Petroleum Demand Lessons from the Late 1970s

Posted by Gail the Actuary on March 19, 2010 - 10:36am

This is a guest post by Kevin Rietmann, known as KLR on The Oil Drum.

A collapse in demand for petroleum products happened in the late 1970s and early 1980s. JD, proprietor of the blog Peak Oil Debunked, examined this briefly in this 2007 post about what he termed ”The Big Glitch”:

So what really does happen when global oil production drops by 15%? Well, it turns out we know the answer to that one because it actually happened once before, in the early 1980's. Production hit a high of 66mbd in 1979, and over the course of 4 years dropped by 14% to 56.6mbd in 1983. In fact, oil production didn't surpass the 1979 high until 1993, 14 years later.

So what did the world look like in 1983, after oil production had collapsed by 15%? I'll tell you what. Go out to your local freeway, and look at it during rush hour, when it's totally crammed with cars. That's exactly what 1983 looked like. I was gassing up as usual, totally oblivious. The "crisis" had such a minor impact on daily life, that I didn't even realize anything out of the ordinary was happening, let alone a liquid fuels armageddon that was wholly shattering the oil dependent economy and reducing the citizenry to poverty. I could be wrong about this, but I'm pretty sure that no one was forced by starvation to eat their Flock of Seagulls albums.

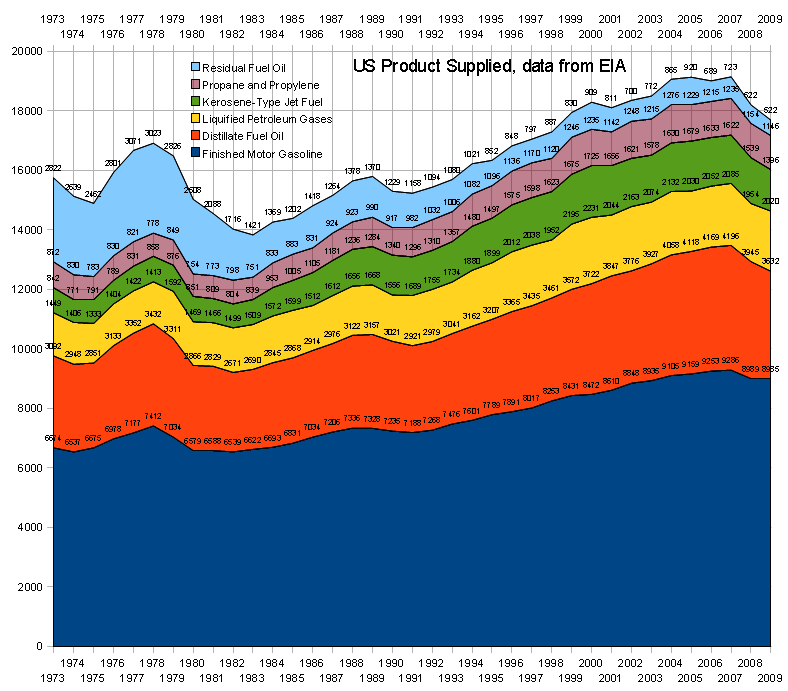

As it happens, demand for petroleum has gone down in the wake of JD's rant; how does it compare to the shortfall of 3 decades ago? This post will examine what happened in the late 70s to demand for the various petroleum products, and compare their rate of downturn to what has transpired since their corresponding recent peaks. This will be about US demand, using EIA data, as it is by far the most comprehensive to be had. The general situation in other regions of the world will be covered briefly at the end.

CERA's Current View of Peak Demand

To move from bloggers to think tanks, CERA made their first pronouncement about US peak demand on June 19, 2008, claiming that a long-term shift in consumer behavior, spurred on by increased penetration of the market by higher efficiency vehicles and higher volumes of biofuels displacing petroleum products, would mean 2007 would be the all time high for US gasoline demand. As it happens, 2008 and 2009 average volumes of gasoline supplied were at 96.80% and 96.75% of the 2007 value, so this initial forecast isn't exactly playing out. A year after CERA issued their report their Managing Director Jim Burkhard stated at a presentation that "Peak Oil is Here," referring of course to their notion of peak demand, not a peak in supply. In response Dave Cohen served up his trademark brand of caustic derision in Peak oil = peak demand?

CERA must have been thinking really hard in the first half of 2008 about how to spin the fact that global demand was growing but supply could barely rise to meet it. And then it must have come to them like a bolt from the blue—peak demand! This is an ingenious solution. The oil supply doesn’t have to grow anymore because we don’t need it to. World oil production capacity doesn’t matter anyway. We can acknowledge peak oil without acknowledging peak oil.

And so in June, 2008 when things looked bleak for the oil supply, CERA issued its report, "Drivers Turn the Corner in the United States". CERA knew, as many of us did, that demand would surely collapse with prices over $140/barrel and stay down for a long, long time.

As Dave subsequently points out, that hasn't exactly transpired, is far from accounting for the world as a whole, and also looks like a lame way of covering for a peak in supply. Others have commented on this topic; Sam Foucher posted a detailed article here in the fall on peak demand in the OECD; and in the last month a pair of additional excellent critiques of peak demand have been published by Kurt Cobb and Chris Nelder. Chris references a Deutsche Bank paper from last fall which is worth reading as well; I will comment briefly on one of its cornerstone assumptions later in this post.

While CERA aren't specifically citing historical examples of demand troughs as JD did - although they are more than happy to bring up failed historic peak oil forecasts, as well as deigning to mention failed past attempts at bringing unconventional oil to market in their uberbullish supply projections - this article will cover the major demand contraction of the late 70s/early 80s, which, as JD points out, restrained production for about 13 years worldwide, and compare them to how things are currently unfolding.

Overview of Demand Destruction in 70s/early 80s

To give a general overview of how the previous phase of demand destruction unfolded, here is a pertinent excerpt from pgs 717-718 of CERA chairman Daniel Yergin's Pulitzer Prize winning history of the oil industry, "The Prize":

Significant changes were also taking place in demand. The massive twentieth-century march toward higher and higher dependence on oil within the total energy mix was reversed by higher prices, security considerations, and government policies. Coal staged a massive comeback in electricity generation and industry. Nuclear power also made a rapid entry into electricity generation. In Japan, liquefied natural gas increased its share in the energy economy and in electricity generation. All this meant, around the world, that oil was being ejected from some of its most important markets and was rapidly losing ground. Its share of the market for total energy in the industrial countries declined from 53 percent in 1978 to 43 percent by 1985.

Not only was petroleum experiencing a declining share of the energy pie, but the pie itself was shrinking, reflecting the profound impact of increased energy efficiency, otherwise known as conservation. Though often dismissed or even ridiculed, conservation had turned out to have massive impact. Energy conservation in modern industrial society meant, for the most part, not deprivation, not "small is beautiful," but greater efficiency and technological innovation. The 1975 legislation that mandated a doubling of the average fuel efficiency of new automobile fleets to 27.5 miles per gallon by 1985 would reduce United States oil consumption by 2 million barrels per day from what it would otherwise have been—just about equivalent to the 2 million barrels per day of additional oil production provided by Alaska. Altogether, by 1985, the United States was 25 percent more energy efficient and 32 percent more oil efficient than it had been in 1973. If the United States had stayed at the 1973 levels of efficiency, it would have used the equivalent of 13 million barrels of oil more than it actually did in 1985. The savings were huge. Other countries made their own dramatic savings. Japan over the same period became 31 percent more energy efficient and 51 percent more oil efficient.

By 1983, the first year of economic recovery, the impact of conservation and fuel switching was clear. Oil consumption in the noncommunist world was 45.7 million barrels per day, about 6 million barrels less than the 51.6-million barrel-per-day level of 1979, which had been the high point. So, while demand had fallen 6 million barrels per day between 1979 and 1983, non-OPEC production had increased by 4 million barrels per day. On top of that, the oil companies eagerly sought to dispose of the tremendous inventories they had built up in anticipation of a demand level that never materialized. Those three trends—the collapse in demand, the relentless buildup of non- OPEC supply, and the Great Inventory Dump—reduced the call on OPEC by something like 13 million barrels per day, a fall of 43 percent from the levels of 1979! The Iranian Revolution and then the Iran-Iraq War had crippled the exporting capacity of those two countries. Yet suddenly, instead of the feared shortage, there was a large surplus of production capacity over market demand in short, the makings of a massive glut.

