Oil Price Closes Above $100 a Barrel - New Peak Oil Press Release

Posted by Gail the Actuary on February 20, 2008 - 1:00pm

This is another press release about $100 barrel oil. It is fairly similar to the one we sent out in January when oil hit an intraday high of $100 barrel. Feel free to send copies of it to folks you know, and to link to it in your web sites. If you know any newspaper people to send it to, that would be especially good.

The price for West Texas Intermediate (WTI) oil closed above $100 for the first time on February 19, 2008. "Rising oil prices have been giving a clear signal of pending shortages for over five years now," according to TheOilDrum.com. By ignoring this signal, world leaders are steering the world toward an energy disaster characterized by shortages, high energy prices, inflation, civil unrest and famine.

The $100 a barrel closing price is a sign that times will never be the same again. "The world is entering a new era. In this new era, the supply of energy will dominate the political landscape in a way that is not being recognized by any of the presidential candidates," according to TheOilDrum.com.

In past years, newspapers and magazines have assured citizens that there is no problem with future oil supply. Articles have suggested that oil prices will be lower in the future; they may even collapse due to excess supply.

Recently, published articles have added some caveats. There is a need for increased investment, both for exploration and for improved production technologies. The media doesn't mention that rates of return on the new investments are likely to be very low. At some point, it will become economically unattractive to keep searching for very small quantities of oil and gas that are expensive to extract.

The problem that oil companies are encountering is that there is a finite number of oil reservoirs, and many of these have been producing for over fifty years. In time, a large part of the oil that was originally in place has been removed. The oil that comes out now, comes out slowly, and is often mixed a high proportion of water.

In order to keep production up, additional wells are drilled into the reservoir. At some point, the strategy of adding more wells to keep production up ceases to work. Oil production from a long-produced field begins to decline, no matter how many new wells are drilled. Peak Oil Curriculum - Part 1

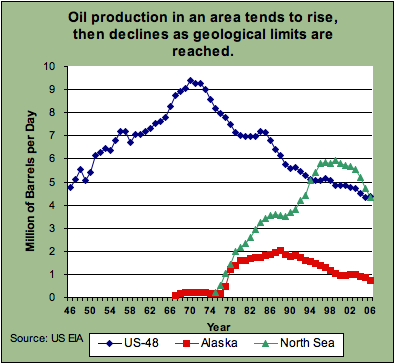

According to Gail Tverberg at TheOilDrum.com, "This problem of reaching irreversible decline happens for whole regions, the way it does for individual fields." For example, US oil production in the 48 states reached a peak in 1970. US production has since declined from a maximum of over 9.6 million barrels a day, to the current level of around 5 million barrels a day. (A barrel is 42 gallons.) More recently, the oil fields of the North Sea, Alaska, and Mexico have also begun to decline.

As more and more areas deplete, smaller fields are brought into production. Because they start out with less oil, these small fields do not last as long. Drilling activity must be increased in order to find even smaller fields. These, in turn, deplete even more rapidly, exacerbating the need for new wells.

According to TheOilDrum.com, "The world is now reaching the point where in the aggregate, all of the oil fields of the world are coming to peak production." As peak world production draws near, the rate of increase in oil production can be expected to stall because of constrained resources. This can happen even with rising demand. Once production falls short of what is needed, oil prices can be expected to increase, so that demand is brought in line with available supply.

The consequences of energy supply shortages can be surprisingly great. Energy shortages can lead to public unrest, such as occurred recently in Myanmar. In times of inclement weather, energy shortages can lead to a loss of export supply, if the supplier finds that domestic demand is consuming all that is available. Problems for importing nations then suddenly become worse.

Energy shortages can disrupt basic industries and lead to currency declines, as shown by South Africa's recent experience. South Africa energy crisis According to Gail Tverberg of TheOilDrum.com, "Higher energy prices can raise food prices, and can affect people's ability to repay their mortgages. Thus, energy prices can affect the financial sector." Peak Oil Curriculum - Part 2

There is now a fragile balance between demand and available supply. All ears await the next OPEC announcement on March 5. Will OPEC lower production? Will they leave production the same? Even in this country, any minor refinery incident has become a cause for concern, and a possible spike in oil prices.

World oil production is now about 85 million barrels a day. While some increase from this level may be possible, it is unlikely that daily production will ever equal 90 million barrels. "Some major organizations have forecast future production of 120 million barrels a day or more, but these estimates are not realistic," according to TheOilDrum.com.

In the coming months, the $100 per barrel closing price marker will be lost in the debate over other issues. The issue of limited oil supply is not an issue that will go away, however. Rather, it will steadily increase in importance. Eventually, there will be the cries for action, and for culprits to blame -- most likely within the first term of the presidential candidates.

"The presidential candidates currently pay little attention to energy policy. This needs to change," according to TheOilDrum.com. It would be best if candidates could change their focus before events force a change. So far, however, the markers of an approaching energy crisis have been largely ignored.

About The Oil Drum

The Oil Drum is a web-based community that discusses all aspects of energy -- from science and technology to its societal and geopolitical impacts. The editors and readers are drawn from many disciplines in academia and industry. The Oil Drum has a staff of more than twenty including individuals from the United States, Canada, Europe, and Australia.

The Oil Drum's parent organization is the Institute for the Study of Energy and Our Future, a 501(c)3 corporation. The Institute is funded solely by private contributions and advertising revenue from The Oil Drum's website.

More information on peak oil and its impacts on energy security is available on The Oil Drum website (www.theoildrum.com).

###

Another link to the press release.

I think that one of the big problems we face is fairly simple. The media likes to attribute high oil prices to some simple factor which changes daily.

For example its been noted that if a large refinery goes down it makes sense for crude prices to decrease and finished products to increase. Instead crude goes up. That's like the price of timber going up when a large sawmill burns down.

Certainly geopolitical factors and other issues play a role in high prices. But constantly high and increasing prices for years deserves a serious investigation. Attributing these prices to the event of the week does the world a disservice.

Distillery burns down - price of barley soars.

But we just busted $100 again.

NYMEX now at 100.61.

Is there a lot of speculative money pouring into the market just now ?

Bloomberg seems to have given up providing explanations.

Perhaps they are getting bored with all these new records.

NYMEX now 100.92

Am I the only person on TOD following this ?

I will leave it to someone else to post the next record.

Sorry, but I can't resist informing you all that NYMEX has now reached 101.20.

Will someone please shut me up !

The question isn't so much particular indices rising above $100 a barrel. Its more "what is the future path of prices and when will be the last point the price is below $100?"

Now personally I originally calculated the end of Feb for the rise above $100, so the previous high caught me by surprise and this price is in keeping with the maths.

However, what with the likelihood of a number of large fields coming onstream this year, together with the probability of recession, I'd have to say I'd expect a fall back to the $60-$80 region in time for the US elections. That's excepting someone doing something stupid.

However I still see no reason to believe the start of the decline won't be in the 2011-12 timeline - 3-4 years away. What are we doing to prepare and adapt? Where is the movement? We are getting inside the planning horizon of business and politicians, but still the action isn't there at a large scale level.

Next to the large scale picture, day to day movements on Nymex are unimportant.

I think it goes slowly to $110, then the economy slows down and it settles back in to the mid-70s or 80s for a while, save any other geopolitical events. But still...that's gotta be enough to make it hurt. Especially with crack spreads finally catching up and gasoline demand about to increase.

I agree I did not expect it to go this high. However my worst case scenario indicates that GOM and other high technology old producing regions should be declining fairly rapidly now. Small field infield drilling etc. If this is true then I think the price is heading for 150 or so by mid summer.

However short term I'm waiting to see when the US can no longer import all the gasoline it wants. Once gasoline and blending components for export are maxed out thats when the fun begins.

