More thoughts on Prudhoe Bay

Posted by Heading Out on August 8, 2006 - 11:41am

To begin with, thanks to Westexas, the cause of the corrosion appears to be known.

And a tip of the hat to Mike A for an UPDATE, I have moved into the post on these bacteria. (8:35 AM)

And (10:35 AM) I also added a note on where Platts suggests the relief supplies might come from. It gives an idea of the global nature of the business. I also add a comment from the Oil and Gas Journal that perhaps I got out too far by assuming that the new corrosion was the same as the old.

[editor's note, by Prof. Goose] EIA says Prudhoe Bay back to normal after January (thanks Darwinian).

Flow from the individual wells in the field has been decreasing, Triffin (ibid) also noted that:

The average well production rate was about 546 barrels of oil per day in 2001, 375 barrels per day in 2002, 350 barrels per day in 2003, 317 barrels per day in 2004 and 293 barrels per day in 2005.Since the diameter of the pipeline remains the same, as the flow drops, then so does the speed of the oil through the line.

The petroleum news article explains further.

All indications are that the corrosion that caused the hole in the transit line was biological in origin, caused by sulfate reducing bacteria inside the pipeline, Johnson said. . . . . The bacteria form in water, so that problems associated with microbiological corrosion tend to be associated with water carrying pipelines, such as the lines that are used for waterflood operations. . . . . . BP has viewed oil carrying transit lines, such as the line from GC-2 that developed a leak, as much less susceptible to corrosion than a water bearing line. But the company has regularly monitored the Prudhoe Bay oil transit lines for internal corrosion using two techniques: ultrasonic testing and the use of corrosion coupons. . . . . . The company ran a smart pig through the GC-2 transit line in 1990 and again in 1998. According BP's incident investigation report for the transit line oil spill, the 1990 pig run "noted nothing of significance" and the 1998 pig run "showed moderate internal and external corrosion". The evidence for corrosion in 1998 was confirmed by ultrasonic testing -- BP subsequently used the ultrasonic testing to monitor any continuing development of corrosion in the line. . . . It was only in an inspection in September and October of 2005, that evidence of increasing corrosion activity started to appear. . . . . . . However, an inspection of the line after the March 2006 leak showed evidence of high rates of corrosion, even in place that had been free of corrosion in the fall 2005 inspection. Clearly, there had been an exponential growth of corrosion, culminating in the hole that caused the oil spill.It was in surveying the miles of pipe following this initial accident that the problems with the corrosion damage throughout the transit pipe network have become apparent. Corrosion pits have penetrated almost all the way through the wall in over 12 places. The article notes that the accelerated rate of corrosion is of considerable concern, and posits two different possible causes. The first is due to the nature of the oil that comes from GC-2, which has a higher solids content. These might have adsorbed some of the corrosion inhibitors that are injected into the line, diluting the concentration beyond the point that they were effective.

The other possible cause is a little more worrying. It was noted that the corrosion occurred in the section of the pipe from GC-2 before it joined the flow from GC-1 on the way to the terminal. The speed of the oil is slower where the flow is from only one center. This suggests that as the field production declines, and flow slows, the corrosive bacteria are being able to settle and pit into the walls of the pipe. There are two worries here, one for the transit network, as flow declines, but also now perhaps for the main Trans-Alaska line also, since as flow diminishes (as it now is) both now, transiently, and permanently in the future, then the speed at which the oil moves will also drop. And apparently there may be a speed at which, all of a sudden, bacteria, and thence corrosion, blooms.

The need to make sure that the problem is completely addressed, BP cannot afford another spill, is probably behind the decision to replace at least 16 miles of the pipeline. Since they must also satisfy the Alaskan authorities, the process is likely to take longer rather than shorter.

Oil production at Prudhoe Bay could take six months or, perhaps, as much as a year to return to normal, Societe Generale said, citing an assessment by one of the bank's engineers with an oil-field services background.So what do we do in the meanwhile.

"Three weeks is the absolute minimum," said Deborah White, an energy analyst with Societe Generale in Paris. "Six weeks makes a more likely base case." . . . . . Signaling that the pipeline maintenance effort would be more complex than originally thought, Bob Malone, president of BP America, said BP would replace the field's main transit lines as part of a "wider plan in restoring production and operations in a safe manner." BP will also conduct a study, together with supervising government agencies, to determine if it's possible to continue production from some parts of the field, Malone added.

Totonella pointed to where the Alaskan oil went, when there was more of it:

Puget Sound: 419,521 barrels/day

San Francisco 123,870 barrels/day

Los Angeles 333,006 barrels/day

Hawaii 42,682 barrels/day

Exports 78,763 barrels/day

Source: Alaska Department of Revenue.

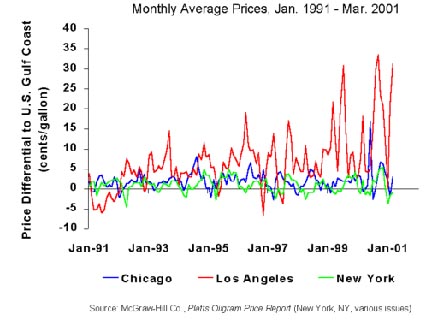

And if one goes to the EIA, they have correlated spot shortages with retail gas prices. It does note, perhaps a little smugly, that the west coast (PADD 5) is almost self-sufficient in gasoline and low-sulfur diesel. However, the downside to that is that gas prices have been the most volatile of the country.

There are two principal reasons for the greater price volatility in California. First, only 13 refineries in California supply the gasoline and diesel fuel markets in that State. The unexpected loss of supply from one of the larger refineries represents the loss of a significant share of supply. Second, the California Air Resources Board (CARB) product quality requirements for both reformulated gasoline and diesel fuel are more stringent than any other in the United States and all other countries. Because California does not routinely receive product supply from outside the region, refiners in the U.S. Gulf Coast and other countries that may be able to supply CARB quality products do not maintain inventories of these products and any possible response to meeting California supply shortfalls will be delayed. Consequently any unexpected disruption of supply from a California refinery results in short-term price increases.On the other hand they did not find a consistent response to incidents. So I suppose we will have to watch this one play out.

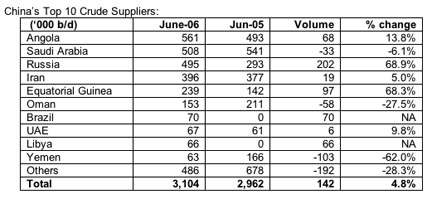

In the same way it will be interesting to see, given that the oil seems to need to be refined in CA to meet their specifications, where they get it. It can either be piped from the Gulf, or it might come from OPEC. Well if we look at where Intertanko tells us that China is getting their oil, maybe we can see who is shipping that way.

Well Saudi supplies to China have been dropping, and they have those tankers full of oil, with no place to go . . . . . .? (Of course the refineries would have to be able to refine that oil . . . .)

It will be interesting to see.

UPDATE: 8:35 AM EST

And, thanks to Mike A there is more information on the bacteria that are causing the problem.

I'm a corrosion engineer in the industry with some experience with sulphate reducing bacteria (SRB) so I'll give a quick primer on SRB for those that are interested.One thing that this event has the potential to show is that oil is possibly entering a phase where it stops being fungible. We have seen some of that in the difficulty that Saudi Arabia have encountered in selling some of their heavier crude. Now, from the other side, the serious question arises as to where the California refineries can find a crude that they can refine. It is not that easy, as an article in Platts discusses. (Hat tip for the tip ). However, it also suggests that BP are not totally unprepared.SRB are small (5 microns long by 1 micron wide), anaerobic (require absence of oxygen) and ubiquitous, a typical North Sea concentration might be 1 cell per gram. When conditions are right they can multiply to the level of millions of cells per gram and generate significant quantities of hydrogen sulphide (H2S). The H2S together with the stagnant conditions formed by the colony on the pipewall lead to enhanced pitting corrosion rates, which are on the order of 1-2mm/year, depending on conditions.