Recent Drop in Demand vs Drop in Demand in 1970s

This article will examine that collapse in demand. These peaks happened at different times; a problem with building a complete data series is that monthly numbers for the 70s aren't included for many minor products such as ethane-ethylene or petroleum coke, with data only going back to January 1981, a few years after the local peak had arrived. Another shortcoming in the EIA data is that the "Finished Petroleum Products Supplied" series also only begins in January 1981; luckily a monthly series for "Crude Oil and Petroleum Products" does go back to 1973, when the data also begins for products such as Liquified Petroleum Gases and Propane and Propylene. By summing the product series which are included I've derived numbers for monthly Finished Products sans crude oil, which look to be accurate enough; when the series begins the difference between the last summed value and the first EIA number is 93 kb/d, a wholly negligible difference, so I feel confident in using the summed values here. I should explain that Crude Oil itself was a product supplied, presumably for power generation or industrial applications. It peaked at 66 kb/d in 1983, and had hit 0 kb/d in 1999, where it has stayed ever since.

Here are the local peaks for 1973-1979, all values in kb/d:

Crude Oil and Finished Finished Distillate Liquified Petroleum Products Petroleum Products Motor Gasoline Fuel Oil Petroleum Gases Feb-1979 Feb-1979 Jun-1978 Jan-1977 Jan-1979 21287 19794 7913 5103 2086 Kerosene-Type Propane Residual Jet Fuel and Propylene Fuel Oil Feb-1979 Jan-1977 Feb-1978 951 1354 3974

The actual peak for Propane/Propylene was Jan 1973, at 1376 kb/d; to this day Propane/Propylene is a very seasonal product, with winter numbers exceeding those of summer by some 40%, so I have taken the liberty of using the above figure from Jan 1979, which is only 22 kb/d short of the 1973 number.

By calculating percentage values of these product streams from their local peak value we can see how much demand had contracted over the years. I've built up monthly series for 6 years after each 70s local peak, which can be matched with the local peaks from the last 6 years. In most cases these are the absolute peak for the past decade, with a couple of exceptions.

The recent peaks in 2004-2009 for these products were as follows:

Crude Oil and Finished Finished Distillate Liquified Petroleum Products Petroleum Products Motor Gasoline Fuel Oil Petroleum Gases Aug-2005 Aug-2005 Jul-2007 Feb-2007 Jan-2004 21666 19473 9640 4582 2596 Kerosene-Type Propane Residual Jet Fuel and Propylene Fuel Oil Dec-2005 Feb-2007 Aug-2005 1756 1798 1051

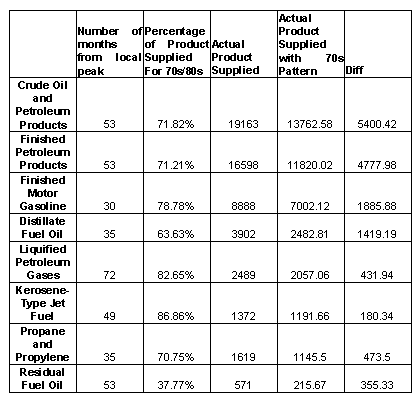

Some of the absolute peaks for the past decade were previous to these dates, so after this section I will conduct the same analysis using annual figures. But first, here are what the December 2009 product supplied numbers would have been, if the decline had followed the same pattern as obtained in the late 70s/early 80s, along with the difference between actual values and what they would have been following the percentage pattern which obtained in the late 70s:

To clarify, here is an example: Dec 09 is 53 months from the modern Aug 05 peak for Crude Oil and Petroleum Products; the equivalent local peak happened in the 70s in Feb 79, and 53 months later was at 71.82% of that peak value. The "Actual Product Supplied" is what was actually brought to market in Dec 09; the next column is what it would have been at 71.82% of that Aug 05 value.

Clearly the current contraction in demand is far less steep than what obtained previously; note that the majority of the peaks in each instance occurred on the cusp of severe economic downturns, beginning in the US in December of 1980 and 2007 respectively. The current recession is by almost all measures proving to be more severe than that of 1980-83, but is having less effect on petroleum demand. To be sure demand destruction has occurred, but if CERA's projections are going to come to pass the rate of contraction will have to show a sizable uptick soon.

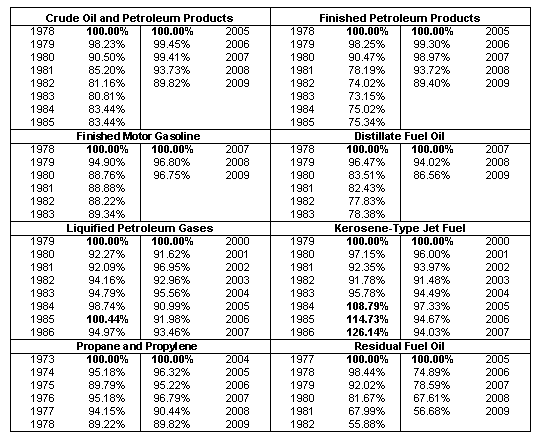

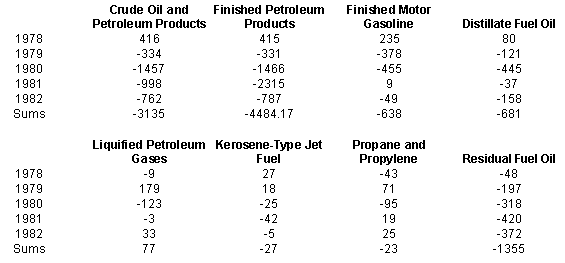

Here are tables contrasting the two local eras of peaking, this time on an annual basis:

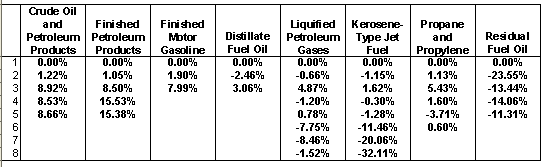

Starting with the peak values from each era and subtracting the current percentages from the 70s numbers, we get:

To clarify once more: positive numbers indicate steeper declines in the past, negative numbers mean the current values are steeper. The averages for these numbers are:

CO&PP FPP FMG DFO LPG KTJF P/P RFO 6.83% 10.11% 4.95% 0.30% 2.11% -0.28% 1.11% -15.59%

As can be seen resid is contracting faster now than it did previously, but not to the same volumetric effect:

Note as well that LPG and jet fuel quickly exceeded their local peaks; the number of years for each product to exceed its 70s peak were as follows:

CO&PP FPP FMG DFO LPG KTJF P/P RFO 21 n/a 16 20 8 7 8 n/a

But this is misleading to an extent; many streams were back up to ca. 95% within shorter spans of time. Gasoline, for instance, bottomed out at 88.22% in 1982, rising to 98.97% in 1988, before declining again for a few years.

Years to hit bottom:

CO&PP FPP FMG DFO LPG KTJF P/P RFO 7 7 6 6 6 4 3 n/a

Those who wish to examine this in further detail may download my "Product Supplied - Annual" spreadsheet linked at the end of this essay.

CERA's call of course is for demand to never exceed 2007, not for it to decline at comparable rates to historic precedents. But can demand be said to have permanently peaked now? After all, the more sharp declines from the 70s hit bottom fairly quickly; Crude Oil and Petroleum Products only declined for 5 years before beginning its subsequent rise. And for any domestic declines to have meaningful significance in the first place they must be balanced against fast rising demand from developing nations.

The current demand destruction is much milder than those of the past. Are we wrong to assume the pace of decline won't pick up? As Yergin points out, an inflexible attitude about strong future demand took many by surprise 30 years ago, with investors placing faith in bullish forecasts which failed to pan out in spectacular fashion.

What are the qualitative differences between then and now? Do low hanging fruit remain to be picked? I will delve deeper into two examples: finished motor gasoline and residual fuel oil.

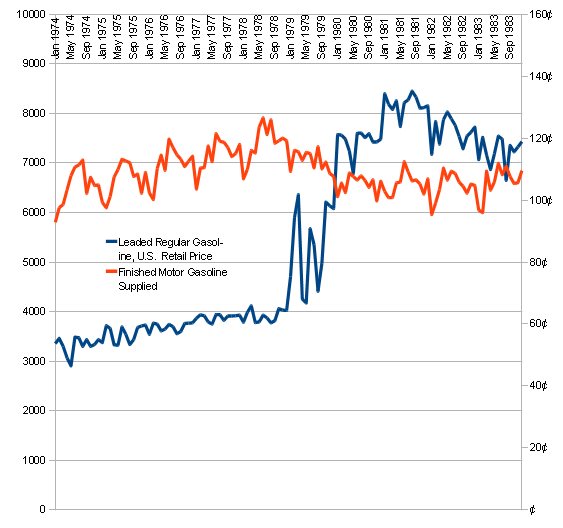

Finished Motor Gasoline - Potential for Improvement

Gasoline is the sector of the petroleum industry with which we are all familiar; why did demand for it fall so sharply in 1978-1980? The price spike in the wake of revolution in Iran shutting down its petroleum industry had an obvious effect, as can be seen in this graph:

CAFE standards were meanwhile bringing vehicles to market with much higher fuel economy standards; past figures are followed by tentative present goals set by the White House/EPA:

Model Passenger Percent Year car MPG Improvement 1978 18.00 5.26% 1979 19.00 5.00% 1980 20.00 9.09% 1981 22.00 8.33% 1982 24.00 7.69% 1983 26.00 3.70% 2011 30.20 8.94% 2012 31.96 5.51% 2013 33.72 5.22% 2014 35.48 4.96% 2015 37.24 4.73% 2016 39.00 4.51%

This would firm up the CERA scenario of efficiency curbing demand, if these goals were actually met; however, Dave Cohen explained in his article Obama Tackles the Liquid Fuels Problem that whether this will happen is actually a surprisingly open question.

