Fermenting the Food Supply

Posted by Stuart Staniford on January 7, 2008 - 11:30am

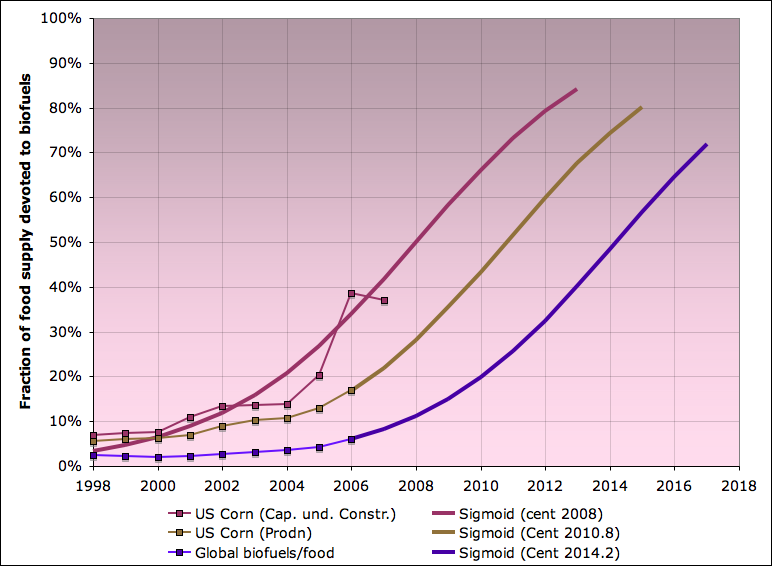

Modelling Biofuel Production as an Infectious Growth on Food Production

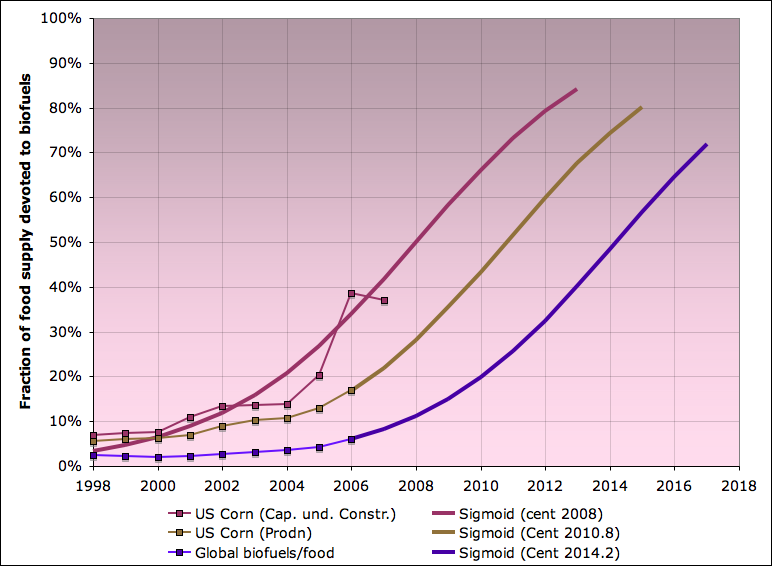

Biofuel capacity or production as a fraction of food supply for three different cases, along with sigmoidal (ie logistic) projections, 1998-2018. Plum curves show US corn ethanol processing capacity in service or under construction as a fraction of ethanol potential of entire US corn crop. Brown curve shows actual production of US ethanol as a fraction of ethanol potential of US corn crop. Violet curve shows global biofuel production as a fraction of estimate of biofuel potential of entire global human food supply. Sigmoidal curves all have K = 1/3 (infection doubling time of three years), and cross the 50% line at 2008, 2010.8 and 2014.2 respectively. Sigmoids are scenarios, not forecasts. Actual biofuel production growth will depend heavily on oil prices and policy responses to increasing food prices. See text for sources and methods.

I will use a mixture of existing data, analysis of biofuel profitability, and simple modeling of biofuel production as an infection or diffusion process affecting the food supply, to demonstrate that there are reasonably plausible scenarios for biofuel production growth to cause mass starvation of the global poor, and that this could happen fairly quickly - quite possibly within five years, and certainly well within the life of the existing policy regimes. It doesn't have to be this way, but unless we start doing things differently soon, the risks are significant.

This piece is very long, and I apologize for that. But I think it's important - I'm coming to the view that biofuel growth is by far the greatest near-term challenge arising from the plateauing of global oil supply that we have experienced over the last two years.

I'm going to focus a lot on the US corn ethanol situation, because it's where the pattern has developed the furthest, and it's also where we have the best data. Then I will broaden out to look at the global situation where I think the same pattern is developing, but a few years behind. Let's first look at global biofuel production just to orient ourselves.

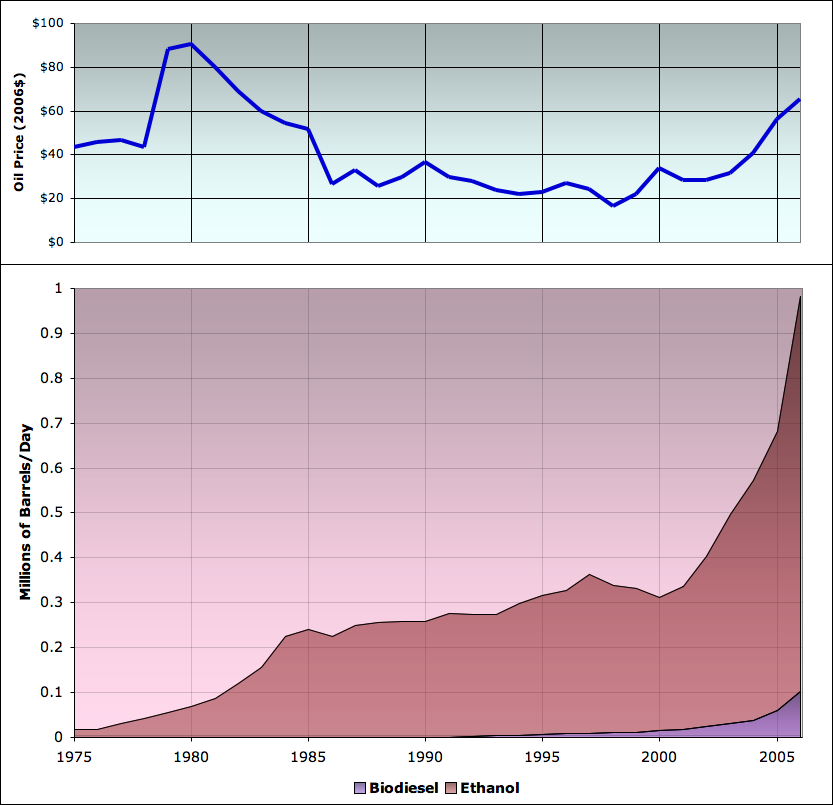

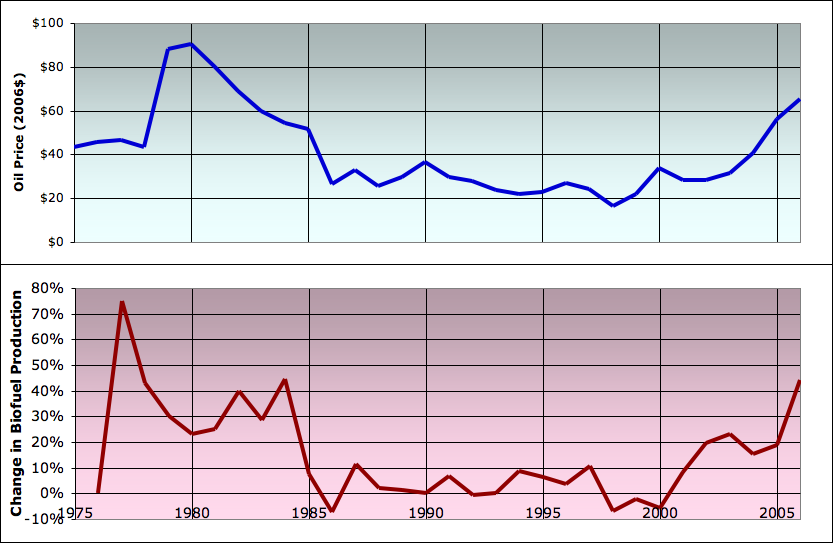

This next graph shows (in the lower panel) the annual production numbers for ethanol and biodiesel from 1975-2006. Here, and throughout, I am going to use volumetric units of millions of (42 US gallon) barrels/day, for the convenience of those of us used to thinking about oil supply. However, be aware that the energy content of biofuels is lower than that of fossil fuels (ethanol has only about two thirds of the energy content per gallon that gasoline has, for example).

Major components of global biofuel production, 1975-2006 (bottom), with oil prices (top). Sources: Worldwatch Institute for biofuel production through 2005, and various sources for 2006 (1, 2, 3, 4). Oil prices are sourced from BP and are expressed in 2006 US dollars.

This graph shows the major facts. Beginning from a very small base in the 1970s, by 2006, biofuel production reached about 1 million barrels/day, a little over 1% of the roughly 85mbd of liquid fuel production in that year. Ethanol is the largest flow by far, but biodiesel has started to become important. Growth of both products in the last few years was explosive - that is a key fact at the core of the problem. Furthermore, that growth is correlated with oil prices (shown in the panel at top). When oil prices are high, biofuel production increases rapidly, but when oil prices are low, biofuel production grows more slowly or stagnates.

This next graph shows US ethanol production (almost all of which comes from corn) as a fraction of the global biofuel supply:

US ethanol versus global biofuel production, 1980-2006. Sources: US figures are from Renewable Fuels Association. Global figures from Worldwatch Institute for biofuel production through 2005, and various sources for 2006 (1, 2, 3, 4).

As you can see, the US is a major biofuel producer, but both the US and non-US supplies have been growing rapidly. The reason the US corn ethanol supply is growing so rapidly is a large number of new ethanol plants being built (as well as expansions of existing ones). Here are the numbers from the Renewable Fuels Association (they have a very helpful list of every plant in production or under construction):

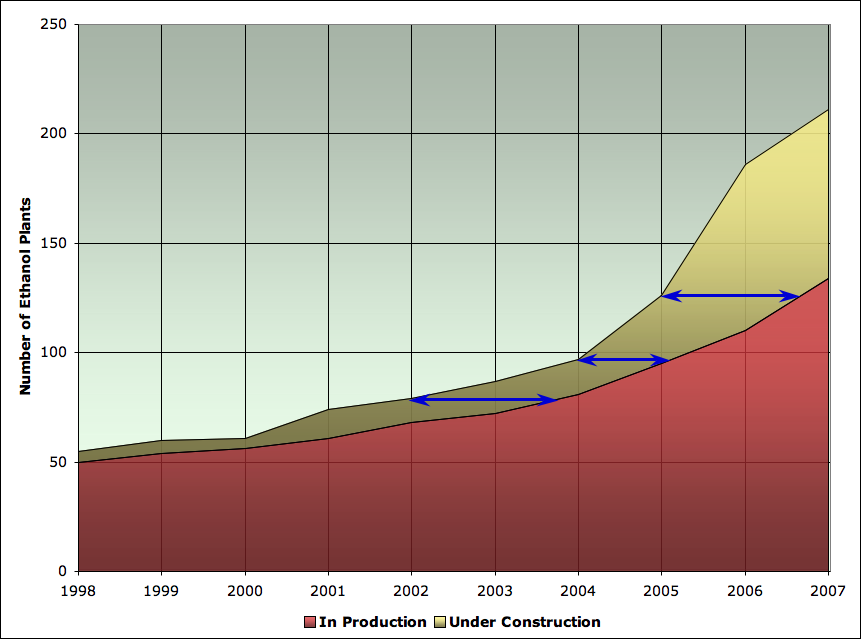

US ethanol plants in production or under construction at year end, 1998-2007. 2007 numbers may be a month or two earlier than the end of the year. Sources: Renewable Fuels Association.

