Where we are headed: Peak oil and the financial crisis

Posted by Gail the Actuary on March 25, 2009 - 9:07am

Nearly all of the economic analyses we see today have as their basic premise a view that the current financial crisis is a temporary aberration. We will have a V or U shaped recovery, especially if enough stimulus is applied, and the economy will soon be back to Business as Usual.

I believe this assumption is basically incorrect. The current financial crisis is a direct result of peak oil. There may be oscillations in the economic situation, but generally, we can't expect things to get much better. In fact, there is a very distinct possibility that things may get very much worse in the next few years.

In this post, I will put together some of the pieces I see. This post is based on a presentation, so includes more than the usual amount of graphics. The post repeats many things I have said before, but I wanted to bring more of the pieces together into more of an overview article. This is a link to a PDF version of the presentation. This is a link to the Powerpoint version.

Our One-Way Economy

Our economy is very much a one way economy--because of its heavy reliance on debt, it needs to grow.

It is easy to overlook the importance of debt. Most businesses would not be able to build new factories without debt. Businesses would tend to be much smaller than they are today without debt. International trade would be much more difficult without debt. Even at a personal level, debt is very important. How many citizens would be able to purchase homes without a mortgage, or go to college without a student loan?

In order for our debt-based system to work as planned, the economy needs to grow. Otherwise, there are way too many defaults.

In a growing economy, many debtors find that their financial situation has improved by the time it becomes necessary to pay back the loan. Even though it is necessary to pay back the loan plus interest, the debtor still has plenty of funds left over for other things, because of the growth of the economy, and his or her improved circumstances.

The reverse is true in a shrinking economy. When the time comes to repay the loan, many debtors find that they have been laid off or their incomes have declined. Repaying the debt becomes much more difficult. Default rates rise. Those who do repay debt often find they do not have funds left for all of their other obligations.

For a business, a declining economy makes capital planning difficult, because one doesn't know whether there will be sufficient demand for a product, or sufficient raw materials for the product, for the full lifetime of capital equipment that is being purchased. One would like to think that a new factory, or a new machine, will be usable for its planned lifetime, say 40 years. But in a declining economy, it is just as likely that some necessary element will be missing, 10 or 20 years from now.

In this environment, how does one amortize costs? Why would a lender be willing to make a long-term loan?

There is an academic paper called This Time is Different: A Panoramic View of Eight Centuries of Financial Crises. The paper finds that throughout history, government defaults on debt have occurred very frequently. The paper notes (page 15):

It is notable that the non-defaulters, by and large, are all hugely successful growth stories.

This is precisely the effect we would expect. When economies of countries are able to grow rapidy, they can repay their debt with interest. But as growth wanes, it becomes much more difficult to repay debt, and many more defaults occur.

Our debt-based financial system needs growth to continue. It is not a Ponzi scheme, but it has the same problem with not being sustainable without growth. The inability of the financial system to continue without growth becomes a separate risk factor to the economy, greatly magnifying the effect of even a slight long-term slowdown. The need for growth is the reason why Bernanke and Geithner are working so hard to get the economy to grow again.

The Energy Stumbling Block

If all of the raw materials we need continue to grow rapidly, then there is a chance the growth paradigm can continue. But increasingly, this is not the case. A major stumbling block is cheap energy:

Cheap energy keeps our cars and factories running. It leaves homeowners with money to repay their mortgages, and permits the long-distance transfer of goods needed for globalization.

We live in a finite world. Cheap energy can't go on forever. Eventually it runs out, and we have to move on to expensive energy. This is precisely what has been happening, for both oil and natural gas.

The OECD can be thought of as the organization of oil consuming nations. It includes the United States, Canada, Europe, Japan, and Australia. On this graph, Rune Likvern has plotted:

• The amount of oil consumed by the OECD

• The price of oil

What we see on this graph is that the oil consumed by OECD reached a peak in 2005, and has started to decline since then. Prices started to rise about the same time the amount of oil OECD was able to purchase began to decline.

What was happening at this time was that world oil production reached a plateau, about 2005. There were more and more bidders for what oil was available, and prices started to rise. OECD wanted more and more oil, but the oil producing nations also wanted more oil, and developing nations like China and India also wanted more oil. In response to all of this demand, the price of oil went up and up, but total world supply barely budged, and the amount of oil that OECD was able to buy started to drop.

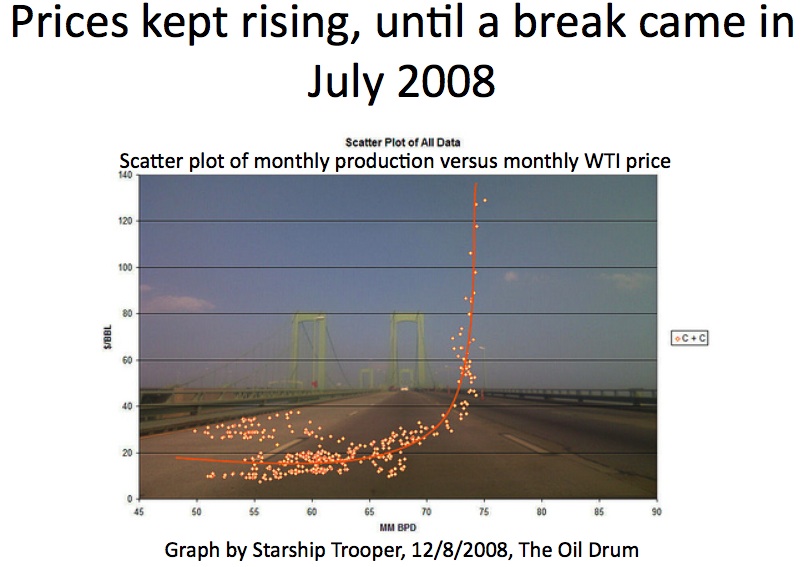

The first pains of the higher prices started being felt in 2006, and rose in a crescendo until a major breaking point was hit in July 2008. In that month, the highest world oil production of all time and the highest price of all time both occurred, followed by a major break in the financial markets. Let's go back first to 2006.

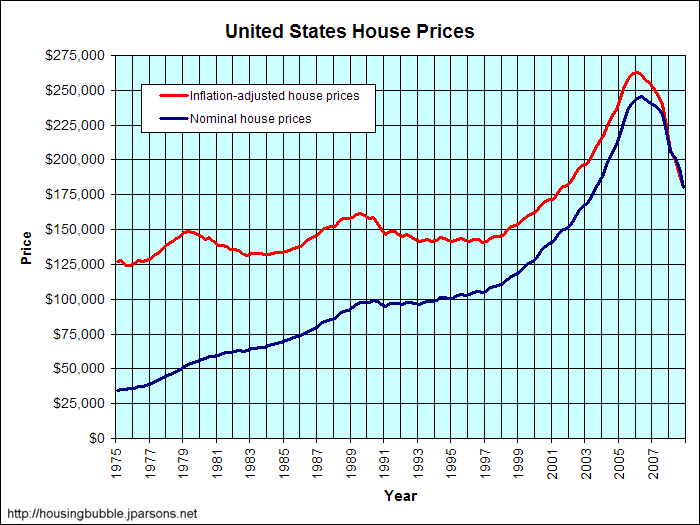

Even prior to 2006, mortgage payments were a very vulnerable portion of the economy. Families had been encouraged to take on large amounts of debt, and the increased demand for homes had sent housing prices upward.

Once prices of oil started to rise, the higher gasoline and diesel prices helped push a system which was inherently unsustainable over. By 2006, families had become less able to maintain high mortgages, and home prices started to decline. This started the decline in home prices that we are seeing today. One can see from the graph that home prices in 2009 are still very high by historical standards, so this process is likely not yet over. If people are out of work and too many houses have been built, the ultimate level of home prices may even drop below historical norms.

This graph is a scatter diagram which plots the quantity of oil produced in a month and the price of oil in that month over a several year period. As the price of oil went up, the quantity of oil produced went up--but not by very much. The price finally hit the high point on the graph of $147 a barrel in July 2008, in the same month world oil production hit its maximum point.

At this point, a break occurred. Commercial credit started becoming much less available, which reduced demand. With the reduced demand caused by the lack of credit, prices dropped very quickly from $147 barrel to a low of $31 barrel in December 2008. The financial crisis as we know it had started.

This financial crisis is precisely what many of us had forecast would be the outcome of peak oil, because resources need to be level to increasing in order for the economy to keep growing. (One can disguise the lack of growth for a time by expanding credit, and Greenspan used precisely that approach in the early 2000s.) Once available resources start declining, growth begins to decline, debt defaults start rising, and soon after that, credit availability starts to decline. We can summarize what happens in the following chart:

All of these problems lead us to the current financial crisis, caused by trying to continually expand our economy in a finite world. Lack of low-priced oil was a major limiting factor. Even if we had managed to get past the need for low-priced oil, there were other limits as well that we were reaching, like fresh water and cheap natural gas. I won't be able to talk much about these today, but these limits would also tend to have the same impact on a financial system that requires growth--cause massive debt unwind, and possible collapse of the system.