In addition we are going through the worst downturn in vehicle purchases in history; while 1980 sales were down -18.6%, subsequent years showed milder contractions followed by vigorous rebounds, with an -8.67% average for years of decline; 2006-2009 is -11.09% average:

Total car/ YOY Total Vehicle Sales as % LDV sales Sales Registrations of fleet 1978 15,122,000 3.4% 142,049,000 10.65% 1979 13,984,000 -7.5% 145,451,000 9.61% 1980 11,389,000 -18.6% 149,477,000 7.62% 1981 10,678,000 -6.2% 152,026,000 7.02% 1982 10,426,000 -2.4% 153,494,000 6.79% 1983 12,132,000 14.1% 157,658,000 7.70% 1984 14,187,000 14.5% 160,264,000 8.85% 2003 16,548,000 -1.6% 222,857,000 7.43% 2004 16,906,000 2.1% 228,276,000 7.41% 2005 17,001,000 0.6% 231,905,000 7.33% 2006 16,505,000 -2.9% 234,525,000 7.04% 2007 16,089,000 -2.5% 237,403,000 6.78% 2008 13,260,747 -17.6% 246,000,000 5.39% 2009 10,429,553 -21.4% 250,000,000 4.17%

While January auto sales were up 2.6%, suggesting 2010 sales will rebound to some extent, it is questionable that they will improve to any great degree. Toyota's stuck accelerator woes have impacted sales of hybrids as well, undercutting another of CERA's precepts, as Prii account for no less than 48.12% of US hybrid sales. In the 70s the size of the vehicle fleet was smaller in the first place as well, allowing new vehicles with greater MPG to have a proportionately larger effect on fleet fuel economy, as can be seen in the above chart.

Counting on hybrids to negate demand for gasoline in the short term is on shaky ground in the first place, since, while their total sales volume has climbed up to a whopping 2.71% of yearly totals, as a percentage of the total US fleet all hybrid sales from 2005-2009 amount to .6568% of the total, a rather insignificant amount; if these had been pure EVs by 2009 they would have negated about 60 kb/d of demand, to give an idea of what an upper bound for their savings would be. Not all of the fleet is in daily use, of course; a general number I use for calcs is the percentage of the US labor force which drives to work solo, that is, 76.1% of ca. 154 million workers = ca. 117 million vehicles, assuming there is a 1:1 correspondence between workers and vehicles, which of course isn't the case; this is a subject of ongoing research for me. But with this lower bound figure (useful for estimating how long it will take to replace the essential part of the vehicle fleet) as a static number cumulative 2005-2009 hybrid sales still only account for 1.38% of the total fleet.

The Deutsch Bank study somehow proposes that total US hybrid sales for 2010 will be 4.2% of "light vehicles," that is, "cars, personal light trucks, commercial light trucks, hybrids, plug-in hybrids and pure electric vehicles." My sources for sales are the Hybrid Dashboard (the Toyota article linked above) and the Hybrid Car Review, both of which do capital work in compiling sales figures.

I haven't fully explored the inroad of hybrid commercial vehicles here; PHEVs aren't on the US market yet, or much of anywhere else for that matter; the lone example marketed in Happy Motoring China has proven to be an utter flop; BYD, the company that builds that PHEV and who plan to be the world's #1 automaker by 2020, have delayed selling it outside of China from 2010 to 2011, and only ca. 10k Volts are slated to be in showrooms at the end of the year; thus the DB forecast for 2010 is quite the question mark, barring total sales contracting sharply enough for it to come about, which I assume isn't what they're talking about.

DB consider PHEVs to be a "game changer," comparable in their effect on petroleum demand to how kerosene shouldered aside whale oil in the 19th century. As the evidence above suggests, the net effect to date is very minor. This isn't US-centric on my behalf either, the US and Japan respectively account for 47.53% and 44.68% of global hybrid sales.

CERA also consider biofuels to be a major factor in future demand destruction; those interested in this should seek out Robert Rapier's articles, both here and on his R-Squared Energy Blog.

Savings in Residual Fuel Oil for Power Generation and Heating in the 1970s

The other sector I will focus on is residual fuel oil, used for "the production of electric power, space heating, vessel bunkering, and various industrial purposes." Note that it accounted for 16.65% of total US demand in 1977, declining over the decades to 3.13% in 2009. As can be seen in this chart of post-peak YOY differences in amount supplied, the cumulative short term savings from phasing out residual fuel oil amounted to around twice that from either gasoline or distillates:

Much of these savings came from declining use of resid for electrical generation; the EIA's Annual Energy Review includes data on use of petroleum in the electric power sector from 1949-2008; in 1977 this amounted to 1,575 kb/d, 51.3% of 3071 kb/d total; for 1982 it was 642 kb/d, 37.4% of a total 1716 kb/d. The sum of YOY Diffs for resid 1973-2009 amounts to -2300.5 kb/d, almost completely obviating the 2310.58 kb/d accounted for by gasoline.

Potential for Savings in Petroleum for Power Generation and Heating Now

Other nations are strongly dependent on petroleum for power generation; JD also had a post on this topic in March 2008. In North America resid was displaced primarily by natural gas; in Europe nuclear and hydro served the same function. Various regions have changed their mix of petroleum consumption over the years; as a preliminary example, here is BP data on OECD demand, broken down into 4 general sectors:

OECD (1978) OECD (2008) Light distillates 31.89% 36.25% Middle distillates 29.36% 36.13% Fuel oil 23.47% 7.43% Others 15.28% 20.19%

Other examples may be seen in the BP Stat Review. My worksheet version has more percentage figures like the above (link at bottom). JD's preliminary figure for 2004 use of petroleum in power generation worldwide was 3.58 mb/d; using a newer edition of the same data source (the World Bank's World Development Indicators (WDI)) I get 3.82 mb/d for 2006, a slight increase. Both of our figures were for 620 kwH/bbl or 35% efficiency, which I've subsequently discovered is likely to be a bit on the high end, given what this 2000 EIA paper suggests:

The national average thermal efficiency of power generation from fossil fuels in 1999 was estimated to be 32.54 percent, slightly higher than the previous year's average of 32.42 percent.

This refers to the US. Perhaps efficiency improved 2% in the interim; JD gives no source for his figure. Numbers like the EIA's are common in other articles I've come across, as well as being in use by knowledgeable commentators such as Engineer-Poet.

JD also includes this very intriguing bit of information from veteran oil industry analyst Henry Groppe:

[Henry Groppe] believes that something like 20mbpd of the current 84mbpd of oil demand is going for heat and power generation primarily in developing countries. He thinks that with oil in the $50-$60 range, all of this will get converted to coal or natural gas, and that, along with vehicle fuel efficiency, will be the main initial responses to peaking, and will keep us out of serious economic pain for a decade or so.

This is from Stuart Staniford, relating what various speakers had to say at the 2005 ASPO-USA Denver Conference. Whether he subsequently examined this in depth I'm not sure; my intuition is that efficiencies in developing countries are often likely much lower than the EIA figure for the US, as Groppe's comment might suggest; either that, or a sizable amount of demand worldwide is for domestic heating. What is more, these same countries which are heavily dependent on oil for power are often major producers of that oil in the first place. According to the WDI data no less than 19082 kb/d of production is coming from oil producing nations who also are >50% dependent on oil for their power generation. Here are some preliminary numbers (using the 35% efficiency figure), all values in kb/d:

2006 cons for elec 2006 Total generation Consumption % of Total Iraq 138.85 532.99 26.05% Kuwait 152.50 266.87 57.14% Iran 152.77 1,693.04 9.02% Indonesia 171.15 1,172.91 14.59% Italy 202.60 1,812.59 11.18% China 227.82 7,381.77 3.09% Mexico 238.24 1,969.95 12.09% United States 358.87 20,687.42 1.73% Japan 409.60 5,213.11 7.86% Saudi Arabia 415.53 1,841.44 22.57%

The choice of countries here is dictated simply by their being those which used the highest volumes of oil for power generation in 2006. As Groppe suggests these numbers could in many instances be much higher, especially in countries with antiquated/dilapidated infrastructure such as Iran or Iraq. If 23.8% of world demand is accounted for by power and heat, a staggering amount of low hanging fruit is waiting to be plucked, and the substitutes in many important cases needn't necessarily be other fossil fuels or nuclear; as has been observed, Saudi Arabia is the Saudi Arabia Of Solar Energy, and they are making preliminary noises about going renewable, with possible assistance from EU members, too. This could potentially be a major growth sector for renewable companies, freeing up oil exports in the process; whether the OECD example of shifting away from petroleum for power generation can be ported successfully to developing nations will be the subject of a future article, along with a closer examination of how global petroleum demand has changed.

