US Peak Oil Adaptation: Prognosis in a Credit Crunch

Posted by Stuart Staniford on September 2, 2007 - 10:00am

Let's first review the situation to date. I began worrying that we might be essentially at peak oil already back in November 2005. This was the date of Ken Deffeyes' famous prediction based on Hubbert Linearization, but my concern was based as much on the plateauing of the monthly oil production series in spite of high prices. As more evidence emerged, I firmed in my view that peak oil is probably about now.

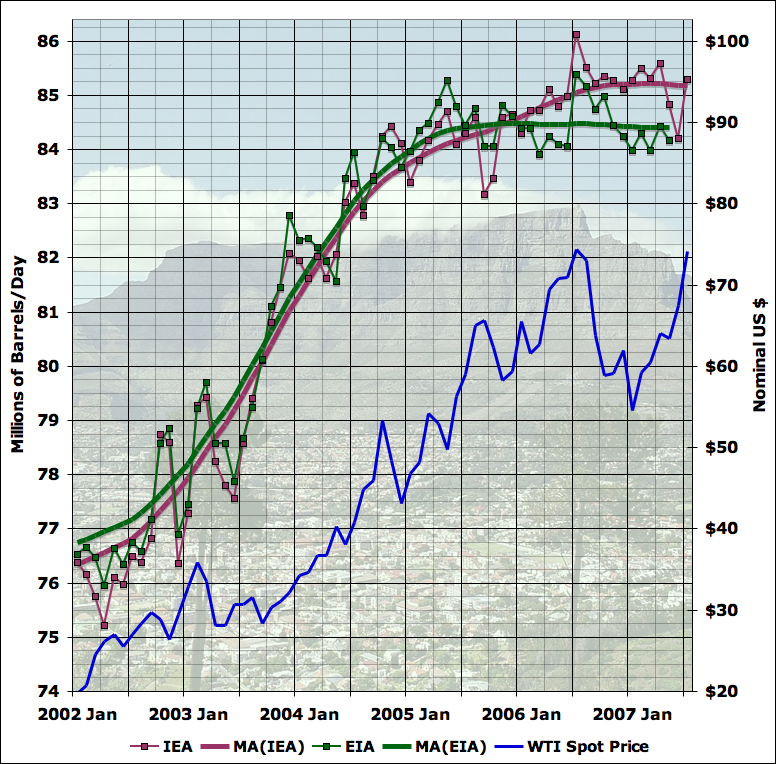

A couple more years of data have not changed the picture much:

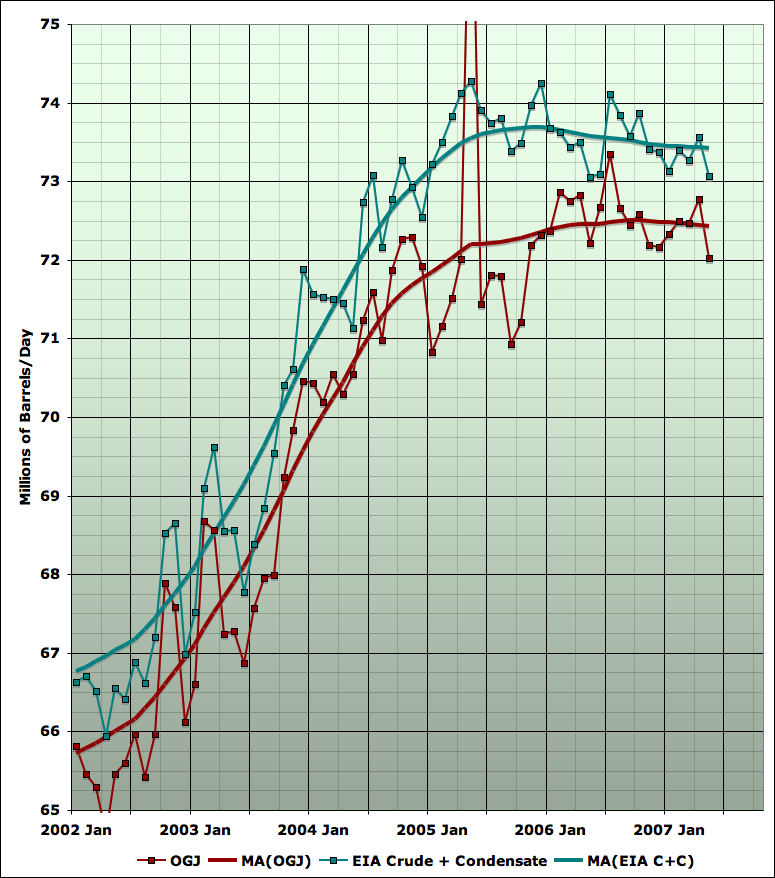

The EIA data for total liquid fuels show a plateau since early 2005, while the IEA data increased slowly for a little longer but have shown a plateau for the last year. Looking at narrower definitions of oil produces a broadly similar picture:

The EIA's crude plus condensate actually shows a very slight decline since a peak in late 2005, while the Oil and Gas Journal series for crude alone has a gradual increase to a plateau in 2006 and 2007. For more background on this plateau debate, see this tutorial post - I used to track this stuff every month but it got boring.

In my view, the immediate cause of this oil supply plateau is that Saudi Arabian oil production stopped increasing, as of late 2004, and then began to decline: at least part of this is likely due to the depleted state of North Ghawar. If this unsourced graph is to be believed, Ghawar production has declined 1mbd (20%) from 2005 to 2007.

In looking at United States adaptation to the situation, I've primarily focussed on usage in road transport, which represents about half of total US oil usage (which in turn is about a quarter of global oil usage). And historically, the transportation sector is the least elastic user of oil in the US.

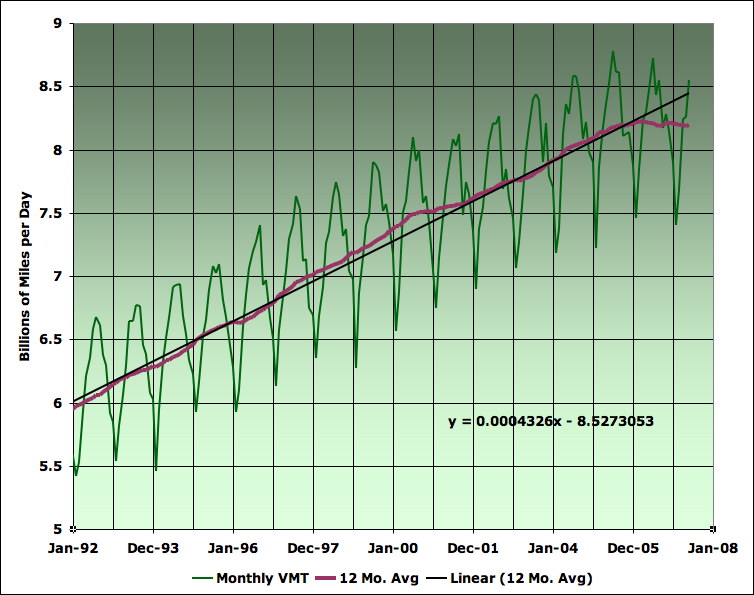

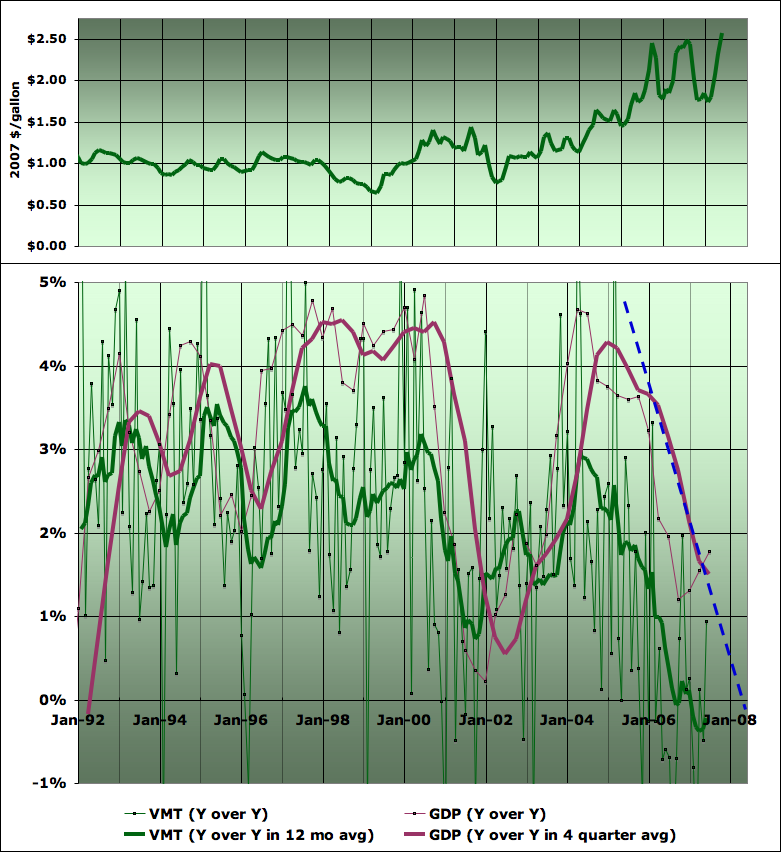

It's convenient to separate road transport usage of oil into two factors: the total vehicle miles traveled (VMT), and the efficiency with which the vehicle fleet currently uses oil. The recent trends in vehicle miles traveled I've studied in detail in the past, but here's an update:

Basically, increases in VMT were fairly steady over the last 15 years until late 2005, when VMT flattened out and began to decline slightly (broadly coincident with the plateauing of global oil supply). This isn't altogether good news. Historically, there's a decent correlation between changes in US miles travelled and overall economic growth:

On this basis, I suggested in 2005 that the (then) drop in VMT growth would presage a drop in economic growth, and refined this at the start of 2006 to a prediction that the US economy would enter recession in 2007 (a prediction based on my perceptions of the bursting of the housing market bubble also). I may have gotten the timing at bit wrong, but basically that still looks close, and we may get there by the end of 2007.

