CFTC - Futures Position Limits on Energy?

Posted by nate hagens on July 8, 2009 - 10:41am

Let's return to a central theme: that finite resources are being quantified by infinite money. Today the CFTC made some announcements regarding transparency in futures positions; also Congressional hearings began with intent to limit futures positions sizes , especially for energy speculators. Unfortunately, this 'speculation' issue is one of many red herrings that ignores the widening fundamental disconnect between financial and real assets. (PBS Nightly Business interviewed me on this topic -sound bite from 3:16-3:40). Below the fold is a brief summary of what I said in the longer interview followed by an open thread on the topic of the future of energy futures.

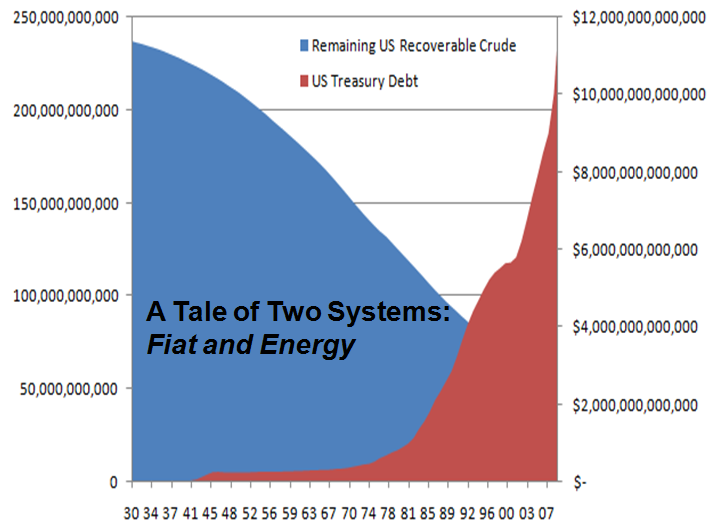

US lower 48 remaining recoverable oil** vs. US Treasury Debt

Our first hearing will focus on whether federal speculative limits should be set by the CFTC to all commodities of finite supply, in particular energy commodities, such as crude oil, heating oil, natural gas, gasoline and other energy products,”

Energy and natural resources are what we have to spend (or to marshal). Money is just a marker for these real assets, and the ever expanding definition of money - now extending to margin, credit, debt, on and off balance sheet derivatives, etc. - has caused an extreme, paradigm changing disconnect between financial assets, and what they were originally designed to represent. We need growth in order to pay back debt and need energy gain ((gross - costs)*scale) in order to grow.

Historical purchasing power of US dollar thru 2004 (American Institute for Economic Research)

The value of fiat currencies erodes over time, while remaining high quality energy increases in strategic value, even if not recognized in monetary terms. Historically, based of course on historic comparisons, commodities were the ugly stepchild in investment portfolios. As long as energy and resources were cheap, more long term gearing/profits were to be had from the vanilla 'derivatives': stocks and bonds (these are derivatives of our real capital: natural, built, social and human that underpins them), than from the commodities themselves. But as the world, in recent decades, was flooded not only with liquidity, but an order of magnitude (or more) increase in notional credit, relaxed oversight rules, relaxed lending standards, higher leverage, etc., those digits with the highest velocity have had to seek a home. Their doing so culminated in 2007-8 via a dramatic commodity market rally, (within which, oils kiss of $147 last July grabbed the most attention). What really happened in the ensuing 9 months was not a sharp drop in commodity demand, but a global margin call of epic proportions - all sorts of players were caught long and short (mostly long) had to pare down positions in almost all asset classes (US treasuries being notable exception). During the 5 years ended July 2008, the SP500 and crude oil had an R^2 of -.29, for the 7 months after: R^2 of .97! (Daily closes, graph here) The point of this is that oil was not in a speculative bubble, unless you amend that statement to: "oil was one of many instruments in a fiat liquidity bubble, but it was the most important commodity to the global economy so the media paid most attention to it". And to those who are adamant thatt speculators were responsible for oils rise last year: coal tripled in the same period and is not traded on the NYMEX....

Speculators are generally ignored unless either of the two unassailable American entitlements: rising stocks and cheap oil, are not on trend, and a witch-hunt for bad guys ensues. As we are mired in a deepening recession, the roots of which lie in the generation long replacement of tangible things with paper and digits, the logical human reaction to oil moving back from $40 to $70 is to blame someone, in order that it retreat some and not act as economic headwind. (The same thinking mans logic used to request temporary withdrawals from the national emergency Strategic Petroleum Reserve to reduce oil from $70.) The blame it seems, will again fall on speculators, (note: technically the majority of participants in our economic system should now be defined as speculators -we are buying/spending natural resources on margin with a downpayment of belief). As we have been writing on these pages for years, oil supply has maxed out, so any stabilization in demand will naturally result in rising prices. Couple that with many investors concerned about the inflationary impacts of quantitative easing, and there is a demand for ETFs, futures and derivatives representing real-not-derived-from-thin-air) assets, or the digital entries that legally control real assets. Recent liquidity dislocations arising from the linkage between the natural gas ETF, UNG, and natural gas futures have also heightened concern about position limits, and today UNGs administrator announced that no new shares will be created. In the end the demand for paper natural gas is higher than the demand for real natural gas. An odd situation, but the blame shouldn't be on the hedge funds, but on who designed the rules they follow. (On a deeper level, the blame is on all of us, for sleepwalking into this situation)

So what does this mean? Energy, particularly liquid fuel, is the hemoglobin of modern civilization. Price signals based on the marginal unit create long term distortions for utilities and energy policymakers. On the micro level, it is only a matter of time before a highly leveraged, underregulated hedge fund (think Amaranth, Ospraie, but bigger) causes dislocation in energy markets due to their size. On the macro level, depending on which estimates you trust, global notional derivatives are in excess of 1,000 trillion, while global GDP is only $55 trillion (and a decent chunk of that financial, aka questionable). If we accept the peak oil estimates of global remaining recoverable crude oil of around 1 trillion barrels, that equates to $62 trillion using todays closing NYMEX price. This is roughly equal to US treasury total debt (including unfunded Medicare, Social Security liabilities).

We have a monumental problem - a system whose claims on the future are higher than its real assets. This CFTC debate is a tiny microcosm of the greater social landscape.

Reducing positions sizes and increasing margin in energy futures is a step in the right direction to equilibriate paper markers with real wealth. But it will have immediate negative repurcussions (reducing liquidity, reducing confidence in system, increasing volatility etc.), which is why it ultimately won't happen. We will continue to borrow from all aspects of our socio-ecological system to keep the current paradigm intact (growth at all costs, marginal unit pricing, infinite substitutes, market will solve it, etc). Sooner, rather than later, a plan for re-linking scarce resources to what and how we execute social transactions is going to occur. Like M. King Hubbert, I am in favor of an energy based currency and no futures trading at all other than for producers and those taking delivery. But these ideas are so many steps beyond 'regulating oil futures in order to keep prices low' I expect I am wasting my breath. As debt increases, and resources deplete (especially the cheap ones), a reckoning lies ahead. One way or another we have to attack the fractional reserve banking system rules. Proactively or reactively and gradually or in one fell swoop are the main questions.