SRB get their energy from the reduction of sulphate(SO4 2-) to sulphide (S 2-). They thus require another species to be oxidised, usually volatile fatty acids (VFAs) such as acetate (i.e. vinegar!) which are present in most reservoir waters. The requirements for their growth are:

1 Nutrients, ie. sulphate & VFAs for their metabolism, together with trace nutrients such as Nitrogen & Phosphorous

2 Moderate temperature 5-50 deg C, although some thermophiles can grow at temps up to 70 deg C

3 Moderate pH (~5-10), salinity (less than 5-10%) and pressure (less than 500 bar).

4 Absence of poisoning species such as oxygen or biocide chemicals

5 Low enough flowrate to establish colonies on the pipewallI'd say in the alaskan pipelines all the physical conditions of temperature, pressure, salinity, lack of oxygen and flowrate were met. Acetate and other VFAs will normally be presented in produced reservoir formation waters.

Often reservoirs will sour (ie. start producing H2S) after seawater injection as the seawater provides a large source of sulphate ions. It normally takes many years for injected seawater to make its way back to the producing wells but if this has occured that that could be the source of the sulphate for the SRB.

"There's about 3 to 4 million barrels of unsold Persian Gulf crude in September; this will help clear it," said one Asian crude trader. He added that "it's in a small number of hands, so will get done quietly." The source noted BP and Shell recently had been buying additional volumes of Persian Gulf crude, possibly in anticipation of a Prudhoe Bay shutdown, which has been experiencing problems for several months.I just noticed a couple of sentences in the story in the OGJ that suggest that the corrosion is not the same as that discussed above, and which caused the March pipe failure.

BP Alaska Pres. Steven Marshall reported a wall thickness loss of more than 70% in the 30 in. pipeline. He said the corrosion appears to be of a different type than the corrosion that was responsible for a Mar. 2 leak in Prudhoe Bay Operating Area pipelines. "Clearly, there is another corrosion mechanism occurring here," Marshall said.

So if this issue of corrosion is problematic due to reduced flows, has this been documented elsewhere (like in West Texas for instance) or is it only the reduced flows in combination with the arctic climate and specific nature of the crude from that basin?

Basically, is this a problem that could recur elsewhere (or has already occured) anytime flow through pipelines drops a certain amount below the optimal range.

major, you know how we like charts here.....can you deliver a chart to demonstrate the validity of that position?

:-)

...you gottta' laugh, this has without a doubt been one of the most outragous days I CAN EVER RECALLL, in logic, in press coverage, in wild and stupid assertions both here on TOD and all over the energy and national press.....it has now completely entered the real of "Bizarro World". I have NEVER SEEN such an open and obvious attempt to whip up histeria to the max, to creat fear, and to drive the price higher with assertions that are COMPLETELY STUPID ON THE FACE OF IT. Linking this idiotic situation to "peak" in any way will only serve to discredit peak as a subject of serious study,

With the histrionics I have heard today, I would like for someone to tell me how anyone is going to accept any advice from anyone involved in the "energy speculation game", and the operative word here is GAME.

What a freakin' joke.....

Roger Conner known to you as ThatsItImout

Once a sulfur-reducing bacteria colony gets a good toe-hold they create a tough-as-hell shell. Scraper pigs won't dislodge them in the worst case. Then the acids that they metabolize burn a very neat hole straight down. You'd swear that some holes had to have been done with a drill; perfectly circular with clean, straight sides. These guys are really bad news.

I managed a few smart pig surveys like the ones that I imagine found the corrosion in Alaska. The technology is was pretty amazing 10 years ago, and it must be Star Wars-like today. With decent maps and a good odograph (yuk, yuk), we could usually make one backhoe hole to find the corrosion. And the corrosion was always there. Although sometimes the anomoly was actually from some very, very lucky backhoe operator sometime in the past who almost had a really bad day.

Heh, heh. I spent two years in Ponca City myself. But I will never, ever move to Lake Charles.

Gotta love zydeco.

Sounds like a new John Carpenter movie is in the works.. maybe Jim Cameron.

You even have to provide the appropriate ecosystem: pig launchers, pig traps, pig signallers, etc. A pipeline system is much more than just some round steel that you punch a hole through. Just make sure that OD > ID.

BTW they got their name from the sound they make as they travel the line.

True story? I don't know. Does anybody know?

I find it interesting to consider the timing of this event. If energy prices soar before November, the republicans stand a poor chance in the polls. If however, a great deal of oil is let out of the strategic reserve around that time, energy may take the back burner to whatever contrived panic the media stirs up that week. Furthermore, if an energy event occurs in the late summer/fall causing consumer to become accustomed to $4 per gallon gasoline, then this event is suddenly resolved in, say, late October, I think we could be looking at the same strategy as releasing oil from the reserve. Hopefully, the whole situation will backfire and leave us with $5 per gallon gas by election day...

Another interesting timing factor: BP, Exxon, and COP have now potentially arrived near the closing phase of a $20-30 billion natural gas deal (with arguably extraordinary "incentives," credits, and tax bennies regarding both oil and gas).

Alaska governor Murkowski has adopted a posture of being more eager to close even than the Big 3, who simply seem to have outfoxed the governor from day one. Meanwhile, for re-election this fall, Murkowski is not doing well in the polls, and for some time it has seemed that the legislature would not approve a variation on his package deal.

Now, suddenly, with the pipeline closing, Alaska's primary revenue source (90%-ish?) has dried up. Gasp. Suddenly during the last days of legislative special session, we've been delivered a new incentive to close the deal.

I have been pretty much only reading here and the articles linked here, but shutting down the largest U.S. oil field for an indefinite period is connected to peak oil in one concrete sense - which producer or combination of producers will now make up for a significant shortfall likely to last months?

Since I don't believe in any oil industry meta-conspiracy (I do believe that oil companies will act in a normal fashion to maximize profit in ways which many would consider indecent), this is one of those rare windows into reality - the pipeline will truly be delivering less.

If the shortfall can be compensated (which opens its own can of worms between short and long term), obviously with a time lag, peak is not really here. If replacing 400,000 barrels a day of formerly fairly average quality crude on the world market is not possible in any realistic time frame, I would consider it a sign of peaking to peaked production.

I do wonder how crazy the speculation has been.

If you look at NYMEX crude prices over time and did not know there was a pipeline issue starting would you really be able to point out that the price was so different there had to have been an event this week?

I think NYMEX crude prices are close to business-as-usual. Only a slight increase has occurred yet.

Although there may be "plenty" of oil in the ground, it gets harder and harder to produce. This results in a peak well before all the oil is produced. One of the things that makes oil production more difficult is corroding infrastructure. It's not difficult to understand. If we're near peak, then this could rush us to peak a little earlier. The return of the 400,000 bpd, if it happens, may not make up for declines following the premature peak, which would make that the actual peak.

Tony

Is there a standard definition? To me "Peak Oil" is short for "peak (maxium) oil production rates".

I have seen articles, even from ASPO, that use the term "peak" to refer to non-global oil production rate peaks. For instance Colin Campbell writes that the FSU had multiple production peaks.

400,000 barrels off line for two or thre months, will insure that US oil production in 2006 will be lower than hurricane reduced US production in 2005.

US domestic oil production of crude only (not counting condensate) averaged 5.097 mb/d in 2005. This year through week ending July 28, US crude production had averaged 5.083 mb/d. But production was climbing fast as we continued to recover from hurricane damage. It had reached a yearly high of 5.275 mb/d the week ending July 7th. But last week we saw production drop to 4.94 mb/d. And I suspect it will drop a little further this past week. Now there is little chance that US 2006 production will surpass 2005 production.

The data for week ending August 4th will be on the net tomorrow at 1PM Eastern time at:

http://tonto.eia.doe.gov/oog/info/twip/twip_crude.html

"Tony, you are exactly correct, this has everything to do with Peak Oil. If we were not at or near the peak, then 400,000 barrels off line would be no big deal. Only in a very tight oil market could such panic be caused by such a small cut in oil supplies."

That's exactly my point....400,000 barrels is no big deal.

"Only in a very tight oil market could such panic be caused by such a small cut in oil supplies."

Give carte blanche control over OPEC and and Alaska supplies, and I can make a tight oil market....I don't need peak to do that.....no conspiracy theory either before folks start screaming their head off, just good control of your product, you would do it in any business.....