The Underlying Problem of Peak Oil

Nearly all readers of this site are familiar with Peak Oil Theory.

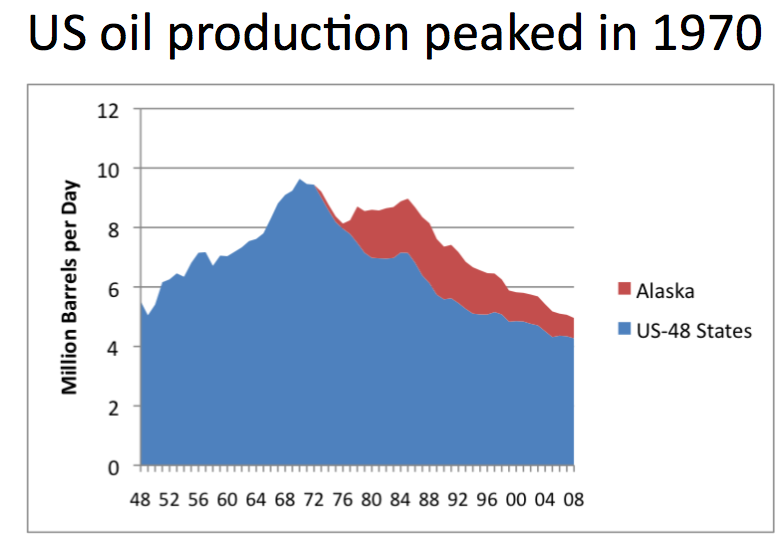

US oil production reached its peak in 1970. M. King Hubbert had long predicted a peak in US oil production about that time, but few believed him. At the time of the peak, the US was producing oil only in the 48 states. When the need for more production became clear, we were able to bring Alaska production on, after building a pipeline.

We were also able to ramp up oil production in the North Sea and in Mexico, soon after US oil production started to decline. These sources are now beginning to decline as well. One can see from these graphs that the shape of production curves varies depending on location. It is not always symmetric.

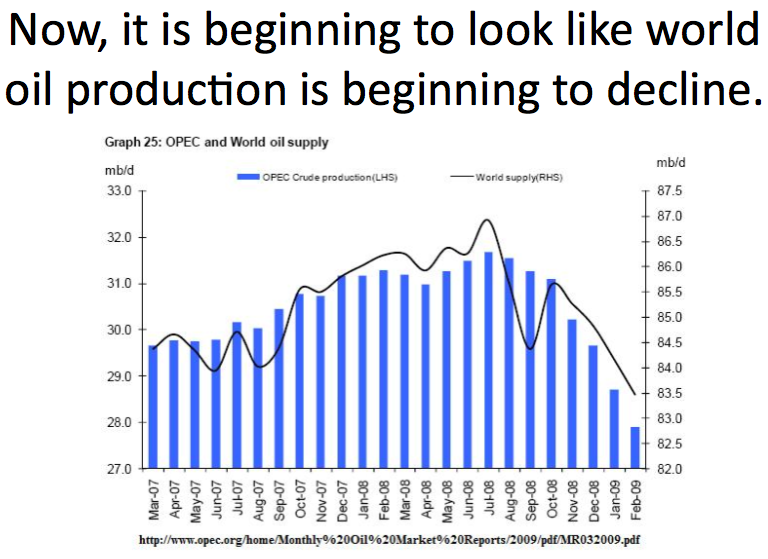

This is a graph from a recent OPEC publication. The graph is a bit confusing, because it shows two things on it--OPEC oil production, using the scale on the left hand side, and world oil production, using the scale on the right hand side.

Once prices dropped from the high levels obtained in July 2008, companies suddenly became a great deal less interested in producing oil. New projects were put off, because the available price of oil dropped below the cost most companies needed to bring on new production. The graph indicates that production fall immediately after the drop in price.

(Note: Companies by and large didn't "shut in" existing production, because much of the cost for existing production had already been incurred, and the marginal cost for maintaining production was quite low. The continuing production from these older wells is the reason that we are temporarily able to buy oil cheaply now, even though we can't expect this long term. Production from these older wells declines each year, and must be made up for by new wells, if production is to even remain flat.)

(Note: The drop in world oil production in September 2008 was the result of two hurricanes in the US Gulf of Mexico.)

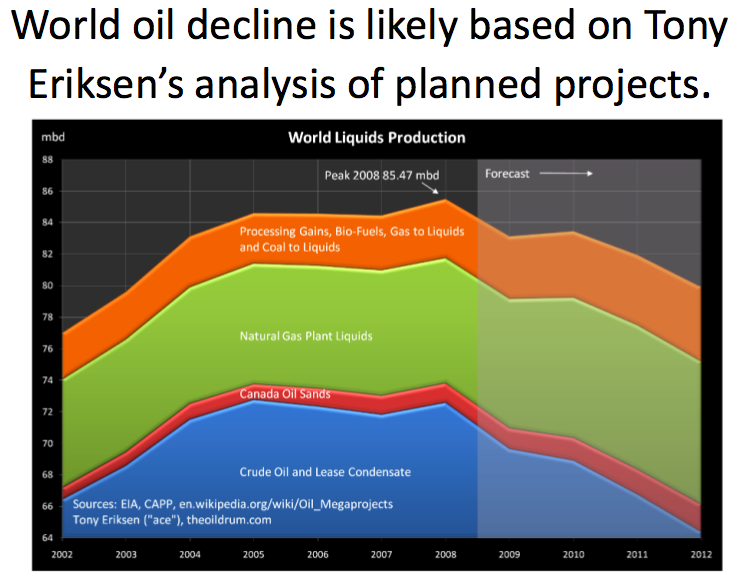

Tony Eriksen ("ace") made this forecast of oil production based on an analysis of likely future production for individual large fields, from this database. Prior to the drop in price, it looked like world oil production would continue on a plateau for a while longer, or possibly even increase a bit. Once companies understood the drop in price, they started deferring production plans until prices were better. But existing fields continue to decline due to depletion. The result of the cutback in new production, and the decline due to depletion in existing fields, is the expected pattern of decline Tony shows in this graph.

Where is the Energy Sector Headed?

As I indicate on this slide, I see the major factor affecting the energy sector to be the credit unwind. Pretty much all sectors are affected, because the collapse of the credit market affects the entire economy.

The problems of the credit unwind are pervasive. There are both the direct problems of not having credit, and the indirect problems of low prices and low funds available for investment. The result of this is that net investment drops considerably.

There seems to be lots of supply out there, but there isn't a good way to get to it.

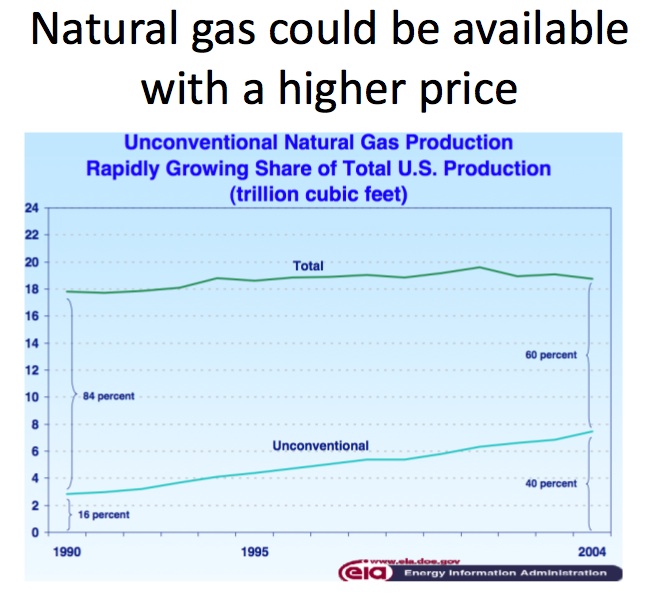

The situation with natural gas isn't too much different from that with oil. Conventional natural gas is the inexpensive natural gas. It has been declining in supply. Unconventional natural gas is generally quite a bit more expensive. At today's prices, it doesn't make much sense to drill new unconventional wells, because the costs exceed the likely price that will be available.

Most unconventional gas is too expensive to produce at today's prices, so decline is likely in the next few years. Small companies are leaving the business, and not likely to come back, even if the price of gas goes up again.

