Oilwatch Monthly - January 2008

Posted by Rembrandt on January 30, 2008 - 10:45am in The Oil Drum: Europe

The January 2008 edition of Oilwatch Monthly can be downloaded at this weblink (PDF, 1.6 MB, 21 pp).

A summary and latest graphics below the fold.

Latest Developments:

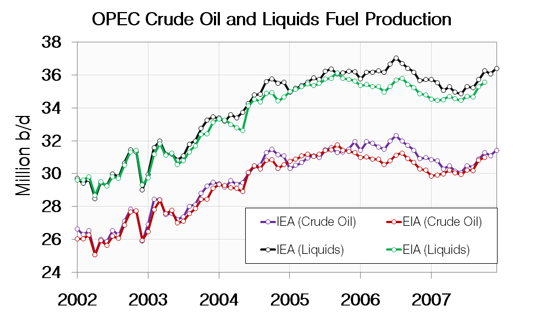

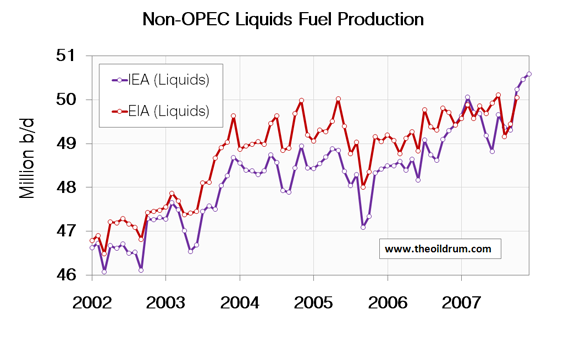

1) Plateau production - For the second consecutive month world production has increased significantly, confirming the end of the plateau that began in 2005. The IEA figures result in an average global production in 2007 up to December of 85.26 million b/d, more than the average 2006 production of 85.00 million b/d and the average 2005 production of 84.10 million b/d. The EIA in their International Petroleum Monthly puts the average global 2007 production up to October at 84.47 million b/d, slightly lower than the average 2006 production of 84.60 million b/d and the average 2005 production of 84.63 million b/d.

2) Total liquids - In December world production of total liquids increased by 450,000 barrels per day from October according to the latest figures of the International Energy Agency (IEA). Resulting in total world liquids production of 87.00 million b/d, which is the all time maximum liquids production.

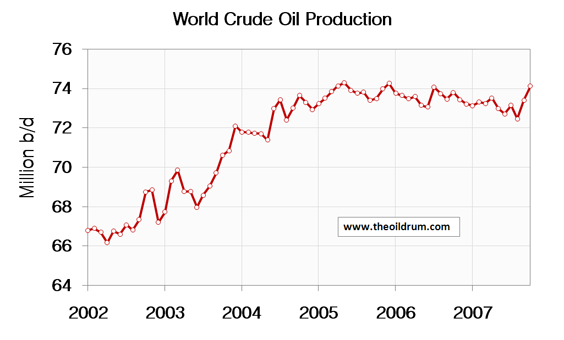

3) Conventional crude - Latest available figures from the Energy Information Administration (EIA) show that crude oil production including lease condensates increased by 714,000 b/d from September to October. Total production in October was estimated at 74.12 million b/d, which is 174,000 b/d lower than the all time high crude oil production of 74.30 million b/d reached in May 2005.

A selection of charts from this edition:

Interesting, entering unchartered territory here. Either random plateau fluctuations can account for this or are we hitting The Overshoot Point?

1. Maintaining a plateau by increasing extraction rate gradually (time scale arbitrary)

http://mobjectivist.blogspot.com/2005/12/top-overshoot-point.html

2. Creating new peaks by rapidly increasing extraction rate

http://mobjectivist.blogspot.com/2005/11/can-we-delay-peak-by-upping-ext...

gradual

fast

Get ready for the Peak Oil Denialists to re-emerge. We need lots of ammo to bat them away.

The important piece is conventional oil, which still peaked. If we discount the NGL by energy content and subtract 2/3 of the tar sands (which is reprocessed NG) then we are far past peak. Personally, I would like to see the NG and Coal derived fuels taken out, because they need a different analysis to predict peak. There is no simple math model that is going to include the US corn crop size in it's all liquids prediction.....

Agree. The input discovery profile is much more accurate for conventional crude due to periodic backdating. The problem with non-conventional oil is that the discovery inputs come from other sources, e.g. NG fields, which have never been factored into an equivalent backdated discovery profile. Certainly the conventional crude has hit a peak already.

Whatever ounce of reserve growth there might be I added to the Dispersive Discovery model and came up with this:

http://www.theoildrum.com/node/3287

Which takes it to the current date. Not allowing any reserve growth or an extrapolated discovery profile tail puts the peak back at 2004/2005. I think the key is in unknown discoveries and having a good model to predict the decay.

The optimistic view is to use the BP Discovery data which uses a BOE (Barrel of Oil Equivalent) discovery dataset, which must take into account the NG fields, etc. This can push the peak to 2010.

http://www.theoildrum.com/node/2712

Deduct bio fuels and processing gains as well.

The Dec 2007 peak is a biofuels, processing gains and OPEC NGLs peak.

We have:

July 2006:

Total liquids: 86.13

biofuels .15

processing gains 1.88

OPEC NGLs 4.73

Subtotal oil 79.37

December 2007:

Total liquids: 86.95

biofuels .46

processing gains 2.11

OPEC NGLs 4.89

Subtotal oil 79.49

So the base oil production for these 2 months is only 120 kb/d apart. That's within the accuracy of statistics. We are kidding ourselves if we think that was a lift off from the plateau. The difference to the July 2006 peak is that we have now higher production for 3 months, while the 2006 peak was a one-off month only. However, there where 4 months in 2007 with much lower production, so part of the Oct-Dec peaks was a compensation for that.

And by the way, the November figure was revised downwards from 86.55 (reported in December 2007) to 86.08. So let's see how the December data will change in the next 2 months.

What we see here also are desperate attempts to add whatever can be added to hide the peak and confuse us. What next? Re-processed cooking oil? It's coming:

http://www.theoildrum.com/node/3531#comment-295916

And let's not be surprised to see not only December reported levels taken down a notch, but November again as well.

If re-processed cooking oil begins to be used in significant quantities then I hope it is included. This distinction between "crude oil" and other liquids is lost on me. If "other liquids" can be used in place of crude then by all means include them in the reporting. Forget the "energy cost to produce" disclaimers. Do we distinguish crude pumped from deep sea wells as compared to easily obtained land based crude? No. It's all crude that gets used for transportation, just as the "other liquids" are. It's all the same to me. But then I'm not invested in "being right" on some prediction I made. The Peak is coming. It might already be here or it might not. But it's coming. If we get more production of "other liquids" be it cooking oil or anything else, I see that as good news. More time to prepare for the post peak world and to pour money into eneregy services stocks at these low levels.

In the peak oil camp we have two competing arguments:

1. Pessimistic geological inevitability states that the peak will happen and there is nothing we can do about it. Declines are inevitable and will happen soon. The Geological inevitability argument favors a pure peak model focusing on 'easy oil' or 'crude + condensate.'

2. Optimistic economic market adaptability states that high prices will cause a wealth of new supply we never saw before inevitably delaying the peak to some remote future date. The economic marketers will, likely focus on 'all liquids.'

In my opinion, both views are valid. The geologic side points to old supply and its inevitable decline, the economic side points to increasing incentives to bring new supply online with each jump in price.

I think that's what we're seeing now. On the conventional crude side, former shut in capacity is opened as the high price makes it economical again. Furthermore, previously unconventional crude such as heavy oil is being added to the mix as the world demands for any oil of any kind. So in conventional crude, the decline is mitigated by innovation in pursuit of profit.

Also, on the unconventional side, the same thing is happening. Tar sands, oil shales or oil from shale basins, biodiesel, recycled cooking oil, ethanol, gas to liquids, and coal to liquids are all doing their best to come to market and make a profit.

Peak market inevitablists state that all these new liquids don't have a good EROI and more energy goes into them than ends up coming out. They claim that this will hasten the peak by resulting in rapidly crashing economic systems as the high EROI model puts a breaking strain on the world economy. In my opinion, the inevitablists are, for the most part, wrong. Long term, unmatched EROI does result in crashing systems. But the new fuels don't have negative EROI, just a worse EROI than conventional oil. But with the high EROI priced into the market, the new fuels become viable. So the adjustment results in economic slowdown as opposed to crash -- at least for the time being.