Roger Conner known to you as ThatsItImout

Now of course, we assume coordination between these players....

Algeria, Indonesia, Iran, Iraq, Kuwait, Libya, Nigeria, Qatar, Saudi Arabia, UAE, Venezuela....uhh, that's called OPEC, a sum greater than the combined nation areas you mentioned....and over half world production the last time I checked. Let's play through a few of the remaining ones you mentioned...Nigeria, small player, but we need um', Khazakistan, let the devil have the hindmost, no one knows where to find Khazakistan, and only the Europeans care...Angola, we keep hopin', but a marginal, the North Sea, call the ambulance, this ones on life support...continental U.S., still important to us, but I think Hubbert himself kind of explained our "flexibility" after 1970, Alaska, please, don't, laughter causes my side to hurt, Brazil, who "supplies" themselves, and the loose catagory of "most other major suppliers" (???? Addresses, names, we need NAMES!!)

Now most folks here assume that the majority of the nations above are peaked (conspiracy theory? No, it's a fact of history in many cases, and consensus based on visible evidence in some others....but some say they are not peaked, so there would need to be a conspiracy to hide it), and proceed to say of OPEC (we don't know if it's peaked or not...conspiracy to hide it?) that of OPEC, "as Saudi Arabia goes, so goes OPEC, and as OPEC, so goes the world (check the very good posts by Westexas), so The long and short of it is, do I need to be in "conspiracy" with Khazakistan to create a tighter oil market?

Greyzone, I think you were involved in a string on Aug 5th called " Heinberg: Middle East at a Crossroads" in which I was also involved. In explaining the incongruities of explanation for what seemed to be almost exactly the same results in 1979 through 1981 as we are seeing today, they used two major explanations: War (question: Is it possible there could be a war issue in the Persian Gulf today?) and to use another poster of long standing at TOD's own words,

"But the vast majority of us knew very well that OPEC was manipulating production and that the production swings was due to OPEC control and not anyone peaking."

My answer remains as it did then: And yet, if control and " "manipulating production" then (1979-1981) could create a situation where every Gulf state and in fact world production could drop for a half decade, and Saudi Arabia could stand at "plateau" for the full decade of the 1990's, why is it considered the ultimate horrendous sacralige to be considered remotely possible today? Do we assume the world oil producing nations have renounced all desire for Earthly gain, and taken at last the vow of poverty (chastity? ummmm....perhaps later....)

J'accuse...you say....

"You claim no conspiracy needed then cite one as the basis of your post. Circular logic in the extreme."

Whom did I accuse of conspiracy with who, who are the conspirators? I would make the case that if I accept the logic right here at TOD, then Saudi Arabia could engage in a conspiracy of one....no one knows their true production, their true capability, their true URR, and as the wise men say, "as Saudi Arabia, so goes the world"....it is to be noted that here, to speak of a "conspiracy of one" would be forbidden because it uses the concept of conspiracy! But to call the Saudi's bold faced liars is considered a great sport! (o,k, it may be justifiable sport and great fun, but still...)

I must close confronting you with some hard questions my friend.

How is it that folks here at TOD will blush as though they have seen a great sin, foul indecency, or Lady Godiva upon her stallion, will cringe and turn away (!) from any suggestion that the producers of oil would act in their own behalf, and exercise their right to hold some sway over supply, (gad, man, De Beers has been doing it for over a century!!),... while having no difficulty accepting with no evidence or proof the idea that their suburban neighbors will in fact beat them with shovels to a merciless death in their happy post peak garden just to steal a bushel basket of their rutabagas!

P.S. you guys have got to help me kick this writing habit, it is just too much fun! :-)

Roger Conner known to you as ThatsItImout

I think that the common link regarding "Peak Oil" is aging infrastructure and rising water cuts in the large fields. Simmons talked about the problems the Saudis are having with increased corrosion as their water cuts rise.

As I noted elsewhere, all of these old, large fields are on their way to where the East Texas Field is now--99% saltwater and 1% oil (oil stained brine, as Matt Simmons put it).

Having said that, the Ghawar decline (probable but not officially confirmed) and the Cantarell decline (officially confirmed) stories are actually much bigger stories than Prudhoe Bay. I would guess that the ratio of Prudhoe Bay stories in the MSM to Ghawar/Cantarell stories is on the order of about 100:1.

Ghawar has produced about five times as much oil as Prudohoe Bay, and the (Heinberg) reported decline of about 2 mbpd at Ghawar is five times what Prudhoe Bay was producing before the shut-in.

The rise and fall of the large oil fields is the reason that we can compare all of these regions to each other using the HL method, and the fact that we now have credible reports that all of the four largest producing fields are now declining is a key reason that I believe that we are on the downslope of peak production.

Hubbert accurately predicted the Lower 48 peak. An associate of Hubbert's, Deffeyes, using a simplified version of Hubbert's technique, predicted a world peak for late 2005 (within a range of 2004-2008), and world production is down since late 2005. I don't see any conspiracies here. I see simple--and relentless--depletion.

What are you nuts? A lightbulb goes out in Bangladesh and it taken as proof of peak oil. A rusting pipeline must be triple proof. Maybe quadruple.

Perhaps you could elaborate?

A good example of everyone panicing would be 9/11, when half the country went mad that day. Rumors, gossip, hearsay. People lining up at the pumps to try and get gas, runs on the stores for everything from milk to clothing.

Another minor example -here in the South, everytime there's a hurricane in the Gulf (and we're nowhere near the coast), or a winter storm coming through, everyone and their brother runs to the store for milk, bread, flashlights and the like.

External stimuli finally illiciting a response?

Now, if it all blows over and things go back to 'normal', people will forget and go back to their normal habits like nothing ever happened. I think it will take a few more shocks for people to wake up to the fact that PO is real, this is serious, and the situation is likely to be permanent.

Just MHO.

"The sleeper must awaken!"

There might be a good model for PO transition in there somewhere...

"He who controls the spice, controls the universe!"

As for hurricanes, well, Southerners are just stupid that way....

Finally, if the cause of corrosion is biological, presumably they will check the entire pipeline. Has this been done, or will there be further output restrictions?

http://www.platts.com/Oil/Resources/News%20Features/prudhoe/index.xml

Great link--Everybody needs to read this!

That is a very informative link on the West Coast problem of securing the correct API ingredients to efficiently process crude through the refineries.

It also states that there is no GoM to West Coast pipeline--Heading Out, have you made a small mistake in your original post for this thread? Whether or not this pipe dream exists or not is something we definitely need to clarify once and for all.

Bob Shaw in Phx,AZ Are Humans Smarter than Yeast?

Makes it a little harder to explain why we had a post-Katrina price spike out here, doesn't it?

I suppose some will suggest that the flow of refined products from California went east, restricting our supplies ... but I wonder how much was just an emotional reaction in the markets.

"Steve, the way this would work in practice is that gasoline from New Mexico or Texas would be piped east rather than west. The bottom line is as if a gallon of gasoline were "shipped" from California to Georgia, though of course the market would accomplish the same thing in a much more efficient way."

I think that's where I got the bit about "flow of refined products from California [going] east"

http://www.econbrowser.com/archives/2005/09/lockyer_to_the.html

This seems to mirror the UK gas situation at the moment. We have a free market for our oil and gas, but continental Europe doesn't. We sell our oil and gas to anyone with money, but nobody will sell us any gas when we need it in winter. Could be hard for California to get the extra supplies of oil it needs. It certainly won't be quick. They will have to import extra petrol from somewhere, with a time lag built in. Perhaps there will be politicians saying people must conserve (wonder if Cheney likes that comment) and drive less.

And when Gazprom cut supplies, Italy and France faced 25% shortfalls - there isn't any magic natural gas fairy in the EU, the same way there isn't a magic petrol fairy in the U.S.

OK... so 400,000 barrels per day, divided into 4 million, is 10 days.

Where will the other 21 come from?

Chris

(Yeah yeah, I read the sludge story.)

Can anyone answer that with a high level of confidence?