Previously on this topic:

A Closer Look at Oil Futures 9/2/2006

Natural Gas - A Tale of Two Markets 9/26/2006

At $100 Oil, What Can the Scientist Say to the Investor? 1/04/2008

Peak Oil and Reflexivity and Peak Oil 6/08/2008

CFTC - Speculation My A$$ 7.23.2008

Hurricanes, Hedge Funds and Energy Markets

No Naked Short Selling==>No Future Energy 9/19/2008

The Credit Markets, Financial Crisis, and Real Wealth (Guest post by Herman Daly 10/13/2008

comment on global margin call 10/25/08

Advice to Pres. Obama - Yes We Can But Will We 1/15/2009

**Remaining recoverable oil is based on Hubbert Linearization by Samuel Foucher here less actual production (consumption) - approx 25 GB recoverable left excluding GOM and Alaska.

Minor point, but I think that the HL plot that you showed is for Total US (assuming crude + condensate).

Shouldn't the currency be based on a basket of non-renewable resources which include energy, minerals, fresh water, etc.?

Just a quick point. Since every commodity can be valued in terms of the energy required to obtain it at the site of use, energy still provides a better single valuation measure. The real issue is to choose the right form of energy. I favor basing a paper/digital currency on 'exergy' which takes into account the quality as well as quantity of energy available to do useful work. That is, exergy is based on both potential and coupling of form with prime movers/heaters, etc. from which useful work is obtained.

Exergy accounting should be realtively straightforward. It is the net energy potential after accounting for energy invested to obtain a usable form (e.g. electricity, gasoline, etc.). Setting an exergy standard for monetary units should achieve most of the things Nate favors. In addition it puts a strict constraint on the nature of money creation, especially debt creation. To be specific, no debt can be created execept in anticipation of provable availability of gross energy supplies (e.g. oil already pumped and awaiting refinement). All other borrowing should come from savings (e.g. the actual gasoline in tanks that hasn't been used due to lower demand - or water behind the dam!). Borrowing against a speculative future availability of energy would be prohibited. Borrowing from saved (unused exergy) in order to invest in energy conversion capital equipment would be the highest use of liquid capital.

Then, live simply and happily!

Question Everything

See category of Biophysical Economics.

George

I love this idea BUT.

The US would never ever go this route because the middle east would become the world bank.

If we could all get along it would solve most everything.............if we could all get along that is.

Isn't the attempt to wring the speculators out of the system completely misguided. It seems to me that a critical data set was established between 2004 and July 2008, which was that the price of crude tripled and production remained essentially flat. Whether the rise in the price of crude was due in part to the role of speculators and/or market participants getting caught in short squeezes, is, on the whole, immaterial. What is important is that the world does not appear to be able to reliably produce much more than 85mm barrels/day of crude and other energy liquids. Rather than waste everyone's time trying to reset the rules for the energy futures market, it would be far more worthwhile to take dramatic measures to decrease the U.S.'s and rest of the world's use of fossil fuels in transportation. anyway, just my thoughts.

Wait a minute! Isn't the energy crisis solved? I mean kitegen has an EROEI of 375! Thorium has the potential to provide infinite energy and there is space based solar power? :)

Scarcity is so old school! We live in the Economists world of abundance and plenty, can't wait for the singularity to occur!

Yes! When computer scientists create 'Artificial Stupidity'.

Indistinguishable from the real thing. The Singularity will look and sound just like Ronald Reagan.

"It's morning in America, again!"

"No, you jackass, it's 9:33 at night!'

It's going to be hard for the CFTC to distinguish 'Bad' speculators and 'Good' speculators. Good speculators are needed to take the opposite positions of physical trades - they provide the all important liquidity. The bad speculators simply buy the market and and use their size and transaction velocity to push up prices.

The problem is that one of the 'Bad' speculators is Goldman- Sachs, the fourth branch of the US government.

OUCH!

Another 'Bad' speculator is China, buying oil with some of its dollar reserves. Here, China would be 'screwing' America in the morning again ... but, what's new? I imagine all the producers are buying long- dated crude contracts - and some call it hedging! This would make the producers bad speculators. Why wouldn't producers manipulate the market? Easier to make cash on oil you DON'T have to deliver ... and if for some ungodly reason delivery is required ... they actually have crude oil to deliver!

Yeaaaay!

Also, shippers and refiners are selling crude back and forth to each other outside of the reach of CFTC. A tanker load of crude is represented by a receipt. How many times will that receipt change hands between the Gulf of Arabia and the Gulf of Mexico? Between the terminal and the the refinery?

I say, good luck CFTC! I really hope this is the 'singularity' thing can bring back Hope. You know, so we can 'move forward'.

Ronald Reagan, moving forward into morning in America, again ...

http://economic-undertow.blogspot.com/2009/07/defeating-evil-everywhere....

It's "the magic of the market" till the magic produces things we don't like. Then it's "those nasty speculators." It's been the same thing all along. But somehow we can't face that the system that creates huge amounts of apparent wealth for a few can also destabilize the entire system for all.

The main point of course is that the system goes nuts as real limits come into view. But TPTB, most economists, and most of the public cannot acknowledge such a possibility, so a scapegoat must be found. Not that I hold traders blameless. But to pin the problem on a few people rather than the blindness of the whole system is myopic at best.

From the main post, first sentence: "finite resources are being quantified by infinite money."

Blame it on Fibonacci for introducing the Arabic (really Indian) numerical system, complete with that handy cypher, that provided materialistic, piratical, spiritually backward European monkeys the ability to imagine and calculate limitless plunder in a limit world.

I still don't totally get it how speculators can affect oil prices. The speculators are playing with future markets. Real oil is priced in spot markets. Unless speculators have a big tank, I don't understand how they can buy oil from spot market and make the price rise.

Of course they can cause future markets to rise and create contango. Then someone can make money by buying oil from spot markets and storing it as has happened recently. But was this case what caused the spike in last year? Or was it real demand from refineries?

Nate,

global notional derivatives are in excess of 1,000 trillion, while global GDP is only $55 trillion

Is this relevant? By the nature of derivatives they are bets taken against each other, they are not physical products, when the 1000 trillion are added together, won't they become close to zero?

No

a)they can be created just by a penstroke (via fractional reserve banking) - that used to allow 10:1 leverage on its own but de facto it is much higher than that due to dropping required reserve percentages, reducing the categories of funds needing a reserve and allowing funds to be swept from a reservable category to a non-reservable category overnight.

b)furthermore, if you and I each put up $5,000 margin for an oil futures contract, and you go short at $65 and I go long at $65 we collectively have $10,000 of capital controlling $130,000 of ostensibly offsetting positions. In theory - if oil moves $30 per barrel (up or down), one of us wins money from the other - but what if after your $5,000 is burned through, you walk away, owing the futures brokerage/exchange $25,000. Someone, either me or the brokerage is out $25,000. Multiply this example by millions of counterparties and positive feedbacks worldwide and you have recipe for disaster.

It is possible though that a large % of those contracts offset, but not likely. No one knows.

Nate,

Doesn't that mean that the counter-party risk is the $5,000 capital the contract buyer outlays not the $30,000, in other words in aggregate not the 1000Trillion but the actual amount of "non-leveraged" investment.? Surely it's possible to estimate this from the leverage ratio of specific investments?

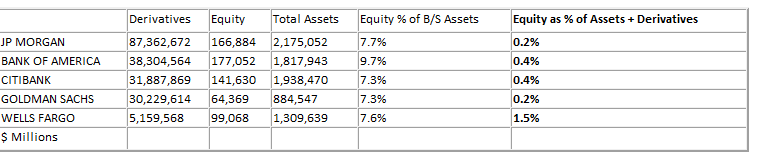

Not possible, but we have alot of clues. Here is equity as % of assets for some major banks at end of 2008:

I am in the (minority) camp that believes we have significant deflation before inflation -quant easing is drop in a bucket compared to credit destruction in real economy.