So far it seems we can always buy all the gasoline we want but I suspect that sometime this year maybe the fall this will end.

The reason I think this is important is its root cause will be simply not enough oil for refinery capacity thus building more refineries in the US and competing for crude does no good.

Before this import prices for gasoline should increase substantially and like I said it seems we can get whatever we want now. But thats the number to watch it will go down before crude imports.

However my worst case scenario indicates that GOM and other high technology old producing regions should be declining fairly rapidly now.

Memmel, Prof. G.

That would be a good subject for a write up.

GOM - 3 Years Later

With all the post Kat-Rita damage at the time, and how much was impared, it would be a great study to take a clinical look now.

How much was lost?

How much capacity was/will never be reclaimed?

Dollar amount of loss?

etc.

Just Sayin...

I found a wealth of data on the DOE website. I'd have to dig up the links but I posted them here a few times. Simmons has given several talks on the issue.

Bringing it all together is a bear since their is a treasure trove of data and a number of good summary papers exist.

Short summary is if the rest of the world that has invested in advanced extraction methods follows the decline patterns seen in the GOM we are fucked.

And sorry to use such language but...

Nup.

$180 by the end of the year, I say. Just in time to give the knockout punch to the US economy - then it drops back down a bit to $130, and all that unfulfilled demand from China, India, etc drags it back up slowly.

Sorry, but I don't see the importance in your reporting every new record. It is not as if the world is going to end with someone paying $101 for a barrel of oil. Go and do something useful.

It is basically a reason for a news-like story to tell to the press. Sometimes there are teachable moments. We are hoping this is one of them.

Gernos - at The Oil Drum we don't really give a damn about the oil price but we do care about energy shortages and the impact upon society;-)

However, by chance I just happened to click by accident on this chart busting spike over at 321.

http://www.321energy.com/index.php

I think we'll see the oil price move sharply up to $110 from here.

Closing prices today:

Tapis $101.79

Bonny $101.07

Louisiana $103.50

WTI $100.83

http://www.upstreamonline.com/market_data/?id=markets_crude

We may see Brent break through $100 tomorrow.

And by way of partial explanation of what is going on in terms of supply and demand imbalance I think this chart is part of the story:

Our outlook for Russia from the Khebab/Brown Top Five Net Exporters Paper:

Bloomberg seems to have given up providing explanations.

I noticed that as well. Wasn't too long ago you'd see a story entitled "Oil trading higher on Middle East concerns" replaced ten minutes later by another that read "Oil trading lower on latest job report", followed shortly thereafter by a third telling us "Oil little changed at market close". Personally, I never found their analysis all that helpful; then again, I never understood the inner workings of these things and I suspect I never will. I've resigned myself to the fact that my only real connection to the markets is at the pumps and that little fill slip the oil man drops through the mail slot.

Cheers,

Paul

Great Piece, Gail. Insightful, well-written, and non-hyperbolic. A Serious Reader will be Impressed.

The graph is worth the price of admission. I've put it around at a couple of my favorite blogsites.

Thanks! We try to get the word out. It is hard to know how long the disconnect will last.

$99.98 at 11:50 C 022008 and the Dow, S&P and Nasdaq are up.

There is a signal out there that is incoming.

A total disconnect.

For me the signal is that Ben's printing press is operating at full speed. IMO the plan all along has been the US to maintain its energy supply by outbidding other countries, borrowing like there is no tomorrow and exporting the resulting inflation to the rest of the world.

A collapse of the dollar is no concern because it is ultimately propped by our foreign creditors and trading partners which will do every possible effort to keep the status quo.

This strategy is working so far.

Interesting idea, but I suspect that there is little of the us-them thinking you are referencing (e.g., U.S. v. other country). I strongly suspect that ole Ben and the gang think of "us" as the global capitalist elite and the them is some vaguely defined and despised enemy of capitalism. If you think these people make decisions based on nationalism, I think you are barking up the wrong tree. Yes, they use the institutions of government to their advantage, but they are not great patriots. Negative cash flows from one part of the economy to another are not necessarily a bad thing (in the capitalist view) and can even be a source of profit.

You are right, but I was simply assuming your point. USA as a political and geographic entity is relevant as much as it is the place where most of the global capital is concentrated, the elites in Europe or East Asia are no better than that and of course are participating in this schema. It is simply the same old game - the rich vs the poor and how the rich can get richer without the poor guys revolting. There is nothing new under the sun and inflation is a century old way of shifting wealth from the bottom to the upper classes.

But you are right and I don't doubt that these folks care about the average American as much as they care about the average Nigerian or Indian.

There are pundits (Mish Shedlock,e.g.) who are saying that the Fed is actually removing liquidity from the monetary system. This is leading to monetary deflation, even while we have rising prices for increasingly scarce commodities.

There is also argument made for a rebounding dollar based mostly on the fact that other currencies -- primarily the Euro -- will fall faster than the dollar falls. Race to the bottom!

I won't get into much discussion about it but how does this reconcile with this news for example:

U.S. banks said "quietly" borrowing $50 billion from Fed

I guess according to BB "toxic waste" also qualifies as an asset

Just to add something to support your point: I don't think the Euro area is in a better shape either. The money supply there has been growing in double digit rates and IMHO their housing bubble is even bigger than the US one. Only the scarcity of land is preventing it from popping yet, but noone knows for how long this will hold it.

But two dead fish don't make one alive. I expect the same thing as here to start unfolding in Europe too. There will be way too much money chasing too few assets and it will be a rocky ride when this all comes crashing down.

Levin: The printing press is not open to 99% of the economy. IMHO, the Fed is funnelling money to the banks under the mistaken (?) assumption that this will allow increased lending. Instead of increasing lending, investment banks are increasing their speculative activity. It isn't just oil, pretty well all commodities are on fire lately. I can't prove this-it is a possibility I don't see discussed.

As I write this, gold is at $945 an ounce. On fire indeed.

Oil, natural gas, coal, wheat, other grains, and most metals are ALL on fire right now. The smart money is moving into commodities and gold and other metals. (A couple of free stock tips fuh ya: DBA, MOS, CEF, RIO. Look at the chart, set it to a two-year view, and ask yourself what's to stop any of them, short of a major global recession.) Yes, this push above $100 is allegedly driven by short term events, and yes I believe that is largely the result of speculative money coming back to the sector, having been severely sold off in January. But even though we know those factors are temporary and probably a wrong basis for valuation, it doesn't make oil any cheaper, does it?

My range for oil this year: $80-$150. Big volatility. Median price probably around $110.

I believe these sectors will continue to hit new heights, and volatility will increase, as we approach the 2010(ish) peak. After that, anybody's guess.

All this takes me back to 1980/81. The oil price hit the equivelent of $100 in todays money and gold hit $800 an ounce (in 1981 dollers). Daja vu all over again?

High or very high oil price will knife into the mid and lower classes.

While they can cut down (and do) there is an incompressible range - going to work, shopping, educating children, going to doctors etc. Keeping the economy, normality, chugging along.

If ‘oil’ is no longer affordable after all sacrifices have been made, the economy collapses. Like a cheese soufflé. First with a grand huffy sigh, then down into desperation. And while the world PTB cares nothing for Joe 6-pack and his capacity to pay for BBQ, beer, a lawn mower, video games or Victoria’s Secret underwear, and so on, a systemic collapse is an ultimate horror for them.

"Rather, it will steadily increase in importance."

That is the one line that worries me. I think the crisis will evolve in an unsteady fashion. We have seen how the climate denialists utilize any short term counter fluctation to heap scorn on global warming. I expect the same dynamic with perception of peak oil. Just as there are price spikes due to events, I expect there will be spikes of both signs. A major new capacity comes on-line, or a sudden decrease in demand somewhere, and that will provide enough fodder for peakoil denialism. I hope you can edit in an UN to make it "unsteadily increase in importance".

