Tech Talk - Future Bakken Production and Hydrofracking

Posted by Heading Out on February 15, 2013 - 5:48am

Before there were refrigerators folks kept drinks cool by putting them into clay jars that had been soaked in water. The evaporation of the water from the clay cooled the container and its contents, which today includes wine bottles. On the other hand, for many years artisans have taken clay in a slightly different form, shaped it and baked it and provided the teacups which keep the liquid inside until we drink it.

Two different forms of the same basic geological material, with two different behaviors and uses. Why bring this up? Well, there is a growing series of articles which continue to laud the volumes of oil and natural gas that the world can expect from the artificial fracturing of the layers of shale in which these hydrocarbons have been trapped for the past few million years. It has been suggested that there is no difference between this “unconventional” oil and the “conventional” oil that has been produced over the past century to power the global economy. And yet, despite the scientific detail which some of these critics discuss other issues, they seem unable to grasp the relatively simple geologic and temporal facts that make the reserves in such locations as the Marcellus Shale of Pennsylvania and the Bakken of North Dakota both unconventional and temporally transient. Let me therefore try again to explain why, despite the fact that the oil itself may be relatively similar, the recovery and economics of that oil are quite different from those economics involved in extracting conventional deposits.

But before getting to that, let’s first look at the current situation in North Dakota, using the information from the Department of Mineral Resources (DMR). According to the January Director’s Cut the rig count in the state has varied from 188 in October, through 186 in November, and 184 in December, to 181 at the time of the report. Why is this number important? Well, as I will explain in more detail later, the decline rate of an individual well in the region is very high, and thus the industry has to continue to drill wells at a rapid rate, just to replace the decline. (This is the “Red Queen” scenario that Rune Likvern has explained so well.) The DMR recognize this by showing the effect of several different scenarios as the number of rigs changes.

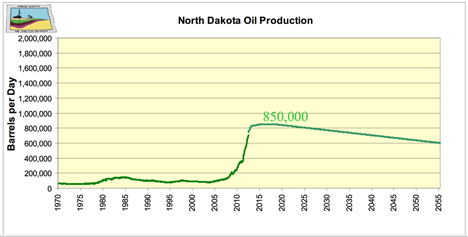

For example, they project that 170 rigs will be able to drill around 2,000 wells a year. At that level, and with some assumptions about the productivity of individual wells that I am not going to address here, but which Rune discussed, I would suggest that it is irrational to expect that new wells will continue to sustain existing first year levels as the wells move away from formation sweet spots. Yet, accepting their assumptions for now, DMR project that the 170 rigs will generate the following production from the state:

The DMR plot also assumes that the wells are developed and brought into production in a timely manner. In October the state produced an average of 749 kbd of oil, which was through mid-January, the current peak level of production. Currently it is estimated to cost $2 million to frack a well, and in January there were 410 wells waiting on that service.

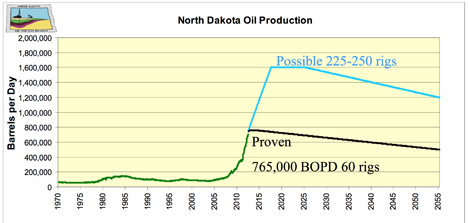

In order to reach a higher level of production (and bear in mind that OPEC has been projecting significant further increases in production to make their anticipated supply and demand levels balance) the DMR looked at estimates of production if there were 225-250 rigs, and contrasted that with what would happen if the rig count fell almost immediately to 60.

Note that at 60 rigs, the state production goes into an immediate decline. Somewhere in between those two extremes lies the likely future, but with the Director noting a December price of $77.09 that future may be at the lower, rather than higher end of the scale. (Though in January it popped back up to $87.25).

To illustrate the sensitivity of these numbers consider that if the rig count fell from 170 to 100, then production would decline to 800 kbd but would still fall into decline in 2020, while at 200 rigs the production would rise to a peak of 1 mbd, although the peak interval might only be four years from the 2,400 new wells added each year.

The ferocity of the decline rates of these wells is part of the reason that they are called unconventional, since they do not behave in the same manner as a conventional well, nor can they be developed in a similar way.

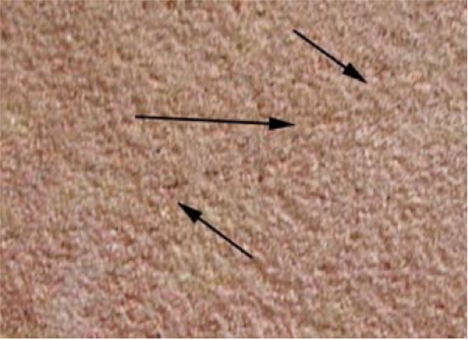

To return to the geology of the deposits (and shale is a consolidated clay) the middle Bakken formation is made up of a combination of layers of shale, sandstone, siltstone and limestone. These are, in general, rocks that have a very low permeability, and that property was explained in more detail in an earlier post. Simplistically it is a measure of how easy it is for fluid to flow through the rock, and for most of the Bakken rock it is not easy at all. If it were then there would be no need to put in the crack paths that the oil uses to reach the well. Let me repeat a figure from that post:

I have been on a site where my hosts (a federal agency) had injected fluid that they were hoping would penetrate a layer of ground so that it would form an impermeable barrier. It had not, even though the ground was relatively easy for the fluid to penetrate. Instead it had all flowed into a crack no bigger than the one shown in the picture above, and the attempt was a failure.

Put that into reverse where you are trying to pull fluid out of the ground. There are two places where the fluid (oil or gas) is located, in the natural cracks and joints of the rock – which the hydrofrack is designed to cut across. And in the much lower permeability of the blocks of rock that are edged by these fractures, bedding planes and joints.

Over the millennia the oil/gas has migrated to those bedding planes and natural joints and fractures in the rock. When the well is first put in place, that fluid is more easily available to flow through the intersecting crack pattern to the well. But as those interstices empty out it is much more difficult to move the oil from the rock surrounding the natural cracks into that crack and thence to the well.

Most illustrations of hydraulic fracturing show a network of artificially induced cracks getting more numerous as they move away from the well. That actually is not the way it normally happens. The majority of the cracks that open are already there, and these are much easier to develop – as my unfortunate hosts learned – that it is to try and generate a multiplicity of new fractures, as I have previously explained here and here. The production, to go back to my initial metaphor, begins to move over that first year of production and then dramatically fall in yield, from relying on the permeability of the wine cooler part of the rock, to that of the teacup.

Yair . . .Could anyone give a description of the fracking process that an old(ish)'dozer hand could understand.

I see talk of 500,000 hp and more with I asume turbine engines? . . . I can't get my head around what kind of pumps would be used and reduction boxes and what all to soak up all those revs.

Cheers.

Here is a few frac trucks for sale, with their specs. Basically a 3 or 5 cylinder piston pump, rated to 15,000psi and driven by a 2000 plus hp diesel engine.

If you need more volume and horse power, you hook several, anything up to around 20, in parallel.

http://www.stewartandstevenson.com/equipment/market/oil-gas/frac-well-st...

http://www.industrialdieselmfg.com/catalog/frac-pump-units-well-stimulat...

http://www.jereh-pe.com/english/products/09091010271082.shtm#

http://www.nov.com/Well_Service_and_Completion/Stimulation_Equipment/Fra...

Shale oil is no threat to oil producers World’s future will be shaped by scarcity of oil, not abundance

This article is published by Gulf News, so they are pro OPEC, but they get it right in this case.

BP is blowing smoke with those numbers. Shale production will never reach 6.5 mb/d in the US, not even by 2030. But Gulf News is right, shale numbers are not sufficient to counter the decline from the world's currently producing fields.

Ron P.

Darwinian quoted:

In spite of thousands of oil wells drilled in shale plays, production has increased from few thousand barrels a day in 2005 to just about 1.5 mbd now. Further increases are expected such that production of shale and tight oil supply is estimated by BP to reach 6.5 mbd in the US and 9 mbd worldwide in 2030. As good as these numbers are, they are not sufficient to counter the decline from currently producing conventional oil fields in the world.It is a matter of whose decline rates for conventional crude one wants to accept. CERA is saying 4.7%, Exxon said 4-6%, and Schlumberger, stated that an accurate average decline rate is hard to estimate, but an overall figure of 8% is not an unreasonable assumption.

If Robelius is correct in estimating that the giants will come off their plateaus about 2018 (and we think that he is) decline rates will probably exceed 10%. In that scenario no amount of drilling in the shale deposits could ever make up the difference.