Now I'd like to make some observations given this new paradigm that's slowly coming to fore:

1. Biofuels adds a viable new fuel and feedstock for the market. Biofuels may not be as flexible or as good as oil. But with oil struggling or running out, it makes a worthwhile addition. Furthermore, innovation will push biofuels to improve on a long timescale. Look at biofuels to add around 300,000 barrels per day to world supply on a year on year basis for the forseeable future. With algal biofuels, switch grass other and cellulosic ethanol it may be possible to expand this growth on a year on year basis at a 3-5 year horizon.

2. Unconventional oil will continue to grow so long as the price of oil remains high. Tar sands in Canada will continue to expand. Natural gas needed to produce the sands will be imported or nuclear reactors will be built on site. Canada is too dependent on export of oil sands crude to the US to lose its engine for economic growth. It will make the needed investment. Other unconventional basins in the US, Venezuala, and around the world will also be expanded. Look at unconventional oil to add around 300,000 barrels per day to the world supply on a year on year basis for the next 15-20 years.

3. Conventional oil still has a few cards left to play. The most visible is Iraq. This country is the least developed of the Middle East and, probably, has the most realistic reserves estimates. It is possible that Iraq could add as much as 400,000 barrels per day for each year for the next ten years IF geopolitical conditions in the country allow for further development. Also, continued high prices will push producers to find every drop of supply available. As stated before, previously uneconomic conventional crude will come onstream slowing decline rates as well.

4. High prices will incentivize consumers to conserve fuel either by purchasing less consumptive vehicles and appliances, or by reducing the amount they travel and use energy. It will also create increasing pressure for corporations to make available new technologies that are more efficient and reduce and/or eliminate structural dependence on oil and gas. Hybrid autos, Plug in hybrids, electric autos, smaller cars, more energy efficient light bulbs and the continued increasing viability of wind and solar to meet grid demand and then grid to transportation demand will help to reduce demand growth in fossil fuels and shift demand to other energy sources. Ironically, we are most likely to see these changes first in the United States as that country has the most to lose from structurally high oil prices. In fact, we have seen a flattening in demand in the US over the past two years. It is possible that this will continue despite predictions US demand will increase in 2008. Analysis of consumer behavior already shows a strong consumer bias away from large vehicles (SUVs and other trucks) to smaller more fuel efficient models. New technology may well enhance the ability of US consumers to shift demand away from oil. Also expect these trends to begin to take hold in Asia and around the world as all countries try to answer the problem of high or increasing energy costs.

Pessimists deny the resilience of the world economy. Optimists overstate it. Often it is the pessimist's argument that these mitigating factors will be overwhelmed by the massive structural inertia of peak oil. Optimists state that these factors will, almost magically, facilitate a smooth transition. And therein lies the rub. It is likely that both sides are wrong. In my opinion, there will be a crisis. Optimists will be shocked that peak oil actually happened and put a crimp on global economic growth and impacted geopolitics for decades. Pessimists will likely be shocked that the world didn't end, there wasn't a mass die off, and the world economy did survive in some form -- albeit one radically altered from the one we see today.

In conclusion, it seems the world has reached a plateau in conventional oil resulting in a price shock. The structure has changed to produce all economically viable liquids of any type. This first scramble, in my opinion, will likely push the overall liquids peak date out a couple of years. ASPO is betting on 2010 and this seems a good estimate to me at this time. Despite the peak date likely falling back, I wouldn't bet too much on a price contraction. There is far too much market control by OPEC and far too much likelihood of new demand from Asia to result in much relaxing in price even if there are large quantities of new liquids on the market. I'd expect OPEC to start defending the price of oil at around $80 per barrel. So, regardless, the next two years are still likely to see high prices.

Despite my relative optimism as opposed to the pessimists, I am not a 'magical economy' optimist either. I do think that oil will struggle to make any gains it does in overall liquids. The decline rate and expanded consumption in producing nations will take a serious toll. So I don't expect to see a long term, decisive, rally in supply. More like marginal gains struggling to reach an overall top of around 88-99 million barrels per day in the range of 2010-2020 with best possible cases adding 1mpd per year at a year on year average until finally succumbing to the decline rate.

In my opinion, the 88-90 mbpd top is the most likely scenario putting the peak in the 2009-2010 range. Of course, I could very well be wrong. As this is only an opinion based on a little better than back of the napkin analysis.

Best wishes to all!

Rob

I think that's what we're seeing now. On the conventional crude side, former shut in capacity is opened as the high price makes it economical again. Furthermore, previously unconventional crude such as heavy oil is being added to the mix as the world demands for any oil of any kind. So in conventional crude, the decline is mitigated by innovation in pursuit of profit.

Give me an estimate of the amount of shut in oil to current reserves that would become available if price, say, doubled. This is easy to add to any model to figure out the change it will make to the production profiles. I contend that if it is small in comparison to the reserve growth that already occurs, that it won't make much of a difference.

I agree that it probably won't make a huge difference and that it probably is at the margin when compared to reserve growth. If, for example, in the US it is something on the order of +15,000 - 30,000 bpd per year all it does is bite into the decline rate. But if you slow the decline rate on aggregate across the world it provides more opportunity for unconventional + biofuels to make up the difference. By itself, it is small. When considered on aggregate it contributes. That's all I'm saying.

For my part, I agree that we've likely hit the plateau/peak in conventional oil. So my analysis is based on the viability of new fuels/efficiencies.

Hi Rob,

I guess I have two issues:

1. Is that both Deffeyes and Staniford have shown a very tight correlation between the US oil production and the logistic curve, which leaves no unexplained variation for price. Essentially what determines how much oil will be produced tomorrow is about 98% how much oil was produced last year, last decade, etc (where you are on the curve). This may not be intuitive, but there it is. I don't believe that WHT's model has price as a variable either (unless he changed it recently).

2. All the substitutes that are being proposed are conversions of other energy sources. Meaning if we try to switch to biofuel, we need more natural gas (or coal). But NG in much of the world is also in decline. And coal is nearing peak and will be just as difficult to ramp up. You mention the tar sands, but where will the NG come from to power the process?

Energy and GDP are tightly correlated. 98% in a study I am reading right now. We could easily see a drop of 50% in energy supply over the next 20 years. That would be a 50% drop in GDP. Is that Armageddon? No, it does not have to be. But the political and economic stress is going to push people. Imagine every single person getting a 50% pay cut. We are seeing poor choices from politicians (turn the food into fuel) and poor choices from those impacted (truck drivers blockading refineries). I have to say I am quite worried.

Overall decline in the US did not follow a smooth graph or even a cliff scenario that most refer to here. Yes, we found oil elsewhere (Alaska, offshore) but that oil did contribute to the economy and round out the shocks so they were not as severe. I don't think it's likely we'll find zero significant new oil or even fail to use oil we already know is in place (for example North Slope). Now I know this cannot stop an inevitable peak. But it can buy time and soften the decline.

In a real sense, Hubbert was correct. But the details did not dance perfectly to his prediction. US production slid down a rather gentle slope on the downside.

Not all substitutes are complete conversions of fossil fuel. And though there is a natural gas input into synthetic fertilizer and insecticide feedstocks not all biofuel crops must rely on synthetic fertilizer and insecticides. So, yes, there is an input. But the solar input, for example, is far greater. Ethanol is a net gain and though not as good as oil it is still a net gain.

Canada will have to import LNG for tar sands. No way around it if they use gas plants to heat the bitumen. If there's no NG, they'll build nuke plants in the production basin. Yes, coal and NG will probably peak too. But the timeframes are not quite as close as oil so we have a little wiggle room.

So, yes, world conventional oil will probably go into decline. But I think there are factors both in conventional, unconventional, new tech, and efficiencies that will help slow the fall rate and squeeze more productivity out of each barrel while shifting to other energy sources. I also think it's possible with new projects, Iraq, and others that overall liquids can still grow a bit. As I said before, I don't think it will be much more than 88-90 mbpd.

We must calculate all the NG, oil, and energy used to run equipment used to grow the crops, produce the seeds, the fertilizers, harvest, and make the ethanol production.

