DrumBeat: May 22, 2007

Posted by Stoneleigh on May 22, 2007 - 7:00am

Since the rise in agriculture started gaining altitude last spring, hedge funds have been pouring money into commodity exchanges, driving up prices and transforming backwater grain bourses like the Kansas City Board of Trade and the Winnipeg Commodity Exchange into highstakes casinos. Since 2005, corn has nearly doubled. Wheat is up 50% in the same period, while canola, one of the biggest crops on the Canadian prairie, has climbed 34%.

But the biggest effect of all the new hedge fund cash sloshing through the system is a major increase in volatility. Prices are on the rise but the upward trend has been anything but smooth.

"We are unaccustomed to this," said Mr. Gary, who adds that he hasn't seen this level of volatility since the 1970s when a group of big speculators briefly "muscled the markets around." But what's happening now is different, far more treacherous for traditional players.

Like many experts, Mr. Gary believes the markets have become disconnected from the fundamentals as prices rocket through peaks and valleys that have little to do with supply and demand.

Many of the hedge funds are trend players, who make bets based on the technical details around the direction they think prices are heading, moving in and out of the market with lightening speed. For them, volatility is an opportunity to make money.

Biofuels Producers See Big Barriers To Targets Set By Bush

Leading producers of ethanol and biodiesel Friday said their industries faced serious barriers to meeting the 2017 growth targets outlined this week by President George W. Bush to reduce dependency on gasoline.

"The current solutions won't get you there," Jeff Trucksess, executive vice president of Green Earth Fuels LLC, a biodiesel developer, told an industry gathering here Friday morning.

Following up on prior pledges on energy policy, Bush Monday outlined additional measures to boost alternative energy development, limit gasoline consumption and comply with a recent Supreme Court ruling on global warming. Bush's plan included a goal to produce 35 billion gallons of renewable and alternative fuel by 2017, many times above current levels.

A Bush administration official Friday defended the viability of the president's goals, but the discussion at the Houston event underscores the magnitude of the challenge facing the U.S. as it struggles to feed its growing energy needs in an increasingly carbon-limited world.

Corn-based ethanol: a domino of instability (pdf warning)

The price of corn has doubled: as corn has become more scare, livestock producers have switched to wheat. The price of wheat has skyrocketed. Wheat is in extremely short supply as production worldwide has declined for 6 years in a row and demand has continued to grow. There is no extra wheat in storage or in the fields to meet the extra demand as livestock producers switch to wheat.

Corn-based ethanol: The Dominos Begin to Fall (scroll down)

Well the numbers are really becoming quite clear as it relates to corn. THEY ARE VERY UGLY. There is no room for a poor crop, but we are already at a poor crop because of the late planting. People and livestock require food. The crop is not going to be the size that was intended or required to meet all these demands of the competing groups of consumers: people, livestock and ethanol. Corn stocks in China, Mexico, the former Soviet Union, the EU and India are low as well. Food protests are emerging in many of these places. World corn consumption has exceeded production for 7 out of the last 8 years.

Brazilian biofuels can meet world's total gasoline needs - expert

Currently, Brazil uses only 0.8% of its entire territory (8.5 million square kilometres) for the production of biofuels - an insignificant patch of land, so to speak. But if it were to cultivate energy crops for biofuels on a quarter of its territory (around 212 million hectares), the country could supply the entire world's current gasoline needs (which stand at around 24 million barrels per day).

This projection is based on the idea that second and third generation biofuels become viable. Such biofuels, based on the use of entire crops the lignocellulose of which is transformed via biochemical and/or thermochemical conversion techniques, would double the output per hectare of land for sugarcane. There are some indications that second generation biofuels may enter the market sooner than expected: Dedini SA, Brazil's main ethanol plant manufacturer recently announced a breakthrough in cellulosic ethanol production, which increased the output of a hectare of sugarcane by 30%. A doubling of the output is expected in the coming years (earlier post). Moreover, such a scenario would also entail the introduction of new, high yielding energy crops designed specifically for particular environments, as well as new forms of livestock production (no grazing on pastures).

Peak Oil Now? New Data Leads to Speculation

New data from the U.S. government shows something disturbing. An analysis of the data suggests that we may be looking at the peak of oil production, right now.

More oil firms move into costly oil sands

More oil firms are joining the rush to tap oil from sands in Canada's Alberta province, a costly process that may secure future output but needs higher oil prices to make money.

Norway's Statoil last month agreed to buy a privately held Canadian oil sands venture for nearly $2 billion, following deals by the likes of France's Total and China's Sinopec.

The moves into oil sands offer access to oil reserves that rival those of Saudi Arabia and lie outside the volatile Middle East. But Statoil's deal looks expensive and the rewards lie far in the future, analysts say.

Move over Fort Mac, a new boomtown is born

Grande Prairie is the unknown Fort McMurray, an Alberta energy capital that's riding a wave of booming growth - yet remains well below the radar of even most Albertans.

The city's population has risen 50 per cent in the past decade, cementing its place as the urban hub for a sprawling region of 250,000 people that includes northeastern British Columbia, the Yukon and the southern Northwest Territories.

While the Grande Prairie area is rich in forests and agriculture - its glacier silts and long hours of summer sunshine make for ideal growing conditions - oil and natural gas are what have brought the city its new boomtown status. In the nearby Foothills of the Rocky Mountains, gas exploration is everywhere, and to the north of the city, the hunt for oil has also taken off, with junior Galleon Energy Inc. discovering an oil field recently that shows potential to produce more than 10,000 barrels a day.

And then there's the "other" oil sands - deposits in the Peace River area north of Grande Prairie, where Royal Dutch Shell PLC is pursuing a 100,000-barrel-a-day project.

Brace yourself for another industrial revolution. Coal is back. The highly combustible, carbon-rich mineral deposit that was formed over millions of years from decayed plant matter fuelled the first industrial revolution. More than an economic development, it is etched in the psyche of nations where coal mining meant lives lost, labour strife and the genesis of enduring political movements.

Today, thanks to rapidly developing clean coal technologies, coal is stoking the next industrial revolution. This is good news because despite centuries of accumulated noxious emissions, coal remains embedded in the deepest reaches of the world's economies, where it is the largest single source of electricity and produces over 70 per cent of the world's steel. According to Natural Resources Canada, coal mining, coal transportation and coal-fired electricity generation (25 stations in six provinces) together account for 73,000 jobs and $5.8 billion (1 per cent) of Canada's GDP.

Biochar turns a negative positive

Dozens of scientists who gathered in Australia three weeks ago for the first annual International Agrichar Initiative conference say that making "char" and burying it in soil – a process called "sequestration" – could prove a valuable approach to managing climate change.

It seems an odd suggestion, but early research shows that "agrichar" or "biochar" sequestration not only keeps carbon dioxide from reaching the atmosphere, it can actually extract it and contribute to the goal of reducing atmospheric concentrations. Instead of being "carbon neutral," the storage of biochar in soil is being dubbed as "carbon negative."

"Our calculations suggest that emissions reductions can be 12 to 84 per cent greater if biochar is put back into the soil instead of being burned to offset fossil-fuel use," Johannes Lehmann, an associate professor of crops and soil sciences at Cornell University, wrote in the latest issue of the scientific journal Nature.

Derivative Disaster: Deriving the Truth

For anyone who adheres to logic or reason - the chart above clearly shows that to incur losses trading Natural Gas from the 'long side' of the magnitude that BMO is now reporting [680 million at last count] - one would NECESSARILY have been "LONG NATURAL GAS" through one or both of the circled steep price declines depicted on the chart above [A and/or B].

What this means is that the BMO incurred their losses BEFORE their year end. So now, shouldn't we really be asking the question, Why weren't these losses reported in Q4 when they were incurred - and in all likelihood - were still much greater than they are being admitted to now?

Because derivatives are classified as "off-balance sheet items", institutions like the BMO, Amaranth, Enron et al have the ability to play "shell games" with their unrealized profits/losses and effectively prolong [or time, perhaps?] the exact time when they assimilate/admit [mark-to-market] their impact back into the balance sheet.

