DrumBeat: April 25, 2008

Posted by Leanan on April 25, 2008 - 9:03am

New Matthew Simmons presentations

Including:The 21st Century Energy Crisis Has Arrived

Are We Nearing The Peak Of Fossil Fuel Energy? Has Twilight In The Desert Begun?

The Peak Oil Debate As The EIA Turns 30

Clothing stores feel sharp economic pinch: High fuel, food prices crimping spending on apparel

After years of routinely asking consumers what they think of the coming fashion season, it would seem that nothing could surprise C. Britt Beemer. But this year, when Beemer asked women to rate spring clothes, he got an unexpected response — 50 percent of women said they hadn’t even noticed what’s in store windows....If rising food and fuel prices aren’t exactly getting you in the mood to hit the mall for a new spring outfit, you’re not alone.

Clothing retailers are facing a double whammy of drooping consumer interest — fueled by economic woes — coupled with their own rising costs for raw materials such as cotton, fuel to transport goods and even labor in China.

North Pole could be ice free in 2008

You know when climate change is biting hard when instead of a vast expanse of snow the North Pole is a vast expanse of water. This year, for the first time, Arctic scientists are preparing for that possibility."The set-up for this summer is disturbing," says Mark Serreze, of the US National Snow and Ice Data Center (NSIDC). A number of factors have this year led to most of the Arctic ice being thin and vulnerable as it enters its summer melting season.

LOS ANGELES - Spurred by visions of their cities frying in a warmer world, mayors around the nation have grasped a green solution: trees! Like Johnny Appleseed, they have vowed to sow their seeds in great profusion, promising millions of new trees in the coming years. Arbor Day, that old fusty holiday, is getting a makeover.Cities once planted trees because they were beautiful. Now trees are being retasked as "green infrastructure" managed by "urban foresters" to work as powerful energy-saving, carbon-sucking, wastewater-treating tools to save the planet. But as the mayors spin their green dreams, their releaf teams have had to confront a brutal reality: Planting a tree is a lot harder than it looks.

Insects left disfigured by nuclear radiation

No one wants to live too close to a source of artificial radiation, not even insects. Cornelia Hesse-Honegger has spent 20 years travelling around the world, mostly in Europe, capturing and studying over 16,000 insects, many living in the vicinity of nuclear power stations, or other artificial sources of radiation. Her conclusion, not surprisingly, is that exposure to radiation increases the chances of deformity.

How to End the Global Food Shortage

The world economy has run into a brick wall. Despite countless warnings in recent years about the need to address a looming hunger crisis in poor countries and a looming energy crisis worldwide, world leaders failed to think ahead. The result is a global food crisis. Wheat, corn and rice prices have more than doubled in the past two years, and oil prices have more than tripled since the start of 2004. These food-price increases combined with soaring energy costs will slow if not stop economic growth in many parts of the world and will even undermine political stability, as evidenced by the protest riots that have erupted in places like Haiti, Bangladesh and Burkina Faso. Practical solutions to these growing woes do exist, but we'll have to start thinking ahead and acting globally.

The Politics of Food is Politics: An Alternative Agriculture is Possible

We buy food at the supermarket; so we don't generally experience -- directly -- the association between fuel and food. The connection, however, is every bit as central in the current food production regime as the link between aircraft engines and their fuel. Industrial monocropping for global distribution is "neither tooled nor organized for oil at $120-a-barrel." It is not just the far-flung food transport network (much of it refrigerated and fuel-hungry) that creates the intimate dependency on oil; it is the whole scheme called industrial (or corporate, or "modern") agriculture.This oil/food link -- during the onset of what some call the Peak Oil event -- has resulted almost overnight in steep food-price inflation, hitting peripheral economies like a tsunami.

I do not wait for permission to become a gardener but dig wherever I see horticultural potential. I do not just tend existing gardens but create them from neglected space. I, and thousands of people like me, step out from home to garden land we do not own. We see opportunities all around us. Vacant lots flourish as urban oases, roadside verges dazzle with flowers and crops are harvested from land that was assumed to be fruitless. The attacks are happening all around us and on every scale - from surreptitious solo missions to spectacular campaigns by organised and politically charged cells.This is guerrilla gardening.

Hundreds of EPA scientists cite political interference

Washington — Hundreds of Environmental Protection Agency scientists say they have been pressured by superiors to skew their findings, according to a survey released Wednesday by an advocacy group.The Union of Concerned Scientists said more than half of the nearly 1,600 EPA staff scientists who responded online to a detailed questionnaire reported they had experienced political interference in their work.

Falling Polish coal output raises energy security fears

Poland's largest hard coal companies said Wednesday they produced 1.8 million metric tonnes less in this year's first quarter compared to the same period last year, raising concerns about supplies to the country's power plants. Poland produces almost 95% of its electricity from coal-fired plants.

The fact is, nuclear power has not recovered from the crisis that hit it three decades ago with the reactor fire at Browns Ferry, Alabama, in 1975 and the meltdown at Three Mile Island in 1979. Then came what seemed to be the coup de grâce: Chernobyl in 1986. The last nuclear power plant ordered by a US utility, the TVA's Watts Bar 1, began construction in 1973 and took twenty-three years to complete. Nuclear power has been in steady decline worldwide since 1984, with almost as many plants canceled as completed since then.All of which raises the question: why is the much-storied "nuclear renaissance" so slow to get rolling? Who is holding up the show? In a nutshell, blame Warren Buffett and the banks--they won't put up the cash.

World’s largest solar farm set for California

Stealth Bay Area solar startup OptiSolar has quietly revealed plans to build the world’s largest photovoltaic solar farm on the central California coast — a 550-megawatt monster that would be nearly 40 times as large as the biggest such power plant operating today.

With First Car, a New Life in China

SHUANG MIAO, China — Li Rifu packed a lot of emotional freight into his first car. Mr. Li, a 46-year-old farmer and watch repairman, and his wife secretly hoped a car would improve the odds of their sons, then 22 and 24, of finding girlfriends, marrying and producing grandchildren.

Is humanity's restlessness a threat to the planet?

Humanity's history is marked by constant movement, mass migration from continent to continent in search of a better way of life. Is this restless addiction to travel - and our desperate demand for more fuel to feed it - our fatal flaw as a species?

The rapid pace of environmental change threatens to drastically transform our world. What might the future look like? Alan Weisman, best-selling author of The World Without Us, peers ahead 50 to 100 years to construct plausible scenarios for three widely divergent ecosystems, and the people who inhabit them.

U.S.-contracted ship fires toward Iranian boat

WASHINGTON (Reuters) - A cargo ship contracted by the U.S Military Sealift Command has fired at least one shot toward an Iranian boat, a U.S. defense official said on Friday....The United States in January said Iranian boats threatened its warships on January 6 along a vital route for crude oil shipments.

Strike refinery shutdown complete

The shutdown of the Ineos oil refinery at Grangemouth in central Scotland has been completed, the company has said.

White House Rejects Dem Plan Linking Arms Deals with OPEC Output

The White House said Thursday that Senate Democrats are "barking up the wrong tree" by threatening to hold up arms deals with Saudi Arabia and other Organization of Petroleum Exporting Countries unless the oil-producing countries agree to increase oil production."The last thing that we want to do is increase our dependence on foreign sources of energy," White House spokeswoman

CNOOC in Tax Dispute in Nigeria Over OML 130 License

Chinese oil producer Cnooc Ltd. (CEO) is involved in a tax dispute in Nigeria that might affect the price of its biggest-ever acquisition of a foreign oil field.

Hunger returns. We look to history for solutions

What can we learn from the green revolution? And could a “second green revolution” extricate us from today’s food problems?

Unpaid utility bills soar as economy sags

CHICAGO — Hundreds of thousands of utility customers are at risk of disconnections as the sagging economy drives up the number of past-due home heating bills and the amounts owed, utility companies in cold-weather states say.Xcel Energy says 17%-19% of its 1.1 million Minnesota customers and its 280,000 Wisconsin customers are in arrears. That's about the same as a year ago, but balances owed are up 10% in Minnesota and up 20% in Wisconsin, says Pat Boland, Xcel's credit policy manager.