As you can see, there has been a huge construction boom in the last few years. Looking at 2006, when we had 317kbd of ethanol produced in the US, that was coming from about 100 ethanol plants. Thus the average ethanol plant only produces 3kbd of ethanol - miniscule by oil industry standards. The blue lines indicate the average time for the population under construction to become the population in production at various points along the way. That lag is only 1-2 years, very short by oil industry standards. I think these are important points - these plants are very small, and they can be ramped up quickly at quite modest levels of investment. Thus the biofuel supply can respond quickly to changes in profit incentives of ethanol plant operators. There's quite a lot of these plants now, and a lot more on the way.

For me, always the most important thing about some flow is to understand how it relates proportionately to other relevant measures in the situation. And what I want to do now is relate US ethanol production capacity to the US corn crop. That requires converting bushels of corn (which the USDA National Agricultural Statistics Service keeps track of), to ethanol. The National Corn Growers Association has statistics for that, as follows:

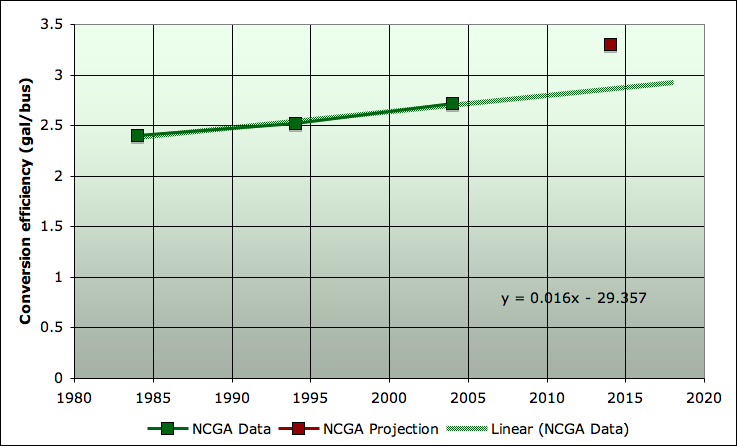

Conversion efficiency of corn to ethanol over time. Sources: National Corn Growers Association.

As you can see, the efficiency of ethanol plants is rising slowly, but appreciably. Note that the NCGA has a theoretical estimate for 2014. I figure they are doing their jobs well, which is to be a trade group and aggressively promote the interests of their members, so in my extrapolations later, I used the linear extrapolation of the historical trend, rather than something based on their 2014 estimate (the red dot).

Let's just pause a moment and figure out how much food we are talking about when we discuss bushels of corn, or gallons of ethanol. A bushel of corn is 56 lb (or 25.4kg) of corn. At about 8000 btu/lb we get 113120 kCal/bushel. Given the average human diet globally contains 2800 kCal/day (see figure below), 1 bushel represents 40 days worth of calories for a person (if that person eat only corn!). Thus at current conversion efficiencies of about 2.8 gal/bushel, the corn in a gallon of ethanol represents a shade over two weeks worth of food (again, all corn). A 15 gallon fuel tank of ethanol is thus 7 months worth of corn calories for one person. Of course, the American corn crop is mainly fed to animals, and after conversion to meat, eggs, or dairy at efficiencies in the range of 1/10 - 1/3, the 15 gallon tank of ethanol is more like 1-2 months worth of food calories for a person.

Anyway, given the USDA corn production statistics, NCGA conversion efficiencies, and RFA data for the amount of ethanol production capacity on stream or under construction, I made the following graph:

Capacity of ethanol plants at year end, in production and under construction (stacked on each other), together with total ethanol potential of the entire US corn crop (not stacked). Expressed in millions of barrels/day of ethanol. Sources: USDA National Agricultural Statistics Service for corn production, National Corn Growers Association for conversion efficiencies, and Renewable Fuels Association for ethanol plant capacities.

This graph completely floored me from the moment I saw it, and immediately suggested the conclusion of this piece. Let me try to develop the argument in stages though. The first thing to note is that the corn crop generally increases over time. This is due both to ongoing improvements in the yield/acre of modern industrial agriculture, but also increasing acreage planted to corn versus other crops (especially in 2007). The corn crop also fluctuates, both due to acreage decisions and the vagaries of the weather.

More importantly, the amount of ethanol processing capacity is growing much faster than the corn crop. Whereas in 2006, the US produced 317kbd out of a global total of 982kbd, once all the construction under way is complete, the US will be able to produce almost 1mbd by itself. Let's focus in on the ratio of the ethanol processing capacity (both finished and under construction) to the corn crop. That looks as follows:

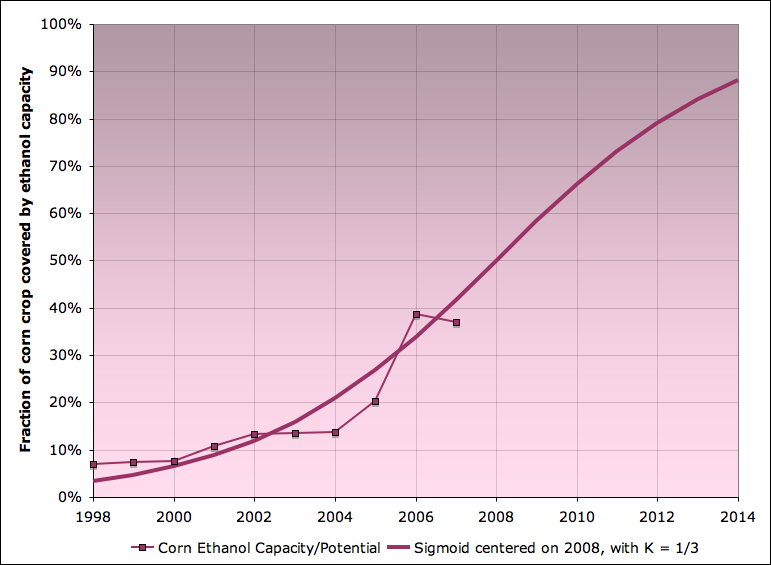

Capacity of ethanol plants at year end, in production and under construction, as a percentage of total ethanol potential of the entire US corn crop in that year. Sources: USDA National Agricultural Statistics Service for corn production, National Corn Growers Association for conversion efficiencies, and Renewable Fuels Association for ethanol plant capacities.

Starting out from 7% in 1998, the percentage of the corn crop covered by ethanol plant capacity in progress has now reached 37-38% of the corn crop.

Furthermore, the general shape of this graph is very familiar to me, and strongly suggests thinking of the process of ethanol conversion of corn as an infection process (or spread process, or diffusion of innovations process, to use various terms from different disciplines for more or less the same kind of thing). There are a large variety of processes in both the natural and social sciences which have the general flavor of something spreading exponentially in a finite setting, and then slowing down as it saturates the finite available capacity. An infection spreading through a vulnerable population of plants or animals is one classic example. The diffusion of a new product or innovation through a marketplace of potential users of that product is another. An invasive plant or animal species spreading through an ecosystem new to it is another case.

In the context of corn ethanol plants, the general idea is that if the existing plants are doing well and making money, there is a basis for building more of them. Because there are plants already operating successfully, there are a set of skilled employees, managers, and contractors that know how to build and operate ethanol plants. There are investors who are comfortable enough with the industry to risk their capital and are excited about the returns that building more plants might offer. There are farmers who are aware of the possibility of selling corn to ethanol plants if there was one close enough (or forming co-operatives to start their own). And there are marketing and distribution channels that know how to get ethanol sold to final consumers.

The larger the industry is currently, the more new plants it could potentially implement next year. (Its desire to do so will be heavily influenced by current profitability, but let's return to that point in a few paragraphs). So when things are going well, a young industry naturally grows exponentially - the amount of new capacity each year is proportional to the existing size of the industry. Eventually, however, any industry tends to mature - something or other limits further growth. In most cases, it's lack of further customers interested in the product. However, the corn-ethanol growth process faces another obvious limit, which is that it cannot convert more than 100% of the corn crop to ethanol.

To try to help your intuition for growth/spread processes, I'm including the following short video. The spread of a computer worm or virus through a population of vulnerable computers is another example of exponential growth in a finite situation that I am particularly familiar with, having being involved heavily in research on it a few years back. This example, made by collaborators of mine, shows the progress of the Code Red worm spreading across the globe in 2001 (the size of the red balls depend on the number of infection cases in each city):

Animation of spread of Code Red computer worm on July 19th, 2001. Source: CAIDA.

Notice the way nothing much seems to happen for a while, then the infectious agent seems to infect lots of cities at large scale very quickly, then slows down as it runs out of vulnerable computers to infect. That's a classic property of exponential-spread-in-a-finite-system situations.

Looked at globally, computer worms infect cities, because that's where the computers are. By contrast, ethanol plants infect areas with a lot of corn:

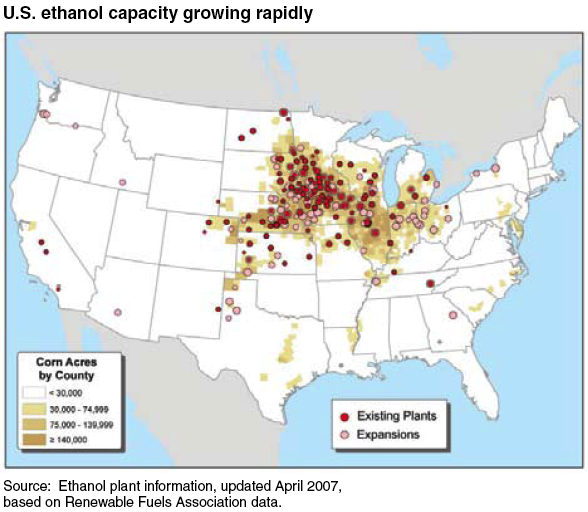

Location of ethanol plants onstream and under construction. Sources: USDA: Ethanol Expansion in the United States, plotting data from the Renewable Fuels Association.

Hopefully this suggests to you, as it does to me, the visual metaphor of little dots of red and pink mold growing in a Petri dish (yet another case of exponential spread in a finite system).