Near the end of your posting--you said FFs could be piped from the GoM to CA. I apologize if I missed an earlier posting on this, but do you know the transit volumes and transit time, and if this would be sufficient to safely resupply CA, OR, WA, NV, and AZ? This is info that I was not aware of, but it is a relief to know that tankers will not have to make round trips past the Falkland Islands.

Also Greenman's earlier posting on Panama's Isthmus pipeline states that it was used one-way [West-to-East] when utilized back in the 80s [link info was '87 dated]. Do you know the current operational status and if the pipeline is bi-directional?

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

http://www.gasandoil.com/goc/news/ntl24027.htm

The page is dated:

volume 7, issue #19 - Tuesday, October 01, 2002

Could the warming due to global warming be the driver behind the bacterial infestation?

One realistic dynamic in this affair is the reduced flow rate. The pipes were sized for a particular flow rate. As flow rates slow down, water starts to settle out and create a nice micro-environment for galvanic and bacteriological corrosion.

Increased galvanic corrosion in The Great White North, eh?, could possibly be correlated to warmer temps. Galvanic corrosion is the garden-variety corrosion that we are most familiar with. And it requires an electrolytic medium for electron transport. Moisture in the soil provides that path in the case of pipelines. Cathodic protection systems are installed to mitigate corrosion. I don't know, but would suspect that corrosion slows to a virtual stanstill when the soil is frozen.

Now I'm curious. Anyone familiar with CP systems in The Great White North, eh? Are they operated differently during the winter than in the summer? Eh?

My partner was involved in modelling the effects of geomagnetic storms on transmission systems a few years ago, and other erstwhile colleagues have been doing the same for pipeline CP systems (see here for the title of one paper and excerpt from the introduction). Pipelines at high latitudes would be most at risk from this type of problem - initiating corrosion which could then increase the impact of other corrosive agents.

None.

Fascinating. So a serious charge could be generated on the pipeline, concentrate at a certain point, and then blow a hole through the polymer or tape coating through an over-voltage. Yep, if that mechanism exists, then the resulting failure in the coating would be a problem.

For those who don't know, corrosion defense for a pipeline system is generally a layered approach. The first line of defense is a coating on the exterior of the pipe that acts passively to hide the steel from the evil agents of corrosion. For mainline pipe, the steel arrives on the job site with an extruded polymer coating. Special tape is also wrapped on the pipe for a variety of reasons: compromised polymer coatings, thin spots, clumsy welders, or manifolds.

A second layer is a CP system that actively creates an electric potential that keeps those rascally electrons in their place. Excuse the over-broad handwaving, but a technical discussion could be quite long and would not contribute greatly at this stage.

In essence, the electrons in the pipe steel want to go to ground and the CP system creates a barrier. They are in a higher energy state and will gratefully take any opportunity to go elsewhere. I sense some parallels to Hollywood stars and fidelity here, but we'll leave that for now.

The voltage difference that electrons in the steel see between their present state and elsewhere is slight, less than a volt. But the number of electrons in a pipeline system is pretty big. More than at least 12 I should think. Yeah, definitely more than a dozen. I feel pretty safe there. When the pipe has a gap in its coating, this area suddenly sees a greatly reduced electrical resistance between the pipe and ground. So all the electrons for miles around take this spot as their chance to leave.

If the CP system is shut down, poorly maintained, badly designed, or any of the other hundred reasons why complexity is so hard to maintain, corrosion rates can get pretty hairy.

Question? Does the technology exists in applying a liner in the existing oil pipes like that is used in other piping systems? It seams that this would reduce the down time immensely in getting oil flowing once again.

But in practice where real dollars are at stake, not for any non-trivial application.

You could build a case where a sufficiently small pipeline for a sufficiently valuable product could justify the cost. But it would be dead-on-arrival in this case.

A pipeline system is a reasonably complex thing. And a gathering system, as this seems to be, is very complicated. There are likely to be a number of different diameters of pipe. It probably grew hodge-podge as the field was developed. There are specialized fittings that reduce pipe size (concentric and eccentric), turn corners, provide branching points, etc. Significant waterways, roadways, etc. are usually provided with block valves so that a rupture can be mitigated by closing the valves; oil companies want to keep the oil in the pipe just as much as the next person, albeit for different reasons. Pumping stations have got a whole suite of complexities with manifolding, pig stations, etc. making a mess of an internal coating project.

Generally, corrosion in a modern pipeline system will be fairly localized. In this sort of situation it's relatively simple to cut out a small section and put in a 'pup' as short sections of pipe are called. In the bad ol' days bare steel was just thrown in the ditch and after enough time you really have to rip it all out and start all over. The Louisiana gathering system that I worked on had some really bizarre stuff, and there was some butt-naked pipe that had been in the ground for decades. Whoo--weee!

I think I've heard '16 miles' as the amount of pipe to replace in Alaska. I'm puzzled why so much. And I wonder how readily available that much stock is. I've never been up there, but isn't the summer season the wrong time to do significant work? Logistics may be a real bugger. Wanta make some money fast? Go bring a few containers of mosquito headgear to the North Slope!

Bjj, did you forget to put a smiley face after this statement? Humor seems so out of place in this post. Otherwise what the hell are you talking about?

;)

It's not really a case of bacterial 'infestation', because, as was pointed out by a previous poster, sulfate reducing bacteria are ubiquitous. They are everywhere and just need the right conditions to multiple to dangerous levels and do their dirty work.

Nor is it just oil pipelines that have this problem. Pitting caused by sulfate reducing bacteria is also a common problem in potable water distribution lines. It's almost like plaque that forms on your teeth. A crust develops, and then bacteria find a nice cozy place underneath the crust to do their thing.

Also keep in mind that even though the flow of oil through a pipeline is turbulent, there is still a thin relatively quiescent 'boundary layer' of oil between the pipe wall and the main body of flow. This is probably why bacterial colonies are not automatically swept away by the flowing oil.

Alternatively, is there a way to reconstruct the pipes such that they can flow faster with less oil, hence less corrosive?

Good question, I have another one: is it possible to keep the speed up in the existing pipeline when there is less oil?

In other words, if the slow-flow-boosting-bacteria-growth theory is correct, is there a cheaper way to resolve the problem than the huge expense of replacing the pipeline? I can think of two possibilities offhand - both pretty wild, admittedly:

So I don't see why it'd be a serious problem, as you can pump 3/4s oil and 1/4 water with buffers at either end to keep flow rate up.

Don't mean to jump you, sorry.

The idea is to keep H2O out, not deliberately put it in. And this situation shows how sneaky water is and will resist attempts to get it out. Despite what I've seen in the press, I actually trust that the BP pipeline folks actually have pride in their work and generally take prudent steps to run their system professionally.

And lastly, Alaska has another attribute that would argue against using water. Hint...0 deg C. Imagine how frantically they would be working right now if the engineers were saying, "umm boss, we have to start the pumps back up in 48 hours or we're going to have a 73 mile popsicle on our hands."

thanks for the imagery

so now I'm trying to visualize emptying this pipeline.

needless to say I'm drawing a blank

Good grief man, do you know how dangerous that could be? The hot air emissions could set the whole thing ablaze!

A woman is driving down the same road.

As they pass each other, the woman leans out of the window and yells "PIG!!"

The man immediately leans out of his window and replies, "BITCH!!"

They each continue on their way, and as the man rounds the next corner, he crashes

into a pig in the middle of the road.

If only men would listen.

By next morning, and after having not slept, she still is unsure if she had killed the supreme being.

PO is a gloomy topic. Gotta have some humor to keep your sanity. Cheers.

It can definitely work as a screen for English comprehension, though.

Ever seen that show,"The Office"?

As long as you and Donal laugh, I'm happy.

SRB are small (5 microns long by 1 micron wide), anaerobic (require absence of oxygen) and ubiquitous, a typical North Sea concentration might be 1 cell per gram. When conditions are right they can multiply to the level of millions of cells per gram and generate significant quantities of hydrogen sulphide (H2S). The H2S together with the stagnant conditions formed by the colony on the pipewall lead to enhanced pitting corrosion rates, which are on the order of 1-2mm/year, depending on conditions.

