If We Can't Get Oil from Mexico . . .

Posted by Heading Out on September 11, 2009 - 10:16am

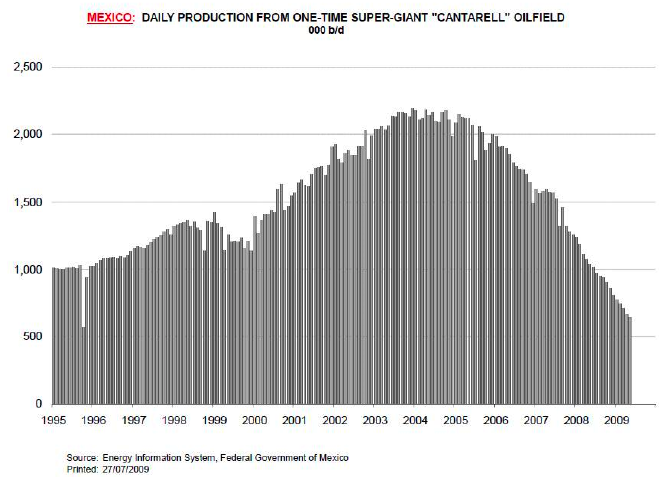

The news from Mexico just continues to get worse with bad news from all three of their biggest oil fields, even as our perennial cornucopian talks of “a Mexican surprise.” As Gregor noted recently (h/t ft energysource) at the beginning of the year Cantarell was producing 862,000 bd and at the end of July this was down to 588,000 bd. The graph plotting decline continues to show a linear decent at the rate of 35,000 bd per month or roughly 100,000 bd every three months – giving it just 17-months at that rate (ending right at the end of next year) until there is nothing left. Somewhere in there the drop is likely to stabilize, but suddenly and soon the questions as to where the replacement hundreds of thousands of barrels are going to come from is going to stop being an almost academic exercise.

But they aren’t the only ones in trouble. Consider U.S. net imports from Mexico over the same period. That decline also looks pretty linear, with a projected intersection with zero in 2014, depending on where you draw the line.

Mexico itself is not likely to be able to come up with much of an answer.

The President just changed the head of Petroleos Mexicanos (Pemex) as the revenues that the state gets from sale of its oil (making up nearly 40% of the federal budget) dropped 30% in the first half of the year. Current Mexican Government predictions that overall Mexican production will stabilize at 2.5 mbd over next year don’t reflect the collapse of Cantarell, and also fail to recognize that the promised increases in production from other fields are not reaching the goals set. It is only a few days since the production at Chicontepec was “evaluated” after falling some 12,000 bd short of target. This field is still in development, with ultimate production targeted at 550,000 to 700,000 bd by 2017, but as it is already 16% behind the mark that does not augur well for that future.

As Euan Mearns pointed out the fields at Ku-Maloob-Zaap (KMZ) which lie adjacent to Cantarell are being produced in the same way as Cantarell, and thus production has recently risen dramatically.

Ku Maloob Zaap (KMZ) adjacent to Cantarell in the Gulf of Campeche is the largest source of new production growth. It recently overtook Cantarell as Mexico’s biggest producer, with record output of 814,000 b/d in April. The KMZ complex produced 740,000 b/d of crude in 2008, up from 550,700 b/d in 2007. Production has doubled in the last 3 years with a nitrogen reinjection program similar to one at Cantarell. Pemex expects KMZ production to peak at 820,000 b/d before declining to 810,000 b/d next year.

Read that last sentence again! Now the oil in KMZ is proving to be much heavier than that from Cantarell and so may not decline at quite the same rate, but given the very rapid increase in production, and that the peak is already here, this does not bode well for sustaining Mexican production using that region for any great period into the future. Rather it might increase the already precipitate drop in total production levels going into 2011.

Mexican exports of heavy crude (that from Cantarell and KMZ) had fallen, by July to 1.06 mbd from 1.22 mbd in January. Pemex had domestic sales of 1.8 mbd in July which is up some 45,000 bd from January, largely due to increases in sales of motor gasoline. The country imports some 550,000 bd of refined products.

If we go back to the Export Land Model, if internal demand continues to grow, and if Chicontepec proves to consistently fail to produce the needed production by as much as 20% or more (assuming that they are now working the best prospects first) and if we start to see the decline in KMZ next year . . . . . .

And to quote an “expert” on the subject:

Michael C. Lynch, president, Strategic Energy & Economic Research Inc., differs from the generally pessimistic consensus on Mexico. “I think Mexico will probably surprise many,” he said.

Lynch said, “[Pemex’s] first need has been capital; the government has a long tendency to starve them of money, and only recently has this been reversed. Mexican drilling activity is twice what it was a couple of years ago, and they have a lot of medium-sized fields that could make a serious contribution. (The decline in rigs rates has helped them, but the peso decline offset that somewhat). Deregulation and outside investment would certainly help, but capital is the main thing.”

Perhaps somebody could explain to Michael that when one uses the word “surprise” it generally means you’re going to hear good news – none of this is!

Thanks, Dave!

Mexico is truly worrying. Sitting at the doorstep to the US, if there is social disorder, it becomes an issue of the US.

Mexico's best hopes seem to be Cantarell and KMZ. Even with KMZ rising, US net imports have been falling off a cliff. One wonders what will happen when KMZ starts falling.

I looked at one of the references you linked to. It makes KMZ sound even more problematic than you mentioned.

The long term planning guys who work for the pentagon are very seriously worried about Mexico and rank it as one of the worst countries in the world in terms of risk of becoming a "failed state".

Although the report issued in November, 2008, was concerned with criminal gangs and drug cartels, not peak oil.

I beg to differ,you must read the entire report and remember that although the folks on our political left like to make fun of the military,officers are expected to read between the lines and reason from all data available-not necessarily just what is in this ONE REPORT-and draw appropriate conclusions.

Sorta like somebody saying "we need five new Saudi Arabias "and Joe Sixpack not getting the message-you are not getting the message,it is in polite military code words.An officer possessed of "slightly less than average abilities" in this langauge is not considered to be able to hold down some easy job such as keeping track of the use of paper and staples(the sort of job that woulkd be found for him elsewhere in business or government,given his abilities)-he is out on his axx .

OFM,

We seem to have nothing but a sack of hammers, and all the world's problems seem like nails.

Many of our troops and their spouses and their families and the misguided folks 'supporting' them by putting yellow 'ribbon' magnets on their SUVs still like to think and say that we are over 'there' valiantly trying to 'bring democracy and freedom' to those poor suffering people.

So what will we think to accomplish with our military in Mexico?

Will be run more radio ads with dramatic music with a alpha male voice over guy extolling the virtues of being a USAF Predator pilot part-time, and an airline pilot as your regular job? Will these operators 'flying' out of The Nellis AFB area and other CONUS areas command their Predator UAVs to establish numerous orbits over Mexico and 'surgically strike' select targets with Hellfire missiles?

Or will we get really saucy and have some great grandson of Blackjack Pershing lead an expeditionary force into Mexico to clean out the cancers and establish democracy and freedom there as well?

Closing the border with a robust wall/fence over the entire distance backed up with ~300,000 well-trained, well-armed border guards, combined with a massive Peace Corps/relief effort would be a better choice if things go very bad in Mexico.

Going in (or over) and trying to bring peace and prosperity at the point of a gun (or Hellfire missile) is not the way.

Most of the military brass still pine for the good ole days of planning to mix it up with the Ruskies, now the Chinese, and planning for KWII. They lust for a high-tech gorilla package campaign with a thousand air sorties per day, ATACMs, CALCMS, and TLAMS raining down on the opponents, with B2s and F22s raining death from above and sweeping the sky clean. Very few officers relish the prospect of house-to-house fighting in a dirty guerrilla war/police action/low-intensity conflict/nation-building escapade. The lust for the 'AirLandBattle' Fulda Gap concept with thousands of tank on tank and plane on tank and plane-on-plane engagements.

I know.

Moon watcher,

Hey man I just pointed out that the think tank types have Mexico near the top of thier list of possible trouble spots-with good reason so far as I can see from reading the Mexican news myself.