Mackenzie pipeline partners pursue Ottawa's purse

Partners in the $16.2-billion Mackenzie Gas Project, who were previously opposed to allowing Ottawa to join the project as a partner, are now pursuing the federal government to take an equity stake, possibly even a majority position.

Proponents, led by Imperial Oil Ltd., are to meet today with the federal government to discuss the massive project's fiscal terms. The talks will include an equity partnership with Ottawa that was recently "thrown on the table," said Randy Meades, executive director of the federal project co-ordination secretariat at the Department of Indian Affairs and Northern Development.

Ottawa denies possible buyout of Mackenzie Valley pipeline

Indian and Northern Affairs Minister Jim Prentice denied reports that said the federal government is eyeing a stake in the massive Mackenzie Valley natural gas pipeline project.

"No, it's erroneous, that is not happening," Prentice told CBC News on Friday.

"It's not an option that I am looking at as minister. Plan A or Plan B or any plan has to be a free enterprise-based model for the Mackenzie Valley pipeline."

Scouring Scum and Tar from the Bottom of the Pit

Very recent developments reinforce and amplify all these facts. Multinational corporations, including majority players such as ExxonMobil, ConocoPhillips and Shell, who also happen to be the promoters of the Mackenzie Valley and/or Alaska arctic natural-gas pipelines, have confirmed a grand-total planned investment of $100 billion into the tar sands in the next decade. This makes it the largest mega-project complex in the world, growing to an astounding total of at least $160 billion when all the required arctic natural-gas supplies from the Mackenzie Valley and Alaska pipelines are added - which requires coining a whole new word: "gigaproject."

Brokers like Raymond James Ltd. and the Canadian Imperial Bank of Commerce are advising investors about the realities of "peak oil" and counseling them to invest in the tar sands, which they describe as the planet's last new significant oil-supply addition with total production forecasts whose total output will rival Saudi Arabia by 2030.

Russia draws Europe into its orbit

To be sure, Putin's visit to Kazakhstan and Turkmenistan last week heralded a profound shift in the co-relation of forces in the Caspian and Central Asia. This shift is discernible from many angles.

First and foremost, it is becoming clear that with the transition of power in Ashgabat, Turkmenistan, its policy of "positive neutrality" under the late president Saparmurat Niyazov is giving way to one of rejoining the Central Asian fold. That means Putin's 2002 proposal for a "gas exporters' alliance" comprising Russia, Turkmenistan, Kazakhstan and Uzbekistan may be taking a giant leap forward.

Thus Russia's transit monopoly through the so-called Central Asia-Center Pipeline, known officially as the Single Export Channel, will remain firmly in place for the foreseeable future. Thereby, Central Asian states' gas reserves are, in effect, amalgamated with Russia's into a single pool that will be marketed under Russia's physical and commercial control.

Turkmenistan, which has a potential capability of exporting 100bcm of gas annually, was crucial to the realization of Moscow's idea of the "gas exporters' alliance" - which was why the "Great Game" over Turkmen energy policies in the post-Niyazov era became so absorbing in recent months.

NASA Finds Vast Regions Of West Antarctica Melted In Recent Past

A team of NASA and university scientists has found clear evidence that extensive areas of snow melted in west Antarctica in January 2005 in response to warm temperatures. This was the first widespread Antarctic melting ever detected with NASA's QuikScat satellite and the most significant melt observed using satellites during the past three decades. Combined, the affected regions encompassed an area as big as California.

Harper-Bush alliance feared threat to G-8 environment pact

Prime Minister Stephen Harper is poised to join President George W. Bush in scuttling or watering down any statement on climate change from the G-8 summit in Germany next month.

While European countries are pushing for their counterparts to recognize that a future climate change treaty must be designed to prevent average global temperatures from rising by more than 2 C - a dangerous threshold identified by leading climate experts - Canadian government officials, along with the Bush administration appear to be resisting.

After meeting with federal negotiators at a United Nations conference in Germany, environmental groups fear that the Harper government's position could prevent the implementation of an effective international climate change agreement at the end of the Kyoto protocol in 2012.

Wide-ranging accord with U.S., Mexico could dwarf NAFTA, MPs hear

Cliff Sosnow, of the Chamber of Commerce, said implementing SPP initiatives "can better position Canada in the U.S. market and enhance North American competitiveness generally vis-a-vis other established and emerging economic forces."

But MPs heard a cautionary message from the left-leaning Canadian Centre for Policy Alternatives.

Its executive director, Bruce Campbell, described the SPP as "the umbrella for a vast array of security and economic initiatives under way to further integrate the North American market. It's a NAFTA-plus or deep integration initiative.

"The cumulative effect of the SPP over time could be profound - even more significant than NAFTA - depending on how far or fast it goes."

See No Evil, Report No Evil: Why the media isn't telling you about deep integration

In March, it will be two years since the leaders of Canada, the U.S. and Mexico launched the Security and Prosperity Partnership in Waco, Texas. By now, if the media had done its job, the SPP would be a household name like NAFTA and the WTO. Yet most Canadians remain blissfully unaware of this powerful new agreement.

So, you may ask, why has such a contentious issue drawn so little media attention? And what does this say about the state of the Canadian news industry?

Business visionary predicted North American union in '93

Drucker authored some 39 books before his death in November 2005 at the age of 95. Born in Austria, he moved to the U.S. in 1937. He became a citizen in 1943. He taught management at New York University from 1950 through 1971. He regularly contributed to the Wall Street Journal, Harvard Business Review, Atlantic Monthly and the Economist.

Most of those denying the drive toward integration, or for a North American Union, point out that it has not been debated in Congress that no legislation has been introduced for actual merger. But Drucker pointed out 14 years ago that political and economic inertia was already so strong, the formalities of legislation would not be necessary to achieve the goals.

Fears over looming energy crisis in UK

This is not the postapocalyptic vision of some film-maker, but a realistic scenario as Britain grapples with a looming energy crisis. The statistics are frightening. In only eight years, demand for energy could outstrip supply by 23% at peak times, according to a study by the consultant Logica CMG. The loss to the economy could be £108 billion each year.

“The idea of the lights going out is not a fantasy. People seem to accept that security of energy supply is a right. It is not. The industry will have to work hard to maintain supply and for that we need a clear framework,” said Simon Skillings, director of strategy and energy policy at Eon UK, Britain’s largest integrated energy company.

Drought puts pressure on electricity

The water shortage across eastern Australia is now so acute it has begun to affect power supplies, and the country is at risk of electricity shortages next year.

"I think we are in denial, and are going to have brownouts in NSW if we don't get snow this winter," a source within the electricity market said.

Coal and hydro power generation require very large amounts of water, and the Snowy scheme depends on it for 86 per cent of its generation capacity.

"Last year we had the lowest snowfall ever recorded. If this happens again we are in trouble," the source said. He declined to be named because electricity pricing and supply is a politically charged subject.

Prices are already tipped to double in South Australia.

Petroleum Resources Of The Western Desert of Iraq

On 18 April 2007, the US energy consultancy IHS issued a press release stating that up to 100bn barrels of oil resources remained to be discovered in the Western Desert of Iraq (www.ihs.com). The following day this release was quoted on the front-page of London’s Financial Times and the following week in many other newspapers and magazines (for example: Dubai’s Gulf News, 23 April; Time Magazine, 24 April; and MEES, 30 April).

This conclusion stands in stark contrast to the 2004 study by the US Geological Survey (USGS) and GeoDesign (a consultancy that specializes in Iraq’s petroleum geology) that estimated the undiscovered oil resources of Iraq’s Western Desert to total only 0.5bn barrels at the 95% level of probability, and 1.6bn barrels at the 50% level of probability (Verma, Ahlbrandt and Al-Gailani, 2004).

U.S. Embassy in Iraq to Be Biggest Ever

The new U.S. Embassy in Baghdad will be the world's largest and most expensive foreign mission, though it may not be large enough or secure enough to cope with the chaos in Iraq.

The Bush administration designed the 104-acre compound _ set to open in September in what today is a war zone _ to be an ultra-secure enclave. Yet it also hoped that downtown Baghdad would cease being a battleground when diplomats moved in.

