest locations appear to have been drilled first, and the locations being drilled now give poorer yields. He has also shown that the average well in the Bakken now requires a price of $80 to $90 barrel, which is close to the recent selling price. If increased production is desired, the price of oil will need to start increasing (and keep increasing) to provide the incentive needed to drill wells in less-choice location.

There are other issues as well. If there is a need to drill an increasing number of wells just to stay even, or an even larger number, to increase the amount of oil produced, we start to reach limits on many kinds: number of rigs available, number of workers available, miles driven for water to be used for fracking. Perhaps the issue that will limit production first, though, is limits on debt available to producers. Rune Likvern has also shown that cash flows from tight oil extraction tend to run “in the red,” so an increasing amount of debt financing is needed as operations ramp up. At some point, companies hit their credit limit and have to stop adding new wells until cash flow catches up.

Evidence Regarding Rate of Growth of Oil Extraction Costs

Bernstein Research recently published information showing that the marginal cost of oil production was $92 barrel in 2011 for non-OPEC, non Former Soviet Union oil producers at the 90th percentile of production. This cost is increasing at 14% per year (or about 12% a year in inflation adjusted terms). Even at the median marginal cost level, costs appear to be increasing at a compound annual growth rate of 9% (or about 7% in inflation adjusted terms). See also this FTAlphaville post.

If we take the $92 barrel cost in 2011 at the 90th percentile of production and increase it by 7% a year (arguably we should be using 12% per year), the real cost will be $169 barrel in 2020, and $467 a barrel in 2035. These are far in excess of the IEA oil price estimates shown on Figure 2. There is no reason to believe that Bakken and other tight oil production costs would be substantially cheaper.

For Further Study, Based on a Recent IMF Analysis

It is very clear to me that the IEA oil estimates way too high, unless prices are much higher. Of course, prices can’t really be much higher, or the economy will go into recession. As a result, production both for the US and the rest of the world is likely to be much lower than forecast by the IEA.

It would be useful to have a better estimate of exactly where the world is headed. One way this might be done is by adapting the indications of a new IMF working paper called Oil and the World Economy: Some Possible Futures. The working paper considers some unknown time, between now and 2020, when the rate of increase in oil supply is assumed to decrease by 1%. While it is not stated in the report, it appears to me that this is similar to what actually happened about 2005, when the rate of oil production increase dropped from 1.3%” annual increase to 0.1%, a 1.2% decrease. (Figure 4, below).

I have a few observations regarding such an adaption:

(a) The model could be adjusted to consider the fact that a drop in the trend rate of about 1.2% actually took place in 2005, rather than simply assuming that a 1% decrease will happen at some unspecified point in the future. It appears to me that shift in the oil extraction trend line underlies many of the world’s problems in the last several years.

(b) The treatment in the model of diminishing returns should be adjusted. It is my understanding that this is currently handled assuming a 2% annual increase in real costs of production. The model could be adjusted to reflect a more realistic (higher) annual cost in oil production, and indirectly, required selling price.

(c) The authors of the IMF report suggest building a more resource-based model, and I would agree that this would be helpful. There are many interlinkages that the current model cannot adequately capture. A more resource-driven model, especially one that considers balance sheets of world governments, would appear to be better.

My View of What is Happening Now

As noted above, world crude oil production seems to have hit a plateau, starting about 2005. This is working its way through the economy with varying effects over time. The major effect at this point of time seems to be on the finances of governments that import oil, although it started earlier, with different aspects more apparent.

In general, what happens as we reach a situation of diminishing returns, and thus rising real oil prices, seems to be as follows:

As the price of oil rises, the price of food and commuting tend to rise. Both of these are considered essential by most consumers, so consumers cut back in discretionary spending, to have sufficient funds for the essentials. This leads to layoffs in discretionary industries, such as vacation travel and restaurant eating. The rise in laid off workers leads to an increase in debt defaults, and problems for banks. Housing and commercial real estate prices tend to fall, because of reduced demand, further adding to debt default problems.

Governments of oil importers get drawn into this in many ways: (1) Their revenues are reduced, because they receive less tax revenue from people who are laid off from work and from businesses with fewer sales. (2) They are asked to prop up failing banks, and to stimulate the economy. (3) They are also asked to pay workers who have been laid off from work. The net of all of this is that the governments of many oil importers find themselves with huge budget deficits, and declining ability to fix these deficits. This pattern is precisely what we are seeing today in many of Eurozone countries, the United States, Japan.

The statements about rising oil production in the US are just a distraction. Diminishing returns mean that US oil production will never increase very much. Oil costs will remain high, and this will be the real issue disturbing economies around the world.

Abridged version of a post at Our Finite World.

Hi Gail:

I respectivefully think you made some pretty big mistakes in your reading of the EIA report:

The first is that the report says that North America - not the USA - will become a net exporter of oil by 2030: P1 EIA Executive summary:" The result is a continued fall in US oil imports, to the extent that North America becomes a net oil exporter around 2030." As a Canadian, I am allway amused that Americans assume our oil is your oil. We do love our big brothers and sisters to the south, but you do take us a little bit for granted and that is why the Canadian government would like to develop some friends for our oil in Asia by building a big pipeline to the BC coast.

You may also have confused energy self-sufficiency with oil self sufficiency. The former including coal, biomass, solar,wind, etc. P 2 EIA states "United States, which currently imports around 20% of its total energy needs, becomes all but self-sufficient in net terms." I think this is possible.

If the US were to invest a huge effort into digging up more coal and shipping it to China, then, yes, it may become "self-sufficient in net terms". Energy-wise that is, but not money-wise, since oil is more valuable than coal, on a per-energy-unit basis. Energy quality counts. And we'd still be vulnerable to global oil supply limits and interruptions. Thus "independence" in this sense may not mean much. Still, it is true that the US has huge energy resources. If we'd only cut down our per-capita usage to European levels (half of US levels) we'd be "energy independent" in a good way.

I think you mean IEA, not EIA. The IEA is based in Paris; the EIA is US based.

I will have to admit that with respect to the first sentence or two, I was mostly going by the newspaper hype, and may have read some newspaper hype wrong. I should have gone back to the original report, and tried to dig through and pick out exactly what matched what. If the IEA had some reasonable tables of their results, without trying to dig through the 600 page report, it would make life easier. When I get a chance, I will adjust that sentence, after I am certain I am sure what is right with respect to "all liquids", which is the issue at hand.

My post doesn't really depend on that particular sentence. The arguments are about their assumptions, especially with respect what price extraction can occur at.

I agree. Oileng quibbles about semantics and then basically ignores what the article says to use his supposedly helpful post to agree with the IEA report while skirting your argument entirely Gail.

It is not just semantics - there are some implications that most people in the media have missed.

This statement may be true as presented, but I think the implications should be very disturbing to Americans.

It is basically true because Canada is half of North America and has considerably greater proven oil reserves than the US - at least 8 times as much oil due to its vast oil sands.

Canada can ramp up its oil production substantially - potentially doubling its output - but it will be expensive oil, not cheap oil. Because Americans will not be able to afford to buy that much expensive oil, Canada will have to export the surplus oil to Asia. While highly lucrative for Canada, this is not much help for the US.

I think what they are trying to say is that the US will become self-sufficient in net total energy by burning its own natural gas and exporting the displaced coal production to Europe - to replace diminishing European supplies of natural gas. I don't think that this is the type of energy self-sufficiency that either Americans or Europeans had in mind.

The changing terminology in this report is obscuring the implications of what it is saying, and sending the wrong message to a lot of people, particularly those in the mainstream media and their audience.

You make a lot of good points in your post.