Nate,

Thanks, that very interesting, if those derivatives are not hedged or poorly hedged it's easy to see big financial problems quickly developing.

Hi guys,

Nate, I'm on your side. Japan's been "printing money" for almost 20 years now and know nothing of inflation. The deleveraging continues. It will take a long long time for paper money to catch up with "digital" money, especially with the demographic and peakoily situation.

Welcome to Kondratieff winter. Like in Narnia maybe a winter that will never end...

Well, will take a while to be played out:-(

Cheers, Dom

a 0% interest rate isn't printing money.

Choose your value for N. Inflation can always be made to win in a fiat system. All it takes is for someone to stand up and say "I am going to make your money worthless.", then actually start doing it.

"0% interest rate"

You're refering to Japan, right?

You're right, hyperinflation sounds so *easy*, but...

Please explain how to add money to the system in order to create price inflation (central bank / treasury). Why isn't it working right now?

Where did your $MONEY come from to multiply with inflation ($N)??

Fiat is not Fiat, meaning, it is not just "printed" without obligation. Instead, it is "borrowed" into existence. In the (Central Bank's) books "new" money looks like this:

Debit = Credit

Looking at your equation let's define:

$MoneyB + $NewDebt = $MoneyA + $NewMoney

Now, like a good Enron, wie act like we don't have any debt or say that our debt is part of the economy too and redefine: $MoneyB = $MoneyA + $NewMoney + $NewDebt, which will end in bankrupcy if there's no wealth behind that new debt. But that's not our question right now.

What we like to do in our economy is forget that the new debt ever has to be paid back:

$MoneyB = $MoneyA + $NewMoney

If this were the case, then inflation would be easy to produce. Then your equation could make sense. But what's happening now is not only new debt but also "deleveraging" ($DebtRepaid) and/or "defaulting" ($DebtDefault). Meaning:

$NewMoney = $NewDebt - $DebtDefault&Repaid

meaning:

$MoneyB = $MoneyA + $NewDebt - $DebtDefault&Repaid

Which tells me that inflation will ONLY occur if we make more debt than what is being defaulted and deleveraged.

Or is there a fault in my logic?

Cheers, Dom

IF you see John Mauldin around the fire in that camp, tell him Goober sayes hey. But that is pretty much what he said today: things are going to deflate for quite awhile. I want to believet that, but it is hard to reconcile delation with a debtor dominated democracy. Can't happen for very long, before the government just starts handing out money.

Nate,

The net of all derivatives/oil contracts is ZERO. For every long JPM has there is a short somewhere (and vice versa of course).

Bringing the number of "paper barrels" in line with the number of physical barrels doesn't change that. The only way to make a tight link between paper and real barrels is to not allow offsetting transactions / netting but to require physical delivery of every contract. Obviously that would cause trading, and therefore to some extend price discovery, to grind to a halt.

WeekendPeak

the net of ALL derivatives may be zero on paper but is not zero in reality, because much of the capital used by investment banks was penstroked into existence. It is not about oil contracts so much as it is about TOTAL claims in our system compared to real things. I talk about this all the time and must not be making myself clear - half the people get it right away and others continue to think it is a zero sum game - it isn't. The proof is that if it was announced that all derivatives/credit/loans/futures contracts etc. were to be settled next week, the world would be bankrupt (creditors far outweigh the amount of capital in system). It is true for oil and probably true for a large % of interest rate swaps etc. that they could be offset, but not the whole system - I doubt anyone knows how deep the system is in hock until we have a 'cancel all debts' jubilee.

Neil1947, you are quibbling over a detail irrelevant in the big picture

The best governments can do - within the current paradigm - is print money to plug the holes on the balance sheets. That's not enough, however, to keep business running. The bankers know they cannot make loans expecting them to get paid back from real wealth; the only way they can make money now is to extend the printing and looting.

The pledges - the loans and bonds and social security and whatever - exceed Gaia's blood. Smart traders shut down or game the system.

cfm in Gray, ME

Exactly! These claims violate basic laws of the universe.

Nate,

There is a possibility of systemic risk higher than just the percentage of non-offset contracts.

What if Neil1947 had also taken out a contract with me with him long at 60 (5k margin also), hedging the risk (and limiting his payout if the price does rise).

Neil would consider himself "offset" -- theoretically he can't loose (or gain) more than 5k.

The problem is if I then reneg on the 20k difference that the large swing puts me out, Neil is then suddenly exposed to the risk, possibly causing him pass this loss onto you.

These "offset" contracts are only as good as the person at either end of the chain (mitigated by the margin at each step of the chain, and the cash reserves of each player in the chain).

The problem is that it is this extra systemic risk which is quite hard to quantify - what is the correlation between bankruptcies of non-offset traders, and people who hedge themselves? -- i would imagine quite low, until a critical threshold is reached which burns through the intermediate cash reserves, then it would become highly correlated. To my (non economically trained -- i've a BSc, not a Becon) mind this would seem to be the largest non-linear risk within the current financial system. We've haven't seen this happen within mortgage securities; there wasn't much hedging, just complete on-selling, with the insurance companies having insufficient capital to cover the difference in value.

On an exchange traded contract, the exchange takes the credit risk. The exchange also sets collateral levels and maximum daily price swings. They'll sell out your position long before you owe them 20 grand you don't have.

Maybe. This assumes that the market is moving slow enough that they can keep up. In a rapid dislocation, they might not be able to find a buyer before they are under water. Even with max daily swings, if they can't find enough buyers at the right price, someone is going to eat a real loss.

Think market panic.

I agree with many of your points - however, I wouldn't necessarily say that funds like Amaranth and Ospraie are examples of extreme leverage. They flamed out spectacularly, but they weren't close to losing more money than they had cash on hand. I think that those are an example that the commodities futures market works really well compared to say, fixed income and equity markets.

For the size of their positions, the commodities markets handled those blowups extremely smoothly. We have actually had many dramatic blowups of both physical players and financial in the past few years, and none of them turned out to be systemic risk. Take 'speculators' out of the equation, and when a physical player blows up, it's going to be ugly, with nobody to provide liquidity. This is a problem with what lawmakers are trying to do.

It's a little specious reasoning to compare the amount of oil left with derivatives contracts. One is consumed and gone forever and one is not. Making a bet on something doesn't use up a resource.

The graph shows US Treasury Debt (not including social security and Medicaid shortfalls) vs remaining oil.

And the point is that we need growth in order to pay back debt and need energy gain for growth.

And the point is that we need growth in order to pay back debt and need energy gain for growth.

Do you mean "we need growth in nominal GDP in order to pay back nominal debt plus interest, or real growth and to have real growth we need either growth in total energy( FF plus renewable) OR a decline in energy intensity(energy/GDP)."

It's likely we will have some debt reduced by inflation, some real growth in GDP due to energy efficiency and considerable growth in renewable and nuclear energy replacing much of the 160EJ of oil with a much smaller amount(15-30EJ) of electrical energy.

After all it's not the energy in crude oil that's important its the energy delivered as work or as useful heat, and 85% of oils energy is lost during refining, distribution and low efficiency ICE engines.

If this is the case (and I think it is) then ie: debts will not be paid. What then?