Now as it happens I have a great deal of respect for the abilites of the guys who wrote Joe 2008 as everything in it seems to jibe with reality as I see it -including calling peak oil before 2015 iirc.

I gather that your are ex military yourself and I do not doubt that you have many reasons to be disillusioned as such. But I wonder if your real problem is not so much with the military as such as with what you percieve as MISUSE the military.I have some serious reservations along those lines myself.

As to what our military might do in or to Mexico I must admit I have no real idea but I do think there is a real possibility that the border will have to be militarized and possibly just closed outright.You may know the the Governor of Texas is deploying considerable numbers of Texas Rangers(so far as I know just a fancy name for state as opposed to county or city cops)on the border now and is seeking help from Washington to dea with violence along the border.

I have never had the privilege of knowing any high ranking officers well but I do know some officers well and they don't seem at all crazed or blood thirsty to me.I am rereading a history of the oil industry now (The Prize) and it seems to me that Ike-the highest ranking officer we ever had- did a masterful job of steering us around a couple of possible wars.

Now I will get myself labeled as a right wing nut by saying so but My estimation is that if it weren't for the fact that we have been militarily involved in the Middle east for my entire life we would be buying that oil from the USSR maybe, or maybe There would be a United Arab Republic pushing us around the way we are pushing them around.

O Bama is not going to be bringing the troops home,although I expect him to talk about it once in a while.How do you think our economy would do without the House of Saud in our pocket?

Soldiers are necessary evil in my estimation,all else is commentary.

You talk a lot and you write well but do you understand EMPIRE?

Porge if that remark about empire is addressed to me ,yes i think so.

The thing is that our empire is a sort of empire lite-we try to be a little nicer than most owners of empires,actually paying for oil we take from occupied countries,etc.

The reason almost all my comments are addressed by name is so there is not doubt about which comment I am responding to,I am not neccesarily addressing the author directly.

OFM,

We seem to have nothing but a sack of hammers, and all the world's problems seem like nails.

Many of our troops and their spouses and their families and the misguided folks 'supporting' them by putting yellow 'ribbon' magnets on their SUVs still like to think and say that we are over 'there' valiantly trying to 'bring democracy and freedom' to those poor suffering people.

So what will we think to accomplish with our military in Mexico?

Will be run more radio ads with dramatic music with a alpha male voice over guy extolling the virtues of being a USAF Predator pilot part-time, and an airline pilot as your regular job? Will these operators 'flying' out of The Nellis AFB area and other CONUS areas command their Predator UAVs to establish numerous orbits over Mexico and 'surgically strike' select targets with Hellfire missiles?

Or will we get really saucy and have some great grandson of Blackjack Pershing lead an expeditionary force into Mexico to clean out the cancers and establish democracy and freedom there as well?

Closing the border with a robust wall/fence over the entire distance backed up with ~300,000 well-trained, well-armed border guards, combined with a massive Peace Corps/relief effort would be a better choice if things go very bad in Mexico.

Going in (or over) and trying to bring peace and prosperity at the point of a gun (or Hellfire missile) is not the way.

Most of the military brass still pine for the good ole days of planning to mix it up with the Ruskies, now the Chinese, and planning for KWII. They lust for a high-tech gorilla package campaign with a thousand air sorties per day, ATACMs, CALCMS, and TLAMS raining down on the opponents, with B2s and F22s raining death from above and sweeping the sky clean. Very few officers relish the prospect of house-to-house fighting in a dirty guerrilla war/police action/low-intensity conflict/nation-building escapade. They lust for the 'AirLandBattle' Fulda Gap concept with thousands of tank on tank and plane on tank and plane-on-plane engagements.

I know.

Though they did mention peak oil in a general sense, and loss of revenue could be a tipping point for the Mexican government;

By 2012, surplus oil production capacity could entirely

disappear, and as early as 2015, the shortfall in output could

reach nearly 10 MBD.

Will,thanks,I didn't feel like hunting that quote up.

All the dots are there and any reasonably well informed person can connect them-people who work for Uncle Sam are allowed to say quietly and obliquely that the theatre is on fire but they cannot scream "fire!"

Fortunately military planners are tasked to deal with what CAN HAPPEN as opposed to what politician and businessmen want or expect to happen.

If they are ranking countries on their "failed state" potential, I wonder how Canada and the US rank with our economies so heavilly tied to growth. I am sure we won't be that far behind the rest.

I'm not too worried. By the end of 2010, we as a nation will have gotten our priorities straight and won't need any oil from Mexico.

Que?

Pedro Azul.

The Mexican experience will make peak oil an undeniable issue.

I think.

My WAG at what Nate's getting at.

Or hit an economic crash, with the same result.

Do I detect some snark here?

What should we make of our hypocrisy in mourning the death of the the thing that kills us.

What should we make of our hypocrisy in mourning the death of the the thing that kills us.

Nice! Okay I take it for a walk at times?

Nate the next thing you know Micheal Lynch will be quoting YOU.;-)

So you're expecting the Republicans to retake the House? :)

You are soooo right! We will all have realized our true calling and become a nation of artists of this caliber... None of us will be engaged in our consumerist lifestyles any longer!

http://video.yahoo.com/network/100063489?v=5771163&l=100063517

Thank you. That was a WOW video.

Why worry when such good news is just around the corner? I predict we are going to get our priorities so straight that we'll be using less oil in 2012, much less oil in 2015 and far less oil in 2020. We'll cut millions of barrels from our demand and eventually we'll cut our consumption by over 14 million barrels per day. Countries around the world will join together with us in cutting their demand along with us.

Exporters will help us do this demand cutting by cutting their production.

I see Eric Idle up on the cross singing "Always look on the bright side of life".

So KMZ may decline slower than Cantarell - but doesn't heavy oil respond worse to pumping it faster? (All other things being equal.)

If Pemex is desperate to make up for their declines, it seems to me that they will end up with less efficient recovery from KMZ, and possibly damage to the reservoir.

Why is it so desperatley obvious to even the most casual observer what is about to happen and yet our governments continue to concern themselves with line-items that in retrospect will seem like building sand castles as the tide comes in?

The sooner we hit energy induced chaos and a popular/mass remit to do something serious the better IMO.

Nick.

I admire your optimism, but I'm afraid that the "popular remit" will involve a dictatorial demagogue stoking war fever, if history be any guide.

It seems that has already happened when Bush was elected. Obama is about the same. ;-)

It should also be desperately obvious to even the most casual observer that you cannot legislate human behavior. This is an adaptive challenge, not a technical challenge.

Debbie, its both an adaptive AND a technical challenge. But the adaptive change needs to happen first, otherwise all the technical expertise and creativity will go into a black hole.

If you want to write a guest post expanding on your comment, I think its a great topic. Thx.

Thanks, I needed more volunteer work. :-)

I'll add it to the queue.

Debbie-

Another question that needs to be answered: Do we have time to take a reformist solution, and is there any evidence that a reformist strategy works to promote major change?

If, not, what is the next step?

(I am a former resident of HB, and am quite impressed with you commitment and action)

I am inspired by the permaculture movement. Had 200 people show up to a lecture last week (in Orange County)!! I will be taking this course beginning in November. People can either participate in the transition or wait and watch life unfold in front of them. I have always chosen action--much more fun and what do we have to lose.

Wish you were still in HB to help with the Great Transition.

Holy crap, Im in Orange county! Let me know when the next one is!

If Orange County, CA, then email me so I can.

I think that you are missing something here. It's true that it's devilishly difficult to "legislate" some forms of human behavior, such as the sex drive. We do make a strong attempt to coral man's natural desire for sex, making it illegal for men to have sex with young pubescent women. U.S. society also agrees with this attempt to constrain human behavior, so it tends to work in most cases.

The problem of Peak Oil is different in that limiting the amount of available oil would be rather easy, since much of what we use is imported. A U.S. government that wanted to limit consumption could simply bar some portion of imports and let the market decide who gets what. Out of concern for social stability, that government could institute some sort of allocation scheme, such as direct rationing to the end users or a large tax to discourage the use of oil and it's products. The recent proposed legislation to cap CO2 emissions is another such approach, although it's directed towards industrial users, with the result being price increases in the market. Human behavior would change over time as a result of any such effort.