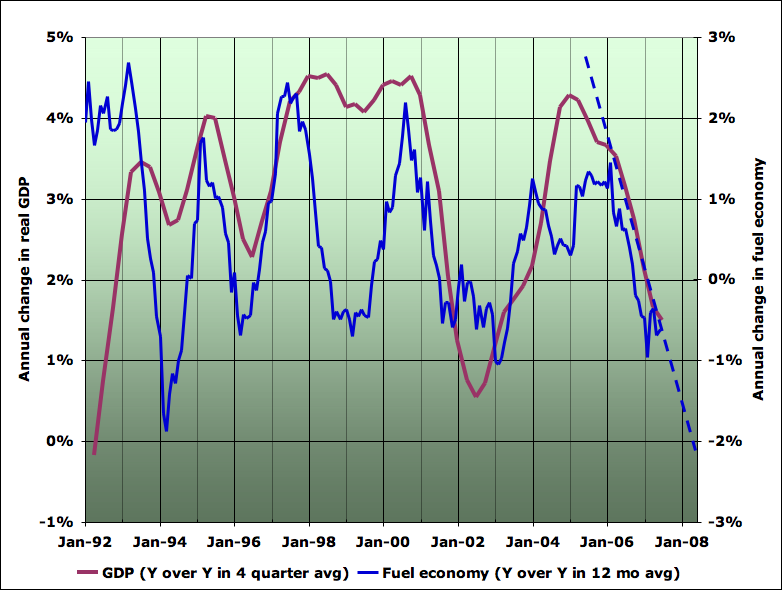

This next graph updates that VMT-GDP connection with the monthly data over the last 15 years (through May 07 in the VMT, and Q2 07 in GDP).

I've also put the increase in gas prices in the top panel for context. However, I think it's important to stress that I'm not suggesting high gas prices are the sole cause of the drop in VMT (and GDP). On the contrary, I think those movements are likely multiply caused by both the oil supply constraint (which required some drop in vehicle usage somewhere), and the housing bubble bursting and resulting economic slowdown (which has been a major control on who has had to do the conserving). More on this in a moment, but let's turn to the other factor in road transportation oil usage - average fuel economy.

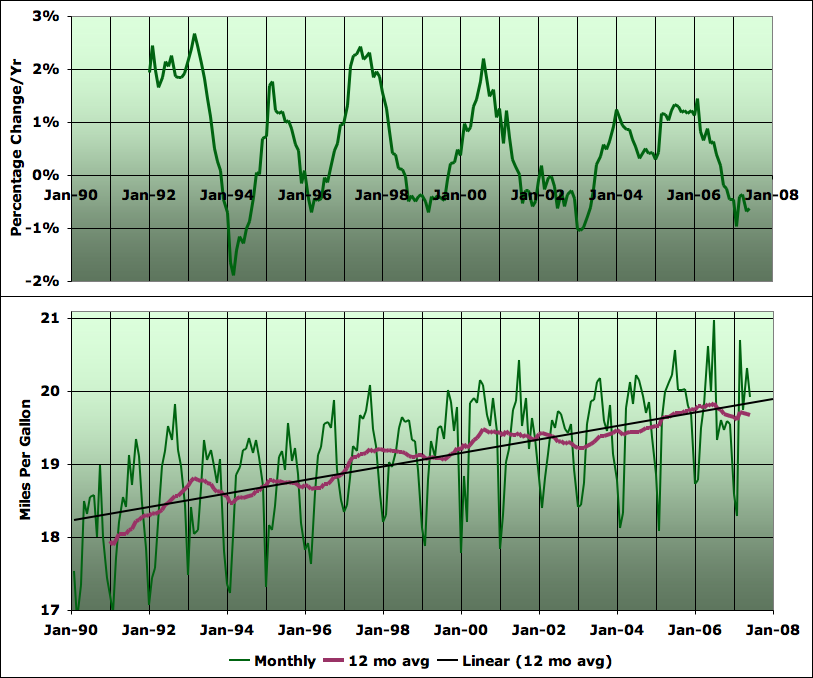

The news here is pretty bad - progress is essentially non-existent. I've discussed my methodology in detail before, but essentially I'm dividing the total number of vehicle miles by the amount of gasoline consumed, with an approximate correction for diesel vehicles. So this next graph represents the average fuel economy achieved by the entire gasoline powered fleet on the road (ie not just the fuel economy of new vehicles).

As you can see, fuel economy has been getting very gradually better over the last 15 years, but the trend in the last couple of years is actually getting poorer not better as one might hope. This is in contrast to the reaction to the seventies oil shocks, where, once things got under way, deployed fleet fuel economy improved by several percent per year. People really have not gotten the message yet - in part, they may still be treating the high gas prices as a temporary situation, rather than perceiving it as an important long-term need.

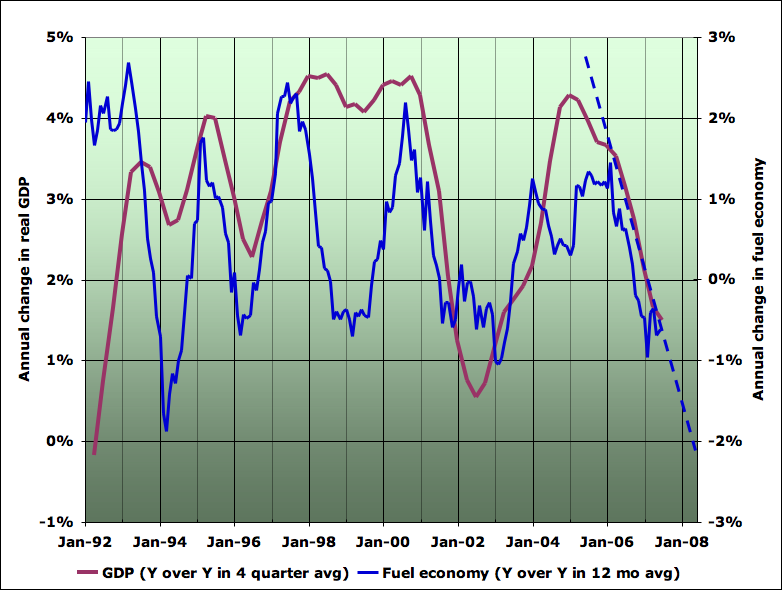

However, I also hypothesize that part of what is going on is as follows. There seems to be a decent rough correlation between fuel economy changes and economic growth:

The recent poor fuel economy growth fits into this pattern. I assume that what is happening is that as the economy slows, people buy fewer cars, and thus are less prone to replace older less efficient vehicles with newer more efficient ones. This is probably particularly true of lower income consumers who are particularly likely to be driving older vehicles (and now struggling to pay their subprime mortgages). This hypothesis should be confirmed more deeply (and I welcome any data or studies anyone is aware of which bear on this point). But for now, let's just keep going, noting the strong possibility that this correlation may continue to hold in the future.

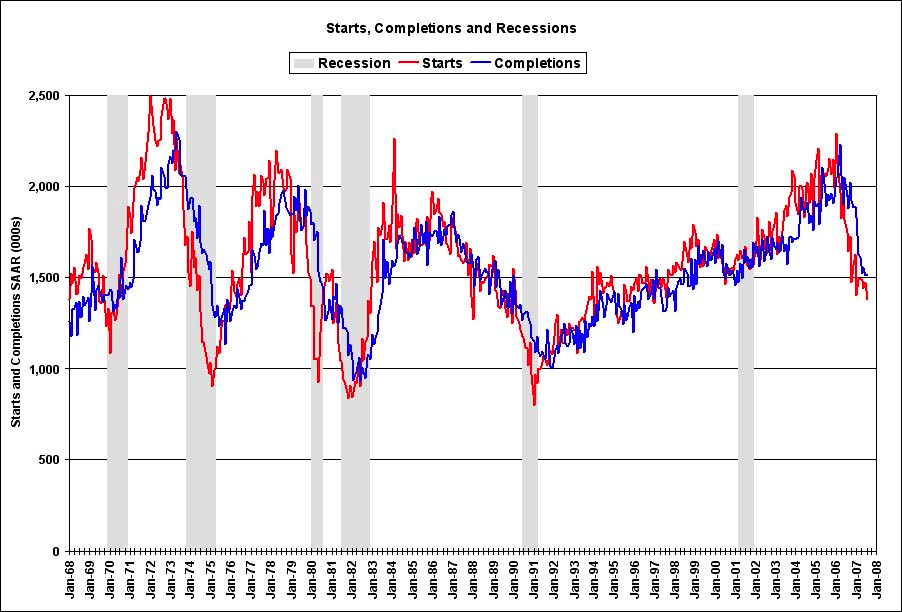

I have not blogged extensively on the US housing bubble and crash. This is not because I haven't considered it very important and followed it closely, but rather because Calculated Risk does such a stellar job. He makes most of the graphs I would tend to make, and I think has generally excellent judgement in interpreting them. Thus up till now I've been largely content to read that blog every day and feel like I know what's going on. To summarize a few salient stats now though, here's new housing starts and completions.

As you can see, new housing starts are a decent leading indicator of recessions, and peaked about the beginning of 2006 and have been falling sharply since. I take this as further evidence for the "recession around the end of 2007" hypothesis.