What May Be Ahead

In conclusion to this article, here is the following paragraph from Stuart's 2005 piece excerpted above:

I need to research it, but that story made a lot of sense to me. Fuel switching in heat and power was exactly what the US and Europe did back in the late 70s and early eighties, so it's believable that developing countries would do that this time around. Combine that with a lot of OECD fuel efficiency improvements (which have already begun) and we can probably maintain economic growth through quite a bit of the early post-peak era (except for geo-political shocks). That also buys us more time to start doing the harder things that will need to be done down the road.

Staniford Oil Drum articles on the US vehicle fleet:

The Auto Efficiency Wedge

Why We Drive

Some very messy spreadsheets of mine, Open Office format:

Electricity (from World Development Indicators 2009)

Statistical Review of World Energy 2009 Work Copy

Hybrid Vehicle Sales

Product Supplied - Annual

Product Supplied - Monthly

I don't think JD has much of a sense of the discovery to production life-cycle, or he just won't admit it. Clearly, the late 1970's and early 1980's showed real perturbations in global oil production. These were not phantom.

The Oil Shock Model easily demonstrates the perturbations. Nothing surprising about the behavior as it simply adjusts the extraction rates. Thats why I called it the Oil Shock model, as these perturbations will cause "shocks" to the system. So the OPEC adjustments on production produced most of the level adjusting shocks to the global supply during those years.

I figure the only reason the model is not generally accepted is because we are indoctrinated in using a fixed heuristic model such as the Logistic. The straight Logistic or sigmoid function does not accomodate any perturbations because the basis for it (as conventionally accepted) is the brain-dead Verhulst equation.

Search Oil Shock model on TOD or go to http://mobectivist.blogspot.com if this perks your interest.

I know JD has never challenged the model directly, probably because he doesn't have a good argument against it. And that's why he won't acknowledge it either, as it would ultimately deflate his arguments and his web site would become pointless.

Can't recall JD having much to say about models in general, other than latching onto HL as evidence that world production will decline at a gentle 1%, allowing for his conservation/electrification scheme to do its thing. Mostly he's a first order guy like me, and he digs up solid data on subjects like those listed in the article, which fly under the radar of many peakists, whether deliberately or not. His other bête noire is or was "Doomers" and their frothing prophecies of imminent death and destruction, which is nothing I disagree with; their opposites on the cornucopian side are certainly tiresome - remember TheAntiDoomer?

On balance I think his blog is good work, a welcome antidote from that Doom. Don't see the need for all the ******* profanity, though.

[dp]

Oil is a fossil source of usable energy. If peak oil was the only imminent shock to global civilisation then I would have more time for JD. He may be optimistic about decline rates, but peak oil in isolation would not be a game changer. However, global population is now at unsustainable levels for a whole host of resource and environmental reasons, and the limits to growth are rapidly making themselves felt. On top of that we have a global financial model which requires exponential growth of measurable GDP - in practice this means exponential growth in the consumption of physical resources. This is fundamentally unsustainable, and the wheels are coming off the wagon.

The first oil shock was an early warning on exponential growth. The second one is a very late one.

No one should latch onto HL (Hubbert Linearization). I agree with Robert Rapier and a few others that HL is absolutely the wrong way to go in understanding oil depletion. Sam Foucher did a valient job of reconciling HL with the Oil Shock model here (Hybrid Shock Model - http://www.theoildrum.com/node/2430), but it is really not necessary.

HL only comes about because of a coincidental mathematical identity implicit within the Verhulst equation that Deffeyes somehow became infatuated with. However, oil production is not governed by that equation, which should theoretically only work for lifeforms that can reproduce and reach a steady-state carrying capacity. Oil does not reach a carrying capacity however, since oil molecules do not reproduce. They may "die" but they don't reproduce.

More here: http://mobjectivist.blogspot.com/2007/03/derivation-of-logistic-growth-v...

So the only thing I share with JD is that I don't spend any time with doomerish thoughts. I don't swear on my web site (cuss level currently at 3.8%), yet it makes we want to scream when the facts are deliberately obscured for some hidden agenda. That is what gets me about JD and his **** musings.

It seems to me like JD hasn't posted since October 09? Has his blog moved or something? His arguments were interesting. Although I am far less optimistic than JD, I think that TOD needs more people like him who attempt to disprove doomers - it keeps the doomers on their toes and keeps their arguments logical.

On an unrelated note, it's a shame that we lost Airdale. Even if he really does stay off the internet and live out his last couple years farming like he said he would, he will probably be remembered by most here for a long time - from what he said about his kids, he probably had a far greater aggregate impact on the world through his TOD postings than raising his kids.

Both occasionally publicly state they're retiring, only to reappear after a while. It happens; I know, how could anybody get sick of the Internet...

Would like to hear back from Bob Shaw, too.

I can imagine getting sick of something if you treat it as a game.

On the other hand, some of us are in this for the long haul and find the Internet the best way to mine for data and ideas.

That was his mistake. He should have tried to disprove the scientists and not the doomers. A science of doom does not exist.

WebHubbleTelescope said, "A science of doom does not exist."

Hmmm...that could actually make for an interesting discussion!

I prefer to think of it as more of an art than a science, call it "An art of doom". :-) Several years ago I found an article in a literary magazine discussing the long history and seeming need in the human psyche for apocalyptic forecasts and predictions...no culture seems to go without them, they are like psychics and astrologers, never totally absent.

RC

Greer had some excellent comments about mindsets, apocalyptic and otherwise, in the Long Descent. The book is built on old blog entries so if you want you can fish those out of his archives.

If we want to remain optimistic about the future, the only mindset we need to understand is that of the people with some sort of authority. And then you get into scientific and analytical policy discussion, which is where my head is always at.

For some reason I have not read Greer at all, but noticed that he is the one that writes the Archdruid Report, which I have heard about. That just goes to show that I definitely miss most of the hypothetical and philosophical arguments in favor of the scientific and analytical side of things.

Maybe if we were still getting a lot of electricity from oil, and using a lot of heating oil, we could substitute like in the time period JD mentions. Also, if hybrids got twice the mileage and were the same price or cheaper, efficiency could trump Jevons for a few years like in the early `80s when people flocked to more fuel-efficient cars. However, as they say, "This Time Is Different." People need to realize this. Even I am terrified by attempts at an infinite growth paradigm:

http://bravenewclimate.com/2010/03/19/britains-energy-future/

Sure,

efficiencies will work in the short term only for the Jevons effect to increase energy use in the long run fueling our exponetially growing socio-economic system.

Jevons paradox works because the increased efficiency drives down energy prices and decreases in energy use caused by the greater efficiency allows one to use more of the energy. This time is different in that despite increased fuel economy, crude oil prices would likely still increase. Thus Jevon's paradox will likely not occur in this scenario - assuming that we are peaking in oil production now.

Of course, this scenario supports the point that the increased fuel economy may happen anyways whether CAFE standards were increased or not....

Retsel

Retsel wrote; "Jevons paradox works because the increased efficiency drives down energy prices and decreases in energy use caused by the greater efficiency allows one to use more of the energy."

This is not quite how Jevon's paradox operates. It works because the increased efficiency makes it attractive for more people to employ this efficient technology. James Watt's improved steam engine (over the Newcomen) meant it could be used, profitably, for many more applications, so coal used increased dramatically. Even if the coal price went up, it was still cheaper/better/more reliable/scalable than horses.

This is really a case of increased efficiency of Fuel A displacing usage of Fuel B. The same has happened in Europe with diesel cars, which have become more efficient and more widely used even as diesel prices have increased. But the proportion of diesel cars on the road in Europe has no chance of making any impact on world oil prices, or Euro fuel taxes, which are the main price components.

What is different this time is that increased efficiency (e.g. hybrids) is (slowly) displacing more less efficient vehicles using the same fuel, and probably won't lead to more miles being driven. For example, the taxi industry, is rapidly hybridising, and decreasing their fuel use, but this won't lead to more people riding cabs. A family replacing their old sedan with a hybrid may drive more "recreational" miles, as opposed to commuter miles, but this will only lead to a small increase in their miles driven.