This amount of energy must be subtracted from the ethanol produced before we add any figures of ethanol production to any figures of world liquids production.

.

If we do not do this, we are double counting the ethanol production figures.

If it takes an equivalent of 70 barrels of oil to make 100 barrels ethanol, we are only adding 30 barrels of liquids to world production, not 100 barrels.

.

DocScience

http://www.angelfire.com/in/Gilbert1/tt.html

According to the US Department of Agriculture in a 2004 study, ethanol returns energy at the rate of 1.67:1 over the course of its entire supply chain so the net energy gain, in 2004, was 167% vs energy invested. The USDA study was confirmed by follow-on studies by Argonne National Laboratory and the University of Nebraska among others.

Those against ethanol development often cite studies from the 1970s and 80s that don't take into account modern efficiency gains, technological advancement, and economies of scale for current ethanol production. Energy return on energy invested increased from 1.25:1 in 1995 to 1.67:1 in 2004 according to USDA studies. It is reasonable to assume that with continued scaling, ethanol EROI will continue to increase rapidly until the market matures.

This issue met heated debate in Congress in the period of 2002 - 2005. The debate resolved many issues underlying ethanol and due, in part, to strong gains in EROI a major initiative to increase ethanol production was supported.

Energy return on energy invested increased from 1.25:1 in 1995 to 1.67:1 in 2004 according to USDA studies. It is reasonable to assume that with continued scaling, ethanol EROI will continue to increase rapidly until the market matures.

That's not actually what happened. They changed the way they were accounting for the energy. The 1.67 ratio came from them assigning more of the energy inputs to the co-product credits - just sleight of hand.

First, I just want to say that I think a grid supported transportation system is the most preferable option. So I'm a major supporter of an electric based transportation system and bridge energy systems like hybrids and PHEVs. I see ethanol and other biofuels, which I don't believe will ever be produced in volumes great enough to match current oil production, as part of the solution. At best, I can't see biofuels ever topping more than 10mbpd. But if a high cost fuel can delay the peak a little longer while incentivizing the transition then I'll support it as a practical option.

That said, I want to address your statement directly and I'm not doing it out of any disrespect whatsoever for your research. Just to say it seems strange that you'd attribute this increase to an accounting change. Can you show me, in the report, where they changed the accounting? Otherwise, it's your word against the USDA.

In the interest of fairness, I'm going to post a number of related reports:

http://www.calrenewablefuels.com/pdfs/Energy%20Balance.pdf

http://www.nytimes.com/2006/06/25/business/25ethanolside.html

http://www.carbohydrateeconomy.org/library/admin/uploadedfiles/How_Much_...

Some state the USDA's findings. Others support the debate.

And Robert, I saw your R2 blogs, so you needn't repost them here. I guess I fall in the camp that supports ethanol as a bridge fuel and doesn't agree with the negative EROEI arguments.

So for my part, here is my opinion/analysis:

1. Biofuels help mitigate the peak.

2. Corn ethanol eeks out a net energy return with more positives in sugar cane, and potential cellulosic.

3. All biofuels help lead us away from oil and promote energy independence which is, overall, a good thing.

4. Energy diversity is, in my opinion, the best way to deal with contracting supply. IMO the preference should be on the options that move us away from fossil fuels.

5. The US is strong in agriculture and, long term, can win with biofuels.

6. I think that all sides of the field are likely to have skewed their reports to bias their respective interests. A shame, really.

Biofuels are going to be remembered as a great tragedy. Read Stuart's "Fermenting the Food Supply" and this article:

http://www.earth-policy.org/Updates/2008/Update69.htm

At maximum we could get 10% of our liquid fuels at a cost of billions starved. The energy returns are marginal, so biofuels buy us very little time for a huge capital investment. Far better, cheaper, and more ethical to require more efficient vehicles by law.

The fairest way to state ethanol's EROEI is as follows:

Pimentel and Petzak's original studies used old averages for productivity and inputs. That would be about the equivalent of bringing currently unfarmed marginal land into corn production and old conversion technology. Pimentel's first studies didn't even include an accounting for the value of the co-product. Figure EROEI in the range of .9 to 1.2

Using average farm productivity and average technology, figure between 1.2 and 1.75 EROEI.

Using the latest technology AND setting up a system where the ethanol plant is next to a feedlot, so the distiller's grains don't need to be dried for transport purposes, and you can reach 1.9 EROEI or so. The drying of distiller's grains sucks a lot of natural gas, so if you can eliminate that step, efficiency is improved. You can truck distiller's grain wet, but only for short distances due to economics. You cannot ship distiller's grains by rail while it is wet.

As to the problem of accounting for co-products, part of the difficulty is that the corn is transformed from largely a starchy source of calories, to a source of protein (DDG). Probably the best ways to account for the change in composition would be to either use the relative feed value ratings, or examine the monetary value of the input corn to the value of the output distiller's grain (dried or not) and use the ratio of the prices to determine what percentage of the corn was "used up" in the ethanol conversion.

On the basis of what your talking about you right. However you do something that all of us tend to do; that is forget to look at the entire picture. Biofuels have a direct link to food production. If youv'e been paying attention to receant news in the grain markets you'll notice that biofuels have pushed up food prices, in combination with oil. Along with the price increases the overall stockpiles of grain have fallen to roughly a thirty year low. So actually biofuels will simply add to the coming problem of food production. The largest risk of peak oil is it's affect upon food production. Which is already being streched thin by demand, and with climate change negativly affecting it; peak oil could be the straw that finnaly caused global food production to collapse.

There are no peak oil denialists. Everyone concedes the reality of peak oil, even uber-cornucopians like Mike Lynch, CERA and Yergin.

The people you call "denialists" are actually realists who believe in a delayed peak, and don't buy into the "we've already peaked" advocacy hype. This is partly due to the sorry track record of all the mainstream peak oil forecasters. Campbell, Deffeyes and Pickens have, between them, incorrectly identified the peak more than a dozen times. So it's no surprise that you folks blew it again. This keeps happening because you are more concerned with hyping peak oil for advocacy purposes than with soberly looking at the facts.

Spin it all you want. This time, the late peakers were right. :P

Can you supply an energy equivalency comparison for the peaks in '05 and '06 with the apparent current one? I suspect on that basis there may not have been a new peak at all.

If the total energy is not higher, there is no new peak in any useful sense. Total barrels of liquids means nothing.

Cheers

Brilliant. Of course, that will take a thoughtful and deep analysis of energy conversion and efficiency factors. Unfortunately, I think that is beyond the realm of JD's expertise, which largely resides in the sophistry field.

JD I guess you are not a Peak Oil Denier, but just suffer from a severe case of mathematical modeling anxiety.

But WTF is a "late peaker"? I assume that someone has a model for that and that the depletion shows a more severe downslope after a "late peak".

WebHubble Telescope asks,

"But WTF is a "late peaker"? I assume that someone has a model for that and that the depletion shows a more severe downslope after a "late peak".

That's actually a very good question, and an important one as it pertains to the Peak Oil debate and how it is portrayed in the public (ala MSM).

I am not speaking for JD here, but let me take a shot at this and why it is of great interest:

If we take a "peak now" or early peaker, we would now be talking about those who believe that crude oil plus NGL (i.e., strictly liquid crude, not counting all liquids which would include ethanol, or tar sand, which is not liquid) peaked in 2005.

Late peakers would be those who take the peak to or past what any useful projections can go, about 2030 or later, making it effectively a "non-issue" because the construction of the exploration/extraction and consumption paradigm cannot be estimated without major amounts of conjecture.

Mid-range would be about halfway between these two extremes, half twenty five years plus 2005, or around 2017, so say 2015 to 2020 as a rough guess.

Why is all this guesswork important?

In the course of a modern technical culture the size of the U.S., Europe, Japan and China coming on fast, it is not important. Any of the estimates save the post 2030 one would require emergency mitigation effort NOW. If the "peak now" crowd is right, mitigation would be pretty much pointless, we would just have to see where the broken glass lands and work from there. So in the big picture, peak now or peak anwhere before 2010 or 2012 does not amount to a grain of sand worth of difference.

If we take the mid range of 2017 however, we get a different picture. A great deal can change in 10 years. For an example, think of the difference between 1972 and 1982 during the last major energy crisis period. It is like two different worlds.

For the individual investor/consumer planning his daily investments and life, the difference between "peak now" and peak around 2017 is all the difference in the world.