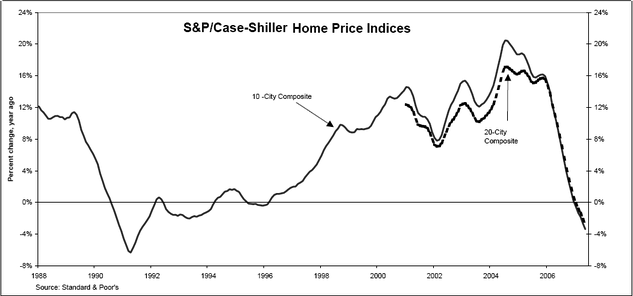

Prices of existing homes reached a maximum rate of acceleration in mid-to-late 2004 - at a staggering 15-20% in major metro areas - and then began to decelerate sharply:

Prices are now falling in this index (which I prefer to median home price indices as it is constructed based on comparing sales of the same house over time, and thus it not subject to problems of the sample changing significantly between up and down markets). For more on the housing bubble, I recommend this nice summary.

The major driver of the extremely high rate of acceleration in house prices was a combination of very low interest rates (engendered by the Federal Reserve attempting to mitigate the effects of the 2000-2002 tech crash) and a near complete collapse in lending standards in recent years, allowing all manner of exotic and imprudent mortgages to be passed off on people who could ill afford them. This has all come to a grinding halt in recent months, and now appears to be giving rise to a massive credit crunch. I refer you to Stoneleigh's excellent primer and Jerome's comments for more details.

So the question of the hour is: how bad is this credit crunch going to be?

I don't claim to have a methodology that I believe in to answer that question. Obviously, the mainstream economic consensus is that there is nothing to worry about. However, the mainstream economic consensus has been retreating one step at a time, which is not confidence-inspiring. As part of my research for this post, I read a sample of the Federal Open Market Committee minutes for the last few years, and it's somewhat like being in a parallel universe. Clearly, it's related to my universe, in that energy prices, housing activity, etc, are discussed. However, the discussion always seems to be about what happened in the last quarter, and projections about the future invariably assume that whatever is wrong now will moderate or not get much worse. Since the trend of events in the housing market has been to get steadily worse, this gives an impression of unreality: the committee invariably seems to fail to anticipate major negative developments. A sample from the March 2007 meeting will give you the idea. This is just after major disruptions in the subprime mortgage sector in February.

Participants reported signs of stabilization in housing demand in most regions of the country. At the national level, sales of new and existing homes, while fluctuating in recent months, did not display declining trends. The inventory of new homes for sale reportedly had fallen further from its recently elevated level. Participants noted, however, that such inventories likely would need to be worked down appreciably more before growth in housing construction would resume. The increase in delinquencies on subprime adjustable-rate mortgage loans and the ensuing increase in interest rates and tightening of credit standards in the subprime mortgage market likely would constrain home purchases by some borrowers, perhaps retarding the recovery in the housing sector. However, there was no sign of spillovers from the subprime market to the overall mortgage market; indeed, interest rates on prime mortgage loans had declined somewhat in recent weeks, along with yields on U.S. Treasury securities. Moreover, home-buying attitudes had improved and continuing job growth could be expected to support home sales.There's not the slightest hint of concern here that within a few months the Federal Reserve would need to be engaged in massive injections of liquidity to stabilize the financial system during a panic.

For another, now famous example, consider this April 2005 statement from then Chairman Greenspan:

“With these advances in technology, lenders have taken advantage of credit-scoring models and other techniques for efficiently extending credit to a broader spectrum of consumers. The widespread adoption of these models has reduced the costs of evaluating the creditworthiness of borrowers, and in competitive markets, cost reductions tend to be passed through to borrowers. Where once more-marginal applicants would simply have been denied credit, lenders are now able to quite efficiently judge the risk posed by individual applicants and to price that risk appropriately. These improvements have led to rapid growth in subprime mortgage lending; indeed, today subprime mortgages account for roughly 10 percent of the number of all mortgages outstanding, up from just 1 or 2 percent in the early 1990s.Oops.

The FOMC comes across to me in their minutes as completely complacent as to the risks of speculative bubbles and the fact that unrestrained credit-creation has caused house prices to get seriously out of sync with incomes. No meeting minutes I read showed any deep discussion about the systemic risks of the kind of risk transference engaged in due to the creation of asset backed securities and CDOs. A search found no mention whatsoever of "peak oil" in any minutes of any Federal Reserve body, or any staff report, though there is regular discussion of "energy prices", treated as an essentially mysterious exogenous factor.

In general, there's an excessive reliance on the assumption that whatever markets are currently doing must be fairly optimal, and a failure to recognize (or at least discuss) that market systems, being collections of fairly imperfect human beings acting under uncertainty, are subject to certain well known pathologies and occasionally get into speculative spirals that can end in very abrupt dislocations. There's no mention of a "housing bubble" in any recent minutes or statements: one has to go back to 2003 to find Alan Greenspan downplaying the idea:

The very large flows of mortgage funds over the past two years have been described by some analysts as possibly symptomatic of an emerging housing bubble, not unlike the stock market bubble whose bursting wreaked considerable distress in recent years. Existing home prices (as measured by the repeat-sales index) rose by 7 percent during 2002, and by a third during the past four years. Such a pace cannot reasonably be expected to be maintained. And recently, price increases have clearly slowed.My confidence is thus low that the FOMC has an adequate understanding of what it is up against, or that its reassurances can be relied on. It will do its best, but it is fundamentally complacent and reactive in its outlook and can be relied on to fail to anticipate new developments, especially negative ones, ahead of time. I'm willing to revise this conclusion with more data - in particular, Fed Reserve chairman Ben Bernanke has left a large trail of very influential academic papers that I'm now digging into, and hope to report further on.It is, of course, possible for home prices to fall as they did in a couple of quarters in 1990. But any analogy to stock market pricing behavior and bubbles is a rather large stretch. First, to sell a home, one almost invariably must move out and in the process confront substantial transaction costs in the form of brokerage fees and taxes. These transaction costs greatly discourage the type of buying and selling frenzy that often characterizes bubbles in financial markets. Second, there is no national housing market in the United States. Local conditions dominate, even though mortgage interest rates are similar throughout the country. Home prices in Portland, Maine, do not arbitrage those in Portland, Oregon. Thus, any bubbles that might emerge would tend to be local, not national, in scope.

Third, there is little indication of a supply overhang in newly constructed homes. The level of overall new home construction, including manufactured homes, appears to be well supported by steady household formation and not dependent on high and variable replacement needs or second-home demand. Census Bureau data suggest that one-third to one-half of new household formations in recent years result directly from immigration.

On the other side, one has a variety of fans of Austrian economics and the gold standard who tend to the view that the expansion of credit due to recent Fed easing has fueled the debt boom and make a contraction now inevitable. On the whole, they appear somewhat more in touch with reality than the FOMC. I read Mike Shedlock pretty regularly as the most quantitative and rational exponent of this viewpoint that I've come across in the blogosphere. He has been predicting a financial meltdown due to the credit bubble for some time, but I've still yet to see something that gave me a solid belief that we can estimate how bad this credit crunch could get.

Let me set aside that concern, and just lay out what has spooked me over the last couple of weeks, which is the whiff of financial panic. The events that caused the Fed and the European Central Bank (the ECB) to have to inject such massive amounts of liquidity into markets to maintain target interest rates were described by Paul Krugman in his Op-Ed Very Scary Things as follows:

Everyone knows now about the explosion in subprime loans, which allowed people without the usual financial qualifications to buy houses, and the eagerness with which investors bought securities backed by these loans. But investors also snapped up high-yield corporate debt, a k a junk bonds, driving the spread between junk bond yields and U.S. Treasuries down to record lows.Clearly, we have a situation in which financial system players have started to lose confidence in each other. The public has not lost confidence in financial institutions, but they are losing confidence in each other. They are probably better informed than we are, suggesting that as the chain of bad debt and overpriced assets continues to unwind, we could see more institutional failures, and more public loss of confidence in the financial system.Then reality hit — not all at once, but in a series of blows. First, the housing bubble popped. Then subprime melted down. Then there was a surge in investor nervousness about junk bonds: two months ago the yield on corporate bonds rated B was only 2.45 percent higher than that on government bonds; now the spread is well over 4 percent.

Investors were rattled recently when the subprime meltdown caused the collapse of two hedge funds operated by Bear Stearns, the investment bank. Since then, markets have been manic-depressive, with triple-digit gains or losses in the Dow Jones industrial average — the rule rather than the exception for the past two weeks.

But yesterday’s announcement by BNP Paribas, a large French bank, that it was suspending the operations of three of its own funds was, if anything, the most ominous news yet. The suspension was necessary, the bank said, because of “the complete evaporation of liquidity in certain market segments” — that is, there are no buyers.

When liquidity dries up, as I said, it can produce a chain reaction of defaults. Financial institution A can’t sell its mortgage-backed securities, so it can’t raise enough cash to make the payment it owes to institution B, which then doesn’t have the cash to pay institution C — and those who do have cash sit on it, because they don’t trust anyone else to repay a loan, which makes things even worse.

And here’s the truly scary thing about liquidity crises: it’s very hard for policy makers to do anything about them.

The Fed normally responds to economic problems by cutting interest rates — and as of yesterday morning the futures markets put the probability of a rate cut by the Fed before the end of next month at almost 100 percent. It can also lend money to banks that are short of cash: yesterday the European Central Bank, the Fed’s trans-Atlantic counterpart, lent banks $130 billion, saying that it would provide unlimited cash if necessary, and the Fed pumped in $24 billion.

But when liquidity dries up, the normal tools of policy lose much of their effectiveness. Reducing the cost of money doesn’t do much for borrowers if nobody is willing to make loans. Ensuring that banks have plenty of cash doesn’t do much if the cash stays in the banks’ vaults.