Xcel disconnects 600-650 customers daily, he says. "Obviously the economy is playing a very big role in the disposable income that folks have," Boland says. Another factor: Cold weather added 7%-8% to this year's bills.

The extent of the problem is becoming apparent now because most states in the Midwest and Northeast have moratoriums on disconnecting utilities in winter months. Those restrictions typically end March 31 or April 15.

Petrol stations in Scotland are already running dry, despite appeals for motorists not to panic buy ahead of a strike by workers at one of Britain's biggest oil refineries.Several filling stations in Edinburgh are down to just two or three pumps as customers queue to stockpile fuel.

And at least one station has been closed, ahead of the imminent strike at Grangemouth, based nearby.

The Era of Cheap Food, Energy and Credit at an End

Eight years into a new millennium, it feels like the end of an era.The end of the eras of cheap credit, cheap food and cheap energy. Will they be back? Even Pollyanna might swallow hard before giving the nod to that one.

Driving down the highway we have seen the future pass us by

What Kunstler did was make you feel guilty driving anything larger than one of those Smart cars that are only slightly bigger than a breadbox, and kicking the thermostat up a notch. He is quite literally a Prophet of Doom.Doom? At the rate we were using oil in 2006, he estimated that the known reserves would be drained by 2043. That's 35 years away — as far in the future as 1973 is in the past, which is not that long ago, if you're about my age. I know exactly where I was in 1973: Waiting in a gas line at a Sunoco station in Florham Park, in the days following the Yom Kippur War. The 1973 gas shortage was blamed on international politics. The coming shortages are based on Mother Nature running dry.

SOUND BITES and sloganeering just won’t cut it anymore. Energy security—defined as reliable supplies at reasonable cost obtained in an environmentally sustainable manner—is no longer assured. All the presidential candidates loudly proclaim that they will reduce our dependence on foreign oil and, as a bonus, curb carbon emissions. Yet these same politicians, for the most part, have overlooked a serious problem. In so doing, they risk missing an important opportunity.We are on the verge of an oil-production crunch—in which the growth in the global demand for oil will outpace supply. This is expected to occur, if present trends continue, after 2012.

Brazil: biofuels threaten food production only in U.S.

NEW YORK (Reuters) - Brazil's finance minister rejected on Monday the idea that the production of biofuels is driving higher the price of food globally, saying that this is a problem restricted to the United States."It endangers (food production) here in the United States, but not in Brazil, not in African countries, not in Latin American countries, which have enough land to produce both" food and biofuels, Guido Mantega told journalists in New York.

National Expert Touts Fuel Alternatives

While prices at the pump keep rising, some say it's time to look for alternatives.National expert and author, Richard Heinberg, visited Vermont to talk to lawmakers. He thinks we're close to peak oil, which is the point when the rate of oil production will start to decline. He told Vermont leaders that they should look at cutting back on driving and buying local food to avoid the fuel it takes to truck it across the country. He also suggested helping people better insulate their homes so they're using less home heating oil.

Buying Our Way to a Better Planet?

There is a debate, subdued at times, between various approaches toward changing the planet to the better. In many ways, my viewpoint (on the optimist side) tends toward the 'enviro-capitalist', thinking that we can work to structure the economy to make the right choice, the easy (and preferred) choice. There is a challenge between using financial mechanisms as a tool to move toward a A Prosperous, Climate-Friendly Society and going overboard.

Energy Independence Isn't Very Green

THERE'S BROAD AGREEMENT that America should reduce its dependence on imported oil, but far less agreement on why. Are we combating global warming, or are we distancing ourselves from hostile and unstable regimes? The popular reply is that it hardly matters - we need to do both and the goals reinforce each other. But these two national energy goals are not only different but frequently in conflict, and effective policy will not be forged until those conflicts are addressed.

Top scientist objects to coal-based power plant

Dr. James Hansen has asked Gov. Tim Pawlenty to quash the plant, citing the governor's work to reduce greenhouse gases. But Pawlenty hasn't reached for the "off" switch yet.

There's more to $120 oil than speculation

So there we were, dancing on the doorstep of $120 this week.When we last discussed oil prices in this space, crude was crossing the $100-a-barrel milestone. That was less than four months ago.

Crude futures barreled through that threshold and have kept climbing, which wasn't supposed to happen. Our mounting economic downturn was supposed to curtail demand and drive prices down.

Our demand is falling — the International Energy Agency predicts U.S. oil consumption will slip by 2 percent this year — but the markets don't seem to have noticed.

It's as if our recession is meaningless.

"All the conventional wisdom about oil markets is wrong," said Jeffrey Brown, an independent geologist in Dallas who studies energy market data.

T. Boone Pickens Predicts $125/Barrel Oil

"My IQ is the gas price. At $3 I'm a genius. At $1.50 I'm a moron. Don't talk to me too fast; it's at $1.53 today."T. Boone Pickens, 1999 from his online biography.

Here's the headline: T. Boone Pickens thinks oil prices are still going up. So who the heck is this guy and why should you care?

A rebounding dollar started to take the steam out of crude prices, until another militant attack in Nigeria spooked oil markets Friday, reports AP. Is crude set to go higher with more disruptions? About 700,000 barrels per day could be taken offline if British unions strike and disrupt North Sea refineries, reports the WSJ (sub reqd.)Does that count as a severe disruption, though? That’s the White House criterion for releasing oil from the Strategic Petroleum Reserve, now 97% full, while Democrats call for the government to ease prices with a timely release of crude, also in the WSJ (sub reqd.) Higher energy costs, from heating oil to gasoline, to electricity are hammering households, reports the NYT: Federal aid for energy bills is at its highest level in 16 years.

Oil Prices will stop rising, but until then

Oil prices are breaking new records and it seems like not going to cool down soon. In energy business, the predictions are doomed to get falsified. Short terms blink some hint, but in the long run it is full of surprises. This is the magnet of this business. And we are not sure when the prices will slow down. But panicking makes everything worse.

Carolyn Baker: Peak Civilization And The Winter Of Our Disconnect

For countless Americans across the nation, this winter has brought with it something far more distressing than brutal, bone-chilling temperatures-horrific, traumatic revelations that the American dream, neatly packaged and sold for decades, has become their worst possible nightmare. Should they happen to see on TV the guy from the Countrywide commercial greeting them with "Homeowners...", they are probably wondering why he hasn't been assassinated and at the very least wondering why Countrywide is still in business.

Kunstler's book details many factors of the ongoing global oil crisis we now face, which will, Kunstler says, lead to the inevitable destruction of American society and way of life. When this happens, Kunstler also alludes to the dwindling of globalism and the inability of suburban life forms to exist.I really didn't want to listen. I want my American dream. I want my white-picket fence, a big backyard where the kids can play and the dog can run free while I watch from the house with my loving husband. I want my big, fat paycheck to buy expensive, fancy furniture. I want to entertain guests with my fancy china. I want to take jet planes all around the world where I can lay in pristine sands of paradise beaches. And, I want my big, fancy cars so I can drive into town when I need some groceries or want to spend a day at the spa - that is, of course, how all Americans dreams turn out, right?

UK: Dithering governments blamed for biofuel tanker shortage

Britain is facing a big shortage of ships for carrying biofuels unless politicians give clear guidelines about the future of renewable fuels, a leading maritime organisation warned last night.The comments from Lloyd's Register that the world fleet might be "unable to cope" unless an extra 400 suitable vessels - 20% of the present fleet - were constructed, came after energy minister Malcolm Wicks questioned the use of biofuels at a time of rising food prices.

The Peak Oil Crisis: The Case for 2008

It is conventional wisdom for most of the people following the peak oil story that we still have a few years to go before the real troubles begin. Some say 2011, others 2015 or later, but in general, among those calculating the depletion vs. new supply balance most have been talking about troubles starting in years rather than months.Let’s ponder for a second the meaning of “peak oil.” Ever since the concept was invented some 50 years ago, peak oil has meant the point in time when world oil production increases to a level that never again will be reached. For most of us, however, peak oil will not be a point on a government chart, but will be the day when we drive up to a gas station and find the tanks empty, restrictions on how much we can buy, or more likely a price that makes us realize our lifestyles are going to change. We can no longer afford to use our cars in the manner that we have been doing all our lives.