The simplest model of exponential spread in a finite system is called the logistic equation, which gives a simple sigmoid (S-shaped) curve. It's called the SI model in epidemiology. I'm going to spare you the math, since it's well discussed elsewhere. At the time of the Code Red computer worm, I happened not to be familiar with that piece of math, and I rederived the equation in the middle of the night as the worm was spreading and I was trying to predict how long it was going to take before it saturated ("saturated" meaning that it ran out of vulnerable computers to infect). I ended up with a graph like this:

Rate of infection attempts at one location on the Internet due to Code Red worm on August 1st, 2001. Blue line is data, and red line is logistic model. Sources: S. Staniford, V. Paxson, N. Weaver, How to 0wn the Internet in your Spare Time.

That particular infectious agent was a fairly simple-minded thing, and it followed the simple model very well indeed. Note again the pattern of a long period of very little sign of growth, then the rapid rise in the graph when most of the infections occur, and then the tail off as the worm struggles to find the last few uninfected computers amongst a sea of already infected ones. Once you are in the middle of that graph, things are going pretty fast. It's this that leads, in infectious disease control, to the huge emphasis on quarantining the early cases. It's so much easier to put a stop to an infection that hasn't got a grip yet, versus one that has already gotten a good grip on a sizeable fraction of the vulnerable population and is now making new infection attempts in all directions at a huge rate.

Which is the perspective that I bring to 40%, as the fraction of this years corn crop that could be processed by the ethanol capacity under construction. 40% is well into the steep part of a sigmoid. Let's take a look again at that graph of the ratio of ethanol capacity (producing and under construction together) to the ethanol potential of 100% of the corn crop. This time I'm going to add a sigmoid model extrapolated out into the future.

Capacity of ethanol plants at year end, in production and under construction, as a percentage of total ethanol potential of the entire US corn crop in that year, together with sigmoid model with K = 1/3 centered on 2008. Sources: USDA National Agricultural Statistics Service for corn production, National Corn Growers Association for conversion efficiencies, and Renewable Fuels Association for ethanol plant capacities.

Ok, the fit is a bit rough - clearly this ethanol plant spread process is a little more complex and noisy than the computer worm I just showed you. Still and all, I think this graph should set off pretty serious alarm bells. The fit does look like it's capturing some of the important dynamics of this process, and it suggests that we'll be using almost all of our corn crop for ethanol in 5-7 years. That's not very far off. Should we believe it?

Let's investigate further. One of the major departures from a straightforward logistic spread model is that the doubling time (or equivalently the growth rate) has varied significantly through the life of the process. Let's look more closely at the changes in the growth rate of this ratio, along with oil prices again.

Bottom panel: capacity of ethanol plants at year end, in production and under construction, as a percentage of total ethanol potential of the entire US corn crop in that year (left scale), together with year on year change in that percentage (right scale). Top panel: oil prices (annual average in $2006). Sources: USDA National Agricultural Statistics Service for corn production, National Corn Growers Association for conversion efficiencies, and Renewable Fuels Association for ethanol plant capacities. Oil prices are sourced from BP.

I suggested earlier that the growth rate has a lot to do with oil prices, and I've made that more explicit in the graph above with the green lines. When oil prices spike up, a year or so later we have a new burst of ethanol capacity under construction (which then comes on stream 1-2 years after that).

(Note that the drop in the growth rate of the ratio in 2007 is largely a result of a 20% increase in the acreage put under corn from 2006 to 2007, due to the high demand for corn - this increase came almost entirely from reducing the acreage under soybeans and cotton. See p 18 here for details.)

You might argue that correlation isn't causation, and this suggests that it's important for us to assess the profitability of ethanol plants more carefully - clearly growth of the industry will have a lot to do with perceived profitability of ethanol plants, but do they actually get more profitable when oil prices go up, or is the low energy return of the ethanol process such that they don't actually do any better?

Let's start with the price of ethanol. I can't find raw data in the public domain, but I did find this graph of rack prices in various locations over the last ten years. (The rack price is basically the wholesale price at regional distribution terminals).

Rack ethanol prices at various points in the country May 1997- May 2007. Source: California Energy Commission.

It helps to understand the relationship between ethanol prices and gasoline prices. I took the graph above and made the contents of it the background to my own graph of gasoline prices (on the same scale). That gave this:

Retail and rack gasoline prices, national US averages, and ethanol prices at various points in the country (background). Source: California Energy Commission for background ethanol rack prices, and EIA for gas prices (which are all grade, all formulation national averages)

The purple curve is a national average retail price (average across all grades and formulations), while the blue curve is the rack gasoline price. Clearly, ethanol and gasoline prices correlate fairly well (as one might expect, given that the main end use of ethanol is to mix it into gasoline). However, wholesale ethanol prices are often higher than wholesale gasoline prices. This is possible for two reason. Firstly, gasoline formulators are effectively required in many states to include ethanol in gasoline for oxygenation (to reduce tailpipe emissions of carbon monoxide). In particular, the spike of ethanol prices above gasoline in mid 2006 is likely due to the phaseout of MTBE (a groundwater polluting oxygenator that Congress decided not to shield oil companies from liability for). Secondly, formulators receive a 51c tax credit for each gallon of ethanol included in retail gasoline. This allows them to pay more for ethanol than for gasoline and still make money.

The fact that ethanol prices tend to strongly correlate with gasoline prices is suggestive, but we also need to understand the costs of making ethanol. I have relied here on the outstanding USDA 2002 Ethanol Cost-of-Production Survey. (We are only looking now at operating costs, not capital costs, ie the costs of running the plant and making ethanol, not the costs of building the plant in the first place - which at that time averaged about $1.50 for each gallon/year of capacity). Let me summarize the operating costs from that survey in the next graph.

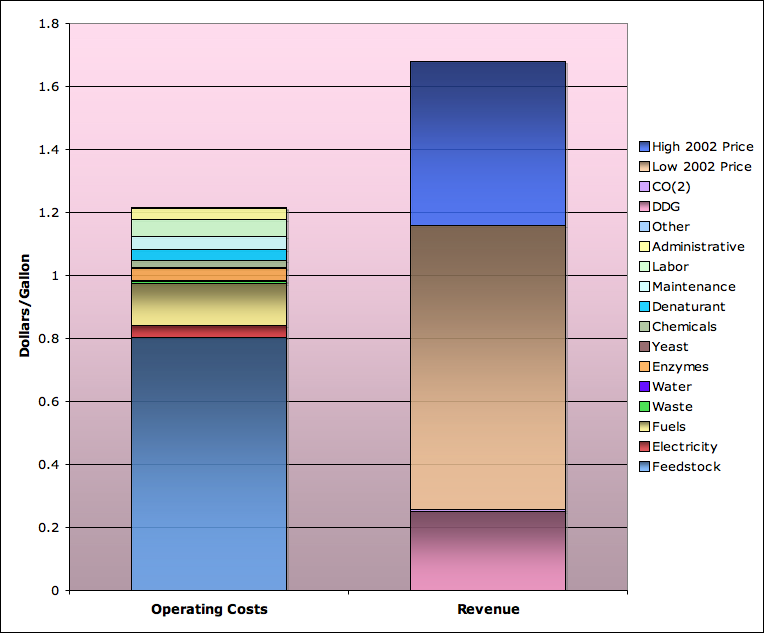

Ethanol operating margin analysis for 2002. Source: USDA 2002 Ethanol Cost-of-Production Survey for cost data and and DDG and CO2 revenue. California Energy Commission for ethanol prices.

This is rather complex, but let me try to explain the highlights. The left column represents a breakdown of the average costs per gallon of making ethanol. The largest item by far (blue) is the cost of the corn. The second largest item (yellow) is fuel to provide process heat in the plant. Generally, this has been natural gas in the past, but there is currently an ongoing shift towards using cheaper coal instead. The rest of the bars are all smaller - administrative expenses, enzymes, maintenance, etc, etc.

The right column of the graph represents the revenues for that gallon of ethanol. The bottom (pink item) is the revenue from selling the distiller's dry grain (DDG) residue left over from fermentation, which is used as animal feed. The brown column takes us up to the lowest ethanol price obtaining at any time in 2002 (from the earlier California Energy Commission graph). The blue column takes us up to the highest price of the year. 2002 was not a great year to be making ethanol, with operating margins ranging from a scanty 25%, to negative (selling the ethanol for slightly less than the operating costs of producing it). This was because oil and ethanol prices were relatively low in 2002.

This explains why capacity growth in 2003 and 2004 fell back to essentially zero.

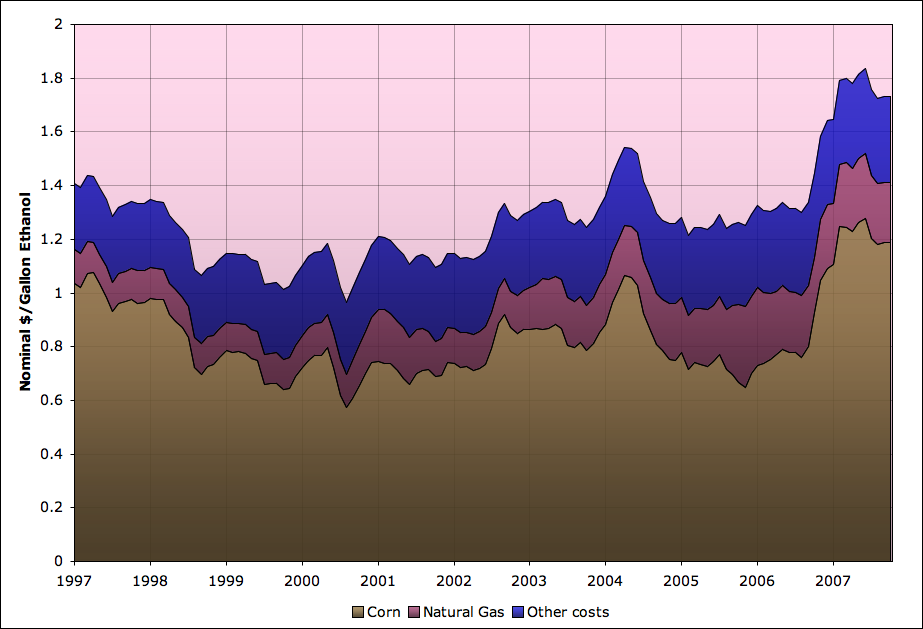

To extend this analysis further, we cannot rely on survey data, which has not appeared since the 2002 survey. However, with just a little modeling, we can get close. What I did was to take the 2002 cost structure and divide it into three components: the corn, the natural gas, and everything else. The corn and natural gas components I extended to other years by using corn and natural gas price data. The "everything else" component I assumed to be more slowly changing and I just inflated it at a fixed 2 1/2% annual rate. I think this will get us fairly close. My cost structure model then looks like this:

Ethanol production operating cost model, Jan 1997-October 2007. Source: USDA 2002 Ethanol Cost-of-Production Survey for 2002 cost data. Corn prices came from USDA NASS, with conversion efficiencies from National Corn Growers Association. Natural gas costs were indexed from 2002 using price data from EIA. Other costs were computed from 2002 data by inflating at 2 1/2%/year.

As you can see, the main impact on the cost structure of ethanol producers is the price of the corn, which is quite volatile - varying by a factor of two over the course of the last ten years. Natural gas prices have been less important as a factor, and I assume they will get moderated further over time by switching to the use of coal.