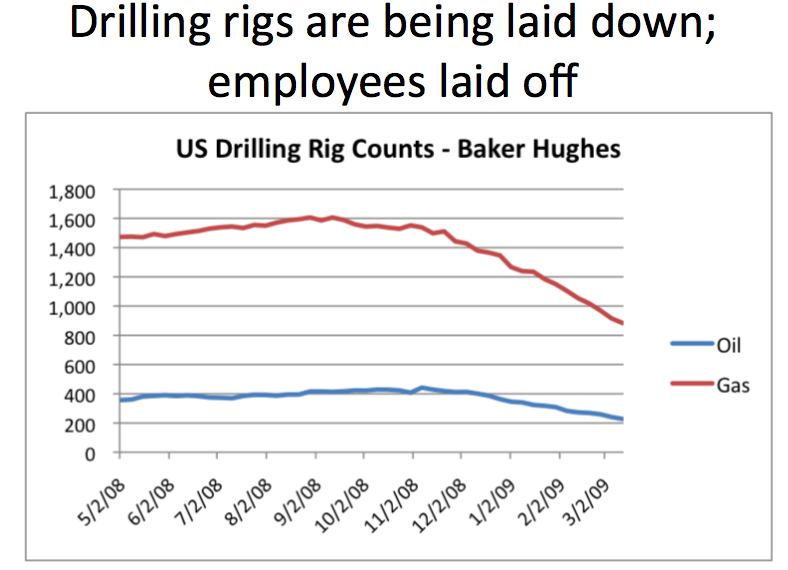

This graph shows the number of drilling rigs in operation in the US, both for oil and for natural gas. These drilling rigs are leased, so a company cannot easily stop drilling until its contract is up for renewal. Even with this limitation, the number of drilling rigs has dropped almost in half from the high point, for both oil and gas. The drop in drilling rigs doesn't immediately affect production, but one can be certain it will affect production long-term. We are living in the calm before the storm.

Lack of growth is causing the credit unwind. There is nothing Bernanke or Geithner or the G20 meetings can do to fix the lack of growth--it is closely related to the lack of cheap oil and cheap natural gas, now that these have been depleted.

Growth is not possible any more--at best, we will get oscillation. Prices will drop, as it has recently. Demand will start to pick up again. Prices will rise rapidly, until a new lower production limit is reached, and more defaults on debt will occur, starting the cycle over again.

There is a real possibility that the whole system may crash. The value of the dollar may drop, or countries may become afraid of international trade, for fear that trading partners will not be able to make good on their promises. It may be necessary to start over with a new financial system that does not permit much debt. (This would not be easy. Governments are often overthrown when currencies fail.)

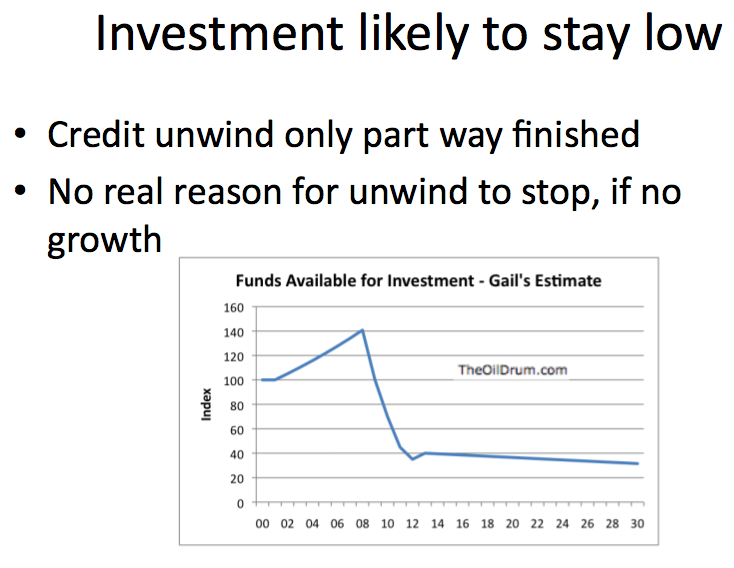

It seems to me that the amount of investment is likely to drop, even below the level it is today. The reason that investment is likely to drop is because the credit unwind is only part way finished. Without growth, the credit unwind can only continue. With low credit availability, prices will stay low. The amount of cash flow oil companies and other energy companies will have will stay low. With little opportunity for borrowing, there will not be very much income available for investment.

With little investment, even forecasts such as the one I showed by Tony Eriksen may prove to be optimistic. Instead of oil production declining slowly, it may decline much more quickly:

Such a drop in production might occur if there is a major financial crash. (See Where Is Oil Production Headed?: An Adverse Scenario.)

Long Term Prospects

Even the good scenario is not very good. Oil, gas and other commodity prices may fluctuate, but there will be little credit and little funds for investment. The economy will be doing no better than today, and quite probably worse.

In the bad scenario, there will be a major financial crash, and the United States will somehow need to replace our currency (and the currency of other countries around the world) with a currency that is less tied to debt--perhaps a currency tied to natural resources of some kind. Countries may cease to trust each other, and there may be a rise in protectionism. If new currencies are not adopted immediately, it may be difficult to carry on business.

Planning for the future, we need to assume that credit will be much less available than it is today. Cash will be king. In planning, cash flow will be more important than discounted present value. Economic growth will be something remembered fondly from the past. The closest approximation will be a temporary upswing while the world is oscillating between shortages at high prices and low prices with little credit availability.

The world is likely to become more localized in all of this. Successful companies will emphasize long-term relationships with local customers.

For Further Reading

Our World Is Finite: Is This a Problem? April 2007

Peak Oil and the Financial Markets: A Forecast for 2008 January 2008

Where Is Oil Production Headed?: An Adverse Scenario March 2009

For those still skeptical of the tie in between higher oil prices and housing, I recommend a reading of Driven to the Brink. How the Gas Price Spike Popped the. Housing Bubble and Devalued the Suburbs (PDF).

The (permanent) loss in value for decentralized housing locales could be estimated by calculating NPV of annual payment streams for extra commuting costs. It was estimated in Wisconsin alone 50 cents of higher gas prices resulted in $300 million in annual gas spending; that spending comes out of home site prices (land values). A two-dollar price increase, $1.2 billion annually, NPV for a twenty-year time frame: ? Factored up for a national loss estimate= ?

I suspect easily $1 trillion in real estate value vaporized due to increased commuting costs. That would represent a roughly $10,000 discount on the site value (land alone) for about 100 million homesites nationwide. This value only returns if long-run commuting costs return to late 1990's/early 2000 values. Likely? Not. So, how to value all the loans associated with that land? Add on top of that destroyed structural value (pipes stolen, etc.) and add on that the declining employment and wages (net demand for housing). We are paying/have paid a hefty price for not planning for peak oil. Whoops.

In 2008, New Orleans home prices rose 4%. Much of that is post-K effect, but unflooded real estate in my area is definitely up.

Alan

Are wages and salaries going up too?

Are houses 2.5 to 3 times average yearly wages salaries?

A single shotgun (~600 sq ft) in decent condition in a decent neighborhood (say Gentilly) can be bought for $75,000. 75K is significant, because that is the homestead exclusion for property taxes in Louisiana.

Alan

A double shotgun renovated as a single shotgun (1,200 sq ft) for $75,000 about 6 blocks from the French Qtr on the border between good & bad neighborhoods.

http://www.latter-blum.com/RLNet/Listings/ListingDetails.aspx?ListingId=...

I know analyses have shown that the drop in home values is much greater in distant suburbs than in central cities, going along with what you are saying.

The distinction between land values and home values is important to maintain. There are thousands (millions?) of vacant home sites, the inventory of lots, that quickly lost value. For an interesting example, see the unfortunate saga of one little regional player, Lakeland Finance in Minnesota. They obtained their funding for exurban projects from some now familiar faces (Bank of Scotland) and lo and behold, they have no idea how to value what was supposed to be $500 million of far-flung residential bliss.

Minnesota's housing wastelands

The Star Tribune site has a link to the RBS receiver report for these "troubled legacy assets" and the story includes some apocalyptic photos of what's left behind.

Demographics are also a factor in the collapse of demand for distant suburbs. Young families with children are a declining share of the population and this shift will grow in coming decades. So, land for commercial and residential development in distant suburbs is a bad investment, regardless of gasoline prices.

In other words, the drop in gasoline prices won't restore the distant suburbs, even if the disastrous credit conditions could be taken out of the picture.

http://graphoilogy.blogspot.com/2008/12/simple-explanation-for-rising-oi...

And then there is the problem with net oil exports. Compounding the problem is the fact that the volume of net oil exports tends to be "front end loaded," i.e., as one would expect, the bulk of net exports occur around peak production. For example, Indonesia had shipped 44% of post-1996 cumulative net oil exports by the end of 1998, with the remaining 56% being shipped in the following six years. Our middle case is that the top five will have shipped about half of post-2005 cumulative net oil exports by the end of 2012, with the other half being shipped from 2013 to 2031.

Average annual US crude prices versus actual (EIA) and estimated (2008) net oil exports from the top five net oil exporters:

I got the opinion that the financial problems grew faster then the possible

extraction and utilization of unlimited mineral resources. It is possible

that high gasolene and heating prices in USA conencted to peak oil or if you

wish the bottlenecks in the extraction of resources triggerd the financial

crisis but if that had not happend the bubble ought to have popped in a few

months or years anyway.

But unfortunately I don not know how to prove that opinion.