If it is "peak now" (meaning anywhere between 2005 and 2012) we are pretty much in "hang on tight mode", the time for mitigation at even a personal level becomes very difficult. One sees this in the "scaler" pattern of thought put forth by those who accept "peak now" ranging from let's move to the farm and homestead...no, wait, the future is in dense packed cities close to public transit....let's go solar, no wait, it will take too long, let's lobby for nuclear, no wait, that will take as long and cost too much in concrete and money, no wait, let's switch to natural gas...no, that's no good, the demand will drive the price up and we can't trust the infrastrure, but we could go to LNG...but the market is going to be stressed....

If the peak is percieved as closer to 2017, one can plan in a "vector" and not a "scaler way, carefully planning investments and life choices to come out at the right place in 10 years.

Both of these scenarios are of course completely different than "late peak" i.e., post 2030. If that projection is accepted, for many of us here on TOD it would occur effectively at the end of our life on Earth, and woud be viewed as a "legacy" issue, that is, what kind of world we want to leave to our offspring.

As for the "downslope" after peak, whenever peak occurs, I tend to agree with Simmons and the Hirsch report. The timing of the peak does not seem to have much effect on how steep the downslope is. Due to the modern way in which we try to extract as much oil as possible on the "first sweep" and the methods of water injection now used, the downslope will probably be steep, no matter whether it's peak now or peak 2030. That is a real concern. There will be little or no advance warning.

The reason that many of us are so opposed to predicting the exact timing of peak is due to fear of the damage that false alarms will do to preperation and mitigation. It is for this reason that I have always said that mitigation, i.e., consumption reduction, must be sold on multiple fronts, not just fear of peak.

Carbon reduction, national security, economy security, appropriate and modern energy production for the region, all are great selling points that accomplish the same goal that is needed to face peak oil: Reduction of fossil fuel consumption, scaling of alternatives and efficient and elegant engineering. Peak fear is only one factor. If we put all of our eggs in the "peak now" basket, and turn out to be correct in principle but wrong in timing, it could undercut the efforts that must be made toward mitigation and taking our first steps toward leaving a carbon based energy system behind could be crippled. Then when peak comes (as it surely will) we would be far past the point of no return.

Some argue that we already are past the point of no return, that the first major false alarm occured in the 1970's and destroyed the idea of the possibility of real and ongoing oil shortages being accepted for a generation. People now believe that, like the 1970's, this is just another logistical and political crisis, and will resolve itself soon enough. It can be argued that we have never recovered the momentum we had toward a post carbon world we had in those crisis days of the 1970's.

We cannot risk another false alarm.

RC

I must respectfully disagree. There really cannot be such a thing. The alarm, and it is a real one, has already sounded. Your own logic tells us this.

Anything before 2030 equals serious problems for which we do not have solutions. (Solutions meaning the combination of tech + funds + will + organization.) But even that misses the real nail head: regardless of PO's existence or not, we still have climate change. We must act with regard to climate change if we wish to survive and/or avoid severe discontinuities. Truly, any discussion of one without the other is chasing one's tail. The only real advantage to understanding PO and acting on it is that it is slightly more urgent in either the peak now or peak '17 scenarios, so will bring changes faster.

So, in any real sense, the only sensible thing to do is to act as if PO is here.

"we cannot risk another false alarm"...................... can we afford to assume infinite resources ?

Now, now, let's not pretend to misunderstand ThatsItImout's meaning. In all the major consuming countries, even China, the governments are somewhat responsive to wishes of the population, whether through fear of voters, fear of rioters, or both. That makes false alarms a crucial factor in whether the actions of the sort you advocate by implication are actually taken, or not; as repeated false alarms normally come to be ignored. Actions are a political matter so they are normally initiated by ignoramuses and jobsworths. They are not a scientific, mathematical, statistical, or engineering matter.

"'we cannot risk another false alarm'...................... can we afford to assume infinite resources ?" The average voter will not have the foggiest notion what that rhetorical question is about. He or she barely squeaked through algebra, has long since forgotten it anyhow, and never went any further into analytical math or calculus. For example, and with all due respect to Albert Bartlett, the phrase "the exponential function" will be entirely meaningless noise, nothing more.

"Barclay's estimates that the investment banks alone are holding as much as $615 billion of structured securities guaranteed by bond insurers. If the insurers default, hundreds of billions will be lost via downgrades.

So, in practical terms, what does it mean if the bond insurers go under?

It means that the system will freeze and the stock market will crash."

http://www.lewrockwell.com/orig8/whitney6.html

(and this is Mike Whitney, not Lew Rockwell)

"From CNBC: Bond Insurers Face Downgrade Despite Call for Delay

Wall Street bond rating agencies are poised to downgrade two big bond insurers, Ambac Financial Group and MBIA ... the downgrades could come as early as Wednesday."

Can anyone imagine getting paid in BTU's?

Of course not. Because there would be no way to game the system.

The US Empire is crumbling now. It's doing so because it's

run out of a growing supply of BTU's.

This is the evidence that we've peaked in energy. The creation of

more debt is impossible.

Huh? That is, how does this fit here?

"Can anyone imagine getting paid in BTU's? Of course not. Because there would be no way to game the system."

Oh, dear. Sit down in a comfortable chair, relax with a cuppa, and think again. I propose that you seriously misunderestimate the gaming capabilities of your fellow human beings, especially the politicians among them. Nobody's literally going to get paid in BTUs. Ever. A BTU is an abstraction. I can't hand one to you. I can't even measure one out without first installing a great deal of complex context and instrumentation. All I can do is to pay you in paper or electronic notes said to be backed by BTUs. That's it. So soon enough, there would be redeemable notes and not-quite-so-redeemable notes. There'd be special gilt-edge notes for members of politically-correctly favored groups. There might be fast-expiring notes for not-so-favored individuals. Eventually, on the excuse of "stimulus", more notes would be issued than could ever be redeemed. At some instant, the pennny would drop. The "BTU window" would immediately be slammed shut...

"The US Empire is crumbling now. It's doing so because it's run out of a growing supply of BTU's.

Maybe. Maybe not. You cite a news/opinion piece that blames excessive deregulation without even mentioning BTUs. The only oil in the whole piece is "snake oil", which fuels only human foolishness. Fools have been inflating financial bubbles for centuries now, and coming to grief when the bubbles burst. That predates fossil fuels and will surely outlive them. And we know perfectly well that in the USA, the authorities have inflated bubbles, one from another, for a very long time now. Alan Greenspan and Ben Bernanke don't even bother to dispute this, they just claim it's not their problem. However, while all this is interesting and may well prove disastrous, it isn't even evidence, much less proof, that the bursting of the latest bubble is anything to do with BTUs.

Be all that as it may, none of it responds to the original point, which was simply that actions take place in a political arena run mainly by ignoramuses and jobsworths who tug at emotions and play Queen for a Day. Actions hardly ever take place in a scientific or mathematical arena run by experts who value facts. Anyone who wishes to succeed at promoting any particular action needs to take due heed.

PaulS, you have a fan club. I respectfully ask permission to use your above post to educate.

Thank you.

"ccpo on January 30, 2008 - 4:42am | Permalink | Subthread | Comments top

We cannot risk another false alarm.

I must respectfully disagree. There really cannot be such a thing. The alarm, and it is a real one, has already sounded. Your own logic tells us this.

The alarm, and it is a real one, has already sounded.

My above post is to demonstrate that the PO crisis is here, now.

"Why was MBIA given AAA rating?"

You might say that this has nothing to do with PO.

I say it does because the most secure debt in the world is AAA rated.

And EROEI is totally based on wealth creation.

The world creates wealth thru energy growth, based entirely

on debt creation, energy monetized.

If the highest rated debt is called into question, it means that wealth never existed.

Where will you/we then get the EI to get the ERO?

The finacial markets freeze/collapse is the Black Swan

heralding PO now.

Asking better questions

by Brandon Marshall

http://www.energybulletin.net/39729.html

Hysterisis-It describes a system where the starting point is no longer available because of what the system did to reach its current state. In other words, walking the path has changed the travelers, but it has also changed the path. The travelers cannot return the way they came.