The problem as I see it is the lack of will on the part of the politicians who run this country. If they were to make a serious attack on the situation, they would be voted out of office, either because the voters became enraged or as a result of a cut in funding from corporate sources, who would fund their opposition. Our Disney Land world of TV illusions has forced us into a corner where truth is seen as a lie and the image if more important than the substance. I suppose you might label that "human behavior", but I think it's more likely the result of individual greed and poor statesmanship...

E. Swanson

Or, the U. S. could put upper limits on domestic production, along the lines of the early Texas Railroad Commission. Just a thought . . . deplete overseas production rather than domestic supplies . . .

But agreed, this is all highly unlikely. There first needs to be a mass adjustment in perceptions.

Or, the US government could simply buy oil for a greatly expanded SPR, raising demand and thereby price. Other users would have to cut back. This would have the added bonus of having some left when exports become unavailable.

The problem is expense, which means we would have to cut down on other consumption through reduced spending or higher taxes.

Personally, I favor a very simple solution: tax it.

"Tax it " sounds good but it's probably too late- we have have too many poeple who are already right at the edge of insolvency on a day to day basis-they are probably going under before to long anyway but any further rise in thier expenses or drop in thier income means the end game plays out a lot faster-they will not stand for rising prices based on conservation taxes,they are fighting for week to week survival NOW.

OBama can't bring it up and congress wouldn't pass it.

So we keep trying to hold our personal heads above water by drowning the guy next to us,trying to use him as a life preserver.

The tax should be revenue neutral, offsetting say payroll taxes on the first $10,000 of income.

Of course, that doesn't change the fact that you are correct: it is a political no-go.

Or the US government could choose to not release ANWR or Florida Gulf or East Coast offshore etc. for drilling......

I am personally in favor of releasing ANWR and OCS for two reasons:

1. For ANWR, as I understand it, if we don't do it soon, the pipeline will fall below MOL and make getting the oil later much harder (I would, however support the US buying that oil for a SPR).

2. For OCS, I would love for them to release the oil, on 12 year pump it or lose it leases, auctioned to the highest bidder. This would shut up the Drill, Baby, Drill crowd. Make them put their money where their mouths are.

Some of my intelligent hard core right wing acquaintances say in private that the "eco nuts" have done us all a big favor by preventing such drilling while we burn up the middleeast oil,which they (again privately)say we are getting for either nothing or next to nothing,meaning that the federal debt will eventually be repudiated.By then the remaining oil within our borders will be neede so badly that even the Sierra Club will be in favor of drilling as they see it.

But getting them to see that the govt should aggressively pursue renewables is still a hard sell-they tend to believe that when the renewables are needed the market will supply them.So they at least believe in peak oil but not peak oil in the very near future.

I'm wondering why China, with the benefit of central planning, does not do itself the same favor and slow down domestic production in favor of imports. It seems like a cheap way of storing oil.

Bio -- I don't have the numbers at hand but China has relatively little domestic production to curtail. They are essentially "storing" oil right now: they have been spending 10's of billions of $'s buying up or investing in foreign oil reserves all around the globe. This includes the big Deep Water plays off Brazil and west Africa. They also cut a deal with Venezuela last year to build three new oil tankers and a few refineries (in China) especially designed to handle the Vz heavy crude (the oil the Gulf Coast refineries had thought they would use to make up for the loss of Mexican oil imports). China is light years ahead in long term resource planning than all the other consuming countries IMO.

I've repeatedly said publically on my own blog that, yes, the environmentalists have done us a great favor by saving ANWR and OCS oil for when we really will need it. They do not think that is what they are doing. But once world oil production starts declining 3%, 4%, 5% per year the public will clamor to open up all closed off oil fields.

The question then is this: What's the optimal time to open up ANWR and OCS for drilling? Now? Or 5 years from now?

The existing pipeline is too large and near it's end of life.

The Alaskan Railroad goes from Seward & Anchorage to Fairbanks.

It could be extended north some more (see Russian expertise in Siberia and Chinese in Tibet) and new small pipelines could be built from railhead to drain last bit from Prudhoe Bay et al.

Perhaps second small pipeline to go from new railhead to Valdez or new rail spur.

Build small hydroelectric dam and electrify Alaskan RR.

Alan

It is a common thing to shove a liner thru a worn out water main - doing so is cheaper than digging it up and installing a new main.

Might it be possible to downsize an existing old oil pipeline in a similar fashion? After all the access road, the right of way, the environmental impact statement,pumpimg stations,etc ,are sunk costs.Once the old line is out of service I don't see any reason why you couldn't shove a smaller pipe right thru the one already there by cutting out a section every mile or so and welding a section onto the liner,shoving her in another sixty feet,welding on another section.....of course this would require some specialized heavy machinery and engineering ingeniuty but it looks doable to this old welder/construction guy/rolling stone.

Maybe this is every day stuff already?

It would require to many pumping stations, please note there are about 64 earth quakes a day in Alaska, now most are 2.2 or less everyday. The design of a new pipeline is way to costly.

I can see a sunset on the current pipeline once the fields production drops below 400k/day.

I had the pleasure of sitting next to one of the design engineering who designed and oversaw the pipeline in Alaska, it was one of the best times traveling back to Alaska I ever had.

I don't think electric trails will work to well when it's -40degF,

In the slope I left my truck on 24/7, it's not a place where man belongs, well except during time to take big game.

Sorry for getting off topic :)

I don't think electric rails will work to well when it's -40degF

Someone needs to tell the Russians !

They electrified the world's most strategic road (rail or rubber), the Trans-Siberian, in 2002. -30F is a warm day on some sections of that line.

They finished electrifying to Murmansk on Christmas Eve, 2005 (i.e. winter). Murmansk is 68°58'N, Barrow is 71°18′N

As far as earthquakes, the streetcars of San Francisco were operating the day after the Great Earthquake.

Alan

Ok Alan, I stand corrected, thank you.

But that's them do you think we can really do that? sorry I don't think we can do that here, we live in a land where cash is king, greed rules, logic thinking is underminded time after time.

We still pump 1.1 million barrels/day out of the East Texas oil field. Unfortunately, it is 99% water.

We will want to extract every last barrel we can from Prudhoe Bay et al. The existing infrastructure simply cannot do it. Minimum operating levels, age and all that.

The Alaskan RR is already half way there. Rail can handle massive quantities of oil (China imported all it's oil from Russia via rail until recently) but not as cheaply as pipelines *IF THERE IS ENOUGH QUANTITY TO JUSTIFY A PIPELINE*.

It will be an engineering call on where to extend the RR, or just build a new small pipeline from the North Slope to Fairbanks. I have a hard time seeing how a brand new, small pipeline would be cheaper than just improving the existing Alaskan RR from Fairbanks south.

A pipeline can only be used to transport oil, a rail line has MANY other potential uses (and will last longer than a pipeline). Mining and tourism come to mind. Some limited logging potential.

Alan

It would require to many pumping stations, please note there are about 64 earth quakes a day in Alaska, now most are 2.2 or less everyday. The design of a new pipeline is way to costly.

I can see a sunset on the current pipeline once the fields production drops below 400k/day.

I had the pleasure of sitting next to one of the design engineering who designed and oversaw the pipeline in Alaska, it was one of the best times traveling back to Alaska I ever had.

I don't think electric trails will work to well when it's -40degF,

In the slope I left my truck on 24/7, it's not a place where man belongs, well except during time to take big game.

Sorry for getting off topic :)

I do not think it will quiet them. The ones I have conversed with think there is a vast amount of oil under American soil that has been held off-limits by a government conspiracy, environmentalists or high taxes. They deny that peak oil has occurred in the U.S., and when I state otherwise or show them the data, they say the reason for the declining production is political and not geological. They refuse to believe that America is running out of crude oil. They act like children who put their hands over their ears and loudly proclaim their beliefs to drown out all other information. Facts make no difference.