When analyzes what the situation should look like, and comes up with an expectation as to how things look, and everything falls in place according to expectation, one has a fair amount of confidence that the model works. Go back and look at my post from 2007, when I was not yet on the staff of The Oil Drum. You might also look at my Financial Forecast for 2008.

Gail, I've suggested in the past actually calculating the differential on the amount of money spent on fuel, heating, etc., by the public as a result of the higher prices. This would help move your idea from theory to near-fact as the $ spent will likely align very nicely with what people couldn't pay on their mortgages.

You'd have to be a little careful with food and bio-fuels, etc., but I did a very rough calculation and came up with between 1 and 1.5 TRILLION dollars between '03 and '08. Back then, that was a lot of money.

But my math skills are non-existent and I'm just an angry keyboard monkey.

:)

Cheers

Good idea, but I am not sure I would know exactly how to go about it, either.

For one thing, the higher price of oil translated into higher prices of food and of goods of all sorts, so the homeowner got hit in many ways.

Also, it seems like there is sort of a multiplier effect as payments work their way through the system. The money a homeowner spends on oil products goes to a significant extent to pay foreign producers of that oil. If the homeowners had spent the money on their mortgage, this money would have gone to pay various employees of the mortgage company and holders of the debt, and they might have bought some additional products as well. This additional money would have helped the economy, over and above the original impact.

Gail,

I don't think it would be an efficient use of your time, nor would it be necessary, to track all that down. Just covering the basics of oil prices, (some of) the various fuels and some of the food commodities (particularly in relation to ethanol) would be enough to establish a minimum level of additional costs high enough to support your thesis. Maybe not even all I have listed. Like I said, I'm getting between 1 and 1.5 trillion based on oil alone.

Cheers

The relevant paragraph appears to be:

Your hypothesis appeared to be that the order of events would be:

Is that what we saw? The order that actually occurred seemed to be:

It's not clear that your model correctly predicted the sequence of events, and hence the causative links it draws are somewhat suspect.

Moreover, several of these events were already widely predicted by early 2007. The subprime crisis - and hence the seeds of the banking crisis - had already started and gained significant attention by the time you posted (timeline, CR).

It's really not at all clear that the causal link from oil to the financial crisis you're suggesting exists. Oil markets seemed to be quit well-behaved for months after the financial crisis was well-known, meaning that oil is not a likely cause. In fact, oil prices in were fairly low (about $50) in Feb 2007, at exactly the same time the financial crisis was gaining strength and recognition. If high oil prices caused the financial crisis, why was it still growing during a period of relatively low oil prices?

The available evidence does not appear to support the hypothesis that high oil prices caused the financial crisis. It may have worsened an already-existing problem, but it seems clear that problems in the financial system were widespread and widely known even back when oil prices were fairly low.

Evidence suggests that this financial crisis is not due to peak oil.

Ah, more like this:

1. Oil prices rise sharply (The sharpest rise percent-wise was actually around the '03-'04 time frame.)

2.Mortgages get in trouble.

3. Banks get in trouble.

4. Discretionary spending falls (more).

5. Oil prices fall sharply

6. Recession occurs.

As were PO effects by Campbell, I think is the oft-quoted in this regard. He predicted it in '06 for about when it all happened.

I have posted elsewhere some possible connections. To repeat and expand.

* Glass-Steagall: '99

* Cheney on oil decline: '99, ME the prize

* BuCheney ignore terrorism in favor of focusing on Iraq: '01

* 9/11: '01

* Iraq scapegoated: 9/12/01

* Plans for Iraqi oil drawn up: '02

* Invasion: '03

*Oil prices rise: '03 - '08

* Iraqi oil production bogged down in war; no oil dividend: '03 - present

* Iraqi oil law mired in controversy; strongly favors original Big Oil conglomerates tossed out by Hussein: '03(?) - present?

I disagree with Gail that PO is THE cause, but it was and is a significant cause if one just looks at the evidence.

Dang... baby crying...

Back. So, there are very clear correlations. The arguments over causation will require more than just opinion. I have already made my suggestions to Gail in that regard. I think you may want to gather evidence as to why these correlations are not causal since it is not only Gail making such connections.

Cheers

Depends on when you start the credit bubble off :)

Obviously price increase for anything will cause problems if housing cost are going up at a rapid rate but certainly the decade of long build up played a role in eventually eroding consumer savings well before the final pop.

If you look at the housing bubble correctly in my opinion is something thats been building since the 1980's with a steady decline in the loan requirements and steadily increasing values one would then say that the housing bubble popped itself when prices started increasing to rapidly. Things simple got out of hand. With this viewpoint the housing bubble was already popping itself by 2003-2004 when it went insane.

Two external factors are involved at this point the initially low interest rates really driving the bubble then increasing interest rates and rising oil prices and finally the insanity of the bubble itself by 2005.

I'd argue that the final rate of increase in prices was the biggest driving force since it leapt home prices well beyond wages its even worse then the loans themselves. If prices had not increased so rapidly the availability of exotic loans would not have had as big of a impact. The reason is far fewer people would have sought them to purchase a home.

Any ponzi scheme carries the seeds of its own destruction intrinsically no external factors are required given this its interesting that the government effectively drove the housing ponzi scheme to a fast collapse with its actions in concert with rising oil prices.

If you think about it if oil prices had really increased first and the government had done nothing to drive the housing bubble so fast it burst then oil prices would have risen and housing would have cooled off and probably slowly deflated we would have never got this huge crisis we have now.

Now for the tinfoil hat crowd the real driver i.e low interest rates was after 9/11 and as the Iraqi war started up. So if there was a real decision to crash the decades long housing bubble by brute force then it happened then. Before oil prices went up but at the start of the US war for Iraqi oil.

So without intervention history would have been different the housing bubble would not have gone so high before it popped and rising oil prices would have resulted in a less vicious pop and no crisis.

Now I'm not suggesting that all of this was planned outside of interest rate changes the rest could readily have been simply making the best of the situation (if your a banker)

However even before I became aware of peak oil it was obvious that growth in China and India would eventually mean the US got a lot less of the world resources. I'd say this was blatantly obvious to everyone. And this rather obvious point is what lead me to look at resources and eventually find out about peak oil. Next I'd say that a peak by 2030 at the latest was probably broadly accepted even in the highest circles if not sooner so its also obvious using this that the US would be squeezed hard by 2010-2020 at the latest as global growth simply squeezed the pig (US) ever more.

Bottom line is the US was going to hit the wall within 20 years with the most generous estimates and this could be seen as early as 2000 esp if you included our financial condition even then.

You really don't need much of a tinfoil hat to recognize that we where in sight of the end of the oil driven growth economy at least for the US. I guess at this point you really only have two choices either too collapse it slowly and live with the situation or rev it up till everyone hits the wall and try to grab the pieces before it falls apart. One has to guess that if this was the thinking then the real game was how do you make China fall ?

A slow collapse would simply have resulted in China bolstering its internal economy early on and not becoming so addicted to exports. If you look at the history we also really suckered in the Chinese big time after 2000.

http://www.marktaw.com/culture_and_media/TheUSTradeDeficit.html

But the decisions seem to reach even farther back in time. The roots of both the housing bubble and the trade deficit extend back into the 1980's.

The end result for the US seems to be no matter how you look at things that the peak in US production which was obvious by the 1980's seems to have driven most of the long term decisions and trends that where finally it seems forced to blow up now. Also one might guess looking at Alaskan production that by the mid 1990's or so that it was obvious that Alaska was not going to save our internal oil production. And last but not least given falling domestic oil production and growth in China with our without the active participation of the US in playing the export game the US would have been marginalized.

So although the exact timing of various things is not clear I'd say the big picture concerns and early decisions where made back in the 1980's and repeatedly reaffirmed and made from then on out. In fact following the fate of oil and money in the US back in time. Nixon left the Gold standard in 1971 US oil production peaked in 1970.

Striking coincide is it not ?

A massively unregulated and overleveraged financial market allowed for hyperinflation of commodities prices over and above real demand as well as pumping up of demand by priming credit markets for houses/credit cards.

http://www.aspousa.org/index.php/2009/03/the-role-of-speculation-in-the-...

So this was a positive circle. Easy credit to consumers was offloaded as CDOs, etc. squared and cubed to the nth degree and proceeds reinvested in anything available at the moment, gold, dollars, oil, etc. Now if markets had been regulated and no offshore derivative stuff then a rational price for houses, commodities could have been achieved. Make originating banks keep loans on their books and speculators take delivery of commodities and then you would have seen no bubble and no bust, just a slow growth cycle according to population growth until real geological PO squeezed it dry.

To some extent but the shape of extraction of a resource depends on of course the willingness of people to extract it.

The only example I can think of for rational extraction of a non renewable resource is stone quarries. In general we have to have stone ( even for concrete of course ). So its a intrinsic resource but its also one we will moderate our use of i.e use substitutes or alternatives if it becomes to expensive. Stone has its own unique set of economics but it is arguably and example of a resource that can be locally depleted and that we have adjusted to deal with.