PaulS-

"Nobody's literally going to get paid in BTUs. Ever. A BTU is an abstraction. I can't hand one to you. I can't even measure one out without first installing a great deal of complex context and instrumentation. All I can do is to pay you in paper or electronic notes said to be backed by BTUs. That's it. So soon enough, there would be redeemable notes and not-quite-so-redeemable notes. There'd be special gilt-edge notes for members of politically-correctly favored groups. There might be fast-expiring notes for not-so-favored individuals. Eventually, on the excuse of "stimulus", more notes would be issued than could ever be redeemed. At some instant, the pennny would drop. The "BTU window" would immediately be slammed shut...

"The US Empire is crumbling now. It's doing so because it's run out of a growing supply of BTU's."

Thank you very much. That's exactly the system we've had since

the Fed pulled "gold" dollars in 1930 and Nixon divorced gold from

the $ in 1971. Both Oil Watersheds.

"Eventually, on the excuse of "stimulus", more notes would be issued than could ever be redeemed. At some instant, the pennny would drop. The "BTU window" would immediately be slammed shut..."

See Fed intervenes in MBIA AAA ratings for details.

Why buy insurance for AAA securities?

""Can anyone imagine getting paid in BTU's? Of course not. Because there would be no way to game the system."

Oh, dear. Sit down in a comfortable chair, relax with a cuppa, and think again. I propose that you seriously misunderestimate the gaming capabilities of your fellow human beings,"

LOL if you need proof just have a look at how the Russian Pipeline system is set up. Yulia Tymoshenko is not known as the GAS princess for nothing. She and others have been rorting that system for years, They were only found out when Putin tried to take control of the rort, He did not know how to steal the gas and got caught.

Notice how easily Putin pulled Yulia up by her short hairs?

Yulia wasn't taking money from Russia, she was taking it from her fellow Ukes.

Notice how the Orange Revolution has died?

And I bet the Odessa/Brody pipeline has still not been reversed.

Here's a guy better able to explain than me:

"

Our world is facing two fundamental and interlinked challenges: fossil fuel depletion and global climate change caused by greenhouse gases. These are monster issues and lurk behind each and every major political, economic and strategic decision, from revamping transportation infrastructure to overhauling pension systems and making war.

While there are still entrenched interests that wish to muddle the issue, the Chairman of Shell Oil has just released a statement which begins:

By 2100, the world’s energy system will be radically different from today’s. Renewable energy like solar, wind, hydroelectricity, and biofuels will make up a large share of the energy mix, and nuclear energy, too, will have a place.

Further down, he states:

After 2015, easily accessible supplies of oil and gas probably will no longer keep up with demand. As a result, we will have no choice but to add other sources of energy – renewables, yes, but also more nuclear power and unconventional fossil fuels such as oil sands. Using more energy inevitably means emitting more CO2 at a time when climate change has become a critical global issue.

____________________________________________________

(*) This is a proposal I made some time ago in a comment to The Oil Drum. It was in response to calls for the re-instatement of the gold monetary standard, which I regard as ill-suited to an era of resource depletion and climate change.

Posted by Hellasious"

http://suddendebt.blogspot.com/2008/02/greenback-thought-experiment.html

I think Putin's problem was he was not an engineer, so he did not know how to steal the gas, So he used politics to smash the Gas oligarchies. Smart move, As for the Russian Pipeline system, Its like a spiders web, with hungry poisonous spiders in every corner, I dont think I have ever seen a map of the system that I believe to be 100% accurate, I wonder who the new whipping boy (country) will be this year to exlpain any shortages, I think Belarus has had enough turns on that Merry-Go-Round, With the cold snap hitting Europe this week, I wonder if Georgia, will suddenly be left in the cold and Dark again.

I'll not speak for the other fellow, but, again, if there is a fire, you cannot possibly have a false alarm. There is a fire, thus no false alarm. Rather than saying we shouldn't raise a false alarm, thus implying there may not be a problem, we should be figuring out how to say what to whom to get them to realize there is, indeed, a fire.

If you consider PO on its own, there is a fire. At best, it is 30 years to the peak. The Hirsch Report tells us we need 20, at least, to prepare. The chances of that happening if we are worrying about false alarms is zero. 30 years is not long to alter a world's fuel use. And prices (positive feedbacks) are already causing trouble for individuals and companies.

If you consider global warming on its own, Hansen tells us it's already to late to avoid serious changes. Virtually any delay will likely result in unimaginable changes. If we get emissions to 20% of current by 2050 or so and to nearly zero by 2100, we *might* end up with a habitable planet. Please, please, please tell me where you see the false alarm .

If you consider either one of these with the impact of the coming global recession, possible depression, how do we fund mitigating either?

If you consider the extra costs associated with either PO or GW from climate chaos, you see there will be reduced resources for combating either as a result of their very existence.

If you consider any or all of these in relation to one another, the positive feedback loops are obvious.

Please, enlighten me as to the nature of the false alarm, for I must be deaf dumb and blind to it. All I see is a huge warning sign flashing "DANGER! Bend over and kiss your sorry ass goodbye!"

I don't have the chops to explain this to anyone mathematically or philosophically, but my common sense, my logic, my intuition and lots of others with the same vision tell me this is no false alarm.

The shit is hitting the fan, like it or not. Take it from someone who knew BushCheney would turn out to be the neo-Antichrist and we'd invade Iraq if they were elected even before he won the election.

Systems theory, chaos theory, feedbacks, bifurcations... I don't care how you look at this, the only way forward is through a trial by fire. The only question is how hot the fire is going to get. I.e., we *know* GW and high fuel prices are kicking our butts already. The only question is to what extent will PO and/or the financial meltdown will affect things?

By definition, the current situation cannot be characterized as a false alarm.

Cheers

Re climate change, the possibility of emissions being miniscule in 2100 is not slight. How much of what will be left to burn? Oil then NG then Coal in relatively quick succession.

One thing that is increasingly undeniable is a trend towards greater energy prices as 'the easy oil' runs out and its knock on effect on Agricultural and transport costs.

This price signal gives us 9 years in the 2017 case -not long enough perhaps but at least we will have started down the path of wind, solar, more nuclear, LNG buildup, etc.

In the Peak Now case we are essentially looking at a major crash sometime very soon and crash speed/cost/inefficiency type buildout coupled with major hardship and massive demand destruction.

In both cases the astute investor would be wise to build up a portfolio of Energy related investments and Gold, at least that's the conclusion I have come to (although of course I have 'bought into' the general idea that 'the end is nigh' at some point... :o)

Regards, Nick

Wrong. There are many projects just now in the planning stage like huge airpot extensions and freeway projects. One year earlier oil shortages to demonstrate to all these planners what peak oil means may save us plenty of money which would otherwise go down the drain

Dear, dear. You, too, misunderestimate the follies of politicians, such as we were discussing upthread. One need not bother about stopping projects like that unless they seem set to get past the NIMBYs. If there's a reasonable chance of that, then they surely have enough political momentum as to be unstoppable by a small or even moderate change in oil price. All that money about to create all those "jobs" won't stop flowing for anything short of a major war that shuts down Saudi Arabia or the Gulf, and maybe not even then. Remember, too, that despite all the whingeing, the actual cost of oil is still only a fraction of the overall cost of transportation, especially in tax-happy Europe.

Airport expansion may be especially unstoppable. It is said to "create jobs", to "boost the regional economy", and generally to serve as a magic elixir. Without a big expansive airport, you simply haven't got a real city. If upper-level managers, engineers, and the like can't fly in and out at the drop of a hat, firms will threaten to move elsewhere, taking "jobs" with them, and politicians will ultimately respond.

Oh, and even after the recent oil price rises, airfares are still dirt cheap; a small shift in the peak date will not change that materially in the short term. So long as I choose carefully, and after adjusting for inflation even using the hedonically-impaired US Consumer Price Index, I can fly from Minneapolis to Japan today for not much more than it cost to fly just to New York three decades ago. Even with all the phony surcharges designed to conceal the true price, it's still only around ten US cents a mile, far cheaper than the 50.5 US cents our IRS takes as the deductible cost for trips made by car.

I think that it will become obvious, over time, that this problem is not temporary and will not go away. In my opinion, we are in the first stage of the peak. Where things get a little difficult because production increase rates are falling and we are struggling to mitigate the differences. I would argue that some mitigation is occurring already and that is why we are seeing increases in liquids where we didn't expect it (or after a likely peak in crude, but not in NGL and in the face of increasing unconventional oil supplies and biofuels).