People don't understand what kind of world the IEA has in mind. Somehow, demand is supposed to be reduced greatly as well, especially in the New Scenarios and 450 Scenarios. I covered some of my issues with demand and substitution in a part of the post that is available on the Our Finite World version, but not shown above.

Hi Gail,

great article!

Actually the Figure one you have shows what the IEA believes about USA oil production

10 million barrel a day soon..

I was always amazed by the imagination the IEA people put into their outlook

(claiming that they represent the different governments ..)

but this time the imagination went too much

when one compares with the EIA estimate from Feb. 2012

the difference is beyond "words"

http://www.eia.gov/todayinenergy/detail.cfm?id=4910

not even 7 million barrel a day ..

so how comes that all media and all around the planet just put blindly the headline?

actually here is (unfortunately only in german)

http://www.tagesspiegel.de/wirtschaft/welt-energie-ausblick-energiewende...

but you can click on the graph what the journalist

digged out of the 600 page report (also for gas)

and yes: IEA believes Russia is going down!!!!

and concerning Iran.. 2015 supposed to go up again

(one wonders if the IEA people know already when the liberation war 2 of the

oil will be won?)

regards

Michael

About the IEA, a very important read is below :

http://petrole.blog.lemonde.fr/how-the-global-oil-watchdog-failed-its-mi...

Lionel Badal's investigation about the 1998 IEA report, when they tried to do a "honest", Hubbert and reserves data oriented report, the result being more or less the whole team being fired except Fatih Birol ...

That last "report" and the MSM noise around it is truly amazing.

You can also end up wondering to what extend it is a "communication leaflet" to pump the shale gas & oil investment bubble.

As described for instance in :

http://www.resilience.org/stories/2012-10-25/financial-co-dependency-how...

Yves, in one way Birol has done a good job - he has got some key PO facts into the report yet dressed it up as cornucopian. That way he gets to stay in post and tell the truth (kinda).

But great article Gail! And Lionel Badal's is a good read too.

Jon.

Yes Birol is playing on a thin line, in some more "off line" interviews he has been quite direct I seem to remember.

Bonjour, YvesT, pas trop découragé par les réactions sur l'article du Monde sur NDDL ?

Bonjour, lequel ?, il y en a plein ! :)

Mais sinon c'est clair que ce rapport délirant de l'AIE n'aide pas les choses.

Quel pathétique cette affaire...

Hi,

thanks yes i saw this "lemonde" blog.

actually really amazing that they presume that Russia goes down by 10%

(the russian government does not foresee this till 2030 officially.. but the BP numbers say that

they have static reserves for about 20 years ..)

but no decline for Europe (EU) ..

in my view the decline in Russia plus 5% annual increase might be starting giving full

pain to the EU really by around 2015..

by the way the nuclear power was downgraded also in the IEA report

by about 50 GWe from 630--> 580 GWe

too little compared to real possibilities ...

but anyway

michael

It is frustrating that the IEA does not make clear graphs of what is happening, and scatters numbers throughout the report, so that the analyst needs to look for them, and figure out for him or herself.

The taggespiel graphs in the report you link to are nice ones. They are pretty close to English, so that it is possible for readers to figure out what they are saying. The left graph is oil production; the right graph is natural gas production:

One minor point I should mention (that doesn't impact what you are saying, but may be of interest to numbers buffs) is that my graph, and the graphs the IEA shows with respect to oil production, do not include "refinery expansion". It is not really clear whether a person should include this or not in production numbers, because refinery expansion partly relates to imported oil. In particular, it occurs to the greatest extent when heavy oil is "cracked", and the shorter hydrocarbon strings take up more volume than the longer hydrocarbon strings did before cracking. For example, heavy oil from Mexico and from Canada would seem to contribute significantly to refinery expansion. Adding light shale oil to US mix would seem to add little refinery expansion. Refinery expansion amounted to 1,076,000 barrels to US "Total Liquids" supply in 2011, according to EIA accounting. (BP does not include refinery expansion in the numbers it puts out, with respect to production by country, but it would seem to be included in consumption by country. This is a reason for the difference between the two.)

I am fairly certain that in the total numbers, the IEA does not omit refinery expansion. It may in fact be included in other US production amounts--just not the oil analysis I was working off of.

frustrating..

actually i noticed that this year even the "key plots" are not shown anymore

but, after all they do it on purpose no?

otherwise people perhaps would not buy the message so easily

michael

The message is definitely more confusing this year, without good summary charts. I don't think that they really want people to know what is happening.

The EIA numbers show that crude oil and natural gas liquids (which is what is shown in the first chart in this article from the IEA report) is heading to 10 million barrels per day (likely for next year)

At the end of 2011, 8.1 million bpd from crude oil and natural gas liquids.

Now 9.076 million bpd from crude oil and natural gas liquids.

http://ir.eia.gov/wpsr/overview.pdf

From most recent week

6.709 million bpd crude

2.367 million bpd from natural gas liquids

9.076 million bpd.

http://www.eia.gov/dnav/pet/pet_sum_sndw_dcus_nus_w.htm

End of 2011

5.851 million bpd crude

2.15 million bpd natural gas liquids

8.0 million bpd crude oil and natural gas liquids

http://nextbigfuture.com/2012/11/us-oil-production-near-term-and-long.html

Hi advanced nano..

it seems that you mix oranges and apples or whatever juice you like.

thanks for the numbers anyway..

now as we are enjoying predictions ..

perhaps you observed the latest predictions and hard numbers for nuclear produced KWhe..

just have some numbers for China if you want..

latest saying:

http://www.miningweekly.com/article/china-cautious-but-still-committed-t...

the article itself has a few jokes.. but

Before Fukushima, many in the sector were expecting China to set a 2020 capacity target of around 80-90 gigawatts (GW), up from the current 12.57 GW. The new target has now been scaled back to 58 GW

this means 46 GWe new at most.. 26 under construction today = 26 GWe

so, even if Chinese manage to do wonders (5 year construction time ..)

they need to start construction of 20 reactors in the next three years now..

not a single one this year and last year.. will be difficult to reach the target..

the WNA http://www.world-nuclear.org/info/inf63.html

writes:

``The former head of the NEA said that full-scale construction of nuclear plants would resume in March 2012. "

now we are in November..

``Resumption of approvals for further new plants was suspended until a new nuclear safety plan was accepted and State Council approval given in October 2012 (see also Post-Fukushima review below).

Following the Fukushima accident, concern regarding possible river pollution will mean delays until at lest 2015 to the inland AP1000 plants which were due to start construction in 2011. "

hm.. 2015... do you understand this?

and new mines .. and well

please update your nuclear outlook against mine

(others are very welcome..).

It seems you can't even predict next year numbers anymore..

yes, right Kazakhstan had some by me unexpected great years for uranium

the rest of the planet followed my 2009 data ..

comments please

(ah.. please do not claim that it was all the unpredicted earthquake...

the cracks in old reactors in Belgium are not coming from earthquakes ..)

So I have won 5 out of our 7 bets so far.

http://nextbigfuture.com/2012/04/world-nuclear-generation-in-2011-was.html

Kazatomprom is on track to increase uranium production by 1200 tons in 2012.

Cameco is off 200 tons.

Cameco is still on track to start the production from the Cigar Lake mine in late 2013

and this should have substantial levels starting in 2014.

Ranger in australia is guiding to 3400-3700 tons for 100 to 400 tons more than 2011.

http://www.researchviews.com/energy/power/uranium/NewsReport.aspx?sector...