Well only if you accept any of the figures except those of Leonardo Maugeri who says:

All others, including CERA and Exxon, estimate declines that would be far greater than anything shale oil could possibly offset.

By the way, the article you quoted from makes for some very good reading about decline rates. I had to google it but finally found it: Giant oil field decline rates and their influence on world oil production

Ron P.

Darwinian said:

Playing a little devil's advocate here but; assuming CERA's 4.7% decline rate and world production of conventional crude at 70Mb/d (which is probably a little high) gives a decline of 3.3 Mb/d per year. If all the world's shale deposits were worked equally that loss could be compensated for. Of course the the rest of world doesn't appear to have as many "sucker" investors as the US, but if it did, shale could cut a hell of a swath of a few years.

The shale industry is backed by big money, with good PR, and they are not "quit" telling a complete lie. They also work in a geographical area, that fortunately for them, has a lot of people with more money than brains. But all in all - you are probably correct.

No, that's not it at all. Those companies who are investing in shale oil in the US are making money, so they are not suckers. The shale crude (tight oil) deposits in the rest of the world are not really all that great. And there are other problems, both economic and political, that mean very little tight oil will be produced anywhere but in North America. At least that is the opinion of the IEA and on this one I agree with them.

Ron P.

Darwinian said:

I said investors, not companies. With 55 to 85% yearly decline rates how are those investors going to look in five years; especially in places like the Bakken's which have $10 million wells. In the Eagle Ford, which has lower cost wells, and dismal production (143 b/d), they are looking at $40/barrel just to cover drilling costs.

Chesapeake got into the shale gas game early, and is now selling everything the company has to stay out of receivership. Decline rates were much higher than originally projected. The rest of the shale industry will find the same thing happening to them. The 0.1 Darcy relative permeability of the strata they are working declines very rapidly. Fracking has been used extensively in conventional wells for more than forty years, and is very well understood. The fractures are not permanent features of the rock. In conventional wells were the injector is fracked the fractures propagate to the producer and the well waters out in a few years. In these low permeability rocks the fractures silt up and undergo mineralization.

The fact that some of these companies are making money is like saying because the man that started the chain letter made $100,000 proves everyone should buy into a chain letter. Its called a Ponzi scheme!

maybe, but oil ain't gas. Gas is essentially sold in local markets. If the Cushing bottleneck disappears with the completion of the oil pipeline from there to the Gulf Bakken oil will be sold at world market prices. Quite a difference between US shale gas and US shale oil in that respect.

I do not follow shale oil co.'s stock prices and have no idea how its valuation compares to likely long term pay out--I'd hazard a guess money is made/lost in playing its swings and that will be the case for the foreseeable

For anyone interested in learning a little more about frac'ing here is a good introduction by Dr. Mukul M. Sharma at U Tex at Austin. He discusses the process in the latter part of the report.

http://www.rpsea.org/forums/produced_sharma.pdf

Those are pretty huge shale gas resources. How much of that is extractable ?

circa 2005 does anyone know what was the perceived projection of US shale/tight oil production?

I'd hadzard a guess that at $55 a barrel is wasn't worth extracting , and to add that most thought the USA economy would tank at anything over $100 lead to the belief that again nobody would be getting the stuff out of the ground and these higher prices, Turns out the USA is a little bit tougher than imagined.

Well the US economy is staggering along , you cant trust any official figures on growth or inflation and what the current oil price is doing to the economy . But I admit I was surprised at the modest amounts garnered at historically high prices from these shales and other un-conventional oil - I just think this will lead to a shark-fin decline on top of the conventional decline predictions.

shark-fin lite if you like .

Well we might have terminal bleeding and staggering along but nobody is convinced these are normal times except Faux News and MCM ( and the BBC at times ) -but the prognosis is still poor for growth and good times !

I not sure this can be repeated if we have oil at $140-150 for a few years - Does anyone have a handle of what is reserves that become a resource and extractable at these prices ? If its significant we may have a longer more drawn out affair .....

Forbin

"Turns out the USA is a little bit tougher than imagined."

Yeah, injecting a few $trillion into an economy may make it seem that way, along with a few tens of billions each month as a maintenance dose. It doesn't mean the patient isn't terminal. Just keep'em as comfortable as possible, as long as as you can. Makes it easy to ignore a bit of tingling and numbness growing in the extremities, a sharp pain now and then. That dizziness you experience may become permanent, but most become accustomed to it. A vague sense of forboding is to be expected, but no reason one can't go about one's usual activities, albeit, at a slowing rate. When the inevitable arrives, the patient has little memory of their former self and is at least apathetic about their fate, if not welcoming it.

So it goes. The world isn't what it was.... BEEP! "This is your Fed Pharmacy reminding you that your prescriptions are due to be refilled at the end of the month".

http://en.wikipedia.org/wiki/File:USDebt.png

Tough comes in the form of a deep hole.

Add on to that other ways people are stretching things - particularly the increasing age of cars on the road. I would hazard a guess that it extends to other "durable" goods as well...appliances, furniture, and whatnot.

The US may look "tough" but there are things which seem to indicate that the toughness is fed by the seed corn. One of these seasons there's going to nothing to plant and nothing to harvest.

Isn't it possible that the inflation figures are fudged sufficiently that oil prices as a proportion of economic production overall is about the same as it was in 2005? And that more than just a few folks with sufficient resources are keeping things going by filling the gaps between reality and 'officiality'? At least for the moment, perhaps as they wait for some technological super cure to come along?

Just wondering since if something like that is not occurring it leaves me perplexed.

Craig

The average Brent price in 2005 was about $54.50. Brent closed Friday at $118.90. No, it is not possible that inflation figures have been fudged that much.

Ron P.

Ron,

I think that the US inflation numbers are pretty much correct, so we agree on the point that Brent prices are much higher now than they were in 2005.

For those that think that the "true" inflation is more like that found at Shadowstats, we can construct a "real" oil price series based on the inflation index found at Shadowstats.

Over the period from 1986 to 2000 the average real price of imported crude was about $29/barrel in 2012 $ based on the CPI inflation index. Using Shadowstat indices the average price of imported crude over the same period (using 2012 $ based on Shadowstat's numbers) was about 89 dollars/barrel. In fact, if we believe Shadowstats the average 2006 real crude oil price was $106 and in 2012 it had declined to $100.

If you believe that the Shadowstat numbers are correct (which I do not), then you would also need to believe that current crude prices are only a little higher than the 1986 to 2000 period ($100 average for 2012 vs $89 in the 1986 to 2000 period.

I used the following website to construct the "Shadowstat Price index" from 1969 to 2012 (pick shadowstats using the options button, use 1983 as the starting year and change the target year from 1969 to 2012 to create a price index which parallels the CPI used by the EIA, they are similar from 1969 to 1984 and then diverge, CPI=2.30 and Shadowstat=8.52 in 2012):

http://www.halfhill.com/inflation.html

For an alternative to Shadowstats check:

http://bpp.mit.edu/usa/

DC

Thanks for those links. I have become so tired of having to "believe" what others tell me inflation is, be it from the cooked official government stats, or from Shadowstats. The problem with Shadowstats is that it simply takes the government data and supposedly subtracts out all the alleged fudge factors the government applies over the years to massage inflation lower. But it's still based on government data and what the government deems to be important in quantifying "cost to live", or whatever you'd like to call it. If the data formulation is flawed from the beginning, then trying to "unfudge" it isn't going to be much more useful.

I have endeavored to come up with my own set of inflation statistics since I refuse to believe that it needs to be that difficult. Seriously, anyone with access to historical charts for prices can come up with their own stats; why do we need to accept what economists tell us at face value? I have little confidence that 1) what the government is measuring, and 2) then assimilating into one catch-all inflation number of say 2% (what the hell does THAT mean?) is applicable to any meaningful analysis of economic performance over the years, nor of the resources we are taxing of the planet.

Through my initial investigations based on principles of thermo-economics, it seems that this whole concept of "inflation" is really touchy-feely and arbitrary to begin with, and that attempting to generate one single be-all, end-all inflation number has little usefulness besides providing some figure for the investor herds to obsess over, and divert their attention away from investigating things in more detail. So, it seems that any inflation number is, more than anything, just another gimmick to keep people from understanding what's going on, to confuse and obfuscate the real issues under some single, mysterious number coming from the authority of officialdom. Furthermore, I have not much more than zero regard for anything any economist says anyways.