SRB get their energy from the reduction of sulphate(SO4 2-) to sulphide (S 2-). They thus require another species to be oxidised, usually volatile fatty acids (VFAs) such as acetate (i.e. vinegar!) which are present in most reservoir waters. The requirements for their growth are:

- Nutrients, ie. sulphate & VFAs for their metabolism, together with trace nutrients such as Nitrogen & Phosphorous

- Moderate temperature 5-50 deg C, although some thermophiles can grow at temps up to 70 deg C

- Moderate pH (~5-10), salinity (less than 5-10%) and pressure (less than 500 bar).

- Absence of poisoning species such as oxygen or biocide chemicals

- Low enough flowrate to establish colonies on the pipewall

I'd say in the alaskan pipelines all the physical conditions of temperature, pressure, salinity, lack of oxygen and flowrate were met. Acetate and other VFAs will normally be presented in produced reservoir formation waters.Often reservoirs will sour (ie. start producing H2S) after seawater injection as the seawater provides a large source of sulphate ions. It normally takes many years for injected seawater to make its way back to the producing wells but if this has occured that that could be the source of the sulphate for the SRB.

Thxs for this info. Any guesses on how far down the pipeline this corrosion has occurred? Do you think the pumps and manifolds are significantly corroded too? Does 50 miles of pipe seem reasonable, or for enhanced safety and future uptime should they just go ahead during this shutdown and replace all pipe to the top of the Brooks Range?

Bob Shaw in Phx,AZ Are Humans Smarter than Yeast?

How far down the pipeline the problem goes entirely depends on the conditions. Pumps would not be at risk as the flow rate would be too high for SRB colonies to form on the metal surface. Similarly, manifolds may have too high/turbulent flow for establishment of the bacteria. Also manifolds are often at a much higher temperature which could be a factor.

Regarding length down the pipe the problem extends, this would depend on the amount of nutrients originally present. If there is only a relatively small amount of sulphate or VFAs at the pipeline inlet, the limiting reagent could be consumed within the first few kilometres. I have figures for the amount of sulphate/acetate SRB can metabolise per day at home somewhere.

If someone can find a water analysis I can run some calcs ;)

Mike

If the reservoir initially had a low amount of VFAs it is possible that was completely consumed in the reservoir by reaction with sulphate from the seawater (sulphate is normally in excess as seawater has ~2,700 mg/L sulphate whereas VFA concentration on the orders of hundreds of mg/L) such that there are no nutrients remaining for microbial activity in the pipelines.

Again, it really depends on the chemistry of the produced waters.

Bacteria have been found deep deep under the earth, and are often found in acquifers. Normally, if physical conditions (temperature, pressure, salinity) of a reservoir allow SRB activity then sulphate and VFAs will not be found in the same reservoir - over geological time all of the limiting reagent will have been converted to hydrogen sulphide H2S.

Seawater injection into reservoirs is the primary cause of reservoir souring - the formation water provides the VFAs and the seawater provides the sulphate. Even if initially the reservoir is too hot or too saline, local cooling and/or dilution of the reservoir by seawater will allow SRB activity to take place. Biocide treatments can delay the onset of souring by reducing the amount of bacteria injected into the reservoir, but no biocide treatment is 100% effective and the bacteria will eventually become established.

The most effective treatment these days is actually to inject nitrate ions, which encourages the growth of nitrate reducing bacteria whic produce harmless nitrogen gas and outcompete the SRB for the VFAs. However this is an expensive treatment due to the fact that the nitrate injection must be continuous and of a similar amount to the amount of VFA in the reservoir. Nitrate has been used for waste-water (sewerage) treatment for a long time, and has only recently been applied to reservoir treatments.

It is my understanding that treated seawater is being injected into both the water leg and the gas cap at Prudhoe Bay. I wonder if the gas cap injection is increasing the rate of bacteria growth as part of the water reaches the oil leg through gravity drainage.

Google search results for water injection into the Prudhoe Bay gas cap:

http://www.google.com/search?hl=en&q=water+injection+into+gas+cap+prudhoe+bay

Aren't there marine bacteria that live by oxidizing iron? I recall seeing pictures of the titanic, and it's covered in 'rustsicles' that were bacterial in origin according to the Nat Geo article. I think that't the explanation in the origninal TOD article — bacteria caused pits by oxidizing the iron in the pipe using SO4-- as an oxidant.

Basically it goes like this: life uses reduced carbon as an energy source for growth, maintenance, and reproduction. In an oxidizing environment, CO2 is the thermodynamically stable form of carbon, so reduced C -> CO2 is exoergic. All we need is an oxidant.

The most efficient way in terms of bang-for-buck to oxidize carbon is to use oxygen as your oxidant.

CH2O + O2 -> CO2 + H2O

Here CH2O is shorthand for carbohydrate, not formaldehyde. This releases 478 kJ/mol C and is known as aerobic respiration.

Somewhat less efficient is nitrate reduction, aka denitrification, which uses nitrate as an oxidant:

NO3- + 5/4 CH2O + H+ -> 1/2 N2 + 5/4 CO2 + 7/4 H2O

This is good for 398 kJ/mol C, good enough to be competitive in aerobic environments.

Then there is sulfate reduction:

SO4= + 2 CH2O + 2 H+ -> H2S + 2 CO2 + 2 H2O

This is good for 126 kJ/mol C

In the absence of other oxidants, there is always carbon itself, which disproportionates to the tune of 70 kJ/mol C

2 CH2O -> CO2 + CH4

Obviously aerobic respiration has a huge competitive advantage, which is why the other routes only work in anaerobic conditions (except denitrification, which is widespread, but since N is usually a limiting element and is used for proteins, it's limited to microbial systems) Anaerobic oxidation in general is limited to microbial systems.

SRB are probably most common in marine sediments: only the top few cm or so is aerobic, and anaerobic oxidation can extend 100s of m into the sediment column, mostly by SRB. There is also a type of SRB which also uses iron

8 SO4= + 2 Fe2O3 + 15 CH2O + 16 H+ -> 4 FeS2 + 15 CO2 + 23 H2O

This leads to huge deposits of reduced S, which is the source of sourness in petroleum. The FeS2 deposits as pyrite, or fool's gold, and is not stable in oxygen (though kinetics are slow):

4 FeS2 + 8 H2O + 15 O2 -> 2 Fe2O3 + 8 SO4= + 16 H+

(this is why mine tailings are acidic) In any case, those deposits of reduced S (~1.5x10^20 mol) are important in the global oxygen cycle. Clearly if we keep reduced material where oxygen can't get to it, that leads to a buildup of oxygen, and reduced sulfur currently accounts for ~1/3 of the total oxygen in the atmosphere. Deposits of reduced carbon account for the rest. So "fool's gold" actually has real value, if we don't dig it up, anyway. Unlike true gold, which just sits there looking shiny.

Let's run some numbers ... 478 kJ/mol C ... if we use one photon to reduce one C atom, and there are 6.02 x10^23 photons or atoms in a mole, and E = h nu, and c = lambda nu, we find we need a photon with a maximum wavelength of about 250 nm.

Minor problem: the photon flux on the surface of the earth at 250 nm is zero. No biggie, you set up a wildly complicated battery of light absorbing compounds (chlorophylls first probably, then carotenoids, anthocyanins, fucoxanthins ...) and a stunningly complex energy transfer mechanism (requiring more complex compounds like cytochromes, ferredoxins, phosphate esters) as well as the infrastructure to make and maintain the whole thing, and you can use several photons of lower energy that are plentiful in the solar spectrum to reduce that atom of C. All in a day before clean rooms, lasers, HPLCs, etc. If you've ever done photochemistry, you know that calling this "nontrivial" is a massive understatement. Even today our attempts at solar powered carbon reduction are clunky, amateurish, and just plain pathetic compared to what a green plant does.

Needless to say, photosynthesis changed everything, from atmospheric and marine composition and chemistry to terrestrial landforms to the hydrologic cycle to radiation balance to climate.

Which leads to the inevitable question:

Are Human Beings smarter than blue-green algae?