Over the long term, depending on which way the seesaw of sectarian division and grinding warfare teeters, the massive city-within-a-city could prove too enormous for the job of managing diminished U.S. interests in Iraq.

The $592 million embassy occupies a chunk of prime real estate two-thirds the size of Washington's National Mall, with desk space for about 1,000 people behind high, blast-resistant walls. The compound is a symbol both of how much the United States has invested in Iraq and how the circumstances of its involvement are changing.

Electricity Crisis Hobbles an India Eager to Ascend

Look up at the tops of buildings, and on any given day, you are likely to find three, four or six smokestacks poking out of each, blowing gray-black plumes into the clouds. If the smokestacks are being used, it means the power is off and the building whether bright new mall, condominium or office is probably being powered by diesel-fed generators.

This being India, a country of more than one billion people, the scale is staggering. In just one case, Tata Consultancy Services, a technology company, maintains five giant generators, along with a nearly 5,300-gallon tank of diesel fuel underground, as if it were a gasoline station.

The reserve fuel can power the lights, computers and air-conditioners for up to 15 days to keep Tatas six-story building humming during these hot, dry summer months, when temperatures routinely soar above 100 degrees and power cuts can average eight hours a day.

The Gurgaon skyline is studded with hundreds of buildings like this. In Gurgaon alone, the state power authority estimates that the gap between demand and supply hovers around 20 percent, and that is probably a conservative estimate.

China's rural millions left behind

In China, if they can, people try not to think about the countryside at all.

When they do, it is not of a rural idyll, but a grim, dirty place where people are poor and life is harsh.

In Britain the countryside is somewhere to escape to. In China it is somewhere to escape from.

Casino Royale: China and the Ghosts of 1929

Every one there had their own story, but they all had one common theme, BUY STOCKS! The regular bank lobbies were mob scenes of people rushing to withdraw their savings. Every bank had long lines. They are selling their homes, hocking the jewelry, anything to get liquid. Rich and poor alike are withdrawing their money and throwing it at the market. And throwing it is the right metaphor to use: Taxi cab drivers, shoeshine boys, restaurant employees, public employees, you name it, they WANT IN. They are selling their homes, jewelry, or whatever to invest.

The Chinese are prodigious savers (typically 50% of their incomes are saved), knowing from close personal experience that the government is good for nothing, and if they fail to provide for themselves there will be no one who will. But outside the stock brokerages bicycles are piled up, (my wife commented on the poor condition of them, a sure tip off they are poor) these poor, unqualified persons are all trying to get rich quick, and just like what happened in the NASDAQ and housing frenzies in the US. People bemoan the slow emergence of the Chinese consumer, well this emergence has undergone a detour, as instead of consumers they are emerging as the Chinese investor instead. Rushing like lemmings headed over a cliff, a waterfall of investors hurling themselves over the edge. Mass investors hysteria is a worldwide phenomenon seen many times in history, whether it be the original tulip mania, south seas bubbles right up to today’s economies. It is front and center in China today.

US Blames China As It Leads The World Into The Next Depression

When the US economy contracted after the collapse of the 1929 stock market bubble, the US Congress acted. And as it often happens in history, the action backfired. Instead of protecting the US economy and US markets, the Smoot-Hawley Tariff Act of 1930 plunged the US and the world into the Great Depression of the 1930s.

The road to hell is paved with good intentions. That was true in 1930 and is true today in 2007. The US Congress, looking for someone to blame for America’s mounting economic problems—increasing trade deficits, loss of jobs, declining competitiveness, etc.—is now blaming China. And, once again, instead of protecting America’s economy, the US Congress is about to pull the lynchpin on the global economy.

The economic and financial landscape of 2007 bears striking similarities to 1929. Back then, there were large, unregulated pool operators and other insiders constantly muscling the tape in whatever direction they chose. The public, too, was involved, thinking the country was experiencing a new era. Meanwhile, business began deteriorating in the spring of 1929, though the partying in stocks lasted until the fall.

To give you a flavor of those times, I'd like to quote from Frederick Lewis Allen's "Only Yesterday," which is one of my favorite books about 1929: "Mergers of industrial corporations and of banks were taking place with greater frequency than ever before, prompted not merely by the desire to reduce overhead expenses and avoid the rigors of cut-throat competition, but often by sheer corporate megalomania. And every rumor of a merger or a split-up or an issue of rights was the automatic signal for a leap in the prices of the stocks affected -- until it became altogether too tempting to the managers of many a concern to arrange a split-up or a merger or an issue rights not without a canny eye to their own speculative fortunes."

Some of the dangers emanating from the vast expansion in securitized lending derive from the incentives inherent to the current structure. Unlike with traditional financing arrangements, where profits accrue over the life of a loan, lenders nowadays expect to garner the bulk of their profits up front, in the form of fees and net proceeds from the sale of the obligations.

This has spurred a widespread emphasis on short-term profits at the expense of longer-term stability. Naturally, banks and other lenders focus on quantity rather than quality — that is, the volume of loans they can originate and the amount of money they can realize up front, rather than borrowers’ willingness and ability to repay the debt, long-term potential, or the broad banking relationship.

Distorted incentives have also promulgated “moral hazard," especially during a time of easy money. Strong demand from yield-hungry investors and an aggressive push by bankers to come up with the goods has caused standards to fall sharply. Together with the fact that risk is quickly passed along to others, the modern approach to lending has boosted bad credit-granting decisions to an unprecedented degree.

Consequently, when the credit cycle turns negative and the economy rolls over into recession — if it hasn’t done so already — a far greater portion of outstanding loans will turn sour at a much faster pace than in the past, kick-starting a swirling snowball of defaults that will have a devastating knock-on effect throughout the economy and the financial system.

Securitization has also fostered moral hazard in other ways. Cheap financing, seemingly unlimited opportunities to garner high fees and short-term profits, a significant increase in global trading and arbitrage, and the complacency that normally accompanies periods of unusual stability have all helped to nurture the illusion that there will always be a market for any sort of tradable instrument.

That, in turn, has encouraged investors and speculators to buy and sell with near reckless abandon, concentrating in areas that seem to offer the juiciest returns, and following the herd into ever riskier investments — with little regard for the downside. Believing that they will always have an “out,” money managers have become entranced by securitization alchemy, buying any sort of rubbish as long as it has been sprayed with “eau de liquidity.”

Scientists Foresee Extinction Domino Effect

Birds, animals, insects and even plants are on the move around the Earth, trying to flee new and increasingly inhospitable local weather conditions. For some, including alpine species and polar bears, there is nowhere to go. And many others, like plants, lack the mobility to stay ahead of changing climatic conditions.

"We're already seeing species moving, but they're not moving fast enough to avoid potential extinction," says Jeremy Kerr, an ecologist at the University of Ottawa in Canada.

Scientists link world's big dams to methane and global warming

Brazilian scientists say they have found evidence that the planet's large dams emit nearly 115 million tons of methane every year, a figure that would put the water-control structures among the top contributors of human-caused greenhouse gases.

In a study released earlier this month, the scientists claim the world's 52,000 dams contribute more than 4 percent of the warming impact linked to human activities. The study even suggests that dams and reservoirs are the single largest source of human-cased methane, a gas that traps heat in the atmosphere.

Environmental groups have rallied against dams for years, arguing that they destroy rivers and riparian habitat and wastewater through evaporation. The claim that the structures also cause global warming is new and is certain to be disputed by the hydropower industry as well as water supply managers.

In the years to come the northern plains, heavily dependent on the Ganga, are likely to face severe water scarcity. Together with the onslaught of industrial and sewage pollutants, the rivers fate stands more or less sealed.

"Among the categories dead, dying and threatened, I would put the Ganga in the dying category," says WWF Programme Director Sejal Worah.

The other heavyweight to join in the list from the Indian subcontinent is the mighty Indus. The Indus, too, has been the victim of climate change, water extraction and infrastructure development. "In all, poor planning and inadequate protection of natural means have ensured that the world population can no longer assume that water is going to flow forever," WWF says, adding that the worlds water supplier rivers on every continent are dying, threatening severe water shortage in the future.