I really want to develop these stats myself but this 40 hour-a-week work gig really cuts into fun time!

Hi Null,

Some economists are better than others, I personally like Krugman ( http://krugman.blogs.nytimes.com/ ) but I lean a little to the left so I tend to agree with his views. The government CPI data is not perfect, but if you compare it with the billion prices project, it is not too far of the mark IMO.

People love to poke fun at economists for not getting things right, but a large problem with social science in general is that controlled experiments are not possible. A second problem is that once people think that an economic theory is valid, that knowledge affects behavior which affects the social system and often invalidates the original theory (due to the change in behavior.

One example of this is that Keynsian Theory was dominant from about 1950 to 1975, and this dominance led to a pretty decent ability of governments to moderate business cycles. By 1985 economics was becoming all about free market ideology and rational expectations because the business cycle was no longer a problem, the government was the problem and any interference with the market was deemed unacceptable. This led to deregulation of banking, the housing bubble and a worldwide financial crisis. Krugman and many other economists get this so don't paint economists with too broad a brush, there are some economists further to the left of Krugman that also get the idea that there are limits to growth. For example James Boyce at U Mass Amherst http://www.umass.edu/economics/boyce.html . See also the following paper on climate policy:

http://www.peri.umass.edu/236/hash/fb91544e83eee767c313513fbcf60ea5/publ...

DC

I pay very little attention to anything mainstream, including 'The Newspaper of Record', but given what bleeds through my filter I'm a bit surprised to hear you say this: I personally like Krugman. Given what bits I've heard from him, he seems really not to grok our predicament - of course few do. A quick search turned up this: http://www.declineoftheempire.com/2012/05/understanding-paul-krugmans-vi... wherein he says this: If only we had "appropriate" pricing of fossil fuels, it would be "remarkably easy" to replace them.

I don't think so, really.

I wonder are you familiar with Steve Keen? Here are a couple of his links: http://debunkingeconomics.com/

http://www.debtdeflation.com/blogs/

I'm only familiar with him from having heard him interviewed on The C-Realm Podcast, Radio Ecoshock and perhaps The ExtraEnvironmentalist as well. He seems to have a full appreciation of resource limits.

If only we had "appropriate" pricing of fossil fuels, it would be "remarkably easy" to replace them.

That's exactly right. When oil went from $20 to $100, US oil imports dropped in half. $2/liter fuel in Europe has been the primary reason (geology and history the 2nd) that personal fuel consumption is only 18% of the US and Canada.

If fuel were properly priced in the US at, say, $7/gallon, the US would reduce fuel consumption very quickly.

Hi Nick,

I agree that higher prices will help, but I don't agree it will be easy. I like Krugman better than most economists, I think James Boyce (who is not well known, compared to Krugman) has a better handle on resource limits

(http://www.peri.umass.edu/236/hash/fb91544e83eee767c313513fbcf60ea5/publ... ).

Note that imports decreased by half, but oil consumption only decreased from 20.8 million barrels per day (mbpd) in 2005 to 18.66 mbpd in the most recent 12 months, this is the response to prices more than tripling from 2002 to 2012 ($30 to $100). When prices triple again maybe we can get another 11 % decrease to 16.74 mbpd by 2020. I hope the response to a rise in oil prices to $300/ barrel will be stronger than an 11% decrease in petroleum demand.

A rise in carbon taxes would be a big help, if we don't do that then in 2025 people will look back on the cheap prices of 2020 as peak oil is recognized as a "proven" theory. At some point oil prices will rise enough that substitutes will take over, I don't know what price level that is, maybe $500/ barrel will do it, at that price it may be "remarkably easy" to get people to buy more fuel efficient cars, use public transportation (and demand more of it), move to more transit oriented development, etc.

I am not sure what magic is in a price of $7/ gallon for gasoline, real gasoline prices were $1.61/ gallon in 2001 and $3.11 in 2011 (both are in 2005 $) the nominal price in 2011 was $3.53, so if we assume another doubling of gas prices we might see a similar reduction in gasoline usage. From 2001 to 2011 gasoline consumption decreased from a peak of 9.3 mbpd in 2007 to 8.7 mbpd in the most recent 12 months ( a 7 % decrease). It may take $15/gallon to see a quick reduction of gasoline use in the US.

DC

DC,

Do you have a study of Boyce's that's more illustrative of his understanding of resource limits? This study seems to argue that climate change is no more important than traditional pollutants, and that policies to limit CC should include emphasis on the traditional pollutants for the sake of equity for minorities. This doesn't suggest a strong sense of urgency about CC.

I agree that carbon taxes are extremely important.

oil consumption only decreased from 20.8 million barrels per day (mbpd) in 2005 to 18.66 mbpd in the most recent 12 months, this is the response to prices more than tripling from 2002 to 2012 ($30 to $100). When prices triple again maybe we can get another 11 %

Percentage increases aren't important. What's important is absolute increases, and their level compared to the substitutes. Below about $60/bbl there are no economic substitutes for oil, but as oil gets farther and farther above $60 substitutes become more and more obvious and pressing. In other words, this is not a linear function.

There's no way oil prices will stay above $200 for very long, unless the Persian gulf goes up in flames.

Nick,

Typically whan looking at consumer responses to a change in prices, one uses the percent change. Why? If we are talking only about absolute changes in price, then the price itself doesn't matter. So if we say the price of X went up by 1000 dollars, it sounds like a lot, but not if X is a Boeing 787.

You can claim that you know at above $60 per barrel substitutes become more attractive, but the evidence suggests that the response is quite slow. The average annual real imported crude price (2012 $) has been above $58 since 2005

( http://www.eia.gov/forecasts/steo/realprices/ ). At some point, you are correct that substitutes will become competitive, but to get people to change their preferences those substitutes must be both cheaper and more convenient.

I don't have your confidence that the price must be X in order for those changes to occur, I think that if we both guessed at X, my guess would be higher than yours, but only the future can answer the question of what X actually is.

You are confident that at $200 per barrel, oil would be so expensive that substitutes will take off, time will tell. I think that increased demand form China, India, Brazil, and other rapidly growing economies will outstrip the ability to increase supply by 2016 to 2020 and that increased prices will be needed to allocate the available oil. I think that $200 oil will be easy to achieve under those conditions, at that point prices may be high enough to cause demand to fall as substitutes become popular, if not prices will continue to rise.

Did you read the paper or just the abstract? The point of the Boyce paper is that in the process of addressing CO2 emissions, that one should address other externalities at the same time. As a simple example consider two sites that emit the similar levels of CO2 per year say a coal fired power plant vs several natural gas fired power plants (in the Western US Natural Gas power plants emit about 43 % of the CO2 per MWh as coal power plants). To maximize the overall benefit to society it makes sense to consider all emissions from these power plants, both CO2 and other harmful emissions as well. If we don't do that and consider ONLY CO2 emissions then reducing CO2 emissions from the coal fired plant would be considered exactly the same as reducing the same quantity of CO2 from natural gas fired power plants. In fact most coal power plants emit a number of other harmful pollutants and if we ignore these then we are leaving potential societal benefits "on the table", by treating the two as equivalent.

To me it makes sense to devise a policy that maximizes the benefits to society.

Boyce is not saying that CO2 is not as important as other pollutants, he is saying that when choosing which CO2 emissions to reduce, design a policy that reduces CO2 from the dirtiest plants first.

What does this have to do with resource limits? There are many resources besides fossil fuels, two which are addressed in this paper are clean air and an atmosphere with appropriate levels of carbon dioxide (less than 450 ppm).

More Boyce papers:

http://www.peri.umass.edu/193?tx_peripubs_pi1%5Bauthor_id%5D=2

put Boyce in under author

in particular, the following focuses on policy to address climate change

http://www.peri.umass.edu/236/hash/a53e6e14d91f22614b1ebe5fdd33cd0a/publ...

and to a lesser extent

http://www.peri.umass.edu/236/hash/928ccab881f907b53f0ba22a1bf978c7/publ...

DC

DC,

I think we agree that Boyce is a good source on environmental economics. At the moment, it looks to me like Climate Change is more important than either "criteria" pollutants, or equity/racial justice issues, but that's a quibble.

Typically whan looking at consumer responses to a change in prices, one uses the percent change.