To summarise, most vehicle miles driven are fairly non discretionary, and increased efficiency won't lead to a lot more vehicle miles driven, and it certainly won't cause fuel switching from anything else to gasoline. It may delay switching from gasoline to other fuels, like CNG and electric, which would prolong gasoline use, but still not increase the rate of usage.

I'd say that the % of discretionary travel is likely half and half:

At least in the US. If more citizens lived within walking distance of their destinations that would certainly help.

Diesels haven't really cut down on European fuel usage, at least by the broad measures of light and middle distillates that BP data uses; middle has increased while light declined but the sum of the two over the last 20 years has slowly increased. If dramatic fuel economy improvements came about that would have an impact on global demand, but the European example shows that diesel driven fuel economy improvements weren't enough to drive demand down; population growth alone perhaps did that in. They did moderate demand of course, but only so it could grow like crabgrass elsewhere in the world.

PHEVs do hold the promise of almost divorcing the motorist from hydrocarbons, but as I laid out in the article they are only now being fielded. Another question I have is to what % of the overall market luxury vehicles have ever penetrated. After all, if GM can show strong profits selling 60k Volts per year why bother increasing production, if the expansion costs weigh too heavily on the balance sheet? To get to the bottom of this one I need much more data on past model sales; it would also be useful to get an idea of how fast makers have rolled out new models in the first place.

KLR, Thanks for that. I would have to agree, based on that graph, that half the driving is "discretionary". But that doesn't mean that doesn't mean, of course, that people ca/are willling to give up half their driving. I would guess that a 10% reduction is easy, but more than that starts to require changes to more than driving habits (changing to smaller vehicles, moving closer to work, working from home, taking transit where available, etc).

I haven't got the numbers in front of me, (though someone recently posted a graph showing the breakdown of US oil consumption) but the total US gasoline consumption changed has changed little over the last five years, even the the price more than doubled in that period, and is now more than 50% of where it started. If you add in ethanol, it might be that light motor fuel (gasoline + ethanol) hasn't decreased at all.

When gasoline was $4 plus, US vehicle miles decreased for the first time on record, but only by a few % points. So if it took a doubling to get 3% reduction, what kind of price increase do we need for 10, 20, 30% reduction? And if prices are that high, consumers, at the lower end are so squeezed that they can't afford a newer car or to move etc, all they can do is pay the cost.

Folks who can afford to but the limited number of PHEV's are much better off, but as you point out, it will only be a small fraction of the market. Even if 10% of new car sales are EV, that is only a 1% portion of the total vehicle fleet, so the overall impact is negligible in the short term.

Agreed about the carmakers - their mission is to be profitable, not to solve the nation's oil problem's. If the Volt is only profitable at $40k plus, then that is as low as they should sell it for. Past figures on luxury car sales might not be the best indicator. In 06, no one was buying entry level versions of anything, they were all optioned to the max. Now, that has settled down a bit. Still, even a Volt at $30k is tough when you can buy nice, fuel efficient mid size Hyundai's for $15k, and subcompacts for less than $10k . Toyota still sells more Yaris than Prius.

Returning to my original theme though, US motor fuel consumption barely budged during the highest prices and now worst recession in a generation. I think it will take quite some time, and/or even worse prices/economy to make any substantial (>10%) reductions in motor fuel usage.

Honestly, you guys must get over the "OmiDog, gas at $4.00?" paradigm. I'm almost certain that the price of gasoline is so cheap it has very little if any measurable effect on consumption. For evidence, I offer Canada, where gasoline has sold for at least US$4.00 / gal since forever, yet the mix of vehicles used is the same, distance driven is higher, etc. etc.

How about some evidence? And analysis?

Len,

By "you guys" I am not sure if you are including me, but the point of my reply to KLR there was that the price makes little difference - it needs "structural" changes (changing vehicles/relocating etc) to reduce oil usage.

I live near Vancouver and pay about the same as you do for fuel, though I have lived in Australia and Europe where it is twice the price. When you have a practical alternative to driving, you take it, otherwise you have little choice. Difference is, of course, that Euro cities (and countries) are set up for lots of transit use and we are not.

The Americans are fixated on high gasoline prices because they have never really had them, and think it's the end of the world as they know it. For most of them there is no short term alternative to driving. Personally I think a serious price and/or supply shock is what's needed to jolt them in to action. But whoever are the politicians that are in office when that jolt happens, likely won't be for long. California turfed out their governor over high electricity prices, the whole country could easily do the same to Obama (or anyone else)

I agree they should just get over it, but somehow I just can't see that happening - it will be forced on them and they will be very bitter and feel that it's someone else's fault. It may indeed be someone else's fault that oil prices are high, but it's their own fault that they have no real alternative to using it. I just don't want to be the one that has to tell them that...

32% Can tax instead of US 20%. Are you Canadian? Neither of us have anything to complain about: CPPI Canadian Petroleum Products Institute — Questions & Answers Or boast about, you've seen the charts of subsidized prices around the world.

Price shocks move consumers, as the chart of gasoline supplied vs gasoline price in the article shows pretty clearly, when taken in tandem with the gains in CAFE at the time. I think I've found some evidence that a shift back to MT took place as well; a FHWA report from 1977 said 91.6% of commutes were personal vehicle, 4.6% public vehicle, 3.8% other. Chart in "Our Nation's Highways 1981 (.pdf, 12 mb), available from Archives - Publications - HSS - Policy Information - FHWA. That would have knocked some of the gasoline out of the picture; I know that the current figure for personal vehicle solo is 76.1%. But the 1977 number might have carpooling folded into it.

Here is gasoline supplied vs VMT; both are currently on the rise:

2009 was 96.75% of the 2007 peak in gasoline supplied, as shown in the...chart in the middle of the article. Darn, should've slapped numbers on those things. As the chart above that one illustrates, 2 years after the equivalent peak in the 70s demand was 1880 kb/d lower, so we're not cutting back as eagerly this time.

VMT began to slide down in 2006, people responded to a much lower price than the ultimate peak. The Brookings Institute analyzed this phenomenon: The Road … Less Traveled : An Analysis of Vehicle Miles Traveled.

How people will respond to further price shocks is up in the air. I fully expect another one this summer, though, which should result in another round of political theater; perhaps some will begin to demand more constructive action from pols, or real explanations. As always, Interesting Times.

A high level of consumption is baked into our built infrastructure. We are a lot more auto- dependent than we were thirty years ago.

Much of the industry that occupied the US economy is overseas. Higher fuel costs are balance by much lower labor costs and different tax/tariff structures.

Price shocks will take place at lower price levels than previous. There is less money in circulation, more unemployment, less credit and more risk. A crude price of + $100 is probably out of the question. The US economy would have a coronary before the price reached that level, not so much because of the high oil price but the inflationary implications of that high price. We are certainly not in 2008 anymore!

The current price is probably what the market will bear. Here's Nymex Unleaded gasoline superimposed over Brent Crude:

ULG has shown a tendency to run higher than the underlying crude price. In fact, Brent has so far been unable to test the January high. Why are prices doing this? Because refiners - which buy ALL crude - are desperate to make some coin! Unfortunately, the higher unit price cuts into volume. The refiners are in a trap, being stranded by high input costs that they themselves cannot pass on. Industrial fuel components are in the toilet due to the ongoing business slump and high priced gasoline cannot create sufficient margin as a substitute.

Steve, I think a $100 US price is a very real possibility. All it needs is a pirate attack on a tanker in the Gulf of Aden or Strait of Molucca to go wrong (i.e. ship burns/sinks/explodes) or any escalation of anything between Iran and Israel/Iraq/US, or some serious pipeline attacks in Iraq, requiring increased US presence and oil will be over $100 by the end of the week.

Agreed that for purely economic reasons it shouldn't get that high, but there is much more to oil price than purely economic reasons, and therein lies the problem. The US economy is driven, in part, by a commodity that can quickly become priced at recession inducing levels for reasons not directly related to supply and demand. I say not directly because the fact is, that if supply is curtailed or even just seriously threatened, the prices move up, and fast.

While I agree that high oil prices are inflationary, I'm not convinced it would cause the US economy to have a coronary, further or extended recession, yes, but not collapse. For an average family, their cost of health care is bigger, and rising faster, than gasoline. As consumers spend less, the things they tend to cut back on - consumer goods - are mostly imported. They things they can't cut back on - food, insurance, health care, layers, mortgage payments, are (mostly) not imported. Yes it's bad for the malls, and tourism/recreation, but real industries (that remain) that create real things or provide real, important services will carry on, though less profitably.