We need to keep in mind that the 120 million barrel figure includes everything from coal to bitumen to shale and biofuels. Their definition of oil includes anything that can be converted into liquid fuels. It is the end products that matter not where it came from as far as the economy is concerned. A big part of the coming crisis is the lack of investment in these other sources of liquid fuels. As a group investors are conservative in both their politics and their investment decisions. They wait until somebody else is making a profit on new technology before they stop investing in old technologies. So far every alternative to oil depends on a subsidy to make their venture profitable. And this need for a subsidy has not gone away with higher oil prices as alternative advocates had claimed.

I think this is a bit misleading.

1. 'All liquids' are not necessarily readily exchangeable for all crude oil uses.

2. Also, I believe the net energy from the non-crude 'All liquids' is generally lower, and sometimes much lower, that that for crude. This will indirectly impact the economy in increasingly significant ways.

As I have pointed out many times apparently to little avail, oil is heavily subsidized both by policy and de facto. Wars for oil security as in Iraq are a de facto subsidy. The SPR is a de facto subsidy. The oil depletion allowance is a de facto subsidy since a similar soil depletion allowance is not available to bio fuels. The blenders credit is a subsidy to both ethanol and the oil companies, since it is the oil companies that actually collect it and none are complaining. It is a buy off of the liquid fuel distribution monopoly that would otherwise stop ethanol production in its tracks.

What surprises me about the oil market is how shallow and short the correction was from the first $100.00 dollar touch at the beginning of the year. I expected this base to have a pull back closer to $80.00, but it didn't happen. Also here we are breaking out again after only about 6-7 weeks of basing around $87.00 to $95.00. This tells me this is a very strong market which is anticipating the spring driving season as well as heavy agriculture demand. It is an up market like we have been experiencing the last few springs. Apparently it is getting stronger each year at least in dollar terms. Percentage wise it appears to about the same. $125 or more here we come.

Hi practical and Thomas,

I was listening, practical - (or, should say, I agree and have for a long time :))

I'd sure like to see someone(s) develop this further and possibly write up.

Thomas says:

"So far every alternative to oil depends on a subsidy to make their venture profitable. And this need for a subsidy has not gone away with higher oil prices as alternative advocates had claimed."

The salient point is that the "need for a subsidy" has not gone away - in fact, it can't.

The entire (extremely costly) oil-consuming infrastructure was built via "subsidy" and, as you, (practical), point out - is maintained via "subsidy" as we speak.

This connection needs to be documented and laid out for others to see.

It does seem, though, that there are better and worse places to spend "subsidies".

....and the national highway system is an oil/FF subsidy....and the tax break on mortgages on three car garage mega-homes in exurbs is an oil/FF subsidy...etc etc etc

That's not "according to TheOilDrum.com"; that's according to whoever you're quoting...which appears to be yourself.

Unfortunately, the entire piece reads as "Gail Tverberg has certain beliefs, and is trying to give them weight by claiming they come from TheOilDrum.com". In fact, none of the quotes you attribute to TheOilDrum.com exist anywhere other than this article (google search, site restricted to theoildrum.com), which makes the entire piece seem outright deceptive, and that isn't helpful for credibility.

Not to mention that trying to quote a website is just weird. The website didn't write those words, some person did. Why are you unwilling to credit the person for their words?

If you believe something, say it; don't try to mislead people into believing it comes from more than just you. If it's really a press release from a group of people - and that's not how it reads - then do what everyone else does and put all of your names at the bottom. Right now, honestly, it just looks fringey, crackpot, and deceptive. As written, it's probably doing more harm than good.

False, These are not just Gail's beliefs but those of a consensus on the TheOilDrum.com

see:

http://www.theoildrum.com/node/3487

http://www.theoildrum.com/story/2006/8/12/114231/281

http://europe.theoildrum.com/story/2006/11/25/125137/18

http://www.prnewsnow.com/PR%20News%20Releases/Industry%20Specific/Oil%20...

see, after "googling" you can find 4 articles where CERA's credibility is torn apart on TheOilDrum.com, the vast vast majority of the comments under them also accept CERA's lousy record and lousy credibility.

I disagree...

-Crews

I believe that before this press release went out that all the contributors had an opportunity to discuss it, give feedback, etc. That's an extensive list of people that probably could have protested if they dissented.

The prior press release about $100 oil was written by Heading Out. There were many quotes of "TOD" in that press release as well.

I suppose we can ask PG whether this piece was simply posted by Gail or was the result of combined inputs from multiple TOD editors and contributors. Would that answer your objections? Ah no, I forgot, it's fringey, crackpot, and deceptive (according to you).

When we put out press releases on this web site, we are pretty much stuck following their rules. Everything we submit as a press release is graded by PRWeb's editors, to see that it adequately follows their rules. If it doesn't get a passing grade, it doesn't get published.

The basic idea of a press release is that it is supposed to be a story that a newspaper or magazine can pick up and run, as is. They can also run an excerpt, or use some of the links provided in the press release to provide background for a story they might run. The article needs to be in the third person, so as to match the style of newspapers and magazines.

PRWeb requires that press releases be in the third person. They suggest quoting yourself. If the press release uses the words we or us, except in a quote, they won't run the press release.

The person who perhaps had the most input to this story was Heading Out. It is difficult to say, "An analyst writing pseudonymously as Heading Out at TheOilDrum.com." The easy way out, when this was written about midnight last night, was to just quote myself. The press release we put out in January when oil first touched $100 a barrel was posted under Heading Out's name. If you look back at it, you will see that there are a lot of similarities to the current post.

He doesn't need this explained. The simple fact it is a "press release" tells anyone reading it the nature of the thing. He's being argumentative, per usual.

Gail,

I think that your taking on the role of press spokesperson can be formalized and then it is just "TOD spokesperson Gail said..."

It is probably useful to have three or four others who are willing to take on quotes under their own names as well. It would be good to have people from all the branches doing this so that TOD Europe, Canada, and ANZ get mentioned. When the media committee sends around a draft press release to our committee it often has blanks to fill in for quote attribution and if someone volunteers to take it then they rework the quote to their own tone.

Since TOD is basically a public education organization, having a media committee would probably makes sense.

Chris

md,

I really like your suggestions. I hope Gail and others see them.

Good idea. We kind of have this, but may need to get others from other countries involved.

Hi Pitt,

Just a "IMVHO" suggestion: it's difficult to give constructive criticism, and I don't have the link at hand for something I read that's a good ref. on this.

My suggestion, for now, is to re-write w. specifics so you give Gail something to work with. (Anyway, she replied - don't know if you've seen it yet.)

I believe there was some previous discussion on how to attribute quotes and/or opinions. Perhaps "editors at TOD" would be one option.

Q: Do you like the idea of TOD putting out press releases (as a general thing)? Do you think it's helpful and/or useful?

I made similar comments on the last PR. The style does make it look cranky. At least, write something like "Gail Tverberg who writes for TheOilDrum.com says '...'". It would help if TOD contributors used real names instead of internet handles. It may be cool on the 'net, but in the real world press releases from anonymous web posters goes straight in the round bin.

If you are going to take a leaf out of the MSM publicity book, you need to make it look professional.

I can at least try the "who writes for" version. It does sound a little more standard.

We've been tracking who is paying for the democratic debates. The coal industry is covering a large share: http://www.thedailygreen.com/environmental-news/blogs/shapley/debate-coa...

I don't think they are ignoring energy policy at all. They are lapping it up.

Chris

In general I like the release but I think that it should also make mention in some way that after the decline of US output it was able to keep growing by drawing down on 'other peoples oil' and that just is not going to be possible after PO. In fact the rate of growth and the Export Land Model predict that even if output remains constant Importers will get less...