Sure, and that's just fine most of the time. My point: that assumes a constant relationship: e.g., "10% increase in price causes 3% decline in consumption". I'm arguing that doesn't apply here. A doubling in price of oil from $20 to $40 is pretty trivial. A doubling from $100 to $200 is a very big deal. A doubling from $200 to $400 just won't happen unless the Persian Gulf is in flames, and even then it wouldn't last that long.

Why the difference? Several reasons.

1st, $40 oil is small relative to income.

2nd, $40 oil is small relative to other costs, including oil production-related costs like refining, distribution, profit and taxes; and small relative to other consumer costs, such as vehicle depreciation.

3rd, $40 oil is cheaper than substitutes such as hybrids, plug-ins, carpooling, ethanol, CNG, online shopping, etc. As long as prices are below the price of substitutes, there will be no substitution.

Now, why haven't we seen more substitution since prices rose above $60?

1st, short term elasticity is much smaller than long-term. Oil prices haven't been high for very long, and Peak-Lite is something that didn't exist in the history of the oil industry until about 2005.

2nd Many consumers, such as long-distance truckers, don't have good "visibility". Many are *still* waiting to see if, say, natural gas prices stay low, and oil prices stay high. They have good reason, given historic volatility. Others have only recently decided that high prices are here to stay, and are still in the transition - taxis, for instance, will take several years to move fully to hybrids.

3rd, the oil industry has fought viciously to confuse the public about this issue. It has succeeded pretty well. Only prices staying high for a long time will break through that, and that delays the transition.

4th, R&D, and capital investments, take a while. Plug-ins (pure and EREV), for instance, only really took off in 2012, 7 years since 2005.

5th, change has many costs, including new infrastructure, new maintenance procedures, training of everyone involved, etc. As long as the savings from substitution are small, change won't happen. As the difference between oil prices and substitutes rises, the incentive gets larger until it breaks through. That's a non-linear relationship.

Still, you have to realize that things would change quickly if prices rose above about $150. For instance, the last time prices rose above $125 container ships started slowing down: they can reduce fuel consumption by 50% by only slowing down by 20%. For another example, when oil prices rose in the 1970's Industrial consumers switched away from oil for process heat essentially overnight. There would be many short-term changes like that. There would also be sharp medium term changes: in the 70's the US got 20% of it's electricity from oil - that went to 5% relatively quickly, and now is about .7%.

That's the nice thing about decentralized markets: they are very flexible, and they can change things around in a million ways to optimize costs. Of course, markets are inhabited by humans who can make mistakes, as noted above, but when they get moving, don't get in their way or you'll be run down.

Hi Nick,

I agree that climate change is more important than other pollutants, but I will restate that your impression that Boyce thinks any differently is mistaken, he believes that one can kill two birds with one stone and while attacking the problem of climate change a smart policy reduces both climate change and other pollution by prioritizing the carbon emissions that emit other dangerous pollution as well.

How long do prices need to be high? Remember Keynes quote, "In the long run we are all dead."

Again you think an oil price of $150/barrel will cause things to change quickly, such a price would lead to gasoline prices of about $4.60/gallon. I disagree that such a price would cause rapid change, though it would help move things in the right direction. If prices rose to $300/barrel gasoline would be around $8.20/gallon (I am assuming gasoline taxes do not rise). This would be similar to European levels and would help even more, but keep in mind that Europe still uses a lot of oil, half of US levels per capita. As the BRIC countries and other rapidly growing countries aspire to European levels of petroleum consumption, much more reduction of petroleum use will be needed and prices will need to rise even higher without tax policies to reduce petroleum consumption.

We are mostly in agreement, many of your points support the notion that a rise in prices doesn't lead to rapid change. I agree that the process is both non-linear and unpredictable. You are optimistic that at $150/barrel oil we will reach a "tipping point" where everything will change rapidly. I think this notion is speculative and I think your price point for where this might occur is low by a factor of 2 to 3.

DC

Hi DC,

Well, I have no problem with Boyce's analysis. My point is that CC is not only more important, but it's also badly neglected by comparison, and it's facing fierce resistance from legacy industries. Those industries will use any delaying tactic possible, and it seems unwise to me to burden any kind of CC policy initiative with attempts to take care of any other problems. Perhaps its not his job to point out that practical problem with his theoretical arguments (although I kind've think it is), but we need to keep it firmly in mind.

For instance, the very best initiative to deal with CC would be a carbon tax. It's simple and effective (which is why it's been murdered in the political process). Adding anything that related to other pollutants would make it far more complex to both legislate and to regulate.

you think an oil price of $150/barrel will cause things to change quickly

When prices rose above $125 five years ago, things did indeed start to change very quickly. Keep in mind that prices were above that level for 3 or four months only. Industrial/commercial users starting cutting back quite sharply, which is part of why oil prices dropped to $40 briefly, before KSA could cut back on production.

Europe still uses a lot of oil, half of US levels per capita.

Yes, because European I/C users aren't taxed as much as consumers. Consumers use 18% as much, while I/C actually uses more than the US.

As the BRIC countries and other rapidly growing countries aspire to European levels of petroleum consumption, much more reduction of petroleum use will be needed

Substitutes work as well for them as they do for OECD countries. The economics of batteries, for instance, are the same. Above about $80, electric transportation starts to be cheaper. When oil prices are at $100, the difference is only $20, which isn't enough to overcome the "friction" of change. But prices at $120 double that incentive, and prices at $160 quadruple it.

Just as importantly, BRIC countries still have some price controls/subsidies for fuel consumption, and those are on the edge of bankrupting the government or quasi-government entities that bear the burden of those subsidies. Those subsidies would have to be abandoned in the face of $200 oil, which would be dramatically raise consumer and I/C fuel costs For instance, India has recently had to abandon gasoline subsidies, and is on the precipice with diesel.

I think your price point for where this might occur is low by a factor of 2 to 3.

I think if you look at the details of these various markets, you'll come to a different conclusion.

Have you looked at the billion prices project? http://bpp.mit.edu

Yes the link was in my first comment in this thread.

DC

You state that in January there were 410 wells waiting to be fracked. As I recall from a previous link, which I cannot seem to locate right now, that is up from 350 wells waiting to be fracked in December. The point is that fracking is the delay, not the rig count.

Even if they did increase the rig count to 225 or 250, it would make no difference. All that would do would be to increase the backlog of wells waiting to be fracked. Is this not the case? If not, why not?

Ron P.

Is there a seasonality to either drilling or fracking? I.e. are the average number of wells drilled or fracked different in winter than summer? Be it due to weather or e.g. annual revision cycles of equipment or regulatory constraints?

No but they are subject to really bad weather. The decline they had in November they blamed on a snow storm. And the last decline they had before that was in April 2011. They blamed that on a snow storm also.

North Dakota experiences first crude oil production decline in 19 months

Ron P.

No but they are subject to really bad weather. The decline they had in November they blamed on a snow storm. And the last decline they had before that was in April 2011. They blamed that on a snow storm also.

Don't know if you've worked in tough winter conditions much, but they slow overall man-hour productivity considerably, so if frac trucks availability is setting a limit on non-winter production most certainly that limit is choked down further in the winter even after a blizzard has passed and been dug out--though if new snow falls often enough in ND eastern MT there is no end to the snowdrift hassle.

I've worked more than a shift or two in subzero blows--it slows all you do. Working in the heavy gear is a bit like dragging anchor. Guaranteed none of the hookups go better when its -15°F blowing 30mph--hardly rare weather in Bakken country.

A guy working on my crew put it rather simply one subarctic 'long season.' The way he put it: if management wants a good comparison between what a hand can do in deep winter and moderate weather they should stand outside the porta potty and time the guys going in to take a leak. No one stays in those stinkin' booths longer than needed, but no doubt dealing with all the heavy clothing keeps a guy there way longer in the dead of winter--and some of the booths can be 'exceptional.' One time way out on the road system when we were using the 'local' underequipped potty contractor we had to keep stacking 2x4s around the seat to stay above the quickly rising rock solid mountain peak in the center. Winter work has all kinds of fun twists...of course break up follows winter...a whole fresh set of challenges that can mire things to a crawl for a spell.

The question was: are the average number of wells drilled or fracked different in winter than summer?

And my answer was: No but they are subject to really bad weather.

And looking at the actual data, that is the case. The Bakken data found at ND Monthly Bakken* Oil Production Statistics no discernable seasonal pattern can be detected in new wells put on line. Except of course the two months, April 2011 and November 2012 in which they had severe snowstorms.

That was my point. Of course winter weather is a lot harder on the workers but they seem to be drilling and fracking just as many wells in the winter as they do in the summer... except in the case of snowstorms of course.