Olympic Dam has produced over 3000 tons in the first 9 months and is on track to 4100 tons versus 3853 in 2011.

http://www.bhpbilliton.com/home/investors/reports/Documents/2012/121017_...

http://nextbigfuture.com/2012/11/kazakhstan-uranium-production-is-up-8.html

Uranium predictions Brian Wang Dittmar midpoint Actual 2010 56000 tons 45,000 tons 50,500 tons 53,663 tonnes 2011 60000 tons 45,000 52,500 tons 55,400 tonnes 2012 64000 tons 45,000 54,500 tons should be an increase to 57000+ tons 2013 68000 tons 45,000 56,500 tons 2014 72000 tons 45,000 58,500 tons 2015 76000 tons 45,000 60,500 tons 2016 80000 tons 45,000 62,500 tons 2017 84000 tons 45,000 64,500 tons 2018 88000 tons 45,000 66,500 tonsGeneral increases from Kazakhstan, another Mongolian mine, Africa developing another mine in a new country (Tanzania)

http://www.reuters.com/article/2012/10/24/tanzania-uraniumone-idUSL5E8LO...

Cigar Lake and the other increases means that my uranium production bets look like winners for me through 2018.

On the generation side.

China will complete plenty of reactors over the next couple of years to offset Japan. Germany is delaying the shutdown of more reactors. Japan will start turning on more reactors. You had made the silly prediction starting in 2014 of the a big drop in generation based on uranium shortages that did not happen.

I will not win the generation bet in 2012 but I think 2013 is possible and 2014 and 2015 are definite and 2016 is likely. I think 2017 and 2018 will be good too.

It will not be as comfortably won but there will be enough new reactors.

012 India, NPCIL Kaiga 4 PHWR 202 generating

2012 Iran, AEOI Bushehr 1 PWR 950 started

2012 Russia, Rosenergoatom Kalinin 4 PWR 950 started and generating

2012 Korea, KHNP Shin Kori 2 PWR 1000 generating

2012 Korea, KHNP Shin Wolsong 1 PWR 1000 generating

2012 Canada, Bruce Pwr Bruce A1 PHWR 769 started

2012 Canada, Bruce Pwr Bruce A2 PHWR 769 started

2012 Canada, NB Power Point Lepreau 1 PHWR 635 started

2012 India, NPCIL Kudankulam 1 PWR 950 starting first week of Dec

2012 China, CNNC Qinshan phase II-4 PWR 650 connnected in 2011 but generating this year

2012 China, CGNPC Hongyanhe 1 PWR 1080 on track for Dec start or very early in 2013

2012 China, CGNPC Ningde 1 PWR 1080 on track for Dec start or very early in 2013

2013 India, NPCIL Kudankulam 2 PWR 950

2013 Korea, KHNP Shin Wolsong 2 PWR 1000

2013 Korea, KHNP Shin-Kori 3 PWR 1350

2013 Russia Leningrad II-1 PWR 1070

2013 Argentina, CNEA Atucha 2 PHWR 692

2013 China, CNNC Sanmen 1 PWR 1250

2013 China, CGNPC Ningde 2 PWR 1080

2013 China, CGNPC Yangjiang 1 PWR 1080

2013 China, CGNPC Taishan 1 PWR 1700

2013 China, CNNC Fangjiashan 1 PWR 1080

2013 China, CNNC Fuqing 1 PWR 1080

2013 China, CGNPC Hongyanhe 2 PWR 1080

2013 India, Bhavini Kalpakkam FBR 470

2014 Finland, TVO Olkilouto 3 PWR 1600

2014 Russia Vilyuchinsk PWR x 2 70

2014 Russia, Rosener Novovoronezh II-1 PWR 1070

2014 Slovakia, SE Mochovce 3 PWR 440

2014 Slovakia, SE Mochovce 4 PWR 440

2014 Taiwan Power Lungmen 1 ABWR 1300

2014 China, CNNC Sanmen 2 PWR 1250

2014 China, CPI Haiyang 1 PWR 1250

2014 China, CGNPC Ningde 3 PWR 1080

2014 China, CGNPC Hongyanhe 3 PWR 1080

2014 China, CGNPC Hongyanhe 4 PWR 1080

2014 China, CGNPC Yangjiang 2 PWR 1080

2014 China, CGNPC Taishan 2 PWR 1700

2014 China, CNNC Fangjiashan 2 PWR 1080

2014 China, CNNC Fuqing 2 PWR 1080

2014 China, CNNC Changjiang 1 PWR 650

2014 Korea, KHNP Shin-Kori 4 PWR 1350

2014 Japan, Chugoku Shimane 3 ABWR 1375

2014 Japan, EPDC/J Power Ohma 1 ABWR 1350

2014 Russia Beloyarsk 4 FNR 750

2015 USA, TVA Watts Bar 2 PWR 1180

2015 Russia, Rosenergoatom Rostov 3 PWR 1070

2015 Taiwan Power Lungmen 2 ABWR 1300

2015 China, CGNPC Yangjiang 3 PWR 1080

2015 China, CPI Haiyang 2 PWR 1250

2015 China, CGNPC Ningde 4 PWR 1080

2015 China, CGNPC Fangchenggang 1 PWR 1080

2015 China, CNNC Changjiang 2 PWR 650

2015 China, CNNC Fuqing 3 PWR 1080

2015 China, China Huaneng Shidaowan HTR 200

2015 India, NPCIL Kakrapar 3 PHWR 640

2016 France, EdF Flamanville 3 PWR 1600

2016 Russia, Rosenergoatom Novovoronezh II-2 PWR 1070

2016 Russia, Rosenergoatom Leningrad II-2 PWR 1200

2016 Ukraine, Energoatom Khmelnitsky 3 PWR 1000

2016 India, NPCIL Kakrapar 4 PHWR 640

2016 India, NPCIL Rajasthan 7 PHWR 640

2016 China, CGNPC Yangjiang 4 PWR 1080

2016 China, CGNPC Hongyanhe 5 PWR 1080

2015 China, CNNC Hongshiding 1 PWR 1080

2016 China, several others PWR

2016 Pakistan, PAEC Chashma 3 PWR 300

2016 USA, Southern Vogtle 3 PWR 1200

2017 Russia, Rosenergoatom Baltic 1 PWR 1200

2017 Russia, Rosenergoatom Rostov 4 PWR 1200

2017 Russia, Rosenergoatom Leningrad II-3 PWR 1200

2017 Ukraine, Energoatom Khmelnitsky 4 PWR 1000

2017 Korea, KHNP Shin-Ulchin 1 PWR 1350

2017 India, NPCIL Rajasthan 8 PHWR 640

2017 Romania, SNN Cernavoda 3 PHWR 655

2017? Japan, JAPC Tsuruga 3 APWR 1538

2017 Pakistan, PAEC Chashma 4 PWR 300

2017 USA, Southern Vogtle 4 PWR 1200

2017 USA, SCEG Summer 2 PWR 1200

2017 China, several

2018 Korea, KHNP Shin-Ulchin 2 PWR 1350

Great list thanks..

so we can see how badly nuclear does these days

you forgot to mention a number for 2012 up to August (IEA)

for the OECD countries ... about 85% of all ..

Jan-Aug 2012 down 11.2% relative to 2011

so you know already

http://www.iea.org/stats/surveys/mes.pdf

actually you might reflect on why Korea is down -1.9% this year even though

out of the newly 2 grid connected reactors both are in Korea and noticed as started end of January..

sounds like a bad start..

France is also down 6.4% .. (overall France up 2%)

according to the official PRIS list.. 2 others were reconnected to the grid in Canada after a long shutdown

http://www.iaea.org/pris/

2 constructions were canceled 2 were closed forever in UK -0.7 GWe

and only 3 new constructions began..

your list (from the WNA?) is double and tripple counting it seems ..

do you need this to feelgood?

also,

talking about

WNA (as an interesting source) has something to say on uranium mining ..