I had the fantasy some years ago that suddenly all debts were canceled. It was dreamy, entertaining for a while but I couldn't come up with a "what then?"

Nate,

The two lead articles in this months Atlantic magazine deal with renewable energy and the management (or mismanagement) of economic bubbles and monetary policy.

Author James Fallow has done an admirable job of combining commentary with an interview with Nouriel Roubini,aka as Dr Doom, the New York University economist who called it correctly last year-and put his rep on the line in so doing.

I've insisted since my first comment on the matter in this forum that inflation is a very real risk,and that the printing press,or it's electronic counterpart,is a machine capable of crushing any amount of deflation,a conclusion I reached years ago from reading history and occasional pieces by economists who seem to make sense -to me at least.

Dr.Roubini,in response to questions concerning pumping money into the economy to help offset the collapse of a bubble(specifically abouut the timing of raising interest rates):

"that is very tricky...do it too fast ...eend up like Japan .back in a recession..do it too slowly you RISK CREATING INFLATION OR ANOTHER ASSET BUBBLE" page 92 July August 2009

In either case,prices rise-and sfaik there is every possibility of both inflation in the technical sense of the word AND another bubble. Double whammy!!

And don't forget what you do on a slick road when you KNOW you have only two choices-either you keep moving or you stop moving,maybe never to move again,until rescued by either spring or somebody with a BIG ole tow truck or maybe a helicopter.And there is nobody out there with either a tow truck OR a copter big enough for the job.

If she looks like she's stalling,human nature and history says they will floor it and try to bull thier way thru.

The one thing you absolutely cannot do and survive under fire is stop moving out in the open.

If there is any sort of additional crisis during the next few years,such as a HOT little war someplace,or if the guys sailing the monetary ship miscalculate.........?

The article on the status of renewables and the mindset of the current players is just as good.

Great article Nate. Some amazing analysis here. I particularly like articles like this that go beyond just analyzing oil supply or projected supply, instead linking energy in its relationship to the economy. You nailed it in so many ways.

"As we are mired in a deepening recession, the roots of which lie in the generation long replacement of tangible things with paper and digits, the logical human reaction to oil moving back from $40 to $70 is to blame someone, in order that it retreat some and not act as economic headwind."

"Energy, particularly liquid fuel, is the hemoglobin of modern civilization."

"Like M. King Hubbert, I am in favor of an energy based currency and no futures trading at all other than for producers and those taking delivery. But these ideas are so many steps beyond 'regulating oil futures in order to keep prices low' I expect I am wasting my breath."

It probably is a waste of breath because the same human behavior that ridiculed and ignored Hubbert, is still with us.

This is a graph shown is a WSJ article called Oil speculators under fire, comparing long oil positions and prices of oil. I am having a hard time seeing a strong correlation. For a while it looked like prices went up as long positions went up, but it doesn't look that way recently.

Many commercial contracts are also highly speculative I don't think just the non-commercial is good enough to get the full picture. Not to mention we don't know the real leverage levels.

To follow to some extent with Nates posts the leverage is probably more important than if the positions are net long or short. Since leveraged player esp those with large positions will be forced to make moves on fairly small market swings.

One would think that now leverage is a lot lower however the stock market is still at very high P/E ratios which makes one wonder if a lot of people have simply doubled down across many markets in and attempt to recoup losses. Personally I think that we may have even more dangerous leveraged positions now than we had back in 2007-2008.

And by dangerous I mean not just probably higher leverage levels but also high levels of potential systemic counter party default. In short not only did we learn nothing but we have probably gotten worse.

Well, here's my recreation of the readymade graph for 2008 CL (Crude Light) available from Current Commitments of Traders Charts. I threw in the WTI price as an added wrinkle.

Their graph also shows open interest, which loses volume through the year. Would be even slicker to add up the various parties who are net long or short. At any rate it makes less than no sense that the big players would jump out the escape hatch right when the rocket was headed for escape velocity; unless they knew it'd never make it into orbit, that is. Or some acid was eating its way through their parachutes?

I don`t think there is a significant correlation either, evidence shows that speculators in the future market are trend followers, they change positions following price fluctuations and not the converse. However, one thing that could help is to refine the categories used by the CTFC, using just 2 or 3 categories is just plain silly and makes analysis very difficult in particular when traders have no incentives declaring themselves as non-commercial.

Great article and analysis as usual.

I did a quick google on the 'value of money' and came across some interesting websites with calculators and database series on national inflation rates, purchasing power (erosion), GDP, etc., but nowhere -and i mean nowhere- in any of the so-called 'economic websites' that I followed did they make the link between currency (or credit) and our natural capital.

http://projects.exeter.ac.uk/RDavies/arian/current/howmuch.html

That's why I keep coming back to this sight for information about our economy. It's not just about the credit or currency folks! It's about how it interacts and relies on energy.

Kudos to Hubbert and Nate!

Yes, most economists miss the boat by not taking our energy situation in to account...also why I read TOD.

My understanding is that very little crude is traded in the open or futures markets, but rather is bought and sold on contract, after private negotiation.

Anybody know differently?

I have been a TOD reader for one year and I am a young professional that has worked in the oil and gas industry since 2003. I am glad that there is an active online community providing critical analysis on the worlds current energy issues.

I am in the camp that global liquids production peaked sometime back in 2005/06 and we are now witnessing the volatility in price that follows a widely used resource that is in terminal decline and has reached a supply/demand imbalance.

This recent call from various governments around the world to put the lid on "speculators" is just the dog and pony show that politicians will conduct to try and find someone to blame for the recent price volatility. Considering in the oil and gas industry uses futures markets and hedging quite a bit to mitigate market risk there is definitely a lot of concern about what may happen here but most don't think real regulation is actually possible.

Governments appear to be starting to worry now, peak oil is becoming reality and a more frequent headline in the news. Many economies and businesses cannot and will not be able to operate in an environment where such a critical resource can fluctuate so violently in price. This is going to cause further contractions and many more bankruptcies beyond some of the recent automotive, banking and airline industries which I consider to be the "canary in the coal mine" businesses for peak oil. I also think it will pose significant problems into the oil and gas industries ability to survive in its current form much less increase production.

The fact that cap and trade is likely to pass in some form and that the current administration is providing little to no incentive/leadership in switching the U.S. to natural gas as a transport fuel and as the most realistic and economical bridge fuel to re-newables is a complete travesty."New Deal" type government programs and increasing oil scarcity are now only going to exacerbate our economic woes.

We are entering perilous times, an energy induced recession I expect to last well into the next decade and a total upheaval of the American way of life as we know it.

Definitely a group effort to "Shoot the Messenger." In this case, higher--and more volatile--oil prices are the messenger that is bringing news of constrained oil supplies, especially constrained supplies of exported liquids.

Not only do we have the singularity, we have the 'Great Incomprehensibility'.

It's apparently incomprehensible that the energy markets wouldn't price supply and demand forward like other markets do.

Arguing the date of peak oil is a denialist strategy as the price effects of constrained supply against steadily increasing demand are inescapeable.

What is more intriguing is the question of what held prices so low for so long during the 'Great Moderation'; 1985 - 1999?

Probably speculation and price manipulation (along with a flood of oil from the North Sea and Prudhoe Bay).

Funny, nobody complained about it back then ...

Nate -- the real problem is that no one owns the soil, water, or air.

No human owns any part of our habitat.

We have hallucinated capitalism as we have run riot over the planet.