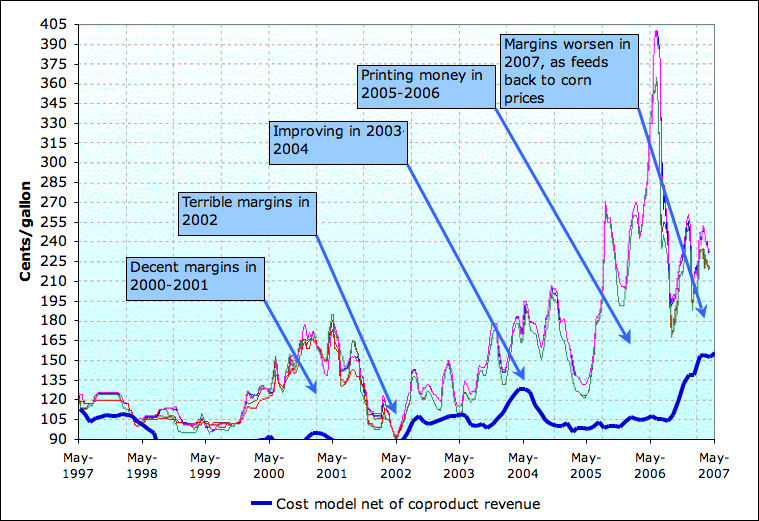

We can now take this cost model and look at the rack price of ethanol against it:

Ethanol prices at various points in the country, along with operating cost model (with DDG revenue subtracted from costs). Source: California Energy Commission for background ethanol rack prices, and USDA 2002 Ethanol Cost-of-Production Survey for 2002 cost data and DDG revenues. Corn prices came from USDA NASS, with conversion efficiencies from National Corn Growers Association. Natural gas costs were indexed from 2002 using price data from EIA. Other costs were computed from 2002 data by inflating by 2 1/2%/year.

In my mind, this makes pretty clear what is going on. Making food into biofuel was profitable in 2000-2001, with oil/gas prices high, so the industry started to expand. It stopped being very profitable in 2002, so the industry stopped growing. Then it became hugely profitable in 2004-2006, and we had an enormous wave of expansion which is still coming to fruition. However, that additional demand has backed up into corn prices, which have now increased. Thus margins are falling, and we will probably see a drop in the growth rate of corn ethanol capacity for a while. However, if oil prices go up much further, then there will be another big growth wave. This one will be starting from around 35% or 40% of the corn crop and going up from there. Clearly, that will drive another big round of corn price increases.

So at this point, corn prices are indexed to oil prices via biofuel arbitrage. There are lags and imprecisions in that linkage, but corn prices cannot fall too far below gasoline prices, or biofuel production will become very profitable and the industry will quickly grow to the point that corn prices are bought back into relationship with oil prices. Furthermore, the large displacement of soybean and cotton acreage to corn in 2007 suggests that this arbitrage is quickly extending to other agricultural commodities. I by no means think that last process is complete, but it has started.

That's bad news because demand for oil is extremely inelastic, and the world is struggling to grow the supply of it at present, so over the medium term it seems fairly plausible that there will be further rises in oil prices. As we will see shortly, one can throw the entire global food supply at our fuel problems and still only make a modest impact on them.

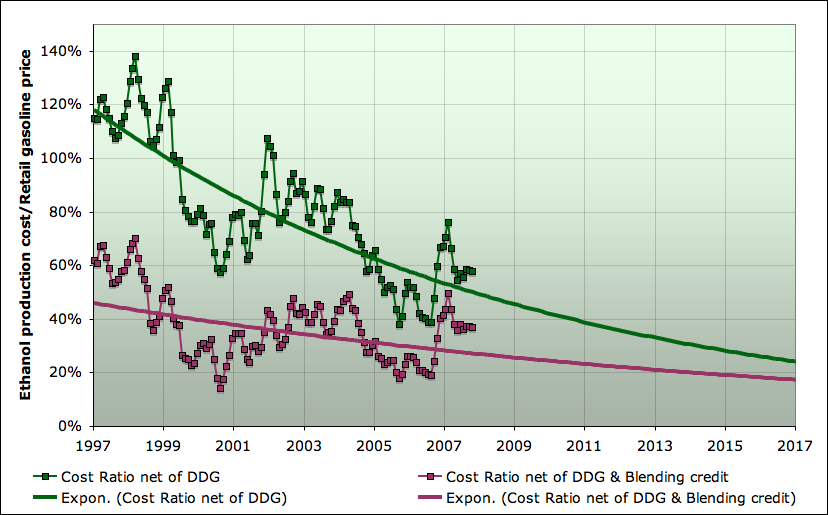

Before we turn to the global situation, I want to make one last graph on corn ethanol. Taking the same cost model I just showed you, I made a graph that shows the cost of making ethanol as a fraction of the (retail) cost of a gallon of gasoline. In both cases, I subtracted the DDG revenue from the ethanol cost, but in one of the lines I also subtracted the 51c/gallon blending tax credit.

Ethanol production operating cost model as a fraction of retail gasoline cost, Jan 1997-October 2007. Green curve is cost net of DDG revenue. Plum curve is also net of 51c/gallon blending tax credit. Source: USDA 2002 Ethanol Cost-of-Production Survey for 2002 cost data. Corn prices came from USDA NASS, with conversion efficiencies from National Corn Growers Association. Natural gas costs were indexed from 2002 using price data from EIA. Other costs were computed from 2002 data by inflating by 2 1/2%/year.

As you can see making ethanol has been getting steadily more profitable, and the unsubsidized margins are recently getting comparable to the subsidized margins back in 1997. (The fit lines are exponential just to guide the eye to the trend - I have no great confidence in the extrapolation).

Let's now turn to the global picture.

Last year, President Fidel Castro of Cuba alleged that plans by developed countries to power cars with biofuels risked starving up to 3 billion people. While I am no fan at all of communist dictators, I fear he might have a point here. I established above that biofuel profitability/growth creates an arbitrage between oil prices and corn prices. We will see that the same trends are going on globally. They aren't as advanced, but the basic mechanism are going to be the same, and the growth rates are comparable. With fuel prices and food prices linked together, then the dinner tables of the poor are in a competition with the gas tanks of the global middle and wealthy classes. And we already figured out that a 15 gallon tank of ethanol is 7 months worth of corn calories for one person.

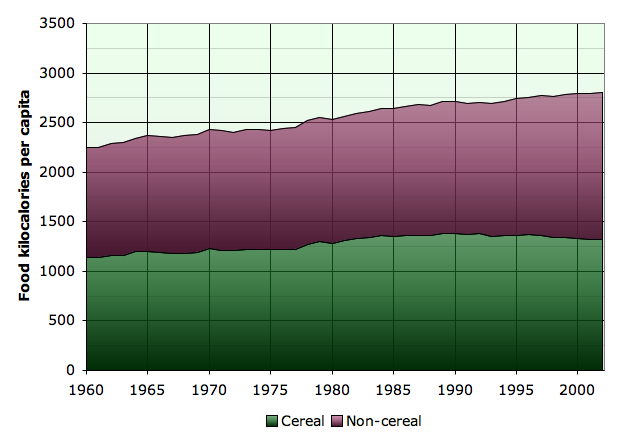

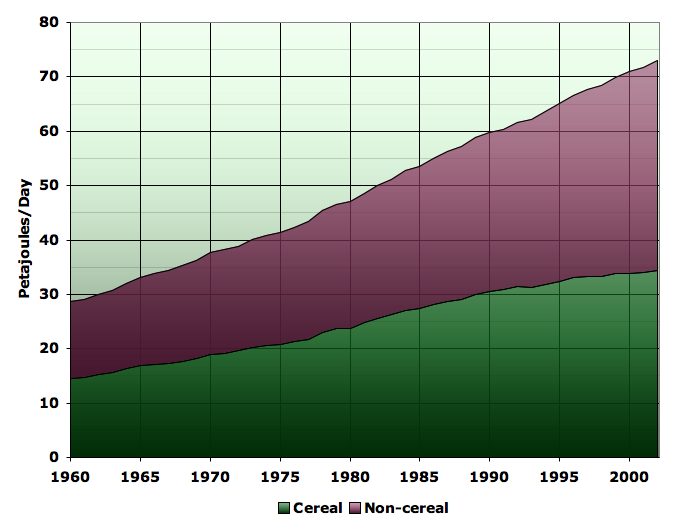

Let's start with the UN Food and Agriculture Organization's statistics on energy in the global diet:

Global food energy intake per capita, 1960-2002. Source: FAO.

As you can see, at least until 2002, the world has been getting better and better fed. This comes despite the global increase in population over the period:

World population, 1960-2005. Source: US Census.

So far, so good. Multiplying the food intake by the population, and noting that 1 kilocalorie is 4.184 kilojoules, we can derive the total energy content of the global human food supply:

Total energy in global food supply, 1960-2002. Source: US Census for population, and FAO for food intake.

Since the amount of land in use has been fairly constant, most of the increase in food energy over this period has come from steadily increasing crop yields.

A petajoule is 1015 joules, or about 278 million kilowatt-hours. Ok, so is 70 odd petajoules a lot, or a little? To answer that question, I'm going to compare the food supply to the global supply of liquid fuel via a notional conversion to biofuels. For the cereal portion of the human diet, I can straightforwardly apply the exact same conversion factors as for corn above (on the theory that a calorie of rice or wheat can be induced to make about the same amount of ethanol as a calorie of corn - a little more than 50% of the calories in the corn make it into the ethanol).

The rest of the diet is more complicated - it ranges from things like lettuce and celery that are probably poor prospects for biofuel feedstock, through things like potatoes and cassava which would probably do about as well on a per-calorie basis as cereals, and then to meat, eggs and dairy products which have, in many cases, been converted at low efficiencies from cereals. I'm not in a position at the moment to make a precise accounting of this, so I just assume as a rough calculation that these things will cancel out, and I directly translate 1 non-cereal food calorie to 1 ethanol calorie. That assumption could be off by a few tens of percent, but it wouldn't make any difference to the overall conclusion if it was.

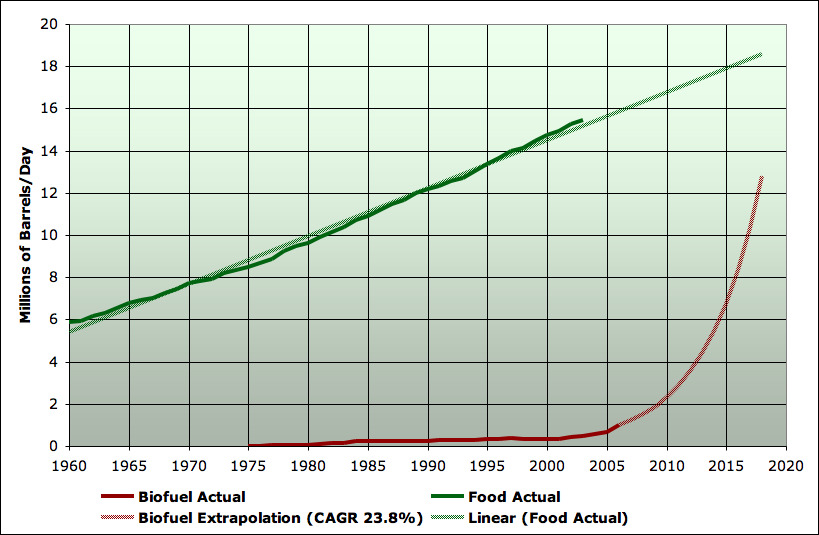

Given all that, I can estimate the volume of ethanol equivalent of the global food supply, and compare it to the actual liquid fuels. (Again, remember in these volumetric calculations that the ethanol barrels are really only 2/3 as good as the oil barrels).