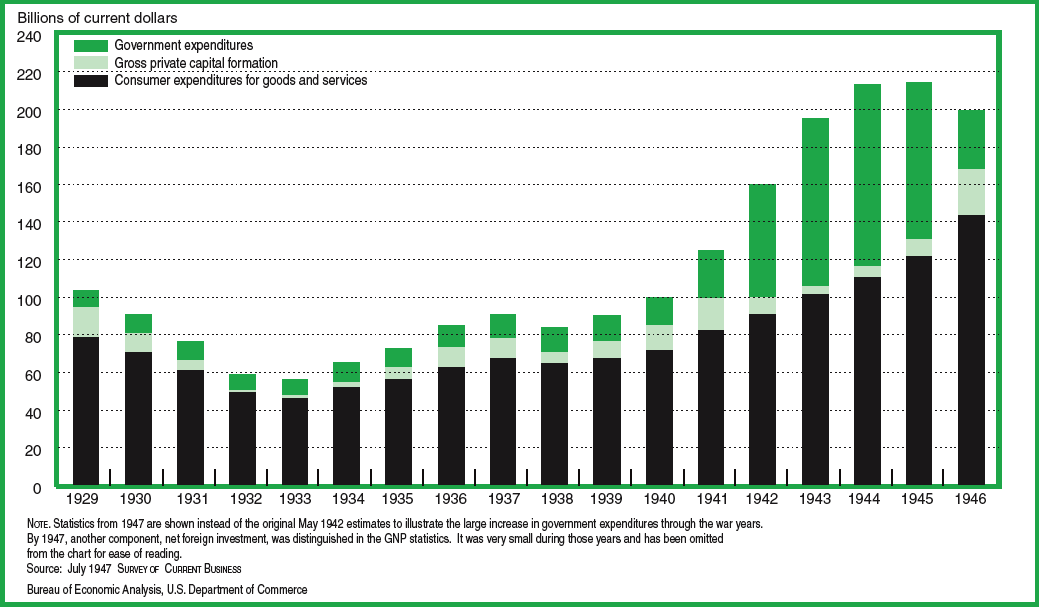

The last financial panic of major significance in the US was was the Great Depression, which was essentially the result of a large debt fueled bubble that crashed in 1929. This led to a series of bank failures and panics and large-scale public loss of confidence in the financial system. That in turn led to a major contraction in the amount of money in circulation (since so many banks disappeared), and a drop in the velocity of money as people and institutions tried to improve their balance sheets and hold more cash. This didn't happen all at once, but as a rolling collapse over a period of four years. The Fed did more or less what you would expect (drop interest rates fairly rapidly beginning in 1929), which didn't really work. Then they were obliged to raise them again to counteract a run on Federal gold reserves by foreign governments, which greatly exacerbated the domestic difficulties. Prices dropped dramatically, as did real output. The data are chilling:

Now, this is probably a worst case for what we might face in the next few years, and there are some reasons to think things will be much milder. But let's just explore it as a worst case. There are two points I want to draw from it. One is obviously to note the sharp contraction in GNP generally from 1929 to 1933. It almost halved in nominal terms, and even in real terms, it dropped by a third. A contraction in GDP of that order of magnitude today would likely produce a very dramatic drop in oil usage (recall the correlation between GDP and VMT growth), which would without doubt collapse energy prices to pre-peak levels for a number of years. In the great depression, the unemployment rate rose from 3% to over 20%. With no income, and likely very restricted ability to borrow, that's a lot of people who wouldn't be doing too much driving.

Furthermore, consider the "Gross Private Capital Formation" element of GNP. That is private investment, and it dropped to almost nothing in 1932 or 1933. Now private investment today includes things like research and development in alternative technologies, venture capital funding of clean-tech startups, installation of wind power or solar power sites, laying down of new railroads, new nuclear power plants, coal-to-liquids plants, development of new oilfields, etc. Recall also the correlation I pointed out between fuel economy changes and economic growth - in a depression, it's a safe bet that average fuel economy of the fleet would simply degrade as few people bought cars and the existing fleet got older and less efficient. In short, whatever your preferred method of mitigating or adapting to peak oil, you can pretty much kiss it goodbye during a major meltdown of the financial system.

This, of course, will not make peak oil go away. Credit crunches and even depressions, as extremely painful as they may be, are inherently temporary. After a suitable time, the offending debt somehow gets written off and offending assets are repriced and the economy resumes growing. However, when this one passes, peak oil will still be there waiting for us. And whatever time we lose in investing in all the things we need to do is an opportunity lost forever.

So, I would really like to get a better handle on how bad this credit crunch is likely to get before it's done.

As usual, I think that the net export situation is the key factor. Expanding net exports + cheap money resulted in the final real estate boom that we are likely ever to see. I don't think that it is a coincidence that the US Personal Saving Rate has declined as oil prices increased (and as net export declined), since 2005.

Peak Exports suggests, in my opinion, that most US debts will never be paid back to the creditors, or the debts will be repaid with hyperinflated currency, take your pick.

If we assume that the top five net exporters (about half of world net exports in 2006) continue to show about a 5% rate of increase in consumption and if we assume a 5% rate of decline in production, their combined net exports will be down by about 75% within 10 years.

Basically, I think that the decline in net exports will outpace the decline in consumption because of a contracting economy.

I think that the American consumer is facing inflationary food and energy prices and the deflationary effects from increased job competition and because of the real estate slump/crash. All I can say is that I repeatedly tried to warn anyone who would listen of what was coming.

Hubbert linearization, which you are genererally a big believer in, says the top level decline rate would be barely different from zero over the next ten years. It wouldn't project a 5% decline until after 2040. So your model is considerably overstating the situation.

HL is just part A of the calculation.

Net exports are production - domestic demand.

Domestic economies of oil exporters should be expected to boom in a high oil price environment (especially major exporters although Norway just saves their earnings). Also oil exporters typically shield their domestic market from price signals (Norway has the highest gas taxes in the world).

Combined, the impact is strong domestic demand growth, despite weak of negative growth in production.

In 2006, Russia had decent production growth but minimal export growth due to strong internal demand.

I would strongly suggest that Putin cares more for Moscow taxi drivers than he does US SUV drivers. Likewise, Saudi is more concerned about filling the tanks of their many new teenage drivers than filling the tanks of our teenage drivers.

Gas rationing in Iran is an interesting contra example. The statements today by the former oil minister should give a clue as to the internal reasoning.

How many nations look that far ahead and take disciplined steps to do something about it (and gas in Iran is still about 35 cents/gallon) ?

I would not be surprised to see Russian production increase in 2007 and exports fall.

The transition of the UK from exporter to importer was speeded by the Export Land Model. By my "back of the envelope" calcs, they would still be an oil exporter by a 250,000 b/day if they used as much oil as they did in 1996.

Reduced North Sea production has had no apparent effect on domestic consumption growth in Great Britain.

Alan

"HL is just part A of the calculation".

My point is that Jeffrey isn't getting that 5% in production decline from Hubbert Linearization. I don't know where he's getting it - as far as I know, there's no evidence for it. And even if one completely bought the rest of the model (which I don't), that 5% near-term production decline arbitrarily doubles the size of the problem.

As noted down below, I am talking about the decline rate by the top net exporters, not the world.

Based on crude oil production data through 5/07, and if we assume flat production for the rest of 2007, the year over year decline in Saudi crude oil production would be 5.9%, for Norway, 4.8%, versus 5% plus recent increases in consumption (EIA data).

When Russia starts declining, which may be happening now, I suspect that the production decline rate may be in the vicinity of 10% per year.

Stewart, download Rembrandt's latest Oilwatch monthly here and look at chart #11. That has the dramatic decline of net exports Jeffrey's talking about

jim

Jim, your link does not work.

How about this?

(the html style manual has changed recently, and I'm sort of a technopeasant...)

My understanding is the 5% decline is in next exports not production. And this is from his export land model.

I assume a post of it applied to world is forthcoming from WT so we can discuss it in depth later.

Next:

I find it interesting you did not discuss how this monetary environment would effect investment in oil production and exploration and in general the oil and energy industries. I'd say we can expect investments in major projects to decrease significantly. My main concern has become a sort of extension of the export land model where it becomes increasingly profitable to produce less and less oil for two reasons.

1.) Expensive oil makes it expensive to extract.

2.) Monetary problems makes it difficult to invest large amounts of money in projects with a long term payout and a requirement for high prices to be profitable. The reason the price, has to be high goto 1.

3.) Export Land effect where high prices increases internal consumption and money spent on expanding capacity is "lost" to the subsidized internal market thus discouraging extensive investment by the national oil companies.

So the coupling of high oil prices and a weakening economy seems to set off a sort of downward spiral that cannot be easily solved. In my opinion declines in production will steepen significantly as the economy worsens and national oil companies will respond by continued cuts in exports both intentional and as a result of production declines, lower investment levels, and increased internal consumption forcing the oil price to remain high and setting us on this downward path even as the economy weakens.

Overall you seem to get into a paradoxical situation that as oil becomes more expensive less is produced.

Memmel

big oil companies don't borrow for exploration, they are mostly awash in cash. They will sometimes borrow for a fixed asset with a fixed life, like a production platform or to finance a takeover

And, not all oil will be expensive to extract. But the oil coming onstream will be a magnitude more expensive, and also rusting infrastructure on stripper fields.

Bob Ebersole

First your talking trillions to say develop the arctic so I don't think they are awash in cash considering the costs they would need to incur to keep production up. Not even close. Next I think they will have to continue to do serious stock by backs as they report lower and lower reserves. The market has not been kind to oil companies with large hord's of cash and shrinking reserves. The simplest way to solve this problem is to buy other oil companies. Next one would expect profit margins on the refining side to fall soon and even go negative as oil gets expensive. Politically their is a limit to how much refining profit a company can make.