In recent weeks there have been developments suggesting that the troubles associated with peak oil may be coming faster than many realize.

Peak oil's a chimera. Dumb policies are the real problem

Fossil fuels are finite by definition. Eventually, since a growing global population will consume more energy, we'll run out of oil.Some time after the world's oil reserves are depleted, what little food hasn't been contaminated with Bisphenol A will be gone.

Climate change will have rendered the earth uninhabitable, and WE'RE ALL GONNA DIE!

The environmental movement has become a death cult seduced by the fantasy of the coming Apocalypse.

Avoiding a 'Soylent Green' Future

Here is something to keep in mind concerning the sudden Soylent Green hysteria about rising food prices: Resources are limited only by the imagination and creativity of people operating in a free marketplace. Peak oil? Maybe. Peak energy? No way. Likewise, I don't think that McDonald's selling vat-grown burgers and algae fries is in our future.

Is B.C. ready for peak-oil refugees?

When Kitsilano-based strategic planner, architect, and peak-oil proponent Richard Balfour talks about environmental refugees, he mentions his own speculation that “20 to 30 million people” could be living in the Georgia Basin in the next 15 to 20 years.“They come in three waves,” Balfour told the Georgia Straight in an interview at his home. “The first is the one that is already happening, where people with money think they are going to find refuge up here. So they are buying up the coast of B.C. and the farmland of the Interior. The second wave is the middle class thinking they are going to move up to have a better place for their family, and that has started. And then starts the true wave, where you have the refugees arriving with nothing. How do you stop them?”

Some Aspects of the Future Supply of Middle Eastern Oil

In a recent edition of his ‘blog’, one of the authors of Freakonomics (2005) – Stephen Levitt – made a few comments about his short stay in the United Arab Emirates [UAE] state of Dubai. As most viewers of CNN are aware, luxury is the order of the day in that lucky nation, however in mulling over the details of this condition, Professor Levitt failed to emphasize the key economic element behind Dubai’s rise from a fishing village to a middle eastern version of Monaco. The ingredient to which I am referring is systematic diversification, which in this case means that emphasis is unambiguously put on the conservation rather than the production/export of crude oil – where crude oil is oil as it is found underground, i.e. unprocessed. This approach means that less than 10% of Dubai’s GNP is now directly attributable to oil, and as trade and the provision of services increases, measures may be taken reduce the output of crude even further.

Saudi Output Growth Can Help Forestall Peak Oil, Bernstein Says

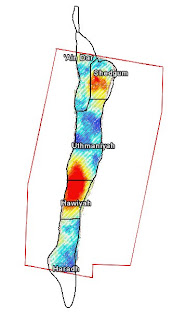

"Saudi and global oil production has the potential to grow slowly going forward," the authors wrote. "We do not believe world oil production supply is peaking today."Proponents of peak-oil, the theory that global production has or is about to reach its zenith, say booming demand and dwindling supply are responsible for the rising price of oil. Analysts debate the extent and timing of a drop in crude production in Saudi Arabia, the world's biggest oil exporter. Some argue Saudi Arabian Oil Co., known as Saudi Aramco, is downplaying reservoir declines and that the country may be forced to reduce output.

Sanford Bernstein commissioned a survey by GeoVille Information Systems to use satellites to monitor drilling at Ghawar, Saudi Arabia's biggest oil field. The analysis ``concludes that the Saudi peak oil production conspiracy theories, based on little or incomplete current field data, do not fit with our findings.''

OPEC oil output to dip in April - Petrologistics

LONDON (Reuters) - OPEC oil supply in April is expected to slip by 100,000 barrels per day (bpd) from March, led by lower supply from Iraq, Iran and Nigeria, an industry consultant said on Friday.All 13 members of the Organization of the Petroleum Exporting Countries are set to pump 32.5 million bpd this month compared with a revised 32.6 million bpd in March, Conrad Gerber of tanker tracker Petrologistics, told Reuters.

High oil prices put focus on Strategic Petroleum Reserve

New York - Uncle Sam is adding 60,000 barrels of oil a day to giant underground caverns in Texas and Louisiana to be used for the proverbial "rainy day."Is it raining yet?

UK: Petrol crisis looming as fuel fears grow

Britain could be on the brink of a petrol shortage as work begins to close a pipeline that delivers 30% of the UK's oil.It's feared a two-day strike at the Grangemouth refinery could spark panic buys at petrol stations.

Record oil price to boost oil majors' profits

LONDON (Reuters) - Exxon Mobil, Royal Dutch Shell and BP are expected to report bumper first-quarter profits next week, thanks to record crude prices, but $110 per barrel oil will also squeeze refining profits and delay a return to oil production growth.

Strike shuts 200,000 bpd of Exxon Nigeria oil - source

LAGOS (Reuters) - A strike by workers at Exxon Mobil in Nigeria has forced the company to shut down some 200,000 barrels of crude oil output, a senior union official said on Friday.

Oil pipeline bombing reported in Nigeria

LAGOS, Nigeria - Militants say they have sabotaged an oil pipeline in Nigeria's south.The Movement for the Emancipation of the Niger Delta says its fighters hit a pipeline late Thursday in southern Rivers State.

That brings to four the number of pipelines the militant group claims to have blown up in the past week.

European airlines face squeeze on profit

The American airline industry lost $1.5 billion (£760 million) in the first three months of the year and fears are growing that European carriers will be the next to feel the pain.High oil prices have caused enormous losses among airlines in the United States, forcing them to seek bankruptcy protection, cut capacity and look for mergers.

Britain faces industrial unrest as unions threaten strikes

Britain faces a wave of industrial unrest this summer as unions, emboldened by Gordon Brown’s climbdown after the 10p tax revolt, ballot millions of members on strike action.Workers in local government, the health service, the Civil Service, the Royal Mail and even the Sellafield nuclear site could join teachers in an escalating confrontation with the Government over pay.

...Mark Serwotka, of PCS, the Civil Service union, said: “The 10p tax U-turn has shown that the Government can change its mind and it needs to change its mind on public sector pay. People on the minimum wage are facing rising fuel, mortgage and food costs and are being expected to take a pay cut in real terms. The Government has to act quickly to stem unrest.”

BMI reveals approaches from ailing airlines

Several airlines struggling to cope with the record oil price have approached BMI to sound out whether the carrier would be interested in buying them."They have already started coming to us," said the chairman Sir Michael Bishop after a speech in which he predicted the slowing economy and the record price of fuel was leading to a clear division of airlines into the "haves and have-nots." Those able to withstand the difficult conditions – five airlines have folded in recent weeks – would be determined largely by their fuel hedging positions. BMI, he said, has hedged 75 per cent of its fuel for this year.

Natural-gas vehicles hot in Utah, where the fuel is cheap

SALT LAKE CITY - Troy Anderson was at the gas pump and couldn't have been happier, filling up at a rate of $5 per tank.Anderson was paying 63.8 cents per gallon equivalent for compressed natural gas, making Utah a hot market for vehicles that run on the fuel.

It's the country's cheapest rate for compressed gas, according to the Natural Gas Vehicle Coalition, and far less than the $3.56 national average price for a gallon of gasoline.

Global warming fix could damage ozone layer

A climate "fix" to curb global warming would have a serious side effect, damaging the Earth's protective ozone shield.

Environment groups target Senate races on climate

WASHINGTON (Reuters) - U.S. environmental groups joined forces on Thursday to target Senate candidates in Colorado, New Hampshire and New Mexico, aiming to elect a 60-vote majority to deal with global warming.Environmental measures have failed to clear Congress by "a handful of votes in the Senate" in recent years, the groups' leaders said, noting the legislation to fight climate change is set for debate by the full Senate this year.

the oil drum was linked in the bakken shale blog yesterday. let the bakken bickering begin.............

Now that should be interesting. If it's the blog I cited the other day, I'd like to see some support for their numbers. Do you have a link?

One other OT point -- the reason I'm an independent is I don't want to be blamed for any one political party's obvious stupidity.