Ethanol equivalent of human food supply compared to global liquid fuel supply, 1965-2002. Cereal and non-cereal portions of food supply are stacked, but fuel is not stacked on food. Source: US Census for population, and FAO for food intake. Liquid fuel numbers are from BP.

You can immediately see the problem here. The biofuel potential of the entire human food supply is quite a small amount of energy compared to the global oil supply - somewhere between 15-20% on a volumetric basis, so 10-15% on an energy basis. If you look at the rate of growth from the mid 1980s to 2000 (and it would be similar to 2005 but the graph doesn't go that far), we were requiring about an additional 10mbd per decade. So if we continue to try to drive more at historical rates of growth, eg as the middle class in China, India, and other developing countries continue to build roads and get cars, while our oil supply is stagnant, we can only get about a decade or thereabouts from converting our entire food supply to fuel.

However, just because it's not a very good idea globally, doesn't mean it wouldn't be profitable to the folks doing the conversion. Let's look at the growth rates in global biofuel production, and compare them to oil prices.

Annual change in biofuel production, 1975-2006 (bottom), with oil prices (top). Sources: Worldwatch Institute for biofuel production through 2005, and various sources for 2006 (1, 2, 3, 4). Oil prices are sourced from BP and are expressed in 2006 US dollars.

Again, we see a mirror of the US situation - when oil prices are high, biofuel production growth rates respond very dramatically in a short time. When oil prices are low, biofuel production almost stops growing. With the increasing oil prices of recent years, global biofuel production is up by a compound annual growth rate (CAGR) of 23.8%/year from 2001-2006. This next graph shows extrapolations of global food supply (expressed as mbd of ethanol), extrapolated on the highly linear trajectory it's been following, with biofuel production continuing to grow at 23.8%:

Biofuel production and energy equivalent of food supply, 1975-2018. Food is extrapolated linearly. Biofuel production is extrapolated at the CAGR of growth from 2001-2006 (23.8%/year). Sources: as above.

It appears that the biofuel production will be catching up to the food supply very quickly. Clearly, we are in the same exponential-growth-in-a-finite-box situation, again. It's just earlier in the process than with the US corn ethanol situation.

To make this comparison clearer, this next graph shows three things. Firstly, I repeat the same ratio I showed you earlier (US ethanol capacity in production and under construction divided by total corn crop ethanol potential). I also repeat the same sigmoid I showed you before. For the global case, we don't have capacity under construction estimates, just actual biofuel production, which I show as a ratio to the biofuel potential of the global human food supply. To help make the connection, I have put the US ethanol production on the same graph, as a ratio of the US corn crop ethanol potential again. The latter is just a couple of years behind the capacity build-out curve.

With the idea that the dynamics are roughly the same here, I've put the same sigmoid with the same basic doubling time as a projection for all three cases. I just shifted the time offset - the global production curve is offset about 3 1/2 years behind the US corn ethanol production curve.

Biofuel capacity or production as a fraction of food supply for three different cases, along with sigmoidal (ie logistic) projections. Plum curves show US corn ethanol processing capacity in service or under construction as a fraction of ethanol potential of entire US corn crop. Brown curve shows actual production of US ethanol as a fraction of ethanol potential of US corn crop. Violet curve shows global biofuel production as a fraction of estimate of biofuel potential of entire global human food supply. Sigmoidal curves all have K = 1/3 (infection doubling time of three years), and cross the 50% line at 2008, 2010.8 and 2014.2 respectively. Sigmoids are scenarios, not forecasts. Actual biofuel production growth will depend heavily on oil prices and policy responses to increasing food prices. See text for sources and methods.

The underlying idea is that both oil and cereals are global commodity markets. If it's profitable to make food into fuel in the US, even without a subsidy, then it's profitable elsewhere also - possibly more so given lower labor costs. So the basic growth dynamics are the same. The infection just hasn't got as strong a grip on the whole globe yet, but it's growing at similar rates.

I want to stress something here about the implications of the recent growth rates for the timing of the problem. Something growing at 25%/year growth doubles in three years. So in both the last two graphs with different extrapolations, you see global biofuel production hitting half the global food supply within about six or seven years. We'll discuss in a moment what factors could stop that from happening, but first I just want to point out that these time constants render cellulosic ethanol irrelevant to the issue.

Cellulosic ethanol is what most most advocates of biofuels assume that the future will belong to. It is ethanol made out of the cellulose in various kinds of agricultural waste, fast-growing grass or tree crops, etc. In an abstract, in-principle, kind of way, it might indeed be possible some day to produce a lot of fuel this way, since current global consumption of about 8 gigatons of fossil fuel carbon is an order of magnitude smaller than the roughly 60 gigatons of carbon fixed by the world's plants (net primary productivity). However, cellulosic ethanol is not commercially practical today, and there are reasons to wonder whether the transportation and material handling issues will be overcome soon. At the moment, there is a single pilot plant operating in the world at a non-commercial scale, and otherwise the technology is in the lab.

Let's grant, for the purpose of discussion, that all the problems will get solved and cellulosic ethanol will get off the ground commercially a couple of years from now. It won't have any meaningful impact on what happens with food-based ethanol. Remember the Code Red video, and the shape of the sigmoid curve? Remember how the infectious agent spends a long time quietly multiplying below the radar screen till it gets into the sharply rising part of the curve and seems to take everything over all at once? Cellulosic ethanol is at the very beginning of that long growth process. Food based ethanol is on the steep part of the curve already.

Ok. So this is all incredibly bad news. What could stop this process from continuing?

Well, I think there are three major possibilities worth mentioning. Again, the key point is that the spread rate of biofuel plants is controlled by the profitability of those plants. That in turn is mainly set by the difference between oil prices and food prices.

So, for possibility number one, if oil would go back down to $20 a barrel, that would certainly do the trick. There are people who continue to believe that the current stagnation in oil supply will end soon, and allow prices to fall. I'm not going to spend a lot of time on that possibility: we're still waiting, alas. Those who would claim oil will go back to $20, or $35, or $40, or $60, are getting quieter and quieter as it passes the $100 mark. My own view is that we are on the bumpy plateau of global oil supply. I do not expect either large increases or large decreases in oil supply any time soon, though small increases and decreases are certainly possible. If that is correct, I expect oil prices to increase in the medium term, though certainly they could go down in the short-term if the credit crunch affects the global economy enough.

The second way that biofuel conversion of food could sharply slow is when food prices get high enough. This is certainly going to happen before 100% of the food gets turned into fuel. The question is, at what point? When we have a bidding war between the gas tanks of the roughly one billion middle class people on the planet, and the dinner tables of the poor, where does that reach equilibrium?

This is not an easy question to answer. The situation is unprecedented enough that it's not easy to find good data with which to project the situation. Significant uncertainty remains, but I have found a couple of ways of making rough estimates, both of which produce similar answers.

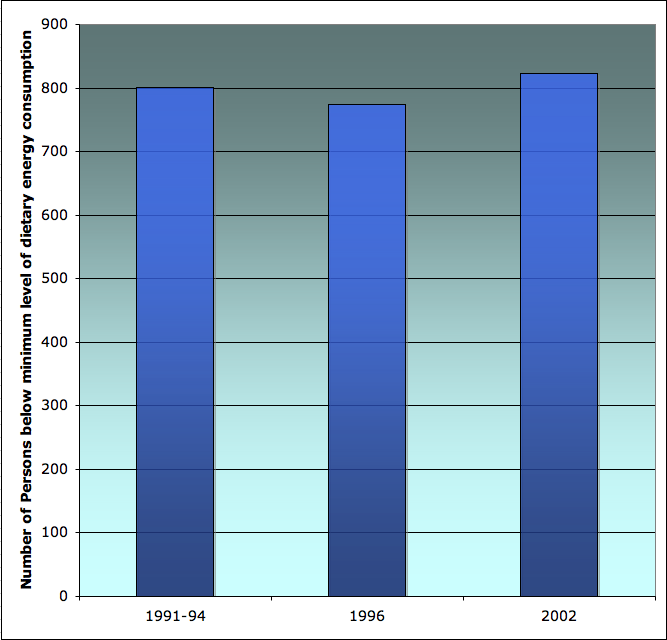

One thing that probably puts a lower bound on the number of persons affected by large food price increases is the number of people who were already chronically hungry. The UN, as part of its Millenium Development Goals effort, has statistics on how many people currently cannot meet minimum dietary energy guidelines. Throughout the 1990s, that hovered around 800 million people:

Global population unable to meet minimal dietary energy requirements according to UN Millenium Development Goals Indicators.

Presumably, it remained a similar number, at least until the major food commodity price increases of the last couple of years. I wouldn't claim to be very knowledgeable on this, but I struggle to imagine how someone who wasn't meeting minimum dietary guidelines already can continue to exist on half as much food, or a quarter as much food, as food prices come into equilibrium with the current oil price level, or perhaps double again should oil prices double again. I would imagine that if you are hungry all the time you would already be devoting most of the skills and resources available to you to the problem of eating, and you would have limited ability to increase that in the face of large increases of food prices.

This still leaves the question of how many people who were able to meet their minimal dietary needs at historic food price levels might not be able to do so at doubled or quadrupled prices.

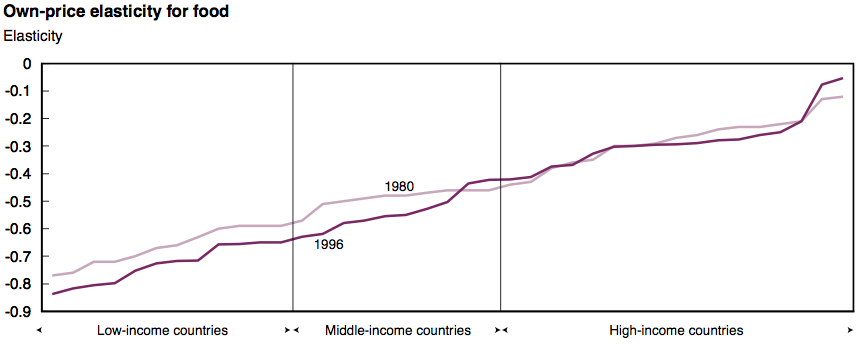

I managed to find some data for food consumption elasticities across a broad range of countries in a USDA study Cross-Country Analysis of Food Consumption Patterns by Regmi et al. The most important graph is the price elasticities:

Food income elasticity by country income according to Regmi et al..