JD, do you also keep a failed tally on the optimists predictions? Obviously, not the year of peak (though predictions on C+C peak, would be nice) but estimates of proven reserves and production in different regions?

These new figures prove nothing. Crude still hasn't surpassed the May 2005 level - we might see this level surpassed next month, or production might drop again - statistically this increase is completely insignificant - the overall trend is still a slightly sloping plateau.

Personally I don't think we'll know if we've peaked for another 6 months, and we might not even know then.

Admittedly the all liquids is looking less like a peak. If I remember correctly though, this graph includes unconventional and bio-diesel, which have lower EROEI and less energy per barrel - the best way to see if oil energy has peaked would be to look at total enery, not total volume.

The point pedrodelgado makes about the all liquids production adding a lot of low EROEI fuels that displace very little basic conventional oil is important. If you take out the volumes of the unconventional fuels that take about as much conventional oil to make as they replace, it directs much of the climbing global demand not on the total liquids curve but on the conventional crude curve. A true curve of global oil energy supply would have to deduct all unconventional with EROEI less than about 3 and calculate a net energy supply for all EROEI over this level. This curve would look similar to conventional plus NGL - much flatter than the all liquids curve.

JD, (peak oil denier), the jury is still out. Average 2007 C+C production, through October, is 600,000 barrels below 2005 C+C production. Even with the surge in November and December the world will still finish 2007 at about half a million barrels per day below 2005!

I doubt seriously that average production in 2008 will surpass that of 2005. Three nations were responsible for 1.8 million barrels of all gains since 2005. They are Angola, Russia and Azerbaijan. Angola will probably gain .3 mb/d by 2011 which means their production is slowing. Azerbaijan has in no way peaked but their production is slowing dramatically. Russia has likely peaked as their January production is about 150,000 barrels per day below their peak of 2007 and about 100,000 bp/d below their 2005 average. Other nations in decline will likely stay in decline.

So don't count your chickens before they hatch. 2005 is still the peak and will likely remain the peak.

Russia reports their production about three times per week here

http://www.riatec.ru/en/shownews.php?id=37182&sha=1&sfa=1&RiatecSess=461...

in tons per day. Russian 2007 production was 491,481 tons or an average of 1,346.5 tons per day (all liquids). You will have to do your own math as to how many barrels that is but my figures come out as posted above. January average is 1330 tons per day or just over 16 tons per day below last years average.

Ron Patterson

Just a minor clarification - that is 1000 tonnes per day. That is a metric tonne - 1000 kg, 2200 lbs or ~7 barrels

And on the consumption side:

Russia to Be Europe's Biggest Car Market in 2 Years

2008-01-30 08:26 (New York)

By Lyubov Pronina

Jeez, Ron. The guy's blog has a prominent heading that reads something like 'Disclaimer for idiots: this site accepts that oil is finite and will peak one day.'

The bone (Boone? haha) he picks with you people concerns matters such as uncertainty of timing of the peak and a highly probable complete no-show in the 'end-of-civilization' stakes: that is, we're gonna get by.

That makes someone a 'peak oil denier'? A bit of critical thinking amongst the joyous whoopin' and hollerin'?

Given the state of the data and the possibility of explanations other than those that can be classified as geological, the only reasonable position to take on matters such as 'when Peak' (not 'if Peak') is agnosticism. I don't know. But neither do you. That, however, does not mean 'sit back and do nothing'. It is merely to accept that one may, indeed should, be prudent in the face of uncertainty.

You see, the problem is that it doesn't help to go running around shouting that 'the Peak' was yesterday or will be tomorrow, when other people - reasonable and knowledgeable people (and I don't refer to myself there) - don't need to agree with you. When they are not compelled to agree with you on the basis of the available evidence.

Oh, hang on, that must make me a 'troll' ...

Hmmm. I think it's a little early to call game over. C+C is still flat and so are world imports. The marginal gains, as many noted, are all coming from unconventional + biofuels. Though I don't agree with the folks who say there's no energy gain from these new sources, I do think they're less efficient overall so the structure is having to adjust, wouldn't you say? In any case, doesn't the current price indicate that demand, in fact, hasn't been met and the world would want a bit more oil than it currently has?

In my opinion, this is all just the start of a very long drama.

Popcorn anyone?

Thanks for posting these graphs. I think that the effect of increased extraction rates is a bit alarming because of the shape of the graph more than anything. And it does a good job of explaining our current extraction profile.

That has been happening since the 1980s - the current production is already significantly boosted by new technology/efficiency.

First, Matt Simmons has pointed out that we are getting a boost of NGL from gas caps being blown down in oil fields that are in terminal decline, e.g., (as Euan pointed out) the Brent Field.

Second, some historical perspective on initial crude oil declines:

The US Lower 48 (C+C, EIA) data around the peak were as follows. The initial annual decline rate for 1971 and 1972 was quite low, -0.9%/year:

1970: 9.41 mbpd

1971: 9.25

1972: 9.24

1973: 9.01

The world data (C+C, EIA) are as follows (through October for 2007). We are still below the monthly 2005 peak, although there is some evidence of a rebound in the fourth quarter, but note that the Lower 48 data for 1971 and 1972 were flat. In any case, through October, the world C+C data are showing an initial annual decline rate of about -0.5%/year.

2005: 73.8 mbpd

2006: 73.5

2007: 73.2

One difference, we are producing nonconventional resources worldwide, which was not the case in the Lower 48.

Our (Brown/Khebab) premise is that Texas is to the Lower 48 as Saudi Arabia is to the World. Texas had a sharper post-peak decline rate (-4%/year) than the overall Lower 48 (-2%/year), which is also the same pattern that we see for 2006 and 2007 regarding Saudi Arabia and the world.

Texas and the Lower 48 as a Model for Saudi Arabia and the World (May, 2006)

http://www.energybulletin.net/16459.html

The Texas/Saudi (C+C) graph from the captioned paper (updated with 2006 and estimated 2007 data; note that Saudi Arabia did show a fourth quarter increase in production):

BTW, I estimate that--because of rising consumption--if Saudi Arabia wanted (and were able), in 2008, to match their 2005 net export level, they would have to produce about 11.7 mbpd (Total Liquids), versus a 2005 production level of 11.1 mbpd.

Great info. Thanks for this!

Any data on world oil exports ?

That, I am confident, has peaked.

Best Hopes,

Alan

Ala WestTexas's Land Export Model?

what we need is a net energy extraction land model.

Net energy ala EROEI is fallacious unless it compares apples and apples or includes price if it compares apples and oranges. There is little point to it if it is comparing apples and apples and apples have one price as oil does. If it compares apples and oranges as in the case of electricity and ethanol compared to oil, it is fallacious on it's face. Models that omit a critical factor are fallacious. They tell us nothing useful and are an pseudo exercise for the intellectually obese.

They tell us nothing useful and are an pseudo exercise for the intellectually obese

Only for those that can only intellectually digest pablum.

I am capable of adjusting for the fact that both NGL and ethanol have roughly 70% of the energy density of crude oil (and the total liquids mix is trending towards more ethanol & NGL and less crude oil), that ethanol requires a bit of oil to produce and even more natural gas (less in Brazil, more in the USA), that oil exporting nations (except Mexico lately) keep consuming more domestically, refinery gains (more asphalt is being upgraded to higher value products, which typically increases volume), etc.

Analysis is more than looking at a graph, but a graph is a useful starting point.

Best Hopes for Intellectual Analysis,

Alan

Alan

Given that you are now just repeating a discredited argument, again and again, let me just link to the most recent time I pointed out the problem:

http://www.theoildrum.com/node/3531#comment-296190

It's likely that some fuels have a higher value due to higher energy density. That said, if you can get a comparable result with another fuel it's a possible substitute.

One point I'd like to make -- in the case of electricity, the amount of return you get on energy can be greatly increased through technological advancement. Electricity engines are already much more efficient than the ICE and with the technology for these kind of engines being relatively new on the mass market scheme, the potential for improvement is much greater than an ICE.