Probably the best example of how I think this will play out is Iran.

Next most of the oil reserves left are in the ME or other regions under the control of National oil companies these are actually the ones I'm more concerned about since these are the onces that will be cash constrained.

And all this expenditure billions and even trillions of dollars if it happened and happened in time would be to keep oil prices low. I think that just like any other technical solutions offered ethanol etc the chances of the oil industry investing trillions to keep oil prices low are slim now. Especially for the National companies.

As far as I can tell to keep production close to what it is now over the next few years if all the giants are in decline is going to take a mind numbing amount of cash with a lot of it borrowed I just don't see this happening. And a lot of these projects need 60+ a barrel to be profitable.

And consider a few hurricanes through the Gulf...

In any case I don't consider the current cash reserves of the majors to be that important.

Oh and about borrowing.

Oil companies are not immune.

http://www.time.com/time/magazine/article/0,9171,917303,00.html

Memmel

of course oil companies aren't immune. Chevron bought Texaco about 5 years ago, who is trying to sell their bonds? I think old bonds like that would be as gilt-edged as they get.

But you're getting awfully far ahead of the curve on Artic Ocean exploration. The countries surrounding the ocean own claims out to 200 miles offshore, and are just now trying to figure out who owns the rest. I don't care if there are 10 Ghawars out there, the production problems out there are likely to be as big as sending a rocket to Titan to send back methane, and just as likely to make money. Maybe our greatgrandchildren will have some oil after all.

Bob Ebersole

Mike, you're also right that the only way they can grow their reserves is buy other companies, especially since they had a thirty year period where the big guys didn't explore in the US. They can also dump an almost infinite amount in tar sands and oil shale. But I suspect in another 10 years they will be like tobacco companies, their only worth being what the dividends are on the stock and with about as much social catchet. The big boys are being set up to take all the social blame for the energy problems, just like the Mexicans are being set up to take the blame for our employment problems. Bob Ebersole

Your making it hard for me to argue with you hmmph :)

I'd like to add that how the National Oil companies react is going to be a big factor. It makes sense that in the presence of economic uncertainties in importing countries and with a lot of oil investment eaten up by internal demand and with prices increasing fairly fast as production drops they will not be very aggressive about increasing production over the next few years.

I'm very concerned in general about how global peak will effect the oil companies and so far its not looking good.

There's probably quite a few small companies that will do very well mopping up the smaller nuggets of remaining oil -thats been discussed here before. Also, any company offering 'magic bullit' recovery methods with also do very well out of a strong desire to increase output.

Nick.

Hi memmel,

To help me clarify what you and Bob are talking about here:

Is there a big difference between "the majors" and the NOCs in the available capital for new projects normally?

And what are the implications of this? So, are you saying that the NOCs don't have as much - or (well, where does the money go? KSA for eg.) - or that they, for eg. KSA will be pressured to keep the revenue flowing? - (towards whomever they are supporting w. the profits now)?

And how does the degree of cooperation among NOCs - (is there any?)- affect the picture? and/or between NOCs and "majors" for that matter?

Thanks, Stuart (belated as it is),

Memmel, ok so...

re: "2.) Monetary problems makes it difficult to invest large amounts of money in projects with a long term payout and a requirement for high prices to be profitable. The reason the price, has to be high goto 1."

1) Would a consistent price rise as opposed to volatility fix this problem?

2) Remember back when you were talking about the normal oil market ceasing to function much after "peak"? (I believe w. the rules already in place for a (de facto was it?) rationing system - question mark?) Anyway...how does the idea about the market no longer being relevent (once decline has "set in") relate to the dynamic you are talking about here? Do the determinants of price change in some fundamental way under such a scenario?

as a person who worked in SA for several years as an engineer I tend to agree with this post. Saudi production is probably as much investment driven as demand driven. This was a problem they had in the 70's. They have little use for dollars which are depreciating and inflation is rampid. Why drop $100bn into an oilfield that's just going to give you $ 150bn in overpriced treasury bonds.

One thing that hurts our markets is that a nano percent of the population understands them. A telephone company with declining sales, declining eps, a 4% dividend paid with borrowed money, an accounting system that classifies a guy who goes from a wire to digital cable a "new customer" and a PE of 27 is not an investment. It's a Ponzi scheme.

Ponzi schemes are always the result of easy money, where all good investments are too expensive. Today, people avoid bonds because they can't afford to own them. Not a good sign.

Peak oil can be traced almost to the month to Fed rate decreases. Supply and demand have been extremely consistent.

Stuart,

As you may recall, the reason that I (accurately in turned out) warned of a net export decline in January, 2006 was because the top exporters (based on HL), especially Saudi Arabia, Russia and Norway, were much more depleted than the world is overall, plus an expectation of a rapid increase in domestic consumption.

For the top three net exporters in 2005, the year over year changes in production, consumption and net exports from 2005 to 2006 are as follows (EIA, Total Liquids):

Saudi Arabia: -3.7% (Prod.); + 5.7% (Cons.); -5.5% (Net Exports)

Russia: +1.6%; +5.6%; -0.2%

Norway: -6.6%; +6.0%; -7.8%

From the point of view of importing countries, global oil production is pretty much irrelevant.

Ah, so when Hubbert Linearization suggests a pessimistic answer (exporters are deeply depleted) you believe it, but when it suggests a more optimistic answer (global declines will be slow), you throw that out. (FWIW I think HL applied to Saudi Arabia is not likely to be very reliable).

I don't believe I ever said that. For the record, I expect the global production decline to probably be low, in the vicinity of 2% per year, and I just made that point in a NPR radio interview this morning with Jason Bradford.

I just think that the global decline rate is utterly irrelevant from the point of view of importing countries. If the US were the sole source of crude oil in the world, net exports would have ceased more than 20 years before world production peaked.

In regard to the Saudi HL plot, two points: (1) The most accurate pre-peak Texas URR estimate came from discounting the "dogleg up" and (2) Saudi Arabia showed, discounting the recent dogleg up, a very stable HL plot, which suggests that Saudi Arabia is somewhere between 60% and 70% depleted.

My bet is on a fast crash in world net oil exports.

BTW, the Texas versus overall Lower 48 model is interesting. The long term Lower 48 decline rate has been about 2% per year, versus the long term decline rate of about 4% per year for Texas. So, the non-Texas Lower 48 decline rate was probably in the vicinity of 1.5% or so. At peak production, Texas accounted for roughly one-third of Lower 48 crude oil production. The Texas decline rate was sharper because it peaked at a later stage of depletion than the overall Lower 48.

Today, the top five net oil exporters account for about one-third of total world liquids production. So, in terms of percentage of production and stage of depletion, one could argue that the top five net exporters are more or less to the world as Texas was to Saudi Arabia.

This brings me back full circle to why I basically, in January, 2006, considered a net export decline to be virtually a mathematical certainty--the top net exporters are more depleted than the world is overall, and then we plug in the rapid rate of increase in domestic consumption.

"...........a mathematical certainty--the top net exporters are more depleted than the world is overall, and......."

This makes a great deal of sense on several levels. Not reassuring mind you, but it has the smell of truth. Reminds me of some National Geographic episodes. Specifically those having to do with sharks and lions feeding habits. Devour what is readily available first, then move on to the more difficult prey.

Rembrandt showed all liquids down -5% in the last Oilwatch Monthly.

http://europe.theoildrum.com/node/2864

If we look back to 2005 to 2006 exports drop -3.5%. If we assume the Saudi drop was voluntary, exports would have still dropped 2%. I "guessed" at HL levels using some charts from Graphoilogy. What it looks like is happening is that many exporters are just entering the rapid decline phase of HL (Mexico, Norway, Saudi Arabia) we should see accelerating changes in these countries. PEMEX is projecting another 300kb drop this year. That is nearly 1% of exports alone.

change

Data from:

http://www.eia.doe.gov/emeu/cabs/topworldtables1_2.htm

HL Estimates taken from:

http://graphoilogy.blogspot.com/2006/09/hubbert-parabola.html

Jon Freise

Analyze Not Fantasize -D. Meadows

As noted above, I agree with Stuart that the most likely scenario for the world decline is a fairly low decline rate. The problem, in my opinion, is that most of this decline will occur in the top exporting countries, and then we plug in the rapid increase in consumption in exporting countries.

In any case, consider the simple fact that the three remaining fields that are still producing one mbpd or more of crude oil are all in top 10 exporting countries and all three of the fields are almost certainly in long term decline.

In my opinion, the rapidly developing Net Export Crisis is the most important issue of our time, and most of the world seems to be oblivious to it.

Following is the concluding portion of my January, 2006 post, and I have shown an excerpt from Stuart's post above--to the effect that the decline in world oil production was largely accounted for by the production decline in the world's largest net oil exporter.

http://www.theoildrum.com/story/2006/1/27/14471/5832

Hubbert Linearization Analysis of the Top Three Net Oil Exporters

Posted by Prof. Goose on January 27, 2006 - 1:47pm

This is a guest post by westexas

Stuart's comments from up top:

Edit:

Regarding the current top 10 net exporters, their rate of increase in consumption from 2000 to 2005 was 3.2% per year. From 2005 to 2006, their rate of increase was 4.6%. If Mexico had maintained its 2004 to 2005 rate of increase in consumption, the top 10 increase from 2005 to 2006 would have been 5.7%. In any case, this overall increase tracks the oil price increase (Brent, EIA). From 2000 to 2005, Brent increased at 12.7% per year. From 2005 to 2006, Brent increased 17.7%.

Top 10 consumption, in one year (from 2005 to 2006), increased by 500,000 bpd (Total Liquids). If Mexico had maintained its rate of increase, the top 10 increase would have been 664,000 bpd.