Dollars, digits, and digital data related to currency are all part of the delirium tremens -- the trembling madness -- of a species drunk on the liquor of easy access to energy combined with a bizarre mash-up of superstition, primitive rage and fear, and very clever (and thus very dangerous) technology.

The ideas and numbers presented by economists show us nothing of reality in the way that economists intend.

They do reflect the reality of a kind of manic madness fed by increasing amounts of the liquor of abundant material resources which for awhile hid the madness completely.

In order to keep the hallucination going we need ever increasing amounts of this liquor.

The only way to keep increasing the amounts of the liquor we crave is to kill off other people and take their share.

We do this on a daily basis and in a very organized and intentional way. We call it war and extend our superstitious rampage as far as we can.

I appreciate your article, but do not see a way to back ourselves out of our predicament.

If we all make the best efforts we can, then some things might just work.

Meanwhile the only thing that matters is love, so all is not in vain.

Discussion of economics is fine, but we ought to start with a clear rejection of the dehumanizing nightmare inflicted on us by economists thus far.

Veblen made some sense, didn't he? I've not read much of his stuff, and it has been years. Jay Hanson just mentioned him over on "peak oil killer ape" as one who challenged the prevailing economic model of his time.

beggar, I agree.

I don't think that 'economists' have inflicted a dehumanizing nightmare on us, though. Like people in general, some are good, some bad, but for the most part we've all (economists included) been operating in a paradigm of plentiful resources. It's unfortunate more people haven't realized it's time to change, but you can't blame people for acting the way they have for the past 100 years.

Also, economics are the lens through which we'll first see the realities presented here impact our lives. Obviously, they already are. The economics of our situation will dictate our response.

Here I go again on comparing things that are different. In the graphs that Nate uses up top, the first shows the decline in remaining recoverable crude vs. rising nominal treasury debt. This looks alarming of course.

And the next graph shows the declining value of the dollar. Can't have it both ways! If the dollar's real value has declined as shown in the second graph, the first graph which is the real recoverable crude must be compared to the real value of U.S. Treasury Debt adjusted for the declining value of the dollar shown in the second graph.

If the dollar has declined in real value to 1/10 of its former real value, then the debt's real value has declined in proportion. Therefore the real value of the Treasury Debt is about 1.2 trillion dollars not the 12 trillion shown. Real must be compared with real and not nominal as is done in the first graph since the remaining recoverable crude is real.

This is a serious logic flaw. Real must be compared with real. The value of the Treasury Debt shown in the first graph should reflect the decline in the value of the dollar shown in the second graph. Then the situation would not look so alarming. Inflation is a friend borrowers.

One could also argue that the value of (real) energy has actually gone up due to the realities of EROEI and the increasing scarcity of oil coupled with the the still negligble demand decline. Now if the value of the fiat currency on which the transactions for that commodity are based is undergoing value destruction then I believe you begin to see the above scenario. Disclaimer I'm not an economist and my comment is but a hunch. I'm sure others here will quickly slap me down and put me in my place :-)

Fmaygar,

I may be in over my head too,it's been a l;ong time since I was in school and the intricacies of the oil markets are apparently sufficient to befuddle even the pros.

But you can bet your life that the real value(however that term is defined econ) of energy in plain english is going up.A tank of gas spent joy riding is a tank gone forever,but a tank in my tractor is food in the pantry a few months down the road.

X: The chart doesn't include unfunded USA federal liabilities which are estimated to run as high as 9 times the Treasury debt. I assume you realize this yet it doesn't fit your thesis so you ignore it.

Excellent post, Nate.

Firstly, I recently found a very interesting argument

The Commodity Conundrum

from one Shalom Hamou which goes totally against conventional wisdom, but which I find quite convincing. (My bold)

What underlies his yield curve argument - and also the proposals I have been working on for an "Energy Standard" and International Clearing Union etc - is the relationship between Money, Value (money's worth), and credit.

Secondly, I believe that the CFTC are barking up the wrong tree.

For a deliverable contract, the futures market converges on the spot market, and not vice versa, and while position limits are useful coming in to the spot month, they are not really necessary even there because any clearing member who goes in to a delivery month without ensuring that either he, or his clients, are in a position to make or take delivery in accordance with exchange rules is in deep shit.

In my view, and this was the tenor of my evidence to the UK Parliament Treasury select committee last year, the big problem lies in the (rightly named) Brent complex ("Brent" is of course now BFOE - Brent, Forties, Oseberg, Ekofisk).

The hugely traded ICE BFOE contract is of course cash settled and therefore can have no direct influence on the physical or "spot" market price any more than a bet between me and Nate.

It is settled against a price calculated against trading in respect of the BFOE 600,000 barrel forward contract, but even this price is not that against which most of the global oil price is calculated. It is the Platts assessment of "dated" BFOE contracts to which we must look for that, and the relationship between the ICE futures price, the forward price, and the dated price is what makes the Brent complex...well, complex. It is also a licence to print money for intermediaries at the expense of end user producers and sellers.

Moreover, although it may not be easy for US politicians to accept, WTI is, through the existence of massive arbitrage trading between BFOE and WTI, almost entirely irrelevant as a pricing benchmark other than in the US. The ICE BFOE tail wags the NYMEX WTI dog, and a great part of NYMEX trading continues to be locals feasting on order flow.

I have long believed that a good starting point - and indeed the basis of a new global energy architecture is a global trade repository

Trade Body should be in control of oil sales

Such a registry, through an exclusive user group ("International Energy Trade Association"), gives both a mechanism for transparency, and also a tool for enforcing and maintaining agreed market standards - ie suspension or termination of membership of the user group, and hence of the right to register transactions.

I digress.

For as long as we have a financial system dominated by intermediaries intent on maximising profits - and moreover a system in which these profits are accounted not in Units of value but in Units consisting of claims over value asserted "ex nihilo" by credit institutions - then we are stuck on the current treadmill.

I believe that the key is to create a partnership-based framework within which end users transact directly, and where intermediaries transition to service providers. In fact we are already seeing this trend writ large in the way that producer NOCs are taking back ownership on reserves from NICs, and re-engaging with them as service providers.

As I outlined here, my proposal is essentially for the creation of simple but radical new asset classes, which are to all intents and purposes new currencies. In particular, these would be units redeemable in gas, electricity, and other carbon-based fuels but priced against a Unit of Measure or "Value Standard" consisting of a fixed amount of energy.

It is only by bringing to bear a full global market price of energy to bear on those nations profligate in its use that we will see a serious reduction, and through monetisation, we may compensate the citizens of these nations with Units redeemable in energy which have a global value in exchange.

Within a partnership framework it will be possible to address resource use, apply a carbon levy, and much else on the basis of sharing gain and pain.

My take on what has been going on these last 15 years in the oil market is that we have seen three periods:

Firstly, from the mid 90's to maybe 2002/3 we saw the dominance of investment banks and oil trading intermediaries who routinely and systemically created artificial levels of price volatility. They profited from this, and from information asymmetry at the expense of end user producers and consumers who were using the market for its intended primary purpose - ie hedging.

Secondly, from 2002/3 to last year was the era of the hedge funds, who began to lead market volatility, but the investment banks morphed seamlessly into making money from prime brokerage, and privileged knowledge of order flow and positions.

Finally, and more recently, we have seen the flow of money into "safer" ETFs and the likes of the GCSI.

Pillaging these big fund positions has been going on for years. I blew the whistle on it 9 years ago and lost everything I had - livelihood, home, family - as a result, but it has long since been accepted that such conduct is a fact of market life.