One conservative friend was honest when told that America's off-limits oil amounts to only two years of supply. From Wikipedia:

http://en.wikipedia.org/wiki/Oil_reserves_in_the_United_States

Her response was that we need to believe there's oil somewhere. If it isn't in the OCS, it must be elsewhere, because we need it.

LOL! Just another example of how techno-FF-faith > looming reality. From feeble memory, Matt Savinar of LATOC fame once said: 'that the true God for all life is energy'. It is what separates us from dirt, sand, and rocks.

Consumer, Bingo.

Hi Black Dog,

Overall, I think you make an excellent comment - but, I beg to differ:

I suspect that "individual greed" is far less a cause than our collective inability to understand the concept of "truth". The US is a nation where something like 85% pecent of the population "believes" in things like the the infallibility of holy books and a infinite life in paradise after one dies. The great majority of the US population accepts these goofy myths as being "true". I submit that the intellectually crippling effect of these belief systems makes it impossible for the average citizen to discern what is a lie and what is true. Organized religions, corporations and political entities all have a vested interest in promoting the idea of "faith" in their particualr agenda.

Critical thinking (in a scientific sense) and solid reasoning skills appear to be far less important than a good grasp of football statistics. I suspect that this is the underling reason we are in your "Disney Land world of TV illusions".

Bicycle Dave: (+100)

.

I have Faith.

I have Faith that a thoroughgoing investigation of the natural world will always yield a greater understanding of and a closer approach to truth.

I have Faith in science.

Maybe I can expand this into a credo.

Is science going to save you?

I don't know but it has a better chance of pointing to truth than anything else.

And what you gonna do with the truth? What if the truth is irrelevant?

Science believers are not much different from religious believers. Too much bigotry, to my taste.

Well, we could always help Mother Nature along with her little entropy project. Turning natural resources into a few low-entropy flat screen TVs and a big pile of high entropy waste seems like a very good beginning to me.

Once one gets past the stuff that we've been able to produce because of a fortuitous coincidence of stored knowledge and stored energy, the difference between the human value of our Truth and any of the other various Truths on this planet seem marginal to me. We find truth in Science because it's a big part of our cultural narrative, and as a result we feel validated by its products. Other cultures with other narratives have different values and different truths. The fact that our version of truth has enabled us to dominate theirs is not a good measure of its intrinsic value as far as I'm concerned. People who think that it a measure of the value of our truth are swimming like fish in the sea of our culture, oblivious to the existence of water.

Truth is only irrelevant in religion and politics. Since religious debates are by definition irrelevant, I assume you are proposing that politics may trump truth vis. future energy supplies?

So you're proposing to find politicians who can "fix" your problems by simply passing laws declaring petroleum shortages illegal, punishable by imprisonment or death (of whom)?

If science is asking the wrong question in any given circumstance, the answer it returns will be irrelevant.

For me the prime example of this is science answering the question, "How can we get more energy?" when the question we really need an answer to is, "Why do we feel that using more and more resources will make us happier?"

It's not about politicians legislating "Pi=3.0". It's about what questions truly need answering right now, and whether science (whatever that word means) is the appropriate framework to use. If the crucial questions pertain to our values and cultural narratives, being able to calculate pi to a million decimal places may be irrelevant.

Isn't that discussed at length above? Reduced wars, genocides, mass starvations, etc. What would be your reaction to the announcement of a 92% efficient solar cell technology comprised solely of plastic and carbon which was so cheap to fabricate that its simply automatically included on every eaternal covering material available? Would you still denounce that as a negative for society? (Google Optical Rectenna)

I certainly wouldn't denounce it as "a priori negative", no. However, I might not call it an unalloyed good, especially as my viewpoint extends beyond the purely anthropocentric. While it would help with global warming, the increased human activity such a development would enable might not be the best thing we ever did for non-human species. I=PAT and all.

No development (idea, technology, event etc.) is all good, and no development is all bad. There are no one-sided coins. In that dynamic tension is where science loses its traction, and unscientific things like values come into play.

-This was kinda my point, while these politicians are being told by large bodies like the IEA that there is no real problem then they will never do anything. Ultimatley I think Matt Simmons is right in that the data is just not available to be able to say with too much cetainty and while this doubt remains there is/never will be a popular remit to do anything becuase the negatives are all at some unspecified future time probably after XYZ President leaves office...

I think the real danger is that PO gets masked by something else -like a financial crisis for example...

...so in the end we have the picture of this Saudie Camel herder riding over Ghawar and he says to his friend "sure we had loads of the stuff left but since the Western Economies collapsed in the Great Anarchy nobody wanted the stuff anymore so we turned the pumps off..."

Nick.

Amen to that, Nick.

One minor clarification regarding the Export Land Model (ELM), an increasing rate of consumption is not a requirement for an accelerating net export decline rate. I proposed the ELM as a way to help me understand, and then explain, Net Export math. The three factors which control the net export decline rate are: (1) Consumption as percentage of production at final peak; (2) The rate of change in production and (3) The rate of change in consumption.

I originally stipulated that Export Land was consuming 50% of production at final peak, with a -5%/year production decline rate and a +2.5%/year rate of increase in consumption. If we assume production of 2 mbpd at final peak, production 9 years later would be at 1.3 mbpd, with consumption of 1.3 mbpd. You can vary the three factors to see how the net export decline changes, e.g., with no increase in consumption net exports would go to zero in 14 years, instead of 9 years, not a big difference, and it would still be an accelerating net export decline rate.

The key three characteristics of the ELM, as stipulated, are: (1) The net export decline rate exceeds the production decline rate; (2) the net export decline rate accelerates with time and (3) The net export decline is front-end loaded, with the bulk of post-peak net exports being shipped early in the decline phase.

The only way that an exporter will not show a net export decline rate in excess of their production decline rate is if they cut consumption at the same rate, or at a rate higher than, their production decline rate. I have now reviewed 21 case histories of declining net oil exports (four former net oil exporters & 17 exporters showing a production decline), I have not yet found an example of an exporting country cutting their consumption enough to keep their net export decline rate below their production decline rate. The four former net exporters all showed the three characteristics of the ELM, as stipulated (with the caveat that China had increasing production).

I recently divided the other 17 case histories into two groups, those with a recent peak in 2005 or later and those with a peak in 2004 or earlier. The 2005 or later group had a median net export decline rate of about -3%/year. The 2004 or earlier group had a median net export decline rate almost three times higher, -8.3%/year. In other words, comparing median net export decline rates, the 2004 or earlier group showed an accelerating rate of decline in net exports relative to the 2005 or later group.

Finally, here are the four year comparisons for three net oil exporters, which were consuming 50% to 60% of their production at their respective final production peaks, plus the ELM, as stipulated. The observed net export decline rate for Mexico is entirely consistent with what the the model and recent case histories suggested that we would see.

Indonesia (1996-2000)

-1.7%/year (Prod.) & -11.5%/year (Net Oil Exports)

Mexico (2004-2008)

-4.7%/year & -13.5%/year

UK (1999-2003)

-5.5%/year & -15.4%/year

ELM (4 years after peak)

-5.0%/year & -15.9%/year

Accepting that increased domestic use isn't a necessary part of the model, both Russia and Mexico are increasing consumption at a rate that is already negatively impacting export capabilities and just makes the situation worse. It will likely happen in the Middle East also.

The US and China are examples of rapid net export declines, even as their production increased, because of increasing consumption. Here are the numbers for four former net oil exporters. The rate of changes in production and the net export decline rates are from final production peaks (net export peak for China) to the final year of net oil exports.

Four Former Net Oil Exporters

Production & Net Export Increases/Declines Per Year, Over the Referenced Time Frame, Are Respectively Shown (EIA, Total Liquids)

China (1985-1992)

+1.8%/year (Prod.) & -16.9%/year (Net Oil Exports)

Indonesia (1996-2003)

-3.9%/year & -28.9%/year

Egypt (1999-2006)

-3.8%/year & -37.1%/year

UK (1999-2005)

-7.8%/year & -55.7%/year

The median net export decline rate over the decline periods was about -33%/year (declining by 50% every 2.2 years). Of course, as noted elsewhere, the net export decline rates started out "slow," and accelerated with time.