The definition of the price elasticity is that it's the ratio of the percentage change in quantity consumed as a result of a certain percentage change in price. For the low income countries in the sample, price elasticity is about -0.7. Thus a 10% increase in price would be expected to result in about a 7% reduction in food intake. It's not clear that elasticities can safely be scaled up to very large changes in price, but if they could, a 100% price increase would imply a 70% decrease in food consumed, which would presumably create severe hardship or death by starvation for most people in poor countries (unless their income derived from growing food, and they had secure title to their land).

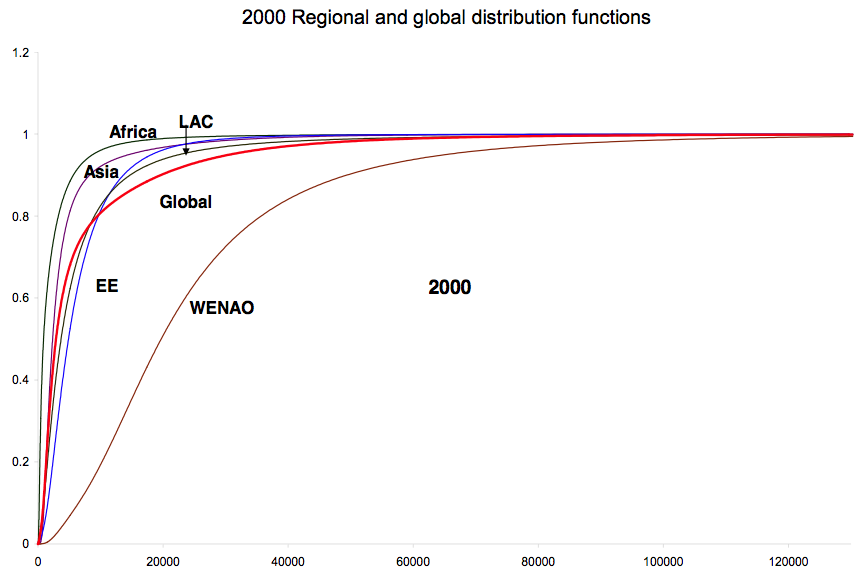

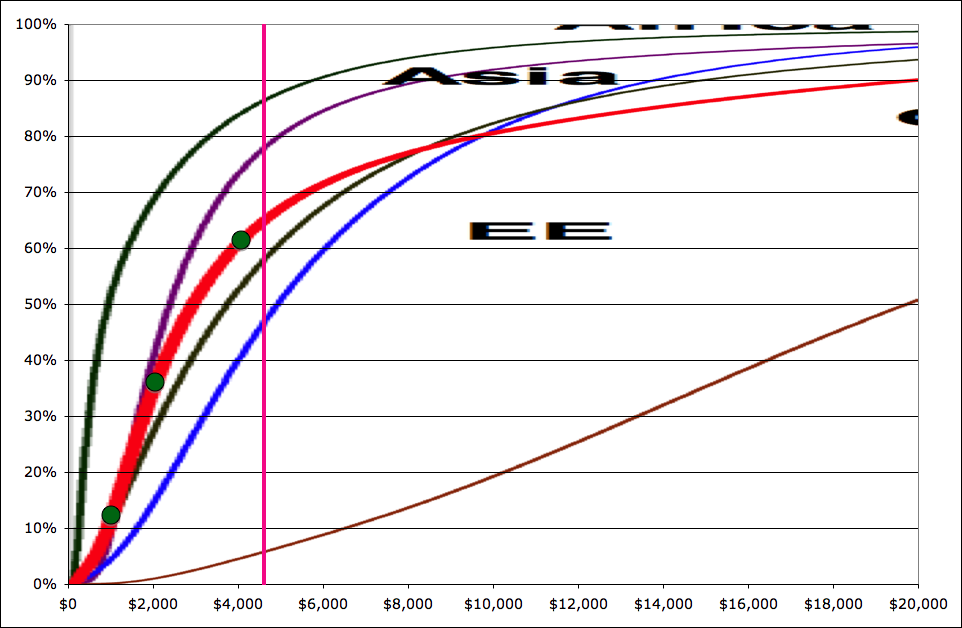

The definition of low-income country in the Regmi et al study is that it has less than 15% of US per-capita income. Per capita income in the US in 2000 was just a hair less than $30,000, so 15% of that is $4500. According to this global income distribution data,

Global income cumulative distribution according to Chotikapanich et al..

for which I've blown up the low end here,

Low end of global income cumulative distribution according to Chotikapanich et al.. Pink line represents the $4500 income level.

about two-thirds of the world's population would fall into the low income category, and thus would apparently be extremely vulnerable to doubling or quadrupling of food prices. For another approach to the same thing, we can look at income elasticities (the ratio of the percentage change in food consumption produced by a certain percentage change in income):

Food income elasticity by country income according to Regmi et al..

Here the value for the lower-income 2/3 of the world's population is about +0.7. What this means is that a 10% reduction in income has about the same effect on food consumption as a 10% increase in food prices. This suggests that we can use the global income distribution (shown above) to roughly estimate the impact of a doubling or quadrupling of food prices. We noted earlier that according to the UN about 800 million people are unable to meet minimal dietary energy requirements. That is 12% of the world population. On the income distribution (one graph back), the 12% mark corresponds to $1020/year in income (shown as the lowermost green dot). By looking at the $2040 level (36% of the global population - second green dot up), and the $4080 level (61% of the global population - third green dot up), we can estimate that a doubling in food prices over 2000 levels might bring 30% or so of the global population below the level of minimal dietary energy requirements, and a quadrupling of food prices over 2000 levels might bring 60% or so of the global population into that situation.

These estimates should be regarded as quite uncertain. Still, it seems hard to make a case that food price increases will cause a cessation of biofuel profitability before a significant fraction of the global population is in serious trouble. The poor will not be able to bid up food prices by factors of two and four and keep eating. In contrast, the quadrupling of global oil prices, and tripling of US gasoline prices, over the last five years has had very minimal impact on driving behavior by the middle classes.

The core problem is that gasoline price elasticity in the US is about -0.05, versus the -0.7 price elasticity for food consumption by poor consumers. This makes clear who is going to win the bidding war for food versus biofuels in a free market.

This brings me to the final thing that could stop runaway biofuel growth: public policy. So far, there has been a fairly broad coalition in favor of increasing ethanol production. This encompasses agricultural interests, environmentalists hoping to reduce carbon emissions and rely on a renewable fuel, and many citizens concerned about reliance on Middle Eastern oil supplies. The Renewable Fuels Association reported recently that 3/4 of Americans believe we should increase our reliance on ethanol. This kind of thinking has led to subsidies and mandates for biofuel production in the US, in Europe, and even in a number of developing countries.

My conclusion in this analysis is that this broad agreement is in fact mistaken. It is based on a failure to appreciate the speed with which high oil prices and profitable biofuel operations can fuel a very rapid growth of the industry up to the point that it consumes a sizeable fraction of global food production. This will have only modest benefits for global fuel supply, but will cause massive abrupt global hardship in poor countries. Many unforseeable consequences may follow from that.

I suggest we reconsider our policy.

Jeezus Stuart. This is like a Phd thesis. Seriously.

And the implications, though not completely surprising after reading TOD for two years, are overwhelmingly bad, and utterly believable.

This line from your conclusion is worth repeating:

Thus equity, or the lack thereof will increasingly be a part of energy discussions.

Your post highlights yet another huge advantage of crude oil - its scale.

And if you merge your conclusions with the findings of the National Academy Report, "The Implications of Biofuel Production for US Water Supplies", it becomes pretty obvious that food is not the only other 'non-energy' resource that will be squeezed out trying to ramp up this strategy; water health, water availability, soil, environmental toxins, etc. all will be detrimentally affected. We are pulling everything in towards the center, from people, critters, natural systems, etc. to fuel profits, to fuel consumption, to fuel profits, etc. The adverse effects of this materials economy have been out of the public eye for a long time. Methinks the biofuels spectacle is going to bring them out into the open, and soon.

This policy must be reconsidered. Because as momentum creates more and more biomass processing/ethanol plants, there will be that many more special interests lobbying to keep them going. Man this is frightening... Thanks for your continued top notch work. Makes me want to go work on my addiction post right now, before I have my coffee.

Incidentally, I wonder how much wine/beer we consume, pints/gallons converted to barrels, netted down for ethanol content, compared to the gross projections for ethanol in your post??

Are advocating converting the wine production to ethanol? That's blasphemy! (Well brandy companies already do that but age it in oak and sell it for 100 $/gal)

On the other hand if you tell the populace: "wine or fuel" then agro-fuels would end really fast.

Very impressive, Stuart!

Despite the huge amount of information you have gathered, I missed seeing who makes the money from the ethanol production. I'd like to see how much they donated to certain political parties and which candidates!

I don't know but part of Obama's plan for energy independence and fighting global warming is biofuels as stipulated in the recent Democratic debate. He also supported CTL last year but has either abandoned that notion or is downplaying it as someone may have gotten to him on that one.

Now Stuart or someone needs to get to Obama because now it appears that he may be next President of the United States.

Illinois is a big corn producing state and a big coal producing state. Not too hard to figure out where Obama's advice has been coming from, there.

Yep, time for a change. Sure.

My assessment of the situation has always gone something like this:-

The energy content of the current global oil supply is about seven times the energy content of enough food to feed everyone on earth, so we could starve ourselves without having much impact on the fuel supply.

So, fuel from food is nothing more than a dangerous distraction from the peak oil problem. Stuart shows very well just how dangerous it is and how quickly the situation might deteriorate.

...meanwhile -on another planet?- Peter Kendall (president of the UK's National Farmers' Union) argues that:

Link: Biofuels 'will not lead to hunger'

Excellant article, another real eye-opener and well argued.

Nick.

I think there is a kernel of truth in what he said, in that the income of farmers is already and will continue to rise. Some third world peasant farmers will benefit from an overall rise in market prices. The heaviest burden will fall on the urban poor in developing countries. But a caveat is that peasants in traditional societies often do not have legal title to their land in the sense a modern state would recognize it. Biofuel profitability will likely accelerate the trend of wealthy landowners finding a way to kick them off it.

Also, even in developing countries there are many people who, while they may not starve, are sure going to be extremely unhappy about the trend in food prices.

Recent experience with outsourcing the EU's animal feed production to South America IParaguay, parts of Brazil, parts of Argentine) points otherwise. The benefits of higher prices go to a limited number of large farmers and the indsutry which support them, the rural population gets driven off to the city slums and the rural areas concerned get 'used up' in 10-15 years, what's left is desert.

And now for the shamelss plug: a talk/discussion happening on soy in paraguay at CEDLA, Amsterdam, this friday at 1530hr.