I think a big factor in the difference from the 70's is that there were real supply disruptions, not just price rises. When people were faced with not being able to get fuel, at any price, there is a more severe reaction. Finding out that the price at the pump just went up $1 won't make you race to the gas station, but hearing that imports have been curtailed and supplies are threatened certainly will. Some serious supply disruptions in the Persian Gulf might just re-create those conditions again. And with that situation threatening China and India's supply too, I think the price of the remaining oil will be bid up that much faster.

(duplicate)

(duplicate)

Hey Paul ...

What you mention about real supply disruptions is where the issue (probably) lies. If an incident causes the loss of one tanker, it would not represent a supply disruption. There are many tankers parked off Rotterdam and Singapore that are simply waiting as replacements. I think any action would have to represent a disruption of a substantial percent of oil flows.

Then again; $100 oil, economic crash, price plummets. I think this would happen even with a longer- term interruption in supply. I bet demand destruction would have more effect this go around than it did in 09.

What I'm trying to get at is an assumption: that oil prices can easily rise to much higher levels. This assumption leaves the false sense of assurance that current prices are 'low' and that nothing must be done to change the way business is done.

It's also shoddy economics. When Jeff Rubin yaks on and on about $200 oil I cannot take him seriously. Where is that money going to come from? Not from production which is strangled by the same $200! The oil import trade is really fundamental. Most people - even college profs and PhD's - just don't get it.

When the USA imports fuel, what does the exporter receive in return? The answer is not much. Outside of UK, Norway and Canada, the returns have not been production or productive leverage. Oil exports is called 'The Oil Curse'. Most exporters are poor. Even Saudi Arabia is a culturally poor backward country - a stifling religious police state.

What countries get in return for their incredibly useful oil is money. All that oil - for decades - out of the ground and into the air as pure waste. Nothing to show for it, anywhere. Just mess, noise, rusting junk, biodegradable houses and bulging landfills. What this means is the commerce return on oil produced has not been of great value. As prices continue to rise the commerce return on oil shrinks. (CROEI)

What is left instead is the money value returned for oil produced; (MROEI). The outcome of this is the world's economies are reverting toward buying and selling money, rather than making and selling goods and services. Buying and selling money is behind the euro crisis, the squabbling in Washington over Chinese dollar reserves; concern over debt, carry trades in US and Japanese central bank rates ... and why Main Street is shutting down. It long since lost its place in the money line. Main street's productive capacity is falling worthless when measured against the oil it consumes.

This productive capacity includes a lot more than domestic fuel consumption which isn't productive at all - it's a dead loss, in fact.

What is happening in Latvia right now (its government collapsed today, BTW) is the reflected image of what the rest of the rest of the world will be, starting ... last year! Every country in the world (except perhaps China) will be Latvia, with GDP falling 20% and wages being slashed. Why? Because the business of the world will be buying and selling money and if you don't have any or the right denomination you will be a Latvian.

But ... all this is ignored behind the comforting facade of 'Oil @ $150 a barrel' as if there will be money flowing into the sewers and out the shower heads. I'll believe it when I see it!

Another idea I work on is the assumption that the past depreciating dollar is doomed to always act this way. This is very dangerous for those who believe it. The 'worthless dollar' assumption is part of the establishment's propaganda aimed at convincing you to turn loose of your dollars! "Buy Gold!" Buy guns and ammo! "buy euros!"

Don't! Do what the rich people are doing; selling their stuff for cash! That's what I'm doing. Selling everything I own, what isn't bolted down and some that is; books, computers, cameras, furniture ... everything. Don't believe the inflationary dollar assumption. It's a lie!

Times change. A dollar is worth about a half gallon of vanishing fossil energy. It's valuable! Whatever is bought with that dollar must produce more than a half- gallon of crude oil can.

I agree, it's not entirely realistic to look at crude availability simply as an economic issue. I plead guilty to 'modeling' and simplification.

In order for the dollar price to change dramatically - outside of some 'Black Swan' event that actually disrupts supply such as a major Gulf hurricane - there would have to be another leg of the finance crisis with some untoward twist. Such a twist would require a dollar devaluation. With deflation all around, it is hard to see what the twist could be. The twist would be doing the damage to the economy, not the devaluation. Of course, the devaluation would then do its own damage a bit later.

Steve, "I think any action would have to represent a disruption of a substantial percent of oil flows." I would suggest that the action would merely need to have the potential to disrupt that significant %. A Gulf of Mexico hurricane, no, any military or even terrorist event in the Persian Gulf, yes.

And who can afford $100 oil? China and India (and even Japan) they all produce far more GDP per barrel of oil than the US, as do most Euro countries. I'm not saying it won't induce recession, but that other countries can handle it better than US, because they don't waste so much oil on personal transport. And the US consumer is already a declining force in the world market, so any further US slowdown won't hourt the rest of the world as much - it has already done it's damage.

Don't know enough about the money trading part to make a meaningful comment there, other than the observation that physical goods or services do seem to be much less important.

That pie chart is fascinating to me, being the suspicious cynic I am...notice that 34 percent of the pie is given over to some very general catagories: "other family or personal business 19%"(?), and just plain "other" 15%(?). Those are some big undefined catagories!

We should recall that the move to more efficient vehicles is not the only technological revolution underway...telecommuting to reduce driving to the workplace is still in its infancy, and the nature of shopping is being revolutionized by online shopping...I think much more fuel consumption is descetionary than we often may believe...of course, everything relies on price...if oil stays cheap or gets cheaper, any "revolution" in consumption stalls, because it simply gets off the consumers radar and becomes not worth the effort.

RC

The pie chart was lifted from Staniford's Why We Drive which I linked to at the end of the article; he got it from one of the National Household Travel Surveys I believe. It's as robust as any other survey, I'd imagine. IEA said that "Other" was what people tended to cut down on first in supply emergencies, too.

If you assume 12kmpy driven, that's 3360 for work. Taking off 104 days for weekends, 10 statutory holidays and 5 vacation days, the average distance driven to work is only 6.8 miles, and only 7.1 with 2 weeks vacation. It wouldn't take much of a battery to get you there, assuming the car didn't weigh 2 tons.

Jevon's paradox works because we use money to measure everything.

So people will spend the same amount of money on energy hence use more when it is cheaper.

If we used energy as the measure the paradox would not hold.

We should measure potential economic activity in energy units available.

In a practical world an energy unit currency would be a good idea but the biggest problem is how do we get from here to there? How do we go from a money based society, that has been in existence for thousands of years and is the accepted paradigm the world over, to valuing energy in a more realistic way?

That is the big question that has only one answer I am afraid.

A total failure of the monetary system.

Jevons paradox will thwart efforts to delay the peak significantly, but if oil scarcity is causing significant societal disruption post-peak, then improving efficiency will not be met with increased demand. The central question is what standard of living can be maintained with a decreased oil supply, and that is entirely an efficiency question. Some people think there are big efficiency gains yet to be made...and this seems to be the case. Other people then point out that many efficiency gains will be expensive and slow to implement...and this also seems to be the case. Sorting out what will actually happen involves that devilishly difficult task of predicting the future...but you can be sure that Jevons paradox will not cause efficiency gains to be compensated by increasing demand during an oil shortage.

Demand destruction will play a bigger role post peak than Jevons Paradox. They will both concentrate energy into the hands of a few much like monetary wealth now.

I read on another blog the suggestion that the best way to eliminate air pollution (soot) and deforestation in India, etc. would be small efficient solar or similar generators for families.

The idea suggested by KLR above is very similar, that massively inefficient, older oil fueled power plants in 3rd world countries could be replaced freeing up oil for critical uses, stretching out our transition time to alternative enrgy sources.

The Chinese of course are famously known for their command economy fast infrastructure replacement capability (though they use coal for electricity so this would not help in oil). However in India and other countries funds and political will are missing probably to do this. Ancient polluting car models are also running around in 3rd world along with all the efficient toyotas (2 stroke DDR Trabis still manufactured in Egypt for example). So bringing 3rd world up to western energy and environmental standards could help a lot in all areas, i.e. pollution and conservation, impoving standards of living along the way.

People mention occasionally how cheap it would be to save all the rain forests dollar for dollar as the poor farmers that clear the forest just need a few bucks to survive. So pay them minimum wage (UN development aid or similar) to take care of the jungle. Lots of low hanging fruit is available in 3rd world and in first world, but very different fruit. Development aid should be steered in that direction definitely from IMF or wherever. It might be much more cost effective to help replace old infrastructure with modern infrastructrure in 3rd world using western multis with state supported loans with tried and true technology as to try to bring the 1st world up to the 22nd centruy 100% renewables satus. This would be a cheap way to buy us time of course. In the west of course conservation (insulation/passive heating/cooling, solar thermal) is the most cost effective way compared to increasing electrical capacity with solar and wind projects(to recharge more I pods/nintendos/laptops) to feed the growth economy of throw away electronic products from Asia.