Here are the 17 case histories of oil exporters showing a production decline in 2008, relative to a recent peak, which may or may not be a final production peak.

17 Net Oil Exporters Showing Production Declines*

Production & Net Export Declines Per Year, Over the Referenced Time Frame, Are Respectively Shown (EIA, Total Liquids)

PRODUCTION PEAKS IN 2005 OR LATER:

Equatorial Guinea (2005-2008)

-1.45%/year (Prod.)& -1.46%/year (Net Oil Exports)

Russia (2007-2008)

-0.9%year & -2.4%/year

Saudi Arabia (2005-2008)

-1.0%/year & -2.7%/year

(Median About -3%/year)**

Iran (2005-2008)

-0.5%/year & -3.4%/year

Ecuador (2005-2008)

-1.7%/year & -4.4%/year

Nigeria (2005-2008)

-6.4%/year & -6.9%/year

PRODUCTION PEAKS IN 2004 OR EARLIER:

Gabon (1997-2008)

-3.7%/year & -3.8%/year

Oman (2000-2008)

-3.1%/year & -4.4%/year

Venezuela (1997-2008)

-2.6%/year & -4.5%/year

Norway (2001-2008)

-4.7%/year & -5.1%/year

Syria (1996-2008)

-2.4%/year & -5.5%/year

Colombia (1999-2008)

-3.6%/year & -8.3%/year

(Median -8.3%/year)**

Yemen (2001-2008)

-5.4%/year & -11.5%/year

Mexico (2004-2008)

-4.7%/year & -13.5%/year

Denmark (2004-2008)

-7.6%/year & -16.4%/year

Malaysia (2004-2008)

-4.2%/year & -16.8%/year

Vietnam (2004-2008)

-3.5%/year & -46.0%/year

*BTW, I didn't show Iraq, because of the war, but for what it's worth, from 2000 to 2008 it shows the same production & net export pattern as these 17 examples.

**Incidentally, at a -3%/year net export decline rate, net exports would fall by 50% in 24 years. At -8.3%/year, net exports would fall by 50% in 8.7 years (Rule of 72). But the point is that as time goes on, net export decline rates tend to accelerate, with some oscillations along the way.

The blogger that used to post Net Oil Exports has not updated his charts since last year nor posted anything since January. My question: Is there anyweher we can get a chart of net oil exports from say the 20 largest exporters as we used to get from this blogger?

Ron P.

The key problem with estimating current net exports is consumption. If I were going to try to do it, I would take year to date average total oil production, and then do two cases for consumption: (1) Same level as 2008 and (2) Same rate of change as 2005-2008. This would basically give you a low case and a high case for consumption, for most exporting countries.

Of course, we have some voluntary reductions in production this year, but IMO we are beginning to transition from voluntary + involuntary reductions in net oil exports to mostly involuntary reductions in net exports in future months & years. Regarding the Big Enchilada, Saudi Arabia, if we see 2010 annual oil prices above 2009, and if Saudi Arabia still has not exceeded their 2005 annual production rate, we would have seen five years of Saudi production below their 2005 rate, with four of the five years showing year over year increases in oil prices, at which point, IMO, it will get increasingly hard to claim that 2005 was not the final production peak. But, in any case, I think that it is extremely unlikely that Saudi Arabia will ever again exceed their 2005 net export rate.

Based on the Pemex data through July, it looks like their net exports to date are 0.99 mbpd, versus 1.08 mbpd for 2008 (EIA). They import more product than they export, so I took the difference and subtracted it from crude exports. When you do this for 2008, it shows 1.04 mbpd, pretty close to the EIA number. My estimate, given the steep Cantarell decline, is that the annual net export rate will be around 800,000 bpd (a year over year decline rate of -30%/year), on track to approach zero net oil exports by the end of 2012.

Hang on.

If you assume Cantarell will hit zero production at the end of 2010 then the decline in exports should hit an inflection point. KMZ may begin to fall away slowly, but Chicontepec and other offshore drilling should produce something to offset it.

Thus its only net increase in consumption that will push the exports down, and with the significantly reduced tax income its likely that will be curtailed by a general recession.

In short I'm not so sure the 2012 date makes sense, rather Mexico will hit a 0.5Mbpd export plateau for a number of years. Not enough to keep them running, but not a net importer either.

Time will tell.

Hang on.

Garyp, I don't think anyone is assuming that Cantarell will hit zero production in 2010. Let us not throw such gross exaggerations into our caculations. That just reduces our credability.

Ron P.

If you project the current decline rate of Cantarell to the axis, it reaches zero production in Dec 2010.

Now maybe that rate will flatten somewhat, but so far down it hasn't and that just increases the overall production numbers anyway. eg higher net exports.

Personally I DO think Cantarell will hit zero production by this date, mainly because below a point it becomes uneconomic to keep such a large production facility going for a dribble of oil. When do you cut your losses and move attention elsewhere?

Time will tell.

Well no, it just doesn't work that way. Usually a field declines at a certain percentage rate. Though Cantarell is declining at a linear rate right now that is an anomaly rather than the rule. This cannot possibly continue. As they get nearer and nearer to zero the decline rate will revert to a percentage change rather than a linear change. In other words it will tail out. They will produce a few barrels per day for many years to come.

Ron P.

There is also one other decline behavior, hyperbolic decline, that is slower than exponential. My studies of that particular behavior shows that it may be related to a reserve growth component.

The other thing is that linear, hyperbolic, and exponential are indistinguishable when the decline is slight. But you are definitely correct in that linear will turn into either exponential or hyperbolic and is not sustainable. The only thing that prevents it from showing the latter behaviors is if the operators decide to shut it down.

If memory serves, Cantarell is a very unusual field, dome shaped with gas at the top and water at the bottom. Theory on conventional fields says the profile of the production decline should already have begun to level out, but its remained steadfastly on a linear downward trend.

Now we know that some nitrogen injection has been diverted to KMZ which would give an initial kick to the downward trend, but this does nothing to explain its recent shape. Not an expert myself, but maybe the lessening of gas injection has raised the water level whilst reducing the oil flow at the same time? For some reason its a good 200kbpd less than you would expect if it were following an exponential trend

Whatever it is, this is a field scaled for 2Mbpd production. Even if you can redirect many of the production facilities to service KMZ nearby, at what point does the value of oil recovered not cover the costs of operating the field? What is the size of the fixed costs? Can you make the 2Mbpd-scaled field work at 0.1Mbpd? Because somewhere in there is a red line below which production stops because costs get higher than prices.

I'd contend that if its going to pull out of this dive before reaching the red line of viability its going to have to pull the mother of all right hand turns, and soon.

The Energy Export Databrowser attempts to fill this need. You can review timelines of production, consumption imports and exports for over 100 nations and groups of nations.

Graphs from the Energy Export Databrowser occasionally appear on TOD threads and look like this:

Happy Exploring!

-- Jon

To recap all of the above, let's look at three median net export decline rates for a total group of 21 current or former net oil exporters:

2005 or Later Peaks (6 countries): -3%/year

2004 or Earlier Peaks (11 countries): -8.3%year*

Former Net Oil Exporters (4 countries): -33%/year

*For countries which were still net oil exporters in 2008

In precious net export declines, the decline could be made up by buying oil elsewhere. But this no longer seems to be the case. Continuing net export declines in the future may lead to sever economic collapses. The question is where?

Mexico is a prime candidate for economic collapse as oil revenues dry up in the next few years. What will happen then? Will oil exports soar (temporarily) due to lack of domestic demand? Will oil exports plummet due to chaos?

There will come a time in the not to distant future where models will no longer apply, because:

1. Economic collapse, chaos in exporting country

2. Economic collapse, chaos in importing country

3. War

4. World War

5. Economic collapse everywhere

***************

And another thought: when/if the saudi-fields start to decline at higher rates, then will be real trouble worldwide.