On the subject of iron sulphides, it is interesting to contrast that the kinetics of pyrite FeS2 reaction with oxygen are so slow whereas the finely divided FeS formed in process equipment with even trace amounts of H2S is extremely reactive. So reactive that its known as pyrophorric iron sulfide - i.e. self-igniting. I've seen incident reports of self-ignition of process equipment opened to air even when it is only treating a few ppm of H2S. Chemistry is wonderful stuff...

You do: CH4 is swamp gas. It's also landfill gas. Also, if conditions are right (simple sugar feedstocks, enclosed reaction volume), the process does not go all the way to CO2 and CH4 but stops when concentrations of CH3CH2OH (toxic waste) build up enough to kill the critters that cause the reaction. Then we call it fermentation, and encourage it in huge quantities. The CO2 part, of course, provides the fizz. (So next time you pick up a glass of your favorite pale ale, or single malt scotch, or a bottle of La Tache, think Bacterial waste! Mmmm!)

Didn't know that! But it doesn't surprise me, sounds like a surface area thing. Heating a block of aluminum gives you warm aluminum, heating finely divided aluminum powder ... think thermite bomb, the Hindenburg, when an Exocet meets an HMS Sheffield class destroyer ... think Run away!

SO4-- + 4Fe -> S-- + 4O-- + 4Fe++

This reaction provides energy and labile iron in an anaerobic environment. I trust that Mike A's facts are correct in that acetate is also a limiting nutrient. The bacteria still need carbon for synthesis and it's hard for a low-energy anaerobe to break down paraffins. They would need phosphate and fixed nitrogen as well.

It would also explain the destructive nature of the little buggers to pipelines. They are manufacturing rust as a byproduct of metabolism. Or a mishmash of ferric and ferrous sulphides and oxides.

I was keeping a marine aquarium many years ago, trying to maintain some invertebrates, mostly, from Cape Cod back in Indiana — the parents were biologists. Anyway, I made little gadgets for circulating water with glass tubing and bubbling air; the tubing was held in place by plaster (CaSO4) and buried in sand at the bottom of the aquarium.

After several months, and most of the interesting varmints were gone, I took it apart and the plaster was all soft and black and stinky. Anaerobes in the mud/sand had gotten into it and reduced some of the SO4-- to organic S compounds, reducing the plaster to muck. It was noticeably stinkier than the rest of the bottom material.

In reply to your comment, yes, the SO4-- is in a high oxidation state. I suspect the pipeline microbes make use of sulphate to oxidize iron. That sort of redox combination is known to power some extremophile bacteria. Iron is also a handy micronutrient and shell-building material for them (such as the aerobes eating the Titanic). Of course acetate and other organic goo also comes in handy, since our little bugs need carbon.

I'm basically agreeing with your post, and thanks for contributing it.

The Big Lebowski?

That would be a hell of a 40 gallon fire hazard--probably illegal to store that much without a proper permit and installation equipment! Don't store any inside or near your house as it will probably expand and try to pressure-vent fumes past the gascan cap. I don't recommend it if your property is small or if your kids are still at home--not worth the risk. If crunch time hits-->carpool, bus, buy a scooter/cycle/street-legalized ATV, bicycle, etc.

Bob Shaw in Phx,AZ Are Humans Smarter than Yeast?

Losing 10% of your oil supply for a couple of months shouldn't be a real problem given the large quantities of stocks PADD 5 has. Panicking will cause a problem, where there wouldn't have been one.

Gasoline is a fairly dangerous thing to have around the house. A separate outbuilding can improve the picture somewhat - especially without any potential source of ignition and very good ventilation.

Unfortunately, a number of people are likely to start doing just what you thought, and it will kill and maim a number of people.

Latest update from San Fran Chronicle:

Excerpts:

-----------------

20¢ a gallon gas price hike predicted for California

State has crude oil reserves, but closure of Prudhoe Bay eventually will hit bay refineries.

"Throughout the course of the month, you'll see refineries have to cut runs, which is going to yield less gasoline, less diesel, less jet fuel," said Denton Cinquegrana, West Coast markets editor with the Oil Price Information Service.

The federal government moved Monday to calm fears of an oil shortage by offering to lend crude from the nation's Strategic Petroleum Reserve to refineries that requested it.

That offer, however, has little practical effect on California refineries. The petroleum reserve is stored on the Gulf Coast, not in California. Any crude coming directly from the reserve would need to be sent by ship -- a three-week trip.

"They have to bring it in by tanker because there are no incoming pipelines to California's refining centers," said Tupper Hull, spokesman for the Western States Petroleum Association, which represents West Coast refiners.

------------------------

Reads like they assume it will be no problem getting ships through the Panama Canal--Hope they are right. Or is 3-weeks the normal time to sail around South America? I was hoping to read about transfers through the Panama Isthmus Pipeline.

Bob Shaw in Phx,AZ Are Humans Smarter than Yeast?

We estimate it could take between 2-3 months to get it back on line," Bruce Lanni, an industry analyst with A.G. Edwards, wrote in a research note. "However, there are no assurances that it will return to current capacity, given the complexities and age of the reservoirs. Thus, we would not be surprised to see volume losses in the area of 5 percent to 10 percent."

This news report says the oil goes around South America to the West Coast.

Excerpts:

-----------------

For now, there will be a short-term impact to the consumer of 10 to 20 cents more for a gallon of gasoline, said Borenstein, with the institute's Center for the Study of Energy Markets.

But if the shutdown keeps the drain on current capacity from being replaced from the Alaska fields, there will be a significant long-term impact, he said.

"We simply can't move oil in quickly enough" from other sources like Texas or South America, Borenstein said.

There is no pipeline to funnel sweet crude into California from Texas or the Gulf Coast, and the giant tankers that haul supplies over water are too big for the Panama Canal.

That means they must navigate down around the tip of

South America, eating valuable time before the state's supplies can be replenished.

-------------------------

I am going to try googling something on the Panama Pipeline, the MSM is not mentioning it so maybe it is dysfunctional.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

Panama Pipeline currently inoperative according to EIA

--------------------

Transit time from Alaska to U.S. Gulf Coast refineries is about 16 days, as compared to 40 days for a trip around Cape Horn (the southern tip of South America).

If transit were halted through the Canal, the Trans-Panama pipeline could have been used to re-route a significant proportion of northbound oil to the Atlantic. This pipeline is located outside the Canal Zone near the Costa Rican border, and runs from Puerto Armuelles on the Pacific to Chiriqui Grande on the Caribbean. It had been used to ship Alaskan oil to Gulf Coast ports; however, the pipeline was closed in early 1996 following the decision to allow Alaskan oil to be exported outside the U.S. Plans are currently being made to reverse the flow of the pipeline to allow about 650,000 barrels/day of South American oil to flow from Atlantic to Pacific destinations; this plan is contingent upon lining up enough customers to make the investment needed to reverse the flow.

-----------------

Looks like the Supertanker: USS Condoleezza Rice has to sail the Drake Passage in wintertime.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

I presume you mean summer time. Southern South America is entering springtime now. No picnic anytime of the year though.

Disruptions are normal to the world oil market. The levels of disruption fluctuate over time. Any number of things can cause an supply interruption, from routine maintenance to wars to politics. After 9/11, something changed.

Crude Oil Prices 1947-2004

The rules of this game have changed. From Stuart's post.

Click to Enlarge

My view is that regarding oil shocks, we are now living in a different world. In this era, suppliers are asserting their power. Consumers (US, China) are aggressively trying to secure supply. The illusion created by low prices in the 1990's, especially the 1998 dip, is now broken. The gloves are off. Geopolitical news is now mostly energy news. Even Condy "Oiltanker" Rice has admitted as much. This trend will never change in our lifetimes. Those unsustainable exponential growth curves eventually end up changing the rules of the game. Any kind of event can tip the system into a new paradigm. So...

An historical shift has occurred. It's not just "starting to add up", Danny Boy. It's been making sense for some years now.

The times, they are a changing.

However, I think there is a substantial chance (roughly one chance in four using totally subjective probability) of a severe global economic slowdown/recession/depression that will produce substantial oil surpluses and falling prices within the next eight years. True, global recession does not reverse peak oil (which is, for all intents and purposes, here and now), but it could produce rapid and drastic price declines in petroleum products that could last for a couple of years, depending on how long it takes to pump enough money into economies to erase debts and get investment moving again.