I don't know if you saw this regarding Vietnam Coal Exports to China: 100% to 0% in 7 years...

http://www.energy-daily.com/reports/Vietnam_to_cut_coal_exports_to_China...

Regards, Nick.

Any demand destroyed in the US will be sucked-up by Chindia and other hot economies. Those who think oil will drop below $80 must rethink as the US is no longer the "indespensible" economy. The same applies to any new supply coming online; it, too, will be sucked-up by the same group of booming economies. In this respect, globalization has succeded beyond the dreams of the globalists.

Most oil price forecasts ignore Chindia and the US dollar devaluation. The oil price doesn't look as impressive when measured in gold.

You can't use gold this way in my opinion. Consumables like oil food etc should be measured agianst wages. Wages have not increased. You can look at the relative price of oil in Europe vs the US and the currency differences do have and effect. Except that the stronger Euro is also causing price inflation.

So overall the best measurement is simply vs wages. If wages are stagnant or falling and the price of oil is going up the real price or cost i.e percentage of wages is increasing.

IN these terms both food and oil are taking a larger and larger part of peoples income. I make a decent salary and I cringe at food prices these days. For the first time I can remember I bought milk in the grocery store and wondered how a poor person could afford it then realized they probably could not.

Memmel: True, and I realize I am somewhat redundant on this topic but IMO most Americans incorrectly view the US dollar as a constant. The Yuan hits a new record high against the dollar pretty well every day and it is only recently that China has started to loosen the reins. Keeping the Yuan undervalued has subsidized the US consumer and it appears this phase might be ending. As Jim Willie and others note, massive inflation (devaluation of US dollar) will buoy oil prices even in a very deep recession. Oil supply/demand is one variable, the value of the US dollar is the other mobile variable.

I agree that the there are two forces at play that are linked but not exclusively so. The first being tightening supply in the oil markets and the second being the value of the dollar depreciating, forcing oil exporters to seek more per barrel, just to stand still in real terms.

Much of Americas oil consumption is now structural i.e peoples lives literally hinge on a system which depends on oil being consumed at a certain level. In a life threatening situtation, you will pay and do pretty much anything it takes to stay alive. Inflating your money supply, flogging off assets, electing maniacs, starting wars and stealing from others are all responses that can be expected. The USA has already embarked on many of these.

Memmel--

Are you still in Irvine? The time is getting late----

I'm trying to get my friends in Laguna to wake up. It seems hopeless.

Yes and I agree.

But my wifes brother was finally able to move from Taiwan which won't be a pretty place in the future. And I'm working on convincing here parents to consider moving. Its a bit of a migration not just me moving.

Also the housing debacle has put a big crimp in my plans. I can't afford to lose hundreds of thousands of dollars buying a home and acreage.

In fact here is a host of issues which make it difficult to move now.

1.) Prices are still way out of line the financial loss buying now would be crippling for me. I would never be able to sell if I had too.

2.) Many smaller towns are probably going bankrupt soon I'm worried about both taxes and services. Its going to get ugly esp. in California/Oregon

3.) My wife has a lot of relatives in Irvine I'd like to find a place thats easy for them to move too later.

4.) I'm concerned about my own future employment as things unfold. Making a commitment to a mortgage right now is difficult I'm in the mobile industry and do a lot of open source work I'm hoping both will do ok as people can't afford MS products and more people use public transit thus potentially using their phones more as they transit. My experience is that mobile phones are probably going to be the last thing people give up. If you disagree then you don't know the industry.

5.) I think the way things will unfold is that various groups will find themselves living at a lot lower standard of living. Right now this seems to be primarily people in the real estate industry and financial services. Other service oriented companies will go down. I don't think it's going to start at least with people involved in what I call BS jobs taking the largest hits.

So the depression won't immediately hit everyone equally. I'm obviously hoping that I manage to last. I'm fairly good at what I do but this at best means I'll probably be able to keep a job. The salary is unknown I'd like to be able to make it on 50k a year with both me and my wife working.

6.) Given the above and the fact my parents would welcome me back to their paid off farm right now I plan to wait till 2009 to move.

Its not a decision I like making but I was wiped out during the dot.com bust and am just now back on my feet. Hopefully I'll fare better now. Worst case is I'm a good worker and intelligent I'm sure I'd make a good farm hand. But you have to be pretty realistic about what's going down and assuming your going to maintain your current income level is probably the worst bet you can make when planning for whats coming. Buying a home and losing it because I lose my job is not what I want to do right now. At the moment I think mobility is important till things start taking obvious directions.

On the peak oil side we still have a chance of boosting production next year or at least keeping level if we don't see steep drops then this means the real pain is further out say 2012-1015. Only my worst case scenario has the SHTF as early as 2009. On the GW side I think we have a good chance of major famines in 2008-2009 if a region suffers major crop losses. In short 2008-2009 will be really crappy but still relatively normal. Global finance issues will continue to cause serious problems but this translates to stagnant wages and job losses for the little people. Again bad years but probably nothing compared to whats coming.

Finally I spent 2 weeks near London and I was shocked at the amount of traffic considering that gasoline is close to 10 dollars a gallon. Massive traffic jams etc. Poor public transport outside of London and trains too London. Only the wealthy drove large cars the rest generally drove small fuel efficient cars. This made me realize that whats happening in 2008-2009 is the death of suburbia not of our basic mode of living. Suburban living is toast and the long commute in a big car. But we still have a lot of waste to wring out of the system before things get really tough. I found that Europeans seemed to be basically living day to day. Generally they seemed to be saving but outside of that it seemed most people where just treading water with expenses close to salaries. In the US outside of tanking housing we should be able to do the same at least for a few more years.

But understand that over a longer period I'm a super doomer I just think that it will take time for things to unwind and right now my best decision is to hold tight and save money until housing prices come down and I have a job.

Hopefully people that have made foolish decisions will suffer the worst initially and prudent people will do better.

True, BrianT, but it's not like it won't get there eventually.

Excellent article Gail, you and TheOilDrum.com have done a great service to the peak oil community and I'm sure will continue to do so in the future.

A very predictable consequence of blackouts.

http://allafrica.com/stories/200802200149.html

South Africa: Govt Budgets R2 Billion to Alternative Energy

http://allafrica.com/stories/200802200662.html

South Africa should embrace green building

http://www.edie.net/news/news_story.asp?id=14214

Overnight they added 220MW of power by basically doing nothing!

Solar is suddenly more viable in Botswana.

http://allafrica.com/stories/200802050781.html

Hi Gail,

I saw John Kaufmann of the Oregon Dept of Energy give a talk and he used this slide. I felt it did a great job of showing why oil prices are up. I wonder if the oil drum could not create something similar? Perhaps with real data? Analysts are scrambling for answers as to why prices are so high. Might as well give them a mental model. Just a thought.

http://www.energy.state.or.us/jk/Peak_Oil_Overview.pdf

Hi g,

Nice reference, thanks.

There is an assumption in this graph that major Economic impacts start 'sometime in the future' but I wonder to what extent the current financial mess we are in is a direct result of the end of really cheap oil in the 90s, lower returns on basic investment methods since then and hence the need to come up with exotic financial instruments to supplement previous returns that cannot be made anymore due to higher input costs...

Nick.

Hi Nick,

You echo my thoughts exactly. Cleveland found inflation was predicted by money supply/fuel use, which essentially means that the true reserve currency is energy. Just in the last 10 years or so in the west we had the North Sea peak, North American natural gas peak, and world oil peak. A huge bubble had to form as monetary policy overshot reality.

Mr Trout - an excellent graphic, not too dissimilar to one used by Roscoe Bartlett a few years back. I also agree entirely that the economic problems associated with this are well under way, manifest as pressing inflation if nothing else. The future demand curve is of course price dependent and high price must bring that down to meet the supply curve. This is already happening which means we have a raft of "poorer" consumers waiting to step into the breach and buy cheaper oil should the price fall back.