I would really love to see some detailed analysis on world regions, regarding oil supply, peak date, etc. These kind of articles were all over TOD just about 2 years ago, but to my disappointment they have dried up.... A detailed look at Russia for example would be very nice.

And where will we get the fuel to maintain these wars? Our country is already bankrupting itself supporting a 600 billion dollar a year military-industrial complex, plus the additional hundreds of billions squandered in Iraq and Afghanistan. If we default on our deficits, we will be forced to dismantle much of our much-vaunted military and remove much of our presence abroad.

To assume that resource depletion = war assumes that we will still have enough resources enough to make war. I argue that if we can't even maintain the kind of financial outlay required for the level of military involvement we have now, we surely won't be able to maintain a war economy with a crippled economic system AND the lack of sufficient fuel resources with which to make war and occupy foreign territories for the purposes of resource extraction. I think our economic situation will simply be too dire to support any kind of sustained conflict on a global level. It takes an awful lot of money and resource capital to maintain Fascism.

I think the word you're looking for is revolution. History teaches us that governments which cannot provide for their people are overthrown. The problem we will face is that there won't be much of anything to provide.

Hello DanBrown,

Your Quote: "I think the word you're looking for is revolution. History teaches us that governments which cannot provide for their people are overthrown. The problem we will face is that there won't be much of anything to provide."

That is Jay Hanson's Thermo/Gene fast-crash scenario writ large. My Optimal Overshoot Decline Scenario would bring the foreign-based US troops home to put them to work immediately building transport canals & Alan Drake's standard gauge RR & TOD [the national 'spine & limbs'] plus narrow gauge 'ribcages' of SpiderWebRiding Networks. In short: a Revolution away from personal easy-motoring to Kunstlerization and localized permaculture.

If Mexico collapses soon: the US military may have to come home anyway to patrol [fight and wage war?] along the US Southern Border. This would be similar to the tragic Israel/Palestinian Overshoot situation, except that I would expect the US Navy to commandeer the last dregs of Cantarell for total export to the US. The US Army could also easily carve off the KMZ land area, then send that oil to the USA, too.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

You outline the classis situation that actually STARTS WARS rather than prevents them. The country powerful enough to risk a big time aggressive move usually does not actually do so right away,given the very real risks involved and the fact that there is usually internal dissension in favor of peace.The fight is usually delayed -until such time as the generals say "it must be now or never-later we will not have the resources to fight".

Daniel Yergin lays this out in fascinating detail in The Prize as it played out in Japan and Germany from about 1900 onward.His focus is of course mainly on oil but the principle applies across the board to land, water, and other minerals.His analysis is consistent with every other historian I have read but others don't emphasize oil so much.

It is not inconcievable that we (the US) might simply quit playing "nice" in the Middle East and just start taking the oil if doing so means the difference between survival and collapse.

The Germans and the Japanese both knew that they had to win fairly quickly(at least the professional soldiers knew,the edidence as to the politicians undrestanding this is mixed) and they lost largely because they could not consolidate thier winnings fast enough-the war became a war of arrtition and we whipped them with our productive capabilities more so than we did with rifles.

If we or any other major power decides to fight dirty oil may not be that big an issue inso far as the fight goes-just one modern bomber can pretty well take out a city all by itself over a period of a few days without resorting to nukes for instance-modern day artillery can zero in on a target well enough to destroy it in a couple of minutes whereas in WWII a trainload of ammo might have been used to knock out one bridge or airfield.

No really modern army or air force has ever really been turned loose and told to "just clean them out so we can take over whatever is left"-the political repercussions have been judged SO FAR to be too much to risk.

But on the other hand no country possessed of such a military has ever really and trily faced it's own collapse yet and also been in a position to possibly save itself by pulling out all the stops and waging truly unlimited warfare on another country .

Hello OFMac,

Excellent Points. That is indeed the looming Black Swan dilemma: Trying to determine when/where/how Adam Smith's 'invisible hand' finally decloaks into a fist in a black glove from energy & resource scarcity.

Of course, when this finally does occur, such obvious and ruthless resource grab aggression will cause rapid bifurcation everywhere; quick political polarity into numerous kinds of additional new, cascading fast-crash scenarios--the mindset of "I and/or my tribe got ours, screw you [the politically defined by scapegoating] outsiders".

A terrifying scenario indeed. The world has never witnessed such lop-sided military power either. Take the US navy for example. There has never been a time in history (with the possibly exception of 1946) when one nation's navy so completely dominated all the World's ocean's so as to be able to deny passage to anyone.

However, I would like to add a note of optimism. The amount of consumption in the US (and elsewhere) that is wasted on useless, pointless or irrelevant pursuits is truly amazing (e.g. watering Kentucky bluegrass in the suburbs of Phoenix in July, driving a 500 hp motor boat up and down a lake for "fun", a single person commuting to work in a 4-tonne SUV for 2 hours+ each day by sitting on a "parkway" to use a computer/phone at an office instead of the home computer/phone, eating beef from corn and soybean fed cows, poorly maintained/highly inefficient toys/tools, etc., etc.). The actual ability of the US (and other countries) to reduce consumption in times of turbulence and for a good cause without hampering truly important activities like food production and minerals exploitation is huge. Take a look at the reduction in consumption during WW2 for the UK for example. The US (and other countries) could/would reduce its consumption if it had to. This could take effect very quickly (at least the first part) if a real emergency occurred. Also the real barriers to the use of natural gas as a fuel to largely supplant gasoline/diesel are relatively small. IN times of real emergency conversion would occur quickly.

So although there are many reasons to worry (a lot), and I do NOT advocate complacency. Panic is also counter-productive.

Ian

So this just ensures our military will be well supplied with oil as civilians are forced to cut back.

What ever we don't use our military will. If you want to look at inelastic demand look at the US military. And to put my tinfoil hat on for a moment if oil production are really crashing the US military needs diesel.

You have your neighbor on the verge of collapse any chance that you might see a distillate build up in the US in preparation for a war in Mexico ?

US refiners are all hyped on a sharp turn up in distillate demand soon. The stock market is predicting a rapid turn around.

Anyone with common sense knows the fundamentals are still shit ...

So whats being predicted ???

WAR

80% of our military oil usage is air power. A heapin' helpin' of that comes from the somewhat dated idea that we need humans inside aircraft to do our fighting. A lower energy air force could be quickly and easily achieved by a reduction in mission tempo first and then a focus on doing things like this.

http://www.f-16.net/news_article1333.html

CyberDyne Systems/SkyNet, here we come!

MilTechnocopia

I am not doubting the idea that the only reason why the US would suddenly need more refined fuel is to go to war with another country. I would like to see evidence that the refiners are expecting a ramp up in demand soon, however.

I think war in Mexico will only happen when the Mexican government fails, that way the war won't be seen as an invasion, but rather a situation where the US goes in and imposes martial law in concert with the Mexican army to prop up the existing power structure there in exchange for some measure of control.

Or, we might invade Iran/Pakistan soon. My understanding of the situation is that not only do all the usual special interests win from these wars in the middle east (Military-industrial complex, financiers, ect...), but it gives the US a base of operations to keep all that oil safe from the Chinese.

If I am not mistaken, a lot of Chinese oil comes from Kazakhstan, which means that Afghanistan would be a good place to start from if you wanted to take control of Kazakhstan; the only other good place is Russia. From my armchair general's perspective, if the US wants to come out on top, China and Russia must be played against each other. No doubt, the CIA is trying to destabilize things in Khazakstan.

Ian,

I agree that thre is some reason for optimism in regard to avoiding a resource war.Certainly it would be easier and smoarter for us to follow the paths of conservation and efficiency as you suggest than it would be for us to actually start such a war as might finish us off.

And while I am not proud of my country in every respect in relation to its past history,I am reasonably sure that we will continue to actually pay for middle eastern oil rather than just confiscate it.Of course our checks may eventually bounce!

I am not confident about the overall situation on a world wide basis.A war could start in many places for many different reasons and get out of hand in a hurry.

Then WE might have to make the fateful decision made by Germany and Japan in the late thirties.Fight while we are still able-with conventional forces, steer clear and maybe decline to second rate power,escalate to nukes or use possible new secret waepons.....we live in interesting times.