I do not understand the premises of those who say Peak Oil is more than a few years away. Or, to be more precise, I do understand the premises but find them to be mere wishful thinking.

In regard to economic recovery, I have great faith in the power and inclination of central bankers to destroy the value of moneys so as to mitigate a global depression, and once inflation effectively eliminates debt, then we have a whole new ballgame.

If my best guestimate is correct, load up on debt now, because dollars are going to turn into pesos, and the Euro won't be much better.

The uncontrolled deflation scenario I put at maybe one chance in fifty. Helicopter Ben has those bundles of currency all printed up and ready to go; perhaps FEMA will send their black helicopters to redistribute wealth. (Stranger things have happened in fairly recent history.)

Now, if someone increases the money supply, its value, measured in the standard of value, will sink. That's inflation.

Prices can also rise for reasons that have nothing to do with inflation. A good example is the oil price. It rises, and because it's used in the production of some many other products, the general price level rises. This, however, is no inflation, because the value of the money measured in the standard of value has not changed at all. If the central bank now reduces the money supply, the value of money will increase. This, however, is deflationary for the economy.

Modern money, however, is the standard of value and the medium of exchange at the same time. So, it is quite difficult to distinguish inflationary price increases from other price increases, even though the difference is still important. When central banks cut the money supply because of the oil price, they create deflation and hamper growth.

Inflation is typically measured by the consumer price index (CPI), which is flawed. Inflation can hide in real estate prices, equity prices, commodity prices, which are not represented in the CPI. This makes such things as housing bubbles possible.

(*) Marked for future reference.

Thanks for the reply. :)

I was less than precise in my question. I was not asking for "the" (or even "a") definition of inflation, I was asking for the definition DS (rhymes with BS, make of that what you will) uses. Just wanted to know the terms of reference in order to assess his assertions correctly.

Sadly, I my question was inadequately phrased and thus subject to an equally inadequate reply. Having used three dictionaries (two printed), I noticed that even those contained more than one definition per entry.

There is a lunatic fringe out there that insists that the dictionary (any collegiate or large dictionary will do) and the textbooks are all wrong! That the proper definition of inflation is glibbety globbety glue, rather than the definitions that have been in solid use for the past century and a half.

Among reputable economists, to the best of my knowledge, there is no debate about definitions of inflation at all. Now there are debates--and legitimate ones--about how to measure inflation, but note that the two common formulations

- a decrease in the value of money and

- a general increase in the price level

are exactly equivalent--just different words for the same concept.However, once again, you have my sincere apology.

Specifically who does deny their equivalence?

BTW, it is simple arithmetic to show that the two formulations are identities.

The problem is, that usually, we think that the price of a good is its market value. So, what is the price of money?

This can be easily solved if you distinguish the medium of exchange purpose of money from the standard of value purpose.

In such a case, there is a price for the medium of exchange. If this price sinks, you have inflation, if it rises, you have deflation. Inflation and deflation have nothing to do with the prices of the other goods.

When money is both medium of exchange and standard of value, there is no longer a price of money. There still is a market value. This market value is formed by the supply of money and the demand for money.

When prices increase because of an increased scarcity of oil, that has nothing do to with inflation, even though prices go up. In such as case, typically, the demand for money will increase. That means that the market value of money increases as well, so we have deflation rather than inflation. A central bank that wants to stabilize the value of money should increase the money supply.

When, however, the central bank increases the money supply and the demand for money is constant, the value of money decreases. Prices go up again, this time, because of inflation.

You don't find this in standard textbooks, but in books about money theory. In my point of view, it is much more convincing than the tautology that the value of money is its purchasing power.

The Central Banks print more money, since the price of oil goes up and most oil needs to be paid in $. So you suggest this additional money is only used to trade oil and it does not affect the rest of the economy? How?? Only initially there is additional money supply needed to facilitate payment. After it is paid there is just more money circulating in the economy chasing the same amount of produced goods, so we have inflation equal to amount of additional money. Since we use money both as an exchange mechanism and as a store of value the net result is still that the additional supply flows into increased equity values if not also our wages are increased by the same proportional amount. We have been witnessing this for the last few years.

Following this logic the increase in energy prices will soon have us on the path to hyperinflation....

I agree, Don. The only way I can see a deflationary collapse occurring is accidentally, coming from some unexpected direction and catching the Fed off guard.

You hit the nail on the head. The economic slowdown has already begun, even if the media fails to acknowledge it, and it will soon accelerate. To the media's great shock and consternation, we could have negative growth by the end of the year. Another thing the media has backwards is the threat of inflation. The markets know that the real threat is recession and even deflation, not inflation. Just look at a chart of the exchange traded bond fund TLT, which has risen steadily over the past two months or so, sending yields down. Throughout this same period, the MSM has continued to talk about rising yields. Remember, the bond market is 5 times larger than the stock market, so as money continues to pour into funds like TLT, equities and COMMODITIES will be hard hit. Another thing to keep in mind is the lag time involved with housing. While equities respond to events immediatly, or even anticipate events, with housing there is a definite lag. What happens during this lag? Inventories rise. Well, inventories have been rising and are now at record levels. Soon enough, home prices will begin their delcine, and this will be extremely deflationary over the next ten years or so. The housing market decline and its recessionary and deflationary consecuences will be THE story of the next ten years. But for now, the key concept is declining global liquidity. Over the past year or so, central banks around the world have been steadily reducing liquidity. Again, there is a lag time here, but whenever this has happened in the past, equities and ESPECIALLY commodities have been hard hit. It is always difficult to go against the herd. Two months ago, the media was ridiculously bullish on equities, but that was the best time to sell or go short equities. The media is still ridiculously bullish on commodities. Go to any MSM financial site and you can read an endless stream of articles telling you to pour your money into commodities. And, in fact, that's what everyone has done over the past two or three years. Meanwhile, the insiders are selling. In short, everything seems to indicate a near term pullback in commodities and energy prices.

Of course, none of this takes, "peak oil" into account. That's why i'm here. I find Mathew Simmons' arguments, and the arguments of many TOD posters to be incredibly convincing. I'm trying to figure out who's arguments will trump who, and when. IMOHO, I think we will see oil decline to around $57 by November 15th, which also happens to be my birthday. On the other hand, "peak oil," may, at some point, lead to what traders will call, "an unexpected upside breakout." Even if oil peaks, though, I think we will witness an epic battle as far as oil prices are concerned. The housing market is a behemoth.

This is what I struggle with: I understand that recession has historically brought about a softening of demand for commodities, oil included. However, I would reason -- and this is pure speculation, as my background is in agronomy not economics -- that if we are about to descend the back side of Hubbert's Peak, there might be no softening of demand for oil (or nat gas), even while economic growth stagnated or declined. Limits to petroleum and gas supplies would presumably make essential commodities more difficult to obtain and, thus, have the effect of bouying commodity prices.

So, I continue to struggle with trying to understand what's to come...???

I'm struggling with exactly the same thing. Everything I normally focus on is screaming, "sell oil!", yet the Simmons book, and the arguments he lays out, give me pause. A few threads back, I wondered if, at the time of peak oil, we will see a discrepancy in the behavior of oil and other commodities, with oil rising far more than other commodities, which won't be peaking at the same time. Simmons seems to suggest this when he says that, "only self-aggrandized traders" think that oil is, "just another commodity." So far, oil and other commodities have followed exactly the same pattern. This suggests to me that oil has yet to peak.

BTW, I think the commodities boom will last at least another ten years, i'm just predicting a short term pullback.

Copper went to 3900 in may, then dropped to 2900 in june and is now back at 3600. Gold followed a similar pattern, up to 730, down to 570 and now at 650. Oil however kept trading in 70-75 and now seems to be in 75-80.

How is this following the same pattern?

I'm watching closely, though, to see if more examples of what you noted begin to appear in the future. I think that would be very telling.

I still think it's fair to say, at this point, that oil has behaved like, "just another commodity."

This is a very tricky situation. The reduced liquidity and foreseeable slowdown in economic growth in the US (if not recession) are obviously bearish.