Currently, I'm getting a little annoyed about Democrats harping about the SPR (stop filling it, release oil...). In my opinion, this equates to lighting the extra four boilers on the Titanic. It removes/reduces our ability to respond in the event of a real emergency. Having a marginal effect on oil prices now = getting to New York in record time. When it becomes plain for all to see that we're heading into the teeth of peak oil, we'll want every last drop in that reserve.

Where I rail against Republicans is their stupidity when it comes to alternative energy. They only think with the oil half of their brain. But when thinking with that half, they can be pretty darn smart.

here is the link to the bakken shale blog :

http://bakkenshale.blogspot.com/search?updated-min=2008-01-01T00%3A00%3A...

(top link http://www.bloomberg.com/apps/news?pid=20601072&sid=afwStwp54V7o&refer=e... )

The verb Forestall means :

To prohibit from occurring by advance planning or action: avert, forfend, obviate, preclude, prevent, rule out, stave off, ward (off) ... according to answers.com

Is this the silliest point in time? Where people are allowed to say the maximum of stupid things....

Impossibilities are approved and printed with Fat Types in MSM, never double checked.. just swollowed and accepted!

The 2 things that amazed me about the Bloomberg article:

1. They mention peak-oil outright and give its simplified definition.

2. They don't 100% trash peak-oil researchers.

The last line is actually a big statement on a major financial web site.

If Russian production is declining as well, will KSA's "slower growth pace" really help out the world situation.

Step by step...MSM is facing up to some hard, cold facts.

Obviously there is a “silent approval of PO taking place/imminent”, since they state that it (PO) can be Forestalled! Why forestall anything that doesn’t exist nor will happen …?

Also strange from within that article :

Right now WTI is at 118 $ ....and it is early 2008.

Your post Paal caught my eye. 114 by 2015, yet right now in 08 its 118?! Really makes you wonder if these guys worked on this article in a mountain hideaway and then published it before watching the revolving ticker on CNBC to see what oil is actually trading at. Either that, or they work for CERA.

Exactly. I think it would be unrealistic for any of us here to expect the MSM to suddenly have a sea change of opinion and embrace peak oil. Nevertheless, they ARE mentioning it, AND not immediately dismissing it as some sort of nutbar conspiracy theory.

As the term becomes more prevalent in the media I think more inquiring minds will come across it, look into it, and take it seriously (this includes other journalists).

The process is maddeningly slow, but look how long it took AGW to be taken seriously... granted, peak oil theory may be older, but it was in the face of ever-increasing production or deliberate supply shut-ins whereas AGW was slow on the uptake in spite of increasing temps and emissions.

Besides, if the MSM 'got it' who would we make fun of?

What has been quietly accepted (without mentioning it) is that Peak $40 oil has passed. Suncorp said the other day they need a floor of 75-80, none of the proposed non-conventional work at $40. Realistically, you cannot compare "oil" extracted or derived in the future at a cost of e.g. $400 a barrel to today's oil.

It's a process of "Handling the Internalization" of the message.

They cannot come right out and say anything.

How J6P receives the amalgamation of soundbytes and internalizes them IS the task at hand.

It's not so much handling the message as handling the internalization of the message.

Watch how topics come up, watch the EXACT wording used by Expert from the xyz Foundation. (fill xyz in with your fav. Like AEI or Heritage, or or)

In my book, any time peak oil gets mentioned anywhere, no matter how it's framed, is another chance that someone ignorant of the subject may copy and paste the term into Google and eventually find their way here.

I would prefer peak oil be mentioned in a more fair context, but still. I believe MSM has avoided using "peak oil" in lieu of euphamisms for over two years now in order to cloud the topic in the public's mind. Searching for the goldmine of information gets much easier when you know the correct terms upon which to search.

bernstien apparently bases his conclusion on the claim that there is no subsidense above ghawar. what an unmitigated crock of s***. the pressure in ghawar is being maintained with water injection, there would be no subsidense.

Furthermore, the oil at Ghawar is >6000 feet underground, overlain by and encased in rock. Why would the ground subside, with or without water injection? It's absurd to say the least.

Perhaps the Bernstein analyst, the much discredited Neil McMahon, thinks that oil fields are big underground caverns or somesuch.

Last thing I remember from this guy, he was saying that oil prices were going back to $35 - this was when they were at about $60. Worse than Yergin..... 'nuff said.

the pore volume of all reservoir rock is compressible. in the range of 4 x 10^-6 vol/vol/psi. in the case of unconsolidated rock, the compressibility is much greater. as the pore pressure is reduced, the pore volume compresses. in some cases, this can result in subsidense at the surface.

the removal of 60Gb (or about 84 gb of reservoir volume) from a reservoir at 7500' depth could result in subsidense, depending on the compressibility and flexibility of the overlying strata. the reservoir pressure in ghawar has been maintained by water injection for most of the reservoir life, so recent subsidense is a non issue.

hypothetically, i dont think we have enough data on ghawar to say if subsidense would or would not have occured, had the pressure been allowed to deplete.

Its not uncommon for subsidense to happen. Long Beach CA comes to mind as and example you have have many others from both mining and oil and gas. The indonesian mud volcano is probably the best example. But what does this have to do with oil outside of the fact it can happen if you withdraw the fluid. Its very common in water wells but I can't think of a worse way to measure reserve levels.

Throwing a abacus down the stairs works better.

there are examples of subsidense in some faily deep north sea fields. maybe euan means could shed some light on this, if he's around.

i dont think bernstien is trying to claim that their analysis is able to determine flow rate:

"Rapidly depleting reservoirs tend to collapse slowly in small ``micro-earthquakes'' if oil and gas are extracted"

i believe that statement implies that "rapid depletion" is not occuring. and he is correct in a sense, pressure depletion is not occuring.

Ekofisk has undergone subsidence in the Norwegian CS.

"Ekofisk has undergone subsidence in the Norwegian CS."

apparently ekofisk is a different animal (not related to compressional subsidense).

i found this on wiki:

"Detailed geological investigation showed that it was the result of delayed compactional diagenesis of the Chalk Formation reservoir rocks. As hydrocarbons were produced and replaced with water"

yeah I know.

Different beast altogether.

Compaction is going on in the north sea and the North Sea southern basin is subsiding anyway (eg Essex and Holland ) Just as Scandinavia and Northern Scotland are rising due to isostatic readjustment.

The Ghawar satellite story is just nonsense

I'm very foggy on this point. To the extent that brine displaces oil, wouldn't subsidence only be associated the pore compression due to the pressure differential between "normal" reservoir pressures [more or less the pressure of a standing column of brine to formation depth] and whatever additional pressures might be present due to gas in solution?

Ekofisk has a water column (north Sea)

And then a few thousand feet of uncompacted claystones that are fairly recent and results of rapid deposition and undergoing de-watering and are therefore prone to continued compaction and loss of volume These ultimately follow a normal compaction trend , though overpressure was a problem , but near surface are uncompacted.

Add the weight of a few thousand tons of platform(s) on top of this.

Ekofisk reservoir is a soft chalk. I believe the entire column is still undergoing diagenesis and prone to compaction. Then extract the oil at virgin formation pressure from the chalk. Quickly...

But, it is not Ghawar and the subsidence (or lack of) is not an issue at Ghawar.

Someone up top suggested that many seem to believe that oil is found in giant underground pools. It is true that many people do seem to think this and I have heard this myself.

This article is not worth anymore time from any here except to say it is doo-doo.

Just how is a satellite going to determine limited subsidence, unless we are talking a very detailed SAR radar (something Geoville don't mention in their website service list)?

I have to wonder if someone might have been repurposing JoulesBurn's work - but they couldn't be that crass, could they?

I don't know if they like my work or not, but I am definitely a fan of their brand of comedy:

Satellite Sleuthing Gone Bad

Can't wait to read Abqaiq and Eat It Too.

I can't either. Oh wait...

ASTER elevation data is no better than +/- 12.5m at best (according to a NASA doc). So there is zero percentage chance that they could be estimating reservoir collapse using it.

I'd also suggest that from the diagram,

if that's what they have produced, would call their work even further into question. The red looks to be gas, so ignoring that they actually suggest no drilling in most of Ghawar. Hardly something to base a "everything's fine" on, particularly since Aramco have already stated loads of infill drilling.