Goldman Sachs magic commodities box

Hell, if you make the rules, you can't break them can you?

Finally, and apologies for such a long post, I think that what is happening in the market is that funds such as GCSI are essentially being used to prop up the market price through long term manipulation of the BFOE complex.

I am reminded of the way in which the International Tin Council kept the tin price artificially high for years - until production ramped up, they ran out of money, and the price collapsed overnight in 1985 in the "Tin Crisis".

I am also reminded - and this is probably a closer analogy to current shenanigans - of Hamanaka's long term manipulation of the copper market which went on for 10 years, and for five years was undetected.

Of course, the producers who are coining in hundreds of billions aren't going to complain about a few billion to middlemen, and the consumers don't know that they are losing.

This brilliant article by Mike Riess is a must read in the context of

Modern Market manipulation

What is needed IMHO is a new global energy settlement at a Bretton Woods II where a new architecture, pricing mechanism, reserve currency denominated in energy and investment distribution allocation is made in respect of energy.

Thanks for bearing with me!

If you would be so kind as to reformat that comment slightly and add a bit more info/graphics, it would make a great guest essay. email me if interested..

Thanks for the mini-guest post! I would be interested in a little more elaboration on:

Do you think it is just Goldman Sachs, or are there others involved? With so many in government from Goldman Sachs, wouldn't they figure this out?

I am sure you have seen Matt Taibbi's article The Great American Bubble Machine about Goldman Sachs in Rolling Stone Magazine. What do you think of his "Bubble 4"?

Clearly there are plenty of people other than GCSI on the buyside, but I suspect that it's only J Aron who have the necessary connection with BP on the physical/forward sell-side.

Whereas Morgan Stanley (who have a couple of top people I have time for) went in big-time into physical market infrastructure, I think Goldman/Aron have been in a cosy partnership these last fifteen years with BP. Probably nothing in writing - just an understanding.

Note also that even though BP sold off their North Sea production (I think they got rid of all of it) they hung on to the pipeline network etc and know EXACTLY what is loading, in storage and moving through the complex.

I suspect - I have no evidence, and the FSA didn't bother looking when I made allegations re manipulation - that for years BP (who have always been structurally short Brent futures, and GCSI (since its inception) who have been structurally long, may have indulged in what I call a "Grand Old Duke of York" strategy. ie they marched the market to the top of the hill and back down again, profiting from the volatility. They could easily compensate each other with OTC wash trades. I'm probably just paranoid. BP and Goldman would never do things like that.

As for Taibbi, I think he's right that Goldman were one of the biggest players behind the bubble. They is certainly a strong view that the mega spike to $147 was Goldman "goosing" the market and shafting Semgroup

Did Goldman goose oil?

I don't know exactly how the main bubble was done (apart from the blatant and persistent hype), but I suspect that the price was gradually shepherded higher and held artificially high for as long as the losses made in buying in Brent/BFOE cargoes at the support price were less than the profits made by selling production priced against BFOE.

Note also that whereas the Brent market in its heyday was Shell's baby, when it was reorganised led by Platts in 2001/2 (I think) it was BP who became top dog in BFOE.

My personal view of Shell is that they are an oil company that aims to make profit, while BP is a profit company that happens to produce (and trade) oil. My professional experience at IPE was that I never had a problem with Shell, and I never had anything else with BP after about 1992.

Right on. Kudos!

Hello Nate,

Regarding futures, options and [S]ulfur: recall my earlier post on the Twentyfold S-price increase and the consequent ripple effects through I-NPK and industrial goods.

http://www.thefreelibrary.com/Multiple+measures+to+cope+with+rising+sulfur+price.(Inorganics)-a0177721247

-------------------------

Mar 26, 2008

...At a time of oversupply in the global sulfur market, it is strange that the drastic price rise has happened. The major reasons are as follows: (a) A long-lasting strike staged by railway workers in Canada, the major sulfur producing country in the world, has blocked transportation and limited the supply of sulfur in some regions; (b) The output of sulfur in the Middle East has remained unchanged in recent years; (c) The ship sinking accident in Russia has led to the disrupted maritime shipping of sulfur.

.... sector is seriously affected

Sulfur is mainly used to produce sulfuric acid. More than 72% of sulfuric acid is used to produce chemical fertilizers, mainly including phosphate fertilizers, mono-ammonium phosphate, di-ammonium phosphate and potassium sulfate.

-------------------------

http://seekingalpha.com/article/105682-intrepid-potash-inc-q3-2008-earni...

----------------------------------

Finally, we want to remind everyone that the potash supply and disruptions are not uncommon as evidenced by the Russian mine flood in 2006, a 2007 Canadian railroad strike, the threat of loss to rail service in Russia in 2007, and a labor strike in Canada in 2008.

-------------------------------

http://www.newratings.com/en/main/company_headline.m?&id=1531244

----------------------

Canadian Pacific Railway track workers declare strike 05/14/07

..The company’s spokesman Mark Seland said a strike would not affect operations and traffic on the railway’s main lines but operations and traffic on branch-lines are likely to be impacted.

----------------------

http://www.reuters.com/article/rbssIndustryMaterialsUtilitiesNews/idUSN1...

-----------------

CP Rail Canadian train crews ratify new contract Wed Feb 13, 2008

----------------

After this RR-strike started, recall that some companies called force majeure as shortages arose. Combined with rising oil prices back then, one could almost say this transportation bottleneck caused a I-NPK and industry bottleneck, which then caused a food bottleneck, which then led to food shortages and rioting. Then, the price of crude crashed, followed by sulfur and other major commodities. As Asimov's List clearly shows: You don't want a "Bottleneck in Nature".

Since there was no futures market for S: perhaps a lot of the companies that needed S bought oil futures to try and hedge against the remarkable price-rise in S? Wouldn't this only help make oil go to $147?

Since I am not an expert, what happens when this S-futures market starts next week?

http://news.prnewswire.com/ViewContent.aspx?ACCT=109&STORY=/www/story/06...

----------------------------

CME Group Announces the Launch of New Sulfur Dioxide Futures and Options Contracts

-----------------------------

Since Recovered-S is from hydrogen sulfide, but sulfur dioxide is generated by burning sulfur and sulfur compounds-->doesn't this new S-market encourage the oil & natgas companies to hoard their sulfur and get a much higher price/ton? Don't forget that these companies already have a big investment in Spent Acid Regeneration [SAR] equipment.

Or am I totally confused by the nexus of market futures meeting complex sulfur chemistry meeting supply & demand? Thxs for any reply.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

One thing that strikes me is with the price of natural gas so low and so volatile, it seems like that would need as much or more investigation as oil. But that doesn't seem to be what is happening, unless I am missing something.

I have suggested something analogous to price supports for both. I don't think that is going to happen either.

It is also possible to speculate on horses, cards, lottery numbers, and the roll of dice or roulette wheels, and maybe even make money on these. It is also possible - or more accurately, probable - that one can lose money on these.

I fail to see very much, if any, difference between these activities and the activities that go on in the trading pits. The odds seem to be just as highly stacked against the ordinary person.

A free people should be free to engage in any of these activities. I see no good reason why any of them should be held up for approbation and encouraged, though. Speculation in all its forms has traditionally been frowned upon, and for good reason. The whole notion of getting something for nothing is highly corrosive of more solid virtues such as honest work, thrift, self-discipline, and prudence. It is these, and not speculation, upon which a great people and a great nation are built and maintained.

lottery numbers and roulette wheels don't deliver the worlds food and goods..