Brent has had remarkable support at $88 for the last 3 months and I anticipate a trading range of 88 to 150 for 2008.

IMO, we should get rid of these mythical "supply" and "demand" curves. They are both the same, past, present and future, and it's called "production" or more correctly "rate of extraction", give or take a small fraction that goes into or comes out of storage.

If you need a second curve, call it "price" although it would appear that it would beter if we could find a way to express it rather than using volatile, fiat currencies.

Hi Hvy,

What better phrase do you have to express the concept of dependency and the idea of "what people want/are used to having and/or using", which seems to be what is meant by "demand"? (Or else I'm taking it the wrong way.)

Would you put the label "price" on what is now called the "demand" curive?

Or, how would you say it? or show it?

You can "call" all that "demand" if you like. The problem is that there is no reproducible way to quantify it mathematically, unless, of course, you happen to be a mind-reader. If you put it on a graph, you are only disseminating disinformation. You might be able to get away with "projections" of production assuming various prices, but how would you take into account "devaluation" of the currency or decisions by producers to "cut back" on production to extend the life of their reserves?

Worldwide, there is only "installed capacity" and fraction of installed capacity that is being utilized, which, when multiplied together, gives you "current extraction rate".

You could also have a curve entitled "fraction of current production used for exploration" with the intention of maintaining current production or increasing it in the future.

Then you could have a curve which indicates "Ratio of Actual Reserve Replacement (per annum) to Rate of Extraction (Expected field life)

When you break it down into individual countries, you can get fraction of extraction exported or fraction of consumption imported.

When you add it all up, there is only Hubbert's curve.

Then you get down to the "economic" part, which is really, as adeptly discussed elsewhere in this thread, the "political" part. By what means is it decided where and how our current production is consumed? I would use a "richness index".

If you plotted daily consumption as determined by people or groups of people on a cumulative basis, starting with the poorest (least able to determine how it is spent), you would have to cover at least 50% of the world population before you even get to 10% of the overall consumption.

As you continued up to 75% of the world population, my guess is that you wouldn't even reach 25% of the total consumption. As you approach the 90% point, maybe 50% is gone; 97% point: 70% is gone.

My guess is that the remaining 3% of the population (world's richest and most powerful people) control the key to how more than 30% of the world's petroleum production is spent. Assuming that 1% of the US population works directly or indirectly for the military, it would come out to be something approaching 15% of the total, if you take into account the personal spending habits of its employees (including current and former Top Brass, well-paid contractors, lobbyists and enableing Congresspeople), as well as actual military expenditures, both on and off the books.

Now, does trying to conjure up fictitous supply/demand curves still seem all that important to you?

HOG

Hi H.O.G.

Thanks, yes I see what you mean.

At the same time, it looks like (at first glance) a handy way to get across the idea of "shortfall" between... 1) What 'we' are used to - 2) what 'we' will get."

Is there any way to capture this? You say not mathematically. Still, it must be quantifiable...? (not at all?) There's "consumption capacity" that mirrors "installed capacity"...?

Anyway, I like your idea of having some visual way to describe the "richness index", since the quote often cited (US produces 5 (?)%of the world's oil but uses 25%) just does not resonate that much, as far as I can tell. (Like, yeah, so...?)

If you assume historically, that "supply" has been installed capacity and "demand" has been actual production, the relationship is quantifiable because you have a historical "price" which ties the two together.

The problem arises when the two curves intersect. Demand can only actually only approach the supply curve, it can never exceed it. An increase in "price" is implicit as they get closer together.

That being said, the whole neoliberal economic theory starts to break down in that there are no longer any "free markets" with respect to the one dominant commodity, the availability of which starts being the determining price factor in all the other "commodities" that are being produced or extracted.

Food is no exception because its invariably dependent on water supplies, fertilizer, pesticides, tractor fuel, processing costs, and soil fertility, which is related to carbon content, which is also diminishing.

"Free market" ideology and its inherent shortsightedness is what has gotten us into this mess. That we could expect the same ideology to get us out of it has to be considered delusional, at best.

But that is what the elite want you to believe. Take Chevron's Ad on TV which indicates that they can somehow be "green" by using their oil profits to buy a geothermal plant that has been around for decades. It just doesn't wash.

Thanks for your remarks on the "richness" or "power" index. It is really the "slope" of the curve at any point that determines this value.

I was modeling world behavior until I got to the last 3% where I conflated it with the US curve. The US population would be distributed into the curve, largely in the top 50%, but with many or even most of us in the top 10% due to our inefficient transportation, food supply and housing paradigms. At the very end, the x-axis needs to be logarithmic if it wanted to show how much petroleum the richest .01% of us actually consumes or causes to be consumed.

Bottom line is that, due to the falling dollar, the "distribution" of US consumers on the curve is going to be moved sharply toward the left (origin). We need to start preparing immediately for this. In short, we need to "stop digging" immediately.

Remedies include closing assembly lines for SUVs, prohibiting new housing over 2500 sq. ft., start relocating a portion of the population out of cities and suburbs, promote "victory gardens" and "green (or white) rooftops in cities, conversion of (some) golf course or street areas into ones that could support cultivation of "high value" fruits and vegetables, promoting this as "exercise" we need anyway.

This is getting too long--just saw Ralph Nader declare for presidency. Maybe he can shake up the dialogue, rather poor in energy solutions thus far.

HOG

Couldn't agree more and I'd go one step further and say that money is simply the way that capital is conferred upon those who then have the right to direct how, when and on what, energy is applied.

The form of the energy is irrelevant and this principle holds true in regard to slaves, beasts or mechanical contraptions. They all need to be fed with energy of one or more type which is transformed into new production of another type.

IMHO, the money system is simply the way we allocate the right to spend energy to those who will be most productive with it. Those who are least productive with it tend to get less of it.

Termoil, you are so totally right. More and more posts are starting to resemble your views. Two hours to the south of me is Professor Joseph Tainter at Utah State University in Logan who laid out in great detail the role of energy and how it relates to societal complexity. His book "The collapse of complex societies" should be required reading for all TOD folks.

Solar Balloons. could be a breakthrough.

http://www.treehugger.com/files/2008/02/cool_earth_gets.php

Given the choice, would people rather start starving to death immediately, or quite a bit later?

That’s really what we’re talking about here, isn’t it?

Back when most folks were subsistence farmers (and the world’s population was a tenth what it is now) day to day living was a practical and direct activity. You grew food, or hunted it, provided your own transportation and shelter, and really understood the importance of staying on good terms with the tribe or land lord.

The means of survival were not abstract, and they were seldom distant.

Now they are both.

For most of the six billion souls currently on earth survival requires money and the overwhelmingly complex systems that money runs. The ‘stuff’ we live on comes from the other side of the planet, as often as not, and the various elements that comprise the system of creation, control and delivery are as distant as you can get on a spherical rock such as ours. That these systems are completely dependent upon shrinking supplies of fossil energy is somewhat hidden from those who don’t make a deliberate effort to figure it out, and it’s daunting even for those who do.

When Peak Energy arrives, death cannot be far behind, but for those who just hate to wait, there is a faster way to the same end. Break another life support system and the dying can start immediately.

The hands down easiest and most quickly devastating one to break is money. Not only is it both the craziest and the most abstract, it’s also the one we use to regulate and control all of the other things that we are capable of regulating or controlling.

How crazy is the modern way of making money? Barking mad. Suicidal.