Do people actually pay for work of this standard?

They alluded to the current "research" on satellite-based interferometry in their previous performance. It seemed ridiculous at the time because, as others have pointed out, Ghawar is kept under pressure -- but I didn't comment on the idea because I didn't want to discourage them from actually going forward with it. Sort of like knowing that someone is going to slip on a banana peel.

I don't know where they got their data from (not ASTER), but SAR can resolve small changes.

SAR can't do miracles, even UWB with a wide aperture, particularly from orbit with all the effects that can produce. That goes double when the region you're talking about is covered by shifting sand dunes.

Frankly I'd have to say the whole thing doesn't pass the sniff test.

"Do people actually pay for work of this standard?"

All the time when they want a particular answer.

Hang on a minute....

Is that all they have? Satellite data?

Ghawar is a grain supported carbonate reservior with water injection to maintain formation pressure with a relatively light overburden cover and on land.

Interestingly, the article states "Rapidly depleting reservoirs tend to collapse slowly in small ``micro-earthquakes'' if oil and gas are extracted too rapidly for water or other substances to fill the gaps, McMahon told Bloomberg News in December" while they keep up pressure by waterinjection.

And it concludes by asserting "The field may be showing signs of ``mild production decline rates at worst.'' "

Which is still a decline off course

Actually if they are blowing down the gas caps on ghawar right now then we should

have some decent seismic data from the area. I'm guessing that gas cap blowdown probably generates a lot more seismic activity then water driven oil extraction.

http://www.sciencedirect.com/science?_ob=ArticleURL&_udi=B6V9Y-4FR8PT6-2...

And

I found this

http://www.sciencedirect.com/science?_ob=ArticleURL&_udi=B6V7P-3VB9B6V-1...

Plus KSA has a seismic array did not find the data.

However the second paper is interesting since it seems to identify the source rock for Ghawar I have not seen anyone calculate how large a reserve could be based on the size of the source rock formation. However given KSA's wild claim it might be interesting to bound them based on the size of the original source rock deposits.

Would blowing down the gas cap manifest itself as a measurable P-Wave or the like?

Dunno myself but it seems to me that it could be big enough to show up on seismic. Considering your basically not replacing the gas with anything else.

I'd assume that its a good contender.

http://www.ig.utexas.edu/research/projects/eq/faq/tx.htm

http://www.nature.com/nature/journal/v257/n5528/abs/257661a0.html

Blowing down the gas cap on a field the size of Ghawar's gotta have some effect.

Even more telling is the straw man: their study "concludes that the Saudi peak oil production conspiracy theories, based on little or incomplete current field data, do not fit with our findings." I am not sure what conspiracy theory they are referring to, since a conspiracy usually involves more than one person and an agreement to commit a bad act. They certainly cannot be referring to Matthew Simmons, since his arguments are made by himself, for good purposes, and on a significant amount of data. Jeepers, for the money these guys make, they should be able to write better than that and knock down a better argument than that-- unless the data they do have is so compelling that this is the only type of argument that they can refute. The rest of our arguments, eh, they won't consider just now. So, carry on, BAU, oil prices have reached their limits, go back to your credit cards and ARM's and SUV's.

anybody who has been reading tod would recognize this scam. but bernstiens claim has enough plausibility to sound authoritative. i think another term for this is goblygook.

and as i have heard many times: if you cant dazzle them with brilliance, baffle them with bullshit.

The eternal skeptics' question: "Who profits? Who pays?"

Perhaps peak oil denial is just a conspiracy to increase the price of oil without inducing general panic.

Perhaps peak oil theory is just a conspiracy to stampede the masses into paying more for oil.

Perhaps we are entering a new and dangerous phase of civilization, and no one, least of all the leaders, know what to do.

the underlying reality will be clear soon enough.

I am beginning to wonder what good it does me to watch the asteroid approach the earth. Who will listen to Chicken Little -- if the sky is indeed falling, no one can push it back up. Reading the Oil Drum (and now, the Automatic Earth) has a sort of morbid fascination for me -- and I justify my sick obsession by convincing myself I am learning some things that will help me survive the coming tectonic shifts.

Start watching Japan:

The net loss of 153.9 billion yen ($1.5 billion) in the three months ended March 31 compared with profit of 33.1 billion yen a year earlier, the Tokyo-based firm said in a statement today. The loss was 15 times larger than the most pessimistic estimate among six analysts surveyed by Bloomberg. Nomura fell 5 percent to 1582.21 yen in German trading after the announcement.

Nomura joined rivals including Merrill Lynch & Co. in reducing the value of bond-insurance contracts after a slump in subprime-infected mortgage securities triggered more than $300 billion in losses and writedowns worldwide. Chief Executive Officer Kenichi Watanabe, reporting earnings for the first time, must also contend with a 27 percent drop in investment banking fees and an insider trading scandal.

``It's clear they haven't managed to boost their main businesses to cover the losses, and that's problematic,'' said Yoshihisa Okamoto, a fund manager at Mizuho Asset Management Co. in Tokyo, which oversees the equivalent of $26 billion."

This story's being covered up.

Bloomberg.com: Japan

Nomura Posts Record Loss on Bond-Insurance Provisions (Update5) ... More News. Government Bonds Fall Most in Nine Years, Sparking Halt in Futures Trading ...

www.bloomberg.com/apps/news?pid=20601101&sid=aC2ilbTGV2Bw&refer=japan - 4 hours ago - Similar pages

But there's nothing in the story about that last sentence.

NeverLNG writes: "Reading the Oil Drum (and now, the Automatic Earth) has a sort of morbid fascination for me -- and I justify my sick obsession by convincing myself I am learning some things that will help me survive the coming tectonic shifts."

I have a similar fascination. I think I'm watching a slow motion train wreck from several cars back from the engine and I just can't take my eyes from the scene. In my minds eye the trains are going too fast to jump off. Several do and most don't live beyond the jump. I can see the other train with dozens of rail cars similar to mine just around a long, long curve. I hope a TV commercial break doesn't cut in. This is gonna be sumptin'.

No worries about the commercial break, since you are actually on the train.

Be hard to deplete reservoir pressure below virgin with no pumps, huh Elwood.

Flowing wells.

Unbelievable waste of time and money.

FF

"Unbelievable waste of time and money."

agreed, the bernstien article is a waste of time. but many ignoranties(new word) wont know the difference and buy it.

you mean

Ignoratii

as in

Literatii

or

Gliteratii

ignoratii or ignorantii,

couldnt find either on dictonary.com

They are not in any dictionary.

They are colloquial terms for the great and good (writers , artises, politicians, celebraties and and other gang leaders in London)

"concludes that the Saudi peak oil production conspiracy theories, based on little or incomplete current field data, do not fit with our findings."

AND

they should be able to write better than that

They CAN, but that's NOT the job at hand.

See my post above about what their "Task" is with giving the news.

Same link:

How on earth did Saudi oil production get to be a conspiracy theory. Sure Saudi is very secretive about their production but that is just their nature. They were very secretive from day one, from even before there was oil found in Saudi Arabia. Saudi, and every other Mid East OPEC nation is behaving exactly as they have always behaved, very secretive and always denying that there are any real production problems.

But saying it is a conspiracy theory makes it sound a little kooky. It makes it sound if the idea that Saudi is peaking is a theory of a bunch of wingnuts and to be taken with a grain of salt. But geology cannot be a conspiracy theory. Facts of geology can be denied, the creationists are doing that today, but that does not make it a conspiracy theory. It just means those doing the denying are either really dumb or a really big liar.

Ron Patterson

As I have previously noted, Peter Huber--who believes that the sum of the output of a group of depleting energy sources will show an infinite rate of increase--is considered mainstream, while people who believe that a finite world has finite limits are considered akin to space alien cultists.

I don't know how you figured it out, but as a space alien I really resent being called a cultist!

That, of course, is essentially a religious position -- unassailable, because data doesn't matter. The Earth is the center of the Universe because God made it that way.

Schools nowadays teach only adherence to received wisdom -- critical thinking is anathema.