CEDLA

Keizersgracht 397

1016 EK Amsterdam

020-5253498

secretariat@cedla.nl

Please note!! No admittance after the lecture begins

Soy production in the Southern Cone: the socio-economic and environment impact

Javiera Rulli (BaseIS Paraguay)

Referent: Barbara Hogenboom (CEDLA)

In the view of many researchers and activists in the global South and North, the model of intensive agriculture based on soy monocultures, production of fodder in one continent and agro industry in another, is extremely problematic. This model results in an emptying of the countryside, contamination of the environment and destruction of landscape and native cultures. According to Javiera Rulli, a biologist working at BaseIS Paraguay, the expansion of agribusiness leads to criminalization of social struggle and violence against indigenous, peasants and the poor in the cities. She will talk about the current tendencies and problems together with An Maeyens (soy campaigner for ASEED Europe) and Nina Holland (campaigner on agrofuels for CEO). To give an impression of soy production and its effects, some parts of a documentary about San Pedro (Paraguay) will be shown.

Javiera Rulli will present the outcomes of two recent studies. "Refugees of the Agro-export model" is the result from an extensive field research brought about in 2006 in Paraguayan campesino communities surrounded by GM soy monocultures. This investigation by a multidisciplinary and international group of researchers (lead by sociologist Tomás Palau) analyses the dynamic of impoverishment and degeneration of the ways of life of rural households, causing rural expulsion and migration to cities. "United Soya Republics" is a collection of contributions by Latin American activists and researchers that depicts the current status of the “Global soy model” that dominates the Southern Cone. The volume shows that soy is not just a crop, but a system that has geopolitical value and sustends an economical globalization of agriculture in function of corporate intere

Very impressive work!

I just have one remark: a large percentage of non-cereal calories is meat. A large fraction of meat producing animals are fed with cereals etc. Do we have worldwide figures for that? That should make your non-cereal million barrels per day more accurate, as farmers that produce animal feedstock will shift to biofuel feedstock. What percentage of worldwide cereal production is fed to animals? or, even better, what percentage of farmland produces animal feedstock?

I believe 2 factors will stop biofuel growth : price competition with food for developing countries, and price competition with animal feedstock, as meat is a product that most people in developed countries do not want to abandon. In public policy i have little hope. Ultimately, low EROEI, water and energy shortages and the much better alternative of solar power should finish the job.

"competition with animal feedstock"

Yeah, I think as prices rise we will see a rise in the fighting between entrenched lobbying groups. Already the meat industry is up in arms over the increased cost of feed. Then add the snack food and beer conglomerates, environmentalists and other groups and suddenly the political pressure to support ethanol starts to evaporate. At some point, hopefully, we see enough pissed off political donors NOT from the corn belt derail the biofuel trends outlined above.

World:

Grain used as animal feed - about 36 % - fair to say a third.

During about the last 50 years, production of meat products (and eggs) *per capita* has doubled, and the trend is ever upward, as the Chinese and others take to chomping big Macs instead of, or as well as, chop-sticking rice with a few scraps of fish in it or half an egg.

Grain to fuel - about 2-3%, or under 3%. Or rising a bit in 2007...

The rest is eaten by humans. In one form or another. Bread, pancakes, spaghetti, burghul mush, nans, muesli, couscous, oatmeal, rice, etc.

These numbers are rough; a sort of average of different numbers, studies, etc. There is no definite authority (afaik.) Easy to look up.

36 %, i thought it would be more like 50-70, as animals eat about 4-6kg of grain for one kg of meat produced and we have 1.3 billion heads of cattle + more billions of pigs + 24 billions of chicken (according to wikipedia). Anyway, the biggest disadvantage of ethanol is that its efficiency is below 0,1-0.5% (from sunlight to useful energy) so solar panels are 2 orders of magnitude better.

Terrific Terryifing post Stuart, this is exceptional quality.

Ill will send this one around in the Netherlands to a multitude of organisations.

Excellent analysis in general. Don't like the faulty obviously biased analogy to viruses and infections though.

I think most ethanol supporters are aware of this stuff, at least I am.

The starving have no money to buy corn so whether the corn is used for ethanol or not is irrelevant to them.

Trying to blame ethanol for the situation developing due peak oil is silly IMO. It is the inappriate pricing of corn that enables the ethanol industry to thrive. If corn were priced for it's energy content, which now would be about $9.00/bu., the ethanol problem addressed in the analysis would largely solve itself.

Trying to stop ethanol now with political action will be very difficult. Ethanol now has a constituency just as oil does. Oil is powerful enough to get it's way with wars, low taxes on gasoline and such. Ethanol is now a somewhat less powerful lobby, but it is strong enough to stop ill conceived measures that would largely benefit foreign citizens. Ethanol is here to stay, get used to it.

Ask not for whom forced food and energy conservation comes, it comes for thee.

"The starving have no money to buy corn so whether the corn is used for ethanol or not is irrelevant to them". The problem is all the many people in the tail of the income distribution who have a little income, but not really enough. Their money is going to go less far, and therefore they are going to get hungrier.

"Trying to stop ethanol now with political action will be very difficult. " No question you are right about that.

Yes, notice that ethanol's clout has managed to give a farm-state Democrat the momentum over the former Democratic front-runner. Can someone remind me when God gave Iowa the authority to choose our presidents for us? Don't expect fast change for politics. Those three billion who may be headed for starvation had better get some good lobbyists quickly.

What an excellent post to start the week with. When you look at things from a Macro/Global perspective it all becomes so much clearer.

I used to think that once subsidies would go away, agro-fuels would simple get out of business for their very low EROEI would make uncompetitive against other liquid energy vectors. But as this post shows the demand for agro-fuels will still be there (very low elasticity) and in the end agro-fuels will compete mainly against food. And this changes the whole picture because food has essentially the same energy inputs as agro-fuels.

Stuart, if you have the time it might be worth to model operational costs growth, factoring feedstock growth. It is likely that grain prices will rise much faster than oil this year; the same could happen again with coal.

How many people of those who live with less than 5000 $/a practice subsistence agriculture? When you live from subsistence agriculture your income can be 0 and you strive. That's hardly the case today when pure subsistence agriculture is mostly gone, but in developing countries, ballpark 60% of the population has to grow most of their food. In this point I diverge from you and Castro, I'm not certain if the poor classes will be affected as much as lower middle classes that do not own land.

Unless they un-peg their currencies from the dollar ;-)

Well I hope that some people like that looney fella Khosla take a look at this.

If people like Khosla look at this, it will validate their decision -that biofuels will scale and they will continue to get their subsidy and higher energy prices will mean profits.

What they don't pay attention to (and possibly don't care about) is the fact that we have an aggregate energy gain for society: say 8:1 on 50 quads, for a total of 400 quads globally. Therefore, any sub 8:1 EROI, even if it makes wild profits, is being subsidized by the remaining cheap high EROI fuels embedded in the infrastructure. So its a Tragedy of the Investing Commons; entrepreneurs can still make money while the planetary condition: human, critter, and ecosystem, deteriorates.

At least they'll know they are evil people. And so will we and the starving mob demanding heads.

Another way this could end is via the "starving mob" effect.

The income inequality in U.S.A. is also very large and even though food is a small percentage of income, what does that matter if you have a rapidly shrinking supply of discretionary $ because your housing costs are fixed, health care costs are rising, energy costs are rising and then food costs go through the roof?

Then consider the potential geopolitical impact of starving mobs in neighboring nations, trading nations, etc.

Well, for once I pretty much agreee with you. However, I think the impact is likely to be greater in countries like the US where most people are not used to making do - or less than making do.

Although it wasn't Stuart's intent, I think this article blosters the doomer case for a farmstead lifestyle. Right now I'm snowed in and probably will be for a few more days. We lost power, phone and (gasp) the internet. Has it been a big deal? Not really. We have our PV system and a back-up generator. We heat with wood and not only have water from our well but from storage taks. We store lots of food, etc. Coversely, my BIL in Carmel, CA still doesn't have power back, lost his water supply when the water company lost power (although the water is back now) and can't cook anything.

I truly believe people need to take some time to seriously look at how vulnerable they are to what may be coming.

Todd

PS I really believe a good starting point is to read Flight From the City by ralph Borsodi. It was first published in 1933. I have a 1972 reprint of it. It isn't a "how to" book but rather a "how his family did it" along with their ratiinales for their decisions.

Hello Todd,

I did a quick google for Flight From the City and found it online here:

Flight From the City

Thanks for the tip, it's on my reading list now. :)

Does it show that? Surely, if corn ethanol has an EROEI of less than one (as Pimental claims), and the source fuels (coal, oil and natural gas) and the end fuel (corn ethanol) are reasonably substitutable in the larger economy, only subsidies could possibly make corn ethanol profitable in the long term. I believe there are non-ethanol specific subsidies to farmers which contribute to ethanol's current commercial viability, not just the subsidies Stuart considers in this brilliant post.

Stuart, thank you for the superb analysis, and the enormously valuable data. Since I'm working on long term food security issues, you've just saved me a huge chunk of work, and I'm appropriately grateful ;-).

Ethanol also works to draw down future food production, and by several analyses has a greater net warming impact on the planet than burning oil. Because ethanol creates enormous incentives for environmentally destructive practices like continuous corn, heavy pesticide use and aquifer depletion, the potential outcomes are probably even worse than you state - that is, not only do we reduce our short term food security, but our long term capacity to keep producing food is dramatically cut into as we use fossil water and desertify arable land, not to mention reducing soil capacity to hold carbon by further warming the planet.

And worse than that...yikes.

Again, this analysis was brilliant and much appreciated.

Sharon Astyk

http://science.reddit.com/info/64s1d/comments/

http://politics.reddit.com/info/64ryb/comments/

http://digg.com/world_news/Biofuels_Could_Cause_Mass_Starvation_of_the_G...

thanks for your support of this very important story...

Gratz - you made Whatreallyhappened.com

top notch work. thanks for u'r followup on this all important issue!!!

this will take pressure from outside the US to reconsider our policy - let's hope not lethal pressure.

we are creating one helluva pressure cooker & if the decline of oil is significant i can't see an ok conclusion. we will need terrific leadership! i get a little hope that obama has a 3rd world perspective that could come thru as president.

thanks again

Infectious agents growth occurs until it runs out of things to infect, either because everything is infected already or because the uninfected become resistant or immune. The growth of ethanol plants is really the spread of an idea -- one of making money. Something which will stop the spread of that idea is a counter idea -- people losing money.

There are barriers to the continued growth of ethanol that you have not addressed. In particular, there is a transportation bottleneck out of the ethanol plant. Ethanol cannot be easily transported in its pure form, as it really likes water. Most of petroleum transport occurs via pipeline, so moving a lot of ethanol around is a problem. Second, there is the final bottleneck to the consumer: autos which can use E85 (and pumps to deliver it) are not in place and won't be in any large number for quite awhile. Given the mandates to use more ethanol, how this dynamic plays out with regards to the infrastructure problems is hard to predict.

But E10 shouldn't be a problem. Transportation is in fact an issue and adds even more to the energy investment side of the equation.

E10 use is economically linked to gasoline. If prices rise high enough such that consumption is reduced, then E10 use goes down accordingly. But I agree that the biggest problem now is transport out of the plant.

FELM--Food Export Land Model

http://www.bbj.hu/main/news_34793_russia+raises+grain+export+duties+to+4...