Mexico is an interesting export case history. Their initial decline in net exports, from 2004 to 2005, was 9.7%. My Export Land Model (ELM) suggests that the net export decline rate should accelerate with time.

If Mexico's consumption from 2005 to 2006 had increased at the same rate that it increased from 2004 to 2005, their net export decline rate from 2005 to 2006 would have been 10.2%, as predicted by the ELM.

However, their consumption fell from 2005 to 2006--presumably because of the falloff in cash transfers back home from Mexican workers in the US (probably because of the decline in housing construction)--and their net export decline was only 1.7% from 2005 to 2006.

Note that Mexico was the only top 10 net exporter in 2006 to show a decline in consumption.

Stuart did not say that he expects a low decline rate. He said that HL suggests a low decline rate. I've seen Stuart in the past mention decline rates from near 0% to as high as 11% in order to examine different cases but I am not sure that I recall Stuart ever "endorsing" a particular decline rate as the most likely one. I do recall Stuart doing some work on what the maximum decline rate would be that the western world could likely adapt to without serious impact. I think he mentioned something like 7% or 8% as an upper bound? (I can't recall for sure as he's written very much here over the last 2.5 years, almost all of it very educational.)

Jeffrey, I know that you favor the HL method for predicting URR but I must remind you that Hubbert himself never ever did any such thing. Deffeyes did this and while Professor Deffeyes is a very intelligent man, I do not think he is of the same caliber as Dr. Hubbert. Specifically, if you read Hubbert's own 1956 paper, all of it, you see that he began with a priori URR estimates. Given these upper and lower bound estimates, he was able to then develop his math to fit his curves into those upper and lower bounds. Once this was done, the forecast for peak date was easily derived. Professor Deffeyes math does not predict a single URR with special accuracy. It assumes that IF a field is produced at maximum production then the URR can be bracketed by the subsequent URR estimates from that math. However, if the field is produced in another manner (as KSA has been), then the line derived from HL becomes fraught with potentially bad assumptions.

Further, note that Hubbert's upper bound forecast ended up being too conservative as we're over 200 GB and still climbing though the end appears to be in sight. Hubbert's going to end up being about 10%-15% too pessimistic even in his most optimistic case. What is interesting there is that this was for the US, which operated under very different conditions than the rest of the world. Inflation of oil figures such as we have seen in the Middle East could not occur in the US and instead we probably had understatement due to SEC rules necessitating that the oil companies be conservative. Note that in forcing this conservative view that the US ends up being in that 10%-15% too pessimistic category.

But then consider the Middle East, where reserves appear to be overstated by 40%-50% in many cases. Clearly the reserves numbers from the Middle East cannot be taken to be as reliable as the US reserve numbers. The force of the SEC's monitoring (not the free market) caused our reserve estimates to dovetail pretty closely to reality. Since no such force is causing the NOC's to moderate their wildly speculative reserve statements in the Middle East, the question becomes exactly how much are they overstated?

And this question is important. The answer to that question, since the Middle East holds a disproportionate amount of the world's oil, will be one of the key drivers of decline.

In my opinion, no one here at TOD has realistically looked at the Middle East as a whole and assessed what the decline rate is going to look like if the 1980s reserve inflations were as badly overstated as they appear. Stuart has hinted at it. Dave Cohen has hinted at it. But no one here seems to want to tackle that very urgent question. And it is indeed urgent. It we are at or within a few years of peak production, the decline rate is very dependent on many unanswered questions. Here's another one that I have never seen discussed by peak oilers - what proof do you have that the production curve for the world must be roughly symmetrical in nature? In other words, people are assuming that the production curve looks like the black curve below but what if it is really like the red curve? Which of you can prove that the red curve is false, especially in light of the wildly inflated reserve numbers from the Middle East, the ever receding "big" fields of Kazakhstan, the overstated "finds" of Jack 2 and China's offshore, both of which have been subsequently amended downwards, etc.?

If I plug the pre-NOC reserve estimates for Middle Eastern nations into a spreadsheet then apply identical reserve growth numbers to those estimates as occurred in the US, the situation is not very pretty.

In short, I think that the HL technique is an interesting additional tool for helping to confirm peak but it does not predict it as Hubbert's methods did. And given that, plus the massive change in global production pattern precipitated by the 1970s oil shock and the subsequent voracious growth, I am not at all sure that the red curve above is wrong. And further, I do endorse your notion of "exportland" because we are seeing it play out in fact right around us. I just question your URR estimates (and those of just about everyone else on this site) because of the wildly inflated numbers from the Middle Eastern NOCs.

By the way, Jeffrey, this is not intended as a personal attack on you or anyone else here. I am simply expressing my reasons for disagreement and my concerns which appear to have never been adequately answered about global production versus actual (versus inflated) reserves. I greatly respect the messages you have been trying to convey because I believe you are spot on about exports and the severity of the crisis facing western civilization (and by extension, the entire world).

P.S. I am going to remind everyone here that in early to mid 2005 we were being assured that by late 2007 we would see huge growth in production because the the mega-projects. This has not occurred and instead global production is down! How many of you that were predicting a 2010 or later peak have amended your forecasts based upon the changes of the last two years? Or are you religiously clinging to an outdated belief because you think your ego is attached to it? Do you believe that the 2008 and 2009 mega-projects will bring us all of what we were supposed to get in 2006 and 2007 plus what was projected for 2008 and 2009?

"The greatest shortcoming of the human race is our inability to understand the exponential function." -- Dr. Albert Bartlett

Into the Grey Zone

I think the red curve is most probable, since secondary and tertiary recovery are happening in conjunction with primary production. (no stripper wells in the North Sea!)

As for 2007 vs. 2010, I found it interesting that after Skrebowski came out with the megaprojects, ASPO changed from 2007 to 2010.

Personally, I thought Dr. Campbell just decided to be conservative, so that he could rest on his laurels, and after all the shit he's be taking for a full decade, he could in the end say "see, I was actually conservative!"

But the megaprojects projected that deep sea would more than counterbalance the declines on land, and that obviously hasn't happened.

Which leads to a question I periodically put out: is anyone monitoring deep sea specifically? It would appear not to easily be lumped in with the standard country by country, region by region tallies.

We're past peak.

In my opinion, yes, we appear to be post-peak. But my question was not about date but the shape of the curve. The area under the curve must represent the total of all oil. The shape of the curve can obviously be changed. Has it changed as I've asked? If it has then the post-peak decline must be severe because the remaining oil is less than many think. If it has not shifted in that manner then the decline may be more manageable. That is the basis of my question - what data do we have that suggests that the production curve is going to be roughly symmetrical?

"The greatest shortcoming of the human race is our inability to understand the exponential function." -- Dr. Albert Bartlett

Into the Grey Zone

If I recall WHT's analyis correctly, convolving a number of curves of widely varying shapes still leads to something resembling the derivative of the logistic curve. Then there are advances like THAI for recovery and upgrading of bitumen; we might still have a steep dropoff, but there are good reasons to believe that we won't.

How this turns out depends partly on geology and technology, but also on what we believe will happen. If we continue with BAU (either because we have been sold a bill of goods by the oil interests, or because we fatalistically believe that nothing we do can avoid an imminent crash) then we will be caught in a crunch. If we push hard to raise efficiency and substitute electricity for oil with PHEV's, EV's and rail, the end of the consumption curve gets stretched out due to lower demand.

what data do we have that suggests that the production curve is going to be roughly symmetrical ?

The Central Limit Theorem.

Take "worst case, a set of varying right angle triangles" (production ramps up to a maximum and then goes immediately to zero) of varying heights, lengths (years of production) and start dates. Add them together and the result approaches symmetry.

Best Hopes for no secular & universal influences on oil production,

Alan

That's a theory. Now what data do we have to support the theory? Yibal certainly throws a curve into that line of thinking. The North Sea doesn't help either. Worse, 60% of global oil production is dominated by 1% of the total oil fields. What happens if we don't have a uniform distribution of triangles but instead are heavily weighted to a small number that dominate the total surface area? You can point to the US but the US was developed before or as these technologies were deployed, unlike the North Sea or Yibal which were developed fully using these technologies and which drastically altered their shape.

There are a host of questions here which are not intuitively obvious (to me at least) precisely because we do appear to have secular and universal influences (the rise and application of new enhanced oil technology for extraction).

My initial assumption was to accept the idea of rough symmetry as you outline, Alan, but two things - the dominance of global production by such a small number of fields and the application of enhanced oil extraction techniques - have caused me to question that assumption. And from what I see of the giant fields that have entered decline - Cantarell, North Sea, Yibal, etc. - the number of small fields needed to offset the steep declines in these fields is not something we can ever hope to attain.

"The greatest shortcoming of the human race is our inability to understand the exponential function." -- Dr. Albert Bartlett

Into the Grey Zone

The Central Limit Theorem applies to independent variables all sampled from the same distribution. This would apply if you were sampling with replacement colored balls from a closed bag, placing the sampled balls back into the bag after each sample.

The variables that we have are all dependent in that energy production today affects energy production tomorrow. Saudi Arabia took 5% of the world's oil offline in the early 70s and economic production everywhere suffered due to ripple effects. This is like the distribution of the sample affecting the distribution of the population with each sampling.

The variables that we have are also not from the same distribution, because as we produce (harvest) energy, we change the environment with every sampling. There are roughly 80 million barrels of oil less in the ground than yesterday. There are X mbpd offline because of weather, accidents, and unrest. Minor technological changes since yesterday affect recovery, exploration, and flow rate. These all affect our ability to produce (harvest) more energy today. This is like sampling, not replacing the balls you took out with each sample, and replacing them instead with an unknown number of balls from an unknown population.

And what we have is a combination of both these scenarios.

The Central Limit Theorem does not prove symmetry in the production curve because it does not apply here.