WNA expects 2012 production to be 52,221 tU. UxC predicts about 63,600 tU in 2012.

http://www.world-nuclear.org/info/inf23.html

so lets see .. but 2014 remains the magic year when Russia stops their delivery of 10 k tons equivalent to the USA

so far .. can't help it..

not my fault that nuclear power plants switch off before they are forced to switch off

my main numbers for produced kWhel are too high so far

you are off by large numbers now and for the next years .. face it

the next big future is not nuclear .. it is powerdown!

A lot of big talk from someone is trailing on the overall wagered predictions with 2 wins to my 6 wins. Plus you had to change models for your uranium predictions, because the model you made to make your bets was wrong. It would have been 7 wins to 1 win if not for the tsunami and mistakes at Tepco during the Tsunami. There are still many years for China and other nations to get back to building more nuclear.

In the early 2020s there will be 20% uprates from dual cooled fuel for South Korea's reactors. Other reactors will have dual cooled from from Lightbridge.

On the uranium side there will be more uranium from phosphate. (400-1000 more tons in the next few years and heading up to 7000 tons)

http://www.world-nuclear.org/info/phosphates_inf124.html

If there is any urgent need and prices move up, Kazakhstan is ready to rapidly ramp up to 30,000 tons per year. So any stumbles from projects in Africa or Canada will be offset with more production from Kazakhstan. There will be no reactors shutdown from lack of uranium, when the company can just make a deal and pay Kazakhstan to produce any shortfall.

Point Lepreau was shutdown since 2008 and was recently restarted.

http://en.wikipedia.org/wiki/Point_Lepreau_Nuclear_Generating_Station#Re...

Wolsong1 (a Candu) only took 839 days for retubing

http://www.world-nuclear-news.org/C_Korean_Candu_restarts_after_refurbis...

Japan should have significant restarts in the latter half of 2013 and into 2014.

China is talking down their nuclear targets now, but their target for 2020 was 40 GW prior to 2005 and then they are still exceeding that and will that level by 2015 with the completion of reactors under construction. I expect the targets will start heading back up. They are using the pause to shift to more Gen 3 and more advanced reactors. The Chinese companies are also aggressively selling to other countries. So we will see where if the overall levels of new nuclear build heads after 2020. Cameco is still forecasting 80 new reactors by 2020 (down from 95).

Hi,

interesting the points you do not reply to..

1) Korean produced TWhe down this year despite 2 new units

2) (nuclear) France is also down 6.4% .. (overall France up 2%)

perhaps i should have written overall french electricity was up 2% so far in 2012)

3) do you doubt the PRIS numbers?

in case at some point it even is too much for Fox news

(feel better?)

http://www.thedailyshow.com/watch/wed-november-7-2012/11-7-12-in--60-sec...

4) why don't you show the numbers from the PRIS

about shutdown reactors as well

and yes this might interest you .. some future earth shaking discoveries are required to solve those remaining

tiny problems..

Aging nuke plants add to Europe's economic woes

http://www.huffingtonpost.com/huff-wires/20121117/eu-eastern-europe-nucl...

Of 372 gigawatts of operational nuclear reactors, looking for about 7 Terawatt hours from each gigawatt of those reactors.

The average size of the existing fleet of reactors is 850 MW.

The two that were shutdown totalled about 707 MWe. So less than 1.

Wilfa 2 was operating between 36-75% of the time in the last 4 years. In 2011 it was at 61%

http://www.iaea.org/pris/CountryStatistics/ReactorDetails.aspx?current=241

Oldbury-A1 was at 54.1%-100% the last three years after a 2 year shutdown.

http://www.iaea.org/PRIS/CountryStatistics/ReactorDetails.aspx?current=237

The new reactors that are completing are average about 1080 MWe in size.

About 80 new reactors completing by 2020 and about 60-70 of them could be done by the end of 2018. Expected to add about 80 GWe. 80*7 TWh. 560 TWh.

Thus I am expecting an average boost each year of about 100 TWh of available capacity.

I am also expecting some uprates and those mainly offset the shutdown of small reactors.

The new additions have to offset the losses in Germany and Japan. I am expecting Japan to turn reactors back on over the next 2 years because of economic reasons. There are 50 reactors that should be operating in Japan. But Japan always only had about 60% operating factor even in better years. 44 GWe. But operating like a world average of 33-35GWe. By the end of 2014, the new reactors would offset the loss of Japanese reactors even if they were not turned on. I am expecting more than the two that are running now. So by early 2014, I am expecting the turned on Japan reactors and new reactors to get back to old generating levels which would be needed to win the generating bets.

All of the Japan reactors that could be operating (at old operating factor) and the new reactors by the end of 2014 should be in a +200-300 TWh position. Or about 2800-2900 TWh for a typical year. Better operations could boost it higher. Again each year thereafter should be 100 TWh better.

The Bulgarian reactors that were cancelled were probably not going to get completed until 2022 or later. No impact on our bets which end in 2018.

South Korea had some microcracks to repair and there was some corruption and unapproved parts.

Operational capacity is not 100% but averages about 78-80%. It is why each GWe of nuclear reactor provides about 7 TWh and not 8.76 TWh.

Operational capacity fluctuates for each country.

thanks for the reply

Nice, something as a hypothesis which can be tested!

7 TWh/per year for each GWe.. sounds about (almost) right!

372 (GWe) * 7 TWh = 2604 TWhe for this year right?

real for this year? will be below 2500 TWh right?

so not a perfect hypothesis ..

for next year starting number will be 372 GWe (now ..)

lets see what the real capacity will be at the end of 2013.. smile

for:

``Thus I am expecting an average boost each year of about 100 TWh of available capacity.

I am also expecting some uprates and those mainly offset the shutdown of small reactors."

thus 100 TWh possible each year stands in your hypothesis = 13 new reactors each year now..

this didn't work out since 2009 .. even the total number of new reactors connected to the grid

was just this (+12 GWe only..)

http://www.iaea.org/PRIS/WorldStatistics/OperationalByAge.aspx

but, at least you make some testable statements for the next few years!

regards michael

The generation for the world total is plus or minus 4 to 5% for a standard deviation. So a good year can have +100 to 200 twh and a bad year negative. 2012 is still a bad year. For our bets I am expecting to get beyond the variability for 2015 and 2016. 2014 would happen if Japan politics goes right. But I am onky expecting half contribution there.

great,

i like your new(?) approach

4-5% uncertainty = +- 100-200(?) Twh

so ``normal" central number = 7 TWh/year and GWe installed power (80% average load factor?)

don't know how you can make +5% but never mind..

thus 372 GWe (now) --> 2604 TWhe ?? +-??? for 2013

our bet is: (2011 was 2518 TWh)

2012= 2550 2700 2625

2013= 2525 2750 midpoint .. 2637.5

with OECD alone (Jan-Aug 2012 down 11.2% relative to 2011)

we know already don't we?

regards

Michael

ps... what are your uncertainties for uranium mining good and bad years?

The fluctuation in uranium mine production is a lot less.

The normal fluctuation would be if a mine hits a lower grade section (like what happened for the Australian mine.)

More common are strikes or an operational accident.

Strikes usually in places like Africa.

Operational accident was the damage to the Olympic mine a few years back or the flooding that stalled out the Cigar Lake mine.

I think the variability is only about 2% for uranium mines in a typical year.

Over the longer term is does not vary that much because if a mine underproduces or does not get started then another mine or country will pick up the slack. (ie Kazakhstan).

For operations. There has been an overall decades long trend to improved reactor generation. There has been efforts by the Ukraine and other countries to improve operations. Some places like Japan have rules that prevent better operations which force more frequent fuel reloading and more maintenance.