Just look at the mainstream way of making money. Borrow too much money to acquire an overpriced thing no matter how ultimately destructive it might be (macmansions where farms used to be, new weapons systems, packaged subprime mortgages, whatever) on the assumption that in the near future that overpriced thing can be re-sold at an even higher price. The players know that the biggest fastest bucks happen when the deal is signed. Once they’ve got the money the question of fair value is someone else’s problem. Ever larger loans mean ever larger profits (and net worth) so Banks are eager to drive the process. It is a world-wide Ponzi scheme gone haywire, and like all such scams (pyramid sales, multi-level marketing, chain letters) it hits the wall when there are not enough fresh suckers to go another round. Suckers are a renewable resource, but when that next ridiculously huge loan can not possibly be repaid, Lenders turn off the money spigot and pray for a government bailout… because they know that what happens next is really going to hurt. But turn it off they do anyway, because lending every penny they’re worth on a dead certain loser would hurt even worse. (They know a thing is a dead certain loser when they are dead certain they won’t lend anyone that much money to buy it.)

That brings us back, remarkably enough, to the problem getting our leaders to do something about the impending peak energy disaster.

Any energy policy capable of adjusting consumption downward to bring it in line with projected supply, will have the immediate effect of destroying the world’s economic system because that system, lamentably, is utterly dependent upon growth. Less energy consumption means less everything… and especially less credit based ‘growth.’ Such a move would end the Ponzi scam. It would cause world wide economic recession on a scale to make the Great Depression an insignificant blip.

Without ever-expanding credit to regulate and control production, distribution and security, the nearly instantaneous consequence would be chaos, starvation and violence. Train wreck on a global scale.

Actually, since the poorest are the most vulnerable it would be a ‘caboose first” sort of wreck.

To carry the train analogy one more step. It’s a little late to be flagging down the engine to warn that the bridge is out. The engine (if you will) is doing exactly what it was designed to do: make more profit for its owners next quarter than it did last quarter. Feeding them facts and expecting sensible results is working about as well as talking to a train.

In other words, we can (and shall) slam into the wall when declining energy supplies cause the collapse, but just forget about any leaders slamming their nation into the wall voluntarily prior to that event. No leader ever achieved power by promising unbearable hardship and death, nor lasted for long by delivering it.

This is all ‘In Plain Sight’ sort of stuff. World events and the otherwise inexplicable obliviousness of our government to Peak Oil, makes sense (in a criminally negligent sort of way) when viewed from this perspective.

The world’s leaders (and our presidential candidates) aren’t ignoring the problem. They see the situation clearly, have carefully estimated consequences and are vigorously responding … by getting as far away from that caboose as they can possibly get.

Indeed.

I've got links to Money As Debt and a couple other presentations on debt and the Fed.

http://aperfectstormcometh.blogspot.com/2008/01/money-debt-fed-and-usury...

This is why I call the current situation a Perfect Storm. It's not just PO and AGW, but also the failings of the fractional banking system and reserve banks. In the end, if all three don't change, we won't have really changed anything. We will simply cycle through the whole thing again.

Understanding Chaos Theory (Chaos-Making a New Science by James Gleick, for the lay person), Kennedy's "The Rise and Fall of the Great Powers: Economic Change and Military Conflict From 1500 to 2000", a tiny bit about complex systems and collapse (E.g., Diamond), global warming (and tipping points see: Chaos, bifurcations) and PO and, voila!, it's all very, very clear.

To Anonymous:

If the person who posted on my blog came from here, thanks for the note. I've altered things there, but can't stand Plain Jane, so you likely will not like this a lot better. Should be a bit easier on the eyes, though.

The blog was really intended for family and friends, so I've not paid much attention to pleasing the typical Netizen. Your post made me check my stats, and Lo and Behold, some folks have stopped by. A few even stayed more than a second! ;)

I'll have to post more often if people are actually reading the silly thing...

Cheers

Oh, it's better than that. This video is ~47 min. long. It's quite thought provoking (and pretty scary). So, grab your lunch, sit down and have a view.

http://video.google.com/videoplay?docid=-9050474362583451279

Hi D,

Q: And this is it? Or do you have some other ideas?

It's weird (and as I'm still the most naive person I've encountered I can ask) - I just wonder...the basics: change our way of doing things.

I mean...okay, if you call it "criminally negligent" to be oblivious - how can this adjectival phrase apply if there is *really and truly* nothing anyone can do?

Or, do you mean to say there is "something" - but leaders will not (for logical reasons)?

What is that "something"?

Or, to put it another way: 1) change culture (esp. put in place human rights and women's rights as human rights - which will also "solve" population growth - well, I'm going to say it does),

2) use every ounce of oil to build solar/wind/whatever else can work w/out oil (I know the infrastructure has to be in place to get to the self-replicating part of this),

3) re-localize agriculture to the regional levels that make sense, organic ag makes sense according to studies...

4) keep education as much as possible ---I don't know...I mean...

I don't know...just kind of share more. (Oh I almost left off stop war, no more nuclear weapons, no more building of new weapons, esp. nuclear ones, no more human trafficking...just stopping the new weapons systems would "save" a bundle? or not?)

Q: In other words, (to get back to your text) if money is "crazy and abstract", what is *not*? What is better? What can work?

Hi Aniya,

Good questions, and since you read my post carefully enough to pose them then I should do my best to answer up.

The first thing you asked was "And this is it? Or do you have some other ideas?"

Oh, I've got plenty of other ideas, but that is a very lengthy subject. Sticking just to the topics raised in my posted comment, the underlying thought I was trying to convey was that we humans now find ourselves in the unenviable position of having to sleep in the bed that we have made. The causes having been set in motion, the consequences shall now be experienced.

That is not to say everyone should just stare into the headlights until impact. Quite the contrary. If there was ever a reason for immediate action, Peak Energy is it.

It's not the first time our species has been seriously challenged, by the way. The genetic record of homo sapiens sapiens (our actual dna) shows that in our not too ancient past we were nearly rubbed out on several occasions, yet here we are.

Certainly there are many things we can and should do (both as individuals and as groups) to help the situation. I would organize these into three categories:

1. Continued intense study of the problem in all of its aspects. The more we know then the more likely we are to discover things that will help us out. At the very least we will be better able to gauge the sequence and timing of events... and timing is especially important in crises.

2. Governmental policy & education of leaders. They are politicians. Their self interest will always (of necessity) come first, so hold their feet to the fire to implement solutions (for example, legally mandated increased fuel economy for automobiles) that will buy us a little more time. But don't expect bankers or presidents to to be selfless or brave. It is not in their nature.

3. Acceptance. Study is good. Facts are good. Even wildly hopeful political reforms are good, but we passed the tipping point over 60 years ago, and the 'powering down' of civilization (always inevitable) is now certain to be rather more traumatic than otherwise. Preparing for that (as best one can) starts with acceptance of the facts so clearly documented here on TOD (and elsewhere.)

Cultural change is essential and your other points are also well taken. I agree completely with your points on human rights, personal kindness, alternative energy development, localization and weapons bans. Such important advances, though, are both incremental and glacially slow and won't fix things fast enough to avert the current disaster. Maybe they can prevent the next one.

In the meantime there are definitely smart things one can do that are fast, effective, and not really all that disruptive of 'normal living'. One of the best such that I've heard of, and the one we have implemented for our own family, is relocating to a more viable community.

We chose a 150 year old farm town just above the flood plain of the Mississippi river in Illinois. Plenty of wood water and soil, and people who still know how important it is for neighbors to take good care of each other.

Hope the above is responsive to your questions. Thanks for asking.

D.

Hi D.,

And thank you for your response.

1) re: "I've got plenty of other ideas, but that is a very lengthy subject."

I'd be interested in this, perhaps you could write it up as an article on TOD?

2) Q: I'm wondering what you see as an alternative to the money system you talk about. Can you describe it or how you see it?

3) That's great you found a place you like. I hope you report on it - and good luck. I'm curious if you're taking your job(s) with you, or how you plan to make a living (if this is something you might want to share.)

Am I missing something but isn't the current production 87 mbpd (instead of 85)?