Can anyone doubt that we are headed back into a medieval theocracy?

.

Does data matter with this claim? This is just as goofy a misstatement as the ones in the article you refer to. I know for a fact that one teacher teaches critical thinking, and that would be me. I do this pretty much every day in my 9th grade English classes.

I can't believe I'm alone. In fact I know that I'm not.

Well said and well done, Bosuncookie.

Wayback when, with the exception of an exceptional physics teacher, most of the critical skills I learned in school could be attributed to English teachers.

My daughter's grade 12 philosophy teacher showed his class a battery powered electric drill of several years vintage and his grandfather's manual drill just the other day. He described his unsuccessful attempt to replace his worn out batteries for the electric unit and described out he completed his home project with his grand-dad's hand drill.

He was teaching them about durability, sustainable systems and resilience, as well as waste. He led the class to consider the vulnerability of technically complex systems, and so on. He is a wonderful teacher, showing and directing his students to films and books dealing with peak oil, among many related subjects. Of course, they are also become familiar with the great philosophers, but most importantly they are learning how to frame questions.

There are a lot of goofy misstatements on TOD. Some of the most silly claim that the liberal arts and humanities are useless luxeries, or close to it. To prepare for a post-peak world, it is opined, young people had better concentrate on 'practical' matters.

There is nothing more practical than learning how to think clearly, critically and imaginatively.

Thanks. I'm just as big a critic of our educational system as the next person; in fact, I chafe under many of the maddening contradictions inherent in my school and my district. So often we seem to be doing the opposite of what we're supposed to be doing...

Having said that, many people toil mightily in the trenches every day working against the myopia of No Child Left Behind and a world gone mad with standardized testing.

Sometimes the sweeping generalizatons get tiresome. In a nation projected to have 3.46 million teachers this year, surely there are a few teaching critical thinking!

Link: http://www.ericdigests.org/2000-3/demand.htm

I have nothing but contempt for the public education system. My granddaughter was struggling badly and her teachers and the system itself fought against us getting any additional help to her. We moved her into a private religious school and she is doing wonderfully there. My wife and daughter spend several hours each evening working with her but they did that when she was in public school too so that is not the difference. The difference is a teacher and school system that was open to customizing the child's lesson plan to help her catch up without being a constant failure.

Are there good teachers in the public school system? Certainly! But the system as currently structured is inherently flawed, focusing more on getting kids pushed through to the next grade and passing standardized tests than in actually teaching the children. Thus it IS fair to criticize the system generically. The fact that there are a few good apples in the bunch doesn't change the fact that the entire basket of apples is mostly rotten.

As the son of a professor and a public school teacher, I always wanted my children to go through the public school system. And in fact my kids did have a couple of VERY good teachers there - but this was not enough to make up for a public school system that has hopelessly failed, finished off by no child left behind and the glut of children with learning disabilities from over-vaccination and dietary problems. Now my children are enrolled in wonderful private schools where they are learning critical thinking skills - but paying for this is a major burden. I will be taking my soon-to-be-worthless 401k money and spending it on education.

In a real sense it was destroyed by money. The NCLB program is designed to pull money out of the school system to the benefit of the testing companies (i.e. Neil Bush, etc.), and once test scores were tied to funding there was no hope for it. Similarly, the initially well intentioned vaccination programs long ago became big business, and the primary motivation is now profit, with disastrous results.

Money destroys everything.

Money destroys everything.

My view: Man's greed (for money etc.) destroys everything.

Yes because all those people who created every damn thing ever created by people were not looking for a profit.

There is nothing wrong with profit gained from creating something. The problem is when most things are created just for (or mainly for) the profit. That's when quality suffers and people justify doing questionable things. Hence our corporate society of mass produced rubbish. Hell, even a guy in his garage can build a better racing motorcycle than multi-million dollar companies (Britten). Passion and drive often produce far superior results than pure profit seeking.

http://nz.youtube.com/watch?v=5HhGQJ2hn8Y

I'm not a Christian, but Timothy 6:10 comes to mind. Often misquoted as "Money is the root of all evil", it is "For the love of money is the root of all evil..."

Yes, I know there are teachers out there busting their buns to teach critical thinking -- my brother-in-law taught 9th grade history for decades, and he was awesome. But it was always an uphill struggle, and in recent years, there was more discouragement than encouragement from the administration and the parents. He is very thankful to be retired and teaches only part time as a sub.

My hat is off to those who are out there doing the work, but in general, although my comment included no data, it must be true that The Oil Drum would be mainstream if the average person thought rationally. It isn't -- it is relegated to kookdom -- because the average person in this culture thinks magically.

Uh, you've hit one of my buttons: claiming the majority of people aren't "rational" when, IMO, they are generally uncurious about the world, of short attention span and prone to excessive regard for their own conclusions. (Yep, there's a potential self-applicability of that final one :-) ) People are generally rational in the areas that interest them (even if it's only figuring out which brand of TV dinner to buy). Part of the difficulty is that curiousity is in undesirable in its own right until you're a functioning adult, yet to get it in adults parents and teachers have got to deal with curious children, who are always more work than nice children who do exactly what you want them to do without any surprises.

Regarding the excessive regard for things you've worked out yourself, I suspect that's inherent human nature and you're only disabused when the physical world doesn't respond in line with your pet theory. There's a Feynman quote from the Challenger disaster that I really like: "For a successful technology, reality must take precedence over public relations, for nature cannot be fooled." To understand it the background is that NASA engineers responsible for the O-rings had written reports giving arguments why the O-rings would work acceptably in low temperature conditions and had given a good presentation that convinced those higher up the management hierarchy. They'd "won" the debate, but the winning the debate without being right doesn't matter.

I'd be inclined to say that the average person doesn't think about oil magically because they don't think about it at all, and to the extent that oil signals impinge on their lives, up until the last year or so there hasn't been one that's signaled "something's wrong".

That's because it calls for an act known as "criticizing".

And criticizing is unpatriotic.

Vespucciland, love it or leave it.

yes Ron, that article is one of the more interesting ones. It had a little "of everything" ..

and thus it concludes my question : Is this the silliest point in time? Answer; YES indeed it is !

The establishment is tossed between their "ultimate hope n’ wishes/BAU" and "the crude reality", this is spawning heaps of silly-talk and a good portion of cognitive dissonance. This result is given “by default”

The Geoville page on Saudi analysis: Spatial monitoring of surface movements and oil production facilities | Applications and Projects | Geoville.com May be of interest.

There's a PDF on that page but it seems to be merely a synopsis in German.

Thank you for finding this.

looks like a consultant looking for work(and promising stuff that cant be delivered). but anyhow what does the pdf say aus duetche ?

If you are curious, you can copy the text of the pdf and put it in Babelfish or some other translator. It's always a rather amusing rendition, but it's better than my German. Nothing new in the pdf, but it is obvious that GeoVista does not understand oil fields and see this as a new opportunity.

"the Saudi peak oil production conspiracy theories" "do not fit with our findings"

As Jeffrey Brown would quote, "Who ya gonna believe? Me or your lying eyes?"

I wonder how Matt Simmons feels about being reduced to a theoretical conspirator?

And I love the prediction of $114 per barrel by 2015. Bernstein is a real rocket scientist.

Saudi Total Liquids production was 11.1 mbpd in 2005. I estimate that if the Saudis wanted, and more importantly, were able, to match their 2005 net export rate, they would have to boost 2008 Total Liquids production to about 11.7 mbpd.

The Saudis and the energy analysts can issue all of the happy talk press releases that they want to, but the fact remains that the #1 net oil exporter has shown back to back annual declines in the volume of product actually delivered to the market, with 2007 showing an accelerating net export decline rate versus 2006.

We shall see what happens in 2008.

It is this production profile which yields the "slow growth" under discussion in the Sanford Bernstein article.

WestTexas the eagle has eaten the noodle I repeat the eagle has eaten the noodle.

Await your reply

Comrade 42

I am en-route to a secure undisclosed location. Will reply later.

Will you share the venison?

http://thequailhunter.com/20061219/cheney-shooting-deer-at-own-home/

Tell the cute stewardess on Aloha Airlines I said hi :)

assuming "the eagle" means the us$, what is the noodle ? yen ? what does that mean?

tell us, tell us.