Over a decade I would expect the generation levels to increase to 7.5 TWh per GWe and then to 8.0 TWh per GWe in the decade after that. The retirement of old and underperforming reactors also edges up the rate.

There is also improving technology that boosts generation. Better uprating technology. Improved fuels which can lengthen the time between refueling.

There is improving technology on the mining side as well. The PhosEnergy system to cheaply get uranium from phosphate mines.

``I think the variability is only about 2% for uranium mines in a typical year.

Over the longer term is does not vary that much because if a mine underproduces or does not get started then another mine or country will pick up the slack. (ie Kazakhstan)."

until there are no new mines and ``new" countries left ..

``The normal fluctuation would be if a mine hits a lower grade section (like what happened for the Australian mine.)"

actually Rossing mine is a good example ..

but overall that is what I presented in my model, glad that you understand and distribute this

hypothesis!

``the end of cheap uranium"

http://arxiv.org/abs/1106.3617

so lets see how large the down fluctuations will be in 2012 and 2013

(2011 was not really a success years in your own definition)

Don't feel you are being singled out, my Canadian friend. I've often heard conservatives in the U.S. let it slip and speak of "our" oil which happens to be in someone else's ground on the other side of the planet. That's the crux of the problem when American energy policy is set by multi-nationals.

When I idly speculate about the distant future, I wonder about an effert to liberate Alberta (perhaps Saskatchewan & Manitoba too with Climate Change) from the tyranny of Ottawa (not a risk with the current PM).

Hopes for a Better Future than That,

Alan

Seems that everyone wants to buy into the tar sands these days so when you come to get "your" oil you may find that the Chinese, Indians, Norwegians and god knows who else have some say on that.

The area colored orange in the first diagram represents the last ditch effort to "mop it all up". Once thats gone, its essentially gone so we shouldnt really be in such a hurry. "Fracking" (recovering "tight oil" by anyother means) is a "mop-up" operation; it's not like we didn't know the hydrocarbons were there, or didn't have "Fracking", just that we weren't in a mop up phase back then, and it was unnecessary to employ such energetically expensive (tertiary) recovery techniques... with such urgency.

Essentially, advanced highly energetic tertiary recovery methods amount to a super straw; that is, the enhanced recovery does not change how much is there, but it does recover crude or "unconventional oil" or "tight oil" that was previously inaccessible using less energetic techniques as well as speed up recovery overall, with a trade off. What that does to the first graph is "fatten up and shorten the tail" (quite exaggerated here); more now less later - or, much more now, much less later. So, not just mopping it up, but sucking up (blasting out) the last "drops" with a whole bushel of super straws.

And the impending (existing) supply constraints of diesel fuel wont help the alt.energy efforts. Diesel fuel derived from crude is an absolute requirement in the construction and maintenance of wind, solar, hydro, you name it and there is no real substitute for it in large quantities, and all these things involve moving heavy objects and pushing lots of dirt.

Current trucks and bulldozers etc do require diesel fuel, and its shortage is a serious problem. But I wouldn't say that diesel "is an absolute requirement", since such vehicles could be rebuilt with gasoline engines, or modified to run on natural gas. At a significant expense of course.

If you are required to use a less suitable fuel for heavy construction equipment than diesel and absolutely must do some heavy constructing of some sort ~:), then you are in desperate straights of some sort....

Not to mention that every time you mention "rebuild" anything, you deduct ten carrots from the cart. ~;)

Not disagreeing with you PDV. Not only is it a mop up operation, it seems to be fizzling out because the current 'high' price doesn't even warrant mopping it up. Diminishing returns, production capacity limitations to building these expensive new wells and financial constraints are all playing roles that are only understood and commented on with insight on this site, by people working directly on the shale plays and others who get it. Nowhere else it seems.

But it does look like a stain that can easily be mopped up in no time on the graph doesn't it? ;)

Diesel fuel derived from crude is an absolute requirement in the construction and maintenance of wind, solar, hydro, you name it and there is no real substitute for it in large quantities,

Electric equipment will do quite nicely. Utilities like the idea of "eating their own cooking". Here's an electric utility boom lift. Here's a consortium of utilities considering a bulk purchase of plug-ins (and a good article). Here's an individual utility buying electric cars. Similarly, utilities are buying hybrid bucket trucks and digger derricks. Here's a large commitment by two major utilities .

Mining, for instance, especially underground, has been electric for some time - here's a source of electrical mining equipment. Caterpillar manufactures 200-ton and above mining trucks with both drives. Caterpillar will produce mining trucks for every application—uphill, downhill, flat or extreme conditions — with electric as well as mechanical drive. Here's an electric earth moving truck. Here's an electric mobile strip mining machine, the largest tracked vehicle in the world at 13,500 tons.

Synthetic fuel will do just fine for the small percentage of liquid fuel that would still be convenient in very remote locations or unusual applications:

Hydrogen from electricity: Wholesale wind power at 6 cents per kWh; 75% efficient electrolysis of hydrogen from water would require 50 kWhs to produce a kilo of hydrogen. That is $3 for hydrogen with 37.5kWh, or an energy equivalent to 1.05 gallons of gasoline.

We could react CO or CO2 with hydrogen to make methanol (the Lurgi process, in which one CO2 and three dihydrogens exothermically become one methanol and one water) at 80% efficiency (Methanol synthesis from syngas is actually highly efficient, in the order of 80-90%. Catalysis of CO2 into CO + 1/2 O2 is probably about as efficient as H20 into H2 + 1/2 O2 since that's the same entropy balance).

If the overall conversion is 60% efficient, you'd have $5 for the methanol equivalent of a gallon of gasoline. Now, that’s just input costs. If the capital cost of the H2O electrolysers is $1 per gallon, you're at $6 per gallon. That doesn't seem bad.

EVs are, of course, much more efficient: electricity to hydrogen(25%loss), hydrogen to methanol(say 25%loss), methanol ICE 75%-80% loss; only about 12% of energy recovered. Compare this with an EV 80-90% of electric energy into useful motion.

Today's electric drive trains cost about $.10/mile, including the amortization of the battery and electricity costs, for the first 30-40 miles per day. On the other hand, these costs rise quickly for the miles beyond that range, due to the battery overhead. If synthesized methanol costs $.20/mile in a PHEV ($6/gallon divided by 40mpg (what is methanol's octane?)), that's pretty cost-effective for the less often used extra range. The more interesting cases are water shipping, long haul trucking and aviation. If $6/gallon is really feasible, those things would go up in cost, but still be feasible (especially water shipping).

Gail, I agree with the main point of the article, great discussion in this post about EROEI and the general lack of consideration for future trends from what is presumably a well funded organization. I do want to challenge you on renewables however.

Unlike established technologies like oil extraction, refining, which have had time to mature, most renewables are nowhere near their potential. It'll be up to the reader to verify, but there are numerous charts, articles, and studies out there, from any number of trade and government organizations, it is fair to say that the cost of most renewables has been decreasing over time for the past few decades (Anecdotally I'm sure you'll agree a solar panel or wind turbine made twenty years ago is not more efficient, desirable, cost effective than one made today). Biofuels are also an interesting argument. Your comments about biofuel from biomass and algae are out of context. You are likely comparing bench/lab/demo scale economics to the mature technology of corn and by relation sugar for feedstock. Biomass and algae are very new technologies and thus should not be compared in the same light. In fact, if you believe industry estimates, many of these technologies if allowed to prosper, will produce greater returns as they develop.