The other rivers of the world are at the mercy of over-extraction, climate change, pollution, dams and over-fishing are the Yangtze, the Mekong-Lancang, the Salween-Nu, the Danube, the La Plata, the Rio Grande, the Nile and the Murray-Darling. The bottomline, therefore, is that rivers are no longer assured of reaching the sea unhindered.

[Note: Here are a few that I picked up this morning. RR]

Why US petrol prices are hitting record levels

Part of the reason that US gasoline (petrol) prices are so high is because refinery capacity is running at near-historic lows. Ironically, this is partly because vital maintenance was put off in the months following Hurricane Katrina, as a large chunk (nearly a third) of refinery capacity was knocked out by the storms. Those delays are catching up now - maintenance can only be put off for so long.

Peak Oil and the Inflation Lie

Given the fact that 1) daily existence in modern life demands various forms of hydrocarbon energy, 2) a vast array of basic material is derived from hydrocarbons (such as plastic), and 3) food and food production depend on hydrocarbons (fertilizers, irrigation and pesticides, energy needed to run machinery, etc.), the exclusion of food and energy costs in the measure of inflation is, therefore, a lie.

Peak Oil Passnotes: The American Driver Pays Up

Nigeria is queuing up to be an even bigger problem. Militant groups in the Niger Delta seem to be acquiring a better use of explosives, something that should worry all the major oil companies. A disused wellhead was blown up belonging to the French company Total, which may or may not be a practise run. We shall see.

While this current hike may be temporary, it is a sign of things to come. The term “peak oil” is one which is becoming more common throughout the world during discussions of the world supply of oil and gas. Peak oil means that world oil production can no longer grow, not that the supply is running out. Although the belief is not universally accepted, most people accept that oil is not as accessible as it once was.

Bubbles are everywhere

http://business.timesonline.co.uk/tol/business/money/investment/article1...

Cat rescued from tree, DOW surges 100 points :-)

http://www.examiner.com/a-741065~A_watery_grave.html

Given that a gallon of water weighs ~8 pounds ("a pint is a pound, the world around") this means that a typical American family of 3 uses over a ton of water a day.

I received my water bill a few weeks ago. Here in Pennsylvania, I paid $40 for 15 thousand gallons of water for my family of four for 6 months. This doesn't include the sewer bill ($300 yearly, paid separately) but it's a ridiculously small amount of money to pay for that much water. It's no wonder we all use so much.

Hmm, in Altoona, we were paying $45 per month for water and sewer. And last I heard, the city was trying to sell off the Water Authority.

I'm in a township outside Allentown. The township gets the sewer payment yearly. The Lehigh County Water Authority gets the water bill every 6 months. $380/12 is $31.67 so not far off from what you pay.

Something that occured to me that I thought I'd toss out there.

Some people have shown graphs of big oil co's investment, specifically Exxon, showing that they are decreasing capital investment and increasing share buy backs. This is being cited as evidence of the Oil Co's knowing that there is no need to make capital investments as there will not be the oil to serve them.

People are also making a big noise about the lack of rigs, experienced staff, raw materials and other related factors being a major bottle neck in the development of new projects as there simply isn't enough infrastructure to meet demand.

Joining the dots, is it not possibly that the mass stock buy backs are simply an artifact of the Oil Co's having masses of money lying around they they can't invest in capital spending because there simply isn't anything to invest in that they aren't already pouring money into?

As I understand things it is generally considered a 'bad' think in the business world to hold on to cash unless you have nothing else to do with it. So unable to invest in capital projects the Oil Co's are doing the only other thing they can think of and returning the money to investors via stock buy backs?

Holding cash is only bad for business when you answer to shareholders who demand it back as a dividend/buyback etc. I remember years ago when MFST had tens of billions in the bank and wasn't doing anything with it. Shareholders began demanding it be returned to them and eventually most of it was. They still have plenty of cash on the balance sheet, but it's incredible for a company to have so much cash it doesn't know what to do with it.

Xyleth

I question that stock buy backs return money to the investors. In order to get that money, I have to sell the stock.

However, if you are a CEO or a member of the Board a large part of your money is in stock options, and raising the value of the stock artificially raises your bonus.

A much more effective way of raising stock prices is to increase dividends, but since dividends aren't paid on options, the CEO, Board and high management don't get overpaid.

I think stock buybacks should be an illegal form of stock manipulation, but I don't see any relief coming from the present administration.

But what if I am CEO, know that my business prospects are excellent, and estimate that the market is undervaluing my company by 30%? In that case, I think buybacks are a great investment. I don't see a thing wrong with that.

Absolutely correct.

First duty of any Board of Directors is to the shareholders.

If the BoD estimate that:

Selling out in a merger

OR

Buying back shares and giving shareholders capital plus equity back is better than continuing

Then there is a fiscal responsibility to say :

' Here. Take your original money plus more that we made for you. We have done all we can. Take your increased money and re-invest it.'

Mercantillist, Adventurist Capitalism 101 since the first Amsterdam Bourse.

That is how it started off. That is how it works.

And once the BoD have a majority share in control, then they can:

Buy up others.

Award remuneration packages that reflect 'the GMR for execs...'

Close it down

Whatever.

This is just the way it works since the first, returning spice ships were sighted off the Hook van Holland.

Back then they didn't quite have the hedge funds buying up real assets with printed toilet paper.

Seems to me that buying back large amounts of shares that can be voted gives some protection. Large cash reserves are a open invitation to a hostile takeover by the thieves.

Exactly right. There are longer term flexibility issues at stake as well--higher dividend payouts might have to be cut in future down years, and nobody likes that. If buying back stock gives a competitive return on capital, that's what management is supposed to do.

In Australia an off market buyback can be great of shareholders..

I have a share which I brought four months ago for just under AUD $10. The company are offering to buy some or my shares for 14% less than the market price.

This sounds like a looser, but for someone in my situation, I will get a tax rebate from the government so that actually get about $1.50 more than the market price. All 100% legal and well known. The rebate is because the company has paid tax and the shareholders get a credit for this tax.

Not being a dummy, I will offer all my shares - and then will buy them back on market. I will be lucky if the accept 10% of them,

Better control of management by the shareholders would prove more beneficial, albeit not as easy.

The big advantage to shareholders of stock buy-backs is a lower tax rate. Capital gains get taxed at a lower rate than do dividends. It's true that you have to sell stock to enjoy the benefit... I guess there's a brokerage commission as an extra tax, versus just depositing a dividend check. But the tax advantage outweighs that very quickly.

it's true though that stock buy-backs do profit holders of options disproportionately. If the buy-backs just balance the extra shares generated by the holders of the options... maybe that is better for shareholders than just paying big bonuses to the execs. At least it motivates the execs to keep the price up. It does have the downside though of being a temptation to manipulate the price.

The main point is really to understand how the overall level of executive compensation is set. Does the typical board of directors do a good job of oversight and of representing the interest of the shareholders?

JimK, Bullcorn, anytime somebody mentions tax advantages before return on investment I keep my money.

The plain fact is I know my own needs and desires and can get them with money. And since stock prices are at least occasionaly based on real returns, high dividends and special dividends make the price go up, but it benefits stockholders as much as options holders.

Of course the talking heads on the financial news programs favor buybacks-they're hired and paid by the primary beneficiaries of the stock watering called options. As I said above, this should be illegal.

Currently in the U.S. both Capital Gains and Dividends are taxed at 15% unless the dreaded AMT gets her hands in your knickers. Who knows what will happen after these investor friendly rules sunset in the U.S. in 2010.

As for me I say give me the dividends I hate stock buybacks they are only good for the management at the top of the food chain. Studies show high dividend payers are the most disciplined users of capital and provide the greatest returns to investor. Besides I can reinvest the cash flow as I see fit either in more of their stock or other.

Subject: Kentucky Homestyle Drip Irrigation System

I believe that on the other side of PO is a burning requirement to sustain life, or at least sustain long enough until our society resurrects itself into something different and more lasting. Perhaps a bartering community ,town square type of society with a large portion of a sustainable agriculture component.

To that end there will be a period(or maybe forever)of an absolute need to provide sustenance for oneself and others via using the soil to bring forth food.