Glad to hear a comparison with last time around as the 70s/80s is always brought up as an excuse to not worry about, i.e. We will get over it through technology, regulation, new oil discoveries, substitution.

Maybe things will change however more substantially than just a technical adjustment of lifestyle. Maybe as often speculated about WWI/II being fought over oil, WWIII will also be a resources fight due to lack of ability or more importantly, desire to adjust. In 1979 Deng Hsiao Peng had just started his reforms and India and East Bloc were still in a poverty mindset(almost nobody with private cars). Now nobody wants to conserve or do anything for the common good (basic communist tenet) as Reagan/Thatcher have won the ideological battle. Greed being good(basic capitalism) and everyone having a right to self detemination (democracy), what is stopping everyone who wants a resource (oil, coal, gas) to claim it is "MINE". So when the economic bubbles can`t be blown anymore, since communism has "failed", i.e. there is no turning back in former East bloc/China and capitalism has apparently failed, in the west with no replacement ideology then all nations will simply go back to primitive brute power plays, without any ideological stance whatever. Kepp the voters/citizens happy or lose your head. It is all a matter of if we can all adjust quick enough o avoid conflict. The will might not be there although technically the capability is always there. People just love a fight and to blame it all on others. It is easier than paying the piper.

I am less convinced about the possibility of converting electrical production from oil to natural gas in less developed countries.

If the countries do not have natural gas of their own that they produce, it is difficult for me to see this happening. It would be difficult to find a supplier (World supplies are likely to get tight in not many years as it is, even without additional demand!) The cost of the infrastructure and the timing to build the pipelines would be issues. Also the problem of coordinating pipelines running through many countries would be an issue.

I would expect that these long-distance pipelines would need to run underground, to prevent sabotage. My impression is that oil pipelines generally run above ground in less developed countries, because of the cost difference. Running the gas pipelines underground would further add to the cost.

Even in countries where oil is produced, it is not clear that there would be natural gas to burn. Natural gas is often reinjected, to maintain pressure. One often sees articles such as this one, about a shortage of natural gas in Saudi Arabia.

If natural gas is available, I would wonder if countries wouldn't use it in cars, as Iran, Argentina, and Brazil have.

By the way, I didn't write the post (I didn't do much at all); Kevin Rietmann wrote it.

There is a major boom in hydroelectric generation all throughout the developing world. Last week Iran agreed to help Ecuador build two dams (and a smaller one) for over 100 MW.

http://ecuadorreport.wordpress.com/2010/03/09/iran-ecuador-to-build-hydr...

Iran is just finishing up the most active hydroelectric building boom in the world (basically built one anywhere it was viable).

Literally hundreds of dams & run-of-river projects are underway. Chavez announced 40 more hydroelectric projects after the last big one is finished in 2014.

Grand Inga could supply the bulk of Africa's electric demand (40 GW, steady for 50 weeks/year). Add some geothermal, solar PV and hydro elsewhere (perhaps an extra nuke or two in South Africa) and Africa could go all renewable/non-carbon.

Kenya is about to put up the first large scale wind farm in Africa.

The alternative is not just natural gas.

Best Hopes for Renewables,

Alan

In the US, and globally, many existing hydro plants are reaching the end of their designed lifespans:

http://www.thenewamerican.com/index.php/tech-mainmenu-30/environment/1752

Environmental concerns not-with-standing, a huge investment will be required to maintain current levels of output from our hydro infrastucture.

Western droughts continue to limit the usefulness of many existing hydro plants (think Lakes Mead and Powell), and flooding millions of acres of forest and agricultural land will exact a price. Our global addiction to ever more energy (clean or otherwise) is an idea we need to rethink. Few really good choices exist.

They emit methane, too - and not just in the tropics: Extreme Methane Emissions from a Swiss Hydropower Reservoir ...

How dam emissions stack up in the greater scheme of CH4 emitted I'm not sure, part of the 10% from waste water?

The Electricity spreadsheet I link to at the end of the article has rundowns for most countries, if you're interested - 1990 and 2006 energy mix, by coal/oil/NG/hydro/nuke, along with some stabs in the dark by me of estimating how much oil they're burning for power.

I'm seeing a lot of crap lately attacking any form of storage-hydro-electric generation. The "methane emissions" angle seems to have been chosen as a particularly useful one, since its so obscure and intractable to quantification for most listeners or TV reporters.

Hmmm... at 16 grams per mole (22.5 litres), 150 mg ~= 1/90 x 22 = 0.2 litre per sq m per day.

"surface is approximately 3.65 km²"

http://en.wikipedia.org/wiki/Lake_Wohlen

total emissions = 3.65 x .2 x 10^6 / 10^3 = 730 cu meters / day.

One typical home in Canada uses about 4821 cu m / year or 13.5 cu m / day.

http://www.netzeroenergyhome.ca/Files/files/events/NZEH-Workshop-07-2007...

"A typical cow burps about 280 liters of methane each day."

So this reservoir is venting approximately as much natural gas as 730,000 / 280 ~= 3,000 cows. About as much as is used to heat 55 Canadian homes.

What the attackers of hydro generation need to also provide is the methane emissions of the alternative methods of heating homes in Canada. How much methane is lost to (wellhead / collection compressor seals / gas processing plant leaks / pipeline leaks / pipeline compressor seal leaks) each year to supply natural gas heating to replace the hydro electricity forgone by not building or renovating a hydro storage system? I do know that, for example in Indonesian gas fields, for every cu m of natural gas extracted and shipped, another cu m of CO2 is extracted along with it, separated and simply released. What's that ratio in N America?

A LOT of this stuff, especially anti-nuclear, is simply the fossil fuel lobby.

Len, good points all. to which I would add that there is considerable methane generation in natural lakes and in forests, from composting/degradation of plant material.

I would think that all the reservoir has done is cause a local concentration of methane emissions that would otherwise have happened throughout the catchment area.

In any case, hydro, properly done, is about the cleanest, and most renewable energy there is.

I expect to see lots of western environmental groups trying to stop the Africans from building hydro, but there are far worse things they can (and have) done to their environment than hydro.

Keeping the ramifications of developing any energy source in the open isn't an "attack". It's clarity. Whether the discussion is wind, hydro, solar, nuclear, etc., there are trade-offs that need to be considered (in an honest discussion). What effect did damming the rivers have on salmon populations in the PacNW? Does that mean that hydro wasn't a good option? Not IMO. Do we need to consider these costs? Yes. There's a difference between unintended consequences and ignored consequences, but they have their costs, just the same.

Well stated, Paul and Ghung. I've nothing against hydro, just throwing in the methane factoid; certainly there are much more massive sources of CH4 around. Done right it's very effective, and anything is an improvement over coal.

Gung,

Agreed that we need to acknowledge and account for these ramifications. However, more often than not, HONEST descussions do not occur, and these ramifications become sound-bites for the media(and thus the generally uninformed masses), fodder for the environmental extreme BANANA crowd, and so-on. This then creates (sometimes) unessessary road blocks, or even bogs down projects to the point they are abandoned. In fact, this is a tactic used by the BANANA (build absolutly nothing anywhere near anything) crowd to stop much development - wrap the project in so much red-tape, create so many obstacles, and generate the appearance of public outcry, that the projects become abandoned.

So IMO the key question isn't "can we discover/discuss the ramifications", but rather (as you pointed out), can this hold this discussion openly and honestly?

What format would these discussions take? in what forum? who mediates and who makes the final decision?

Oh the troubles I have seen as part of hydro projects in BC... truly "Absurdistan" But Enviro Tech said it perfectly.

As an example,there was a public information meeting about a potential run of river project in the BC Kootenay region in a small town called Kalso. One of the main objections is the project would occur in prime grizzly habitat. I wanted to be there just to make the point, "Did it ever occur to you (enviro objectionists) that this town, Kaslo, used to be in prime grizzly habitat?"

I have a very low hypocrisy tolerance level...

"I have a very low hypocrisy tolerance level..."

Then you are living in the wrong province, it is like that everywhere here (quite the opposite of what I observed living in Calgary). Some people here would object to the construction of an ikea chair!

Where I live on the coast there are several run of river projects under constr and proposed. People here say we don't need them as the power is just being exported. Even if this were true, they miss the point that every kWh exported is less tax we have to pay for health, education, roads etc. Of course the noise is loudest from retired people who make minimal contribution to the current tax base, but consume maximal services.

The R o R projects will continue to produce for generations to come - how many other investments can do that?

Grand Inga is just a bit more than a run-of-the-river project. Dedirect the Congo River into a nearby valley (displace hundreds of people) and then a large drop.