If you really want to follow this conjecture through then you would need it seems to ensure that oil would have for some reason been using locally. Tar for example was used for thousands of years in a manner similar to stone.

It seems that if you dig into the problem then you see if a society does not make a resource intrinsic in the sense that its unable to substitute then it never really gets into a trap with the resource. The only example I have of this and its arguably weak is stone. We use it where it makes sense and don't where it becomes uneconomic. Local depletion never really scales to cause a peak oil like effect.

Maybe the old salt trade is another example hard to say the economics of the ancient salt trade are hard to understand everyone gets focused on the fact that in some place salt was worth its weight in gold. They tend to not follow through the entire trade system for salt.

However this is a good link but like I said to fixated on the price of salt.

http://www.salt.org.il/frame_intro.html

Percent increases aren't what matter. A change from $100/mo to $200/mo is much easier to fit into the family budget than a change from $300/mo to $500/mo, even though the former is a larger percentage.

Moreover, saying "oil prices have been rising for 5 (or 10) years" doesn't have any predictive power. That's such a long period that a recession is statistically likely to occur during that period, so it's very difficult to draw a causal relation. With such a long span of time, there's a large risk of coincidental or post hoc reasoning. The terrorist attacks in London came after several years of rising oil prices, but that gives no indication of a causal relation.

If a trend continues for 5-10 years, lots of stuff will happen during that time, but that doesn't mean the trend caused any of it.

"It might be a correlation, it might not!"

Well, thanks, Pitt!

Now, care to actually address anything I said?

Cheers

I have a few issues with the way Gail predicts this to play out.

1. Credit isn't gone, its trapped. There are banks itching to lend, but with the daily fluctuations in political solutions for the banks that lent themselves into insolvancy, the borrowers and lenders are afraid they'll get the raw end of whatever deal washington hands down next if they accept/let go of the money. the inability for the administration/political leaders to accept the fact that the money is gone/we can't pay our treasury bonds will keep the nation zombified like japan, money afraid to move. The key would have been to reveal losses, seperate good and bad debt and dissolve the destroyed banks. Instead, we continue to play the music in the game of musical chairs, hoping that as long as no one sits down, no one has to be out. There is no happy solution for Obama or any of us in the short run, but the longer this drags out, the longer our misery lasts.

2. Oil investment need not be low because of lack of overall economic growth. As demand for raw materials competing with other industries falls, the price of the top-down supply chain for oil and gas exploration falls too. If the average cost then falls below the average peak/valley, investment could restart in the oil industry. Deflation (an inevitable result of the downturn) could renew interest in exploration.

3. Your "One Scenario" graph makes no sense at all. Assuming trade continues, even the worst oil rate decline is less than that and there are already investments made that will reduce that decline. Assuming no new investment from here on out, its atleast 10x the length of time to reach 20 million. We're in for a slow-motion collapse at worst. If you assume trade breaks down, why bother having that graph at all, because essentially the US will be completely dependent on domestic supplies alone, which is not represented by that graph.

We may be in for the end of growth as we understand it or a backwards J recovery (recover above the trough, but fail to ever reach the economic peak again), but man's determination is to improve and eventually we'll be back with another innovation to get us cheap energy again. All we can do now is hold on and hope for wisdom in leaders (and plan for their idiocy), while preparing for our own survival.

As far as I see it, the one scenario graph is a potential future demand graph for oil, and no-one will pump oil for which there is no demand. For it to come about, the global economy must stagnate at or below our current level of consumption, because of some other constraint on it's growth. It could be food, water, natural gas, world war or something else. We do seem to be stuck with an economic system that is fundamentally unstable in any condition other than exponential growth, and until we redesign it, we are going to be living in very unstable times.

Great Article, Gail. Yr theory is just as good as anyone elses!

As for credit ... the Short History of Growth ...

What has been happening is a grand experiment, that the laws of supply and demand can be suspended indefinitely and that the costs of managing the resulting surpluses can be ignored or passed onto others and all associated risks hedged in derivatives markets.

Since an overview of the entire economy would be excessively large and time consuming, an example of the process in action can be found in residential real estate. I hope this will clear up misconceptions about what has happened in residential real estate and what are some likely outcomes. Take the time to read the entire paper, it is quite interesting:

This is a good overview and quite thorough. The time period examined begins roughly in 1994- 95, at the end of the Savings and Loan crisis and deflation of the accompanying housing bubble from 1990- 93. It was at this time that sub- prime lending gained national attention. The study lists the reasons for the growth in this form of lending; changes in laws including those that regulated interest rates, bankruptcy and changes in the tax code; also an increase in securitization also the ocnsolidation of the enterprise into the hands of a few large businesses.

The primary issue of subprime lending beginning in 1995 is the simple fact of it; at that time it was clear that any person with means and the desire to own a house already owned one ... and some owned two! The only way to put customers into houses that were being constructed all around the country was to reach into categories of borrowers who would otherwise not qualify for a loan. This is the 'Why???' behind sub- prime loans.

It would have been sensible for house- builders to ... stop building houses ... or reduce the level of supply. Unfortunately for all concerned the house- building industry during the period built at least 2 million new houses in excess of 'solvent' demand every single year. For ten years and of twenty million houses; and many of these were larger and more expensive. For awhile the synergies of inflation- derived credit expansion allowed the housing market to defy supply and demand; Real estate brokers pumped up media- centric 'house cults' and an accompanying 'investment cults'. There were 'condo parties' in Miami, Los Angeles, Brooklyn and Las Vegas; loan originators became efficient at 'turning around' mortgage credit applications, securitization attracted an increasing flood of 'hot money' capital flows from hedge funds, banks and wealthy individuals. Eventually the originators were reduced to combing the drunk tanks and skid rows dragooning the bottom dwellers of the economic food chain. Dishwasers, ditch diggers, speculators; anyone who could hold a pen and sign the origination papers. By 2006, sub- prime home buyers were beginning to default before the end of the 'teaser rate' period. Others were in default at the end of their first months' occupancy. Supply and demand were seeking realignment.

As for the twenty million houses, these became an awful and perpetual weight upon the entire housing marketplace. A large percentaghe of these houses are in foreclosure, in others the owners owe more on the house than it is worth. At some point the excess houses will be demolished; there is no other way to rebalance supply and demand. The cost to do so is high according to this article in the New York Times about vacancies and foreclosures in Cleveland, OH: roughly $8,000 a house.

Many houses are currently worth a lot less than this, what could be considered a bottom- line valuation. In New Orleans, Detroit, Cleveland, Gary, Buffalo, Las Vegas, etc. there are many houses available for $3,000 or much less, even $100. At the median house price currently of $230,000 the twenty million excess houses are 'worth' $4.6 trillion US this is their 'wealthiness value' what the credit circus would apply if supply and demand could be re- suspended. At their removal price the twenty million are worth $160 billion and this is a GDP value since this number represents a liability - a cost. In the end it is not too unreasonable to measure the worth of all houses in America to fall to the value of $8,000, or what it costs to demolish them. Employment is declining, wages to pay for houses are likewise declining, the credit is systematically declining in all meanings of that term, investment values - that a house will be worth more to someone with money tomorrow - is declining.

The perishing of millions of elderly - the 'Greatest Generati8on' - is putting further millions of properties on the market as heirs demand cash ... this last and foreclosures are forcing the markets. Business hedging strategies and blindness to fundamentals are causing the house market to operate like the stock and futures markets did in October, 1987. In 1987 a similar hedging strategy fueled the Great Crash of October 17, 1987. If communications between Wall Street and Chicago had been better, the hedging technique would have driven both stock and index futures prices all the way to zero.

"Now this cannot happen!" although this is exactly what is happening right now this minute. It is happening in all markets and in all industries simultaneously; credit and finance, autos, houses, retail, general manufacturing, resources ... there is massive overcapacity.

The hedging and oversupply of credit distorted the market. For awhile the gravitational relationship between supply and demand was suspended; despite millions of excess houses - and cars and oil and shopping malls and stores and credit - the prices of all these things kept risiing.

At some point there was insufficient earning power to support the credit value of goods. That was and is the end of inflation.

The actions of the government are still distorting the relationship and are making the necessary adjustment much more destructive:

Says Doug Noland:

and;

So, the outlook for growth or even inflation does not appear sanguine. If the Treasury defaults either by 'missing a payment' or by hyperinflation, the mechanism to drive real production increases will disappear. If the Treasury and the credit system can avoid a default abd allow "true market pricing" then all goods will be priced with an eye to how much it costs to take them to the dump ... at a very low, deflationary rate.

As for credit being trapped; it had best stay trapped. Leaking credit would inflate prices of goods before it trickled down to paying customers. Prices would rise, nobody would pay and the businesses would go belly- up. If there is one indisputable fact in this world it is this:

Everyone is broke.

Thanks for the interesting information.