Yeah -- unfortunately this lottery becomes a larger and larger percentage of our GDP (economy). I said this before -- in the end whether these invesment houses hold future options, buying CDO, MBS, etc... they are in effect betting against each others. The name of the game is to survive -- and to beat the other guys. All modeling will have to take account of what others do and will do -- economy in terms of production of goods is almost irrelevant. Why Obama willing to give these guys hundreds of billions to continue doing that is beyond me.

I guess your comment is rhetorical-for I to state that they own the guy would offend many, so let's just say that it appears that it is extremely important to him that Wall Street insiders prosper (more important even than it was to any former President). It appears to be his most important goal and he is succedding superbly at it considering the circumstances.

With all due respect, Nate, neither do day traders.

I can see the need for farmers and for food processors to deal in futures contracts to lock down prices on which they can plan. That does help deliver product. Traders/speculators only churn what would otherwise be pretty calm waters. I see little evidence that they actually contribute anything productive to the economy.

that was my point. that traders/speculators are able to influence energy policy via leverage (even unintentionally) on something as vital as oil has to stop. Betting on something isnt the most productive use of ones time/skills but it is ok, as long as the bet doesnt leave someone without heat/fuel in 10 months or 10 years. Betting on lottery has individual impact but betting on oil might have societal consequences..

I like the concept, but can this actually be accomplished? Take the US, for example; with tremendous debt and limited oil resources, can the US even cover its debts, much less provide for liquidity for payrolls, purchase orders, etc? Wouldn't the transition be untenably wrenching?

probably

but eventually we have to choose between 'untenably wrenching' and '______ wrenching'.

I see an energy based currency as being the necessary global reserve currency to replace the dollar.

Most of the value circulating in the US (and most other places) is in fact based upon the value of land/location.For instance, around two thirds of US and UK money supply came into existence as mortgage loans.

I think that it is possible to create a new land/location backed currency, as I said here

The REIT Way to solve the Credit Crunch

"Let's return to a central theme: that finite resources are being quantified by infinite money. "

There may very well be other ways to do it, but as was discussed here http://www.theoildrum.com/node/5485 the energy available from the sun is effectively infinite. The only problem is to collect it at a high enough EROEI.

Even with conventional (throw away) rockets space based solar energy pays back the energy needed to lift it to GEO in no more than 100 days. The problem is getting the cost down and there is at least one way, probably many ways, to do this.

Keith Henson

As distorting as participant behavior may be, the futures market is the only system currently in place where one can express an opinion beyond the cult of the present. Beyond, as you like to say, our preference for a steep discount rate. And so there is a dark side to control and limitation of behavior in the futures market--it is a control of information, a limitation on a viewpoint. Unfortuneatly I see a number of actors who would benefit from having this information removed from the futures market. In particular, policy makers of all kinds and legislators. Agreed, generally, there are no good answers to either the problem of the present vs future tension, or, the age old quest for a stable currency. I would almost rather see a control of fractional reserve banking and debt creation first. But notice that no one in government calls for that, do they.

I can imagine a time when the US Treasury Bond market gets out of control, and the call is heard to control speculation in the long end of that futures curve as well.

No easy answers.

G

Maybe the average American schmuck can do his part to support the Treasury bond market a la Argentina-those 401Ks can be filled to the brim with garbage http://www.cnbc.com/id/31764548

I read your interview above and wanted to see it on the TV. I missed the first 5 minutes of the 6:30 pm show so I forced myself to stay awake for the 11:30 pm repeat. As usual, mainstream media left out all of the really good stuff.

This is actually something I've been thinking about/realizing and would require a post in itself.

We denizens of theoildrum and resource depletion rubiks-cubers have been following the nuances of energy, non-energy inputs, finance, sociology, complexity, leverage, psychology, collapse dynamics etc for so long that it is only the marginal insight that excites our brains - but the new connections that cause us to internally say 'aha' would either utterly confuse mainstream journalists or be so obscure/implausible as to cause them reputation risk. I have always thought that to tell the truth and accelerate raising the bar of common discourse would logically result in correct decisions being made - but I increasingly think the opposite. People have been pondering these same concepts since the 1800s and perhaps far earlier. Though the scale has never been this grand, and the entire system never this brittle, a chunk of people in each generation were thinking/looking far ahead. In most cases, a)they didn't end up being acknowledged as right until well after their deaths and b)none of them lived on a planet of 7 billion, so many of which are connected through the just-in-time arteries.

I pretty much live for those 'aha' moments which alas have become increasingly rare as I get older. TOD has filled in some details but done little to alter my overall worldview. As for people of previous generations thinking/looking ahead, even the ones who are remembered as having been right also got a lot wrong - even Darwin. Genius always goes only so far...

Thanks for this posting. But the 2nd graph (Historical real value of US dollar (American Institute for Economic Research) needs some explanation.

What is the "real value" related to? Is it compared to one leaf of bread, gold, UK pound, a mixed bag of goods or whatever? This is important to know as for example a hand made mechanical watch may have got much more expensive whereas a computer got much cheaper (even more if so called hedonic improvements are considered).

The graph shows a log scale graph of the purchasing power of the U.S. dollar beginning with index value of 100 at the passage of the Mint Act of 1792. The solid lines present periods when the dollar was convertible into a specific quantity of gold, and the fluctuations represent changes in the purchasing power of gold. The dotted line ar periods when the dollar was not pegged to gold, (during and after the War of 1812, the Civil War, World War I, and World War II). There was partial convertibility from 1945 to 1971, (the dollar lost purchasing power during the period). The final link between U.S. dollar and real capital was cut in 1971 and then the loss of purchasing power accelerated. By 2004, the dollar had lost more than 92% of its original value. More details are at American Institute of Economic Research http://www.aier.org/.

The reason i showed that graph is that dollars decrease in value over time and energy also becomes more scarce - this sets up a war between fiat and real and the ETF/CFTC issue is a first, but meaningful skirmish.

Does it make sense impose trading restriction to just a subset of the markets. How many more gold contracts are sold than the writers actually hold in their vaults? Is gold a necessity of life? Can the Goldman's not just use the cash generated from this paper market to manipulate their profits in other ways. I think so. Uncle Sam will take care of nephew Goldman, don't you worry. It's just less and less a free market everyday. More deception, but no less screwing of the honest man on the street.

at the core, this argument is about needs vs wants for 7 billion and equality. oil and food are commodities that underpin basic human necessities (at least in this system with this number). Leverage and large position limits on depleting, vital commodities is recipe for trouble.

The only thing I can be sure of regarding the dealings of the oil traders is that I would be broke in a week if I got involved.

But if there is away to let a little sunshine,I'm reasonably sure it would destroy a few slimy creepy crawlies that can only survive in the dark.

Wiil trading limits help in this respect?Will the rest of us-as opposed to the traders themselves,know any more ?

I admit that I scanned thru the comments quickly, so someone may have made this point already, but, with regard to derivatives it is important to define terms. Many in the press and a number of traders, include in the term contracts that are really insurance policies. For example the infamous credit default swaps that AIG wrote that were in fact insurance policies on which, it turns out, they collected a premium that was far to small, thus an asymmetric loser/winner outcome. A true swap and most of the derivatives (not all) related to oil are a sum zero game, the winner getting virtually what the loser loses.