That out of the way, I have thought about methods of gardening and with water perhaps soon to be in short supply or with the grid down and no well pumps, that growing with sufficient moisture is essential to many plants such that additional sources of moisture than rainfall are required.

GW as well could perhaps throw a severe monkey wrench into those efforts. To be sure agriculture is ALL ABOUT the weather. Bad weather,bad crops UNLESS you are able to overcome or deal with such events on a local closein basis.

Here then is a technique that I am using currently that works fairly well for plants that require more than rainfall can produce or a result of what I call 'spiky weather'.

Obtain a 5 gallon plastic feedbucket. These are usually available for free if you can scrounge around.These are the type that drywall compound comes in as well as paint,etc.

Place one or more very small holes in the area just above the bottom and on the side. About the size of a piece of angel hair pasta. Or maybe the very small end of a toothpick. Fill it with water and place near the plants , like tomatoes and cucumbers that need a good and constant supply of moisture in the soil. You want it to just barely drip out of the hole/s. A very slow drip.

In my case I plant my tomatoes and cucumbers in a square three sided cage made of old rusted pasture fencing wire supported by three driven steel fence posts at each corner. I tie the fence up with binder twine as well as use the binder twine(or baling string) to tie up the vines as needed. In the middle I pile up a slight dirt mound and then cover it all with straw mulch. I sit the 5 gal bucket on this mound with four holes (or 3). I can also do this on my asparagus beds, and my berry patches. It doesn't work too well on long row crops but using some small pvc pipe I think I could engineer something that would in combination.

This method saves on water by putting it exactly where needed and not wasting it by using a sprinker(the worst) or a soaker hose(also wasteful). No hoses if you must carry water from a spring or draw it from a well or catch it in a big barrel off your roof,which I used to do in Lexington,Ky.

In the future if water must be carried by hand then having a goodly supply of these 5 gallon plastic buckets would be worthwhile. I intend to go buy some old fashioned galvanized metal buckets as well as a stainless steel one if possible. This is for the possibility of hand milking a cow. Buckets are going to be as needed as badly as Bob Shaws wheelbarrows. IMO.

There are thousands of ideas on how to better grow food by gardening. It would be a folly to try to make this site the repository of all such ideas and techniques.

I put this one out just to jog people into the realization that they must start to become inventive and plan for the future if that future is not going to be the famous soft crash landing many are hoping for.

After my auction and the on the run up to the future I will be resurrecting my old website and placing some of my past experiences with farming and growing there. That is if we still have breathing room for a bit.

I am also wondering how many here are currently or past amateur radio operators like myself? I am going to shortly order the Harbor Freight 45 watt panels. Maybe 2 or 3 of them and adapt them to powering my current radios and my future HF rig. I can polish up on my code and throw a long wire over some trees and use a back end tuner to match the impedance before loading the finals. No linears in this mix and with a likely huge silence out on the frequencies then 100w outputs should be sufficient.

If it goes as I suspect it will then 'hams' will be among the few who will have communications abilities.

Airdale-hoping for the best but preparing for the worst

PS. BTW is there some rule of remaining ON TOPIC on Drumbeats? It says'And now a word from our members'.

PPS. Granted religion ,acid rock, and hot monkey love would be rather off topic but I believe that sustainability and associated topics are not really that far OFF TOPIC.

In fact some TOPIC POSTS are in this general area as regards the future events(Francois Celliar's recent topic post).

Politics seems to be a hot topic as well. How much more important then is life giving FOOD?

PPPS. What I would like to see is a website operating on the same principles as TOD but devoted to sustainability. Perhaps titled : THEFOODDRUM

Granted there may be and likely are sites where this is already done BUT the TOD community is already up and active. Spreading out into disparate sites would leave behind a lot of well worn and very valuable sense of community and endeavor. I have been to other sites. Most are chaos and not well structured. A lot of monkeyfunk goes on that is hard to endure on many sites. Slashdot for instance.

PPPPS. When I created this comment there were no MSM posts about the water situations. I did it before there were any posts. So water is going to become extremely important. This was on my mind yesterday as I worked in my garden in the cool of the evening.

Drip system- I use milk jugs the same way. I find them to be more readily avaiable and have fewer after market uses than 5 gallon buckets. Add liquid fertilizer if you want.

Milk jugs won't last. Lay one out in the sun and before too long it shatters into pieces. Also too small to hold enough.

Also not sturdy enough. You can almost crush it with one hand. Flimsy is the word.

If you wish a gallon container I find antifreeze containers and fruit juice containers to be less fragile and able to last longer.

Where ever drywallers are at work you might find 5 gal containers in their onsite dumpsters.

I have brought good sealable 5 gallon plastic food grade buckets to hold my wheat and corn(shelled) in the basement. If sufficiently low moisture they will not deteriorate nor hatch weevils. Some is still fine after two or three years of storage.

Instead of liquid fertilizer,which I find a waste of time and money(Miracle Grow like), I use cow dung and compost. A 50 lb bag of ammonia nitrate sits in the barn for the ocassional handful I toss on the corn as a side dressing.Costs right now about $11 for a 50 lb. bag.

All my kitchen refuse goes on the compost heap. Hey I read Ruth Stout way way way back.Maybe 70's era and heeded well what she wrote.

Aside: This year I am running into far more snakes around than ever before. Dumping out some mortar there was a black snake on the pile. The dogs worried it until it crawled in a hole. Yesterday walking up the lane from barn to house a huge 7 ft. chicken snake lay right across the lane. The dogs had at it and getting within 6 inches of its coils it still refused to strike. Finally crawled under the pine straw.

I never kill snakes. Only once found a copperhead on the place but lots of king snakes and black racers and chicken snakes..some who live in the barn and under the door is a beautiful king snake who has a nice hole by the water spigot.

Airdale

Airdale, perhaps you would know. Corn/corn flour - Do you let the corn ripen until it gets that mealy/starchy texture or do you pick it while sweet and air dry?

Delusional,

Well let me put it this way. I have four rows of sweet corn. Two are silver queen and two are golden queen. I pick them for eating immediately and parboil some then cut the corn off the cob and freeze for eating later. If you want cream style corn(from the sweet corn) then you slice the kernels off 1/2 way down and scrape out the cream into the plastic bags and then freeze as well.

I also raise 4 rows of 'open pollen' corn. Which we used to use as field corn but also once ate as well. This is NOT hybrid and will reproduce true to form. This I let dry on the stalk. Pick when dried and shuck. Leaving them on the cobs then is ok until needed but you can at that time(if sufficiently dried--the kernel's shell will be quite hard and the interior as well..you want them with about 10% moisture so they will keep well)store them in trash barrels but they take up more space than needed in that form. If you have a manual corn sheller then and if dry enough you can shell them. Keep the cobs for fire starters and to make stoppers. The dried corn can be spread on concrete to further dry if needed. Its a call as to how dry is dry. For this I tend to leave them on the cob until I am sure but DO NOT leave the shuck on as they can cause various problems. Outside but undercover they will pick up moisture if in the shuck.

Ok. I have two varieties of open pollen. One is White Hickory and the other is Truckers Favorite(a yellow corn).

Later I can grind either with my steel burr mill. The more finer you grind the more you proceed from grits to cornmeal to flour. If you like cornbread then sift out some of the husk(bran) or leave it in for roughage, and I believe that part is healthful for that reason but to refine it more you just keep sifting a few times til no more husk(the kernel's shell) is left.

To make hominy you put it in a caustic lime or lye solution til it swells and pops off the shell. This is whole hominy.

If you let that hominy dry and then grind it you have hominy GRITS. Very healthy for its large amount of niacin and other beneficial ingredients. I prefer white hominy grits myself and now they are almost impossible to find at any store. A few mills around the country do sell them over the net.

Thats the way I do my corn. I have tried to grind #2 yellow dent field corn, what most farmers grow for the market, but it was not very good. Didn't make good cornbread IMO but was edible.

Corn is a very good staple for sustainability. You can feed it to hogs or chickens or draft animals or milk cows. You can eat it yourself. It has a very high protein I understand.

The indians I believe lived on corn(maize),squash and beans. As well as wild game.

A few 5 gallon buckets of good open pollen white corn can give one a sense of at least having something set by.