Ron P.

April is break up, which can really bog the trucks down.

I calculated the monthly well additions (my math results always suspect these days, feel free to recheck and go back farther, I stopped after three flattish good weather months) for the Aug 2011- Nov 2012 from the data in your linked page.

wells added:

Aug 2011--128

Sep 2011--118

Oct 2011--115

Nov 2011--142

Dec 2011--151

Jan 2012--115

Feb 2012--105

Mar 2012--193

Apr 2012--125

May 2012--193

Jun 2012--157

Jul 2012--166

Aug 2012--132

Sep 2012--174

Oct 2012--161

Nov 2012--115

So what explains Jan & Feb 2012???

Except for August drop (did oil price dip that month???) looks like deep winter slowdown in Jan and Feb opened onto a rock and roll March followed by blizzard/break up mired April.

If you recall last winter, the US had a mild winter. ND was no exception.

One thing to remember about these fractured reserviors versus old conventional reserviors:

Old fields are using enhansed oil recovery (EOR) methods, from California's Kern county using steam injection to some in Texas using CO2 to KSA using infill drilling of injection wells (combined with max reservior contact) to other OPEC producers using seawater combined with surfectants.

The problem with trying any of these methods is that once a reservior is fractured, the later injection of some fluid or gas to force out more oil will have little effect as the fluid will simply follow the fracture path that the previously produced oil followed. Maybe some fractured wells can be fractured again after production drops, but this is not economical at current oil prices, IMO.

Once Bakken has hit its peak and is in decline, it will not see a resurgence like many conventional fields using EOR. I question the gentle decline forcast by the North Dakota DMR, slope of decline curve will be much steeper, IMO.

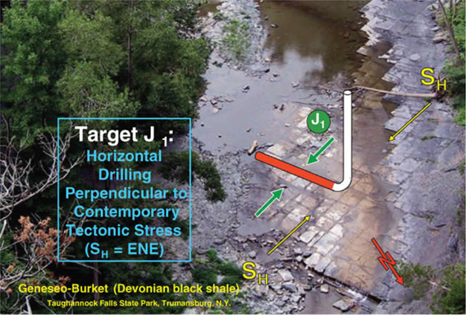

Don't they drill new horizontals and frac along the new parallel line? Or would a perpendicular strike be more likely to enhance recovery?

In any event, I don't think they would try to frac the same line... for the reasons noted.

Craig

As H.O. pointed out above the most productive drilling is for lateral bore to be perpendicular to natural fractures. Not sure if going down same vertical bore then drilling new lateral out through formation (radially from vert. bore) would achieve this.

I have heard that simply refracturing with higher pressure and more fluid can produce increased flow.

Any comments ROCKMAN?

Mb – lateral orientation: a very old debate. First let’s remember that virtually all the producible oil/NG is found in the existing natural fractures. Due to the extremely low permeability of the shale matrix man-induced new fractures will contribute very little FROM THE MATRIX. The goal of a frac job is to intersect natural fractures the lateral didn’t intersect.

So in one theory you may want the lateral to transverse perpendicular to the natural fractures. Predicting the orientation of the natural fracture pattern isn’t always easy but you take your best guess. But there’s a subset of debates: are the natural fractures oriented more vertical or horizontal? Typically a vert orientation makes more sense but the argument can still rage.

Next debate: OK you’re drilling perpendicular to near vert fractures. When you frac what is the orientation on those new fractures? Many engineers will draw pictures showing the induced fractures radiating outwards at right angle to the lateral. But that would mean the induced fractures grow parallel to the natural fractures the lateral was intended to cut at 90 degrees and thus will have a small probability of cutting the natural fractures. Which goes against the primary reason you frac the well.

So the reality. First, just because an engineer/geologist draws the induced fracs moving at right angles to the lateral doesn’t mean that’s how the really grow. There are methods to actually map the orientation of induced fractures and often they don’t grow in a manner anywhere close to the theory. Mother Earth decides which way the induced fracture goes…not us. I’ve seen post frac mapping that not only showed the fracture didn’t go the predicted way but actually didn’t go into the formation they intended to go into but one immediately above or below the intended reservoir. Mother can be very cruel. LOL.

Second, some will argue it’s better to spilt the difference so instead of drilling perpendicular to how they THINK the natural fractures run we should drill at a 45 degree angle to the fracture orientation. Might not cut as many fractures but then when we frac those new induced fractures (growing IN THEORY) at right angles to the lateral will hit more natural fractures.

Third, the practical side. A company’s lease position may not allow a lateral orientation they would normally drill. There are typically state regs that not only determine how close wells can be drilled to each other but also how each well's PRODUCING UNIT is shaped. Too complicated for all the details but here’s one example: the state allowed unit size is 320 acres. But in Texas I can’t draw a unit that’s 10X as long as it is wide. The units don’t have to be square but just not so biased in one direction. Thus a company might be forced to drill in an orientation to meet unit rules that conflict with their engineering preferences.

Fourth, there’s management. I’ve seen more than one manage argue against a proposed lateral orientation because that’s not how Company X is doing it and they seem to be making acceptable wells. Engineers/geologists seldom win against such logic regardless of how much tech support their ideas have. I drilled my first offshore hz well into a shallow sandstone reservoir with a 1,000’ lateral length. Why? Because Pogo had made great wells that were 1,000’ long. Not knowing how to model the potential productivity we went with that recommendation. After testing my well we discovered we could have made just as good a well with a 300’ lateral. Live and learn. LOL.

And lastly, fracture orientations change not only over longer distances but sometimes very short ones. Faulting can completely alter the natural fracture orientation. But even when the seismic shows those potentially altering faults the debates can still rage over which way to orient the lateral with respect to the faulting.

Refrac'ng: Yes some history of making a few more bucks by refrac'ng the Barnett Shale. Not huge increases but profitable because it's a small incremental cost compared to what is spent initially.

In order to make a material difference in the global supply situation, especially in regard to net exports, it seems to me that not only do oil companies have to continue to offset the underlying decline rates from conventional production, they have to offset the overall increase in decline rates from existing wellbores, as an increasing percentage of production comes from shale/tight sources, and they also have to offset the post-2005 decline in Global* and Available Net Exports.

Normalized liquids consumption for (2005) Top 33 Net Oil Exporters, China, India and the US, from 2002 to 2011 (2002 consumption = 100%, BP data), versus annual Brent crude oil prices (in red):

I think that it is likely that these consumption trends will more or less continue. As I have occasionally noted, at the 2005 to 2011 rate of decline in the ratio of Global Net Exports of oil (GNE*) to Chindia's Net Imports (CNI), in 18 years the Chindia region alone would theoretically consume 100% of GNE.

Unless a given American consumer directly or indirectly benefits from oil and gas activity, rising US crude oil production, to a level well below our 1970 peak rate, is pretty much irrelevant to them. I suspect that they are far more focused on the price at the pump.

*Top 33 net exporters in 2005, BP + EIA data, total petroleum liquids

Unless a given American consumer directly or indirectly benefits from oil and gas activity

Any idea about how much of the recent uptick or at least treading water by US manufacturing is directly or indirectly a result of oil and gas activity? Tricky figuring overall effect as higher oil prices cause a drag of varying degree in many sectors of the economy.

I can’t put a number to it but here’s some qualitative idea of what it has done for Texas. Someone reported the other day that Texas accounted for 25% of last year’s GDP. Sounds too high but that’s what was posted. The state’s rainy day fund is so fat ($13 billion) they are thinking about putting $3 billion into drought relief. The gov also plans to create a mechanism whereby the state can start rebating taxes. And there’s that old stat that about 2 out of every 3 jobs created in the country happened in Texas. Yeah…lots of lower paying jobs but better than no jobs for your state, right?

There’s also the downside: we keep throwing more and more money at road construction and not mass transit.

Someone reported the other day that Texas accounted for 25% of last year’s GDP. Sounds too high but that’s what was posted

Possibly that is supposed to read 25% of last year's GDP growth--which might or might not sound high depending on the growth number--not something I keep track of.

I personally have shied away from places with low wage job growth, but that has stuck me way out in the corner (I've been avoiding the big cities as well) with imminent closure of the AFB wing about to hit us in the shorts really hard.

There’s also the downside: we keep throwing more and more money at road construction and not mass transit

We do the same thing up here, get a couple bucks extra from oil and build a bunch of stuff we will have to maintain with less of those bucks coming in later...and later looks to be upon us right now.