Clearly our government caught on to the need for growth, and has done whatever it could to keep the appearance of growth going for longer than anyone would believe possible. Back in my Forecast for 2008, I talked about the "Never to be sold house". The idea was the same as what you are talking about. There are simply many too many houses. If families are poorer, and relatives have to start moving together (or even living in housing they can afford), there are going to be a huge number of left over houses. These extra houses will have to somehow be dealt with.

We likely haven't had much real growth (except in unneeded oversized homes; more expensive health care; and more financial products) in a long time. Somehow government statistics show all kinds of favorable statistics -- productivity growth, growth in real GDP, low unemployment--at the same time the system was starting to unravel.

Hey Gail!

First of all, thanks for that link, I've been looking for it - I know you posted it with a prior article.

One good turn deserves another; this is one of James Galbraith's studies:

http://129.3.20.41/eps/mac/papers/9809/9809010.pdf

I may have posted this once before, but it's worth looking at again if I have.

Mish had this posted over at his hut earlier (and this sort of thing can be found in more and more areas of the country.)

http://129.3.20.41/eps/mac/papers/9809/9809010.pdf

America's Abandoned Cities.

It's too bad that part of the 'development process' in making subdivisions is to scrape off the top layer of soil and haul it away in dump trucks for fill dirt on other developments. Otherwise the demolished developments could be converted to agriculture. The soil can be improved but ... it is a multi- year project.

As far as 'growth', it appears that GDP growth is mostly an artifact of monetary inflation. What's left over is (more or less) useless infrastructure; shitbox buildings, 'never to be sold' houses, freeways and bridges to nowhere in particular, waste dumps, dangling wires.

Gail!!! The government lies! Who would guess? Actually, they measure the surpluses and ignore the costs of managing them. Any surplus, even cash money, carries management costs that increase - exponentially? - with the size and quality of the surplus. A warehouse full of Picassos will require very expensive insurance, 'curators', climate control, security and weatherproofing. A warehouse filled with cash will require a number of financial planners and security - a bank.

I suspect a lot of 'wealthy' people will be surprised how fast their impregnible fortunes disappear.

Gail,

Could immigration be used to soak up this excess of housing in the US and stimulate demand for other goods? I'm sure that at least a couple of hundred million Indians and Chinese or Mexicans could be rustled up to migrate to the land of the free and help solve the problem. They would probably be very industrious too and quickly refit far flung suburbs to productive uses.

Termoil,

Was your question facetious? I believe that trying to solve our over-growth, over-consumption problems by building a few more layers made out of immigrants for the bottom of the Ponzi pyramid is the180-degree wrong-direction answer. What will happen in 10-20 years after your boost of human nitrous oxide to the economy? An even bigger bubble and more horrendous crash with even fewer resources per person and more waste/pollution contaminating the environment?

I have been very surprised as this crisis unfolds that politicians haven't floated the idea of selling USA permanent residencies/work permits in a global auction. The USA still has a lot of value even as an option for a lot of law abiding global citizens. The Ponzi scheme would get fresh capital and the overall economy would benefit. Just a guesstimate: quickly 20 million could be sold at $50000 each. This is 1 trillion dollars-that is not chump change. That is just the immediate cash inflow to the Treasury-the effect on the RE market would be tremendous, along with the overall banking sector and retail. They are absurdly trying to keep a Ponzi scheme afloat without fresh capital.

Moonwatcher, Yes it was a little tongue in cheek but BrianT has pretty much summed up for me. I would not be surprised if the politicians seized on this as a "solution" to fill up empty homes and continue the consumerist orgy a little longer.

But more seriously I think is possible that China may come calling for its loans to be repaid and will want something a lttle more real that little bits of nicely printed paper. It would not surprise me if Chinas long term strategy is to take over the US by buying up all the productive capacity and then exporting their own people to work in them, displacing all the Americans. It may take fifty or even a hundred years, but the Chinese are very patient. They aslo pretty much hold the fate of the US dollar in ther hands. Call it a loaded gun, still holstered at the moment, but everyone knows whos belt it hangs on.

Good work, as usual, Gail.

One minor point I continue to quibble with: I am of the opinion that our economic problems are actually rooted not just in peak oil, but actually in peak global per capita energy. That peaked a couple of decades ago, if the Olduvai thesis is correct. (We've all seen the graph; I'm not necessarilly buying into everything about Olduvai, but the point that per capita energy has already peaked seems to be correct.)

If we had wise, forsighted, prudent leadership, we would have then shifted into what I call "managed decline mode" at that time. I believe that Jimmy Carter actually did try to take the first tentative steps in that direction. Unfortunately, we all know what happened to that.

What we got instead was an effort by people at the top to goose the system, resulting in a couple of decades of what I call "funny money growth". It is this story that leads directly into the current chapter with its massive over-leveraging of all types at all levels, and the impossibility of de-leveraging without inflicing massive economic pain.

What we are seeing now is a desperate, last-gasp effort on the part of the political and financial elites to restart the perpetual growth machine; stagnation and decline is apparently unthinkable and unacceptable to this lot, so they will apparently stop at nothing to try to restart the growth engine. (It is interesting that in past financial crises, A.K.A. "panics", it has been the masses that were in panic mode. This time around, it is the elites at the top that are in panic mode - though careful not to actually show any emotion in public.)

They will fail, of course. This is where peak oil does come in directly. Peak oil has now set a ceiling on the economy, effectively preventing any resumption of the old growth path (real or "funny money"); it is also going to be a ceiling that is continuously lowering.

Decline is our future; I see no real possibility of avoiding that. The only things that are still in question is: how fast, how hard, and to what level?

If we had been in "managed decline mode", the answers to those questions might have been: slowly, softly, and to a level that still allowed for a relatively good, civilized life for a lot of people on a sustainable basis. Unfortunately, every day that passes that we fail to shift into a "managed decline mode" renders that outcome less and less likely. We still haven't begun to shift into a "managed decline mode" yet; indeed, not only are we not even talking about it, I see no evidence that it is even "on the radar screen" of any of the political or financial elites. Anyone who even suggests that this is inevitable and necessary is instantly marginalized and ignored. This suggests to me that we are many years away from actually shifting to a managed decline mode. By that time, we will already be well on our way down the descent path, and a lot of options and opportunities to manage a slow and soft descent to one of the less painful outcome levels will have already been missed. Even then, I would not take it as a given that we must inevitably crash all the way back to neolithic or even paleolithic levels; however, the more catastrophic outcomes start to look increasingly possible the longer we delay accepting the inevitable.

"peak global per capita energy"

Could you clarify because I don't see a peak "decades ago."

I was not aware of the last four data points in that series. The fact that global per capita energy has been almost flat for two decades, though, still supports my thesis that the world had shifted then from growth mode to stagnation mode, with decline to follow. I don't know what the reasons were for the increase over the past four years, although I suspect that China and India have a lot to do with it. Most of us would argue that this is not sustainable and must certainly bump up soon against the peak oil ceiling.

WNC,

"my thesis that the world had shifted then from growth mode to stagnation mode,"

You are probably forgetting that GDP/ energy(BTU) has been increasing by 1-3%per year over last 30years, faster after a price spikes, slower after a price declines BUT always going up. Vehicle fuel economy from 12mpg to >22 mpg, high efficiency light bulbs, better refrigerators, more insulation in homes etc, CA leading the way in US. No reason for this to stop in next 100years.

Also some growth in population, thus a big increase in GDP as well as GDP/capita over last 20-30 years.

You've fallen prey to Simpson's paradox, and the data by no means supports the conclusion you're attaching to it.

See here for a detailed explanation; the short form is that it's an illusion caused by the developing world's population increasing faster than the developed world's population. Energy use has increased for everyone, but the larger proportion of people in developing nations skews the average.

Energy use has been increasing for almost everyone for almost all of the last few decades. To view the last four years as some kind of anomaly is to deeply misunderstand the data.

I believe that if you go back to 1973 you will see the peak per-capita oil conusmption. Population was a lot less then.

EIA data doesn't go back that far.

Euan did a bit a while ago that throws that myth on the fire.

Gail have you changed your thoughts on this topic? I thought that I had understood you to be saying that oil had had indirect effects on this financial crisis. The falling EROEI meant that there wasn't so much gain to be made from normal investments. This precipitated the search for yield and led to all the funny-money lending which we'e seen for this past decade, and which is now crashing.

However, in this piece you seem to be saying much more that it was the direct rise in price in oil which popped things.

Have I misunderstood you? or is this merely a chnage of emphasis?

Peter.

The economy has to have growth to keep it going, so it is very vulnerable to a rise in oil prices, which cuts back growth.

There is a relationship between the amount of debt an economy can sustain and the economic growth rate. To sustain lots of debt, one needs lots of growth.

About 2001, when real growth was lacking, our leaders tried to ramp up debt based growth (low interest loans) and this was continued and expanded. The high level of debt required a high level of growth to sustain it. But with oil production stagnating, there was no way that growth could continue at a high enough level to keep up with debt, which is why the whole system is falling apart. Peak oil would assure that this effect happened eventually. The precise timing was influenced by the high level of debt in the system.