So in response to your assertion that all markets see diminishing returns, that is true in the end of their product lifecycles, but at first they see increasing returns, particularly as technology advances. Next time make room to consider that we could be seeing two curves going in different directions, one down and to the right for fossil fuels, and the other up and to the right for renewables.

I agree that at first you do see increasing returns, as technological improvements make a given technology work better. And even that sometimes there are major breakthroughs. Even for mineral extraction, for a long time there were efficiency gains that overwhelmed reduced ore quality. So people got to thinking that that was the only effect, and a person could count on it, going forward.

My point is that there are a lot of obstacles, and there are reasons why things like cellulosic ethanol haven't been commercially successful to date. According to WIkipedia, the first attempt at commercial cellulosic ethanol was in 1898. If we are still a ways away now, it is not a good sign.

There are obstacles of other types that I did not mention, like "blend walls". It is easy to substitute the first 10% of the fuel than later portions. Than you start reaching problems with non-compatibility, and need to modify vehicles to handle the fuel that does not match vehicle specifications. In a way, this is analogous to the problem we reach in adding more intermittent electricity to the electric grid.

Part of the problem with substitutes such as algae and other biofuels is that we don't have a huge amount of time, now, to bring down costs to where they need to be with many technological advancements (assuming that they really can be done). Also, I am not sure people have set their sights low enough on cost. US infrastructure was build on $20 and $30 barrel oil. A big reason we are having problems now is because the cost of oil is so high now. We really need cheap substitutes for oil--things that would lower our current fuel price--to fix our financial problems.

Miscanthus can grow 20 tons per acre, gasify the biomass then use natural gas to yield 2000 gallons. Right now we grow 30 million acres of corn for ethanol. The same amount of land could make 60 billion gallons of synthetic gasoline. Sundrop, Core and others are working on this.

I like people who focus more on the problem of producing enough food with land available than more fuel as the implications of PO pinch more and more. I'm thinking permaculture, Savory Institute, lots of hedgerows. Not mining the soil with monocultures. Monocultures tend to use so many energy inputs its not funny.

This is a good point. We need land for food, and are likely to need quite a lot more land for food, as fossil fuels decline in supplies.

In addition, biologists are telling us that we are over-utilizing biomass right now. For example, this issue is discussed in the academic article, Approaching a State Shift in the Earth's Biosphere. What they were in particular concerned about was the impact on climate change. Raising the amount of biomass used in fuel production in not a good idea, regardless of some theoretical reduction in CO2 production.

We have 500 million acres of pasture land in the U.S. not being used to grow food. Miscanthus can improve land quality by the root structure returning carbon and nutrients to the soil.

I will not try to convince anyone here, if you want renewable energy for 200 million vehicles using liquid hydrocarbon fuels, this is one way. If you want to wait for millions of wind turbines and a million miles of wireless electric highways for all those EVs out there, then that is your choice.

Sitting around analyzing EIA reports, trying to debate how much oil is REALLY left does not seem constructive. We all know oil is a finite resource, once you refine it, burn it, then push it out the tailpipe it is GONE. It is WAY past time to plan and implement alternatives, I hope we all can see that.

Cal, the plan that I've been implementing for some time now rests on the conviction that none of these schemes to extract gallons of energy from pint bottles will come to anything, and that the religious faith that technology will always come to the rescue with some new twist, and that progress is inevitable and eternal, are mistaken: venerable myths (in the educated sense of the word) whose time is now ending.

So as a result, we all -- those of us who get to live through it -- will now negotiate, perforce, what JMGreer calls The Long Descent of industrial civilisation; or what Jim Kunstler calls The Long Emergency. My hunch is that this new era began decisively around 2005-2008 (though hard, precise boundaries of these processes are always rather artificial, of course).

Whether we like it or not, we'll adjust -- without the option -- to far fewer cars, making far fewer journeys; to intermittent and much less electricity; to austerity and scarcity both widespread and persistent; to the widespread delapidation of suburban sprawl, with actual abandonment of simply no-longer-viable exurbs; to the straightforward collapse, dissolution and disappearance of the US empire of bases; to the rapid and near-complete depopulation of large swathes of the dryland areas of the continental US, as they become simply non-liveable for large populations of humankind without a superabundance of cheap energy and distant, pumped water; and on...

And that will be simply to the end of this century. For a glimpse of what things might be like four centuries on, see JMG's online futurist installment novel 'Star's Reach', at 'The Archdruid Report' website; where, if you trawl through his archive there, you'll also find high-grade, highly realistic and intelligent examples of the sort of realworld, practical, hands-on plans and preparations that are going on right now, down in the grassroots, below the radar of 'our leaders' and their economic and business 'experts' -- all of those poor bemused aveugles trapped in the now-obsolete assumptions of the old era that came to an end in the first half of the decade just past.

Jim Kunstler gets very ratty at the way, even at the Aspen gatherings of supposedly savvy environmentalists, conversation keeps swinging round compulsively to the magical new-tech ways that all the cars can be kept running; when anyone looking with merciless realism at what's happening can see that that's just not going to happen; nor all the other grossly overindulgent excesses of the 'non-negotiable' American Way of Life. Kiss it goodbye folks, just as we here in Europe are being force-fed the same farewell to our only slightly less profligate version...

Practical permacultures tailored to many places, and the sort of intelligent and respectful use of grasslands now being propagated by such nodes as the Savory Institute, mentioned several times in the comments to this post, are the sort of seriously realistic planning for the immediate future that we need now. Eating the biosphere in a vain attempt to keep the current overpopulation of humankind living our current ways of life for a little longer -- especially the way of life of we of the global Pampered Twenty Percent -- is a zombie idea, already dead, and just waiting to fall over finally.

Considering all of the above, this latest exercise in delusionality put out by the compliant paid-hacks of the IEA is about as useful as a one-legged man at an arse-kicking party.

Miscanthus can grow 20 tons per acre, gasify the biomass then use natural gas to yield 2000 gallons. Right now we grow 30 million acres of corn for ethanol. The same amount of land could make 60 billion gallons of synthetic gasoline. Sundrop, Core and others are working on this.

I'd like to see references to that. That is HUGE volume, way more than any other agricultural crop we have, like, as in, double. How do you irrigate it when we run out of groundwater? Fertilize it when we run out of fossil fuels?

There is no way, I repeat NO WAY biofuels could ramp up to provide even a fraction of the energy we currently use, to make up the difference for when fossil fuels end, on a global basis, and especially in the US.

No way, not in a million years. Let's give it up, right now, toss the fantasy aside and move on to pursuing the only hopes we have: wind, solar and nuclear. Do the math, add it all up, and consider that the total Net Primary production of the planet has GONE DOWN, not up! Just because some engineer can come up with some reactor to turn an acre of grass into something you can burn in an ICE doesn't mean it can be scaled up to power the world. And just because some people have found that they can drive their diesel cars on old french fry grease doesn't mean it could power the world.

Wikipedia's page for Miscanthus x Giganteus, which does rather read like an advertisement, says that

3 250 US gal of ethanol per acre is 72 MJ/m2, which is about what the most productive sugar cane fields produce in total biomass. (The world average for sugar cane is in the 30s. Source: V. Smil, "Energy in Nature and Society", Ch. 3)

Although Miscanthus is a C4 plant (like sugar cane), it seems unlikely that it would perform at this high a level. It would have to outperform sugar cane's single field record, across the whole country. And in worse soils and climates.

But even if it only reaches 25% of the hype, CalGuy's 500 million acres would produce over 12 million barrels per day of ethanol (assuming a productive land use ratio of 50%, the rest being unsuitable for crops or machinery, and/or used for storage and service areas and access and transport corridors).

Seems too good to be true -- even at the price of land and waterway degradation, lost water for other uses, biodiversity loss, dust storms, etc., etc.