With regard to Goldman, Morgan and others, the best way to look at their flow of derivatives (in oil, I don't know much about the rest of their books) is to think of a bookie. Mostly they make their money on the "vig", or the bid/ask if you like, so the larger their deal flow, the more they make. Everyone forgets that the line on a football game has not one thing to do with the bookie's forecast of the outcome, it is just the number at which they get equal $ volume on each team as that is their goal, insuring a risk free 10%. Swaps get priced in fundamentally the same way.

What CFTC changed back when was to allow Goldman et al to have a virtually unlimited position (making them "commercials"), as a hedge against OTC derivatives and, equally important to the movement of oil prices, against index funds. If speculators had any thing to do with driving prices higher, it seems to me most likely that it is due to the Index funds whereby many categories of investors went (almost) permanently long. As these funds grew, you could see their bids come into the ring (before electronic trading took over), the cardinal sin for the fellow executing their trades was failing to get filled, not price. Their orders were "just f...ing buy it"!

At the end of the day, I have yet to see any advocate of the "evil speculator driving up futures prices" story, give a satisfactory answer to the fact that there is a seller for every buyer, a short for every long.

This is a good analogy - I hadn't thought about it that way (I did write my masters thesis "Does the Millionth Monkey Live in Vegas?" comparing the inefficiencies in football and basketball markets to securities mkts).

So what would happen if the CPMs and asset allocators all decided to have 20%+ of their clients money in commodities?? (we'd have WAY more paper demand for commodities than actual demand I suspect - which is what happened in Q3-Q4 2008) -I'd like a traders perspective on it though...

Coal is traded through a NYMEX Clearport in connection with the CME. See here for description: http://www.nymex.com/coa_fut_descri.aspx

A few observations:

Non-commercial traders were allowed into the oil futures market under the pretext that they would engage in legitimate hedges. What actually happened is that they acted as funnels for outside money which couldn't directly access the market. These transactions were handled through what were essentially credit swaps. As you might expect, all this extra money in the market drove up prices. It could do so especially because of the built in leverage in the market where margins were only on the order of 5-7%. The result was an explosion in paper barrels so that there might be a 100 paper barrels for every real barrel. Guess which part of a market dominates if you have a 100 of one thing compared to one of another. There is this idea that real barrels should count for more because, well, they're real, and that this somehow will exhibit itself at settlement time. But this is to misunderstand how the futures market actually works. All of the those paper barrels just get flipped into new contracts purchased again at a 5-7% margin. Real barrels have no priority in this, which is why, of course, the market has lost its price finding function. The price of real barrels is just dragged along after the paper barrels. And this is also true for the spot pricing as well. As long as these non-commercials could exit a position in the market at a higher one than when they entered that was where they made their money. It was the differential between the two. Real world producers were happy because they made a killing on the absolute or underlying price, which had been jacked up year over year since 2004. The situation was made even murkier when OTC trading and then alternative trading platforms were introduced. There was concern about the alternate platforms, i.e. that the price of domestically produced crude might be determined in London or the Emirates but the real opaque portion of the market was the OTC side. There was a Levin bill last winter that was supposed to address this. But he screwed up the language so that oversight went to other futures markets like natural gas but not crude. The CFTC is now talking about reporting requirements but I don't think any have actually been finalized so the crude markets are really not so much different than they were last year. The real question is who is playing them this time around. Are the not so departed investment banks in the markets as agents or principals? Are any of the sovereign wealth funds who certainly have an interest in spiking crude prices involved? The truth is we won't know for a while if ever because to date the market remains significantly opaque.

Nate,

Interesting, your thesis. I would expect, by definition, the football/basketball "market" to be very inefficient if the "line" is used as predictive of outcome. Though I admit that it can be freaky accurate at times.

As to your point about paper demand, I have pondered its impact over the years as it grew. My conclusion, at least till proven wrong, is that we need to view this from a slightly different angle. It cannot be viewed in the classic sense of demand for a commodity, none of the paper folks have any desire, or the ability (especially as to crude oil) to make or take delivery. In truth theirs is a demand for a financial hedge, in many cases this "hedge" should be described as a desire to broaden and diversify their speculation. The truth is that none of the participants in the market, including refiners and producers, as a general rule, sets out to make/take delivery, at least via going though expiry and the exchange procedure. By and large, commercials who do go through a delivery process do so via EFPs and ADPs (Exchange For Physicals and Alternative Delivery Procedures). To get a bit ahead of myself, once the EFP is done, the sorting out down to an ACTUAL delivery has a long way to go, the physical market trades several hundred times the volume physically delivered, and has for at least 35 years I can attest to.

As to your point about the increase in trade volume and open interest, it is beyond your wildest imagination, as I said, I have been a participant in the oil markets from prior to the advent of futures (1981 I think), and I cannot believe the size of the market today. The size and daily trade volume alone argues against there being any truly serious market manipulation. Here are some recent Open Interest numbers, I have used CFTC data which combines the "delta" of the regular board traded options into the standard WTI contract, plus the burgeoning variety of exchange traded products based on WTI futures:

NYMEX Open Interest

"regular" WTI futures 2,592,000

WTI spread options 101,000

WTI calendar options 213,000

WTI Eur style option 181,000

Average Price Options 549,000

Financial settle WTI 174,000

ICE(British exchange)

WTI 492,000

Total Open Interest WTI 4,302,000

These are as you know, contracts of 1,000 barrels, so this represents 4.3 billion barrels, if I add the open interest for Brent futures, we go over 5 billion barrels, or over 60 days of total worldwide production of crude oil. To be honest, I have only taken the main contracts, there are others. Now as to daily volume, I did some research a few months ago and the short version is that if we combine NYMEX with ICE for the major contracts we will go over 1,000,000 contracts traded daily (remember, volume is NOT the same as open interest, you can trade a jillion contracts without a change in open interest). One million contracts is equal to One Billion barrels, or more than 13 days of total world production. Even with margin requirements averaging 5-7% as hugh says, thats a lot of money. So, as to speculators manipulating prices, one needs to define manipulation a little better but the sheer size of the market makes long term manipulation a little difficult to do. As a trader, of course I can start rumors, come in as a seller or buyer at critical times, trade when volume is low to accentuate a move, etc., but this is all momentary. As I said in my original post, I do believe that the advent of "Long Only" funds, changed the tone of the market considerably, and for a while that was supportive. For a while, but look how fast the market fell (markets almost always fall faster than they go up) when the market perception shifted from, "they will be there to buy no matter how high" to "they gotta get out no matter how low". The irony I see is that if you accept the "evil speculators pushed price up" theory, the speculator that did the deed is most likely the small guys buying shares of USO.

As to who holds the positions, you will find that "commercials" positions are roughly 10 times the size of "non-commercials". The non-commercial category was originally established and intended to report the positions of large speculators, including in theory the spec positions held by those who were otherwise considered commercials. My understanding is that today it has the positions of the "funds" including the index funds like USO. I will admit that CFTC reports are a little cloudy, and they aren't folks I ever wanted to talk to. I do believe that the Goldmans, Morgans et al are largely included in the commercial category these days. As always, one of the big drivers on the commercial side is refiner hedging, buy crude/sell products. Most refiners hedge only a % of their business, but to hedge 100% of US crude runs would require approximately 420,000 contracts per month, so for one year, more than 5,000,000 contracts open interest, from this you can see the size of the market.

Sorry to have rambled, hope this is of interest. Here is the CFTC link: http://www.cftc.gov/dea/options/deanymesof.htm