Oh and by the way, California has created more new jobs than the next 10 fastest growing states combined in recent months.

Time to hang up that old canard, Rock.

"California contributed more than 15 percent of the nation’s new jobs between October 2011 and October 2012 - adding more jobs in 12 months than Texas and the rest of the other top-10 fastest-growing states combined"

from:

http://www.bizjournals.com/sacramento/blog/sanford-nax/2012/12/californi...

http://www.bloomberg.com/news/2012-08-29/california-defies-lower-tax-tex...

http://www.cbsnews.com/8301-18563_162-57562186/california-leads-nation-i...

g2s – From your reference: “California added 365,100 nonfarm jobs in the year ending in July, a 2.6 percent increase and the state’s largest 12-month gain since 2000. Texas picked up 222,500, or 2.1 percent, according to U.S. Labor Department statistics. California also outpaced Texas the prior month.” Yep…beat Texas…by a whole 0.5%.

And from your same reference: “To be sure, California is the only state where three cities have filed for bankruptcy in the past two months. The state’s unemployment rate of 10.7 percent in July was the third-highest in the U.S., trailing only Nevada and Rhode Island. Texas ranked 30th with a jobless rate of 7.2 percent, beating the national average of 8.3 percent.”

Nice that CA added more jobs than Texas for a few months. Drop me a line when the CA unemployment rate isn’t more than 40% greater than the Texas unemployment rate. Or least no worse than 29% greater than the national average. Sorry but my old carard still whips your new canard's butt. LOL.

Just to clarify: California added 64% more jobs than Texas, 365,000 vs. 222,000.

California added 2.6% more jobs to their total number of existing jobs. Texas added 2.1% more jobs on top of existing jobs. So yes when adding 142,000 more jobs than Texas, they added 2.6% vs. Texas' 2.1%, 0.5% more.

The unemployment rate in California, in the last year, has dropped more than that in Texas. Granted it is starting from a higher place.

I have no desire to argue politics. Or Texas vs. California (except maybe for best surf spots!). I am cheered to notice that things in California are getting better with a democratic governor and legislature that has changed the rules to diminish the obstructionist role of the minority republicans. I've been a green for years as both parties make me ill.

The fracking debate is getting hot and heavy here in CA. Lots of hysteria.

g2s - Didn't think we were arguing politics...just tossing some relatively meaningless change in stats. LOL. And I do wish CA the best as well as enjoying your gov hitting ours with the fart line. Keep us up to date on frac'ng in CA. I've already seen some of the hype being spewed out about the Monterey Shale.

I don't think there is anything special about predicting the flow from a fractured volume. Certain properties are the same (invariant) across the scientific disciplines and use the same basic conservation laws. The simplest approach is to apply a diffusional mass balance argument to a volume and see what the mathematical solution tells us.

If the oil is making its way out via random channels by diffusion, the minds-eye model is one of a random walk. Consider what happens when the fracturing first takes place. In an instant, many fractured pathways will present themselves. Various volumes of liquid will start to move in one direction or another, looking like the classic Brownian motion characteristic of a random walk.

With a minimal number of assumptions concerning the geometry, the rate of collection of the bits that randomly walk towards a sink is straightforward to derive mathematically. The constraint on the solution is that the enclosing collection volume is not infinite. We also assume an effective diffusion coefficient that scales the rate at which the liquid can flow. This is related to the average permeability of the substrate.

A full derivation here:

http://theoilconundrum.blogspot.com/2012/07/bakken-dispersive-diffusion-...

If you want to play around with the diffusion formulation, here is the cumulative of a diffusional flow as a Wolfram Alpha plot

The bottom line of these types of diffusional flows is that the initial flow is fast, and then it starts to slow down rather quickly as many of the random walkers start to move in the wrong direction. Once they move far enough away from the sink, it will take them that much longer to get back.

The only thing that would force them to move toward the intended sink is if some force was applied, either through a gravity head or other kind of pressure. This would change the characteristic diffusional flow into a hyperbolic flow, which is well known to reservoir engineers. Hyperbolic flow is more efficient and doesn't have as long a tail as the diffusional flow.

Not all wells will follow perfectly this behavior, but in aggregate they will, which is seen with every cumulative Bakken profile that I have seen posted or published so far.

It would be so easy to verify the behavior if the NoDak agency that archives the data would make it all available, instead of the rolled up behavior that they provide.

https://www.dmr.nd.gov/oilgas/stats/historicalbakkenoilstats.pdf

Rune Likvern has data that he was able to scrape off of PDF pages. Look at Figure 4 in this post and one can see the characteristic cumulative profile

http://fractionalflow.wordpress.com/2012/09/05/er-skiferolje-en-game-cha...

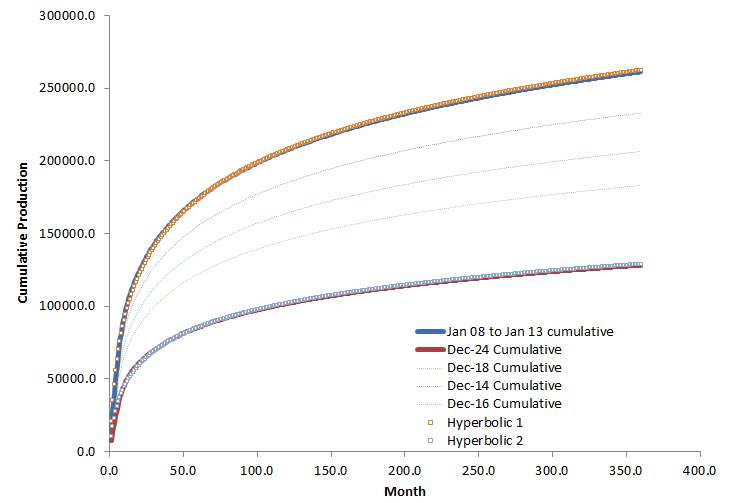

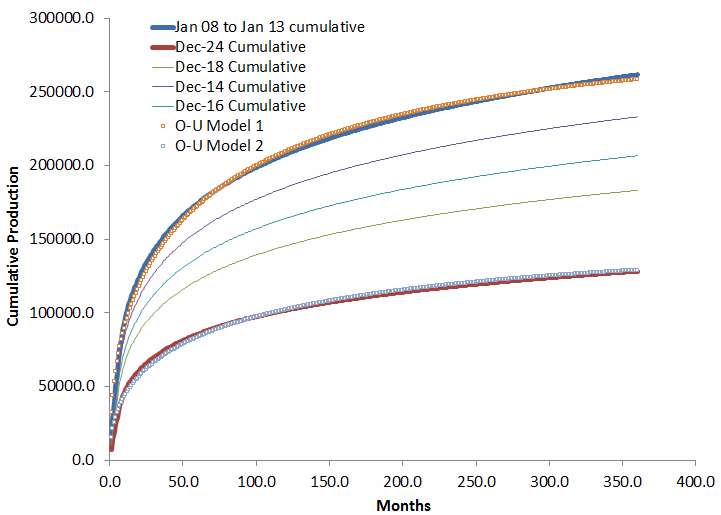

Another analyst James Mason was able to get a start with the data, using a modified hyperbolic heuristic:

http://solarplan.org/Research/Mason_Oil%20Production%20Potential%20of%20...

DCoyne who also posts here is picking up the analysis as well, showing that something between a diffusional flow leaning toward a heuristic hyperbolic flow is occurring.

http://oilpeakclimate.blogspot.com/

Another view is by Brackett who had some data that I analyzed here

http://theoilconundrum.blogspot.com/2012/09/bakken-approaching-diffusion...

The bottom-line is that given just a little more data, we should be able to characterize the declines fairly well. There are so many of these wells that the statistical aggregate should be good enough to make some long term predictions. The actual data doesn't lie and probability and statistics will fill in any gaps.

The only thing that would force them to move toward the intended sink is if some force was applied, either through a gravity head or other kind of pressure. This would change the characteristic diffusional flow into a hyperbolic flow, which is well known to reservoir engineers. Hyperbolic flow is more efficient and doesn't have as long a tail as the diffusional flow.

Don't know how you'd get gravity not to play some role, but no doubt gas is providing other kind of pressure considering they can only flare a well for one year and the size of the bright spot on ND/MT in the satellite night earth composite

Gravity could make the net flow go either way, in that it can cause the oil to go deeper through new cracks, or go upward due to higher overpressure. The net is the drift flow that would ride on top of the random walk.