But the general commodities-cycle argument is very convincing and I don't see much weakening.

For instance, copper has come back up not on speculative excess, but because the Chinese are still using it at an amazing rate and stocks are low. Copper is plentiful in the ground but my sense is that the supply situation isn't going to change much for the medium term at least. (With zinc and nickel the long-term situation is much more bullish than copper).

Gold and silver demand is quite strong. The new etf has eaten up a sizeable percentage of available physical silver.

Grain stocks are low, particularly for wheat. More and more it's reasonable to think that there will correlation with energy prices. Sugar especially.

The fundamentals are intact, as they say. I'm reluctant to take off much exposure for short-term expectations.

Could the June pullback and sideways action into fall be the correction you're looking for?

Take a look at the Seventies, and assume that they never ended.

In the early Eighties, we saw a decline in oil demand--because of the high prices and because of a recession--and we saw a supply increase.

This time, we will not see a net supply response. Vast amounts of money will be spent on energy projects, but IMO all of the efforts will only serve to slow and not reverse the decline in the total energy supply.

Why I think it will be worse: In the Seventies, US labor still had some pricing power and could demand wage increases to offset higher energy costs.

This time around, US workers have little leverage to demand higher wages. Additionally, US personal savings rates have declined from upwards of 10 percent in the seventies to effectively zero in 2006. So, increases in the cost of energy can only be offset by reductions in consumption or an increase in borrowing.

Often, inflation and deflation are presented as "either/or" scenarios, but could we be entering a period where both will be significant? Increasing costs of energy production will drive up prices of everything from oil to toilet tissue. Simultaneously, people will be pressed to liquidate assets (houses, cars, jewelry, etc.), in order to meet household expenses (they can't, after all, expect wage increases or to draw on savings). Unsold inventories will create more deflationary pressure as unsold goods will have to be sold off at "sale" prices in order to get them off the floor. These things I would expect to have some deflationary effects.

We don't just import cars, we import the labor to make those cars. No imported cars, happy days for the UAW. Also the UMW, the USW, the OCAW, etc.

Thus I wonder if we are on the verge of a transition in currencies where the dollar fades as the international currency of choice. However, I don't expect the Euro to move in. No, in that scenario I would expect the Chinese yuan to do to the dollar what the dollar did to the British pound.

Thus, if China takes less of a hit during a downturn than the US, demand could remain constant or continue growing even though the US was floundering. If that happens, I wonder if the yuan could become the new currency of choice?

So it IS the Seventies!

I am concerned about the prospect of a liquidity crunch, in which money denominated only in electronic blips may inconveniently 'evaporate' at some point, leaving a relatively small amount of actual paper money which could then be very valuable (until the powers-that-be fired up the printing presses in earnest, which I would expect them to do in desperation after deflation has largely run its course and borrowing from overseas has ceased to be an option).

My thoughts are that a depression would drop the price of almost everything, although the purchasing power of the majority would fall even more quickly which would result in things becoming generally less affordable despite being nominally cheaper. There would probably be a temporary oil surplus, although capital-intensive oil exploration and tertiary production techniques would be very difficult to fund during a deflationary credit collapse, hence lower nominal prices would be temporary as production could decline dramatically.

A significant concern of mine is that the perception of a peak by governments will cause them to act in extremely counterproductive ways, and it is these actions which I would expect to have the most negative effects. If governments were prepared to be reasonable about a strategic resource in short supply (pigs will fly first IMO), then the global market for oil would continue to operate, with oil (at least initially) cheaper in nominal terms due to economic pullback and supplies going to the highest bidder.

However, governments are likely to respond to the perception of a peak by behaving like motorists who have heard a rumour that there might be a petrol shortage. In other words, I expect them to panic - to try to secure supplies through bilateral contracts (ie take oil off the market) and, where that fails to ensure security of supply, to engage in entirely counter-productive resource wars.

The global market for oil would probably be a casualty under such a scenario, which would make obtaining supplies far more difficult and expensive than it need have been. It would make extracting oil and transporting it far more difficult as well, as resources would have to be devoted to protecting very expensive infrastructure. With money in short supply, that would not be easy. The net result IMO would be tremendous price volatility, with considerable spatial as well as temporal variability in both price and supply. Supply interruptions, perhaps prolonged, would probably be commonplace, hence reducing structural dependency on fossil fuels now is highly advisable IMO.

I agree, but I don't think it will work. Even a nominal short-term rate of zero won't be low enough as real interest rates (nominal rate minus negative inflation) will still be high enough to deter borrowing and lending. I would expect a tidal wave of involuntary debt-liquidation.

It wasn't pretty, and it might be worse this time around.

The shear volume of weapons and the propensity towards violence in the US scares me shitless. While I don't live there I do have immediate family there and have resigned myself to this fate as much as it pains me to even acknowledge it.

The Fed and other central banks have the power to create more money without limit. I see no plausible reason to think that they will not expand money supplies HOWEVER MUCH IS NECESSARY to prevent deflation.

As a last resort, Helicopter Ben was not kidding: Before we would see a rerun of the Great Depression the helicopters will be loading chunks of cash from the roofs of the twelve District Federal Reserve banks and dropping the cash wherever people congregate. Indeed this scenario of helicopters literally dropping cash from the sky goes back to the nineteen fifties when there was concern about a deflation that would tend to result after a thermonuclear war with the Soviet Union. About a two year supply of cash (if memory serves) was stashed away at the district banks in sub sub basements behind a couple of feet of hardened steel and under who knows how many dozens of yards of reinforced concrete.

Wonder if all that lovely green stuff is still there . . . .

It hits some harder than others, especially if filling a gas tank is an important expense in your life.

the supply may rise towards infinity...

I'm sure it is obscene.

peace love and carrots

Maybe you can explain what is going on inside Bernanke's head. A few months back he signalled that he was going to bear down on inflation. A quarter point later and he seems to be done.

Only after huge increases in unemployment do I expect to see the monetary floodgates opened--along with Government deficits in the multitrillion dollar range. In other words, so long as the real GDP perks along as it has been doing for the past few years, there is no reason to do any easing of the money supply--and the case for much tightening is also weak.

Thus for now, the Fed is calling out to us all: "Steady as we go!"

If unemployment does not get well above ten percent, then we may avoid hyperinflation; this scenario could very well happen. Note that while the Fed cannot (directly) control the rate of growth of employment, it can monetize the debt and turn dollars into minidollars (or "pesos" as I put it) whenever The Powers that Be decide to do so.

"Shhhteady ashhh you go. Full shhhshhteam ahead!"

And the rest is history.

http://design.alfred.edu/coursemedia/Courses_files/IntotheStorm.pdf

By the way, I'm new to TOD (as a logged in user anyway) and wanted to ask if I'm the first one anywhere who teaches a college class (Oregon) on Peak Oil in political science(!?)

(hope it's not too off-topic)

Two questions back:

- What was the reaction of the students?

- What was the reaction of fellow teachers?

(IIRC, some of the people at Post Carbon Institute teach and I think the author of Resource Insights also teaches.)so far, the reaction of the students is great. The ones who are vocal seem to be totally buying into it and have for example slammed Greg Palast's infantile recent Anti-Hubbert article (I assigned that as a homework). I have one more week to go in a 4 week intensive summer class. I am right now thinking of making them post on TOD or (if they don't wanna log on) write comments on TOD topics to me.

The faculty? Well, among some I sense an evolution, from "Huh?" over "What, do YOU believe in THAT?" (meaning PO) to "There may be something there. Ok, go ahead with teaching this!" (I am a graduate student), even to "Yeah, PO may be true, but don't kill your career with it"

Then there are others who think of PO as a sort of cult. And that's before they've seen TOD! ;-)

ps. I'll have two guys linked to the Postcarbon Institute explaining permaculture to my class (and myself, ha ha) next week!

My personal belief is that young minds are more flexible.

You start up with an old fart (like myself) whose mind is cemented into a very rigid belief system and it very difficult to get them (i.e. your older & esteemed faculty colleugues) to entertain the idea that perhaps (1% chance) some foundational part of their belief system (i.e. human "progress" is forever) is deeply flawed.