The the joke was 42. The rest did not mean anything.

To explain a bit more.

http://en.wikipedia.org/wiki/Answer_to_Life,_the_Universe,_and_Everything

Of course Douglas Adams has left this world a poorer place. But In my opinion his approach to life makes him the religious leader of peak oil if there is one. If you can't view life like he did then your not ready to ELP.

So if anything the conspiracy if there is one is to ELP enjoy life and recognize the fools in the rate race for what they are.

Don't panic.

Good luck. I heard Dick Cheney is a terrible roommate and NEVER lets you heat up nachos in the microwave.

Yep, a well-paid rocket scientist who knows on which side his toast is buttered.

Economy: 2 years of pain

I should show this article to my parents who continue to pour obscene amounts of money into a rental property they own at Mont Tremblant in spite of the rental market completely drying up thanks to high gas prices, high CA$, and people with no disposable income... tell me any of that's going to change any time soon?

They believe they can funnel rental income (currently HUGE loss) into lavish improvements thereby making it into a 'million-dollar vacation property' that they can sell for huge profit. The problem with this is that there's already a massive over-supply of vacant multi-million dollar vacation homes, but they believe that the glossy real estate rags teeming with these things are proof of high demand. Sadly, this is their retirement plan, and no matter how much I plead with them I can't get them to give up their pipe dream.

- The Progeny of Yerginites

They are going to suffer no doubt, so will thousands of others who spend 3-5 hours each weekend going to the cottage, and those in the small towns who rely on those cottagers for their livelyhood. Yep, we are going to see major changes, and soon. I fear it will be too late now for your parents. I'm kinda thankful my father died last fall, so he does not see all this come crashing down. It's my grandchildren I worry about the most. At least my kids understand and some of them are actively changing and preparing.

Your parents need to sell that house, take the loss, and do something more productive with their nest egg. The fact that they have such an undiversified retirement plan worries me. Tell them a really smart person urges them to sell ;)

I don't know if everyone caught the remarks made on CNBC during the interview with Jeff Rubin but peak oilist's were referred to as "PHOPHETS OF DOOM".. Until Mr Rubin corrected the interviewer..

Crude price forecasts are all over map

I can't help but respect this David Wyss character -- at least he admits that he has no idea what he's talking about. If only more economists were as wise as him...

Better get ready for $2.25 gas [Liter]

Gas prices in Mendocino Co, NorCal... super, $4.05-4.15; diesel $4.43-4.45.

There was a story on CNN this morning about a gas station in the middle of nowhere (in California somewhere) that charged over $6 a gallon. And the guy was losing money on the deal.

Turns out, there's a reason why he's the only gas station for miles around. There's no power in the area, so he has to run his gas station off a generator. He said he uses 100 gallons of diesel a day.

They also showed video of long lines of cars waiting to buy gas in New Jersey. People were trying to fill up before gas prices jumped 22 cents a gallon.

Early warning signs of a 1970's Deja Vu? Problem is that I don't foresee the Seventies ending this time.

free market economics ?

The Saudis turning on the tap.

"The Saudis turning on the tap..."

In the other direction.

Nigeria, Saudi, Russia, Forties, The North Sea, Mexico --

Seems we have one hell of a mess brewing on the supply side.

EV's with opera windows and fine Corinthian leather? Disco and polyester forever? Climate change and energy and food scarcity stuff, etc. are one thing, but there are limits to what I can accept.

It's ALL about the Stag, Baby!

(Click Here For Music)

Now, there's a candidate for solar!!!

wholesale...around 320 dollars a day. 320*365=$116,800 PER YEAR...ummm...he could start a fairly nice solar power plant for that kinda dough.

He is in California...sun shouldn't that much of a problem. Throw up a wind turbine for cloudy days and some battery backup.

Anyone in the area what to pitch the guy. Get your start in gas station renewable backups :P

Somebody needs to show this guy what a solar panel is...

Uh ? 100 gallons diesel a day = 100 * 12 * 3.6E6 = ~16e9 J day^-1

which is 185kW load averaged over 24 hours.

Solar at 10 hours a day to be generous = 450kW or @ $9 per watt ...

he'd better be selling finest Columbian pure to make a profit on that.

Another fine example of math gone bad. Where are you getting these numbers from?

If he has even a 5-6kw array going, he could preclude most of what he probably draws with diesel. If he has heavy pump or tool loads, the Gennie could kick in for peak times, or on demand.

Of course, if his $6 gas is still a loss-leader, there's surely no cash around after the diesel bill to put up for a PV system. But arguing that running Diesel gennies is cheaper than Solar is ridiculous.

Bob

what's wrong with the 'math' ?

100 gallons diesel the man says he uses.

1 gallon diesel is about 12kWh or 40MJ so he uses

100 * 3.7 * 12 * 3.6e6 = 16e9 J or is it not ?

16e9 / 86400 seconds in a day = 185000 watts or is it not ?

Since the sun doesn't shine at night, even in the States, I figured on 10 hours per day. So he needs a peak kWp of 24/10 * 185 or ~450kw or is it not ?

Roughly $8 a watt including batteries and inverter etc and ... what's the problem ?

I guess he doesn't use all his diesel for power generation but you can pick up gen sets of that size for the order of $20-30k.

I know I only have a physics major and no PhD but ...

Generators are only about 30-40% efficient while the solar PV cells are delivering straight electricity. So the first thing you need to do is reduce your total energy number to whatever is actually used by the station (in the form of pumps, lights, etc.) as opposed to what is consumed by the generators.

There's more you can correct but you can start there.

What's wrong is the meaning you're trying to attribute to your calculation.

besides a purely theory-based assumption of what his running electric demand might be- using the energy available from diesel fuel, since we have no information about his actual electrical draws, as the generator is going to be sized somewhere over his demand, and it has a conversion efficiency and waste heat to be discounted..

But clearly, at today's rates, he can be expected to be paying some (100gal * 365day 36,500* $4.00?/gal) $146,000/yr in diesel just for this electricity.. growing year after year, and assuming diesel is available. If we knew how many actual KWH he is able to glean from this fuel, we could compare the cost/watthr to solar, but beyond that, you still have to consider the much costlier implications of BOTH the diesel cost hikes and a supply emergency, which will make pretty much any investment into a renewable supplemental source a smart purchase.

Trying to second guess a solar installation cost for his (assumed) total electrical demand today is really an unhelpful comparison, which is why I didn't find the extrapolated numbers to be very useful. Designing a solar setup for this business would probably entail a system that provided some 60-80% of his current usage, if that much, and a parallel effort with the owner to economize on any waste and excessive draws in the system, as there will very likely be a number of them. Keep the gennie, but make your principal watts come off the panels, and the rest that you pay for in fuel will be an incentive to find more economies in your daily MO.

Bob

OK I see what you mean, I guess it's just a 1st order estimate but in the ballpark. The common theme is there's no energy dense substitute for diesel.

Thanks for your comments, guys.

Hellooo? It's a GAS STATION. There's an electric pump to run the gas pump, which runs maybe 1hr a day. There are some fluorescent lights. There might be a refrigerator. If he has a shop, he might use a few power tools intermittently.

He's not growing marijuana (I think).

Leanan that sounds to me like a place called Desert Center, out in the middle of nowhere on I-10. If I understand correctly that place runs off of locally generated power, and may well be charging $6 a gallon these days.

It used to be somewhat common when driving around some of the more sparsely populated parts of the US to sometimes come across gas stations with a sign reading "LAST GAS FOR X00 MILES"

We are probably going to start seeing such signs popping up again very soon now.

My bike has a range of about 180-190 miles on a fill, so I may be stopping and partaking of of expensive gas and maybe a yoo-hoo and a moon pie, at every chance.

Fleam - do not click the "post" button more than once. Clicking on it repeatedly will not make the server work any faster. Quite the opposite, actually. And you end up with multiple copies of the same post.

OK ..... peak internet here lol.

Gas prices Broome County, NY upstate 3.61 regular, Diesel 4.60 this morning.