And, how can you be so sure to say that it will never exceed 90 mbpd, given new megaprojects coming on stream, and Saudi Arabia and Iraq planning to boost output by 2-3 mbpd in coming years?

If it really materializes and we see 90+ in few years, will you at least be embarrassed? Or, as many "bold" predictors did in previous years, just issue new release with updated numbers?

Someone on the WSJ energy blog posted a note to the effect that concerns about Peak Oil were bogus and that a more likely date for a production peak was around 2555.

If we take just the top five net exporters, at their current rate of increase in consumption, in 2555 they would be consuming about six X 10 to the 18th power barrels per day of petroleum, about 70 Gb per second.

A more relevant real life example is Hubbert's original 1956 low case/high case projection for the Lower 48. He found that a one third increase in URR delayed the Lower 48 peak by all of five years.

In any case, IMO October, 2007 was the inflection point at which the bidding war for declining net oil exports began to get serious.

I have to keep reminding myself of the ELM. Probably because when I add that back into my thinking I am tempted to pack a tent and head for the hills. It would be FABULOUS if you could write up something on exports over the last five years or so and as up to date as the data allows, just actual export numbers, and graph it. No analysis, no models: sheer numbers.

For those of us not so strong with the stats it would very much help clarify the situation.

Figure 17 has the recent top five net export history and projections--low case, middle case, high case:

http://graphoilogy.blogspot.com/2008/01/quantitative-assessment-of-futur...

Our middle case is that in less then 10 years it will take 100% of the combined net oil exports from Saudi Arabia, Russia, Norway, Iran and the UAE just to meet current US net import demand.

Boone Pickens was just on CNBC warning that the rising cost of paying for imported oil is going to be catastrophic for the US economy.

ELM and its consequences are like death, you know it will come eventually. But I'm not convinced it will come so soon. Maybe this crisis is just a blip before production and exports go up again. Of course, not indefinitely, maybe to 90, maybe to 100 mbpd, or maybe you guys are right and that's it, 87 is all we get. Time will tell.

How the recent discoveries (Norway 40 Gb, Brazil possible 100, etc.) fit into immediate exports drop theory? And Iraq and KSA possible increases of production?

Above example regarding 2555 peak and 70Gb per second consumption is ridiculous. Rate of consumption will at some point drop to or below zero, when real constraints kick in (recession, cut of subsidies, ..). As Roger Conner (Thatsitiimout) pointed few days ago regarding exponential function - examples that presume infinite exponential growth are not based in reality.

Regarding 70 Gb per second for the top five in 2555, actually Peter Huber asserts that our aggregate energy consumption will increase--forever--and in fact this is the underlying conventional wisdom expectation.

Regarding the ELM, consider Saudi Arabia, which produced 11.1 mbpd, total liquids, in 2005. Because of rapidly rising domestic consumption, I estimate that if Saudi Arabia wanted, and were able, to match their 2005 net export level, they would have to boost 2008 total liquids production to about 11.7 mbpd.

If we scale back the infinite growth model to the Economist Magazine's 70 year time frame for Saudi Arabia (they asserted that Saudi Arabia could produce, at their 2005 rate, for 70 years without ever finding another drop of oil), at their 2006 rate of increase in consumption, Saudi Arabia in 2075 would be consuming 108 mbpd.

"...examples that presume infinite exponential growth are not based in reality."

Bingo! That would include all capitalist economies...

Tvrdy--I don't see where you've factored in the amount of depletion, which is considered 8%/yr by Schlumberger. Even CERA says it's 4.5% Being directly engaged in servicing oil fields, I think Schlumberger's 8% number more reliable. It also seems clear that whatever new extraction comes into play must overcome this daunting "staircase" for overall flow rates to increase. 86 MBPD depleted at 8% needs about 6.9 MBPD additional just to keep the flow rate flat. All the available evidence shows this is becoming a very difficult task. The recent discussion of the inability of the IOCs to fully replace their reserves is quite telling, as their experience becomes a proxy for the NOCs ability to do same.

Which would be the more prudent expectation to follow: Quantity Supplied continues to lag Quantity Demanded, thus price will continue to rise to maintain equilibrium; or, Quantity Supplied somehow expands to meet the Quantity Demanded (which includes demand recently destroyed, as that demand still exists) at some lower price that enables previuosly destroyed demand to be fulfilled.

Yes, difficult task but obviously not impossible, at least for some time (as recent increases and scheduled megaprojects show). I am not arguing we won't be in trouble, I'm just saying not now or not so soon. There is still possibility for supplies to increase but as you say, they will be met by increased demand and price will rise.

Interesting times ahead.

In paragraph five: the sentence "The oil that comes out now, comes out slowly, and is often mixed a high proportion of water." Perhaps "mixed with a high proportion of water" would sound better? As someone who used to read reams of press releases as an editor, any time I saw a typo it made me cringe and much less likely to take the info seriously.

Otherwise, great piece! I read the Oil Drum daily!

Hello,

I find the following in the article:

According to Gail Tverberg of TheOilDrum.com, "Higher energy prices can raise food prices, and can affect people's ability to repay their mortgages. Thus, energy prices can affect the financial sector."

That is very true. And the financial sector can definitely affect the energy sector.

So why was TOD Canada shut down?

Could you finally provide us with some information on what happened there?

Thank you,

FB

Gail the Actuary wrote:

"Even in this country, any minor refinery incident has become a cause for concern, and a possible spike in oil prices."

Now, I am heavily invested in energy company stocks, and thus, watch the energy scene very carefully. But while I hear this all the time, I have absolutely never understood the logic of it. Refinery shuts down, oil price spikes. Why? I ask.

I wish someone could explain it to me. Here is how I analyze it:

Refinery shuts down; therefore less oil is processed, more must be left in the storage tank.

Because of this, there is less refined product on the market, less gasoline and petrochemicals.

That adds up, in my book, to a LOWERING of oil price and a rise of gasoline.

I wish someone could clear up my confusion, cause I don't see where I am confused.

seismobob,

I was thinking the same thing. As a former economic analyst, I can tell you many times these people grasp at anything in attempts to provide explanations for events - that is their job afterall, and the media doesn't wait for thoughtful, time-consuming actual analysis. So, if a research firm takes the time to really analyze, their name won't show up in the newspiece and they lose marketing exposure. Most of these firms that provide these so-called "facts" are businesses first, researchers second.

It is counterintuitive, but less refining capacity leads to less gasoline, so gasoline prices rise. If gas prices are higher, refiners can afford to pay higher prices for oil. It's therefore a balance between gasoline demand and oil supply, not just oil demand and supply. Over time increased oil stocks and reduced gas demand will have a downward effect on price, but a sudden change may cause an upward spike.

BobCousins wrote:

"It is counterintuitive, but less refining capacity leads to less gasoline, so gasoline prices rise. If gas prices are higher, refiners can afford to pay higher prices for oil. "

Sorry, Bob, that simply won't do at all! It is like saying that I have invested well, made a few million and thus CAN afford to pay $200,000 for a Ford Taurus. That does not equate to being WILLING to pay $200,000 for a Ford Taurus.

Similarly with refiners. They are not in the business of giving money away because they have too much and desire to pay more for oil.

I don't know how old you are, but if you are young, I would ask for my money back from the college for the economics course you attended. Shoot, even if you are 80 I would suggest you ask for a refund.

Let's say you are making an average salary, somewhere in the Mid $30k's You really can afford to pay $100 for eggs. Do you want to?

Let's have one of those 'Gas is soooooo expensive' treads.

Gas is 1.553 euro/l here in the Netherlands. That makes 8.66 US$/gallon.

Anybody can top this?

;-)

About 12 SEK/l in Stockholm. 7.2 USD/gallon.

Gas is around $8.84/gal here in Norway...