Is intellectually obese like being a fathead?

edited

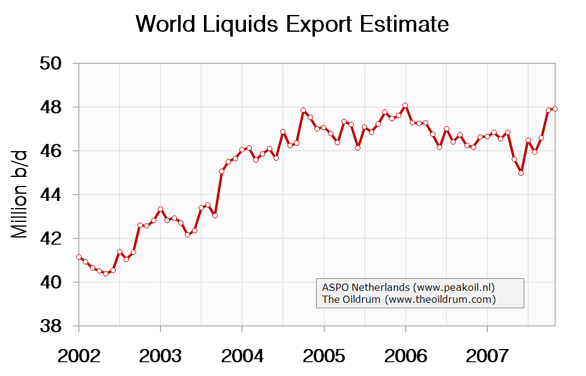

The chart is given in Rembrandt's post. The current value is roughly equal to the peak value. Factoring out the noise, exports appear to be on a plateau of about 47mbd. Hardly the "ferocious net export crisis" [bold letters in the original] which Jeffrey (Westexas) forecast for the end of 2006.

You don't find a three year perfectly flat plateau combined with increased demand of about 5mb/d to be a problem? Do you think the shortages happening around the world are unconnected to this dichotomy? Does the ELM state there will be no plateau in exports? Further, if a prediction was made, was it made as a certainty or a possibility?

As most people seem to expect the "plateau" in oil production could go as high as 90mb/d or more (should it go as high as 95 or even a hundred, it will still be a huge crisis), m'thinks thou dost crow too much.

Cheers

Yes indeed. The problem is that we have never experienced not having a "relief valve" before. When the USA peaked in the early 70's, a relief valve was provided by other parts of the globe and we never got to see an extended plateau in the USA production profile. Unfortunately, at this point, the world economy lacks a relief valve to suck from and we may see this plateau creep up in the next few years.

Unless of course should the dramatic happen:

"Mars, Bitches!"

Actually if you do a bit of checking of the EIA data FOR A NUMBER OF YEARS (so you can see what is happening to individual exporting countries) instead of looking at a couple of months of, almost certainly to some extent, faulty data, you will see that the prediction of the net exports ELM model IS HAPPENING NOW!

http://www.eia.doe.gov/emeu/cabs/topworldtables1_2.htm - use the source tab.

Hint - try downloading the world data into excel and put a trendline through it!

Another piece of evidence is the price rise

( http://www.upstreamonline.com/market_data/?id=markets_crude )

we have seen over the November/December period - as long as the invisible hand of the market wasn't picking it's nose, the rise (especially compared to the previous two months) indicates continuing demand destruction in the traded oil (that's 'net exports') part of the market. Since supply and demand are matched by the price that indicates net exports were down even though total production may have been up over the period.

2006 and my estimate of 2007 data indicate that combined net exports by the top five (half of 2005 total net exports) are dropping at about one mbpd per year (which means an accelerating net export decline rate), on track to approach zero net exports around the 2031 time frame (our middle case scenario).

In the bottom half, we do have some countries showing net export growth, e.g. Canada and Angola, and the Kashagan Field is off on the distant horizon somewhere, but we also have exporters like Mexico, which will probably approach zero net exports around the 2015 time frame.

Whether it is a ferocious net export crisis yet is probably a function of whether or not you have been priced out of the market yet. We can say that the decline in net oil exports has corresponded to an oil price that is currently about 2.5 Yergins--about 2.5 times Yergin's predicted long term index price of $38. So, are you in the Yerginite Camp? Do you think it is a swell idea to continue with the SUV/Suburban way of life?

BTW, if you want to go back to the original January, 2006 post, all three of the top net exporters showed 2006 declines in net exports based on EIA data (very slight for Russia, but nevertheless down).

The IEA November figure on your chart is bound to be out, when the full data becomes available today/tomorrow. The January summary reported a 0.87 mbpd increase for December, which places the November figure at 86.13, not the previously reported 86.55. Not sure about the revised October figure yet.

The full IEA figures are now out. October's production has been revised up, very slightly, to 86.51 (that's three upward revisions in a row). November's has been revised down markedly to 86.08, and December's was rounded up in the summary; it was actually 86.95. So it looks like November wasn't a new peak, but January's may have been.

Always check IEAs revisions.Eg,you can reduce their Dec # by 200m bl/da because of Mex actual prod, pub after IEA estimates.

This depends on how you define plateau. Hirsch noted a 4 mb/d range in his recent rebuttal to CERA's latest Pollyanna claim that future discoveries will cover our assets, so to speak. With that range, the plateau is not breached - particularly if you count from 2005, which most people seem to given that was the period of the previous peak. That would give us a range from about 84 to 88mb/d. Above 88 might be considered a move above the current plateau, but only if it continues over the next year or two. Even then, the increase is minor when weighed against a combined 5mb/d+ for depletion and increased demand. It's nothing more than a slight shift of the plateau upwards.

All that said, with all the possible fields coming on line in '08, I would expect '08 to be the final, ultimate peak in all liquids. There is a small chance it might also be a new peak in easy crude, too. Still, if we ever get above 90, I'll be mightily surprised - especially if you exclude the break-even corn ethanol.

The question must be asked and answered: Is production really rising if the energy value of the barrels is less? How can it be considered to be so if the work that can be done is less?

Or do these charts convert barrels of measured liquid to energy equivalency?

Cheers

All that said, with all the possible fields coming on line in '08, I would expect '08 to be the final, ultimate peak in all liquids.

Uh huh. That's what you folks said in 2004, and 2005 and 2006 and 2007, and for that matter, back in 1998 and 2000, and 2001 and 2002 and 2003. Your modus operandi is well known:

“Never again will we pump more than 82 million barrels.”

-- T. Boone Pickens, 9th August 2004. On the Kudlow and Cramer Show, MSNBC.

Source

“Global oil [production] is 84 million barrels [per day]. I don't believe you can get it any more than 84 million barrels."

-- T. Boone Pickens, addressing the 11th National Clean Cities conference in May 2005.

Source

"I don't believe that you can increase the supply beyond 84 or 85 million barrel as day."

-- T. Boone Pickens, on "CNN In the Money", June 25, 2005.

Source

"Supply is—you‘ve just about had it on supply; 85 million barrels a day world supply is about it. "

-- T. Boone Pickens, on Hardball with Chris Matthews, MSNBC, Aug. 26, 2005

Source

First of all, I am not "you folks." That you would use such a term makes you either a troll or ignorant or both. It simply doesn't apply to the myriad people concerned about this issue. Speak clearly, friend, speak clearly. Second, it especially doesn't apply to me since I was not involved in this area of debate in those years.

Next, past performance does not equal future performance. This is simple logic. Your post is completely lacking in logic.

Further, except for the first quote, the others are all conditional, not absolute, which makes your point, illogical as it is, not very compelling.

Additionally, no self-respecting person with a modicum of intelligence worries about being wrong, they are concerned with seeing what is at the time and making their best effort. Life is nothing if not fail, fail, fail, fail with a final success. Just as with walking, you can't move forward without falling a little first.

Simply, if you think Peak Oil is solely about how many barrels get pumped, you know precious little about the issue.

Finally, since there have been past peaks, YOU were wrong at those times, no? Were you later vindicated by new informaton? Don't be so fast to claim victory. Any to be had is yet years away.

Now, if you've no analysis to support your comments (said analysis would be welcomed by any intelligent, objective person), you should remove yourself from the proximity of your keyboard and save your trolling for the trout.

Cheers

Certainly the TOD people are definitely not "you folks". The key is to keep data open and fully exposed with public visibility. The problem with TBoone's Farm is that he has his own private stash of data (along with his cache of ripple) that you or I will never see. Therefore anything said by him is not to be trusted until it can be vetted by sleuths such as the TOD hordes.

Others have used models such as the Logistic, which I have severe heartburn with and discount for mathematical reasons.

Really, it is only in the past few years that some modicum of decent statistical analysis, models, and public data for the global view has become available.

WHT: YOu should understand that both JD and Franz have made more money in the oil patch than T Boone ever has, and are hanging out here from sheer boredom. I'll gladly lump myself into "you folks" if it gets me into the Pickens will, even if only as an honorable mention.

As in investments? Not intentional but more out of financial laziness, I have never sought out energy investments. I am one of those engineers that enjoy solving problems more than making a killing. I could never imagine inhabiting their skin and wallowing in their mindset. Yuck.

Save it, JD. You know these here people got Peak Oil fever. Once a man’s packed his shotgun, his banjo, and a year’s worth of chewing tobacco, there’s no reasoning with him. Those hills are a-callin’, and he’s a-gettin’ ready for a rebel yell!