In a pinch you can bake corn pones in a fireplace ashes. This is how the pioneers did it as I read. Ash pones they were called.

A mix of boiled tomatoes and corn is called succotash. I add some left over biscuits to this mixture. Also very good.

With corn and wheat you can eat biscuits and cornbread. This is what I grew up on as a youngster. No white bread at that time.

Airdale

PS. If you have large animals to feed corn to then its best to keep that part on the cob. Easier to store and feed and no need to shell it. Shelling corn by hand is rather tiring.

The cobs seem to help it stay viable if stored in say like a corn crib. Some used to store it in large screened cribs with a top cover only. Course the rats and mice had a field day with it unless you had some snakes around to control them. Like the huge chicken snake that hangs around my back porch. 7 feet long at least. Harmless as could be.

Great info, airdale! I have never done anything with corn except growing sweet corn - I might have to try my hand with something a bit more storable.

I grow lots of stuff, but other than some pickling and tomato sauce canning, mostly I freeze what I can't eat fresh. I want to become less reliant on freezing. I have good luck with dried beans (pinto and black, mostly).

"Like the huge chicken snake that hangs around my back porch. 7 feet long at least. Harmless as could be."

Unless, of course, you're a rat ;-)

Sgage,

Its my understanding that most , if not all, sweet corn is hybrid. Therefore not able to save seed.

I tried boiling and eating some of my White Hickory but it was very tough and the kernels were not that easy to chew. Therefore the best use of it is ground up into meal or grits. Or perhaps hominy.

Dehydrating is a very good method of preservation as it making fermented foods like kraut.

Airdale

Thanks for the input... I plan to try varieties of corn suitable for drying/grinding/hominy-making. Really trying to figure out how to put stuff by, by many techniques.

I've done a bit of dehydrating. My mother used to make awesome sauerkraut. I'm growing cabbages this year for the first time in years...

As Alan might put it... Best hopes for being able to eat when hungry...

- Steve

Airdale,

Yours are some of my favorite post on this board. I have seen a few posters diss you in the past but I like my farmers like my bread, CRUSTY! Also very envious of your 60+" of Kentucky rain. We are lucky to get 15" here in West Texas in a "wet" year.

Mose in Midland

I think the only place in the US (sans mountains) that averages 60+ inches of rain per year is the Gulf Coast, from about Lake Charles, LA to Panama City, FL. Southern KY averages in the low 50's.

New Orleans only averages 57 inches (a dozen years ago we got 100 inches though). Most of Kentucky is in the 40 to 50 inches of rainfall belt and the southern third of KY is in the 50 to 60 inch belt. (The same map shows New Orleans in the 60 to 70 in belt)

New Orleans data is below. I copied and stored the US rainfall map, but did not bookmark it.

http://www.rssweather.com/climate//Louisiana/New%20Orleans/

Local tomatoes are a spring only event in New Orleans. Disease gets them before we are well into summer.

Summer weather is not our strong point,

Best Hopes for only mild summer breezes,

alan

Alan,

Did you get my email?

bjj at mchsi . com

Have you tried growing the little cherry tomatoes in a large pot filled with potting soil? They grow & ripen pretty quick, & thus might get you a crop before disease gets them. If you start a succession of new plants every month or so, you might be able to get a continuous supply of fresh tomatoes all summer. You might also try dusting with sulfur if fungus is a problem (which probably is your #1 problem given your high humidity). Placing the pots where they get good sun and good air circulation will help quite a bit. Be sure to select a tomato variety with VFN disease resistance, that will make a big difference too.

Such succession planting is also the way to keep yourself in lettuce all summer.

Interesting concept !

We grow Creole tomatoes here, VERY quick ripening and flavorful.

I may try that.

As far as lettuce, I have my doubts (I know someone that planted in November, we had a mild winter and they harvested till March or so).

Otoh, peppers grow like weeds.

Best Hopes,

Alan

Tomatoes and peppers (and eggplants) are close relatives and are tropical plants, so you should be able to grow both there.

Lettuce likes shade & plenty of moisture in the summer, heat is a problem but starting the seeds indoors in a cool spot and then transplanting will help. You need to select loose leaf varieties that mature fast, and harvest them fast before they bolt. Growing lettuce in containers under a shady tree might be worth a try, especially if you can rig up some type of drip irrigation to keep them watered.

From the Western Regional Climate Center's Climate Summaries, annual average precipitation:

Hoquiam, WA: 69.69" (1953-2006)

Shelton, WA: 66.19" (1948-2002)

Lowland stations, but nearby mountains (namely the Olympics) may have some effect on these fairly high totals. Most lowland stations in western Washington and Oregon receive about 35 to 50 inches annually.

-best,

Wolf

How careful do you have to be when you're drying or storing the field corn? When I lived in Kenya, it was common to see stories in the paper about poisonings from improperly stored corn. There is a mold that grows on the corn and produces a toxin, called aflatoxin I believe.

Could have been aflatoxin. This is a bluish mold as I recall. There was a lot of talk about it several years ago.

Caused by high moisture. I had some ear corn I left on the patio with the shucks on and it got rained on. Later it had blue mold all over some of the ears which I then saved only for seed and not to eat. The rest I pitched.

How careful? I think 10 % moisture is fine. It gets pretty dry hanging on the stalk but don't want to wait too long before picking. Then shuck it and let it dry a bit more on the cob. Its gets real brittle when its dry and rattles when shelled. I sometimes use a moisture meter that they carry on the combine to check mine. Now I sorta tell by experience. There are very small insect eggs on grain. If you let some moisture get on it then sometimes moths or weevils will infest it. If dry enough then your safe from weevils.

I have had store brought meal get slighty damp on the kitchen counter and later in the pantry moths were coming out of it. Of course cooking easily destroys all these on your home grown grain. They appear to always be there but unless the moisture is high then you have no problems. Weevils will tunnel inside a wheat berry and hollow it out totally.

I would never eat corn that had any evidence of mold or off color. Check with a farm agent in your county. They should know all about this. Otherwise I much prefer the home grown grain.

Airdale

As a child, 'succotash' was a mixture of lima beans and corn - about 50/50.

Thank you for that excellent information. Could you recommend a brand of burr mill? I can look all I want but have never used one so don't know what to look for.

Thanks in advance

D

Delusional,

My grain mill is according to the booklet "Country Living Grain Mill".

It comes with a large wheel for manual labor and has a smaller pulley for setup with an electric motor(not supplied). Many elect to tie the pulley up with a bike frame and provide leg power to grind grain.

It grinds more than grain. Beans,etc. Just so they are dry.

I got it via the internet but don't have the site URL since that was long ago.

With a electric motor I can easily grind a few pounds of corn meal in about 1/2 hour. Never tried wheat as yet.

The burrs are adjustable from coarse to fine. I am pleased with mine. I plan to order a few more of the steel burrs cause in the event of a failed ag system I am sure that I can trade grinding for many other items. Like eggs,milk,etc.

Perhaps a PV hookup with a DC motor would be wise too.

Airdale

AirDale,

How about a Simple Blog for your insights? Much Easier than browsing through a lengthly list of posts.

Thanks!

http://www.theoildrum.com/user/airdale/comments

I remember reading (a long time ago) that you can put a piece of dry ice in the bucket on top of the grain, place the lid on (unsealed) until the ice evaporates, then seal the lid (without uncovering the bucket). The idea is that the CO2 replaces the oxygen, killing any pests and preventing the oxidation that spoils the food. Should keep for years if it works as advertised. I've never tried it myself--should probably test it now while there's still time (I hope!)

I know that the dried food in a lifeboat was preserved in airtight cupboards by putting a candle inside and shutting the door. Apart from using up oxygen [probably not as much as you would like], I guess you get carbon monoxide and probably soot and smoke, so that might kill a few beasties too.

Hey I read Ruth Stout way way way back.Maybe 70's era and heeded well what she wrote.

For those who haven't heard of Ms Stout:

http://www.homestead.org/Gardening...

running into far more snakes

Yeah, I was piddling in the garden in my central texas McBurb and found a couple of little brown snakes. Don't know the species, I think they were grass snakes. I turned them out into a brush pile in the greenbelt so the dogs wouldn't kill 'em.