Well, clearly that is why Norway's standard of living is so low. Oh, wait a minute. . . .

Up here in BC we are paying $4.56/US Gallon (5.40/Imperial Gal)

Richard wrote:

"Let's have one of those 'Gas is soooooo expensive' treads.

Gas is 1.553 euro/l here in the Netherlands. That makes 8.66 US$/gallon.

Anybody can top this?

;-)

"

Having lived in the UK with similar petrol prices, it isn't that petrol is so expensive, it is that your taxes are expensive. One needs to clearly differentiate between the two.

Great piece Gail! Fact is the Cornicopians keep denying peak oil, yet all the data points to higher prices and low and behold we breach 100 bucks for a barrel of oil. Yet we're only at some part of the plateau called peak. What will be the price when supply sharply descends down the other side of the bell curve?

The complexity of the globalized economy has been bouyed up to this level by cheap liquid energy filled oil. As that fuel from any source gets more expensive to bring to market, the price will rise ever higher and the basis for economic expansion will cease. The global economy will reduce in scale and activity to the level the energy that is affordable can sustain.

I contend we are already in the long emergency, but that's why its called long, because it won't be like pulling off a bandaid. At first it will be inconvenient with higher prices at the pump and grocery store, then as rationing takes hold downright aggravating, then scary as food becomes extremely expensive, followed by horrendous as unrest leads to riots for food and fuel, ultimately degrading into a day to day struggle to be part of the percentage of the world population that survives the long emergency.

This scenario could have been avoided if a Plan B had been formulated and implemented as oil becomes too expensive. But as older wise people will tell you, humankind always waits until something is a crisis to respond. But that approach in this case is too little, too late.

...

Gail said:

I would like to ask what people here think of the likelihood that we are heading towards war whether or not leaders recognise this?

The discussions I have heard so far centre on the sort of sentiment that the US should not attempt to seize oil assets.

I would like to point out that it is not just the US that behaves in that way, all great powers do.

The immediate cause of the war in the Pacific was Japan's attempt to maintain access to oil, and hunger for resources had driven her earlier into war with China.

German plans for war and subsequent operations were heavily influenced by oil and other resources, and the earlier history of the British Empire was both of the seeking of resources and the attempt to retain them.

If shortages bite, with China temptingly near the resources of Eastern Siberia and Australia, with hydrocarbons and uranium both available in large amounts there, will the temptation not be to secure them?

Similar considerations apply to India and Pakistan and the gulf region.

During the middle ages warfare was endemic, as productivity was fairly constant so if you wanted to get on you basically had to grab someone else's land.

Under shortage conditions caused by peak oil, to be perhaps joined fairly soon by peak gas and even peak coal it would seem very difficult indeed to avoid similar considerations leading to war.

Humans love to steal from each other. The net energy gain can be tremendous as it may take only a days work to relieve someone of a lifetime of savings. Isn't that what our financial pirates have done, diverted pension fund monies into 25 million dollar bonuses by selling worthless investments. Sometimes we shoplift on a national scale when we take resources from other nations while filling the Swiss bank account of a cooperative tyrant. At other times it's like a giant football game with great patriotism except that it's not a symbolic pigskin that the teams compete over.

I would encourage all nations, including Iran, with significant untapped natural resources to develop nuclear weapons because you will be a target of actual aggression or blackmail, "Send us your uranium and coal or prepare to glow in the dark."

Leaving the morality aside, it seems your thesis is that the possession of nuclear weapons would deter aggression.

That seems undoubtedly true, up to a point.

Taking Siberia from Russia, for instance, would not be an easy proposition, but the calculations become difficult when everyone is circling for the same pot of resources. For the Chinese leadership, for instance, at what stage would they think that Russia will feel so threatened by that great mass of humanity in China so temptingly close to much-needed resources that Russia would seek to strike first?

At what stage might they deem it probable that America would seek to seize the gulf, and that they had better do so first before they are shut out?

The same considerations would go through the minds of all the leaders, not only wanting the resources for themselves, but the fear of being shut out, of taking action too late.

For instance, China goes, say, for a massive nuclear build, but has little readily accessible uranium herself - now hopefully they would decide to pay the small premium for uranium from sea-water, but there are not only the uranium resources to consider, but coal, of which Australia has large stocks.

Since Australia is an ally of the US, in their manoeuverings for oil, when would China think that the US might seek to bring pressure to bear by restricting China's access to Australia's coal and oil?

What would China do about it?

It is distressingly easy to write scenarios in a world of energy shortage where fear as much as greed leads to war.

Hi Dave,

Your point is well taken. Canada is rich in many resources and not just fossil fuels, but potash, uranium, hydro-electricity, agricultural products and perhaps most importantly fresh, clean water. It's not unreasonable to expect these resources to become far more valuable with time and that our neighbour to the south would cast its eyes upon us in the event their own needs cannot be meet through normal means. As many of us know, our trade agreements with the U.S. pretty much guarantee an uninterrupted flow of energy in the event of an emergency, but should these shortages become chronic and increasingly more severe and the political consequences ultimately unpalatable, it's not hard to imagine what might follow next. Put bluntly, don't expect to quietly eat your lunch when the starving man next to you has a gun.

Cheers,

Paul

Hi Paul,

Canadian independence has been pretty much a grace and favour affair ever since Britain clearly could no do much to protect her, say for around 100years, and the trade agreement you refer to obliquely reflects that,

If anyone in government there was dumb enough to threaten, say, an interruption of supplies from the oil sands, they would be as independent as Tibet a week later.

There is no chance of the Canadians being allowed to be ahead of the US in it's access to resources, their problem would rather be to ensure they don't end up right at the back of the queue, like the Tibetans.

I suppose a Canadian premier could divert some of your nuclear resources and build a few bombs, but with a border that long and a population 10 times as numerous just south of it they could simply walk in, more or less ass individuals, and unless you were up for mass suicide you couldn't do much about it.

Just a few thought on a couple of other players, Europe and Japan.

Europe would seem to me to be in severe trouble, with an underdeveloped nuclear industry, half of the US fleet of reactors, few fossil fuel resources and a long border with a very troublesome neighbour, Russia.

That is not the half of it though, as it is the borders to the south and east which are likely to cause even more problems.

A middle east in turmoil with everyone competing for the remaining FF resources needs no explanation, nor does an Israel desperately concerned with her security, nor does the endless stream of would-be immigrants travelling up from Africa.

What is more worrying is civil war, with a substantial Moslem population already alienated and likely to be unsettled even further by events in the Middle East. I really don't see a good outcome to that one.

Japan looks brighter, and perhaps has the best prospects of all.

With no natural resources of her own, and no prospect of winning them militarily, unless she allows herself to be perceived as a threat by putting herself forward as America's unsinkable aircraft carrier, or opted in as a partner with China in a land grab in Siberia, then she will have to develop her strength, her technology. No resources mean that she would not be a temping target.

With 40% of power generated by nuclear means the lights should stay on, and if pushed could fast forward the development of small, mass-manufacturable nuclear plants which would use fuel much more efficiently, whilst uranium could be got from sea water.

http://advancednano.blogspot.com/search/label/thorium

advanced nanotechnology: thorium

All that is very nice, but the glaring weakness is of course food supplies.

Hydroponics and high density agriculture would need to be pushed to the very limit to cope, although as ever the main supply would probably come from selling these nuclear technologies and other technologies on to everyone else.

As regards food supplies Japan is self sufficiant in rice. The only thing thay are self sufficiant in.

Even that is iffy.

Poor Crop Forces Japan to Consider Rice Imports

http://query.nytimes.com/gst/fullpage.html?res=9F0CE6DC1E3AF935A1575AC0A...

Americans and Canadians often boast that our two counties share the world's longest undefended border. Hmmm, wonder what the implications of that might be...