Russia raises grain export duties to 40%

07 Jan 2008

This is breathtakingly excellent work. The elasticity numbers for driving and eating give a pretty good glimpse into the future, IMO.

I'd like to add one thing regarding future income disparities between the rich and poor. In Energy Intensity and GDP in 2050 I project that due to the rise in third world populations, the general drop in national GDPs due to energy decline, and the relative lack of improvement in the energy intensity of third world economies, the number of poor (those living in countries with an average per capita GDP under $3,000 per year) could balloon from 1 billion today to 5 billion by 2050, while the mean income within that group drops from about $2000 to $1200.

The implications of such an income change in the presence of biofuel use by the rich is doubly ominous. I fail to see how the third world could experience such a convergence without a massive human tragedy.

This is a useful analysis. I think though that there is sufficient flexibility in the food supply that the starvation you are worried about can be averted for long enough for policy to rationalize. A drastic reduction in animal protien consumption can maintain dietary inputs. I've noticed that the prices of organic milk and eggs have held steady as the price of the non-organic products rise to meet them. Also, my local butcher is now competitive with Safeway. I noticed also that the cattlemen's association opposed the energy bill. I think that the sqeeze can be placed on the middle class rather than the poor by driving the feedlot industry out of business through competition with free range meat, eggs and milk which often use non-arable land. A wrinkle to this is that ethanol plants are being planned as can be seen in the ethanol plant blight spread down into Texas and Arizona where corn is not grown:

Placing the cost of ethanol on those who consume it through a large increase in the price of animal protien may be something the market can manage. This would be worth investigating further. Could we be seeing the end of McDonalds?

Chris

As Stuart has pointed out, both oil and cereals are global commodities. While there might be "sufficient flexibility in the food supply" of the United States or other OECD countries, here are a couple of facts that suggest this situation is not universal:

Africa gets only 10% of its food calories from meat.

Africa imports 25% of its food calories.

Africa has less than 10% the per capita GDP of the OECD.

To me, that situation doesn't spell "flexibility", it spells "calamity".

I'd agree with you except that it is hard to get blood from a stone. This is why so much effort is put into getting the middle class to act against its economic self-interest. That is where the money is. Even debt vultures are really out to fleece donor countries rather than the bankrupt counties they initially victimize. I suspect that food aid will continue to flow for several more years and it will be our sacred cows that get gored, moving public policy away from biofuels. $15/chicken will get people's attention I think.

Chris

I see two problems with your argument. Firstly, the price elasticity of meat is lower in rich countries than the price elasticity of grain in poor countries:

What this implies is that meat consumption in rich countries will go down less (percentage-wise) than grain consumption in poor countries. Secondly, the price of meat won't rise as much percentage-wise as the price of grain, since grain is only one input to meat production (albeit an important one).

That said, I think meat price increases in developed countries are likely to get politically explosive.

On the other hand, it does not take a big reduction in meat consumption to free up quite a lot of grain, and elasticity in countries affected by famine is set close to zero owing to foreign aid. That effect might change but the geopolitcal opportunities for say, China, to step in seem too large right now for it to disappear quickly.

Chris

Hi Stuart,

Thanks for a great post. In a wonderful way, you give the dimensions of the competition that we are beginning to see between joules for food and joules for transportation. This competition is not new. Before the 1900's transportation meant horses. Horses eat a lot more than people, and there was competition at every stage. Should this field be planted for wheat or used as pasture? Should a railroad car be filled with food or hay?

Dave

This seems to underline a certain TOD editor's perspective - we will burn everything to try to keep things rolling.

What struck me reading this is how casually the debate about changing America's driving habits was dismissed.

Now having proved to your own satisfaction that unless Americans reduce their driving, involving dramatic changes to how Americans live, changes which have been put off for my entire adult life, maybe we should be discussing how much suburbia is worth in terms of human lives. Business as usual will literally mean killing millions, just to be able to keep the wheels within American suburbia rolling.

Pretty shocking results, regardless. Normally, megadeaths have been pretty much restricted to nuclear war and epidemic scenarios - thinking about burning the world's food for fun and profit is grim. And for those that bow at the altar of a free market, simply a logical extension of how the market will solve our problems - including too many poor people, it seems.

Thus, each refill of a gas tank with E85 equals the death of at least one person from starvation. Imagine having to look at a picture of a starving child with bloated belly, dying in his/her mother's arms, every time you pulled up to a gas pump. . . with the reminder that by filling your tank, you are ultimately killing this child.

It would put a different perspective on things, wouldn't it.

Unfortunately, there will be plenty of people that don't give a damn, including some on this board. I would just point out though, that there is a basic difference between seeing bad things over which one has no control happen to innocent people, and causing those bad things to happen by one's own actions. In the first case, one is just a passive, helpless observer; in the second case, one is what we commonly call a criminal.

Not wanting to see a criminal in the mirror every morning, it is time for me to get serious about making some BIG lifestyle changes.

"Unfortunately, there will be plenty of people that don't give a damn, including some on this board. I would just point out though, that there is a basic difference between seeing bad things over which one has no control happen to innocent people, and causing those bad things to happen by one's own actions."

Uhhh... so let me get this straight: you see filling up one's tank with E85 as morally equivalent to murder because some overpopulated, resource-poor third world country has failed to embrace birth control and take positive steps to educate and care for its own people? Mmmkay...

Actually, I do "give a damn" about poverty and starvation. I just don't agree with your interpretation of the cause (my buying gas for basic transportation) or solution (my switching to regular gas or some other 'morally superior' form of NRG).

I am no big fan of ethanol and agree with most TODers that it's a dead-end in the NRG big picture. Even so, I just don't buy the "living as a Westerner = murder" moralist argument. We could all try going back to a pre-mechanized, subsistence farming lifestyle ( I say "try" because at current U.S. population level, it's not going to happen). We could even attempt to re-distribute most of U.S. food production around the world. Even assuming all this this were practically & politically feasible, what good would it do as long as the rest of the world keeps adding another 80 million extra hungry mouths to the planet each year?

There can be no solution to the world's hunger problem without addressing the root cause: population overshoot.

I don't buy the "living as a Westerner = murder" idea either. However, what we are talking about here is a radical disequilibrium: a deliberate decision to divert a massive percentage of the world's food supplies, knowing full well the disasterous consequences -- all done to keep the ICE private passenger automobile running, and with a cavalier dismissal of alternatives (like much higher CAFE standards, fast track development of EVs, Alan Drakes EOT). This goes quite a ways beyond the mere fact of differential levels of development and wealth.

We (or actually TPTB, those in positions of political power and those with economic power in symbiotic relation with them - ordinary folks like me have no significant input or influence) have a choice. We COULD pursue a pathway toward an energy efficient future built around renewables. The TPTB have decided to reject that future, and to instead pursue a last ditch, no holds barred, desparate gamble to extend BAU and their own advantageous position in it for as long as possible, with no regard to the consequences for anyone else. This is no "tragic mistake", nor something done in ignorance - they know very well what they are doing.

The average Joe or Jill Sixpack filling up at the gas station probably DOESN'T know the consequences of his actions, however. They certainly haven't been told. Thus, I don't really blame them. But how would you tell them? This was the point of my previous post. They are not going to read an article like Stuart's masterful as it may be. Having been thoroughly conditioned by visual advertising, however, a powerful visual just might break through and expose them to the reality of the situation.

Actually, I'd go you one further. I'd guess that even if Joe or Jill Sixpack *did* understand the global consequences of filling up their SUV with E85, I doubt they'd much care. However, I agree that we *could* and *should* be doing far more than we are now.

But here's the rub: the average consumer does not respond well to teary-eyed appeals from Sally Struthers and sad looking Africans. Let's face it --most people are basically selfish. It seems to be hard-wired into our DNA. However, consumers *do* respond to price signals sent at the pump, and until very recently, those price signals all said "consume away, there's plenty more where that came from!" Once regular petrol reaches a critical threshold (say $10 USD/gal.), we can actually expect this situation to get *worse* not better, as ethanol and other/better bio-fuels start to become even more profitable.

Of course, we could be spending the hundreds of billions we've wasted on Iraq and tax-cuts for the rich on promoting birth control & women's literacy around the globe, or developing alternative energy sources. But The Decider has decided that this is not a priority. And the leaders of dozens of other third-world countries aren't doing squat about population overshoot either, or, in some cases, are actively suppressing/subverting family planning efforts. For some, it's primarily due to religious beliefs, for others it's due to some combination of ignorance, fear or greed.

So, either we --and other world leaders-- acknowledge reality and "get with the program" in a big hurry, or we let the status quo continue and the world will "solve" our long-term problems for us... just not in a nice way. I wish I had some other plausible solution that did not involve mass starvation, war and misery for the vast majority of the world's population, but unfortunately I don't.

WNC Observer,

A quibble: I do not think that providing fuel for cars is the major political purpose of corn ethanol in the United States. I think making the grain farmer lobby happy is the biggest purpose with the car usage a rationalization.

Btw, Anyone interested in what population overshoot + dwindling natural resources + ignorant, backward population adds up to, here you go:

http://www.cnn.com/2008/WORLD/africa/01/06/kenya.crisis/index.html

Oh, but we're different! We're special! Or at least all the cornucopians will tell you that we are, without one shred of real evidence other than their wishful thinking.

I never said "we're different" --at least not genetically/biologically. Americans and all Westerners are fortunate to have been born into societies with abundant (but finite) natural resources, universal literacy, and relatively stable, quasi-democratic governments (though slowly migrating towards plutocratic rule in the U.S.). None of this changes the fact that we will also be impacted by Peak Oil, though unlike Kenya or most other third-world nations, technologically advanced nations DO have the resources to deal with it --*if* we get moving right away.

My apologies, HARM. I was being facetious because many of the cornucopian responses you will get around here to population (as the elephant in the room) are basically what I posted - we're different, this time it's different, we're going to turn this around, etc.

I agree that so long as population remains off limits for discussion, then any attempted solution is trying to fix a symptom and not the underlying problem.

NP --I think we're basically on the same page.

Some similar thoughts were crossing my mind.

I think this is a very thorough analysis, but in order to get any realistic policies implemented, the policy makers, who to some extent depend on voters to get in office, need permission from said voters. The problem is that the voting public isn't generally aware of the limitations of ethanol or any other biofuels, and unfortunately this analysis isn't going to change that. That's not a criticism of the essay, the details need to be available to back up the conslusions, but to get John Q. Public on board you need to be armed with a simpler message to lead with. What I've had the most success with is using calories (nutritional, actually kcal) as the energy unit because it is accessible to most people, and pointing out that the average American burns ~45000 Calories in gasoline per day, while consuming 2000 in food. So, are we just going to increase food production 20x? To be fair, no-one I've talked to is lining up to form an eco-village with me, but I've at least managed to get a few people thinking.

What can one say to Jeremiah the Prophet? This was one of the greatest gloomiest messages ever. Honestly, we need to get our politicians to read this. (Jeremiah's message got to the king too, but the king burned it in the fire after they read it to him - Jer 36:16-26)

I'm concerned that the first world is going to be able pay for ethanol and the third world/poor are not going to be able to pay for food.