The analogy to this is if you opened up a perfume bottle in one end of a room. If there was no steady air flow, the time it would take to reach the other side is determined completely by diffusion. If there was a draft that could assist the perfume, it could get there faster or slower depending on the prevailing direction of the gradient. This is just Darcy's law.

or go upward due to higher overpressure

Not quite following you here. Propant will keep the fractures from being closed by rock pressure if I understand correctly so overpressure from the overburden wouldn't seem to be be factor if the flow channels were being propped open. I might be looking at this too simple mindedly--what training I have in this field I've received on this site ?-)

No doubt gravity forces oil up when the oil floats on denser water pulled beneath it but from what I've heard this is not heavily in play in the Bakken region--though again I might have misunderstood that as well.

The Bakken oil production is gas pressure driven from what I've been told, the flare is just a handy if crude indicator of the pressence of the gas drive.

Either way, the gas pressure could force the oil deeper as much as it can force it out. Which way it goes is essentially described as a random walk.

Here is an analogy that just occurred to me. Think in terms of a leaf blower and how inefficient that contraption is on grass unless it is pointed perfectly at a leaf. The leaves essentially move in random directions.

I also realize that in conventional reservoirs, the concept of fractional flow is important, but how it fits in here I am not sure.

Mind you, I don't have any special training in this field either, but I have been herding electrons and holes in the electronics world for years, and I consider this analysis like child's play compared to the complexity of diffusional and drift flow in a semiconductor. Diffusion is diffusion and it hasn't changed much since Einstein worked on Brownian motion. It seems that we should be able to get a simple formulation for an average decline of a Bakken field.

It's possible that the companies have all this considered as tacit knowledge, bit I am not seeing them reveal any secrets in public.

I am not a geologist but have worked on flow problems as an engineer. A liquid such as oil will flow from high pressure location to low pressure location. As the gas trapped with the oil moves to the well bore it expands, reducing in density due to lower pressure. Once the expanding gas is part of the vertical fluid column it will help move the oil out since the pressure continually declines up the column, not just due to the well bore being open to atmosphere or collection tank, but due to lower density of the liquid top to bottom. I would guess that as the gas content declines, so does the oil flow.

Another comment about the gas being flared: the ND DMR will tax the gas coming out of any well after one year, thus giving the producer an incentive to capture the gas. But, the producer can apply for a variance beyond the one year grace period, thus allowing flaring to continue longer at no cost to the producer. The state legislature this year will probably change this law on gas production, disallowing any variance for flaring beyond one year of production. Then the producers will be taxed after one year regardless of what happens to the gas.

THE AVERAGE BAKKEN(ND) 2011 WELL

More and updated full time series with production data from NDIC for wells with first reported flow January 2010 or later and minimum 12 months of reported production has been added from NDIC and to my databases.

Around 200 wells started as from June 2011 and through December 2011 (min 12 months production history) out of 873 wells reported added by NDIC during said period, were used to define the “Average Bakken ND 2011 well”.

“Average Bakken ND 2011 well” was found to have a total flow for the first 12 months of reported production of 84 000 Bbls (crude oil). The decline from year 1 to year 2 (using data for wells started from January 2010 was found to average 46% (the declines are all over the place, but the 46% decline from year 1 to year 2 was derived through linear correlation with data from close to 150 wells with at least 24 months full time production history.

The total flow for the first 12 months (84 000 Bbls) for the “Average Bakken ND 2011 well” contrasts the NDIC typical well that has been used in various presentations and which suggests that the typical well in Bakken North Dakota has a total flow of 169 000 Bbls during the first 12 months.

The chart above shows the moving average of total crude oil flow the first 12 months and with first reported production January 2010 or later (yellow circles connected by black line).

The dark red line shows the moving average of the 50 recent wells (12 months full time production history) in sequence as from January 2010 and as of December 2011.

The number of wells (presently at more than 400) is close to doubled since last time the figure was shown, and the trend remains, the well productivity has declined since the summer of 2010 and appears now to have stabilized at around 84 000 Bbls for newer wells.

- Rune

BAKKEN (ND) PLATEAU OF 700 kb/d WITH THE BAKKEN(ND) 2011 WELL

The chart below is from a simulation to get an estimate of how many producing wells that need to be added during 2013 and 2014 to get to a plateau of 700 kb/d by January 2013 for crude oil production from Bakken in North Dakota, and maintain that plateau through 2014 using the “Average Bakken ND 2011 well” described further up.

(The Bakken field stretches into Montana and Canada, and here it is looked at Bakken in North Dakota.)

To maintain the plateau of 700 kb/d with the “Average Bakken ND 2011 well” it was estimated to require an additional 1 200 - 1 300 producing wells through 2013 and another 1 000 - 1 100 additional producing wells through 2014.

The chart above shows the results from the simulation using the “Average Bakken ND 2011 well” as from January 2010 and through December 2014. The colored areas are production by month, year. The transparent colors are from the simulation from January 2013 and through December 2014, stronger colors actual.

The thick red line shows actual production as reported by NDIC.

For the period January 2011 and through November 2012 the model was on average within 2% of actual reported NDIC data.

The gap between actual and simulated during 2010 is due to wells with higher productivity than the “Average Bakken ND 2011 well” started to flow during 2010.

The red dots with black circles are added producing wells by month reported by NDIC (right y-axis).

- Rune

Rune finds that the average decline from year 1 to year 2 is 46%.

For a pure diffusional flow, the theoretical result should be 58%.

Diffusion is one of those scalable processes that once you know the rate decrease in the first year, you can calculate the rate for the second year.

I would guess that these are like 70% diffusive flow, just from looking at year 1 to year 2.

If we can get year 2 to year 3 numbers, that would show the evolution more accurately. The first year always shows noise because of uncertainty in start time. For example, a January start versus a June start, where the end of the calendar year represents a year. This is one of the bureaucratic bookkeeping decisions that can screw up the statistics.

If DCoyne is reading this, I think he knows what I am talking about.

WHT,

For what it is worth the chart below shows how decline for year 1 to year 2 for wells started from January 2010 and as of December 2010 (24 months of full flow as from December 2011 and as of November 2012).

The chart represents 144 out of the 732 wells started to flow as from January 2010 and through December 2010 in Bakken (ND).

Apparently the decline from year 1 to year 2 is all over the palace, the simple average is 48%, but decline rates from year 1 to year 2 appears to correlate with first year flow, the higher flow the higher decline, and again the decline rates are all over the place.

WHT, what is it you are trying to say….in English?

- Rune

Take a look at the average cumulative data for Bakken wells (from Mason) as the dashed blue line.

I added green arrows at the 1 year and 2 year cumulative points. The trend is that the cumulative at the two year point is diminished from the 1 year point by around 50% (just by eyeballing it).

Next to the dashed blue line is a dashed red line which is the expected diffusional decline which best fits the data.

Notice how the trend continues to decline year-over-year beyond that point, and matches to what Mason sees in his data. In his paper, he calls it a hyperbolic decline formula modified by selected power-law exponent.

You have a point about variability in the data, and that will always exist, if only because the data is collected in different ways. However, there is an average decline for these wells and I contend that it is close to a diffusional decline.

BTW, the diffusional decline curve is

C(t) = C0/(1+1/sqrt(D*t))

where C0 is the asymptotic limit, and D is the diffusional flow.

Okay, for a non-mathematician, just what the hell does that mean? And can that be translated into an average percent decline for the first year? For the second year?

Ron P.

Ron, If the production is measured as some value the end of the first year, pure diffusion would knock that down to sqrt(2)-1 of its value at the end of the second year. That is the the 58% decline I mentioned. Rune had an average of 46% in his collected data, with a whole lot of variation from well-to-well.

The square root comes about from the basic Fick's Law of diffusion, which has been renamed by hydrology and reservoir engineers as the Darcy's law variation. (Every discipline of science and engineering has a diffusional law that they get to rename)

WHT,

This is very interesting and it very well may be that the decline follows the pattern you describe.

I think that as of now, as there are little hard data available on tight oil wells on decline over several years, any projections on future declines are just that, projections.

Most oil companies are aware of this and circumvent this (issue) by looking at Net Present Value (NPV) which is nothing else but discounting the flow (disguised as discounting the cash flow).

NPV is a method to evaluate if a project adds value for the company.

Using NPV, the rate of late life decline rates impacts the NPV in a small way. Physical flow is of course affected by decline.

Oil companies are motivated by NPV.