Customers in the remotest areas will be cut off, simply by dint of their locality. We see this already with occasional spot shortages in the Midwest. Areas with low population density will get short shrift, guess what the largest US city by area is? Jacksonville? (#5) Houston? (#10) Try Yakutat City, Alaska; many cities and counties in AK are consolidated. Such regions of low population density will have to do without in the face of pressing demand from elsewhere, whether from enraged populaces in large cities or a thirsty military. What the net effect of the savings will be, or the economic fallout, is anyone's guess. I'm still waiting for that study on the economic impact of the Colonial Pipeline shutting down last fall. List of United States cities by area - Wikipedia, the free encyclopedia

Alaska is busy hunting solutions to this whole remote oil delivery issue. They've got villages that generate electricity with diesel that gets hauled in world war II era tankers. How does an aircraft build sixty years ago constantly flying heavy loads? My guess is there is some very, very tired aluminum out there.

I sat with one of their guys at the Ammonia Fuel Network conference last year and he was talking about small scale hydropower ammonia production being squirreled away for generating. The sooner this gets done the better.

Glad you're there for 'em, SCT. SW is just the thing for such remote locales, until/unless they work out the kinks in that nuclear battery Toshiba was testing out in the bush. Build turbines as sturdy as those tankers and you're set for the century. You gotta hand it to the workers who built those old planes. That, and it's crucial to turn a blind eye to using rubber bands and spit to hold the things together now.

OFM,

My question to the masses is: What exactly have we learned from history?

Sure, we can drop lots of JDAMs (Joint Direct Attack Munitions, 2000, 1000, or 500-lb GPS/IME-guided bombs) from bombers and 'fighters', and our AC-130 gunships can blow people's heads clean off from thousands of feet slant range, and yes we have all kinds of other gee-whiz war gadgets such as predator UAVs firing Hellfire missiles and so forth, and so much more!

My point is: We can 'surgically strike' all the live-long day, but when it comes down to it, we have to control ground and infrastructure (wells, pipelines, etc) with American grunt boots on the ground.

And that is when the fun begins: See: Vietnam, Algeria, Afghanistan/Russia, Iraq, Afghanistan/U.S. coalition. Conquest may be easy, but control is a witch.

And if we do that, we will likely receive our blindingly bright comeuppance from the invaded cultures, fulfilling the worst nightmares or fantasies of the Bush/Cheney crowd.

OK, to answer my leading question: Nothing at all.

Moonwatcher,

Ian not sure exactly where you are coming from-what I have said that you are responding to,I mean.

So Maybe we are on different pages.

Let's hope that things never come to such a pass but I contend that controlling the population on the ground and the culture of said population is technically no longer an issue because we now have the technical ability to simply wipe every body out.Everybody.No resistance. Period.

I contend that this has not yet been done for two reasons-first that the capability was not there before say the wwwi or wwii era.Second that no country in a position to do it has yet had a clique in control bloodthirsty enough to actually try to do it-although Hitler tried to wipe out the Jews and Gypsies.Bad true but a long way from EVERYBODY in Poland for instance.

So far the fact that tv cameras are virtually everywhere plus maybe plain old squeamshness for lack of a better term has prevented any really powerful country from its power to just STERILIZE a problem area -say Saudia Arabia for instance.

Personally I have no doubt that we COULD kill every body in Saudia Arabia and seal the borders and just kill everybody that approaches.Of course the chances of The US doing that are functionally zero because the political repercussions would unmanageable-plus I hope we just aren't that inhuman.

So what we've learned from history is that -as you say- you can't go into a place like the middle east and make people do what you want.But now the rules have changed.You can just "killem all and let God sort'em out".

For now we can keep the troops there and at the cost of lots of money and a few dead American men every week we can make sure the oil continues to flow our way.

Do you see any sign from Washington that the troops are coming home?I don't.And let us not forget that all it would take is a few minutes to draw up the paperwork-the dems are in charge.Nows thier chance to put thier words into action and put the military industrial complex in its proper place.

My guess for what its worth is that things have gotten into such a mess that there is no way out-what ever happens ,it is not likely to be something pleasant.

What is likely to be the fallout in Mexico, assuming no one will lend them money so there will be massive contraction in federal spending? I know they have a constant problem with guerrillas in the south but is this likely to lead to a civil war? Where is Jeff Vail when you need him ;~). HO, care to speculate on geopolitical implications and timing?

I was hoping to get back to the Yucatan with my kids in a couple years.

Very, very busy at work at the moment, not that I can really complain about that.

I'd be very interested to see projections for the decline rate at KMZ compared to Cantarell under the same production conditions--don't know enough to begin speculating. I've also heard that PEMEX is investing huge sums in Chincontepec and getting only very small production in return. Not good. Next, I'm sure PEMEX will cite the recent GOM deepwater news and say they need new regulations to allow them to raise the capital to explore at depth.

Anyway, three of Mexico's major sources of income are at threat: oil exports, tourism, and remittance income from migrant workers in the US. To the extent the US expereiences an economic recovery, it will bouy two of these three sources and mitigate the effects of declining oil production. Worth noting that the fourth major source of Mexican economic activity--drugs--isn't at threat, but also doesn't put much money in the government coffers.

Mexico should be an interesting bellwether: how much can the "Nation-State" cut services and fail to provide for the security and wellbeing of its constituents before it becomes irrelevant, and what will this (probably long) process look like? My guess is that "Mexico" the Nation-State will recede to patchwork relevance: keeping up a facade on the international scene, exerting control over what oil production infrastructure it has, and maintaining increasingly isolated enclaves of "law and order." That said, Mexico could also show that the Nation-State structure is far more resilient than many (including me) have thought. If the Nation-State can remain relevant in Mexico over the next few years despite all the problems it faces, then I think the global Nation-State system will last for quite some time. If not, watch out. (Other bellwethers worth watching include Pakistan and Nigeria, in my opinion.) Either way, it will be very informative to watch how the Mexican Nation-State works to adapt and cope with the situation...

It's interesting that you should mention Pakistan and Nigeria, because both nation-messes are currently being kept from spiraling out of control through large influxes of money from the developed world - Pakistan's in military and direct aid, and Nigeria's in oil revenue. And where does that money come from? We print it of course, right here in the U.S. of A. These are the last exports of an empire in decline - debt and empty promises.

A large fraction of that money is siphoned off by a corrupt ruling elite in both Pakistan and Nigeria, a situation that is likely to get worse as the global economy declines. The price of oil will IMO crash again with the equity markets, and with it Nigeria's income. And at some point Pakistan will no longer be 'worth it,' and will be abandoned by the US, like Russia did to Cuba when the rouble imploded. So I see it as inevitable that perpetually teetering states like Pakistan and Nigeria will ultimately be cast adrift by a developed world that simply can't afford them any more.

How is Mexico any different? Its importance to US stability doesn't change the fact that it's too big and too far gone for the US to prop up forever with aid and cops and NAFTA concessions. It's more likely that the post-crash norm will become what Ilargi calls "beggar-thy-neighbor," where the developed world will buy breathing room through deliberate attacks on smaller nations' economies and currencies, like the UK did to Iceland.

In this view of the future, the center holds by a deliberate shedding of the periphery - the logic being, if there has to be a decline in total per capita consumption, better them than us.

Get ready for the third installment in John Carpenter's franchise: "Escape from Mexico."

Mexico will hit MOL at some point. Which part of the periphery will be cut off first is open to debate; as is happening in Iraq, a tremendous amount of bunkering goes on: PEMEX: Mexico Loses $700 Million Annually to Oil Theft

Here's a graph of their distribution system: http://www.geni.org/globalenergy/library/national_energy_grid/mexico/gra... Also Mexico Pipelines map - Crude Oil (petroleum) pipelines - Natural Gas pipelines - Products pipelines.

Mexico purchasing product with the receipts from crude sales, all through the same corrupt agency, makes it seem to me that losing exporter status will be doubly painful for them, or perhaps exacerbate/speed their descent towards MOL. Also it will mean a loss of revenue for US refineries that were providing them with product; they will seek business elsewhere in the world, one imagines, but you wonder if there won't be a transitional period where they have to adjust to shipping on tankers instead of pipelines; perhaps some of these southbound lines will fall into disuse.