I don't think I am really saying anything different than in the past.

I think that I've seen you emphasize more that the reason why real growth wasn't coming after 2001 was due to lower EROEI, the end of easy oil etc.

But as I say, this may simply be me reading things in which weren't there, or just seeing things differently from day to day,

Peter.

Ain't necessarily so ... the dynamics of financialization determine its structure, not the needs of the greater economy. The growth of participants' profits is what determines the architecture.

Much of the hoopla surrounding financialization has been the propaganda promoting a 'Post Petroleum' economy where 'IT Services' and 'New Means of Communication' will replace dirty, heavy industry. Of course, this was false.

I don't think it matters whether the this or that by itself is 'The' reason for our current predicament. Since energy is an input and it has a cost - relative and absolute - and that cost is hard to turn into an investment (there is no return on energy expenditure after the fact) the effects of accumulated energy cost will ultimately have a dampening effect on economic activity. That's why I cannot quibble with Gail's conceptualization. Even if it's technically tenditious today, it won't be sometime in the (immediate) future.

Thinking of what the hubbert curve looks like, I'd expect that a longer rear-view mirror will show that problems started surfacing in the financial system when the upward trend in the production curve started to fall and that would be well before peak. It might correspond better to per capita, but still, "the system" itself would be sensitive to a falling rate of return regardless. That would be the point where marginal returns began to diminish - well before absolute returns and peak itself. [Sorry, I'm a little confused with first and second derivatives here, but the whole argument tying the financial system to Peak Oil seems to me about changes and inflection points in rates of change. Tainter.]

Another point is about "plenty of stuff if prices where higher". What if it's not the higher prices that is the issue, but the greater chunk of the economic pie overall that the higher prices indicate? That would put the argument in line with Hall's pieces of some months back, where he drew those charts of energy taking bigger and bigger bites out of the overall economy. It's not that the price is high, but that the price*quantity is too big a proportion of the economy. So there will never be a situation where we can find "plenty of stuff" at higher prices because we can't generate the price*quantity of stuff in aggregate.

The financial crisis is first and foremost an evironmental and ecological crisis. Limits.

So yes, Peak Oil has set a limit on the economy and we have to shrink because we cannot make the economic pie as big as it would have to be. It's an EROI argument as well.

And yes again to managed decline. Scale, distribution and allocation. What is fair and who decides. This is an entirely different economic paradigm. And if Nate is right, that the adherents of the current paradigm have to die off first, then maybe the "enlightened" might not want to do anything that decreases die-off among the old guard. For example, there are some proposals about extending Medicare, working from oldest to youngest. I've started making the case for working from youngest up instead. The boomer generation - we've ripped off enough of the planet - not our turn any more.

cfm in Gray, ME

I think you are right. As the rate of increase in fuel supply dropped, even this would be enough to make problems for our system that required growth. Our government, realizing the need for growth, would step in and push growth ahead any way it could--encouraging builders to build more big houses, even if we didn't need them; encouraging financing for even those who had no chance of paying the loans back; holding interest rates down (as it is doing now).

I agree it is a limits issue. One can print more money, but this doesn't make more resources. All we can do is allocate what is available.

Heathcare is a whole other issue. The elderly are offered surgery, no matter how old they are, or how poor health they are in. The amount of care provided in the last six months or year of life is very high, with very little benefit. We would be better off spending more on health care of young people. Also, why do we need so many specialists and sub specialists, with very high salaries? It seems like no matter how mundane the problem (draining a cyst, for example), one has to transport the elderly person to yet another specialist.

If oil supply growing less quickly were enough to destroy an economy, how did it survive the late 70s/early 80s, when oil consumption fell 20%, and didn't recover for twenty years?

Recent history tells us that an outright drop in oil supply, much less a mere slowdown, is not sufficient to destroy the economy. Why is this time so different?

Debt. Absolute and relative. Public and Private.

Why are you conflating falling supply with falling consumption, i.e. conservation?

Cheers

This is not a popular point of view, and a lot of folks are going to disagree--vehemently--though it was iterated long ago by Colin Campbell (video).

More recently, it was even articulated by the CEO of FedEx, Fred Smith (radio).

My own view is that this is for the historians to decide. And yet the claim that the inflection in the flow rate of crude oil in 2005 has nothing to do with the current economic collapse forces us to accept the following improbabilities:

1. That the state of the economy is completely unrelated to stagnant energy flows;

2. That the onset of collapse during peak oil is a mere coincidence;

3. That the many experienced academics who predicted a peak and collapse between 2005-2010 were just lucky;

4. That historical correlations between oil price spikes and recessions (1973-76, 81-83, 91-93) are irrelevant;

5. That the inflection in oil flow rate in 2005, the subsequent mother of all oil price spikes—WTI at $147 in the summer of 08—the subsequent flight of trillions in wealth from oil consuming nations to oil producing nations, the subsequent price spike in all oil-dependent activities, the subsequent reduction of discretionary spending, and the subsequent decline in the economy, is not sequential at all but an illusion.

We are living an experiment we cannot repeat while varying the conditions.

We can only guess what would have happened if, in 2005, the previously-undiscovered super-giant Ummagumma oil field in Pennsylvania had come on line; if oil production had gone on increasing exponentially; and if oil prices had stayed cheap. Would the real-estate-triggered collapse have been as comprehensive? Who’s to say?

Likewise, we can only guess what would have happened if, in 2005, our financial institutions had been as sound as houses (as it were); if debt loads had been sustainable; and if mortgage rates had stayed affordable to people of modest means. Would the peak oil flow rate and subsequent price spike have gone on to ruin the economy to the extent it is now? Who knows?

It will interesting to hear the responses to this.

No argument from me.

My August, 2006 missive:

http://www.energybulletin.net/node/19420

Net Oil Exports Revisited

by Jeffrey J. Brown

Hi westexas,

I found this breakdown of stimulus spending. The section that deals with, "Fossil energy research and development" states a figure of $3,400,000,000. I have no idea if this is a large amount or not in relation to the problem, maybe you or anyone would care to comment?

It wasn't just Collin Campbell and I that talked about the expected relationship to the financial market. M. King Hubbert pointed out the relationship many years ago:

In my opinion, starting about 1970, our MBA's got the bright idea that we could make the most of growth through leverage--borrow from the future to make more for today. This only works going up the hill. Once the economy starts going down, one suddenly has a mountain of debt that can't be paid back. Because of all this debt, there are often multiple entities with claims on the same resources. One has a huge immediate problem that is quite different from the slow geological decline of the oil.

Really. You think that started in 1970. How cute.

wow. what an awesome quote. thanks gail. (that seems to be like my main post. sorry. don't get an ego, girl ;)

hubbert didn't freak out. im guessing he know approx. how much time we all had.

time can move so slowly. i believe bandaids will steer us clear of the worst of violence, the dies irae every doomer sees all too clearly.

it's so strange. i have two children, aged 2 and 4. my wife is a nurse, 26 credits away from being a practitioner. and we're like trying like all h e double hockey sticks to get our house in shape to sell. but then where to buy? countryish affluent suburb will be fine intra-societally, post-peak. but will the internally displaced metro area target it? medium(ly) affluent 'burb will be mediocre at best intra-societally, as the looser fringes tear at the greater fabric, but will it be ignored?

like i said, so strange. i think im about to go back to school to get my contractor's license in a jiffy, so i can install as many solar panels as possible as quickly as possible with what stimulus money i can get my hands on. that is a win-win-win situation.

still, where to live? and how do i clean up after these two angels fast enough to sell this damnibul house while opinion is up. up!

oh. ccpo. you are doing excellent work. thanks for your response a few weeks ago (just read it. (i am so busy)).

if gail's assertion that peak oil is now and massive drop is in 11'-12', then eroei will remain in obscurity (mechanically, and then academically speaking) for oh about 5-7 years. (and that's discounting military action.)

im so glad our president is our president. can you imagine if bush had been our president during peak oil? oh wait...

i really wish i could say something more technical.

(still firmly convinced that our fate rests in the hands of the scientists.)

thanks everyone,

Missing from this analysis is any acknowledgment of trade deficits and international capital flows.

U.S. Trade deficit (billions of dollars) Year Total Petroleum Pct Petroleum End-use* End-use 1998 247985 43348 17.48% 1999 345559 59187 17.13% 2000 449468 108284 24.09% 2001 427165 92950 21.76% 2002 484353 93234 19.25% 2003 547552 120402 21.99% 2004 666183 163998 24.62% 2005 782740 229191 29.28% 2006 836077 270918 32.40% 2007 819373 293221 35.79% 2008** 856177 418621 48.89% *This includes petroleum and products extracted from petroleum **Extrapolated for full year based on 1st nine months http://www.census.gov/foreign-trade/Press-Release/current_press_release/...These trade deficits were recycled back as low-interest-rate loans to U.S. corporations (mostly to the banking and shadow banking industries), causing inflated asset prices, including residential housing, commercial real estate, stocks, bonds, securities such as MBSs, CDOs, etc. and perhaps speculative instruments linked to the price of oil and gas.