The problem we face is systemically nonlinear, dynamic, chaotic.

The Central Limit Theorem doesn't require the variables to have the same distribution. It only requires them to be numerous and independent.

RobertInSantaBarbara

I haven`t escaped from reality. I have a daypass.

Incorrect. The sample must come from the same population, therefore the variables have the same distribution. Please do your homework.

Your daypass has been revoked.

Your illustration omits a third possibility - a curve skewed in the opposite direction to your red plot, with a long tail to the right. Is this scenario not also a possibility? Why or why not?

Correction to above post: ". . . one could argue that the top five net exporters are more or less to the world as Texas was to the Lower 48.

westexas,

"I just think that the global decline rate is utterly irrelevant from the point of view of importing countries."

Well.. it is relevant; it is has been the signal for: Go Get it before anybody else does! Start the wars in the middel east!

Roger from the Netherlands

"It wouldn't project a 5% decline until after 2040."

Stuart,

Forgive me, but the graph you linked has different values from your world HL analysis in your story "Hubbert Theory Says Peak is Slow Squeeze".

http://www.theoildrum.com/story/2005/12/5/133418/045

The graph you linked is not showing a peak until 2015 or so? (hard to judge by eye). What article would you recommend as most accurate?

Jon Freise

Analyze Not Fantasize -D. Meadows

Indy

Stuart has mentioned his need for quantitative analysis of the

expected duration of the housing recession.

Fred at iTulip published a chart sourced from Northern Trust in Chicago, which can be used to estimate the duration of this bust. It predicts 5 - 10 years, and does not incorporate the effect of the baby boomers retiring during this period.

Previously, I heard that baby boomer retirement alone was sufficient to trigger a housing slump, because retirees generally shift to smaller houses, apartments, yachts, or motor homes, while selling their big homes.

Together, I believe that the US will as Stuart mentions, consume less oil going forward. But I also agree that demographics in exporting countries as shown by the ELM and demographics in China and India will shift this product from the US to Asia.

What I am saying is the US will lose in this zero sum game, and the winners will be the rising economies of India - China - Asia - Latin America.

to a fixed rate mortgage, but this may be impeded by a continued tightening of lending standards.

see:

http://www.itulip.com/forums/showthread.php?p=12232#post12232

http://www.itulip.com/housingbubblecorrection.htm

INDY

We now need to push for oil fields to be set aside as an energy input into all those projects required to de-carbonize our economy. The worst case scenario is one in which we have a recession, with a weakened financial system, the easy and cheap oil gone, but with our coal fired power plants still chugging along and our ice sheets disintegrating.

Thanks to Stuart for a good explanation of credit crunch and housing bubble for a non-economist. I plan to take economics this semester so I can at least understand the basics when folks talk about markets. The multiple converging crises we face require an interdisciplinary understanding. The geologists, economists, chemists, biologists, physicists, climatologists, agricultural scientists, engineers, ecologists, social scientists all need to bring their data and think together. The specialization of knowledge, while essential, hamstrings us from complete understanding. situation at any time. If our economy tanks, oil depletion and greenhouse gas emissions continue at a lower rate, but contraction squashes innovation and adaptation. Necessity is the mother of invention, but only if you have capital.

Stuart,

Sooner or later the U.S. will experience a recession; my own guess is that it will be later, and my forecast for real GDP growth for the U.S. in the fourth quarter of 2007 is 2.5%. However, to be quite honest, last year I thought there would be a recession in 2007, but I was wrong: Consumer confidence and employment have held up very well.

Confidence is the name of the game. If there is a panic and consumer confidence goes down, then consumption spending goes down and so does the GDP. Right now I do not see panic spreading, and the financial markets are generally healthy, despite weakness in the subprime mortgage market and concerns about the resetting of Adjustable Rate Mortgages.

My own opinion is that Peak Oil will trigger recession through the impact of higher oil prices on the economy. I do not know when this will happen, but my best guess is that gasoline between four and five dollars a gallon would be sufficient to trigger a recession. Higher gasoline and heating oil and diesel prices will have worse effects, and the recession could last many years.

A recession would not be all bad from a Peak Oil standpoint. For one thing, a recession allows resources to be shifted, e.g. from home construction to oil exploration. I think that good investment opportunities in the energy industries will persist, and that there will probably be plenty of funds available to seek profits, e.g. in drilling for more oil. In terms of resource constraints, I worry far more about a shortage of engineers than I do a shortage of funds. Where there is opportunity for great profit, funds will be found, but we cannot replace our aging petroleum engineers by borrowing money.

Over the longer term of the next fifteen years I expect a situation similar to the seventies and early eighties, but worse: stagnation or negative growth in real GDP combined with worse inflation followed by much worse inflation as the Fed uses monetary policy to try to mitigate the effects of Peak Oil. Granted, monetary policy is not a good tool to use against the problems of Peak Oil, but it is all the Fed has. In terms of fiscal policy, I expect both tax cuts and great increases in spending as the U.S. government tries to stimulate a declining economy. Massively increasing government deficits plus easy money means monetization of the deficit, which will be extremely inflationary.

In my opinion, the odds of inflation versus deflation are nine to one. I think the Fed and other central banks have the power and the will to prevent any deflation. We'll know a lot more in a few weeks.

Hmmm. I'm not sure how you can say financial markets are "generally healthy". My understanding is that both the subprime and Alt-A markets have essentially disappeared due to lack of demand in the secondary market. That is 40% of the mortgage market last year no longer exists. And the largest mortgage lender in the country (Countrywide) just exercised all it's credit lines in a single lump.

How is that "healthy"?

Also, employment is historically a coincident or lagging indicator of recessions.

Worse Coutryside spent all that money in a single lump. Enron did that right before they went bankrupt.

Countrywide bankruptcy is a foregone conclusion in the industry - I have a friend at Iowa Realty and they've had them on deathwatch for weeks now.

B of A bought warrants in countryside. They are in too deep and can`t get out. Time to short B of A.

RobertInKyoto

I haven`t escaped from reality. i have a daypass.

Well, BoA bought a new special class of shares that pays a mandatory cash dividend. Several analysts have pointed out that it is logical to assume that BoA shorted the same number of CountryWide common shares. So they get the cash dividend for as long as CountryWide can stay solvent, the shorts hedge their equity if CountryWide is bankrupt, and the terms on the special shares give them some chance of getting a piece of the pie post-bankruptcy. There's no way they're going to lose money on this.

I feel bad because I have no idea what any of this means.

http://money.cnn.com/2007/08/23/magazines/fortune/eavis_countrywide.fort...

B of A bought a convertable bond. They don't have to short the stock to not care about the stock price. They can hang on to the bond. Like all bonds, they will get their interest until the borrower goes bankrupt. Sorry, B of A can easily lose their entire investment. A post-bankruptcy piece of CountrySide is worth nothing.

Countryside's main problem isn't toxic mortgages but toxic management. This is the next Enron and stabilizing their balance sheet doesn't change that.

RobertInSantaBarbara

I haven`t escaped from reality. I have a daypass.

http://money.cnn.com/2007/08/24/magazines/fortune/eavis_citigroup.fortun...

Guess which two bank stocks I'm going to buy puts on. I won't get naked shorts past the wifey.

RobertInSantaBarbara

I haven`t escaped from reality. I have a daypass.

The financial markets are generally healthy compared to what they were during much of the seventies and early nineteen eighties. Recall that only a quarter century ago the prime rate was at twenty percent--now that was a credit crunch!

If you look at the difference in interest rate between top graded corporate bonds and junk bonds you'll see that the difference is at historically low levels. True, this difference has increased in recent weeks, but it has not increased very much--not what you'd find in a panic.

The big barometer of financial confidence is the stock market. It is less than ten percent off recent highs. When the Dow Jones Industrial Average plunges below six thousand, then we'll see panic. So long as the stock market makes strong recoveries to selling pressure (as it has over the past week) I don't think we are in anything like a financial panic. It is hard to claim a financial panic in the absence of a bear market in stocks.

I think the consumer confidence numbers bear even closer watch than do the employment numbers, but one reason that consumer confidence has been so strong is that unemployment has been so low. Just as we'll only be able to see Peak Oil in the rear view mirror, so we'll also only be able to see the next recession one or two quarters after it begins. But so long as consumer spending holds up, we are not going to have a recession.

Your argument is not valid. To say "the stock market has only declined 10%" would always be true 10% into any historical stock market decline of any size. The same argument could have been made at several points in 1930. Obviously, the 10% decline reflects the degree to which the mass of financial investors have absorbed the credit crunch so far. It doesn't tell us anything about how much further it has to run. Most of the news coverage is telling us that no-one really understands which institutions have exposure to problematic assets.

I do not at present see how to do better. But one approach I am interested in pursuing is coming at it from the angle of how much house prices have to decline before the housing market can reequilibriate, given the new (old) mortgage standards (30 year fixed, 10% down or so). Then it's perhaps possible to get some handle on what proportion of household balance sheets might get impossible along the way, which in turn might give some rough idea of what the fundamental valuations of mortgage securities should look like (I realize there are a lot of non-linearities in this problem - it might not even have a unique solution).

If anyone knows of any references relevant to that kind of modeling, I'd appreciate it.

At no point during the nineteen thirties were stock market averages within 10% of the 1929 highs.

The single best indicator of financial confidence in the economy is the movement of major stock averages; I think the second-best indicator is the spread between high grade corporate boands and junk bonds. The data simply do not show a panic at this time.

Is panic in the future possible? Sure it is, and it may happen. My point is that problems in the subprime mortgage area have been fairly well contained, and speculation that they will spread is merely that--speculation. Evidence, as opposed to speculation, shows that there is plenty of liquidity in the market: Consumers are still borrowing more on their credit cards, and the great majority of businesses (which are indeed credit worthty at this time) have no problems in financing their inventories. When credit stops expanding we have a crunch, and we are not there now.