Also here is a map of their distribution system, taken from the Statistical Yearbook 2009:

As my first graph shows, Mexico is declining to production levels not seen since the early 80s, with an intervening rise in consumption, some of which was paid for by revenue from that same increase in production. Has an equivalent pinchers action happened to a major producing nation before?

Indonesia is the classic example. From the Energy Export Databrowser:

Indonesia is just over the horizon to our north from here in Australia. It is no mistake that a lot of our military assets are in the north.

Well,

So far neither those Kiwis nor them penguins seem like much of a threat!

Our assets are up there because that's the only place a conventional attack would come from (conceptually, India could attack from the North-West as well). No doubt our new F-35's will be stationed up there (if they ever get delivered), where they will be completely useless (due to not having any significant combat range). The F-111's get retired at the end of the year, bringing to an end the 50+ year reign of the RAAF's Strategic Bombing Capability (and commesurate high throw-weight and loiter time), and the RAAF's dominance of south-east Asian airspace.

At least our nearby neighbours don't have any significant attack-and-hold capability, so even in the event of a desire for a military strike, they don't have much to back it up with. The Oil fields off the north-west coast are vulnerable to hit-and-run attacks, however.

China and India are the wildcards in the deck.

How much were they importing before they went net, how much of the proceeds were from sales of crude, how dependent was their government on same, how dependent were they on giant fields, how corrupt was/is Pertamina? And I could go on. Most of the answers are given in broad form at the EIA: Indonesia Energy Data, Statistics and Analysis - Oil, Gas, Electricity, Coal I'm more interested in the details of how Mexico will handle losing its exporter status than how closely it follows the pattern of other nations in its decline.

Just a reminder; Pakistan has nukes which changes a lot of things for that part of the world.

I live in Costa Rica, a country which was taken by surprise as Mexico began to cut it's offer to supply a proposed new refinery as the situation with Cantarell began to play out.

Re: the situation in Mexico.

Recent approval of plans to create 6 US military bases in Colombia might just maybe, somehow, possibly in a tiny way be related to the declining production in Mexico and the growing "resource nationalism" in South America.

I expect at least one reply: "No duh....."

since we are talking sur Americana;

HELP!

"Guatemala declares ‘state of calamity’"

http://www.ft.com/cms/s/8571db1a-9d7c-11de-9f4a-00144feabdc0,Authorised=...

"Alvaro Colom, the Guatemalan president, announced he would invoke the public order laws to impose a “state of calamity” in an effort to stave off mass hunger in the Central American nation.

The measure allows the government to make special purchases of food and Mr Colom said he hoped it would inspire the international community to send aid."

First we'll experience donor fatigue, then the financial inability to respond, then the simple operational inability to respond due to crop production levels. I write about this ... I think it's fairly broadly seen, but it doesn't draw a lot of comments.

http://www.dailykos.com/story/2009/9/8/778867/-Comforting-The-Dying

This is the net export graph from Energy Export Databrowser.

These figures are only through 2008. 2009 is worse, based on EIA data.

To my mind the most pressing concern about Saudi Arabia is not the health of Ghawar and the other fields, it is the amount of oil and gas they will need to consume internally coupled with the tinder-keg atmosphere in the Kingdom.

With 25% of the population under the age of 25, dirt poor and restless the Saudi Royal Family are not dumb enough to think they can ignore them for ever. Not if they want to keep their heads on their shoulders at any rate. The huge population increase in the KSA over the last 30 years has put an enormous strain on the water supply. They are actively building out desalination capacity which uses a lot of energy to run. They will also need to feed this growing 'army' and give them something useful to do and most importantly they will need to demonstrate that the average would-be Al-Queada fanatic is seeing something positive come out of the KSA's oil reserves. If all they see is the rich getting richer then there is real trouble. Internal demand for their product HAS to go up.

A little reported mini-war is happening daily on the Yemeni-Saudi border. The Royals are scared out of their socks and no doubt the US government too. If that little 'problem' flares up it could cause real chaos.

Excerpted from our top five net oil exporters paper (note that 2005-2008 Saudi consumption exceeded the +5.7%/year rate of increase, and inclusive of Saudi Arabia, Sam's best case is that that the top five will have shipped half of their post-2005 cumulative net oil exports by the end of 2014).

From top five paper:

The Economist magazine, in an article about Saudi Arabia published in August, 2006, had the following remarkable statement:

It was remarkable that the Economist would make a 70 year projection without even considering the effect on net exports of increasing domestic Saudi consumption.

Based on EIA data, Saudi Arabia showed a +5.7%/year increase in consumption from 2005 to 2006. Figure Four shows a flat line production of 11 mbpd (total liquids) versus a +5.7%/year increase in consumption which would result in Saudi oil exports ceasing in about 2036. The long term net export decline rate (2005 to 2030) would be about -10%/year. As noted above, the year to year net export decline rate would start out slowly and accelerate with time.

For what it's worth, at +5.7%year, the Saudis would be consuming 108 mbpd in 2075, which seems “somewhat” unlikely, since this is about 40% more than current total world liquids production.

Isn't it absolutely certain that SA is pumping less than their capacity? That would make the above graph really irrelevant. I assume that there is a Saudi production drop in the future but it most certaily hasn't happened already.

Since there is no "official" audit of KSA oil, the only way we will know peak KSA oil happened is in the rear view mirror. WT said that if prices stay up AND 2010 KSA production does not exceed 2005 production then we have probably seen KSA peak. Either way, internal KSA consumption is going up so ELM applies for fuel exports to the world.

I agree that many people are absolutely certain that Saudi Arabia is immune to the laws of physics, but I do think that part of the 2009 decline in production is voluntary.

In any case, based on EIA data, as noted above, the observed 2005-2008 production decline rate was -1.0%/year (total liquids, EIA). And as noted below, if 2010 annual oil prices are above the 2009 price, and if Saudi Arabia still has not exceeded the 2005 annual rate, I think that it will become increasingly hard to claim that 2005 was not the final Saudi production peak, since they would have shown five years of lower production relative to the 2005 rate, as oil prices rose year over year for four of the five years--at about the same stage of depletion at which the prior swing producer, Texas, peaked. However, the more important metric is the volume of net oil exports, and I think that it is extremely unlikely that Saudi Arabia will ever again exceed their 2005 net export decline rate.

BTW, in regard to the chart, what it shows is a flat production rate of 11 mbpd (their 2005 rate was 11.1) for the indefinite future--and the effect on net oil exports of increasing consumption.

I never inferred they were immune to physical constraints. My only point is that they have continued to develop existing deposits even during the past year as prices have collapsed. On that basis alone I think that asserting they have reached their peak production is premature.

Well, oil prices have "collapsed" to a current level five times higher than the 1998 average annual price. In any case, I am basing my argument on the Saudi HL plot through 2005 versus the total Texas HL plot:

http://www.energybulletin.net/node/16459

Could it be that the Saudis figured out that they have only so much left and want to sell it at the sweet spot of price and volume?

They don't want to give it away cheap anymore.

Of course the price of oil in dollars also reflects the inflation effects of a declining currency and the markets reaction to that but there has to be a component of dearness of oil to the producers at this point.

Just guessing.

The day they quit exporting is the day that everyone there connected in any way with the ruling class flees for thier life.

Huh?!?

Never heard about it, can you give some references?

Saudi-Yemen Border Closed by Disgruntled Sheik, Armies of Liberation, March 3, 2009

Yemeni forces bomb Shiite rebels near Saudi border, The Daily Star, Ahmed Al-Haj (Associated Press), August 13, 2009:

Saudis Threatened by Al-Qaeda Terror, Yemeni Rebels, Bloomberg, Sept. 9, 2009.

I do not know how much of this is propaganda because the violence started recently over an issue between a Yemen Sheik and Saudi Arabia, but now the western media is blaming al Qaeda, Iran and Shiites.