40 GW of almost steady power for 50 weeks/year (half of watershed above equator, half below, so contrasting rainy seasons).

Alan

A Grand Inga promotional site:

http://www.sapp.co.zw/documents/The%20Grand%20Inga%20Project.pdf

This may be a "Grand" solution to some of Africa's growth problems, including electricity, river navigation, irrigation?, tourism, etc. It seems that the loss of one of the planet's greatest remaining wild river ecosystems is a small price to pay for "progress". And the loss of many unique species to BAU is nothing new either. 40 GW trumps 40 species every time.

"I don't live in lakes. You're gonna need new fish"

It would not be a loss of one of the "great wild rivers", anymore than hydro at Niagara Falls has spoiled the Great Lakes.

Divert a few miles of river away from the cataracts (some flow there still) and into a valley with a few hundred people. Gain, renewable power for centuries equal to 40% of the US nuclear power fleet.

Wild overstatement,

Alan

Overstatement? I hope you're right, Alan.

Let's see: The Colorado, the Columbia, the Nile, a dozen Amazon tributaries, Three Rivers in China, the Hudson, even the Great Lakes system and the St. Lawrence, (shall I continue?), Tennessee, Ohio, Chattahoocee, Savannah, (dozens more) all have suffered the alterations of humans' ambitions. Beg pardon if I think that extracting 40 GW of energy from this river system may have major consequences to its ecosystem. I just hope it's worth it.

That 40 GW is otherwise spent on friction in the cataracts. A close analogy to Grand Inga is Niagara Falls, where 4+ GW is extracted at night and off-season. No reported effects except that the Niagara Falls will last MUCH longer before becoming the Niagara Cascade.

And yes, the reduced carbon emissions are worth 1,000 times the damage that Grand Inga will cause (i.e. trivial to nil).

Alan

"Thanks, Alan! We feel better now."

Dams are ecological nightmares, and need to be removed as fast as possible.

The idea of building more is madness, from a dying species on a plundered planet.

Ignorance.

Let us burn more coal instead.

BTW: Grand Inga is basically a run of river scheme with almost no storage. All it does is redirect the path of the river and avoid the cascades.

Alan

Gail, I must agree with you on this, I think the "dash to gas" for many nations could turn out to be a costly detour. Right now, the dash to gas seems easier than endorsing real renewable alternatives (sun, wind, geothermal) and there are big corporations pushing conversion to natural gas as the greatest thing since sliced bread.

The Germans seem to me to have the right idea...go ahead and bear the cost of renewable energy research and implementation...they know what it is like to be reliant on others (the Russians) for gas and know it is not a cure all.

RC

One thing I'd like to add because I think its important is that when I calculated oil consumption from atmospheric C02 data basically all the demand collapse in the early 1980's disappeared. Indeed oil consumption rose substantially.

There was a flattening then slight dip leading into 1980 i.e you can see some evidence of the oil Embargo and the Iranian revolution. But the vaunted demand collapse afterwards did not happen. This is on my blog you can get there from my bio.

Now as the 1980's wore on demand did fall off. and finally fell back to early 1970's levels. I argue that CAFE standards did play a large role however it simply took time for the newer more fuel efficient cars to grow in the fleet. Also by 1985 offshoring esp of manufacturing jobs was gaining ground this also finally caused a slight decline in fuel consumption then flattening for a while.

Now this is interesting because it political.

Realistically there is only one place on the planet at the time that you could have gotten a 3mbd or better surge in production sustained for about five years.

Thats Saudi Arabia.

Not only did they not cut to the bone to support oil prices but they surged production significantly over what they had produced before. I suspect the Iranian Oil crisis and CAFE standards and overall peak oil concerns of the time scared the piss out of them. Also it seems they where tied politically with Reagans war against the Soviet Union their other rival in production. All kinds of very interesting politics going on at the time. Including of course nationalization of Aaramco.

My best guess is they produced between 12mbd-15mbd over the course of 5 years while claiming close to 4-5mbd or so.

10 mbd is about 3GB a year or so over five years is about 15GB

Now you can see why I brought it up :)

If I'm right then Saudi Arabia is significantly more depleted then the official numbers suggest.

Going here

http://www.theoildrum.com/node/2476

We can subtract 15GB for a remainder of 50GB.

That was about 3 years ago and being conservative assume its now 2GB for another 6 off puts them at about 44GB remaining.

44/175 = 74% depleted

Saudi Production should indeed be crashing and has been for some time.

Indeed if we take 60% depletion as a reasonable estimate for peak like WT uses then they basically peaked in declined effectively in lock step with rising prices.

Now a bit of common sense suggest that its difficult to change oil demand rapidly as its a infrastructure product. Fantastic claims require fantastic evidence not claims. VMT data from the period show no dramatic change. If all these resid uses collapsed then no way where people driving to the jobs formerly powered via residual fuel use. Switching to NG is expensive and non trivial as a significant amount of infrastructure is needed. I'm not claiming we did not eventually conserve and fairly dramatically it simply took almost a decade to make bring oil consumption under control. This claim is very reasonable and doable and fits will with the adoption of NG and CAFE standards. It makes sense.

Now if the last great period of demand destruction was basically a hoax then you can see why I've very skeptical about this time around. Again I'm not saying conservation has not occured indeed with my calculation we are well past peak by about a decade and 10mbd. If the supply is not there its not burned thus conservation was forced on us. But just as back then I expect that actual changes this time where mild i.e demand simply does not change fast. Now this does not mean we did not have a demand collapse inverse spike at the height of the financial panic and with hurricanes wiping out supply. Plenty of data suggest we almost had a short panic where commerce ground to a halt. However as I've said before a good bit of this was delayed demand that eventually was met later. Since the panic was short and deep it played a role in allowed a significant surge in oil to build. This combination of real physical oil and financial Armageddon collapsed the prices. I also see hints that perhaps large quantities of oil where stored in the first half of 2008 and dumped on the market. A good bit of the last part of the price spike could well have been the result of deliberate storing of oil stressing the market even more then dumping it in concert with the US's actions against Lehman and Bear Sterns that sparked the economic collapse.

Now its important to understand that it looks like a fairly significant amount of real production I think about 1mbd or so was with held for about six months. Assuming it was pumped and stored in tankers all during the first half of 2008 you get about 180 million barrels of oil. Figure the collapse freed up and additional say 50 million barrels of oil during the demand revers spike and also that you have 1mbd brought back online. Your talking about roughly 400 million barrels of oil. Created with some pretty fancy footwork that almost collapsed the world economy.

And who says you can't get blood out of a turnip ?

Thus even with my outrageous claims I can actually figure out a way to create a huge surge of oil at the height of financial calamity that ensures that the collapse in prices also has strong support from a veritable flood of physical oil.

We no joke had a glut. And of course the economic contraction certainly impacted demand even if it was smaller than most people estimate. It as still significant say perhaps 1% or so our about 1mbd globally.

Of course like I said it looks like KSA is in steep decline my C02 data suggest the world is itself declining at about 1mbd and you have export land. The exact times depend on all the numbers but obviously this trick only buys you about 1 to 1.5 years before you hit the wall again. This time playing tricks is not viable and I suspect the attempt to cool the economy got a bit out of hand last time.

But within about a year or so your running about a 1mbd deficit. Once it approachs that you have about six months at most before things get very very tight.

Tin Foil ?

You betcha I like to call it Lead Foil tin does not do it justice.

Regardless of the accusations I think they fit very well with whats happened and also if correct paint a good picture of the future. This story if you will which I call the real oil supply fits very well with history and explains a lot of things.

Indeed the irony is that KSA's tricks way back in the 1980's to prevent a steady and aggressive move off of oil ala Jimmy Carter play a big role in eventually causing our current situation. Not only do I think its probably very close to the truth it has the added bonus of showing the danger of creating a moral hazard. Eventually you will pay.

Does it matter sure. Demand did not drop much and by now natural growth and falling production coupled of course with export land ensures that the oil supply is even more constrained. Also although its too early to tell I am seeing signs that we potentially left our slow 1mbd decline curve for a much steeper one over the same period. The shenanigans certainly cloud the picture and diving monthly C02 data is just that diving.

http://www.esrl.noaa.gov/gmd/ccgg/trends/

However the slope of the C02 data post 2008 seems to have changed and we see a number of surges along with what I contend was withholding at the start of 2008.

The surges probably represent concerted dumping of oil I suspect a effort was made too deliver a good bit of the oil rapidly to flood the fairly just in time supply change.

Next we do see a sharp increase in the recent months. However for now at least given the record breaking cold spells I'm not convinced this is oil but a surge in coal and NG usage. For C02 you have to have all three to figure out oil.