- Rune

It's kind of coincidental that the hyperbolic discounting that investors apply is similar to the hyperbolic decline that these reservoirs go through. Both of these show long tails in the rate of return. Maybe it's not a coincidence.

I agree that when they decide to pull the plug will have an effect on the cumulative total, that is fairly obvious.

The stabilized first-year well-productivity numbers (84,000) may indicate that the "sweet spot" area of Bakken (ND) is larger than some at TOD have been estimating. Alternatively, it may indicate that the drilling itself is becoming more productive even if the well-area is somewhat less "sweet".

Is that a possible conclusion?

I have never tried to estimate the area of the “sweet” spots like Alger, Sanish, Parshall, Reunion Bay, Van Hook (other around here are better at that) etc., but there are still large areas left to be drilled in the sweet spots and judging by data from NDIC it appears that companies have been drilling more in the sweet spots during the recent year and drilled/completed less in the less prolific areas in Bakken (ND).

The results from the simulation so far suggests that the 2011 well productivity has continued into 2012 and perhaps through 2012 (too early to say for sure).

There could be a combination of strategies resulting in a stabilization of the well productivity; technological improvements; more focus of activity to the sweet spots as better mapping and understanding of the trend develop with time, new emerging “sweet spots”…..we will know more as more data become available.

- Rune

"The total flow for the first 12 months (84 000 Bbls) for the “Average Bakken ND 2011 well” contrasts the NDIC typical well that has been used in various presentations and which suggests that the typical well in Bakken North Dakota has a total flow of 169 000 Bbls during the first 12 months."

This appears to be a tremendous discrepency. If you are Darwinian and don't believe in conspiracies, then you believe the ND numbers ("Why would they lie?"). On the other hand, if Rune is anywhere close, then why would ND continue to promote those high average well production numbers, since by now they must know they are wrong?

Right now, since all the recent independant estimates of "average" Bakken well production (for instance, by Hughes, etc.) are all much lower than the ND-promoted averages (and closer to Rune's numbers), then right now I have to assume that ND's numbers are more about promotion than reality, and one begins to wonder about any of the numbers they put out.

Elmo,

More on NDIC numbers for typical Bakken well;

https://www.dmr.nd.gov/oilgas/presentations/WBPC2011Activity.pdf (big pdf document)

Link above to a NDIC document, slide no 10, shows 427 Bbls/d (average per calendar day, 156 kb for year 1) for Year 1 for typical Bakken well

https://www.dmr.nd.gov/oilgas/presentations/presentations.asp (big pdf document)

Link above to another NDIC document slide no 10, 486 Bbls/d (average per calendar day, 177 kb for year 1) for Year 1 for typical Bakken well

I got my numbers from a different public document (“Oil and Gas Production Tax Comparison, Montana and North Dakota") showing 467 Bbls/d (average per calendar day, 170 kb for year 1) for Year 1 for typical Bakken well.

- Rune

Rune, where am I wrong? the graph on page 10 of the first link shows the “typical” Bakken well starting Year 1 at 923 b/d and ending the year at 486 b/d, for an average of 705 b/d rather than 427. Times 365 makes it slightly more than 257,000 barrels for the first year, rather than 156,000 barrels.

In any case, any hunches how the NDIC results can be so far off from the independent analysis of yourself, Hughes, and Bernstein? Your estimate of 84,000 barrels/yr. comes in at 230/d for the first year. Bernstein’s graph suggested about 238/d. Hughes' graph suggested about 325/d.

The first number is the IP (Initial Production, 923 bbl/d) number, the second number (427 bbl/d) is average daily flow for year 1. Then follows average daily flow for year 2...etc.

Deviation from Bernstein may be due to number and actual wells used, cut off for the analysis (data as of October 2011 versus December 2011) etc.. A deviation should be expected, but not a a big one.

Hughes I am not sure of, but there it could be selection of individual wells and/or looking at "fields" also including wells in Montana.

Did this help?

Rune

Well, if you somehow know from someplace other than the graph or the link that the other numbers are averages for the year but the 923 is instead the start of production at time zero, than I will have to take your word for it. Because even you have to admit that there is no way anyone could discern this from the graph and it is not explained in the link.

You are pretty sure the other numbers are not production at the end of each year, right?

Elmo, if you download one of the presentations and look at the production/well profile you will find that the first number starts at year 0, the second at year 1, then the numbers follows the years, apart from that I have it from reliable sources as well.

Rune

I understand exactly what Elmo is talking about. There has to be some sort of average for the initial production value. Depending on whether this is averaged over a day, a week, or a month, you will likely see different numbers.

Even though there is noise in this measure, from a modeling perspective it is important. What happens with diffusional models, is that you can see a singularity at delta time. But this quickly dissipates, and if you know the time the initial production is averaged over, you can use the averaged value in the analysis. Otherwise it is not used.

WHT,

The IP number is not a reliable indicator for future production. I have seen data on wells with high IP and fast declining flow and wells with low IP and turning out to be very good wells.

And I agree, the presentations should have specified what the numbers are, I have seen presentations doing just that. Normally IP is over one day (these are specified in the NDIC data for each well), and yes there are great variations in the IP numbers.

After discussing the best approach to handle this it was found that looking at full time series data over at least 12 months of reported production was the most reliable (and time consuming) method.

I am leading Elmo to the data sources and explaining how to read them (or he may seek clarifications from other professionals). Elmo is capable of understanding the data and also starts asking the right questions...which is good and I wish more people would do that.

What I have seen is that as people get access to the data source and read them by themselves they may form an independent opinion from them...thing with hard data is, they do not lie.

Yes, there will be some noise, but if several studies arrives to numbers in the same area then it is possible to reduce the influence from noise. Elmo referred to Bernstein that had arrived to similar numbers as me (some deviation should be expected, I have not included dry wells and wells with tiny and erratic flows).

- Rune

Rune,

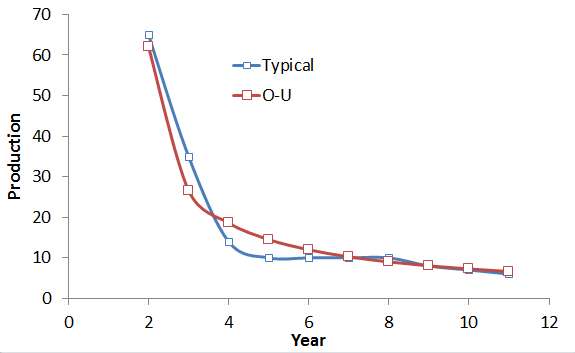

This is a diffusion model fit to the "typical well". It is a bit different than the diffusion model that I have used in the past because it uses what is called an Ornstein-Uhlenbeck (O-U) process random walk.

The O-U process places a "drag" on the random walkers causing a reversion-to-the-mean, which describes a flow that can't get to far from its starting point.

What is interesting about an O-U process is that it has a steep drop and then it transitions to what looks like a fat-tail before it goes into a thin-tail exponential decline. Note that the Initial Production value I used in the model was an average over the first 3 months. That is how I got it to match to the IP data point.

This particular fit gives a cumulative of 600,000 barrels for the typical well, which is probably about double the amount that you are getting with your analysis.

I think Bob Brackett from Bernstein Research is also suggesting 250,000 barrels cumulative for the average well. OTOH Mason's analysis is saying 600,000 barrels or above.

I believe your point is that the "typical well" is an inflated number in comparison to what you are seeing. Are you saying that it is inflated by a factor of two?

WHT,

First, thanks for sharing. I think it is difficult to predict the decline (call it average decline) several years out in time. It becomes educated guesses. The "typical" Bakken well you used (from NDIC/DMR I take) would have an EUR in the area of 600 kb (crude oil) after 40 years.

The "average 2011 well" that I used was defined from around 200 unique wells from all over Bakken starting to flow in the period June 2011 - December 2011 (12 months of reported flow or more).

If I apply the decline rate as used by NDIC/DMR as from year 2 and on wards I get an EUR of around 450 kb (crude oil) after 40 years, but again it is difficult to predict future decline rates.

I used a decline rate of 46% from year 1 to year 2 for the well that was derived from actual data.

The typical Bakken well by NDIC/DMR has a decline rate of 65% from Year 1 to year 2.

The differences in the decline rates (around 20% from Year 1 to Year 2) works out to a big difference as it is compounded over several years.

So if I apply NDIC/DMR decline rate from year 1 to year 2, the EUR for the "average 2011 well" becomes far less.