Jeff Rubin might be holding back somewhat-he works for CIBC and they are definitely not in the doom business. Although he forecasts 2.25, his opinion might be far higher-a few months ago he issued a forecast saying the subprime mess would not be a big deal-at the time I am confident listeners pictured a gun being held to his head by his superiors on that one (CIBC has been burned badly).

$1.60 = €1.-

Gas here is €1.58 ~ $2.52 a liter.

Greetings from the land where 2/3 of the population lives below sealevel.

Dont worry,

All that bulky wooden furniture floats.

BTW: Do you guys still get tax relief on boats?

And when we are at $2.50 a liter where will yours be? €3.00 a liter? Yep.

By European standards, that's still almost peanuts. In Germany today the price of 1 liter hit €1.48.

€1.48 = $2.31

1 liter = 3.89 US gallons

3.89 * $2.31 = $8.99

So Germans are now paying $9 per gallon.

Why can't the government just do something about it?

I drove from Luxembourg to Trier and back today. Large cars still zooming past my modest little Citroen C1 at 160 km/hour. Same as in 2007, 2006, 2005 ....

On a light note, my wife and I have come to realize we have been talking about peak energy issues far too much when our 3 1/2 year old daughter asked, “Daddy, what is energy?” I tried to explain it was the power to do work and energy can come from “the sun, like solar power, from wind, from coal, and oil.” She jumped in excitedly, “and hot chocolate?!?”

Ah yes, Hot Chocolate Geothermal (HCG) shows great promise. A Wonka Industries pilot facility at the famous bubbling chocolate pits of Rotorua, New Zealand already provides enough power for 300 homes, and pipes hot milk to local houses where it is circulated through radiators for winter heating and early-morning heart-starters.

Sadly few other countries are blessed with such abundant and delicious resources. The treacle pits of Venezuela come a distant second.

My 3.5+ year old daughter also loves hot chocolate, and overhears far too much; it's amazing what they pick up from conversations.

Anyone who can't take a dip in oil prices should sell on the price rise due to the Ineos/Forties news today. There is probably (no guarantees) going to be a consolidation here, with the chance to buy in again at lower prices. It will probably be a shortish consolidation, but a lot is up in the air with the dollar that could lengthen the consolidation or make the lower end of it lower. So, it's impossible to know the future, but the risk/reward equation for owning oil isn't the greatest right now for short-term positions.

I agree with you that the supply disruptions probably arrested, at least for a while, a short term correction, but it is interesting that oil and the dollar are both rising today. Having said that, IMO the physical market, i.e., an accelerating net export decline rate, is driving the market.

Yeah, yeah, Westexas, I agree with you about the accelerating export decline rate, and I am long-term bullish on oil. I still see us hitting the $140s by the end of the year. I'm not selling long-term positions I bought to buy and hold. It also looks like the dollar will continue in this trading range and probably not break out on some big rally.

But look at what's happened to backwardation over the past couple of days. Speculators are essentially getting close to a buck to go long, up from 50 cents a couple of weeks ago, and 75 cents a few days ago.

It's risk/reward. The risk just got significantly higher short-term.

As well as Forties production hit there's also this

Exxon's Nigerian Unit Shuts in Production on Strike

Add in various pipeline attacks and it looks as if that's over 1.5MB/day of production shutoff this weekend worlwide. Both situations remaining unresolved. What would a lack of 1.5Mb/day due to strike action do to oil prices if say both lasted for a month?

Yeah, that certainly sounds bullish, and I love the action today. (Speaking as a trader, not a citizen.) I sold just over $119, but we may get a good set up to buy back in as early as next week.

But what's striking is that the commercial traders aren't buying on this news. Maybe they expect a big inventory add next Wednesday. Or maybe they expect a dollar rally to save them. Or maybe they're just in denial. Too soon to tell.

Conventional wisdom seems to be solidifying around the idea that the Fed isn't going to lower interest rates next week. There are some good reasons why the Fed shouldn't lower rates further, but I'm not sure the conventional wisdom takes those reasons into account. I think the CW has it that everything is right with the economy, so there is no need for further cuts. I have no idea what's going to happen with oil next week, but I did lower my short-term exposure a bit today, after upping my long-term holdings yesterday. After POT got hammered for crushing their earnings, I'm beginning to distrust my expect-o-meter.

Your expect-o-meter sounds in pretty good shape to me.

Meanwhile, the gasoline subsidy (i.e. rebate) checks hit bank accounts starting Monday.

META:

Why do we keep on commenting the Bloomberg / CNBC crap?

Even most people in the investment business know it's utter bullcrap: "oil price went up today $0.75, because...", "oil prices are going to go down to €XX, because I have a crystal ball in my office", etc.

Random causal reasoning, dogmatic pontification and wild guessing disguised as educated analysis, without any base theory, empirical data or critical inquiry. There are of course exceptions, but those are usually the guys/gals, who are representing the minority view, i.e. usually also looking at the downside risk.

But for balanced, honest and hopefully scientific analysis? Fuggedaboutit! They're in the business of making news (entertainment) and if there's none, they can always make it and spice it up.

Yes, noticing their change in attitude is relevant. Like Schöpenhauer said:

PO is not quite in third stage yet, but going back-and-forth between stage one and two.

rgds,

Samu

PS Final geology imposed production plateau now or later? I don't think we're there yet, but I also don't think it makes any difference and there's no use bickering about it, esp. with dogmatics who do not want to look hard at empirical data from the field or to challenge their belief structures (e.g. markets fix all).

I love watching analysis of oil prices, my recent favourite was this:

http://www.thestreet.com/_yahoo/video/strategysession/10412773.html?cm_v...

It's almost like voodoo.

Hhahah! What a laugh riot, thanks for that.

This is exactly the kind of crap that gives TA a bad name, and deservedly, if you ask me :)

That was the funniest thing I've seen in a long time.

Wow. That immediately made me think of this South Park bit:

http://www.youtube.com/watch?v=vA4RvAf2Vds&NR=1

The logic is about the same.

She is a technical stock analyst, a chartest, even with stocks that is a very dubious way of predicting price and valuation, chartism does not so much deal with actual value but with profit making and taking, it is circular because the chart people and the programs used do actually affect the price of stocks, it is in effect a heard mentality that manipulates valuation.

The declining availability of oil from decline and increased demand make this type of valuation meaningless, she would be better off taking her ruler and sticking it in the Saudi sand, she would get a better idea of the future of oil than from her price - valuation chart.

Although I doubt the KSA would even allow that.

This young lady would have been much more believable if she had neatly coloured in her graph with wax crayons and put on some smiley facey and cross facey stickers.

Yeah, just ONCE I'd like to hear them say: "The DJIA (or oil, or whatever) changed by a fraction of a percent today. It was a totally random fluctuation due entirely to statistical noise and is of no real significance whatsoever."

Ha! I wrote a piece along those lines for newspoetry.com in 2002:

Stocks Down Amid Inscrutable Factors

New York (Associated Poets) -- Stocks were down over 1% in mid-day trading for absolutely no reason. There was no demonstrable correlation between the movement of the major stock indexes and any known factors, including today's news or recent economic data.

"The stock market is just fluctuating randomly," a leading analyst explained. "Will it go up from here or down? I don't know. Perhaps we should roll dice," the analyst continued.

The stock market has been known to fluctuate randomly before, but any suggestion that today's random fluctuation is part of a pattern was quickly dismissed by leading economists. "It's impossible to predict when the market is going to fluctuate randomly, and when its fluctuations will be based on confirmable factors," said Lee Ding, an economist at the Leading Economic Institute in Leading, MA.

Investors are as concerned as they can be, given that there is no specific reason to be especially concerned.

New source for biofuels discovered

http://www.eurekalert.org/pub_releases/2008-04/uota-nsf042308.php

That's the kind of report that really bugs me.

Not only does the bacteria produce cellulose but it secretes sugars in the process - fascinating.

It is pretty interesting. If it can be scaled I really don't see anything bad about it. As always with this kind of stuff, Robert Rapiers input is greatly appreciated.

If it can be scaled I really don't see anything bad about it.

1) Food sources to the bacteria comes from where?

1a) Processing the food to get it into the bacteria gets done how?