The question of how low home prices would have to fall to be "reasonable" (in terms of incomes) is an interesting and important one. The short answer is that in some markets (parts of California, for example) they could fall a great deal to come into some kind of "equilibrium." As Greenspan correctly stated, real estate markets are local, and it is more useful to look at regional trends rather than national averages. There is no doubt but that falling home prices will have a "poverty effect" and tend to hold consumer spending down. The magnitude of this effect is hard to estimate, though I believe several economists have done so, primarlily in connection with the reverse "wealth effect" of rising home prices.

It is not clear that the sub-prime "problem" has been "contained." In fact it is the concern that the problem extends well beyond subprime that resulted in the recent market frisson (wouldn't want to call it a panic as Don excludes that possibilty).

To understand the problem you need to be clear on the difference between "risk" and "uncertainty."

Risk can be quantified, it can be made known and by by being known one can determine your appetitie for risk and the reward for accepting risk.

But the structure of the CDOs and the other new financial instruments make it impossible to accurately calculate the risk. We are talking about derivatives of derivatives of derivatives packaged and resold, re-packaged and resold so that no one can be certain exactly what they hold and the amount of risk they to which they expose themselves.

This is the reason that no one wishes to trade these securities. No one has any true idea of what the risk exposure may be. And the problem is not contained. The problem cannot be said to be contained until all of these instruments are properly priced. And they cannot be priced to market until they are traded. And nobody wants to trade because no one can be sure of what they are buying or what they are selling. It is a very, very, big problem and it is not, repeat not contained.

They thought that dispersing the holdings would reduce risk by spreading out the ownership, as in the intuitive concept of "safety in numbers". But now they can't find a good paper trail and so it turns into actually more risk?

That is basically correct.

In financial markets 'risk" is something that we can objectively quantify. We can know it and delimit it and therefore we can price it and trade it. But because we are speaking of derivatives of derivatives of derivatives what was thought to be investment grade risk (AAA) is now revealed to be an unknown quantity. No one really knows the value and we cannot mark it to market until we trade it and no one is willing to trade it because no one really understands what it is that they are buying or selling. So the markets are encountering a global liquidity crisis. Making Fed funds available does not alter the underlying problem in fact it may make it worse.

With fractional reserve banking it is possible to take one dollar of capital and generate eight dollars worth of loans. Not all the customers will want their money at the same time so the bank effectively creates money where none existed. This structure works as long as all participants have confidence in it. We trust it.

The creation of derivatives has resulted in something similar such that the total of all outstanding derivatives is eight or ten times total world GDP. This structure works as long as all participants have confidence in it. The current problem is that the financial institutions have themselves lost confidence and are refusing to trade with each other out of fear of what they may be buying and the the fear that the counterparty may not be able to repay money loaned. This is a crises precisely because the banks do not trust each other. Different parties bought what they thought was a rated investment grade instrument (AAA) and they are now realizing that these may have been misrated and are actually a much lower grade security. What they thought was safe capital and carefully priced risk is now turning into huge uncertainty where the value of all instruments is being called into question.

I double checked and you are correct - there was a recovery following the crash, but it was within 1929. However, this doesn't invalidate my general point.

In terms of financial markets being healthy, would you care to comment on recent trends in short term treasuries:

The data point for today is from this FT story, the rest is from the St Louis Fed.

There is no doubt but that short and intermediate term treasuries have been very strong. That is exactly what would be expected to occur from the Fed pumping liquidity into the financial markets. In my opinion the Fed has been successful: The credit crunch has been averted, and the squeeze on liquidity is easing.

When BBB bonds take a tumble, and when the Dow Jones Industrial Average goes down a thousand points over a few days, then we may have a panic and a crunch. As I read the data, we are not there. The Fed did what the Fed is supposed to do--and their actions worked.

I do not know the future. Hurricane Dean or some later hurricane could do real damage to oil and fuel producing capabilities: I can visualize a recession triggered by hurricane-induced oil shortages. But we don't know what damage Hurricane Dean (or future hurricanes) will do to oil output. Similarly, we do not know the financial damage that might occur from from a credit crunch. But to date, neither the hurricane damage nor the credit crunch has happened.

Perhaps my perspective is different from that of many younger people because I've lived through more recessions and more trouble in the financial markets than have most people. In the financial markets what we have seen so far is maybe a tropical storm--but by no means even a Category 1 hurricane.

I'm no Pollyanna. We may have a fast crash, and we may have a slow catabolic squeeze, but for this month and this year I see no reason to push the panic button.

It would be interesting to see various forecasts of U.S. real GDP growth for the fourth quarter: I'm sticking with 2.5%, which is a slackening from the current rate of growth. And the number I'll be looking for is the first revision--not the original "flash" estimate.

"There is no doubt but that short and intermediate term treasuries have been very strong. That is exactly what would be expected to occur from the Fed pumping liquidity into the financial markets."

I don't think the timing of that explanation works right? The major liquidity injections where around Aug 8-10th, whereas this sudden huge drop in treasury yields is late last week, and especially today. Most coverage I've seen interprets this as a flight to quality in the money markets (which is not reassuring to be happening on this scale today). I'll go see if I can find the data on open market operations to be sure.

So now how does this explain the dramatic plunge in treasury yields in the last three or four business days (especially today)?

Financial markets have unpredictable time lags. For example, when the Fed eases money the impact on inflation is somewhere between six months and thirty-six months. The Fed has been buying Treasury securities over the past couple of weeks, sometimes more and sometimes less, but the Fed has been pumping reserves into the system at a goodly rate through routine daily open market operations.

I do not know why there was a sudden one-day change in Treasury bills, but my guess is that it was due to an accumulation of weeks of Fed easing. I do not consider a fall in Treasury Bill or Treasury note (or bond) yield to be an ominous sign. On the contrary, it is a sign of easing credit and easier money to borrow.

For those who want to know when to panic, look at the interest rates on less-than-investment-grade bonds. Now when those bonds spike up to historically high levels (and currently they are relatively low, compared to historical averages), then there is a matter for concern. In other words, junk bonds are a canary in the coal mine. That T-bill yields fall abruptly tells me that there has been a significant easing in credit and money.

"I do not know why there was a sudden one-day change in Treasury bills, "

Well, obviously, it's because some group of folks, apparently not the Fed, must have been trying to buy an awful lot of treasuries, presumably because they suddenly saw treasuries as much more desirable than whatever it was they were holding before. The obvious attribute of short term treasuries is their very low risk of default. So, I'm with the Financial Times:

"Healthy"? I think not.

"Flight to quality," O.K. we do have that. But what I have yet to see is a flight AWAY from junk bonds. When junk bond yields skyrocket, then we'll see panic--and in my opinion not until then.

Also, to the best of my knowledge, there is not one single bank in the U.S. in trouble--not a single one at or near insolvency. In a credit crunch banks get into trouble along with everybody else.

If the financial markets are so unhealthy, then why did most stocks go up today?

Don super doomer Mike here :)

Actually I agree with you about current conditions.

We are just returning to a normal market the fact that a few are already losing a lot of money just shows how distorted the market has become.

As a representative of the super doomer community your right things are not that bad.

Yet :)

I think the real pain will be after January that when we will pass right through a normal economy and head into a deepening recession. So I think normal will be a Indian Summer.

Well but this is my concern (and Krugman's). 30 years ago (or 80 years ago), you got your mortgage from a bank, which kept it on its books as an asset, along with the other loans it was making. So the credit creation process was largely mediated through banks. Today, you get your mortgage from someone like Countrywide (which apparently is "near insolvency"), who sells it into the secondary market as part of an MBS. An institutions like that are going down like flies. So is this not a contraction in the amount of credit being extended?

Most stock investors are still in denial :-)

Or the fed is monkeying around in the futures market. They manipulate interest rates and money supply...why not entertain the fact that they can also extend their reach into the futures markets and manipulate the indicies?

If the market was so sick, why did it go up so much in 1929 before the crash? See? I can ask the inverse silly question too. You are arguing theology again, without any scientific basis for what you say except that it is because you say it is. Circular logic in the extreme. Go argue with Billy Graham, please.

Further, your lack of knowledge is WRONG. Countrywide bank has experienced runs, for god's sake. Citigroup and Bank of America just had reserve lending requirements temporarily lifted by the government. Of course they play this as "normal" but when the hell else did this ever occur on this scale before? In addition, we have GM and Ford telling us they are going to close US plants entirely. We have GM seeing double digit declines in sales for June and July and now offering 0% interest, $0 down, no payments til 2008 loans to buy GM vehicles. We see Ford doing similarly utterly desperate things. Yet because this has all crept up on us slowly, because we are the proverbial frogs in the pot, we've come to accept this as normal? This would have been seen as insane in the era when I grew up, Don. You too, and you know it.

And what about the huge 6.9 billion euro bet against the European exchange falling by 30% by September 30? Or the $500 million in shorts against the S&P 500 falling 30% by the end of September?

How do you answer Justin Oliver at Canaccord Adams?

The Fed has put their finger in the dike but now leaks are springing up elsewhere. Even the big banks do not want to do business with one another. Why? Because no one knows what the real risk is anymore! The Fed is France, fighting the last war. The Fed is standing at the Maginot line while the world economy is doing a blitzkrieg around it. Bernanke is so intent on not repeating 1929 that he's going to get something worse instead. "History does not repeat, but it does rhyme." (Mark Twain)

"The greatest shortcoming of the human race is our inability to understand the exponential function." -- Dr. Albert Bartlett

Into the Grey Zone

I am still betting on the Fed and other central banks to be effective in preventing a credit crunch. Once again, look at the financial markets--stock markets and also the market for junk bonds.