If we did the sums carefully, though, we'd probably find that the capital required to develop the land and build the ethanol plants would be better spent on vehicle efficiency and vehicle capacity utilisation improvements.

I don't advocate planting 500 million acres nor do I advocate making ethanol. We could use 50 million of the 500 million acres and make synthetic gasoline. This has been done, it is not magic nor wishful thinking.

I won't argue with people that just want to argue. I won't sit around and take bets on when we will run out of oil. I would rather come up with solutions so that we do NOT run out of oil, because we use less of it.

"we'd probably find that the capital required to develop the land and build the (ethanol) plants would be better spent on vehicle efficiency and vehicle capacity utilisation improvements." {it is not ethanol, it is synthetic gasoline I advocate}

If there is a $5000 premium for a hybrid car and we sell 10 million per year in the U.S. that is a $50 billion premium. If we do that for 10 years we pay $500 billion and we only have HALF the 200 million cars replaced with cars that get 30% better mileage.

A million gallon per day fuel plant costs about $1 billion. If we build 100 of those, we make 100 million gallons per day out of the 300 million gallons of gasoline consumed each day.

The fuel plant has a life of more than 40 years, the car has a life of about 10 years. So we will continue to replace cars that cost more and don't reduce oil imports ALL that much. I favor hybrids AND synthetics, we get where we want to go faster at lower societal costs.

Build renewable energy, and it takes very little to run it. Hydroelectric, solar, wind.

A synthetic gasoline plant requires massive resources to run, and lots of money as well.

I do wonder if the proposed grass to gasoline plant would have an EROEI >1. Having seen a number of these schemes, I am pretty sure the overall operating EROEI would not be high enough to be viable.

Alan

BTW, the average Americans car now lasts 18 years - I drive a 31 year old car (early production 1982 Mercedes Benz 240D with manual transmission).

I don't advocate hybrids, because they cost more. Improvements to ordinary IC engines have some way to go yet, at a much lower per-vehicle cost.

The big gains come from increasing utilization, which decreases spending required for road maintenance and expansion compared to the base case: that's likely to have a net negative cost over 10 years even including the investment in research and any new infrastructure.

I think North America will be energy independent by 2040. Consider,

1. Accelerating move to hyrbid and EV transport (and x/over to NG). Cheaper than fossil cars by 2030

2. Massive new NG reserves available for decades (many wells now being capped for future)

3. Cost of PV panels falling to 50-60 cents per watt by 2016 (they were $4/watt in 2008)

4. PV Microinverter technology falling to 50 cents per watt by 2020 (today is around $1/w installed)

5. Slow but certain increases in N.A. oil production (albeit at higher prices)

Germany is already generating 10% of their electricity via PV panels, and one report puts German electricity at 100% renewable by 2050. With rebated U.S. home PV now under $2.00/watt installed and grid-tied, I think we're on a similar trajectory. Electric vehicles are now paying back in 6 years. By 2020, equivalent payback should be around 3 years. And by 2030, assuming oil prices continue to rise, non-EV road transport will be economically silly.

That said, I've studied peak oil for a decade and am still convinced that global oil demand vs. supply will cause increasing economic hardship. North American oil demand will be falling, but the 2/3 world (Africa, China, India, E Euro, Indo, etc.) is coming alive and will demand increasing supplies of increasingly expensive oil. Those regions will feel peak oil's economic effects the hardest. North America will feel the pain indirectly by not being able to sell as much stuff into those regions whose growth rates will be impacted by higher oil costs. Hopefully, by 2030, peak oil's global impact will be partially mitigated by the proliferation of EVs and ultra-cheap PVs.

With respect to peak-energy, I remain convinced that the most important number to watch is "household energy expenditure as a percentage of non-discretionary expenditure." In the last 10 years, that number has effectively doubled. The larger the %, the slower our economy will grow.

As for your 5 points, you omit a high price for crude oil spurring demand destruction and increasing efficiency. That has been the main factor decreasing U.S. consumption of crude oil since 2007.

I think a big factor in reducing crude oil use is the reduction of people in the labor market, because they cannot find jobs. Young people without jobs do not buy cars to drive to jobs (and to drive otherwise). Others who have dropped out of the labor force find that they too have to drastically cut back on driving, to help balance their budget.

When we look around the world at where oil use is rising, it is rising where people have jobs. Economist talk about "demand," but I think they should say, "ability to afford" oil. People with good paying jobs can afford cars and vacations that use oil. The jobs themselves tend to use oil as well, for making and transporting goods. So oil usage goes where the jobs are.

Efficiency may play a role too, but it seems to be a smaller one.

Gail, when are you going to reveal the master actuarial formula that combines f(t) variables of: macro- and micro-economic dynamics, global and regional energy demand, global and regional supply constraints, highly interdependent future trends, environmental penalties, national risks, investment and government incentives, and the impact of all other variables on national and global GDP?

This is why peak energy residual is difficult to predict. We need that formula!

Quite a lof of my posts are on Our Finite World, but not on The Oil Drum. (If nothing else, there seems to be a limit to the proportion of financial stories that TOD wants in its mix--which is OK--every site has to have its own focus.)

One recent Our Finite World post about energy use and employment was this one: The Close Tie Between Energy, Employment, and Recession.

That is a brilliant piece of work. Bravo. Reminds me yet again that no matter how hard we try to identify the variables, there are always more, hiding.

Yes, all it took to reduce the USA's oil consumption by 10% (1.9 million barrels per day) was the ejection of six million people from the work force. [sarc] The next 10% will be harder. That might take 12 million. [/sarc]

Combined net oil exports from Canada, Mexico, Venezuela, Argentina, Colombia, Ecuador and Trinidad & Tobago (oil exporters in the Americas with 100,000 bpd or more of net exports in 2004, BP):

And my comments regarding the IEA report:

The increase in US crude oil production (Crude + Condensate, EIA), from 5.4 mbpd in 2004, which was our production level prior to the 2005 Gulf Coast hurricanes, to 5.7 mbpd in 2011, and to an average production rate in excess of 6.0 mbpd in 2012, is good news, from the point of view of the US economy.

However, it’s critically important to understand that the overall rate of decline in oil production from existing wellbores is going up, as an increasing percentage of US crude oil production comes from shale oil plays, which have a very high decline rate, much higher than the older conventional fields, such as the Prudhoe Bay Field in Alaska. Inevitably this results in the “Red Queen” problem, where US oil producers have to run faster and faster, just to stay in place.

Meanwhile, the primary factor affecting US consumers at the pump is a measurable post-2005 decline in Global Net Exports of oil (GNE*), with developing countries, led by China, so far consuming an increasing share of a declining volume of GNE. This bidding war for net oil exports drove the annual global (Brent) price of oil from $55 in 2005 to $111 in 2011. Note that US consumers are almost fully exposed to the global oil price, since Mid-Continent refiners are paying West Texas Intermediate (WTI) based prices for crude oil, but largely charging Brent based prices for refined product.

As Yogi Berra is reported to have said, “It’s tough to make predictions, especially about the future,” but when we review recent annual net export data, from 2005 to 2011, the trend is extremely worrisome, especially in the context of conventional wisdom that there does not appear to be a problem with a virtually infinite rate of increase in our consumption of a finite fossil fuel resource base.

In 2005, the ratio of GNE to Chindia’s (China + India’s) Net Imports of oil (CNI) was 8.9. In other words, for every barrel of oil that the Chindia region net imported, there were 8.9 barrels of GNE (Global Net Exports of oil). In 2011, this ratio had fallen to only 5.3, and the rate of decline in the ratio accelerated from 2008 to 2011, versus 2005 to 2008. At the 2005 to 2011 rate of decline in the GNE to CNI ratio, the Chindia region alone would theoretically consume 100% of GNE in only 18 years.