I haven't seen but one other snake in the 8 years I've lived here, so it must be a good year for them.

| The problem will solve itself.

| But not in a nice way.

Here's how to avoid manual lifting of water...use one or more 45w panels in parallel to charge a deep cycle lead acid battery with voltage regulator. Connect via timer to a 12 volt pump either to supply the drip system either directly or to a high mounted tank with the valve set to slow trickle.

A compressed air wind powered bubble pump could be used to lift water from a shallow well or dugout. A bubble pump works by gas bubbles providing lift up through a narrow hose lifting water between the air bubbles. A coffee percolator is an example.

"Here's how to avoid manual lifting of water..."

Yeah That, or have kids!

http://www.unicef.org/mozambique/media_2159.html

Bob Fiske

I was just reading the posts above and thinking that I should really grow more garden. I grew up on a farm with both a mom and grandmother that had a few acres of kitchen garden and all I have are memories of pulling weeds and picking vegetables and berries. My mom still plants way more than sensible for 2 people in their 70's. I like landscaping and yardwork, but I only have a bit of tomatoes and peppers, because I am scarred for life by child labor.

Thanks Grandma! :-)

I don't hear people talking about root cellars for storage. My parents still have one and you can keep potatoes pretty solid until way into the next spring.

One of the most unique Ideas I have seen for a pump for a well was:

Bicycle frame with pedals, rear wheel (without tire) (no front wheel necessary)

A rope is the output mechanism.

A heavy pulley on one end with the rope around it is lowered into the well. The weight of this tightens the same rope (which is a circle) is around the rear tire holder.

When a person peddles the rope passes thru the water. Water tension helps hold the water to the rope as it rises. At the receiving end a device to "wipe" the water from the rope into a bucket.

from the article the Aide worker said it brought up a good deal of water, several gallons per hour depending on effort.

Quid Clarius Astris

Ubi Bene ibi patria

A Simple, Durable Drip System

I've used this system on many crops for years. It isn't free and requires some water pressure to work: Lay out a length of 1/2" black plastic pipe where your crops are planted. Take an ice pick and punch a hole right through the pipe where each plant is (sometimes, like with tomatoes, it's good to put a hole on either side of the plant about 1 1/2' apart), or if it is something like corn every foot or so (You want at least a foot between the end of the sleves - see below). Now take a hatchet and whack 6" lengths of 3/4" black plastic pipe. Slide these pieces onto the 1/2" pipe so they cover the holes. Put a plug in the exit end of the 1/2" pipe (you don't usually need a clamp), put a male adapter on the entrance end with a pipe to hose fitting and attach the hose. That's it. For corn, we use three pipes spaced about 6-8" apart. Our longest runs are about 120'.

This system beats the heck out of something like T tape for home growers.

Todd; a Realist

Unlike Airdale, I like soluble fertilizers. FWIW, I described my growing method(Todd's Black Gold Method) here: http://www.theoildrum.com/node/2410#comment-173726 It is a combo of mulching and terra preta. Anyway, I fertigate using soluble 20-20-20 plus trace elements. My farm supply stocks Grow More brand and it contains B, Cu, Fe, Mn, Mo and Zn (all chelated). I like fertigating since I have to irrigate just about every day anyway. The advantage is that I am putting down a miniscule amount of chemical fertilizer so I haven't seen any disruption of the rhizosphere as one might get with a slug of dry chemical fertilizer. Further, the amount added is somewhat proportional to plant size thereby minimizing excess fertilizer.

I also really like having trace minerals being added since most soils are deficient in them. Although I do add glacial rock dust, it's really hard to assure adequate amounts are available without soil testing.

Sustainable food production is a good topic. But for those without the land, energy or skill to grow a significant portion of their own food, may I suggest that people at least learn how to cook. So many people anymore eat primarily prepared or highly processed food and don't know how to make a dish from scratch.

As inflation in food prices increases, the simplest, most effective response is to go to more basic ingredients. Peasant cookery, developed over the centuries, is relatively well-balanced nutritionally, tasty, and cheap.

Actually, peasant cookery is very much oriented on starches to deliver the calories. My parents always told me when eating fish, meat, whatever: "eat some bread with it!" There not really a nutritional reason to do that. People don't need starchy grains as a major part of their diet. They eat it because they grow it, and they grow it because it's easily taxable and transportable, even with simple technology.

I'm going to get myself a used above ground swimming pool (I see them all the time in the local free advertising fliers) and fill it with my well and rainwater run-off from the house and pole barn. Using the pool as a reservoir I can irrigate my plants during dry periods. Airdale, I'm an avid reader of your posts and I value your insights gained from real life experience. My perception from the many posts on this and other sites, especially the ones critical of farmers, is that many in the peak oil community think that once it hit’s the fan they’ll be able to immediately take up gardening and continue on their merry way. We’ll see. I’m looking forward to your website coming back. Please post its’ address when it is up

Bruce on my ten acres in Cumberland County Illinois

Bruce, you may want to consider grabbing all of those free above ground pools that you can find. If you use them for water storage, great. But beyond that, the aluminum in them is worth a lot of money. I have a friend who dismantled a neighbors pool and brought the metal to the scrap dealer. He pocketed $350.

But that was probably a best case scenario, since he said this pool had a big aluminum deck on it. Still, it could be worth your while.

Airdale, have you tried the fora on Matt Savinar's site? Many of the small homesteaders who post there seem to know what they're talking about, and the signal-to-noise ratio isn't bad.

I agree that those ubiquitous white plastic buckets are one of the many benefits of the Oil Age that will be sorely missed. Since they are stackable, watertight, airtight, and almost completely verming proof, they are great for caching anything that will fit inside.

At the school where I work the custodians throw out many non-toxic water emulsion floor wax buckets with the watertight lids still on. I rinse them out really well, dry them, and they're ready to go. I recommend to everyone getting to know the Head Custodian at a school near you and use this free resource while it lasts.

Errol in Miami

Hey Airdale;

Go ahead and give us some posts on Hot Monkey Love.. as I hear it, the best of them use all sorts of petroleum products, but the PO-aware ones are now experimenting with Dairy! (To a soundtrack of Acidophilus Rock)

I've got a set of the Harbor Freight Panels. Every few months (if ever again!!) they drop the price from $250 to $199, for a very decent price per watt! I have them as 'stocks' against future energy woes, but have not managed to get the roof hardware, or rig the grounding wire and battery-areas to get the system up and running. For now, they are my 'security blanket' for knowing I CAN keep some lights, radios and tools running, in a pinch. (Along with other brands, I have about 230w of PV available) Not without the requisite irony, these are Chinese products, oh ye, informed and conscious conoodsumers!

I copied your Drip System for my wife, who has asked me to research the subject for her. Now do I tell her that, 'Yes, I WAS on the Oil Drum today, BUT I got the info you wanted.. see how great TOD is, Honey!?', or do I just say, "Honey, I got the info you wanted..."

Food is hardly off-topic. Oat Mash and Honey is going to be one of our Liquid Transp Fuels again, I'm willing to bet!

Bob Fiske

Oh, PPS, or more appropriately, PKT..

I am not a HAM user, yet. But I am very interested in Packet Radio and 'Mobile Ad-Hoc Networks', using a 'simple' Modem/Radio combination to keep our ability to independently link our computers, in the unlikely event of a Telephony/Cable/Satellite-related Internet failure.

http://en.wikipedia.org/wiki/Packet_radio

Have any of you had experience with this?

Bob Fiske

I've got the same set of $200 solar panels. I would recommend ordering a $25-30 7amp 12v solar panel charger conroller from Northern Tools or Harbor Freight. The control box that comes with the $200 set of panels from H.F. does not prevent flow-back into the panels at night NOR does it prevent overcharging of the battery.

You can still have it rigged up to that control box so you may use the included 2x 12v CFL bulbs that come with the set. (Very cool, those usually run $12-$15 each if bought seperately.)