Jed: Look, Pa! Oil production’s a-fallin’!

Pa: [laconic silence, punctuated by tobacco squirt:] Yep, Jed. Peak Oil, I reckon.

OR:

Jed: Pa! Oil production’s the same as last week!

Pa: [tobacco squirt, followed by laconic silence:] Be that there Peak Oil, I reckon, Jed.

OR:

Jed: Pa! Pa! Oil production’s a-risin’!

Pa: Yep, Jed. [tobacco squirt]. Peak Oil, I reckon.

[Jed’s eyes grow wide with that rebel yell excitement …]

Jed: Yeeeeeeeeeee-haaaaa!

[Insert obligatory banjo solo and the sound of ricocheting bullets here]

Peak oil consumption is being experienced in some parts of the world TODAY - maybe not in your part of the world yet, if you are very lucky.

The real point of peak oil is that when it finally happens it will be the end of CHEAP oil - that oil has increased dramatically in price relative to most other things for 10 years now is irrefutable.

When peak crude oil occurs, as there are no adequate alternatives, we will need sources of synthetic oil - these (the difference between crude oil and total liquids) are increasing year by year also.

Weekly or monthly figures are very variable, wrong to some extent because of the way they are collected, and easy to manipulate - nobody takes much notice or loses their job if the figures are subsequently altered (lowered).

If you were a politician would you want people to suddenly correlate peak oil (indicated by the record price of oil) with the current financial mess, or would you put a few well placed figures into the statistical system to make it look like we are good to party on ... so spend, spend, spend. That is something a 'plunge protection team' (if it existed!) could do at almost no cost.

xeroid, trolls are for shootin'...er... ignorin'. Note the complete and total lack of any data, links, analysis.

Cheers

Yeah, I know - but what percentage of the population think like that?

Some way we have to make the message clear enough so that even trolls can understand it.

I don't suppose they realise the implications of E=MC2 or 'space-time' either! :-)

I think that we should use this time period as an opportunity to unload highly energy dependent assets on the true believers in the Yerginite Community.

You may never have noticed this, but life is too short to go supplying data, etc., to people with a bad case of confirmation bias. And seeing as you are all such intelligent analysts, I thought I wouldn't actually have to SAY the words 'confirmation bias' for you to be able to get the hint ... but no, it appears simple ridicule is too complicated for you to figure it out. Gee, and the sketch included three different scenarios with exactly the same outcome predicted each time ... thought it was a bit of a giveaway myself.

Never mind. At least I was amused by Jed getting his 'rebel yell' moment as the oil supply actually goes up. Now children, let's name some places where we might have seen that before?

By the way, a 'troll' is not simply a person who disagrees with you, nor even someone who chooses ridicule over reasoned argument. After all, to be honest, I think reasoned argument doesn't get that far with most of the true believers here. Most of you are so certain that you DESERVE ridicule. You'll still be here in ten years' time, when - maybe - oil has really peaked, and it's made sod-all difference, and you'll be whining on about 'all liquids' not counting, and daring people to do complicated EROEI calculations that actually would go against you even if they were done in the first place, and that you were really right because 'oil' has peaked ... but the society you (and, incidentally, I) hate will still be here, kicking along, hardly even noticing what has happened.

Face it, guys, there's a good chance it ain't going away, Peak Oil notwithstanding.

You wanna head for the hills? Great. You don't need Peak Oil for an excuse. Just take up line dancing.

Reckon so. [tobacco squirt]

That is, you till have nothing to say? That's an awful lot of verbiage to get to: Y'all don' listen. Y'all don' got no edumacation. Y'all ain't worth th' trouble a 'splainin t' ya.

You're arrogant. And not too bright given the fallacies you employ have already been pointed out to you, friend. If you're going to say nothing at all, I suggest you save a joule or two and say it more succinctly.

Be of use. (Cider House Rules)

Cheers

Franz - that was damn funny!

Seriously though, in my opinion 90% of the wrangling on this thread and other conversations around the planet on this topic are about 'being right'. My Dad is tougher than your Dad, etc.(edit -you are absolutely right about confirmation bias - I wrote about that here and in a comment here).

But in the grand scheme of things, the cheap energy era is either over, or close to it. If we continue to increase production up to 90 mbpd that only is a 'good thing' if a)it frees up more energy to society than the 86mbpd did, b)it does so at a lower cost c)it does so without 'borrowing' from the environment and most importantly, d)we find better ways to use the energy other than the current consumptive trajectory which externalizes costs, raises the GINI coefficient, and is not contributing to real progess (a la Genuine Progress Indicator or some measure other than GDP or DJIA)

C'mon, Nate. Apply a small amount of that enormous brain power to this. Who in this thread besides Hans and Frans are saying they know all? Nobody. As you hint at in your opinion voiced above, some things are pretty obvious and don't require much thought and are essentially impossible to argue against.

I say this: in some combination, climate change, PO and the financial crisis are leading us to a very nasty period of time. Of this there is zero doubt. But, I do not claim to know exactly what it will look like, what the combination will be, how deep it is going to be, etc. I don't think I am much different from most people concerned about these issues.

Hans and Franz here, they are dogmatic: you are fools and you are wrong.

Meh... Seen enough of that crap from the "anti-" crowd leading up to the not-very-startling conclusions of the IPCC.

Cheers

well said.

and 90% was one of them 'exaggerations'...:-)

If only...

Cheers

What drives the economy is cheap conventional oil. As biofuels add to numbers without a clear understanding of their petroleum input, I would recommend discussions focus on World Crude Oil, not all liquids.

It would be great to have that number and a net export number.

I think barrels of oil equivalent suffices. The total energy is the key (excepting for where use is constrained for a particular type of energy).

It is somethign we can expect, as the use of biofuels increases the oil that goes into their production has already been tallied, then it is used to produce another liquid fuel which is then also tallied, this in fact could then be used to create another liquid fuel repeat as necessary till we get the right numbers to make the books look good.

Wont help actual energy supply though, there is no free lunch.

From the report:

I think T. Boone Pickens was right.

Total Energy indeed. Food is fuel. The price rises in food grains have in many ways mirrored those of oil. Clearly, the end of cheap oil is the end of cheap food, as long as they are convertible. Thus while the volume of liquids rises, food stocks are falling, and belts tightening. And while Brazil shows a bumper crop of bioethanol this year, it is easy to forget that the weather is not always kind. As per the northern climate...

"We desperately need a good harvest to ease the current situation," says Klaus Schumacher, chief economist at Toepfer International, a large agricultural trading company headquartered in Hamburg. "If that doesn't happen, we'll soon face a genuine supply problem."

A wealth of scary data in der Spiegel, "Our Hungry Planet", Jan 24 2008: http://www.spiegel.de/international/world/0,1518,530791,00.html

This gem included:

"A simple calculation points out biofuel's less-than-stellar potential. To fill the roughly 100-liter (26-gallon) tank of an SUV, an ethanol producer has to process about a quarter of a ton of wheat. This is enough wheat for a baker to bake about 460 kilograms of bread, which has a total nutritional value of about a million kilocalories -- enough to feed one person for a year."

No wheat? ... no bread? ... no problem! ... the economists say we can use 'cake' ... whatever that is!

Wheat is a grass, we eat it's seed! We can use the rest of the plant for fuel. It's not either fuel or food, it's food and leftover waste as fuel. Increasing ethanol production would increase food production also.

Animal fats, non-eatable parts of corn and wheat plants, can all be used as fuel without reducing food production, and would otherwise be waste products.

Unfortunately what you propse is currently unworkable - and even if it were, sadly it would be unsustainable.

In the UK, until recently, we used to burn the straw where it fell from the harvester which immediately returned the P and K and trace elements to the soil and avoided the use of dangerous and expensive pesticides and weedkillers.

For environmental reasons (bad smoke) the straw is now ploughed back in after harvest to improve soil structure and retain the essential nutrients - but now we need the chemicals, sigh!

Like many other proposals it is not sustainable in the long term (and if you were able to ask your forebears who undoubtably knew about this, maybe not even short term?) to let the minerals leave the farm never to return.

In the long term my favorite invention the flush toilet as in current use is unsustainable too, as eventually the one-time-use mined artificial P & K are no longer available and have all made it to the ocean. :-( but what does that mean for human diseases?