While the increase in US crude oil production is very helpful, and important to the US economy, the fact remains that the US, and most other net oil importing OECD countries, are gradually being priced out of the market for exported oil. And it remains to be seen how long the US can maintain year over year increases in US crude oil production, when the bulk of new supply comes from probably the highest decline rate wells we have ever seen in the US.

In any case, for an average US consumer, the price at the pump, for the foreseeable future, would appear to be largely driven by the fact that the developing countries, led by China, have been consuming and probably will continue to consume, an increasing share of a declining volume of Global Net Exports of oil.

One thought as saw that the IEA was planning on big increases in oil production from Iraq and Brazil was, "Why would these countries export the majority of their new production? They have populations of their own that need more oil supply."

I would agree that if they can ramp up production (and that is not all that certain) they may agree to export some. But just as likely, they would want to use it for their own people. If they can, they would like to make higher priced products from it, and sell those, so that they can get additional revenue for the additional value added. (Of course, with enough refineries around the world, this doesn't entirely make sense.

So I expect even if production does ramp up, exports will lag behind a lot. This is also true in Iran.

Wes,

driz mentioned the year 2040. I have not noticed a projection by you that goes so far into the future. I should think that such a projection would be very iffy, given that peak was between five and ten yrs ago and 2040 is wildly far in the future compared to that little span of data. But you have looked at the data far more deeply than I. What say you?

I think the ELM estimate of Global Net Exports is that they decline as a linear function of time, not as a negative exponential. If that really is what happens won't North America be, per force, 'independent' because there won't be any oil to import at any price? And won't this be true well before 2040? Can you think of any complicating effect that might be added to your model to extend the import dependence era out as far as 2039?

Here is a link to my post down the thread regarding my $64 trillion question, which has some additional data:

http://www.theoildrum.com/node/9622#comment-930164

And here is the key part of my above post:

Some additional info. All of the following estimates are based on extrapolating six years of declining ECI values or declining GNE/CNI values (1995 to 2001 for the Six Country Case History and 2005 to 2011 for Saudi and global data):

Estimated Six Country post-1995 CNE:

9.2 Gb

Actual Six Country post-1995 CNE:

7.3 Gb

Estimated Remaining Six Country post-1995 CNE, at the end of 2001:

3.7 Gb

Actual Remaining Six Country post-1995 CNE, at the end of 2001:

1.8 Gb

Note that the actual Remaining Six Country post-1995 CNE, at the end of 2001, was about half of the estimated value.

Estimated post-2005 CNE for:

Saudi Arabia: 45 Gb

GNE: 445 Gb

ANE: 168

Estimated Remaining post-2005 CNE, at the end of 2011, for:

Saudi Arabia: 28 Gb

GNE: 349 Gb

ANE: 87 Gb

geek7,

Exxon and others show projections to 2040. It's just another opinion on the map, a data point of interest, but little more. After a while, you see that everyone's data points carry the weight of their own special interest. And even the best independent energy projections rely on dynamic data, subject to change over time. Look at some of our peak oil energy projections from 2002-2005. We couldn't have anticipated N.A. shale oil, fracked NG, the remarkable drop in PV energy cost, and other dynamics re-shaping our projections.

PV's trajectory is clear -- we will achieve effectively free daylight electricity by 2040. By that time, installed PV will be somewhere in the range of 60 cents /watt, which is the system-life equivalent of 1.3 cents per kwh. Evening electricity costs will be offset by grid-tie credits, making electricity effectively free. This is a game-changer. Germany is already achieving 10% of their electricity via PV, and on some days up to 30%. One report puts Germany on track to achieve 100% renewable national electricity by 2050

http://thinkprogress.org/climate/2012/06/12/497984/solar-provides-10-of-...

This accelerated move to "free" electricity will continue to spark massive dollars of research into electrical storage and more effective EV vehicles. By 2040, I would not be surprised to see pure-EV vehicles that exceed in every respect the performance of fossil or even hybrid vehicles. Exxon thinks the USA in 2040 will be using 15% less oil than today. Based on our trajectory towards free electricity, I think we'll be using less than 15M b/d.

This move to PV will also cause a massive shake up in the nature of "power company." Big, big changes ahead, and perhaps more than any other country, the USA stands to benefit greatly. Energy independence by 2040, if not sooner.

Main problem with renewables that produce electricity (PV, CSP, wind, hydro, etc) is that storage is neither easy nor cheap. Right now in St. Louis the wind is calm, sun went down 2-1/2 hours ago, Mississippi river is near record low for this time of year (dams near St Louis have hydro), so how do we use renewables to keep the lights on here? Although not being the best solution, coal, nuclear and gas are making the kilowatts for us.

I don't beleive that EV's will make serious inroads into our transportation beyond more than 10 or 20% of the auto/light truck fleet as long as liquid fossil based fuel is available. Even if gas or diesel costs $6 per gallon people want the ease of refilling and security of long range, besides needing a low cost vehicle. Perhaps EV's will become a major part of the fleet when people of the middle class simply cannot afford cars and opt for using trains (if available in the future) or just staying home.

"I don't beleive that EV's will make serious inroads into our transportation beyond more than 10 or 20% of the auto/light truck fleet as long as liquid fossil based fuel is available."

But 30 years is a technological eternity. By 2040, 75% of all cars will drive themselves (IEEE Forecast). By then, EV technology will best fossil propulsion in ALL respects - efficiency, range, cost, emission, etc.. The cost of daylight charging will be inexpensive, and a single charge will run hundreds of miles. By 2040, non-hybrid transportation will be a historical relic, though many specialty vehicles will still use pure fossil drives (aircraft, certain trucks, trains, etc.). Hybrid sales will triple by 2015 alone. And the long-term chart slopes up dramatically from there.

Today in USA, 75% of fossil oil is burned in automobiles, trucks, and home heating. By 2040, reduce that demand by at least 50% (probably closer to 75%). North America will be using FAR less oil in 2040 than it does today and I'm convinced (for reasons stated) we will see energy independence by 2040. Most industrializing countries cannot make that same claim and will be impacted by increasingly expensive oil.

"Main problem with renewables that produce electricity (PV, etc) is that storage is neither easy nor cheap"

But we don't need to be 100% renewable to be energy independent, though the more the better. By 2040, the mix of PV, EV, cheap NG, and other emerging tech will have ushered N. America into a new age of energy freedom. It's not N. America's energy future that concerns me. It's the industrializing countries and the price of global oil. Peak oil remains real and will impact global prosperity.

driz wrote:

The cars that are left perhaps. Auto Addicted personal cars are not sustainable by any means in the millions they exist today. What will be essential will be "Grid Electric Vehicles" ie Trains, LightRail, trolleys for public transit. Auto addicted Americans always make the mistake of assuming that the only problem with Auto Addicted transit is how to fuel your 2 ton personal vehicle.

But the problem goes way beyond that to the huge costs of the infrastructure and support issues around Auto Addiction - the 30K deaths per year, hundreds of thousands of injuries, the ambulance squads and traffic cops paid by our tax dollars or contributions, the football field of asphalt for every 5 personal cars, the waste of 12x the land area for personal autos or trucks. There is already transit available which does not require millions of personal drivers - ie trains, lightrail, buses.

The whole "self-driving" personal vehicle is a hi tech solution to a problem which does not need to be solved in the same category as electric can openers, leaf blowers and auto dispensing paper towels. It actually gains nothing at huge expense versus existing solutions. Ie. manual can openers, rakes, manual paper towel dispensers and public transit.