If you don't want to mount them to your roof, you can do something similar to what I did, which was put them on my back deck that we never use. Sadly, my house mate moved my bicycle from where it was safely standing to in front of my solar panels, then when the next storm came around, it blew my bicycle into the panels, cracking the front of one of them. So far the damaged panel still works, but I don't anticipate that will last after the leads begin to corrode due to exposure.

I use my deep cycle battery that is charged by the panels for things like charging my laptop, cellphone, etc. I also use it for power when camping, I'll haul it into my Subaru along with one of the three panels, and a 1500W (3000W peak) Xantrax modified sinewave inverter that my bro picked off of eBay for $100. I've used it during storm-induced power outages, and it works just fine. That's even using one of those cheap Walmart Everstart batteries. I've had the setup for 2 years now. I'm anxious to see just how many years I can squeeze out of this cheap battery.

Thanks for the heads up on that Controller-distrib box. I was wondering what kind of electronics they put in there.

I do have a 'Morningstar Sunguard 4.5' Charge controller that I got from Arizona Wind and Sun for about $35. I don't think it has MPPT features, but is small and light and from a reputable company.. in case you or Airdale want to check them out. It's fully sealed/potted, and I found it recommended online by a kayaker who built it into a small boat-worthy charging system for his trips.

Bob Fiske

Best of all, Hot Monkey Love is a renewable resource!

Great idea airdale! Going to try it in the garden and look for more buckets. This is the kind of info we need and your idea for a food forum is a good one. We have an established community here that could serve as a basis for such things.

Goodness. Today is a sheer avalanche of peak oil news.

Sometime I get lost in the details of a problem and have to step back and remember what the problem really is.

I have to think about how the problem can be fixed and everyone gets to keep "move'in on up " like the Jeffersons (1975-85 tv show)

The real problem, I think, is ENERGY. As expressed in BTU.

How you get it, store it, transport it and use it are the details I get lost in and I forget the real problem.

This week as been a hard one on my energy needs. I live 100% off the grid using Solar PV's, Wind and a Gasoline Generator. My base electrical power needs each day is 6826 BTU and I use in total about 10239 BTU each day. Normally the Sun/Wind will take care of all my electrical needs down here in my little piece of the Bahamas. But this week there's been no Sun or Wind to speak of, so I've had to run the Genset each day.

back to the problem at hand, see how easy it is to get sidetracked.

According to the EIA the world used (in Quadrillion BTU)

1 Quadrillion Btu = 1,724,137,931 Barrels of Crude Oil (I think? can someone check my math)

As long as we can get more Btu each year the party will go on. When this starts dropping the party is over. I think??????

Ed

Crude oil peaked in May 2005 at 74,151,000 barrels per day.(EIA data)

Something is out of whack...

Are you over by a factor of 10 on the number of barrels = 1 Qd BTU?

"You can never solve a problem on the level on which it was created."

Albert Einstein

This time, it is Professor Jacobson taking exception to Mr. Khosla's version of events:

Mark Jacobson Responds to Vinod Khosla

The "Why Food Cost More" article on commodity speculation is amusing. Last Friday on RR's blog under Gouging is an Idiotic Explanation RR posted a comment regarding the increase food prices due to ethanol and I made this remark:

I then went off saying that an increase in US corn price is good for Canadian grain and mixed farming and that ethanol production wasn't going to be a long term food problem because the ethanol plants aren't feasible on $5/bu corn and will shut down...

(the rest is here): Gouging is an Idiotic Explanation

edit: Thinking about this a bit more, judging by the NH3 usage/price that unless there is a major corn crop failure there probably will be more corn surplus regardless of ethanol usage due to higher acres and higher fertilizer input. In whatever case, there are less soybeans.

BP shuts 100,000 bpd at Prudhoe due leak-US lawmaker

Ron Patterson

What is Prudhoe bays' oil/water cut?

I found it. As of 10/8/06 is was 66% water cut.

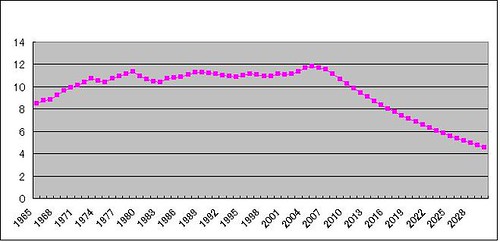

I was looking into the Olduvia theory (OT) recently. I was playing around with the numbers and thought maybe someone else would be interested in it.

I started by grabbing the BP data for world energy use in oil barrels equivalent and population data from the UN.

I first plotted boe per capita from 1965 to 2005 and saw pretty much what Heading Out saw in his post on OT. For fun I decided to extrapolate out into the future to see what it'll take to get to 37% of the peak energy use per capita (and hence the end of industrial civilization according to OT).

So I started with assuming a 3% energy decline starting next year. I also assumed a 1% population growth till 2040 (which got me pretty much inline with the United States Census Bureau projections).

You can see the results below.

It only takes until 2031 to reach 37% of the peak (1995 11.85boe per capita). Right in line with a 100 year span of industrial civilization starting in 1930.

So next I wondered what would happen if the decline in energy wasn't quite so bad. So I plotted 2%. Same result 2031. 5% decline got us there in 2031 as well. Then I tried a 0% decline in energy though 2040 and that only stretched it out to 2038. These were all done with a population increase of 1% annual.

Unless I really screwed this up the results are pretty startling. It doesn't really matter what the decline rate will be post peak. Even a modest exponential increase in population will seal the fate of the industrial world in about 25 years.

If every nation produced every barrel possible in the near future then a 3% decline is way too high. For the next three or four years, the decline rate will likely be less than 1%, if that. Then as more nations peak, the decline rate will increase to 2% and so on.

However that is assuming business as usual even after the world becomes aware that world oil production has peaked. It is highly unlikely that anything will be business as usual after the world becomes aware of peak oil. Some nations will start to hoard oil, either keeping it for themselves or waiting for a higher price later on.

The investing public will become aware that industry will probably shrink, right along with the energy supply. This will cause a stock market collapse and all the repercussions this will bring.

And as far as population projections are concerned, every projection will be altered dramatically when the consequences of peak oil begin to take effect. And that will happen long before 2040.

Ron Patterson

Compared to the consequences of Peak Oil, all other events in human history shrink to insignificance.

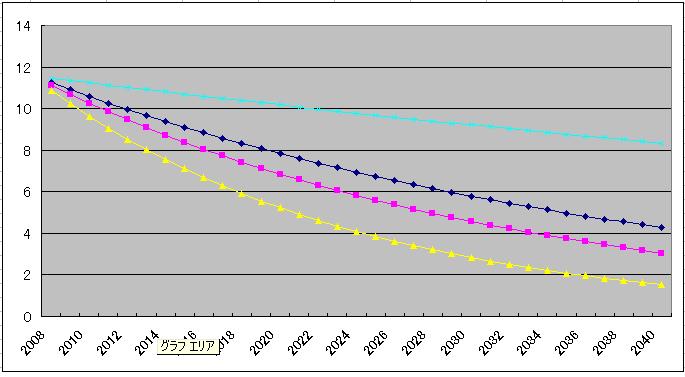

I screwed up my second graph.

Here's the correct one.

Light Blue is the 0% energy decline.

Dark Blue is the 2% decline

Pink is the 3% decline.

Yellow is 5% decline.

So the rate of decline post peak does make a difference. But it seems to me we are still headed into the gorge.

I agree population growth will stop (die off?) at some point before the 37% mark.

And then we have the Export Land Model, e.g., a single digit decline in Mexican crude oil production = a double digit decline in oil exports.

The top 10 net oil exporters showed a 3.25% decline in net oil exports, annual average from 2005 to 2006 (EIA, Total Liquids). From 12/05 to 12/06, the decline in net exports is sharper than 3.25%.

Where do you get these numbers? According to the shipping industry, tonne/miles increased in 2006 and are up 11% since 2002. The crude-oil tanker business is also doing very well. There are currently over 150 newbuild VLCC tankers on order through 2011, expanding the current fleet of 460 by a third. It is hard to square these facts with a situation in which exports are shrinking, unless somehow much less oil is traveling via pipelines.

Not if 2000 tankers over the next few years are being decommisioned:

http://www.greenpeaceweb.org/shipbreak/news104.asp