This begs the question: "What would have happened if the U.S. could not have borrowed the money to buy oil?" I think three things might have been different:

1) One of the elements that contributed most to blowing up the credit bubble--the loaning back to the U.S. of dollars spent to buy oil--would not have existed, and thus the credit bubble would have been smaller.

2) If the U.S. had not been able to borrow the money to buy oil, it would have to have made do on less--U.S. demand would have been lower.

3) If U.S. demand were to have been lower, the price probably would not have acheived the heights that it did.

Also, all this analysis seems to be based on one assumption, and that is that economic growth is not possible without growth in energy consumption. It seems to me that "growth," which we officially define as GNP, is a value-laden concept. Could we not choose to redefine "growth" so that it is not so energy intensive?

I am afraid I couldn't cover everything.

Growth in this case really has to do with having income to pay back loans. Growth from the point of the wage-earner stopped earlier than growth from the point of view of profit-making corporations, because wages weren't rising. (We were hiring programmers from India instead.) Hence the early vulnerability of home mortgages to default.

Growth is also needed to pay back governmental debt. Does anyone really think the US economy will grow enough to pay back all of the additional debt we are taking on now?

Barak Obama and his advisors apparently do, if last night's press conference is any indication. At least that is the official public position.

I believe the Obama administration is engaged in what might be called an economic hail mary pass. He and his advisors are not stupid. They undoubtedly know that the foundation of today's economy is crumbling and total collapse is a very real possibility. Remember when the president repeatedly warned that we face extreme economic problems? The media, market and politicians told him to stop being so negative and to give us "hope" that things will soon return to normal. Well, now he is following their advice. I understand that crying "FIRE!" in a crowded theater is not the best way to safely evacuate everyone. However, now we are being told that the fire really isn't so bad and is under control, so we can return to our seats and continue to enjoy the show. I think I will begin walking towards the exit sign.

Gai,

"Does anyone really think the US economy will grow enough to pay back all of the additional debt we are taking on now?"

I do, if the economy grows at 3% and the US is paying 2% interest on debt above inflation, the governments revenues can grow more than 3% so principal will be repaid( if they have a Clinton type president/Congress that runs a balanced budget; 8years of GWB type spender/tax cuts could give a different outcome.) Raising taxes on those who can pay is a good start, raising gasoline taxes for all is an even better second action, raising sales taxes on low mpg vehicles even better, as long as the taxes are not spent on new highways.

Gail, thanks for this post. I just started a similar discussion on the Dutch Peak Oil forum today. Speaking about a coincidence. However... my conclusion is that the relation between peak oil and the credit crisis is not as tight as you say it is. I read the article on the rolling stone website: The Big Takeover ( http://www.rollingstone.com/politics/story/26793903/the_big_takeover/print ) and after reading that i'm convinced that even if oil production still was rising we would have had a credit crisis anyway. Maybe a bit later, but eventually it would have crashed because the credit system was not sustainable by design (if you read the article you'll understand why i say this). By the way, i think the rising oil prices helped the credit system crash, but those high prices were imho also a result of almost the same greed as with the design and the abuse of the credit system and not so much the result of physical oil demand.

And if the relation is not as tight, maybe we can get a (small) recovery of the economy before peak oil really kicks in. Before the credit crisis we spoke about economical decline due to peak oil after 2010, 2012, 215 or even later... Were we really wrong then? When you just look at the production charts who would have thought that it all would happen so fast. Imho the correlation between the oil production (that is what peak oil basically comes from) and the economical data of the last year is not extremely high. Proving a causal connection is very far away, if not impossible...

Quite a few of us (M. King Hubbert, Collin Campbell, and myself, at a minimum) all expected this kind of problem, because money has to keep rising exponentially to repay debt with interest and resources can't continue to grow fast enough, even with gains from efficiency. See quotes elsewhere on the thread.

I suppose one can conjecture other explanations. I don't see a point in why, however.

1st point i try to make is that the credit system was bad enough in itself to crash and 2nd point i try to make that it's nearly impossible to "prove" a causal connection between peak oil and the credit crisis. It's too easy to connect peak oil and the credit crisis because they occur at the same time and some things we thought would happen after peak oil actualy happen.

I agree that Gail's work here is a bit too simplistic, but at the end of the day, her general observations are accurate. All the more so when you consider that the real power in the White House was Cheney, and nearly all the major players in that administration came from the oil industry, even C. Rice.

When you factor in that Cheney now-infamously implicitly cited Peak Oil was coming in 1999, and that they went into Iraq on trumped up charges, Greenspan's and Bush's blowing up of the credit bubble makes a lot more sense.

There is no way they didn't know this was coming in some form or other. Again, Cheney stated the need for something like 50 mbd of new oil by 2010 back in '99, while noting the ME was the prize.

So, yeah, it's basically impossible to say this is not all connected.

EDIT: I should add BuCheney needed the bubble to pay for the simultaneous wars and huge tax cuts.

Cheers

While there is no doubt that the sharp run-up in oil prices has been a drag on the economy, I find it hard to see it as a main contributing cause to the suburban housing problem.

To take an example, if a not-untypical suburban household drives a total of 20,000 miles per year at an average mileage of 20 mpg, then they will consume 1,000 gallons of gasoline a year. Thus, in their case the difference between $2.00 gasoline and $4.00 gasoline amounts to $2,000 per year, a serious financial drain to be sure, but I think hardly enough to make most people decide to sell their suburban house, or to avoid moving to the suburbs, or to seriously drive down housing prices in general.

No, I think the effects of this financial mess, involving excessive bad debt, excessive leverage, and outright fraud, largely dwarfs the effects of peaking (as opposed to 'peak') oil. If our financial system had been healthy at the time of the oil price spike, then the effect of that spike would very likely have been only a minor downturn, not the near collapse we actually have.

This whole thing happened far to fast for anything solidly physical to have caused it.

Electronic money has no mass, moves at the speed of light, and can go in and out of existence with a stroke on a keyboard. Oil, on the other hand, does have mass and far more institutional inertia regarding the manner in which supply and demand try to come into balance.

joule -- Valid points to a degree but I'll offer my view. First, the housing melt down was triggered by mortgage defaults and not any lessened desire to live in the suburbs regardless of the price of gasoline. We would agree there perhaps. But the question really goes to the cause of the big increase in mortgage defaults. IMO, many would have defaulted even had energy costs not spiked. Too many liars borrowing money who had limited abilities to repay. For many of the others it wasn't the increase in the monthly gasoline bill. It was the loss of a job as a result of economic recession (or at least the slow down) brought on by higher energy prices over the last several years. But I would agree this is where the logic gets complicated: higher energy led to increased lay offs which led to increased defaults which led to declining home values which led to collapse of the over-leveraged financial system (especially the derivative market) which led to huge losses of equity in the system which led to huge declines in borrowing capability which led to a big drop in demand for housing which led to an ever decreasing ability for folks to refinance those adjustable mortgages which led to more defaults which drove home prices down even more which hurt the financial markets even more. So many feed back loops it difficult at times to see where one stops and another begins.

Thus the question seems to be could the increase in energy prices have really been such a tipping point? I agree that the system seemed doomed to fail just from the volume of potential bad home loans written. But would it have been as damaged without the energy price increases in the last 3 or 4 years? And had it not been so bad would the whole financial market not have collapse as catastrophically as it did? Every one is free to have their own answer but I don’t think it would be easily to back up any one argument too definitively. Just too many “what ifs”. One could make a point that the financial meltdown has brought about a delay in the negative effects of PO. Or just as easily say that we are suffering from many of those same proposed effects but due to a different source. Or that we’re seeing combined but interrelated effects of both. This is one reason I think it’s nearly impossible to predict how much or little current federal actions will help or hurt the system. It seems as though we’ve entered a world that will be dominated by unintended consequences. The only real questions is how badly we’re injured or aided by those circumstances.

ROCKMAN -

I wholly agree with you that there are all sorts of messy feedback loops at work here, probably many of which we are not even aware of. The possible chain of causes you mention sound plausible to me, and I really think it's hard to pin it all on any single cause, which is why I think that this notion of peak oil being the primary cause is more than a bit dubious.

Suffice to say that the our entire system is getting increasingly stressed from multiple directions. At least that we can be absolutely certain of. But just as different individuals are susceptible to different kinds of health problems, so too do different complex economic systems get sick in their own unique and largely unpredictable ways. I guess this is just a different way of saying that failure modes are hard to predict, but that when a system gets over-stressed, it WILL eventually fail one way or another.

I think I agree with this point of view.

Why do we have to try to explain the collapse as a result of high-oil prices and high-oil prices as a result of peak oil (or some other nice explanation of a clean chain of causation).